Abstract

A statistical inference for ruin probability from a certain discrete sample of the surplus is discussed under a spectrally negative Lévy insurance risk. We consider the Laguerre series expansion of ruin probability, and provide an estimator for any of its partial sums by computing the coefficients of the expansion. We show that the proposed estimator is asymptotically normal and consistent with the optimal rate of convergence and estimable asymptotic variance. This estimator enables not only a point estimation of ruin probability but also an approximated interval estimation and testing hypothesis.

1. Introduction

Ruin probability has been one of the central topics for long time in insurance mathematics since the paper by Lundberg (1903), where a compound Poisson type surplus was supposed. After him, various stochastic surplus models have been considered, and we found that Lévy processes seem to be good candidates for insurance surplus models from several aspects: (1) computational convinience; (2) compatibility with financial theories and dynamical risk managements; (3) statistical prediction of the future surplus. On the aspect (1): Lévy process has properties of independent and stationary increments, and it derives many beautiful mathematical formulae for ruin probability and other ruin-related quantities via the fluctuation theory of Lévy processes; see Huzak et al. (2004), Feng and Shimizu (2013), and Kyprianou (2014), among others. On (2), Trufin et al. (2011), Shimizu and Tanaka (2018) proposed dynamic risk measures based on ruin probability and its related quantities, which are useful not only in insurance but also financial mathematics. See also Schoutens and Cariboni (2009) for relations to credit risk modeling. In this paper, we focus on the aspect (3), which is the most important step to make the ruin theory applicable in practice.

1.1. Ruin Probability Under Lévy Surplus

On a stochastic basis with usual conditions, let be an -Lévy process of the form

where and are constants, W is an -Wiener process, and L is a spectrally positive -Lévy process with the Lévy measure . We assume that the Laplace exponent of L, say, , is given by

This implies that satisfies the condition

Assume that is a risk process of an insurance company, where the constant corresponds to the premium rate and corresponds to the randomness in insurance business—aggregate claims, frequent costs, and uncertainties of premium income, for example. If , then L is a compound Poisson process that corresponds to the aggregate claims process only. If , then the process L has many infinitely small jumps in any finite time interval. In such a case, “large” jumps of L are interpreted as “large” claims, and the small jumps are approximations of other uncertainties of costs and some other businesses as well as “small” claims that frequently occur. Therefore, it would be natural to assume that is known and the constant and the Lévy measure are unknown.

When the company has the initial surplus , the ruin probability is given by

The properties of the function is studied in Huzak et al. (2004) in detail under general Lévy insurance risks. See also Biffis and Morales (2010) for more general Gerber-Shiu functions. As is well known regarding the property of Lévy processes, the ruin probability satisfies if and only if the following net profit condition holds true:

Otherwise, ; see, e.g., Kyprianou (2014), Theorem 7.2.

Under the conditions (1) and (3), the function satisfies a defective renewal equation (DRE) as given in Proposition 1, which easily leads to important results of , such as the Laplace transform, the Pollaczeck-Khinchine formula, and the Cramér-type approximation such as , among others. In this paper, the DRE is essential for the construction of a statistical estimator of later. With a DRE approach for , the conditions (1) and (3) are necessary, and cannot be relaxed; see Remark 1. Hence, these conditions are assumed throughout the paper, even where not specifically mentioned.

1.2. Earlier Works on Estimating Ruin Probability

The ruin probability depends on some unknowns: and functionals of . This motivates actuarial researchers to estimate from past surplus data over a long time interval , where as .

Recently, many authors have made contributions to statistical estimation of ruin-related quantities under not only classical compound Poisson risks but also Lévy insurance risks. Shimizu (2011), in the first statistical work on ruin-related quantities under a Lévy process with infinite activity jumps, uses a “regularized” Laplace inversion of an empirical estimator of the Laplace transform of the Gerber-Shiu function. The idea of estimation by regularized inversion is credited to Mnatsakanov et al. (2008), who considered a classical risk model for the estimation of . The proposed estimators are consistent in the sense of the mean integrated squared error with the rate of convergence . However, this rate is slower than the expected ideal rate in this context, and a finite sample performance gets worse; see Zhang (2016) for some numerical experiments. This is due to the “regularized” Laplace inversion, where some tuning parameter is needed to avoid the ill-posed problem of Laplace inversion; see Carroll et al. (1991) and Chauveau et al. (1994) for details. See also Shimizu (2012). To overcome this problem, Zhang and Yang (2013) consider the Fourier inversion of an empirical Fourier transform of the ruin probability. Thanks to the one-to-one properties of Fourier transform in -space, their estimators can realize a better rate of convergence for some . Moreover, the Fast-Fourier Transform (FFT) algorithm allows easy computation of their estimators. See also Shimizu and Zhang (2017) for estimation of the Gerber-Shiu function, where the rate is realized.

