The Potential of Blockchain within Air Rights Development as a Prevention Measure against Urban Sprawl

Abstract

:1. Introduction

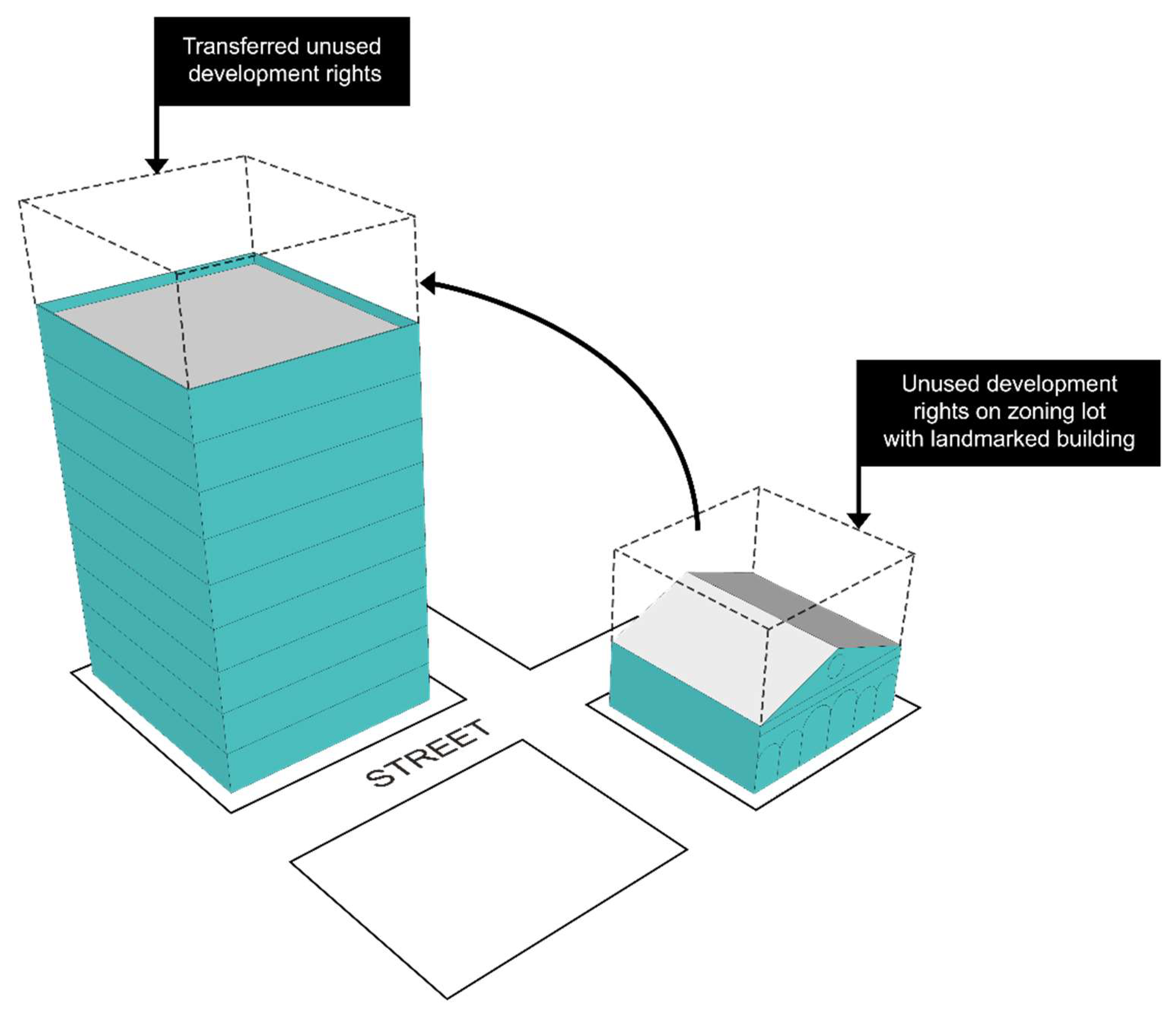

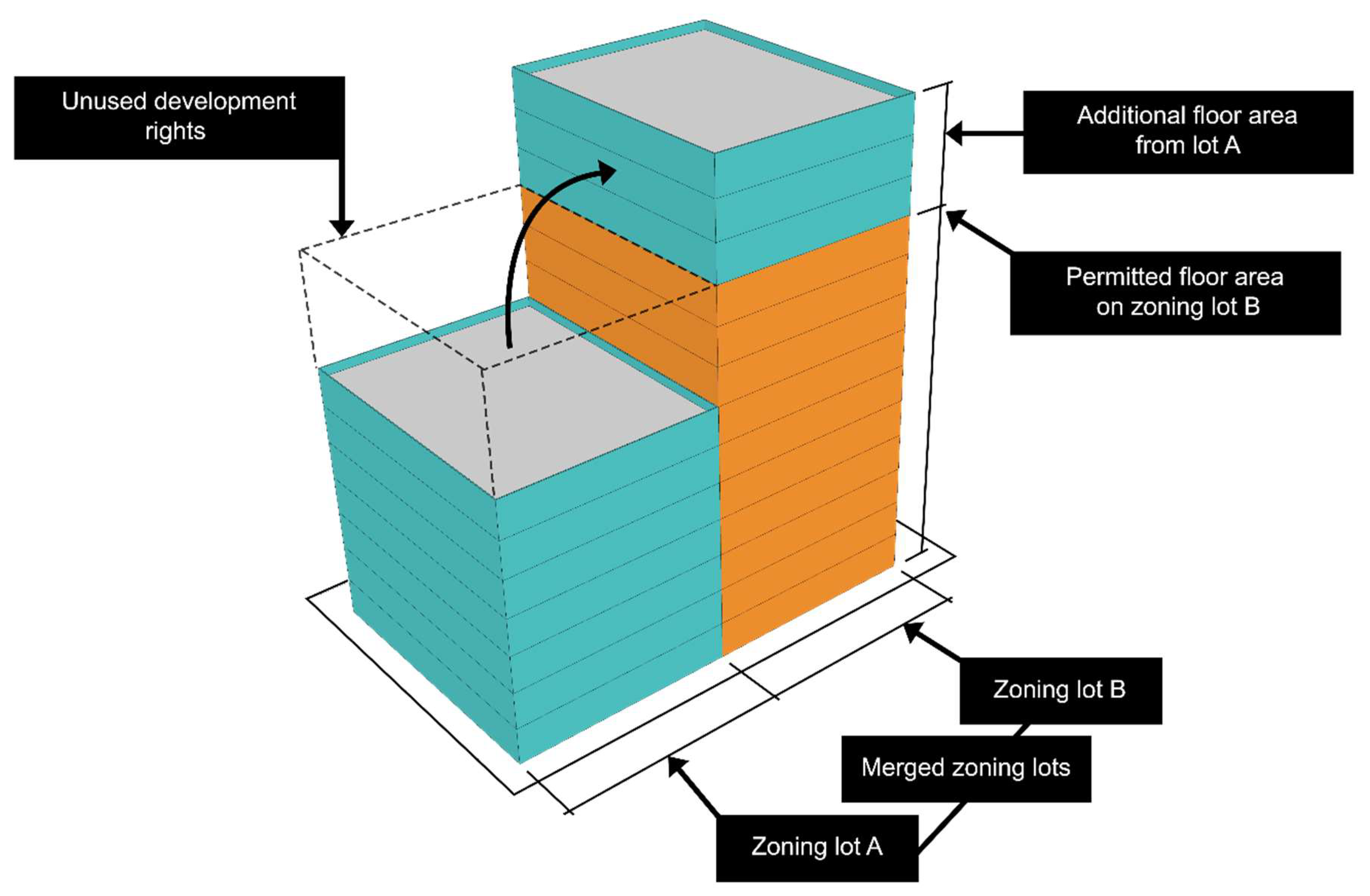

