U.S. Consumer Demand for Plant-Based Milk Alternative Beverages: Hedonic Metric Augmented Barten’s Synthetic Model

Abstract

:1. Introduction

2. Literature Review

3. Model Specification

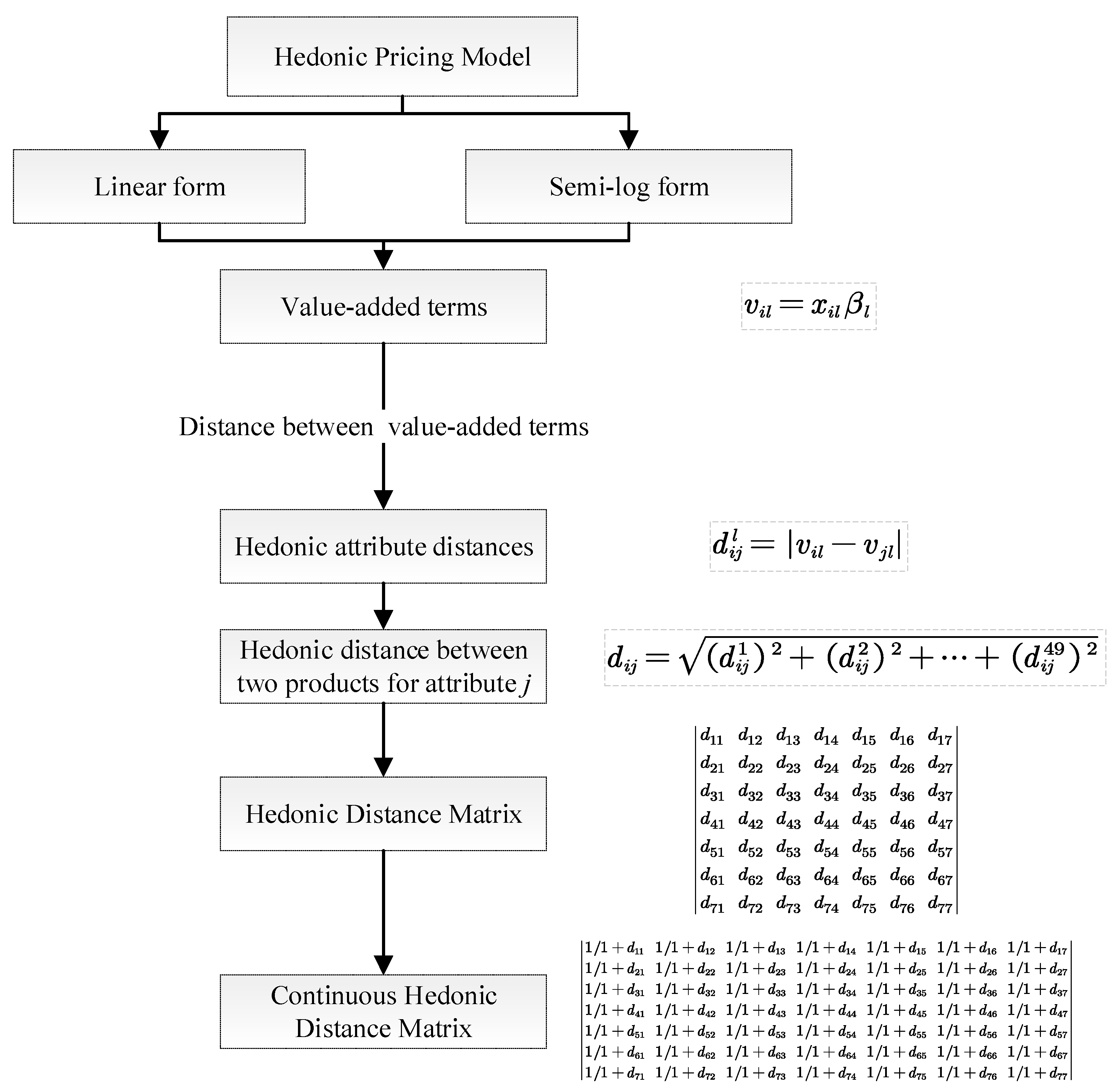

3.1. Hedonic Attribute Space and Hedonic Distance Measurement

3.2. Own-Closeness Index Measurement

3.3. Reparameterization in Demand System

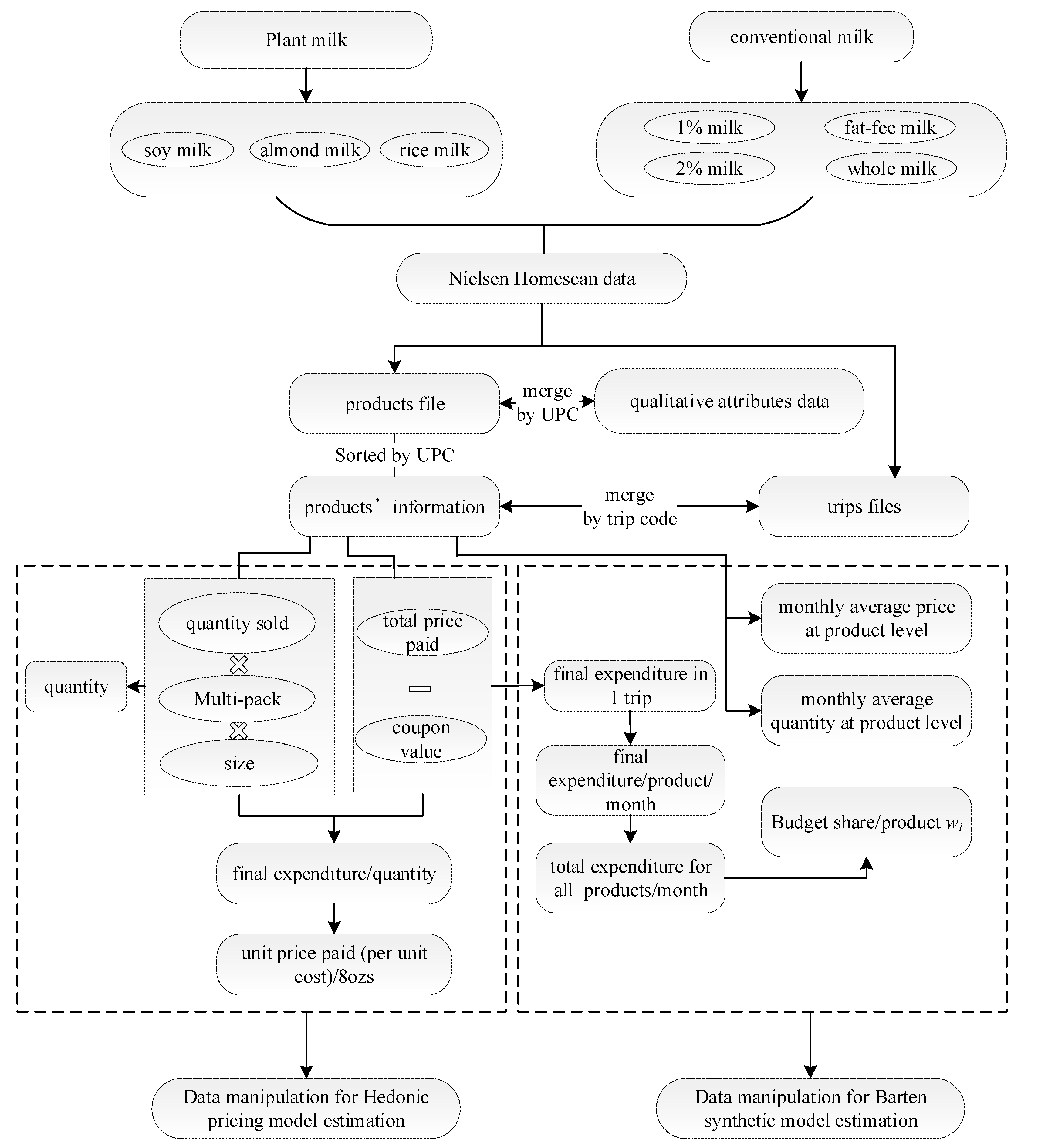

4. Data

4.1. Data Manipulation for Estimating Hedonic Pricing Models

4.2. Data Manipulation for Estimating Demand System

5. Empirical Results and Discussion

5.1. Estimation Results of Hedonic Pricing Models

5.2. Estimation Results from Barten’s Synthetic Demand System

6. Conclusions and Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Dummy Variables | Soy Milk | Almond Milk | Rice Milk | 2% Milk | 1% Milk | Whole Milk | Fat-Free Milk |

|---|---|---|---|---|---|---|---|

| 8 oz. | 8 oz. | 11 oz. | size < 8 oz. | 8 oz. | size < 8 oz. | size < 8 oz. | |

