The Impact of Blockchain Technology and Dynamic Capabilities on Banks’ Performance

Abstract

1. Introduction

2. A Literature Review

2.1. Blockchain Technology (BC)

- Immutability: After a transaction is validated, it cannot be changed by any party;

- Traceability: The transaction history is fully and transparently audited;

- Consensus: To avoid conflicts, all participants must agree on a single dataset;

- Automation: Under specific circumstances, commands and transactions can be performed automatically.

- 1.

- Cost Savings Leading to Higher Profit Margins:

- The reduction in operating costs directly improves banks’ profit margins. For example, by cutting trade finance costs by 50–80% and KYC compliance costs by up to 50%, banks can reallocate these savings to other areas, such as innovation or customer acquisition [48,50]. For a Spanish bank with annual operating costs of EUR 1 billion, a 50% reduction in trade finance and KYC expenses could save EUR 50–100 million annually, significantly boosting profitability;

- 2.

- Revenue Growth Through Customer Loyalty:

- Increased customer loyalty drives revenue growth by reducing churn and attracting new customers. Loyal customers are more likely to use additional services, such as loans or investment products, increasing the bank’s revenue per customer. The PwC survey finds that 84% of consumers value transparency and suggests that blockchain’s ability to enhance trust can lead to higher customer retention [56]. If a bank retains an additional 5% of its customer base annually, and each customer generates EUR 500 in revenue, a bank with 1 million customers could experience an additional EUR 25 million in annual revenue;

- 3.

- Scalability and Market Competitiveness Through Process Efficiency:

- Improved process efficiency allows banks to scale operations and serve more customers without proportional increases in costs. Faster transaction settlements and streamlined KYC processes enable banks to handle higher transaction volumes, attracting business clients who value speed and efficiency. This scalability enhances market competitiveness, potentially increasing market share. For instance, a bank that reduces cross-border payment times from 3 days to 4 sec using blockchain can capture a larger share of the EUR 150 billion global remittance market [53], directly boosting revenue.

2.2. Dynamic Capabilities (DC)

2.2.1. Integration of Blockchain with Dynamic Capabilities Theory (DCT)

Absorptive Capacity

Innovation Capacity

Detection Capability

2.3. Regulation of Blockchain in the European Union and Spain

2.3.1. Markets in Crypto-Assets Regulation (MiCA)

2.3.2. Digital Operational Resilience Act (DORA)

2.3.3. European Blockchain Services Infrastructure (EBSI)

2.3.4. Distributed Ledger Technology (DLT) Pilot Regime

2.4. Regulation of Blockchain in Spain

2.4.1. Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance

2.4.2. Regulatory Sandbox for Innovation

2.4.3. Data Protection Challenges with GDPR

Key Differences

- Sector-Specific Challenges:

- Performance Outcomes:

- Adoption Barriers:

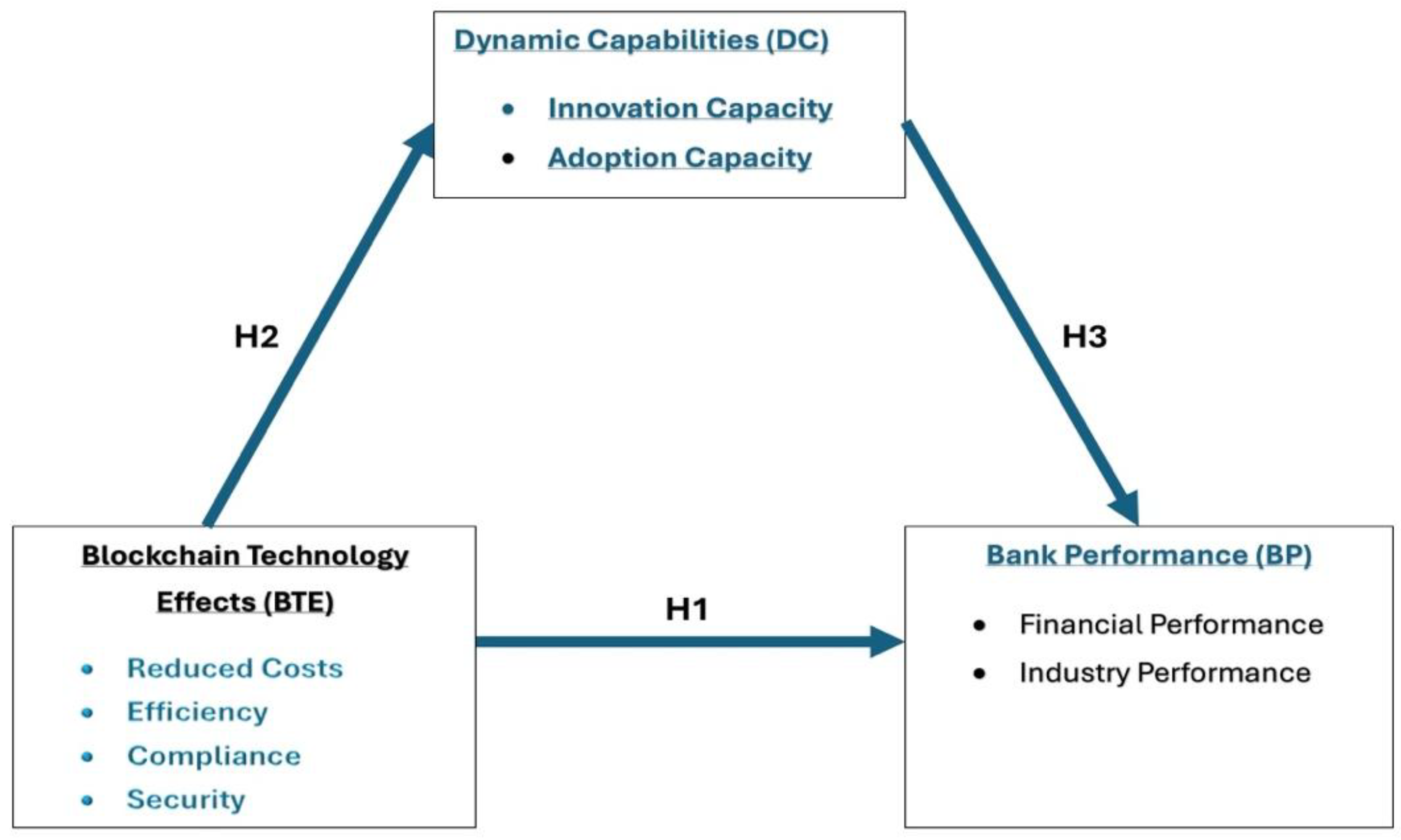

2.5. Development of the Conceptual Model and Hypotheses

3. Methods

- -

- Development and Review of the Dynamic Capabilities (DC) Questionnaire: The research team devised a questionnaire intended for validation, which underwent a review process resulting in the inclusion of eight items—two corresponding to each dynamic capability. These items were subsequently subjected to evaluation via the Delphi method in the latter half of June 2024.

