Exploring Factors Impacting User Satisfaction with Electronic Payment Services in Taiwan: A Text-Mining Analysis of User Reviews

Abstract

1. Introduction

- RQ1: What factors influence user satisfaction in app reviews for specialized electronic payment institutions in Taiwan?

- RQ2: How do the factors influence user satisfaction and dissatisfaction, and how do they differ?

2. Related Works

2.1. Topic Modeling

2.2. Sentiment Analysis

2.3. Analysis of User Reviews of Mobile Payment Apps

2.4. Electronic Payment Institutions in Taiwan

3. Methodology

3.1. Data Collection and Sentiment Analysis

3.2. Data Preprocessing

- One review stated, “I was unable to log into my account; it kept spinning in circles, then got stuck and crashed. The same issue occurred after I uninstalled and reinstalled the app”. This review clearly expressed dissatisfaction, and the sentiment analysis accurately judged it strongly negative. However, the user rated it 5 stars.

- Another review mentioned, “Saving paper money is both environmentally friendly and convenient; it considers multiple factors and keeps pace with modern times”. This review conveyed a positive sentiment, and the sentiment analysis assessed it as strongly positive, but the user rated it 1 star.

- A different review noted, “After I installed the app and opened it, it indicated that an update was needed. When I clicked on the update, the app crashed”. Although this review expressed dissatisfaction, the sentiment analysis incorrectly categorized it as strongly positive.

- Lastly, one review stated, “The previous login issue has been completely resolved!” While this review offered a positive evaluation, the sentiment analysis mistakenly interpreted it as negative.

