1. Introduction

Smart cities fulfill multiple functions: they catalyze innovation, address urban challenges such as environmental sustainability and population pressures, and modernize infrastructure. Ultimately, they enhance the quality of life for residents through improved services and sustainable development while strengthening economic competitiveness. According to several studies, smart cities can promote innovation by positioning themselves as hubs for learning and innovation [

1,

2,

3,

4,

5,

6,

7,

8]. Smart cities have the potential to offer a “favorable environment” that stimulates creativity, promotes cooperation among many stakeholders, and eases the sharing of knowledge [

5]. Smart cities’ potential to stimulate innovation across diverse sectors, particularly communication, energy, and transportation. Further examined smart cities as mechanisms for fostering innovation in innovation-driven economies. They concluded that offering a “platform” for experimentation, co-creation, and knowledge sharing can help smart cities fulfill their potential as innovation hubs. Additionally, the European Commission has suggested that smart cities might serve as “testing grounds” for innovation by offering a “conducive environment” in which creative solutions based on collaboration between enterprises, academic institutions, and residents can be tested [

3,

8].

Additionally, recent international studies highlight that innovation ecosystems and smart specialization strategies are central to understanding how regions can foster sustainable and inclusive smart city development. The European Commission’s Joint Research Centre (2023) emphasizes that the “Smart Specialization Framework (S3)” has evolved to incorporate sustainability and inclusivity as core dimensions of regional innovation systems, enabling territories to leverage their unique strengths in knowledge and technology [

9]. Similarly, the OECD’s “Science, Technology and Innovation Outlook, 2023” stresses the “twin transitions” of digitalization and green growth, underscoring the role of mission-oriented innovation policies in strengthening regional resilience and competitiveness (OECD, 2023). More recently, the OECD report “Innovation Policy Transformed?” (2025) demonstrates that inclusion and sustainability are now as central to innovation agendas as digital transformation, reshaping how regional capacity is defined [

10]. Beyond policy, empirical research also points to the enabling role of digital finance and digital infrastructure in enhancing regional innovation capacity, particularly in emerging economies [

11]. These contemporary perspectives suggest that regional innovation capacity should no longer be seen as only a function of technological advancement, but rather as a multidimensional construct shaped by sustainability, inclusivity, and digital transformation. Integrating these insights provides a more up-to-date theoretical lens for examining how Egypt’s governorates can act as engines of innovation within the Vision 2030 framework.

Egypt Vision 2030 (launched February 2016) outlines a comprehensive framework for sustainable development. Smart cities are fundamental to this vision, with fourth-generation cities—the country’s newest urban developments—prioritized to achieve balanced regional development and promote innovation [

12]. Compared to the previous generation of Egyptian new cities, this new generation of cities places a greater focus on innovation, sustainability, and the use of ICT [

13,

14]. The fourth generation of new cities is currently being developed. Egypt Vision 2030 envisions a future filled with fourth-generation cities that would bring innovation to every region of the nation. Egypt has already started implementing its ambitious plan, building 14 new fourth-generation cities across several governorates based on this vision. With a combined land area of 380,000 acres, these ambitious cities represent over half of all urban growth undertaken in the past 40 years. They are designed to house 14 million people and provide 6 million jobs [

15].

Smart cities have progressed beyond tech-fix solutions, now striving to spark innovation and balanced regional development [

1,

2,

7]. Egypt’s new smart cities reflect this trend, attempting to alleviate population issues while nurturing innovation hubs. Egypt Vision 2030 emphasizes that these new cities must have a strong innovation ecosystem to develop into true innovation hubs. Policymakers are confident that millions of highly educated and competent individuals will flock to these new cities, which will have cutting-edge urban services made possible by advanced technology. There are two benefits to the influx of people into new cities. On the one hand, this is anticipated to lead to a more balanced geographical distribution and ease urban tensions in other large Egyptian cities that arose from fast population development. On the other hand, Egyptian officials figured out that making the new cities hubs of innovation means getting lots of smart and skilled people to live there.

The extensive international literature examines smart cities as innovation ecosystems, with previous research emphasizing the critical role of technological advancement, innovation, and knowledge sharing, particularly in developed regions [

2,

7]. Nevertheless, there is still a dearth of empirical evidence regarding smart city development strategies in Egypt and other developing countries. Further, the Egyptian smart city development process did not include a thorough quantitative evaluation of the regional innovation capacity of the governorates hosting the new smart cities. The purpose of the current study is to address the research gap by evaluating Egyptian governorates’ innovative capacity and their potential to serve as innovation hubs for the growth of these new, fourth-generation smart cities. This study develops a Regional Innovation Capacity Index (RICI) using cluster analysis and spatial autocorrelation analysis to thoroughly examine regional innovation disparities.

The innovation potential of the new smart cities is closely linked to the existing capacities of the governorates where they are being developed. Nevertheless, Egyptian smart city planning processes have failed to incorporate comprehensive assessments of regional innovation capacity. Consequently, this study analyzes the potential of fourth-generation smart cities to promote balanced, innovation-driven regional development. Since implementation is still ongoing, the effectiveness of the Egyptian smart city program cannot be fully assessed at this stage. Instead, the research focuses on identifying which governorates are most likely to support the innovation-driven smart city concept, with the aim of determining which regional innovation systems are sufficiently developed to enable effective policy implementation.

This study contributes a novel approach by analyzing how Egyptian regions’ innovation capacities align with their smart city development strategies. This research contributes to the literature by evaluating both regional innovation capacities and their correspondence with proposed smart city initiatives. This methodology assists decision-makers in identifying regional innovation challenges and potentials, specifically regarding Egypt’s Vision 2030 development framework. This research results offer practical suggestions for strengthening capabilities in struggling governorates, which helps foster inclusive and sustainable regional development. This paper is organized into four main sections: it begins by explaining what regional innovation capability means, followed by outlining the assessment methods used; then, it presents the results of different analyses, and concludes with a discussion of key discoveries and their relevance to policy.

2. Towards a Comprehensive Framework for Defining Innovation Capacity

Understanding the innovation capacity of smart cities requires examining the concepts of smart cities and innovation. In essence, a smart city is an urban setting that combines sustainability, technology, and governance to enhance economic growth, environmental quality, and the welfare of its residents. However, the definition of smart cities varies depending on different perspectives. Smart cities integrate digital infrastructure and urban design concepts to produce cities that are not only technologically sophisticated but also distinctive in their identity and planning, emphasizing urban competitiveness, distinctiveness, and singularity [

16]. They contend that to guarantee uniqueness rather than conformity, smart cities need to take placemaking and socio-morphological features to ensure uniqueness rather than homogeneity. According to Chowhan, Sen, and Mukherjee [

16], smart cities are commonly embedded within neoliberal urban restructuring processes, where technology-driven development is presented as a panacea for urban challenges [

17]. They emphasize the necessity to assess whether smart cities primarily serve governance and economic interests or achieve social and environmental sustainability. More recently, Mills conceptualizes smart city capacities as a combination of exploiting technology, fostering innovation, promoting cross-sector collaboration, and orchestrating within complex institutional settings [

18]. José et al. highlight key innovation challenges, including strategic vision, organizational agility, ecosystem development, and alignment with digital transformation, that determine whether smart cities can deliver on their promises [

19,

20]. Otherwise, Tutak underscores the critical role of stakeholder collaboration and open innovation in producing inclusive smart city outcomes [

20].

In this context, innovation refers to cities’ ability to create, adopt, and maintain novel concepts, technology, and governance structures that propel urban change. Chowhan et al. contend that smart city innovation predominantly involves ICT-enabled solutions and infrastructure aimed at optimizing urban operations [

17]. They also criticize the top-down approach used in many smart city projects, which may ignore the socioeconomic and environmental realities of the local area. However, Abusaada & Elshater stress that innovation should be viewed as a multifaceted process that encompasses not just technology developments but also social involvement, urban regulations, and sustainable design practices that promote the uniqueness and identity of cities [

16].

To clarify how innovation capacity operates within smart cities, it is essential to situate smart cities as innovation ecosystems, rather than solely technology-driven urban initiatives. Jacques demonstrates that smart city systems embody innovative urban management strategies that address complex urban challenges through governance and technological adaptation [

21]. Beckers further highlights that integrating innovation into smart city governance is important for enabling cities to transition from infrastructure automation toward reflective and innovative decision-making processes [

22]. Also, Almulhim, in a systematic literature review, underscores that urban resilience in smart city planning depends on fostering inclusiveness, stakeholder engagement, and sustainability, all key dimensions of innovation capacity [

23]. Ivaldi et al. provide empirical evidence that national innovation trajectories determine smart city models and their innovation outcomes, underscoring the necessity of incorporating regional institutional and policy contexts into innovation capacity evaluations [

24]. Extending this perspective, Gupta presents a multi-level framework for cultivating capabilities such as innovation orchestration and institutional coordination within smart city ecosystems [

25].

