Production Inventory Optimization Considering Direct and Indirect Carbon Emissions under a Cap-and-Trade Regulation

Abstract

1. Introduction

- Develops a sustainable production inventory or EPQ model based on the direct and indirect emissions that classify them according to the three emission scopes.

- Studies the effect of the carbon cap, carbon price, and other environmental-related parameters on production inventory optimization under the carbon cap-and-trade system.

- Incorporates the effect of defective products in a sustainable EPQ model, considering direct and indirect emissions.

2. Method

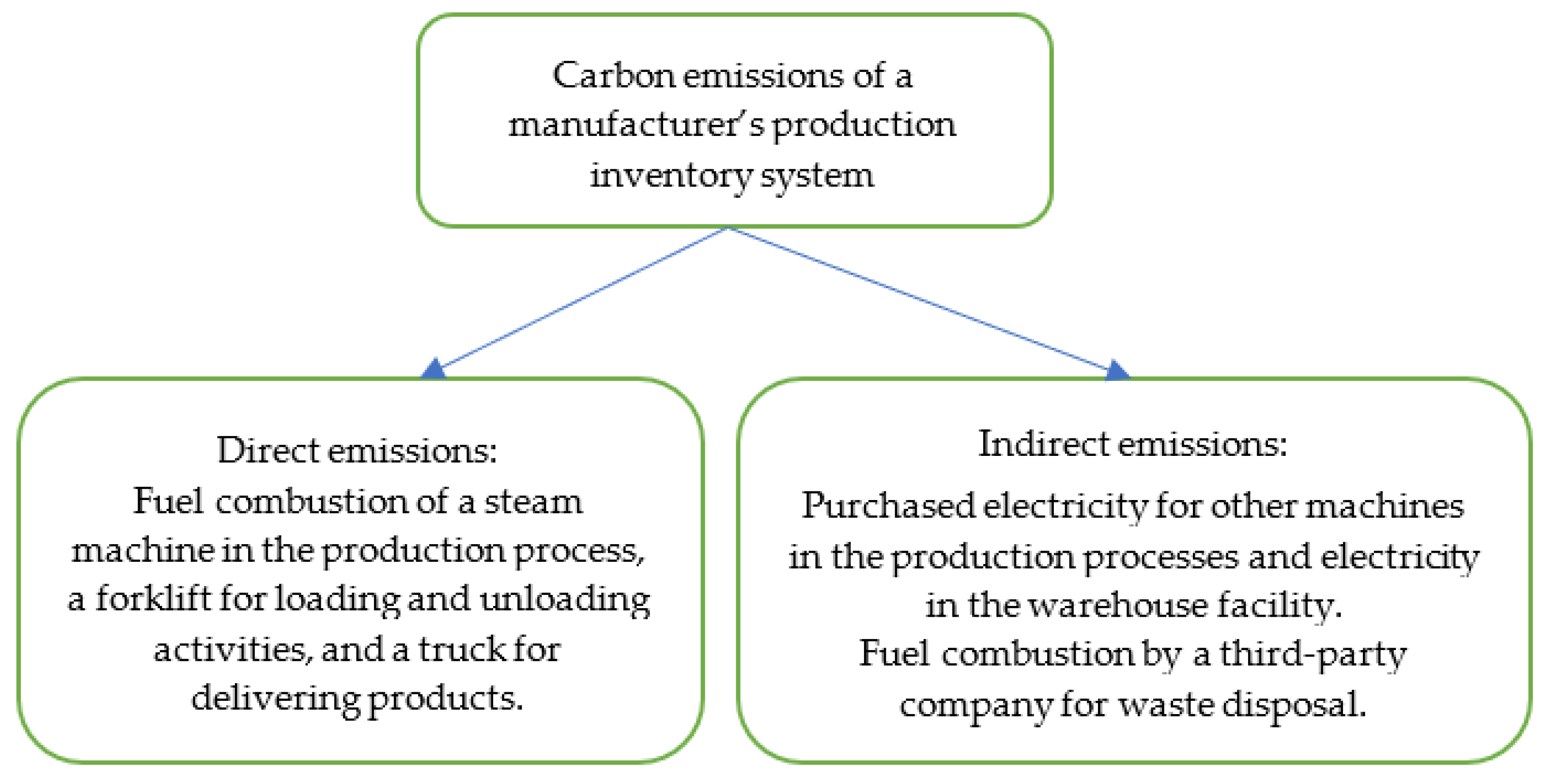

2.1. Problem Description

2.2. Assumptions

- A manufacturer produces one type of product based on a customer’s design. For example, a corrugated box manufacturer produces one type of box ordered by an FMCG manufacturer or an automotive component manufacturer produces one type of component for a car manufacturer.

- Demand from the customer is known and constant.

