Analysis of Solar Energy Development Strategies for a Successful Energy Transition in the UAE

Abstract

:1. Introduction

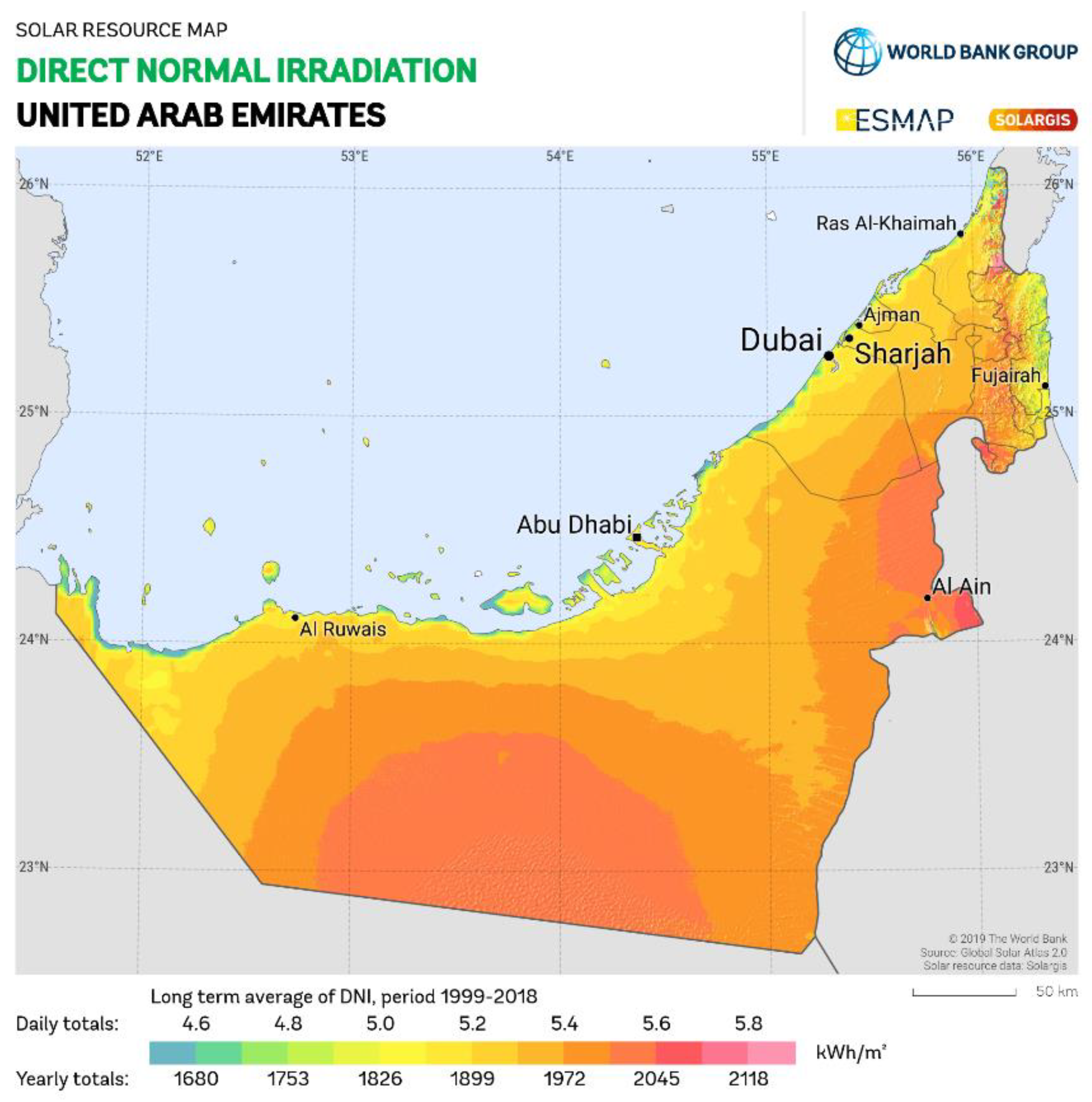

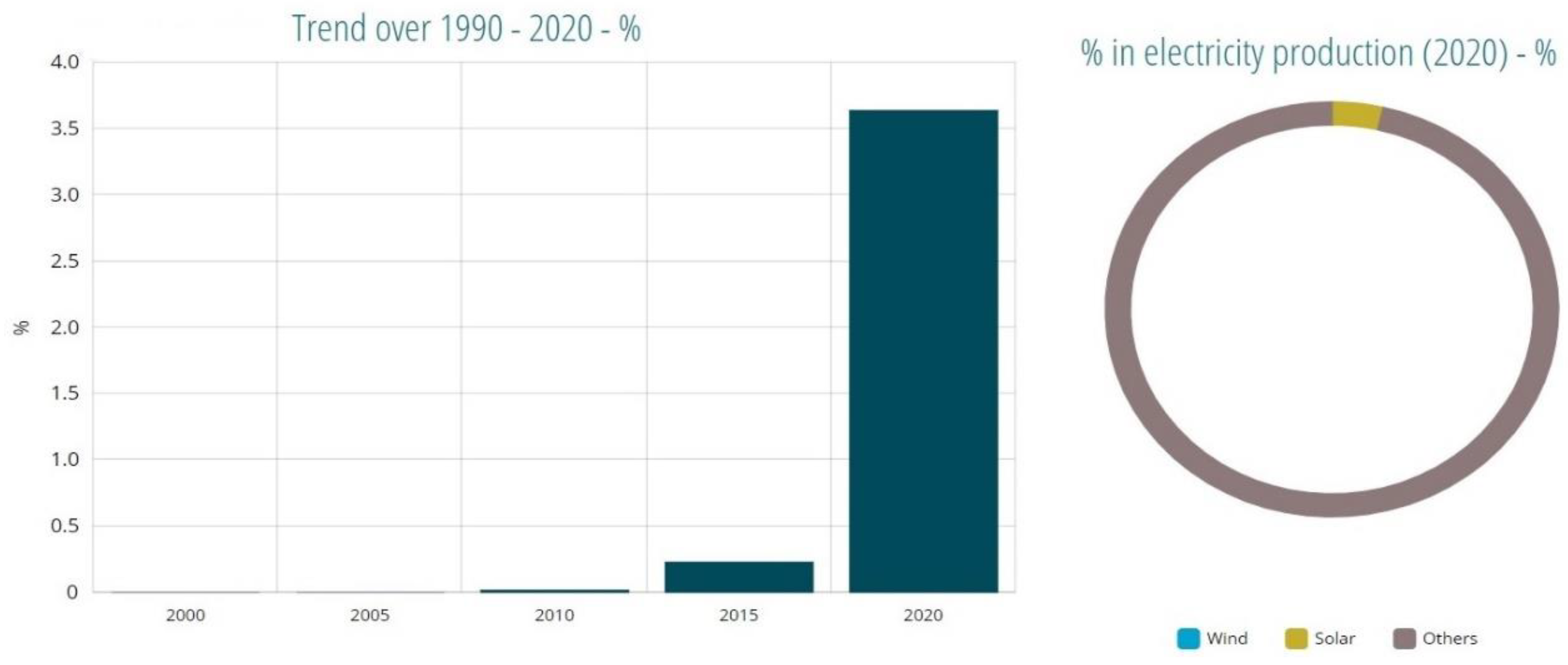

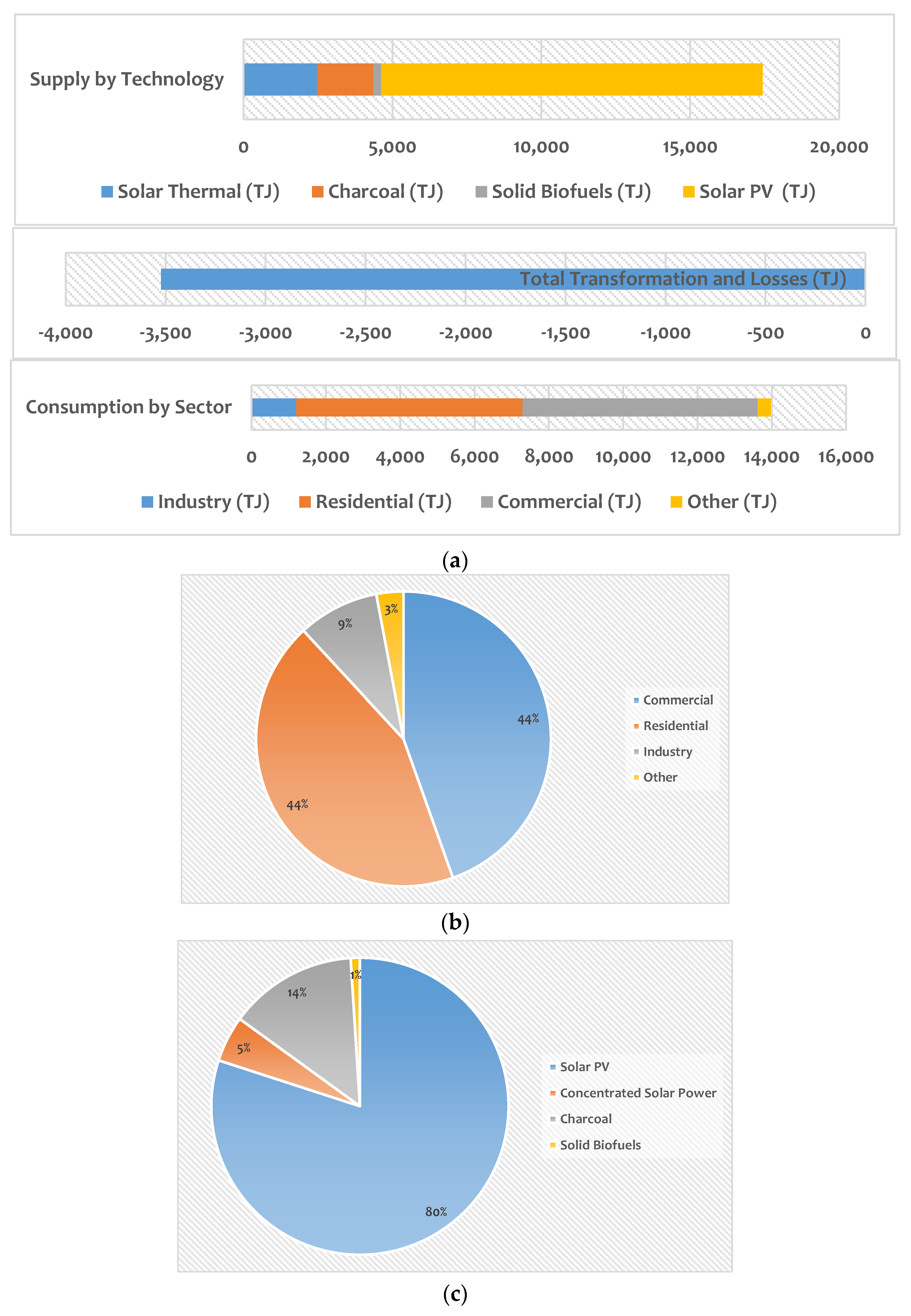

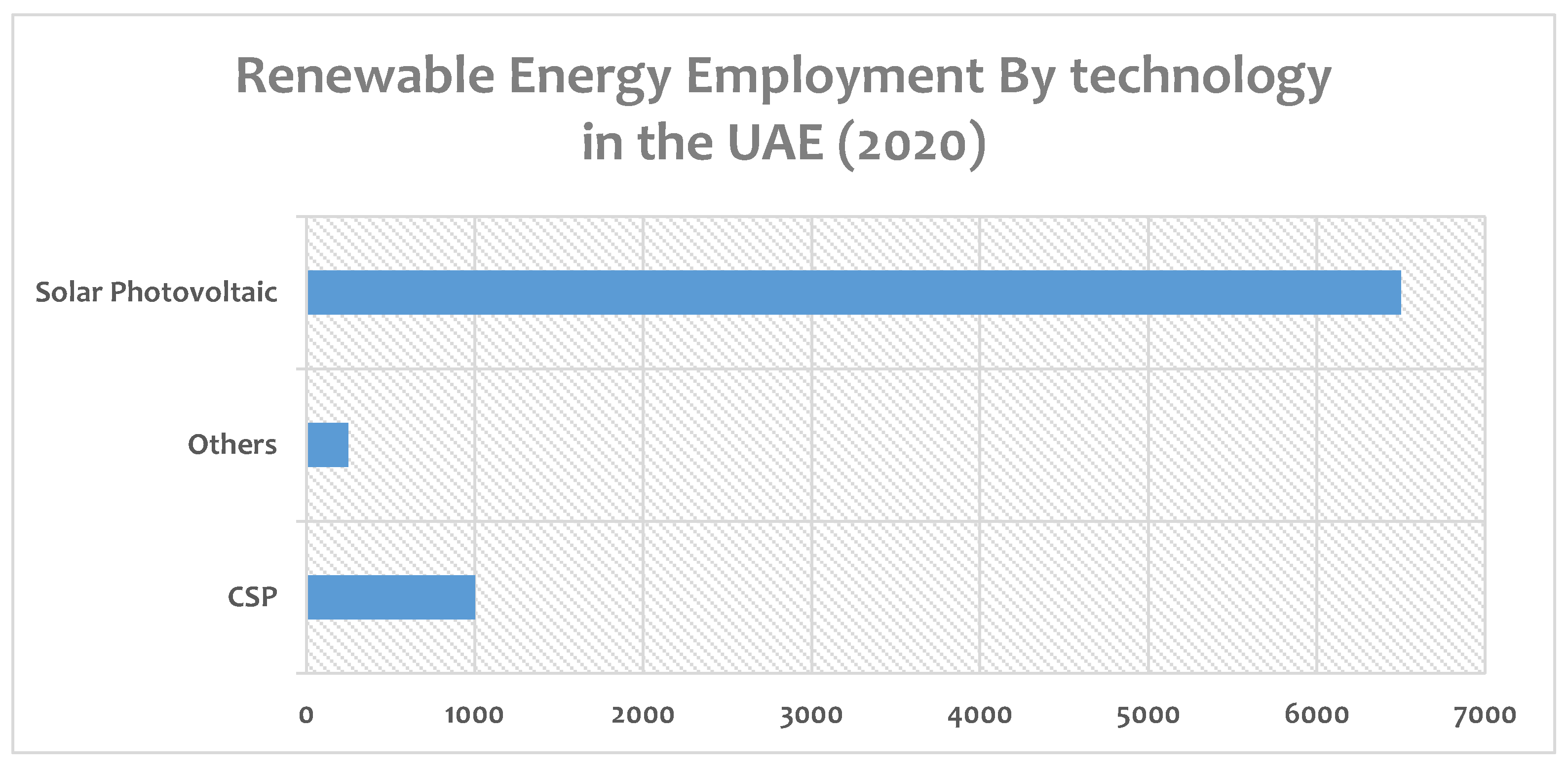

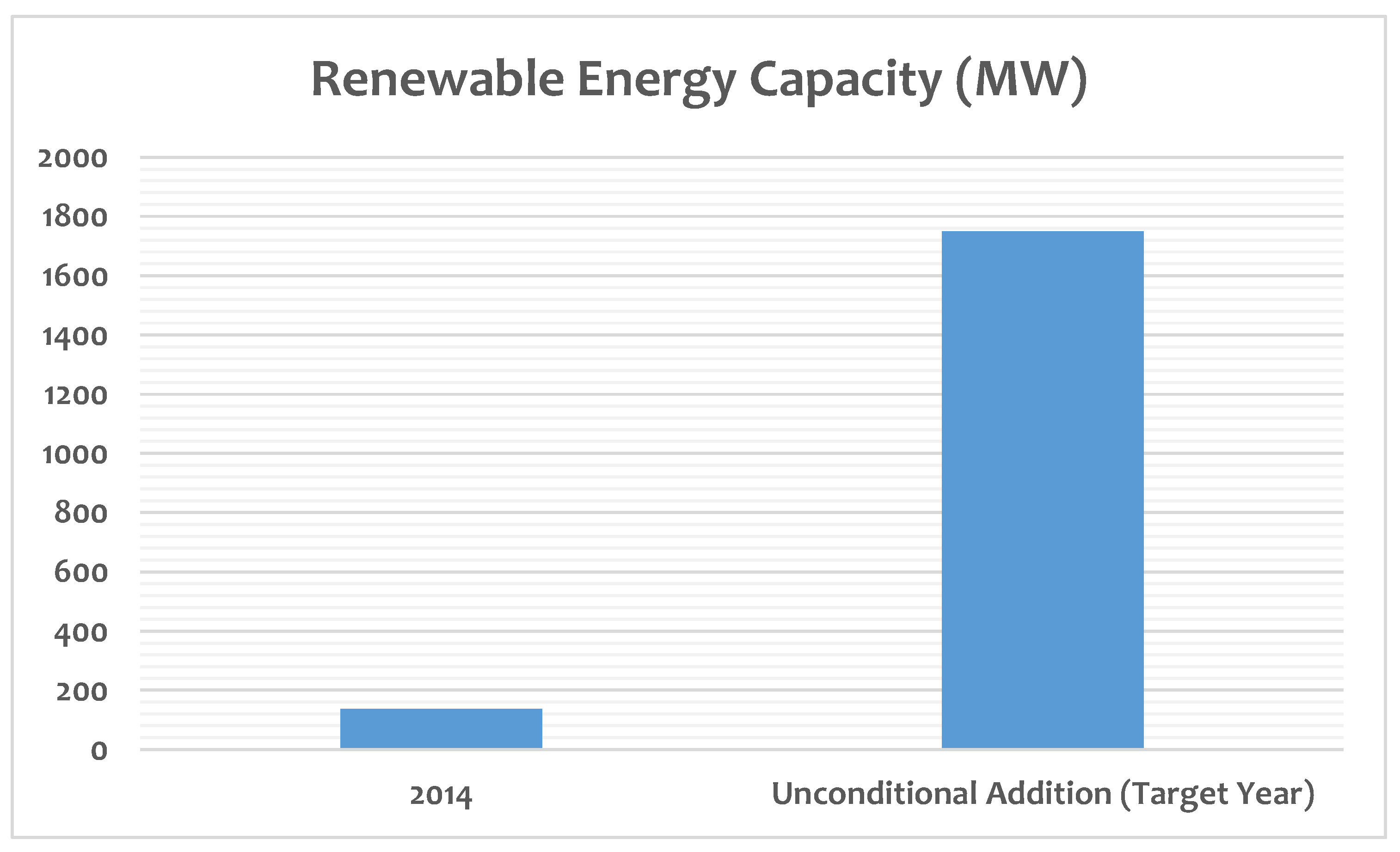

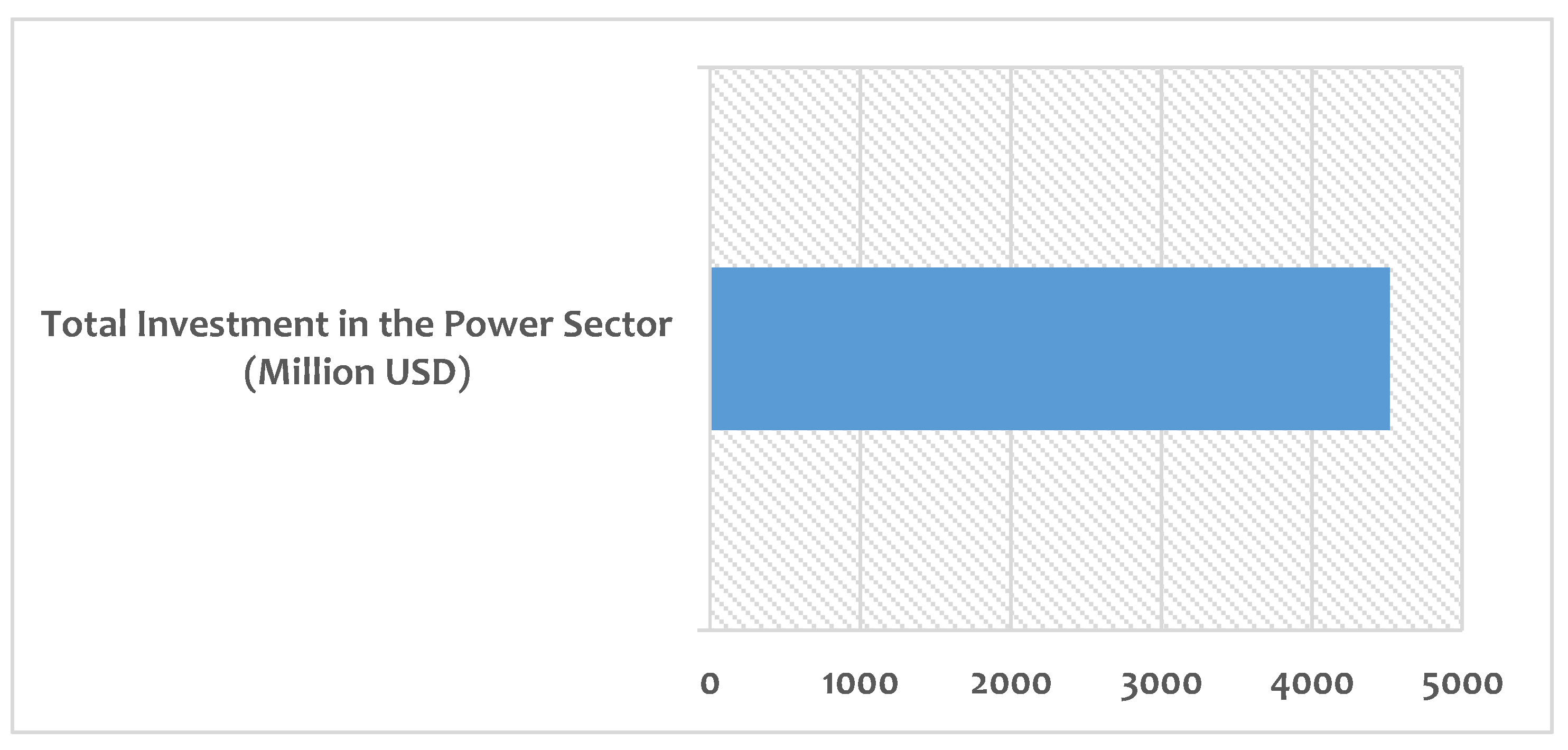

2. Background and Current State of Solar Energy Development in the UAE

3. Situation in the UAE in the Field of Different Types of Solar Energy and Its Applications

3.1. Solar Rooftop Plan

3.2. Parking Lot Solar Canopy Installations

3.3. Facilities in Remote Islands

3.4. Domestic Solar Water Heating Facilities

4. Solar Energy Industry in the UAE and Its Practical Programs on Its Development

4.1. Solar PV Cell Production

4.2. Power Generation

4.2.1. Large-Scale PV Power Plants

4.2.2. Large CSP Plants

4.2.3. PV Installations in Buildings and Complexes

4.2.4. Solar Coolers

4.3. Desalination Plants

4.4. Street Lighting

4.5. Independent Transportation Strategy

4.6. Construction of Floating Solar Power Plants in the Persian Gulf

4.7. Solar Energy and Its Application in the Oil and Gas Industry

4.7.1. Supplying Electric Power for Oil and Natural Gas Production Operations

4.7.2. Supplying the Thermal Energy Requirements of the Oil Production Industry

- -

- Solar thermal applications at low and medium temperatures for heating processes;

- -

- Applications of high-temperature solar heating in oil production for enhanced oil recovery.

5. SWOT Analysis

- -

- Strengths of a business or project that makes it superior to others.

- -

- Weaknesses that make a business or project vulnerable.

- -

- Opportunities that the project can take advantage of.

- -

- Threats to the project that can cause trouble for the business or project.

5.1. Strengths

- -

- The UAE government is committed to developing renewable energy resources, especially solar energy.

- -

- Required infrastructure and industrial bases in the UAE are developing.

- -

- This type of energy is limitless, and the UAE is rich in radiation and has enough land to use solar energy.

- -

- There are attractive places in the UAE with high potential for renewable energy, especially solar energy.

- -

- The UAE has some of the highest political stability in the Middle East.

- -

- The UAE obtains some of the largest investments in this field, which motivates the private sector globally.

- -

- Due to the high amount of land available, the UAE government provides the required space for solar energy.

- -

- In the city of Masdar, several universities offer engineering programs and active research centres related to renewable energy. The country provides sufficient funds for research and development in the solar energy field.

- -

- Most operational projects in this country have been successful [3].

- -

- The UAE is also known for its commitment to the global GHG mitigation agenda and plans to mitigate its CO2 emissions by 30% by 2030 [44].

- -

- The International Renewable Energy Agency (IRENA) headquarters is located in Abu Dhabi, a good research opportunity for the UAE.

5.2. Weaknesses

- -

- The initial capital cost of solar energy development is still high compared to fossil fuel technologies.

- -

- Some solar technologies, such as CSPs, are still expensive.

- -

- Lack of awareness among people and users about solar energy needs to be cultured quickly.

- -

- Power for households and the commercial sector still depends on fossil fuels.

- -

- The applied research results on commercial solar energy are not yet considered [28].

- -

- Solar energy is only available during the day and must be stored for night use with a storage system and battery, which increases costs [12].

- -

- The UAE has an opportunity to establish rooftop solar energy units on a small and home scale, namely the solar roof market, which has its drawbacks in terms of beauty and safety.

- -

- Large-scale storage of solar power is not feasible.

5.3. Opportunities

- -

- Investment in the UAE is uncomplicated and profitable.

- -

- The UAE promises profitable renewable energy markets, especially solar hydrogen [48].

- -

- The UAE government strongly supports the solar energy industry and labour market [49].

- -

- There is a growing trend for private sector participation in solar energy in the UAE, and private companies have established most of Abu Dhabi’s power and water-producing capacity [23].

- -

- The UAE has implemented an auction mechanism to support giant solar energy projects [50].

- -

- Focus and invest in a variety of energy storage technologies.

5.4. Threats

- -

- Despite the relatively good advancement in solar energy, local investors may still recognize it as an unreliable and risky investment.

- -

- The global behavior of oil reserves and the fluctuations and challenges in this field can be a serious threat.

- -

- The fossil fuel market will continue to be volatile and out of control.

6. Strategies Based on SWOT Analysis

7. Conclusions

- The construction of solar power plants with higher capacities should be supported. Investing in large-scale renewable energy, particularly solar, can pay off in a relatively short period for the private sector. In addition, government research grants for energy storage systems should be made available for companies and universities.

- Allowing users to put solar panels on their roofs and selling any excess electricity back to the grid was successful in the UAE. The government and panel manufacturing businesses should collaborate to give the private sector green funding.

- The government should facilitate investment in the UAE’s solar power generation value chain for international corporations. In addition, energy investment forecasting for solar energy projects should be encouraged.

- Making solar panels out of recycled materials, for instance, should be encouraged because it will help reduce the amount of fossil fuel needed for the life cycle of solar power.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- National Media Council. UAE Annual Book 2018; National Media Council: Abu Dhabi, United Arab Emirates, 2018.

- Mokri, A.; Ali, M.A.; Emziane, M. Solar energy in the United Arab Emirates: A review. Renew. Sustain. Energy Rev. 2013, 28, 340–375. [Google Scholar] [CrossRef]

- IRENA. Renewable Energy Prospects: United Arab Emirates; IRENA: Abu Dhabi, United Arab Emirates, 2015. [Google Scholar]

- Islam, M.; Kubo, I.; Ohadi, M.; Alili, A. Measurement of solar energy radiation in Abu Dhabi, UAE. Appl. Energy 2009, 86, 511–515. [Google Scholar] [CrossRef]

- BP. BP Statistical Review of World Energy; BP: London, UK, 2021. [Google Scholar]

- Howari, F.; Nazzal, Y. On the Future of Energy and Resource Security in the United Arab Emirates; Zayed University: Abu Dhabi, United Arab Emirates, 2018. [Google Scholar]

- United Arab Emirates: Energy Country Profile. Our World Data. Available online: https://ourworldindata.org/energy/country/united-arab-emirates (accessed on 24 May 2022).

- Statista. Carbon Dioxide Emissions from Fossil Fuel and Industrial Purposes in Qatar from 1970 to 2020; Statista: Singapore, 2021. [Google Scholar]

- EAD. Abu Dhabi State Of Environment Report 2017. Years Prot; Environment Agency: Abu Dhabi, United Arab Emirates, 2017.

- El Chaar, L.; Lamont, L.A. Global solar radiation: Multiple on-site assessments in Abu Dhabi, UAE. Renew. Energy 2010, 35, 1596–1601. [Google Scholar] [CrossRef]

- Soomro, M.I.; Mengal, A.; Shafiq, Q.N.; Rehman, S.A.U.; Soomro, S.A.; Harijan, K. Performance Improvement and Energy Cost Reduction under Different Scenarios for a Parabolic Trough Solar Power Plant in the Middle-East Region. Processes 2019, 7, 429. [Google Scholar] [CrossRef] [Green Version]

- Guangul, F.M.; Chala, G.T. Solar energy as renewable energy source: SWOT analysis. In Proceedings of the 2019 4th MEC International Conference on Big Data and Smart City (ICBDSC), Muscat, Oman, 15–16 January 2019. [Google Scholar]

- ENERdata. Electricity Domestic Consumption. 2022. Available online: https://yearbook.enerdata.net/electricity/electricity-domestic-consumption-data.html (accessed on 7 May 2022).

- IRENA. Solar Energy Data. 2022. Available online: https://www.irena.org/solar (accessed on 7 May 2022).

- IRENA. Renewable Energy Balances by Country (2019). 2022. Available online: https://www.irena.org/Statistics/View-Data-by-Topic/Renewable-Energy-Balances/Country-Profiles (accessed on 30 June 2022).

- IRENA. Final Renewable Energy Consumption (2019). 2022. Available online: https://www.irena.org/Statistics/View-Data-by-Topic/Renewable-Energy-Balances/Final-Renewable-Energy-Consumption (accessed on 30 June 2022).

- Abuzaid, H.; Abu Moeilak, L.; Alzaatreh, A. Customers’ perception of residential photovoltaic solar projects in the UAE: A structural equation modeling approach. Energy Strat. Rev. 2022, 39, 100778. [Google Scholar] [CrossRef]

- Saadawi, H. Application of renewable energy in the oil and gas industry. In Proceedings of the SPE Middle East Oil and Gas Show and Conference, MEOS, Manama, Bahrain, 18–21 March 2019. [Google Scholar]

- Alhammami, H.; An, H. Techno-economic analysis and policy implications for promoting residential rooftop solar photovoltaics in Abu Dhabi, UAE. Renew. Energy 2021, 167, 359–368. [Google Scholar] [CrossRef]

- Islam, M.; Alili, A.; Kubo, I.; Ohadi, M. Measurement of solar-energy (direct beam radiation) in Abu Dhabi, UAE. Renew. Energy 2010, 35, 515–519. [Google Scholar] [CrossRef]

- Ferroukhi, R.; Ghazal-Aswad, N.; Androulaki, S.; Hawila, D.; Mezher, T. Renewable energy in the GCC: Status and challenges. Int. J. Energy Sect. Manag. 2013, 7, 84–112. [Google Scholar] [CrossRef]

- Elnajjar, H.M.; Shehata, A.S.; Elbatran, A.A.; Shehadeh, M. Experimental and techno-economic feasibility analysis of renewable energy technologies for Jabel Ali Port in UAE. Energy Rep. 2021, 7, 116–136. [Google Scholar] [CrossRef]

- Mezher, T.; Goldsmith, D.; Choucri, N. Renewable Energy in Abu Dhabi: Opportunities and Challenges. J. Energy Eng. 2011, 137, 169–176. [Google Scholar] [CrossRef]

- Alnaser, W.E.; Alnaser, N.W. Solar and wind energy potential in GCC countries and some related projects. J. Renew. Sustain. Energy 2009, 1, 022301. [Google Scholar] [CrossRef]

- Al Naqbi, S.; Tsai, I.; Mezher, T. Market design for successful implementation of UAE 2050 energy strategy. Renew. Sustain. Energy Rev. 2019, 116, 109429. [Google Scholar] [CrossRef]

- Hachicha, A.A.; Al-Sawafta, I.; Ben Hamadou, D. Numerical and experimental investigations of dust effect on CSP performance under United Arab Emirates weather conditions. Renew. Energy 2019, 143, 263–276. [Google Scholar] [CrossRef]

- FGhaith, F.A.; Razzaq, H.-U. Performance of solar powered cooling system using Parabolic Trough Collector in UAE. Sustain. Energy Technol. Assess. 2017, 23, 21–32. [Google Scholar]

- Sgouridis, S.; Abdullah, A.; Griffiths, S.; Saygin, D.; Wagner, N.; Gielen, D.; Reinisch, H.; McQueen, D. RE-mapping the UAE’s energy transition: An economy-wide assessment of renewable energy options and their policy implications. Renew. Sustain. Energy Rev. 2016, 55, 1166–1180. [Google Scholar] [CrossRef]

- Ghaith, F.A.; Abusitta, R. Energy analyses of an integrated solar powered heating and cooling systems in UAE. Energy Build. 2014, 70, 117–126. [Google Scholar] [CrossRef]

- Al-Alili, A.; Islam, M.; Kubo, I.; Hwang, Y.; Radermacher, R. Modeling of a solar powered absorption cycle for Abu Dhabi. Appl. Energy 2012, 93, 160–167. [Google Scholar] [CrossRef]

- Al-Othman, A.; Tawalbeh, M.; Assad, M.E.H.; Alkayyali, T.; Eisa, A. Novel multi-stage flash (MSF) desalination plant driven by parabolic trough collectors and a solar pond: A simulation study in UAE. Desalination 2018, 443, 237–244. [Google Scholar] [CrossRef]

- Berdikeeva, S. Water-Scarce UAE Bets on Solar-Powered Water Desalination. 2019. Available online: https://insidearabia.com/water-scarce-uae-bets-on-solar-powered-water-desalination/ (accessed on 24 May 2022).

- Tachi, T.; Hanaoka, H.; Osman, B.; Takemura, K.; Ohkuma, N. Water Solutions that Help Protect Ecosystems. Hitachi Rev. 2011, 60, 2011. [Google Scholar]

- How Dubai is Attracting More ‘Green’ Vehicles to Its Roads. 2021. Available online: https://www.arabianbusiness.com/industries/energy/463426-how-dubai-is-attracting-more-green-vehicles-to-its-roads (accessed on 21 May 2022).

- Malek, C. Solar Boats and Electric Buses: Take a Ride on the UAE’s Eco-Friendly Transportation. 2019. Available online: https://www.arabnews.com/node/1436766/lifestyle (accessed on 24 May 2022).

- Dubai Electricity and Water Authority. 2022. Available online: https://www.dewa.gov.ae/en/about-us/media-publications/latest-news/2019/09/floating-photovoltaic-system (accessed on 7 May 2022).

- Temizel, C.; Irani, M.; Canbaz, C.H.; Palabiyik, Y.; Moreno, R.; Balikçioğlu, A.; Diaz, J.M.; Zhang, G.; Wang, J.; Alkouh, A. Technical and economical aspects of use of solar energy in oil & gas industry in the Middle East. In Proceedings of the 2018 SPE International Heavy Oil Conference and Exhibition, Kuwait City, Kuwait, 10–12 December 2018. [Google Scholar]

- Halabi, M.A.; Al-Qattan, A.; Al-Otaibi, A. Application of solar energy in the oil industry—Current status and future prospects. Renew. Sustain. Energy Rev. 2015, 43, 296–314. [Google Scholar] [CrossRef]

- Nedaei, N.; Azizi, S.; Farshi, L.G. Performance assessment and multi-objective optimization of a multi-generation system based on solar tower power: A case study in Dubai, UAE. Process Saf. Environ. Prot. 2022, 161, 295–315. [Google Scholar] [CrossRef]

- Agyekum, E.B. Energy poverty in energy rich Ghana: A SWOT analytical approach for the development of Ghana’s renewable energy. Sustain. Energy Technol. Assess. 2020, 40, 100760. [Google Scholar] [CrossRef]

- Terrados, J.; Almonacid, G.; Hontoria, L. Regional energy planning through SWOT analysis and strategic planning tools. Impact on renewables development. Renew. Sustain. Energy Rev. 2007, 11, 1275–1287. [Google Scholar] [CrossRef]

- Elavarasan, R.M.; Afridhis, S.; Vijayaraghavan, R.R.; Subramaniam, U.; Nurunnabi, M. SWOT analysis: A framework for comprehensive evaluation of drivers and barriers for renewable energy development in significant countries. Energy Rep. 2020, 6, 1838–1864. [Google Scholar]

- Al Shehhi, A.; Al Hazza, M.; Alnahhal, M.; Shekhria, A.; Al Zarooni, M. Challenges and barriers for renewable energy implementation in the united arab emirates: Empirical study. Int. J. Energy Econ. Policy 2021, 11, 158–164. [Google Scholar] [CrossRef]

- The UAE’s Response to Climate Change. Available online: https://u.ae/en/information-and-services/environment-and-energy/climate-change/theuaesresponsetoclimatechange (accessed on 7 May 2022).

- IRENA. Renewable Energy Employment by Country. 2022. Available online: https://www.irena.org/Statistics/View-Data-by-Topic/Benefits/Renewable-Energy-Employment-by-Country (accessed on 7 May 2022).

- IRENA. Global Weighted Average Total Installed Costs, Capacity Factors, and LCOE (2010–2020). 2022. Available online: https://www.irena.org/Statistics/View-Data-by-Topic/Costs/Global-Trends (accessed on 30 June 2022).

