Application of Risk Management in Applied Engineering Projects in a Petrochemical Plant Producing Polyvinyl Chloride in Cartagena, Colombia

Abstract

1. Introduction

2. Literature Review

2.1. Risk and Uncertainty in Project Management

2.2. Risk Management in Projects

2.3. Risk Management in Petrochemical Projects

2.4. Development of Petrochemical Projects in Colombia

3. Materials and Methods

3.1. Data Collection

3.2. Selection of Information Sources

3.3. Tools and Analysis Techniques

4. Results and Discussion

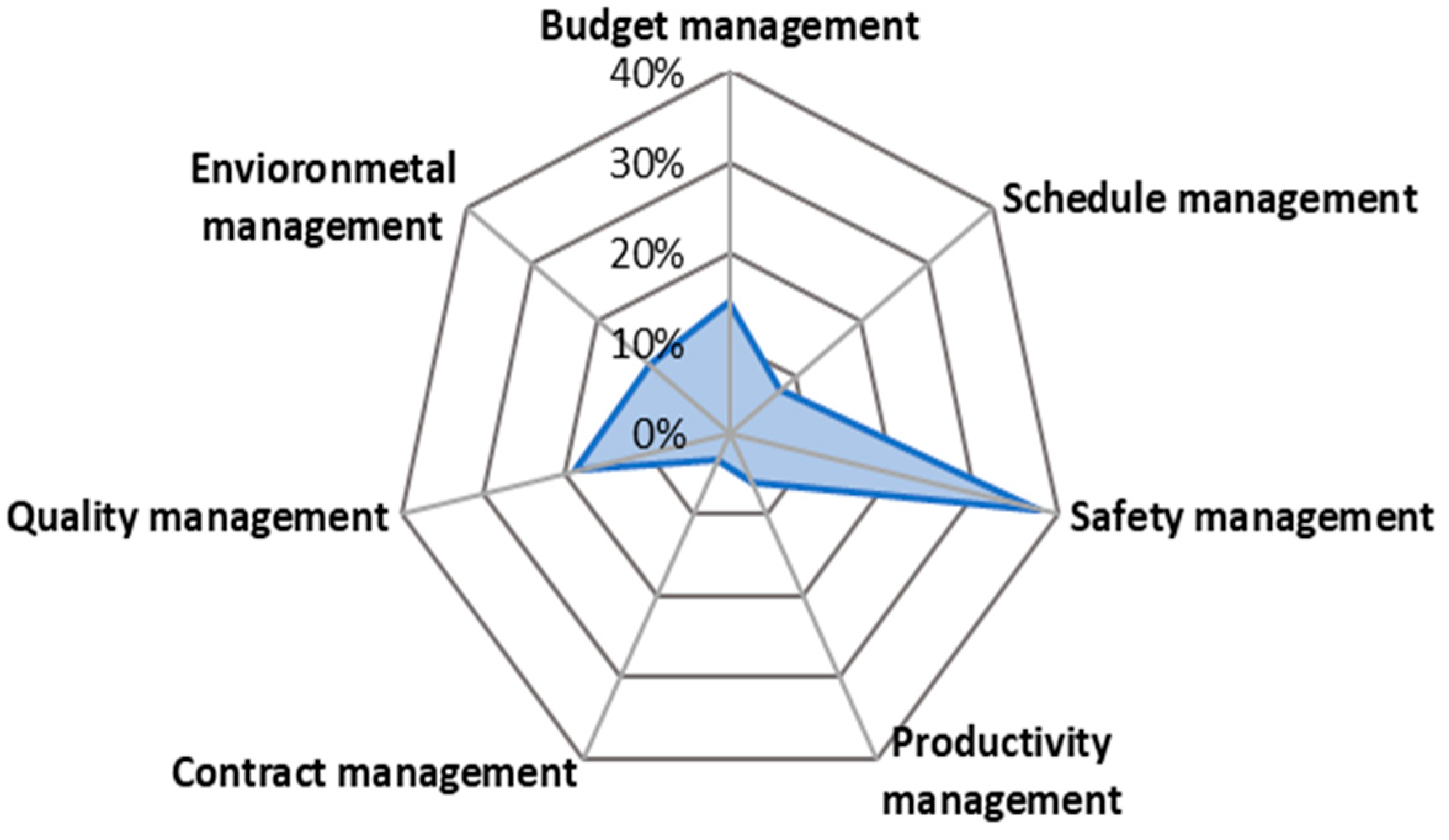

4.1. Selection of Management Factors