3.3. Topic Analysis

3.4. Satisfaction and Dissatisfaction Analysis

4. Results and Discussion

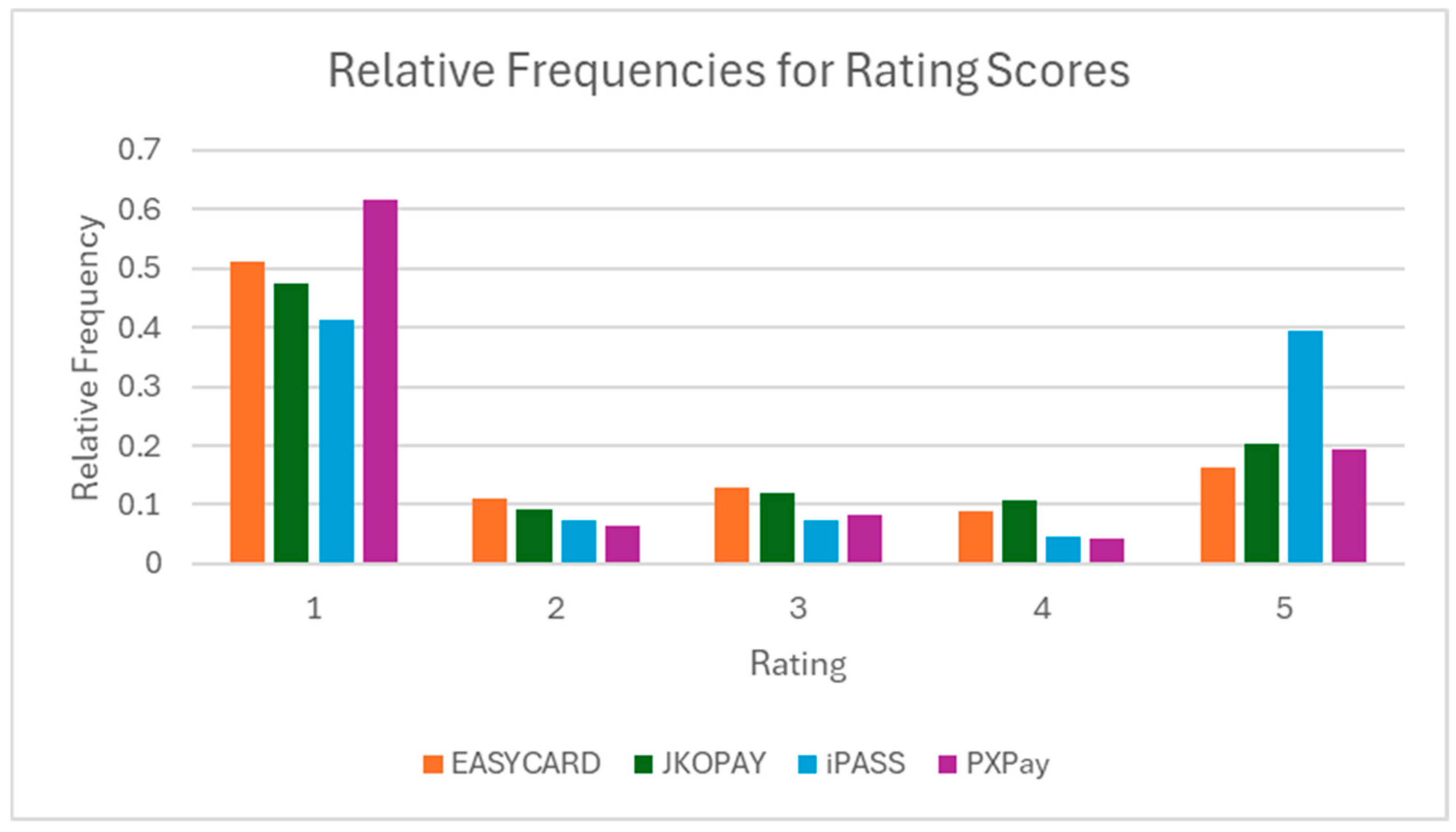

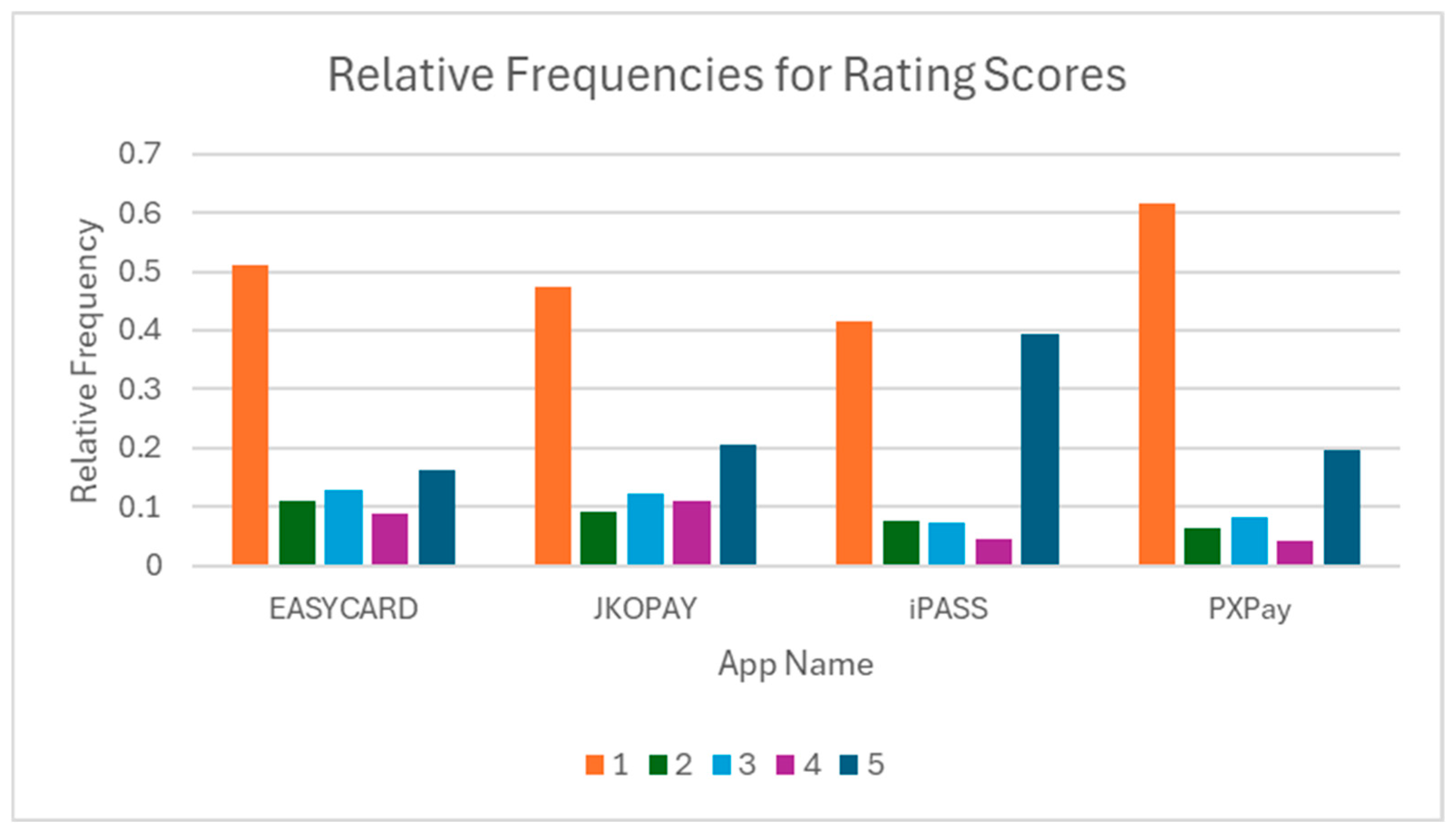

4.1. Factors Impacting User Satisfaction

- -

- Topic 0 had a significant positive impact on Category 2 (β = 3.618, p < 0.001; odds ratio = 37.27). This means that when users’ reviews include this topic, the probability of them expressing an emotion rated at 2 points increased significantly. This indicates that it is a strong negative topic.

- -

- Topic 1 significantly reduced the likelihood of users expressing an emotion rated at 1 point (β = −5.317, p < 0.01; odds ratio = 0.005) and 3 points (β = −8.207, p < 0.001; odds ratio ≈ 0). This suggests that this topic is associated with high satisfaction and has a positive influence.

- -

- The influence of Topic 2 is inconsistent; it significantly reduces the probability of users showing a 3-point emotion (β = −8.769, p < 0.01), while significantly increasing the probability of showing a 4-point emotion (β = 5.093, p < 0.05). This indicates that it has a mixed effect on satisfaction evaluation and can be regarded as a neutral-to-positive topic.

- -

- Topic 3 has a significant positive impact in all categories, with an extremely high odds ratio (up to 9.2 × 1015), indicating a strong correlation with unsatisfactory evaluations and categorizing it as a significant and strong negative topic.

- -

- The coefficients of **Topic 4** are negative and significant across all categories, with an odds ratio close to 0, meaning that its presence almost excludes low emotion values, making it an extremely positive topic.

- -

- Topic 5 significantly increases the odds of users expressing emotions of 1 point (odds ratio = 14,489.137, p < 0.001) and 3 points (odds ratio = 4.06 × 105, p < 0.001), indicating it is a strong negative topic.

- -

- Topic 6 significantly increases the odds of showing a 1-point emotion (β = 2.754, p < 0.05; odds ratio = 15.702). The other categories show similar but non-significant trends, suggesting it is a potentially negative topic.

- -

- Topic 7 has a significant positive impact only in Category 3 (β = 4.332, p < 0.01; odds ratio = 76.07), with the other categories showing no significant impact, classifying it as a moderately negative topic.

- -

- Topic 8 significantly increases the probabilities of 1–3 points (odds ratio = 3023.205, 384.615, 460.681, p < 0.001, 0.01, 0.05), which is indicative of a highly negative topic.

- -

- Topic 9 significantly reduces the probabilities of 1 and 2 points (β = −19.548, −6.957, both p < 0.001; odds ratio ≈ 0), indicating a strong correlation with high satisfaction and categorizing it as a positive topic.

