1. Introduction

Over the past years, the topic of sustainability trespassed the boundaries of academic debate and niche environmentalism, pervading the economic and institutional world as well as public discourse. Such awareness led institutions and policymakers to implement incisive interventions that, in tackling anthropogenic emissions in the atmosphere and mitigating climate change, bear the potential to impact significantly on many economic and industrial sectors. In the European Union (EU), ambitious decarbonization plans (in the wake of the vision indicated by the Green Deal and then operationalized and financed through the Next Generation EU program) led to the so-called Fit for 55 Package (hereinafter Fit for 55), a collection of legislative proposals conceived as a key step towards the EU’s goal of climate neutrality by 2050 that aims to achieve a net reduction in greenhouse gas (GHG) emissions by at least 55% by 2030 compared to 1990 levels. The transport sector is under special scrutiny, as it is responsible for around 25% of GHG emissions in the EU (three quarters of which are attributable to road transport) and has experienced, unlike other sectors, a substantial increase in emissions since 1990 [

1].

The need to shift to more sustainable mobility paradigms is particularly pressing in urban areas, where road congestion and transport-related pollution are more severe. Consequently, new urban models are emerging, aimed at curbing environmental and health-related issues in densely populated areas, and many initiatives and innovative approaches have been proposed, with different degrees of success. Among these, it is worth mentioning

servitization, which encompasses a shift from the concept of ownership (e.g., of a private vehicle) to that of access and use, consistently with the emerging trend of shared mobility. In other words, instead of owning a vehicle, consumers pay for the service of transportation. Exemplary is the so-called Mobility as a Service (MaaS), which can be described as “a holistic transport provision mechanism that meets transport user needs by offering tailor-made mobility solutions enabled through access to and integration of a wide range of vehicle types, journey experiences and complementary services over a single digital interface” [

2] (p. 1). The Avoid–Shift–Improve approach [

3] is a guiding principle for MaaS and is used in sustainable urban transport planning to reduce the environmental impact of transportation by focusing on the key strategies of Avoiding (i.e., reducing the overall need for travel), Shifting (i.e., shifting people away from private vehicles towards more sustainable modes of transportation), and Improving (i.e., improving the efficiency and environmental impact of existing transportation options). Many strategies can be hence synergically implemented to support the envisaged transition and they are heterogeneous in nature and range from active transportation to improved public transport systems, from cleaner vehicles to shared mobility and micromobility, and so on. The latter, for instance, refers to shared bicycles (both electric and conventional) and e-scooters, which represent promising solutions to reduce car dependence and curb traffic congestion and environmental pollution in urban areas. They are especially suitable for the so-called last-mile transport service [

4]. Micromobility is an object of a growing body of literature [

5] thanks to the high potential it bears. E-bikes, for instance, not only support the aforementioned benefits but also combine the benefits of active transport and inclusivity, as they are suitable for a wide variety of users [

6].

Acknowledging such complexity, this paper focuses on one specific aspect of this multi-faceted picture that is gaining the spotlight in public policies as well as in the broader debate that is bound to shape the features of the automotive sector and the mobility ecosystem in the future: electrification of the private car fleet. As previously mentioned, Fit for 55 is one of its most pervasive legislative declinations; its impact on the automotive industry cannot be overemphasized, as it proposes a phasing out of internal combustion engine vehicles (ICEVs) by 2035 (including hybrids). This effectively mandates a complete shift towards zero tailpipe emission vehicles, like electric vehicles (since tailpipe emissions must amount to zero, only fully electric vehicles would be compliant) (EVs), the only solution which, to date, seems like a viable alternative on a large scale to ICEVs and potentially hydrogen fuel cell vehicles (FCEVs) in the coming decade. EVs encompass a spectrum of technologies. Hybrid options, like hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs), rely on both electric batteries and endothermic engines to varying degrees, with the electric component playing a bigger role in the latter; conversely, battery electric vehicles (BEVs) are fully electric and rely solely on electric motors. The remainder of the article will refer to BEVs unless otherwise specified, as currently, they represent the only technology capable of falling within the stringent constraints established by legislation.