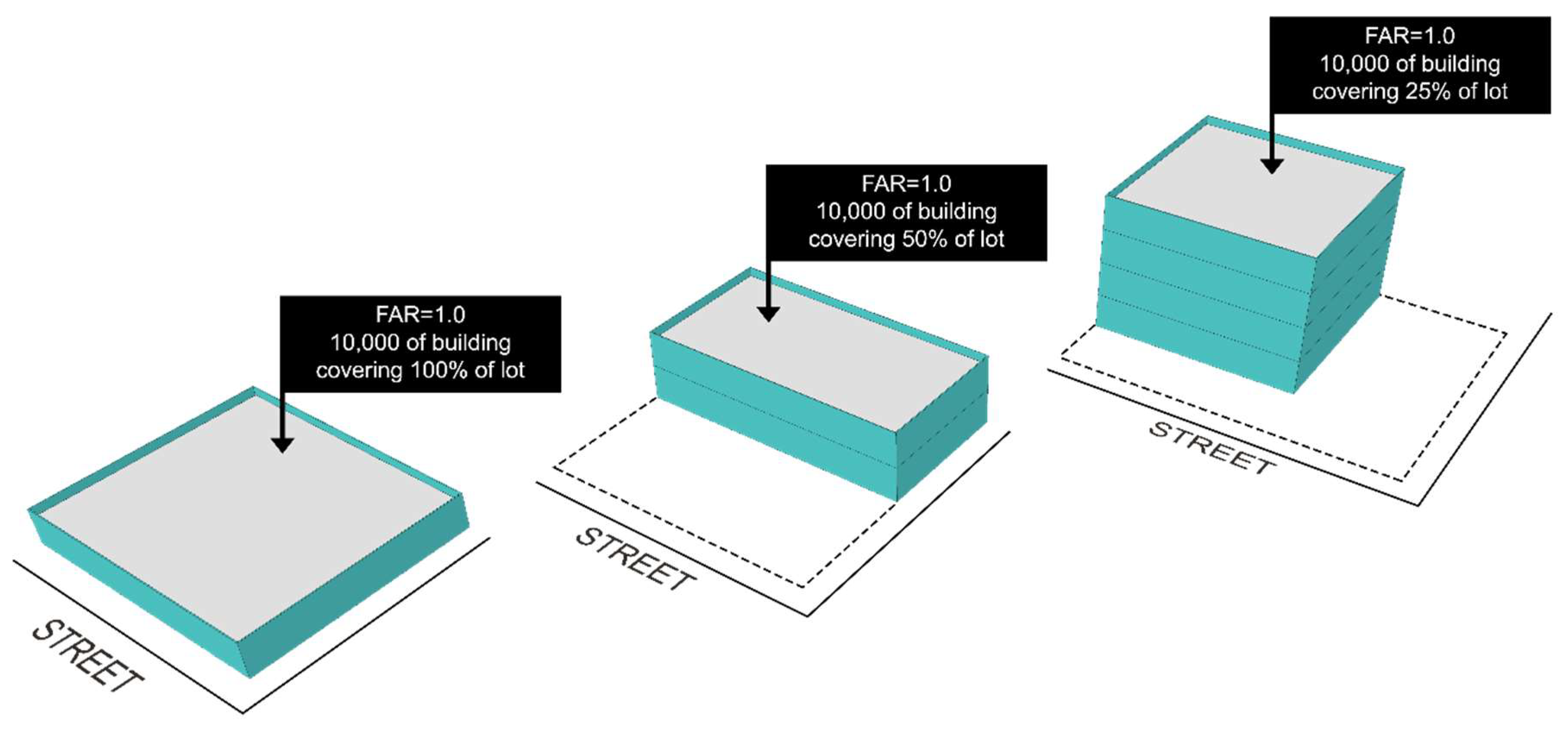

2. Air Rights Development

3. Smart Contracts, Blockchain and the Property Market

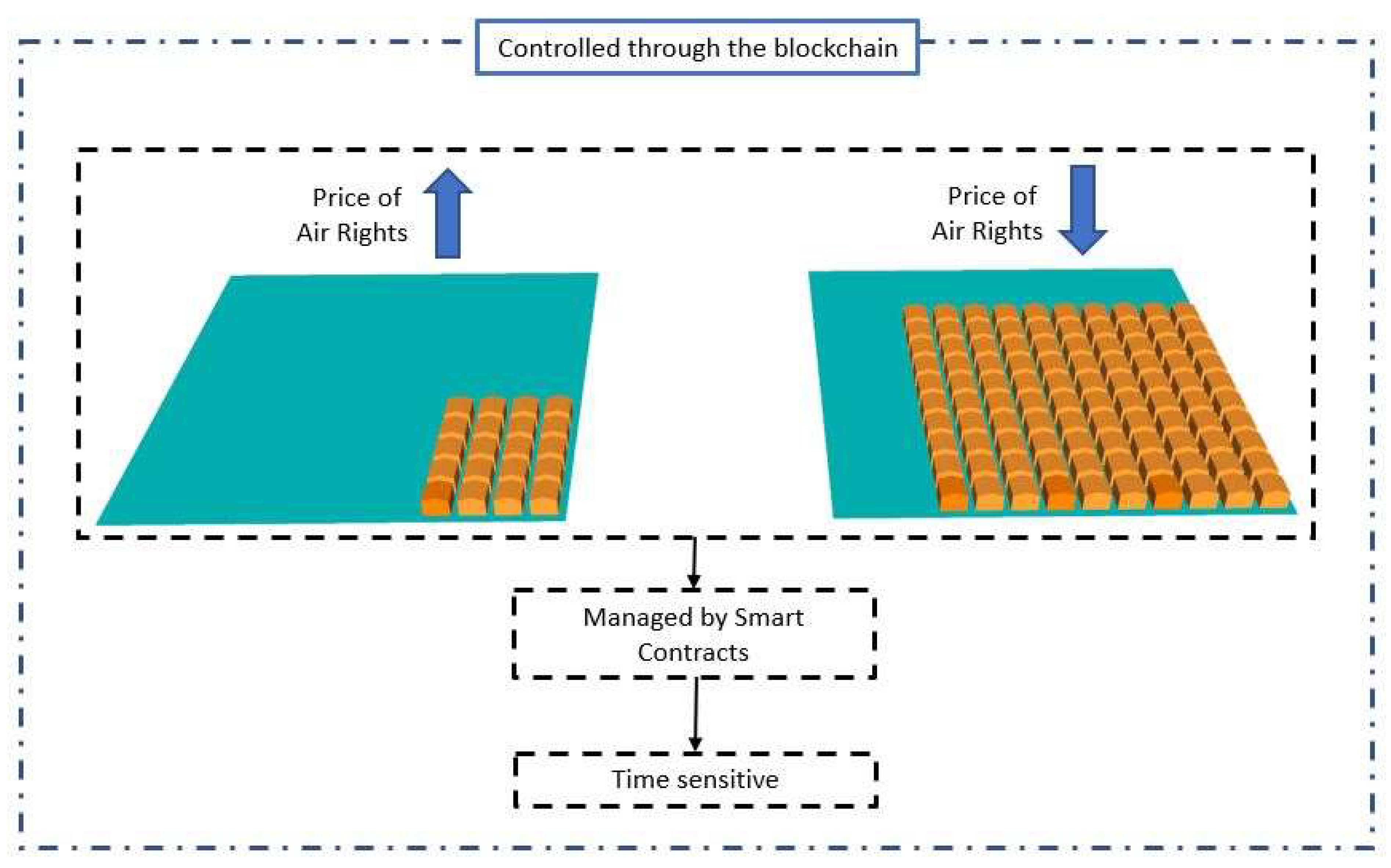

4. Price Uncertainty for Transferable Air Rights

5. A Proposed Model

- Fluctuating prices calculated based on green land availability;

- Smart Contracts;

- Time-sensitive conditions;

- Blockchain ledger systems.