4.1.1. Importance of Management Factors

4.1.2. Consistency of the Matrix

4.1.3. Calculation of the Consistency Index and Relationship

4.1.4. Selection of Risk Factors

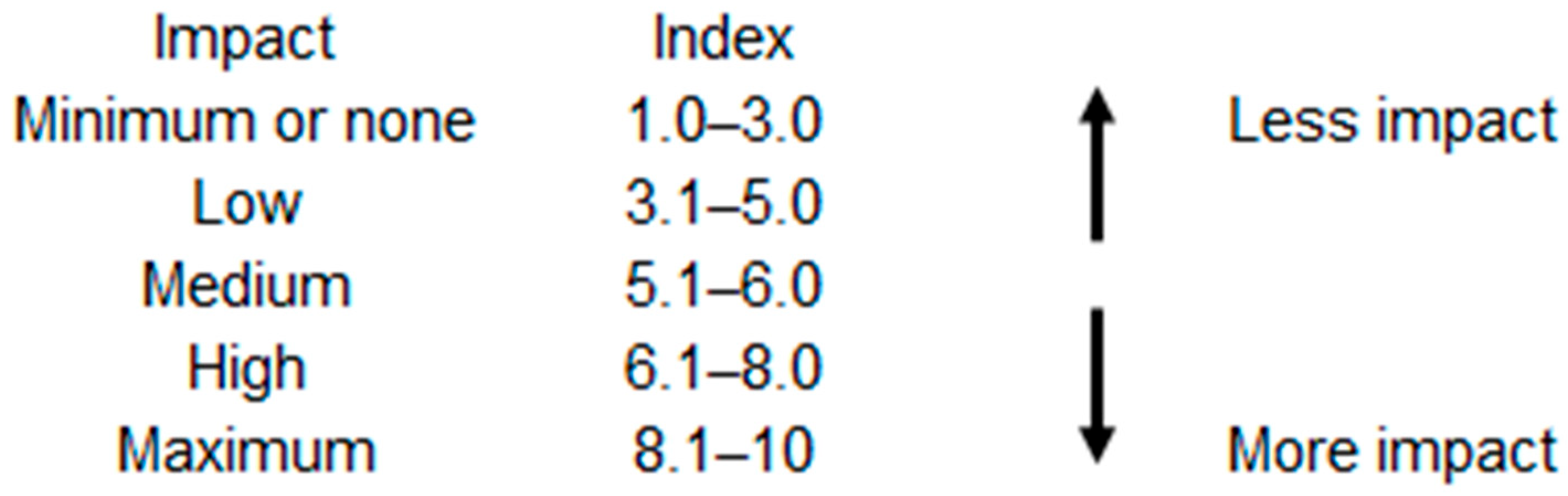

4.1.5. Risk Factor Impact Score

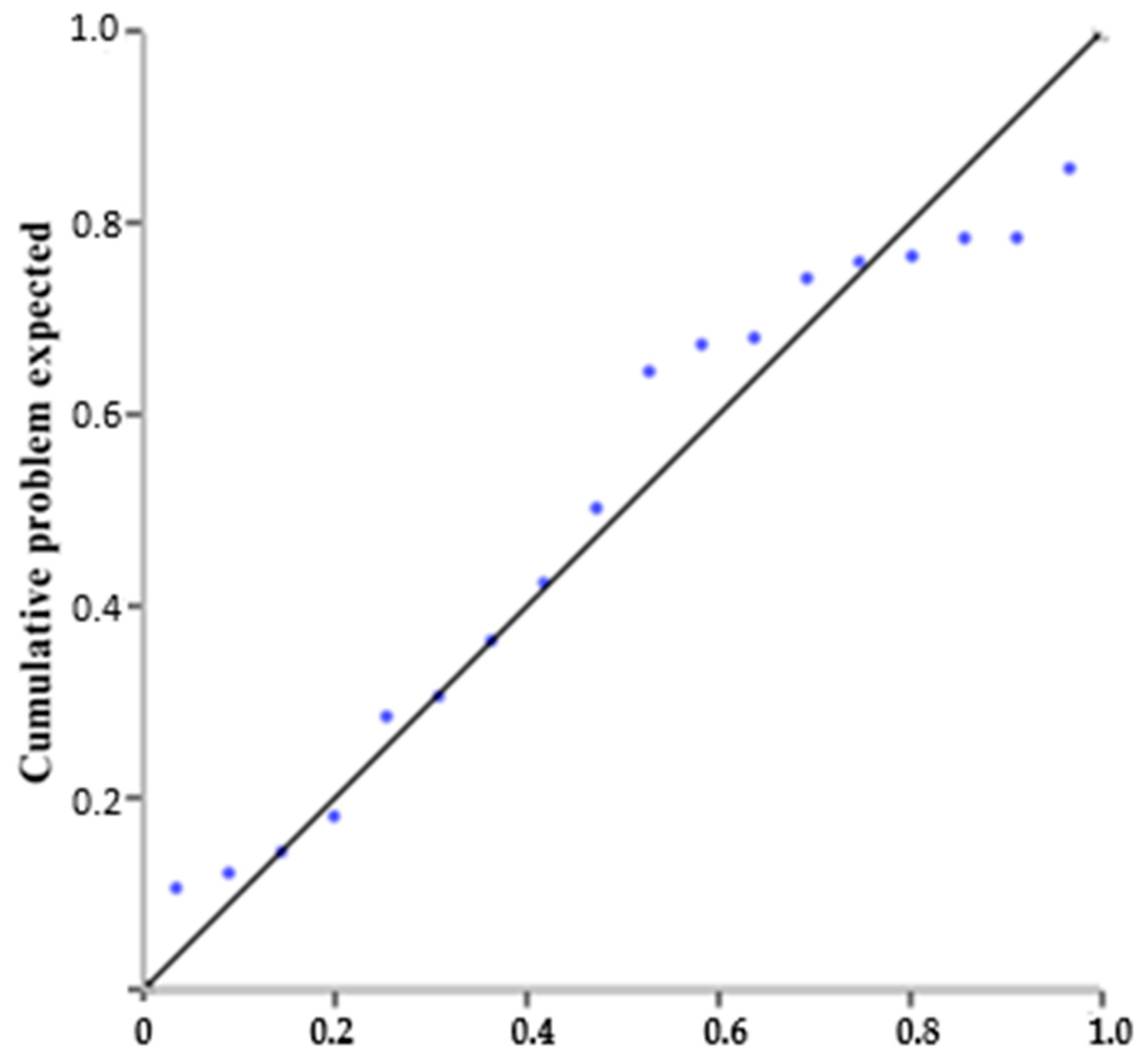

4.1.6. Normality Analysis

4.1.7. Hypothesis Testing

4.1.8. Linear Regression Model

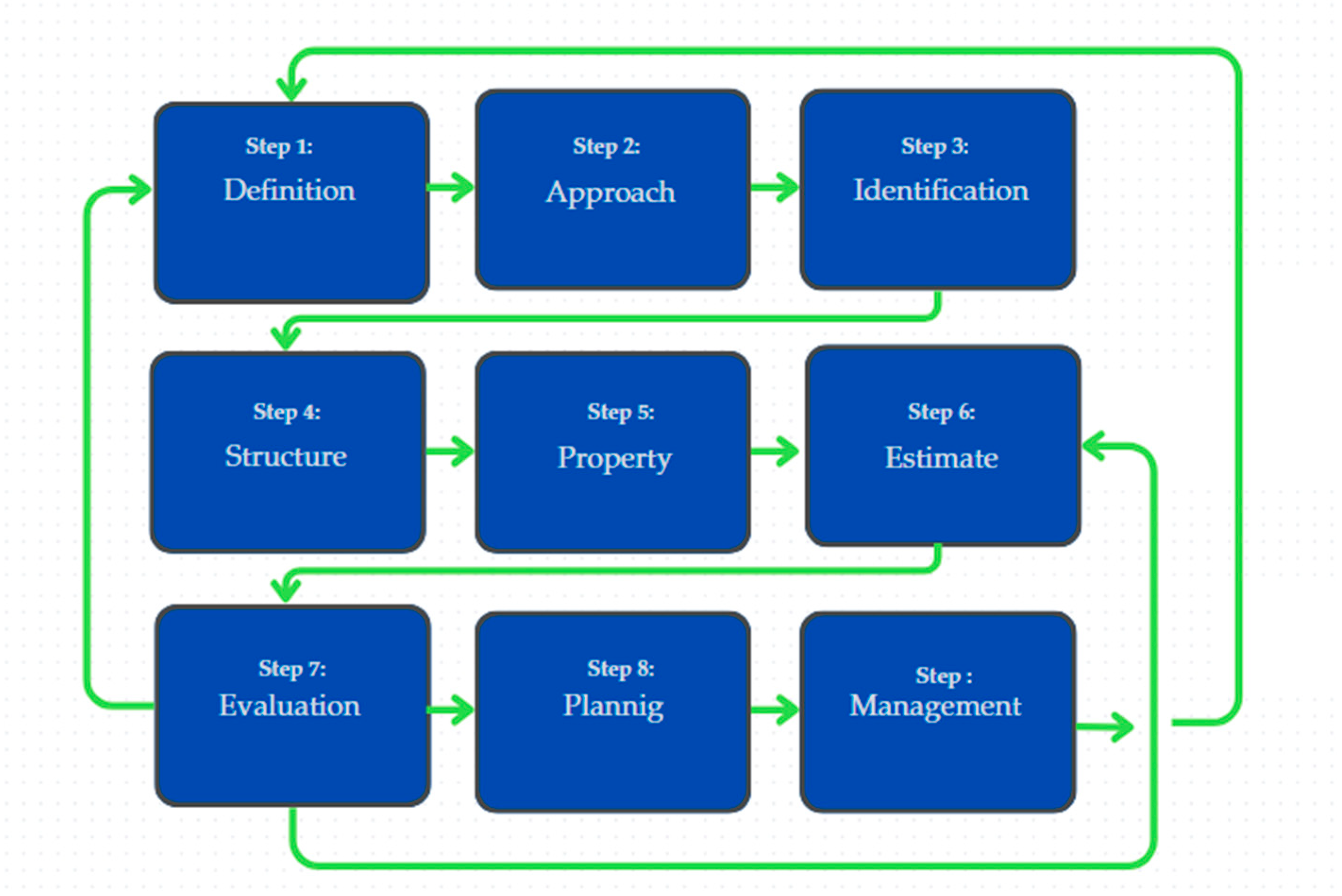

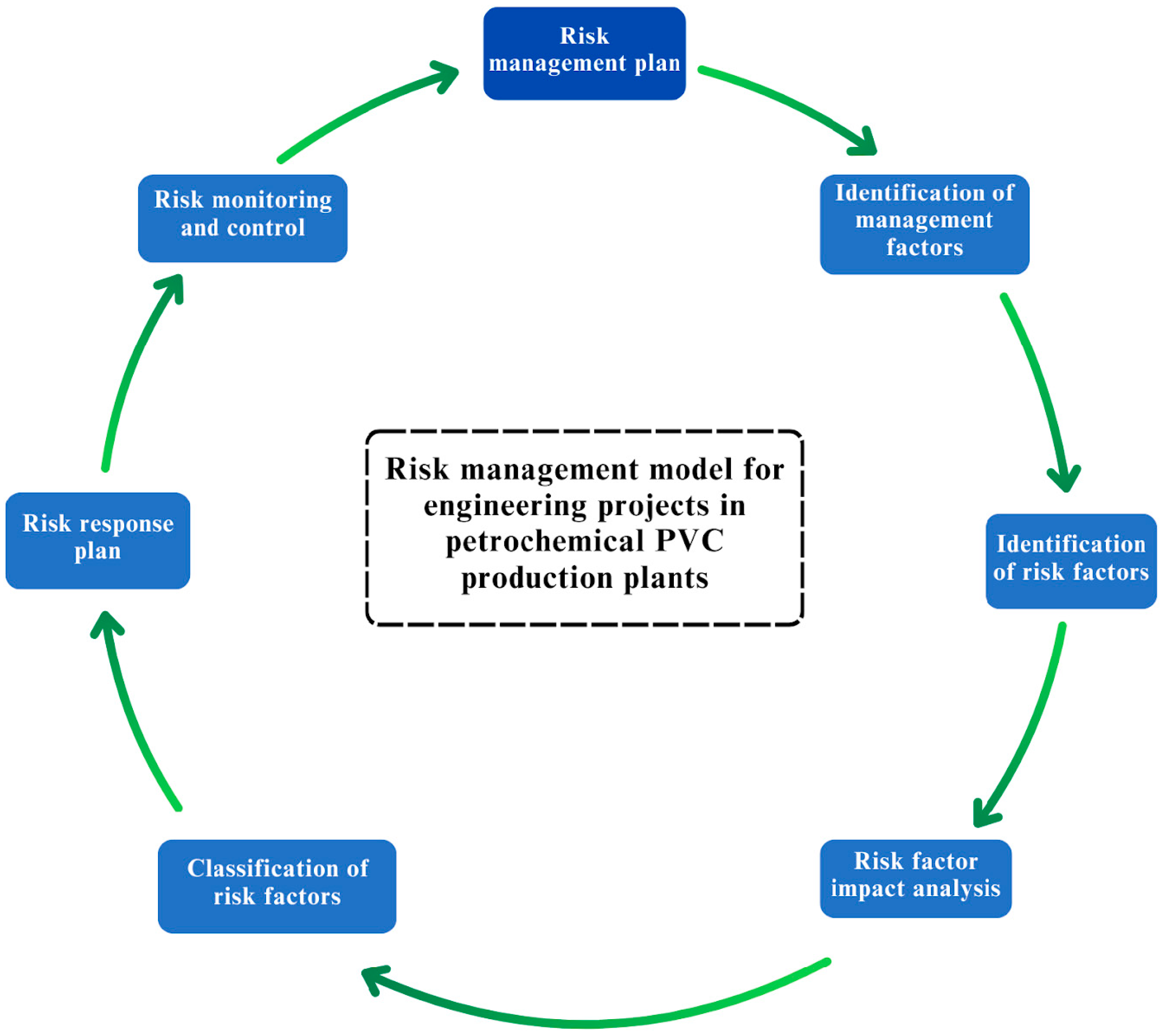

4.2. Proposed Model

4.2.1. Objectives of the Model

4.2.2. Model Components

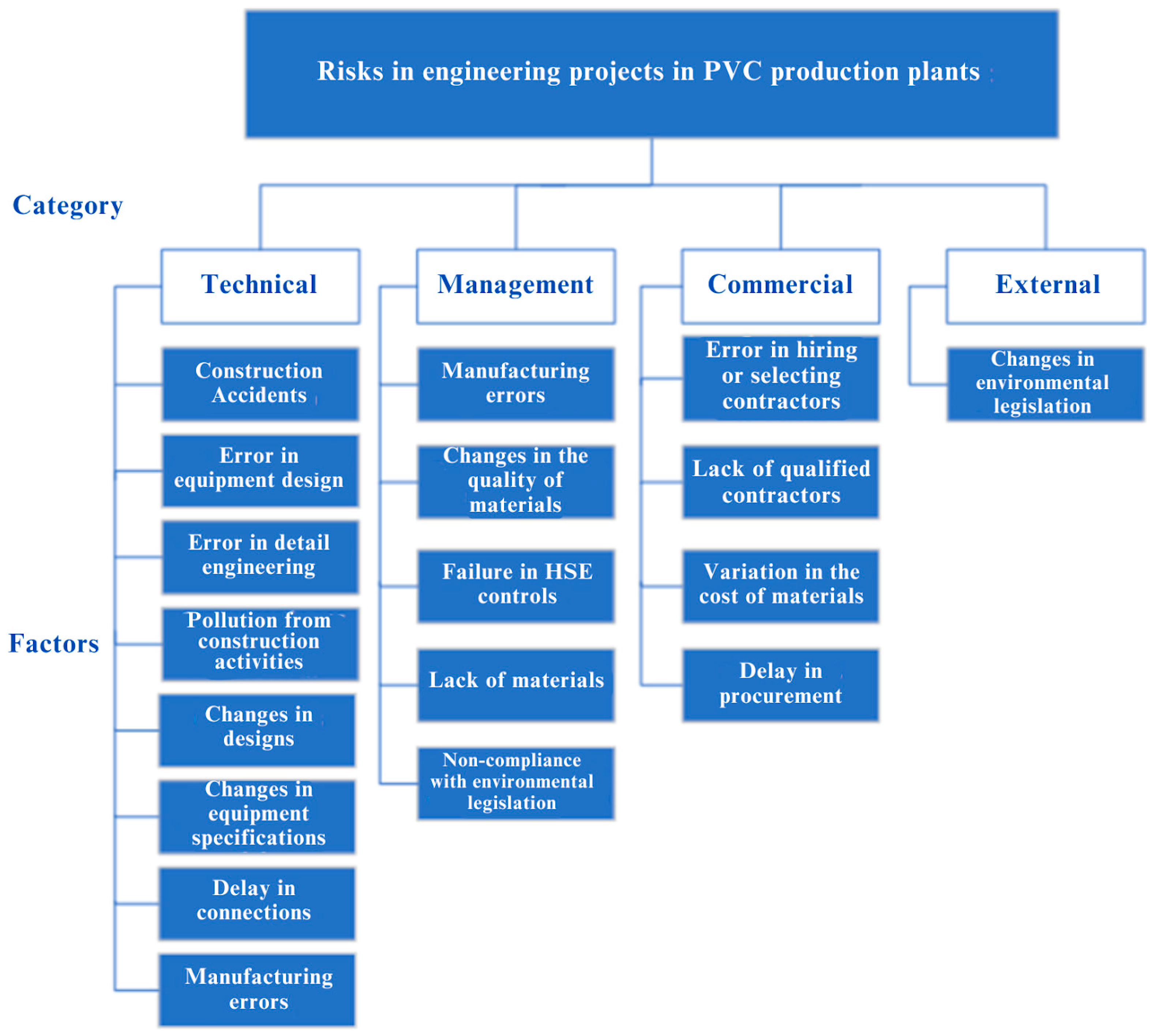