The ability of a region to create, adapt, and promote innovation within a specific geographical area while producing economic benefits is known as regional innovation capacity (RIC). It consists of the abilities, assets, and circumstances present in an area that support and foster innovation-driven endeavors. In economic geography, this idea has gained traction, particularly when considering a knowledge-based economy. RIC affects the results of innovation-related efforts. It describes a region’s or nation’s capacity for innovation, including introducing novel products, services, protocols, ideas, and processes exclusive to that region [

26]. Based on Balconi et al. and Pournasr, innovation capacity serves as a conduit, converting motivational and inspiring inputs into tangible outcomes such as innovations in products and processes [

26,

27].

Regional innovation capability is commonly measured using indicators such as R&D investment, human capital, infrastructure, knowledge generation, knowledge usage, and innovation support institutions [

28,

29]. The regulatory environment [

30,

31], culture [

32,

33], and financing availability are only a few of the many factors that also affect a region’s capacity for innovation [

34,

35]. The attitudes and concepts that promote creativity, such as a willingness to take risks and a tolerance for failure, make up the innovation culture. The laws and rules that control innovation and have a significant impact on an organization’s ability to innovate are part of the regulatory environment. Furthermore, the term “funding availability” refers to the accessibility of grants, loans, and other sources of money for innovation, all of which can be major barriers to innovation for small and medium-sized enterprises. Analyzing regional innovation capacity requires taking into account the important elements and characteristics mentioned above.

Regional innovation capacity encompasses a region’s potential and resources for innovation, whereas regional innovation system describes the processes, networks, and interactions that enable innovation activities. Since these concepts are interrelated and necessary to understand and foster innovation in a particular region, the literature views regional innovation capacity as an indicator of the effectiveness of the RIS.

3. Methods and Data

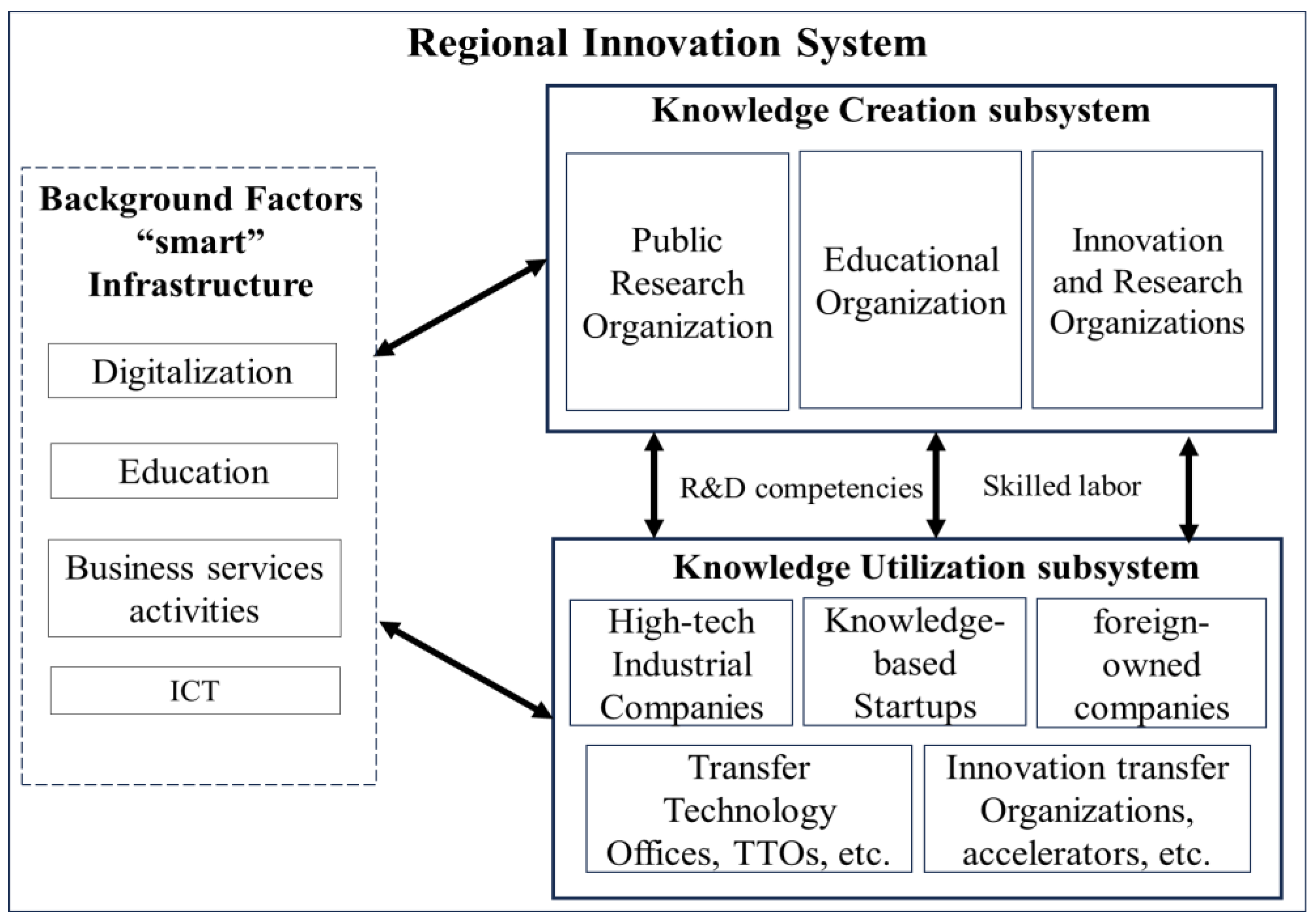

This study developed the Regional Innovation Capacity Index (RICI), a composite indicator designed to measure innovation capacity among Egyptian governorates. Using Trippl’s conceptual framework model, which outlines the fundamental components of a regional innovation system (RIS), the study examined the capacity for regional innovation [

36]. RIS structure can be understood through three critical dimensions: knowledge creation, knowledge exploitation, and the foundational infrastructure that supports these processes [

36]. In order to provide a more complete view of the innovation potential of Egyptian governorates, the current study uses this conceptual framework to examine the subsystems of the Regional Innovation System.

Knowledge Creation subsystem: The Knowledge Creation subsystem is the beating heart of a Regional Innovation System: It is a humming network of organizations that produce knowledge and skills [

36,

37]. From research centers to universities and patent offices, they work together seamlessly to unlock new scientific and technological advancements [

38]. However, for this engine to truly roar, smooth exchange and coordination among these players is crucial [

39].

Knowledge Utilization subsystem is a crucial component of a Regional Innovation System (RIS), which is a complex web that connects ideas to impact. Unlike a closed loop, RIS comprises knowledge creation, application, and exploitation that are all intricately woven together by influencing policies [

40]. According to Pournasr, it involves identifying opportunities, bringing in outside knowledge, integrating it with current expertise, and using it to drive innovation [

26]. This is where the knowledge exploitation subsystem, which emphasizes the private sector’s capacity to convert concepts into concrete results, comes into play [

39]. Its primary competency is obtaining, comprehending, and utilizing knowledge from a variety of sources, including industry partners and research institutions. However, the Knowledge Utilization subsystem shines due to its emphasis on the business side of the equation [

36]. It serves as the critical link, ensuring that the knowledge generated is not just filed away but rather converted into useful outputs that directly support the region’s capacity for innovation and economic growth. In order to demonstrate this interdependence,

Figure 1 presents the effects of R&D skills and skilled labor on knowledge generation and utilization. By bridging the knowledge creation and application gaps, the Knowledge Utilization subsystem essentially acts as the spark that ignites the engine of regional innovation, laying the groundwork for sustained development and economic prosperity.

Figure 1.

Key components of a theoretical framework for RIS performance assessment. Source: Own modification of [

36].

Figure 1.

Key components of a theoretical framework for RIS performance assessment. Source: Own modification of [

36].

Background factors “smart” infrastructure subsystem: Picture a thriving city or regional innovation system (RIS) in which the “smart” infrastructure subsystem, like the city’s complex network of roads, utilities, and services, provides the necessary framework for everything to run smoothly. The “smart” infrastructure subsystem, which was developed in the period of globalization, is at the center and provides the foundation for the two main activities: knowledge creation and knowledge utilization [

41]. In other words, the “smart” infrastructure subsystem functions as the unseen engine that powers a RIS, quietly laying the foundation for knowledge creation, utilization, and eventually, regional prosperity [

39]. It includes both tangible and intangible aspects that support an ecosystem within a RIS. A RIS with a strong smart infrastructure lays the groundwork for innovation to flourish.

This research adapts the empirical framework developed by Bajmócy and Kanó for evaluating innovation performance in Hungarian subregions to examine innovation capacity among Egyptian governorates [

39]. Their approach includes three key analytical elements: developing a composite indicator, conducting K-means cluster analysis, and performing spatial autocorrelation analysis. We implement this proven methodology in its entirety, with minor adaptations to accommodate the Egyptian regional context and available data sources. The application of their framework allows for a systematic and comprehensive evaluation of regional innovation capacity across Egypt’s administrative divisions.

Following Bajmócz and Kanó’s theoretical framework, indicators for the three sub-indices were systematically selected and defined [

39]. This methodology emphasized using their original indicators whenever Egyptian data permitted, thereby ensuring consistency and comparability. However, recognizing the distinct data landscape and institutional characteristics of Egypt’s governorates, we developed theoretically aligned proxy indicators when direct equivalents were unavailable. Three criteria guided indicator selection: (1) theoretical alignment with innovation capacity dimensions—knowledge creation, utilization, and smart infrastructure; (2) reliability and availability in Egyptian data sources; and (3) demonstrated ability to capture underlying sub-index constructs. Each proxy indicator maintains the conceptual integrity of the original framework while adapting to the specific regional innovation ecosystem of Egypt. This approach ensures that our Regional Innovation Capacity Index (RICI) remains theoretically grounded while being practically applicable to the Egyptian governorates structure and available statistical resources.

There are three stages involved in developing the Regional Innovation Capacity Index (RICI) composite indicator for Egypt’s governorates.

Initially, indicators were systematically selected for each sub-index: knowledge creation, knowledge utilization, and smart infrastructure (see

Table 1). Following the deductive approach established in our theoretical framework, we began with these predetermined sub-index categories and then identified specific indicators that would effectively measure each dimension of regional innovation capacity. Each sub-index employed indicators selected for their theoretical relevance to the innovation capacity dimension, reliability and availability within Egyptian datasets, and potential to differentiate among governorates. This process resulted in a total of 18 indicators strategically distributed across the three sub-indices, ensuring that each component of regional innovation capacity was adequately represented in our composite measure. Each sub-index was thus constructed from its respective set of theoretically grounded indicators that collectively capture the multidimensional nature of regional innovation capacity.

The knowledge creation sub-index focuses on variables that indicate research, development, and higher education. The indicators chosen include the number of R&D performing units (scientific research and development), total staff of R&D units, number of scientists with a PhD, number of teaching staff of higher education, expenditure R&D for higher education and government centers, number of patents, number of employees in scientific and research centers, and number of scientific and research centers. It is worth mentioning that, due to the limited availability of disaggregated regional data, especially regarding private-sector R&D and knowledge utilization, certain proxies had to be adopted. In particular, patent applications were used as a proxy for innovation activity, following international practice in regional innovation studies, even though they capture only part of the innovation spectrum. This methodological choice ensured that the framework remained comprehensive and comparable, while acknowledging that informal and non-technological innovation processes could not be fully represented in the index.

The knowledge utilization sub-index includes measures focusing on the private sector’s ability to exploit knowledge and innovation within the Regional Innovation System. Consequently, it includes indicators for the “Number of knowledge-based startups” as well as “Accelerators and business incubators.” The latter indicator is included in the knowledge utilization sub-index since it used knowledge provided by the education and research communities, such as patents. The knowledge utilization sub-index incorporates three key indicators: technology transfer and application offices, foreign-owned companies, and the location quotient of high-tech industries relative to total industries. The location quotient specifically measures a region’s knowledge absorption capacity through its high-tech industrial base.

The “smart” infrastructure sub-index includes the factors necessary for the operation of the other two sub-indices, notably the presence of “talent.” This sub-index includes five indicators: “the number of full-time students enrolled in higher education,” “the number of employees in the ICT sector,” “the number of innovative service provider units,” “the percentage of the population using the Internet,” and “the number of employees engaged in innovation-based business service activities.”

A total of eighteen indicators were collected and divided into three sub-indices to construct the composite indicator of regional innovation capabilities in Egyptian governorates.

The second stage involves calculating the three sub-indices and, in the end, the RICI from the dataset generated. The following steps are part of the RICI’s operationalization:

- (1)

Determining the RICI’s general structure.

- (2)

Determining the RICI sub-indexes’ indicator composition.

- (3)

Sub-index values calculation

Knowledge creation subindex

Knowledge utilization subindex

“Smart” infrastructure subindex

- (4)

Establishing the total RICI value

The methodological steps are explained in full in the following (Using SPSS 23 statistical software, the phases of the initial analysis of the methodology were implemented to create a composite indicator and sub-indicators of the Egyptian governorates’ capacity for innovation.):

Reliability Analysis: To ascertain whether these sub-indicators should be utilized in conjunction to create a composite indicator and to assess the degree of consistency between them, the indicators are first put through a reliability analysis.

Imputation of missing data: Since the indicators used in the dataset had no missing values, there was no need to impute any missing data.

Standardization: Because there are many spatial units, we analyzed the data for indicators for each governorate by normalizing them by population.

Data Normalization: Since indicators in a dataset frequently have different measurement units, this step is essential before aggregating the data. To find the normalized value for each sub-indicator, subtract the minimum value from the indicator value, divide the result by the indicator range (the difference between the indicator maximum and minimum values), and each rescaled value will fall between 0 and 1. The following equation is used to normalize the indicator:

, where is the value of the indicator, and are the minimum and maximum values of the indicator. Thus, the indicators that are normalized have values ranging from 0 where to 1 where .

- 5.

Sub-index aggregation: The arithmetic average approach is used to determine the values of the indicators associated with each sub-index, which in turn determines the various sub-indices.

- 6.

Calculation of the RICI:

where

i = 1, 2,…,

n represents the respective region.

t represents the indicator type/dimension,

q represents the geographic region,

c represents the country/entity being analyzed. The normalization equation should be read as:

x^

t_{

qc} represents the value of indicator

t, in region

q, for country

c. The minimum and maximum values (

min_

c(

x^

t_

q) and (

max_

c(

x^

t_

q)) are calculated across all countries c for the specific indicator t in region

q.

The K-means cluster analysis was the second analysis used in this study. Its goal was to categorize the governorates of Egypt according to the three subindex values of the Regional Innovation Capacity Index (RICI). By grouping the governorates into discrete clusters, this approach helped to improve our comprehension of each one’s propensity for innovation. Using the normalized values of the three sub-indices, the study conducted a K-means spatial cluster analysis for the RICI. In the analysis, three, four, and five clusters were used. Governorates with different traits, capacities, and geographic areas comprised the three- and four-cluster configurations; these governorates were all regarded as part of a single cluster. By evaluating the dispersion of distances from the cluster center, it was found that creating five clusters led to the formation of the most uniform and easily interpreted clusters.

The final analysis focused on spatial autocorrelation, examining whether innovation capacity showed geographical clustering among neighboring Egyptian governorates. The method is known as spatial autocorrelation, and according to Bouayad & de Bellefon, it is the positive or negative correlation that a variable has with itself depending on where it is in space [

42]. Spatial autocorrelation provides an explanation for the systematic pattern in the spatial distribution. Typically, the variables in spatial distribution exhibit either positive or negative spatial autocorrelation, or no spatial autocorrelation at all. The objective of this analysis was to apply two different Moran I analyses: a local spatial autocorrelation analysis utilizing local Moran indices on a governorate size, and a global spatial autocorrelation analysis on a national scale.

- (1)

Global spatial autocorrelation analysis assesses spatial patterns by examining the relationship between geographic location and attribute values. This approach identifies whether features exhibit clustered, random, or dispersed spatial distributions. A deviation from the mean is essentially the cross-product of a variable and its spatial lag. Probably the most common measure of global spatial autocorrelation is Moran’s I statistic [

43,

44]. The direction of autocorrelation is indicated by the real Moran I value, which is provided in

Table 2.

- (2)

To investigate spatial clusters or patterns within a dataset, we can use Local Spatial Autocorrelation Analysis, which looks at whether a variable’s values show spatial dependency or autocorrelation [

46]. Significant local spatial autocorrelation also prompts research into the geographic patterns connected to the indicators within spatial units [

43,

45]. LISAs examine the local relationships between a given location and its neighboring locations. These statistics allow for the recognition of four types of geographical patterns.

Table 3 shows the differences between High -High (+ +), Low-High (− +), High-Low (+ −), and Low-Low (− −) types of spatial associations [

47]. Variables with geolocated data frequently depend on one another spatially, and this dependence decreases with increasing distance between the locations. The database contains 27 units that present the Egyptian governorates; the spatial regularities employ statistical data in conjunction with an Egyptian map to determine the correlation between the data and their location.

4. Results

4.1. RICI

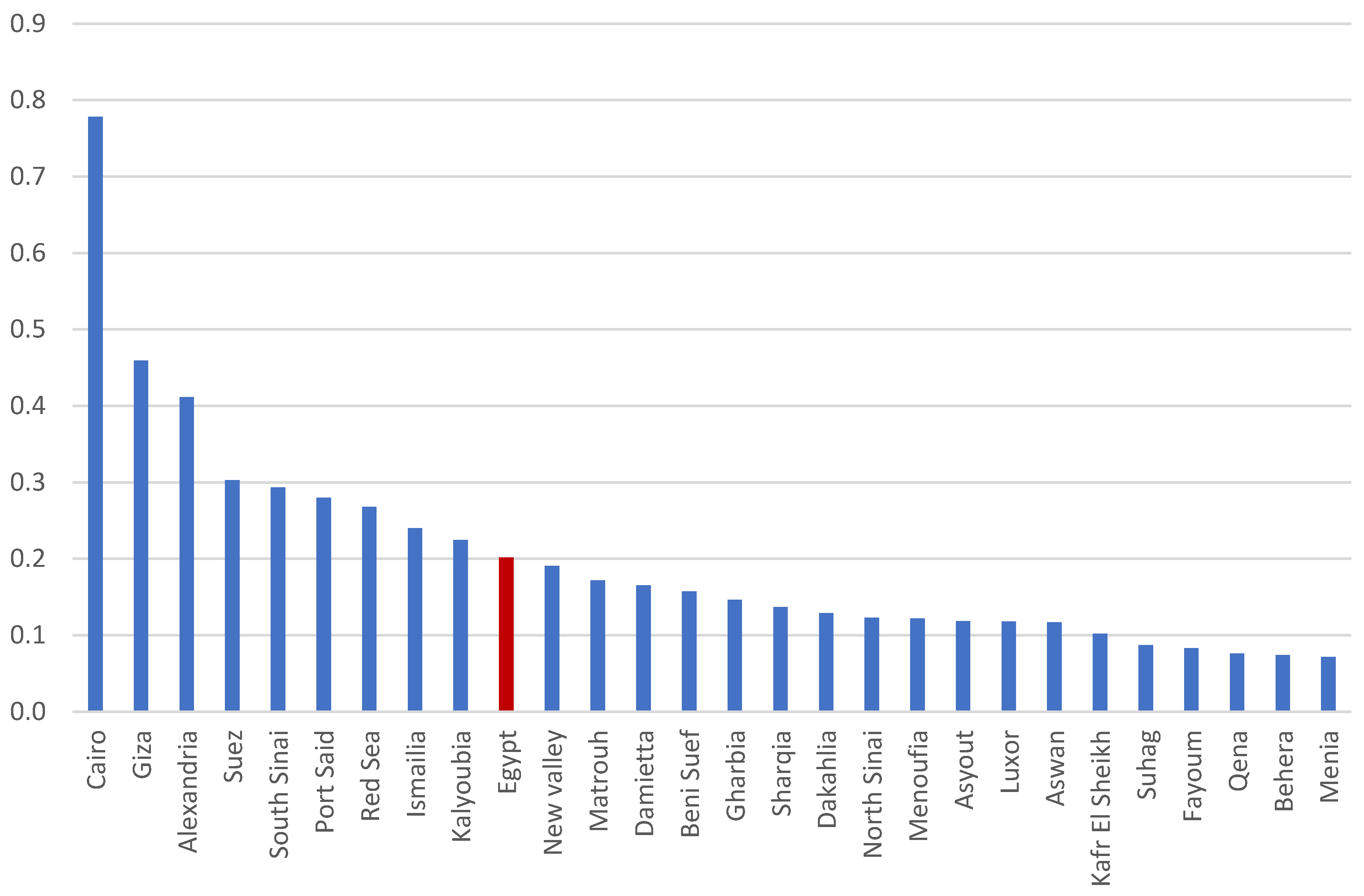

The RICI and sub-index results for Egyptian governorates are presented in

Table 4 with scores standardized to a 0–100 scale and accompanied by rankings. The governorates of Upper Egypt (New Valley, Beni Suef, Asyout, Luxor, Aswan, Suhag, Fayoum, and Qena) and the Delta region (Damietta, Gharbia, Sharqia, Dakahlia, Menoufia, and Kafr El Sheikh) have a completely backward ranking in the RICI, despite the presence of over 17 universities and over 27 research centers. An effective innovation system extends beyond accessible knowledge-generating institutions. Governorates must also demonstrate capacity for knowledge utilization and maintain intelligent infrastructure that facilitates innovation adoption. In addition, the values of the desert governorates of Matrouh and North Sinai, which have limited innovative capabilities, were lower than the average for Egypt. Furthermore, because their economies rely heavily on reclamation and agriculture, Menia and Behera have the lowest RICI scores. Detailed indicator rankings and scores for each sub-index are presented in

Appendix A Table A1. The primary conclusion that can be drawn based on the RICI is that there are significant differences in the Egyptian governorates’ capacity for innovation (see

Figure 2). Cairo Governorate (77.8 RICI score) is significantly better than all other governorates, not just in the RICI composite index but in all of its sub-indices as well. There are only nine governorates that perform better than the national average (20.17 RICI score). Overall, Cairo Governorate performs the best; its performance is over four times higher than the national average, although it is still 22 points behind the hypothetical score of 100. The remaining eighteen governorates, on the other hand, perform below average. The northern governorates of Egypt, particularly the greater Cairo region and the surrounding area, have a disproportionate concentration of innovation capacity.

Furthermore, the governorates of Upper Egypt (New Valley, Beni Suef, Asyout, Luxor, Aswan, Suhag, Fayoum, and Qena) and the Delta region (Damietta, Gharbia, Sharqia, Dakahlia, Menoufia, and Kafr El Sheikh) have a completely backward ranking in the RICI, despite the presence of over 17 universities and over 27 research centers. Additionally, Matrouh and North Sinai, both desert governorates with constrained innovation capabilities, fell below the national average. Furthermore, because their economies rely heavily on reclamation and agriculture, Menia and Behera have the lowest RICI scores.

The three sub-indices, which represent the three facets of regional innovation capacity, combine to provide the total RICI score.