A most recent paper by Zhang and Su (2017) introduces a new idea of estimating the ruin probability (they actually deal with the Gerber-Shiu function) under a compound Poisson risk model. They estimate the partial sum considering the Laguerre -expansion of the ruin probability for ,

where is the kth-order Laguerre function, provided later in (10). They evaluate the -error of an empirical estimator of . Letting be their estimator of , they show that there exists some such that

Taking so that the last order is minimized, we have the optimal rate of convergence:

Note that r is the parameter introduced in the definition of the Sobolev-Laguerre space ; see Section 2.1. Furthermore, it follows from Zhang and Su (2017) that r can be taken arbitrarily large when is a combination of exponentials. Hence, in some “good” case, the constant can be taken arbitrarily, and the rate in (6) becomes close to .

Thus, the earlier works only consider the consistency of their estimators with the rate of convergence, but not the asymptotic distribution of . This paper considers the same type of estimator as in Zhang and Su (2017), but under a Lévy risk process that is possibly of infinite activity. We show the asymptotic normality of the estimator of with the rate : for each and ,

where the asymptotic variance is also estimable from the surplus data. Since approximates to in any order, the asymptotic normality enables us to construct a confidence interval to test the hypothesis for with approximate results.

1.3. Statistical Setting and General Notation

In the statistical argument, we assume that the surplus X is observed in a time interval at discrete time points, with :

Note that . Moreover, we also assume “large” claims from L. That is, for a given constant , we observe , and we do not use “small” jumps. Then, our observations consist of

Later, we consider the asymptotic property that, as ,

which is an ideal situation where most data for X are available at the limit. This is the setting that we should consider at first in inference for continuous-time stochastic processes. As a practical motivation, we would like to estimate the ruin probability from a data set .

Moreover, we use the following notation in the paper:

- and and .

- For a matrix , . Moreover, ⊤ stands for the transpose .

- For each , is the zero vector in . Moreover, and are the -zero matrix and identity matrix, respectively.

- For functions f and g, means that there exists a constant such that for all x.

- For , .

- For and , stands for the Laplace transform operator

- For functions ,

- stands for the convolution of f and g:

- and .

- For a -integrable function ,In particular, as for , we write

- for .

- Denote by the tail function of the exponential distribution with mean : for andMoreover, is its density function: .

2. Some Representations for the Ruin Probability

2.1. The Laguerre Expansion of

Under the net profit condition (3), it is well known that the ruin probability given in (2) satisfies a defective renewal equation (DRE).

Proposition 1.

As , the ruin probability ϕ satisfies the following DRE:

where

As , the Equation (9) also holds true for

Proof.

Remark 1.

Note that from (25) in the proof of Lemma 3, which means the renewal-type Equation (9) is defective. This DRE is essential to construct an estimator of ϕ as is seen below. The condition (1) is necessary to get the DRE, and we cannot include the case where in this statement; see Feng and Shimizu (2013), Lemma 3.1 and its remark.

Let be the (normalized) Laguerre polynomial of order k, defined as

and let be the Laguerre function of , given by

The functions are known to form a complete orthogonal basis of with for any .

Since by Lemma 4, can be represented by the Laguerre expansion

where , and . For each , we denote by

-dimensional column vectors of coefficients for their expansions.

By substituting the expression (11) into the defective renewal Equation (9), using a “convolution formula” for ’s such as

and comparing the coefficient of ’s, we have the following relations among and .

Proposition 2

(Zhang and Su (2017)). Let be a -matrix, whose components are given by

Then, it holds for any that

In particular, the matrix is invertible, and the elements ’s are uniformly bounded.

Let

a -dimensional row vector of the Laguerre functions. Then a “truncated version” of the Laguerre expansion of , say, , is defined as

since is invertible.