4.2.3. Risk Breakdown Structure

4.2.4. Model Overview

4.2.5. Relevance of the Model

4.3. Economic and Environmental Impact of the Model

4.4. Impact of the Human Factor on Risk Management

4.5. Comparison with Other Risk Management Frameworks, Techniques, and Tools

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Yim, R.; Castaneda, J.; Doolen, T.; Tumer, I.; Malak, R. A study of the impact of project classification on project risk indicators. Int. J. Proj. Manag. 2015, 33, 863–876. [Google Scholar] [CrossRef]

- Perminova, O.; Gustafsson, M.; Wikström, K. Defining uncertainty in projects–a new perspective. Int. J. Proj. Manag. 2008, 26, 73–79. [Google Scholar] [CrossRef]

- Al Hasani, M.; Regan, M. Understanding risk and uncertainty management practice in complex projects. Eur. J. Econ. Law Political 2017, 4, 24–38. [Google Scholar] [CrossRef]

- Karlsen, J.T.; Folke-Olsen, O.; Torvatn, T. Project Risk Management: Use and Benefit of Various Tools. En: Int. J. Risk Conting. Mgmt. 2013, 2, 79–101. [Google Scholar] [CrossRef]

- Iles, A.; Martin, A.; Rosen, C.M. Undoing chemical industry lock-ins: Polyvinyl chloride and green chemistry. Ethics Chem. 2021, 279–316. [Google Scholar] [CrossRef]

- Zhang, Y.; Xing, E.; Han, W.; Yang, P.; Zhang, S.; Liu, S.; Cao, D.; Li, M. Petrochemical industry for the future. Engineering 2024, 43, 99–114. [Google Scholar] [CrossRef]

- Stadtherr, M.; Rudd, D.F. Systems study of the petrochemical industry. Chem. Eng. Sci. 1976, 31, 1019–1028. [Google Scholar] [CrossRef]

- Hassani, H.; Silva, E.S.; Al Kaabi, A.M. The role of innovation and technology in sustaining the petroleum and petrochemical industry. Technol. Forecast. Soc. Chang. 2017, 119, 1–17. [Google Scholar] [CrossRef]

- Akhtar, M. Dealing with EPC Project Management Problems and Challenges a Case Study on Petrochemical, Oil and Gas EPC Projects in Middle-East. In Proceedings of the Abu Dhabi International Petroleum Exhibition & Conference, Abu Dhabi, United Arab Emirates, 9–12 November 2020. [Google Scholar] [CrossRef]

- Boaventura, K.M.; Peixoto, F.C.; Fernandes, H.L.S.; Pessoa, F.L.P. Long-Range Investment Assessment in a Petrochemical Industry: Cost and Safety Considerations. Comput. Chem. Eng. 2022, 161, 107737. [Google Scholar] [CrossRef]

- Ostadi, B.; Abbasi Harofteh, S. A novel risk assessment approach using Monte Carlo simulation based on co-occurrence of risk factors: A case study of a petrochemical plant construction. Sci. Iran. 2022, 29, 1755–1765. [Google Scholar] [CrossRef]

- Babaeipour, P.A.; Mohammadi, M.; Kazemi, M.A.A. Designing a Collaboration Model Among Supply Chain Members to Reduce External Supply Risk in the Oil and Petrochemical Industry Using Game Theory. Mgmt. Strateg. Eng. Sci. 2024, 6, 159–168. [Google Scholar] [CrossRef]

- Khodabakhshian, A.; Puolitaival, T.; Kestle, L. Deterministic and Probabilistic Risk Management Approaches in Construction Projects: A Systematic Literature Review and Comparative Analysis. Buildings 2023, 13, 1312. [Google Scholar] [CrossRef]

- Olsson, R. In search of opportunity management: Is the risk management process enough? Int. J. Proj. Manag. 2007, 25, 745–752. [Google Scholar] [CrossRef]

- Cooper, D.; Grey, S.; Raymond, G.; Walker, P. Project Risk Management Guidelines: Managing Risk in Large Projects and Complex Procurements; John Wiley & Sons Ltd.: Chichester, UK, 2005; p. 384. [Google Scholar]

- Do Vale, J.W.S.P.; De Carvalho, M.M. Risk and uncertainty in projects management: Literature review and conceptual framework. GEPROS. J. Sustain. Product. Oper. Syst. Mgmt. 2017, 12, 93–120. [Google Scholar] [CrossRef]

- Jaafari, A. Management of risks, uncertainties and opportunities on projects: Time for a fundamental shift. Int. J. Proj. Manag. 2001, 19, 89–101. [Google Scholar] [CrossRef]

- Vianello, J.M.; Costa, L.; Teixeira, J.P. Dynamic modeling of uncertainty in the planned values of investments in petrochemical and refining projects. Energy Econ. 2014, 45, 10–18. [Google Scholar] [CrossRef]

- Kutsch, E.; Hall, M. Deliberate ignorance in project risk management. Int. J. Proj. Manag. 2009, 28, 245–255. [Google Scholar] [CrossRef]

- Tomanek, M.; Juricek, J. Project Risk Management model based on PRINCE2 and SCRUM frameworks. Int. J. Softw. Eng Appl. 2015, 6, 81–88. [Google Scholar] [CrossRef]

- Project Management Institute (PMI). A Guide to the Project Management Body of Knowledge (PMBOK), 6th ed.; Project Management Institute: Newtown Square, PA, USA, 2021. [Google Scholar]

- ISO 31000:2018; Risk management—Guidelines, 3rd ed. International Organization for Standardization (ISO): Geneva, Switzerland, 2018.

- Ward, S.; Chapman, C. Transforming project risk management into Project uncertainty management. Int. J. Proj. Manag. 2003, 21, 97–105. [Google Scholar] [CrossRef]

- Böhle, F.; Heidling, E.; Schoper, Y. A new orientation to deal with uncertainty in projects. Int. J. Proj. Manag. 2016, 34, 1384–1392. [Google Scholar] [CrossRef]

- Roșu, M.M.; Rohan, R.; Juganaru, E.C. Methodology for risk analysis of projects. MATEC Web Conf. 2017, 112, 09012. [Google Scholar] [CrossRef]

- Chapman, C. Project risk analysis and management--PRAM the generic process. Int. J. Proj. Manag. 1997, 15, 273–281. [Google Scholar] [CrossRef]

- Samimi, A. Risk Management in EPC Projects. Eurasian J. Chem. Med. Pet. Res. 2024, 3, 191–201. [Google Scholar]

- Guerrero, E.C. Análisis de competitividad del sector petroquímico de Colombia basado en los factores productivos de clúster con alto potencial de desarrollo para el mejoramiento continuo del sector. Gestión Compet. Innovación 2013, 1, 12–21. [Google Scholar]

- Li, D. Perspective for smart factory in petrochemical industry. Comput. Chem. Eng. 2016, 91, 136–148. [Google Scholar] [CrossRef]

- Bidder, J. The project management of large petrochemical complexes. Eng. Process Econ. 1976, 1, 55–65. [Google Scholar] [CrossRef]

- Zhiguo, H.; Jiming, W.; Zhiguo, C. Model Choosing Method Based-on Variation Coefficient and Its Application to Project Management of Petrochemical Engineering Construction. In Proceedings of the 16th International Conference on Industrial Engineering and Engineering Management, Beijing, China, 21–23 October 2009; pp. 1749–1753. [Google Scholar] [CrossRef]

- Garcez, M.P.; Sbagria, R.; Kruglianskas, I. Factors for selecting Partners in Innovation Projects-Evidences from alliances in the Brazilian Petrochemical Leader. Rev. Adm. Inov. 2014, 11, 241–272. [Google Scholar] [CrossRef]

