1. Introduction

The transportation of people using fossil fuel-based vehicles forms a complex system that integrates natural resources and technological artifacts built and shaped by society to meet social demands [

1]. To contribute to the decarbonization of transport, this socio-technical system has been transforming with the role of operators in the dominant system, the development of innovative technological alternatives, and the influence of public policies and external movements [

1,

2,

3,

4].

During transitions, new products, processes, services, business models, and organizations emerge, partly complementing and partly replacing existing ones, including new technologies and complementary structures [

5]. Innovative business models that seek to balance economic, social, and environmental aspects can drive transitions towards sustainability, a process known as Business Model Innovations for Sustainability (BMIfS) [

6,

7]. Categorizing business models to describe mechanisms and solutions in a grouped manner collaborates to develop a common language that is useful for monitoring the implementation processes of sustainable business [

8].

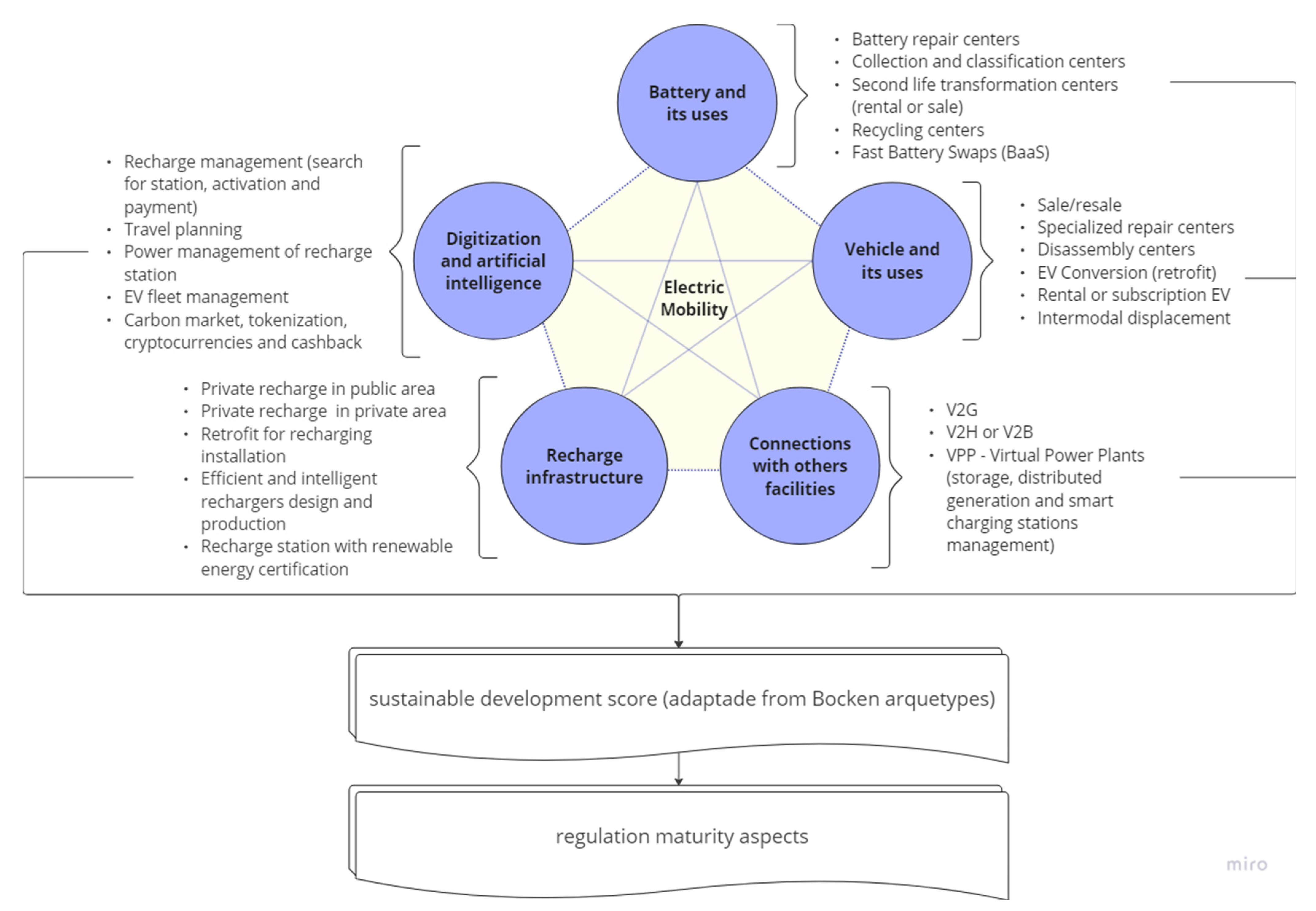

Starting from the hypothesis that there is a dispersion of information regarding business models in electromobility and their connections to sustainable development aspects and regulatory maturity, this work proposes the construction of a framework capable of systematically encompassing the businesses around electric vehicles and allowing for the classification of business models in terms of sustainable development aspects and regulatory maturity. Subsequently, this framework will be validated and applied to the Brazilian context.

Historical processes of technological substitution, resulting from the interaction between dominant structures (regime), external pressures (landscape), and emerging niches, include the multi-level perspective (MLP) as a relevant conceptual framework in the transition to electromobility [

1,

9]. A better understanding of how socio-technical transitions intersect with business dynamics can be achieved by integrating concepts from the MLP into the study of business models [

10], which will be addressed subsequently.

The socio-technical regime is stable, with established routines, norms, regulations, beliefs, and standards of technological development that guide and coordinate the activities of social groups in the execution of a function, resisting out-of-focus development due to restrictive rules [

