Longitudinal Insights into Intelligent Manufacturing Processes: Managerial Expectations vs. Actual Adoption

Abstract

1. Introduction

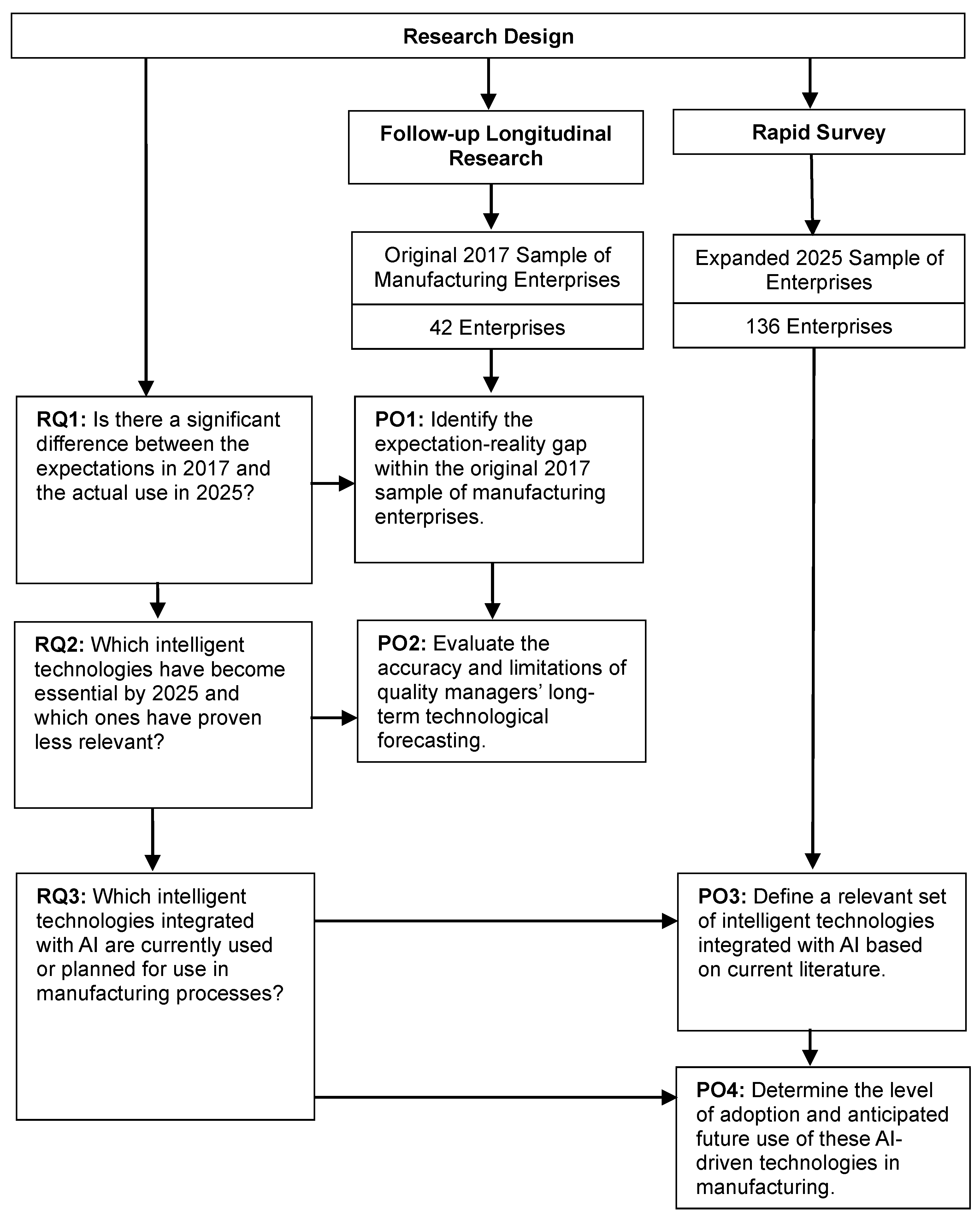

- PO1: Identify the expectation–reality gap within the original 2017 sample of manufacturing enterprises.

