Designing Supply Networks in Automobile and Electronics Manufacturing Industries: A Multiplex Analysis

Abstract

1. Introduction

2. Theoretical Background and Hypotheses

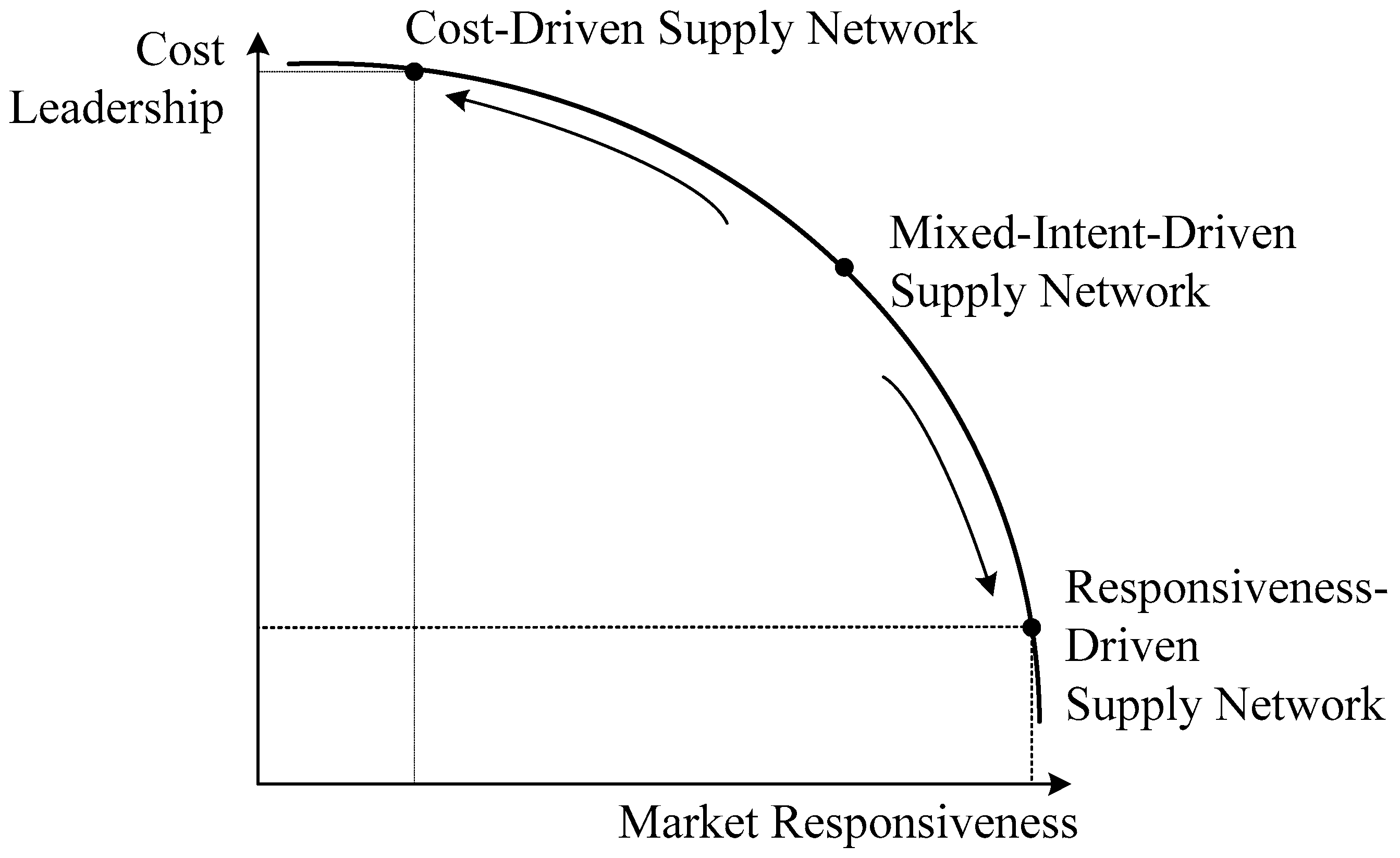

2.1. Network Resource and Strategic Intent

2.2. Supply Network Tie Types

2.3. Indices for Network Characterization

2.4. Hypotheses

3. Methodology

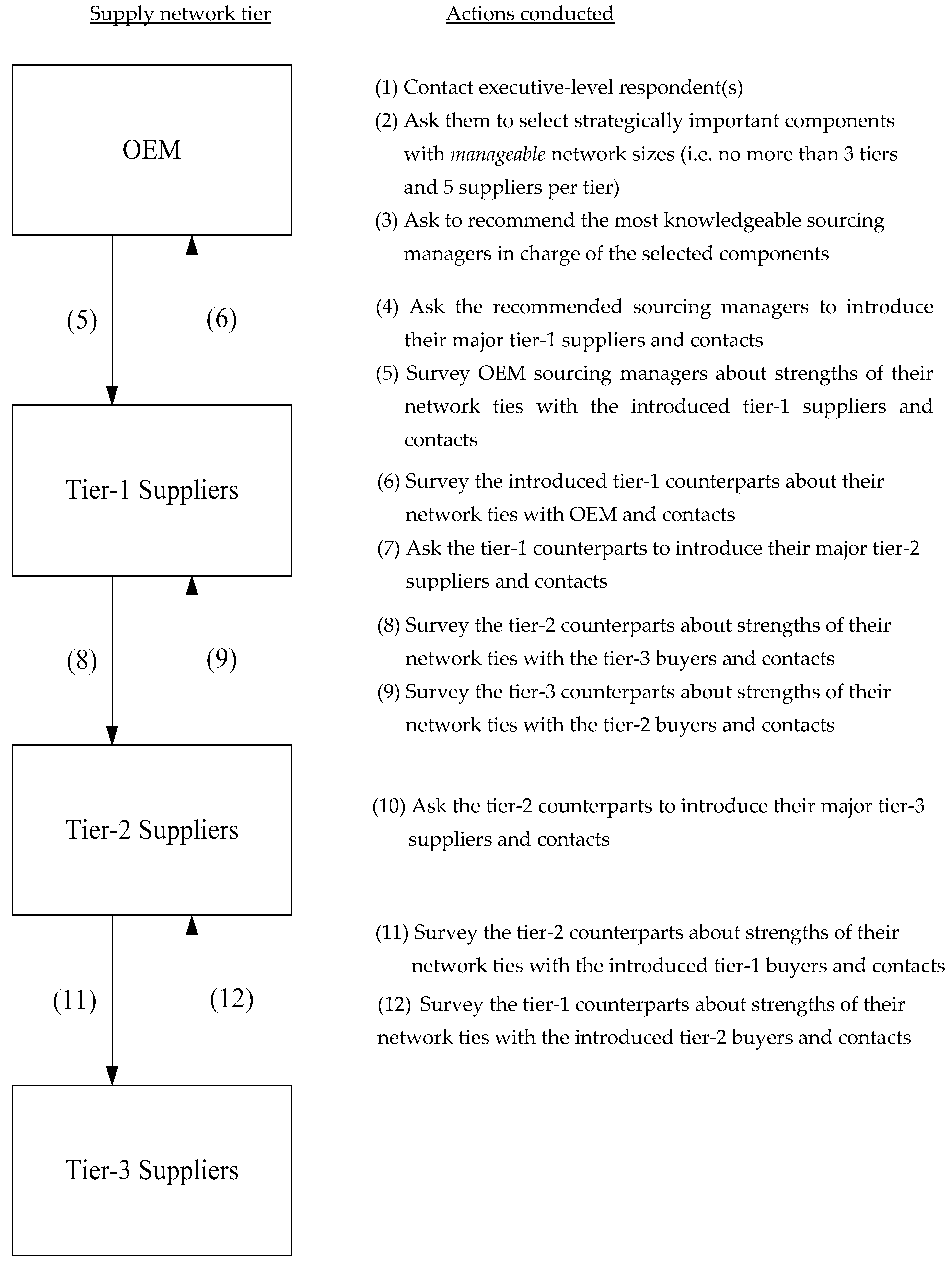

3.1. Data

3.2. Measures

Capturing Strategic Intent

3.3. Methods

4. Results and Interpretations

4.1. Model 1: Strategic Intent and BTC

“Information about cost structure is extremely sensitive for all down-tier suppliers since the buying firm can easily calculate our profit margins, which is not good for us. They (the buying firm) already keep asking us to cut down price while maintaining the same quality level as their products are under fierce price competition. Unfortunately, but inevitably, we are expecting and asking the same thing from and to our suppliers (tier-2).”

