The Shifting Geography of Innovation in the Era of COVID-19: Exploring Small Business Innovation and Technology Awards in the U.S.

Abstract

1. Introduction

2. Background

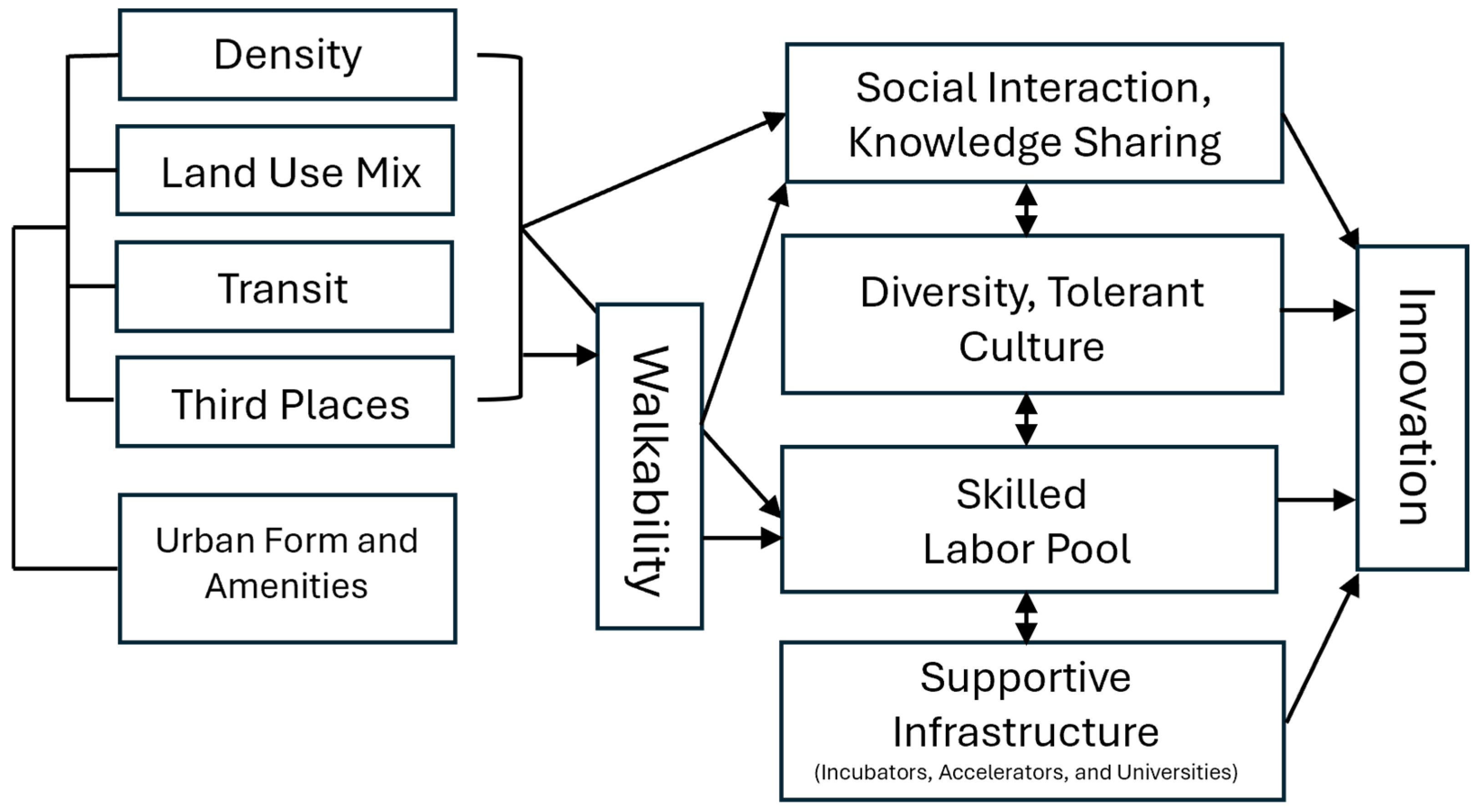

2.1. Innovation and the Built Environment

2.2. The Shifting Geography of Innovation and Startup Activity

3. Methods

3.1. Measuring Innovation: SBIR/STTR Awards

3.2. Intra-Urban Location and Urban Form

3.3. Statistical Analyses

4. Results

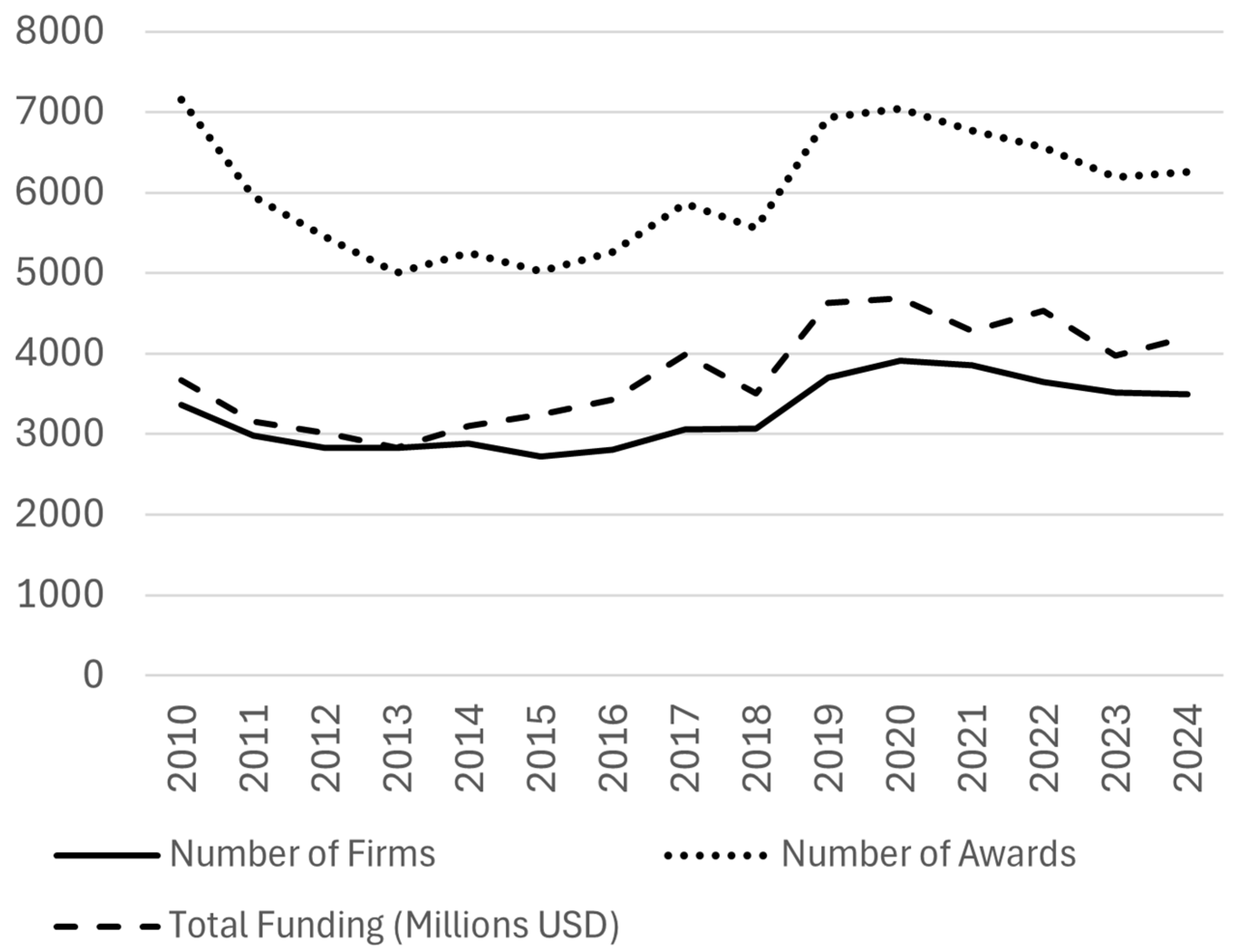

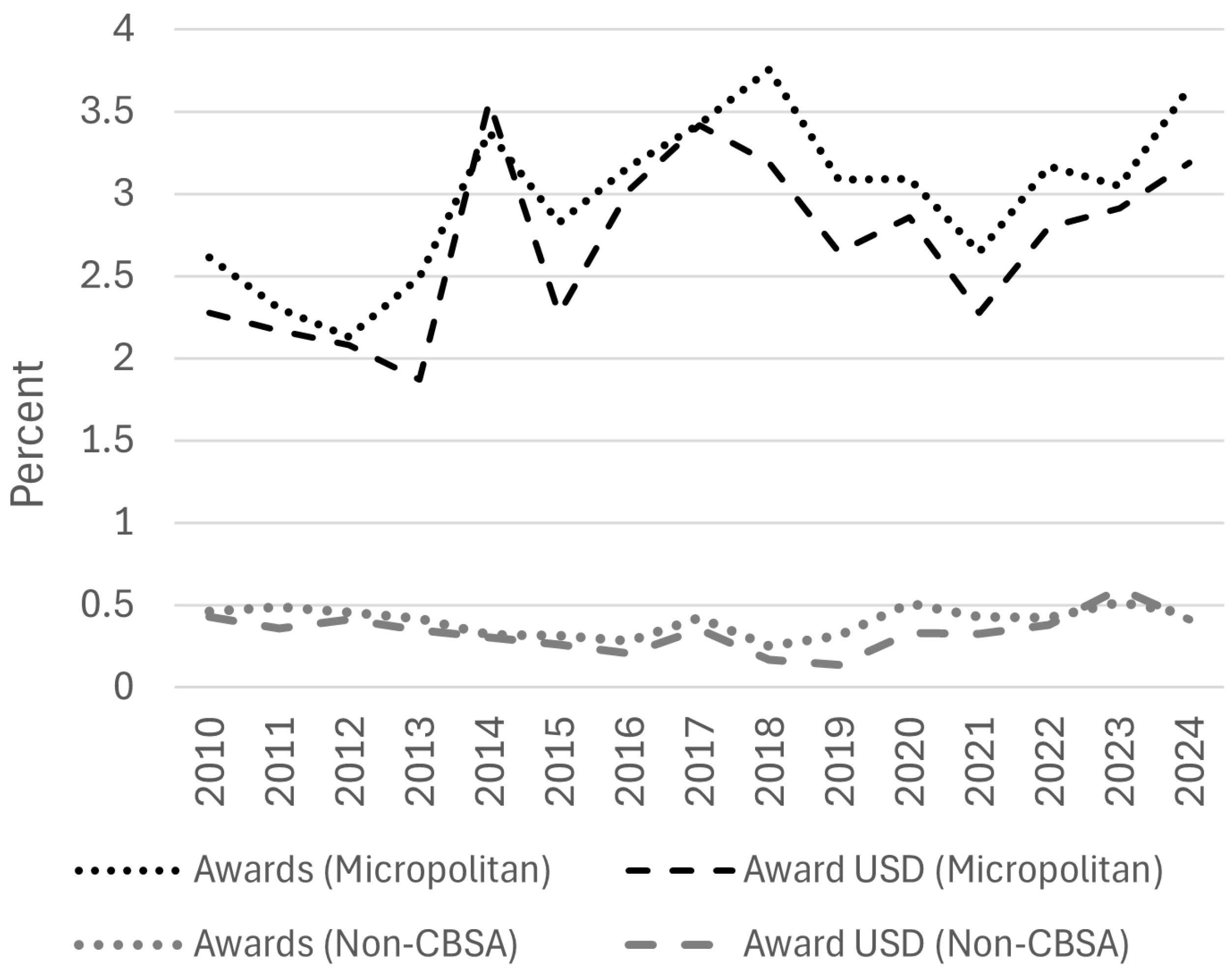

4.1. Number and Spatial Concentration of SBIR/STTR Awards

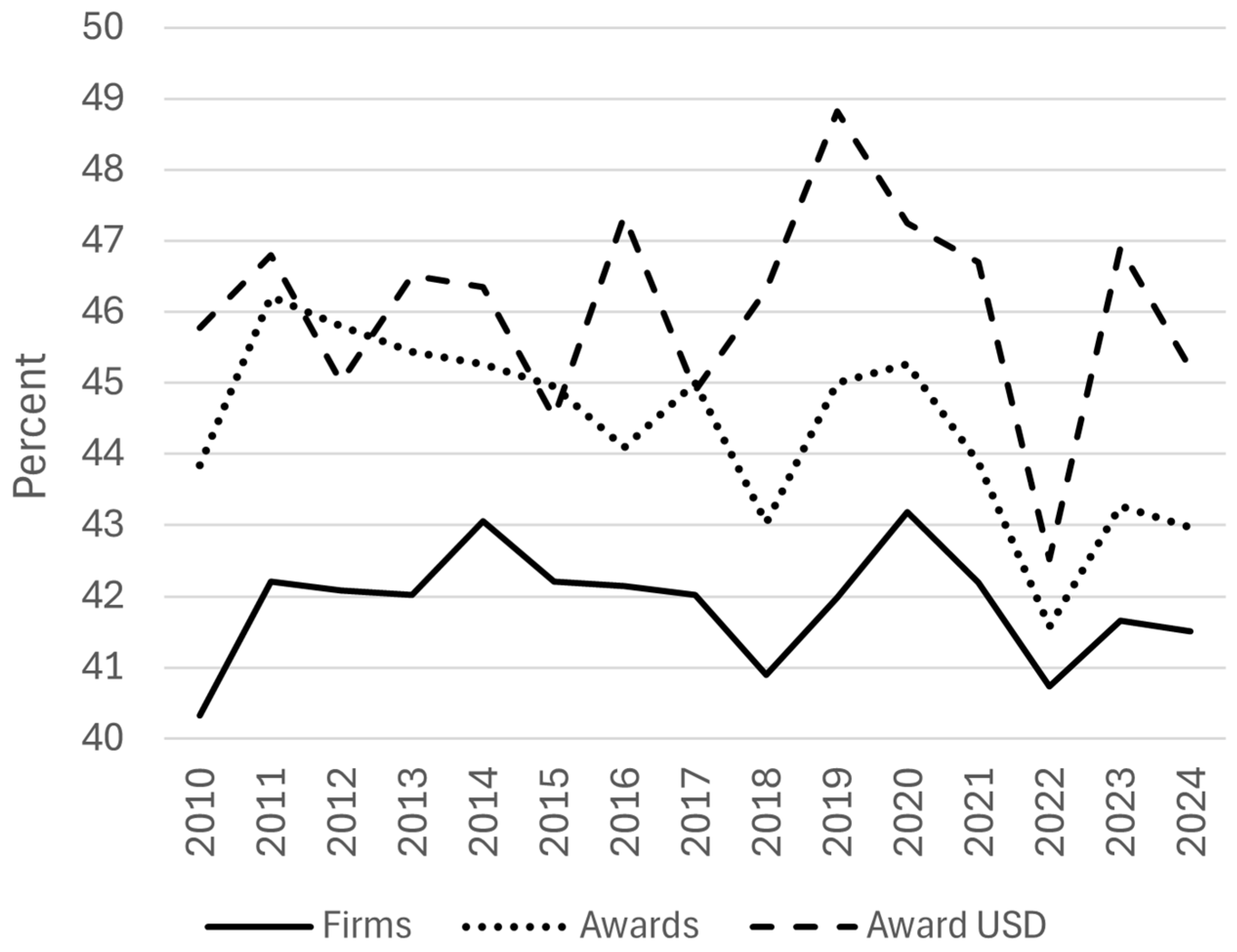

4.2. Firm Location, Neighborhood Walkability, and Transit Accessibility

4.3. Regression Analysis: Controlling for Confounding Locational Attributes