While BEVs represent a promising option for climate change mitigation in the transport sector, there is a heated debate on the possible impacts of a steady development of electrification and diverging opinions on its effective benefits and drawbacks, both in the academic literature and among practitioners. Indeed, notwithstanding the factual advantage in terms of zero tailpipe emissions, critics of electrification argue that BEVs might produce inequities, as well as pollution and waste, which result in biosphere degradation and threats to human health, describing the new technology as

a wolf in sheep’s clothing [

7]. In other words, the impacts on the sustainability of electrification are complex, and many factors should be considered, such as non-exhaust emissions, like brake dust and tire wear, which can be worse for vehicles that are heavier due to battery weight [

8]. Further, factors such as the impact of electricity provision for charging batteries or the impact of vehicle production (given the high CO

2 emissions required for battery production) should be considered. While these concerns are reasonable, most studies suggest that BEVs still outperform traditional ICEVs, even when considering these broader emissions, especially if vehicles are operated in countries with low carbon intensity for electricity production [

9]. Other aspects of concern regarding non-environmental issues, such as the impact on employment, the reconversion of industrial factories and supply chains, and the geopolitical consequences that might derive, consider, for instance, the availability of materials for battery production. In other words, a gradual reconversion of the automotive industry to electric over the next 10 years inevitably entails a series of questions that range from the environmental to the geopolitical dimension and from the economic one to that of industrial and employment policy [

10]. To navigate such a perilous sea full of uncertainties, it is crucial for carmakers to shed further light on the market’s point of view in terms of expectations, concerns, and perceived priorities. This should be considered as a strategic priority since, regardless of the legislation and the availability of EVs, consumers will undoubtedly play a key role in years to come, choosing between BEV purchase or opting for ICEVs as long as allowed by legislation and perhaps predicting a possible rebound in ICEV sales as the deadline of 2035 approaches. Further, consumers are still dubious about the effectiveness of the ban, as it might be affected by developing political situations, the changing majorities and coalitions on the EU political scene, and future negotiations between stakeholders. Many believe (and often hope) that the legislation will be modified and made less stringent to accommodate the needs of incumbent carmakers and the sentiment of a market willing to consider electrification as an option rather than as an imposition.

Stemming from the acknowledgment of the relevance of a consumer-based approach, the present study investigates drivers and drawbacks shaping the intention to purchase BEVs in Italy. To this end,

Section 2 reviews the relevant literature;

Section 3 introduces the empirical setting of the case study;

Section 4 presents the survey-based research method;

Section 5 illustrates and discusses the results;

Section 6 proposes some implications for public policies and the industry, and

Section 7 proposes some concluding remarks and avenues for future research.

2. Literature Review

The literature on mobility electrification is extensive and “spread across insights from diverse perspectives such as engineering, environmental science, social sciences, transportation research, digital innovations” [

11] (p. 2). While a technical perspective was originally predominant, recent years have witnessed a growing interest in marketing and consumer behavior studies focusing on a market-based perspective and individual attitudes towards BEVs. On the one hand, there are empirical investigations adapting well-established theoretical frameworks [

12] to the specificities of BEV purchase antecedents and the connection with perceived advantages and drawbacks of electrification [

13,

14]; on the other hand, extensive reviews and meta-analyses synthesize existing evidence on the topic, proposing avenues for future research [

15,

16,

17,

18].

While the theoretical models that can be applied are heterogeneous and range from rational choice [

19] to normative [

20], self-identity [

21], and technology acceptance [

22] theories, two frameworks emerge as particularly fitting for the analysis of BEV market penetration, as car purchase decisions involve a process of weighing options, where consumers consider (both economic and non-economic) the advantages and disadvantages of available alternatives, such as BEVs or ICEVs.

The first framework is represented by the Theory of Planned Behavior (TPB) [

23], which acknowledges intentions as the strongest predictor of actual behavior and identifies attitudes, subjective norms, and perceived behavioral control as the key antecedents of intentions. Attitudes reflect general (positive or negative) predispositions towards an activity, while subjective norms capture social pressure and perceived behavioral control reflects the extent to which an activity is under volitional control. TPB developments [

24] added further constructs to increase the predictive capability of the model, which has been extensively adopted to investigate BEV purchases in different socio-economic and cultural contexts [

25,

26,

27].

A second stream of research builds on Prospect Theory [

28] and assumes that consumers evaluate product (i.e., BEV) attributes relative to a benchmark; this means the perceived value of improvements or drawbacks (framed in terms of gains and losses) diminishes as they deviate further from such reference point (i.e., diminishing sensitivity). In the case of electrification, the ICEV attribute value is considered as the reference point for the BEV attribute. Attributes considered by consumers that shape their perceptions and attitudes towards BEVs are heterogeneous and typically fall into the macro-categories of instrumental, functional, environmental, and economic. Regarding those considered problematic (compared to the ICEV reference), it is worth mentioning price value [

29], driving range [

30], charging infrastructures availability [

31], and charging time [

32]. On the other hand, environmental performance [

13] and economic incentives [

33] are often investigated as potential advantages of BEVs over endothermic counterparts.