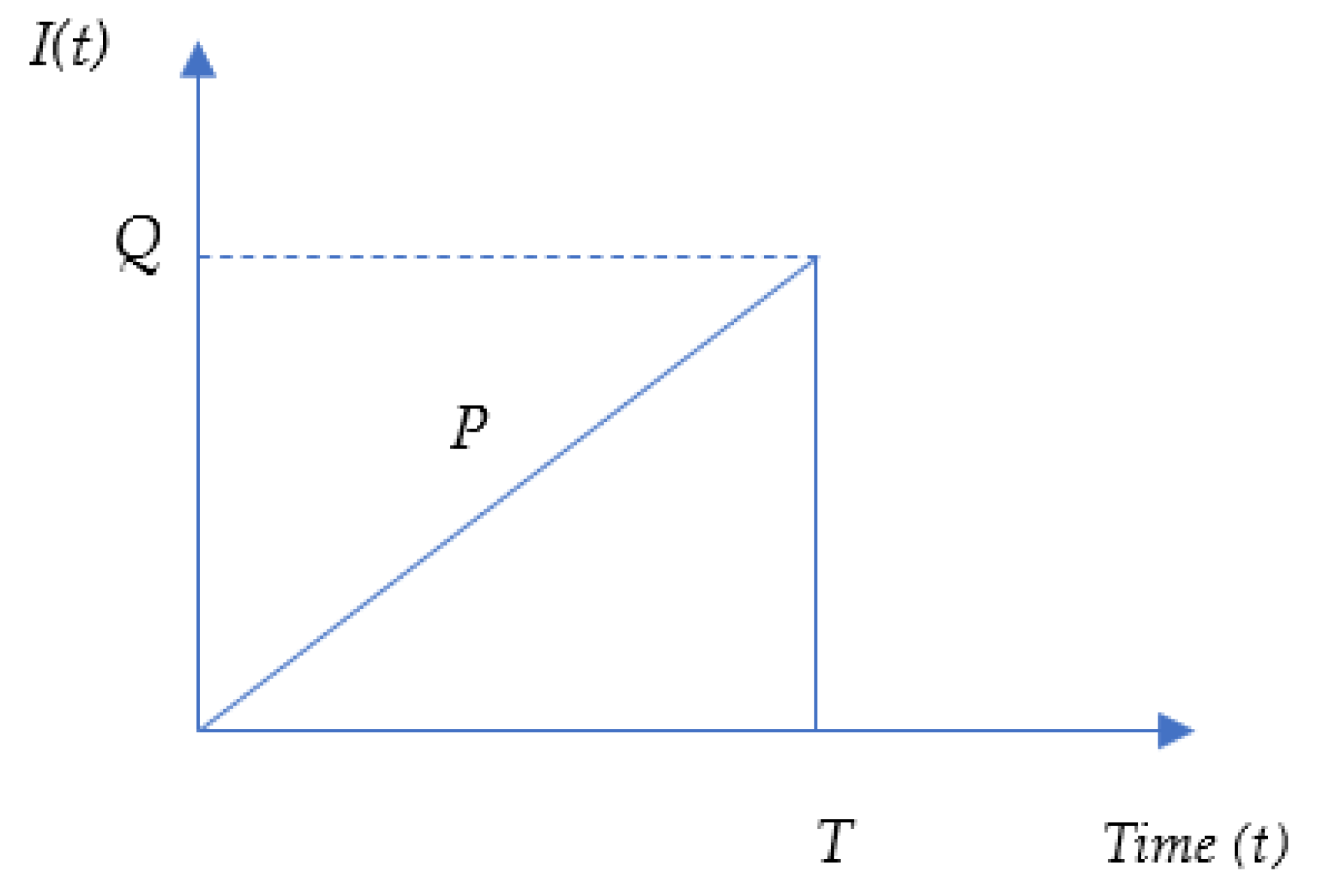

- Production rate is greater than the demand and is constant. The inventory is accumulated during the production period.

- Shortages are not allowed.

- The manufacturer unloads the required material from the receiving dock to the production area. After the production, the manufacturer loads the finished products onto a truck at the shipping dock. Material handling costs and direct CO2 emissions from a forklift are among the consequences, as in Wangsa et al. [15]. The distances from the receiving dock to the production area and from the production area to the shipping dock are the same.

- The holding cost considers the cost of warehousing and indirect CO2 emissions from electricity usage, as in Daryanto and Wee [19].

- A certain amount of solid waste is produced and disposed of at the end of the production cycle by a third-party company. A fixed cost to dispose of and indirect CO2 emissions are among the consequences [19].

- When total emissions exceed the carbon cap, extra carbon quotas are always available in the carbon market. Excess quotas can be sold when total emissions are less than the carbon cap.

2.3. Notations

2.4. Mathematical Modeling

- a.

- Setup cost

- b.

- Production cost

- c.

- Inventory holding cost

- d.

- Material handling cost

- e.

- Transportation cost

- f.

- Waste disposal cost

- g.