- -

- Preparation of the Questionnaire for the Initial Round of the Delphi: In this iteration, experts were solicited for their assessments regarding the clarity and appropriateness of the items associated with each dynamic capability and their respective measurement scales;

- -

- Selection of the Expert Panel: The selection of experts is a critical factor influencing the validity of the Delphi results. The criteria for expert selection and the number of experts chosen were contingent upon the subject matter and the objectives intended to be achieved through the application of the Delphi method. In this instance, the issue was addressed, and the scope of the application was notably specific.

- -

- First Round: The questionnaire developed by the research team was disseminated to eleven experts, who were invited to evaluate the appropriateness of the selected items for measuring the dynamic capabilities. The questionnaire was organized into three sections, each corresponding to one of the three dynamic capabilities. Experts were asked to indicate whether they believed the questions effectively measured the intended aspects. If they deemed any question inadequate, they were encouraged to propose alternative questions and/or provide additional suggestions or comments. After the questionnaire, experts were also asked to identify any other dynamic capabilities not addressed in this study based on their professional experience. This initial round was conducted during the week of 18–24 June 2024;

- -

- Second Round: Following the processing of responses and analysis of the overall results from the first round, a report summarizing the findings was prepared. Based on the feedback and suggestions from the experts, a revised questionnaire for the second round was drafted, which included information regarding the level of agreement on each question and addressed most of the suggestions related to terminology. This second round took place during the week of 25–31 July 2024. In this round, experts were asked to reassess their previous responses, considering the new information obtained from the first round, to reach a consensus.

- (1)

- They reflect the target population for the final survey, and they are IT specialists in the banking industry with significant expertise in the deployment and implementation of blockchain technology.

- (2)

- In the academic sector, specialists whose research efforts are connected in some form to dynamic capabilities, banking performance, and/or economics were chosen.

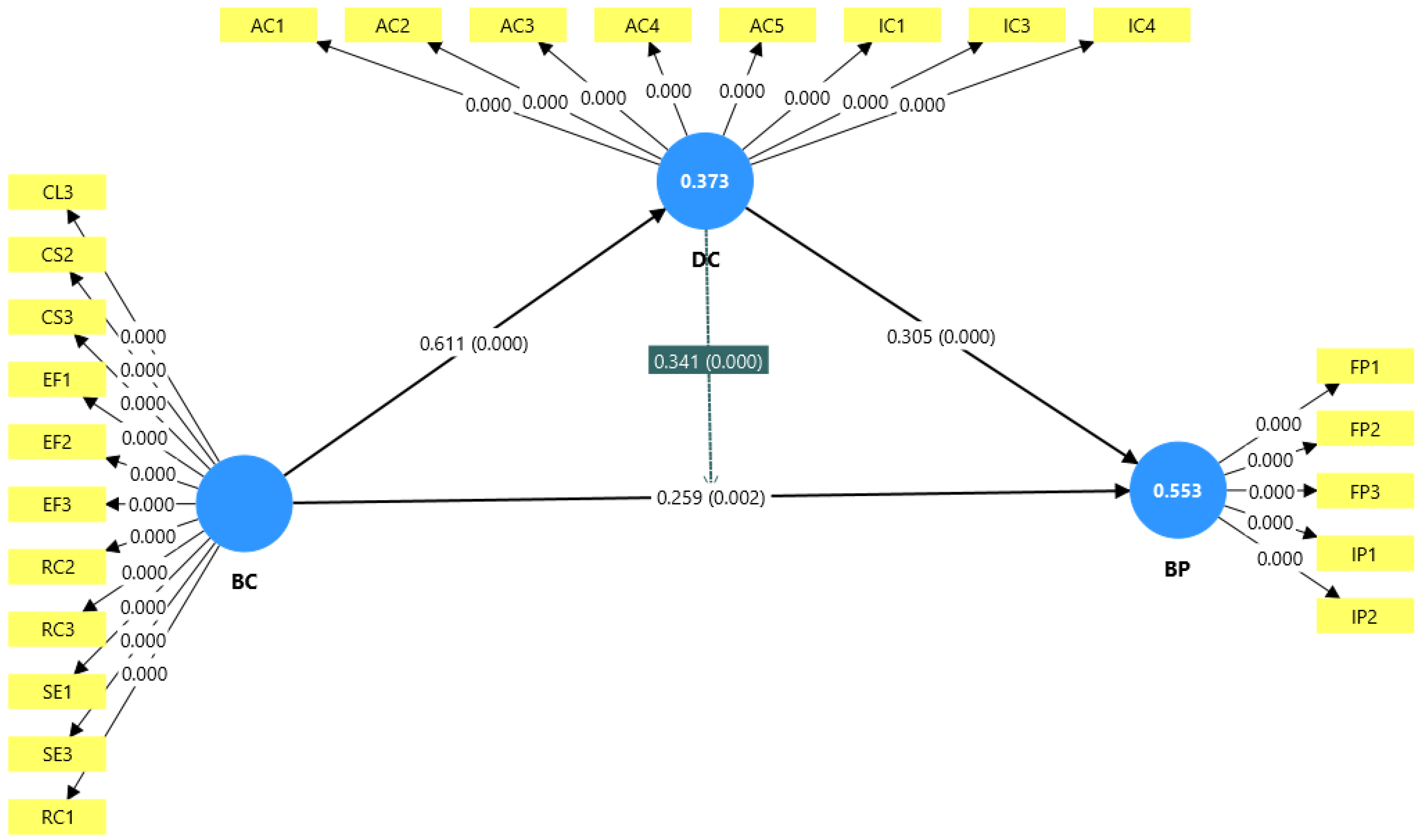

4. Results

4.1. Indirect Effects

4.2. Validating Higher Order Construct

5. Discussions and Implications

6. Conclusions

- Sample limitations: This study’s sample focused on banks, many of which may still be in the early stages of blockchain adoption. Banks with limited blockchain experience may not yet be fully capitalizing on their potential, leading to less dramatic performance improvements.

- The novelty of technology: Blockchain is still an emerging technology, and its widespread application across all banking operations remains limited.

- Many banks may still be in the pilot phase of blockchain projects, which limits observable performance improvements. The full benefits of blockchain adoption may only become apparent after further maturity and integration.