2]. In the transition towards electric mobility, conventional fossil fuel vehicles are at the center of the dominant auto-mobility socio-technical regime, with well-established refueling infrastructure and a strong incumbent industry.

The landscape is a set of boundary conditions that includes material aspects and their arrangements, such as cities and their infrastructure, as well as external factors of a political, regulatory, environmental, social, and cultural nature, encompassing structural trends, social values, and worldviews that both reinforce stability and influence the regime for transformation [

2]. In the case of electric mobility, these factors are related to goals and commitments to reduce greenhouse gas emissions, public health issues arising from pollution in major urban centers, and aspects of long-term energy security, as well as sudden and unpredictable events.

Alternatives for transitions tend to be built at the niche level, from where innovations emerge. These spaces protect pioneering innovations from competition and selective pressures, allowing actors to nurture their development [

11]. The niche innovations of electric vehicles (EVs), including battery EVs (BEVs), plug-in hybrid EVs (PHEVs), and fuel cell EVs (FCEVs), are technologically strengthened with incremental and cumulative changes in conventional fossil fuel vehicle systems that establish progressive contributions to the regulatory, cultural, industrial, and market dimensions [

12].

The difference in the trajectories of the transition to electric mobility when comparing the largest economies with other countries worldwide is reflected in the percentage of sales. According to the International Energy Agency [

13], EVs account for nearly 25% of new vehicle sales, and 95% of these occur in China, Europe, and the USA. Despite Latin America having a high urbanization rate (81%), a clean energy matrix, commitments to decarbonize transportation, availability of minerals such as lithium and copper, and a large consumer market, there are resistances established by the combustion automobile regime. Brazil, Mexico, and Argentina, for example, have a traditional automotive industry and a consolidated auto parts network. They are characterized by a peripheral condition of technological development and disjointed policies that justify the nascent stage of the transition [

14,

15]. Oliveira Filho et al. [

16] point out that Brazil lacks a national plan for electric mobility and structured policies that define a future vision and encourage the consolidation of this segment.