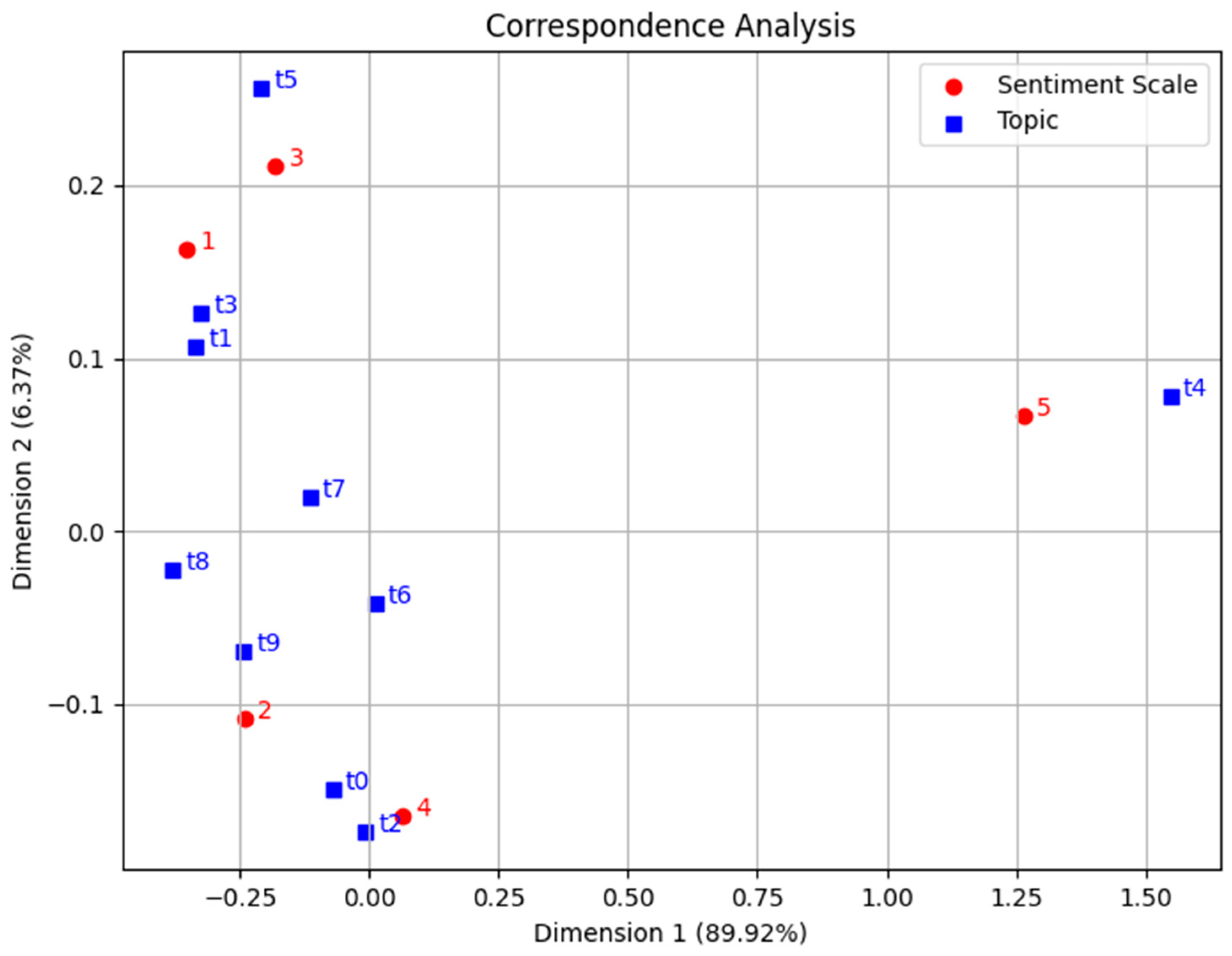

4.2. Correspondence Analysis

4.3. Theoretical and Practical Contributions and Managerial Implications

4.4. Potential Cultural or Societal Aspects Unique to Taiwan

4.5. Platform Bias and Generalizability

4.6. Methodological Limitations in Text Mining

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Topic No. | Keywords | Label |

|---|---|---|

| Topic 0 | 謝謝, nfc, wallet, 悠遊付, app, pay, 更新, 11, Samsung, 嗶乘車, 10, 悠遊卡, 請問, Xperia, Sony | 電子票證與行動支付無縫整合 |

| Topic 1 | 無法登入, 爛透了, 無法註冊, 忘記密碼, 爛死了, 到底, 有夠爛, 登不進去, 更新後, 忘記帳號, 換了手機, 是怎樣, 無法使用, 11, 一直顯示錯誤 | 帳號存取優化 |

| Topic 2 | pay, line, px, app, 街口, 付款碼, ipass, 臺灣, 中華民國, pxpay, 街口支付, 取消px, 為什麼沒有街口幣了, 街口幣, 跟line | 多元支付與點數整合 |

| Topic 3 | 無法更新, 爛死了, play, 應用程式未安裝, 10, 垃圾軟體, 一直要我更新, 爛透了, android, 無法使用, 謝謝, 超爛, nokia, 等待中, 1後 | 應用程式安裝與更新 |

| Topic 4 | 好用, 很方便, 使用方便, 很棒, 很好用, 非常方便, 非常好用, 方便好用, 超方便, 不錯, 實用, 還不錯, 超讚, 太厲害了這個軟體, 優惠多 | 使用便利性與優惠體驗 |

| Topic 5 | 不方便, 有點不方便, 不好用, 很爛, 爛程式, point卡, 不能綁中國信託, 不能綁定信用卡, 不能用信用卡儲值, 中國信託這麼大間, 才發現, 搞毛, 支援的銀行太少, 很不方便, 全支付 | 支付綁定與儲值優化 |

| Topic 6 | 生活繳費, 電費, 水費, 謝謝, 顯示, 繳費, 停車費, 外帶外, 沒辦法繳停車費, 根本沒辦法繳費, 點選繳費, 牌照稅, 電號, 系統搶修查無資料, 要繳停車費 | 多元便捷繳費 |