- Data processing tools: The tools used for data collection and analysis might not fully capture the complexity of the connections between Blockchain technology effects and performance. Future studies could benefit from more advanced data analytics tools to assess blockchain’s impact more comprehensively.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| BC | Blockchain Technology Effects |

| BP | Banks’ Performance |

| DC | Dynamic Capabilities |

References

- Lee, J.Y. A decentralized token economy: How blockchain and cryptocurrency can revolutionize business. Bus. Horizons 2019, 62, 773–784. [Google Scholar] [CrossRef]

- Leal, M.; Pisani, F.; Endler, M. A Multilayer Distributed Ledger Technology Architecture for Immutable Registry of Mobility and Location Information. In Proceedings of the 2022 IEEE 1st Global Emerging Technology Blockchain Forum: Blockchain & Beyond (iGETblockchain), Irvine, CA, USA, 7–11 November 2022; pp. 1–6. [Google Scholar] [CrossRef]

- Berentsen, A. Aleksander Berentsen Recommends “Bitcoin: A Peer-to-Peer Electronic Cash System” by Satoshi Nakamoto. In 21st Century Economics; Springer: Cham, Switzerland, 2019; pp. 7–8. [Google Scholar] [CrossRef]

- Ghossein, T.; Rana, A.N. Business Environment Reforms in Fragile and Conflict-Affected Situations; World Bank: Washington, DC, USA, 2022. [Google Scholar]

- Ghosh, A.; Gupta, S.; Dua, A.; Kumar, N. Security of Cryptocurrencies in blockchain technology: State-of-art, challenges and future prospects. J. Netw. Comput. Appl. 2020, 163, 102635. [Google Scholar] [CrossRef]

- Nawari, N.O.; Ravindran, S. Blockchain Technologies in BIM Workflow Environment. Comput. Civ. Eng. 2019, 2016, 343–352. [Google Scholar] [CrossRef]

- Juma, H. Cross-Border Trade Through Blockchain. In Proceedings of the II International Triple Helix Summit; Springer: Cham, Switzerland, 2020; pp. 165–179. [Google Scholar] [CrossRef]

- Kshetri, N. Blockchain Technology for Improving Transparency and Citizens’ Trust. In Advances in Information and Communication; Springer: Cham, Switzerland, 2021; pp. 716–735. [Google Scholar] [CrossRef]

- Allen, D.W.; Berg, C.; Davidson, S.; Novak, M.; Potts, J. International policy coordination for blockchain supply chains. Asia Pac. Policy Stud. 2019, 6, 367–380. [Google Scholar] [CrossRef]

- Hald, K.S.; Kinra, A. How the blockchain enables and constrains supply chain performance. Int. J. Phys. Distrib. Logist. Manag. 2019, 49, 376–397. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Del Vecchio, P.; Oropallo, E.; Secundo, G. Blockchain technology for bridging trust, traceability and transparency in circular supply chain. Inf. Manag. 2022, 59, 103508. [Google Scholar] [CrossRef]

- Khan, N.; Hossain, S.; Khadka, U.; Sarkar, S. Blockchain in Supply Chain Management: Enhancing Transparency, Efficiency, and Trust. Adv. Int. J. Multidiscip. 2024, 2. [Google Scholar] [CrossRef]

- Taskinsoy, J. The Great Silent Crash of the 21st Century. SSRN Electron. J. 2022, 2, 5. [Google Scholar] [CrossRef]

- Sakız, B.; Gencer, E.A.H. Cryptocurrencies, Blockchain Technology, and Sustainability. In Proceedings of the International Conference on Eurasian Economies, Baku, Azerbaijan, 2–4 September 2020; pp. 200–206. [Google Scholar] [CrossRef]

- Brennan, N.M.; Subramaniam, N.; van Staden, C.J. Corporate governance implications of disruptive technology: An overview. Br. Account. Rev. 2019, 51, 100860. [Google Scholar] [CrossRef]

- Tapscott, D.; Tapscott, A. How Blockchain Will Change Organizations. In What the Digital Future Holds; The MIT Press: Cambridge, MA, USA, 2018; pp. 43–56. [Google Scholar] [CrossRef]

- Kshetri, N. Will blockchain emerge as a tool to break the poverty chain in the Global South? Third World Q. 2017, 38, 1710–1732. [Google Scholar] [CrossRef]

- Carter, C.; Koh, L. Blockchain Disruption in Transport: Are You Decentralized Yet? 2018. Available online: https://trid.trb.org/View/1527923 (accessed on 15 July 2024).

- Carson, B.; Romanelli, G.; Walsh, P.; Zhumaev, A. Blockchain Beyond the Hype: What Is the Strategic Business Value; McKinsey & Company: New York, NY, USA, 2018; Volume 1, pp. 1–13. [Google Scholar]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 2018, 57, 2117–2135. [Google Scholar] [CrossRef]

- Swan, M. Anticipating the Economic Benefits of Blockchain. Technol. Innov. Manag. Rev. 2017, 7, 6–13. [Google Scholar] [CrossRef]

- Karafiloski, E.; Mishev, A. Blockchain solutions for big data challenges: A literature review. In Proceedings of the IEEE EUROCON 2017—17th International Conference on Smart Technologies, Ohrid, Macedonia, 6–8 July 2017. [Google Scholar] [CrossRef]

- Glaser, F.; Bezzenberger, L. Beyond Cryptocurrencies—A Taxonomy of Decentralized Consensus Systems. In Proceedings of the 23rd European Conference on Information Systems (ECIS), Münster, Germany, 1 March 2015. [Google Scholar]

- Miau, S.; Yang, J.-M. Bibliometrics-based evaluation of the Blockchain research trend: 2008–March 2017. Technol. Anal. Strat. Manag. 2018, 30, 1029–1045. [Google Scholar] [CrossRef]

- Kumari, A.; Devi, N.C. The Impact of FinTech and Blockchain Technologies on Banking and Financial Services. Technol. Innov. Manag. Rev. 2022, 12, 22010204. [Google Scholar] [CrossRef]

- Chowdhury, E.; Stasi, A.; Pellegrino, A. Blockchain technology in financial accounting: Emerging regulatory issues. Rev. Financ. Econ. 2023, 21, 862–868. [Google Scholar]

- Garg, P.; Gupta, B.; Chauhan, A.K.; Sivarajah, U.; Gupta, S.; Modgil, S. Measuring the perceived benefits of implementing blockchain technology in the banking sector. Technol. Forecast. Soc. Chang. 2021, 163, 120407. [Google Scholar] [CrossRef]

- Javaid, M.; Haleem, A.; Singh, R.P.; Suman, R.; Khan, S. A review of Blockchain Technology applications for financial services. BenchCouncil Trans. Benchmarks Stand. Eval. 2022, 2, 100073. [Google Scholar] [CrossRef]

- Gupta, A.; Gupta, S. Blockchain Technology Application in Indian Banking Sector. Delhi Bus. Rev. 2018, 19, 75–84. [Google Scholar] [CrossRef]

- Underwood, S. Blockchain beyond bitcoin. Commun. ACM 2016, 59, 15–17. [Google Scholar] [CrossRef]

- Casino, F.; Dasaklis, T.K.; Patsakis, C. A systematic literature review of blockchain-based applications: Current status, classification and open issues. Telemat. Inform. 2019, 36, 55–81. [Google Scholar] [CrossRef]

- Kant, N. Blockchain: A strategic resource to attain and sustain competitive advantage. Int. J. Innov. Sci. 2021, 13, 520–538. [Google Scholar] [CrossRef]

- Pilkington, M. Blockchain Technology: Principles and Applications. In Research Handbook on Digital Transformations; Edward Elgar Publishing: London, UK, 2016. [Google Scholar] [CrossRef]

- Libert, B.; Beck, M.; Wind, J. How Blockchain Technology Will Disrupt Financial Services Firms. Knowledge@Wharton. 2016. Available online: https://knowledge.wharton.upenn.edu/article/firms-can-become-resilient-new-normal/ (accessed on 10 June 2024).