“We already know and understand that they (down-tier suppliers) do not like to share all the information about cost structure. I guess the cost information shared upon our request is 1 to 2 years old or rough numbers only. We cannot simply switch to other alternatives because it raises issues of uncertainty in terms of quality, communication, searching cost, etc. Based on my experience, a quick check for whether their profit margins are reasonable is to meet multiple low-level employees and ask them how their boss is doing during casual conversation. If he recently bought a new car or traveled abroad, for instance, it tends to signify that there is room for additional cuts.”

“I admit that utilizing personal relationships is a key in coping with technological and environmental market uncertainties. At the same time, however, it does not seem reasonable to put too much weight on building and maintaining personal relationships with all the existing down-tier suppliers. Although our market environment changes rapidly, a meteoric rise rarely happens in this business. For instance, the current key technology “A” for component “B” was introduced by one of our few but long-time (more than 8 to 10 years) tier-1 suppliers who have accumulated enough experience and resources to search for the next big thing. We have maintained a short list of the strongest candidates instead of completely predicting what changes will occur. This rule has been worked well so far.”

4.2. Model 2: Strategic Intent and IDC

“Yes, we try to achieve economies of scale in purchasing to reduce costs. We further encourage our immediate (tier-1) suppliers to keep searching for down-tier suppliers who can provide lower cost for them because that also matters to us. As a result, there must be a relatively small number of firms which draw in more transactions than others. Why don’t we simply replace them with Chinese suppliers who can possibly offer lower deals? Considering issues such as quality, security, communication, wage, etc., they can increase total costs while reducing manufacturing costs.”

“Well, I cannot agree with his argument at all. Who will provide the expected price under cost competition with other OEMs? It is the OEM. As they make a bulk purchase for economies of scale, small and medium-sized suppliers like us are heavily relying on them. By utilizing this bargaining power, they continuously press us to drop our markups by implying that they can always switch to Chinese alternatives. We also keep searching for cheaper sub-suppliers around the world, but below a certain price, often we must compromise or sacrifice the current quality level which will eventually backfire on us. As a result, we pay special attention to establishing a personal relationship to gain their trust. For example, we regularly hire the OEM’s retiring executives or managers to build and maintain close personal relationships with the OEM.”

“I admit that we have a pretty high level of autonomy, but they (OEMs) still have a position advantage in sensing and responding to market uncertainties such as consumer demand, price, and end-consumers’ tastes. Unfortunately, OEMs are reluctant to share that information with us because we are doing business with other OEMs including their suppliers, and thus the opportunities of information sharing through professional seminars, workshops, or training are lacking. We try to obtain such information via personal communication. Seeing your result that every network member has almost equal amount of incoming personal ties, it seems our downstream (tier-2 or tier-3) suppliers must be doing the same to our sourcing managers. Well, it is interesting to see everyone got on the same bandwagon.”

4.3. Model 3: Strategic Intent and ODC

“We emphasize the importance of persistent searching for possible supplier alternatives to achieve our price goal. Regular and frequent interactions such as business meetings, conference calls and other formats of online communication have been useful to ensure our suppliers (tier-1) invest enough efforts to progress.” He also added, “Meanwhile, overly close personal relationships with suppliers can put us in awkward situation when we have to lay off the ones that fall short of our expectations. We thus always try to keep personal distance.”

“Our customers (tier-1 suppliers) are closely working with their buyers (OEMs). Considering the technology level of sub-components, unfortunately, they have a relatively wider range of options for finding sub-suppliers like us—they can simply switch to one of our competitors. In order to avoid or at least delay this situation, we try to build and strengthen a close personal relationship with them, and sometimes hire their retiring executives with no manufacturing background for this. This also has been very effective in preventing the retirees with plenty of ‘friends’ in this business from starting their own company, which can be a threat to us.”

4.4. Model 4: Strategic Intent and GCC

“When we source a cost leadership-focused component, the rule of business is quite simple: the supplier who can offer a lower price with reasonable quality wins the deal. The cost part is easy, but it is hard to be sure whether the supplier can meet our expectations on quality. Thus, when discussing and developing contract terms with tier-1 suppliers, we mostly ask them to provide a list of current or potential lower-tier suppliers and to include terms and conditions outlining the quality requirements for sub-components.”

“These two are unexpected, but wholly make sense. Although we try to check sub-suppliers’ quality conformance, it is still officially the tier-1 supplier’s right and responsibility, and hence we cannot directly communicate with lower-tier suppliers on work matters which might lead to the hierarchical network structure of professional interactions. However, we still can indirectly do our part via extensive personal communications, while not directly asking about work-related issues. There are hundreds of possible ways to do this. We also can inquire into the reputation of our original contractor’s sub-supplier through another tier-1 supplier’s sub-supplier, while not violating the original contract.”

“Several governmental, quasi-governmental, or private organizations hold exhibitions and conferences to help the business entities in dealing with this fast changing market. We regularly participate in those events to socialize. Although participants do not explicitly share sensitive work-related information, those events have been regarded as “must go” events not to be isolated from other supply network members. Good personal relationships do not always bring in new business opportunities, but people may be hesitant to work with a total stranger.”

5. Further Investigation

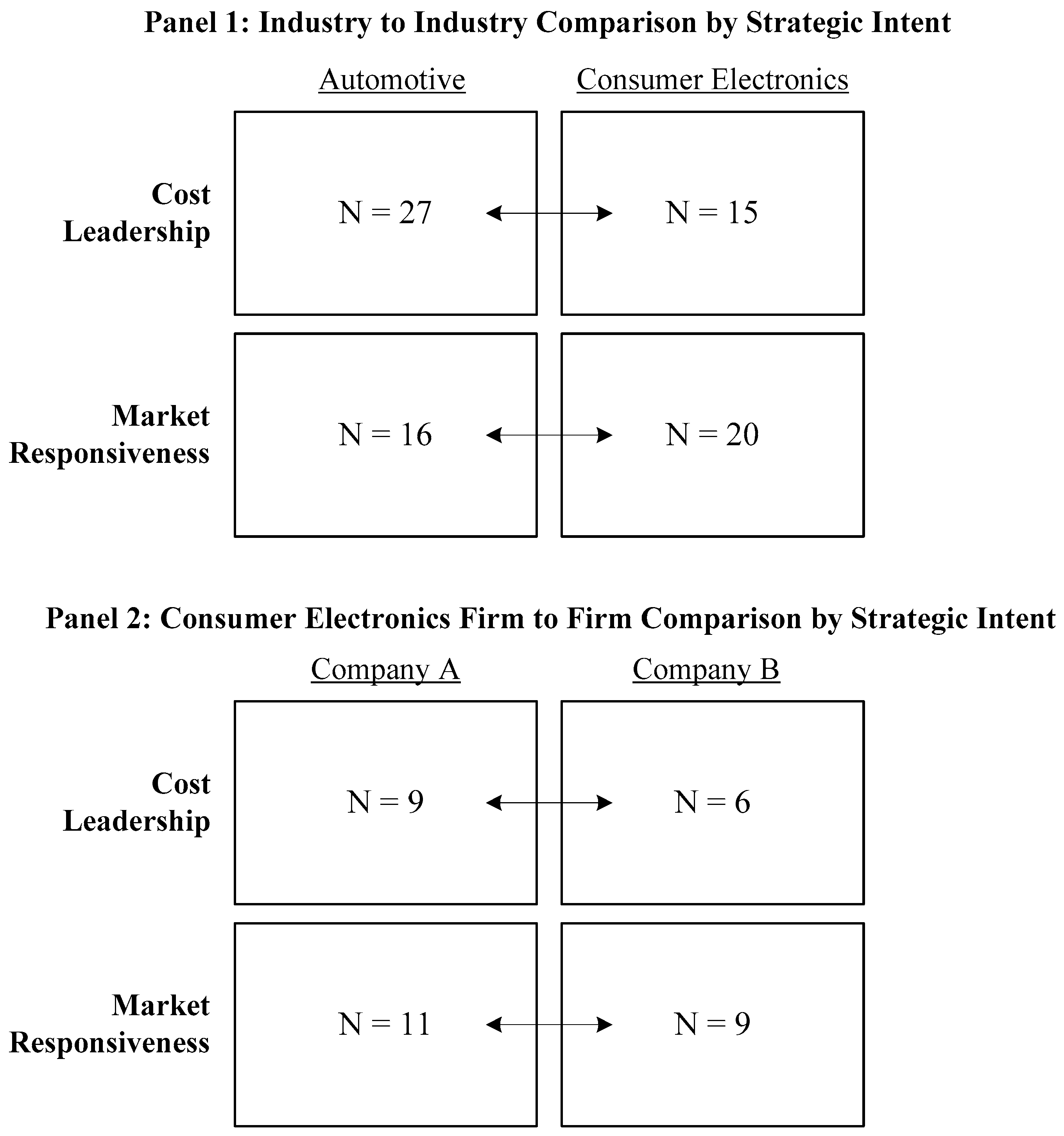

5.1. Industry to Industry Comparison

“I agree with his view—the supplier base makes a big difference. Let me tell you the reason. Of course, we also try to find a supplier which offers the lowest price when we source cost leadership-focused components. One big difference here is the unit price difference between consumer electronics and automobiles; in other words, this industry has more severe consequences for quality problems. This mostly restricts our supplier choice to a shortlist of potential suppliers who previously met our quality requirements or the ones with certain level of quality reputation. Another big difference, I believe, is our understanding of the supply market. We produced most of the components ourselves till about thirty years ago, and our industry change is relatively stable. We therefore do not need to control our suppliers as tightly as consumer electronics OEMs do; rather, we try to develop strong personal ties among supply network members. I personally think Toyota has proven that this approach is quite effective for securing cost leadership while maintaining quality.”