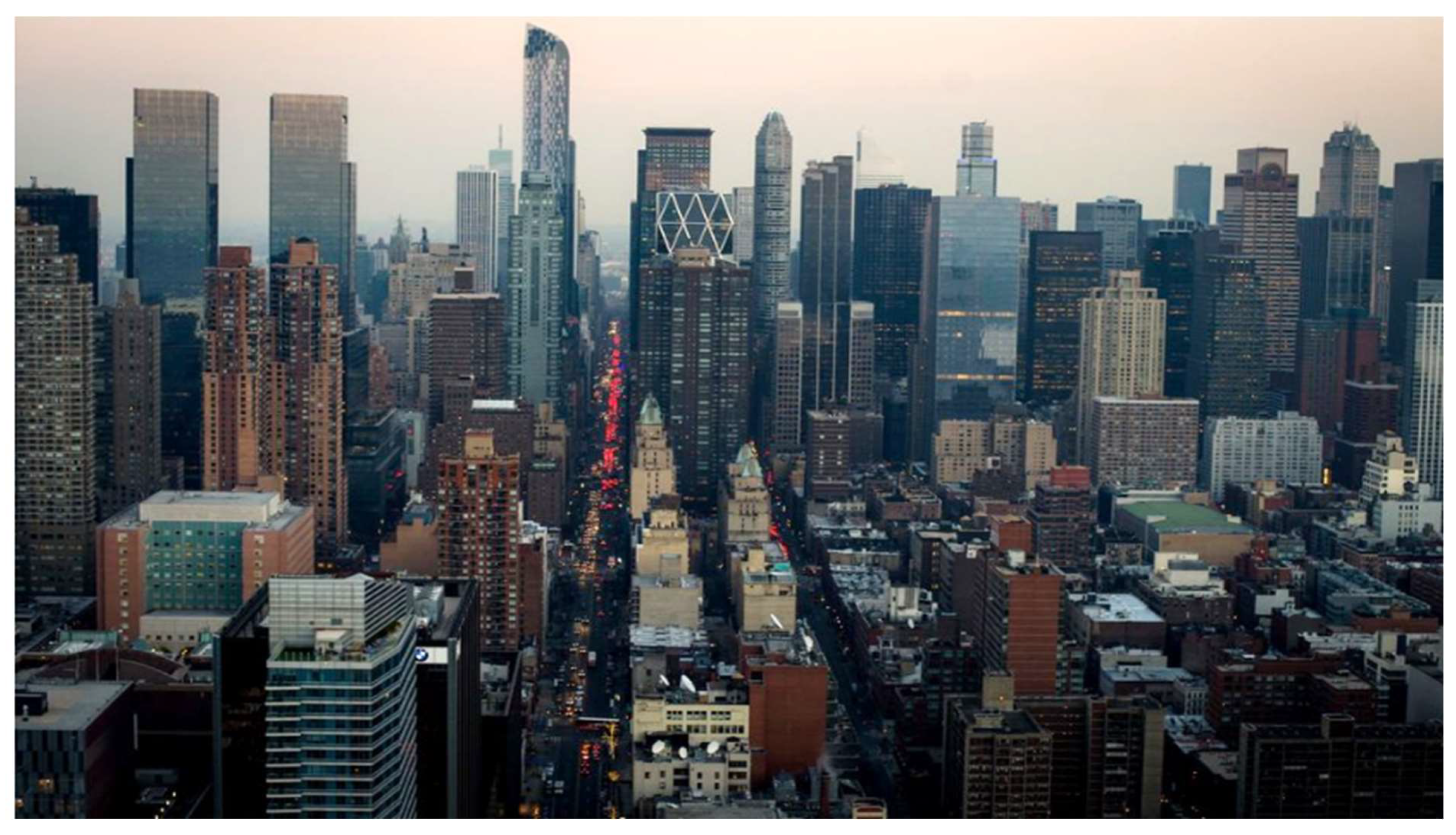

6. A Case Study of Air Rights Development in New York City

‘The building would be the first skyscraper to go up under new zoning rules for the area surrounding Grand Central Terminal, which were designed to encourage the development of taller, more modern skyscrapers and ensure that Midtown remains one of the city’s premier business districts. The new tower will soar as much as 500 feet [152 m] higher than the existing 52-story headquarters on the west side of Park Avenue and contain an additional one million square feet of office space. Chase is expected to buy unused development rights from nearby buildings, generating more than $40 million for public improvements to the streets, pedestrian plazas and sidewalks in the neighborhood under the new zoning plan.’

7. Discussion

8. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Herzog, L.A. Global Suburbs: Urban Sprawl from the Rio Grande to Rio de Janeiro; Taylor & Francis: Abingdon, UK, 2015; Volume 1. [Google Scholar]

- Hamidi, S.; Ewing, R. Is sprawl affordable for americans?: Exploring the association between housing and transportation affordability and urban sprawl. Transp. Res. Rec. J. Transp. Res. Board 2015, 2500, 75–79. [Google Scholar] [CrossRef]

- Bhatta, B. Analysis of Urban Growth and Sprawl from Remote Sensing Data; Springer: Berlin/Heidelberg, Germany, 2010; Volume 1. [Google Scholar]

- Agrawal, S. Neighbourhood Patterns and Housing Choices of Immigrants; Region of Peel: Toronto, ON, Canada, 2010. [Google Scholar]

- Sudhira, H.S.; Ramachandra, T.V. Characterising urban sprawl from remote sensing data and using landscape metrics. In Proceedings of the 10th International Conference on Computers in Urban Planning and Urban Management, Iguassu Falls, Brazil, 11–13 July 2007. [Google Scholar]

- Agrawal, S. New ethnic places of worship and planning challenges. In Plan Canada; University of Alberta: Edmonton, AB, Canada, 2009; pp. 64–67. [Google Scholar]

- Guiling, P.; Brorsen, W.; Doye, D. Effect of urban proximity on agricultural land values. Land Econ. 2009, 85, 252–264. [Google Scholar] [CrossRef]

- Developer pays bra $ 600k for air-rights along greenway. Available online: https://www.bizjournals.com/boston/real_estate/2016/07/developer-pays-bra-600k-for-air-rights-along.html (accessed on 1 January 2019).

- Tan, G.; Clark, P. Timeshare Company Spends $175 Million for Hotel on NYC’S Billionaires’ Row. Available online: https://www.bloomberg.com/news/articles/2018-06-28/hilton-grand-vacations-is-said-to-acquire-manhattan-s-quin-hotel (accessed on 28 September 2018).

- Barr, J. Skyscraper height. J. Real Estate Financ. Econ. 2012, 45, 723–753. [Google Scholar] [CrossRef]

- Barr, J. Economics/financial: The economics of manhattan skyscrapers. CTBUH J. 2015, 4, 34–39. [Google Scholar]

- Goldschmidt, L.A. Air Rights. Available online: https://www.planning.org/pas/reports/report186.htm (accessed on 26 September 2018).

- Colman, M.S. Understanding the Power of Air Rights. Available online: https://www.cityrealty.com/nyc/market-insight/features/future-nyc/understanding-power-air-rights/2923 (accessed on 29 September 2018).

- Abramovitch, Y. The maxim “cujus est solum ejus usque ad coelum” as applied in aviation. McGill Law J. 1961, 8, 247–269. [Google Scholar]

- Schwartz, M.A. It’s up in the air: Air rights in modern development. Fla. Bar J. 2015, 89, 42–44. [Google Scholar]

- Harvey, W.B. Landowners’ Rights in the Air Age: The Airport Dilemma; Faculty, M., Ed.; Maurer Faculty: Bloomington, IN, USA, 1958. [Google Scholar]

- Finn, R. The Great Air Race. Available online: https://www.nytimes.com/2013/02/24/realestate/the-great-race-for-manhattan-air-rights.html (accessed on 28 September 2018).

- Columbia Law Review. Conveyance and Taxation of Air Rights. Columbia Law Rev. 1964, 64, 338–354. [Google Scholar] [CrossRef]

- Schmidt, T. Public utility air rights. J. Air Law Commer. 1930, 1, 52–74. [Google Scholar]

- Chau, K.K.; Wong, S.K.; Yan, Y.; Yeung, A.K. Determining optimal building height. Urban Stud. 2007, 44, 591–607. [Google Scholar] [CrossRef]

- Florida, R. Cities and the Creative Class; Routledge: New York, NY, USA, 2005. [Google Scholar]

- Lachman, M.L.; Brett, D.L.; Becker, L. Gen Y and Housing: What They Want and Where They Want It. Available online: http://uli.org/wp-content/uploads/ULI-Documents/Gen-Y-and-Housing.pdf (accessed on 29 September 2018).

- O’Sullivan, A. Urban Economoics, 7th ed.; McGraw-Hill: New York, NY, USA, 2010. [Google Scholar]

- Bunio, N. Air Rights Develoment and Public Assets: An Implementation Handbook for Public Entities; Ryerson University: Toronto, ON, Canada, 2016. [Google Scholar]

- VDOT. Air Rights Development. Available online: http://www.virginiadot.org/projects/air_rights_development.asp (accessed on 29 September 2018).

- Smit, J. Case Study: Air Rights Housing. Available online: https://www.placemakingresource.com/article/1421290/case-study-air-rights-housing (accessed on 28 September 2018).

- Mazzara, B. As Famous Churches Seek to Sell Air Rights, the City Demands Its Cut. Available online: https://www.bisnow.com/new-york/news/commercial-real-estate/as-famous-churches-seek-to-sell-air-rights-the-city-demands-its-cut-56645 (accessed on 26 September 2018).