- Mu, W.; Bian, Y.; Zhao, J.L. The role of online leadership in open collaborative innovation. Ind. Manag. Data Syst. 2019, 119, 1969–1987. [Google Scholar] [CrossRef]

- Beck, T.; Chen, T.; Lin, C.; Song, F.M. Financial innovation: The bright and the dark sides. J. Bank. Finance 2016, 72, 28–51. [Google Scholar] [CrossRef]

- English, S.M.; Nezhadian, E. Conditions of Full Disclosure: The Blockchain Remuneration Model. In Proceedings of the 2017 IEEE European Symposium on Security and Privacy Workshops (Eurocamp), Paris, France, 26–28 April 2017; pp. 64–67. [Google Scholar] [CrossRef]

- Gao, F.; Zhu, L.; Shen, M.; Sharif, K.; Wan, Z.; Ren, K. A Blockchain-Based Privacy-Preserving Payment Mechanism for Vehicle-to-Grid Networks. IEEE Netw. 2018, 32, 184–192. [Google Scholar] [CrossRef]

- Lundqvist, T.; de Blanche, A.; Andersson, H.R.H. Thing-to-thing electricity micro payments using blockchain technology. In Proceedings of the 2017 Global Internet of Things Summit (GIoTS), Geneva, Switzerland, 6–9 June 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Papadopoulos, G. Blockchain and digital payments: An institutionalist analysis of Cryptocurrencies. In Handbook of Digital Currency; Academic Press: Cambridge, MA, USA, 2015; pp. 153–172. [Google Scholar]

- Yamada, Y.; Nakajima, T.; Sakamoto, M. Blockchain-LI: A study on implementing activity-based micro-pricing using cryptocurrency technologies. In Proceedings of the 14th International Conference on Advances in Mobile Computing and Multi-Media, Singapore, 28–30 November 2016; pp. 203–207. [Google Scholar]

- Guo, Y.; Liang, C. Blockchain application and outlook in the banking industry. Financial Innov. 2016, 2, 24. [Google Scholar] [CrossRef]

- Isaksen, M. Blockchain: The Future of Cross-Border Payments. Master’s Thesis, University of Stavanger, Stavanger, Norway, 2018. [Google Scholar]

- Hassani, H.; Huang, X.; Silva, E. Banking with blockchain-ed big data. J. Manag. Anal. 2018, 5, 256–275. [Google Scholar] [CrossRef]

- Hitt, M.A.; Bierman, L.; Shimizu, K.; Kochhar, R. Direct and Moderating Effects of Human Capital on Strategy and Performance in Professional Service Firms: A Resource-Based Perspective. Acad. Manag. J. 2001, 44, 13–28. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. Sci. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Grech; Camilleri, A.F. Blockchain in Education; Publications Office of the European Union: Luxembourg, 2017. [Google Scholar]

- McKinsey & Company. Blockchain in Trade Finance: A New Era for Efficiency. 2019. Available online: https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-blockchain (accessed on 10 June 2024).

- BBVA. BBVA Uses Blockchain for Syndicated Loans. 2020. Available online: https://www.bbva.com/en/innovation/bbva-signs-world-first-blockchain-based-syndicated-loan-arrangement-with-red-electrica-corporacion/ (accessed on 10 June 2024).

- Accenture. Blockchain for KYC: Reducing Costs and Enhancing Compliance. 2021. Available online: https://www.accenture.com/nl-en/services/financial-services/alliance-quantexa-continuous-know-your-customer (accessed on 10 June 2024).

- Santander. Santander Launches Blockchain-Based International Payments. 2019. Available online: https://www.santander.co.uk/about-santander/media-centre/press-releases/santander-becomes-first-uk-bank-to-introduce-blockchain (accessed on 10 June 2024).

- Otto, M. Regulation (EU) 2016/679 on the protection of natural persons with regard to the processing of personal data and on the free movement of such data (General Data Protection Regulation—GDPR). In International and European Labour Law; Nomos: Baden-Baden, Germany, 2018; pp. 958–981. [Google Scholar] [CrossRef]

- Ripple. RippleNet: Transforming Global Payments. 2023. Available online: https://ripple.com/ripplenet/ (accessed on 10 June 2024).

- Deloitte. Blockchain in Banking: Streamlining KYC and Compliance. 2022. Available online: https://www2.deloitte.com/us/en/pages/about-deloitte/solutions/blockchain-digital-assets-insights.html (accessed on 10 June 2024).

- European Union. Directive (EU) 2018/843 of the European Parliament and of the Council of 30 May 2018 on the Prevention of the Use of the Financial System for the Purposes of Money Laundering or Terrorist Financing (5AMLD). Off. J. Eur. Union. 2018. Available online: https://eur-lex.europa.eu/eli/dir/2018/843/oj/eng (accessed on 15 June 2024).

- PwC. Global Consumer Insights Survey 2020: The Importance of Transparency. 2020. Available online: https://www.pwc.com/gx/en/issues/c-suite-insights/voice-of-the-consumer-survey.html (accessed on 10 June 2024).

- Wang, C.L.; Senaratne, C.; Rafiq, M. Success Traps, Dynamic Capabilities and Firm Performance. Br. J. Manag. 2014, 26, 26–44. [Google Scholar] [CrossRef]

- Barney, J. The resource-based view: Origins and implications. In The Blackwell Handbook of Strategic Management; Blackwell Ltd.: Cham, Switzerland, 2001. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and micro-foundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Weerawardena, J.; Mavondo, F.T. Capabilities, innovation and competitive advantage. Ind. Mark. Manag. 2011, 40, 1220–1223. [Google Scholar] [CrossRef]

- Teece, D.; Pisano, G. The Dynamic Capabilities of Firms: An Introduction. Ind. Corp. Chang. 1994, 3, 537–556. [Google Scholar] [CrossRef]

- Gundu, T. Learn, Unlearn and Relearn: Adaptive Cybersecurity Culture Model. Int. Conf. Cyber Warf. Secur. 2024, 19, 95–101. [Google Scholar] [CrossRef]

