1. Introduction

In supply chain management (SCM), each manufacturer observes customer demand to decide production quantity. If the demand is uncertain, either overstock or understock situations occur at the stockholder. The supply chain players play an essential role in this situation. Demand uncertainty can be caused if the players are unreliable or if they are not exchanging proper information between them. Depending on the demand, the manufacturer produces products and sends those products to the retailer for selling. The retailer controls the overall inventory and sends money to the manufacturer after selling the products. However, sometimes, the retailer is untrustworthy. The retailer does not provide accurate information to the manufacturer. In this case, a consignment policy is applied to reduce the information asymmetry between supply chain players. Additionally, using smart technology, such as RFID, gives an extra advantage for getting real-time information about the products in the inventory. Incorporating these features takes supply chain management to an advanced level as compared to traditional systems.

A consignment policy is an approach where the manufacturer manages the financial part, and the retailer maintains the operational functions. In this policy, the manufacturer acts as a leader, and the retailer acts as a follower. The overall inventory is controlled by the manufacturer only. The retailer sells those products and sends its revenue to the manufacturer ([

1,

2]). The manufacturer provides specific incentives to the retailer for each product sold ([

3]). By a mutual agreement between both the players, unsold products are returned to the legal owner. Additionally, manufacturing the products needs to be perfect to improve the quality of the products (Sarkar and Sarkar [

4]). A service-level constraint for quality improvement was introduced by Moon et al. [

5]. By implementing a service-level restriction in this supply chain model, the product quality is improved by optimizing the model through a distribution-free approach ([

6]). This improved service strategy for the consignment stock is applied in this research to extend the traditional model to gives a higher profit.

A typical warehouse has certain limitations when tracking and tracing products, which causes information asymmetry with unnecessary time consumption. As an advanced smart technology, RFID is implemented to observe every single movement of each product in the inventory ([

7]). The real-time tracking, tracing, and inspecting of products are done in a completely automatic procedure with minimum human interaction and minimum labor cost. This automation policy allows for smart supply chain management in the model ([

8]). Another profitable strategy for using RFID is that RFID tags can reuse, and some amount of data can be stored if needed ([

9]). RFID tags are attached to products and traced by scanners mounted in the warehouse. The real-time information of each product is sent to a server, and users can get information about the inventory from the server by using a computer or smartphone. RFID implementation in supply chain management for optimizing unreliability and increasing the overall profit was briefly described by Biswal et al. [

10].

Demand forecasting plays a crucial role in this smart supply chain model. When the retailer is unreliable and does not send accurate demand information to the manufacturer, demand uncertainty arises ([

11]). Thus, the manufacturer cannot predict the exact market demand. In this situation, the holding cost or shortage cost increases, and the supply chain management system’s total profit decreases ([

12]). Based on previous demand data, LSTM is applied to forecast future demand. A multi-layer LSTM network was proposed by Abbasimehr et al. [

13], which can predict volatile demand data by considering various combinations of LSTM hyperparameters for a provided time series. Using the expected demand leads to higher profit over the traditional model ([

14]). By the forecasted demand, an essential competitive advantage is created for generating superior business performance ([

15]). As information asymmetry makes this type of smart supply chain management unreliable, this study maximizes the entire smart supply chain’s total profit by minimizing the unreliability between supply chain players.

In the existing traditional system, the retailer is unreliable and does not provide accurate inventory information to the manufacturer. As a result, information asymmetry arises between supply chain players. The manufacturer does not have precise demand information for future production. The main contribution of this research is forecasting the future demand using an LSTM method and incorporating RFID and a consignment policy into the traditional model where the profit will be higher than the traditional system. As information asymmetry arises in the traditional model, RFID is implemented to get accurate information about the inventory on a real-time basis for reducing unreliability. A consignment policy is applied in which the manufacturer controls the overall inventory, and the retailer sells the products and sends the money to the manufacturer. The manufacturer provides a fixed amount of money and a commission to the retailer for selling each product. As the demand is forecasted using LSTM, the manufacturer produces goods based on the predicted future demand ([

16]). In this case, the holding cost or the shortage cost is minimized, and the total profit is much higher than the existing traditional model.

Section 1 represents the introduction and contribution of authors along with problem definition, assumptions, and notation of this research. The rest of the research is designed as follows.