The present study focuses on such aspects, including further elements that are worth investigating either because of lack of empirical evidence (e.g., engine silence) or because of relevance in terms of geographical setting (e.g., access to restricted areas) or contingent factors (e.g., rise in energy prices).

While the features of the empirical setting are discussed in

Section 3, it suffices to mention here that there is some evidence investigating motivations behind BEV uptake in Italy, adopting either face-to-face interviews [

34], online questionnaires [

35], or choice experiments [

36]. Yet, new insights are necessary as data from most studies have been collected over the 2013–2018 timespan when BEVs represented an almost indetectable share of car sales and regulations to phase out ICEVs were not in sight.

3. Italy as a Case Study

Italy presents a compelling case study for research on electrification for several reasons. First, it represents one of the most polluted areas of the EU, especially in the north where the morphology of the region and the Alps acting as a natural barrier hinder proper air circulation, resulting in the persistent accumulation of pollutants. Italian urban centers in the Po Valley, according to the European Environmental Agency, represent the most polluted cities in Western Europe (European City Air Quality Viewer,

https://www.eea.europa.eu/themes/air/urban-air-quality/european-city-air-quality-viewer, accessed on 5 May 2024). Electrification of (urban) mobility could be more impactful here than elsewhere, in a context where BEVs are still considered by many as a viable option only for short-range driving habits, of which urban trips represent the typical declination.

But, even elsewhere in the country, most urban centers are exposed to negative consequences for both the environment and the health of citizens due to high urbanization and the consequent concentration of vehicles. Indeed, in Italy, the contribution of transport to air pollution is approximately 42% for NOx (almost exclusively due to diesel engines), 10% for PM10, and 18% of CO [

37], pollutants that impact both at the global level (e.g., global warming, climate change) and locally (e.g., health issues).

Second, Italy boasts a long and rich history in car manufacturing, a sector that has been instrumental to its economic and social progress for more than a century. This legacy persists even as industrial output sensibly decreased in recent years due to a confluence of factors, such as the decline of a player like Fiat (now Stellantis), whose factories and network of suppliers once dominated the Italian automotive ecosystem. In 2022, the national production of vehicles amounted to around 900,000 units (cars and light-duty vehicles), down from the 2 million vehicles produced in 1990; despite this, the automotive sector still represents a particularly relevant sector for the national economy, with a turnover equal to EUR 54 billion and a workforce of 170,000 employees [

38]. Hence, there is great interest in electrification, which, according to the specific perspective, could represent either a

black swan compromising the industry (with subsequent impacts on employment) or, on the contrary, an opportunity for the whole system [

10].

Third, as a member state of the EU, it represents a peculiar example of ICEV phasing out being implemented by means of regulations rather than by consensus-based market mechanisms. As anticipated, Fit for 55 mandates a significant reduction in CO2 emissions from new cars, as by 2030, emissions must be 55% lower compared to 2021 levels, and such a target becomes even stricter by 2035, requiring a complete elimination of tailpipe CO2 emissions from new vehicles (car manufacturers with a lower production volume, specifically between 1000 and 10,000 vehicles annually, are granted a one-year grace period to meet the 2035 target). According to critics, the EU approach could shift public opinion and make people less receptive to BEVs.

Although rapidly expanding, the market penetration of BEVs in Italy is modest compared to EU partners. As illustrated in

Table 1, new registrations have risen from 0.1% in 2015 to 4.1% in 2023, while PHEVs have risen from 0.1 to 4.2% over the same period. Combined, the two technologies account for less than 10% of new car registrations compared to 31% in Germany and 22% in France [

39].

The situation is even more worrisome regarding the entire circulating fleet, as BEVs make up a mere 0.6% of the roughly 40 million cars on Italian streets, many of which are obsolete and fail to meet even Euro 4 emission standards.