- Baden-Fuller, C.; Teece, D.J. Market sensing, dynamic capability, and competitive dynamics. Ind. Mark. Manag. 2020, 89, 105–106. [Google Scholar] [CrossRef]

- Petit, N.; Teece, D.J. Innovating Big Tech firms and competition policy: Favoring dynamic over static competition. Ind. Corp. Chang. 2021, 30, 1168–1198. [Google Scholar] [CrossRef]

- Pasquale, F. The Black Box Society; Harvard University Press: Cambridge, MA, USA, 2015. [Google Scholar] [CrossRef]

- Kant, N.; Agrawal, N. Developing a measure of climate strategy proactivity displayed to attain competitive advantage. Compet. Rev. Int. Bus. J. 2020, 31, 832–862. [Google Scholar] [CrossRef]

- Porter, M.E. Industry Structure and Competitive Strategy: Keys to Profitability. Financ. Anal. J. 1980, 36, 30–41. [Google Scholar] [CrossRef]

- Cater, T.; Pucko, D. How competitive advantage influences firm performance: The case of Slovenian firms. Econ. Bus. Rev. 2005, 7, 119–135. [Google Scholar]

- Arifin, Z.; Frmanzah. The Effect of Dynamic Capability to Technology Adoption and Its Determinant Factors for Improving Firm’s Performance; Toward a Conceptual Model. Procedia—Soc. Behav. Sci. 2015, 207, 786–796. [Google Scholar] [CrossRef]

- Ionescu, A.; Dumitru, N.R. The role of innovation in creating the company’s competitive advantage. Ecoforum J. 2015, 4, 99–104. [Google Scholar]

- Koufteros, X.A.; Nahm, A.Y.; Cheng, T.E.; Lai, K.-H. An empirical assessment of a nomological network of organizational design constructs: From culture to structure to pull production to performance. Int. J. Prod. Econ. 2007, 106, 468–492. [Google Scholar] [CrossRef]

- Zhang, J. The nature of external representations in problem solving. Cogn. Sci. 1997, 21, 179–217. [Google Scholar] [CrossRef]

- Li, S.; Ragu-Nathan, B.; Ragu-Nathan, T.; Rao, S.S. The impact of supply chain management practices on competitive advantage and organizational performance. Omega 2006, 34, 107–124. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Helfat, C.E.; Winter, S.G. Untangling Dynamic and Operational Capabilities: Strategy for the (N)ever-Changing World. Strat. Manag. J. 2011, 32, 1243–1250. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic Capabilities and Strategic Management. In Resources, Firms, and Strategies; Oxford Academic: Oxford, UK, 1997; pp. 268–285. [Google Scholar] [CrossRef]

- Blagoev, B.; Hernes, T.; Kunisch, S.; Schultz, M. Time as a Research Lens: A Conceptual Review and Research Agenda. J. Manag. 2023, 50, 2152–2196. [Google Scholar] [CrossRef]

- Wollersheim, J.; Heimeriks, K.H. Dynamic Capabilities and Their Characteristic Qualities: Insights from a Lab Experiment. Organ. Sci. 2016, 27, 233–248. [Google Scholar] [CrossRef]

- Dashkevich, N.; Counsell, S.; Destefanis, G. Blockchain Application for Central Banks: A Systematic Mapping Study. IEEE Access 2020, 8, 138918–139952. [Google Scholar] [CrossRef]

- Helfat, C.E.; Peteraf, M.A. Understanding dynamic capabilities: Progress along a developmental path. Strat. Organ. 2009, 7, 91–101. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive Capacity: A Review, Reconceptualization, and Extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Cohen, S.K.; Caner, T. Converting inventions into breakthrough innovations: The role of exploitation and alliance network knowledge heterogeneity. J. Eng. Technol. Manag. 2016, 40, 29–44. [Google Scholar] [CrossRef]

- Wang, C.L.; Ahmed, P.K. Dynamic capabilities: A review and research agenda. Int. J. Manag. Rev. 2007, 9, 31–51. [Google Scholar] [CrossRef]

- Lichtenthaler, U.; Lichtenthaler, E. A Capability-Based Framework for Open Innovation: Complementing Absorptive Capa-city. J. Manag. Stud. 2009, 46, 1315–1338. [Google Scholar] [CrossRef]

- Gallego-Gomez, C.; Unir; De-Pablos-Heredero, C. Artificial Intelligence as an Enabling Tool for the Development of Dynamic Capabilities in the Banking Industry. Int. J. Enterp. Inf. Syst. 2020, 16, 20–33. [Google Scholar] [CrossRef]

- European Commission. European Blockchain Services Infrastructure (EBSI). 2024. Available online: https://ec.europa.eu/digital-building-blocks/wikis/display/EBSI/Home (accessed on 10 June 2024).

- European Union. Regulation (EU) 2023/1114 on Markets in Crypto-Assets (MiCA). Off. J. Eur. Union. 2023. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=PI_COM:C(2024)906 (accessed on 10 June 2024).

- IBM. Blockchain for Supply Chain Finance: Enhancing Transparency. 2023. Available online: https://www.ibm.com/blockchain/solutions/supply-chain-finance (accessed on 15 June 2024).

- Deloitte. Blockchain in Capital Markets: Reducing Costs and Enhancing Efficiency. 2022. Available online: https://www2.deloitte.com/content/dam/Deloitte/us/Documents/Advisory/us-advisory-digital-assets-banking-and-capital-markets-regulatory-digest-may-2025.pdf (accessed on 10 June 2024).

- European Central Bank. The Digital Euro: Progress and Challenges. 2023. Available online: https://www.ecb.europa.eu/paym/digital_euro/html/index.en.html (accessed on 15 June 2024).

- Wong, S.; Yeung, J.K.W.; Lau, Y.-Y.; Kawasaki, T.; Kwong, R. A Critical Literature Review on Blockchain Technology Adoption in Supply Chains. Sustainability 2024, 16, 5174. [Google Scholar] [CrossRef]

- Treiblmaier, H.; Petrozhitskaya, E. Is it time for marketing to reappraise B2C relationship management? The emergence of a new loyalty paradigm through blockchain technology. J. Bus. Res. 2023, 159, 113725. [Google Scholar] [CrossRef]

- Fahy, J. The resource-based view of the firm: Some stumbling-blocks on the road to understanding sustainable competitive advantage. J. Eur. Ind. Train. 2000, 24, 94–104. [Google Scholar] [CrossRef]

- Morgan, N.A.; Vorhies, D.W.; Mason, C.H. Market orientation, marketing capabilities, and firm performance. Strat. Manag. J. 2009, 30, 909–920. [Google Scholar] [CrossRef]

- Tsai, M.T.; Shih, C.M. The impact of marketing knowledge among managers on marketing capabilities and business performance. Int. J. Manag. 2004, 21, 524–530. [Google Scholar]