- PO2: Evaluate the accuracy and limitations of quality managers’ long-term technological forecasting.

- PO3: Define a relevant set of intelligent technologies integrated with AI based on the current literature.

- PO4: Determine the level of adoption and anticipated future use of these AI-driven technologies in manufacturing.

2. Literature Review

2.1. Intelligent Technologies Involved in the Research in 2017 and 2025

2.2. AI-Driven Intelligent Technologies Involved in the Rapid Survey in 2025

2.3. Theoretical Summary: Intelligent Technologies vs. AI-Driven Technologies

3. Materials and Methods

| Research Stage | Year/Sub-Study | Description of Activities | Method Applied |

|---|---|---|---|

| S1. Definition of research framework | 2017 and 2025 | Formulation of research questions (RQ1–RQ3) and partial objectives (PO1–PO4). Selection of 14 intelligent technologies and 26 processes for longitudinal comparison. | Conceptual framework design |

| S2. Sample selection based on predefined criteria | 2017 and 2025 | Selection of large manufacturing enterprises (>249 employees), with identifiable NACE codes and comparable production/logistics processes. | Purposeful sampling based on enterprise size and process criteria |

| S3. Questionnaire design | 2017 and 2025 | Development of a structured survey using identical variables from 2017 to maintain longitudinal validity. | Dillman Total Design Survey Method |

| S4. Data collection (longitudinal follow-up) | 2025—Sub-study 1 | Distribution of cover letter and empty research matrix (Table 4), reminder after 10 days, resend after another 10 days, all via a single dedicated email. | Mixed-mode electronic survey using the Dillman procedure |

| S5. Data consolidation and validation | 2017 and 2025 | Confirmation of respondents’ roles, removal of non-responding enterprises, and retention of managers who changed positions within the same company. | Consistency validation, respondent classification |

| S6. Expectation vs. reality analysis | 2025—Sub-study 1 | Calculation of E2017_rel, R2025_rel, and ∆ER for each technology. Comparison across 26 processes. | Quantitative comparative analysis |

| S7. Expansion of research scope | 2025—Sub-study 2 | Identification of 10 AI-driven technologies through a focused literature review. Expansion to 136 enterprises. | Selective literature review + sample extension |

| S8. Rapid survey of AI-driven technologies | 2025—Sub-study 2 | Managers selected five technologies they use or plan to use. Variables AI_IT_abs and AI_IT_rel calculated. | Quick survey method (indicative) |

| S9. Statistical evaluation of sample structure | 2025 | Chi-square test comparing representation across industry groups in 2017 vs. 2025. | χ2-test for structural consistency |

| S10. Interpretation and discussion | 2025 | Identification of overestimated and underestimated technologies and changes in process-specific deployment. | Comparative and interpretive analysis |

| Smart Glasses | Smart Gloves | Smart Watches | Smart Phones/Tablets | RFID Technology | Barcode | QR Code | GPS Tracking | Drones | Autonomous Vehicles | MES | 3D Printing | Virtual Reality Simulation | Collaborative Robots | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| P1: | 0.0 | 0.0 | 0.0 | 50.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 80.0 | 0.0 | 40.0 | 0.0 |