4. Methods

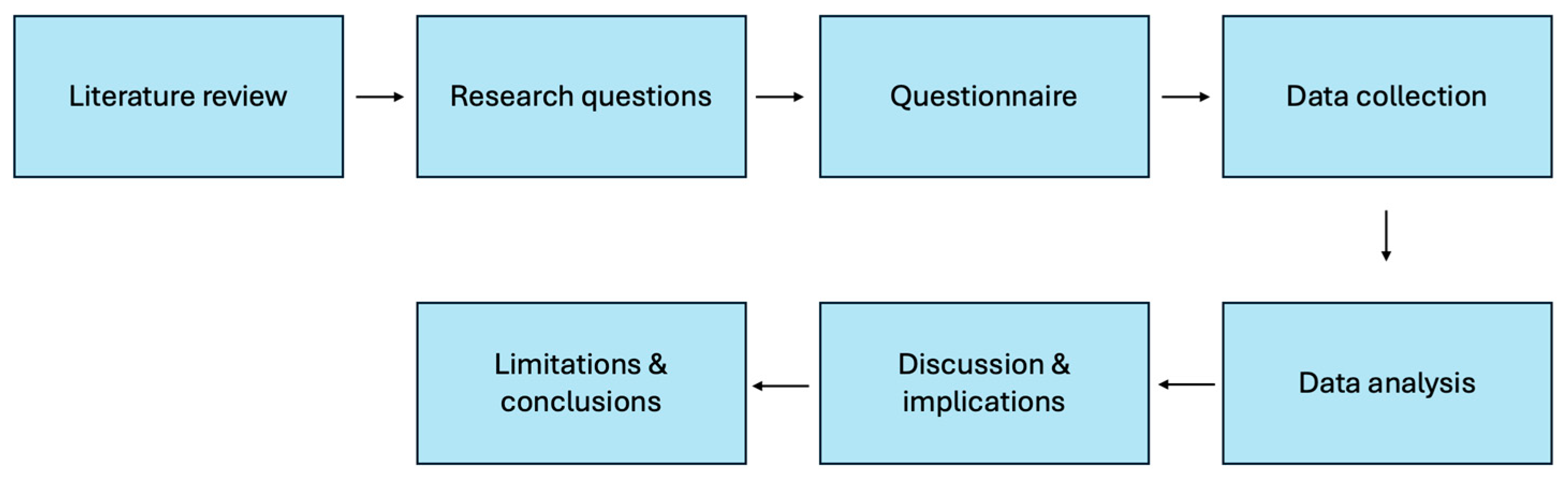

This paper contributes to the literature on urban mobility and electrification by presenting the results and implications of an empirical study performed on a sample of Italian consumers who, on average, have a fair knowledge of the pros and cons of electrification amidst growing public discussion and media coverage on Fit for 55 and its potential impacts. The methodology is based on well-established procedures for survey-based empirical investigations on consumer behaviors in the domain of sustainable mobility and vehicle purchase, and the process is illustrated in

Figure 1.

The literature review focused on electrification in the automotive sector through the lens of consumer behavior, and different types of sources were consulted. First, scientific articles in peer-reviewed journals (browsing databases and search engines such as Web of Science, Scopus, and Google Scholar) stemming from selected contributions were consulted. Further works were analyzed by applying both ancestry and descendency approaches, and also the gray literature (i.e., conference proceedings) was taken into account, whenever pertinent. Further, other sources were considered, such as industry reports or documents from public organizations.

The main research question of the article refers to whether the Italian market is ready to adopt electric vehicles and, more specifically, the factors that affect the perceptions of consumers. Advantages and disadvantages have been selected according to the relevant literature on market penetration of electric vehicles from a consumer perspective [

10,

40,

41]. To provide answers to such questions, this study adopts an ad hoc, self-administered questionnaire, which has been created in accordance with mainstream guidelines and recommended practices for surveys as far as the conceptual frame, the writing of questions, and the pre-testing are concerned [

42]. Initially created in English, it has been translated into Italian to ensure participation from a wider range of Italian consumers, some of whom might not be fluent in English (to guarantee the meaning remained consistent, the Italian version underwent back-translation into English for verification). Before large-scale distribution, a pre-test was conducted on a small sub-sample representative of the target population to assess question clarity and eliminate any ambiguities or misleading wording, and minor revisions were consistently made. The finalized questionnaire (whose questions have been validated by an ethical committee and are compliant with international ethical guidelines for surveys) was uploaded on Google Forms and distributed online to a convenience sample of citizens in northern Italy. The target population has been chosen as northern Italy because it is an area characterized by rapid urbanization and severe pollution problems connected to urban mobility, affecting the quality of life in cities and urban centers. Additionally, participants were instructed to utilize snowball sampling to reach a broader audience of Italian consumers. Of the 1647 questionnaires collected, 114 were excluded as they did not pass the exclusion criteria (respondents who left blank most answers, under 18, without a driving license, or do not drive cars, regardless of whether owned or not). The final sample is hence composed of 1533 respondents (N = 1533), which is a sample size that is considered excellent for the type of investigation [