5.2. Firm to Firm Comparison

“Compared to Company B, we are well known for our product localization which provides various product variants in style and features. We have been doing this by slightly modifying the basic product platform. This approach has been quite successful in the fast-growing markets of developing countries where there are few domestic alternatives for us but consumers are sensitive to price at the same time. Consumers in those countries expect to get more than they pay for and, thus, are very demanding on our product quality. When we source cost leadership-focused components used for the basic product platform, we must devise complete contracts to prevent potential opportunistic behaviors of suppliers (which may lead to our higher contractual IDC). Further, to make sure they abide by those contract terms, we are also supposed to be in control of work-related communications among our supply network members (and that may affect the higher professional BTC). Our market responsiveness-focused components are used for localization purposes. As we have a better understanding of the local markets, in this case, we should keep informing our suppliers of potential local market changes to get them prepared to accommodate those changes (which may impact on the high professional ODC value).”

“Being different from Company A, we mostly launch ‘global products’ using leading-edge technology, and thus rarely localize our products. As a result, we have had a great success in North America and European continent which are the major battlefields of the global consumer electronics industry. We should gain and protect our technological leadership to keep surviving in those competitive markets because our consumers are ready to pay more for a superior product compared to the ones at emerging markets. I believe all these circumstances may contribute to make the network architectural differences between us and Company A. Even when we source cost leadership-focused components, we focus more on quality-for-money rather than lowest cost per se. Therefore, we maintain extensive control via more complete contracts specifying the required quality level over our non-immediate sub-suppliers as well as tier-1 suppliers. This may be leading to our higher contractual GCC. The components focusing on market responsiveness are the key components with short lifecycles for our final products. When we source those components, it’s best to quickly transfer the technologies we developed to our tier-1 suppliers before they get outdated while preventing any potential leakage or spillover of them. This inevitably creates more technical interventions and surveillance activities on tier-1 suppliers, which may be leading to our high professional ODC.”

6. Discussion

6.1. Contributions

6.2. Limitations and Future Directions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Wellman, B. Structural analysis: From method and metaphor to theory and substance. In Contemporary Studies in Sociology; Wellman, B., Berkowitz, S.D., Eds.; Cambridge University Press: New York, NY, USA, 1988; Volume 15, pp. 19–61. [Google Scholar]

- Fjeldstad, Ø.D.; Snow, C.C.; Miles, R.E.; Lettl, C. The architecture of collaboration. Strateg. Manag. J. 2012, 33, 734–750. [Google Scholar] [CrossRef]

- Hoffmann, W.H. Strategies for managing a portfolio of alliances. Strateg. Manag. J. 2007, 28, 827–856. [Google Scholar] [CrossRef]

- Wassmer, U. Alliance portfolios: A review and research agenda. J. Manag. 2010, 36, 141–171. [Google Scholar] [CrossRef]

- Wang, C.-N.; Huang, Y.-F.; Cheng, I.-F.; Nguyen, V.T. A multi-criteria decision-making (mcdm) approach using hybrid scor metrics, ahp, and topsis for supplier evaluation and selection in the gas and oil industry. Processes 2018, 6, 252. [Google Scholar] [CrossRef]

- Brass, D.J. Social Networks in Organizations: Antecedents and Consequences; University of Kentucky: Lexington, KY, USA, 2002; unpublished manuscript. [Google Scholar]

- Gulati, R.; Nohria, N.; Zaheer, A. Strategic networks. Strateg. Manag. J. 2000, 21, 203–215. [Google Scholar] [CrossRef]

- Doreian, P. Event sequences as generators of social network evolution. Soc. Netw. 2002, 24, 93–119. [Google Scholar] [CrossRef]

- Lee, H.L. Aligning supply chain strategies with product uncertainties. Calif. Manag. Rev. 2002, 44, 105–119. [Google Scholar] [CrossRef]

- Choi, T.Y.; Krause, D.R. The supply base and its complexity: Implications for transaction costs, risks, responsiveness, and innovation. J. Oper. Manag. 2006, 24, 637–652. [Google Scholar] [CrossRef]

- Fisher, M.L. What is the right supply chain for your product? Harv. Bus. Rev. 1997, 75, 105–116. [Google Scholar]

- Tienda, M.; Rajman, R. Ethnic ties and entrepreneurship: Comments on black ties only. In Networks and Markets; Rauch, J.E., Casella, A., Eds.; Russell Sage Foundation: New York, NY, USA, 2001; pp. 310–327. [Google Scholar]

- Mowery, D.C.; Oxley, J.E.; Silverman, B.S. Strategic alliances and interfirm knowledge transfer. Strateg. Manag. J. 1996, 17, 77–91. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B.-S. Managing risks in strategic alliances. Acad. Manag. Exec. 1999, 13, 50–62. [Google Scholar] [CrossRef]

- Zahra, S.A.; Ireland, R.D.; Hitt, M.A. International expansion by new venture firms: International diversity, mode of market entry, technological learning, and performance. Acad. Manag. J. 2000, 43, 925–950. [Google Scholar]

- Lin, N.; Ensel, W.M.; Vaughn, J.C. Social resources and strength of ties: Structural factors in occupational status attainment. Am. Sociol. Rev. 1981, 46, 393–405. [Google Scholar] [CrossRef]

- Coleman, J.S. Social capital in the creation of human capital. Am. J. Sociol. 1988, 94, S95–S120. [Google Scholar] [CrossRef]

- Bourdieu, P. The forms of capital. In Handbook of Theory and Research for the Sociology of Education; Richardson, J.G., Ed.; Greenwood Press: New York, NY, USA, 1985; pp. 241–258. [Google Scholar]

- Hamel, G.; Prahalad, C.K. Strategic intent. Harv. Bus. Rev. 1989, 67, 63–76. [Google Scholar]

- Hamel, G.; Prahalad, C.K. Competing for the Future: Breakthrough Strategies for Seizing Control of Your Industry and Creating the Markets of Tomorrow; Harvard Business School Press: Boston, MA, USA, 1994. [Google Scholar]

- Hart, S.L. An integrative framework for strategy-making processes. Acad. Manag. Rev. 1992, 17, 327–351. [Google Scholar] [CrossRef]

- Koza, M.P.; Lewin, A.Y. The co-evolution of strategic alliances. Organ. Sci. 1998, 9, 255–264. [Google Scholar] [CrossRef]

- DiRomualdo, A.; Gurbaxani, V. Strategic intent for it outsourcing. MIT Sloan Manag. Rev. 1998, 39, 67–80. [Google Scholar]

- Ryall, M.D. The new dynamics of competition. Harv. Bus. Rev. 2013, 91, 80–87. [Google Scholar]

- Zaheer, A.; Bell, G.G. Benefiting from network position: Firm capabilities, structural holes, and performance. Strateg. Manag. J. 2005, 26, 809–825. [Google Scholar] [CrossRef]

- Adler, P.S.; Kwon, S.-W. Social capital: Prospects for a new concept. Acad. Manag. Rev. 2002, 27, 17–40. [Google Scholar] [CrossRef]

- Soda, G.; Zaheer, A. A network perspective on organizational architecture: Performance effects of the interplay of formal and informal organization. Strateg. Manag. J. 2012, 33, 751–771. [Google Scholar] [CrossRef]

- Ahuja, G. Collaboration networks, structural holes, and innovation: A longitudinal study. Adm. Sci. Q. 2000, 45, 425–455. [Google Scholar] [CrossRef]

- Verbrugge, L.M. Multiplexity in adult friendships. Soc. Forces 1979, 57, 1286–1309. [Google Scholar] [CrossRef]

- Feld, S.L. The focused organization of social ties. Am. J. Sociol. 1981, 86, 1015–1035. [Google Scholar] [CrossRef]

- Burt, R.S. Models of network structure. Annu. Rev. Sociol. 1980, 6, 79–141. [Google Scholar] [CrossRef]

- Ibarra, H. Homophily and differential returns: Sex differences in network structure and access in an advertising firm. Adm. Sci. Q. 1992, 37, 422–447. [Google Scholar] [CrossRef]