| Topic 7 | 希望這個app也能夠有這個功能可以靠卡馬上查詢餘額, 有一些app都可以靠卡感應立刻查詢餘額, 儲值, 餘額, 支付工具管理, 好爛, 不好用, 希望可以改善, 加油, 16, 隔天進入app查尋金額, 難怪評價不好, 難道不是應該針對, 高層座領高薪這種問題也無法解決, 難道就無法改善嗎 | 餘額查詢優化 |

| Topic 8 | 從相簿選擇, 按鍵, 超麻煩, 爛爆了, 07, 06, 差評, 爛透了, 是怎樣, 問題是隻是買個海外東西不懂其用意, 問題是我根本沒用過, 問題是提供帳戶之後是可以用此app轉帳的, 阿所以我本人的身分證字號就只能卡在以前已經取消的電話號碼裡, 除非用你們的app來付款後才會有免提領手續費機會變相強迫使用你們app, 重來沒有用過街口的我剛下載想要使用看看直接連驗證碼都拿不到 | 使用者體驗與操作便利性 |

| Topic 9 | android, 一直閃退, 會閃退, 11, 10, 閃退, 開啟即閃退, 14, 瘋狂閃退, 無法開啟, 還是一樣閃退, 三星, 會一直閃退, 重新下載好幾次了, app一直閃退 | 應用穩定性與崩潰修復 |

References

- Barnard, Y.; Bradley, M.D.; Hodgson, F.; Lloyd, A.D. Learning to use new technologies by older adults: Perceived difficulties, experimentation behaviour and usability. Comput. Hum. Behav. 2013, 29, 1715–1724. [Google Scholar] [CrossRef]

- Yagmur, S. A literature review: Usability aspects of ubiquitous computing. In Proceedings of the 2016 International Conference on Platform Technology and Service (PlatCon), Jeju, Republic of Korea, 15–17 February 2016; IEEE: Piscataway, NJ, USA, 2016; pp. 1–6. [Google Scholar] [CrossRef]

- Choi, B.; Kim, D. Does the proliferation of smartphones reduce consumer search costs? The case of the Korean gasoline market. Asian Econ. J. 2024, 38, 153–176. [Google Scholar] [CrossRef]

- Bezovski, Z. The future of the mobile payment as electronic payment system. Eur. J. Bus. Manag. 2016, 8, 127–132. [Google Scholar]

- Kim, S.H.; Park, H.S. The effects of mobile application quality on satisfaction and intention to pay mobile application. J. Inf. Syst. 2011, 20, 81–109. [Google Scholar]

- Kuo, T.; Tsai, G.Y.; Lu, I.Y.; Chang, J.S. Relationships among service quality, customer satisfaction and customer loyalty: A case study on mobile shopping APPs. In Proceedings of the 17th Asia Pacific Industrial Engineering and Management System Conference, Taipei, Taiwan, 7–10 December 2016; pp. 7–10. [Google Scholar]

- Hammouri, Q.; Almajali, D.A.; Nusairat, N.; Saraireh, S. Determinants of Users’ Satisfaction with Mobile Apps. Int. J. Adv. Sci. Technol. 2020, 29, 14613–14624. [Google Scholar]

- Lin, Y.C. New Policies Change Industry Rules, New Competitors Are Eyeing the Market, and the Electronic Payment Elimination Round Begins. 2024. Available online: https://www.credit.com.tw/newcreditonline/Epaper/PersonalityContent.aspx?sn=381&unit=595 (accessed on 24 January 2025).

- FSC. Statistics of Credit Card, Cash Card & Electronic Payment Institutions Business Operation as of November 2024; Press Release. 14 January 2025. Available online: https://www.fsc.gov.tw/en/home.jsp?id=54&parentpath=0,2&mcustomize=multimessage_view.jsp&dataserno=202501140004&dtable=News (accessed on 24 January 2025).

- Liu, H.-H.; Tsai, D.-R. Discovering the Potentials and Directions of Mobile Payment Applications Development an Exploratory Study in Taiwan. In Proceedings of the 3rd International Conference on Computer Science and Service System, Bangkok, Thailand, 13–15 June 2014; Atlantis Press: Dordrecht, The Netherlands, 2014; pp. 549–552. [Google Scholar] [CrossRef]

- Kuo, R.Z. Why do people switch mobile payment service platforms? An empirical study in Taiwan. Technol. Soc. 2020, 62, 101312. [Google Scholar] [CrossRef]

- Tsai, J.; Ye, X.; Wang, C. Consumer Behavioral Intension for Using Mobile Payment for E-commerce in Taiwan. J. Internet Technol. 2020, 21, 1821–1828. [Google Scholar]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 1989, 13, 318–340. [Google Scholar] [CrossRef]

- Davis, F.D.; Bagozzi, R.P.; Warshaw, P.R. User acceptance of computer technology: A comparison of two theoretical models. Manag. Sci. 1989, 35, 982–1002. [Google Scholar] [CrossRef]

- Adams, D.A.; Nelson, R.R.; Todd, P.A. Perceived usefulness, ease of use, and usage of information technology: A replication. MIS Q. 1992, 16, 227–247. [Google Scholar] [CrossRef]

- Straub, D.; Limayem, M.; Karahanna, E.E. Measuring system usage: Implications for IS theory testing. Manag. Sci. 1995, 41, 1328–1342. [Google Scholar] [CrossRef]

- Van Laarhoven, P.J.; Pedrycz, W. A fuzzy extension of Saaty’s priority theory. Fuzzy Sets Syst. 1983, 11, 229–241. [Google Scholar] [CrossRef]

- Ng, W.-K.; Chen, S.; Chen, W.-H.; Chen, C.-L.; Jiang, J.-L. Mobile Payment Innovation Ecosystem and Mechanism: A Case Study of Taiwan’s Servicescapes. J. Theor. Appl. Electron. Commer. Res. 2024, 19, 633–653. [Google Scholar] [CrossRef]

- Chen, P.S.; Lee, J.J.; Huang, S.J.; Lin, C.L. A Study on Consumers’ Usage Behavior of the Bank’s Mobile Payment APPs in Taiwan. Bus. Econ. Res. J. 2020, 11, 793–805. [Google Scholar] [CrossRef]

