The Impact of the Development of Society on Economic and Financial Crime. Case Study for European Union Member States

Abstract

1. Introduction

2. Literature Review

3. Methodology and Data

3.1. Measuring the Variables

3.1.1. Dependent Variables (Economic and Financial Crime)

- (a)

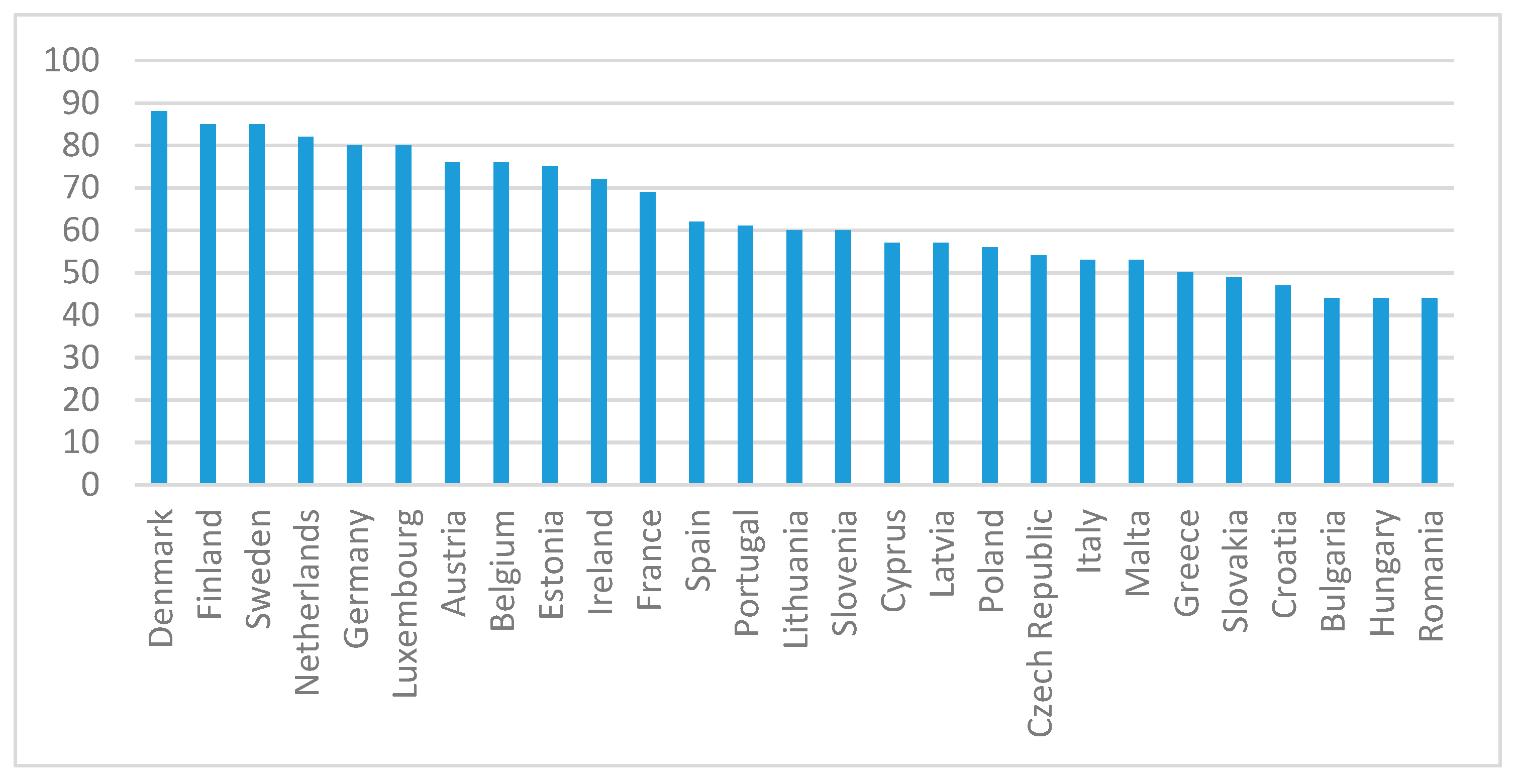

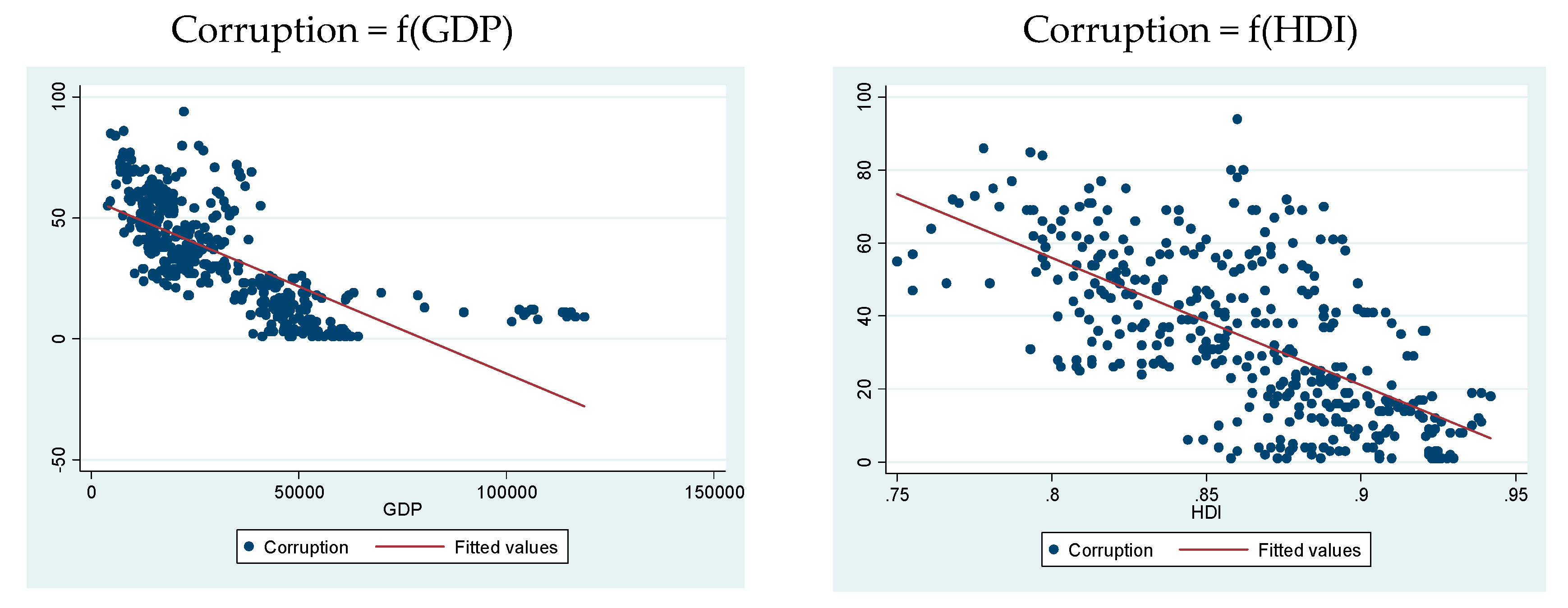

- The Corruption proxy comes from the latest report on the Corruption Perceptions Index (CPI) provided by Transparency International (2020). Subjectively perceived levels of corruption in the public sector of worldwide countries are reflected through this index, on a range from 0 (the most corrupt) to 100 (no corruption). This study particularly deals with countries’ CPI rankings, scaled from the bottom level of corruption to the very top.

- (b)

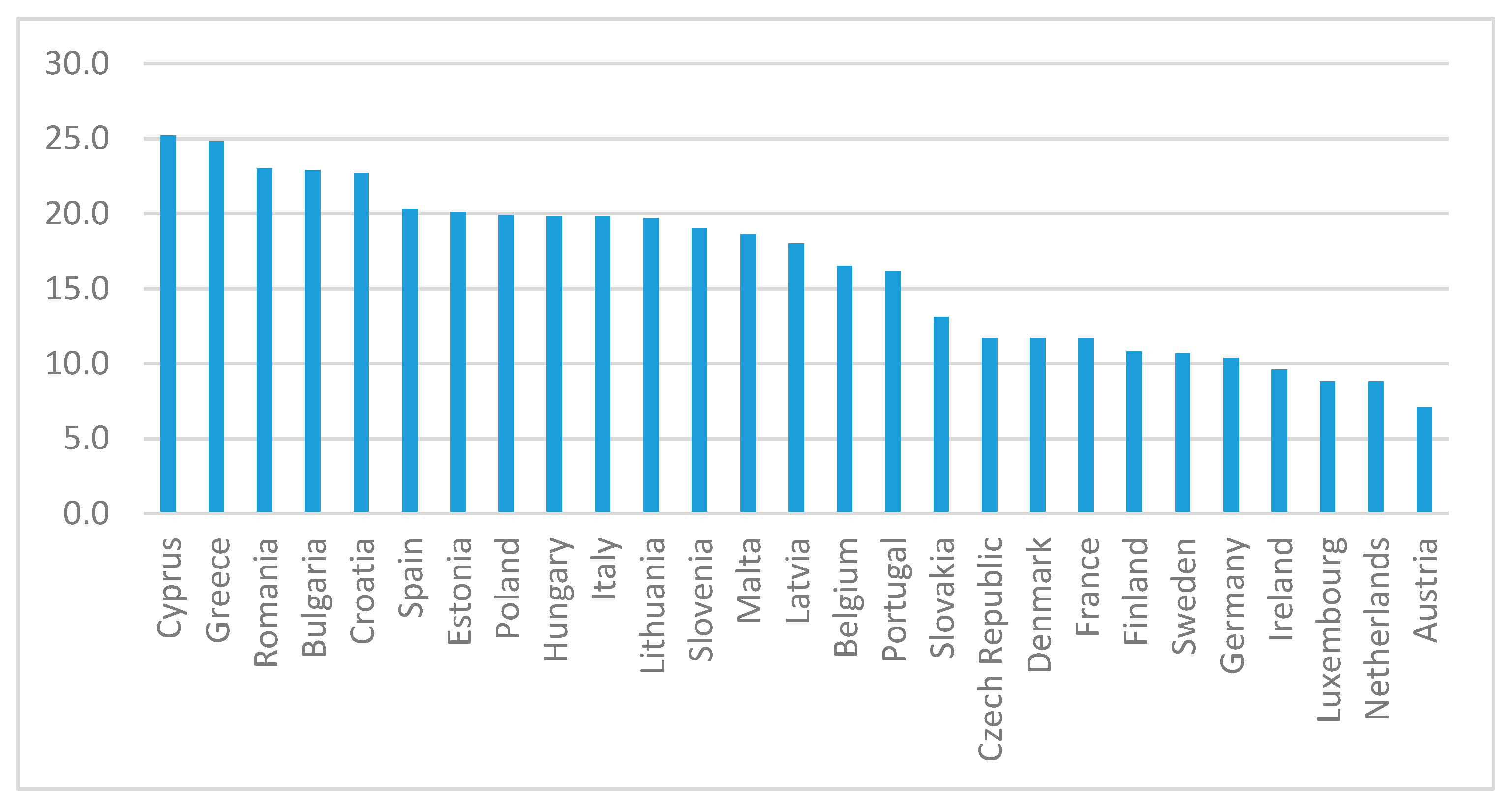

- In order to define shadow economy, we used the narrow definition provided by Schneider and his contributors (Medina and Schneider 2019; Schneider et al. 2010; Schneider and Buehn 2018). According to these researchers, “The shadow economy includes all market-based legal production of goods and services that are deliberately concealed from public authorities for the following: a. to avoid paying income, value added, or other taxes; b. to avoid paying social security contributions; c. to avoid having to meet certain legal labour market standards, such as minimum wages, maximum working hours, and safety standards, and d. to avoid complying with certain administrative procedures, such as completing statistical questionnaires or other administrative forms”. We rely on this narrow definition of the shadow economy and measure it using Medina and Schneider (2019) for the 2005–2017 time interval, in which the shadow economy is estimated as a percentage of official GDPs, for 158 countries, starting from the year 1991.

- (c)

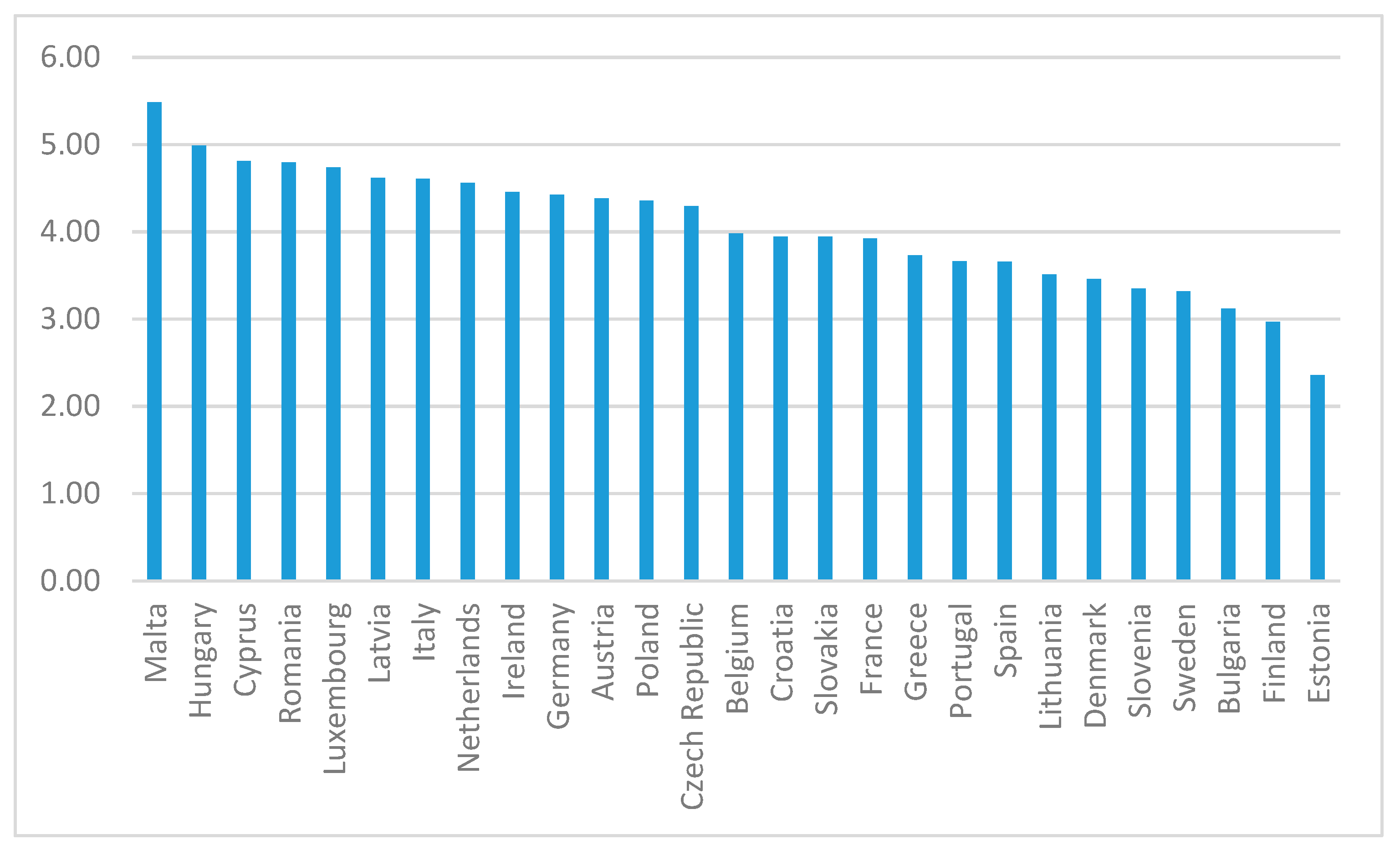

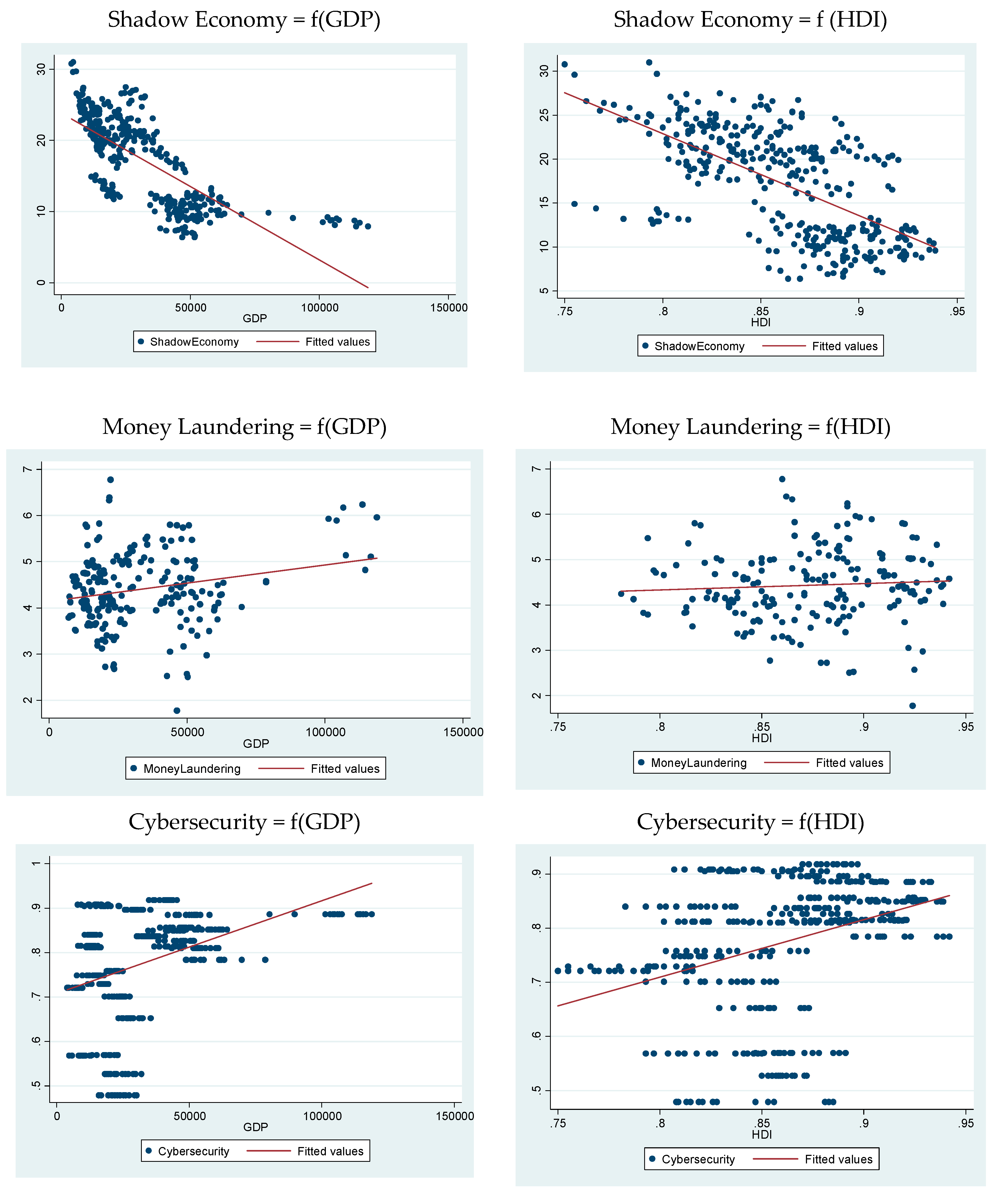

- In order to obtain data on worldwide money laundering, we utilized the Basel AML (Basel Anti-Money Laundering Index), which assesses the risk of money laundering and terrorist financing. This score ranges between 0, which is associated with the lowest risk, to 10, which is associated to the largest risk of money laundering. The Basel AML score is calculated for 141 states from the year 2012 on.

- (d)

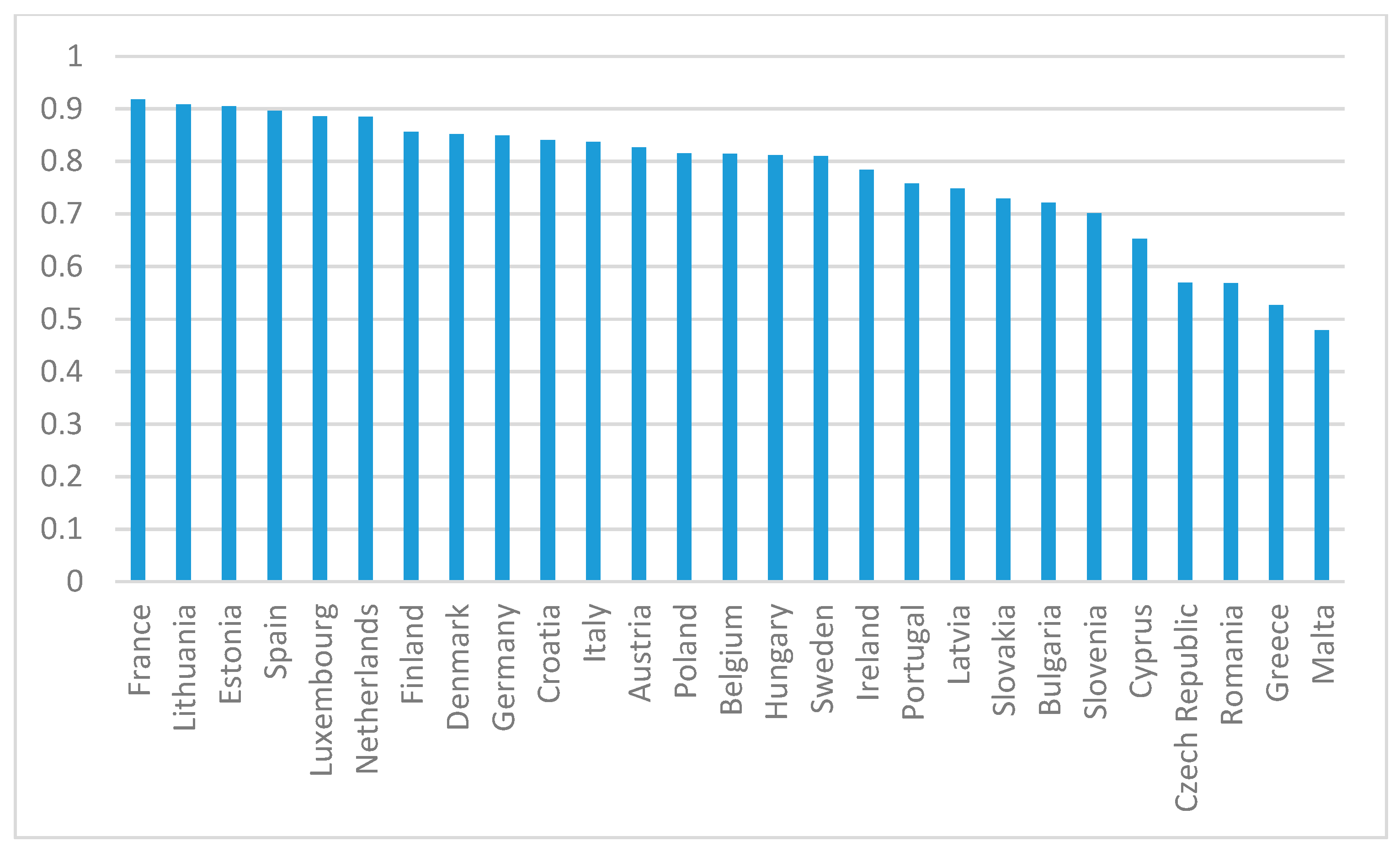

- The level of cybercrime is determined with the help of the Cybersecurity index. For this purpose, we used the Global Cybersecurity Index (GCI), belonging to the International Telecommunication Union (2018). This index ranges between 0, meaning the most vulnerable countries in terms of cyber risks (highest level of cybercrime), and 1 for the less vulnerable ones (lowest level of cybercrime). The larger the level of the GCI is, the more reduced the level of cybercrime is.

3.1.2. Measuring the Independent Variables

- (a)

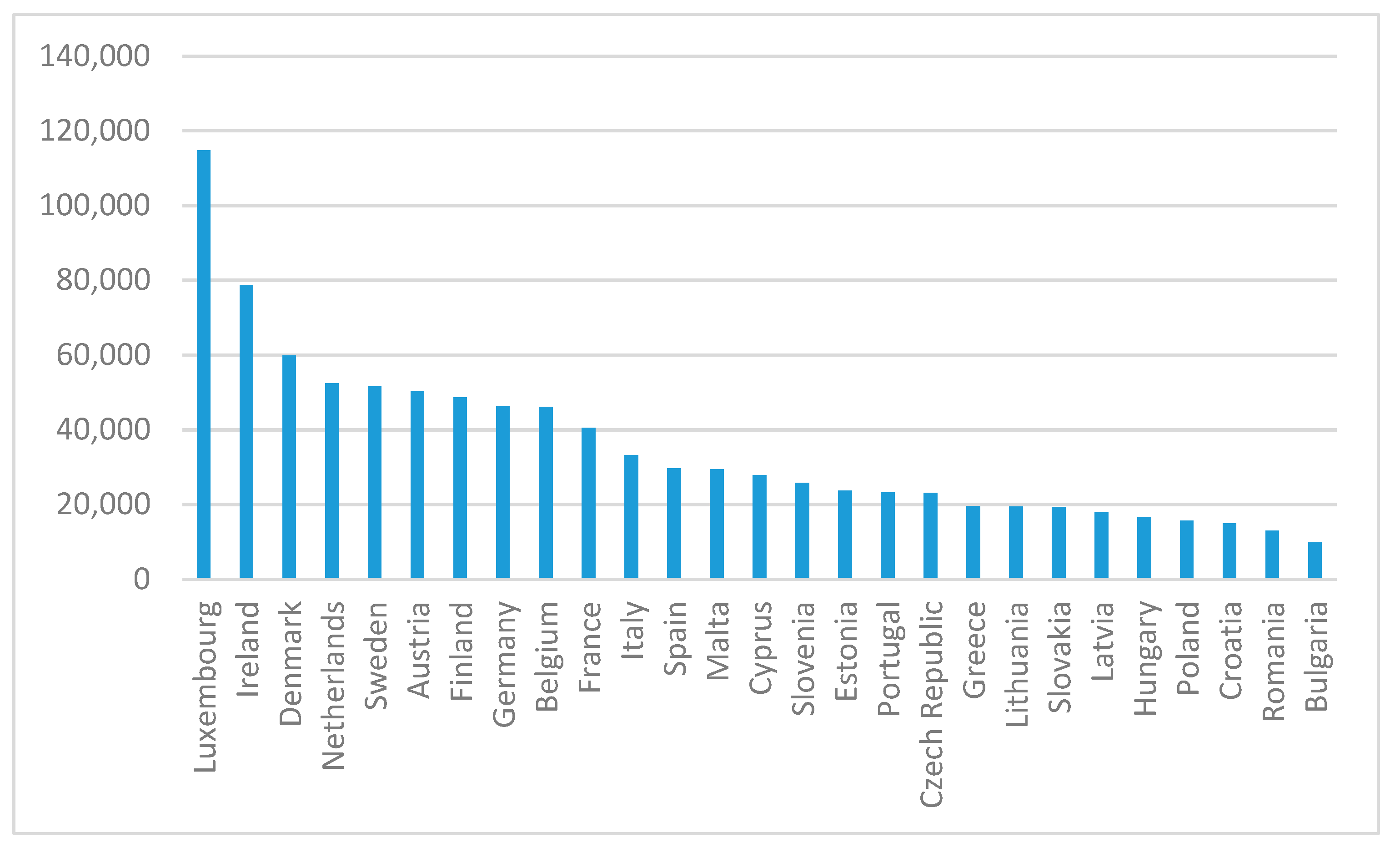

- For the economic prosperity of a country, we used the Gross Domestic Product representing the market values of all finished goods and services produced by an economy within a certain time frame. At present, GDP has become widely used worldwide (Torgler and Schneider 2007; Medina and Schneider 2019; Hoinaru et al. 2020; World Bank 2020) as an estimator for the development and prosperity level of a nation.

- (b)

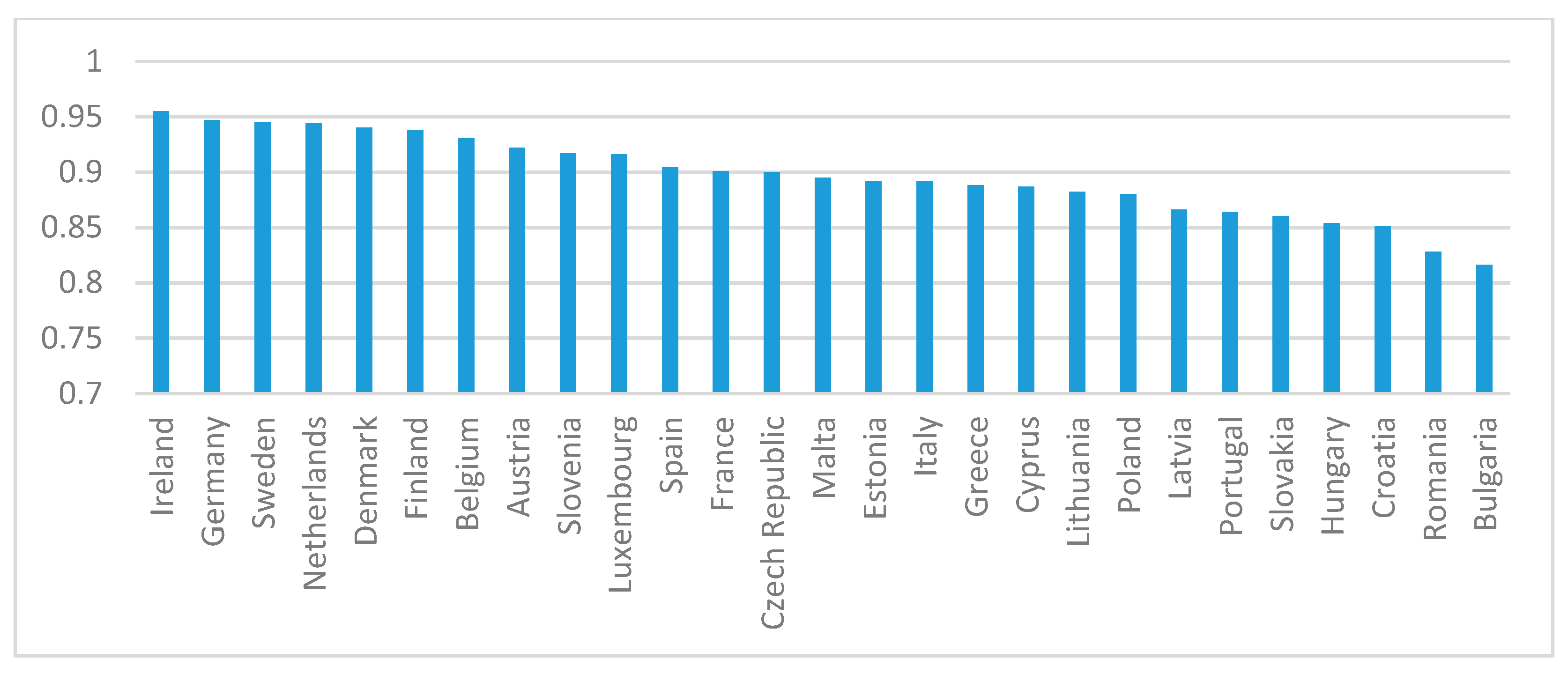

- Sustainable development is required by a growing number of studies as an alternative measure of development which is welfare driven (Stiglitz et al. 2010; Aidt 2010; Forson et al. 2017). In our study, we measured sustainable development with the Human Development Index (HDI), which reflects a final criterion for evaluating the development of a country. It is a composite measure provided by UNDP Human Development Reports (2019) and it has been previously used by many authors (Absalyamova et al. 2016; Murshed and Mredula 2018; Hoinaru et al. 2020) as a proxy for sustainable development.

3.2. Methodology and Data

- Financial and economic crimeit—proxy for the financial and economic crime dimensions of country i in year t (Corruptionit, Shadow Economyit, Money Launderingit, Cybersecurityit);

- β0—intercept;

- β1—linear effect parameter;

- Developmentit—proxy for the development dimensions of country i in year t; it includes:

- GDPit—the per capita current USD gross domestic product of country i in year t and

- HDIit—the human development index of country i in year t;

- —the residual.

4. Results

4.1. Descriptive Statistics

4.2. Main Results

4.3. Robustness Checks

- -

- Robustness checks (1), by using other proxy variables for sustainable development, mainly the Environmental Performance Index (EPI) and the Quality of Life Index (QLI);

- -

- Robustness checks (2), by supplementing Equation (1) through the addition of macro controls near the independent variable already in use. As such, Unemployment rate (Dell’Anno and Solomon 2008; Williams and Schneider 2016; Medina and Schneider 2019; Achim et al. 2021c) and Urbanization rate (Elgin and Oyvat 2013; Yuki 2007; Elgin 2020) are added as control variables in our regression results in order to strengthen our main results.

5. Discussions

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Variables and Data

| Variables | Way of Expressing | Units/Scale | Sources |

| Dependent variable | |||

| Corruption | Corruption is obtained from the Corruption Perceptions Index which measures the subjective levels of perceived corruption in the public sector for the world countries. The score ranges from 0 (highly corrupt) to 100 (very clean). In this study we particularly deal with the countries’ world ranking depending on the level of perceived corruption. | This score ranges from 1, meaning the lowest level of corrupted country in the world, to 180, the highest corrupted countries in the world. | Transparency International (2020) |

| Shadow economy | Shadow economy is determined as a percentage of shadow economy within GDP. | % in GDP | Medina and Schneider (2019) |

| Money laundering | Money laundering is determined as a risk of money laundering and terrorist financing, as it is provided by Basel AML Index. | The score ranges between 0 for the lowest risk to 10, the highest risk level in money laundering/terrorist financing. | Basel Institute of Governance (2020) |

| Cybercrime | Cybercrime is determined with the help of the Global Cybersecurity Index (GCI), as it is provided by International Telecommunication Union. | This index ranges between 0, meaning the most vulnerable countries in terms of cyber risks (highest level of cybercrime), and 1 for the less vulnerable ones (lowest level of cybercrime). | International Telecommunication Union (2018). |

| Independent variables | |||

| Economic development | GDP per capita (GDP) | In US dollars | World Bank (2020) |

| Sustainable development | Human development index (HDI) | The score ranges between 0, meaning the lowest level of human development), and 1, for the highest level of human development. | UNDP Human Development Reports (2019) |

| Environmental performance index (EPI) | The score ranges from 0, meaning the lowest level of environment perfromance, to 100 for the highest level of environment perfromance, | Yale University. Environmental Performance Index (Yale University 2020) | |

| Quality Life Index (QLI) | The score is an estimation of overall quality of life taking into account various national indices, such as purchasing power index, pollution index, house price to income ratio, cost of living index, safety index, health care index, traffic commute time index, and climate index. The higher the QLI of a country is, the better its overall living conditions are. | Numbeo (2021) | |

| Control variables | |||

| Unemployment rate | Total unemployment (modeled ILO estimate). Unemployment refers to the weight of the labor force that is without work but available for and seeking employment. | Percentage of total labor force | World Bank (2020) |

| Urbanization | Urban population (% of total population) refers to people living in urban areas as nationally defined. The data are smoothed by United Nations Population Division. | Percentage of total population | World Bank (2020) |

References

- Absalyamova, Svetlana, Timur Absalyamov, Asiya Khusnullova, and Chulpan Mukhametgalieva. 2016. The impact of corruption on the sustainable development of human capital. Journal of Physics: Conference Series 738: 1–6. [Google Scholar] [CrossRef]

- Achim, Monica Violeta, and Sorin Nicolae Borlea. 2020. Economic and Financial Crime. Corruption, Shadow Economy, and Money Laundering. Cham: Springer. [Google Scholar] [CrossRef]

- Achim, Monica Violeta, Sorin Nicolae Borlea, and Andrei M. Anghelina. 2018a. The impact of fiscal policies on corruption: A panel analysis. South African Journal of Economic and Management Sciences 21: 1–9. [Google Scholar] [CrossRef]

- Achim, Monica Violeta, Sorin Nicolae Borlea, and Viorela Ligia Văidean. 2021a. Does technology matter for combating economic and financial crime? A panel data study. Technological and Economic Development of Economy 27: 223–61. [Google Scholar] [CrossRef]

- Achim, Monica Violeta, Sorin Nicolae Borlea, Lucian Găban, and Ionuț Constantin Cuceu. 2018b. Rethinking the shadow economy in terms of happiness. Evidence for the European Union Member States. Technological and Economic Development of Economy 24: 199–228. [Google Scholar] [CrossRef]

- Achim, Monica Violeta, Sorin Nicolae Borlea, Viorela Ligia Văidean, Decebal Remus Florescu, Eugenia Ramona Mara, and Ionuț Constantin Cuceu. 2021b. Economic and Financial Crimes and the Development of Society. In Standard of Living, Wellbeing, and Community Development. Edited by Ryan Merlin Yonk. London: IntechOpen. [Google Scholar] [CrossRef]

- Achim, Monica Violeta, Viorela Ligia Văidean, Sorin Nicolae Borlea, Alexandra Ioana Rus, and Florin Dobre. 2021c. The impact of intelligence on economic and financial crime: A cross-country study. Singapore Economic Review 31: 1517–26. [Google Scholar] [CrossRef]

- Aidt, Toke S. 2010. Corruption and Sustainable Development; No. CWPE 1061. Cambridge: Faculty of Economics. Available online: https://www.repository.cam.ac.uk/bitstream/handle/1810/242086/cwpe1061.pdf;jsessionid533A12327621029A0EF0B686DD27C5E5C?sequence51 (accessed on 1 January 2021).

- Ali, Mohammed A., Muhammad Ajmal Azad, Mario Parreno Centeno, Feng Hao, and Aad van Moorsel. 2019. Consumer-facing technology fraud: Economics, attack methods and potential solutions. Future Generation Computer Systems 100: 408–27. [Google Scholar] [CrossRef]

- Alm, James, Jorge Martinez-Vazquez, and Friedrich Schneider. 2004. Sizing the problem of the hard-to tax. Contributions to Economic Analysis 268: 11–75. [Google Scholar]

- Amza, Tudor. 2002. Criminologie, Tratat de teorie şi politică criminologică (Criminology, Treatise on Criminological Theory and Policy). Bucharest: Lumina Lex Publishing House. [Google Scholar]

- Aniţei, Nadia Cerasela, and Roxana Elena Lazăr. 2016. Evaziunea fiscală între legalitate și infracţiune (The Tax Evasion between Legality and Crime). Bucharest: Universul Juridic Publishing House. [Google Scholar]

- Bartoloni, M. 2020. Movers and Shakers. August 7. Available online: https://www.theparliamentmagazine.eu/news/article/movers-and-shakers-7-august-2020 (accessed on 8 May 2021).

- Basel AML (Basel Anti-Money Laundering) Index. 2020. Available online: www.baselgovernance.org (accessed on 8 May 2021).

- Benoit, Kenneth. 2011. Linear Regression Models with Logarithmic Transformations. London: Methodology Institute. London: London School of Economics. [Google Scholar]

- Brosio, Giorgio, Alberto Cassone, and Roberto Ricciuti. 2002. Tax Evasion across Italy: Rational Noncompliance or Inadequate Civic Concern? Public Choice 112: 259–73. [Google Scholar] [CrossRef]

- Caselli, Francesco, and Guy Michaels. 2013. Do oil windfalls improve living standards? Evidence from Brazil. American Economic Journal: Applied Economics 5: 208–38. [Google Scholar]

- Chelliah, Raja J. 1971. Trends in taxation in developing countries. Staff Papers, International Monetary Fund 18: 254–331. [Google Scholar] [CrossRef]

- De Rosa, Donato, Nishaal Gooroochurn, and Holger Gorg. 2010. Corruption and Productivity: Firm-Level Evidence from the BEEPS Survey. Policy Research Working Paper, World Bank 5348. Geneva: World Bank. [Google Scholar]

- Dell’Anno, Roberto, and Offiong Helen Solomon. 2008. Shadow economy and unemployment rate in USA: Is there a structural relationship? An empirical analysis. Applied Economics 40: 2537–55. [Google Scholar]

- Durkheim, Emile. 1974. Sociology and Philosophy. New York: The Free Press. [Google Scholar]

- Earnhart, Dietrich, and Lubomir Lizal. 2007. Does Better Environmental Performance Affect Revenues, Cost, or Both? Evidence from a Transition Economy. William Davidson Institute Working Paper Number 856. Ann Arbor: William Davidson Institute. [Google Scholar]

- Elgin, Ceyhun, and Cem Oyvat. 2013. Lurking in the cities: Urbanization and the informal economy. Structural Change and Economic Dynamics 27: 36–47. [Google Scholar] [CrossRef]

- Elgin, Ceyhun, and Ferda Erturk. 2019. Informal economies around the world: Measures, determinants and consequences. Eurasian Economic Review 9: 221–37. [Google Scholar] [CrossRef]

- Elgin, Ceyhun. 2020. Shadow Economies around the World: Evidence from Metropolitan Areas. Eastern Economic Journal 46: 301–22. [Google Scholar] [CrossRef]

- Emerson, John W., Angel Hsu, Marc A. Levy, Alex de Sherbinin, Zachary A. Wendling, Valentina Mara, Daniel C. Esty, and Malanding Jaiteh. 2012. Environmental Performance Index and Pilot Trend Environmental Performance Index. New Haven: Yale Center for Environmental Law and Policy. [Google Scholar]

- Esty, Daniel, Marc A. Levy, Christine Kim, Alex de Sherbinin, Tanja Srebotnjak, and Valentina Mara. 2008. Environmental Performance Index. New Haven: Yale Center for Environmental Law and Policy. [Google Scholar]

- Forson, Joseph Ato, Ponlapat Buracom, Guojin Chen, and Theresa Yaaba Baah-Ennumh. 2017. Genuine Wealth Per Capita as a Measure of Sustainability and the Negative Impact of Corruption on Sustainable Growth in Sub-Sahara Africa. South African Journal of Economics 5: 178–95. [Google Scholar] [CrossRef]

- Gallego-Álvarez, Isabel, Purficacion Vicente-Galindo, Purificacion Galindo-Villardón, and Miguel Rodríguez-Rosa. 2014. Environmental Performance in Countries Worldwide: Determinant Factors and Multivariate Analysis. Sustainability 6: 7807–32. [Google Scholar] [CrossRef]

- Goel, Rajeev K., and Rati Ram. 2013. Economic uncertainty and corruption: Evidence from a large cross-country data set. Applied Economics 45: 3462–68. [Google Scholar] [CrossRef]

- Gogolin, Greg. 2010. The digital crime tsunami. Digital Investigation 3: 3–18. [Google Scholar] [CrossRef]

- Gundlach, Erich, and Martin Paldam. 2009. The transition of corruption: From poverty to honesty. Economic Letters 103: 146–48. [Google Scholar] [CrossRef][Green Version]

- Hair, Joseph F., Jr., William C. Black, Barry J. Babin, and Rolph E. Anderson. 2010. Multivariate Data Analysis, 7th ed. London: Pearson Prentice Hall. [Google Scholar]

- Hoinaru, Razvan, Daniel Buda, Sorin Nicolae Borlea, Viorela Ligia Văidean, and Monica Violeta Achim. 2020. The impact of corruption and shadow economy on the economic and sustainable development. Do they “sand the wheels” or “grease the wheels”? Sustainability 12: 481. [Google Scholar] [CrossRef]

- Husted, Bryan W. 1999. Wealth, culture, and corruption. Journal of International Business Studies 30: 339–59. [Google Scholar] [CrossRef]

- International Telecommunication Union. 2018. Global Cybersecurity Index (GCI). Available online: https://www.itu.int/en/ITU-D/Cybersecurity/Pages/global-cybersecurity-index.aspx (accessed on 25 March 2021).

- Jurj-Tudoran, Remus, and Dan Drosu Șaguna. 2016. Spălarea Banilor (Money Laundering). Bucharest: C. H. Beck Publishing House. [Google Scholar]

- Kirchler, Erich. 2007. The Economic Psychology of Tax Behavior. Cambridge: Cambridge University Press. [Google Scholar]

- Kroll, Stephen R. 1994. Money laundering. A concept paper prepared for the Government of Bulgaria. International Law 65: 835–69. [Google Scholar]

- Kshetri, Nir. 2010. Diffusion and Effects of Cybercrime in Developing Economies. Third World Quarterly 31: 1057–79. [Google Scholar] [CrossRef]

- Leția, A. A. 2014. Investigarea Criminalităţii de Afaceri (Investigation of Business Criminality). Bucharest: Universul Juridic Publishing House. [Google Scholar]

- Mauro, Paolo. 1995. Corruption and growth. The Quarterly Journal of Economics 110: 681–712. [Google Scholar] [CrossRef]

- McAfee. 2018. The Economic Impact of Cybercrime—No Slowing Down. Available online: https://www.mcafee.com/enterprise/en-us/assets/executive-summaries/es-economic-impact-cybercrime.pdf (accessed on 28 January 2021).

- McDowell, John. 2001. The consequence of money laundering and financial crime. Economic Perspective 6: 6–9. [Google Scholar]

- Medina, Leandro, and Friedrich Schneider. 2019. Shedding Light on the Shadow Economy: A Global Database and the Interaction with the Official One. CESifo Working Papers 7981. New York: CESifo. [Google Scholar]

- Merton, Robert K. 1968. Social Theory and Social Structure, Enlarged ed. New York: Free Press. [Google Scholar]

- Murshed, Muntasir, and Farzana Awlad Mredula. 2018. Impacts of Corruption on Sustainable Development: A Simultaneous Equations Model Estimation Approach. Journal of Accounting, Finance and Economics 8: 109–33. [Google Scholar]

- Mussurov, Altay, Dena Sholk, and Gholamreza Reza Arabsheibani. 2019. Informal employment in Kazakhstan: A blessing in disguise? Eurasian Economic Review 9: 267–84. [Google Scholar] [CrossRef]

- Nilson Report. 2020. Card Fraud Worldwide. Issue 1187. Available online: https://nilsonreport.com/about_us.php (accessed on 11 February 2021).

- Numbeo. 2021. Mladen Adamovic. Available online: https://www.numbeo.com/common/motivation_and_methodology.jsp (accessed on 11 February 2021).

- Orviska, Marta, and John Hudson. 2003. Tax evasion, civic duty and the law abiding citizen. European Journal of Political Economy 19: 83–102. [Google Scholar] [CrossRef]

- Paldam, Martin. 2001. Corruption and religion. Adding to the economic model. Kyklos 54: 383–414. [Google Scholar] [CrossRef]

- Paldam, Martin. 2002. The big pattern of corruption: Economics, culture and the see saw dynamics. European Journal of Political Economy 18: 215–40. [Google Scholar] [CrossRef]

- PricewaterhouseCoopers. 2018. Global Economic Crime and Fraud Survey 2018. A Front Line Perspective on Fraud in Romania. London: PricewaterhouseCoopers. [Google Scholar]

- Remeikiene, Rita, Ligita Gaspareniene, and Friedrich Georg Schneider. 2018. The definition of digital shadow economy. Technological and Economic Development of Economy 24: 696–717. [Google Scholar] [CrossRef]

- Ryman-Tubb, Nick F., Paul Krause, and Wolfgang Garn. 2018. How Artificial Intelligence and machine learning research impacts payment, card fraud detection: A survey and industry benchmark. Engineering Applications of Artificial Intelligence 76: 130–57. [Google Scholar] [CrossRef]

- Schneider, Friedrich, and Andreas Buehn. 2018. Shadow Economy: Estimation Methods, Problems, Results and Open Questions. Open Economics 1: 1–29. [Google Scholar] [CrossRef]

- Schneider, Friedrich, and Robert Klinglmair. 2004. Shadow Economies around the World: What do We Know? Working Paper No. 0403. Linz: Universität Linz. [Google Scholar]

- Schneider, Friedrich, Andreas Buehn, and Claudio E. Montenegro. 2010. New estimates for the shadow economies all over the world. International Economic Journal 24: 443–61. [Google Scholar] [CrossRef]

- Schroeder, William R. 2001. Money laundering: A global threat and the international community’s response. FBI Law Enforcement Bulletin 7: 1–9. [Google Scholar]

- Stiglitz, Joseph E., Sen Amartya, and Jean-Paul Fitoussi. 2010. Mis-Measuring OUR Lives: Why GDP Doesn’t Add Up, Commission on the Measurement of Economic Performance and Social Progress. New York: New Press. [Google Scholar]

- Sutherland, Edwin H. 1940. White-collar criminality. American Sociological Review 5: 1–12. [Google Scholar] [CrossRef]

- Świątkowska, Joanna. 2020. Tackling Cybercrime to Unleash Developing Countries’ Digital Potential. Pathways for Prosperity Commission Background. Oxford: University of Oxford. [Google Scholar]

- The OLAF Report 2019. 2020. Luxembourg: Publications Office of the European Union. ISSN 2315-494.

- Torgler, Benno, and Friedrich Schneider. 2007. The Impact of Tax Morale and Institutional Quality on the Shadow Economy. Journal of Economic Psychology 30: 228–45. [Google Scholar] [CrossRef]

- Torgler, Benno, Friedrich Schneider, and Christoph A. Schaltegger. 2010. Local autonomy, tax morale and the shadow economy. Public Choice 144: 293–321. [Google Scholar] [CrossRef]

- Torgler, Benno. 2004. Tax Morale in Asian Countries. Journal of Asian Economics 15: 237–66. [Google Scholar] [CrossRef]

- Transparency International. 2020. Corruption Perception Index. Available online: www.transparency.org/research/cpi/ (accessed on 10 April 2021).

- Treisman, Daniel. 2000. The causes of corruption: A cross-national study. Journal of Public Economics 76: 399–457. [Google Scholar] [CrossRef]

- UNDP Human Development Reports. 2019. Human Development Report. Beyond Income, beyond Averages, beyond Today: Inequalities in Human Development in the 21st Century. Available online: http://hdr.undp.org (accessed on 25 January 2021).

- Williams, Colin C., and Friedrich Schneider. 2016. Measuring the Global Shadow Economy: The Prevalence of Informal Work and Labor. Northampton: Edward Elgar. [Google Scholar]

- World Bank. 2020. World Bank Indicators. Available online: https://data.worldbank.org/indicator (accessed on 10 February 2021).

- Yale University. 2020. Environmental Performance Index 2020. Available online: https://epi.envirocenter.yale.edu (accessed on 15 October 2020).

- Yuki, Kazuhiro. 2007. Urbanization, informal sector, and development. Journal of Development Economics 84: 76–103. [Google Scholar] [CrossRef]

| (a) Results of Pooled OLS Estimation of Financial and Economic Crime as a Function of GDP | (b) Results of Pooled OLS Estimation of Financial and Economic Crime as a Function of HDI | |||||||

|---|---|---|---|---|---|---|---|---|

| Variables | Log Corruption Model (1a) | Log Shadow Economy Model (2a) | Money Laundering Model (3a) | Log Cybersecurity Model (4a) | Log Corruption Model (1b) | Log Shadow Economy Model (2b) | Money Laundering Model (3b) | Log Cybersecurity Model (4b) |

| LogGDP | −1.1213 *** | −0.4461 *** | 0.2165 ** | 0.0904 *** | ||||

| LogHDI | −12.6941 *** | −4.9475 *** | 1.2141 | 1.212 *** | ||||

| Constant | 14.5884 *** | 7.3078 *** | 2.1923 ** | −1.1881 *** | 1.2865 *** | 2.0281 *** | 4.5943 *** | −0.0866 *** |

| R squared | 0.5133 | 0.5934 | 0.0294 | 0.1207 | 0.3410 | 0.3655 | 0.0042 | 0.1119 |

| Adjusted R squared | 0.5120 | 0.5922 | 0.0249 | 0.1185 | 0.3393 | 0.3637 | 0.0012 | 0.1096 |

| N | 405 | 351 | 216 | 405 | 378 | 351 | 189 | 378 |

| (a) Results of Pooled OLS Estimation of Financial and Economic Crime as a Function of EPI | (b) Results of Pooled OLS Estimation of Financial and Economic Crime as a Function of QLI | |||||||

|---|---|---|---|---|---|---|---|---|

| Variables | Log Corruption Model (1a) | Log Shadow Economy Model (2a) | Money Laundering Model (3a) | Log Cybersecurity Model (4a) | Log Corruption Model (1b) | Log Shadow Economy Model (2b) | Money Laundering Model (3b) | Log Cybersecurity Model (4b) |

| EPI | −0.0541 *** | −0.0266 *** | 0.0023 | 0.0046 *** | ||||

| QLI | −0.0171 *** | −0.0054 *** | −0.0056 *** | 0.0014 *** | ||||

| Constant | 7.18451 *** | 4.7455 *** | 4.2525 *** | −0.6118 *** | 5.6413 *** | 3.4966 *** | 5.1296 *** | −0.4666 *** |

| R squared | 0.1747 | 0.3082 | 0.0049 | 0.0465 | 0.3864 | 0.3726 | 0.0758 | 0.1311 |

| Adjusted R squared | 0.1725 | 0.3062 | 0.0005 | 0.044 | 0.3830 | 0.3679 | 0.0713 | 0.1269 |

| N | 378 | 351 | 189 | 378 | 183 | 135 | 208 | 208 |

| (a) Results of Pooled OLS Estimation of Financial and Economic Crime as a Function of GDP, with Unemployment as Macro control | (b) Results of Pooled OLS Estimation of Financial and Economic Crime as a Function of HDI, with Unemployment as Macro control | |||||||

|---|---|---|---|---|---|---|---|---|

| Variables | Log Corruption Model (1a) | Log Shadow Economy Model (2a) | Money Laundering Model (3a) | Log Cybersecurity Model (4a) | Log Corruption Model (1b) | Log Shadow Economy Model (2b) | Money Laundering Model (3b) | Log Cybersecurity Model (4b) |

| LogGDP | −1.1219 *** | −0.4465 *** | 0.2005 ** | 0.0912 *** | ||||

| LogHDI | −12.5517 *** | −5.0795 *** | 2.8448 ** | 1.1793 *** | ||||

| Unemployment | 0.0405 *** | 0.0014 | 0.0675 *** | −0.0051 *** | 0.0105 | −0.0098 ** | 0.0757 *** | −0.0024 |

| Constant | 14.2812 *** | 7.3007 *** | 1.8765 ** | −1.1567 *** | 1.2281 *** | 2.0838 *** | 4.2447 *** | −0.0732 ** |

| R squared | 0.5387 | 0.5937 | 0.1615 | 0.1362 | 0.3429 | 0.377 | 0.1591 | 0.1154 |

| Adjusted R squared | 0.5362 | 0.5913 | 0.1525 | 0.1315 | 0.3394 | 0.3735 | 0.1501 | 0.1107 |

| N | 378 | 351 | 189 | 378 | 378 | 351 | 189 | 378 |

| (a) Results of Pooled OLS Estimation of Financial and Economic Crime as a Function of GDP, with Urban as Macro control | (b) Results of Pooled OLS Estimation of Financial and Economic Crime as a Function of HDI, with Urban as Macro control | |||||||

|---|---|---|---|---|---|---|---|---|

| Variables | Log Corruption Model (1a) | Log Shadow Economy Model (2a) | Money Laundering Model (3a) | Log Cybersecurity Model (4a) | Log Corruption Model (1b) | Log Shadow Economy Model (2b) | Money Laundering Model (3b) | Log Cybersecurity Model (4b) |

| LogGDP | −1.1072 *** | −0.4455 *** | 0.2341 ** | 0.0897 *** | ||||

| LogHDI | −12.7138 *** | −4.9564 *** | 1.2326 | 1.2119 *** | ||||

| Urbanization | 0.0024 | 0.0007 | 0.0023 | 0.0001 | 0.0033 * | 0.0011 * | 0.0023 | 0.0001 |

| Constant | 14.2868 *** | 7.2567 *** | 1.8928 * | −1.1858 *** | 1.0707 *** | 1.9534 *** | 4.4503 *** | −0.0875 * |

| R squared | 0.5140 | 0.5953 | 0.0375 | 0.1204 | 0.3470 | 0.3705 | 0.0086 | 0.1119 |

| AdjustedR squared | 0.5114 | 0.5930 | 0.0272 | 0.1157 | 0.3435 | 0.3669 | 0.0021 | 0.1072 |

| N | 378 | 351 | 189 | 378 | 378 | 351 | 189 | 378 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Achim, M.V.; Văidean, V.L.; Borlea, S.N.; Florescu, D.R. The Impact of the Development of Society on Economic and Financial Crime. Case Study for European Union Member States. Risks 2021, 9, 97. https://doi.org/10.3390/risks9050097

Achim MV, Văidean VL, Borlea SN, Florescu DR. The Impact of the Development of Society on Economic and Financial Crime. Case Study for European Union Member States. Risks. 2021; 9(5):97. https://doi.org/10.3390/risks9050097

Chicago/Turabian StyleAchim, Monica Violeta, Viorela Ligia Văidean, Sorin Nicolae Borlea, and Decebal Remus Florescu. 2021. "The Impact of the Development of Society on Economic and Financial Crime. Case Study for European Union Member States" Risks 9, no. 5: 97. https://doi.org/10.3390/risks9050097

APA StyleAchim, M. V., Văidean, V. L., Borlea, S. N., & Florescu, D. R. (2021). The Impact of the Development of Society on Economic and Financial Crime. Case Study for European Union Member States. Risks, 9(5), 97. https://doi.org/10.3390/risks9050097