What Turns a Product into a Traditional One?

Abstract

1. Introduction

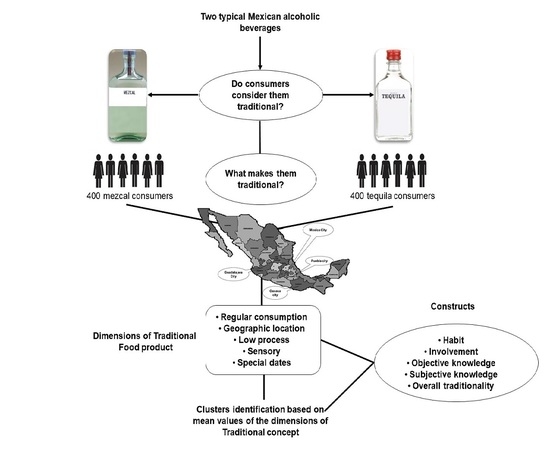

2. Materials and Methods

2.1. Participants

2.2. Survey Design and Implementation

2.3. Data Analysis

3. Results

3.1. Sociodemographic Characteristics of Participants

3.2. Unidmensional Structure and Reliability of the Different Constructs Multi-Item

3.3. Overall Perceived Traditionality and Constructs Per City and Product

3.4. Differences in Dimensions of the Concept “Traditional Food Product”

3.5. Segment Identification and Characterization

3.5.1. Mezcal Segments

3.5.2. Tequila Segments

4. Discussion

4.1. Comparison between Cities

4.2. Mezcal Segments

4.3. Tequila Segments

4.4. The Dimensions of Traditional Concept

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Boza Marttnez, S.; Muñoz, J. Traditional Food Products and Trade: Exploring the Linkages. SSRN Electron. J. 2016. [Google Scholar] [CrossRef]

- Pieniak, Z.; Verbeke, W.; Vanhonacker, F.; Guerrero, L.; Hersleth, M. Association between Traditional Food Consumption and Motives for Food Choice in Six European Countries. Appetite 2009, 53, 101–108. [Google Scholar] [CrossRef] [PubMed]

- Champredonde, M.; Cosiorovski, J.G. ¿Agregado de Valor o Valorización? Reflexiones a partir de Denominaciones de Origen en América Latina. RIVAR 2016, 3, 26. [Google Scholar]

- Guerrero, L.; Claret, A.; Verbeke, W.; Vanhonacker, F.; Enderli, G.; Sulmont-Rossé, C.; Hersleth, M.; Guàrdia, M.D. Cross-Cultural Conceptualization of the Words Traditional and Innovation in a Food Context by Means of Sorting Task and Hedonic Evaluation. Food Qual. Prefer. 2012, 25, 69–78. [Google Scholar] [CrossRef]

- Đorđević, Đ.; Buchtová, H. Factors Influencing Sushi Meal as Representative of Non-Traditional Meal: Consumption among Czech Consumers. Acta Aliment. 2017, 46, 76–83. [Google Scholar] [CrossRef]

- Roselli, L.; Cicia, G.; Cavallo, C.; Del Giudice, T.; Carlucci, D.; Clodoveo, M.L.; De Gennaro, B.C. Consumers’ Willingness to Buy Innovative Traditional Food Products: The Case of Extra-Virgin Olive Oil Extracted by Ultrasound. Food Res. Int. 2018, 108, 482–490. [Google Scholar] [CrossRef] [PubMed]

- Silvestri, C.; Aquilani, B.; Piccarozzi, M.; Ruggieri, A. Consumer Quality Perception in Traditional Food: Parmigiano Reggiano Cheese. J. Int. Food Agribus. Mark. 2020, 32, 141–167. [Google Scholar] [CrossRef]

- Guerrero, L.; Guàrdia, M.D.; Xicola, J.; Verbeke, W.; Vanhonacker, F.; Zakowska-Biemans, S.; Sajdakowska, M.; Sulmont-Rossé, C.; Issanchou, S.; Contel, M.; et al. Consumer-Driven Definition of Traditional Food Products and Innovation in Traditional Foods. A Qualitative Cross-Cultural Study. Appetite 2009, 52, 345–354. [Google Scholar] [CrossRef]