Section 2 signifies the traditional model part. The modeling part of ML-RFID model is formulated in

Section 3. The results of this research are described in

Section 4 followed by a sensitivity discussion on the parameters.

Section 5 contains managerial implications and

Section 6 concludes this research.

1.1. Contribution of Authors

An author’s contribution table based on keywords and literature is described in

Table 1 which clearly illustrates the contrast of this research with previous research.

1.2. Problem Definition, Assumptions, and Notation

The problem definition of this study is demonstrated in this section. The assumptions and the notation used to mathematically validate the proposed model are described below.

1.2.1. Problem Definition

In this study, the difference between the traditional and ML-RFID models in smart supply chain management is described for reducing unreliability. Two supply chain players, i.e., the manufacturer and the retailer, play an essential role but have asymmetric power. Due to the unreliable retailer, the Stackelberg game approach is applied to determine the decision-maker. A future demand distribution is incorporated, dependent on the service based on a machine learning technique, i.e., LSTM. Under a consignment policy, a fixed fee is given to the retailer by the manufacturer to implement RFID, which reduces the players’ information asymmetry by providing accurate information about the inventory. The retailer sells the products, sends the revenue to the manufacturer, and then gets a commission to sell each product. This research gives a higher profit than the traditional model after implementing RFID and a consignment policy with machine learning, providing smart supply chain management in this supply chain.

1.2.2. Assumptions

The following assumptions are used for this research.

A supply chain management is considered with manufacturer and retailer as two players.

Demand depends on the service b, and it is a decision variable.

In the traditional model, the inventory is controlled by the retailer. In the ML-RFID model, the manufacturer controls the inventory by giving a fixed fee along with a commission to the retailer for each product sold.

The lead time demand does not follow a known probability distribution function but it has a known value of the mean and standard deviation ([

26]).

As the retailer is unreliable, the manufacturer installs RFID technology at the retailer’s place to get real-time information about the inventory ([

24]).

The demand dataset consists of ten years of data, and of the data are taken as the training dataset while the remaining are taken as the test dataset.

The data in the test set do not exist in the train set and the demand is always greater than zero.

Using Stackelberg game theory, the manufacturer acts as a leader and controls the inventory. The retailer acts as a follower of the manufacturer ([

27]).

1.2.3. Notation

The notation associated with this research is is attached in

Appendix A.

2. Traditional Model

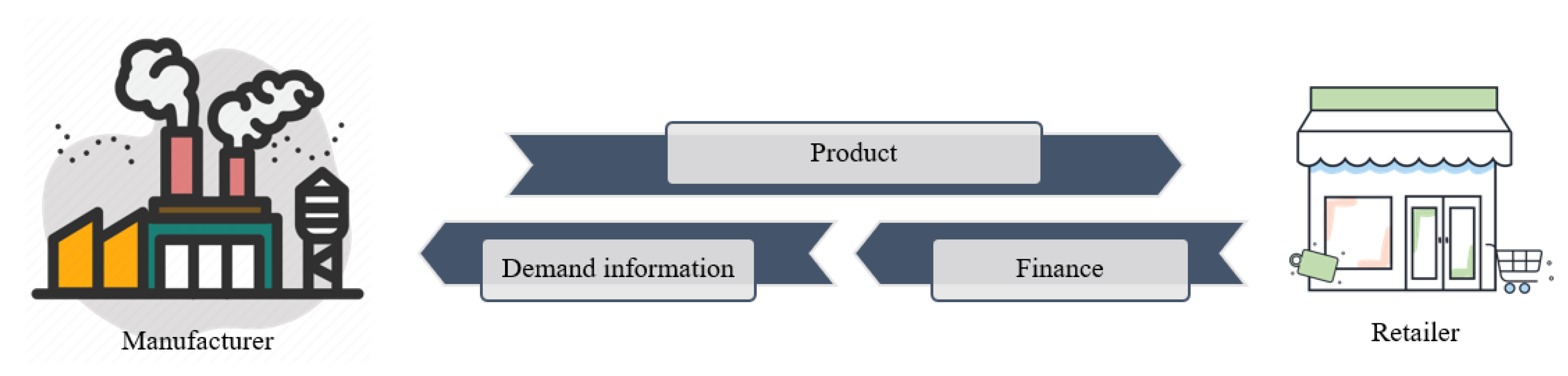

The traditional model is a conventional model where the manufacturer makes products and sends them to the retailer. In this model, the inventory is controlled by the retailer. The manufacturer receives demand information and the money after selling products from the retailer. This traditional model has some limitations related to information asymmetry. When the retailer is unreliable and does not send accurate demand information to the manufacturer, the overstock or understock situation arises.