- Choi, T.Y.; Hong, Y. Unveiling the structure of supply networks: Case studies in honda, acura, and daimlerchrysler. J. Oper. Manag. 2002, 20, 469–493. [Google Scholar] [CrossRef]

- Kim, Y.; Choi, T.Y.; Yan, T.; Dooley, K. Structural investigation of supply networks: A social network analysis approach. J. Oper. Manag. 2011, 29, 194–211. [Google Scholar] [CrossRef]

- Dyer, J.H.; Singh, H. The relational view: Cooperative strategy and sources of interorganizational competitive advantage. Acad. Manag. Rev. 1998, 23, 660–679. [Google Scholar] [CrossRef]

- Cannon, J.; Achrol, R.; Gundlach, G. Contracts, norms, and plural form governance. J. Acad. Mark. Sci. 2000, 28, 180–194. [Google Scholar] [CrossRef]

- Williamson, O.E. The Economic Institutions of Capitalism; Free Press: New York, NY, USA, 1985. [Google Scholar]

- Ghoshal, S.; Moran, P. Bad for practice: A critique of the transaction cost theory. Acad. Manag. Rev. 1996, 21, 13–47. [Google Scholar] [CrossRef]

- Woolthuis, R.K.; Hillebrand, B.; Nooteboom, B. Trust, contract and relationship development. Organ. Stud. 2005, 26, 813–840. [Google Scholar] [CrossRef]

- Poppo, L.; Zenger, T. Do formal contracts and relational governance function as substitutes or complements? Strateg. Manag. J. 2002, 23, 707–725. [Google Scholar] [CrossRef]

- Williamson, O.E. Calculativeness, trust, and economic organization. J. Law Econ. 1993, 36, 453–486. [Google Scholar] [CrossRef]

- Lazzarini, S.G.; Miller, G.J.; Zenger, T.R. Order with some law: Complementarity versus substitution of formal and informal arrangements. J. Laweconomicsand Organ. 2004, 20, 261–298. [Google Scholar] [CrossRef]

- Gulati, R. Managing Network Resources: Alliances, Affiliations and Other Relational Assets; Oxford University Press: Oxford, UK, 2007. [Google Scholar]

- Brass, D.J.; Krackhardt, D. The social capital of twenty-first century leaders. In Out-of-the-Box Leadership: Transforming the Twenty-First-Century Army and Other Top-Performing Organizations; Hunt, J.G., Dodge, G.E., Wong, L., Eds.; JAI Press: Stamford, CT, USA, 1999; pp. 179–194. [Google Scholar]

- Kleinbaum, A.M.; Stuart, T.E. Inside the black box of the corporate staff: Social networks and the implementation of corporate strategy. Strateg. Manag. J. 2014, 35, 24–47. [Google Scholar] [CrossRef]

- Grayson, K. Friendship versus business in marketing relationships. J. Mark. 2007, 71, 121–139. [Google Scholar] [CrossRef]

- Lewicki, R.J.; Wiethoff, C. Trust, trust development, and trust repair. In The Handbook of Conflict Resolution: Theory and Practice; Deutsch, M., Coleman, P.T., Eds.; Jossey-Bas Publishers: San Francisco, CA, USA, 2000; pp. 86–107. [Google Scholar]

- Zaheer, A.; McEvily, B.; Perrone, V. Does trust matter? Exploring the effects of interorganizational and interpersonal trust on performance. Organ. Sci. 1998, 9, 141–159. [Google Scholar] [CrossRef]

- Ireland, R.D.; Webb, J.W. A multi-theoretic perspective on trust and power in strategic supply chains. J. Oper. Manag. 2007, 25, 482–497. [Google Scholar] [CrossRef]

- Stanley, L.L.; Wisner, J.D. Service quality along the supply chain: Implications for purchasing. J. Oper. Manag. 2001, 19, 287–306. [Google Scholar] [CrossRef]

- Lindgreen, A.; Vanhamme, J.; van Raaij, E.M.; Johnston, W.J. Go configure: The mix of purchasing practices to choose for your supply base. Calif. Manag. Rev. 2013, 55, 72–96. [Google Scholar] [CrossRef]

- Borgatti, S.; Mehra, A.; Brass, D.J.; Labianca, G. Network analysis in the social sciences. Science 2009, 323, 892–895. [Google Scholar] [CrossRef] [PubMed]

- Borgatti, S.P.; Li, X. On social network analysis in a supply chain context. J. Supply Chain Manag. 2009, 45, 5–22. [Google Scholar] [CrossRef]

- Carter, C.R.; Ellram, L.M.; Tate, W. The use of social network analysis in logistics research. J. Bus. Logist. 2007, 28, 137–168. [Google Scholar] [CrossRef]

- Galaskiewicz, J. Studying supply chains from a social network perspective. J. Supply Chain Manag. 2011, 47, 4–8. [Google Scholar] [CrossRef]

- Batallas, D.A.; Yassine, A.A. Information leaders in product development organizational networks: Social network analysis of the design structure matrix. IEEE Trans. Eng. Manag. 2006, 53, 570–582. [Google Scholar] [CrossRef]

- Schilling, M.A.; Phelps, C.C. Interfirm collaboration networks: The impact of large-scale network structure on firm innovation. Manag. Sci. 2007, 53, 1113–1126. [Google Scholar] [CrossRef]

- Wasserman, S.; Faust, K. Social Network Analysis: Methods and Applications; Cambridge University Press: New York, NY, USA, 1994. [Google Scholar]

- Freeman, L.C. The Development of Social Network Analysis: A Study in the Sociology of Science; Empirical Press: Vancouver, BC, Canada, 2004. [Google Scholar]

- Krackhardt, D. The strength of strong ties: The importance of philos in organizations. In Networks and Organizations: Structure, Form, and Action; Nohria, N., Eccles, R.G., Eds.; Harvard Business School Press: Boston, MA, USA, 1992. [Google Scholar]

- Uzzi, B. Social structure and competition in interfirm networks: The paradox of embeddedness. Adm. Sci. Q. 1997, 42, 35–67. [Google Scholar] [CrossRef]

- Scott, J. Social Network Analysis: A Handbook, 2nd ed.; SAGE Publications Ltd.: London, UK, 2000. [Google Scholar]

- Marsden, P.V. Egocentric and sociocentric measures of network centrality. Soc. Netw. 2002, 24, 407–422. [Google Scholar] [CrossRef]

- Freeman, L.C. Centrality in social networks conceptual clarification. Soc. Netw. 1979, 1, 215–239. [Google Scholar] [CrossRef]

- Opsahl, T.; Agneessens, F.; Skvoretz, J. Node centrality in weighted networks: Generalizing degree and shortest paths. Soc. Netw. 2010, 32, 245–251. [Google Scholar] [CrossRef]

- Schank, T.; Wagner, D. Approximating clustering coefficient and transitivity. J. Graph Algorithms Appl. 2005, 9, 265–275. [Google Scholar] [CrossRef]

- Newman, M.E.J. The structure and function of complex networks. Siam Rev. 2003, 45, 167–256. [Google Scholar] [CrossRef]

- Opsahl, T.; Panzarasa, P. Clustering in weighted networks. Soc. Netw. 2009, 31, 155–163. [Google Scholar] [CrossRef]

- Pfeffer, J.; Salancik, G.R. The External Control of Organizations: A Resource Dependence Perspective; Harper & Row: New York, NY, USA, 1978. [Google Scholar]

- Lacity, M.C.; Willcocks, L.P. An empirical investigation of information technology sourcing practices: Lessons from experience. Mis Q. 1998, 22, 363–408. [Google Scholar] [CrossRef]

- Ghosh, M.; John, G. Strategic fit in industrial alliances: An empirical test of governance value analysis. J. Mark. Res. 2005, 42, 346–357. [Google Scholar] [CrossRef]

- Wathne, K.H.; Heide, J.B. Relationship governance in a supply chain network. J. Mark. 2004, 68, 73–89. [Google Scholar] [CrossRef]

- Shrader, R.C. Collaboration and performance in foreign markets: The case of young high-technology manufacturing firms. Acad. Manag. J. 2001, 44, 45–60. [Google Scholar]

- Ahuja, G. The duality of collaboration: Inducements and opportunities in the formation of interfirm linkages. Strateg. Manag. J. 2000, 21, 317–343. [Google Scholar] [CrossRef]

- Das, T.K.; Teng, B.-S. A resource-based theory of strategic alliances. J. Manag. 2000, 26, 31–61. [Google Scholar] [CrossRef]

- Lutz, N.A. Ownership rights and incentives in franchising. J. Corp. Financ. 1995, 2, 103–131. [Google Scholar] [CrossRef]