43]. The invitation link was accompanied by a message stating that by participating in the survey, respondents agreed for the information provided to be used at an aggregate level for a scientific publication. To minimize the risk of self-selection bias, the description of the survey was extremely broad and referred to mobility in general, with no specific reference to electrification. The questionnaire is introduced by a brief textbox describing the difference between BEVs and hybrid vehicles, stressing that questions would refer to BEVs unless otherwise specified. Then, the first section of the questionnaire focuses on socio-demographics and preliminary questions about the driving behaviors of the sample (e.g., kilometers driven per year, powertrain of main car used, and so on). In the following sections (along with other questions that have not been included in the present study), respondents are asked to express (adopting 5-point scales) their opinion on factors perceived as advantages (or disadvantages) of BEVs, as these might trigger (or hinder) the intention to purchase such vehicles in the future.

The average age of the sample is 35.3 years old, and females represent 53.4% of respondents.

Table 2 illustrates further socio-demographic details of the sample.

Regarding the powertrain of participants’ cars (respondents driving multiple cars have been instructed to refer to the vehicle they drive the most), there is a clear prevalence of ICE, with 44.3% of the sample usually driving gasoline-powered cars, followed by diesel cars (38.7%), while BEVs and hybrids together represent a slim 0.7%, and the remainder is mainly attributable to LPG. On average, respondents drive 14,800 km per year, which is slightly above the national average yet consistent with the demographics of the sample, as younger generations typically drive more.

Descriptive statistics have been employed for data analysis to summarize the key characteristics of the variables. Specifically, the mean has been calculated to determine the central tendency of each variable, while the standard deviation has been used to measure the dispersion of values around the mean (thus providing insights into the data’s variability) and kurtosis to assess the shape of the distribution (compared to a normal distribution).

Further, to assess the relationships between different variables, the correlation coefficient has been computed, quantifying the strength and direction of the linear association between pairs of variables. These statistical measures allowed us to gain a comprehensive understanding of the data distribution and identify potential patterns or correlations.

5. Results and Discussion

Fit for 55 undoubtedly represents a milestone in the shift towards a new mobility paradigm. Although most respondents were certainly familiar with the key aspects of the proposal, these have been briefly illustrated in a dedicated textbox of the survey. A preliminary question investigated whether respondents were in favor of such a package, and the results suggest that only one-third of the sample (34.8%) agreed with the proposed legislation. Perplexities in the market regard, first and foremost, the approach adopted by the EU in supporting the transition of the automotive industry (and mobility at large), which opts for normative measures over softer alternatives based on involvement and awareness. However, even focusing on aspects directly connected to the product, there are many hindering factors that explain the slow uptake of BEVs in the Italian market that pertain to the economic and technological dimensions and need further investigation.

Table 3 illustrates the results for the critical aspects covered by the survey.

Emerging evidence suggests that the absence of a widespread network of charging stations (3.68 on a 5-point scale) and driving range (3.63) are considered the most critical factors.

The first aspect is particularly problematic, for multiple reasons. From a systemic standpoint, there are huge investments required for a real infrastructural revolution ensuring an adequate diffusion of public charging points to reduce consumers’ concerns, especially for long journeys. At the end of 2022, there were around 370,000 private and 38,000 public charging points in Italy [

39], of which only a minority were fast charge (i.e., greater than 22 kilowatts). Policymakers are addressing such concerns with the revised regulation on Alternative Fuels Infrastructure requiring Member States to expand charging capacity in line with sales of BEVs and install charging points at regular intervals on the main arteries, every 60 km [

44]. From a company perspective, this has relevant implications, as it requires intervention from subjects other than carmakers (thus outside of their control), although there are examples of car manufacturers installing their own charging points (e.g., Tesla) that can be used either exclusively by cars produced by the company or even by vehicles of different brands. From a marketing perspective, carmakers experience the dilemma of whether to focus on an aspect considered critical by consumers yet not distinctive of the individual company. While brand-specific charging stations offer a competitive advantage, communication efforts aimed at promoting the widespread availability of charging infrastructure benefit the entire BEV industry, not just individual companies. In other words, these efforts do not create a unique selling proposition for a single brand; instead, they address a common concern across the industry. Communication from industry associations representing EV manufacturers or government initiatives aligned with Fit for 55 would likely be more effective in reassuring consumers about charging access.