| 8 oz. < size < 10 oz. | 10 oz. | 12 oz. | 8 oz. | 10 oz. | 8 oz. | 8 oz. | |

| 10 oz. | 12 oz. | 14 oz. | 8 oz. < size < 10 oz | 10 oz. < size < 11 oz. | 10 oz. | 10 oz. | |

| 10 oz. < size < 11 oz. | 16 oz. | 16 oz. | 10 oz. | 12 oz. | 10 oz.<size < 11 oz. | 10 oz.<size < 11 oz. | |

| 11 oz. | 32 oz. | 32 oz. | 10 oz. < size < 11 oz. | 14 oz. | 12 oz. | 11 oz. | |

| 12 oz. | 48 oz. | 48 oz. | 11 oz. | 16 oz. | 14 oz. | 12 oz. | |

| 15 oz. | 64 oz. | 64 oz. | 12 oz. | 32 oz. | 16 oz. | 14 oz. | |

| 15oz. < size < 16 oz. | 128 oz. | 14 oz. | 52 oz. | 20 oz. | 16 oz. | ||

| 16 oz. | 16 oz. | 52 oz.<size < 64 oz. | 24 oz. | 20 oz. | |||

| 32 oz. | 20 oz. | 64 oz. | 32 oz. | 32 oz. | |||

| 32 oz. < size < 48oz. | 24 oz. | 94 oz. | 32 oz. < size < 52 oz. | 32 oz. < size < 52 oz. | |||

| 48 oz. | 32 oz. | 96 oz. | 52 oz. | 52 oz. | |||

| 64 oz. | 32 oz. < size < 52 oz. | 97 oz. | 52 oz. < size < 64 oz. | 52 oz. < size < 64 oz. | |||

| 128 oz. | 52 oz. | 128 oz. | 64 oz. | 64 oz. | |||

| 52 oz. < size < 64 oz. oz. | 96 oz. | 94 oz. | |||||

| 64 oz. | 128 oz. | 96 oz. | |||||

| 94 oz. | 128 oz. | ||||||

| 96 oz. | |||||||

| 97 oz. | |||||||

| 128 oz. | |||||||

| 1 Pack | 1 pack | 1 pack | 1 pack | 1 pack | 1 pack | 1 pack | |

| 2 packs | 2 packs | 2 packs | 2 packs | 2 packs | 2 packs | ||

| 3 packs | 3 packs | 3 packs | 3 packs | ||||

| 4 packs | 4 packs | ||||||

| 5 packs | |||||||

| 6 packs | 6 packs | 6 packs | 6 packs | 6 packs | |||

| 12 packs | 12 packs | 12 packs | 12 packs | 9 packs | |||

| 18 packs |

Appendix B

Appendix C

| ln(psoy milk) | ln(palmond milk ) | ln(price milk) | ln(p2% milk) | ln(p1% milk) | ln(pfat-free milk) | ln(pwhole milk) | |

|---|---|---|---|---|---|---|---|

| ln(psoy milk) | 1.00 | 0.65 (<0.0001) | −0.21 (0.01) | −0.62 (<0.0001) | −0.59 (<0.0001) | −0.60 (<0.0001) | −0.63 (<0.0001) |

| ln(palmond milk) | 0.65 (<0.0001) | 1.00 | 0.00 (0.96) | −0.43 (<0.0001) | −0.38 (<0.0001) | −0.43 (<0.0001) | −0.42 (<0.0001) |

| ln(price milk) | −0.21 (0.01) | 0.00 (0.96) | 1.00 | 0.13 (0.10) | 0.12 (0.15) | 0.10 (0.25) | 0.12 (0.15) |

| ln(p2% milk) | −0.62 (<0.0001) | −0.43 (<0.0001) | 0.13 (0.11) | 1.00 | 0.98 (<0.0001) | 0.99 (<0.0001) | 0.98 (<0.0001) |

| ln(p1% milk) | −0.59 (<0.0001) | −0.38 (<0.0001) | 0.12 (0.15) | 0.98 (<0.0001) | 1.00 | 0.97 (<0.0001) | 0.98 (<0.0001) |

| ln(pfat-free milk) | −0.60 (<0.0001) | −0.43 (<0.0001) | 0.10 (0.25) | 0.10 (<0.0001) | 0.97 (<0.0001) | 1.00 | 0.98 (<0.0001) |

| ln(pwhole milk ) | −0.63 (<0.0001) | −0.42 (<0.0001) | 0.12 (0.15) | 0.98 (<0.0001) | 0.98 (<0.0001) | 0.98 (<0.0001) | 1.00 |

| Parameter | Estimate | Std Err | p-Value | |||

|---|---|---|---|---|---|---|

| Linear | Log | Linear | Log | Linear | Log | |

| a0 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | 0.02 |

| a1 | −0.01 | −0.01 | 0.00 | 0.01 | 0.09 | 0.03 |

| a2 | −0.01 | −0.01 | 0.00 | 0.00 | 0.00 | 0.03 |

| ch | 0.00 | 0.00 | 0.00 | 0.00 | <0.0001 | 0.01 |

| cnn | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.11 |

| b1 | 0.01 | 0.01 | 0.00 | 0.00 | 0.03 | 0.00 |

| lambda | 1.20 | 1.31 | 0.27 | 0.27 | <0.0001 | <0.0001 |

| mu | 0.16 | 0.17 | 0.02 | 0.02 | <0.0001 | <0.0001 |

| rho1 | −0.71 | −0.69 | 0.04 | 0.04 | <0.0001 | <0.0001 |

| rho2 | −0.51 | −0.50 | 0.04 | 0.04 | <0.0001 | <0.0001 |

| rho3 | −0.32 | −0.34 | 0.04 | 0.04 | <0.0001 | <0.0001 |

| rho4 | −0.18 | −0.19 | 0.04 | 0.04 | <0.0001 | <0.0001 |

| rho5 | −0.12 | −0.11 | 0.03 | 0.03 | 0.00 | 0.00 |

| d11 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.02 |

| d12 | 0.00 | 0.00 | 0.00 | 0.00 | 0.70 | 0.95 |

| d13 | 0.00 | 0.00 | 0.00 | 0.00 | 0.08 | 0.20 |

| b2 | 0.22 | 0.20 | 0.03 | 0.03 | <0.0001 | <0.0001 |

| d21 | 0.00 | 0.00 | 0.00 | 0.00 | 0.47 | 0.48 |

| d22 | 0.00 | 0.00 | 0.00 | 0.00 | 0.02 | 0.02 |

| d23 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | 0.01 |

| b3 | 0.00 | 0.00 | 0.00 | 0.00 | 0.61 | 0.51 |

| d31 | 0.00 | 0.00 | 0.00 | 0.00 | 0.22 | 0.18 |

| d32 | 0.00 | 0.00 | 0.00 | 0.00 | 0.36 | 0.31 |

| d33 | 0.00 | 0.00 | 0.00 | 0.00 | 0.03 | 0.03 |

| b4 | −0.13 | −0.19 | 0.10 | 0.10 | 0.17 | 0.05 |

| d41 | 0.00 | 0.00 | 0.00 | 0.00 | 0.44 | 0.72 |

| d42 | 0.00 | 0.00 | 0.00 | 0.00 | 0.14 | 0.29 |

| d43 | 0.00 | 0.00 | 0.00 | 0.00 | 0.12 | 0.25 |

| b5 | −0.01 | −0.02 | 0.05 | 0.05 | 0.78 | 0.64 |

| d51 | 0.00 | 0.00 | 0.00 | 0.00 | 0.02 | 0.02 |

| d52 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 |

| d53 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| b6 | −0.16 | −0.17 | 0.07 | 0.07 | 0.03 | 0.02 |