- Emission cost

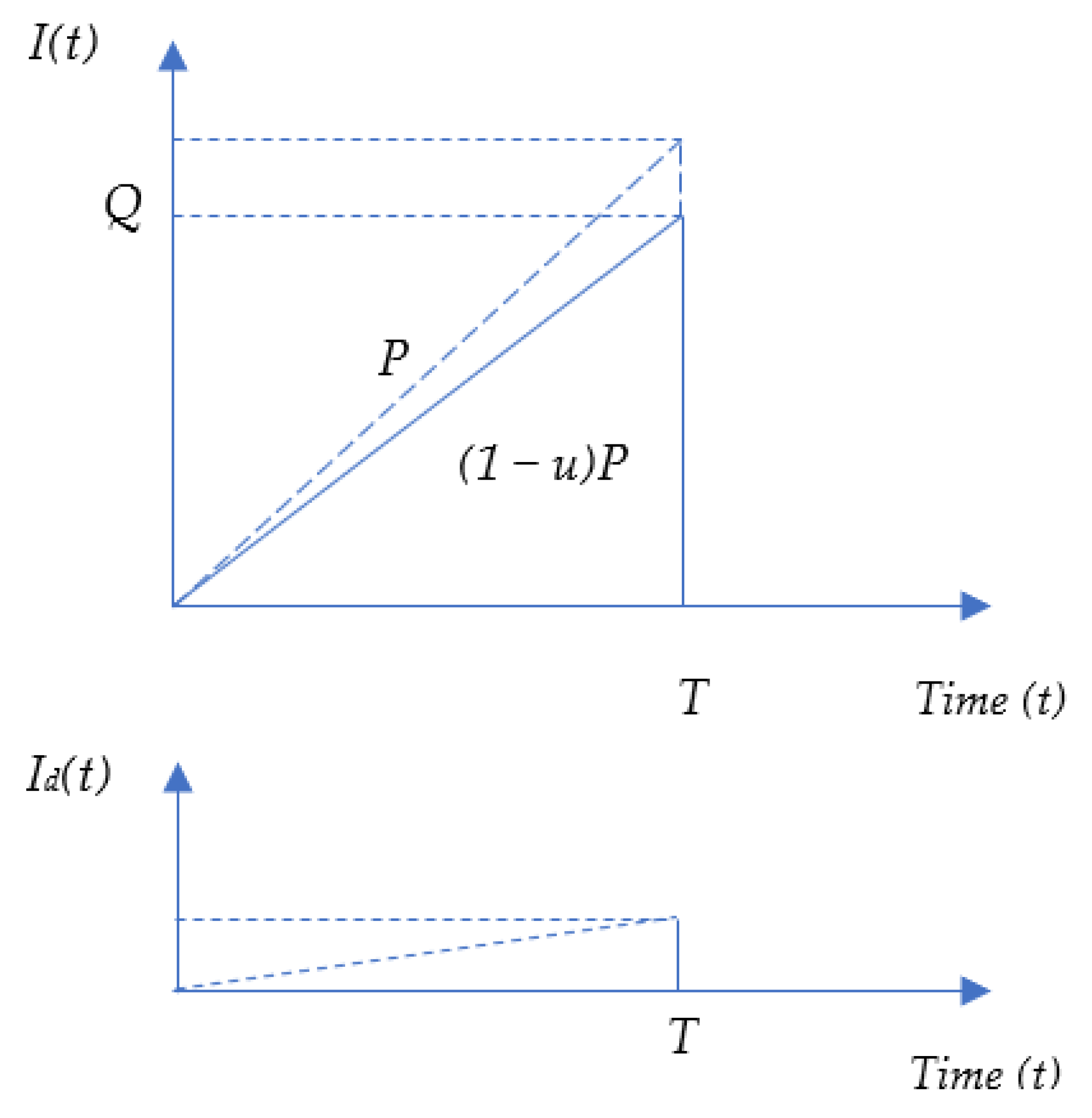

2.5. A Special Case of an Imperfect Production System

- Setup cost per year (Cst) remains the same as Equation (2).

- Production cost per year is the production cost per unit (Pc) multiplied by the production quantity per cycle (PT), multiplied by the number of production cycles per year (D/Q) as follows:Because of the defective product percentage, the production cycle T is equal to Q/(1 − u)P. Hence, Equation (22) becomes

- Due to an imperfect production system, inspection costs arise to ensure that only conforming products are delivered to the customer. Inspection cost per year (Ci) is the inspection cost per unit (Isp) multiplied by the production quantity per cycle (PT), multiplied by the number of production cycles per year (D/Q). As a result, Ci becomes

- Inventory holding cost (Cih) comes from the storage of conforming products (Ci1) and defective products (Ci2). The inventory cost per unit of the defective product (Icd) could be much lower than the inventory cost per unit of the conforming product (Ic). Considering the length of the production cycle under the effect of defective products, we haveThe expected number of defective products per cycle isHence,and

- The cost of raw material handling is proportional to the number of products produced, so the total material handling costs are

- Because only the conforming products (Q) are delivered to the customer, the transportation cost is similar to Equation (6).

- The amount of waste that is disposed of receives an addition from the defective product. However, the cost of waste disposal still follows Equation (7), because it is only affected by a fixed disposal cost per cycle.

- Emission costsAgain, considering the number of produced products as an effect of the defective products, the emission costs are as follows:Therefore,and

