Treasury Bond Return Data Starting in 1962

Abstract

1. Summary

2. Data Description

- Column A: The last calendar day of each month.

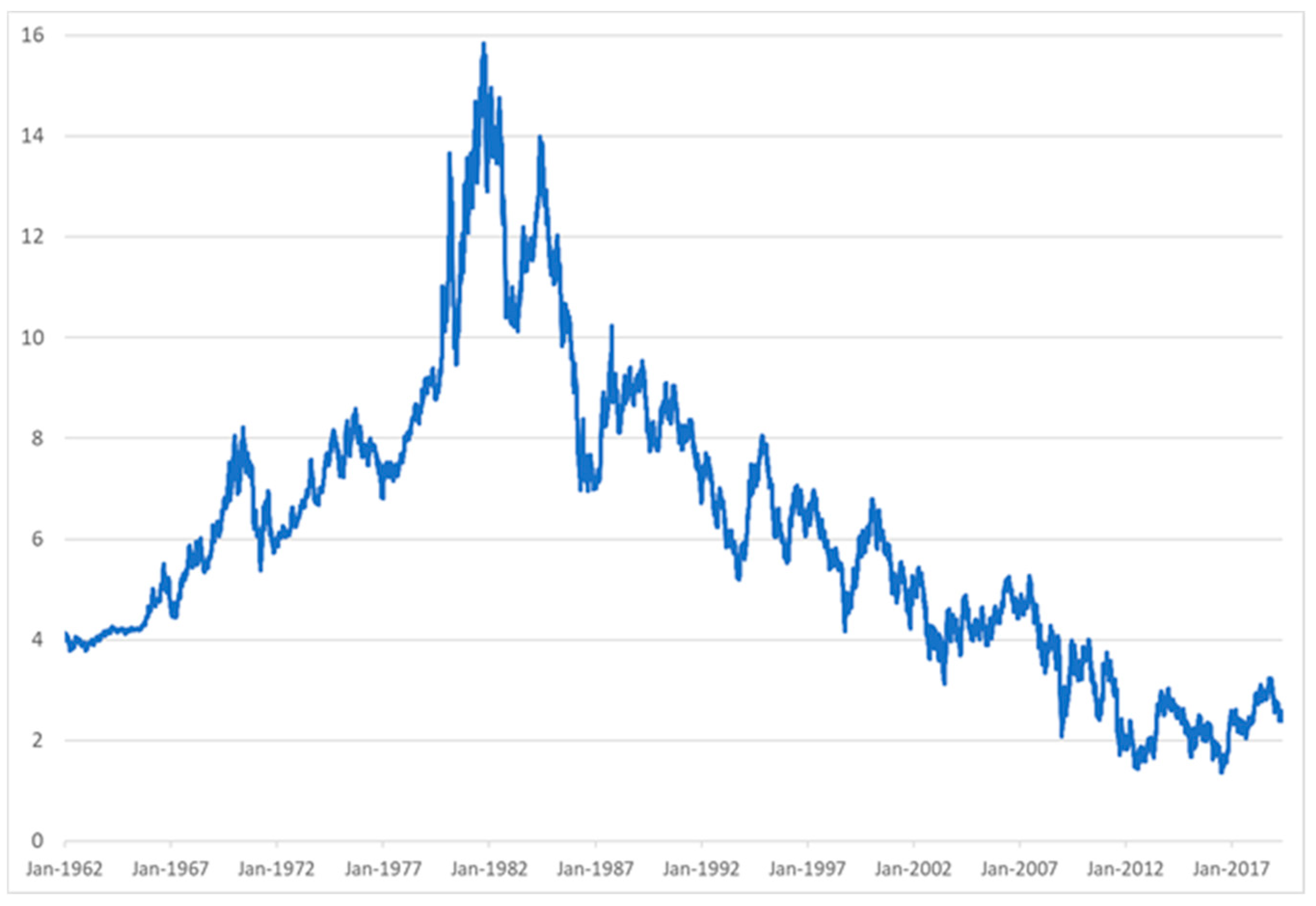

- Column B: The yield-to-maturity of a 10-year fixed maturity Treasury bond. These data are publicly available from [3].

- Column C: The interest rate sensitivity of the price of the 10-year Treasury bond, which is also called the modified duration. This quantity uses as inputs the yield-to-maturity and maturity, using [4] (Equation 4.45 on p. 146).

- Column D: The interest rate sensitivity of the modified duration of the 10-year Treasury bond, which is also called the convexity. This quantity uses as inputs the yield-to-maturity and maturity, using [4] (Equation 4.52 on p. 150).

- Column E: The monthly total return for an investor in the 10-year Treasury bond. This quantity uses as inputs the yield-to-maturity and maturity, derived from [4] (Equation 4.21 on p. 138).