| d61 | 0.00 | 0.00 | 0.00 | 0.00 | 0.73 | 0.99 |

| d62 | 0.00 | 0.00 | 0.00 | 0.00 | 0.52 | 0.32 |

| d63 | 0.00 | 0.00 | 0.00 | 0.00 | 0.59 | 0.38 |

| b7 | −0.12 | −0.14 | 0.05 | 0.05 | 0.03 | 0.01 |

Appendix D

| Almond Milk | Soy Milk | Rice Milk | 2% Milk | 1% Milk | Fat-Free Milk | Whole Milk | |

|---|---|---|---|---|---|---|---|

| Last twelve observations | 0.004 | 0.018 | 0.001 | 0.453 | 0.126 | 0.251 | 0.147 |

References

- Canadian Dairy Information Centre. Per Capita Global Consumption of Fluid Milk. 2015. Available online: https://www.dairyinfo.gc.ca/eng/dairy-statistics-and-market-information/?id=1502465642636 (accessed on 20 May 2020).

- Research and Markets. Dairy and Dairy Alternative Beverage Trends in the U.S., 4th ed.; Research and Markets: Dublin, Ireland, 2017. [Google Scholar]

- Scholz-Ahrens, K.E.; Ahrens, F.; Barth, C.A. Nutritional and health attributes of milk and milk imitations. Eur. J. Nutr. 2019, 59, 19–34. [Google Scholar] [CrossRef] [PubMed]

- Chalupa-Krebzdak, S.; Long, C.J.; Bohrer, B. Nutrient density and nutritional value of milk and plant-based milk alternatives. Int. Dairy J. 2018, 87, 84–92. [Google Scholar] [CrossRef]

- Clayton, A. Milk. 2015. Available online: https://www.ethicalconsumer.org/fooddrink/shopping-guide/milk (accessed on 20 May 2020).

- Rayburn, E. Research Shows No Matter Which Plant-Based Milk You Try, It Will Always Be More Environmentally-Friendly Than Dairy. Available online: https://www.onegreenplanet.org/news/plant-based-milk-try-will-always-environmentally-friendly-dairy/ (accessed on 28 July 2019).

- Verduci, E.; D’Elios, S.; Cerrato, L.; Comberiati, P.; Calvani, M.; Palazzo, S.; Martelli, A.; Landi, M.; Trikamjee, T.; Peroni, D. Cow’s Milk Substitutes for Children: Nutritional Aspects of Milk from Different Mammalian Species, Special Formula and Plant-Based Beverages. Nutrients 2019, 11, 1739. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Gerliani, N.; Hammami, R.; Aïder, M. Production of functional beverage by using protein-carbohydrate extract obtained from soybean meal by electro-activation. LWT 2019, 113, 108259. [Google Scholar] [CrossRef]

- Kandylis, P.; Pissaridi, K.; Bekatorou, A.; Kanellaki, M.; A Koutinas, A. Dairy and non-dairy probiotic beverages. Curr. Opin. Food Sci. 2016, 7, 58–63. [Google Scholar] [CrossRef]

- Kingsley, M. The Next Generation of Plant-Based Beverages. 2017. Available online: https://www.nutritionaloutlook.com/food-beverage/next-generation-plant-based-beverages (accessed on 20 May 2020).

- Cilla, A.; Garcia-Llatas, G.; Lagarda, M.J.; Barberá, R.; Alegría, A. Development of functional beverages: The case of plant sterol-enriched milk-based fruit beverages. In Functional and Medicinal Beverages: Volume 11: The Science of Beverages; Elsevier: Amsterdam, The Netherlands, 2019; pp. 285–312. [Google Scholar] [CrossRef]

- Mäkinen, O.E.; Wanhalinna, V.; Zannini, E.; Arendt, E.K. Foods for Special Dietary Needs: Non-dairy Plant-based Milk Substitutes and Fermented Dairy-type Products. Crit. Rev. Food Sci. Nutr. 2016, 56, 339–349. [Google Scholar] [CrossRef]

- Lea, E.; Crawford, D.; Worsley, A. Consumers’ readiness to eat a plant-based diet. Eur. J. Clin. Nutr. 2005, 60, 342–351. [Google Scholar] [CrossRef] [Green Version]

- Copeland, A.; Dharmasena, S. Impact of Increasing Demand for Dairy Alternative Beverages on Dairy Farmer Welfare in the United States. In Proceedings of the Annual Meeting of Southern Agricultural Economics Association, San Antonio, TX, USA, 6–9 February 2016. [Google Scholar]

- Mintel. In the Shadow of Competition, the Soy Market Slumps. Mintel Press Release. 2011. Available online: http://www.mintel.com/press-centre/press-releases/696/in-the-shadow-of-competition-the-soy-market-slumps (accessed on 20 May 2020).