- Salamon, L.M. Partners in Public Service: The Scope and Theory of Government-Nonprofit Relations; Yale University Press: New Haven, CT, USA, 1987. [Google Scholar]

- Bassok, Y.; Anupindi, R. Analysis of supply contracts with total minimum commitment. IIE Trans. 1997, 29, 373–381. [Google Scholar] [CrossRef]

- Lawrence, T.B. Institutional strategy. J. Manag. 1999, 25, 161–187. [Google Scholar]

- Larsson, R.; Bengtsson, L.; Henriksson, K.; Sparks, J. The interorganizational learning dilemma: Collective knowledge development in strategic alliances. Organ. Sci. 1998, 9, 285–305. [Google Scholar] [CrossRef]

- Oliver, C. Strategic responses to institutional processes. Acad. Manag. Rev. 1991, 16, 145–179. [Google Scholar] [CrossRef]

- McEvily, S.K.; Das, S.; McCabe, K. Avoiding competence substitution through knowledge sharing. Acad. Manag. Rev. 2000, 25, 294–311. [Google Scholar] [CrossRef]

- Celly, K.S.; Spekman, R.E.; Kamauff, J.W. Technological uncertainty, buyer preferences and supplier assurances: An examination of pacific rim purchasing arrangements. J. Int. Bus. Stud. 1999, 30, 297–316. [Google Scholar] [CrossRef]

- Porter, M.E. The Competitive Advantage of Nations; Free Press: New York, NY, USA, 1990. [Google Scholar]

- Morgan, R.M.; Hunt, S. Relationship-based competitive advantage: The role of relationship marketing in marketing strategy. J. Bus. Res. 1999, 46, 281–290. [Google Scholar] [CrossRef]

- Cusumano, M.A. The Japanese Automobile Industry: Technology and Management at Nissan and Toyota; Council on East Asian Studies, Harvard University: Cambridge, MA, USA, 1985. [Google Scholar]

- Dyer, J.H. Specialized supplier networks as a source of competitive advantage: Evidence from the auto industry. Strateg. Manag. J. 1996, 17, 271–291. [Google Scholar] [CrossRef]

- Huang, S.H.; Uppal, M.; Shi, J. A product driven approach to manufacturing supply chain selection. Supply Chain Manag. Int. J. 2002, 7, 189–199. [Google Scholar] [CrossRef]

- Vonderembse, M.A.; Uppal, M.; Huang, S.H.; Dismukes, J.P. Designing supply chains: Towards theory development. Int. J. Prod. Econ. 2006, 100, 223–238. [Google Scholar] [CrossRef]

- Huang, G.Q.; Zhang, X.Y.; Liang, L. Towards integrated optimal configuration of platform products, manufacturing processes, and supply chains. J. Oper. Manag. 2005, 23, 267–290. [Google Scholar] [CrossRef]

- Luke, D.A.; Harris, J.K. Network analysis in public health: History, methods, and applications. Annu. Rev. Public Health 2007, 28, 69–93. [Google Scholar] [CrossRef] [PubMed]

- Cross, R.L.; Parker, A. The Hidden Power of Social Networks: Understanding How Work Really Gets Done in Organizations; Harvard Business School Press: Boston, MA, USA, 2004. [Google Scholar]

- Choi, T.Y.; Dooley, K.J.; Rungtusanatham, M. Supply networks and complex adaptive systems: Control versus emergence. J. Oper. Manag. 2001, 19, 351–366. [Google Scholar] [CrossRef]

- Kumar, N.; Stern, L.W.; Anderson, J.C. Conducting interorganizational research using key informants. Acad. Manag. J. 1993, 36, 1633–1651. [Google Scholar]

- Doreian, P.; Woodard, K.L. Fixed list versus snowball selection of social networks. Soc. Sci. Res. 1992, 21, 216–233. [Google Scholar] [CrossRef]

- Stevenson, W.B.; Greenberg, D. Agency and social networks: Strategies of action in a social structure of position, opposition, and opportunity. Adm. Sci. Q. 2000, 45, 651–678. [Google Scholar] [CrossRef]

- Gunasekaran, A.; Patel, C.; McGaughey, R.E. A framework for supply chain performance measurement. Int. J. Prod. Econ. 2004, 87, 333–347. [Google Scholar] [CrossRef]

- Li, S.; Rao, S.S.; Ragu-Nathan, T.S.; Ragu-Nathan, B. Development and validation of a measurement instrument for studying supply chain management practices. J. Oper. Manag. 2005, 23, 618–641. [Google Scholar] [CrossRef]

- Frohlich, M.T.; Westbrook, R. Arcs of integration: An international study of supply chain strategies. J. Oper. Manag. 2001, 19, 185–200. [Google Scholar] [CrossRef]

- Dillon, W.R.; Goldstein, M. Multivariate Analysis: Methods and Applications; John Wiley & Sons: New York, NY, USA, 1984. [Google Scholar]

- Lamming, R.C.; Johnsen, T.E.; Zheng, J.; Harland, C.M. An initial classification of supply networks. Int. J. Oper. Prod. Manag. 2000, 20, 675–691. [Google Scholar] [CrossRef]

- Fine, C.H. Clockspeed: Winning Industry Control in the Age of Temporary Advantage; Perseus Books Group: Reading, MA, USA, 1998. [Google Scholar]

- McCardle, K.F.; Rajaram, K.; Tang, C.S. Bundling retail products: Models and analysis. Eur. J. Oper. Res. 2007, 177, 1197–1217. [Google Scholar] [CrossRef]

- Mena, C.; Humphries, A.; Choi, T.Y. Toward a theory of multi-tier supply chain management. J. Supply Chain Manag. 2013, 49, 58–77. [Google Scholar] [CrossRef]

- Mehra, A.; Kilduff, M.; Brass, D.J. The social networks of high and low self-monitors: Implications for workplace performance. Adm. Sci. Q. 2001, 46, 121–146. [Google Scholar] [CrossRef]

- Marsden, P.V. Recent developments in network measurement. In Models and Methods in Social Network Analysis; Carrington, P.J., Scott, J., Wasserman, S., Eds.; Cambridge University Press: New York, NY, USA, 2005; pp. 8–30. [Google Scholar]

- Borgatti, S.P.; Halgin, D.S. On network theory. Organ. Sci. 2011, 22, 1168–1181. [Google Scholar] [CrossRef]

- Ketchen, D.J.; Hult, G.T.M. Bridging organization theory and supply chain management: The case of best value supply chains. J. Oper. Manag. 2007, 25, 573–580. [Google Scholar] [CrossRef]

| Tie Type | Conceptual Definition | Measurement Items |

|---|---|---|

| Contractual [41,42] | The extent to which a supply network entity perceives that it has a ‘complete’ formal written contract with its immediate counterpart | We have a formal written contract(s) detailing the operational requirements. We have a formal written contract(s) that detail(s) how performance will be monitored. We have a formal written contract(s) detailing warranty policies. We have a formal written contract(s) detailing how to handle complaints and disputes (e.g., penalties for contract violations). We have a formal written contract(s) detailing the level of service expected from this supplier. |

| Transactional [41,43] | The amount of ‘monetary’ exchange (in percentage points) between a supply network entity and its immediate counterpart(s) | For original equipment manufacturers (OEMs) (i.e., tier-0 firms): A percentage of total spending for each tier-1 supplier of the selected component. For tier-(N) (i.e., intermediate) suppliers where N = 1 or 2: Percentages of total sales derived from the tier-(N − 1) buyer AND total spending for each tier-(N + 1) supplier in dealing with the OEM’s selected component. For tier-3 (i.e., end-tier) suppliers: A percentage of total sales derived from tier-2 suppliers in dealing with the OEM’s selected component. |

| Professional [7,41,42] | A supply network entity’s perceptions of the strength of the interactions with its immediate counterpart in performing ‘work responsibilities’ | We regularly communicate (via face-to-face interaction, conference calls, e-mails, etc.) on work matters. We widely share and welcome each other’s ideas or initiatives via open communication (e.g., joint workshops, etc.). Communication between us occurs at different levels of management and cross-functional areas. I (or our executives) receive periodic feedback (via face-to-face, conference calls, e-mail, etc.) on progress, problems, and plans from this supplier’s counterparts. I (or our executives) do periodic on-site visits to this supplier’s plants. |

| Personal [44,45] | A supply network entity’s perceived strength of the interactions ‘not directly related to work’ with its immediate counterpart | We always invite each other to participate in various activities to socialize. We do personal favors for each other. We voluntarily exchange something of a personal nature to each other on appropriate occasions (e.g., birthday cards, congratulations, condolences, etc.). We often communicate (via face-to-face, phone calls, e-mails, social network services, etc.) during non-working time. We often communicate (via face-to-face, phone calls, e-mails, social network services, etc.) outside work places. |

| Socio-Centric SNA Index | Conceptual Definition | Tie Type | Implications for Directed Valued Supply Network |

|---|---|---|---|

| Betweenness centralization (BTC) | The extent to which particular network actors serve as hubs relative to the rest of the network | Contractual | The extent to which there exist particular focal firms that have more or less complete (or specific) contract terms than other supply network members.

|

| Transactional | The extent to which there exist particular focal firms that have a higher or lower percentage of monetary exchanges than other supply network members (i.e. distribution of sales and spending in the network).

| ||

| Professional | The extent to which there exist particular focal firms that have more or less work-related interactions than other supply network members.

| ||

| Personal | The extent to which there exist particular focal firms that have more or less non-work-related interactions than other supply network members.

| ||

| In-degree centralization (IDC) | The extent to which network resources are converged on particular network actors | Contractual | The extent to which particular focal firms obtain more complete (i.e. less favorable) contract terms from the other supply network members.

|

| Transactional | The extent to which particular focal firms take up a greater percentage of the monetary exchanges occurring inside the supply network than others.

| ||

| Professional | The extent to which particular focal firms obtain more incoming work-related interactions from the rest of the supply network members.

| ||

| Personal | The extent to which particular focal firms obtain more incoming non-work-related interactions from the rest of the supply network members.

| ||

| Out-degree centralization (ODC) | The extent to which particular actors disseminate network resources to others | Contractual | The extent to which particular focal firms provide more complete (i.e. less favorable) contract terms for the rest of the supply network members.

|

| Transactional | The extent to which particular focal firms generate higher percentages of the monetary exchanges occurring inside the supply network than others.

| ||

| Professional | The extent to which particular focal firms have more outgoing work-related interactions to the rest of the supply network members

| ||

| Personal | The extent to which particular focal firms generate more outgoing non-work-related interactions for the rest of the supply network members

| ||

| Global clustering coefficient (GCC) | The extent to which the network as a whole is cliquish (or tightly knit) (i.e. the degree to which all the network actors tend to cluster together) | Contractual | The extent to which members of the entire supply network are directly connected by contract relations

|

| Transactional | The extent to which the members of the entire supply network are directly connected by monetary exchanges

| ||

| Professional | The extent to which all the supply network members freely communicate work-related subjects across firm boundaries

| ||

| Personal | The extent to which all the supply network members freely communicate non-work-related subjects across firm boundaries

|

| Index | Tie | Mean | Stdev | Min | Max | F-Value a | Dunnett T3 |

|---|---|---|---|---|---|---|---|

| BTC | Contractual (C) | 0.5786 | 0.0167 | 0.5505 | 0.6086 | 759.735 ** | C > Pr, Pe > T |

| Transactional (T) | 0.3905 | 0.0222 | 0.3501 | 0.4300 | |||

| Professional (Pr) | 0.4840 | 0.0438 | 0.4102 | 0.5599 | |||

| Personal (Pe) | 0.4922 | 0.0455 | 0.4123 | 0.5698 | |||

| IDC | Contractual (C) | 0.3846 | 0.0200 | 0.3512 | 0.4185 | 355.188 ** | Pe > C > Pr > T |

| Transactional (T) | 0.3246 | 0.0191 | 0.2901 | 0.3599 | |||

| Professional (Pr) | 0.3424 | 0.0289 | 0.2907 | 0.3894 | |||

| Personal (Pe) | 0.4029 | 0.0259 | 0.3628 | 0.4498 | |||

| ODC | Contractual (C) | 0.4895 | 0.0226 | 0.4504 | 0.5299 | 1215.549 ** | C > Pr > Pe > T |

| Transactional (T) | 0.2883 | 0.0468 | 0.2115 | 0.3698 | |||

| Professional (Pr) | 0.4041 | 0.0150 | 0.3802 | 0.4299 | |||

| Personal (Pe) | 0.3404 | 0.0294 | 0.2912 | 0.3898 | |||

| GCC | Contractual (C) | 0.1344 | 0.0212 | 0.1003 | 0.1699 | 45,029.104 ** | Pe > Pr > C > T |

| Transactional (T) | 0.0749 | 0.0146 | 0.0503 | 0.0999 | |||

| Professional (Pr) | 0.1709 | 0.0121 | 0.1502 | 0.1895 | |||

| Personal (Pe) | 0.7976 | 0.0273 | 0.7504 | 0.8497 |

| Tie Type | SNA Index a | (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) | (k) | (l) | (m) | (n) | (o) | (p) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Contractual | (a) | 1.000 | |||||||||||||||

| (b) | 0.763 ** | 1.000 | |||||||||||||||

| (c) | 0.029 | 0.007 | 1.000 | ||||||||||||||

| (d) | 0.065 | 0.026 | −0.201 | 1.000 | |||||||||||||

| Transactional | (e) | −0.127 | −0.135 | 0.010 | −0.130 | 1.000 | |||||||||||

| (f) | 0.759 ** | 0.732 ** | 0.040 | 0.026 | −0.100 * | 1.000 | |||||||||||

| (g) | 0.011 | 0.045 | −0.080 | 0.026 | 0.056 | 0.023 | 1.000 | ||||||||||

| (h) | 0.063 | 0.138 | 0.127 | −0.104 | 0.098 | 0.061 | −0.068 | 1.000 | |||||||||

| Professional | (i) | 0.063 | −0.037 | −0.068 | −0.069 | 0.061 | 0.042 | 0.045 | −0.178 | 1.000 | |||||||

| (j) | 0.177 | 0.139 | 0.036 | −0.051 | −0.056 | 0.143 * | −0.076 | −0.137 | 0.163 | 1.000 | |||||||

| (k) | 0.781 ** | 0.720 ** | 0.043 | 0.016 | −0.050 * | 0.776 ** | 0.143 | 0.001 | 0.029 | 0.116 | 1.000 | ||||||

| (l) | −0.765 ** | −0.716 ** | 0.057 | 0.043 | 0.129 | −0.771 ** | 0.022 | −0.091 | 0.003 | −0.182 | −0.751 ** | 1.000 | |||||

| Personal | (m) | −0.759 ** | −0.713 ** | −0.038 | −0.092 | 0.088 | −0.717 ** | −0.034 | −0.079 | 0.013 | −0.123 | −0.718 ** | 0.683 ** | 1.000 | |||

| (n) | 0.743 ** | 0.764 ** | 0.012 | 0.041 | −0.100 * | 0.737 ** | 0.059 | 0.024 | 0.007 | 0.073 | 0.776 ** | −0.730 ** | −0.750 ** | 1.000 | |||

| (o) | −0.744 ** | −0.736 ** | −0.078 | 0.039 | 0.114 * | −0.744 ** | −0.053 | −0.080 | 0.071 | −0.122 | −0.749 ** | 0.724 ** | 0.671 ** | −0.762 ** | 1.000 | ||

| (p) | 0.733 ** | 0.713 ** | −0.024 | 0.045 | −0.173 * | 0.763 ** | 0.127 | 0.067 | −0.005 | 0.144 | 0.734 ** | −0.726 ** | −0.717 ** | 0.781 ** | −0.712 ** | 1.000 |

| Inter-Index Relationship Set a | p-Value (WSR Test) b | p-Value (Sign Test) b | Direction (/) | R-Square (R2) c | Inter-Index Relationship Set | p-Value (WSR Test) | p-Value (Sign Test) | Direction (/) | R-Square (R2) |

|---|---|---|---|---|---|---|---|---|---|

| Set 1: (b)–(a) | 0.000 ** | 0.000 ** | 0.621 † | Set 22: (n)–(e) | 0.000 ** | 0.015 | 0.026 | ||

| Set 2: (f)–(a) | 0.000 ** | 0.000 ** | 0.558 † | Set 23: (n)–(f) | 0.000 ** | 0.000 ** | 0.579 † | ||

| Set 3: (f)–(b) | 0.000 ** | 0.000 ** | 0.511 † | Set 24: (n)–(k) | 0.260 | 0.518 | 0.645 † | ||

| Set 4: (f)–(e) | 0.000 ** | 0.000 ** | 0.029 | Set 25: (n)–(l) | 0.000 ** | 0.000 ** | 0.646 † | ||

| Set 5: (j)–(d) | 0.000 ** | 0.000 ** | 0.033 | Set 26: (n)–(m) | 0.000 ** | 0.000 ** | 0.581 † | ||

| Set 6: (j)–(f) | 0.000 ** | 0.000 ** | 0.030 | Set 27: (o)–(a) | 0.000 ** | 0.000 ** | 0.529 † | ||

| Set 7: (k)–(a) | 0.000 ** | 0.000 ** | 0.565 † | Set 28: (o)–(b) | 0.000 ** | 0.000 ** | 0.569 † | ||

