Abstract

The aim of the article is to identify the risk factors affecting bancassurance development in Poland. The development is understood here as a change of gross written premiums obtained through banks in Poland. The group of risk factors selected in a survey conducted among financial sector employees was subject to statistical verification. The analysis used both variables directly related to the insurance product (e.g., a regulatory restriction of insurance acquisition costs) as well as those resulting from the specificity of the bancassurance channel, such as the sales of banking products, i.e., cash loans, housing loans and the value of funds placed by customers on deposits. The study was conducted on the basis of data on the gross premiums written in Poland in the years 2004–2019. The result of the applied model confirms the assumptions and the importance of insurance distribution in banks. Significant risk factors (statistically significant) which determine gross premiums written in the bancassurance channel are: the size of policyholder’s family (number of children, dependants) represented by the average number of people in a household in Poland, demand on mortgage loans represents by bank housing loans for households and agent’s commission, represented by the ratio of acquisition costs to gross written premium. The results of the econometric model obtained are consistent with expectations arising from the principles and practice of cooperation between banks and insurers as well as the specificity of insurance products distribution (also local) in the bancassurance channel.

JEL Classification:

G22; G52

1. Introduction

Bancassurance is a term used for the first time in Poland in the 1990s and means the cooperation of banks and insurance companies in order to distribute protection products to retail customers. As part of such cooperation, an insurance company prepares a product offer for bank customers, which is next distributed through bank branches, its hotline or internet banking platforms. Bancassurance plays an important role in insurance distribution from the perspective of customers, banks and insurance companies. Although the phenomenon of cooperation between banks and insurance companies is not new and has been described in many studies, it focuses on the general rules of this market functioning or legal and financial aspects. Publications place less emphasis on the practical aspects of cooperation between banks and insurers or on risk factors modelling (a research gap), including the specificities of insurance products distribution in bancassurance.

The aim of the article is to indicate risk factors affecting the level of gross premiums written obtained by insurers through banks and present the importance of bancassurance as a way of insurance distribution in Poland. The Polish market was selected for analysis because the Polish insurance market is the biggest among other CEE countries in the region. The Polish insurance market, as in other CEE countries, is still regarded as an emerging market but it is worth to pointed out that the financial sector in countries such as Poland plays a crucial role in overall macroeconomic development and capital flow in the region (Śliwiński 2019). Poland is also a good example of a market that has passed through economic transformations. It is also worth adding that Poland has significant shares in the bancassurance channel in the distribution of insurance in the region, and the biggest bancassurance market among other CEE.

A group of risk factors selected in a survey conducted among financial sector employees was subject to statistical verification. The analysis used both variables directly related to an insurance product (e.g., insurance acquisition costs) and risk factors resulting from the specificity of bancassurance, such as the sales of banking products, i.e., cash loans, housing loans and the value of funds placed by customers on deposits.

This publication is divided into six parts. In the Introduction (Section 1), the aim of the article is stated, and the content of its sections is described. In Section 2, an overview of publications concerning bancassurance is presented, as well as an attempt at their synthesis and a discussion of the studies that are key, in the authors’ opinion. Next, in Section 3, the importance of insurance distribution by banks is presented. Section 4 of this publication includes characteristics of the scope of the research and its stages with a description of the research method used. The group of risk factors selected in the survey conducted among financial sector professionals was subjected to statistical verification. The survey results and discussion are presented in Section 5. The last section (Section 6) contains a conclusions summary.

2. Bancassurance—Literature Overview

Bancassurance, although defined fairly recently, has already been the subject of a number of scientific studies. In the international literature, publications dedicated to the problems of a given country (Dharmaraj 2019; Saha and Dutta 2019; Chen 2019) or attempts of cross-border comparisons of relationships between banks and insurers (Kramaric 2019; Preckova 2017) prevail, with the account given to the specificities of a given markets and the differences between them. Such studies are most often conducted for developed markets (Kramaric 2019; Liang 2015), where the history of bancassurance is relatively long or for markets that have a population potential manifested by a huge number of inhabitants, e.g., in India, over 200 million people belong to the middle class (Puja et al. 2019). They also include attempts of summarising the previous research. An exceptionally interesting attempt at a synthesising study in the bancassurance area, in the opinion of the authors, was presented in (Ricci and Fiordelisi 2012). This publication discusses articles on the diversification hypothesis, assuming that the turning of banks to profitable business, which insurance undoubtedly is, offers banks a possibility of improving their risk profile and the rate of return on the banking portfolio. The research also presented a comparison of the performance of institutions diversifying their business together with specialised companies and analysed an increase in efficiency through cost-effectiveness and profit synergies among several types of financial activities. Also particularly interesting are the insights and conclusions drawn from studies on markets’ responses to the announcement of certain events related to bancassurance. A separate group is a summary of articles based on empirical analyses evaluating the wealth effect as well as mergers and acquisitions involving banks and insurance companies. Ricci and Fiordelisi (2012) also take note of other empirical studies on bancassurance, particularly focusing on the combination of banking and insurance activities, but they were not included in any other group. This division is visible in other studies conducted by authors from around the world.

Let us take a closer look at the research on economic efficiency. It is natural that bancassurance business is conducted due to the financial benefits. These benefits may be as follows: profitability increasing, cost-effectiveness and risk reduction (from the bank perspective). Bancassurance research is dominated by studies confirming this observation (Kramaric 2019; Karimian 2017; Hota 2016; Sreesha and Joseph 2011). On the other hand, there are works that indicate the complexity of the topic and emphasise the ambiguity of such a statement. An example of such research can be (Ricci and Fiordelisi 2010). They analysed bancassurance profit and cost efficiency for different ownership types of bank and insurance relation and took into account the impact of firm-specific factors on the attained performance. As a result, the distribution of premiums through bank branches appears positively related to profit efficiency, but the relationship is not statistically significant. What is more is that they do not find strong evidence in favour of revenue synergies for insurance companies cooperating with banks (Ricci and Fiordelisi 2010). As an explanation of this fact was the indication that there are no price advantages in selling policies through bank branches, or that banks are able to benefit most from this cooperation. Our observations concerning the Polish market show that the second explanation may be more valid. The ambiguity of the statement that bancassurance posits as a profitable complement for both banks and insurance companies was also confirmed by research (Ricci and Fiordelisi 2011). In this work, they try to assess Bancassurance performance gains (from both the banking and the insurance standpoints) by estimating cost and profit efficiency using stochastic frontier analysis. With regard to the banking industry, they do not observe any strong evidence in favour of entering the life insurance business. The investigation into the insurance industry highlights the competitive viability of Bancassurance as a distribution channel, especially in terms of cost-efficiency. In terms of profitability, findings suggest that the mix of products should be continuously revised to adapt to customer needs and the evolution of financial markets (Ricci and Fiordelisi 2011). As a consequence, more flexible forms of cooperation, such as cross-selling agreements, should be taken into account as bancassurance cooperation.