For constants , denote by the Sobolev-Laguerre space:

According to Zhang and Su (2017), if for some , then it follows that

for each . This implies that if K large enough, approximates to with arbitrary accuracy in the sense of . Under some regularities on , we can also show that converges to uniformly on as . The following result suggests a uniform convergence of the Laguerre expansion in the Sobolev-Laguerre space.

Proposition 3.

Let with , and let be the partial sum of the Laguerre expansion of f:

Then, it follows that

Proof.

Noticing that , and applying the Cauchy-Schwartz inequality, we have

□

2.2. Coefficients and

The coefficients and can be represented as follows:

Proposition 4.

For each ,

where, for ,

and for ,

Proof.

For , by a standard application of the Fubini theorem, we have

and

Similar calculations can yield the results for . □

Remark 2.

Zhang and Su (2017) consider the case where X is a drifted compound Poisson process (i.e., ) with the Lévy measure ν (i.e., ). Note the above and are consistent with their expressions (3.1) and (3.2) in Zhang and Su (2017).

The expressions of and can also be obtained with the limit defined as . From the assumptions in Proposition 4 and Lemma 5, it follows for each that

Here, we provide some of the properties of and , which will be discussed later.

Lemma 1.

Let Θ be a bounded and compact subset of . Then, it follows for each that

Proof.

Without loss of generality, we may suppose that if is small enough.

Considering that and that since is an exponential density function, we have

Similarly, we also have

□

Lemma 2.

Let Θ be a bounded and compact subset of . Then, it follows for each and that

Proof.

As in the previous proof, we may suppose that if is small enough.

Considering that , it follows that

Then, we have

By the same argument as above, we also have

which leads to

This completes the proof. □

3. Statistical Inference

Our goal is to estimate for a given from observation as in (7) and investigate the asymptotic behavior under the observation scheme (8). The strategy is to estimate the coefficients of the Laguerre series of , which essentially consist of the functionals of the Lévy measure as well as the diffusion coefficient . For that purpose, we will first introduce a few general tools, namely, some statistics and their limit theorem.

Let be a parameter space for , which is a bounded and compact subset of . Hereafter, we suppose that the true value of , say, , is positive () if we consider a diffusion perturbation model. Otherwise, we suppose that is known, and the treatment becomes much easier in this case.

We assume that there exists a known constant , which is small enough such that

and that belongs to the interior of : . We also put , and note that .

Hereafter, we always assume the asymptotics (8) as :

3.1. Estimating the Lévy Characteristics

According to Proposition 4, we should estimate the functionals of the form . In this paper, we use semiparametric-type estimators for those functionals, proposed by Shimizu (2011).

Let be a jump-counting measure associated with the spectrally positive Lévy process :

for each A such that . Note that, as is well-known,

and put , the compensated measure, such that the process is an -martingale if .

For estimation of the functional from the data , Shimizu (2011) proposes the following estimator:

Let

The following results are credited to Shimizu (2011).

Proposition 5.

Suppose that for each . Then, it follows that

Suppose further that

and that there exists some such that, for any ,

with . Then, it follows that

Proposition 6.

Suppose the following conditions for each :

- (i)

- There exists some such that .

- (ii)

- For each , .

- (iii)

- For each ,

Then, it follows for the matrix that

To estimate the diffusion coefficient , we use the results obtained by Jacod (2007); see also Shimizu (2011), Lemma 3.1 and Remark 3.2.

Proposition 7.

Suppose that, for ,

Then, the statist

where , is a consistent estimator of for any constant with a more rapid rate of convergence than :

3.2. Joint Convergence and Asymptotic Normality

Since is consistent with for any fixed , we omit the superscript t in the sequel:

In practice, it would be better to take as large a t as possible to use a sample of sufficient size.

Considering the discussion in the last section, it would be natural to estimate ’s and ’s, respectively, from

where

for each .

Proposition 8.

Consider the condition (15) and suppose that there exists some such that

Then, it follows for any that

Proof.

Since is consistent with the true value of under our assumption, it follows that

Moreover, note that for any subsequence of , there exists a further subsequence , as we see from Lemma 1 and the assumption that

as by the Lebesgue convergence theorem. Since these hold true for any subsequence of , we also see that

as .

To show the consistency of , we use Proposition 5. Thanks to Lemmas 1 and 2, we immediately see that the conditions in Proposition 5 hold true. Therefore, it follows for any that

as , by Proposition 5, (17) and (18).

The consistency of is similarly proved. In particular, the convergence of is similar to the above argument for , and is therefore omitted. As for the convergence of , we can consider it on the event for some since as . On this event, taking , we see that since by definition . Hence, we have

which is integrable and independent of the sample size n. Hence, it follows from the dominated convergence theorem that . This completes the proof. □

For each , let

Proposition 9.

Then, it holds for any that

where , and for any combination of and is given by

Proof.

Without loss of generality, we can show the statement as , that is,

We simply write that and in the proof. The general case where is similarly proved.

Note that

First, for , using , we have

Furthermore, using the mean value theory, we know that there exists a random number, say, , between and such that

which together with , and Proposition 7 gives .

Second, the asymptotic normality of is directly obtained from Proposition 6 by checking conditions (i)–(iii). Condition (i) and the existence of each integral in (ii) are deduced from Lemma 1 and the condition (16). Moreover, as for condition (iii), it follows for each that

from the condition (19). This ensures that

Finally, it remains to show that . Note that

where is a random variable between and . Here, we see from Lemma 2 that , which implies that

We can then conclude from Proposition 5 that and from Proposition 7 that , which connotes that

Similarly, we also see that

under (16). Hence , which completes the proof. □

4. Main Theorems

It follows from Proposition 2 that

Since the matrix consists of , a natural estimator of is given by

where is given by replacing ’s in the elements by ’s and .

Let

be an estimator of the function . We then have a weakly consistent .

Proof.

Note that

since by Proposition 8 and is invertible. Therefore, conditional on the event that is invertible; it then follows for any that

Since and considering , the uniform consistency of (21) holds as follows:

□

Theorem 2.

Suppose the same assumptions as in Proposition 9. It then follows for any and that

where , is given in Proposition 9, is of the form

with the lower triangle matrix given by

Proof.

First, we shall show that is asymptotically normal for each .

Noticing the equality that

we have

Note that, from Proposition 2, the kth component of the -dimensional vector is given by

for each , where

and we assume that as a convention.

Consider the following -lower triangle matrix :

where is the limit in probability, the existence of which is shown in the proof of Theorem 1, (23). Using this matrix , we see that

Therefore, Proposition 9 and Slutsky’s lemma connote that

with given in the statement. As a consequence,

This completes the proof. □

Remark 3.

We can construct a consistent estimator of the asymptotic variance for by the statistics , and although the representation will be complicated. Therefore, the asymptotic normality result of Theorem 2 enables us to construct a confidence interval to test the hypothesis for . If for and , then with a large enough K is uniformly close to the true ϕ on . Therefore, the confidence interval for would be an approximated confidence interval for ϕ.

5. Simulations

We shall try some numerical example to confirm the asymptotic normality of our proposals. We consider the following two models for finite and infinite activity jumps:

- (CP)

- Compound Poisson model: forwhere N is a Poisson process with the intensity , and ’s are IID random variables with an exponential distribution with mean ; the Lévy density , and set . In the simulation, we suppose that , and are unknown. In this case, the ruin probability is explicitly known as

- (GS)

- Gamma subordinator model: forwhere L is a gamma process with the Lévy density with , and set . In the simulation, we suppose that and are unknown. In this model, the ruin probability is not explicit, but we can compute it numerically, e.g., via the Fast Fourier Transform; see, e.g., Zhang and Yang (2013).