| P2: | 3.0 | 0.0 | 4.7 | 60.0 | 0.0 | 0.0 | 10.0 | 0.0 | 0.0 | 30.0 | 80.0 | 90.0 | 80.0 | 50.0 |

| P3: | 3.0 | 0.0 | 0.0 | 45.0 | 0.0 | 10.0 | 14.4 | 5.0 | 0.0 | 20.0 | 80.0 | 94.7 | 77.0 | 90.0 |

| P4: | 2.0 | 0.0 | 0.0 | 60.0 | 5.0 | 10.0 | 14.4 | 0.0 | 0.0 | 20.0 | 80.0 | 94.7 | 80.0 | 90.0 |

| P5: | 3.0 | 0.0 | 0.0 | 50.0 | 5.0 | 10.0 | 14.4 | 0.0 | 0.0 | 21.0 | 80.0 | 94.7 | 80.0 | 90.0 |

| P6: | 2.0 | 0.0 | 0.0 | 30.2 | 11.5 | 10.0 | 40.0 | 11.5 | 0.0 | 70.0 | 80.0 | 14.4 | 0.0 | 0.0 |

| P7: | 3.0 | 15.0 | 0.0 | 50.0 | 16.0 | 77.0 | 80.0 | 11.5 | 16.0 | 70.0 | 90.0 | 90.0 | 30.2 | 50.0 |

| P8: | 5.0 | 14.0 | 4.0 | 40.0 | 40.0 | 77.0 | 80.0 | 2.0 | 16.0 | 77.0 | 95.0 | 90.0 | 20.0 | 90.0 |

| P9: | 0.0 | 14.0 | 0.0 | 40.0 | 20.0 | 10.0 | 11.5 | 5.0 | 16.0 | 77.0 | 95.0 | 14.4 | 20.0 | 90.0 |

| P10: | 2.0 | 0.0 | 11.5 | 30.2 | 18.0 | 10.0 | 11.5 | 5.0 | 11.5 | 20.0 | 96.0 | 50.0 | 90.0 | 40.0 |

| P11: | 11.5 | 28.0 | 11.5 | 40.0 | 29.0 | 10.0 | 41.0 | 10.0 | 11.5 | 80.0 | 97.0 | 90.0 | 94.7 | 94.7 |

| P12: | 0.0 | 0.0 | 0.0 | 50.0 | 5.0 | 10.0 | 12.0 | 0.0 | 0.0 | 0.0 | 80.0 | 90.0 | 97.0 | 80.0 |

| P13: | 5.0 | 18.0 | 35.0 | 80.0 | 30.2 | 80.0 | 80.0 | 10.0 | 30.2 | 77.0 | 95.0 | 90.0 | 9.0 | 30.2 |

| P14: | 3.0 | 0.0 | 0.0 | 50.0 | 0.0 | 6.0 | 11.5 | 0.0 | 0.0 | 0.0 | 80.0 | 14.4 | 50.0 | 0.0 |

| P15: | 6.0 | 0.0 | 50.0 | 90.0 | 0.0 | 0.0 | 8.0 | 0.0 | 0.0 | 0.0 | 80.0 | 0.0 | 29.0 | 0.0 |

| P16: | 7.0 | 5.0 | 7.0 | 50.0 | 30.2 | 80.0 | 80.0 | 15.0 | 40.0 | 50.0 | 94.7 | 77.0 | 78.0 | 90.0 |

| P17: | 14.4 | 32.0 | 11.5 | 70.0 | 29.0 | 80.0 | 80.0 | 32.0 | 20.0 | 30.2 | 90.0 | 40.0 | 40.0 | 60.0 |

| P18: | 9.0 | 0.0 | 11.5 | 80.0 | 0.0 | 70.0 | 77.0 | 0.0 | 0.0 | 0.0 | 80.0 | 90.0 | 94.7 | 0.0 |

| P19: | 0.0 | 3.0 | 0.0 | 70.0 | 15.0 | 70.0 | 77.0 | 15.0 | 20.0 | 50.0 | 90.0 | 0.0 | 9.0 | 90.0 |

| P20: | 14.4 | 0.0 | 1.5 | 30.2 | 29.0 | 90.0 | 90.0 | 11.5 | 0.0 | 30.2 | 80.0 | 30.0 | 40.0 | 18.0 |

| P21: | 3.0 | 0.0 | 11.5 | 30.2 | 75.0 | 100 | 100 | 30.0 | 33.0 | 70.0 | 80.0 | 10.0 | 0.0 | 0.0 |

| P22: | 9.0 | 29.5 | 5.0 | 80.0 | 75.0 | 100 | 100 | 10.0 | 30.2 | 80.0 | 80.0 | 7.0 | 7.0 | 77.0 |

| P23: | 11.5 | 57.0 | 3.0 | 70.0 | 60.0 | 100 | 100 | 10.0 | 40.0 | 77.0 | 91.0 | 5.0 | 11.5 | 50.0 |

| P24: | 2.0 | 0.0 | 0.0 | 80.0 | 80.0 | 100 | 100 | 100 | 60.0 | 80.0 | 80.0 | 0.0 | 11.5 | 30.2 |

| P25: | 3.0 | 32.0 | 3.0 | 70.0 | 80.0 | 90.0 | 91.0 | 50.0 | 29.0 | 70.0 | 80.0 | 0.0 | 14.4 | 90.0 |

| P26: | 2.0 | 0.0 | 15.0 | 90.0 | 90.0 | 100 | 100 | 100 | 60.0 | 77.0 | 94.7 | 0.0 | 11.5 | 0.0 |

| R2025_Trel | 4.76 | 9.52 | 7.14 | 57.14 | 28.57 | 50 | 54.76 | 16.67 | 16.67 | 45.24 | 85.71 | 45.24 | 42.86 | 50 |

4. Results

- E2017_Trel: Quality managers’ expectations related to the technology deployment for 2025, expressed as the arithmetic average percentage of expected deployment of each intelligent technology across the 26 manufacturing and logistic processes (results from 2017).

- E2017_Prel: Quality managers’ expectations related to the process automation for 2025, expressed as the arithmetic average percentage of expected process automation across the 14 intelligent technologies (results from 2017).

- R2025_Trel: Real deployment of the same intelligent technologies in 2025, also expressed as the arithmetic average percentage across the same 26 processes (results from 2025).

- R2025_Prel: Real process automation based on intelligent technology integration in 2025, also expressed as the arithmetic average percentage across the same 14 intelligent technologies (results from 2025).

- ∆ER_T: The difference between expectation and reality, calculated as the gap between E2017_Trel and R2025_Trel for each technology.

- ∆ER_P: The difference between expectation and reality, calculated as the gap between E2017_Prel and R2025_Prel for each manufacturing or logistic process.

- AI_IT_abs = absolute number of managers from manufacturing enterprises where an AI-driven manufacturing technology is used or planned to be used;

- AI_IT_rel = percentage of managers from manufacturing enterprises where an AI-driven manufacturing technology is used or planned to be used.

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Závadský, J.; Závadská, Z. Quality managers and their future technological expectations related to Industry 4.0. Total Qual. Manag. Bus. Excell. 2018, 31, 717–741. [Google Scholar] [CrossRef]

- Crossan, M.M.; Apaydin, M. A multi-dimensional framework of organizational innovation: A systematic review of the literature. J. Manag. Stud. 2010, 47, 1154–1191. [Google Scholar] [CrossRef]

- Damanpour, F.; Aravind, D. Managerial Innovation: Conceptions, processes, and antecedents. Manag. Organ. Rev. 2012, 8, 423–454. [Google Scholar] [CrossRef]

- Damanpour, F.; Walker, R.M.; Avellaneda, C.N. Combinative effects of innovation types on organizational performance: A longitudinal study of public services. J. Manag. Stud. 2009, 46, 650–675. [Google Scholar] [CrossRef]

- Adams, R.; Bessant, J.; Phelps, R. Innovation management measurement: A review. Int. J. Manag. Rev. 2006, 8, 21–47. [Google Scholar] [CrossRef]

- Hao, Y.; Helo, P. The role of wearable devices in meeting the needs of cloud manufacturing: A case study. Robot. Comput.-Integr. Manuf. 2017, 45, 168–179. [Google Scholar] [CrossRef]

- Maly, I.; Sedlacek, D.; Leitao, P. Augmented reality experiments with industrial robot in industry 4.0 environment. In Proceedings of the IEEE International Conference on Industrial Informatics (INDIN), Emden, Germany, 24–26 July 2017; pp. 176–181. [Google Scholar]

- Kolberg, D.; Zühlke, D. Lean automation enabled by industry 4.0 technologies. IFAC-PapersOnLine 2015, 28, 1870–1875. [Google Scholar] [CrossRef]

- Vernim, S.; Reinhart, G. Usage frequency and user-friendliness of mobile devices in assembly. Procedia CIRP 2016, 57, 510–515. [Google Scholar] [CrossRef]

- Mo, L.; Li, C.; Xie, X. Localization of passive UHF RFID tags on the assembly line. In Proceedings of the International Symposium on Flexible Automation, Cleveland, OH, USA, 1–3 August 2016; pp. 141–144. [Google Scholar]

- Ji, X.; Ye, H.; Zhou, J.; Deng, W. Digital management technology and its application to investment casting enterprises. China Foundry 2016, 13, 301–309. [Google Scholar] [CrossRef]

- Fallaha, S.M. Multi agent based control architectures. In Proceedings of the International DAAAM Symposium, Zadar, Croatia, 21–24 October 2015; pp. 1166–1170. [Google Scholar]

- Kletti, J. MES 4.0-but do it the right way! [MES-aber richtig!: Industrie 4.0 braucht horizontale integration]. Product. Manag. 2015, 20, 53–56. [Google Scholar]

- Chen, T.; Lin, Y. Feasibility evaluation and optimization of a smart manufacturing system based on 3D printing: A review. Int. J. Intell. Syst. 2017, 32, 394–413. [Google Scholar] [CrossRef]

- Turner, C.J.; Hutabarat, W.; Oyekan, J.; Tiwari, A. Discrete event simulation and virtual reality use in industry: New opportunities and future trends. IEEE Trans. Hum.-Mach. Syst. 2016, 46, 882–894. [Google Scholar] [CrossRef]

- Murashov, V.; Hearl, F.; Howard, J. Working safely with robot workers: Recommendations for the new workplace. J. Occup. Environ. Hyg. 2016, 13, 61–71. [Google Scholar] [CrossRef]

- Vysocky, A.; Novak, P. Human-robot collaboration in industry. MM Sci. J. 2016, 9, 903–906. [Google Scholar] [CrossRef]

- Silva, J.; Coelho, P.; Saraiva, L.; Vaz, P.; Martins, P.; López-Rivero, A. Validating the Use of Smart Glasses in Industrial Quality Control: A Case Study. Appl. Sci. 2024, 14, 1850. [Google Scholar] [CrossRef]

- Yin, J.; Park, D.; Hong, S. Adoption barriers and future growth of smart wearable technologies in manufacturing. J. Ind. Eng. Manag. 2023, 15, 227–239. [Google Scholar]

- Kempf, K.G. Manufacturing and artificial intelligence. Robotics 1985, 1, 13–26. [Google Scholar] [CrossRef]

- Licardo, J.T.; Domjan, M.; Orehovački, M. Intelligent Robotics—A Systematic Review of Emerging Technologies and Trends. Electronics 2024, 13, 542. [Google Scholar] [CrossRef]

- Kumar, S.P.L. State of the art-intense review on artificial intelligence systems application in process planning and manufacturing. Eng. Appl. Artif. Intell. 2017, 65, 294–329. [Google Scholar] [CrossRef]

- Wan, J.; Li, X.; Dai, H.N.; Kusiak, A.; Martínez-García, M.; Li, D. Artificial-intelligence-driven customized manufacturing factory: Key technologies, applications, and challenges. Proc. IEEE 2021, 109, 377–398. [Google Scholar] [CrossRef]