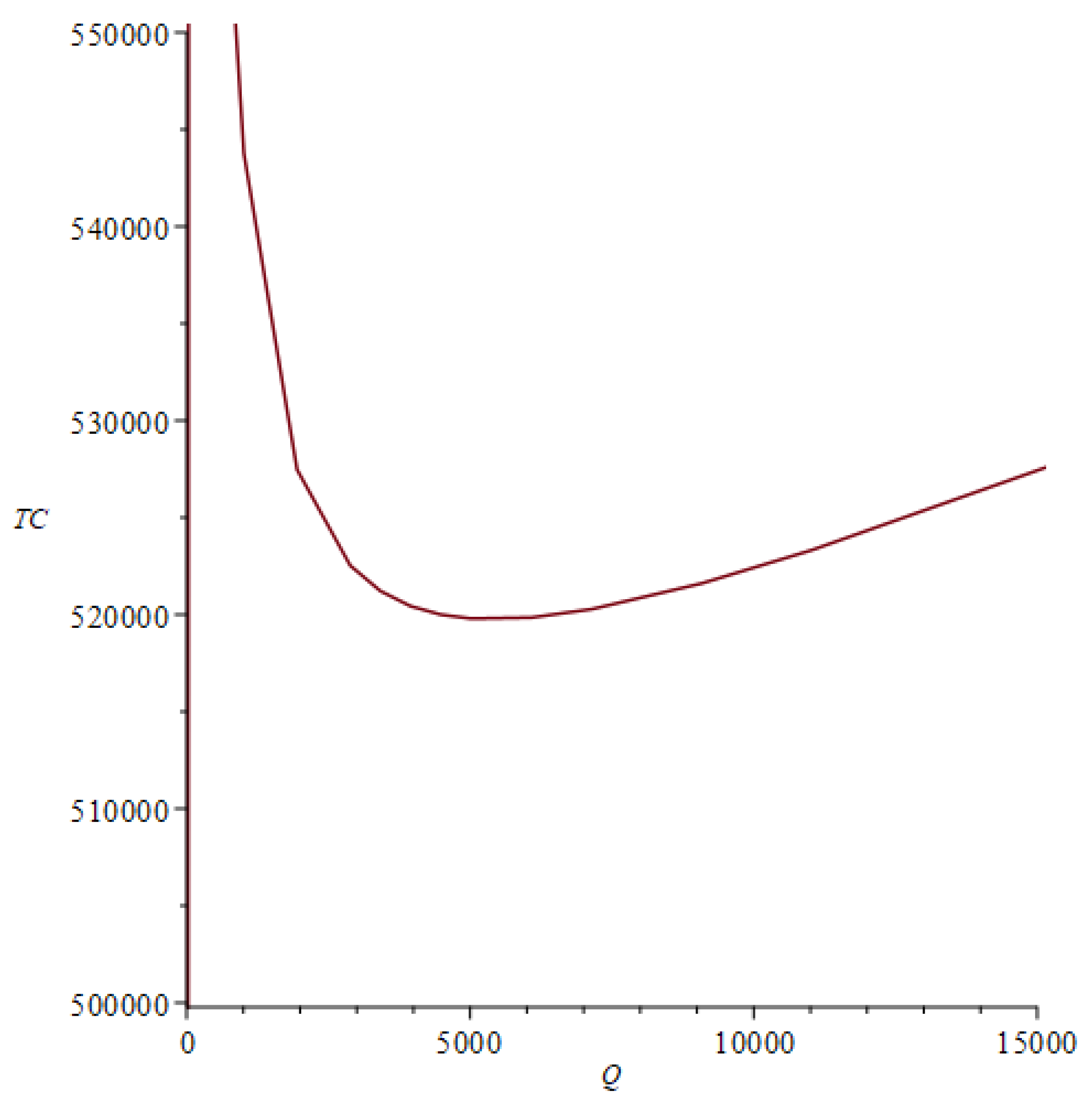

3. Results and Discussion

3.1. Case Illustration

3.2. Numerical Example

3.3. Numerical Example of an Imperfect Production System

3.4. Effects of Changes in Environmental Parameters

- The increase in the carbon cap (Ecap) does not change the decision on the optimal production quantity per cycle (Q); as a result, the total amount of emissions does not change either. Companies can buy additional carbon quotas from the market, so they are less concerned about the number of their emissions. However, as expected, the total cost decreases because the obligation to purchase additional carbon quotas has been reduced. This result follows the findings of Hasan et al. [28] and Sinha and Modak [30], even though they looked at it from a total profit perspective.

- Increased carbon prices (CGHG) are anticipated by reducing the production quantity per cycle (Q). It causes a decrease in the number of emissions (Te). This anticipation also provides a lower total cost (Tc). This result may seem unusual, but this reduction in total costs can only occur if there is part of the carbon quota left (Ecap > Te). If a company’s total emissions are more significant than its quota (Te > Ecap), an increase in carbon prices will burden them. To prove this, changes were made to the carbon cap and carbon price simultaneously. The result is that, when the carbon quota is exhausted, the increase in carbon price will also increase the total cost. This outcome is consistent with Sinha and Modak’s findings [30].

- Total expenses and emissions are significantly impacted by changes in the company’s proximity to the consumer (dc). Hence, businesses must pay close attention to this factor and search for the best shipping option, particularly for long-distance goods. This result is in accordance with the findings of Wangsa [2] regarding the effect of distance on emissions and cost.

- The fuel emissions standard (Fe) also significantly affects total emissions, although it does not significantly change the total cost. Therefore, companies and the government need to consider the type of fuel with lower emissions to reduce emission levels. However, it should be noted that in this developed model, the price difference for a better type of fuel was not considered.

- Other parameters such as dt, c1, Pe, Ee, and We have no significant effect on the total cost or total emissions.

3.5. Effects of Cost Parameters

- The unit production cost (Pc) is the most sensitive parameter for the total cost. The increase in Pc is almost proportional to the increase in the total cost. Hence, the manager must carefully take care of this factor. However, it does not affect the total emissions, as they remain constant.

- Setup cost (s), fixed transportation cost (tfix), and fuel price (Fp) have similar effects on the total cost and total emissions. The increases in s, tfix, and Fp increase the total cost. In contrast, the total emission decreases, which is related to the increase in the production lot size Q.

- As expected, an increase in the inventory cost per unit (Ic) will increase total costs. In addition, the increase in Ic will be anticipated by lowering the production lot size Q to reduce inventory. This results in a shorter cycle time. However, the total emissions increase. Hence, the manager must carefully control the inventory cost (or reduce it if possible) because it is detrimental to the company and the environment.

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- The World Bank. Carbon Pricing Dashboard. 2022. Available online: https://carbonpricingdashboard.worldbank.org/ (accessed on 22 December 2022).

- Wangsa, I.D. Greenhouse gas penalty and incentive policies for a joint economic lot size model with industrial and transport emissions. Int. J. Ind. Eng. Comput. 2017, 8, 453–480. [Google Scholar] [CrossRef]

- Wright, L.A.; Kemp, S.; Williams, I. ‘Carbon footprint’: Towards a universally accepted definition. Carbon Manag. 2011, 2, 61–72. [Google Scholar] [CrossRef]

- Damert, M.; Feng, Y.; Zhu, Q.; Baumgartner, R.J. Motivating low-carbon initiatives among suppliers: The role of risk and opportunity perception. Resour. Conserv. Recycl. 2018, 136, 276–286. [Google Scholar] [CrossRef]

- Das, C.; Jharkharia, S. Low carbon supply chain: A state-of-the-art literature review. J. Manuf. Technol. Manag. 2018, 29, 398–428. [Google Scholar] [CrossRef]

- Karim, R.; Nakade, K.A. Literature review on the sustainable EPQ model, focusing on carbon emissions and product recycling. Logistics 2022, 6, 55. [Google Scholar] [CrossRef]

- Roy, D.; Mashud, A.H.M. Optimizing profit in a controlled environment: Assessing the synergy between preservation technology and cap-and-trade policy. J. King Saud Univ.–Sci. 2022, 34, 101899. [Google Scholar] [CrossRef]

- Benjaafar, S.; Li, Y.; Daskin, M. Carbon footprint and the management of supply chains: Insights from simple models. IEEE Trans. Autom. Sci. Eng. 2013, 10, 99–116. [Google Scholar] [CrossRef]

- Gunasekaran, A.; Irani, Z.; Papadopoulos, T. Modelling and analysis of sustainable operations management: Certain investigations for research and applications. J. Oper. Res. Soc. 2014, 65, 806–823. [Google Scholar] [CrossRef]

- Sathaye, N.; Horvath, A.; Madanat, S. Unintended impacts of increased truck loads on pavement supply-chain emissions. Transp. Res. Part A Policy Pract. 2010, 44, 1–15. [Google Scholar] [CrossRef]

- Huang, Y.S.; Fang, C.C.; Lin, Y.A. Inventory management in supply chains with consideration of logistics, green investment and different carbon emissions policies. Comput. Ind. Eng. 2020, 139, 106207. [Google Scholar] [CrossRef]

- Khan, M.A.; Cárdenas-Barrón, L.E.; Trevio-Garza, G.; Céspedes-Mota, A. Optimal circular economy index policy in a production system with carbon emissions. Expert Syst. Appl. 2023, 212, 118684. [Google Scholar] [CrossRef]

- Lee, K.H. Integrating carbon footprint into supply chain management: The case of Hyundai Motor Company (HMC) in the automobile industry. J. Clean. Prod. 2011, 19, 1216–1223. [Google Scholar] [CrossRef]

- Ong, A.K.S.; Robielos, R.A.C.; Jou, Y.T.; Wee, H.M. Three-level supply chain considering direct and indirect transportation cost and carbon emissions. IOP Conf. Ser. Mater. Sci. Eng. 2020, 847, 012050. [Google Scholar] [CrossRef]

- Wangsa, I.D.; Tiwari, S.; Wee, H.M.; Reong, S. A sustainable vendor-buyer inventory system considering transportation, loading and unloading activities. J. Clean. Prod. 2020, 271, 122120. [Google Scholar] [CrossRef]

- Matthews, H.S.; Hendrickson, C.T.; Weber, C.L. The importance of carbon footprint estimation boundaries. Environ. Sci. Technol. 2008, 42, 5839–5842. [Google Scholar] [CrossRef] [PubMed]

- Mukhopadhyay, A.; Goswami, A. Economic production quantity models for imperfect items with pollution costs. Syst. Sci. Control Eng. 2014, 2, 368–378. [Google Scholar] [CrossRef]

- Datta, T.K. Effect of green technology investment on a production-inventory system with carbon tax. Adv. Oper. Res. 2017, 2017, 4834839. [Google Scholar] [CrossRef]

- Daryanto, Y.; Wee, H.M. Sustainable economic production quantity models: An approach toward a cleaner production. J. Adv. Manag. Sci. 2018, 6, 206–212. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Soleymanfar, V.R.; Govindan, K. Sustainable economic production quantity models for inventory system with shortage. J. Clean. Prod. 2018, 174, 1011–1020. [Google Scholar] [CrossRef]

- Daryanto, Y.; Wee, H.M. Low carbon economic production quantity model for imperfect quality deteriorating items. Int. J. Ind. Eng. Eng. Manag. 2019, 1, 1–8. [Google Scholar] [CrossRef]

- Shen, Y.J.; Shen, K.F.; Yang, C.T. A production inventory model for deteriorating items with collaborative preservation technology investment under carbon tax. Sustainability 2019, 11, 5027. [Google Scholar] [CrossRef]

- Manna, A.K.; Das, B.; Tiwari, S. Impact of carbon emission on imperfect production inventory system with advance payment base free transportation. RAIRO-Oper. Res. 2020, 54, 1103–1117. [Google Scholar] [CrossRef]

- Priyamvada, P.; Gautam, P.; Khanna, A. Sustainable production strategies for deteriorating and imperfect quality items with an investment in preservation technology. Int. J. Syst. Assur. Eng. Manag. 2021, 12, 910–918. [Google Scholar] [CrossRef]