The driving range and so-called range anxiety [

45], representing the fear of running out of power before reaching another charging station, historically undermined the development of BEV sales [

46]. There are many factors impacting the driving range, such as the speed of driving, the outside temperature, and clearly the technology of the battery itself. Undoubtedly, recent years witnessed relevant technological improvements and a sensible increase in driving range; for instance, the driving range of class B BEVs increased from 295 km to 362 km when comparing models proposed to the market in 2018–2020 and those proposed in 2021–2023, while for class C BEVs the driving range increased from 335 km to 411 km [

39]. Still, technology is not competitive with ICEVs yet; this might not be perceived as a big problem for urban commuting, yet even people living in cities need adequate driving autonomy for longer trips. Consequently, most people believe that electric is still an option for wealthier families and individuals who can afford to own a BEV for everyday city trips and an ICEV for longer trips. “BEVs with a longer electric range are still expensive high-end products, while BEVs with a shorter electric range are unable to meet all the travel demands of general drivers” [

47] (p. 1).

The high purchase price of BEVs indeed remains a significant barrier to adoption, ranking third with a score of 3.56. Consumers often perceive BEVs as more expensive than ICEVs of the same class and, while the former typically have lower maintenance costs [

48], their purchase price does indeed remain undeniably higher. Further, some suggest that lower-income categories might have a financial barrier to shifting to electric, stressing how there is an income and equity gap connected with BEV ownership (and this divide is also visible with reference to urban vs. rural areas) [

49].

Over the past decade, falling battery production costs gave hope for a rapid price decrease, potentially bridging the gap entirely. However, recent surges in energy and raw material costs (which represent critical elements for BEVs) dampened this optimism, at least in the short term. The survey also investigated the willingness to pay (WTP) a premium for BEVs compared to ICEVs with similar features, and the results are illustrated in

Table 4.

While it is certainly difficult to compare hypothetical vehicles with different powertrains based on the sole assumption of pertaining to the same class or having similar features, the results provide an indication of how purchase price still represents a crucial drawback of BEVs. Indeed, BEVs currently on the market often entail a premium price exceeding the 20% threshold, which is considered the limit by a vast majority (85.1%) of the sample.

Regarding charging time (3.53), although the performance of BEVs is clearly not comparable with that of ICEVs, the improvements are significant and constant, as there is evidence that a full charge of BEV models launched on the market in 2021–2023 takes, on average, 35% less than a full charge of models launched in 2018–2020 [

39]. Yet, charging times are still a major hurdle for widespread adoption of BEVs, as the (still) significant time difference translates into range anxiety for drivers, especially on long trips where the fear of running out of power is coupled with potential waiting times for a full charge. But the problem is also tangible for people living in cities, as many live in large condominiums with no private parking or the possibility to charge BEVs overnight.

This limited access adds another layer of inconvenience and reinforces the perception of BEVs being unsuitable for long-distance travel, although fast-charging stations in Italy increased by 57% in 2022 compared to the previous year [

39], and the rise is likely to continue.

The next section of the questionnaire investigates the potential benefits of BEVs and how consumers perceive them; the findings are illustrated in

Table 5.

The key argument for investing in electrification is that BEVs represent an important factor in climate change mitigation, thanks to GHG emissions curtailment. To gain insights on the market penetration potential of BEVs, it is important to understand whether consumers perceive these as less polluting than ICEVs and, eventually, whether superior environmental performance does indeed play a role in shaping behaviors. When asked whether BEVs are actually less polluting than ICEVs, the sample is equally split, with a light predominance of respondents remaining skeptical. The implications are strong since the market is not convinced about the single most important advantage of electrification in the wake of growing concerns regarding the fact that (as previously mentioned) exhaust emissions represent only one of the aspects to be taken into consideration. Skepticism might be exacerbated by the unpleasant feeling of a normative obligation to shift to electric, which might affect perceived attitudes and thus decrease intrinsic motivation, which is with self-determination [

50] and cognitive evaluation [

51] theories.

Regarding the other perceived advantages, an important role is arguably played by economic considerations going beyond the purchasing price. There is an increasing awareness of the need to consider the so-called total cost of ownership [

52], which includes expenses that must be borne over the useful life of the vehicle, such as maintenance costs. BEVs arguably entail savings pertaining to ordinary maintenance and other costs, such as, a road tax. In Italy, BEVs do not pay a road tax for the first five years after registration, and then pay only 25% of what is paid by ICEVs.