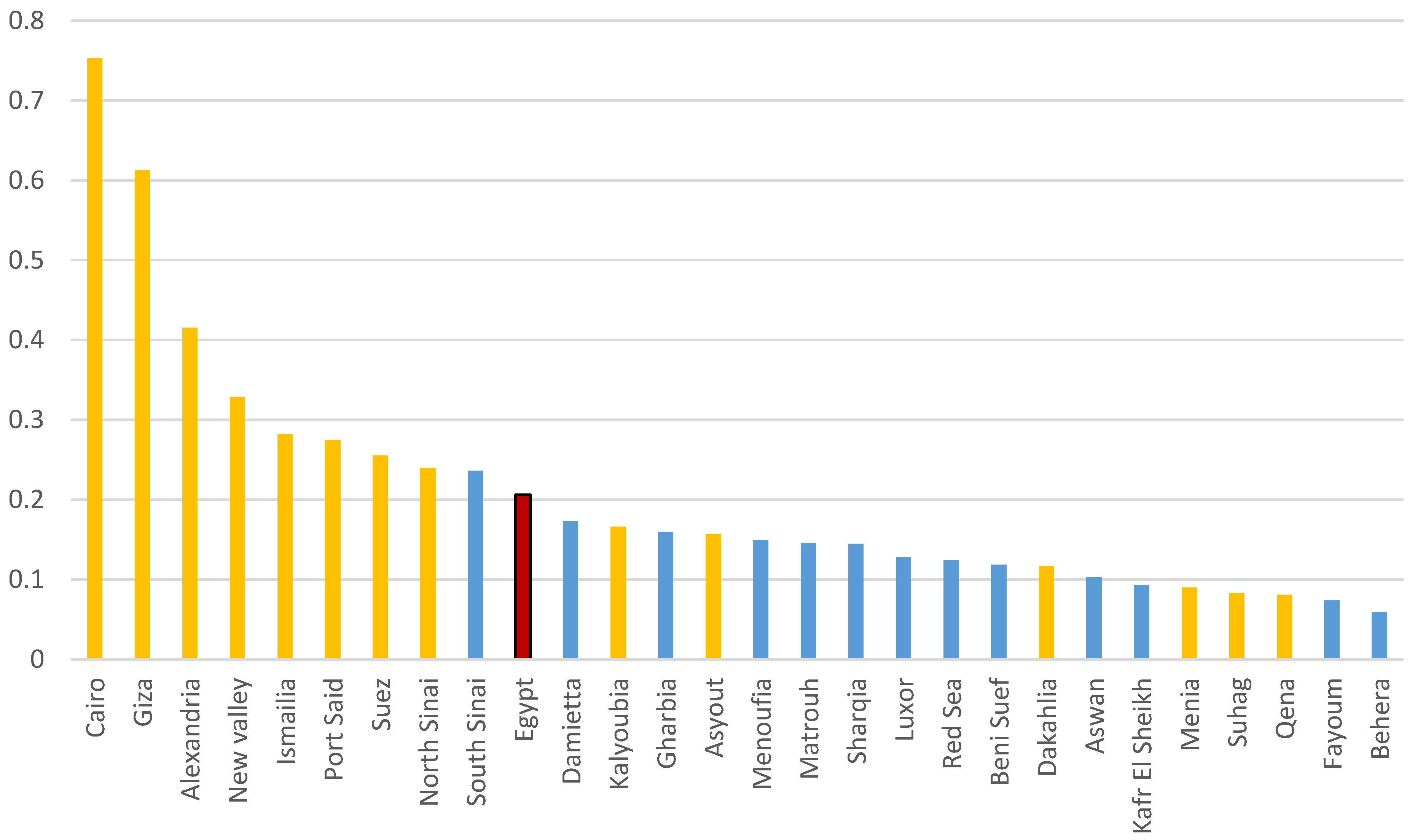

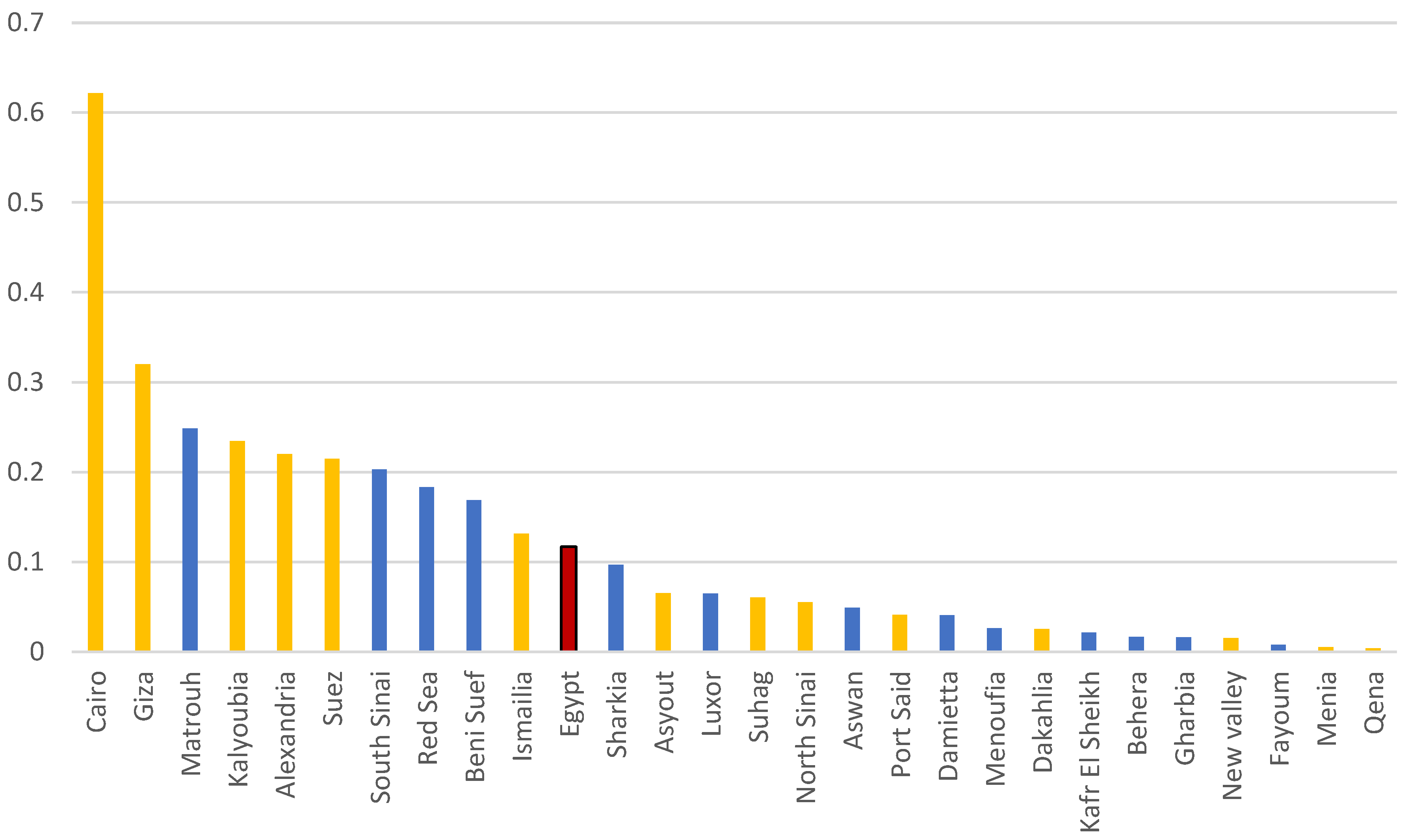

Table 4 illustrates that when it comes to “smart” infrastructure (standard deviation = 19.27) and knowledge utilization (std. deviation = 13.39), regional variances are greatest. When we examine the top three regions for each of the three sub-indices, we discover that the governorates of Cairo, Giza, and Alexandria lead the way in knowledge creation (KC). On the list for knowledge utilization (KU), Cairo, Giza, and Matrouh are ranked highest. Regarding “Smart” Infrastructure (SI), the governorate of Cairo comes on top, followed by Alexandria in second place and Port Said in third.

Governorates in Egypt differ significantly in the Knowledge Creation sub-index; governorates that are above the national average show notable disparities. Cairo, for example, has a strong KC score of 75.28, but South Sinai does far worse, scoring only 23.63. This large disparity reveals a threefold difference, signifying Cairo’s better performance in this sub-index (see

Figure 3). Furthermore, notable variations exist in the order of governorates below the national average; Damietta, for instance, is ranked three times higher than the last Behera.

The eight governorates that have KCs that are above average—Cairo, Giza, Alexandria, New Valley, Ismailia, Port Said, North Sinai, and Suez—are the locations where Egypt’s government plans to construct new smart cities. These governorates will host nine new cities. While South Sinai’s KC sub-index is above the national average, the government still intends to develop new cities in the governorate. Instead, new urban centers will be built in six governorates with below-average KC: Kalyoubia, Asyout, Dakahlia, Menia, Suhag, and Qena.

The analysis identified significant regional variations, with certain governorates such as Beni Suef in North Upper Egypt performing above the national average in specific innovation dimensions. Beni Suef scored 16.9, higher than the national average, to place ninth in the Knowledge Utilization sub-index. Nevertheless, there are no intentions to create new smart cities inside this governorate (see

Figure 4). The KU sub-index is determined by a set of indicators that are intimately linked to the business and industrial sectors’ capacity to make efficient use of cutting-edge technologies and knowledge. This performance may be attributed to Beni Suef’s hosting of multiple Samsung International High Technology facilities since 2013.

Six governorates—Cairo, Giza, Kalyoubia, Alexandria, Suez, and Ismailia—all perform better than the national average in terms of the Knowledge Utilization (KU) sub-index, and these are the governorates in which the Egyptian government plans to construct new smart cities. However, in eight other governorates—Asyout, Suhag, North Sinai, Port Said, Dakahlia, New Valley, Menia, and Qena—the government also intends to construct new urban centers. In these governorates, however, the KU sub-index is significantly lower than the national average. Furthermore, the KC sub-index scores of Matrouh, South Sinai, Red Sea, and Beni Suef are higher than the national average, even though these areas were not selected for the establishment of new cities.