In Brazil, the transition appears to follow the path of diversity, as discussed by Freyssenet [

17], benefiting from the early adoption of biofuels and favorable production conditions. Currently, more than 80% of all Brazilian automotive production involves flex-fuel vehicles, which are capable of operating on either gasoline or ethanol, or any blend thereof, according to consumer preference. Both fuels are stored in the same tank. Consequently, ethanol-powered flex-fuel vehicles and their hybrid variants also contribute to the transition towards sustainable mobility [

18]. In Brazil, today, electric vehicles represent 3% of the market share, of which 63% are plug-in hybrids, and several major car manufacturers are already developing hybrid ethanol–electric models as a result [

13].

New businesses and business models can influence this technological dispute because alternatives can better adapt to different usage habits. For example, if electric urban mobility starts to be seen as a service, thus reducing individual owners, BEVs tend to stand out, as they adapt well to the organization of corporate fleets. If an individualized usage model remains prevalent, the fuel cell vehicle niche can benefit from the infrastructure and usage habits associated with current combustion vehicles [

19]. It should also be considered that the maturity of each alternative can establish different trajectories. Socio-technical transitions, therefore, deal with major changes involving technology, infrastructure, institutions, and policies but tend to not address nontechnical innovations, such as changes in organizational-level processes, or transformations in supply chains, which are present in business models [

6].

Classically, a business model refers to how an organization rationally creates (by bringing technology to the market and offering it to the customer, the value proposition), delivers (by articulating users’ needs and mobilizing a network of stakeholders, customer segments, channels and relationships), and captures value (by presenting the structure of key activities, revenues, expenses, and profits) [

20,

21]. It is a conceptual tool that acts as an intermediary between companies and the broader socio-technical system, facilitating the entry of new technologies into the regime [

4,

22,

23]. The search for efficiency is a learning process that leads to adaptations, radical changes, and even the creation of a new model—the innovative business model (BMI).

Companies that move more flexibly within formally regulated spaces, operate under uncertainty, and seek agile and efficient methodologies have contributed to changes in the automotive and energy industries. Innovations may occur in equipment or products, as in the case of EVs and their charging infrastructure, or in new business models that offer, for example, new fleet management solutions, infrastructure management, or service-based passenger mobility incorporating new integrated payment and route planning solutions [

24]. Therefore, there is a growing recognition that innovation in business models is a vital component of the transition to sustainability, as it creates adjustments between the characteristics of sustainable technologies and new commercialization approaches, facilitating diffusion to both new and traditional markets. From this perspective, non-technological innovation in the business model is necessary to change production and consumption patterns [

25].

Business models can impact the dynamics of the transition in three ways. As part of the socio-technical regime, existing business models make transitions difficult by reinforcing the stability of the current system. As intermediaries between the technological niche and the socio-technical regime, new business models act as translation devices that help new technologies move from their niches to the regime level, driving transitions and the evolution of the socio-technical system. Finally, as non-technological niche innovations, new business models drive transitions by building a substantial part of the new regime without relying on technological innovation [

26]. In Business Model Innovations for Sustainability (BMIfS), researchers argue that focusing on meeting users’ final needs through the provision of a service rather than a product would make it much easier to design systems that achieve goals with radically reduced impacts. For example, Sarasini and Linder [

25] concluded that Mobility as a Service (MaaS) has the potential to radically transform the road transport system and steer it towards a more sustainable path [

8].

The approach related to the possibilities of different business models using combined products and services, known as product–service systems, has been used for classification according to sustainability aspects. In product-oriented business models, companies are encouraged to maximize sales. In contrast, service-oriented business models promote extending the useful life of products, making them cost- and material-efficient [

27]. As the shift towards business as a service, product–service systems transfer the risks, responsibilities, and costs associated with traditional product ownership to manufacturers or operators, resulting in better utilization and maintenance compared to traditional offerings [

28]. Bocken et al. [

8] synthesized and introduced archetypes to describe how a business model can contribute to sustainable development. Boons [

29] proposed a high-order group that described three dominant areas of innovation—technological, social, and organizational—under which eight archetypes categorized business models from a sustainability perspective. Maximizing material and energy efficiency or creating value from waste is associated with technological innovations. Delivering functionality rather than ownership, or encouraging sufficiency, falls under social streams, while re-proposing the business for the environment or developing scale-up solutions is considered organizational changes.