- Muehlhoff, E.; Bennet, A.; McMahon, D.; Food and Agriculture Organization of the United Nations (FAO). Milk and Dairy Products in Human Nutrition. Dairy Technol. 2013, 67, 303–304. [Google Scholar]

- Barten, A.P. The Systems of Consumer Demand Functions Approach: A Review. Econometrica 1977, 45, 23–50. [Google Scholar] [CrossRef]

- Schultz, H. The Theory and Measurement of Demand; Chicago: Social Science Studies; The University of Chicago Press; Cambridge University Press: Cambridge, UK, 1938. [Google Scholar]

- Huang, K. A Complete System of U.S. Demand for Food; Technical Bulletins 157046, United States Department of Agriculture, Economic Research Service; Longman: London, UK, 1993. [Google Scholar]

- Thomas, R. Applied Demand Analysis; Longman: New York, NY, USA, 1987. [Google Scholar]

- Divisekera, S. A model of demand for international tourism. Ann. Tour. Res. 2003, 30, 31–49. [Google Scholar] [CrossRef]

- Lancaster, K.J. A New Approach to Consumer Theory. Journal of Political Economy. 1966, 74, 132–157. [Google Scholar] [CrossRef]

- Barten, A.P. Consumer allocation models: Choice of functional form. Empir. Econ. 1993, 18, 129–158. [Google Scholar] [CrossRef]

- Vanga, S.K.; Raghavan, V. How well do plant based alternatives fare nutritionally compared to cow’s milk? J. Food Sci. Technol. 2018, 55, 10–20. [Google Scholar] [CrossRef] [PubMed]

- Singhal, S.; Baker, R.D.; Baker, S.S. A Comparison of the Nutritional Value of Cowʼs Milk and Nondairy Beverages. J. Pediatr. Gastroenterol. Nutr. 2017, 64, 799–805. [Google Scholar] [CrossRef] [PubMed]

- Sethi, S.; Tyagi, S.K.; Anurag, R.K. Plant-based milk alternatives an emerging segment of functional beverages: A review. J. Food Sci. Technol. 2016, 53, 3408–3423. [Google Scholar] [CrossRef]

- Fuentes, C.; Fuentes, M. Making a market for alternatives: Marketing devices and the qualification of a vegan milk substitute. J. Mark. Manag. 2017, 33, 529–555. [Google Scholar] [CrossRef]

- Laassal, M.; Kallas, Z. Consumers Preferences for Dairy-Alternative Beverage Using Home-Scan Data in Catalonia. Beverages 2019, 5, 55. [Google Scholar] [CrossRef] [Green Version]

- Haas, R.; Schnepps, A.; Pichler, A.; Meixner, O. Cow Milk versus Plant-Based Milk Substitutes: A Comparison of Product Image and Motivational Structure of Consumption. Sustainability 2019, 11, 5046. [Google Scholar] [CrossRef] [Green Version]

- Dharmasena, S.; Capps, O. Unraveling Demand for Dairy-Alternative Beverages in the United States: The Case of Soymilk. Agric. Resour. Econ. Rev. 2014, 43, 140–157. [Google Scholar] [CrossRef]

- Deaton, A.; Muellbauer, J. Economics and Consumer Behavior; Woodhead Publishing: Cambridge, UK, 1980. [Google Scholar]

- Theil, H. The Information Approach to Demand Analysis. Monetary Policy 1992, 33, 627–651. [Google Scholar] [CrossRef]

- Chan, T.Y. Estimating a continuous hedonic-choice model with an application to demand for soft drinks. RAND J. Econ. 2006, 37, 466–482. [Google Scholar] [CrossRef]

- Gulseven, O.; Wohlgenant, M. A quality-based approach to estimating quantitative elasticities for differentiated products: An application to retail milk demand. Qual. Quant. 2014, 49, 2077–2096. [Google Scholar] [CrossRef]

- Hendel, I. Estimating Multiple-Discrete Choice Models: An Application to Computerization Returns. Rev. Econ. Stud. 1999, 66, 423–446. [Google Scholar] [CrossRef]

- Nevo, A. Measuring Market Power in the Ready-to-Eat Cereal Industry. Econometrica 2001, 69, 307–342. [Google Scholar] [CrossRef] [Green Version]

- Pinske, J.; Slade, M.E.; Brett, C. Spatial Price Competition: A Semiparametric Approach. Econometrica 2002, 70, 1111–1153. [Google Scholar] [CrossRef]

- Rojas, C.; Peterson, E.B. Demand for differentiated products: Price and advertising evidence from the U.S. beer market. Int. J. Ind. Organ. 2008, 26, 288–307. [Google Scholar] [CrossRef] [Green Version]

- Gould, B.W. Factors Affecting U.S. Demand for Reduced-Fat Fluid Milk. J. Agric. Resour. Econ. 1996, 21, 68–81. [Google Scholar]

- Sopranzetti, B.J. Hedonic Regression Models. In Handbook of Financial Econometrics and Statistics; Lee, C.F., Lee, J., Eds.; Springer: New York, NY, USA, 2015. [Google Scholar]

- De Haan, J.; Diewert, E. Hedonic Regression Methods. In Handbook on Residential Property Price Indices; OECD Publishing: Paris, France, 2013. [Google Scholar] [CrossRef]

- Palmquist, R.B.; Smith, V.K. The use of hedonic property value techniques for policy and litigation. In The International Yearbook of Environmental and Resource Economics 2002/2003; Tietenberg, T., Folmer, H., Eds.; Edward Elgar: Cheltenham, UK, 2002; pp. 115–164. [Google Scholar]