- IRENA. Global Weighted Average LCOE and Auction Values (2010–2021). 2022. Available online: https://www.irena.org/Statistics/View-Data-by-Topic/Costs/Global-LCOE-and-Auction-values (accessed on 30 June 2022).

- Kazim, A.; Veziroglu, T. Utilization of solar–hydrogen energy in the UAE to maintain its share in the world energy market for the 21st century. Renew. Energy 2001, 24, 259–274. [Google Scholar] [CrossRef]

- Dicce, R.P.; Ewers, M.C. Solar labor market transitions in the United Arab Emirates. Geoforum 2021, 124, 54–64. [Google Scholar] [CrossRef]

- Krupa, J.; Poudineh, R.; Harvey, L.D. Renewable electricity finance in the resource-rich countries of the Middle East and North Africa: A case study on the Gulf Cooperation Council. Energy 2019, 166, 1047–1062. [Google Scholar] [CrossRef]

- IRENA. Renewable Energy in the NDCs. 2022. Available online: https://www.irena.org/Statistics/View-Data-by-Topic/Climate-Change/Renewable-Energy-in-the-NDCs (accessed on 7 May 2022).

- IRENA. Avoided Emissions Calculator. 2022. Available online: https://www.irena.org/Statistics/View-Data-by-Topic/Climate-Change/Avoided-Emissions-Calculator (accessed on 7 May 2022).

| S1 | Existence of developed infrastructures and industrial bases | SO1 | Construction of solar power plants with higher capacities and reduction of fossil fuel consumption in the country |

| O1 | Having a very open and attractive investment climate | ||

| S2 | Extensive private sector investments | SO2 | The private sector can take over the market for renewables, especially solar, and its investment will pay off over a short time. |

| O2 | Increasing trend of private sector participation in the field of solar energy | ||

| S3 | Existence of several universities offering engineering programs and several active research centres related to the development of renewable energies | SO3 | Proposals of funds and research projects on energy storage systems by the government |

| O3 | Focus and investment on different types of energy storage systems |

| W1 | Lack of awareness among people and users | WO1 | Granting special facilities and privileges to users to install solar panels on the roof and selling electricity to the grid in case of surplus production |

| O1 | Having the opportunity to deploy solar units on a small and home scale | ||

| W2 | Available only during the day | WO2 | Research and development on storage facilities to store electricity generated by solar energy and use it when supply and demand do not match |

| O2 | Focus and investment on different types of energy storage systems | ||

| W3 | High initial cost | WO3 | Cooperation of government with panel production companies to provide funds for the private sector |

| O3 | Increasing trend of private sector participation in solar energy development | ||

| W4 | Most technologies are new emerged | WO4 | By advertising on national media, the government can address the challenges associated with the emergence of these technologies |

| O4 | Government support for the industry | ||

| W5 | Some solar technologies are not yet used and are expensive | WO5 | Participation and presence of investors in the auctions and the development of solar power plants |

| O5 | Executing an auction mechanism to support the establishment of solar projects |

| S1 | The political stability of the government | ST1 | Encouraging global companies to invest in the UAE’s solar power generation value chain |

| T1 | The global behaviour of oil reserves strongly influences the solar energy market | ||

| S2 | Existence of several universities offering engineering programs and several active research centres related to the development of renewable energies | ST2 | Cooperation of graduates in the field of energy economics with centers for access to up-to-date information on improving and developing energy investment forecasts |

| T2 | Accurate forecasts and predictions are possible for the industry | ||

| S3 | Extensive private sector investments | ST3 | Using financial methods to encourage a reduction of fossil fuel demand and mitigation of greenhouse gas emissions by solar energy production |

| T3 | Local investors recognize solar energy as an unsafe and risky investment | ||

| S4 | A 30% reduction in CO2 emissions by 2030 | ST4 | Transforming the UAE into the carbon market center of the Gulf Cooperation Council countries |

| T4 | The fossil fuel market will continue to be volatile |

| W1 | Dependence on fossil fuels | WT1 |

|

| T1 | The global behaviour of oil markets strongly influences the solar energy market | ||

| W2 | Lack of awareness among people and users | WT2 | Attract investors to the industry by raising awareness and seeking help from experts to estimate the return on investment |

| T2 | Local investors recognized it as an unsafe and risky investment | ||

| W3 | Some solar technologies are not yet used and are expensive | WT3 | Giving special discounts to local investors for the construction of solar power plants |

| T3 | Local investors recognized it as an unsafe and risky investment |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Salimi, M.; Hosseinpour, M.; N.Borhani, T. Analysis of Solar Energy Development Strategies for a Successful Energy Transition in the UAE. Processes 2022, 10, 1338. https://doi.org/10.3390/pr10071338

Salimi M, Hosseinpour M, N.Borhani T. Analysis of Solar Energy Development Strategies for a Successful Energy Transition in the UAE. Processes. 2022; 10(7):1338. https://doi.org/10.3390/pr10071338

Chicago/Turabian StyleSalimi, Mohsen, Morteza Hosseinpour, and Tohid N.Borhani. 2022. "Analysis of Solar Energy Development Strategies for a Successful Energy Transition in the UAE" Processes 10, no. 7: 1338. https://doi.org/10.3390/pr10071338

APA StyleSalimi, M., Hosseinpour, M., & N.Borhani, T. (2022). Analysis of Solar Energy Development Strategies for a Successful Energy Transition in the UAE. Processes, 10(7), 1338. https://doi.org/10.3390/pr10071338