5. Discussion

6. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

References

- Florida, R.; Mellander, C. Rise of the Startup City: The Changing Geography of the Venture Capital Financed Innovation. Calif. Manag. Rev. 2017, 59, 14–38. [Google Scholar] [CrossRef]

- Adler, P.; Florida, R.; King, K.; Mellander, C. The city and high-tech startups: The spatial organization of Schumpeterian entrepreneurship. Cities 2019, 87, 121–130. [Google Scholar] [CrossRef]

- Balland, P.-A.; Jara-Figueroa, C.; Petralia, S.; Steijn, M.; Rigby, D.; Hidalgo, C.A. Complex economic activities concentrate in large cities. Nat. Hum. Behav. 2020, 4, 248–254. [Google Scholar] [CrossRef] [PubMed]

- Spencer, G.M. Knowledge neighbourhoods: Urban form and evolutionary economic geography. Reg. Stud. 2015, 49, 883–898. [Google Scholar] [CrossRef]

- Esmaeilpoorarabi, N.; Yigitcanlar, T.; Guaralda, M.; Kamruzzaman, M. Does place quality matter for innovation districts? Determining the essential place characteristics from Brisbane’s knowledge precincts. Land Use Policy 2018, 79, 734–747. [Google Scholar] [CrossRef]

- Bereitschaft, B. Are walkable places tech incubators? Evidence from Nebraska’s ‘Silicon Prairie’. Reg. Stud. Reg. Sci. 2019, 6, 339–356. [Google Scholar] [CrossRef]

- Yigitcanlar, T.; Abu-McVie, R.; Erol, I. How can contemporary innovation districts be classified? A systematic review of the literature. Land Use Policy 2020, 95, 104595. [Google Scholar] [CrossRef]

- Fritsch, M.; Wyrwich, M. Is innovation (increasingly) concentrated in large cities? An international comparison. Res. Policy 2021, 50, 104237. [Google Scholar] [CrossRef]

- Huggins, R.; Thompson, P. Cities, innovation and entrepreneurial ecosystems: Assessing the impact of the COVID-19 pandemic. Camb. J. Reg. Econ. Soc. 2022, 15, 635–661. [Google Scholar] [CrossRef]

- Mozaffarian, L.; Zandiatashbar, A.; Reyes-Sanchez, A. How Remote Working and Placelessness Affect Future Planning for Innovation Districts: A Systematic Review of the Literature. J. Plan. Lit. 2024, 40, 218–234. [Google Scholar] [CrossRef]

- Curran, D.; Lynn, T.; O’Gorman, C. The role of personal factors in the location decision of software services start-up firms. Eur. Plan. Stud. 2016, 24, 551–567. [Google Scholar] [CrossRef]