- Cropper, M.L.; Deck, L.B.; McConnell, K.E. On the Choice of Funtional Form for Hedonic Price Functions. Rev. Econ. Stat. 1988, 70, 668. [Google Scholar] [CrossRef] [Green Version]

- Ladd, G.W.; Suvannunt, V. A Model of Consumer Goods Characteristics. Am. J. Agric. Econ. 1976, 58, 504–510. [Google Scholar] [CrossRef]

- Nimon, W.; Beghin, J. Are Eco-Labels Valuable? Evidence From the Apparel Industry. Am. J. Agric. Econ. 1999, 81, 801–811. [Google Scholar] [CrossRef]

- Hotelling, H. Stability in Competition. Econ. J. 1929, 9, 41–57. [Google Scholar] [CrossRef]

- Sabidussi, G. The centrality index of a graph. Psychometrika 1966, 31, 581–603. [Google Scholar] [CrossRef] [PubMed]

- Wang, W.; Tang, C.Y. Distributed computation of classic and exponential closeness on tree graphs. In Proceedings of the American Control Conference, Portland, OR, USA, 4–6 June 2014. [Google Scholar]

- Barten, A.P. Consumer Demand Functions under Conditions of Almost Additive Preferences. Econometrica 1964, 32, 1–38. [Google Scholar] [CrossRef]

- Neves, P.D. A class of differential demand systems. Econ. Lett. 1994, 44, 83–86. [Google Scholar] [CrossRef]

- Keller, W.; Van Driel, J. Differential consumer demand systems. Eur. Econ. Rev. 1985, 27, 375–390. [Google Scholar] [CrossRef]

- Matsuda, T. Differential Demand Systems: A Further Look at Barten’s Synthesis. South. Econ. J. 2005, 71, 607. [Google Scholar] [CrossRef]

- Yang, T.; Dharmasena, S. Consumers preferences on nutritional attributes of dairy-alternative beverages: Hedonic pricing models. Food Sci. Nutr. 2020, 8, 5362–5378. [Google Scholar] [CrossRef]

- Drewnowski, A. The Carbohydrate-Fat Problem: Can We Construct a Healthy Diet Based on Dietary Guidelines? Adv. Nutr. 2015, 6, 318S–325S. [Google Scholar] [CrossRef] [Green Version]

- Taubes, G. Good Calories, Bad Calories: Fats, Carbs, and the Controversial Science of Diet; Penguin Random House: New York, NY, USA, 2008. [Google Scholar]

- Colen, L.; Melo, P.; Abdul-Salam, Y.; Roberts, D.; Mary, S.; Paloma, S.G.Y. Income elasticities for food, calories and nutrients across Africa: A meta-analysis. Food Policy 2018, 77, 116–132. [Google Scholar] [CrossRef]

- Salois, M.J.; Tiffin, R.; Balcombe, K.G. Impact of Income on Nutrient Intakes: Implications for Undernourishment and Obesity. J. Dev. Stud. 2012, 48, 1716–1730. [Google Scholar] [CrossRef] [Green Version]

- Skoufias, E.; di Maro, V.; González-Cossío, T.; Ramirez, S.R. Food quality, calories and household income. Appl. Econ 2011, 43, 4331–4342. [Google Scholar] [CrossRef] [Green Version]

- Widarjono, A. Food and Nutrient Demand in Indonesia; Oklahoma State University: Oklahoma City, OK, USA, 2012; unpublished dissertation. [Google Scholar]

- Faharuddin, F.; Mulyana, A.; Yamin, M.; Yunita, Y. Nutrient elasticities of food consumption: The case of Indonesia. J. Agribus. Dev. Emerg. Econ. 2017, 7, 198–217. [Google Scholar] [CrossRef]

- Barten, A.P. Maximum likelihood estimation of a complete system of demand equations. Eur. Econ. Rev. 1969, 1, 7–73. [Google Scholar] [CrossRef]

- Paraje, G. The Effect of Price and Socio-Economic Level on the Consumption of Sugar-Sweetened Beverages (SSB): The Case of Ecuador. PLoS ONE 2016, 11, e0152260. [Google Scholar] [CrossRef]

- Guerrero-López, C.M.; Unar-Munguía, M.; Colchero, M.A. Price elasticity of the demand for soft drinks, other sugar-sweetened beverages and energy dense food in Chile. BMC Public Health 2017, 17, 180. [Google Scholar] [CrossRef] [Green Version]

- Chacon, V.; Paraje, G.; Barnoya, J.; Chaloupka, F.J. Own-price, cross-price, and expenditure elasticities on sugar-sweetened beverages in Guatemala. PLoS ONE 2018, 13, e0205931. [Google Scholar] [CrossRef]

- Irz, X.; Kuosmanen, N. Explaining growth in demand for dairy products in Finland: An econometric analysis. Food Econ. 2013, 9, 47–56. [Google Scholar] [CrossRef]