It is also worth paying attention to another trend observed in the world literature related to bancassurance. Customer experience has attracted a lot of attention in scientific research on the relationship between banks and insurers. It is believed that customer experience adds a competitive advantage to service firms (Choudhury and Singh 2021). However, the competitive advantage in bancassurance must be viewed in a broader sense, because of the fact that banks face competition not only within the banking industry but also with the insurance industry (Choudhury and Singh 2021). Key factors influencing customer experience in bancassurance in the 7p marketing mix dimensions are presented in Table 1. As can be seen from the table below, the key factors influencing the customer experience are rather related to the processes and specificity of the insurance distribution channel in banks (Place).

Table 1.

Key factors influencing customer experience in bancassurance in the 7p marketing mix dimensions.

During the analysis of international literature, with particular emphasis on the latest works published in 2021, we confirm the trends mention at the beginning of this section. In the recent international literature, publications dedicated to problems of a given country (Zharikova and Cherkesenko 2021) or attempts of cross-border comparisons of relationships between banks and insurers prevail, with the account given to the specificities of given markets and differences between them, including digital (Ganapathy 2021). This confirmed our belief that it is impossible to conduct research in the field of bancassurance without taking into account the local specificity of this business.

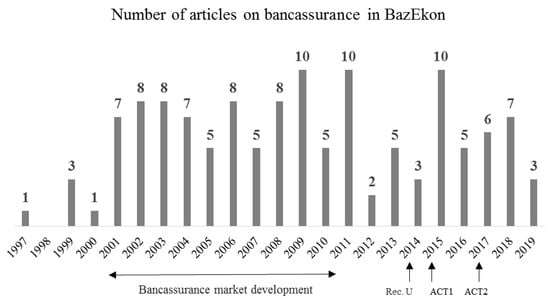

Among Polish scientists, the topic was eagerly described in the first decade of the Twenty-first century. An increase in the number of publications was also observed in 2011 and 2015. Recently, the topic of bancassurance has lost some of its popularity, which can be proven by the number of publications in a given year available in the EKON base. The smaller number of publications was not in line with dynamic changes in the legal environment, which had a significant impact on the cooperation of banks and insurers, such as: Recommendation U, amendment of the Act on Insurance and Reinsurance Activity or introduction of the Act on Insurance Distribution, implementing to the Polish law the provisions of the EU Insurance Distribution Directive (IDD). In the authors’ opinion, all these changes have constituted significant risk factors affecting the level of gross premiums written through bancassurance.

Having analysed the available scientific literature, it can be stated that the issues covered so far concern mainly relationships between banking and insurance sectors and a description of the general characteristics of the bancassurance market functioning. The research and studies prepared by (Monkiewicz 2000; Pajewska 2000), were of great importance for this publication and constituted a foundation of this research. Thus far, studies on bancassurance have included an analysis of market data on the structure of gross written premiums and the scope of insurance. Publications also refer to the matter of credit risk taken by banks and a possibility of its mitigation using relevant life and property insurance. The topic of Insurtech appears in the newest studies as an opportunity for further development of the bancassurance market in Poland (e.g., Polish Insurtech hiPRO and Braintri in Lisowski and Chojan 2020). Studies also include topics related to the legal or consumer aspects and also those related to product and finance.

This thesis can be confirmed by an analysis of articles included in the ECON base (Figure 1). As of 12 February 2021, this database contained 129 publications with bancassurance as a keyword, of which 64 were published in sector magazines and 65 in scientific magazines. The 65 publications from the scientific magazines were assigned to one (45) or two (20) key categories of the thematic area of cooperation between banks and insurers. They were categorised after an analysis of the summaries and keywords. The results are presented in Table 2.

Figure 1.

Number of publications in the EKON database with bancassurance as a keyword in the years 1997–2019, source: own study based on data from EKON.

Table 2.

Classification of articles with bancassurance as a keyword.

The largest number of studies in the EKON Útabase, which fulfil the above mentioned criteria, pertain to the general rules of the bancassurance market functioning. These studies are of various character and level of generality, though a vast majority of them contain characteristics of the existing models of cooperation between banks and insurers (Sadurska 2019; Malinowski 2011; Gajdek 2016; Wierzbicka 2009). These studies also point out the source and factors influencing the development of banking and insurance cooperation (Gajdek 2016; Gwizdała 2018, Swacha-Lech 2006) that could be used to its evaluation (Breś-Błażejczyk 2005).

Polish researchers have often analysed trends in risk development by presenting and describing sales analyses and product analyses. In these studies, data show the number and structure of insurance contracts concluded as part of bancassurance in various contexts and timeframes (Košík and Poliak 2011; Ociepa-Kicińska 2019; Pajewska-Kwaśny and Tomaszewska 2009; Pisarewicz 2013, 2014; Staszczyk 2013).

Many studies on the bancassurance sector focus on the changing legal environment and consequences of implementing new regulations such as Recommendation U of the Polish Financial Supervision Authority (Recommendation U on Best Practice in Bancassurnace 2014). These studies point out to legal requirements arising from the legislative acts and the consequences of the newly implemented regulations and their evaluation as well as their impact on the correct functioning of the market and providing better protection to all its participants (Kowalski and Kowalska 2015; Łosiewicz-Dniestrzańska 2016; Sereda 2015).

Almost as often as with legal aspects, studies and papers on bancassurance have dealt with broadly understood financial aspects. They have analysed the principles of settling remuneration received by banks for offering insurance products and assessed an impact of changes in recognition of insurance commissions in banking books on their results, treatment of revenues, costs and products cash flows (Łada and Białas 2017; Pielichaty 2014, 2015, 2017; Szewieczek 2011).

Polish researchers have dedicated much less space to the consumer aspects and customer experience during insurance distribution by banks. Nevertheless, there appeared studies (Wierzbicka 2016) that referred to the instances and consequences of mis-selling, the unfair sales of financial products not matching customer needs. Some of these works are a loose reference to Gigerenzer (2014).

Last but not least is the category called by the authors of this article a development premise. In these papers, authors refer to market development factors in Poland (Gostomski 2011; Dobrucka 2004), by comparing them to the foreign markets (Swacha-Lech 2003), and analyse modern customer service which uses the Insurtech technology (Gwizdała 2018).

An analysis of the Polish and worldwide literature on bancassurance, taking into account its pieces analysing the demand on insurance (Jaspersen 2016; Zietz 2003; Śliwiński 2016, 2019; Śliwiński et al. 2013), has allowed the authors of this paper to find that the area of modelling the risk factors which determine the level of gross written premiums generated as part of bancassurance had not been widely covered in research and, in part 4, they indicated a list of variables that were subject to testing and used for the model. Not without significance was an analysis of the market of insurances offered through banks, included in part 3 of this article.