- Priyan, S.; Mala, P.; Palanivel, M. A cleaner EPQ inventory model involving synchronous and asynchronous rework process with green technology investment. Clean. Logist. Supply Chain 2022, 4, 100056. [Google Scholar] [CrossRef]

- Moon, I.; Yun, W.Y.; Sarkar, B. Effects of variable setup cost, reliability, and production costs under controlled carbon emissions in a reliable production system. Eur. J. Ind. Eng. 2022, 16, 371–397. [Google Scholar] [CrossRef]

- Mashud, A.H.M.; Roy, D.; Daryanto, Y.; Mishra, U.; Tseng, M.L. Sustainable production lot sizing problem: A sensitivity analysis on controlling carbon emissions through green investment. Comput. Ind. Eng. 2022, 169, 108143. [Google Scholar] [CrossRef]

- Hasan, M.R.; Roy, T.C.; Daryanto, Y.; Wee, H.M. Optimizing inventory level and technology investment under a carbon tax, cap-and-trade and strict carbon limit regulations. Sustain. Prod. Consum. 2021, 25, 604–621. [Google Scholar] [CrossRef]

- Yassine, N. A sustainable economic production model: Effects of quality and emissions tax from transportation. Ann. Oper. Res. 2020, 290, 73–94. [Google Scholar] [CrossRef]

- Sinha, S.; Modak, N.K. An EPQ model in the perspective of carbon emission reduction. Int. J. Math. Oper. Res. 2019, 14, 338–358. [Google Scholar] [CrossRef]

- Entezaminia, A.; Gharbi, A.; Ouhimmou, M. A joint production and carbon trading policy for unreliable manufacturing systems under cap-and-trade regulation. J. Clean. Prod. 2021, 293, 125973. [Google Scholar] [CrossRef]

- He, P.; Zhang, W.; Xu, X.; Bian, Y. Production lot-sizing and carbon emissions under cap-and-trade and carbon tax regulations. J. Clean. Prod. 2015, 103, 241–248. [Google Scholar] [CrossRef]

- Katadata Insight Center Indonesia Carbon Trading Handbook. 2022. Available online: https://cdn1.katadata.co.id/media/filespdf/2022/Indonesia_Carbon_Trading_Handbook.pdf (accessed on 22 December 2022).

- Wee, H.M.; Daryanto, Y. Imperfect quality item inventory models considering carbon emissions. In Optim. Inventory Manag; Shah, N.H., Mittal, M., Eds.; Springer Nature: Singapore, 2020. [Google Scholar] [CrossRef]

- Astanti, R.D.; Daryanto, Y.; Dewa, P.K. Low-carbon supply chain model under a vendor-managed inventory partnership and carbon cap-and-trade policy. J. Open Innov. Technol. Mark. Complex. 2022, 8, 30. [Google Scholar] [CrossRef]

- Hariga, M.; As’ad, R.; Shamayleh, A. Integrated economic and environment models of a multi stage cold supply chain under carbon tax regulation. J. Clean. Prod. 2017, 166, 1357–1371. [Google Scholar] [CrossRef]

- Daryanto, Y.; Krämer, K. Analysis of logistics and supply chain management agility in corrugated box industry. Spektrum Ind. 2016, 14, 53–62. [Google Scholar] [CrossRef]

| Author(s) | Inventory Model | Direct-Indirect Emissions | Function of Emission Cost | Cap-and-Trade Regulation | Defective Products |

|---|---|---|---|---|---|

| Wangsa [2] | Two-echelon | Yes | Production, transportation | No | No |

| Huang et al. [11] | Two-echelon | No | Production, transportation, storage | Yes | No |

| Ong et al. [14] | Three-echelon | Yes | Production, transportation, storage | No | No |

| Wangsa et al. [15] | Two-echelon | Yes | Production, transportation, storage, material handling | No | No |

| Mukhopadhyay and Goswami [17] | EPQ | No | Production | Yes | Yes |

| Datta [18] | EPQ | No | Production, storage, disposal | No | Yes |

| Daryanto and Wee [19] | EPQ | No | Production, transportation, storage, disposal | No | No |

| Taleizadeh et al. [20] | EPQ | No | Production, storage, disposal | No | No |

| Daryanto and Wee [21] | EPQ | No | Production, transportation, storage, disposal | No | Yes |

| Shen et al. [22] | Two-echelon | No | Production, setup, storage, ordering | No | No |

| Manna et al. [23] | EPQ | No | Production, transportation | No | Yes |

| Priyamvada et al. [24] | EPQ | No | Production, storage, preservation | No | No |

| Priyan et al. [25] | EPQ | No | Production, transportation, storage | No | Yes |

| Moon et al. [26] | EPQ | No | Production, setup, storage | No | Yes |

| Mashud et al. [27] | EPQ | No | Transportation, disposal | No | No |

| Yassine [29] | EPQ | No | Ordering, transportation | No | Yes |

| Sinha and Modak [30] | EPQ | No | Production, storage | Yes | No |

| This study | EPQ | Yes | Production, material handling, storage, transportation, disposal | Yes | Yes |

| Notation | Description |

|---|---|

| D | Demand rate (units/year) |

| P | Production rate (units/year) |

| s | Setup cost ($/cycle) |

| Pc | Production cost ($/unit) |

| Ic | Inventory cost ($/unit/year) |

| cf | Forklift capacity (lbs/travel) |

| sf | Forklift speed (miles/h) |

| ff | Forklift fuel consumption (L/h) |

| df | Forklift traveling distances from the receiving dock to the production area and from the production area to the shipping dock (miles/travel) |

| tfix | Fixed cost ($/delivery) |

| Fp | Fuel price ($/L) |

| w1 | Raw material weight, which is assumed to be 110% of product weight (lbs/unit) |

| w2 | Product weight (lbs/unit) |

| pf | Production fuel consumption factor (L/unit) |

| Fe | Fuel emissions standard (tonCO2eq/L) |

| dc | Distance from manufacturer to customer site (miles) |

| c1 | Fuel consumption of an empty truck (L/mile) |

| c2 | Variable fuel consumption from truckload (L/mile/ton) |

| cd | Waste disposal fixed fees per cycle ($) |

| Pe | Production electricity consumption factor per cycle (kWh) |

| We | Warehouse electricity consumption factor per cycle (kWh) |

| Ee | Electricity emissions standard (tonCO2eq/kWh) |

| dt | Distance between the manufacturer and the third-party location (miles) |

| Te | Total emission quantity (tonCO2eq) |

| Tc | Total cost ($) |

| Ecap | Emission cap or limit (tonCO2eq) |

| CGHG | Carbon price ($/tonCO2eq) |

| Decision variables | |

| Q | Optimum production quantity per cycle (unit products) |

| T | Cycle length (year) |

| Parameters | Changes | Q | T | TC | %CTC | TE | %CTE |

|---|---|---|---|---|---|---|---|

| Ecap = 10,000 | +50% | 5415.0 | 0.2707 | 469,756.4 | −9.62 | 1352.5 | 0 |

| +25% | 5415.0 | 0.2707 | 494,756.4 | −4.81 | 1352.5 | 0 | |

| 0 | 5415.0 | 0.2707 | 519,756.4 | 0 | 1352.5 | 0 | |

| −25% | 5415.0 | 0.2707 | 544,756.4 | 4.81 | 1352.5 | 0 | |

| −50% | 5415.0 | 0.2707 | 569.756.4 | 9.62 | 1352.5 | 0 | |

| CGHG = 10 | +50% | 5639.7 | 0.2820 | 476,507.1 | −8.32 | 1347.9 | −0.34 |

| +25% | 5528.5 | 0.2764 | 498,134.6 | −4.16 | 1350.1 | −0.17 | |

| 0 | 5415.0 | 0.2707 | 519,756.4 | 0 | 1352.5 | 0 | |

| −25% | 5299.1 | 0.2649 | 541,372.2 | 4.16 | 1355.0 | 0.18 | |

| −50% | 5180.6 | 0.2590 | 562,981.4 | 8.32 | 1357.6 | 0.38 | |

| dc = 50 | +50% | 5433.4 | 0.2717 | 572,555.2 | 10.1 | 1935.9 | 43.1 |

| +25% | 5424.2 | 0.2712 | 546,155.8 | 5.08 | 1644.2 | 21.6 | |

| 0 | 5415.0 | 0.2707 | 519,756.4 | 0 | 1352.5 | 0 | |

| −25% | 5405.8 | 0.2703 | 493,357.0 | −5.08 | 1060.8 | −21.6 | |

| −50% | 5396.6 | 0.2698 | 466,957.5 | −10.1 | 769.1 | −43.1 | |

| dt = 30 | +50% | 5416.2 | 0.2708 | 520,109.5 | 0.07 | 1387.7 | 2.61 |

| +25% | 5415.6 | 0.2708 | 519,932.9 | 0.03 | 1370.1 | 1.30 | |

| 0 | 5415.0 | 0.2707 | 519,756.4 | 0 | 1352.5 | 0 | |

| −25% | 5414.4 | 0.2707 | 519,579.9 | −0.03 | 1334.8 | −1.30 | |

| −50% | 5413.8 | 0.2707 | 519,403.4 | −0.07 | 1317.2 | −2.61 | |

| c1 = 0.4345 | +50% | 5434.6 | 0.2713 | 519,805.4 | 0.009 | 1352.9 | 0.029 |

| +25% | 5424.8 | 0.2712 | 519,780.9 | 0.005 | 1352.7 | 0.015 | |

| 0 | 5415.0 | 0.2707 | 519,756.4 | 0 | 1352.5 | 0 | |

| −25% | 5405.2 | 0.2703 | 519,731.9 | −0.005 | 1352.3 | −0.015 | |

| −50% | 5395.4 | 0.2698 | 519,707.3 | −0.009 | 1352.1 | −0.029 | |

| Fe = 0.01268 | +50% | 5418.3 | 0.2709 | 525,953.5 | 1.19 | 1972.1 | 45.8 |

| +25% | 5416.7 | 0.2708 | 522,855.0 | 0.59 | 1662.3 | 22.9 | |

| 0 | 5415.0 | 0.2707 | 519,756.4 | 0 | 1352.5 | 0 | |

| −25% | 5413.4 | 0.2707 | 516,657.9 | −0.59 | 1042.6 | −22.9 | |

| −50% | 5411.8 | 0.2706 | 513,559.3 | −1.19 | 732.8 | −45.8 | |

| Ee = 0.02264 | +50% | 5636.6 | 0.2818 | 520,310.4 | 0.11 | 1402.3 | 3.68 |

| +25% | 5526.9 | 0.2763 | 520,036.2 | 0.05 | 1377.8 | 1.87 | |

| 0 | 5415.0 | 0.2707 | 519,756.4 | 0 | 1352.5 | 0 | |

| −25% | 5300.8 | 0.2650 | 519,470.8 | −0.05 | 1326.1 | −1.95 | |