- Morales, M.A.; Dominguez, E.R.; Ibarra, A.A.; Reynaga, N.S.; Delgadillo, S.A.M. A methodological improvement for assessing petrochemical projects through life cycle assessment and eco-costs. Int. J. Life Cycle Assmt. 2014, 19, 517–531. [Google Scholar] [CrossRef]

- Pham, L.H.; Hadikusumo, H. Schedule delays in engineering, procurement, and construction petrochemical projects in Vietnam. Int. J. Energy Sec. Mgmt. 2014, 8, 3–26. [Google Scholar] [CrossRef]

- Elwany, M.H.; Elsharkawy, A. Impact of Integrating Earned Value Management and Risk Management on the Success in Oil, Gas and Petrochemicals Engineering Procurement and Construction EPC Projects. Int. J. Adv. Scient. Res. Mgmt. 2016, 1, 75–88. [Google Scholar]

- Heravi, G.; Fathi, M.; Faegh, S. Multi-criteria group decision-making method for optimal selection of sustainable industrial building options focused on petrochemical projects. J. Clean. Prod. 2017, 142, 2999–3013. [Google Scholar] [CrossRef]

- Kim, Y.S.; Kang, H.W. Development of a Model for Risk and Cost Analysis in Overseas Plant Construction Projects Focusing on Petrochemical Plant Construction Projects. KSCE J. Civ. Eng. 2017, 21, 1549–1562. [Google Scholar] [CrossRef]

- Khalafi, S.A.; Akhoondi, E.H.; Ghamsari, J.A.; Ansari, P. Determining the Most Significant Contributing Risk Factors to Petrochemical Project Failure. In Proceedings of the 9th European Conference on Management Leadership and Governance, Klagenfurt, Austria, 14–15 November 2013; pp. 114–121. Available online: https://www.researchgate.net/profile/Seyedamirhesam_Khalafi/publication/320073596_Determining_the_Most_Significant_Contributing_Risk_Factors_to_Petrochemical_Project_Failure/links/5b24295d458515270fd1c1e9/Determining-the-Most-Significant-Contributing-Risk-Factors-to-Petrochemical-Project-Failure.pdf (accessed on 23 December 2023).

- Damnjanovic, I.; Røed, W. Risk management in operations of petrochemical plants: Can better planning prevent major accidents and save money at the same time? J. Loss Prev. Process Ind. 2016, 44, 223–231. [Google Scholar] [CrossRef]

- Uher, T.E.; Toakley, A.R. Risk management in the conceptual phase of a project. Int. J. Proj. Manag. 1999, 17, 161–169. [Google Scholar] [CrossRef]

- Vásquez, H. La Historia del Petróleo en Colombia. Rev. Univ. EAFIT 1994, 30, 99–109. [Google Scholar]

- Acosta, K. Cartagena: Entre el progreso industrial y el rezago social. Econ. Región. 2013, 7, 5–66. [Google Scholar] [CrossRef][Green Version]

- Vaidya, O.S.; Kumar, S. Analytic hierarchy process: An overview of applications. Europ. J. Oper. Res. 2006, 169, 1–29. [Google Scholar] [CrossRef]

- Saaty, T.L. The analytic network process. In International Series in Operations Research and Management Science; Springer: Boston, MA, USA, 2006; Volume 95, pp. 1–26. [Google Scholar] [CrossRef]

- Badiru, A.; Kovach, T. Statistical Techniques for Project Control; CRC Press & Francis Group: Boca Ratón, FL, USA, 2012; p. 412. [Google Scholar]

- Bhushan, N.; Rai, K. Strategic Decision Making: Applying the Analytic Hierarchy Process; Springer: London, UK, 2004; pp. 11–21. [Google Scholar]

- Pant, S.; Kumar, A.; Ram, M.; Klochkov, Y.; Sharma, H.K. Consistency Indices in Analytic Hierarchy Process: A Review. Mathematics 2022, 10, 1206. [Google Scholar] [CrossRef]

- Brunelli, M. Introduction to the Analytic Hierarchy Process; Springer Nature: Dordrecht, The Netherlands, 2015; p. 83. [Google Scholar] [CrossRef]

- Alonso, J.A.; Lamata, M.T. Consistency in the analytic hierarchy process: A new approach. Int. J. Uncertain. Fuzziness Knowl.-Based Syst. 2006, 14, 445–459. [Google Scholar] [CrossRef]

- Ahmadi, M.; Behzadian, K.; Ardeshir, A.; Kapelan, Z. Comprehensive risk management using fuzzy FMEA and MCDA techniques in highway construction projects. J. Civ. Eng. Manag. 2016, 23, 300–310. [Google Scholar] [CrossRef]

- Sadeghi, N.; Fayek, A.R. Fuzzy Monte Carlo Simulation and Risk Assessment in Construction. Comp.-Aided Civ. Infrastruct. Eng. 2010, 25, 238–252. [Google Scholar] [CrossRef]

- Qazi, A.; Shamayleh, A.; El-Sayegh, S.; Formaneck, S. Prioritizing risks in sustainable construction projects using a risk matrix-based Monte Carlo Simulation approach. Sustain. Cities Soc. 2021, 65, 102576. [Google Scholar] [CrossRef]

- Qazi, A.; Simsekler, M.C.E. Risk assessment of construction projects using Monte Carlo simulation. Int. J. Manag. Proj. Bus. 2021, 14, 1202–1218. [Google Scholar] [CrossRef]

- Sobieraj, J.; Metelski, D. Project Risk in the Context of Construction Schedules—Combined Monte Carlo Simulation and Time at Risk (TaR) Approach: Insights from the Fort Bema Housing Estate Complex. Appl. Sci. 2022, 12, 1044. [Google Scholar] [CrossRef]