Access to LTZs (i.e., Limited Traffic Zones) represents a crucial aspect of urban mobility in Italy, as an increasing number of municipalities are implementing restrictive policies to limit traffic in specific areas, typically city centers [

53]. Although regulations might vary depending on the municipality, BEVs typically benefit from concessions or free access, which represent a valuable advantage for 44.9% of the sample. As regulations are becoming more stringent over time, it is safe to infer that free access to restricted areas is likely to play an increasingly relevant role in shaping market perceptions about the benefits of driving BEVs.

The silence of the engine represents a topic of interest, as it can be perceived very differently in different segments of the market. On the one hand, it offers advantages such as the perception of being a high-end and prestigious vehicle or a more relaxing and enjoyable driving experience [

54], leading several car manufacturers to focus their communication on this markedly distinctive aspect, which can be particularly enticing in city centers affected by noise pollution. Yet, for some consumers, there are also important drawbacks, like cultural factors (i.e., roaring engines as a synonym for performance and a rewarding element of the driving experience) or safety concerns, with BEVs being less noticeable, especially in areas with poor visibility [

55]. The results of the survey are consistent with such mixed feelings, as noiseless engines are perceived as the least important advantage of BEVs (2.84).

The above discussion highlighted the relevance of BEV perceived benefits, with (economic, technological, and infrastructural) factors that are heterogeneous and often have no connection between them; for example, engine quietness does not relate to charging time, nor do maintenance costs directly relate to the availability of charging stations. Yet,

Table 6 shows a positive and significant correlation (

p-value < 0.001) between all these aspects.

This suggests that, consistent with cognitive dissonance mechanisms [

56] and the tendency of individuals to seek consistency in evaluating different attributes of a product, once a consumer forms an overall opinion (positive or negative) about BEVs, such broad predisposition tends to influence the perception of all specific aspects, regardless of the actual relationships between them; that is, people who value environmental benefits might be somewhat more likely to find economic savings appealing, and so on.

A further question investigates whether respondents intend to translate positive attitudes about BEVs into actual purchase intentions (the respondents already driving BEVs have not been considered in this specific question). The average score (on a 5-point scale) is 2.15 for respondents currently driving ICEVs and 2.58 for those currently driving hybrid cars. This is interesting, as even consumers with a direct experience with electric powertrains are hesitant about shifting to full electric, as only 22.5% of them show strong commitment in this sense. Similarly, the intention of ICEV drivers to shift to hybrid is quite weak (2.58), highlighting a strong resistance to change in large segments of the market.

This study also investigates the correlation between the perceived benefits of BEVs and the intention to purchase (though correlation does not necessarily imply a causal relationship). There is a positive moderate relationship between intention to purchase a BEV and both environmental performance (r[1451] = 0.42, p < 0.001) and savings on maintenance costs (r[1451] = 0.40, p < 0.001) (while for the other variables, the relationship is more modest, albeit positive). At the same time, it ought to be stressed that the correlation is not high, suggesting a broad skepticism in most respondents about a possible shift to electric powertrains. This might indicate that many consumers are aware of the actual benefits of BEVs yet do not base their purchasing decision on these dimensions (i.e., I know that BEVs are less polluting, but I am not interested in the environmental impact of my car).

6. Bridging the Gap: Implications for Policy and Industry

The global imperative to transitioning towards sustainable mobility paradigms has spurred a proliferation of initiatives that manifest in diverse forms, ranging from policy frameworks to economic incentives and from investments in R&D to public awareness campaigns. Such strategies can be categorized into two primary goals: either to curtail private car use by promoting alternatives, such as active transportation, public transit, or shared mobility and micromobility options, or to accelerate the adoption of cleaner vehicles (consistently with the Avoid–Shift–Improve principle).

Car fleet electrification represents a key cog in the wheel of such a composite mechanism of interconnected strategies and tools. The findings of this study underscore the complex interplay between consumer attitudes, policy frameworks, and carmakers’ strategies in the transition to individual mobility based on electric vehicles, stemming from the acknowledgment that such a shift requires a joint effort where all involved actors work collaboratively to create a conducive environment for the widespread adoption of BEVs.