3. Meaning and Specificity of Bancassurance in Insurance Distribution in Poland

Bancassurance is a commonly used term, although not defined in the Polish provisions of law regulating the insurance distribution market. In a broad sense, bancassurance is a cooperation between banks and insurance companies. Additionally, although bancassurance definitions in the literature have evolved along with the market development, it should be stated that one of the first definitions of the cooperation between banks and insurers in Poland (taking into account local conditions), which was the basis for further studies, was formulated in R. Pajewska (2000). It most often consists of offering insurance with the use of a bank’s distribution network. Usually, the role of banks is to act as an intermediary in concluding individual insurance contracts or offer to join an insurance contract for another party’s account concluded by the bank (the so-called group insurances). Insurance offered to bank customers may be bundled with a banking product (e.g., loan, payment card) or not bundled directly with a banking product. Cooperation between banks and insurance companies encompasses life and property insurances, also including insurance-based investment or savings products. It is commonly believed that the cooperation of financial institutions in the scope of bancassurance is beneficial to all stakeholders, i.e., banks, insurance companies and customers (Table 3).

Table 3.

Benefits for bancassurance stakeholders.

According to the Act (Insurance Distribution Act 2017), an insurance distributor can be a direct insurance company, but it can also act through an insurance agent, a supplementary insurance agent or an insurance broker. The Act states directly that an insurance intermediary distributes insurances in exchange for remuneration. For the full picture, one should also bear in mind a possibility for the insured to join an insurance contract concluded for the other party’s account, particularly group insurance. However, according to the Act (Act on Insurance and Reinsurance Activities 2015), in this relationship, the policyholder may not receive remuneration or other benefits in connection with offering an opportunity to benefit from insurance coverage or activities related to the performance of an insurance contract. The role of banks in insurance distribution in Poland is presented in Appendix B. According to the Act (Act on Insurance and Reinsurance Activities 2015), as in other European countries, risks in insurance are divided into two sections: Section I is life insurances, whereas Section II is other personal insurances and property insurances.

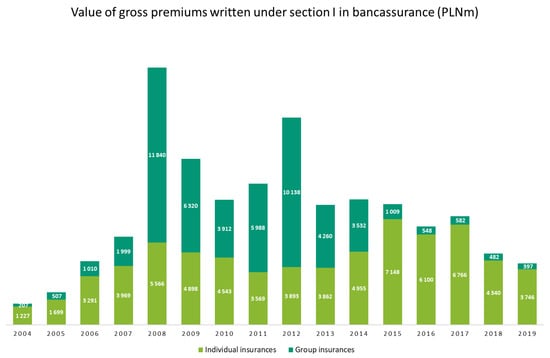

3.1. Life Insurances in Bancassurance

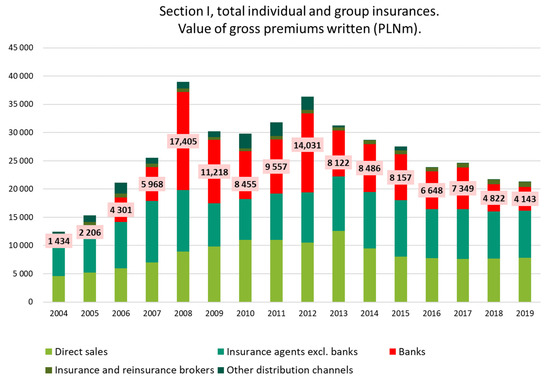

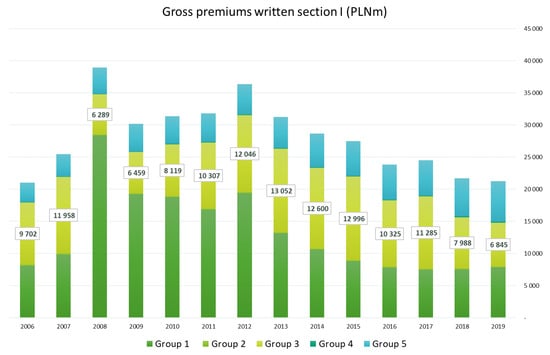

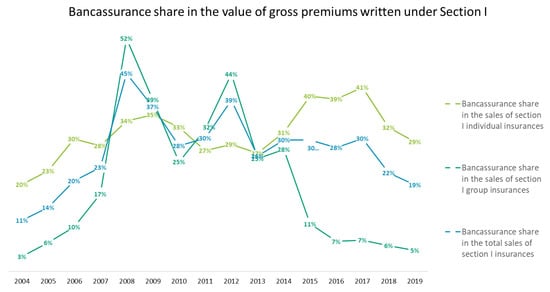

For more than a decade, bancassurance has changed its significance in the distribution of life insurances. As one can see in the chart below (Figure 2) and Figure A1, Figure A2 and Figure A3 in Appendix C, the value of gross premiums written and the share in its total value were systematically growing until 2007. In 2008, the value of gross premiums written in bancassurance considerably increased as part of group contracts. The significant share of group insurances maintained until 2014 and, when Recommendation U (Recommendation U on Best Practice in Bancassurnace 2014) and the Act on Insurance and Reassurance Activity (Act on Insurance and Reinsurance Activities 2015) entered into force, their share fell below 10% of the gross premiums written in bancassurance. Such a major change in bank offers was related mainly to regulations restricting the possibility of charging remuneration by policyholders in connection with activities performed under group contracts. The new regulations also had an impact on the distribution of insurances of the investment character because the Act (Act on Insurance and Reinsurance Activities 2015) introduced a cap on the cost of terminating an insurance contract to a maximum of 4% of the premiums paid or the current value of the units of insurance capital funds. The last strong legislative impulse was the entry into force in 2017 of the Act on Insurance Distribution (Insurance Distribution Act 2017), implementing the Insurance Distribution Directive (Directive of the European Parliament and of the Council (EU) 2016) to the Polish law. It imposes a number of requirements on insurance intermediaries, connected with organising insurance distribution, matching an offer to customer needs, as well as information obligations.

Figure 2.

Value of gross premiums written in Section I, source: own study based on KNF’s data (Polish Financial Supervision Authority 2001–2019).

Life insurances with the highest value of gross premiums written in bancassurance are the products being credit collateral (Payment Protection Insurance, PPI) and savings and investment products. PPI is insurance aimed at facilitating the repayment of a consumer loan, mortgage loan or credit card in the situation of an insured’s death or when the borrower becomes ill, has an accident or loses a job. It is considered to be the product that gave rise to bancassurance. This type of insurance has been offered on the British market since the 1990s and its greatest development took place in the years 2001–2009. Already in 2004, the British supervisory institution Financial Services Authority diagnosed that offering PPI involves a risk of violating consumer rights and issued a number of guidelines regulating this market. In Poland, the key risk factor affecting gross premium development, among the others mentioned above, were the restrictions on the level of commission paid to banks, set by the Polish Financial Supervision Authority under Recommendation U. Products of the savings and investment nature can take a form of life insurances from Section I of the Act (Act on Insurance and Reinsurance Activities 2015), in particular, life insurances from group 1 or insurances from group 3. In this category, an offer includes PRIIPs, the assets of which are fully invested in investment funds (the so-called unit-linked) and structured products where assets are partly invested in low-risk investment instruments (bank deposits, treasury bonds) and partly in derivatives. This market started to develop in Poland in the 1990s and was very successful. In the peak moment, the annual value of the gross premiums written under group 3 insurances was PLN 10–12 bn.

