Achieving Climate Targets via the Circular Carbon Economy: The Case of Saudi Arabia

Abstract

1. Introduction

2. Literature Review

3. Methodology

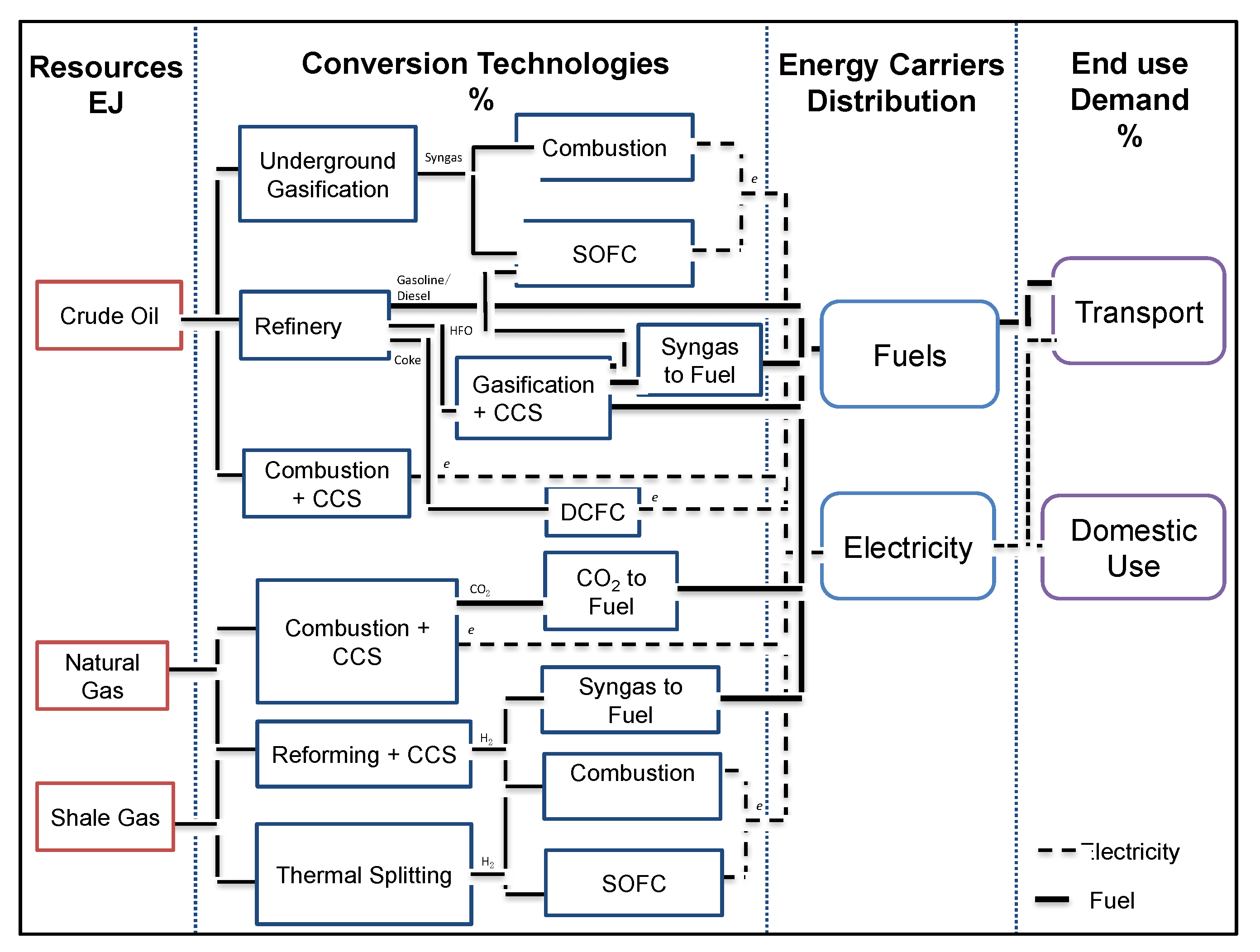

3.1. Model Development

3.2. Model Data

4. Results and Discussion

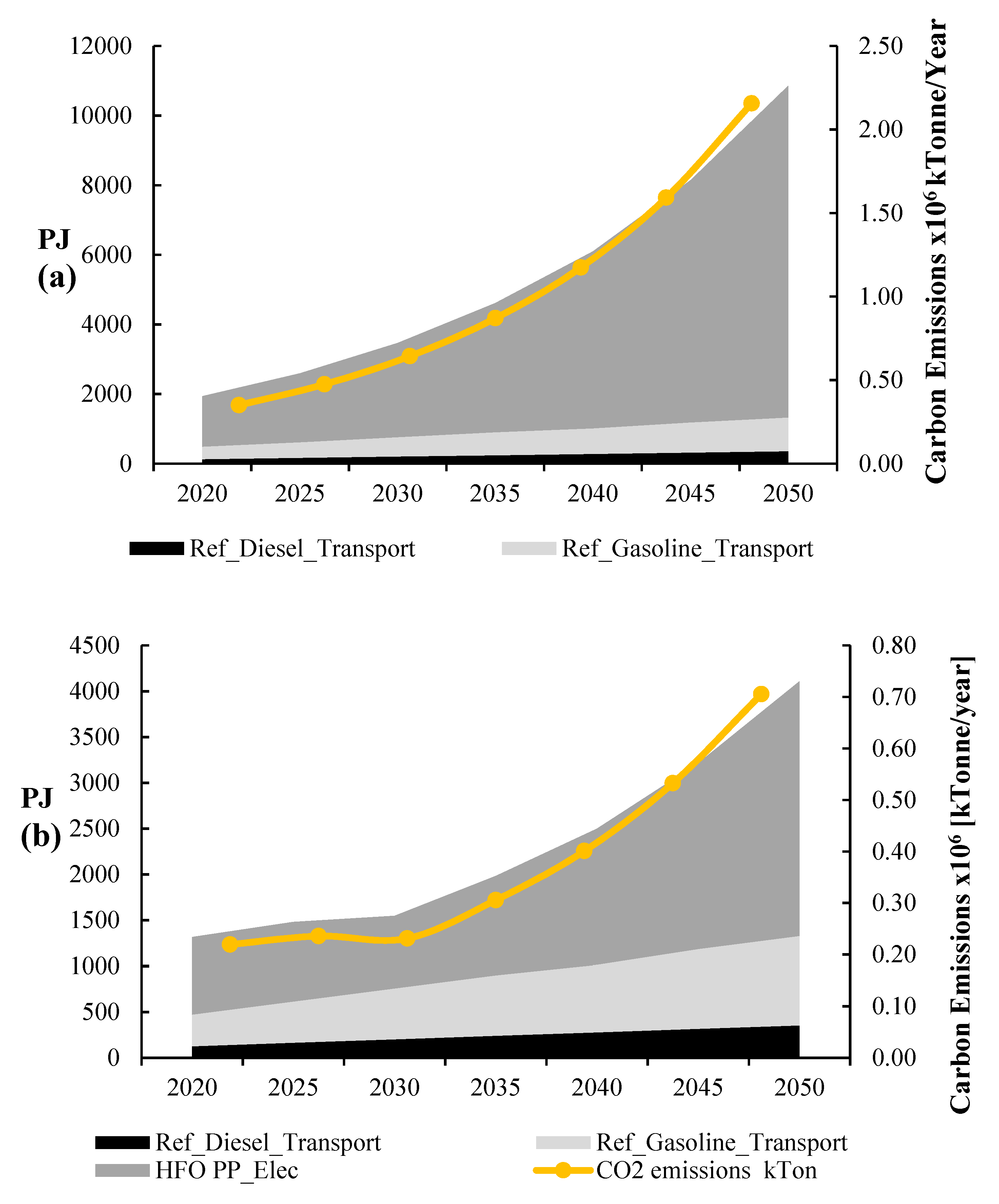

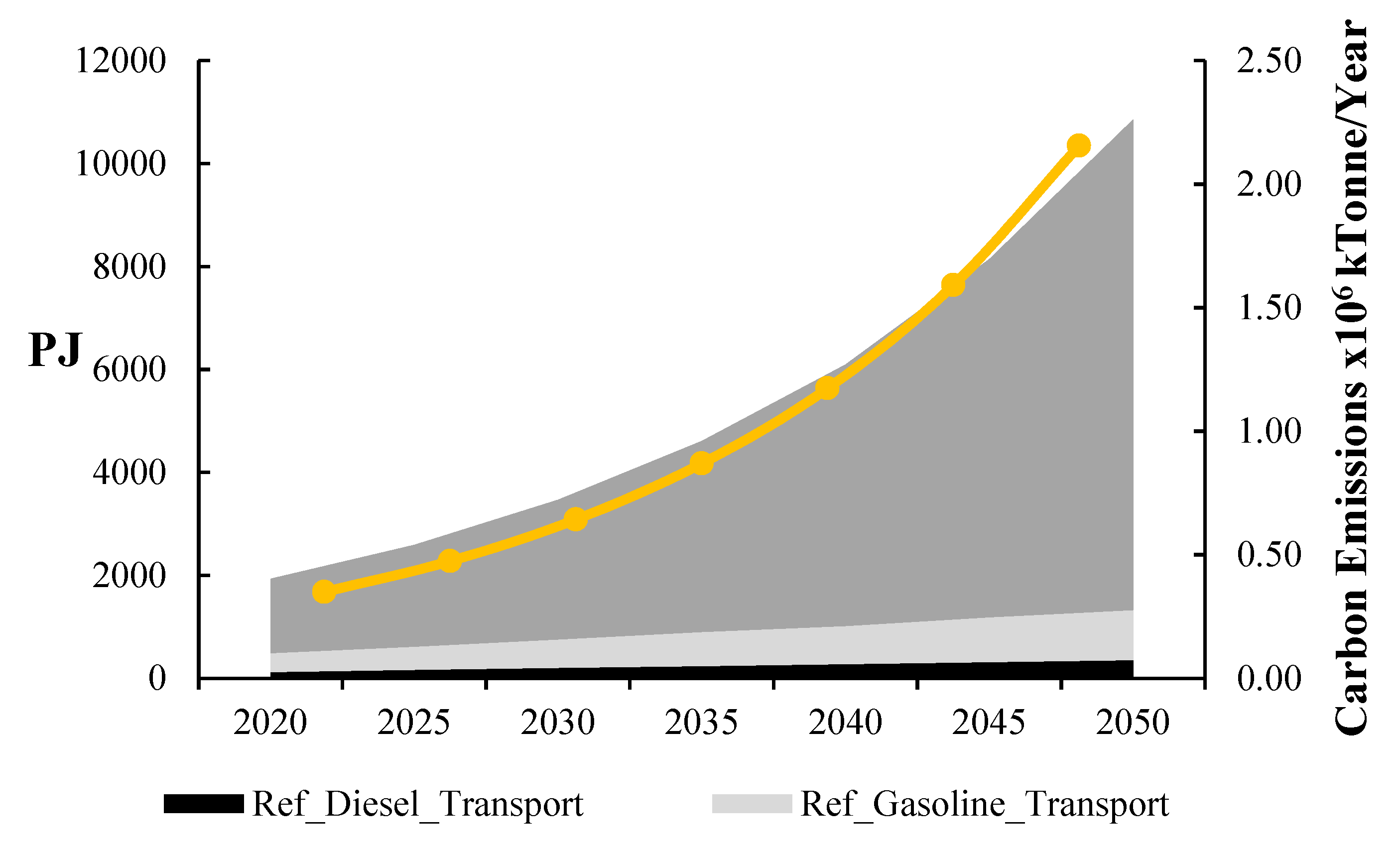

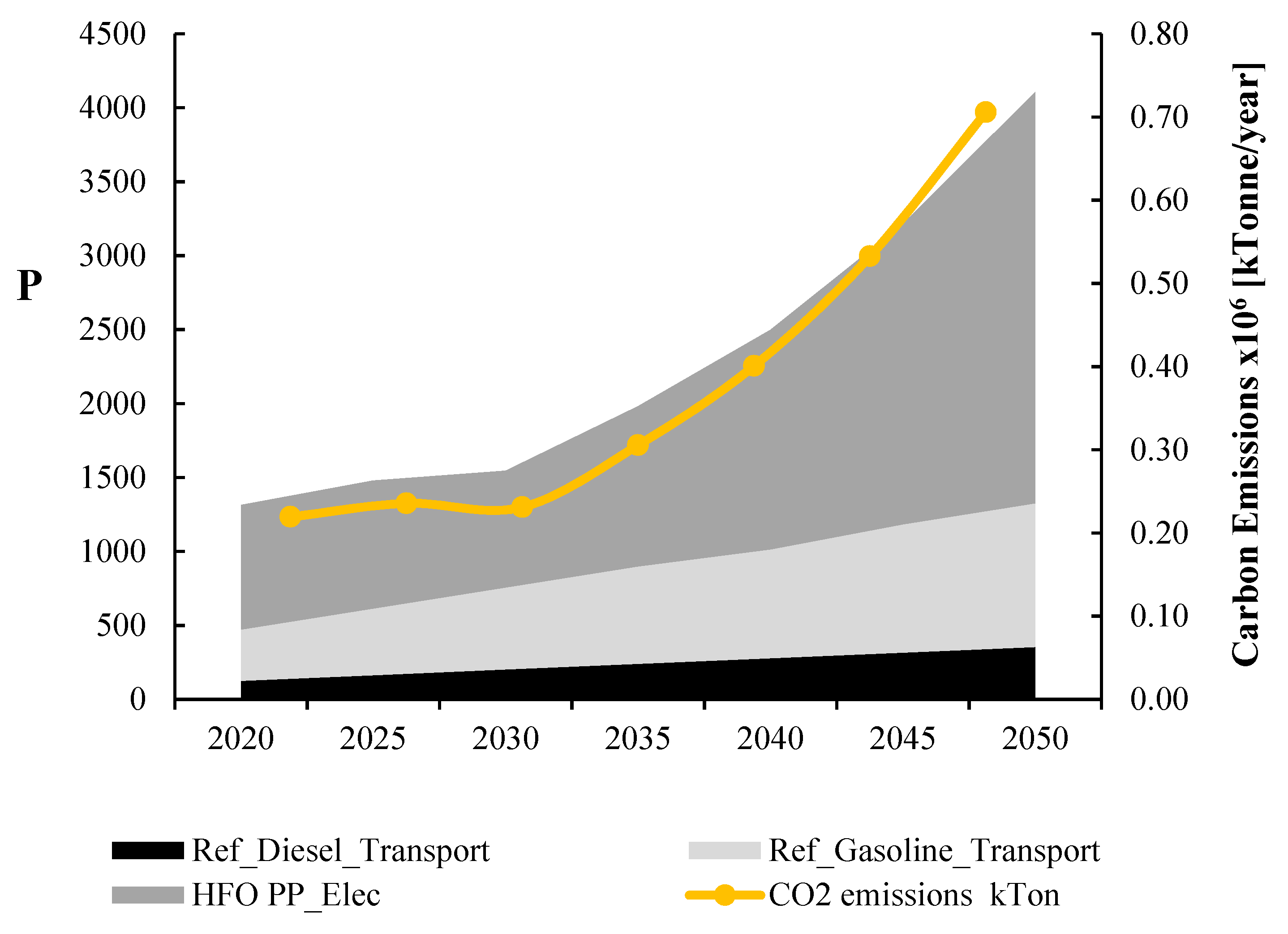

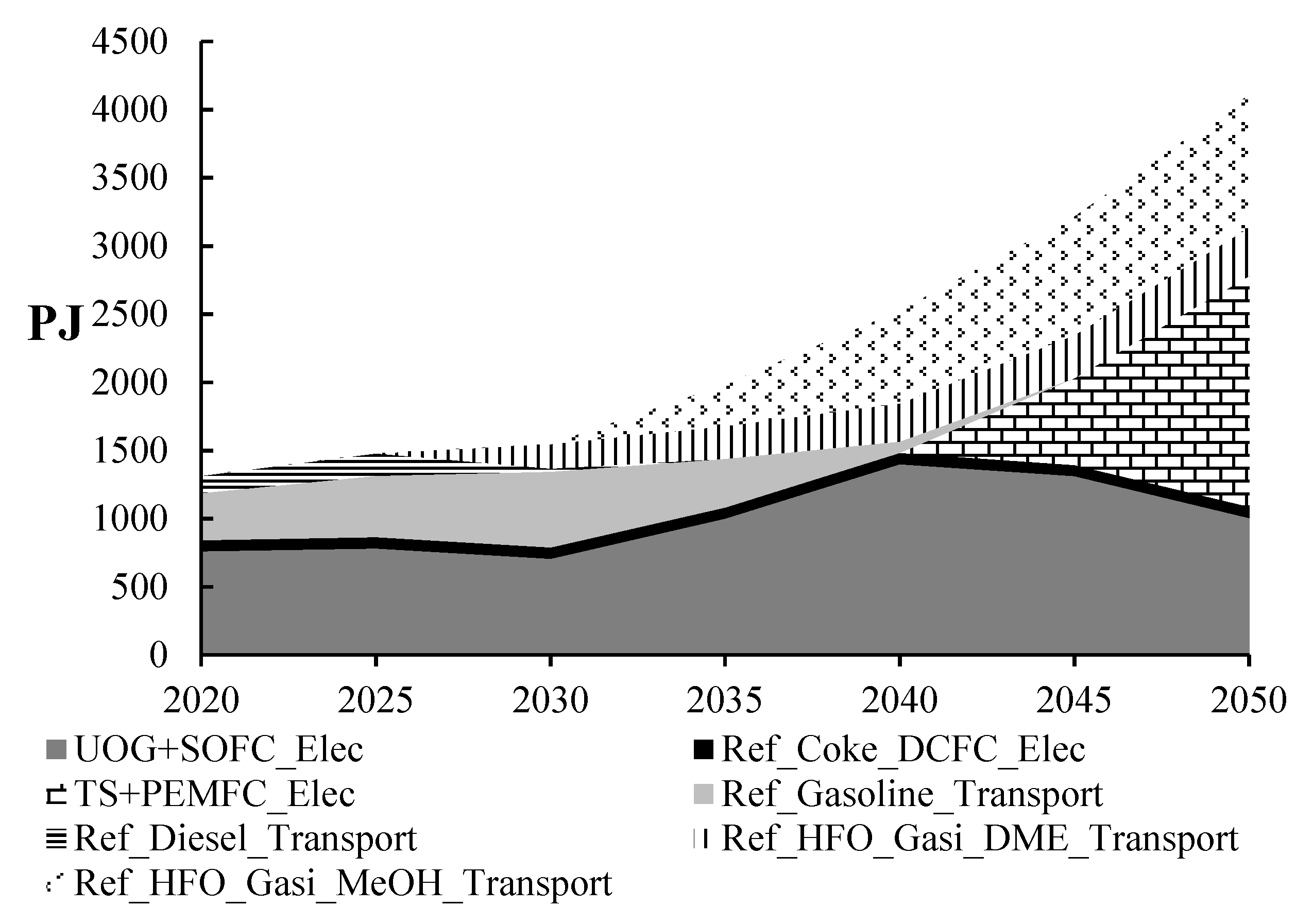

4.1. Energy System

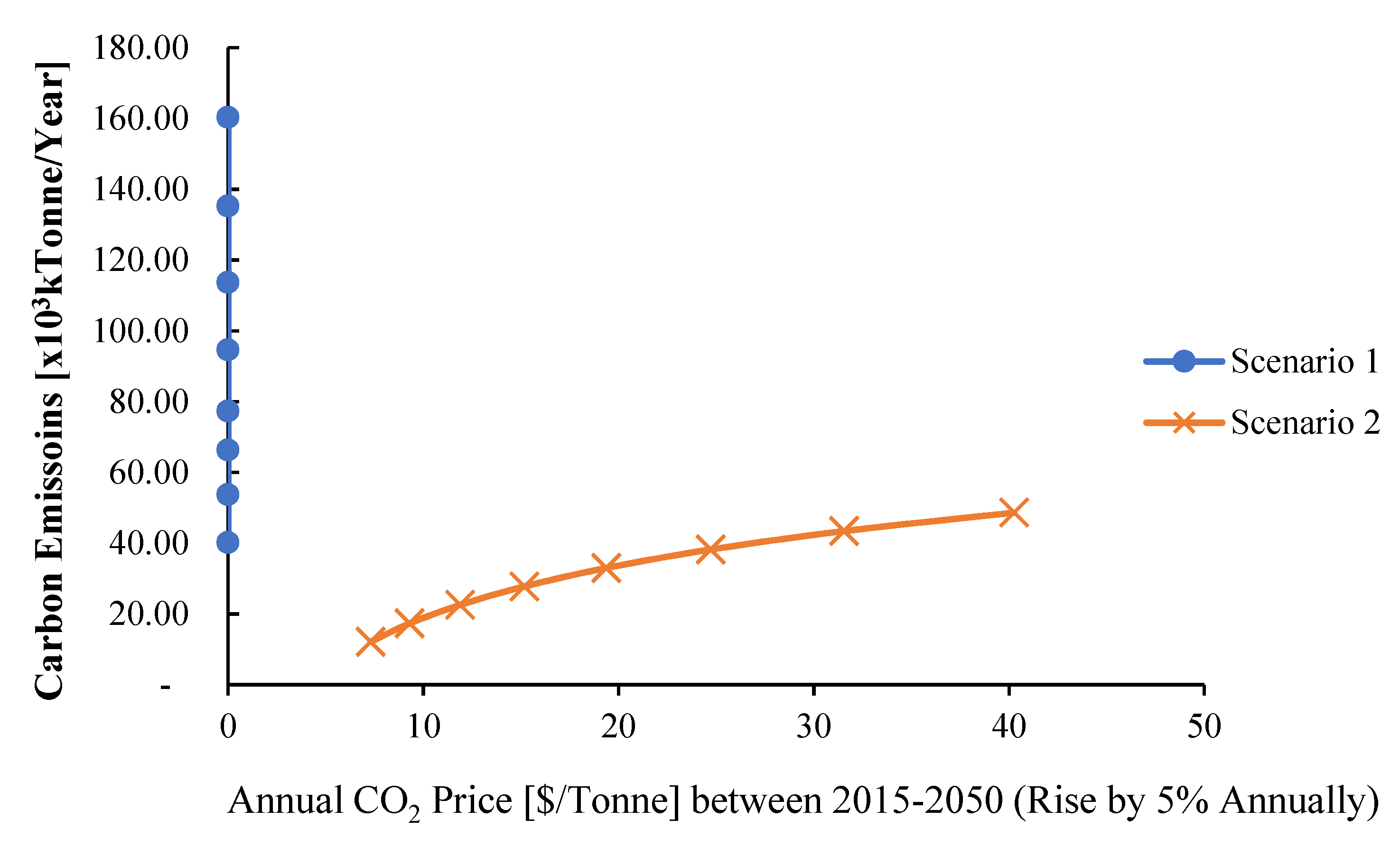

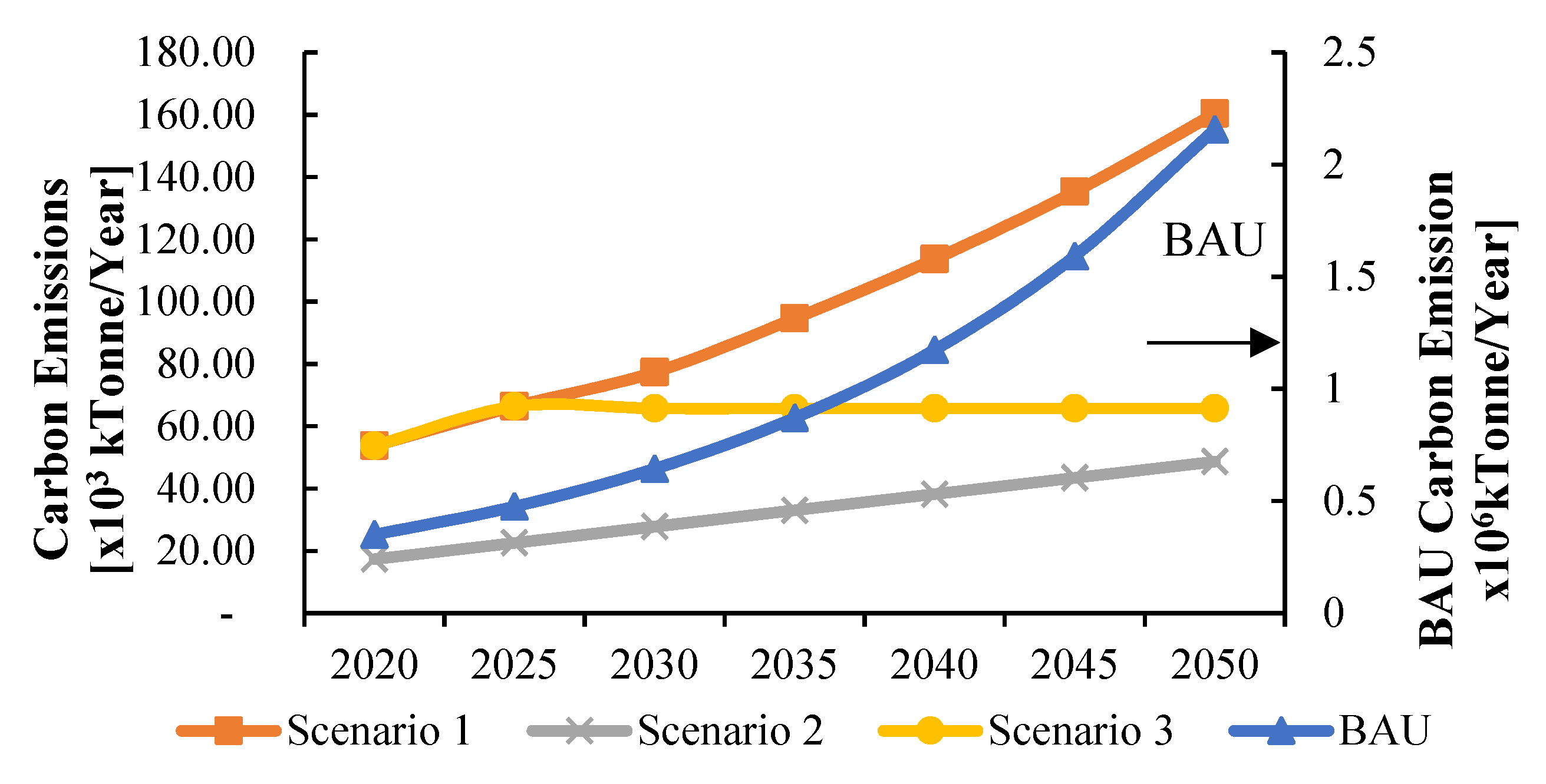

4.2. Impact of CO2 Pricing

4.3. Impact of Capping CO2

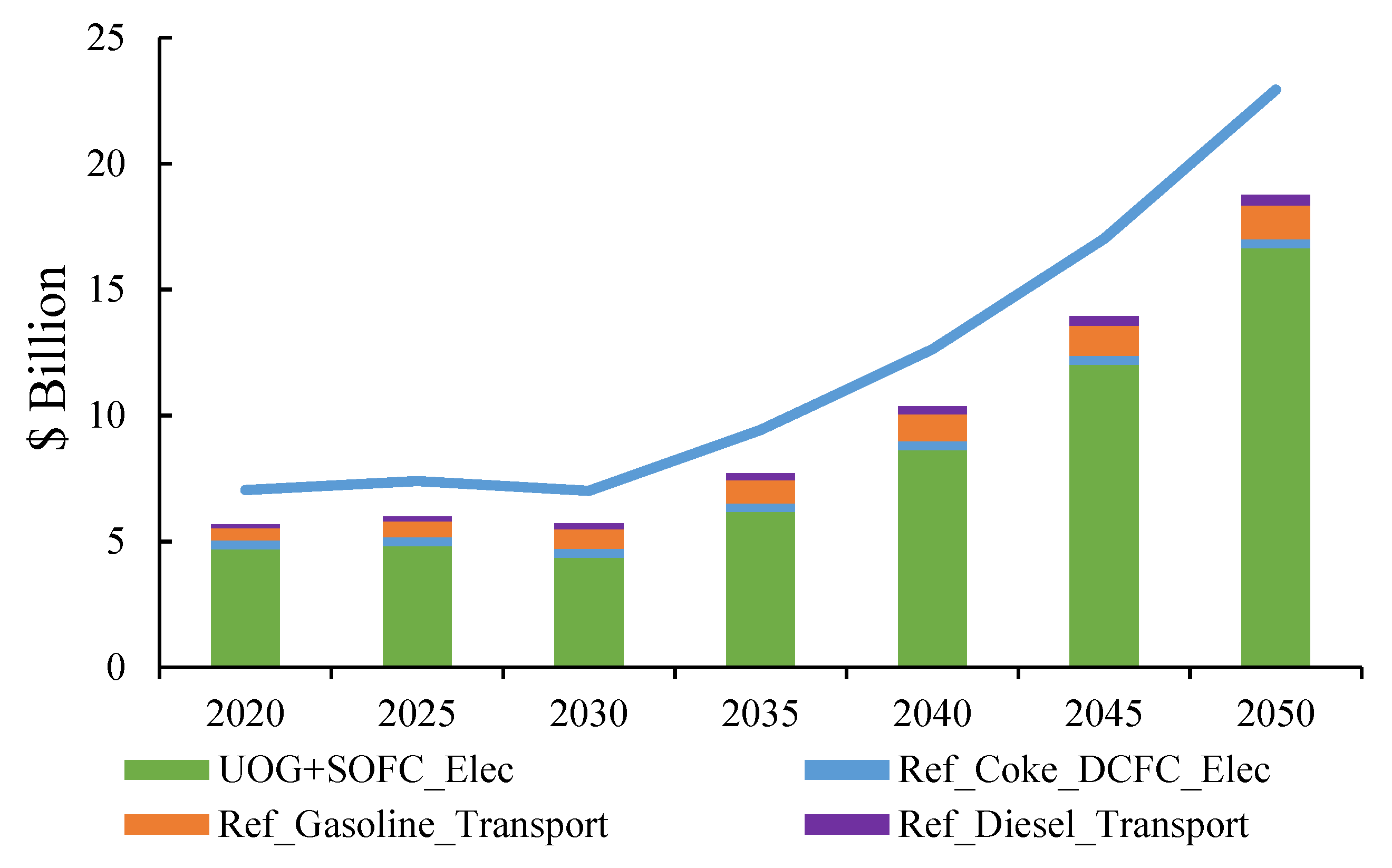

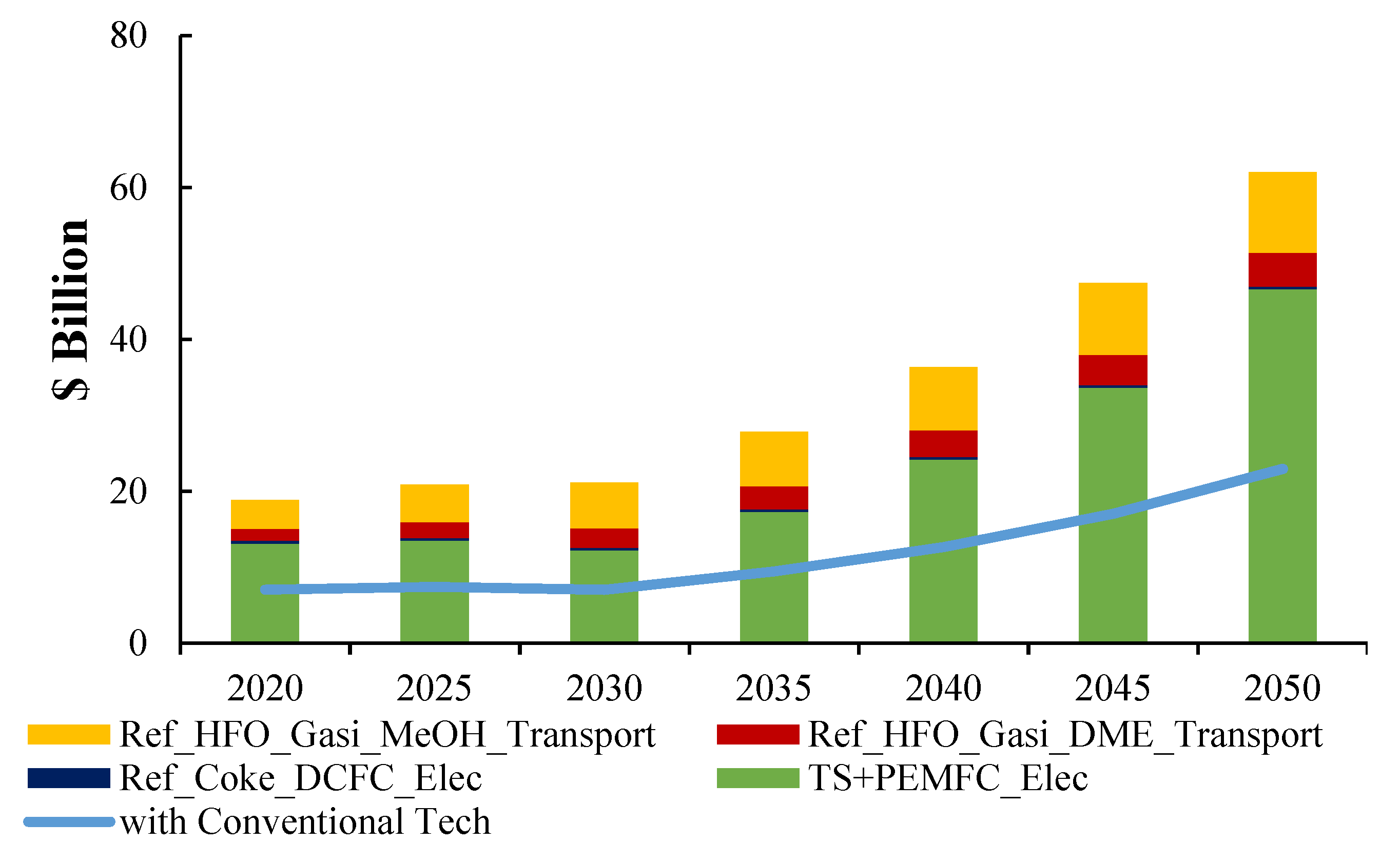

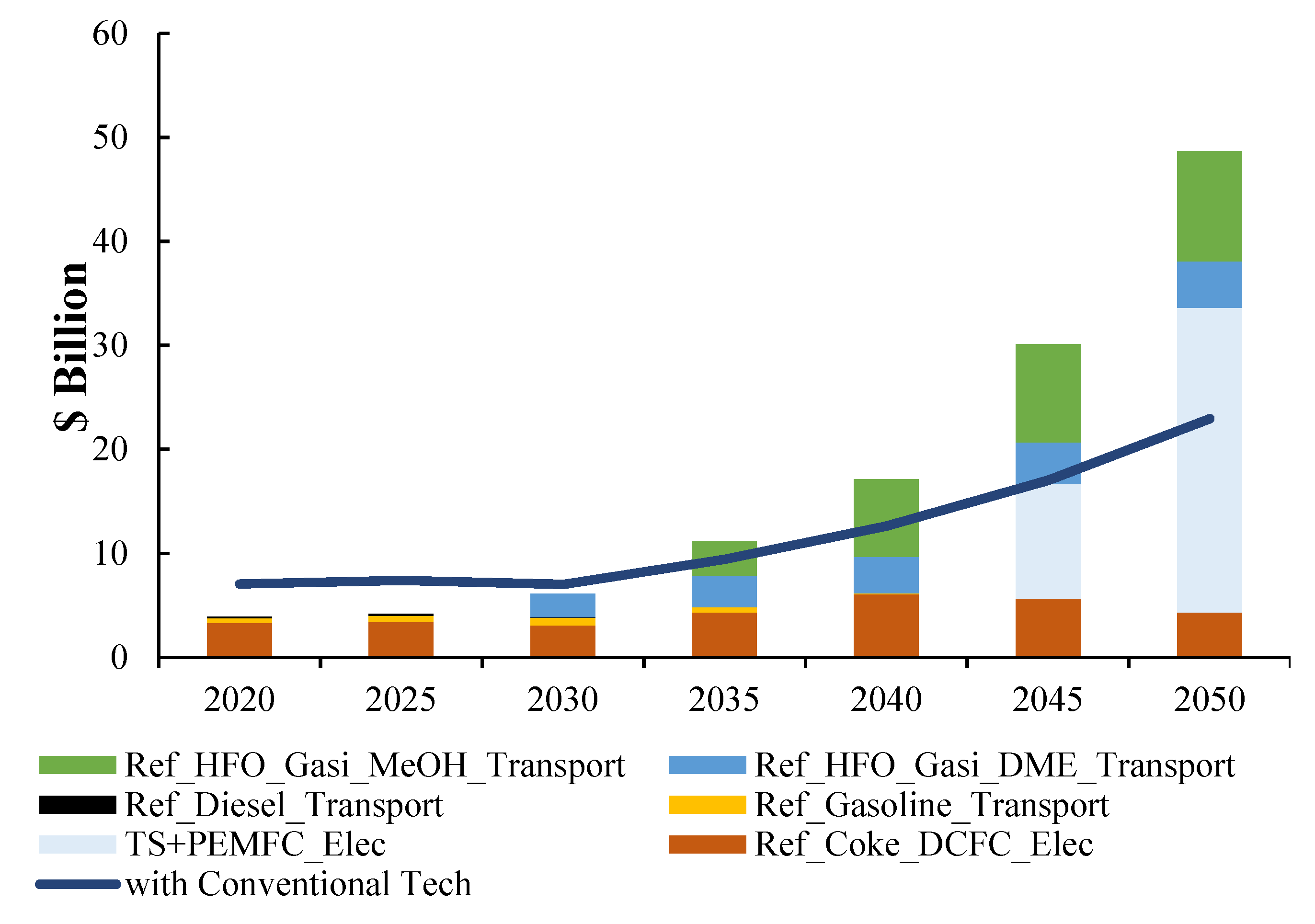

4.4. Investments Requirements