To this end, policymakers should, first of all, keep into great consideration a global trend that is recognizable in different national contexts, including Italy, and which is also detectable in the results of the present study. Such a phenomenon refers to a sort of shift in consumers’ sentiment towards electrification; while it is not possible to talk about a proper deterioration, there are indeed many signals that show that as public discourse surrounding electric vehicles matures and consumer confidence grows, the simplistic dichotomy of BEVs as green and sustainable and ICEVs as dangerous and polluting is evolving into a more nuanced appraisal of the comparative advantages and disadvantages of each technology. While in the early stages of electrification, the public perception of BEVs tended to be framed by stark contrasts in terms of environmental benefits vs. financial costs (i.e., strikingly better environmental performance thanks to zero tailpipe emissions, counterbalanced by very high upfront purchase prices), such an oversimplified, binary view is now leaving the ground to a more sophisticated awareness about the complexities of the electrification challenge. In all of this, a relevant role is certainly played by different policy measures emerging in different parts of the globe to support the development and the market uptake of the new technology. In some countries. like Italy, the top-down transition to electric has been perceived by many as overly prescriptive, leading to disaffection in relevant shares of the population that might be enticed by more gradual policy trajectories.

The results of this study confirm that there is wide skepticism regarding the normative approach to support a transition to greener mobility paradigms based on the phasing out of ICE technology. Although there is an awareness that market-based mechanisms might fall short of achieving a tangible penetration of electric vehicles in the Italian circulating fleet, some suggest that policymakers should consider a more nuanced and flexible strategy based on a gradual, stepwise approach and on investing in aspects, such as financial incentives targeted to contrast the income and equity gap, a robust expansion of the network of charging infrastructure (which is crucial to address range anxiety and build confidence in consumers), or even the promotion of technology neutrality as the guiding principle for fostering innovation and sustainability.

Useful insights also emerge with reference to carmakers’ need to focus on developing cars that align with the preferences of prospective purchasers, offering transparent information about the performance of vehicles and their actual environmental impact.

On the one hand, the results confirm the need to invest in technological innovation since, notwithstanding recent improvements, aspects like driving range and charging time are still perceived as relevant barriers by the market. On the other hand, it is worth noting that as far as communication strategies are concerned, automakers are facing a challenging situation, a sort of twofold competition that is brand based (with other BEV companies) and technology based (with ICEVs). Should the key differentiation message be, for instance, framed around brand-based or technology-based competition? The communication strategy of BEV companies itself is indeed evolving over time. For instance, messages initially focused on pioneering technological aspects (describing BEVs as a niche product for wealthy environmentalists interested in “zero emissions”), while in recent years, sustainability has been gradually replaced by other factors, such as driving autonomy or a rewarding and pleasant driving experience. The product is, therefore, presented as the new normal, no longer reserved for a narrow niche, with the emotional component often taking over more purely performance or technological details.

Further, the results suggest that the market is composed of different sensibilities on BEVs so communicational strategies should abandon one-size-fits-all approaches and instead frame different messages targeting specific segments. For example, “tailored marketing to potential user groups with a higher focus on environmental aspects (“green drivers”) versus technology innovation and driving fun (“car enthusiasts”) is recommended in combination with the provision of correct and understandable information to avoid rebound and negative spillover effects” [

57], (p. 11).

Regarding the focus on the green drivers segment, to encourage widespread BEV adoption, marketing strategies need to move beyond hyperbole and focus on transparency and collaboration. This means avoiding greenwashing and adopting truthful messaging, as exaggerating the environmental benefits of BEVs can lead to disillusionment when consumers discover limitations (e.g., the environmental impact of battery production).

To realistically highlight how BEVs currently represent a significant leap forward in sustainability compared to traditional ICEVs, messages should avoid technical jargon yet adopt an LCA-oriented approach to present in a concise and effective way the superior environmental performance of BEVs once different aspects (e.g., all sources of emissions, battery disposal, etc.) have been taken into account.

Finally, the issue of charging points represents a cornerstone of the shift to a new paradigm since large-scale BEV deployment is unrealistic without adequate charging infrastructure. The approach could be based on industry collaboration and government and media focus on progress. Regarding the first aspect, carmakers are often hesitant to invest in communicating improvements in charging infrastructures since investments would also benefit competitors (freeriding). Industry bodies like trade associations can play a crucial role by facilitating collaboration among carmakers (in a sort of demand-led competition) and, by pooling resources, launch large-scale campaigns promoting the overall growth of the charging network. Secondly, public awareness campaigns should be implemented to inform the public not only about the new legislation (i.e., Fit for 55) but also about the progress being made with reference to sensible infrastructural aspects, and media outlets could play a vital role in highlighting the general improvements and expansion of charging infrastructure across the country to reassure potential buyers from a third-party and thus more credible source.