- Funk, A.; Sütterlin, B.; Siegrist, M. Consumer Segmentation Based on Stated Environmentally-Friendly Behavior in the Food Domain. Sustain. Prod. Consum. 2021, 25, 173–186. [Google Scholar] [CrossRef]

- Bruwer, J.; Li, E.; Reid, M. Segmentation of the Australian Wine Market Using a Wine-Related Lifestyle Approach. J. Wine Res. 2002, 13, 217–242. [Google Scholar] [CrossRef]

- Vanhonacker, F.; Pieniak, Z.; Verbeke, W. Fish Market Segmentation Based on Consumers’ Motives, Barriers and Risk Perception in Belgium. J. Food Prod. Mark. 2010, 16, 166–183. [Google Scholar] [CrossRef]

- Brunsø, K.; Birch, D.; Memery, J.; Temesi, Á.; Lakner, Z.; Lang, M.; Dean, D.; Grunert, K.G. Core Dimensions of Food-Related Lifestyle: A New Instrument for Measuring Food Involvement, Innovativeness and Responsibility. Food Qual. Prefer. 2021, 91, 104192. [Google Scholar] [CrossRef]

- Flynn, L.R.; Goldsmith, R.E. A Short, Reliable Measure of Subjective Knowledge. J. Bus. Res. 1999, 46, 57–66. [Google Scholar] [CrossRef]

- Wood, W.; Neal, D.T. The Habitual Consumer. J. Consum. Psychol. 2009, 19, 579–592. [Google Scholar] [CrossRef]

- Gómez-Corona, C.; Escalona-Buendía, H.B.; García, M.; Chollet, S.; Valentin, D. Craft vs. Industrial: Habits, Attitudes and Motivations towards Beer Consumption in Mexico. Appetite 2016, 96, 358–367. [Google Scholar] [CrossRef] [PubMed]

- Bell, R.; Marshall, D.W. The Construct of Food Involvement in Behavioral Research: Scale Development and Validation. Appetite 2003, 40, 235–244. [Google Scholar] [CrossRef]

- Verbeke, W.; Vackier, I. Profile and Effects of Consumer Involvement in Fresh Meat. Meat Sci. 2004, 67, 159–168. [Google Scholar] [CrossRef] [PubMed]

- Bruwer, J.; Huang, J. Wine Product Involvement and Consumers’ BYOB Behaviour in the South Australian On-premise Market. Asia Pac. J. Mark. Logist. 2012, 24, 461–481. [Google Scholar] [CrossRef]

- Vanhonacker, F.; Kühne, B.; Gellynck, X.; Guerrero, L.; Hersleth, M.; Verbeke, W. Innovations in Traditional Foods: Impact on Perceived Traditional Character and Consumer Acceptance. Food Res. Int. 2013, 54, 1828–1835. [Google Scholar] [CrossRef]

- Ellis, D.; Caruana, A. Consumer Wine Knowledge: Components and Segments. Int. J. Wine Bus. Res. 2018, 30, 277–291. [Google Scholar] [CrossRef]

- Banović, M.; Fontes, M.A.; Barreira, M.M.; Grunert, K.G. Impact of Product Familiarity on Beef Quality Perception: Impact of Product Familiarity on Beef Quality Perception. Agribusiness 2012, 28, 157–172. [Google Scholar] [CrossRef]

- Sáenz-Navajas, M.-P.; Ballester, J.; Peyron, D.; Valentin, D. Extrinsic Attributes Responsible for Red Wine Quality Perception: A Cross-Cultural Study between France and Spain. Food Qual. Prefer. 2014, 35, 70–85. [Google Scholar] [CrossRef]

- García-Barrón, S.E.; Hernández, J.d.J.; Gutiérrez-Salomón, A.L.; Escalona-Buendía, H.B.; Villanueva-Rodríguez, S.J. Mezcal y Tequila: Análisis conceptual de dos bebidas típicas de México. RIVAR 2017, 4, 25. [Google Scholar]

- Molina-Guerrero, J.A.; Botello-Álvarez, J.E.; Estrada-Baltazar, A.; Navarrete-Bolaños, J.L.; Jiménez-Islas, H.; Cárdenas-Manríquez, M. COMPUESTOS VOLÁTILES EN EL MEZCAL. Rev. Mex. Ing. Quím. 2007, 6, 10. [Google Scholar]