Further, to reduce its environmental impact, each industry must follow some legislative regulations. Each industry mitigates its carbon footprint by incorporating a cap and trade policy ([

28]). For the approach, a measurement of the environmental effect is considered in this model ([

29]). This model consists of three subsections: the retailer’s traditional model, the manufacturer’s classic model, and the total expected profit for the conventional model.

Figure 1 represents the process diagram for the traditional model.

2.1. Retailer’s Traditional Model

In the traditional model, the retailer’s holding cost of the total product’s inventory is incurred. The entire lot is purchased at a wholesale price by the retailer from the manufacturer. Thus, the retailer maintains the products’ proprietorship, and products are sold to the customer at a selling price. In this model, the manufacturer no longer has responsibility for the products. The manufacturer does not acquire holding costs for a single product after making the delivery to the retailer. The demand of the retailer is , where a is the scaling parameter, and are shape parameters, b is the service provided to the customers, and is the measurement of the environmental effect.

The total profit of the retailer under the traditional model is:

As the retailer is unreliable, the manufacturer does not get proper demand information. Thus, an overstock or understock situation arises in this conventional model. The necessity of the lead time demand information is essential to calculate the holding or shortage during the lead time period. According to Gallego and Moon [

18], without having distribution information, one can easily calculate the expected holdings or shortages during the lead time demand using a lemma that places an upper bound. Using this lemma, one has the following:

Lemma 1. (i)The expected quantity for overstock: (ii) The expected quantity for understock: Using Equations

and

, the expected profit for the retailer is calculated for Equation

, and it can be written as:

2.2. Manufacturer’s Traditional Model

The manufacturer follows the optimized decision in the traditional model. The revenue of the manufacturer is

and the manufacturing cost is

where the unit production cost is denoted by

k. The expected profit of the manufacturer under the traditional model is:

2.3. Total Expected Profit for the Traditional Model

By adding Equations

and

, the total expected total profit under traditional model is

According to Sardar and Sarkar [

25], the maximum profit can be obtained by taking the derivative of Equation

with respect to

,

L,

b, and

. Now, the optimum values for the decision variables are:

3. Integrating ML, RFID, and Consignment Policy to Reduce Unreliability (ML-RFID Model)

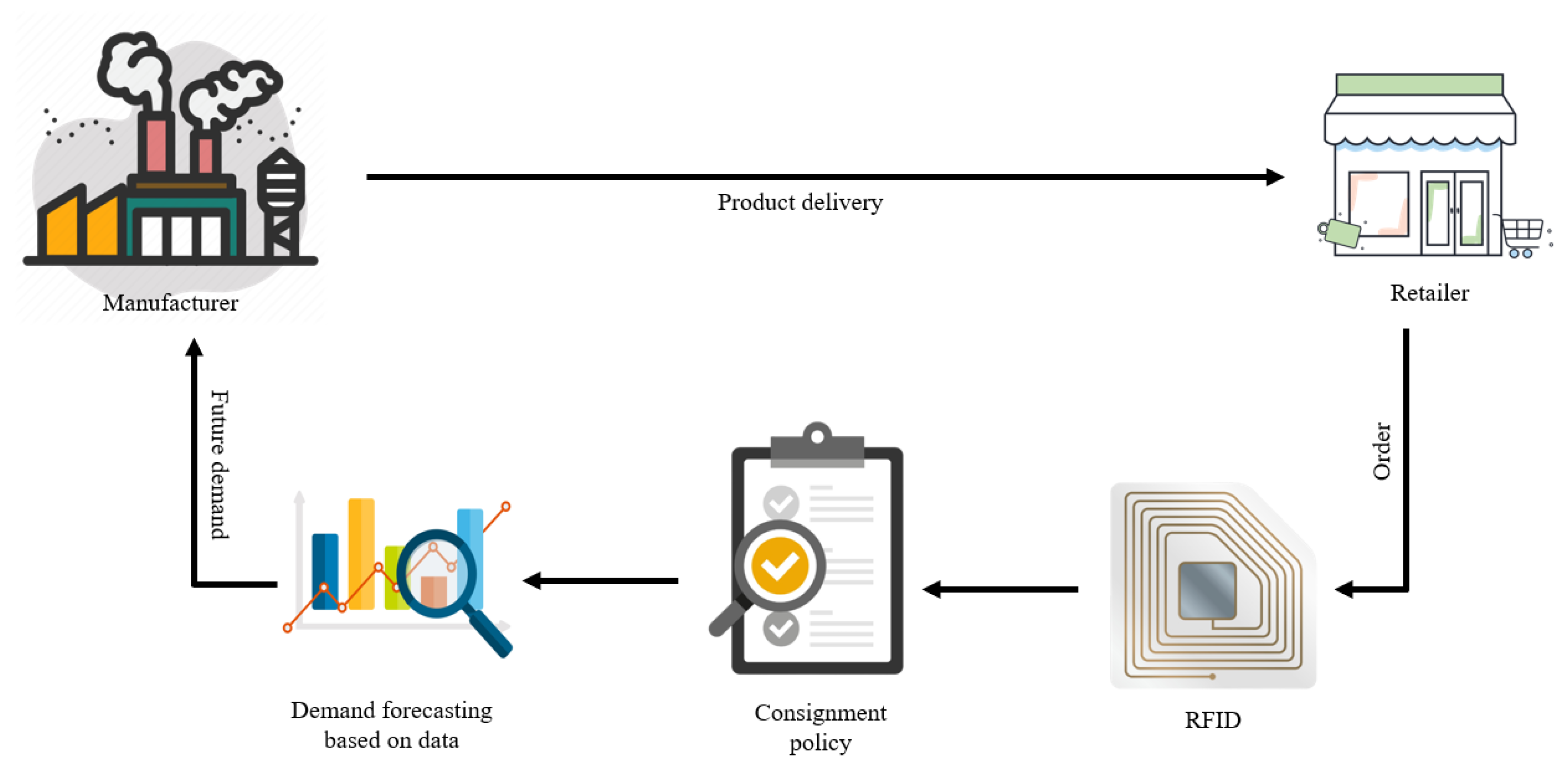

In the ML-RFID model, products are sent to the retailer by the manufacturer, and the retailer maintains the inventory. The retailer does not have to pay any money until the products are sold. In a consignment policy, two different segments are present. In the first segment, the inventory prepares for receiving the products. In the second segment, the retailer sells the products, and the revenue is sent to the manufacturer. The Stackelberg game approach is used where the manufacturer behaves as a leader by controlling the overall inventory, and the retailer acts as a follower ([

30]). The manufacturer maintains the consignment stock and sends a commission to the retailer for each product sold with a fixed fee; thus, the retailer’s revenue is generated. Implementation of RFID reduces the unreliability by real-time tracking of each product in the inventory, which leads to higher profits than the traditional model. LSTM is used to remove the uncertainty of demand so that the holding cost and shortage cost are minimized, increasing the profit of the whole smart supply chain management strategy. The implementation of demand forecasting over the ML-RFID model is shown in

Figure 2.