- Tikhonov, A.I.; Sazonov, A.A.; Kuzmina-Merlino, I. Digital production and artificial intelligence in the aircraft industry. Russ. Eng. Res. 2022, 42, 412–415. [Google Scholar] [CrossRef]

- Balamurugan, E.; Flaih, L.R.; Yuvaraj, D.; Sangeetha, K.; Jayanthiladevi, J.; Kumar, T.S. Use case of artificial intelligence in machine learning manufacturing 4.0. In Proceedings of the 2019 International Conference on Computational Intelligence and Knowledge Economy (ICCIKE), Dubai, United Arab Emirates; 2019; pp. 656–659. [Google Scholar] [CrossRef]

- Soldatos, J. Artificial Intelligence in Manufacturing, 1st ed.; Springer: Cham, Switzerland, 2024; 516p. [Google Scholar] [CrossRef]

- Ahmad, J.; Awais, M.; Rashid, U.; Ngamcharussrivichai, C. A systematic and critical review on effective utilization of artificial intelligence for bio-diesel production techniques. Fuel 2023, 338, 127379. [Google Scholar] [CrossRef]

- Waltersmann, L.; Kiemel, S.; Stuhlsatz, J.; Miehe, R. Artificial Intelligence Applications for Increasing Resource Efficiency in Manufacturing Companies—A Comprehensive Review. Sustainability 2021, 13, 6689. [Google Scholar] [CrossRef]

- Rojek, I.; Mikołajewski, D. Use of Machine Learning to Improve Additive Manufacturing Processes. Appl. Sci. 2024, 14, 6730. [Google Scholar] [CrossRef]

- Antosz, K.; Pasko, L.; Gola, A. The Use of Artificial Intelligence Methods to Assess the Effectiveness of Lean Maintenance Concept Implementation in Manufacturing Enterprises. Appl. Sci. 2020, 10, 7922. [Google Scholar] [CrossRef]

- Hassan, N.M.; Hamdan, A.; Shahin, F. An artificial intelligent manufacturing process for high-quality low-cost production. Int. J. Qual. Reliab. Manag. 2023, 40, 1777–1794. [Google Scholar] [CrossRef]

- Azizi, A. Applications of Artificial Intelligence Techniques in Industry 4.0, 1st ed.; Springer: Singapore, 2019; 61p. [Google Scholar] [CrossRef]

- Bhardwaj, V.; Yadav, S.; Kaur, N.; Anand, D. The Future of Work: Robotic Process Automation and its Role in Shaping Tomorrow’s Business Landscape. SN Comput. Sci. 2025, 6, 111. [Google Scholar] [CrossRef]

- Madakam, S.; Holmukhe, R.M.; Jaiswal, D.K. The future digital work force: Robotic process automation (RPA). J. Inf. Syst. Technol. Manag. 2019, 16, e201916001. [Google Scholar] [CrossRef]

- Doguc, O. Robot Process Automation (RPA) and Its Future. In Handbook of Research on Strategic Fit and Design in Business Ecosystems; IGI Global Scientific Publishing: Hershey, PA, USA, 2020; pp. 469–492. [Google Scholar] [CrossRef]

- Chakraborti, T.; Isahagian, V.; Khalaf, R.; Khazaeni, Y.; Muthusamy, V.; Rizk, Y.; Unuvar, M. From robotic process automation to intelligent process automation. In Business Process Management: Blockchain and Robotic Process Automation Forum. BPM 2020. Lecture Notes in Business Information Processing; Springer: Cham, Switzerland, 2020. [Google Scholar] [CrossRef]

- Santos, F.; Pereira, R.; Vasconcelos, J.B. Toward robotic process automation implementation: An end-to-end perspective. Bus. Process Manag. J. 2020, 26, 405–420. [Google Scholar] [CrossRef]