The Act (Act on Insurance and Reinsurance Activities 2015) has introduced significant changes in the construction of this type of insurances, in particular a cap on the so-called liquidation fees, namely, the costs incurred by the customer when terminating an insurance contract, to a maximum of 4% of the premiums paid or the current value of insurance capital fund units. It was the legislator’s response to the allegations raised by the regulator and institutions representing consumers that customers are misled as to product features and costs related to this type of policy, including too high of costs burdening policyholders in the case of terminating a contract before the end of an insurance period. This change, apart from strengthening customer protection, has also had an impact on the profitability of products offered, from the point of view of an insurance company and a distributor. In practice, it has caused a portion of investment insurances to withdraw from offering this product, in particular the long-term ones with a regular premium paid (period of insurance 10 years or more).

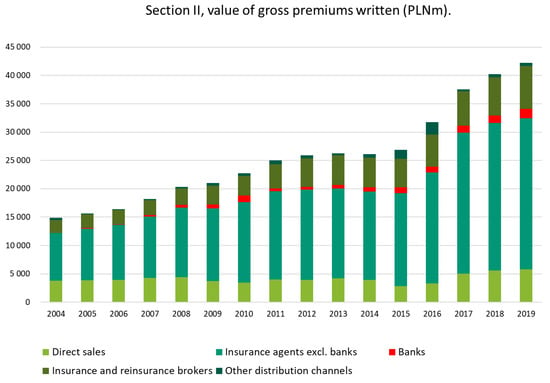

3.2. Other Personal and Property Insurances

It is worth noting that life insurance is dominant in banking distribution, and other personal and property insurances are rather marginal (Figure 3). Other personal and property insurance sales volumes by banks are not significant in relation to life insurance, described in Section 3.1. Out of them, on a visible scale, banks only offer property insurances linked with mortgage loans. Banks’ attempts can be observed to open up to the distribution of other Section II insurances as well, e.g., car insurances, civil liability, financial risks, legal protection and travel insurance, but to date, the level of gross premiums written in these groups, generated via bancassurance, has been negligible.

Figure 3.

Value of gross premiums written in Section II, source: own study based on KNF’s data: (Polish Financial Supervision Authority 2001–2019).

The purpose of a property insurance is to protect the customer against the risk of losing the ability to repay the contracted loan and the bank against the credit risk consisting of no repayment of the liability by the debtor. When insurance contracts are entered into in connection with a mortgage loan, a policy is prepared, along with its assignment to the bank. It means that if the real property becomes destroyed (for instance, by a fire, flood, etc.), the bank will obtain money as compensation from an insurance company and will dedicate it first to the payment of the debt.

From the bank’s point of view, insuring the real property is obligatory when a mortgage loan agreement is concluded. This arises from the provisions of the act on the mortgage loan and on the supervision over mortgage loan intermediaries and agents (Act on Mortgage Loan and Supervision over Mortgage Loan Intermediaries and Agents 2017): ‘a lender may require from a consumer to conclude or have an insurance contract related to the mortgage loan agreement or an assignment of receivables from this insurance contract to the lender, informing the customer, at the same time, about a possibility of choosing an offer of any insurer who covers the minimum scope of insurance accepted by the lender’. For a borrower, it means that concluding the contract is a condition for being granted a mortgage loan, though they are free to decide whether such a policy is to be bought through the bank to which they apply for a loan or at another insurance intermediary or directly in an insurance company.

4. The Research Method and Database

The determinants of premiums written in bancassurance were tested in two stages. In the first stage, based on the literature studies (see page 2) and market analysis (page 6), the authors of this study prepared a list of factors that might determine the level of gross written premiums generated by banks. These factors were subject to verification in the form of a survey (Appendix A) among professionals taking part in the process of insurance products preparation and distribution, both in banks and insurance companies. The research was conducted between 15 February 2021 and 26 February 2021. Twenty-seven fully completed questionnaires were obtained as part of the survey out of 39 requests for filling in (the response rate was 69.23%). In the opinion of the research team, the survey encompassed a significant part of experts dealing with bancassurance in Poland and working as professionals in financial institutions. Each answer was given the following score: I strongly agree, 3; I rather agree, 2, I neither agree nor disagree, 1; I rather disagree, −1; I strongly disagree, −2; I have no opinion, 0. Next, the scores were summed for each question and the results obtained are presented in the table below.

Answers obtained as part of the survey should be considered reliable (Cronbach’s α = 0.709 > 0.05). The first quartile was determined based on the sum of the answers to each question, and only those variables for which the sum of the scores was greater than the first quartile of all analysed variables were included in the model (marked in grey in Table 4). The first quartile method allowed for the selection of the variables according to their significance (indicating the factors about which the experts were most consistent). Moreover, this method allows minimising the probability of omitting important variables while optimising the efforts in model preparation.

Table 4.

Results of a survey among financial institution employees.

Data used for the research were taken from the most reliable sources in Poland and Europe. Annual bulletins on the insurance market published by the Polish Financial Supervision Authority in the years 2004–2019 were the basis for establishing the total gross premiums written in Poland (gross written premium, GWP) and the ratio of acquisition costs to gross written premium (Wka). The gross written premium in bancassurance (GWP_total) was established as the product of the premium and the banks’ share in insurance distribution. Data on bancassurance were taken from the website of Insurance Europe (InsuranceData 2020). The share of the gross premiums written under Section II generated through bancassurance in the total gross premiums written in bancassurance is not significant. Data on bank real property loans to private individuals (in PLNm) and loans and other banking receivables from households, corresponding to cash loans, were taken from publications of the National Bank of Poland (NBP 2020). Moreover, data from the Polish Central Statistical Office (Statistics of Poland; GUS 2020) and Polish Chamber of Fund and Asset Managers (IZFA 2020) were used for the study (as it is in Table 4). A binary variable (DUM) corresponding to the caps on the so-called costs of exit from a PRIIP (life) product of up to 4% described in Section 3 was also introduced into the analysis. This variable takes the value −1 when the caps are introduced, and a value of 0 before the caps were introduced.

The research method used a linear regression between the dependent variable, which was, respectively, change of gross written premium in bancassurance (∆GWP_total) in the years 2005–2019 and the explanatory variables shown in the table below (Table 5). The model was built on the increments of variables.

Table 5.

Summary of the regression procedure used.

5. Results and Discussion

In the procedure for the model, some variables were found to be statistically insignificant; therefore, these variables were removed from the model. The final variables used for the risk model for bancassurance development are: the size of policyholder’s family (number of children, dependants) represented by the average number of people in a household in Poland; demand on mortgage loans, represented by Bank housing loans for households and agent’s commission, represented by the ratio of acquisition costs to gross written premium. The final form of the model of the gross written premium in bancassurance is shown in Table 6.