- Bryan, K.A.; Guzman, J. Entrepreneurial migration. Rev. Econ. Stat. 2023, 1–45. [Google Scholar] [CrossRef]

- Felzensztein, C.; Tretiakov, A. Technology adaptation: Micro new ventures in a COVID-19 lockdown. Int. J. Entrep. Behav. Res. 2023, 29, 1007–1026. [Google Scholar] [CrossRef]

- Battistella, C.; Nonino, F. Open innovation web-based platforms: The impact of different forms of motivation on collaboration. Innovation 2012, 14, 557–575. [Google Scholar] [CrossRef]

- Florida, R.; King, K. Rise of the Urban Startup Neighborhood: Micro-Clusters of Venture Capital and Startup Activity at the Neighborhood Level. Martin Prosperity Institute Working Paper Series, June 2016. Available online: https://creativeclass.com/_wp/wp-content/uploads/2019/11/2016-MPIWP-003_Rise-of-the-Urban-Startup-Neighborhood_Florida-King.pdf (accessed on 6 April 2025).

- Zandiatashbar, A.; Hamidi, S.; Foster, N.; Park, K. The missing link between place and productivity? The impact of transit-oriented development on knowledge and creative economy. J. Plan. Educ. Res. 2019, 39, 429–441. [Google Scholar] [CrossRef]

- Tang, H.; Zhang, J.; Fan, F.; Zhengwen, W. High-speed rail, urban form, and regional innovation: A time-varying difference-in-differences approach. Technol. Anal. Strateg. Manag. 2022, 36, 195–209. [Google Scholar] [CrossRef]

- Pancholi, S.; Yigitcanlar, T.; Guaralda, M. Place making for innovation and knowledge-intensive activities: The Australian experience. Technol. Forecast. Soc. Chang. 2019, 146, 616–625. [Google Scholar] [CrossRef]

- Yigitcanlar, T.; Pancholi, S.; Esmaeilpoorarabi, N.; Adu-McVie, R. Innovation District Planning: Concept, Framework, Practice; CRC Press: Boca Raton, FL, USA, 2024. [Google Scholar]

- Denham, T. The limits of telecommuting: Policy challenges of counterurbanisation as a pandemic response. Geogr. Res. 2021, 59, 514–521. [Google Scholar] [CrossRef]

- Lim, J.; Kang, E.; Lim, H.; Jung Won, S. Rise of work from home & post-pandemic urban form in global cities. J. Korea Plan. Assoc. 2023, 58, 5–26. [Google Scholar] [CrossRef]

- Hamidi, S.; Zandiatashbar, A. Does urban form matter for innovation productivity? A national multi-level study of the association between neighbourhood innovation and urban sprawl. Urban Stud. 2019, 56, 1576–1594. [Google Scholar] [CrossRef]

- Ewing, R.; Hamidi, S. Measuring Urban Sprawl and Validating Sprawl Measures; National Institutes of Health; Smart Growth America: Washington, DC, USA, 2014.

- Kotkin, J. The New Geography: How the Digital Revolution Is Reshaping the American Landscape; Random House: New York, NY, USA, 2001. [Google Scholar]

- Lindelöf, P.; Löfsten, H. Proximity as a Resource Base for Competitive Advantage: University–Industry Links for Technology Transfer. J. Technol. Transf. 2004, 29, 311–326. [Google Scholar] [CrossRef]

- Montoro-Sánchez, A.; Ortiz-de-Urbina-Criado, M.; Mora-Valentín, E.M. Effects of knowledge spillovers on innovation and collaboration in science and technology parks. J. Knowl. Manag. 2011, 15, 948–970. [Google Scholar] [CrossRef]

- Helmers, C. Choose the neighbor before the house: Agglomeration externalities in a UK science park. J. Econ. Geogr. 2019, 19, 31–55. [Google Scholar] [CrossRef]

- Garreau, J. Edge City: Life on the New Frontier; Doubleday: New York, NY, USA, 1991. [Google Scholar]

- Serrano, V.R.D. The intrametropolitan geography of knowledge-intensive business services (KIBS): A comparative analysis of six European and U.S. city-regions. Econ. Dev. Q. 2019, 33, 279–295. [Google Scholar] [CrossRef]

- Di Giacinto, V.; Micucci, G.; Tosoni, A. The agglomeration of knowledge-intensive business services firms. Ann. Reg. Sci. 2020, 65, 557–590. [Google Scholar] [CrossRef]

- Bereitschaft, B. Exploring the spatial intersection of small firm innovation, urban form, and demographics in the Washington, DC, metropolitan area. Prof. Geogr. 2023, 75, 1006–1023. [Google Scholar] [CrossRef]

- Glaeser, E.L. Learning in cities. J. Urban Econ. 1999, 46, 254–277. [Google Scholar] [CrossRef]

- Homan, S. Liveability and creativity. City Cult. Soc. 2014, 5, 149–155. [Google Scholar] [CrossRef]

- Oldenburg, R. The Great Good Place: Cafes, Coffee Shops, Bookstores, Bars, Hair Salons, and Other Hangouts at the Heart of a Community, 3rd ed.; Marlowe: Washington, DC, USA, 1999. [Google Scholar]

- Rantisi, N.M.; Leslie, D. Materiality and creative production: The case of the Mile End neighborhood in Montréal. Environ. Plan. A 2010, 42, 2824–2841. [Google Scholar] [CrossRef]

- Soares, I.; Weitkamp, G.; Yamu, C. Public spaces as knowledgescapes: Understanding the relationship between the built environment and creative encounters at Dutch university campuses and science parks. Int. J. Environ. Res. Public Health 2020, 17, 7421. [Google Scholar] [CrossRef]

- Coll-Martínez, E.; Méndez-Ortega, C. Agglomeration and coagglomeration of co-working spaces and creative industries in the city. Eur. Plan. Stud. 2023, 31, 445–466. [Google Scholar] [CrossRef]

- Madaleno, M.; Nathan, M.; Overman, H.; Waughts, S. Incubators, accelerators and urban economic development. Urban Stud. 2022, 59, 281–300. [Google Scholar] [CrossRef]

- Battistella, C.; Biotto, G.; De Toni, A.F. From design driven innovation to meaning strategy. Manag. Decis. 2012, 50, 718–743. [Google Scholar] [CrossRef]

- Verganti, R. Design as Brokering of Languages: Innovation Strategies in Italian Firms. Des. Manag. J. 2003, 14, 34–42. [Google Scholar] [CrossRef]

- Verganti, R. Design, Meanings, and Radical Innovation: A Metamodel and a Research Agenda. J. Prod. Innov. Manag. 2008, 25, 436–456. [Google Scholar] [CrossRef]

- Zukin, S. Seeing like a city: How tech became urban. Theory Soc. 2020, 49, 941–964. [Google Scholar] [CrossRef] [PubMed]

- Kayanan, C.M. A critique of innovation districts: Entrepreneurial living and the burden of shouldering urban development. Environ. Plan. A Econ. Space 2022, 54, 50–66. [Google Scholar] [CrossRef]

- Pratt, A.C. Urban Regeneration: From the Arts `Feel Good’ Factor to the Cultural Economy: A Case Study of Hoxton, London. Urban Stud. 2009, 46, 1041–1061. [Google Scholar] [CrossRef]

- Zukin, S. The Innovation Complex: Cities, Tech, and the New Economy; Oxford University Press: New York, NY, USA, 2020. [Google Scholar]

- Fang, L.; Rao, F. When industry diversity meets walkability: An analysis of innovation in Baltimore, United States, and Melbourne, Australia. J. Plan. Educ. Res. 2021, 44, 958–969. [Google Scholar] [CrossRef]

- Malizia, E.; Motoyoma, Y. Vibrant centers as locations for high-growth firms: An analysis of thirty U.S. metropolitan areas. Prof. Geogr. 2019, 71, 15–28. [Google Scholar] [CrossRef]

- Morisson, A. A Framework for Defining Innovation Districts: Case Study from 22@ Barcelona. In Urban and Transit Planning. Advances in Science, Technology & Innovation; Bougdah, H., Versaci, A., Sotoca, A., Trapani, F., Migliore, M., Clark, N., Eds.; Springer: Cham, Switzerland, 2020. [Google Scholar] [CrossRef]

- Makkonen, T.; Mitze, T. The geography of innovation in times of crisis: A comparison of rural and urban RDI patterns during COVID-19. Geogr. Ann. Ser. B Hum. Geogr. 2024, 106, 96–118. [Google Scholar] [CrossRef]

- Motoyama, Y. Where do high-growth firms go? GeoJournal 2023, 88, 493–510. [Google Scholar] [CrossRef]

- Samani, A.R.; Riahisamani, R.; Mishra, S.; Golias, M.M.; Jung-Hwi Lee, D. Evaluating relocation behavior of establishments: Evidence for the short-term effects of COVID-19. Environ. Plan. B Urban Anal. City Sci. 2024, 51, 2012–2030. [Google Scholar] [CrossRef]

- Fazio, C.E.; Guzman, J.; Liu, Y.; Stern, S. How Is COVID Changing the Geography of Entrepreneurship? Evidence from the Startup Cartography Project; National Bureau of Economic Research Working Paper 2021, No. 28787; National Bureau of Economic Research: Cambridge, MA, USA, 2021. [Google Scholar]

- Rosenthal, S.S.; Strange, W.C.; Urrego, J.A. JUE insight: Are city centers losing their appeal? Commercial real estate, urban spatial structure, and COVID-19. J. Urban Econ. 2022, 127, 103381. [Google Scholar] [CrossRef]

- Florida, R.; Rodríguez-Pose, A.; Storper, M. Critical commentary: Cities in a post-COVID world. Urban Stud. 2023, 60, 1509–1531. [Google Scholar] [CrossRef] [PubMed]

- Kotsubo, M.; Nakaya, T. Urban exodus or suburbanization? Medium-term COVID-19 pandemic impacts on internal migration in Japan. GeoJournal 2024, 89, 149. Available online: https://link.springer.com/article/10.1007/s10708-024-11162-y (accessed on 1 June 2025).

- Bereitschaft, B. The declining impact of walkability and transit accessibility on U.S. home values during the COVID-19 pandemic. J. Hous. Res. 2025. [Google Scholar] [CrossRef]

- SBIR.gov. Participating Federal Agencies. Small Business Innovation (SBIR) and Small Business Technology Transfer (STTR). U.S. Small Business Administration, Washington, D.C. Available online: https://www.sbir.gov/participating-agencies (accessed on 1 June 2025).

- NIH. Small Business Innovation Research Grants (SBIR)—Phase I (R43). National Institutes of Health: Bathesda, MD, USA. Available online: https://grants.nih.gov/funding/activity-codes/R43 (accessed on 1 June 2025).

- Rosenbloom, J.L. The geography of innovation commercialization in the United States during the 1990s. Econ. Dev. Q. 2007, 21, 3–16. [Google Scholar] [CrossRef]

- Onken, J.; Aragon, R.; Calcagno, A.M. Geographically-related outcomes of U.S. funding for small business research and development: Results of the research grant programs of a component of the National Institutes of Health. Eval. Program Plan. 2019, 77, 101696. [Google Scholar] [CrossRef]

- Chapman, J.; Fox, E.H.; Bachman, W.; Frank, L.D.; Thomas, J.; Reyes, A.R. Smart Location Database Technical Documentation and User Guide. Version 3.0; United States Environmental Protection Agency (EPA): Washington, DC, USA, 2021. Available online: https://www.epa.gov/system/files/documents/2023-10/epa_sld_3.0_technicaldocumentationuserguide_may2021_0.pdf (accessed on 20 April 2025).

- Thomas, J.; Reyes, R. National Walkability Index Methodology and User Guide; United States Environmental Protection Agency (EPA): Washington, DC, USA, 2021. Available online: https://www.epa.gov/sites/default/files/2021-06/documents/national_walkability_index_methodology_and_user_guide_june2021.pdf (accessed on 30 April 2025).

- Walk Score®. Walk Score Methodology. 2025. Available online: https://www.walkscore.com/methodology.shtml (accessed on 1 June 2025).

- Nelson, P.B.; Frost, W. Migration responses to the COVID-19 pandemic: A case study of New England showing movements down the urban hierarchy and ensuing impact on real estate markets. Prof. Geogr. 2022, 75, 415–429. [Google Scholar] [CrossRef]

- Zhao, P.; Gao, Y. Discovering the long-term effects of COVID-19 on jobs-housing relocation. Humanit. Soc. Sci. Commun. 2023, 10, 633. [Google Scholar] [CrossRef]

- Ilham, M.A.; Fonzone, A.; Fountas, G.; Mora, L. To move or not to move: A review of residential relocation trends after COVID-19. Cities 2024, 151, 105078. [Google Scholar] [CrossRef]

- Kane, K. How have American migration patterns changed in the COVID era? Growth Chang. 2024, 55, e12742. [Google Scholar] [CrossRef]

- Richter, S.M. Revisiting urban expansion in the continental United States. Landsc. Urban Plan. 2020, 204, 103911. [Google Scholar] [CrossRef]

- Heider, B.; Siedentop, S. Employment suburbanization in the 21st century: A comparison of German and US city regions. Cities 2020, 104, 102802. [Google Scholar] [CrossRef]

- Ray, R. Open for business? Effects of Los Angeles metro rail construction on adjacent businesses. J. Transp. Land Use 2017, 10, 725–742. [Google Scholar] [CrossRef]

- Iseki, H.; Jones, R.P. Analysis of firm location and relocation in relation to Maryland and Washington, DC metro rail stations. Res. Transp. Econ. 2018, 67, 29–43. [Google Scholar] [CrossRef]

- Day, J.P.; Veeroja, P.; Yang, X. From edge city to city? Planning intentions for edge cities. J. Am. Plan. Assoc. 2022, 88, 565–577. [Google Scholar] [CrossRef]

- Bereitschaft, B. No longer just work and play? Exploring recent residential growth within America’s “edge cities”. GeoJournal 2024, 89, 230. [Google Scholar] [CrossRef]

- Bhatia, A.; Cabreros, I.; Elkeurti, A.; Singer, E. Trump Has Cut Science Funding to Its Lowest Level in Decades. The New York Times. 22 May 2025. Available online: https://www.nytimes.com/interactive/2025/05/22/upshot/nsf-grants-trump-cuts.html (accessed on 1 June 2025).