This study aims to propose a framework capable of encompassing businesses related to electromobility, grouped by interconnected thematic cores, and establishing relationships with aspects of sustainable development and regulatory maturity. This framework is then applied to the Brazilian context. The significance of this study stems from the observation that the transition to electromobility follows divergent paths between countries in the Latin America and the largest economies. The structure of the proposed framework and its application in examining the Brazilian context contribute to the broader body of research related to these transitions in the Global South, particularly in Latin American countries, which are in the early stages of EV adoption and have different conditions associated with energy safety and sources of greenhouse gas emissions. Using the proposed framework, it is possible to conduct an organized survey of businesses within the fleet electrification chain, map regulatory gaps, and identify sustainable projects that are well suited to specific regional public policy contexts and interests. Subsequent sections present the methodology used to construct and validate the framework, along with the main findings from the Brazilian context. The Discussion section offers a detailed analysis of the situation, focusing on the business models, regulatory maturity, and future perspectives. The conclusions underscore the regulatory gaps and incoherencies on public policies, as well as trends in business models in Brazil, demonstrating how the proposed framework can facilitate analyses in other developing countries.

2. Methodology

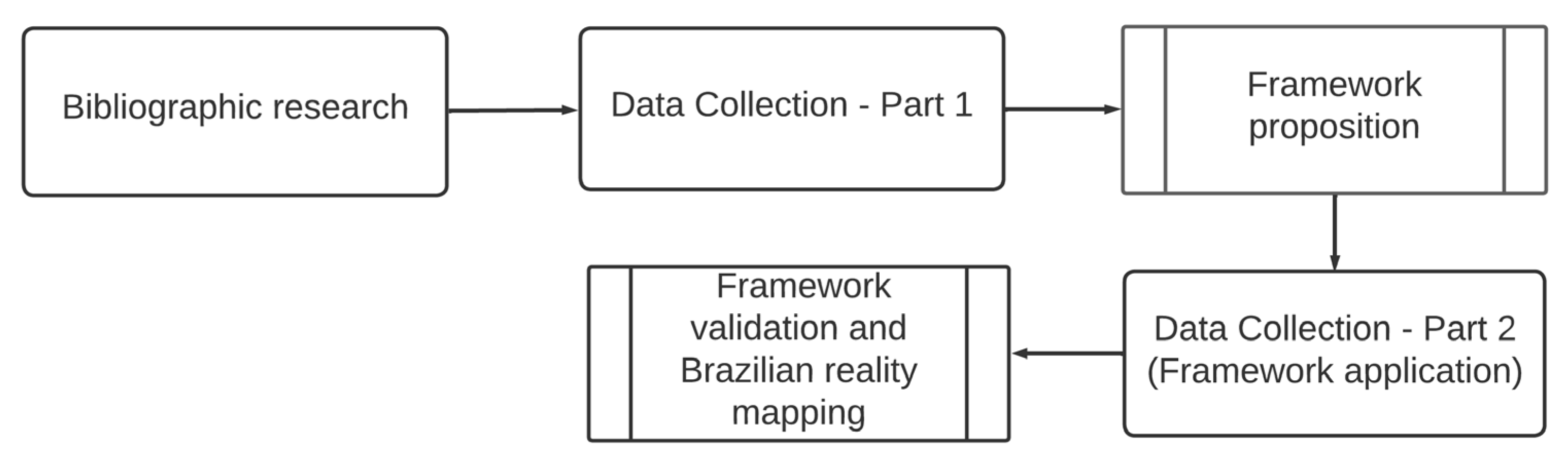

This is an exploratory and qualitative work that uses a literature review to establish the conceptual basis of the study, followed by participant observation through experience with the object of the study for data collection, as summarized in

Figure 1.

A literature review was conducted with three themes to support the process of observation, reflection, and analysis of the collected data, converging to establish the proposed framework:

Transitions to Sustainability;

Innovative Business Models to Drive Transitions;

New businesses in electric mobility.

The first stage of data collection involved observing facts, experiences, and business connections through active participation of the authors, focusing on surveying existing businesses and identifying new business opportunities. This was conducted at technical and commercial events organized to discuss the demands and opportunities in the electric mobility sector. These activities took place from October 2022 to March 2023 in Brazil and were organized by Latin American entities promoting electromobility. Participants included stakeholders from the market such as the automotive industry, technological innovation startups, charging solutions companies, the electrical sector, government, and academia.

The processing of data from the first stage of collection was consolidated with a survey of existing, new, and promising business models related to the electric mobility ecosystem, classifying them into five interrelated thematic cores around the electric vehicle, supported by a literature review and enabling connections with sustainable development aspects adapted from Bocken et al. [

8].

In the second stage of data collection, the framework was applied through interviews with five stakeholders immersed in the electric mobility ecosystem in Brazil. The selection of experts was such that they could address all business dimensions of the framework. The interviewees worked in the following areas:

Charging infrastructure.

Installation and retrofit.

Electric mobility operator.

Digitization and data services.

Studies, support, and project management.

The project was previously submitted to the Research Ethics Committee, which issued a favorable opinion regarding the data collection instrument. This instrument consists of an interview guide by topic for validating the structure, thematic cores, and Brazilian conditions, comprising questions that are in accordance with ethical standards. The semi-structured questionnaire ensured that both the researcher and participant had greater flexibility to delve deeper into specific issues identified throughout the script, in order to validate the proposed framework as a support tool for new studies associated with Business Model Innovations for Sustainability (BMIfS) and to map regulatory gaps.

The interviews were scheduled, recorded, and transcribed with an average duration of 45 min and always started with a brief presentation of the proposed framework and its objective to seek the involvement of participants in data collection, culminating in three open questions:

- (a)

Validation of the framework.

- (b)

Contribution to understanding how regulation or its gaps impose barriers or drive the advancement of electromobility.

- (c)

Future perspectives.

From the interview transcripts, contributions presented by the stakeholders were organized. Through reflection, analysis, and interpretation of the data collected at this stage, a structured report and summary table were created. These documents encompass the framework validation process, the current characteristics of business models in Brazil, aspects related to advances and regulatory gaps that influence business development, and future perspectives on current businesses and opportunities.

4. Discussion

The proposed framework, when applied to Brazilian specialists, mapped the state of electric mobility in Brazil, identifying regulatory gaps and unveiling various business opportunities through the integration of thematic cores, particularly in conjunction with digital solutions. The interviews were limited to five experts, who collectively covered all thematic areas. A significant focus was placed on regulatory issues related to charging infrastructure and grid connections, topics that the experts identified as particularly critical. To enrich this area of study further, future research could involve additional stakeholders such as Brazilian automakers, vehicle importers, manufacturers, battery recyclers, and staff.

4.1. Business Model Innovation for Sustainability

The disruptive condition of the transition to electric mobility brings about new actors that were not part of the fossil fuel mobility value chain [

21]. In addition to vehicle manufacturers, supply chains, sales, and sales services, there is the involvement of other sectors, such as the energy, battery, and electronics industries responsible for the development of charging systems and battery management systems, software developers, solution integrators, and operators of information and communication technology services that deal with charging, energy, fleet, and battery management, among others.

Business models that deliver complete solutions to users using accurate and transparent information are currently in demand. Furthermore, the structure tends to be distributed among more stakeholders with well-defined roles, such as in the recharging service, where the charge point operator invests and maintains the infrastructure and the mobility service providers intermediate the charging, manage the payment, and provide other services, such as reservations and identification of availability, through a digital platform. This movement is new and has been occurring since the involvement, with investment, of agents in the energy sector (electricity and petroleum) who have an economic interest in the charging infrastructure.