- Gallardo-Valdez, J. Industria tequilera, Visión y Tecnolia de su Desarrollo. In Ciencia y Tecnologia del Tequila: Avances y Perpectivas; Gschaedler-Mathis, A.C., Rodríguez-Garay, B., Prado-Ramírez, R., Flores-Montaño, J.L., Eds.; Grupo Promueve Compañias SC: Guadalajara, Mexico, 2015; pp. 1–15. [Google Scholar]

- Macias-Macias, A.; Valenzuela-Zapata, A.G. El Tequila en tiempos de la mundialización (The Tequila in times of globalization). Comer. Exter. 2009, 59, 14. [Google Scholar]

- Informe Estadístico 2020. Available online: https://www.crm.org.mx/PDF/INF_ACTIVIDADES/INFORME2019.Pdf (accessed on 7 August 2020).

- El Mapa de Lo Que Beben Los Mexicanos. Available online: https://www.elfinanciero.com.mx/Empresas/Marcas-de-Whisky-Dominan-Ventas-de-Bebidas-Alcoholicas/ (accessed on 7 August 2020).

- Taherdoost, H. Sampling Methods in Research Methodology; How to Choose a Sampling Technique for Research. SSRN Electron. J. 2016. [Google Scholar] [CrossRef]

- Rojas-Rivas, E.; Rendón-Domínguez, A.; Felipe-Salinas, J.A.; Cuffia, F. What Is Gastronomy? An Exploratory Study of Social Representation of Gastronomy and Mexican Cuisine among Experts and Consumers Using a Qualitative Approach. Food Qual. Prefer. 2020, 83, 103930. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.; Babin, B.; Anderson, R. Multivariate Data Analysis, 7th ed.; Prentice Hall: Hoboken, NJ, USA, 2010. [Google Scholar]

- George, D.; Mallery, P. SPSS for Windows Step by Step: Asimple Guide and Reference, 11.0 Update, 4th ed.; Allyn & Bacon: Boston, MA, USA, 2003. [Google Scholar]

- Sobal, J. Cultural Comparison Research Designs in Food, Eating, and Nutrition. Food Qual. Prefer. 1998, 9, 385–392. [Google Scholar] [CrossRef]

- Köster, E.P. The Psychology of Food Choice: Some Often Encountered Fallacies. Food Qual. Prefer. 2003, 14, 359–373. [Google Scholar] [CrossRef]

- Giacalone, D.; Frøst, M.B.; Bredie, W.L.P.; Pineau, B.; Hunter, D.C.; Paisley, A.G.; Beresford, M.K.; Jaeger, S.R. Situational Appropriateness of Beer Is Influenced by Product Familiarity. Food Qual. Prefer. 2015, 39, 16–27. [Google Scholar] [CrossRef]

- Aurifeille, J.; Quester, P.G.; Lockshin, L.; Spawton, T. Global vs. International Involvement-based Segmentation: A Cross-national Exploratory Study. Int. Mark. Rev. 2002, 19, 369–386. [Google Scholar] [CrossRef]

- Caporale, G.; Monteleone, E. Influence of Information about Manufacturing Process on Beer Acceptability. Food Qual. Prefer. 2004, 15, 271–278. [Google Scholar] [CrossRef]

- Charters, S.; Pettigrew, S. Product Involvement and the Evaluation of Wine Quality. Qual. Mark. Res. Int. J. 2006, 9, 181–193. [Google Scholar] [CrossRef]

- Cowley, E.J. Recovering Forgotten Information: A Study in Consumer Expertise. Adv. Consum. Res. 1994, 21, 58–63. [Google Scholar]

- Hall, J.; Binney, W.; Barry O’Mahony, G. Age Related Motivational Segmentation of Wine Consumption in a Hospitality Setting. Int. J. Wine Mark. 2004, 16, 29–43. [Google Scholar] [CrossRef]

- Olmedo-Carranza, B. El Tequila: De Su Origen a Su Desnaturalización. ¿A Quién Le Pertenece Su Conocimiento? Una Aproximación. Rev. CENIC Cienc. Quím. 2010, 41, 1–13. [Google Scholar]

- Crawford, A. Attitudes about Alcohol: A General Review. Drug Alcohol Depend. 1987, 19, 279–311. [Google Scholar] [CrossRef]