4.5. Impact of Technology Policy

5. Conclusions and Policy Recommendation

- Hydrocarbons can be a part of the national energy mix while meeting climate targets

- Having a low carbon policy combined with a carbon reduction target may stabilise emissions by 2025

- Clean hydrocarbons must be associated with significant measures in energy efficiency

- Total investments required in clean hydrocarbons will amount $121.23 billion, $37.76 billion higher than the investments needed under the BAU scenario

- Explicit new policies are needed for incentivising clean hydrocarbon technologies

- Enhancing energy efficiency measures via reforms in fossil fuel subsidies

- Continued R&D in the carbon neutral and carbon negative technologies is needed

- New business models are needed for cost-effective implementation of clean hydrocarbons technologies

Funding

Acknowledgments

Conflicts of Interest

Appendix A

References

- Meyer, B.; Keller, F.; Wolfersdorf, C.; Lee, R.P. A concept for the circular carbon economy sector coupling of the energy, waste, and chemical industry. Chem. Ing. Tech. 2018, 90, 241–248. [Google Scholar] [CrossRef]

- Koytsoumpa, E.I.; Bergins, C.; Kakaras, E. The CO2 economy: Review of CO2 capture and reuse technologies. J. Supercrit. Fluids 2018, 132, 3–16. [Google Scholar] [CrossRef]

- Tapia, J.F.D.; Lee, J.Y.; Ooi, R.E.; Foo, D.C.; Tan, R.R. A review of optimization and decision-making models for the planning of CO2 capture, utilization and storage (CCUS) systems. Sustain. Prod. Consum. 2018, 13, 1–15. [Google Scholar] [CrossRef]

- Norhasyima, R.S.; Mahlia, T.M.I. Advances in CO2 utilization technology: A patent landscape review. J. Co2 Util. 2018, 26, 323–335. [Google Scholar] [CrossRef]

- Herzog, H.J. What Future for Carbon Capture and Sequestration? Environ. Sci. Technol. 2001, 35, 148A–153A. [Google Scholar] [CrossRef]

- Rahman, F.A.; Aziz, M.M.A.; Saidur, R.; Bakar, W.A.W.A.; Hainin, M.R.; Putrajaya, R.; Hassan, N.A. Pollution to solution: Capture and sequestration of carbon dioxide (CO2) and its utilization as a renewable energy source for a sustainable future. Renew. Sustain. Energy Rev. 2017, 71, 112–126. [Google Scholar] [CrossRef]

- Tollefson, J. Low-cost carbon-capture project sparks interest. Nature 2011, 469, 276–277. [Google Scholar] [CrossRef][Green Version]

- Scott, V.; Gilfillan, S.; Markusson, N.; Chalmers, H.; Haszeldine, R.S. Last chance for carbon capture and storage. Nat. Clim. Chang. 2013, 3, 105–111. [Google Scholar] [CrossRef]

- Ok, M.; Jeon, M. Properties of poly (propylene carbonate) produced via SK Energy’s Greenpol™ Technology. In ANTEC 2011 [Proceedings]; Society of Plastics Engineers: Richardson, TX, USA, 2011. [Google Scholar]

- Kim, J.; Henao, C.A.; Johnson, T.A.; Dedrick, D.E.; Miller, J.E.; Stechel, E.B.; Maravelias, C.T. Methanol production from CO2 using solar-thermal energy: Process development and techno-economic analysis. Energy Environ. Sci. 2011, 4, 3122–3132. [Google Scholar] [CrossRef]

- Pardakhti, M.; Jafari, T.; Tobin, Z.; Dutta, B.; Moharreri, E.; Shemshaki, N.S.; Srivastava, R. Trends in solid adsorbent materials development for CO2 capture. ACS Appl. Mater. Interfaces 2019, 11, 34533–34559. [Google Scholar] [CrossRef]

- Abanades, J.C.; Arias, B.; Lyngfelt, A.; Mattisson, T.; Wiley, D.E.; Li, H.; Brandani, S. Emerging CO2 capture systems. Int. J. Greenh. Gas. Control. 2015, 40, 126–166. [Google Scholar] [CrossRef]

- Creamer, A.E.; Gao, B. Carbon-based adsorbents for post-combustion CO2 capture: A critical review. Environ. Sci. Technol. 2016, 50, 7276–7289. [Google Scholar] [CrossRef] [PubMed]

- Sanz-Perez, E.S.; Murdock, C.R.; Didas, S.A.; Jones, C.W. Direct capture of CO2 from ambient air. Chem. Rev. 2016, 116, 11840–11876. [Google Scholar] [CrossRef] [PubMed]

- Lackner, K.S.; Brennan, S.; Matter, J.M.; Park, A.H.A.; Wright, A.; Van Der Zwaan, B. The urgency of the development of CO2 capture from ambient air. Proc. Natl. Acad. Sci. USA 2012, 109, 13156–13162. [Google Scholar] [CrossRef]

- Murthy, B.N.; Sawarkar, A.N.; Deshmukh, N.A.; Mathew, T.; Joshi, J.B. Petroleum coke gasification: A review. Can. J. Chem. Eng. 2014, 92, 441–468. [Google Scholar] [CrossRef]

- Alshammari, Y.M.; Hellgardt, K. A new HYSYS model for underground gasification of hydrocarbons under hydrothermal conditions. Int. J. Hydrogen Energy 2014, 39, 12648–12656. [Google Scholar] [CrossRef]

- Alshammari, Y.M.; Hellgardt, K. Partial oxidation of n-hexadecane through decomposition of hydrogen peroxide in supercritical water. Chem. Eng. Res. Design 2015, 93, 565–575. [Google Scholar] [CrossRef]

- Alshammari, Y.M.; Hellgardt, K. Sub and supercritical water reforming of n-hexadecane in a tubular flow reactor. J. Supercrit. Fluids 2016, 107, 723–732. [Google Scholar] [CrossRef]

- Yousef, M.A.; Klaus, H. CFD analysis of hydrothermal conversion of heavy oil in continuous flow reactor. Chem. Eng. Res. Des. 2017, 117, 250–264. [Google Scholar]

- Bhutto, A.W.; Bazmi, A.A.; Zahedi, G. Underground coal gasification: From fundamentals to applications. Prog. Energy Combust. Sci. 2013, 39, 189–214. [Google Scholar] [CrossRef]

- Prabu, V.; Jayanti, S. Underground coal-air gasification based solid oxide fuel cell system. Appl. Energy 2012, 94, 406–414. [Google Scholar] [CrossRef]

- Wang, F.; Deng, S.; Zhang, H.; Wang, J.; Zhao, J.; Miao, H.; Yan, J. A comprehensive review on high-temperature fuel cells with carbon capture. Appl. Energy 2020, 275, 115342. [Google Scholar] [CrossRef]

- Baldi, F.; Wang, L.; Pérez-Fortes, M.; Maréchal, F. A cogeneration system based on solid oxide and proton exchange membrane fuel cells with hybrid storage for off-grid applications. Front. Energy Res. 2019, 6, 139. [Google Scholar] [CrossRef]

- Zhang, X. Current status of stationary fuel cells for coal power generation. Clean Energy 2018, 2, 126–139. [Google Scholar] [CrossRef]

- Talbot, D. A Practical Fuel-Cell Power Plant. MIT Technology Review. Available online: https://www.technologyreview.com/2006/10/23/227781/a-practical-fuel-cell-power-plant/ (accessed on 11 June 2020).

- Rodat, S.; Abanades, S.; Sans, J.L.; Flamant, G. A pilot-scale solar reactor for the production of hydrogen and carbon black from methane splitting. Int. J. Hydrogen Energy 2010, 35, 7748–7758. [Google Scholar] [CrossRef]

- Pregger, T.; Graf, D.; Krewitt, W.; Sattler, C.; Roeb, M.; Moller, S. Prospects of solar thermal hydrogen production processes. Int. J. Hydrogen Energy 2009, 34, 4256–4267. [Google Scholar] [CrossRef]

- Ozalp, N.; Kogan, A.; Epstein, M. Solar decomposition of fossil fuels as an option for sustainability. Int. J. Hydrogen Energy 2009, 34, 710–720. [Google Scholar] [CrossRef]

- Agrafiotis, C.; von Storch, H.; Roeb, M.; Sattler, C. Solar thermal reforming of methane feedstocks for hydrogen and syngas production—A review. Renew. Sustain. Energy Rev. 2014, 29, 656–682. [Google Scholar] [CrossRef]

- Alshammari, Y.M.; Sarathy, S.M. Achieving 80% greenhouse gas reduction target in Saudi Arabia under low and medium oil prices. Energy Policy 2017, 101, 502–511. [Google Scholar] [CrossRef]

- Alshammari, Y.M. Energy transition in transport using alternative fuels: Can new technologies achieve policy targets? OPEC Energy Rev. 2019, 43, 301–326. [Google Scholar] [CrossRef]

- Alshammari, Y.M.; Benmerabet, M. Global scenarios for fuel oil utilisation under new sulphur and carbon regulations. OPEC Energy Rev. 2017, 41, 261–285. [Google Scholar] [CrossRef]

- Abanades, S.; Flamant, G. Production of hydrogen by thermal methane splitting in a nozzle-type laboratory-scale solar reactor. Int. J. Hydrogen Energy 2005, 30, 843–853. [Google Scholar] [CrossRef]

- Gillingham, K. Hydrogen Internal Combustion Engine Vehicles: A Prudent Intermediate Step or a Step in the Wrong Direction; Department of Management Science & Engineering Global Climate and Energy Project; Precourt Institute for Energy Efficiency of Stanford University: Stanford, CA, USA, 2007. [Google Scholar]

- Abbas, H.F.; Daud, W.W. Hydrogen production by methane decomposition: A review. Int. J. Hydrogen Energy 2010, 35, 1160–1190. [Google Scholar] [CrossRef]

- Peng, X.D. Analysis of the thermal efficiency limit of the steam methane reforming process. Ind. Eng. Chem. Res. 2012, 51, 16385–16392. [Google Scholar] [CrossRef]

- Bertram, C.; Luderer, G.; Pietzcker, R.C.; Schmid, E.; Kriegler, E.; Edenhofer, O. Complementing carbon prices with technology policies to keep climate targets within reach. Nat. Clim. Chang. 2015, 5, 235. [Google Scholar] [CrossRef]

- Bauer, N.; Baumstark, L.; Leimbach, M. The REMIND-R model: The role of renewables in the low-carbon transformationfirst-best vs. second-best worlds. Clim. Chang. 2012, 114, 145168. [Google Scholar] [CrossRef]

- Fischer, C.; Greaker, M.; Rosendahl, K.E. Strategic technology policy as a supplement to renewable energy standards. Resour. Energy Econ. 2018, 51, 84–98. [Google Scholar] [CrossRef]

- Simoes, S.; Nijs, W.; Ruiz, P.; Sgobbi, A.; Thiel, C. Comparing policy routes for low-carbon power technology deployment in EU–An energy system analysis. Energy Policy 2017, 101, 353–365. [Google Scholar] [CrossRef]

- Sendstad, L.H.; Chronopoulos, M. Sequential investment in renewable energy technologies under policy uncertainty. Energy Policy 2020, 137, 111152. [Google Scholar] [CrossRef]

- Das, P.; Mathuria, P.; Bhakar, R.; Mathur, J.; Kanudia, A.; Singh, A. Flexibility requirement for large-scale renewable energy integration in Indian power system: Technology, policy and modeling options. Energy Strategy Rev. 2020, 29, 100482. [Google Scholar] [CrossRef]

- Kim, J.E.; Tang, T. Preventing early lock-in with technology-specific policy designs: The Renewable Portfolio Standards and diversity in renewable energy technologies. Renew. Sustain. Energy Rev. 2020, 123, 109738. [Google Scholar] [CrossRef]

- Chapman, A.; Itaoka, K.; Farabi-Asl, H.; Fujii, Y.; Nakahara, M. Societal penetration of hydrogen into the future energy system: Impacts of policy, technology and carbon targets. Int. J. Hydrogen Energy 2020, 45, 3883–3898. [Google Scholar] [CrossRef]

- Ding, H.; Zhou, D.; Zhou, P. Optimal policy supports for renewable energy technology development: A dynamic programming model. Energy Econ. 2020, 104765. [Google Scholar] [CrossRef]

- Perez, A.J.G.; Hansen, T. Technology characteristics and catching-up policies: Solar energy technologies in Mexico. Energy Sustain. Dev. 2020, 56, 51–66. [Google Scholar] [CrossRef]

- Pitelis, A.; Vasilakos, N.; Chalvatzis, K. Fostering innovation in renewable energy technologies: Choice of policy instruments and effectiveness. Renew. Energy 2020, 151, 1163–1172. [Google Scholar] [CrossRef]

- Hille, E.; Althammer, W.; Diederich, H. Environmental regulation and innovation in renewable energy technologies: Does the policy instrument matter? Technol. Forecast. Soc. Chang. 2020, 153, 119921. [Google Scholar] [CrossRef]

- Kalkuhl, M.; Edenhofer, O.; Lessmann, K. Renewable energy subsidies: Second-best policy or fatal aberration for mitigation? Resour. Energy Econ. 2013, 35, 217234. [Google Scholar] [CrossRef]

- Goulder, L.H.; Schein, A. Carbon Taxes vs. Cap and Trade: A Critical Review; National Bureau of Economic Research: Cambridge, MA, USA, 2013. [Google Scholar]

| Technology | Description | Challenges | Projects | Reference |

|---|---|---|---|---|

| CCUS | Using amine absorption unit to remove CO2 from flue gas followed by CO2 separation and transportation to depleted reservoirs | CO2 transport, capture costs, energy penalty | Sleipner Project Norway | [2,3,4,5,6,7,8] |

| Solar CO2 Conversion | Photo reduction of CO2 into CO followed by its conversion to H2/syngas and later to methanol | Efficiency and costs of production | SK Oil Refinery, Korea | [9,10] |

| SOFC | Electrochemical conversion of fuel which generates electrons | Catalyst development, and cost of production | GE new SOFC prototype with 6 KW | [22,23,24,25,26] |

| Underground Gasification | Conversion of heavy oil into hydrogen | Process relatively less understood | Tested for Coal by Cougar Energy, Australia | [16,17,18,19,20,21,22] |

| Solar Splitting | Thermal decomposition of natural gas, using solar energy, to generate hydrogen and carbon | Energy requirement, efficiency and solar intermittency | Under development | [27,28,29,30] |

| Technology Combination | Acronym | Efficiency % | LCOE [$/GJ] | CO2 Factor [kTonne/PJ] | Notes |

|---|---|---|---|---|---|

| Natural Gas Power Plant + Carbon Capture | NGPP + CCS_Elec | 0.49 | 14.46 | 24 | Assuming 80% carbon captured |

| Natural Gas Power Plant | NGPP_Elec | 0.56 | 7.51 | 123 | Cost is based on current gas prices |

| Heavy Fuel Oil Power Generation | HFOPP_Elec | 0.45 | 7.62 | 215 | Cost is based on current fuel oil prices |

| Heavy Fuel Oil Power Plant + Carbon Capture | HFOPP + CCS_Elec | 0.37 | 16.13 | 53.83 | - |

| Thermal Splitting + PEM Fuel Cell | TS + PEMFC_Elec | 0.42 | 17.26 | 0 | Thermal splitting using energy supplied from solar thermal plant |

| Steam Reforming of Methane using Solar Thermal Plant + Hydrogen Combustion | SMR + H2Comb_Elec | 0.51 | 17.26 | 24 | Assuming Solar Thermal for Reforming |

| Thermal Splitting + Hydrogen Combustion | TS + H2Comb_Elec | 0.42 | 14.08 | 24.6 | Thermal splitting using energy supplied from solar thermal plant |

| Refinery Gasoline to Cars | Ref_Gaso_Transport | 0.27 | 1.38 | 86.07 | Efficiency is based on WTW |

| Refinery Diesel to Cars | Ref_Diesel_Transport | 0.41 | 1.15 | 86.64 | Efficiency is based on WTW |

| Refinery Coke + DCFC | Ref_Coke_DCFC_Elec | 0.54 | 4.32 | 0 | - |

| Refinery HFO + Gasification to MeOH | Ref_HFO_Gasi_MeOH_Transport | 0.21 | 10.90 | 42 | With CCS |

| Refinery HFO + Gasification to DME | Ref_HFO_Gasi_DME_Transport | 0.23 | 12.66 | 22 | With CCS |

| Underground gasification + SOFC | UOG + SOFC_Elec | 0.42 | 6.17 | 17.01 | Assuming UOG is near commercialisation |

| HFO Gasification + H2 combustion | Ref_HFO_Gasi + H2Com | 0.38 | 7.50 | 17.01 | With CCS |

| Sector | 2015 | 2020 | 2025 | 2030 | 2035 | 2040 | 2045 | 2050 |

|---|---|---|---|---|---|---|---|---|

| Domestic Electricity | 1052 | 1441.65 | 1974.87 | 2705.31 | 3705.90 | 5076.58 | 6954.21 | 9526.32 |

| Domestic Electricity (Assuming 60% efficiency) | 768 | 842 | 864 | 789 | 1082 | 1482 | 2030 | 2781 |

| Diesel–Transport | 88.12 | 126.12 | 164.12 | 202.11 | 240.11 | 278.11 | 316.11 | 354.11 |

| Gasoline–Transport | 242.0 | 346.34 | 450.68 | 555.02 | 659.35 | 736.69 | 868.03 | 972.36 |

| Sector | PJ/Year |

|---|---|

| Heavy Oil | 10,000 |

| Shale Gas | 5000 |

| Natural Gas | 4000 |

| Crude Oil | 2000 |

| Scenario No. | Scenarios | Description |

|---|---|---|

| Ref | BAU | Business as usual scenario, i.e., carry on with existing policies with no price on carbon |

| Sc.1. | Oil Phase-Out | Ban on crude oil in power generation with no price set on CO2 |

| Sc.2 | Carbon Tax | Globally uniform carbon tax of $7.3/Tonne increasing at 5% annually |

| Sc.3 | Carbon Cap | Capping carbon emissions by 15% (65.7 million Tonne) by 2030 maintained till 2050 |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alshammari, Y.M. Achieving Climate Targets via the Circular Carbon Economy: The Case of Saudi Arabia. C 2020, 6, 54. https://doi.org/10.3390/c6030054

Alshammari YM. Achieving Climate Targets via the Circular Carbon Economy: The Case of Saudi Arabia. C. 2020; 6(3):54. https://doi.org/10.3390/c6030054

Chicago/Turabian StyleAlshammari, Yousef M. 2020. "Achieving Climate Targets via the Circular Carbon Economy: The Case of Saudi Arabia" C 6, no. 3: 54. https://doi.org/10.3390/c6030054

APA StyleAlshammari, Y. M. (2020). Achieving Climate Targets via the Circular Carbon Economy: The Case of Saudi Arabia. C, 6(3), 54. https://doi.org/10.3390/c6030054