| −50% | 5184.0 | 0.2592 | 519,178.8 | −0.11 | 1298.5 | −3.99 | |

| Pe = 1159 | +50% | 5511.1 | 0.2755 | 519,996.6 | 0.05 | 1374.3 | 1.61 |

| +25% | 5463.3 | 0.2731 | 519,877.0 | 0.02 | 1363.5 | 0.81 | |

| 0 | 5415.0 | 0.2707 | 519,756.4 | 0 | 1352.5 | 0 | |

| −25% | 5366.3 | 0.2683 | 519,634.7 | −0.02 | 1341.3 | −0.83 | |

| −50% | 5317.2 | 0.2659 | 519,511.9 | −0.05 | 1329.9 | −1.67 | |

| We = 1545 | +50% | 5542.7 | 0.2771 | 520,075.7 | 0.06 | 1381.4 | 2.14 |

| +25% | 5479.2 | 0.2740 | 519,917.0 | 0.03 | 1367.1 | 1.08 | |

| 0 | 5415.0 | 0.2707 | 519,756.4 | 0 | 1352.5 | 0 | |

| −25% | 5350.0 | 0.2675 | 519,594.0 | −0.03 | 1337.5 | −1.11 | |

| −50% | 5284.3 | 0.2642 | 519,429.5 | −0.06 | 1322.2 | −2.24 |

| Parameters | Changes | Q | T | TC | %CTC | TE | %CTE |

|---|---|---|---|---|---|---|---|

| s = 1400 | +50% | 5909.5 | 0.2955 | 520,992.7 | 0.24 | 1342.9 | −0.71 |

| +25% | 5667.7 | 0.2834 | 520,388.0 | 0.12 | 1347.3 | −0.38 | |

| 0 | 5415.0 | 0.2707 | 519,756.4 | 0 | 1352.5 | 0 | |

| −25% | 5150.0 | 0.2575 | 519,093.9 | −0.13 | 1358.4 | 0.43 | |

| −50% | 4870.6 | 0.2435 | 518,395.3 | −0.26 | 1365.3 | 0.94 | |

| Pc = 50 | +50% | 5415.0 | 0.2707 | 769,756.4 | 48.10 | 1352.5 | 0 |

| +25% | 5415.0 | 0.2707 | 644,756.4 | 24.05 | 1352.5 | 0 | |

| 0 | 5415.0 | 0.2707 | 519,756.4 | 0 | 1352.5 | 0 | |

| −25% | 5415.0 | 0.2707 | 394,756.4 | −24.05 | 1352.5 | 0 | |

| −50% | 5415.0 | 0.2707 | 269,756.4 | −48.10 | 1352.5 | 0 | |

| Ic = 5 | +50% | 4421.3 | 0.2211 | 522,798.9 | 0.58 | 1378.2 | 1.90 |

| +25% | 4843.3 | 0.2422 | 521,354.3 | 0.31 | 1366.0 | 1.00 | |

| 0 | 5415.0 | 0.2707 | 519,756.4 | 0 | 1352.5 | 0 | |

| −25% | 6252.7 | 0.3126 | 517,942.7 | −0.35 | 1337.1 | −1.14 | |

| −50% | 7658.0 | 0.3829 | 515,791.4 | −0.76 | 1318.9 | −2.48 | |

| Fp = 1.02 | +50% | 5431.4 | 0.2716 | 566,717.8 | 9.03 | 1352.1 | −0.03 |

| +25% | 5423.2 | 0.2712 | 543,237.1 | 4.52 | 1352.3 | −0.01 | |

| 0 | 5415.0 | 0.2707 | 519,756.4 | 0 | 1352.5 | 0 | |

| −25% | 5406.8 | 0.2703 | 496,275.7 | −4.51 | 1352.6 | 0.01 | |

| −50% | 5398.6 | 0.2699 | 472,795.0 | −9.03 | 1352.8 | 0.02 | |

| tfix = 1000 | +50% | 5772.6 | 0.2886 | 520,650.3 | 0.17 | 1345.4 | −0.53 |

| +25% | 5596.6 | 0.2798 | 520,210.5 | 0.09 | 1348.7 | −0.28 | |

| 0 | 5415.0 | 0.2707 | 519,756.4 | 0 | 1352.5 | 0 | |

| −25% | 5227.1 | 0.2613 | 519,286.6 | −0.09 | 1356.6 | 0.30 | |

| −50% | 5032.1 | 0.2516 | 518,799.2 | −0.18 | 1361.2 | 0.64 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Daryanto, Y.; Setyanto, D. Production Inventory Optimization Considering Direct and Indirect Carbon Emissions under a Cap-and-Trade Regulation. Logistics 2023, 7, 16. https://doi.org/10.3390/logistics7010016

Daryanto Y, Setyanto D. Production Inventory Optimization Considering Direct and Indirect Carbon Emissions under a Cap-and-Trade Regulation. Logistics. 2023; 7(1):16. https://doi.org/10.3390/logistics7010016

Chicago/Turabian StyleDaryanto, Yosef, and Djoko Setyanto. 2023. "Production Inventory Optimization Considering Direct and Indirect Carbon Emissions under a Cap-and-Trade Regulation" Logistics 7, no. 1: 16. https://doi.org/10.3390/logistics7010016

APA StyleDaryanto, Y., & Setyanto, D. (2023). Production Inventory Optimization Considering Direct and Indirect Carbon Emissions under a Cap-and-Trade Regulation. Logistics, 7(1), 16. https://doi.org/10.3390/logistics7010016