- Mamede, H.S.; Costa, D.A.S.; Oliveira, P. Robotic Process Automation (RPA) adoption: A systematic literature review. Manag. Prod. Eng. 2022, 14, 1–12. [Google Scholar] [CrossRef]

- Hyun, Y.G.; Lee, J.Y. Trends analysis and future direction of business process automation, RPA in the times of convergence. J. Digit. Converg. 2018, 16, 313–327. [Google Scholar] [CrossRef]

- Eulerich, M.; Waddoups, N.; Wagener, M. The dark side of robotic process automation (RPA): Understanding risks and challenges. Account. Horiz. 2023, 38, 143–152. [Google Scholar] [CrossRef]

- Moffitt, K.C.; Rozario, A.M. Robotic process automation for auditing. J. Emerg. Technol. Account. 2018, 15, 1–10. [Google Scholar] [CrossRef]

- Zhang, C.; Issa, H.; Rozario, A.; Soegaard, J.S. Robotic process automation implementation case studies in accounting: A Beginning to End Perspective. Account. Horiz. 2023, 37, 193–217. [Google Scholar] [CrossRef]

- Beerbaum, D. Artificial intelligence ethics taxonomy–RPA as business case. Eur. Sci. J. 2022. [Google Scholar] [CrossRef]

- Tao, F.; Zhang, H.; Liu, A.; Nee, A.Y.C. Digital twin in industry: State-of-the-art. IEEE Trans. Ind. Inform. 2018, 15, 2405–2415. [Google Scholar] [CrossRef]

- Van Der Horn, E.; Mahadevan, S. Digital twin: Generalization, characterization, and implementation. Decis. Support Syst. 2021, 145, 113524. [Google Scholar] [CrossRef]

- Liu, M.; Fang, S.; Dong, H.; Xu, C. Review of digital twin about concepts, technologies, and industrial applications. J. Manuf. Syst. 2021, 58, 346–361. [Google Scholar] [CrossRef]

- Zheng, Y.; Yang, S.; Cheng, H. An application framework of digital twin and its case study. J. Ambient. Intell. Humaniz. Comput. 2019, 10, 1141–1153. [Google Scholar] [CrossRef]

- Bhatti, G.; Mohan, H.; Singh, R.R. Towards the future of smart electric vehicles: Digital twin technology. Renew. Sustain. Energy Rev. 2021, 141, 110801. [Google Scholar] [CrossRef]

- Mashaly, M. Connecting the twins: A review on digital twin technology & its networking requirements. Procedia Comput. Sci. 2021, 184, 299–305. [Google Scholar] [CrossRef]

- Yu, W.; Patros, P.; Young, B.; Klinac, E.; Walmsley, T.G. Energy digital twin technology for industrial energy management: Classification, challenges, and future. Renew. Sustain. Energy Rev. 2022, 161, 112407. [Google Scholar] [CrossRef]

- Qi, Q.; Tao, F.; Hu, T.; Anwer, N.; Liu, A.; Wei, Y.; Wang, L.; Nee, A.Y.C. Enabling technologies and tools for digital twin. J. Manuf. Syst. 2021, 58, 3–21. [Google Scholar] [CrossRef]

- Mihaita, A.S.; Peimbert-García, R.E. Digital twin technology challenges and applications: A comprehensive review. Remote Sens. 2022, 14, 1335. [Google Scholar] [CrossRef]

- Hosamo, H.H.; Imran, A. A Review of the Digital Twin Technology in the AEC-FM Industry. Adv. Civ. Eng. 2022, 2022, 2185170. [Google Scholar] [CrossRef]

- Fuller, A.; Fan, Z.; Day, C.; Barlow, C. Digital twin: Enabling technologies, challenges, and open research. IEEE Access 2020, 8, 108952–108971. [Google Scholar] [CrossRef]

- Malykhina, G.F.; Tarkhov, D.A. Digital twin technology as a basis of the industry in future. Eur. Proc. 2018. [Google Scholar] [CrossRef]