| Set 8: (k)–(b) | 0.000 ** | 0.000 ** | 0.567 † | Set 29: (o)–(f) | 0.000 ** | 0.332 | 0.544 † | ||

| Set 9: (k)–(e) | 0.000 ** | 0.000 ** | 0.026 | Set 30: (o)–(k) | 0.000 ** | 0.000 ** | 0.594 † | ||

| Set 10: (k)–(f) | 0.000 ** | 0.000 ** | 0.617 † | Set 31: (o)–(l) | 0.000 ** | 0.000 ** | 0.638 † | ||

| Set 11: (l)–(a) | 0.000 ** | 0.000 ** | 0.622 † | Set 32: (o)–(m) | 0.000 ** | 0.000 ** | 0.553 † | ||

| Set 12: (l)–(b) | 0.000 ** | 0.000 ** | 0.563 † | Set 33: (o)–(n) | 0.000 ** | 0.000 ** | 0.549 † | ||

| Set 13: (l)–(f) | 0.000 ** | 0.000 ** | 0.530 † | Set 34: (p)–(a) | 0.000 ** | 0.000 ** | 0.510 † | ||

| Set 14: (l)–(k) | 0.000 ** | 0.000 ** | 0.584 † | Set 35: (p)–(b) | 0.000 ** | 0.000 ** | 0.567 † | ||

| Set 15: (m)–(a) | 0.000 ** | 0.000 ** | 0.550 † | Set 36: (p)–(e) | 0.000 ** | 0.000 ** | 0.040 | ||

| Set 16: (m)–(b) | 0.000 ** | 0.000 ** | 0.561 † | Set 37: (p)–(f) | 0.000 ** | 0.000 ** | 0.591 † | ||

| Set 17: (m)–(f) | 0.000 ** | 0.000 ** | 0.579 † | Set 38: (p)–(k) | 0.000 ** | 0.000 ** | 0.575 † | ||

| Set 18: (m)–(k) | 0.000 ** | 0.000 ** | 0.560 † | Set 39: (p)–(l) | 0.000 ** | 0.000 ** | 0.520 † | ||

| Set 19: (m)–(l) | 0.000 ** | 0.000 ** | 0.632 † | Set 40: (p)–(m) | 0.000 ** | 0.000 ** | 0.595 † | ||

| Set 20: (n)–(a) | 0.000 ** | 0.000 ** | 0.543 † | Set 41: (p)–(n) | 0.000 ** | 0.000 ** | 0.527 † | ||

| Set 21: (n)–(b) | 0.000 ** | 0.000 ** | 0.517 † | Set 42: (p)–(o) | 0.000 ** | 0.000 ** | 0.592 † |

| Variable | Mean | Stdev | Min | Max |

|---|---|---|---|---|

| (a) Contractual BTC | 0.5786 | 0.0167 | 0.5505 | 0.6086 |

| (b) Contractual IDC | 0.3846 | 0.0200 | 0.3512 | 0.4185 |

| (c) Contractual ODC | 0.4895 | 0.0226 | 0.4504 | 0.5299 |

| (d) Contractual GCC | 0.1344 | 0.0212 | 0.1003 | 0.1699 |

| (e) Transactional BTC | 0.3905 | 0.0222 | 0.3501 | 0.4300 |

| (f) Transactional IDC | 0.3246 | 0.0191 | 0.2901 | 0.3599 |

| (g) Transactional ODC | 0.2883 | 0.0468 | 0.2115 | 0.3698 |

| (h) Transactional GCC | 0.0749 | 0.0146 | 0.0503 | 0.0999 |

| (i) Professional BTC | 0.4840 | 0.0438 | 0.4102 | 0.5599 |

| (j) Professional IDC | 0.3424 | 0.0289 | 0.2907 | 0.3894 |

| (k) Professional ODC | 0.4041 | 0.0150 | 0.3802 | 0.4299 |

| (l) Professional GCC | 0.1709 | 0.0121 | 0.1502 | 0.1895 |

| (m) Personal BTC | 0.4922 | 0.0455 | 0.4123 | 0.5698 |

| (n) Personal IDC | 0.4029 | 0.0259 | 0.3628 | 0.4498 |

| (o) Personal ODC | 0.3404 | 0.0294 | 0.2912 | 0.3898 |

| (p) Personal GCC | 0.7976 | 0.0273 | 0.7504 | 0.8497 |

| (q) Component Type | 0.4183 | 0.4949 | 0 | 1 |

| Cost Leadership (Group 1) versus Mixed (Group 3) | Market Responsiveness (Group 2) versus Mixed | |||||

|---|---|---|---|---|---|---|

| Variables a | B b,c | SE c | RRR [95% CI] c | B b,c | SE c | RRR [95% CI] c |

| Model 1 (H1A and H1B) (LR χ2 (10) = 94.89; Probability > χ2 = 0.000) | ||||||

| (a) | 76.710 *** | 23.904 | 2.06 × 1033 [9.29 × 1012, 4.59 × 1053] | −21.634 | 20.100 | 4.02 × 10−10 [3.13 × 10−27, 5.18 × 107] |

| (e) | 21.530 * | 12.451 | 2.24 × 109 [0.0564938, 8.89 × 1019] | 0.703 | 9.692 | 2.019 [1.14 × 10−8, 3.59 × 108] |

| (i) | 0.446 | 6.103 | 1.562 [9.98 × 10−6, 244581.9] | −3.681 | 5.082 | 0.025 [1.19 × 10−6,533.6256] |

| (m) | −20.594 ** | 8.668 | 1.14 × 10−9 [4.77 × 10−17, 0.0271508] | 17.498 ** | 7.866 | 3.97 × 107 [8.006318, 1.97 × 1014] |

| Component | 1.006 * | 0.519 | 2.735 [0.9886056, 7.567924] | −0.108 | 0.451 | 0.898 [.3710203, 2.171726] |

| Intercept | −45.002 ** | 18.181 | 2.86 × 10−20 [9.56 × 10−36, 0.0000855] | 4.102 | 14.464 | 60.452 [2.95 × 10−11, 1.24 × 1014] |

| Model 2 (H2A and H2B) (LR χ2 (10) = 99.17; Probability > χ2 = 0.000) | ||||||

| (b) | 10.033 | 21.109 | 22761.83 [2.45 × 10−14, 2.11 × 1022] | −3.517 | 19.845 | 0.023 [3.81 × 10−19, 2.31 × 1015] |

| (f) | 37.792 * | 21.402 | 2.59 × 1016 [0.015697, 4.27 × 1034] | −36.833 * | 21.472 | 1.01 × 10−16 [5.33 × 10−35, 190.9992] |

| (j) | −0.938 | 8.629 | 0.391312 [1.77 × 10−8, 8667815] | 2.981 | 8.073 | 19.70147 [2.65 × 10−6, 1.47 × 108] |

| (n) | 41.345 ** | 17.086 | 9.04 × 1017 [2586.658, 3.16 × 1032] | −41.923 *** | 15.227 | 6.21 × 10−19 [6.79 × 10−32, 5.67 × 10−6] |

| Component | 1.063 ** | 0.504 | 2.893625 [1.077254, 7.772601] | −0.174 | 0.475 | 0.841 [.3311284, 2.133791] |

| Intercept | −34.559 *** | 7.591 | 9.80 × 10−16 [3.38 × 10−22, 2.84 × 10−9] | 27.460 *** | 8.384 | 8.43 × 1011 [61622.66, 1.15 × 1019] |

| Model 3 (H3A and H3B) (LR χ2 (10) = 83.19; Probability > χ2 = 0.000) | ||||||

| (c) | −12.753 | 9.824 | 2.89 × 10−6 [1.26 × 10−14, 666.7517] | −1.879 | 9.075 | 0.153 [2.88 × 10−9, 8094740] |

| (g) | −2.017 | 4.925 | 0.133 [8.54 × 10−6, 2071.658] | −0.787 | 5.143 | 0.455 [0.0000191, 10858.15] |

| (k) | 73.708 *** | 26.823 | 1.03 × 1032 [1.51 × 109, 6.97 × 1054] | −42.428 | 26.820 | 3.75 × 10−19 [5.56 × 10−42, 25285.06] |

| (o) | −27.289 ** | 13.628 | 1.41 × 10−12 [3.53 × 10−24, 0.5607792] | 27.576 ** | 12.362 | 9.47 × 1011 [28.39945, 3.16 × 1022] |

| Component | 1.076 ** | 0.494 | 2.934 [1.115116, 7.721501] | 0.172 | 0.456 | 1.187 [0.4853584, 2.904532] |

| Intercept | −15.353 | 14.600 | 2.15 × 10−7 [8.03 × 10−20, 575571.5] | 7.305 | 13.738 | 1488.243 [3.01 × 10−9, 7.35 × 1014] |