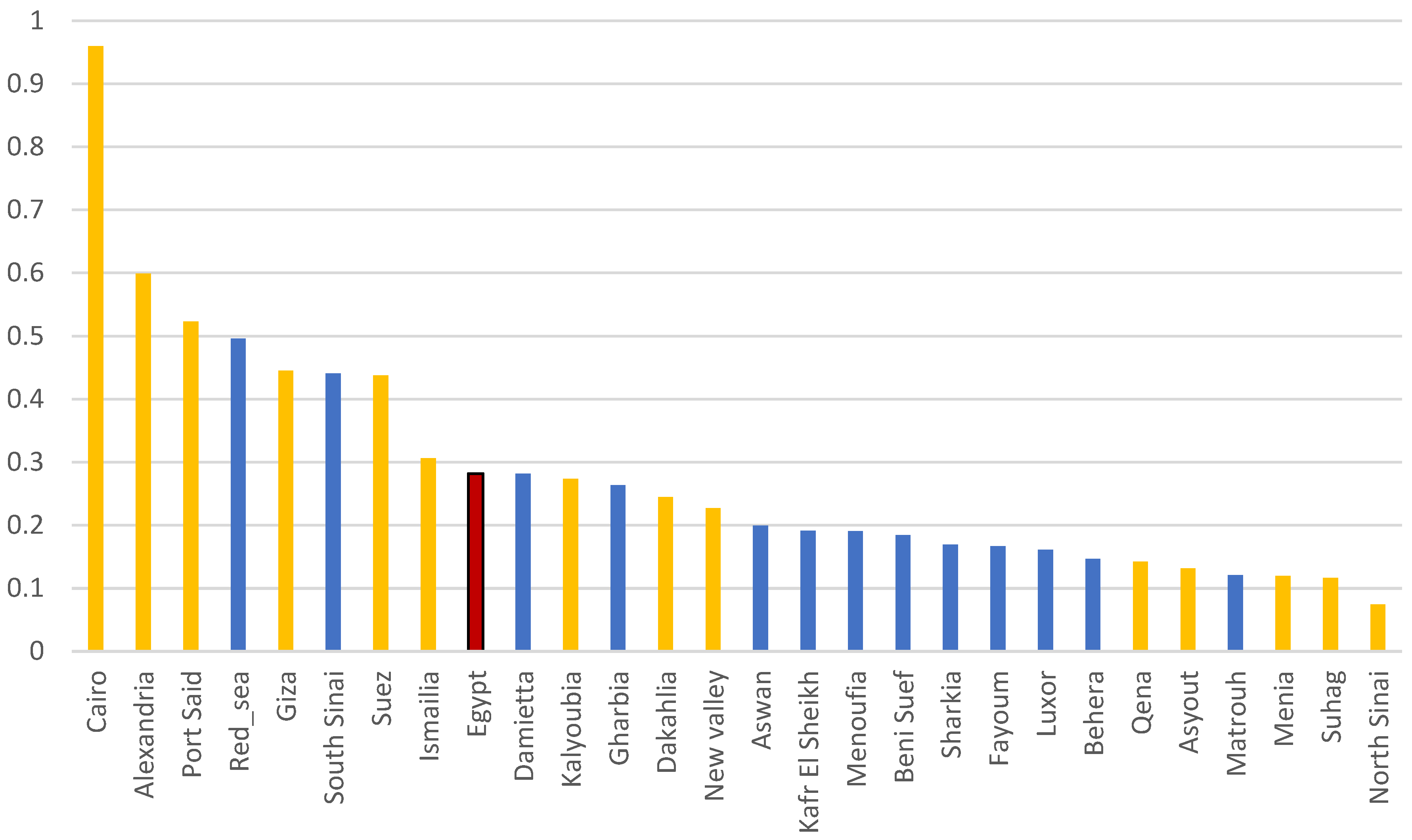

Non governorate in the Delta (Sharkia, Damietta, Menoufia, Dakahlia, Kafr El Sheikh, and Gharbia) or Upper Egypt (Asyout, Luxor, Suhag, Aswan, New Valley, Fayoum, Menia, and Qena) performed better than the national average (score 28.19) on the “Smart” Infrastructure (SI) subindex. In contrast, governorates in the Greater Cairo region, a majority of governorates in the Suez Canal region (Ismailia, Port Said, South Sinai, and Suez), and the Alexandria governorate are situated above the national average (see

Figure 5). Cairo, Alexandria, Port Said, Giza, Suez, and Ismailia are among the six governorates in Egypt where the government plans to construct new cities; these governorates all perform better than the country as a whole in the “Smart” infrastructure (SI) sub-index. However, the SI sub-index is lower than the national average in eight other governorates—Kalyoubia, Dakahlia, New Valley, Qena, Asyout, Menia, Suhag, and North Sinai—where the government also intends to construct new urban centers. Furthermore, the “Smart” infrastructure (SI) sub-index scores of the Red Sea and South Sinai are higher than the national average, despite the fact that these areas have not been designated for the creation of new cities.

Examination of the RICI composite indicator and associated sub-indicators reveals the value of adopting a multifaceted approach to evaluating innovation capacity across Egyptian governorates. Furthermore, by supplying the required background conditions, “smart” infrastructure plays a significant role in facilitating the adoption of innovation inside these governorates. The analysis’s findings showed that, in Egyptian governorates above the national level, the composite RICI varied significantly from the knowledge exploitation sub-index and the “smart” infrastructure sub-index. It should also be noted that the construction of the RICI relied on equal weighting of the selected indicators. This approach was chosen to ensure methodological transparency and comparability in the absence of validated longitudinal or expert-based data that could justify alternative weighting schemes. While equal weighting offers a clear and replicable baseline, it may also obscure the varying influence of different components, such as human capital, infrastructure, or institutional frameworks, on overall regional performance.

4.2. Spatial Cluster Analysis

The second significant conclusion was unveiled by the K spatial cluster analysis: the standardized scores of three sub-indices were used for categorizing Egyptian governorates according to their capacity for innovation.

Table 5 and

Figure 6 present the findings of the cluster analysis. Based on the factors that were investigated, five clusters were found to be as follows:

Only one governorate in the first cluster is the Cairo governorate, which has superior innovation capacity. Although the Cairo governorate does well in all three categories, it is powerful in knowledge utilization (3.7677). Furthermore, under the knowledge utilization sub-index, Cairo Governorate stands out among the other governorates in this cluster regarding the indicators of knowledge-based startups, foreign-owned businesses, and incubators and business accelerators. In addition, every indicator in the “smart” infrastructure sub-index performed remarkably well regarding the availability of background variables that foster innovation, like the proportion of highly educated students, ICT industry workers, and individuals engaged in innovation-based business services activities.

The second cluster comprises Giza and Alexandria, boasting strong innovation capacity. All the governorates in the cluster rank much higher than average in each of the three sub-indices. The Knowledge Creation sub-index scored the highest value (1.9253) for the second cluster. The RICI investigation further showed that, in terms of regional innovation capacity, the two governorates came in second and third, respectively.

The five governorates that make up the third cluster have a medium innovation capacity. In the RICI and its sub-indices, governorates in the third cluster outperform the Egyptian average; nonetheless, in comparison to governorates in the first and second clusters, their innovation potential is mediocre. This third cluster includes the majority of governorates in the Suez Canal region, including Suez and Port Said, which have significant urban advantages and capabilities. In terms of the “Smart” Infrastructure (SI) sub-index (0.8245), the cluster governorates score better compared to the other two sub-indices, indicating their medium innovation capacity.

The three governorates in the fourth cluster can be classified as having a one-sided innovation capacity (high knowledge utilization). In all sub-indices, the governorates in the fourth cluster outperform the national average. However, governorates within this cluster exhibit a notable variation in the Knowledge Utilization (KU) sub-index (0.7488). The governorates that comprise the fourth cluster exhibit a significant variation in the metrics of the location quotient of technology transfer centers (TTO) and high-technology industry concentration. This is mainly because the electronics and technology industries are based in the governorates in the fourth cluster, namely Kalyoubia and Beni Suef. Two examples of these are the Toshiba Al Arabi Industrial Complex in Kalyoubia governorate and the Samsung Industrial Complex in the MENA in Beni Suef governorate.

The fifth cluster comprises sixteen governorates that exhibit a low capacity for innovation. This indicates that a very low level of innovation is demonstrated by roughly 60% of Egyptian governorates. This cluster comprises the governorates of Upper Egypt and the Delta, which do not have the supporting contextual variables, or the ingredients required for knowledge production and utilization to support a regional innovation ecosystem.