- Sheth, J.N.; Newman, B.I.; Gross, B.L. Why we buy what we buy: A theory of consumption values. J. Bus. Res. 1991, 22, 159–170. [Google Scholar] [CrossRef]

- Kumar, A.; Bala, P.K.; Chakraborty, S.; Behera, R.K. Exploring antecedents impacting user satisfaction with voice assistant app: A text mining-based analysis on Alexa services. J. Retail. Consum. Serv. 2024, 76, 103586. [Google Scholar]

- Blei, D.M.; Ng, A.Y.; Jordan, M.I. Latent dirichlet allocation. J. Mach. Learn. Res. 2003, 3, 993–1022. [Google Scholar]

- Newman, D.; Noh, Y.; Talley, E.; Karimi, S.; Baldwin, T. Evaluating Topic Models for Digital Libraries. In Proceedings of the Annual Joint Conference on Digital Libraries, Gold Coast, QLD, Australia, 21–25 June 2010; pp. 215–224. [Google Scholar][Green Version]

- Albanese, N.C. Topic Modeling with LSA, pLSA, LDA, NMF, BERTopic, Top2Vec: A Comparison. 2022. Available online: https://towardsdatascience.com/topic-modeling-with-lsa-plsa-lda-nmf-bertopic-top2vec-a-comparison-5e6ce4b1e4a5/ (accessed on 24 January 2025).[Green Version]

- Grootendorst, M. BERTopic: Neural topic modeling with a class-based TF-IDF procedure. arXiv 2022, arXiv:2203.05794. [Google Scholar][Green Version]

- Egger, R.; Yu, J. A topic modeling comparison between lda, nmf, top2vec, and bertopic to demystify twitter posts. Front. Sociol. 2022, 7, 886498. [Google Scholar] [CrossRef]

- Pal, S.; Biswas, B.; Gupta, R.; Kumar, A.; Gupta, S. Exploring the factors that affect user experience in mobile-health applications: A text-mining and machine-learning approach. J. Bus. Res. 2023, 156, 113484. [Google Scholar] [CrossRef]

- Wu, J.J.; Chang, S.T. Exploring customer sentiment regarding online retail services: A topic-based approach. J. Retail. Consum. Serv. 2020, 55, 102145. [Google Scholar] [CrossRef]

- Kumari, V.; Bala, P.K.; Chakraborty, S. A text mining approach to explore factors influencing consumer intention to use metaverse platform services: Insights from online customer reviews. J. Retail. Consum. Serv. 2024, 81, 103967. [Google Scholar] [CrossRef]

- Geetha, A.V.; Mala, T.; Priyanka, D.; Uma, E. Multimodal Emotion Recognition with deep learning: Advancements, challenges, and future directions. Inf. Fusion 2024, 105, 102218. [Google Scholar]

- Saadi, I.; Taleb-Ahmed, A.; Hadid, A.; El Hillali, Y. Driver’s facial expression recognition: A comprehensive survey. Expert Syst. Appl. 2023, 242, 122784. [Google Scholar] [CrossRef]

- Ismail, S.N.M.S.; Aziz, N.A.A.; Ibrahim, S.Z.; Mohamad, M.S. A systematic review of emotion recognition using cardio-based signals. ICT Express 2024, 10, 156–183. [Google Scholar] [CrossRef]

- Tian, L.; Lai, C.; Moore, J.D. Polarity and Intensity: The Two Aspects of Sentiment Analysis. arXiv 2018, arXiv:1807.01466. [Google Scholar]

- Yi, J.; Kim, J.; Oh, Y.K. Uncovering the quality factors driving the success of mobile payment apps. J. Retail. Consum. Serv. 2024, 77, 103641. [Google Scholar] [CrossRef]

- Basu, B.; Sebastian, M.P.; Kar, A.K. What affects the promoting intention of mobile banking services? Insights from mining consumer reviews. J. Retail. Consum. Serv. 2024, 77, 103695. [Google Scholar] [CrossRef]

- Luo, J.M.; Hu, Z.; Law, R. Exploring online consumer experiences and experiential emotions offered by travel websites that accept cryptocurrency payments. Int. J. Hosp. Manag. 2024, 119, 103721. [Google Scholar] [CrossRef]

- Wang, W.-J.; Chen, C.-J.; Lee, C.-M.; Lai, C.-Y.; Lin, H.-H. KeyMoji; Computer Program; Droidtown Linguistic Tech: Taipei, Taiwan, 2020; Available online: https://api.droidtown.co/ (accessed on 24 January 2025).

- Ha, J.; Nam, C.; Kim, S. A systematic review of mobile payment literature: What has been studied and what should be studied? Telecommun. Policy 2024, 48, 102795. [Google Scholar] [CrossRef]

- Zhou, T. An empirical examination of users’ post-adoption behaviour of mobile services. Behav. Inf. Technol. 2011, 30, 241–250. [Google Scholar] [CrossRef]

- Chatterjee, S. Explaining customer ratings and recommendations by combining qualitative and quantitative user generated contents. Decis. Support Syst. 2019, 119, 14–22. [Google Scholar] [CrossRef]

- Alrizq, M.; Alghamdi, A. Customer satisfaction analysis with Saudi Arabia mobile banking apps: A hybrid approach using text mining and predictive learning techniques. Neural Comput. Appl. 2024, 36, 6005–6023. [Google Scholar] [CrossRef]

- Balcıoğlu, Y.S. Analyzing Customer Sentiments and Trends in Turkish Mobile Banking Apps: A Text Mining Study. Dumlupınar Üniv. Sos. Bilim. Derg. 2024, 80, 49–69. [Google Scholar] [CrossRef]

- Shankar, A.; Tiwari, A.K.; Gupta, M. Sustainable mobile banking application: A text mining approach to explore critical success factors. J. Enterp. Inf. Manag. 2022, 35, 414–428. [Google Scholar] [CrossRef]