- Pruetz, R.; Standridge, N. What makes transfer of development rights work?: Sucess factors from research and practice. J. Am. Plan. Assoc. 2008, 75, 78–87. [Google Scholar] [CrossRef]

- Savvides, A.L. Smart growth through joint highway air rights and transit-oriented development. Int. J. Sustain. Dev. Plan. 2017, 12, 1142–1154. [Google Scholar] [CrossRef]

- Mathur, S. Sale of development rights to fund public transportation projects: Insights from rajkot, india, brts project. Habitat Int. 2015, 50, 234–239. [Google Scholar] [CrossRef]

- Swan, M. Blockchain: Blueprint for a New Economy; O’Reilly Media, Inc.: Sebastopol, CA, USA, 2015. [Google Scholar]

- Kosba, A.; Miller, A.; Shi, E.; Wen, Z.; Papamanthou, C. Hawk: The Blockchain model of cryptopraphy and privacy-preserving smart contracts. In Proceedings of the Conference: 2015 IEEE Security and Privacy Workshops (SPW), San Jose, CA, USA, 21–22 May 2015; IEEE: San Jose, CA, USA, 2016. [Google Scholar]

- Allam, Z. On smart contracts and organisational performance: A review of smart contracts through the Blockchain technology. Rev. Econ. Bus. Stud. 2018, 11, 137–156. [Google Scholar] [CrossRef]

- Deloitte. Blockchain in Commercial Real Estate: The Future Is Here! Deloitte Centre for Financial Services: New York, NY, USA, 2017. [Google Scholar]

- Turk, Ž.; Klinc, R. Potentials of Blockchain technology for construction management. Procedia Eng. 2017, 196, 638–645. [Google Scholar] [CrossRef]

- Chen, H.; Chiang, R.H.L.; Storey, V.C. Business intelligence and analytics: From big data to big impact. Mis Q. 2012, 36, 1165–1188. [Google Scholar] [CrossRef]

- The truth about Blockchain. Available online: https://hbr.org/2017/01/the-truth-about-blockchain (accessed on 29 September 2018).

- Lauslahti, K.; Mattila, J.; Seppälä, T. Smart contracts—How will Blockchain technology affect contractual practices? ETLA: Helsinki, Finland, 2017. [Google Scholar]

- O’Shields, R. Smart contracts: Legal agreements for the Blockchain. UNC Sch. Law 2017, 21, 176–194. [Google Scholar]

- Engebretson, J. NCTC/AMC Agreement Reached, But Not All Small Cablecos Are on Board; Telecompetitor: Wilsonville, OR, USA, 2016. [Google Scholar]

- Frankel, D. Around 105 NCTC Cable Operators Ended up Dropping AMC, Report Says; Questex LLC.: Framingham, MA, USA, 2016. [Google Scholar]

- Peters, G.W.; Panayi, E.; Chapelley, A. Cryptocurrencies and Blockchain technologies: A monetary theory and regulation perspective. In Who Will Disrupt the Disruptors? The Journal of Financial Perspectives; FinTech: London, UK, 2015; pp. 92–113. [Google Scholar]

- Romano, D.; Schmid, G. Beyond bitcoin: A critical look at Blockchain-based systems. Cryptography 2017, 1, 15. [Google Scholar] [CrossRef]

- Jehanzeb, K.; Bashir, N.A. Training and development program and its benefits to employee and organization: A conceptual study. Eur. J. Bus. Manag. 2013, 5, 243–253. [Google Scholar]

- Savelyev, A. Contract law 2.0: ‘Smart’ contracts as the beginning of the end of classic contract law. Inf. Commun. Technol. Law 2017, 26, 116–134. [Google Scholar] [CrossRef]

- Brown, E.; Kusisto, L. The Stuyvesant Incentive—New York City Backs Effort by Blackstone to Raise Millions from Development Rights. 2015. Available online: https://www.wsj.com/articles/the-stuyvesant-town-deal-sweetener-1445554680 (accessed on 29 September 2018).

- Clinch, J.P.; O’Neill, E. Assessing the relative merits of development charges and transferable development rights in an uncertain world. Urban Stud. 2010, 47, 891–911. [Google Scholar] [CrossRef]

- Shahab, S.; Clinch, J.P.; O’Neill, E. Timing and distributional aspects of transaction costs in transferable development rights programmes. Habitat Int. 2018, 75, 131–138. [Google Scholar] [CrossRef]

- Baird-Remba, R. City Sets Price for West Chelsea Air Rights at $625 a Foot, Favoring Buyers. Available online: https://commercialobserver.com/2018/02/city-sets-price-for-west-chelsea-air-rights-at-625-a-foot-favoring-buyers/ (accessed on 7 March 2019).

- King County. Transfer of Development Rights Bank. Available online: https://www.kingcounty.gov/services/environment/stewardship/sustainable-building/transfer-development-rights/bank.aspx (accessed on 7 March 2019).

- Grover, R.; Göks, F.; Corsi, A.; Kindap, A. Transfer of Development Rights: Technical Note; World Bank: Washington, DC, USA, 2018; pp. 1–53. [Google Scholar]

- Furman Center. Buying Sky: The Market for Transferable Development Rights in New York City; Center, F., Ed.; New York University School of Law: New York, NY, USA, 2013; pp. 1–20. [Google Scholar]

- NYC Planning. Glossary of Planning Terms. Available online: https://www1.nyc.gov/site/planning/zoning/glossary.page (accessed on 29 September 2018).