4.3. Spatial Autocorrelation Analysis

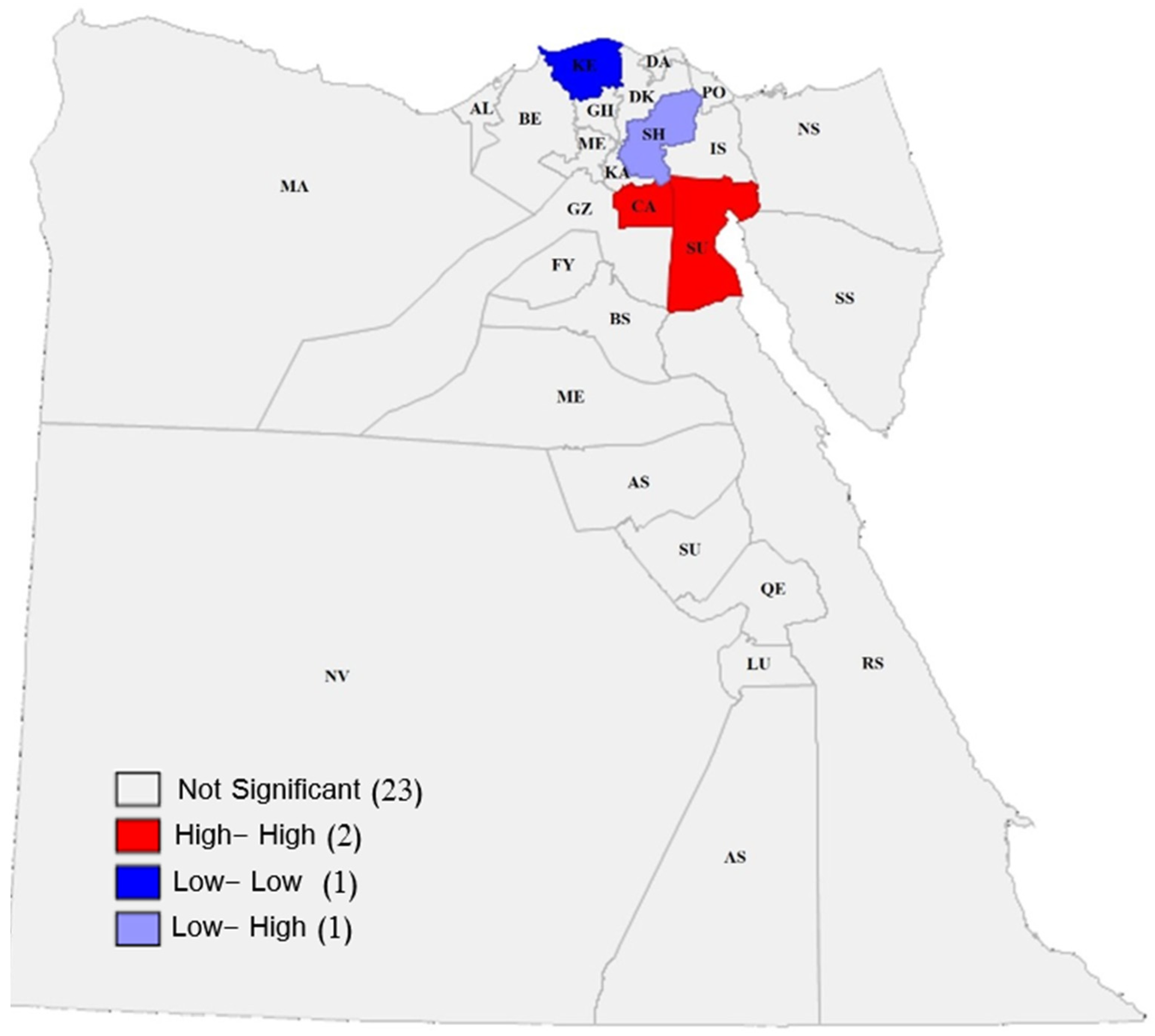

A spatial autocorrelation analysis was performed to examine geographical patterns of innovation capacity and identify governorates with either high concentrations or notable deficiencies. Additionally, the study examined if the innovation capacity of nearby governorate units showed traits that would enable useful comparisons. Real economic territorial ties can transcend governorate borders, and the “spillover” effects of nearby governorates can also have an impact on a governorate’s innovation capacity. Because the Greater Cairo region has a significant innovation capacity, it is crucial to investigate it as well as the Upper Egypt region, which has a smaller capacity. We were able to locate governorate clusters with “strong,” “superior,” and “weak” innovation capacities according to the cluster analysis. Therefore, the spatial autocorrelation analysis is intriguing, especially for this reason, and it is worth studying if these governorates have a significant (positive or negative) impact on their surroundings.

Only the Knowledge Utilization (KU) sub-index has significant (positive) autocorrelation between its spatial values at 0.2049, with a significant

p-value of 0.01, according to the findings of the Moran I test. While the spatial values of the innovation capacity composite index (RICI) and other sub-indices do not exhibit spatial autocorrelation (

Table 6). This demonstrates that the factors affecting the degree of knowledge utilization transcend governorate boundaries; however, for the other sub-indices and the RISI, their existence outside governorate limits is not significant.

The regional dispersion of the Local Moran Index indicates that only four governorates—distributed among the high-high, low-low, and low-high categories—are noteworthy, as shown in

Figure 7. The governorates of Cairo and Suez show a consistent pattern, both showing high values in the knowledge utilization sub-index and falling into the high-high category. This suggests that these governorates constitute an integrated entity with territorial connections that go considerably beyond their limits in terms of knowledge usage. Therefore, aside from this region, no other noteworthy innovation cluster in Egypt exhibits a comparable innovation “radiation” that extends outside the governorate borders.

Furthermore, the Sharkia governorate is a “low-high” example, with Sharkia having a low knowledge usage sub-index score and its surroundings, Cairo and Suze, having a high value. Due to this, Sharkia is unable to take advantage of the advantages that could result from these two governorates’ close vicinity, both of which exhibit a high degree of knowledge utilization.

Furthermore, the Kafr ElSheikh governorate is categorized as low-low for the knowledge utilization sub-index by the spatial autocorrelation analysis. This suggests that Kafr ElSheikh has low knowledge utilization capacities, and it is important to note that the governorates that surround it also have low capacities. Given that Kafr ElSheikh Governorate is located in the Delta region, where knowledge utilization in neighboring governorates also significantly lags behind the national average, this is not surprising.

5. Discussion

The innovation capacity of the governorates in Egypt varies significantly, as

Table 7 shows, with the Northern governorates having comparatively greater levels of innovation capacity. Menia Governorate, which comes in bottom in terms of innovation potential, has a RICI score of 7.15, whereas Cairo Governorate has a score of 77.8. Given that there is a tenfold difference between the two governorates, governorates that possess a significant potential for innovation stand a better chance of realizing the objectives of Egypt Vision 2030. On the other side, governorates that have low innovation capacities are less likely to achieve the objectives of this bold approach. The sub-dimensions of innovation capacity analysis indicate that the Egyptian government intends to give priority to the establishment of smart cities in governorates that are falling behind in important areas such as knowledge infrastructure or human capital. Though they have not performed particularly well overall, certain governorates have performed well in some indicators and have been disregarded for new city construction.

These disparities align with findings from Ali, which highlight the concentration of innovation activities in Egypt’s northern regions, particularly Cairo and Alexandria, due to intensive agglomerations of research institutions, universities, and innovation-based organizations. Also, this study emphasize that such spatial inequalities are a result of historical underinvestment in R&D infrastructure, education, and ICT networks in Upper Egypt and the Delta region. Furthermore, Khorshid et al. found notable variations in the output of innovation and knowledge generation throughout Egyptian governorates, particularly between the southern areas and the Greater Cairo area.

Based on their capacity for innovation, Egyptian governorates might be divided into five groups, according to a K-means cluster analysis. Clusters 1 and 2: These governorates have outstanding and strong capacities for innovation, in that order. Cluster 3: Distinguished by a moderate capacity for innovation, these governorates demonstrate a range of strengths and weaknesses throughout the sub-indices. Cluster 4: Governorates in this Cluster are deficient in the other two sub-indices and possess just the capacity in the knowledge utilization sub-index. Cluster 5: This last group is made up of governorates with poor RICI sub-indices and total scores.

Given that Cairo is the capital of Egypt and a megapolis region, it is not surprising that the first categorizing group (superior innovation capability) comprises only one governorate—Cairo—that has an exceptional capacity for innovation. The literature assessment indicates that local skills and regional innovation capacity play a critical role in the effectiveness of an innovation-driven regional development plan. Because of its advantageous location within the Cairo Governorate’s growing innovation ecosystem, the newly constructed New Administrative Capital (NAC) has the potential to become an exceptional hub for innovation [

48].

The New Administrative Capital’s emergence as an innovation hub exemplifies smart governance principles that leverage data-driven decision-making and technological integration for regional development [

49]. By integrating advanced ICT infrastructure, research institutions, and private-sector partnerships, the NAC exemplifies how intelligent governance can foster innovation ecosystems [

50,

51]. However, as Ali notes, the long-term sustainability of such hubs depends on their ability to generate knowledge spillover effects and support surrounding regions [

48]

Compared to the rest of Egypt, the governorates in the second group have “strong innovation capacity.” With a score of 45.93, Giza placed second in the composite indicator, while Alexandria placed third with a score of 41.93. These governorates are not significant, according to the spatial autocorrelation analysis of the Knowledge Utilization sub-index. To establish high-level innovation hubs, they also encompass a new urban center, New Alamein City (Alexandria Governorate), and New October City (Giza Governorate). By leveraging the innovative capacities of their governorates and regions, these new cities can enhance their innovation ecosystems. Considering this, the governorates of Alexandria and Giza have a strong capacity for innovation, which provides them with additional chances to support their planned new cities. In conclusion, the findings show that governorates with strong human capital, knowledge infrastructure, and vibrant startup ecosystems (e.g., Cairo, Giza, and Alexandria) are prime candidates to take the lead in putting innovation-based regional development policies into practice.