- Madni, A.M.; Lucero, S.D. Leveraging digital twin technology in model-based systems engineering. Systems 2019, 7, 7. [Google Scholar] [CrossRef]

- Hofmann, P.; Samp, C.; Urbach, N. Robotic process automation. Electron. Mark. 2020, 30, 99–106. [Google Scholar] [CrossRef]

- Fernandez, D.; Aman, A. Planning for a successful Robotic Process Automation (RPA) project. J. Inf. Knowl. Manag. 2021, 11, 103–117. [Google Scholar]

- Dillman, D.A. Mail and Internet Surveys: The Tailored Design Method; John Wiley & Sons: New York, NY, USA, 2000. [Google Scholar]

- Dillman, D.A.; Smyth, J.; Christian, L. Internet, Mail, and Mixed-Mode Surveys: The Tailored Design Method; Wiley: New York, NY, USA, 2009. [Google Scholar]

| Smart Devices |

| T1 Smart glasses—wearable displays for guided work, inspection, and documentation T2 Smart gloves—sensor-based gloves for picking, gesture input, and handling T3 Smart watches—wrist devices for alerts, monitoring, and operator support. T4 Smartphones/Tablets—mobile devices for data entry, visualization, and process control |

| Identification Technologies |

| T5 RFID technology—radio-frequency tags for object tracking and inventory accuracy T6 Barcodes—one-dimensional optical codes for product identification T7 QR codes—two-dimensional optical codes enabling richer and faster data capture |

| Localization and Navigation Technologies |

| T8 GPS tracking—position monitoring for external transport and logistics T9 Drones—unmanned aerial systems for inspection and inventory checks T10 Autonomous vehicles—self-guided transport units for internal logistics |

| Information and Robotics Technologies |

| T11 Manufacturing Execution Systems (MES)—system linking planning, control, and shop-floor data T12 3D printing—additive manufacturing for prototypes and specialized components T13 Virtual reality simulation—immersive modeling for planning, training, and system changes T14 Collaborative robots—robots designed to work safely in direct interaction with operators |

| Job Position | Initial Sample | Without Reply | Second Sending | Effective Sample | Completed Surveys |

|---|---|---|---|---|---|

| Quality manager | 21 | 2 | 2 | 19 | 19 |

| Management representative for quality | 13 | 0 | 0 | 10 | 10 |

| Management representative for IMS | 8 | 0 | 0 | 7 | 7 |

| CQO | 2 | 0 | 0 | 2 | 2 |

| New job position | - | - | - | 4 | 4 |

| ∑ | 44 | 2 | 2 | 42 | 42 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Závadský, J.; Závadská, Z.; Osvaldová, Z.; Hiadlovský, V. Longitudinal Insights into Intelligent Manufacturing Processes: Managerial Expectations vs. Actual Adoption. Processes 2025, 13, 3799. https://doi.org/10.3390/pr13123799

Závadský J, Závadská Z, Osvaldová Z, Hiadlovský V. Longitudinal Insights into Intelligent Manufacturing Processes: Managerial Expectations vs. Actual Adoption. Processes. 2025; 13(12):3799. https://doi.org/10.3390/pr13123799

Chicago/Turabian StyleZávadský, Ján, Zuzana Závadská, Zuzana Osvaldová, and Vladimír Hiadlovský. 2025. "Longitudinal Insights into Intelligent Manufacturing Processes: Managerial Expectations vs. Actual Adoption" Processes 13, no. 12: 3799. https://doi.org/10.3390/pr13123799

APA StyleZávadský, J., Závadská, Z., Osvaldová, Z., & Hiadlovský, V. (2025). Longitudinal Insights into Intelligent Manufacturing Processes: Managerial Expectations vs. Actual Adoption. Processes, 13(12), 3799. https://doi.org/10.3390/pr13123799