| Model 4 (H4A and H4B) (LR χ2 (10) = 103.33; Probability > χ2 = 0.000) | ||||||

| (d) | 45.204 *** | 14.005 | 4.29 × 1019 [5.14 × 107, 3.57 × 1031] | −4.344 | 11.244 | 0.013 [3.49 × 10−12, 4.84 × 107] |

| (h) | −5.136 | 17.674 | 0.006 [5.31 × 10−18, 6.51 × 1012] | −15.016 | 17.233 | 3.01 × 10−7 [6.45 × 10−22, 1.40 × 108] |

| (l) | −99.201 *** | 34.835 | 8.27 × 10−44 [1.85×10−73, 3.70×10−14] | 38.369 | 30.095 | 4.61 × 1016 [1.11 × 10−9, 1.91 × 1042] |

| (p) | 41.407 *** | 15.493 | 9.61 × 1017 [62361.18, 1.48 × 1031] | −39.741 *** | 13.917 | 5.51 × 10−18 [7.85 × 10−30, 3.86 × 10−6] |

| Component | 1.468 *** | 0.555 | 4.341 [1.46346, 12.87402] | −0.479 | 0.478 | 0.619 [.2428988, 1.579997] |

| Intercept | −24.175 | 16.119 | 3.17 × 10−11 [6.03 × 10−25, 1665.899] | 25.549 * | 13.943 | 1.25 × 1011 [0.1686685, 9.21 × 1022] |

| Variables a | Cost Leadership b | Market Responsiveness b |

|---|---|---|

| H1A | H1B | |

| (a) | (+) | |

| (e) | (+) | |

| (i) | ||

| (m) | (+) but showed (−) | (−) but showed (+) |

| H2A | H2B | |

| (b) | ||

| (f) | (+) | (−) |

| (j) | ||

| (n) | (+) | (−) |

| H3A | H3B | |

| (c) | ||

| (g) | ||

| (k) | (−) but showed (+) | |

| (o) | (−) | (+) |

| H4A | H4B | |

| (d) | (−) but showed (+) | |

| (h) | ||

| (l) | (−) | |

| (p) | (−) but showed (+) | (+) but showed (−) |

| Cost Leadership | Market Responsiveness | ||||||

|---|---|---|---|---|---|---|---|

| SNA a | Automotive b | Consumer Electronics b | F c | SNA a | Automotive b | Consumer Electronics b | F c |

| (a) | 0.595 (0.009) | 0.599 (0.008) | 0.508 | (a) | 0.565 (0.010) | 0.564 (0.008) | 0.865 |

| (b) | 0.401 (0.010) | 0.403 (0.012) | 1.146 | (b) | 0.366 (0.009) | 0.374 (0.009) | 0.247 ** |

| (c) | 0.489 (0.025) | 0.491 (0.027) | 0.028 | (c) | 0.487 (0.029) | 0.493 (0.021) | 2.752 |

| (d) | 0.144 (0.021) | 0.137 (0.021) | 0.184 | (d) | 0.133 (0.020) | 0.130 (0.021) | 0.005 |

| (e) | 0.386 (0.022) | 0.395 (0.018) | 1.889 | (e) | 0.392 (0.024) | 0.387 (0.020) | 1.164 |

| (f) | 0.341 (0.009) | 0.339 (0.012) | 4.105 | (f) | 0.308 (0.008) | 0.308 (0.010) | 1.950 |

| (g) | 0.296 (0.049) | 0.294 (0.049) | 0.024 | (g) | 0.289 (0.038) | 0.284 (0.042) | 0.461 |

| (h) | 0.075 (0.013) | 0.073 (0.017) | 2.876 | (h) | 0.071 (0.014) | 0.075 (0.015) | 0.023 |

| (i) | 0.486 (0.038) | 0.482 (0.039) | 0.008 | (i) | 0.472 (0.043) | 0.483 (0.043) | 0.113 |

| (j) | 0.345 (0.027) | 0.347 (0.030) | 0.480 | (j) | 0.350 (0.029) | 0.336 (0.028) | 0.135 |

| (k) | 0.414 (0.008) | 0.420 (0.008) | 0.188 ** | (k) | 0.391 (0.008) | 0.395 (0.007) | 0.180 |

| (l) | 0.162 (0.006) | 0.159 (0.006) | 0.751 | (l) | 0.178 (0.007) | 0.180 (0.005) | 2.926 |

| (m) | 0.445 (0.026) | 0.458 (0.023) | 0.908 | (m) | 0.522 (0.026) | 0.536 (0.026) | 0.004 |

| (n) | 0.431 (0.012) | 0.427 (0.013) | 0.000 | (n) | 0.377 (0.012) | 0.381 (0.014) | 0.821 |

| (o) | 0.323 (0.013) | 0.315 (0.012) | 0.005 ** | (o) | 0.371 (0.015) | 0.364 (0.014) | 0.970 |

| (p) | 0.823 (0.016) | 0.819 (0.012) | 4.622 | (p) | 0.777 (0.012) | 0.775 (0.017) | 6.256 |

| Cost Leadership | Market Responsiveness | ||||||

|---|---|---|---|---|---|---|---|

| SNA a | Company A b | Company B b | F c | SNA a | Company A b | Company B b | F c |

| (a) | 0.597 (0.009) | 0.602 (0.005) | 8.069 | (a) | 0.562 (0.007) | 0.567 (0.009) | 0.097 |

| (b) | 0.407 (0.009) | 0.396 (0.013) | 2.304 * | (b) | 0.374 (0.009) | 0.373 (0.009) | 0.065 |

| (c) | 0.488 (0.030) | 0.494 (0.024) | 0.774 | (c) | 0.494 (0.024) | 0.492 (0.019) | 0.561 |

| (d) | 0.128 (0.020) | 0.151 (0.013) | 2.869 ** | (d) | 0.131 (0.020) | 0.128 (0.025) | 1.678 |

| (e) | 0.400 (0.012) | 0.387 (0.023) | 3.419 | (e) | 0.389 (0.021) | 0.385 (0.019) | 0.839 |

| (f) | 0.337 (0.011) | 0.342 (0.013) | 3.062 | (f) | 0.309 (0.011) | 0.306 (0.010) | 0.176 |

| (g) | 0.307 (0.046) | 0.273 (0.051) | 0.052 | (g) | 0.292 (0.047) | 0.275 (0.035) | 4.106 |

| (h) | 0.075 (0.017) | 0.069 (0.018) | 0.031 | (h) | 0.071 (0.014) | 0.079 (0.015) | 0.291 |

| (i) | 0.464 (0.035) | 0.510 (0.028) | 0.155 ** | (i) | 0.470 (0.041) | 0.499 (0.044) | 0.515 |

| (j) | 0.350 (0.032) | 0.342 (0.028) | 1.024 | (j) | 0.334 (0.025) | 0.338 (0.033) | 0.720 |

| (k) | 0.422 (0.007) | 0.416 (0.009) | 0.995 | (k) | 0.392 (0.007) | 0.398 (0.007) | 0.022 * |

| (l) | 0.158 (0.007) | 0.159 (0.007) | 0.019 | (l) | 0.181 (0.005) | 0.179 (0.005) | 0.087 |

| (m) | 0.462 (0.018) | 0.451 (0.030) | 2.837 | (m) | 0.538 (0.020) | 0.533 (0.033) | 8.309 |

| (n) | 0.430 (0.012) | 0.422 (0.014) | 0.122 | (n) | 0.383 (0.014) | 0.379 (0.013) | 0.146 |

| (o) | 0.315 (0.012) | 0.314 (0.013) | 0.090 | (o) | 0.369 (0.012) | 0.358 (0.015) | 0.198 * |

| (p) | 0.817 (0.013) | 0.822 (0.011) | 0.011 | (p) | 0.775 (0.017) | 0.774 (0.018) | 0.007 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, M.K.; Narasimhan, R. Designing Supply Networks in Automobile and Electronics Manufacturing Industries: A Multiplex Analysis. Processes 2019, 7, 176. https://doi.org/10.3390/pr7030176

Kim MK, Narasimhan R. Designing Supply Networks in Automobile and Electronics Manufacturing Industries: A Multiplex Analysis. Processes. 2019; 7(3):176. https://doi.org/10.3390/pr7030176

Chicago/Turabian StyleKim, Myung Kyo, and Ram Narasimhan. 2019. "Designing Supply Networks in Automobile and Electronics Manufacturing Industries: A Multiplex Analysis" Processes 7, no. 3: 176. https://doi.org/10.3390/pr7030176

APA StyleKim, M. K., & Narasimhan, R. (2019). Designing Supply Networks in Automobile and Electronics Manufacturing Industries: A Multiplex Analysis. Processes, 7(3), 176. https://doi.org/10.3390/pr7030176