Table 6.

Results of regression model.

The results obtained indicate the complexity of the modelling issue regarding risk factors that affected bancassurance market development. Statistically significant variables come from two different groups of factors determining its growth—general for all insurance and specific to bancassurance. They also take into account local conditions (the dominant position of Section I—life insurance). The size of the family of the insured person is a factor naturally determining the demand for life insurance, irrespective of the distribution channel. This observation confirms the research cited by Zietz (2003). Family size or the number of children is often indicated as an important personal and demographic determinant of insurance consumption. The positive relationship has been confirmed in the ‘classical’ studies of such authors as in (Zietz 2003; Berekson 1972; Ferber and Lee 1980; Burnett and Palmer 1984; Auerbach and Kotlikoff 1989; Lewis 1989; Bernheim 1991; Browne and Kim 1993; Showers and Shotick 1994). Of course, this relation has also been confirmed in a few more recent studies, such as Reddy and Naidu (2020) or Song et al. (2019). On the other hand, the sale of mortgages is already a bancassurance-specific factor due to the link between the insurance offered and the banking product. The last factor, named acquisition costs, may be classified in both groups, but it also has its own specificities regarding insurance distribution by banks. In further discussion, we will focus on bancassurance channel-specific variables.

The statistical significance of the variable associated with the distribution of loans by banks (Mort) is not surprising. It fully reflects the specific nature of that bancassurance market. According to data from the Polish Insurance Chamber, the share of gross premium written on the sale of stand-alone (not linked with banking products) life insurance in the bancassurance channel (other than investment insurance) was only 5% in 2019 (PIU 2019). This indicates the scale and significance of bundling as a major risk factor in the development of insurance distribution by banks. The statistical significance of this variable also underlines the need to integrate processes and adapt products to a banking product, which banks and insurers are already doing quite effectively. However, it is also worth pointing out additional risks factors that are gaining importance. This factor, which indirectly affects the development of the bancassurance market, is the credit risk of mortgage potential clients. This risk can be represented by two components: endogenous (internal) are located inside households, and exogenous (external) are independent of households. The following factors are also important for lending volumes and credit risk: risk appetite, collateral or diversification of the banking portfolio within target groups. All these factors indirectly become risk factors for the bancassurance sector and could be modelled as separate variables as part of further research.

It should also be noted here that, in order to give a complete picture of the situation, the variable directly linked to the cash loan was not statistically significant. Both individually (Cash variable itself) and as the sum of the variables Cash and Mort. However, the p-value of such variable was 0.051, so only 0.001 exceeded the limit level. An explanation for this can be a large correlation of the variable Cash and Mort (r- Pearson correlation coefficient equal to 0.96).

When analysing the results obtained, it is also worth pointing out the statistical significance of the acquisition cost index (Wka). Acquisition costs are the direct and indirect variable costs incurred by an insurer at the time of selling an insurance contract (both new and renewal). The costs may be in the form of agent or brokerage fee, underwriting costs or medical expenses. The largest share of acquisition costs in the bancassurance channel is the bank’s commission. This result is also not surprising, and it is linked with limiting commissions on the Polish market described earlier and the results of the study by (Ricci and Fiordelisi 2010) cited in Chapter 3. The authors claimed that banks are able to benefit most from bancassurance cooperation. Nevertheless, this factor, in our view, may gain and lose importance. In the current macroeconomic situation, with historically low interest rates, its role is significant. Banks are looking for an additional source of revenue as the interest margin itself becomes insufficient (significant decrease in ROE in the banking sector). In a higher interest rate environment, this factor may play a smaller role. However, it is undoubtedly a significant risk factor.

It should be pointed out, with regard to the specification of the local polish market, that although Polish authors indicated the development of the banking sector as one of the elements of the development of the bancassurance market (Gostomski 2011; Dobrucka 2004; Swacha-Lech 2003), none of them explicitly indicated the factors identified in this research as significant (bancassurance-specific factors): sale of mortgages and acquisition cost. Results obtained in this paper also indirectly confirm the observations contained in (Choudhury and Singh 2021). Significant variables come from two different groups of factors determining its growth—general for all insurance and specific to the bancassurance market. These results are in line with the observation that bancassurance must be viewed in a broader sense because of the fact that banks face competition not only within the banking industry but also with the insurance industry (Choudhury and Singh 2021).

6. Conclusions

Risk factors influencing the development of bancassurance in Poland were verified and determined as part of this research. The group of factors selected in the survey among financial sector experts was statistically verified. Significant risk factors (statistically significant) which determine gross premiums written in the bancassurance channel are: the size of the policyholder’s family (number of children, dependants), represented by the average number of people in a household in Poland; the demand on mortgage loans, represented by Bank housing loans for households and agent’s commission, represented by the ratio of acquisition costs to gross written premium. These above-identified risk factors, through confirmation in the empirical model, constitute a significant added value to this study. Confirmation of development factors or risk factors in the discussion about bancassurance by empirical research is rather rare in the literature. Additionally, it is these empirical studies that decide this paper’s contribution to bancassurance literature.

The results of the econometric model obtained are consistent with expectations arising from the principles and practice of cooperation between banks and insurers as well as the specificity of insurance product distribution (also local) in the bancassurance channel. These results confirm the bancassurance development factors indicated by experts in the studies referred to in part 3 of this publication and are in line with expectations. The mortgage sales volume mainly determines the level of gross premiums written as part of bancassurance. It means that the insurance sector, while distributing its products through banks, incorporates risks related to core banking activities and strongly depends on the credit policies of financial institutions.

Despite the statistically good results, in line with the expectations confirmed by the econometric model, the limitations of this research should not be forgotten. The main limitation is the study period (2004–2019). However, it should also be emphasised that this is the longest available time series in terms of gross premiums written in the bancassurance channel. The number of surveys completed by bancassurance experts may be considered as another limitation (27 fully completed questionnaires were obtained out of 39 requests). Although, in the opinion of the research team, the survey encompassed a significant part of experts dealing with bancassurance in Poland and working as professionals in financial institutions; subsequent research may include some improvement of selecting risk factors based on empirical studies.

Despite the limitations mentioned above subject, the findings provided by this paper are equally very important from the business sector perspective and from the point of view of insurance theory.

Author Contributions

Conceptualization, A.Ś., N.D. and J.D.; methodology, N.D.; validation, N.D.; formal analysis, N.D. and J.D.; resources, N.D. and J.D.; writing—original draft preparation, N.D. and J.D.; writing—review and editing, A.Ś.; supervision, A.Ś. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Publicly available datasets were analyzed in this study. This data can be found here: https://www.knf.gov.pl/publikacje_i_opracowania, https://www.nbp.pl/home.aspx?f=/statystyka/pieniezna_i_bankowa/nal_zobow.html, https://stat.gov.pl/, https://www.insuranceeurope.eu/insurancedata (accessed on 23 December 2020).

Acknowledgments

The authors would like to thank the anonymous reviewers designated by the Journal for their valuable feedback and suggestions, which were helpful in further improving this paper.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Survey on Bancassurance

Information about the study: this survey is conducted as part of testing the determinants of the gross premiums written within bancassurance in Poland. The survey is anonymous, and participation in the study is fully voluntary. An invitation to taking part in the study was sent to professionals participating in the process of insurance products preparation and distribution, both in banks and insurance companies. The study will last from 22 February 2021 to 5 March 2021. The research pertains to all insurance sections and groups, i.e., both investment insurance (insurances with insurance capital funds) and insurance linked and not linked with a banking product, both property and life insurances. Researches: Norbert Duczkowski, Joanna Dropia We encourage you to participate in the survey. It will take not more than 5 min to fill it in.

- Your current role relating to insurance distribution:

- Natural person performing agency activities (in Polish: OFWCA)

- Expert in Agent’s Headquarters

- Management staff in Agent’s Headquarters

- Expert in the Insurance Company Headquarters

- Management staff in the Insurance Company Headquarters

- How strongly do you agree or disagree with the following statements:Key demographic, economic, market factors affecting the premiums written in bancassurance are:

I Strongly Disagree I Rather Disagree I Neither Agree Nor Disagree I Rather Agree I Strongly Agree I Have No Opinion Policyholder’s age Policyholder’s gender Policyholder’s family size (number of children, dependants) Policyholder’s earnings Policyholder’s assets Real properties owned by policyholder Insurance price Inflation Unemployment Situation on the stock exchange (e.g., WIG20 quotations) Exchange rate (EUR/PLN, CHF/PLN, etc.) Interest rate (WIBOR, etc.) - Other demographic, economic, market factors affecting premiums written in bancassurance (which ones—please list them).

- How much do you agree or not agree with the following statements:Key factors specific for the bancassurance sector affecting premiums written are:

I Strongly Disagree I Rather Disagree I Neither Agree Nor Disagree I Rather Agree I Strongly Agree I Have No Opinion Demand on cash loans Demand on mortgage loans Level of bank deposits Link of insurance with banking product (loan, payment card, etc.) Agent’s commission Caps in insurance products construction (e.g., max cost of exit in PRIIPs 4%) Changes in legal environment (e.g., ECJ judgment on returning commissions in case of early loan repayment) - Other factors specific for the bancassurance sector affecting premiums written in bancassurance (which ones—please list them):

Appendix B. Role of Banks in Insurance Distribution in Poland

Role of banks in insurance distribution in Poland

| Type of Insurance Distribution Entity | Application of Banks’ Role in Insurance Distribution in Poland |

| Insurance company | No |

| Insurance agent | Yes |

| Agent offering supplementary insurance | Yes |

| Insurance broker | No |

| Policyholder in insurance contract for other party’s account | Yes |

| Source: own study. |

Appendix C. Section I (Life Insurance) Polish Market and Bancassurance Specification

Figure A1.

Value of gross premiums written in the bancassurance channel, source: own study based on KNF’s data: (Polish Financial Supervision Authority 2001–2019).

Figure A2.

Gross premiums written in Section I, source: own study based on KNF’s data: (Polish Financial Supervision Authority 2001–2019).

Figure A3.

Bancassurance share in Section I gross premiums written, source: own study based on KNF’s data: (Polish Financial Supervision Authority 2001–2019).

References

- Act on Insurance and Reinsurance Activities. 2015. Act on Insurance and Reinsurance Activities of 11 September 2015. Polish Journal of Laws 2015, Item 1844. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20150001844/U/D20151844Lj.pdf (accessed on 14 February 2020).

- Act on Mortgage Loan and Supervision over Mortgage Loan Intermediaries and Agents. 2017. Act on Mortgage Loan and Supervision over Mortgage Loan Intermediaries and Agents of 23 March 2017, Polish Journal of Laws 2017, Item 819. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20170000819/U/D20170819Lj.pdf (accessed on 14 February 2020).

- Auerbach, Alan, and Laurence Kotlikoff. 1989. How Rational Is the Purchase of Life Insurance? Working Paper No. 3063. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Berekson, Leonard. 1972. Birth Order, Anxiety, Affiliation and the Purchase of Life Insurance. Journal of Risk and Insurance 39: 93–108. [Google Scholar] [CrossRef]

- Bernheim, Douglas. 1991. How Strong Are Bequest Motives? Evidence Based on Estimates of the Demand for Life Insurance and Annuities. Journal of Political Economy 99: 899–927. [Google Scholar] [CrossRef]

- Białas, Małgorzata. 2015. Polskie realia współpracy banków z ubezpieczycielami. Studia Ekonomiczne/Uniwersytet Ekonomiczny w Katowicach 225: 28–37. [Google Scholar]

- Breś-Błażejczyk, Jadwiga. 2005. Bancassurance—Sukces czy porażka? Studia i Prace Kolegium Zarządzania i Finansów, Szkoła Główna Handlowa 62: 31–40. [Google Scholar]

- Browne, Mark J., and Kihong Kim. 1993. An International Analysis of Life Insurance Demand. Journal of Risk and Insurance 60: 616–34. [Google Scholar] [CrossRef]

- Burnett, John J., and Bruce A. Palmer. 1984. Examining Life Insurance Ownership Through Demographic and Psychographic Characteristics. Journal of Risk and Insurance 51: 453–67. [Google Scholar] [CrossRef]

- Chen, Tsai-Jyh. 2019. Marketing channel, corporate reputation, and profitability of life insurers: Evidence of bancassurance in Taiwan. Geneva Papers on Risk and Insurance-Issues and Practice 44: 679–701. [Google Scholar] [CrossRef]

- Choudhury, Mousumi, and Ranjit Singh. 2021. Identifying factors influencing customer experience in bancassurance: A literature review. Journal of Commerce & Accounting Research 10: 10–22. [Google Scholar]

- Dharmaraj, Senthil. 2019. Customer perception towards bancassurance—A study of select banks in Tamilnadu. Smart Journal of Business Management Studies 15: 47–57. [Google Scholar] [CrossRef]

- Directive of the European Parliament and of the Council (EU). 2016. Directive of the European Parliament and of the Council (EU) 2016/97 of 20 January 2016 on Insurance Distribution. Available online: https://eur-lex.europa.eu/legal-content/PL/TXT/PDF/?uri=CELEX:32016L0097&from=en (accessed on 14 February 2021).

- Dobrucka, Marta. 2004. Bancassurance jako czynnik rozwoju sektora finansowego. Zeszyty Naukowe/Akademia Ekonomiczna w Krakowie 637: 127–39. [Google Scholar]

- Fan, Chiang Ku, Li-Tze Lee, Yu-Chieh Tang, and Yu Hsuang Lee. 2011. Factors of cross-buying intention—Bancassurance evidence. African Journal of Business Management 5: 7511–15. [Google Scholar]

- Ferber, Robert, and Lucy Chao Lee. 1980. Acquisition and Accumulation of Life Insurance in Early Married Life. Journal of Risk and Insurance 47: 713–34. [Google Scholar] [CrossRef]

- Gajdek, Magdalena. 2016. Bancassurance, nowe zjawisko we współczesnej bankowości. Journal of Modern Management Process 1: 18–26. [Google Scholar]

- Ganapathy, Venkatesh. 2021. Digital Bancassurance Business Models. IBM Pune Research Journal 21: 48–62. [Google Scholar]

- Gigerenzer, Greg. 2014. Risk Savvy. How to Make Good Decisions. London: Penguin Books, pp. pp. 97–99, 255–56. [Google Scholar]

- Gostomski, Eugeniusz. 2011. Perspektywy rozwoju bancassurance w Europie. Prace Naukowe Wyższej Szkoły Bankowej w Gdańsku 9: 119–30. [Google Scholar]

- GUS. 2020. Statistics of Poland. Available online: https://stat.gov.pl/ (accessed on 23 December 2020).

- Gwizdała, Jerzy. 2018. Perspektywy funkcjonowania koncepcji bancassurance w Polsce. Annales Universitatis Mariae Curie-Skłodowska, Sectio H Oeconomia 52: 61–69. [Google Scholar] [CrossRef]

- Hota, Sweta Leena. 2016. Bancassurance: Convergence of banking and insurance—A saga. International Journal of Research and Development—A Management Review 5: 11–15. [Google Scholar]

- Insurance Distribution Act. 2017. Insurance Distribution Act of 15 December 2017, Polish Journal of Laws 2017, Item 2486. Available online: http://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20170002486/U/D20172486Lj.pdf (accessed on 14 February 2020).

- InsuranceData. 2020. Available online: https://www.insuranceeurope.eu/insurancedata (accessed on 23 December 2020).

- IZFA. 2020. Chamber of Fund and Asset Managers. Available online: https://www.izfa.pl/ (accessed on 23 December 2020).

- Jaspersen, Johannes. 2016. Hypothetical Surveys and Experimental Studies of Insurance Demand: A Review. The Journal of Risk and Insurance 83: 217–55. [Google Scholar] [CrossRef]

- Karimian, Paniz Haji. 2017. The effect of bancassurance on bank productivity and profitability, ARDL approach (evidences from banking industry in Iran). American Journal of Economics 7: 177–85. [Google Scholar]

- Kowalski, Jacek, and Elżbieta Kowalska. 2015. Ubezpieczenia grupowe a Rekomendacja U. Zeszyty Naukowe Wyższej Szkoły Bankowej w Poznaniu 59: 99–115. [Google Scholar]

- Košík, Oto, and Peter Poliak. 2011. Sprzedaż produktów bankowo-ubezpieczeniowych w kontekście kryzysu finansowego i postępującej globalizacji. Zeszyty Naukowe Wyższej Szkoły Bankowej w Poznaniu 35: 159–72. [Google Scholar]

- Kramaric, Tomislava Pavicz. 2019. Does bancassurance affect performance of non-life insurance sector-case of EU Countries. International Journal of Economic Sciences 8: 96–108. [Google Scholar] [CrossRef]

- Łada, Monika, and Małgorzata Białas. 2017. Financial Settlements as A Core of Inter-Organizational Management Accounting—Case Study of Bancassurance Cooperation. Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu 474: 77–84. [Google Scholar] [CrossRef]

- Lewis, Frank. 1989. Dependents and the Demand for Life Insurance. American Economic Review 79: 452–67. [Google Scholar]

- Liang, Hsin-Yu. 2015. Suggestions for Bancassurance Markets in China: Implications from European Countries. Geneva Papers on Risk and Insurance-Issues and Practice 40: 279–94. [Google Scholar] [CrossRef]

- Lisowski, Jacek, and Anna Chojan. 2020. InsurTech in CEE Region—Where Are We? In Global, Regional and Local Perspectives on the Economies of Southeastern Europe. Edited by Alexandra Horobet, Lucian Belascu, Persefoni Polychronidou and Anastasios Karasavvoglou. Springer Proceedings in Business and Economics. Berlin: Springer. [Google Scholar]

- Łosiewicz-Dniestrzańska, Ewa. 2016. Rola jednostki zapewnienia zgodności z regulacjami w procesie wprowadzania nowego produktu bankowego na rynek. Studia Ekonomiczne/Uniwersytet Ekonomiczny w Katowicach. Współczesne Finanse 275: 107–18. [Google Scholar]

- Malinowski, Artur. 2011. Zastosowanie bancassurance w Polsce. Zeszyty Naukowe Uniwersytetu Przyrodniczo-Humanistycznego w Siedlcach. Administracja i Zarządzanie 89: 137–46. [Google Scholar]

- Monkiewicz, Jan. 2000. Podstawy ubezpieczeń. Warszawa: Wydawnictwo POLTEXT. [Google Scholar]

- NBP (National Bank of Poland). 2020. Available online: https://www.nbp.pl/ (accessed on 23 December 2020).

- Recommendation U on Best Practice in Bancassurnace. 2014. Recommendation U on Best Practice in Bancassurnace. Available online: https://www.knf.gov.pl/knf/pl/komponenty/img/Rekomendacja_U_38338.pdf (accessed on 14 February 2020).

- Ociepa-Kicińska, Elżbieta. 2019. Produkty bancassurance w bankowości detalicznej w Polsce. Rozprawy Ubezpieczeniowe. Konsument na rynku usług finansowych 33: 53–67. [Google Scholar]

- Pajewska, Renata. 2000. Sojusze bankowo-ubezpieczeniowe. w: J., Monkiewicz, (red), Podstawy ubezpieczeń, tom I—Mechanizmy i funkcje. Poltext: Warszawa, pp. 306–8. [Google Scholar]

- Pajewska-Kwaśny, Renata, and Ilona Tomaszewska. 2009. Tendencje rozwoju bancassurance na rynku polskim. Myśl Ekonomiczna i Prawna 4: 174–83. [Google Scholar]

- Pielichaty, Edward. 2014. Zasady rachunkowości Banku w Świetle Rekomendacji U. Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu 373: 208–16. [Google Scholar] [CrossRef]

- Pielichaty, Edward. 2015. Rozpoznawanie przychodów ze sprzedaży produktów ubezpieczeniowych w księgach rachunkowych banków. Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu 390: 191–202. [Google Scholar] [CrossRef][Green Version]

- Pielichaty, Edward. 2017. Accounting Rules for Revenues Arising from Insurance Products Offered in Banks. Central European Review of Economics and Management 1: 85–105. [Google Scholar]

- Pisarewicz, Piotr. 2013. Struktura sprzedaży ubezpieczeń na krajowym rynku bancassurance. Zeszyty Naukowe Uniwersytetu Szczecińskiego. Finanse, Rynki Finansowe, Ubezpieczenia 62: 419–31. [Google Scholar]

- Pisarewicz, Piotr. 2014. Nowe standardy rynku bancassurance w zakresie ubezpieczeń z elementem inwestycyjnym lub oszczędnościowym. Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu 342: 206–15. [Google Scholar] [CrossRef][Green Version]

- PIU. 2019. PIU Report—Polish Market Bancassurance 4th Quarter 2019. Available online: https://piu.org.pl/wp-content/uploads/2020/04/Prezentacja-Rynek-BA-2019Q4.pdf (accessed on 9 May 2020).