- Bouamra-Mechemache, Z.; Réquillart, V.; Soregaroli, C.; Trévisiol, A. Demand for dairy products in the EU. Food Policy 2008, 33, 644–656. [Google Scholar] [CrossRef]

| Almond Milk | Soy Milk | Rice Milk | 2% Milk | 1% Milk | Fat-Free Milk | Whole Milk | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Linear | Log | Linear | Log | Linear | Log | Linear | Log | Linear | Log | Linear | Log | Linear | Log | |

| Almond milk | 0.00 | 0.00 | 0.26 | 0.26 | 0.54 | 0.51 | 0.74 | 0.62 | 0.52 | 0.92 | 0.39 | 1.30 | 1.13 | 0.79 |

| Soy milk | 0.26 | 0.25 | 0.00 | 0.00 | 0.38 | 0.34 | 0.59 | 0.48 | 0.35 | 0.97 | 0.20 | 1.11 | 1.09 | 0.71 |

| Rice milk | 0.54 | 0.51 | 0.38 | 0.34 | 0.00 | 0.00 | 0.78 | 0.64 | 0.57 | 1.09 | 0.36 | 1.03 | 0.99 | 0.73 |

| 2% milk | 0.74 | 0.62 | 0.59 | 0.48 | 0.78 | 0.64 | 0.00 | 0.00 | 0.58 | 1.11 | 0.68 | 1.14 | 1.40 | 0.95 |

| 1% milk | 0.52 | 0.92 | 0.35 | 0.97 | 0.57 | 1.09 | 0.58 | 1.11 | 0.00 | 0.00 | 0.41 | 1.66 | 1.03 | 0.78 |

| Fat-free milk | 0.39 | 1.30 | 0.20 | 1.11 | 0.36 | 1.03 | 0.68 | 1.14 | 0.41 | 1.66 | 0.00 | 0.00 | 1.16 | 1.42 |

| Whole milk | 1.13 | 0.79 | 1.09 | 0.71 | 0.99 | 0.73 | 1.40 | 0.95 | 1.03 | 0.78 | 1.16 | 1.42 | 0.00 | 0.00 |

| Almond Milk | Soy Milk | Rice Milk | 2% Milk | 1% Milk | Fat-Free Milk | Whole Milk | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Linear | Log | Linear | Log | Linear | Log | Linear | Log | Linear | Log | Linear | Log | Linear | Log | |

| Almond milk | 1.00 | 1.00 | 0.79 | 0.80 | 0.65 | 0.66 | 0.58 | 0.62 | 0.66 | 0.52 | 0.72 | 0.43 | 0.47 | 0.56 |

| Soy milk | 0.79 | 0.80 | 1.00 | 1.00 | 0.73 | 0.75 | 0.63 | 0.68 | 0.74 | 0.51 | 0.83 | 0.47 | 0.48 | 0.58 |

| Rice milk | 0.65 | 0.66 | 0.73 | 0.75 | 1.00 | 1.00 | 0.56 | 0.61 | 0.64 | 0.48 | 0.74 | 0.49 | 0.50 | 0.58 |

| 2% milk | 0.58 | 0.62 | 0.63 | 0.68 | 0.56 | 0.61 | 1.00 | 1.00 | 0.63 | 0.47 | 0.60 | 0.47 | 0.42 | 0.51 |

| 1% milk | 0.66 | 0.52 | 0.74 | 0.51 | 0.64 | 0.48 | 0.63 | 0.47 | 1.00 | 1.00 | 0.71 | 0.38 | 0.49 | 0.56 |

| Fat-free milk | 0.72 | 0.43 | 0.83 | 0.47 | 0.74 | 0.49 | 0.60 | 0.47 | 0.71 | 0.38 | 1.00 | 1.00 | 0.46 | 0.41 |

| Whole milk | 0.47 | 0.56 | 0.48 | 0.58 | 0.50 | 0.58 | 0.42 | 0.51 | 0.49 | 0.56 | 0.46 | 0.41 | 1.00 | 1.00 |

| Almond Milk | Soy Milk | Rice Milk | 2% Milk | 1% Milk | Fat-Free Milk | Whole Milk | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Linear | Log | Linear | Log | Linear | Log | Linear | Log | Linear | Log | Linear | Log | Linear | Log | |

| Almond milk | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Soy milk | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

| Rice milk | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

| 2% milk | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 |

| 1% milk | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

| Fat-free milk | 0 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Whole milk | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Tests | Model | Estimate | p-Value | Test Results |

|---|---|---|---|---|

| Test0 | linear | 10.56 | 0.01 | d11 = d12 = d13 |

| log | 6.26 | 0.10 | d11 = d12 = d13 | |

| Test1 | linear | 9.19 | 0.03 | d21 = d22 = d23 |

| log | 8.62 | 0.03 | d21 = d22 = d23 | |

| Test2 | linear | 5.87 | 0.12 | d31 = d32 = d33 |

| log | 6.55 | 0.09 | d31 = d32 = d33 | |

| Test3 | linear | 3.91 | 0.27 | d41 = d42 = d43 |

| log | 2.08 | 0.56 | d41 = d42 = d43 | |

| Test4 | linear | 16.88 | 0.00 | d51 = d52 = d53 |

| log | 16.05 | 0.00 | d51 = d52 = d53 | |

| Test5 | linear | 0.87 | 0.83 | d61 = d62 = d63 |

| log | 1.41 | 0.70 | d61 = d62 = d63 | |

| Test6 | linear | 81.86 | <0.0001 | lambda = 0, mu = 0 |

| log | 99.93 | <0.0001 | lambda = 0, mu = 0 | |

| Test7 | linear | 1787.5 | <0.0001 | lambda = 1, mu = 1 |

| log | 1810.1 | <0.0001 | lambda = 1, mu = 1 | |

| Test8 | linear | 67.41 | <0.0001 | lambda = 1, mu = 0 |

| log | 79.59 | <0.0001 | lambda = 1, mu = 0 | |

| Test9 | linear | 1832.4 | <0.0001 | lambda = 0, mu = 1 |

| log | 1840.7 | <0.0001 | lambda = 0, mu = 1 |

| Almond Milk | Soy Milk | Rice Milk | 2% Milk | 1% Milk | Fat-Free Milk | Whole Milk | Expenditure | |