Mobility as a Service, recharging as a service, battery as a service, and the use of data as a service tend to present more sustainable solutions, as it is possible to reduce overall resource consumption. By applying this framework, it was possible to identify the tendency for recharge services in Brazil to be strengthened through service subscriptions, making it simpler for users when faced with many alternative solutions and equipment suppliers. Unlike batteries, for which swaps are not technically viable, except in the case of very light vehicles, the battery remains an integrated part of the BEV, which dictates the final cost of the car.

The classic business model in auto-mobility turns around the sale of cars and a series of extra services such as financing, insurance, maintenance, and supply of parts and consumables, that is, it is product-oriented. When the business is service-oriented but still focuses on the product, the service provider is the owner of the vehicle and is responsible for maintenance and management and the user pays for the use. This is the case for individual and unlimited use from leasing or car sharing, which can be one-way or round-trip with usage limits, and the vehicle is shared with other users sequentially. When the business is result-oriented, the user and provider agree on a result and there is no predetermined product involved, for example, in the taxi service.

Service-oriented businesses that use electric propulsion technology can become competitive and effectively contribute to reducing greenhouse gas emissions throughout their lifecycles. A Brazilian study by McKinsey [

30] indicated that for medium-segment vehicles in intense use (greater than 150 km per day), the total cost of ownership of electric cars is lower than that of a combustion vehicle, in addition to a reduction in the total volume of emissions per car, which immediately justifies the electrification of taxi fleets and app cars.

There are environmental and economic advantages in reusing and recycling batteries as they reduce the carbon footprint and increase the residual value of cars, in addition to generating value in the energy storage market for the electrical sector [

31,

32,

33]. Centers for repair, collection, classification, reuse in the second life, development of battery management systems, and other mechanisms for monitoring battery use throughout life constitute an important set of business possibilities that need to be articulated with national policies that deal with solid waste [

34].

4.2. Advances and Gaps in Brazilian Regulation

4.2.1. National Strategies

Several studies have reinforced that stable targets for CO

2 emissions established by national public policies combined with investment in recharging infrastructure, incentives, and cost flexibility for EV purchases and articulation with local measures that bring owners secondary benefits constitute exogenous elements to the socio-technical regime of internal combustion vehicles, generating pressure for changes [

35,

36,

37,

38,

39]. There has been little regulatory evolution in the last five years in Brazil, and there remains an absence of a national electromobility strategy/plan with a long-term structured vision, establishment of decarbonization, and directives that incentivize private investments. Some state and municipal stimuli were not sufficiently articulated. The gaps during the application of the framework were highlighted by Oliveira [

16]. A favorable scenario recognized by interviewees involved the resumption of the sustainability, industrial, and economic development agenda at the federal level.

4.2.2. Recharge Infrastructure

Although the National Electric Energy Agency established the procedures and conditions for carrying out recharging activities, including the possibility of commercial exploitation of EV charging with free price negotiations, uncertainties remain in the nature of tax regarding the precise definition of charging activity as a service that has an aliquot paid to the municipalities and not as the sale of electrical energy, which has another aliquot paid to the state. It was possible to observe the growth of charging infrastructure supported by the entrepreneurial action of private agents and investments by new players from the electric energy and fuel sector, but investors remained insecure.

The technical Brazilian standards that present the requirements for installation to supply EVs were published in 2022 and are currently sufficient to guide the process of fixed electrical installation and retrofitting of the charging infrastructure. Regulations encouraging the certification process of installations are expected to increase the quality of utilities for these purposes.