- Polish Financial Supervision Authority. Annual Bulletin. Insurance Market. Warsaw: Polish Financial Supervision Authority, 2001–2019.

- Preckova, Lenka. 2017. Evaluation of Bancassurance Functioning in Selected Countries of the Financial Group KBC Group. In European Financial Systems 2017: Proceedings of the 14th International Scientific Conference. Edited by Josef Nesleha, Tomáš Plihal and Karel Urbanovsky. Brno: Masaryk University, pp. 192–98. [Google Scholar]

- Puja, Dua, Namita Sahay, and Onkar Singh Deol. 2019. Bancassurance model and its impact on Financial Inclusion: Review and Analysis. International Journal of Research and Analytical Reviews 6: 2. [Google Scholar]

- Reddy, Venkatanarsi Narsi, Seelam Marulu Reddy, and Peela Appala Naidu. 2020. Determinants of Life Insurance at Household Level: An Empirical Analysis of Andhra Pradesh, India. Waffen-Und Kostumkunde Journal XI: 49–61. [Google Scholar]

- Ricci, Ornella, and Franco Fiordelisi. 2010. Efficiency in the Life Insurance Industry: What Are the Efficiency Gains from Bancassurance? EMFI Working Paper No. 2. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Ricci, Ornella, and Franco Fiordelisi. 2011. Bancassurance Efficiency Gains: Evidence from the Italian Banking and Insurance Industries. The European Journal of Finance 17: 789–810. [Google Scholar]

- Ricci, Ornella, and Franco Fiordelisi. 2012. Bancassurance in Europe. Past, Present and Future. London: Palgrave Macmillan. [Google Scholar]

- Sadurska, Małgorzata. 2019. Bancassurance jako sposób generowania efektów synergicznych na rynku bankowo-ubezpieczeniowym. Zeszyty Naukowe Wyższej Szkoły Bankowej w Poznaniu 84: 75–84. [Google Scholar]

- Saha, Shyamasree, and Anirban Dutta. 2019. Factors Influencing Service Quality Perception in Indian Life Insurance Sector. Global Business Review 20: 1010–25. [Google Scholar] [CrossRef]

- Sereda, Paweł. 2015. Wpływ Rekomendacji U na funkcjonowanie rynku bancassurance. Zeszyty Naukowe Uniwersytetu Szczecińskiego. Finanse, Rynki Finansowe, Ubezpieczenia 2: 647–55. [Google Scholar]

- Showers, Vince, and Joyce Shotick. 1994. The Effects of Household Characteristics on Demand for Insurance: A Tobit Analysis. Journal of Risk and Insurance 61: 492–502. [Google Scholar] [CrossRef]

- Śliperski, Marek. 1998. Związki banków z firmami ubezpieczeniowymi i perspektywy ich rozwoju w Polsce. Ruch Prawniczy, Ekonomiczny i Socjologiczny 60: 213–34. [Google Scholar]

- Śliwiński, Adam. 2016. Popyt na ubezpieczenia na życie- przegląd badań światowych. In Polski Rynek Ubezpieczeń na tle kryzysów społeczno-gospodarczych. Edited by Stanisław Nowak, Alojzy Nowak and Andrzej Sopoćko. Warsaw: Wydawnictwo naukowe Wydziału Zarządzania Uniwersytetu Warszawskiego. [Google Scholar]

- Śliwiński, Adam. 2019. Rola ubezpieczeń w gospodarce. Wydawnictwo: Oficyna Wydawnicza SGH. [Google Scholar]

- Śliwiński, Adam, Tomasz Michalski, and Małgorzata Rószkiewicz. 2013. Demand for Life Insurance—An Empirical Analysis in the Case of Poland. The Geneva Papers on Risk and Insurance-Issues and Practice 38: 62–87. [Google Scholar] [CrossRef]

- Song, In Jung, Heejung Park, Narang Park, and Wookjae Heo. 2019. The effect of experiencing a death on life insurance ownership. Journal of Behavioral and Experimental Finance 22: 170–76. [Google Scholar] [CrossRef]

- Sreesha, C. H., and M. A. Joseph. 2011. Financial performance of banks in bancassurance: A study with special reference to State Bank of India. Indian Journal of Finance 5: 10–17. [Google Scholar]

- Staszczyk, Mateusz. 2013. Ubezpieczenie kart płatniczych jako sposób ochrony klienta banku przed finansowymi skutkami nagłych zdarzeń. Acta Universitatis Lodziensis. Folia Oeconomica 284: 195–207. [Google Scholar]

- Swacha-Lech, Magdalena. 2003. Społeczno-ekonomiczne determinanty atrakcyjności działalności bancassurance na rynku finansowym w Polsce (z punktu widzenia banków komercyjnych). Prace Naukowe Akademii Ekonomicznej we Wrocławiu 982: 144–55. [Google Scholar]

- Swacha-Lech, Magdalena. 2006. Bancassurance w mBanku—przyczyny podjęcia współpracy z firmami ubezpieczeń, sposoby realizacji strategii oraz jej pierwsze efekty. Prace Naukowe, Akademia Ekonomiczna w Katowicach. Współczesne problemy finansów, bankowości i ubezpieczeń w teorii i praktyce 1: 243–52. [Google Scholar]

- Szewieczek, Daniel. 2011. Finansowe konsekwencje oferty produktowej w warunkach dynamicznych zmian na rynku bancassurance. Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu 175: 138–49. [Google Scholar]

- Wierzbicka, Ewa. 2009. Kierunki ewolucji bancassurance. Zeszyty Naukowe, Uniwersytet Ekonomiczny w Poznaniu 127: 737–43. [Google Scholar]

- Wierzbicka, Ewa. 2016. Misselling barierą rozwoju ubezpieczeń w Polsce. Zeszyty Naukowe Wyższej Szkoły Humanitas. Zarządzanie 2: 315–27. [Google Scholar]

- Zharikova, Olena, and Katerina Cherkesenko. 2021. Integration of banks and insurance companies activities in Ukraine. Journal of Scientific Papers ‘Social Development and Security’ 11: 42–57. [Google Scholar] [CrossRef]

- Zietz, Emily Norman. 2003. An examinantion of demand for life insurance. Risk Management and Insurance Review 6: 159–91. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).