- Heath, D.B. Anthropology and Alcohol Studies: Current Issues. Annu. Rev. Anthopol. 1987, 16, 99–120. [Google Scholar] [CrossRef]

- Mitchell, V.; Greatorex, M. Consumer Risk Perception in the UK Wine Market. Eur. J. Mark. 1988, 22, 5–15. [Google Scholar] [CrossRef]

- Norma Oficial Mexicana NOM-006-SCFI-2012. Bebidas Alcohólicas-Tequila-Especificaciones; Diario Oficial de La Federación: Mexico City, México, 2012. [Google Scholar]

- Norma Oficial Mexicana NOM-070-SCFI-2016. Bebidas Alcohólicas-Mezcal Especificaciones; Diario Oficial de La Federación: Mexico City, México, 2016. [Google Scholar]

- Van Ittersum, K.; Candel, M.J.J.M.; Meulenberg, M.T.G. The Influence of the Image of a Product’s Region of Origin on Product Evaluation. J. Bus. Res. 2003, 56, 215–226. [Google Scholar] [CrossRef]

- Verlegh, P.W.J.; Steenkamp, J.-B.E.M. A Review and Meta-Analysis of Country-of-Origin Research. J. Econ. Psychol. 1999, 20, 521–546. [Google Scholar] [CrossRef]

- Villanueva-Rodriguez, S.; Escalona-Buendia, H. Tequila and mezcal: Sensory attributes and sensory evaluation. In Alcoholic Beverages; Piggot, J., Ed.; Woodhead Publishing Limited: Cambrige, UK, 2012; pp. 359–378. ISBN 978-0-85709-051-5. [Google Scholar]

- Gellynck, X.; Kühne, B. Innovation and Collaboration in Traditional Food Chain Networks. J. Chain Netw. Sci. 2008, 8, 121–129. [Google Scholar] [CrossRef]

- Bowen, S.; Zapata, A.V. Geographical Indications, Terroir, and Socioeconomic and Ecological Sustainability: The Case of Tequila. J. Rural Stud. 2009, 25, 108–119. [Google Scholar] [CrossRef]

- Carmona-Escutia, R.P. Perfil Sensorial y Círculo Aromático Del Tequila. Tesis que para Obtener el grado de Química de Alimentos; Universidad Nacional Autónoma de México: Ciudad de México, Mexico, 2008. [Google Scholar]

- Delgado-Alvarado, A. Evaluación Sensorial del Mezcal de la Localidad de Totomochapa, Tlalpa de Comonfort, Guerrero, México. Agro Product. 2018, 11, 81–86. [Google Scholar] [CrossRef]

- Almli, V.L.; Verbeke, W.; Vanhonacker, F.; Næs, T.; Hersleth, M. General Image and Attribute Perceptions of Traditional Food in Six European Countries. Food Qual. Prefer. 2011, 22, 129–138. [Google Scholar] [CrossRef]

- Gómez-Cuevas, K.; Delgado-Cruz, A.; Palmas-Castrejón, D. Originalidad del tequila como símbolo de identidad mexicana. Percepción del turista-consumidor a partir de su exportación. RIVAR 2020, 7, 59–80. [Google Scholar] [CrossRef]

- Mouret, M.; Lo Monaco, G.; Urdapilleta, I.; Parr, W.V. Social Representations of Wine and Culture: A Comparison between France and New Zealand. Food Qual. Prefer. 2013, 30, 102–107. [Google Scholar] [CrossRef]

- Douglas, M. Constructive Drinking: Perspectives on Drink from Anthropology; Cambrige University Press: New York, NY, USA, 1987. [Google Scholar]

- Demossier, M. Beyond Terroir: Territorial Construction, Hegemonic Discourses, and French Wine Culture: Beyondterroir. J. R. Anthropol. Inst. 2011, 17, 685–705. [Google Scholar] [CrossRef]

| Mezcal Consumers | Tequila Consumers | |||||||

|---|---|---|---|---|---|---|---|---|

| Variables and Categories | CDMX (n = 100) | GDL (n = 100) | OAX (n = 100) | PUE (n = 100) | CDMX (n = 100) | GDL (n = 100) | OAX (n = 100) | PUE (n = 100) |