- Drollette, D., Jr. The impact of DOGE’s funding cuts on biomedical research, from the point of view of former NIH director Monica Bertagnolli. Bull. At. Sci. 2025, 81, 202–207. [Google Scholar] [CrossRef]

- Science News Staff. Trump Proposes Massive Cuts to Research Spending. Funding for Key Science Agencies Would Be Cut in Half Under 2026 Budget Plan. Science. 8 May 2025. Available online: https://www.science.org/doi/pdf/10.1126/science.ady8072?casa_token=b20YfGOyeGEAAAAA:GE6hHVeiz7tzVmhufelzScSRLPKO81ejVqWspbeBEchAs_PVZ43GrFHNBPAjbgPYxubWIutmg4fNXkw (accessed on 15 May 2025).

- Howell, S.T. Financing innovation: Evidence from R&D grants. Am. Econ. Rev. 2017, 107, 1136–1164. [Google Scholar] [CrossRef]

- SBTC; SBIR: Small Business Innovating America. Testimony of Jere W. Glover, Executive Director Small Business Technology Council, Before the United States House Small Business Subcommittee on Economic Growth, Tax and Capital Access. Small Business Technology Council, Washington D.C. 16 April 2024. Available online: https://www.congress.gov/118/meeting/house/117064/witnesses/HHRG-118-SM27-Wstate-GloverJ-20240416.pdf (accessed on 1 June 2025).

- AAU. Frequently Asked Questions About Facilities and Administrative (F&A) Costs of Federally Sponsored University Research; Association of American Universities: Washington, DC, USA, 2025; Available online: https://www.aau.edu/key-issues/frequently-asked-questions-about-facilities-and-administrative-costs (accessed on 30 May 2025).

- NSF. Policy Notice: Implementation of Standard 15% Indirect Cost Rate; U.S. National Science Foundation: Alexandria, VA, USA, 2025. Available online: https://www.nsf.gov/policies/document/indirect-cost-rate (accessed on 10 May 2025).

| NWI | Walk Score® | Transit Service Freq. | |

|---|---|---|---|

| N | 49,385 | 49,385 | 39,479 a |

| Constant | 9.123 ** | −1.225 * | 0.127 ** |

| Phase II Award (≥1) | 0.056 * | −0.289 | −0.108 ** |

| STTR Award (≥1) | −0.053 | −0.741 ** | 0.010 |

| Ln Distance City Center | −0.420 ** | −3.388 ** | −0.329 ** |

| Ln Gross Activity Density | 0.872 ** | 9.274 ** | 0.495 ** |

| NWI | -- | 2.731 ** | 0.073 ** |

| Walk Score | 0.058 ** | -- | 0.023 ** |

| ≤1 km Rail Station | −0.186 ** | 7.933 ** | 0.850 ** |

| ≤1 km R1 University | −0.138 ** | 4.276 ** | 0.464 ** |

| ≤1 km Interstate Highway | 0.365 ** | −3.527 ** | −0.071 ** |

| Pre-COVID-19 Years 2015–2019 | 0.007 | 0.258 | 0.084 ** |

| COVID-19 Years 2020–2024 | −0.043 | 0.831 ** | 0.142 ** |

| Model Adjusted R2 | 0.540 | 0.636 | 0.723 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bereitschaft, B. The Shifting Geography of Innovation in the Era of COVID-19: Exploring Small Business Innovation and Technology Awards in the U.S. Urban Sci. 2025, 9, 296. https://doi.org/10.3390/urbansci9080296

Bereitschaft B. The Shifting Geography of Innovation in the Era of COVID-19: Exploring Small Business Innovation and Technology Awards in the U.S. Urban Science. 2025; 9(8):296. https://doi.org/10.3390/urbansci9080296

Chicago/Turabian StyleBereitschaft, Bradley. 2025. "The Shifting Geography of Innovation in the Era of COVID-19: Exploring Small Business Innovation and Technology Awards in the U.S." Urban Science 9, no. 8: 296. https://doi.org/10.3390/urbansci9080296

APA StyleBereitschaft, B. (2025). The Shifting Geography of Innovation in the Era of COVID-19: Exploring Small Business Innovation and Technology Awards in the U.S. Urban Science, 9(8), 296. https://doi.org/10.3390/urbansci9080296