|---|---|---|---|---|---|---|---|---|

| almond milk | −0.13 * | −0.06 | −0.06 *** | −1.33 *** | −0.61 *** | −0.92 *** | −0.68 *** | 3.60 *** |

| (0.06) | (0.04) | (0.01) | (0.41) | (0.18) | (0.27) | (0.20) | (0.00) | |

| soy milk | −0.03 *** | −0.50 *** | −0.02 *** | −3.71 *** | −1.62 *** | −2.46 *** | −1.85 *** | 10.07 *** |

| (0.00) | (0.04) | (0.00) | (0.45) | (0.20) | (0.30) | (0.22) | (1.21) | |

| rice milk | −0.13 *** | −0.19 *** | −0.10 | −0.91 | −0.47 | −0.50 | −0.49 | 2.31 |

| (0.03) | (0.06) | (0.13) | (0.93) | (0.40) | (0.62) | (0.46) | (2.50) | |

| 2% milk | −0.00 *** | −0.02 *** | −0.00 *** | −0.42 *** | −0.11 *** | −0.17 *** | −0.12 *** | 0.83 *** |

| (0.00) | (0.00) | (0.00) | (0.03) | (0.01) | (0.04) | (0.01) | (0.07) | |

| 1% milk | −0.00 *** | −0.03 *** | −0.00 *** | −0.36 *** | −0.33 *** | −0.24 *** | −0.18 *** | 1.14 *** |

| (0.00) | (0.00) | (0.00) | (0.03) | (0.02) | (0.02) | (0.02) | (0.08) | |

| fat-free milk | −0.00 *** | −0.01 *** | −0.00 | −0.15 *** | −0.07 *** | −0.28 ** | −0.07 ** | 0.57 *** |

| (0.00) | (0.00) | (0.00) | (0.03) | (0.01) | (0.02) | (0.01) | (0.07) | |

| whole milk | −0.00 *** | −0.01 *** | −0.00 *** | −0.14 *** | −0.06 *** | −0.10 *** | −0.22 *** | 0.55 *** |

| (0.00) | (0.00) | (0.00) | (0.04) | (0.02) | (0.02) | (0.03) | (0.10) |

| Almond Milk | Soy Milk | Rice Milk | 2% Milk | 1% Milk | Fat-free Milk | Whole Milk | |

|---|---|---|---|---|---|---|---|

| almond milk | −0.12 * | −0.13 *** | −0.06 *** | 0.01 | −0.03 * | −0.02 | −0.01 |

| (0.06) | (0.03) | (0.01) | (0.01) | (0.01) | (0.01) | (0.01) | |

| soy milk | 0.00 | −0.25 *** | −0.01 *** | 0.06 *** | 0.02 *** | 0.04 *** | 0.03 *** |

| 0.00 | 0.03 | 0.00 | 0.01 | 0.00 | 0.01 | 0.00 | |

| rice milk | −0.12 *** | −0.13 *** | −0.01 | −0.04 | −0.09 *** | 0.08 | −0.06 *** |

| (0.03) | (0.03) | (0.13) | (0.03) | (0.03) | (0.07) | (0.02) | |

| 2% milk | 0.03 | 0.00 *** | −0.00 | −0.11 *** | 0.03 *** | 0.04 *** | 0.03 *** |

| (0.00) | (0.00) | (0.00) | (0.01) | (0.00) | (0.00) | (0.00) | |

| 1% milk | −0.00 ** | 0.00 *** | −0.00 *** | 0.06 *** | −0.15 *** | 0.04 *** | 0.03 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.02) | (0.00) | (0.00) | |

| fat-free milk | −0.00 | 0.00 *** | 0.00 | 0.06 *** | 0.03 *** | −0.14 *** | 0.03 *** |

| (0.00) | (0.00) | (0.00) | (0.00) | (0.00) | (0.01) | (0.00) | |

| whole milk | −0.00 | 0.00 *** | −0.00 *** | 0.06 *** | 0.03 *** | 0.04 *** | −0.12 *** |

| (0.00) | (0.00) | (0.00) | (0.01) | (0.00) | (0.00) | (0.02) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, T.; Dharmasena, S. U.S. Consumer Demand for Plant-Based Milk Alternative Beverages: Hedonic Metric Augmented Barten’s Synthetic Model. Foods 2021, 10, 265. https://doi.org/10.3390/foods10020265

Yang T, Dharmasena S. U.S. Consumer Demand for Plant-Based Milk Alternative Beverages: Hedonic Metric Augmented Barten’s Synthetic Model. Foods. 2021; 10(2):265. https://doi.org/10.3390/foods10020265

Chicago/Turabian StyleYang, Tingyi, and Senarath Dharmasena. 2021. "U.S. Consumer Demand for Plant-Based Milk Alternative Beverages: Hedonic Metric Augmented Barten’s Synthetic Model" Foods 10, no. 2: 265. https://doi.org/10.3390/foods10020265

APA StyleYang, T., & Dharmasena, S. (2021). U.S. Consumer Demand for Plant-Based Milk Alternative Beverages: Hedonic Metric Augmented Barten’s Synthetic Model. Foods, 10(2), 265. https://doi.org/10.3390/foods10020265