The governorates in the third cluster have “medium innovation capacity” in relation to other categories. The governorates were assessed as medium in relation to the first and second groupings, but they differed in the three sub-indices defining innovation capabilities. Notably, compared to the other sub-indices, the values of the “smart” infrastructure sub-index are noteworthy. The spatial autocorrelation analysis revealed a striking pattern: Suez and its neighboring governorates, including Cairo, displayed a strong positive correlation in knowledge utilization (High-High cluster). Notably, Suez sits beside Cairo, the nation’s innovation leader, and both belong to the positive knowledge utilization cluster. However, other governorates within this cluster, like the Red Sea and South Sinai, did not exhibit this spatial significance due to their vast desert areas. Three developing smart cities in Suez, Port Said, and Ismailia—Galalia, East Port Said, and New Ismailia—join the third cluster. These rising stars are at the second readiness level of the innovation-driven development plan. To advance, the study suggests that Suez, Port Said, and Ismailia give priority to increasing their capacity for innovation, particularly in the areas of knowledge generation and use. These sectors are essential because they supply the necessary energy to support the growth of their new smart cities.

This recommendation reflects broader research findings on the value of targeted investments in R&D and ICT infrastructure for medium-capacity regions. Although medium cities generally underperform compared with larger cities in economic development, strategic investments in R&D and ICT can significantly enhance their competitive position and economic potential [

52]. Such investments, coupled with intelligent governance practices like data-driven policymaking and public–private partnerships, can help these regions (e.g., Suez and Port Said) overcome their limitations and fully leverage their potential as innovation hubs [

53].

The governorates of Kalyoubia, New Valley, and Matrouh comprise the fourth cluster, which is made up of governorates with “one-sided innovation capacity,” or “knowledge utilization.” These governorates do not perform as well in the sub-indices as the governorates in the preceding three categories when it comes to innovation capacity. Consequently, in terms of knowledge utilization, this group of governorates has a relative advantage in terms of innovation capacity, which can be leveraged and developed to enhance their capacities for producing knowledge as well as to support the “smart” infrastructure needed to establish an innovation ecosystem in these governorates. The fourth cluster includes Obour and Toshka, two developing smart cities that, despite their potential, lack the regional innovation infrastructure necessary to support a robust ecosystem. To move forward, they must prioritize strengthening these areas. Knowledge creation (R&D, scientists, etc.) and “smart” infrastructure (higher education, ICT workers, etc.) require special attention because of their limited capacity, which lowers their readiness level for implementing the innovation-driven strategy.

The Egyptian governorates classified as having “low innovation capacity” across all sub-indices make up the final group. The majority of Egyptian governorates fall into this group, which also includes 16 governorates from the Delta and Upper Egypt. Moreover, the results of the spatial autocorrelation analysis of the knowledge utilization sub-index show that all of the governorates in this category were not significant, except the Sharkia governorate. Given that the governorate of Sharkia borders the governorate of Cairo, its neighbors showed a strong positive spatial autocorrelation (low-high). Moreover, Kafr El-Sheikh Governorate’s spatial autocorrelation results show a low negative correlation (low-low) with its neighbors. This is explained by the governorate’s location in the agricultural Delta region, which has low innovation capacity. Further, this fifth cluster of governorates—which includes six new urban centers— (New Mansoura in Dakahlia governorate, West Asyout in Asyout governorate, New Suhag in Suhag governorate, West Qena in Qena governorate, New Rafah in North Sinai governorate, and New Menia in Menia governorate). It is questionable, therefore, if the governorates in this category support the innovation-driven regional development agenda through the new cities, given their insufficient innovation capacity as measured by the three sub-indices. These findings indicate that these governorates lack the innovation capacity necessary to encourage the development of new smart cities as innovation hubs inside their borders.

The challenges faced by these governorates are consistent with the World Bank report that assessment of Egypt’s innovation ecosystem, which identifies limited R&D infrastructure, geographical isolation, and weak knowledge spillover mechanisms as key barriers to innovation [

54]. To address these challenges, intelligent governance strategies must prioritize investments in education, ICT networks, and regional innovation systems [

54,

55]. Additionally, creating physical and virtual bridges between high-capacity and low-capacity regions such as balanced innovative-based activities can facilitate knowledge sharing and collaboration [

54]. Furthermore, the disparities between Egyptian governorates can be addressed through targeted strategies, including providing incentives for low-capacity regions, such as R&D grants and tax cuts for research activities. Enhanced cooperation between research and development centers, universities, and the private sector can also play a critical role in bridging these gaps [

56].

6. Conclusions

This research examined innovation capacity across Egyptian governorates to determine which regions can most effectively support Egypt Vision 2030s smart city development goals. By developing a composite Regional Innovation Capacity Index (RICI), complemented by cluster and spatial autocorrelation analyses, this research directly addressed the lack of quantitative assessment in Egypt’s smart city planning process. The findings demonstrate significant disparities in innovation potential across governorates, thereby answering the guiding research question: which governorates in Egypt have the strongest capacity to contribute to the success of fourth-generation smart cities?

The analysis of the governorates’ innovation capacity reveals the existence of “two Egypts”: one is booming with promise, while the other is having difficulty catching up. Cairo, Giza, and Alexandria are leading the way in terms of innovation potential because of their well-established knowledge hubs, booming startup scenes, and highly trained labor forces. Think of these “innovation hubs” as thriving startup scenes, tech businesses, and research laboratories that are well positioned to spearhead the nation’s innovation movement. However, not all governorates are at this degree of readiness. The need for focused interventions is highlighted by the partial readiness shown by Suez, South Sinai, Port Said, Red Sea, Ismailia, Kalyoubia, New Valley, and Matrouh. They struggle with knowledge generation because they do not have a strong R&D infrastructure or qualified researchers. Their “smart” infrastructure is also not up to par because they cannot obtain a higher education or hire qualified ICT professionals. In addition, the geographical isolation of many Egyptian governorates makes it difficult for them to benefit from the “knowledge spillover” impact that their more inventive neighbors experience. This leads to a vicious cycle in which few resources and information networks impede the growth of certain governorates even further.

These findings have important policy implications. To ensure that the ambitious smart city program contributes to inclusive and balanced regional development, policymakers must adopt differentiated strategies. High-capacity regions such as Cairo, Giza, and Alexandria can be leveraged as national innovation hubs, while medium- and low-capacity governorates require targeted interventions to strengthen their Regional Innovation Systems. Such interventions could include investment in universities and R&D institutions, improved ICT infrastructure, and mechanisms for fostering collaboration between government, academia, and the private sector. At the same time, supporting lagging regions with incentives for innovation-based firms, training programs to build human capital, and policies that encourage knowledge spillovers from leading hubs will be essential. Accordingly, the call for action is clear: these regions’ Regional Innovation Systems (RIS) require major improvements. It is imperative to invest in universities, R&D infrastructure, ICT networks, and the development of a skilled workforce. Additionally, creating both physical and virtual bridges between new smart cities as innovation hubs and struggling regions can facilitate knowledge sharing and collaboration.

This research offers a methodological framework for assessing regional innovation capacity, enabling more evidence-based approaches to smart city planning in Egypt. By explicitly linking the design of new urban centers with regional disparities in innovation ecosystems, the research provides a foundation for aligning urban development strategies with national policy goals. Future research should expand the indicator set and explore additional policy dimensions, such as governance models, environmental sustainability, and social inclusion, to design a more comprehensive framework. In this way, Egypt can not only close the gap between high- and low-capacity regions but also enhance the long-term viability of its smart city agenda as a cornerstone of innovation-driven regional development.

Regarding limitations, this study faced some methodological and data related challenges in evaluating Egypt’s regional innovation capacity. First, the process of indicator definition, as discussed in

Section 3, was constrained by the limited availability of disaggregated data at the governorate level. Although the framework was designed to reflect both knowledge creation and knowledge utilization, reliable indicators for private-sector R&D, innovation collaboration, and knowledge diffusion were largely unavailable in publicly accessible or systematically collected datasets. To address this gap, proxies such as patent applications were employed to approximate innovation activity. While patents are an internationally recognized proxy and widely used in regional innovation studies (e.g., OECD and Eurostat), we recognize that they capture only part of the innovation spectrum and may underrepresent non-technological and informal innovation, which are often important in emerging economies.

Second, the construction of the RICI adopted equal weighting of indicators. This choice was not random; it was intended to ensure methodological transparency. Equal weighting also helped avoid subjective bias in assigning weights. In addition, it allowed us to establish a replicable baseline for Egypt, where alternative weighting schemes could not be validated due to the lack of longitudinal or expert-based comparative data. Nonetheless, we acknowledge that equal weighting may cover the varying influence of certain dimensions (e.g., infrastructure, human capital, or institutional capacity) on innovation performance. Future research could refine this approach by applying advanced weighting methods such as principal component analysis (PCA), analytic hierarchy process (AHP), or stakeholder-driven weighting, once richer datasets are available.

Future research might benefit from adding more detailed indicators to the dataset, particularly in the “smart” infrastructure sub-index. Additionally, although this study takes an innovation-driven approach to smart cities as a tool for regional development, other policy dimensions like governance models, environmental sustainability, and socioeconomic inclusion should be investigated in future studies. A more thorough framework suited to the particular circumstances of Egypt’s governorates might be examined by looking at how smart cities might solve more general urban issues like social justice, climate resilience, and digital transformation.