| Gender | ||||||||

| Men | 60 | 63 | 59 | 59 | 51 | 64 | 57 | 52 |

| Women | 40 | 37 | 41 | 41 | 49 | 36 | 43 | 48 |

| Age | ||||||||

| 18–24 years | 10 | 16 | 24 | 12 | 21 | 15 | 34 | 10 |

| 25–34 years | 39 | 46 | 40 | 37 | 42 | 43 | 44 | 31 |

| 35–44 years | 23 | 29 | 27 | 34 | 18 | 21 | 15 | 36 |

| 45–54 years | 20 | 7 | 7 | 14 | 10 | 12 | 6 | 13 |

| 55 or more | 8 | 2 | 2 | 3 | 9 | 9 | 1 | 10 |

| Experience with the product | ||||||||

| Less than a year | 5 | 16 | 10 | 16 | 1 | 3 | 10 | 4 |

| 1 to 3 years | 17 | 19 | 21 | 26 | 8 | 7 | 24 | 5 |

| 3 to 5 years | 18 | 27 | 15 | 21 | 20 | 10 | 25 | 14 |

| 5 to 7 years | 17 | 20 | 16 | 19 | 18 | 14 | 25 | 14 |

| More than 7 years | 43 | 18 | 38 | 18 | 53 | 66 | 16 | 63 |

| Frequency of consumption | ||||||||

| Every day | 4 | 2 | 10 | 0 | 0 | 0 | 0 | 0 |

| Every third day | 14 | 8 | 21 | 4 | 2 | 3 | 8 | 1 |

| Once a week | 14 | 15 | 15 | 23 | 11 | 26 | 27 | 7 |

| Every 15 days | 22 | 37 | 29 | 21 | 50 | 31 | 24 | 13 |

| Once a month | 46 | 38 | 24 | 47 | 37 | 40 | 41 | 62 |

| Occasional | 0 | 0 | 1 | 5 | 0 | 0 | 0 | 17 |

| Construct | Item | Reference |

|---|---|---|

| Habit | Drinking Mezcal (Tequila) is something that I have been doing for long time. | [11] |

| Drinking Mezcal (Tequila) is something that I do without thinking about it. | ||

| Drinking Mezcal (Tequila) is something that I am used to do since my youth | ||

| Objective knowledge | See supplementary file | Own elaboration |

| Product involvement | Drinking Mezcal (Tequila) is an important part of my life | [12] |

| I just love good Mezcal (Tequila). | ||

| Drinking Mezcal (Tequila) is a continuous source of joy for me. | ||

| Decisions about what Mezcal (Tequila) to drink are very important for me. | ||

| Drinking Mezcal (Tequila) is an important part of my social life. | ||

| Subjective knowledge | I know pretty much about Mezcal (Tequila). | [13] |

| I do not feel very knowledgeable about Mezcal (Tequila) (R). | ||

| I rarely come across a Mezcal (Tequila) that I haven´t heard of. | ||

| Among my circle of friends, I´m one of the “experts” on Mezcal (Tequila). | ||

| Compared to most people, I know less about Mezcal (Tequila) (R). | ||

| When it comes to Mezcal (Tequila), I know a lot. | ||

| Product traditionality * | Mezcal (Tequila) is a beverage historically linked to the region where it is made. | [8] |

| Mezcal (Tequila) is a beverage made with a mild technical process. | ||

| Mezcal (Tequila) is a beverage that has the distinctive sensory characteristics of the region where it is made. | ||

| Mezcal (Tequila) is a beverage that is present at celebrations, meetings and special dates. | ||

| Mezcal (Tequila is a beverage that I consume regularly). | ||

| Overall perceived traditionality | I consider Mezcal (Tequila) as a traditional product. | Own elaboration |

| Mezcal Consumers | Tequila Consumers | |||||||

|---|---|---|---|---|---|---|---|---|

| Construct | CDMX | GDL | OAX | PUE | CDMX | GDL | OAX | PUE |

| Overall perceived Traditionality | 8.8 a | 8.7 ab | 8.9 a | 8.5 b | 8.7 a | 8.8 a | 8.0 b | 8.7 a |

| Habit | 3.4 | 3.4 | 3.7 | 3.3 | 3.4 ab | 3.9 a | 3.6 ab | 3.1 b |

| Objective knowledge | 8.6 b | 8.3 b | 11.3 a | 8.6 b | 10.3 b | 11.4 a | 10.1 b | 7.9 c |