- Alvand, A.; Mohammad Mirhosseini, S.; Ehsanifar, M.; Zeighami, E.; Mohammadi, A. Identification and Assessment of Risk in Construction Projects Using the Integrated FMEA-SWARA-WASPAS Model under Fuzzy Environment: A Case Study of a Construction Project in Iran. Int. J. Constr. Manag. 2021, 23, 392–404. [Google Scholar] [CrossRef]

| Procedure | Definition | Process |

|---|---|---|

| PRINCE2 | Systematic application of principles, approaches, and processes to the tasks of identifying and assessing risks, planning and implementing risk responses, and communicating risk management activities to stakeholders. | Identify |

| Assess | ||

| Plan | ||

| Implement | ||

| APM | Process that enables individual risk events and overall risks to be understood and managed proactively, optimizing success by minimizing threats and maximizing opportunities. | Identify |

| Assess | ||

| Response plan | ||

| Implement response | ||

| PMI | Processes to carry out management planning, identification, analysis, response planning, response implementation, and monitoring of project risks. | Plan |

| Identify | ||

| Qualitative and quantitative analysis | ||

| Plan the response to risks | ||

| Risk response planning | ||

| Monitoring the risks | ||

| ISO 31000 | Provides guidelines for risk management. It offers a structured framework to help organizations identify, analyze, evaluate, treat, monitor, and communicate risks effectively. | Risk identification |

| Risk analysis | ||

| Risk evaluation | ||

| Risk treatment | ||

| Monitoring and review |

| Management Factors | Budget | Schedule | Safety | Productivity | Contract | Quality | Environmental |

|---|---|---|---|---|---|---|---|

| Budget | 1 | 2 | 1/5 | 1 | 3 | 1/2 | 2 |

| Schedule | 1/2 | 1 | 1/5 | 2 | 3 | 1 | 1/3 |

| Safety | 5 | 5 | 1 | 5 | 9 | 3 | 2 |

| Productivity | 10 | 1/2 | 1/5 | 1 | 3 | 1 | 1 |

| Contract | 1/3 | 1/3 | 1/9 | 1/3 | 1 | 0.2 | ½ |

| Quality | 2 | 1 | 1/3 | 1 | 5 | 1 | 3 |

| Environmental | 1/2 | 3 | 1/2 | 1 | 2 | 1/3 | 1 |

| Summation | 10.33 | 12.83 | 2.54 | 11.33 | 26.00 | 7.03 | 9.83 |

| Management Factors | Budget | Schedule | Safety | Productivity | Contract | Quality | Environmental | Sum | Weight |

|---|---|---|---|---|---|---|---|---|---|

| Budget | 0.10 | 0.13 | 0.08 | 0.18 | 0.18 | 0.09 | 0.24 | 1.00 | 0.14 |

| Schedule | 0.05 | 0.07 | 0.08 | 0.12 | 0.12 | 0.06 | 0.04 | 0.54 | 0.08 |

| Safety | 0.52 | 0.34 | 0.39 | 0.31 | 0.31 | 0.51 | 0.24 | 2.62 | 0.38 |

| Productivity | 0.03 | 0.03 | 0.08 | 0.06 | 0.11 | 0.06 | 0.06 | 0.43 | 0.06 |

| Contract | 0.02 | 0.02 | 0.04 | 0.02 | 0.02 | 0.04 | 0.03 | 0.19 | 0.03 |

| Quality | 0.21 | 0.20 | 0.13 | 0.18 | 0.18 | 0.18 | 0.24 | 1.32 | 0.19 |

| Environmental | 0.05 | 0.20 | 0.20 | 0.12 | 0.07 | 0.09 | 0.12 | 0.85 | 0.12 |

| Summation | - | - | - | - | - | - | - | - | 1.0 |

| Risk Factors | |

|---|---|

| Equipment design error | Construction accidents |

| Detailed engineering error | Lack of qualified contractors |

| Failure in HSE controls | Delay in connections |

| Design changes | Planning errors |

| Procurement delays | Manufacturing errors |

| Variation in material costs | Error in contractor hiring or selection |

| Change in material quality | Changes in environmental legislation |

| Change in equipment specifications | Pollution from construction activities |

| Lack of materials | Non-compliance with environmental legislation |

| Management Factors | Budget | Schedule | Safety | Productivity | |||||

|---|---|---|---|---|---|---|---|---|---|

| Score = Index × weight | 14.4% | 7.5% | 37.6% | 6.2% | |||||

| Code | Risk Factors ↓ | Index | Score | Index | Score | Index | Score | Index | Score |

| FR 1 | Equipment design error | 10 | 1.4 | 8 | 0.6 | 4 | 1.5 | 9 | 0.6 |

| FR2 | Detailed engineering error | 8.5 | 1.2 | 9.1 | 0.7 | 3 | 1.1 | 7.7 | 0.5 |

| FR 3 | Failure in HSE controls | 7 | 1.0 | 4 | 0.3 | 8 | 3.0 | 6 | 0.4 |

| FR 4 | Changes in designs | 7.1 | 1.0 | 8 | 0.6 | 4 | 1.5 | 9 | 0.6 |

| FR 5 | Procurement delays | 6.6 | 0.9 | 10 | 0.7 | 4 | 1.5 | 10 | 0.6 |

| FR 6 | Material cost variation | 10 | 1.4 | 4 | 0.3 | 3 | 1.1 | 5 | 0.3 |

| FR 7 | Material quality changes | 9 | 1.3 | 6 | 0.4 | 4.8 | 1.8 | 7.7 | 0.5 |

| FR 8 | Equipment specification changes | 8 | 1.1 | 5 | 0.4 | 4 | 1.5 | 8 | 0.5 |

| FR 9 | Lack of materials | 6 | 0.9 | 9.8 | 0.7 | 2 | 0.8 | 9.7 | 0.6 |

| FR 10 | Construction accidents | 8 | 1.1 | 8 | 0.6 | 10 | 3.8 | 8.8 | 0.5 |

| FR 11 | Lack of qualified contractors | 6 | 0.9 | 7.4 | 0.6 | 4 | 1.5 | 9 | 0.6 |

| FR 12 | Connection delays | 7 | 1.0 | 8.7 | 0.7 | 3 | 1.1 | 10 | 0.6 |

| FR 13 | Planning errors | 9 | 1.3 | 10 | 0.7 | 5.5 | 2.1 | 8 | 0.5 |

| FR 14 | Manufacturing errors | 9.6 | 1.4 | 8 | 0.6 | 6 | 2.3 | 9.3 | 0.6 |

| FR 15 | Contracting or selecting contractor errors | 5 | 0.7 | 8 | 0.6 | 4.5 | 1.7 | 8.3 | 0.5 |

| FR 16 | Environmental legislation changes | 8 | 1.1 | 4 | 0.3 | 5 | 1.9 | 3 | 0.2 |

| FR 17 | Pollution from construction activities | 8 | 1.1 | 5 | 0.4 | 6 | 2.3 | 4 | 0.2 |

| FR 18 | Non-compliance with environmental legislation | 6.1 | 0.9 | 4.2 | 0.3 | 4 | 1.5 | 4 | 0.2 |

| Management factors | Recruitment | Quality | Environmental | Addition | |||||

| Score = Index × weight | 3.4% | 18.8% | 12.1% | 100% | |||||

| Code | Risk Factors | Index | Score | Index | Score | Index | Score | Index | Score |

| FR 1 | Equipment design error | 8 | 0.3 | 8.6 | 1.6 | 8 | 0.3 | 8.6 | 1.6 |

| FR2 | Detailed engineering error | 8 | 0.3 | 10 | 1.9 | 8 | 0.3 | 10 | 1.9 |

| FR 3 | Failure in HSE controls | 5 | 0.2 | 5 | 0.9 | 5 | 0.2 | 5 | 0.9 |

| FR 4 | Changes in designs | 9 | 0.3 | 8 | 1.5 | 9 | 0.3 | 8 | 1.5 |

| FR 5 | Procurement delays | 9 | 0.3 | 5.6 | 1.1 | 9 | 0.3 | 5.6 | 1.1 |

| FR 6 | Material cost variation | 8.6 | 0.3 | 7 | 1.3 | 8.6 | 0.3 | 7 | 1.3 |

| FR 7 | Material quality changes | 8 | 0.3 | 7.5 | 1.4 | 8 | 0.3 | 7.5 | 1.4 |

| FR 8 | Equipment specification changes | 7 | 0.2 | 9 | 1.7 | 7 | 0.2 | 9 | 1.7 |

| FR 9 | Lack of materials | 7 | 0.2 | 8 | 1.5 | 7 | 0.2 | 8 | 1.5 |

| FR 10 | Construction accidents | 6 | 0.2 | 5.8 | 1.1 | 6 | 0.2 | 5.8 | 1.1 |

| FR 11 | Lack of qualified contractors | 10 | 0.3 | 9 | 1.7 | 10 | 0.3 | 9 | 1.7 |

| FR 12 | Connection delays | 6.2 | 0.2 | 8.1 | 1.5 | 6.2 | 0.2 | 8.1 | 1.5 |

| FR 13 | Planning errors | 8.6 | 0.3 | 7 | 1.3 | 8.6 | 0.3 | 7 | 1.3 |

| FR 14 | Manufacturing errors | 9 | 0.3 | 10 | 1.9 | 9 | 0.3 | 10 | 1.9 |

| FR 15 | Contracting or selecting contractor errors | 10 | 0.3 | 9.5 | 1.8 | 10 | 0.3 | 9.5 | 1.8 |

| FR 16 | Environmental legislation changes | 6 | 0.2 | 3 | 0.6 | 6 | 0.2 | 3 | 0.6 |

| FR 17 | Pollution from construction activities | 4 | 0.1 | 5 | 0.9 | 4 | 0.1 | 5 | 0.9 |

| FR 18 | Non-compliance with environmental legislation | 5 | 0.2 | 3 | 0.6 | 5 | 0.2 | 3 | 0.6 |

| Model | Sum of Squares | Degrees of Freedom | Mean Square | F | Sig. |

|---|---|---|---|---|---|

| Regression | 13.310 | 7 | 1.901 | 334.013 | 0.000 |

| Residual | 0.057 | 10 | 0.0057 | ||

| Total | 13.367 | 17 |

| R | R2 | Adjusted R2 | Standard Error of the Estimate | Durbin–Watson |

|---|---|---|---|---|

| 0.998 | 0.996 | 0.993 | 0.07545 | 2.289 |

| Model | Unstandardized Coefficients | |

|---|---|---|

| b | Standard Error | |

| (Constant) | 0.175 | 0.164 |

| Budget | 0.963 | 0.100 |

| Schedule | 1.113 | 0.196 |

| Safety | 1.013 | 0.030 |

| Productivity | 0.765 | 0.278 |

| Hiring | 0.644 | 0.398 |

| Quality | 1.016 | 0.076 |

| Environment | 0.935 | 0.079 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bustamante Visbal, J.P.; Ortega-Toro, R.; Hernández Fernández, J.A. Application of Risk Management in Applied Engineering Projects in a Petrochemical Plant Producing Polyvinyl Chloride in Cartagena, Colombia. ChemEngineering 2025, 9, 75. https://doi.org/10.3390/chemengineering9040075

Bustamante Visbal JP, Ortega-Toro R, Hernández Fernández JA. Application of Risk Management in Applied Engineering Projects in a Petrochemical Plant Producing Polyvinyl Chloride in Cartagena, Colombia. ChemEngineering. 2025; 9(4):75. https://doi.org/10.3390/chemengineering9040075

Chicago/Turabian StyleBustamante Visbal, Juan Pablo, Rodrigo Ortega-Toro, and Joaquín Alejandro Hernández Fernández. 2025. "Application of Risk Management in Applied Engineering Projects in a Petrochemical Plant Producing Polyvinyl Chloride in Cartagena, Colombia" ChemEngineering 9, no. 4: 75. https://doi.org/10.3390/chemengineering9040075

APA StyleBustamante Visbal, J. P., Ortega-Toro, R., & Hernández Fernández, J. A. (2025). Application of Risk Management in Applied Engineering Projects in a Petrochemical Plant Producing Polyvinyl Chloride in Cartagena, Colombia. ChemEngineering, 9(4), 75. https://doi.org/10.3390/chemengineering9040075