- Jones, M.M. Finance of the Fallow Firmament: Valuing Air Rights in Contemporary Manhattan. Master’s Thesis, Massachusetts Institute of Technology, Cambridge, MA, USA, 2015. [Google Scholar]

- Been, V.; Infranca, J. Transferable development rights programs: ‘Post-zoning’? Brooklyn Law Rev. 2012, 78, 12–31. [Google Scholar]

- Smith, M. Buying air rights in NYC: What you need to know about the NYC dev. Rights endorsement. In New York Real Estate Journal; Herrick Feinstein LLC: New York, NY, USA, 2018. [Google Scholar]

- Williams, L.E.; McNichol, D.J. Valuation of airspace. Apprais. J. 1973, 41, 234–253. [Google Scholar]

- Blasio, B.D.; Glen, A. Housing New York: A Five-Borough, Ten-Year Plan; Mayor’s Office New York: New York, NY, USA, May 2014. [Google Scholar]

- Bagli, C.V. Out with the Old Building, in with the New for JPMORGAN Chase. Available online: https://www.nytimes.com/2018/02/21/nyregion/jpmorgan-chase-headquarters.html (accessed on 28 September 2018).

- Giordano, M. Over-stuffing the envelope: The problems with creative transfer of development rights. Urban Law J. 1988, 16, 43–67. [Google Scholar]

- Woodbury, S. Transfer of development rights: A new tool for planners. J. Am. Plan. Assoc. 1973, 41, 3–14. [Google Scholar] [CrossRef]

- Salkin, P.E. New York Zoning Law and Practice, 4th ed.; West Group: Eagan, MN, USA, 2000; Volume 1. [Google Scholar]

- Allan. Development rights transfer in New York City. Yale Law J. 1972, 82, 338–372. [Google Scholar] [CrossRef]

- Goodman, P. Zoning in the fourth dimension. Pace Environ. Law Rev. 1985, 3, 75–113. [Google Scholar]

- Marcus, N. Air rights in New York City: Tdr, zoning lot merger and the well-considered plan. Brooklyn Law Rev. 1984, 50, 867–912. [Google Scholar]

- Pruetz, R.; Pruetz, E. Transfer of development rights turns 40. Am. Plan. Assoc. Plan. Environ. Law 2007, 59, 3–11. [Google Scholar] [CrossRef]

- Joshi, K.K.; Kono, T. Optimization of floor area ratio regulation in a growing city. Reg. Sci. Urban Econ. 2009, 39, 502–511. [Google Scholar] [CrossRef]

- Campbell, B.E. Creating Sustainable Air Rights Development over Highway Corridors: Lessons from the Massachusetts Turnpike in Boston; Massachusetts Institute of Technology: Cambridge, MA, USA, 2004. [Google Scholar]

- Panayotou, T. Conservation of biodiversity and economic development: The concept of transferable development rights. Environ. Resour. Econ. 1994, 4, 99–110. [Google Scholar] [CrossRef]

- Linkous, E.R. Transfer of development rights in theory and practice: The restructuring of tdr to incentivize development. Land Use Policy 2016, 51, 162–171. [Google Scholar] [CrossRef]

- Renard, V. Property rights and the ‘transfer of development rights’: Questions of efficiency and equity. Prop. Rights Priv. Initiat. 2007, 78, 41–60. [Google Scholar] [CrossRef]

- Graglia, J.M.; Mellon, C. Blockchain and property in 2018: At the end of the beginning. In Proceedings of the Annual World Bank Conference on Land and Poverty, Washington, DC, USA, 19–23 March 2018. [Google Scholar]

- Karamitsos, I.; Papadaki, m.; Al-Barghuthi, N.B. Design of the Blockchain smart contract: A use case for real estate. J. Inf. Secur. 2018, 9, 177–190. [Google Scholar] [CrossRef]

- Land & real estate Blockchain solutions: Scheduled private token sale & token distribution event. Available online: https://uploads-ssl.webflow.com/59a68d67ca51d80001e98965/5ae8bda6d99a3d2330d7a75b_Domineum%20Whitepaper%201_2.pdf (accessed on 5 January 2019).

- Unclear land rights hinder haiti’s reconstruction. Available online: https://reliefweb.int/report/haiti/unclear-land-rights-hinder-haitis-reconstruction (accessed on 5 January 2019).