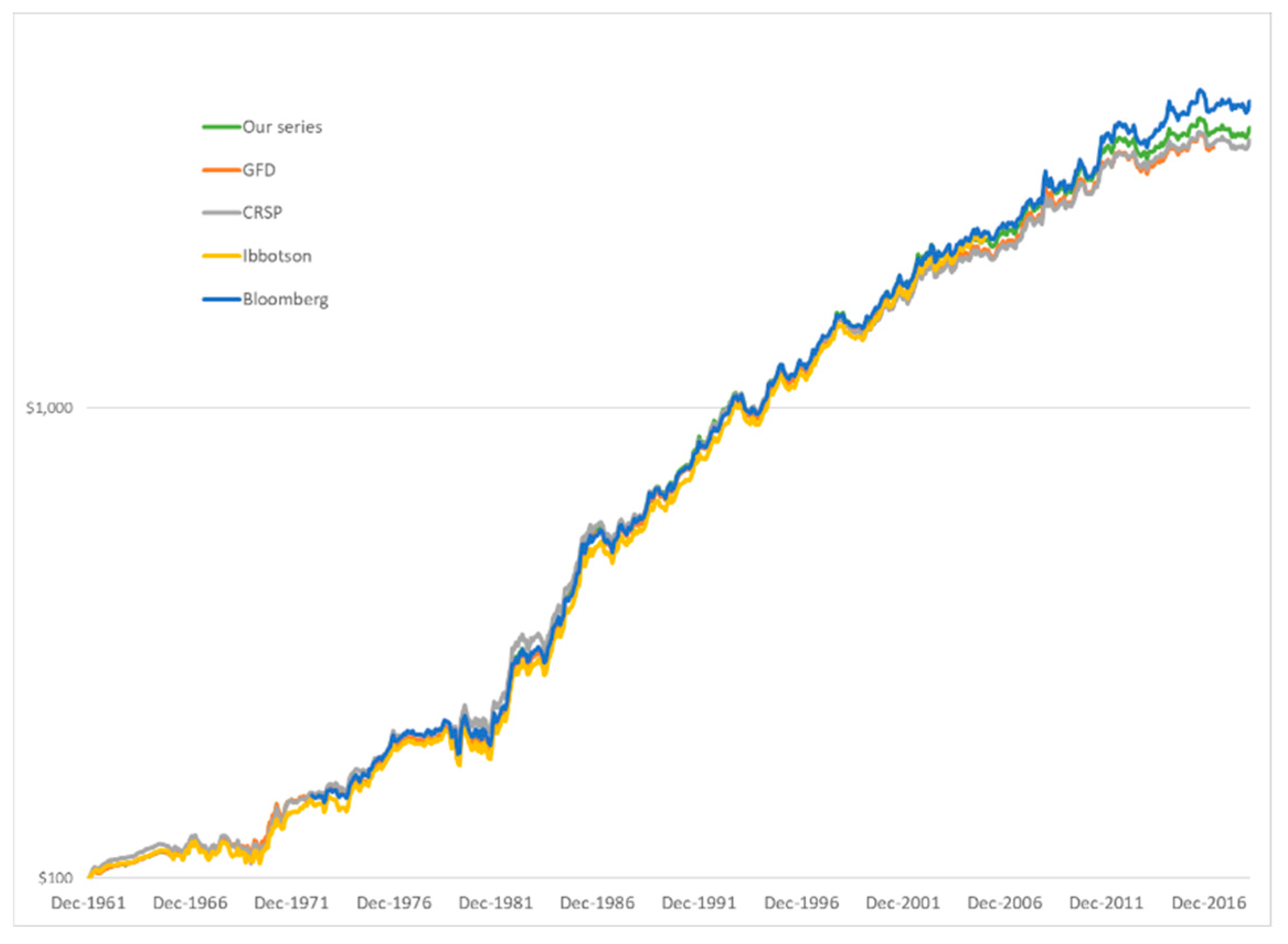

- Column F: The cumulative total return from an investor starting out with $100 on 31 December 1961.

- Column G: Intentionally left blank.

- Column H: The last calendar date of each year.

- Column I: The cumulative return at the last calendar date of each year (from Column F).

- Column J: The annual total return for an investor in the 10-year Treasury bond.

3. Methods

4. User Notes

Funding

Acknowledgments

Conflicts of Interest

References

- Jorda, O.; Knoll, K.; Kuvshinov, D.; Schularick, M.; Taylor, A. The rate of return on everything. Q. J. Econ. 2019. [Google Scholar] [CrossRef]

- Meyer, J.; Reinhart, C.; Trebesch, C. Sovereign bonds since Waterloo. NBER Working Paper No. 25543. Natl. Bur. Econ. Res. 2019. [Google Scholar] [CrossRef]

- Board of Governors of the Federal Reserve System (US). 10-Year Treasury Constant Maturity Rate [DGS10], Retrieved from FRED, Federal Reserve Bank of St. Louis. Available online: https://fred.stlouisfed.org/series/DGS10 (accessed on 15 May 2019).