- Guimarães, J.; Severo, E.; Vasconcelos, C. Sustainable Competitive Advantage: A Survey of Companies in Southern Brazil. Braz. Bus. Rev. 2017, 14, 352–367. [Google Scholar] [CrossRef]

- Harrington, K. Distributed autonomous learning framework. In Disruptive Technologies in Information Sciences II; SPIE Digital Library: Bellingham, WA, USA, 2019; p. 21. [Google Scholar] [CrossRef]

- McCauley, A. Unblocked: How Blockchains Will Change Your Business (and What to Do About It); O’Reilly Media, Inc.: Sebastopol, CA, USA, 2019. [Google Scholar]

- Esper, T.L.; Defee, C.C.; Mentzer, J.T. A framework of supply chain orientation. Int. J. Logist. Manag. 2010, 21, 161–179. [Google Scholar] [CrossRef]

- Prahalad, C.K.; Hamel, G. The Core Competence of the Corporation. In Strategische Unternehmungsplanung/Strategische Unternehmungsführung; Physica; Springer: Berlin/Heidelberg, Germany, 2006; pp. 275–292. [Google Scholar] [CrossRef]

- Ferreira, J.; Coelho, A.; Moutinho, L. Dynamic capabilities, creativity and innovation capability and their impact on competitive advantage and firm performance: The moderating role of entrepreneurial orientation. Technovation 2020, 92–93, 102061. [Google Scholar] [CrossRef]

- Seyedjafarrangraz, F.; De Fuentes, C.; Zhang, M. Mapping the global regulatory terrain in digital banking: A longitudinal study across countries. Digit. Policy, Regul. Gov. 2024, 27, 327–347. [Google Scholar] [CrossRef]

- Trani, A.H.; Tran, D.A. Customer experience and satisfaction with digital banking services. Proc. Int. Conf. Bus. Econ. Soc. Sci. Humanit. 2024, 7, 548–555. [Google Scholar] [CrossRef]

- Heubeck, T. Managerial capabilities as facilitators of digital transformation? Dynamic managerial capabilities as antecedents to digital business model transformation and firm performance. Digit. Bus. 2023, 3, 100053. [Google Scholar] [CrossRef]

- Probojakti, W.; Utami, H.N.; Prasetya, A.; Riza, M.F. Building Sustainable Competitive Advantage in Banking through Organizational Agility. Sustainability 2024, 16, 8327. [Google Scholar] [CrossRef]

- Churchill, G.A., Jr. A Paradigm for Developing Better Measures of Marketing Constructs. J. Mark. Res. 1979, 16, 64–73. [Google Scholar] [CrossRef]

- Nasa, P.; Jain, R.; Juneja, D. Delphi methodology in healthcare research: How to decide its appropriateness. World J. Methodol. 2021, 11, 116–129. [Google Scholar] [CrossRef]

- Krebs, F.; Engel, S.; Vennedey, V.; Alayli, A.; Simic, D.; Pfaff, H.; Stock, S.; on behalf of the Cologne Research and Development Network (CoRe-Net). Transforming Health Care Delivery towards Value-Based Health Care in Germany: A Delphi Survey among Stakeholders. Healthcare 2023, 11, 1187. [Google Scholar] [CrossRef]

- Guan, Z.; Zhang, Y.; Zhu, L.; Wu, L.; Yu, S. EFFECT: An efficient flexible privacy-preserving data aggregation scheme with authentication in smart grid. Sci. China Inf. Sci. 2019, 62, 32103. [Google Scholar] [CrossRef]

- Tripathi, G.; Ahad, M.A.; Casalino, G. A comprehensive review of blockchain technology: Underlying principles and historical background with future challenges. Decis. Anal. J. 2023, 9, 100344. [Google Scholar] [CrossRef]

- Habib, G.; Sharma, S.; Ibrahim, S.; Ahmad, I.; Qureshi, S.; Ishfaq, M. Blockchain Technology: Benefits, Challenges, Applications, and Integration of Blockchain Technology with Cloud Computing. Future Internet 2022, 14, 341. [Google Scholar] [CrossRef]

- Chang, V.; Baudier, P.; Zhang, H.; Xu, Q.; Zhang, J.; Arami, M. How Blockchain can impact financial services—The overview, challenges and recommendations from expert interviewees. Technol. Forecast. Soc. Chang. 2020, 158, 120166. [Google Scholar] [CrossRef]

- Yli-Huumo, J.; Ko, D.; Choi, S.; Park, S.; Smolander, K. Where Is Current Research on Blockchain Technology?—A Systematic Review. PLoS ONE 2016, 11, e0163477. [Google Scholar] [CrossRef]

- Fonseca, M.T.; Álvarez, M.R.; Domínguez, C.Q. Delphi method on transitions and access paths to master’s degrees in social sciences in Spain. In Education, Theory, Methods and Perspectives; 2021; Volume 1, pp. 248–258. [Google Scholar] [CrossRef]

- Mannan, M.; de Filippi, P.; Reijers, W. The Emergence of Blockchain Constitutionalism. In The Oxford Handbook of Digital Constitutionalism; Oxford University Press: Oxford, UK, 2024. [Google Scholar] [CrossRef]

- Chava, S.; Oettl, A.; Subramanian, A.; Subramanian, K. Bargaining Power, Banking Deregulation, and Innovation. SSRN Electron. J. 2012. Available online: https://ssrn.com/abstract=2110455 (accessed on 15 July 2024).

- Sharma, A.; Sharma, D.; Bansal, R. Emerging Role of Blockchain in Banking Operations: An Overview. In Contemporary Studies of Risks in Emerging Technology, Part A; Emerald Publishing Limited: Leeds, UK, 2023; pp. 1–12. [Google Scholar] [CrossRef]

- Ramchandra, M.V.; Kumar, K.; Sarkar, A.; Mukherjee, S.K.; Agarwal, K. Assessment of the impact of blockchain technology in the banking industry. Mater. Today Proc. 2022, 56, 2221–2226. [Google Scholar] [CrossRef]

- Garg, P.; Gupta, B.; Kapil, K.N.; Sivarajah, U.; Gupta, S. Examining the relationship between blockchain capabilities and organizational performance in the Indian banking sector. Ann. Oper. Res. 2023, 348, 1513–1546. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Danks, N.P.; Ray, S. An Introduction to Structural Equation Modeling. In Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R; Springer Nature Link: Berlin, Germany, 2021; pp. 1–29. [Google Scholar] [CrossRef]