- Verkijika, S.F.; Neneh, B.N. Standing up for or against: A text-mining study on the recommendation of mobile payment apps. J. Retail. Consum. Serv. 2021, 63, 102743. [Google Scholar] [CrossRef]

- Perea-Khalifi, D.; Irimia-Diéguez, A.I.; Palos-Sánchez, P. Exploring the determinants of the user experience in P2P payment systems in Spain: A text mining approach. Financ. Innov. 2024, 10, 2. [Google Scholar]

- Lang, C.; Li, M.; Zhao, L. Understanding consumers’ online fashion renting experiences: A text-mining approach. Sustain. Prod. Consum. 2020, 21, 132–144. [Google Scholar] [CrossRef]

- Laws & Regulations Database of the Republic of China (Taiwan). The Act Governing Electronic Payment Institutions (19 January 2023). Available online: https://law.moj.gov.tw/ENG/LawClass/LawAll.aspx?pcode=G0380237 (accessed on 24 January 2025).

- Xiao, S.; Liu, Z.; Zhang, P.; Muennighoff, N.; Lian, D.; Nie, J.Y. C-pack: Packed resources for general Chinese embeddings. In Proceedings of the 47th International ACM SIGIR Conference on Research and Development in Information Retrieval, Washington, DC, USA, 14–18 July 2024; pp. 641–649. [Google Scholar]

- Alharbi, A.; Hai, A.A.; Aljurbua, R.; Obradovic, Z. AI-Driven Sentiment Trend Analysis: Enhancing Topic Modeling Interpretation with ChatGPT. In Proceedings of the IFIP International Conference on Artificial Intelligence Applications and Innovations, Corfu, Greece, 27–30 June 2024; Springer Nature: Cham, Switzerland, 2024; pp. 3–17. [Google Scholar]

- Mimno, D.; Wallach, H.; Talley, E.; Leenders, M.; McCallum, A. Optimizing semantic coherence in topic models. In Proceedings of the 2011 Conference on Empirical Methods in Natural Language Processing, Edinburgh, UK, 27–31 July 2011; pp. 262–272. [Google Scholar]

- Hadiat, A.R. Topic Modeling Evaluations: The Relationship Between Coherency and Accuracy. Master’s Thesis, University of Groningen, Groningen, The Netherlands, 2022. [Google Scholar]

- Chiang, M. Convenience Store 2023 Sales Estimated at Record-Breaking NT$413 Billion; Press Release. (15 March 2024). Available online: https://en.rti.org.tw/news/view/id/2010862 (accessed on 15 April 2025).

- Taiwan Institute of Economic Research. 2020 Communications Market Survey Results Report. February 2021. Available online: https://www.ncc.gov.tw/chinese/files/21021/5190_45724_210217_2.pdf (accessed on 15 April 2025).

- National Science and Technology Council. DIGI+: Digital Nation and Innovative Economic Development Program; Press Release. 9 September 2019. Available online: https://english.ey.gov.tw/News3/9E5540D592A5FECD/659df63b-dad4-47e3-80ab-c62cb40a62cd (accessed on 15 April 2025).

- Lian, J.W.; Li, J. The dimensions of trust: An investigation of mobile payment services in Taiwan. Technol. Soc. 2021, 67, 101753. [Google Scholar] [CrossRef]

- Dhawan, H. Android vs. Apple: How Consumer Demographics Shape Mobile App Strategies. 2024. Available online: https://www.neuronimbus.com.au/blog/android-vs-apple-how-consumer-demographics-shape-mobile-app-strategies/ (accessed on 11 June 2025).

- Kapias, M. Android and iPhone Users: Differences in Behavior. 2025. Available online: https://fireart.studio/blog/android-and-iphone-users-differences-in-behavior/ (accessed on 11 June 2025).

- AppMySite, Inc. Android vs. iOS Users: A Detailed Behavioral Comparison. 2025. Available online: https://www.appmysite.com/blog/android-vs-ios-users-a-detailed-behavioural-comparison/ (accessed on 11 June 2025).

- Testers HUB: Software Testing Company. The Role of User Experience in iOS and Android App Testing Services. 2025. Available online: https://www.linkedin.com/pulse/role-user-experience-ios-android-app-testing-services-testers-hub-6yedf (accessed on 11 June 2025).

- Ahmad, D.M.; Javed, P. Security comparison of Android and iOS and implementation of user approved security (UAS) for android. Indian J. Sci. Technol. 2016, 9, 1–7. [Google Scholar] [CrossRef]

- Dia, H.; Pettersson, N. Evaluating the Accuracy of Sentiment Analysis Models when Applied to Social Media Texts. Bachelor’s Thesis, KTH Royal Institute of Technology, Stockholm, Sweden, 2024. [Google Scholar]

- Ahmad Azrir, A.H.I.; Naveen, P.; Haw, S.C. Improving Sentiment Analysis of Shopee Reviews with Informal Language and Slang. J. Logist. Inform. Serv. Sci. 2024, 11, 151–169. [Google Scholar]

- Ganie, A.G. Presence of informal language, such as emoticons, hashtags, and slang, impact the performance of sentiment analysis models on social media text? arXiv 2023, arXiv:2301.12303. [Google Scholar]