| Product involvement | 4.0 ab | 3.8 b | 4.4 a | 3.8 b | 3.3 b | 3.9 a | 3.8 ab | 3.3 b |

| Subjective knowledge | 4.2 ab | 3.8 b | 4.5 a | 4.1 ab | 3.5 b | 4.2 a | 3.5 b | 3.6 b |

| Dimensions of traditional food product | ||||||||

| Regular consumption | 3.4 ab | 3.0 b | 3.9 a | 3.2 ab | 2.1 c | 3.4 a | 2.5 bc | 3.1 ab |

| Geographic location | 6.4 ab | 6.1 bc | 6.6 a | 5.9 c | 6.3 a | 6.2 a | 6.0 a | 5.1 b |

| Low process | 4.1 b | 4.8 a | 5.2 a | 4.5 ab | 3.5 b | 3.0 b | 3.6 ab | 4.2 a |

| Sensory | 6.1 ab | 6.3 a | 6.4 a | 5.8 b | 5.9 a | 5.7 a | 5.6 ab | 5.2 b |

| YrSpecial dates | 4.9 | 4.7 b | 6.3 a | 5.0 b | 6.3 a | 6.2 a | 5.8 a | 4.9 b |

| Cluster 1 (n = 141) | Cluster 2 (n = 78) | Cluster 3 (n = 181) | Overall Percentage | |

|---|---|---|---|---|

| Sociodemographics * (%) | ||||

| City | ||||

| CDMX | 26.2 ab | 38.5 a | 18.2 b | 25 |

| GDL | 25.5 ab | 14.1 b | 29.3 a | 25 |

| OAX | 20.6 | 28.2 | 27.1 | 25 |

| PUE | 27.7 | 19.2 | 25.4 | 25 |

| Gender | ||||

| Men | 55.3 | 65.4 | 61.9 | 60.3 |

| Women | 44.7 | 34.6 | 38.1 | 39.8 |

| Age | ||||

| 18–24 years | 14.9 | 9.0 | 18.8 | 15.5 |

| 25–34 years | 41.8 | 42.3 | 38.7 | 40.5 |

| 35–44 years | 29.1 | 21.8 | 30.4 | 28.3 |

| 45–54 years | 12.8 ab | 24.4 a | 6.1 b | 12.0 |

| 55 or more | 1.4 | 2.6 | 6.0 | 3.8 |

| Experience and consumption * (%) | ||||

| Experience with the product | ||||

| Less than a year | 12.8 | 5.1 | 13.8 | 11.8 |

| 1 to 3 years | 22.7 | 12.8 | 22.7 | 20.8 |

| 3 to 5 years | 18.4 ab | 11.5 b | 25.4 a | 22.0 |

| 5 to 7 years | 18.4 | 20.6 | 16.6 | 18.0 |

| More than 7 years | 27.7 b | 50.0 a | 21.5 b | 29.3 |

| Frequency of consumption | ||||

| Every day | 2.8 | 14.1 a | 0.6 b | 4.0 |

| Every third day | 8.5 b | 26.9 a | 7.7 b | 11.8 |

| Once a week | 17.7 | 21.8 | 13.8 | 16.8 |

| Every 15 days | 29.9 | 21.8 | 27.7 | 27.3 |

| Once a month | 40.4 a | 14.1 b | 48.1 a | 38.8 |

| Occasional | 0.7 | 1.3 | 2.3 | 1.5 |

| Construct ** (mean values) | Global mean | |||

| Habit | 3.3 b | 4.7 a | 3.1 b | 3.7 |

| Objective knowledge | 9.0 b | 10.6 a | 8.8 b | 9.5 |

| Product involvement | 3.9 b | 5.5 a | 3.4 c | 4.3 |

| Subjective knowledge | 3.9 b | 5.0 a | 3.9 b | 4.3 |

| Overall perceived traditionality | 8.7 | 8.7 | 8.8 | 8.7 |

| Dimension *** (mean values) | ||||

| Regular consumption | 3.1 b | 6.1 a | 2.4 c | 3.9 |

| Geographic location | 6.4 a | 5.8 b | 6.2 a | 6.1 |

| Low process | 3.2 c | 4.4 b | 5.9 a | 4.5 |

| Sensory | 6.2 | 6.1 | 6.1 | 6.1 |

| Special dates | 5.2 | 5.4 | 5.2 | 5.3 |

| Cluster 1 (n = 167) | Cluster 2 (n = 186) | Cluster 3 (n = 47) | Overall Percentage | |