- Patel, R.; Migliavacca, M.; Oriani, M.E. Blockchain in banking and finance: A bibliometric review. Res. Int. Bus. Finance 2022, 62, 101718. [Google Scholar] [CrossRef]

| Study | Focus Area | Key Findings | Results |

|---|---|---|---|

| Kshetri, 2022 [8] | Blockchain and strategic flexibility. | Smart contracts automate processes, reducing friction in dynamic environments. | Increased operational efficiency and faster response to market changes. |

| Tapscott and Tapscott, 2023 [16] | Trust and governance in blockchain ecosystems. | Blockchain reduces transaction costs and enhances trust in decentralized networks. | Improved governance structures and stakeholder collaboration. |

| Kouhizadeh et al., 2021 [20] | Blockchain in supply chain agility. | Blockchain improves transparency, traceability, and real-time decision-making. | Enhanced supply chain resilience and dynamic capability development. |

| Wong et al., 2022 [91] | Blockchain for innovation capabilities. | Decentralized systems foster collaborative innovation and knowledge sharing. | Firms leveraging blockchain exhibit higher innovation performance. |

| H.Treiblmaier, 2023 [92] | Dynamic capabilities in blockchain adoption. | Blockchain enables rapid reconfiguration of resources in response to disruptions. | Organizations achieve higher adaptability and competitive positioning. |

| Aspect | General Research Findings (Previous Summary) | Our focus—Banking-sector-specific |

| Scope | Cross-industry (supply chain, innovation, governance) | Exclusive focus on banking sector performance |

| Key Findings on Blockchain | - Supports dynamic resource allocation [8,92] - Enhances transparency, automation, and trust [16,20] | - Reduces fraud and intermediary costs - Improves transaction security, compliance, and operational efficiency in banks |

| Performance Metrics | - Strategic flexibility [8] - Supply chain resilience [20] - Innovation output [91] | - Customer satisfaction and regulatory compliance - Financial performance (ROA, cost efficiency) |

| Dynamic Capabilities (DCs) | - dynamic capabilities strengthened through agility, innovation, and collaboration [93,94] | - dynamic capabilities in banks rely on regulatory adaptation, customer trust, and rapid fintech integration |

| ID | Professional Profile | Years of Experience | Academic Qualification |

|---|---|---|---|

| 1. | Professor of Economy | +15 years | PhD in Business Org. |

| 2. | Professor of Economy | +12 years | PhD in Economics. |

| 3. | Professor of Economy | +10 years | PhD in Business Statistics |

| 4. | Professor of Business Administration | +20 years | PhD in Business Org. |

| 5. | ITC Manager | +15 years | Graduate in Technology |

| 6. | Network Analyst | +10 years | Degree in ICT |

| 7. | Group Head, Operations | +20 years | Graduate in Compliance |

| 8. | Head of IT | +15 years | Master in Cyber Security |

| 9. | Group Head, IT | +20 years | Graduate in Technology |

| 10. | Blockchain Specialist | +10 years | Degree in IT |

| 11. | Technologist | +10 years | Graduate in Technology |

| Question | Brief Explanation for Including the Question | Reference |

|---|---|---|

| Do you find it easy to use blockchain in your bank? | This question was to figure out whether banks are using blockchain technology or not | [79] |

| If you were able to use blockchain, would this help you plan your activities better? | This question was to figure out whether banks are using blockchain technology or not | [109] |

| How do you currently use blockchain technology? Select as many as you see possible | This question was to determine how blockchain is being used in banks | [27] |

| Do you find it hard to use blockchain that are appropriate for your products? | This question was to determine how blockchain is being used in banks | [27] |

| What information would you like to receive regarding blockchain efficiency? | This question was to determine blockchain efficiency | [110] |

| How would you rate the following functions of blockchain? | This question was to determine blockchain functionality | [31] |

| How should the system work? Perhaps other features you would like to see? | This question was to determine blockchain features | [36] |

| What blockchain technology do you use most at your bank? | This question was to determine blockchain usage | [111] |

| Which of these blockchain technology do you use less often? | This question was to determine blockchain usage | [111] |

| What information should be included in a blockchain? | This question was to determine blockchain features | [36] |

| What are the potentials of blockchain technology? | This question was to determine blockchain features | [36] |

| What are the dangers of blockchain technology? | This question was to determine blockchain security and safety | [112] |

| How do you mitigate against these dangers of using blockchain technology? | This question was to determine blockchain security and safety | [112] |

| How should blockchain work? Perhaps other features you would like to see? | This question was to determine blockchain functionality | [31] |

| What stops your bank from using blockchain? | This question was to determine blockchain adaptability | [115] |

| Does blockchain technology improve banks’ performance? | This question was to determine blockchain efficiency | [110] |

| Does blockchain technology speed up your transactions? | This question was to determine blockchain efficiency | [110] |

| Does blockchain technology provide more security for your transactions? | This question was to determine blockchain security and safety | [115] |

| Does blockchain technology improve customer satisfaction? | This question was to determine blockchain efficiency | [110] |

| Does blockchain technology reduce operational costs? | This question was to determine blockchain efficiency | [110] |

| Does the usage of blockchain technology comply with regulatory directives? | This question was to determine blockchain compliance with regulations | [116] |

| Does blockchain technology improve your banks’ efficiency? | This question was to determine blockchain efficiency | [110] |

| Does blockchain technology improve your bank’s financial performance? | This question was to determine blockchain efficiency | [110] |

| Does blockchain technology increase your banks’ market share? | This question was to determine blockchain performance | [117] |

| Does blockchain technology increase your banks’ ranking in the industry? | This question was to determine blockchain performance | [117] |

| Do you believe blockchain enhances your bank Absorption capacity? | This question was to determine bank’s blockchain capabilities | [118] |

| Do you believe blockchain improves your bank Adoption capacity? | This question was to determine bank’s blockchain capabilities | [118] |

| Do you believe blockchain boosts your bank detection capacity? | This question was to determine bank’s blockchain capabilities | [118] |

| Do you believe blockchain augments your bank Innovation capacity? | This question was to determine bank’s blockchain capabilities | [118] |

| Please state any other competitive advantages your bank enjoys from the use of blockchain technology. | This question was to determine bank’s competitive advantage using blockchain | [118] |

| Variables | Categories | Frequency | Response Rate (%) |

|---|---|---|---|

| Gender | Female | 67 | 39.4% |

| Male | 103 | 60.6% | |

| Age | 25–35 | 79 | 46.65% |

| 35–50 | 75 | 43.83% | |

| 51 and above | 16 | 9.25% |

| Path coefficient | |||||

| Original sample (o) | Sample mean (M) | Standard deviation (STDEV) | T-statistics ([O/STDEV]) | p-values | |

| BC → BP | 0.259 | 0.274 | 0.083 | 3.143 | 0.002 |

| BC → DC | 0.611 | 0.621 | 0.047 | 13.055 | 0.000 |

| DC → BP | 0.305 | 0.312 | 0.080 | 3.825 | 0.000 |

| DC x BC → BP | 0.341 | 0.326 | 0.061 | 5.565 | 0.000 |

| R-square | |||||

| Original sample (o) | Sample mean (M) | Standard deviation (STDEV) | T-statistics ([O/STDEV]) | p-values | |