- Maynard, D.G.; Greenwood, M.A. Who cares about sarcastic tweets? Investigating the impact of sarcasm on sentiment analysis. In Proceedings of the Ninth International Conference on Language Resources and Evaluation Conference (LREC’14), Reykjavik, Iceland, 26–31 May 2014; ELRA: Paris, France, 2014. [Google Scholar]

| Company Name | Number of Users | Number of Users (%) | Cumulative Number of Users (%) |

|---|---|---|---|

| iPASS Corporation | 6,639,696 | 24.45 | 24.45 |

| Jkopay Co., Ltd. | 6,603,252 | 24.32 | 48.77 |

| PXPay Plus Co., Ltd. | 5,197,230 | 19.14 | 67.91 |

| EASYCARD CORPORATION | 3,300,526 | 12.16 | 80.07 |

| All Win Fintech Company Limited | 2,176,120 | 8.01 | 88.08 |

| icash Corporation | 1,522,090 | 5.61 | 93.69 |

| O’Pay Electronic Payment Co., Ltd. | 1,073,838 | 3.95 | 97.64 |

| GAMA PAY Co., Ltd. | 565,232 | 2.08 | 99.72 |

| ezPay Co., Ltd. | 75,161 | 0.28 | 100.00 |

| App Name | iPASS Money | Jiekou Payment | PXPay Plus | Easy Wallet | |

|---|---|---|---|---|---|

| Features | |||||

| Payment | ✓ | ✓ | ✓ | ✓ | |

| Transfer | ✓ | ✓ | ✓ | ✓ | |

| Deposit/withdraw | ✓ | ✓ | ✓ | ✓ | |

| Rewards and redemption | ✓ | ✓ | ✓ | ✓ | |

| Living payment | ✓ | ✓ | ✓ | ✓ | |

| Riding public transport | ✓ | ✓ | ✗ | ✓ | |

| Binding a stored-value card | ✓ | ✗ | ✗ | ✓ | |

| iPASS Money | Jiekou Payment | PXPay Plus | Easy Wallet | |

|---|---|---|---|---|

| Initial Review Count | 686 | 4649 | 919 | 6360 |

| Final Review Count | 417 | 3655 | 700 | 5897 |

| Number of Reviews Removed | 269 | 994 | 219 | 463 |

| Number of short reviews | 267 | 883 | 201 | 311 |

| Reviews with the lowest rating but strong positive sentiment | 1 | 81 | 15 | 102 |

| Reviews with the highest rating but strong negative sentiment | 1 | 30 | 3 | 50 |

| Average Rating | 2.9300 | 2.4769 | 2.1328 | 2.2816 |

| Topic No. | Keywords | Label |

|---|---|---|

| Topic 0 | thanks, nfc, wallet, Easy Wallet, app, pay, update, 11, Samsung, beep ride, 10, Easy Card, May I ask, Xperia, Sony | Seamless integration of e-tickets and mobile payments |

| Topic 1 | unable to log in, completely awful, Unable to register, forgot password, so bad, seriously, utterly terrible, can’t log in, after the update, Forgo account, Changed phone, what’s the deal, not working, 11, constant error message | Enhancement of account access mechanisms |

| Topic 2 | pay, line, px, app, Jiekuo, payment QR code, ipass, Taiwan, R.O.C, pxpay, JKOPay, Cancel px, Why is JKO coin no longer available?, JKO coin, with line | Diverse payment channels and loyalty point systems |

| Topic 3 | unable to update, really terrible, play, app not installed, 10, garbage app, keeps asking me to update, absolutely terrible, android, unable to use, thank you, super bad, nokia, pending, after 1 | Application installation and updates |

| Topic 4 | easy to use, very convenient, convenient to use, great, works well, extremely convenient, highly practical, convenient and easy to use, super convenient, pretty good, practical, quite good, awesome, This app is amazing, plenty of deals | Perceived usability and promotional engagement |

| Topic 5 | inconvenient, a bit inconvenient, hard to use, terrible, poorly designed app, point card, can’t link CTBC bank, unable to bind credit card, can’t top up with a credit card, CTBC is such a major bank, just found out, what the heck, too few supported banks, very inconvenient, PXPay | Payment linking and top-up optimization |

| Topic 6 | daily bill payment, electricity bill, water bill, thank you, display, bill payment, parking fee, take-out, unable to pay parking fee, totally unable to make payments, click to pay bills, vehicle license tax, meter number, system under maintenance and no data found, need to pay parking fee | Convenient payment for various living expenses |

| Topic 7 | hope this app can also support instant balance check via card tap. some apps allow instant balance inquiry via card sensing, top-up, balance, payment method management, terrible, not user-friendly, hope it can be improved, keep it up, 16, checked the balance in the app the next day, no wonder the ratings are bad, shouldn’t they be addressed, even the high-paid executives can’t solve this kind of issue, can’t this be improved | Optimization of balance inquiry features |

| Topic 8 | select from photo album, button, extremely troublesome, absolutely terrible, 07, 06, negative review, terrible experience, what’s going on, the issue is just bought something overseas and doesn’t get the point of this, the problem is I’ve never even used it before, the thing is that being able to transfer money with this app after my account has been provided, so my ID number is stuck with a deactivated phone number, the withdrawal fee is waived only if the payment is made with the app, I’ve never used JKOPay before and I cannot receive a verification code after downloading it | User experience and interaction efficiency |

| Topic 9 | android, keeps crashing, app crashes, 11, 10, crash, crashes immediately upon opening, 14, constant crashing, unable to open the app, still crashes the same way, Samsung, keeps crashing repeatedly, reinstalled several times, app keeps crashing | App stability and crash recovery |

| Topic No. | Topic Name | Interpretation |

|---|---|---|

| Topic 0 | Seamless integration of e-tickets and mobile payments | This refers to integrating electronic tickets with mobile payment apps, enabling users to complete transactions via their smartphones when they are using public transportation, shopping, or dining out. |

| Topic 1 | Enhancement of account access mechanisms | This is related to user account management and access processes, including signup, signing in and out, and password setting |

| Topic 2 | Diverse payment channels and loyalty point systems | This refers to combining electronic payment with various rewards, like membership points, cash back, and discount coupons, ensuring a unified and convenient user experience. |

| Topic 3 | Application installation and updates | This involves downloading and installing the electronic payment app on a mobile device and updating the app to its latest version. |

| Topic 4 | Perceived usability and promotional engagement | This means the electronic payment app is user-friendly and easy to navigate, allowing users to get started effortlessly. It also offers a reward mechanism, providing additional value and benefits while ensuring a smooth experience. |

| Topic 5 | Payment linking and top-up optimization | This refers to the process of binding a credit card or bank account to an electronic payment app and recharging a payment instrument, such as an electronic ticket or stored-value card, through an electronic payment app. |

| Topic 6 | Convenient payment for various living expenses | This means that users can make various payments in life through electronic payment apps, such as water bills, electricity bills, taxes, etc. |