- Tuckman, B.; Serrat, A. Fixed Income Securities Tools for Today’s Markets, 3rd ed.; John Wiley and Sons Ltd.: Hoboken, NJ, USA, 2012. [Google Scholar]

- Board of Governors of the Federal Reserve System (US). 10-Year Treasury Constant Maturity Rate [GS10], Retrieved from FRED, Federal Reserve Bank of St. Louis. Available online: https://fred.stlouisfed.org/series/GS10 (accessed on 15 May 2019).

- Global Financial Data. Available online: www.globalfinancialdata.com (accessed on 2 October 2017).

- Center for Research in Security Prices. Available online: www.crsp.com (accessed on 15 May 2019).

- Ibbotson, R. Stocks, Bonds, Bills, Inflation: 2006 Yearbook; Ibbotson Associates: Chicago, IL, USA, 2006. [Google Scholar]

- Ibbotson, R.; Sinquefield, R. Stocks, bonds, bills, and inflation: Year-by-year historical returns (1926–1974). J. Bus. 1976, 49, 11–47. [Google Scholar] [CrossRef]

- Barclays Live. Available online: https://live.barcap.com/ (accessed on 15 May 2019).

- Bekaert, G.; Mehl, A. On the global financial market integration “swoosh” and the trilemma. J. Int. Money Financ. 2019, 94, 227–245. [Google Scholar] [CrossRef]

- Bianchi, F. The great depression and the great recession: A view from financial markets. J. Monet. Econ. 2019. [Google Scholar] [CrossRef]

- Cheung, Y.; Chinn, M.; Pascual, A.; Zhang, Y. Exchange rate prediction redux: New models, new data, new currencies. J. Int. Money Financ. 2019, 95, 332–362. [Google Scholar] [CrossRef]

- Zaremba, A.; Kambouris, G.; Karathanasopoulos, A. Two centuries of global financial market integration: Equities, government bonds, treasury bills, and currencies. Econ. Lett. 2019, 182, 26–29. [Google Scholar] [CrossRef]

- Doeswijk, R.; Lam, T.; Swinkels, L. The global multi-asset market portfolio, 1959–2012. Financ. Anal. J. 2014, 70, 26–41. [Google Scholar] [CrossRef]

| Sample | Statistic | Our Series | GFD | CRSP | Ibbotson | Bloomberg |

|---|---|---|---|---|---|---|

| 1962–2018 | Average | 6.76% | 6.80% | 6.63% | ||

| Volatility | 7.86% | 7.91% | 7.54% | |||

| Minimum | −7.41% | −7.91% | −6.68% | |||

| Maximum | 13.23% | 12.69% | 10.00% | |||

| Intercept | 0.01% | 0.01% | ||||

| Slope | 1.001 | 1.008 | ||||

| R-squared | 0.996 | 0.934 | ||||

| Wald p-val | 0.143 | 0.344 | ||||

| 1962–2005 | Average | 7.46% | 7.34% | 7.28% | 7.48% | |

| Volatility | 8.02% | 7.99% | 7.80% | 8.02% | ||

| Minimum | −7.41% | −7.91% | −6.68% | −7.40% | ||

| Maximum | 13.23% | 12.69% | 10.00% | 14.04% | ||

| Intercept | 0.01% | 0.02% | 0.02% | |||

| Slope | 1.003 | 0.990 | 0.968 | |||

| R-squared | 0.998 | 0.926 | 0.936 | |||

| Wald p-val | 0.031 | 0.618 | 0.0164 | |||

| 1973–2018 | Average | 7.46% | 7.53% | 7.26% | 7.74% | |

| Volatility | 8.24% | 8.30% | 7.74% | 8.24% | ||

| Minimum | −7.41% | −7.91% | −6.68% | −6.81% | ||

| Maximum | 13.23% | 12.69% | 10.00% | 12.51% | ||

| Intercept | 0.01% | 0.00% | −0.01% | |||

| Slope | 1.002 | 1.032 | 0.972 | |||

| R-squared | 0.995 | 0.934 | 0.945 | |||

| Wald p-val | 0.109 | 0.015 | 0.012 |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Swinkels, L. Treasury Bond Return Data Starting in 1962. Data 2019, 4, 91. https://doi.org/10.3390/data4030091

Swinkels L. Treasury Bond Return Data Starting in 1962. Data. 2019; 4(3):91. https://doi.org/10.3390/data4030091

Chicago/Turabian StyleSwinkels, Laurens. 2019. "Treasury Bond Return Data Starting in 1962" Data 4, no. 3: 91. https://doi.org/10.3390/data4030091

APA StyleSwinkels, L. (2019). Treasury Bond Return Data Starting in 1962. Data, 4(3), 91. https://doi.org/10.3390/data4030091