| BP | 0.553 | 0.563 | 0.050 | 11.000 | 0.000 |

| DC | 0.373 | 0.387 | 0.057 | 6.494 | 0.000 |

| R-square adjusted | |||||

| Original sample (o) | Sample mean (M) | Standard deviation (STDEV) | T-statistics ([O/STDEV]) | p-values | |

| BP | 0.545 | 0.555 | 0.051 | 10.647 | 0.000 |

| DC | 0.369 | 0.384 | 0.058 | 6.391 | 0.000 |

| f-square | |||||

| Original sample (o) | Sample mean (M) | Standard deviation (STDEV) | T-statistics ([O/STDEV]) | p-values | |

| BC → BP | 0.085 | 0.106 | 0.065 | 1.311 | 0.190 |

| BC → DC | 0.595 | 0.647 | 0.157 | 3.783 | 0.000 |

| DC → BP | 0.126 | 0.142 | 0.075 | 1.681 | 0.093 |

| DC x BC → BP | 0.191 | 0.185 | 0.069 | 2.769 | 0.000 |

| Average Variance Extracted (AVE) | |||||

| Original sample (o) | Sample mean (M) | Standard deviation (STDEV) | T-statistics ([O/STDEV]) | p-values | |

| BC | 0.312 | 0.314 | 0.026 | 11.855 | 0.000 |

| BP | 0.385 | 0.387 | 0.029 | 13.464 | 0.000 |

| DC | 0.414 | 0.416 | 0.027 | 15.432 | 0.000 |

| Composite Reliability (rho_c) | |||||

| Original sample (o) | Sample mean (M) | Standard deviation (STDEV) | T-statistics ([O/STDEV]) | p-values | |

| BC | 0.830 | 0.828 | 0.018 | 45.121 | 0.000 |

| BP | 0.756 | 0.754 | 0.024 | 31.791 | 0.000 |

| DC | 0.848 | 0.848 | 0.015 | 58.062 | 0.000 |

| Composite Reliability (rho_a) | |||||

| Original sample (o) | Sample mean (M) | Standard deviation (STDEV) | T-statistics ([O/STDEV]) | p-values | |

| BC | 0.787 | 0.787 | 0.028 | 28.566 | 0.000 |

| BP | 0.617 | 0.618 | 0.050 | 12.314 | 0.000 |

| DC | 0.803 | 0.805 | 0.022 | 36.464 | 0.000 |

| DC x BC | 1.000 | 1.000 | 0.000 | n/a | n/a |

| Cronbach’s alpha | |||||

| Original sample (o) | Sample mean (M) | Standard deviation (STDEV) | T-statistics ([O/STDEV]) | p-values | |

| BC | 0.775 | 0.773 | 0.028 | 27.725 | 0.000 |

| BP | 0.607 | 0.604 | 0.047 | 13.011 | 0.000 |

| DC | 0.795 | 0.974 | 0.023 | 34.447 | 0.000 |

| Heterotrait-monotrait ratio (HTMT) | |||||

| Confidence intervals | |||||

| Original sample (o) | Sample mean (M) | 25% | 97.5% | ||

| BP ↔ BC | 0.868 | 0.870 | 0.725 | 1.012 | |

| DC ↔ BC | 0.761 | 0.763 | 0.654 | 0.863 | |

| DC ↔ BP | 0.819 | 0.825 | 0.686 | 0.960 | |

| Fornell-Larker Criterion | |||

| BC | BP | DC | |

| BC | 0.559 | ||

| BP | 0.614 | 0.621 | |

| DC | 0.611 | 0.613 | 0.643 |

| Total Indirect effects | |||||

| Original sample (o) | Sample mean (M) | Standard deviation (STDEV) | T-statistics ([O/STDEV]) | p-values | |

| BC → BP | 0.187 | 0.194 | 0.054 | 3.473 | 0.001 |

| Specific Indirect effects | |||||

| Original sample (o) | Sample mean (M) | Standard deviation (STDEV) | T-statistics ([O/STDEV]) | p-values | |

| BC → DC → BP | 0.187 | 0.194 | 0.054 | 3.473 | 0.001 |

| Total effects | |||||

| Original sample (o) | Sample mean (M) | Standard deviation (STDEV) | T-statistics ([O/STDEV]) | p-values | |

| BC → BP | 0.446 | 0.467 | 0.070 | 6.390 | 0.000 |

| BC → DC | 0.611 | 0.621 | 0.047 | 13.055 | 0.000 |

| DC → BP | 0.305 | 0.312 | 0.080 | 3.825 | 0.000 |

| DC x BC → BP | 0.341 | 0.326 | 0.061 | 5.565 | 0.000 |

| Original Sample (o) | Sample Mean (M) | Standard Deviation (STDEV) | T-Statistics ([O/STDEV]) | p Values | |

|---|---|---|---|---|---|

| BP ↔ BC | 0.614 | 0.624 | 0.049 | 12.512 | 0.000 |

| DC ↔ BC | 0.611 | 0.621 | 0.047 | 13.055 | 0.000 |

| DC ↔ BP | 0.613 | 0.621 | 0.050 | 12.333 | 0.000 |

| DC x BC ↔ BC | 0.491 | 0.478 | 0.067 | 7.295 | 0.000 |

| DC x BC ↔ BP | 0.603 | 0.587 | 0.046 | 13.015 | 0.000 |

| DC x BC ↔ DC | 0.437 | 0.427 | 0.072 | 6.091 | 0.000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ogunrinde, A.; De-Pablos-Heredero, C.; Montes-Botella, J.-L.; Fernández-Sanz, L. The Impact of Blockchain Technology and Dynamic Capabilities on Banks’ Performance. Big Data Cogn. Comput. 2025, 9, 144. https://doi.org/10.3390/bdcc9060144

Ogunrinde A, De-Pablos-Heredero C, Montes-Botella J-L, Fernández-Sanz L. The Impact of Blockchain Technology and Dynamic Capabilities on Banks’ Performance. Big Data and Cognitive Computing. 2025; 9(6):144. https://doi.org/10.3390/bdcc9060144

Chicago/Turabian StyleOgunrinde, Abayomi, Carmen De-Pablos-Heredero, José-Luis Montes-Botella, and Luis Fernández-Sanz. 2025. "The Impact of Blockchain Technology and Dynamic Capabilities on Banks’ Performance" Big Data and Cognitive Computing 9, no. 6: 144. https://doi.org/10.3390/bdcc9060144

APA StyleOgunrinde, A., De-Pablos-Heredero, C., Montes-Botella, J.-L., & Fernández-Sanz, L. (2025). The Impact of Blockchain Technology and Dynamic Capabilities on Banks’ Performance. Big Data and Cognitive Computing, 9(6), 144. https://doi.org/10.3390/bdcc9060144