| Topic 7 | Optimization of balance inquiry features | This refers to users’ operational experience and efficiency when viewing their accounts, payment tools, or e-wallet balances in electronic payment apps. |

| Topic 8 | User experience and interaction efficiency | This refers to the user’s experience when interacting with the electronic payment app and the smoothness of the electronic payment operation process. |

| Topic 9 | App stability and crash recovery | This refers to ensuring that the electronic payment app continues to operate normally and can quickly recover in case of an unexpected crash. |

| Chi-Square | df | Sig. | |

|---|---|---|---|

| Pearson | 36,169.698 | 36,908 | 0.997 |

| Deviance | 22,559.392 | 36,908 | 1.000 |

| Model | Model Fitting Criteria | Likelihood Ratio Tests | ||

|---|---|---|---|---|

| −2 Log Likelihood | Chi-Square | df | Sig. | |

| Intercept Only | 2.744 × 104 | |||

| Final | 2.256 × 104 | 4.877 × 104 | 40 | 0.000 |

| Effect | Model Fitting Criteria | Likelihood Ratio Tests | ||

|---|---|---|---|---|

| −2 Log Likelihood of Reduced Model | Chi-Square | df | Sig. | |

| Intercept | 2.293 × 104 | 373.718 | 4 | 0.000 |

| Topic 0 | 2.260 × 104 | 35.887 | 4 | 0.000 |

| Topic 1 | 2.261 × 104 | 52.813 | 4 | 0.000 |

| Topic 2 | 2.259 × 104 | 34.779 | 4 | 0.000 |

| Topic 3 | 2.310 × 104 | 540.577 | 4 | 0.000 |

| Topic 4 | 2.446 × 104 | 1.902 × 103 | 4 | 0.000 |

| Topic 5 | 2.275 × 104 | 187.317 | 4 | 0.000 |

| Topic 6 | 2.256 × 104 | 4.902 | 4 | 0.298 |

| Topic 7 | 2.258 × 104 | 15.809 | 4 | 0.003 |

| Topic 8 | 2.259 × 104 | 26.255 | 4 | 0.000 |

| Topic 9 | 2.287 × 104 | 309.005 | 4 | 0.000 |

| Independent Variable | Category 1 | Category 2 | Category 3 | Category 4 | ||||

|---|---|---|---|---|---|---|---|---|

| Coefficient | Odds Ratio | Coefficient | Odds Ratio | Coefficient | Odds Ratio | Coefficient | Odds Ratio | |

| Topic 0 | 0.829 | 2.290 | 3.618 *** | 37.272 | −1.368 | 0.255 | 1.349 | 3.853 |

| Topic 1 | −5.317 ** | 0.005 | −0.863 | 0.422 | −8.207 *** | 0.000 | 1.316 | 3.729 |

| Topic 2 | −0.700 | 0.497 | 4.441 | 84.835 | −8.769 ** | 0.000 | 5.093 * | 162.813 |

| Topic 3 | 36.761 *** | 9.232 × 1015 | 17.953 *** | 6.267 × 107 | 7.591 ** | 1980.046 | 6.136 ** | 462.115 |

| Topic 4 | −31.457 *** | 0.000 | −24.776 *** | 0.000 | −24.778 *** | 0.000 | −12.730 *** | 0.000 |

| Topic 5 | 9.581 *** | 14,489.137 | 1.522 | 4.580 | 12.914 *** | 4.061 × 105 | −1.668 | 0.189 |

| Topic 6 | 2.754 * | 15.702 | 1.474 | 4.366 | 0.698 | 2.010 | 1.664 | 5.279 |

| Topic 7 | −0.732 | 0.481 | 1.239 | 3.451 | 4.332 ** | 76.071 | 1.145 | 3.143 |

| Topic 8 | 8.014 *** | 3023.205 | 5.952 ** | 384.615 | 6.133 * | 460.681 | 2.043 | 7.713 |

| Topic 9 | −19.548 *** | 0.000 | −6.957 *** | 0.001 | −1.032 | 0.356 | −0.727 | 0.483 |

| Topics | t0 | t1 | t2 | t3 | t4 | t5 | t6 | t7 | t8 | t9 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Scales | |||||||||||

| 1 | 655 | 512 | 194 | 524 | 18 | 289 | 92 | 147 | 69 | 55 | |

| 2 | 1025 | 483 | 329 | 444 | 75 | 234 | 120 | 164 | 88 | 91 | |

| 3 | 120 | 75 | 48 | 75 | 27 | 105 | 38 | 38 | 11 | 32 | |

| 4 | 585 | 187 | 215 | 204 | 189 | 116 | 96 | 98 | 30 | 54 | |

| 5 | 287 | 53 | 110 | 54 | 607 | 64 | 51 | 49 | 4 | 10 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tu, S.-F.; Hsu, C.-S. Exploring Factors Impacting User Satisfaction with Electronic Payment Services in Taiwan: A Text-Mining Analysis of User Reviews. Big Data Cogn. Comput. 2025, 9, 165. https://doi.org/10.3390/bdcc9070165

Tu S-F, Hsu C-S. Exploring Factors Impacting User Satisfaction with Electronic Payment Services in Taiwan: A Text-Mining Analysis of User Reviews. Big Data and Cognitive Computing. 2025; 9(7):165. https://doi.org/10.3390/bdcc9070165

Chicago/Turabian StyleTu, Shu-Fen, and Ching-Sheng Hsu. 2025. "Exploring Factors Impacting User Satisfaction with Electronic Payment Services in Taiwan: A Text-Mining Analysis of User Reviews" Big Data and Cognitive Computing 9, no. 7: 165. https://doi.org/10.3390/bdcc9070165

APA StyleTu, S.-F., & Hsu, C.-S. (2025). Exploring Factors Impacting User Satisfaction with Electronic Payment Services in Taiwan: A Text-Mining Analysis of User Reviews. Big Data and Cognitive Computing, 9(7), 165. https://doi.org/10.3390/bdcc9070165