There is also an opportunity to make the existing charging infrastructure profitable, expand the reach of the charger network, and improve the service for users through the interoperability of public charging systems. However, there is no regulation regarding this issue in Brazil, as in Portugal with electric mobility regulation, which incentivizes the interoperability of recharging stations [

40]. In other words, a customer who subscribes to a company’s recharging service can use another company’s infrastructure to carry out the charging and payment procedures in the same manner. This is a win–win situation as the customer is guaranteed faster charging, the owner expands the reach of their charger network and increases profits, and the mobility service provider is remunerated to intermediate the transaction. This is the current system for telecom companies. Currently, EV users in Brazil are forced to install and operate numerous recharge management applications, which is not conducive to a good experience.

4.2.3. Vehicle Connection

The possibility of an electrical grid or building connection increases the use of EVs and creates business and value for mobility systems, bringing the automotive sector closer to the electric energy sector. In other words, the vehicle is no longer just a means of transport but is also a distributed storage system for electrical energy. These connections can be vehicle-to-grid, vehicle-to-home, or vehicle-to-building.

Brazilian regulations treat renewable energies distributed from generation connections to the grid differently from EV connections. When connecting the distributed generation, the excess electrical energy injected into the electrical grid generates credits that can be used within 36 months. In the case of the vehicle, it does not allow the injection of its energy into the grid [

41], thus limiting the connection of the vehicle to vehicle-to-building or vehicle-to-home forms; however, this market has not been explored, except in rare cases of experimental projects or isolated systems.

The integration of photovoltaic or wind generation systems with battery storage systems, which may come from vehicles or stationary systems, increases the complexity of solutions in the decentralized and digitalized electrical sector. Energy supply can come from various sources in different locations or times, with the consumer as the focus and considering technical and economic aspects. This creates demand for a process to manage this energy, known as a virtual power plant [

42].

4.3. Future Perspectives

In a system with an expanded digitalization process, data generation makes it possible to create businesses that use this information (DaaS, data as a service), such as energy system management, recharging station management, or intermodal travel planning [

42,

43]. The ability to integrate multiple stakeholders through artificial intelligence has generated businesses that contribute to the EV acceptance process; however, for this cooperation to enhance the planning of new solutions, the entire mass of data must be available [

44].

Digitalization and artificial intelligence produce innovative solutions that can generate new value or improve processes associated with charging infrastructure, batteries and their use, EVs and their use, and the connection of EVs to the electrical grid or buildings. For example, data on the availability of chargers on a given highway are fed into a charging management application used by the owner of an EV, or the charge status of batteries and the position of charging stations are used to plan a trip in another application; data on the electrical and thermal quantities of the charging and discharging cycles of EV batteries are used to improve the recycling process or use of batteries for second life; information on the position and state of charge of the batteries of vehicles being used in car-sharing systems, reducing recorded emissions, can also generate credits in a regulated market or monetization or cashback in an incentive program. Ultimately, numerous possibilities exist for generating innovative business models.

The transition to electromobility is an inexorable movement in Brazil; however, its speed depends on the involvement of public authorities and national vehicle manufacturers in this discussion. The main businesses and models tend to evolve from incumbent agents to symbiotically incorporate the innovations brought about by startups. The investment capacity of the “old money” prevails to save their business. Recharge tends to be offered as a service. In this type of service, such as a subscription business model, the user does not care about the brand of installed hardware, but rather about the service provided.

By applying the framework, it was possible to identify trends for public and semi-public recharging infrastructure in Brazil that are already found in mature countries, such as the separation of roles between investing agents, who guarantee and maintain the charging station, and charging service providers, who intermediate charging. These operators also seek to penetrate the domestic charger market, which is fundamental to the composition of this infrastructure.

As the recharger is located at the connection point between the vehicle battery and the electrical grid in a building, companies created to deliver mobility services have the opportunity to act in an expanded manner as virtual power plant managers, which may contain distributed generation sources and storage systems. During the application of the framework, it became evident that the possibilities of connecting the vehicle with other installations establish an integration between at least two other thematic centers (digitization–charging infrastructure connection). Companies that pioneered recharging solutions sought to follow this path.