- Apostalaki, M.; Zohar, A.; Vanbever, L. Hijacking bitcoin: Routing attacks on cryptocurrencies. In Proceedings of the 2017 IEEE Symposium on Security and Privacy, San Jose, CA, USA, 22–26 May 2017. [Google Scholar]

- Zhao, J.L.; Fan, S.; Yan, J. Overview of business innovations and research opportunities in Blockchain and introduction to the special issue. Financ. Innov. 2016, 2, 2–7. [Google Scholar] [CrossRef]

- Gatteschi, V.; Lamberti, F.; Demartini, C.; Pranteda, C.; Santamaría, V. Blockchain and smart contracts for insurance: Is the technology mature enough? Future Internet 2018, 10, 20. [Google Scholar] [CrossRef]

- Eyal, I.; Gencer, A.E.; Sirer, E.G.; Van Renesse, R. Bitcoin-ng: A scalable Blockchain protocol. In Proceedings of the 13th USENIX Symposium on Networked Systems Design and Implementation (NSDI’16), Santa Clara, CA, USA, 16–18 March 2016; USENIX Association: Santa Clara, CA, USA, 2016; pp. 45–59. [Google Scholar]

- Silver, N. Finance, Society and Sustainability: How to Make the Financial System Work for the Economy, People and Planet; Palgrave Macmillan Limited: London, UK, 2017. [Google Scholar]

- Bonnet, O.; Bono, P.-H.; Chapelle, G.; Wasmer, E. Réflexions sur le logement, la hausse des prix de l’immobilier et les inégalités en réponse à l’ouvrage de thomas piketty, le capital au xxie siècle/reflections on housing, property price booms and inequality in response to thomas piketty’s capital in the xxist century. Rev. D’économie Polit. 2015, 317–346. [Google Scholar]

- Ge, T.; Wu, T. Urbanization, inequality and property prices: Equilibrium pricing and transaction in the Chinese housing market. China Econ. Rev. 2017, 45, 310–328. [Google Scholar] [CrossRef]

- Allam, Z. Sustainable architecture: Utopia or feasible reality? J. Biourbanism 2012, 2, 47–61. [Google Scholar]

- Siew, G.; Allam, Z. Culture as a driver for sustainable urban development. In Proceedings of the UIA 2017 Seoul World Architects Congress, Seoul, Korea, 3–7 September 2017; International Union of Architects: Seoul, Korea, 2017. [Google Scholar]

- Blockchain to foster trust and transparency. Available online: https://www.lntinfotech.com/blogs/blockchain-to-foster-trust-and-transparency/ (accessed on 5 January 2019).

- Alcazar, V. Data you can trust: Blockchain technology. Air Space Power J. 2017, 31, 91–101. [Google Scholar]

- Casey, M.; Vigna, P. In Blockchain we trust. Technol. Rev. 2018, 121, 10–16. [Google Scholar]

- Allam, Z.; Newman, P. Economically incentivising smart urban regeneration. Case study of port louis, mauritius. Smart Cities 2018, 1, 53–74. [Google Scholar] [CrossRef]

- Allam, M.Z. Redefining the Smart City: Culture, Metabolism and Governance. Case Study of Port Louis, Mauritius; Curtin University: Perth, Australia, 2018. [Google Scholar]

- Allam, Z. Building a conceptual framework for smarting an existing city in mauritius: The case of port louis. J. Biourbanism 2017, 4, 103–121. [Google Scholar]

- Allam, Z. Contextualising the smart city for sustainability and inclusivity. New Des. Ideas 2018, 2, 124–127. [Google Scholar]

- Allam, Z. The emergence of anti-privacy and control at the nexus between the concepts of safe city and smart city. Smart Cities 2019, 2, 96–105. [Google Scholar] [CrossRef]

- Allam, Z.; Newman, P. Redefining the smart city: Culture, metabolism & governance. Smart Cities 2018, 1, 4–25. [Google Scholar]

- Allam, Z.; Dhunny, Z.A. On big data, artificial intelligence and smart cities. Cities 2019, 89, 80–91. [Google Scholar] [CrossRef]

- Allam, Z.; Jones, D. Promoting resilience, liveability and sustainability through landscape architectural design: A conceptual framework for port louis, mauritius; a small island developing state. In Proceedings of the IFLA World Congress Singapore 2018, Singapore, 16–17 July 2018; International Federation of Landscape Architects: Singapore, 2018; pp. 1599–1611. [Google Scholar]

- Newman, P.; Beatley, T.; Boyer, H. Resilient Cities: Overcoming Fossil Fuel Dependence, 2nd ed.; Island Press: Washington, DC, USA, 2017. [Google Scholar]

- Newman, P.W.G. Sustainability and cities: Extending the metabolism model. Landsc. Urban Plan. 1999, 44, 219–226. [Google Scholar] [CrossRef]

| Environmental conservation/sustainability |

|

| Social impacts |

|

| Economically |

|

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Allam, Z.; Jones, D.S. The Potential of Blockchain within Air Rights Development as a Prevention Measure against Urban Sprawl. Urban Sci. 2019, 3, 38. https://doi.org/10.3390/urbansci3010038

Allam Z, Jones DS. The Potential of Blockchain within Air Rights Development as a Prevention Measure against Urban Sprawl. Urban Science. 2019; 3(1):38. https://doi.org/10.3390/urbansci3010038

Chicago/Turabian StyleAllam, Zaheer, and David Sydney Jones. 2019. "The Potential of Blockchain within Air Rights Development as a Prevention Measure against Urban Sprawl" Urban Science 3, no. 1: 38. https://doi.org/10.3390/urbansci3010038

APA StyleAllam, Z., & Jones, D. S. (2019). The Potential of Blockchain within Air Rights Development as a Prevention Measure against Urban Sprawl. Urban Science, 3(1), 38. https://doi.org/10.3390/urbansci3010038