|---|---|---|---|---|

| Sociodemographics * (%) | ||||

| City | ||||

| CDMX | 29.3 a | 26.3 a | 4.3 b | 25.0 |

| GDL | 14.4 b | 35.5 a | 21.3 ab | 25.0 |

| OAX | 30.5 b | 10.8 c | 61.7 a | 25.0 |

| PUE | 25.8 ab | 27.4 a | 12.7 b | 25.0 |

| Gender | ||||

| Men | 49.1 | 60.2 | 63.8 | 56.0 |

| Women | 50.9 | 39.8 | 36.2 | 44.0 |

| Age | ||||

| 18–24 years | 28.1 a | 15.1 b | 10.6 b | 20.0 |

| 25–34 years | 36.5 | 43.5 | 38.3 | 40.0 |

| 35–44 years | 18.0 | 23.7 | 34.0 | 22.5 |

| 45–54 years | 10.2 | 10.2 | 10.6 | 10.3 |

| 55 or more | 7.2 | 7.5 | 6.4 | 7.3 |

| Experience and consumption * (%) | ||||

| Experience with the product | ||||

| Less than a year | 6.0 | 2.7 | 6.4 | 4.5 |

| 1 to 3 years | 17.4 a | 5.4 b | 10.6 ab | 11.0 |

| 3 to 5 years | 22.2 | 13.4 | 14.9 | 17.3 |

| 5 to 7 years | 13.8 | 19.4 | 25.5 | 17.8 |

| More than 7 years | 40.7 b | 59.1 a | 42.6 ab | 49.5 |

| Frequency of consumption | ||||

| Every third day | 3.0 | 2.7 | 8.5 | 3.5 |

| Once a week | 10.2 b | 20.0 b | 36.2 a | 17.8 |

| Every 15 days | 28.1 | 31.6 | 25.5 | 29.5 |

| Once a month | 53.3 a | 42.5 ab | 25.5 b | 45.0 |

| Occasional | 5.4 | 3.2 | 4.3 | 4.3 |

| Construct ** (mean values) | Global mean | |||

| Habit | 3.0 c | 3.6 b | 4.8 a | 3.8 |

| Objective knowledge | 9.4 b | 10.6 a | 8.3 c | 9.4 |

| Product involvement | 3.2 c | 3.6 b | 4.7 a | 3.8 |

| Subjective knowledge | 3.6 | 3.7 | 3.8 | 3.7 |

| Overall perceived traditionality | 8.4 b | 8.7 a | 8.1 b | 8.4 |

| Dimension *** (mean values) | ||||

| Regular consumption | 2.9 b | 2.0 c | 5.2 a | 3.4 |

| Geographic location | 6.4 a | 5.7 b | 4.7 c | 5.6 |

| Low process | 2.2 c | 5.0 a | 4.1 b | 3.8 |

| Sensory | 5.9 a | 5.6 a | 4.3 b | 5.3 |

| Special dates | 6.1 a | 5.9 a | 4.8 b | 5.6 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

García-Barrón, S.E.; Guerrero, L.; Vázquez-Elorza, A.; Lazo, O. What Turns a Product into a Traditional One? Foods 2021, 10, 1284. https://doi.org/10.3390/foods10061284

García-Barrón SE, Guerrero L, Vázquez-Elorza A, Lazo O. What Turns a Product into a Traditional One? Foods. 2021; 10(6):1284. https://doi.org/10.3390/foods10061284

Chicago/Turabian StyleGarcía-Barrón, Sergio Erick, Luis Guerrero, Ariel Vázquez-Elorza, and Oxana Lazo. 2021. "What Turns a Product into a Traditional One?" Foods 10, no. 6: 1284. https://doi.org/10.3390/foods10061284

APA StyleGarcía-Barrón, S. E., Guerrero, L., Vázquez-Elorza, A., & Lazo, O. (2021). What Turns a Product into a Traditional One? Foods, 10(6), 1284. https://doi.org/10.3390/foods10061284