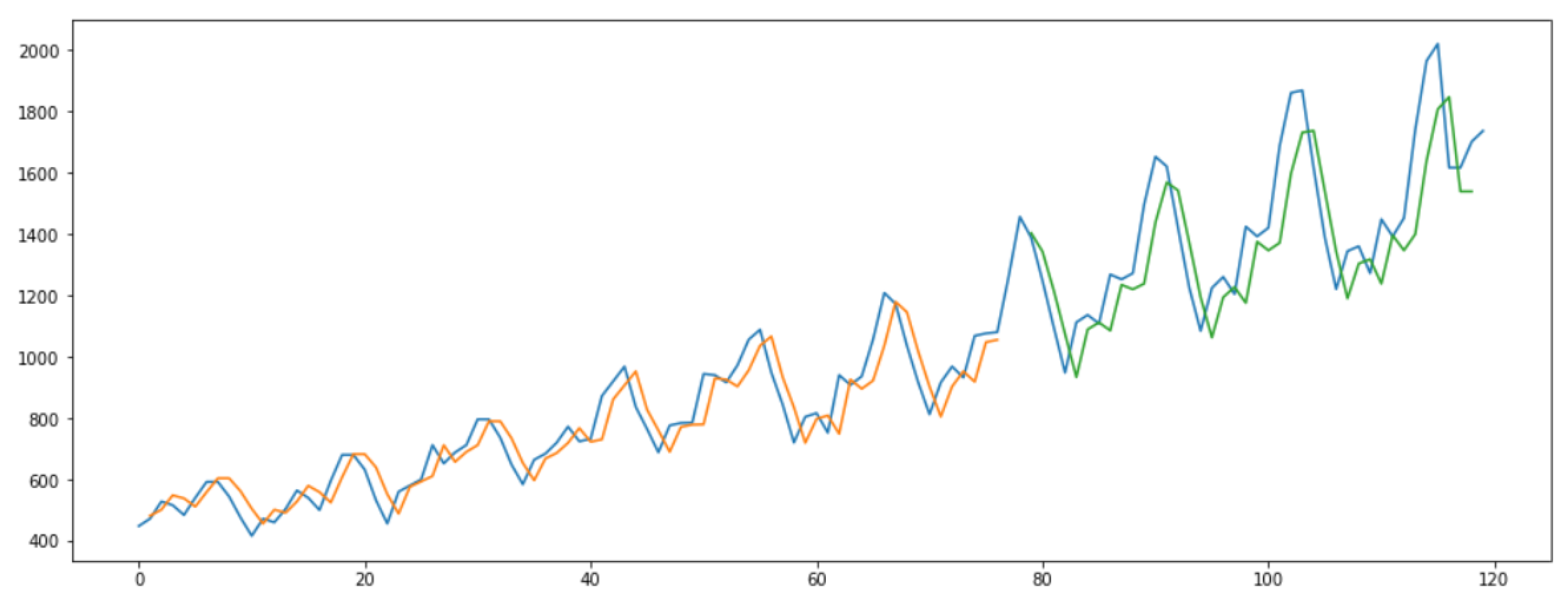

3.1. Forecasting Future Demand to Remove Uncertainty

LSTM can forecast time series data as an extension of the Recurrent Neural Network (RNN). Long-range time-dependent information can store in LSTM by correctly mapping both the input and output data ([

31]). LSTM consists of an input gate, a forget gate, an output gate, and internal cells ([

32]). Those gates and cells control the flow of information. In the LSTM method, the training and test datasets are taken in some specific ratio. The demand patterns are similar for each day. A preprocessing step is done by assigning different weights to the input data, affecting the forecasted data ([

33]). For LSTM, a dataset matrix is formed by converting the array value, followed by reshaping the inputs for predicting and checking the performance matrices.

Figure 3 is a pictorial representation of the LSTM architecture used in demand forecasting.

3.2. Retailer’s Expected Profit for the ML-RFID Model

The retailer carries the product’s inventory but does not hold the total product’s inventory holding cost. This setup functions as a follower in the Stackelberg game approach. Only the operation parts, such as the stock handling and storage area, are carried by the retailer, which means the holding cost and the shortage cost are carried by the retailer. To remove the unreliability of the traditional model, RFID is introduced and the cost for RFID implementation is borne by the retailer. The retailer also receives an amount of money for installing the RFID system from the manufacturer. The retailer agrees to a contract and makes revenue from the commission and the fixed fee given by the manufacturer.

Therefore, the retailer’s expected total profit for the ML-RFID model is

Now, using Equations

and

, the expected profit of the retailer can be written as

3.3. Manufacturer’s Expected Profit for the ML-RFID Model

As per the Stackelberg game approach, the manufacturer is the leader. Thus, the ownership of the warehouse is controlled by the manufacturer only. The manufacturing cost of the manufacturer is . The financial part of holding cost and shortage cost are controlled by the manufacturer over traditional model. The manufacturer also gives a fixed fee to the retailer.

Therefore, the manufacturer’s expected total profit for the ML-RFID model is

Again, using Equation

and Equation

the expected profit of the manufacturer can be written as

3.4. Total Expected Profit for the ML-RFID Model

By adding Equations

and

, the expected total profit under the ML-RFID model can be formulated as:

The maximum profit can be obtained by taking the derivative of Equation

with respect to

,

L,

b, and

(see

Appendix B).

Now, the optimal values for the decision variables are: