1. Motivation and Outline

There is a vast collection of literature describing numerical methods for evaluating options. Among the most popular ones is the binomial tree method which is broadly used because of its simplicity and flexibility. In most binomial models, the price

of a call/put option is connected to the price

of the same call/put option in the Black–Scholes model via an equation of the form

where

is bounded but usually not constant, as it depends on

n. When

is constant, one can use Richardson extrapolation to achieve convergence at a speed of order

. For European options, models have been found

Joshi (

2009b);

Leduc (

2016a) for which the error has the form

for an arbitrary value of

. Obviously, there is a well-known closed form formula for the price of European put/call options in the Black–Scholes model. However, this is not the case for the American put. Yet techniques developed for path-independent European options proved to extend to the study of path-dependent options—for instance, in

Bock and Korn (

2016);

Carbone (

2004);

Grosse-Erdmann and Heuwelyckx (

2016);

Heuwelyckx (

2014);

Leduc and Palmer (

2019);

Lin and Palmer (

2013). Note that the behavior of American options is also connected to the behavior of European options: the American put can be expressed as the sum of a European put and an integral of digital options

Carr, Jarrow and Myneni (

1992).

Many binomial trees have been suggested in the literature for computing option prices—among others,

Chance (

2008);

Chang and Palmer (

2007);

Chriss (

1996);

Cox, Ross and Rubinstein (

1979);

Diener and Diener (

2004);

Jarrow and Rudd (

1983);

Jarrow and Turnbull (

2000);

Joshi (

2009a,

2010);

Korn and Müller (

2013);

Lamberton (

1998);

Leduc (

2016b);

Leisen and Reimer (

1996);

Tian (

1993,

1999);

Trigeorgis (

1991);

Van Den Berg and Koudjeti (

2000);

Walsh (

2003);

Wilmott (

1998). In addition to the intellectual curiosity of understanding how tree models converge to their limits (which is part of the important study of random sums of random variables), the interest in tree methods for pricing security derivatives is motivated by those cases where no simple closed form formula exists. This is the case for American options, for which explicit values for the coefficients

in the expansion of the error

are unknown, and finding them is a challenging and interesting problem. Even the speed of convergence of binomial trees to its Black–Scholes limit remains a long lasting and difficult problem

Lamberton (

1998,

2002,

2018). Thus far, only convergence has been established

Amin and Khanna (

1994);

Jiang and Dai (

2004);

Lamberton (

1993). However,

Joshi (

2009b) pointed out that trading houses need to efficiently price thousands of American options, and that understanding which tree is the best at doing so is an important problem. Because of the lack of theoretical results, such questions and a lot of the insight about the behavior of the convergence of tree methods for American put options have been assessed through empirical studies, such as

Broadie and Detemple (

1996);

Chan et al. (

2009);

Chen and Joshi (

2012);

Hull and White (

1988);

Joshi (

2009b,

2012);

Staunton (

2005);

Tian (

1999).

Joshi (

2009b) studied a broad collection of trees for pricing American options, and found that the most effective ones are the one from

Tian (

1993) and the split tree which was specifically designed by Joshi to minimize the oscillations of the error. However, the convergence theory for the split tree has never been done. The goal of this paper is to describe and generalize the split tree, analyze and optimize its convergence in the European case, and numerically verify that variants of the split tree introduced in this paper significantly improve the convergence of Joshi’s original split tree in the American case.

First we introduce a “flexible” version of Joshi’s original split tree. In Joshi’s original split tree, a drift parameter

is used in the binomial model up to a split time

, after which the tree becomes a Cox Ross Rubinstein (CRR) tree. Moreover, Joshi sets the split time to be the first time step

greater than or equal to half of the maturity, and he sets the drift parameter

in such a way that after the split, half the nodes of the tree are located on each side of the strike

K. We relax these constraints on

and

for the flexible split tree, and we only require that the strike be exactly halfway between two nodes in the log-space, in order to maintain smoothness of the convergence. Joshi’s original split tree is illustrated in

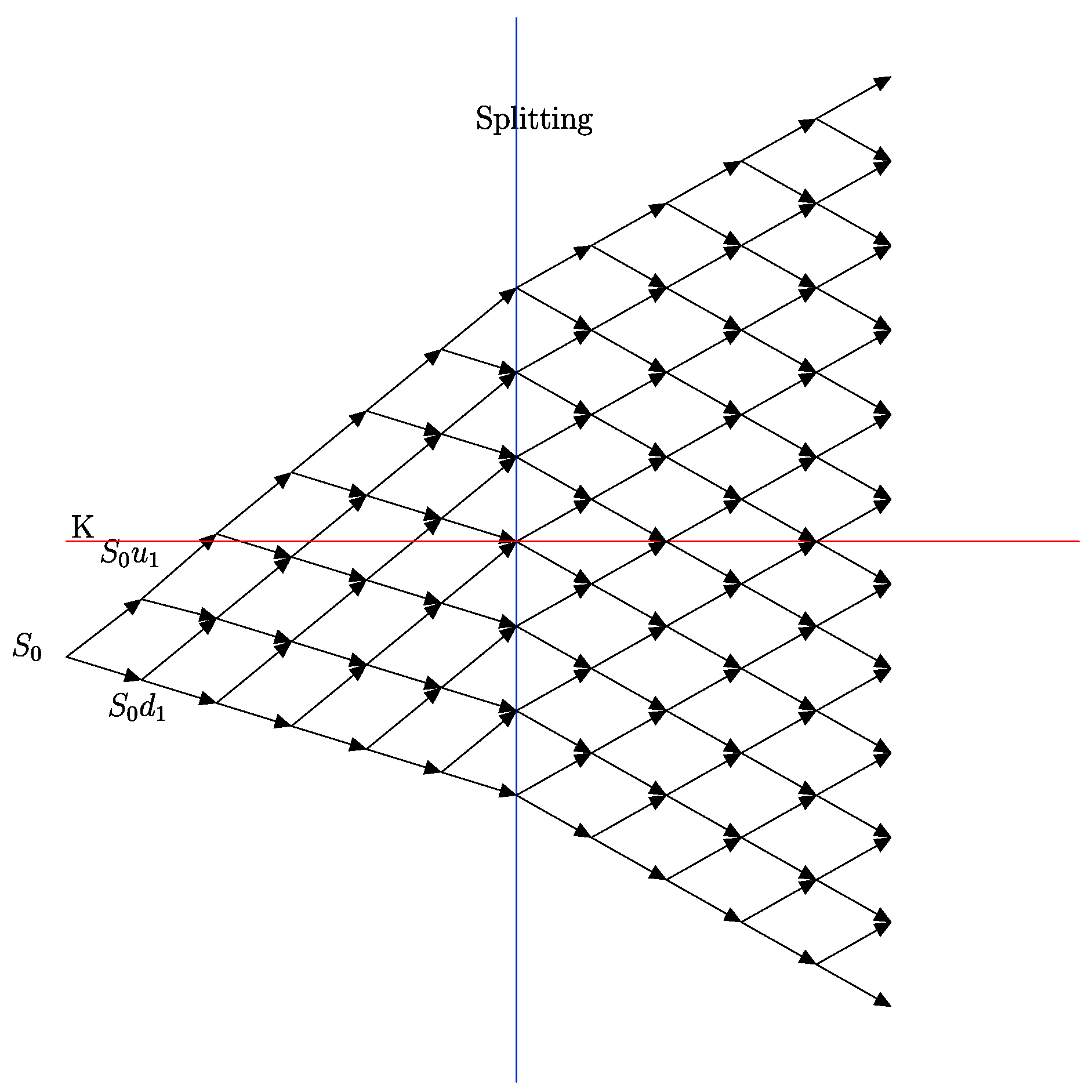

Figure 1 where, for simplicity, the log-transformed values of the tree are displayed.

Next we analyze the convergence of the split tree in the European case. For self-similar binomial trees (those for which the up and down mechanism is identical at every time step) the coefficients

in the expansion of the error (

1) can be calculated with great generality using

Diener and Diener (

2004) or

Chang and Palmer (

2007). However, the split tree is not self-similar because it is the mixture of two trees: a flexible binomial tree as in

Chang and Palmer (

2007), and the Cox Ross Rubinstein (CRR) tree. Hence

Diener and Diener (

2004) or

Chang and Palmer (

2007) cannot be used to calculate

. The calculation of

is the first result of this paper. To the best of our knowledge, it is the first time that an explicit error formula has been found for non-self-similar trees.

Then we define optimal versions of the split tree. When fixing all the parameters of a split tree except its split time

, we say that a split time

is the optimal split time if the magnitude of the coefficient

in (

1) is minimized when the split time is

. When

is the optimal split time, we say that the tree is an optimal split tree. First we prove a general result which provides a close form formula for the optimal split time

. However, there are many optimal split trees, even when the parameters

,

K,

r,

, and

T are fixed. We consider optimal split trees under three natural constraints. The first constraint is to have all the nodes in the final layer of the tree centered around the strike

K, as in Joshi’s original split tree. Joshi’s arbitrarily fast converging tree for European vanilla options

Joshi (

2010) is also centered around the strike. This motivates studying the optimal split tree under this natural constraint, and we call it the optimal centered split tree. However, the “centered” constraint sometimes prevents us from getting

. This is our motivation for the maximal range optimal split tree, which is the optimal split tree under the constraint that the range of values of the spot

for which

at the optimal split time

is maximized. Now, the maximal range optimal split tree may result in a very small optimal split time

and a large drift

. If

is very small and the number of time steps

n is not large, there can be very few time steps prior to the split time, which may result in increased oscillations of the error. This is the motivation for our last optimal split tree. In the optimal split tree near

, we seek to choose the drift

in such a way that

occurs at a split time which is as close as possible to some target

.

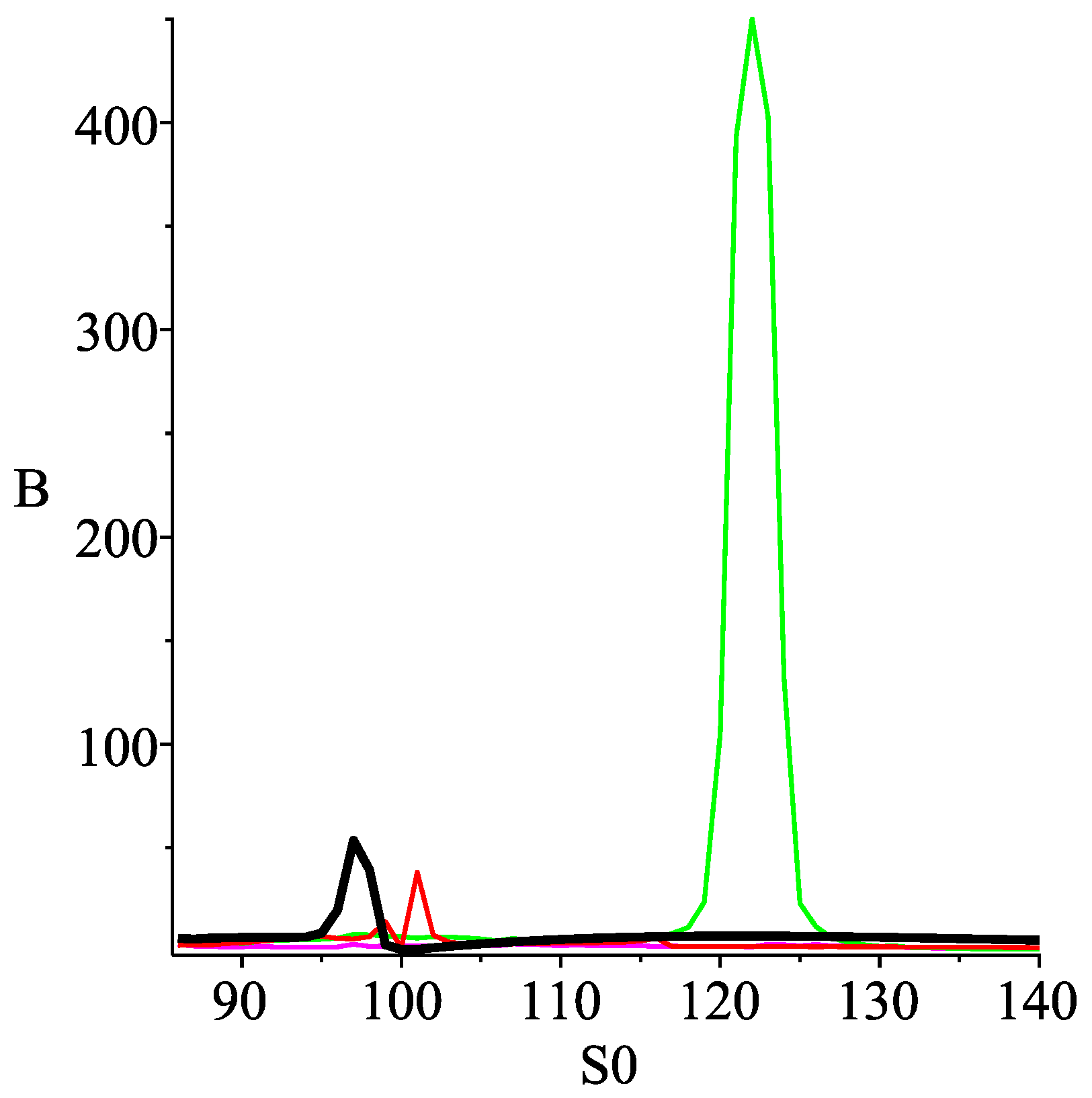

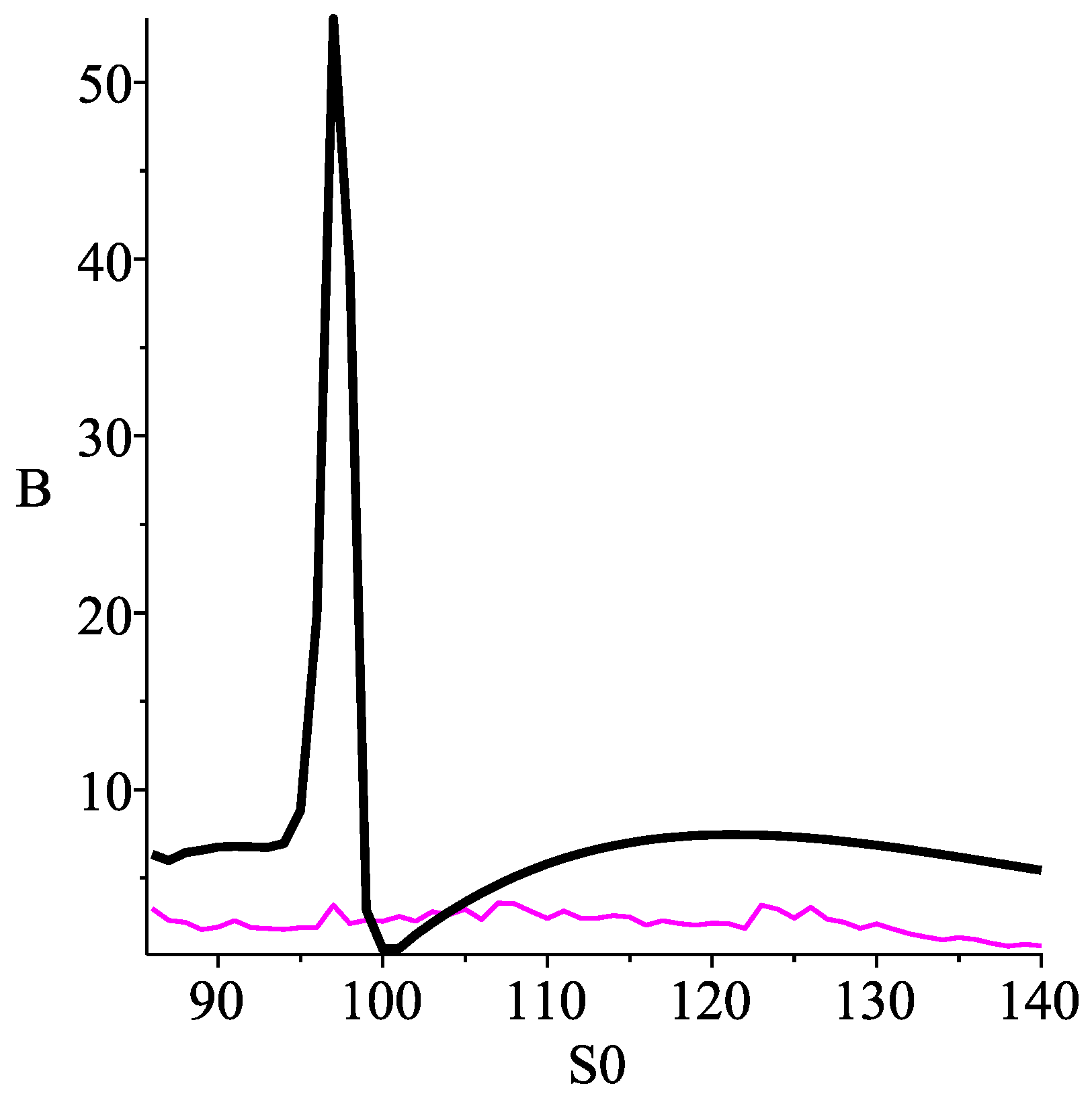

Finally, we test our split trees in the American case. Our numerical results suggest that one of our optimal split trees is capable of significantly improving the accuracy of the convergence of Joshi’s original split tree for the American put. We explain how this increased accuracy translates in a measure of increased speed. In this measure, our numerical result suggests that one of our optimal split trees could be significantly faster than Joshi’s original tree.

2. The Split Tree

In the setting of put or call options in the Black–Scholes model with spot price , strike K, risk free rate r, volatility , and maturity T, the binomial tree method with n time steps, is equivalent to replacing the Black–Scholes geometric Brownian motion with a process such that at every positive time t which is a multiple , the process jumps from its current position to with probability p, and jumps to with probability . Such trees are called self-similar because the jumping mechanism is identical at every time step.

Binomial trees typically exhibit an oscillatory convergence, and numerous choices of

and

p have been proposed to smooth and accelerate this convergence. In the Cox Ross Rubinstein (CRR) model

Cox, Ross and Rubinstein (

1979), the choices are

In the flexible binomial trees,

Chang and Palmer (

2007);

Tian (

1999), the values of

u,

d, and

p are given by

where the additional drift parameter

may depend on

n but must remain bounded.

Let

. In the split tree with split time

and drift parameter

, the process

follows a flexible binomial tree with parameter

on the interval

, and it follows the CRR model thereafter. This means that the values of

d and

p used to calculate

at time

are constant for

and

. In fact, the split tree uses

u,

d, and

p from (

4) for

, and it uses (

3) for

. Seeking good convergence properties, the split tree requires that

falls exactly halfway between two nodes in the log-space. Here

is any number in the interval

. However, given a split time

, the actual time at which the values of

u and

d switch from (

4) to (

3) can only be a multiple of

. When

is not a multiple of

, we round it to the nearest multiple of

. In this manner, we can assume that

is a multiple of

. Note that the cases where

and

correspond to no splitting, which is treated in

Chang and Palmer (

2007). Thus, in order to simplify the exposition, when calculating the coefficient of the error

in

we make the assumption that

As for

, we can express it in the form

where, for some integer

depending on

n,

or equivalently

The parameter

is actually a practical way of determining

because one of the defining properties of the split tree is that

falls exactly halfway between two nodes in the log-space and this is guaranteed by (

7) and (

8). To see this, consider first the special case where

n is even, and where

with

m even. Then an even number of time steps,

, is left until maturity

T. At time

, the tree is centered around

This means that, if at time

the total number of up movements is equal to the total number of down movements in the tree, then the value of

is

. As an even number of time steps is left until maturity, it follows that in the CRR model (and therefore in the split tree)

is a terminal node. Hence, in the log space, the terminal nodes of the tree have the form

The cases

and

give the two neighbors of

. Thus,

falls exactly halfway between two nodes in the log-space, as claimed. The other cases (

n even and

m odd,

n odd and

m odd, and

n odd and

m even) can be treated in a similar manner. Throughout this paper we make the assumption that

satisfies

or equivalently

The simplest way to specify a split tree is via the split time and the implicit parameter ℓ. Here is a formal definition.

Definition 1 (Split tree with parameters

and

ℓ)

. Consider a spot price , a strike K, a risk free rate r, a volatility σ, a maturity T, and a number of time steps . Given a split time , and some integer ℓ, define by (8), and define λ by (7). Define also , , and byFinally, define the time steps , for , by . The split tree with parameter τ and ℓ is the stochastic process which is constant on each interval , such that , and which at every time step , jumps from its current position to with probability , and jumps to with probability .

Definition 2. We say that a split tree is centered if .

Definition 3. Joshi’s original split tree is the special case where , and τ is the smallest time step greater than or equal to .

3. Rate of Convergence of the Split Tree

In this section, we provide two expressions for the coefficient of

in the expansion in powers of

of the error for the split tree value of a call option

, against the Black–Scholes price

. We also show that the coefficient of

is null. Given splitting parameters

and

, we find an explicit formula for the value of

in

. Here

c is a smooth function of

and

. In

Section 3.1 we provide a

generic expression for

c, and in

Section 3.2 we transform this generic expression into an

explicit closed-form formula.

3.1. Generic Expressions for the Coefficients of in the Error

We use the semigroup notation introduced by Leduc in

Leduc (

2013). Consider any Markov process, for instance, a discrete Markov process

,

with

for some process

with independent increments. Consider now

, the conditional expectation given that

. Then for any non-negative measurable function

f, any

, and any

, the Markov property gives that

Obviously, with

we obtain the

discounted expectation semigroup operator. It satisfies

In other words, is the price of an option with maturity t and payoff function f, when .

As always, the strike

K, spot price

, maturity

T, risk free rate

r, and volatility

are fixed. We denote by

the flexible binomial model of

Chang and Palmer (

2007) with parameter

and

n time-steps until maturity. Hence

is the stochastic process associated with

and

p given by (

4). We denote by

its semigroup operator. Note that the CRR model corresponds to a flexible binomial model where

. Given a split time

and drift parameter

, we denote by

and

the stochastic process and semigroup operator associated with the corresponding split tree. Finally,

denotes the semigroup operator associated with the geometric Brownian motion.

To shorten expressions we set

Then

and the price

of a call option with maturity

T in the split tree model can be written as

Motivated by our extension of the results in

Leduc (

2013), Theorem A2 in

Appendix C, we introduce another abbreviation: given a non negative measurable bounded function

h, we write:

where

If h is smooth enough then Theorem A2 says that is the coefficient of in the expansion of the error for an option with payoff h evaluated in the flexible model with parameter when .

Moreover, for every

and

, we also use the notation

where

and

are as in Chang and Palmer’s Theorem A1 given in

Appendix B; that is,

Note that is the coefficient of in the expansion of the error of a call option in the CRR model when .

Let be the price of a call option in the Black–Scholes model of the option, when the maturity is t, the strike is K, the risk free rate is r, the volatility is , and the spot price is x. The next proposition provides a generic expression that connects the option’s price in the split model to the price in the Black–Scholes model.

Proposition 1. Consider a European call option with strike K, spot price , maturity T, risk free rate r, and volatility σ. Let the split time , , be bounded away from 0 and T. Moreover, let the drift be bounded and of the form for some of the form (8). Then the price in the Black–Scholes model is related to the price in the split tree model by the equationwhere 3.2. Explicit Expressions for the Coefficients of in the Error

In this section we give an explicit closed form formula for

of (

15). First note that

and

It follows from (

12) that

The derivatives with respect to the spot price

of a call option in the Black–Scholes model are well known, and from there we see that for

,

where

is as in

Section 3.1, and

With simple algebraic manipulation we re-write (

17) as

where

and

The following theorem, proved in

Appendix A, provides an explicit closed form formula for the coefficient

of

in the expansion of the error of a call option evaluated with the split tree.

Theorem 1. Consider a European call option with strike K, spot price , maturity T, risk free rate r, and volatility σ. Let the split time , , be bounded away from 0 and T. Moreover, let the drift be bounded and of the form for some of the form (8). Then the price in the Black–Scholes model is related to the price in the split tree model by the equationwherewith Note that when

and

n is odd,

, and regardless of the value of

, there is no splitting since the process is CRR throughout. Our error formula therefore coincides with the formula in

Chang and Palmer (

2007); that is,

Note also that the case

does not fall under the assumption of Theorem 1 above. However, when

there is actually no splitting and because

K is exactly halfway between two nodes; the oscillating term

in the formula of

Chang and Palmer (

2007) vanishes. Simple algebraic manipulations show again that our formula coincides with the formula in

Chang and Palmer (

2007) (see Theorem A1 in

Appendix B); that is

The following provides another expression for which we will use for defining optimal split trees.

Lemma 1. For , the term can be rewritten aswhere Proof. This follows from minor algebraic manipulation of (

22) after replacing

by

. ☐

4. Optimal Split Trees

It is natural to optimize the splitting parameters

and

(or equivalently

and

ℓ) for performance: we want to minimize the value of

in

In fact, we will show in this section that unless is deeply in or out of the money, the splitting parameters can always be chosen in such a way that .

All parameters being fixed except the split time , we say that a split time is the optimal split time if the magnitude of is minimized when is equal to . When the split time is equal to the optimal split time, we say that the tree is an optimal split tree.

In this section we study optimal split trees under three constraints, and under these constraints we find closed form formulae for the optimal split time and the optimal drift parameter .

For centered trees, where , we find the optimal split time , which minimizes .

We find and , which maximize the range of values of for which .

We find and , which minimize the magnitude of under the constraint that is as close as possible to some specific value .

4.1. The Optimal Split Time Given ℓ

Before defining our optimal split trees, we a need a general result which is the topic of this section. Recall that

and that, given a split time

,

Proposition 2 (Minimum of

given

ℓ)

. Consider a European call option with strike K, spot price , maturity T, risk free rate r, and volatility σ. LetAssume that , and consider integers such that is bounded and bounded away from 0. Then the magnitude of the function defined by (25) is minimized when τ takes the value given by Proof. If (or equivalently ) then the value of does not depend on . Hence minimizes . Note that . Hence it is clear that for every . Thus, if , then the magnitude of is minimized when . It remains to consider the case where and . Then because and . Moreover, when takes the value . Since and , it is clear that is always strictly positive. It remains to show that . In fact, because is a strictly increasing function of , , and . ☐

Theorem 2 (Optimal splitting time

given

ℓ)

. Consider a European call option with strike K, spot price , maturity T, risk free rate r, and volatility σ. Let , , be defined byAssume that , and consider integers such that is bounded, bounded away from 0, and converges to as . Let , , and be the limits of respectively , , and . When , assume additionally that n is large enough so that . Let given by Round into , the nearest multiple of in the interval , and consider the value of a call option evaluated in the split tree with parameters ℓ and . If and , then converges to its Black–Scholes limit at a speed of order . Otherwise, the convergence occurs at a speed of order .

Proof. When

, the tree is not a split tree but rather a flexible binomial tree with parameter

and the rate of convergence is

, as shown in

Chang and Palmer (

2007).

We just need to consider the case where

and

. In this case we assume that

n is big enough so that

is bounded away from 0, and

. Note that

is bounded. Thus

is bounded away from 0. It follows that

is also bounded away from 0. From Lemma 1

Because

we see that

. Note, furthermore, that it is not possible that

when

, because otherwise

Thus is also bounded away from T. We have shown that is bounded away from 0 and from T.

Finally, the rounding of

into its nearest strictly positive time step,

, affects the value of

by an amount of order

, since

is continuously differentiable for

and its first derivative,

, is bounded. Thus

Theorem 1 then yields that

as wanted. ☐

Remark 1. When considering optimal split tree with maturity T, the case where can be seen as a degenerate case of the split tree. Trees of this family, introduced by Chang and Palmer (2007), are called flexible trees. We set when the magnitude of the coefficient of in the expansion of the error (5) is not minimized by any split tree but is rather minimized by a flexible tree. 4.2. The Optimal Centered Split Tree

Joshi’s original split tree is a centered split tree because

. However, in general, Joshi’s tree is not the optimal centered split tree because it does not minimize the magnitude of the coefficient of

in the expansion of the error. This is because

is not, in general, the optimal split time. The optimal split time is given by Theorem 2. Note that, obviously, when

,

When noting that

,

, and

converge to

where

it is easy to apply Theorem 2 in order to find the optimal split time.

Definition 4 (Optimal centered split tree). Consider a European call option with strike K, spot price , maturity T, risk free rate r, and volatility σ. Let , assume that for every n, and let be as in Theorem 2. The optimal centered split tree is defined to be the split tree with parameters ℓ and .

4.3. The Maximal Range Optimal Split Tree

Recall that if

is the price of a call option in a split tree model, and

is the corresponding Black–Scholes price, then

In the optimal centered split tree, unless is too deep in or out of money. Otherwise, the value of is minimized. This occurs under the constraint that . Here we want to lift that constraint in order to maximize the range of values of for which can be achieved.

Recall that for split trees

Assume that

is bounded, bounded away from zero, and converges to

as

. Recall

and

from Theorem 2. Then the optimal time

takes the form

and

when

A glance at (

25) reveals that

is a polynomial of degree 2 in

, and the coefficient of

is negative. Alternatively,

can also be seen as a polynomial of degree 2 in

,

and again the coefficient of

is negative. We want to find the value of

(or the corresponding value of

) which maximizes

. This maximizes the range of values of

for which

and

are guaranteed.

As a function of

,

achieves its maximum whenever

reaches its maximum. Now

is just a polynomial of degree two in

,

Hence it reaches its maximum at

Through the formula (

30) and (31), the optimal drift

translates into an optimal choice

of

ℓ given by

or equivalently

We can also write

as

where

However,

may not be integer, so we round it to the nearest integer

. This is essential to preserve the structure of a split tree. Let us write

. Obviously

. It is easy to verify that

In this manner we can define the maximal range optimal split tree in a similar manner as we defined the optimal centered split tree.

Definition 5 (Maximal range optimal split tree)

. Consider a European call option with strike K, spot price , maturity T, risk free rate r, and volatility σ. Let , let be as in (33), let be the nearest integer to , and set for every n. Let be as in Theorem 2. The maximal range optimal split tree is defined to be the split tree with parameters and . 4.4. The Optimal Split Tree Near

Suppose that a constant

is given. Recall

defined in (

20), and note that

can be written as

where

Here our goal is to choose as close as possible to in such a way that , or if this cannot be achieved, we want to choose in a way that minimizes .

Let

. Then

, where

We need to consider three cases. Case (1)

. Then it is possible to choose a real value

of

such that

. There are two choices for

which are given by

Case (2)

and

. This implies that

. Now if we replace

by

then

. Note that

Note also that the roots of

are 0 and

. Since

, this means that

if and only if

. Thus

. Now there are two possibilities: either

or

. In the first case the value of

that we want is given by

since it gives

. In the second case, We understand that

for every value of

. Hence we want to maximize

. This means choosing

Case (3)

and

. This implies that

. In this case,

for every

x, and thus

for every value of

and

. However, we know from Lemma 1 that regardless of the value of the parameter

ℓ, if

for every

then

is maximized when

. Hence we select

, and we want to maximize

. The maximum occurs at

The three cases can be summed up in the following definitions:

and

Using the (

30) and (31), with

replaced by their approximations

we obtain

which can be re-written as

where

In order to preserve the structure of a split tree,

is rounded to the nearest integer

. From

, we obtain

as

We define

. Obviously

. Then

and

The rounded value of

appears to be a good estimate of

, but nothing guarantees that it is accurate. We need to apply Theorem 2 in order to find

from

. However, there can be two values of

(corresponding to the possible two different values for

). It turns out that we can carefully choose

in order to further smooth out the convergence. Note that the choice of

exists only when

. In this case, Theorem 2 says that

where

Because

has oscillations of order

, so does

. The best choice of

D is the one for which these oscillations are minimized. Hence we determine the value of

D (and therefore the values of

,

,

, and

) by choosing the value of

D for which the magnitude of

is minimized. Now

By simplifying, we obtain

where

(Note that the case where is irrelevant since it corresponds to a situation in Theorem 2 where . In this case we can arbitrarily choose the largest value of D.) The following sums up the definition of the optimal split tree near .

Definition 6 (Optimal split tree near

)

. Consider a European call option with strike K, spot price , maturity T, risk free rate r, and volatility σ. Let , Let be as in (37). In the case where (37) gives two definitions of , choose the one corresponding to the smallest value of (39). Should in (39), choose the largest value of D. Next, let be the nearest integer to , and set for every n. Finally, let be as in Theorem 2. The optimal split tree near τ is defined to be the split tree with parameters and . 6. Conclusions

In this paper we introduced a flexible version of Joshi’s original split tree and we developed the corresponding convergence theory in the European case. Our flexible split trees are characterized by two additional parameters: the drift and the split time. This allowed us to define optimal values of these parameters under different constraints. For European options, we found an explicit formula for the coefficients of and in the expansion of the error, and we found closed form formulae for the parameters of our optimal split trees. Numerical results suggest that the optimal split tree near can significantly improve the convergence of Joshi’s original split tree.

Because stock options prices are quoted in the Black–Scholes model, binomial tree methods apply naturally to them, as a numerical method to price them when a closed form formula is not available. However, for real options requiring the modeling for several uncertainty sources, the Monte Carlo approach introduced in

Longstaff and Schwartz (

2001) can be the best choice (see, for instance,

Lomoro et al. (

2020),

Pellegrino et al. (

2019), or

Sun et al. (

2019)). The finite difference method (see, for instance,

Wilmott (

1998)) is another broadly used numerical tool to price options. An empirical study in the style of

Joshi (

2009b) that could compare, analyze, quantify, and contextualize the respective advantages of the Monte Carlo approach, the finite difference method, and the tree method, would be an broad and interesting project.