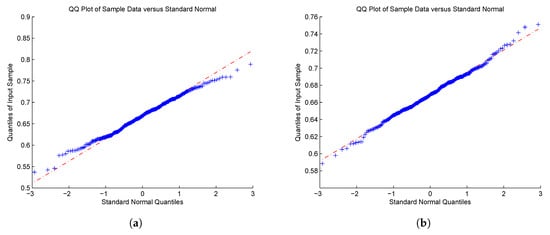

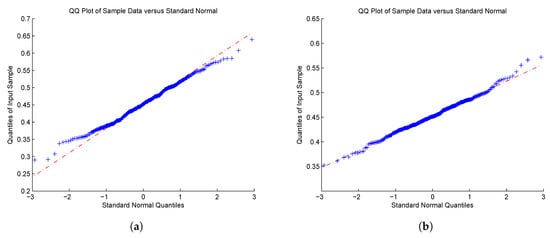

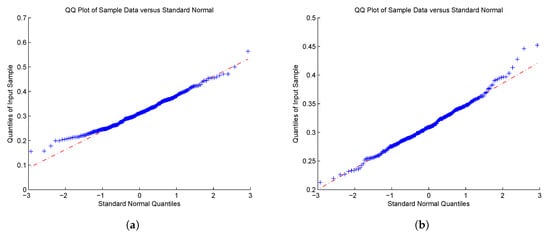

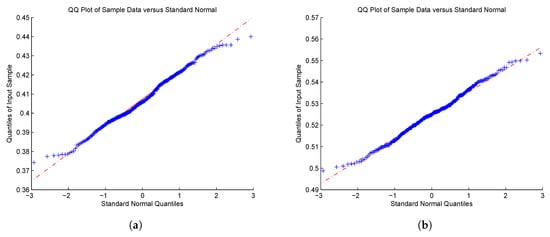

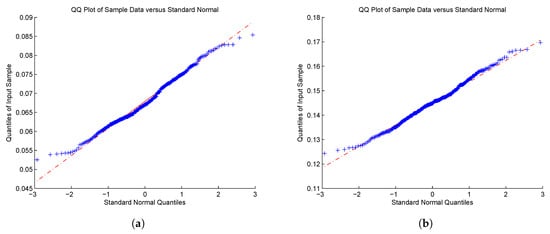

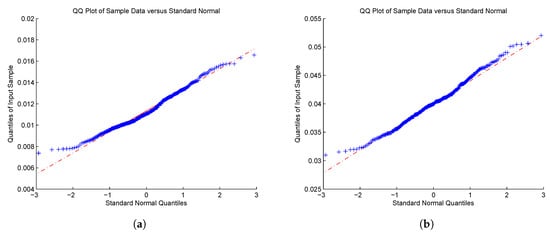

To observe the asymptotic normality of the proposed estimators of , we show QQ-plots for with and by 300 replications under a sampling setting (7) with and , and compare the results among the different values of the initial reserve and 120, 360 in the sequel. The results are given in Figure 1, Figure 2 and Figure 3 for Model (CP), and Figure 4, Figure 5 and Figure 6 for Model (GS).

Figure 1.

QQ-plot of for (CP); (a) , and (b) .

Figure 2.

QQ-plot of for (CP); (a) , and (b) .

Figure 3.

QQ-plot of for (CP); (a) and (b).

Figure 4.

QQ-plot of for (GS); (a) , and (b) .

Figure 5.

QQ-plot of for (GS); (a) , and (b) .

Figure 6.

QQ-plot of for (GS); (a) , and (b) .

Most of the results manifest asymptotic normality as the value of becomes large. As for the case of with in Figure 3 and Figure 6, the right tails still seem not to converge to the normal distribution. Although we cannot explain this phenomenon quite well, it might be due to the value of selected, which significantly affects the estimation of parameters. How to choose in practice is an important problem, but this is beyond the scope of this paper. It is a theme that merits serious consideration by researchers.

6. Concluding Remarks

In this paper, we consider the statistical inference for ruin probability of Lévy insurance surplus under a certain sampling scheme. The samples consist of a mixture of n-discrete samples of the surplus, which are assumed to be a book record of the (e.g., daily) surplus, and a ‘large’ jumps that are insurance claims larger than a certain threshold .

We consider the Laguerre expansion of the ruin probability, which is the series expansion based on the Laguerre functions in (10) and the coefficients are obtained in explicit form that includes unknown quantities: the diffusion coefficient and functionals of Lévy measure of the form . Those unknowns are estimable from our sampling data, and we showed the asymptotic properties of those estimators, which leads us the asymptotic normality of the estimated partial sum of Laguerre expansion of the ruin probability as and as well. The asymptotic distribution enables us to construct the asymptotic confidence intervals of ruin probability, which would be important to apply the ruin theory in practice.

In this paper, we assumed that and that we can observe all the jumps that are larger than , which means that we can observe all the infinitely many jumps in the limit. Of course, such a situation is not realistic, but this paper investigates the rate of convergence and the possibility of the asymptotic normality of the estimators under a kind of ideal situation. We clarified the speed of that goes to zero as in Proposition 9, which should be the first step to be specified in the theory of statistical inference. Note that the rate condition on is only for theory, but is not checkable in practice as always in asymptotic statistics. In the simulation, we use as an example that satisfies the asymptotic conditions in Proposition 9. However, in practice, the value of is naturally determined, e.g., the value of deductible if it exists, or the smallest jump size within the observations. The asymptotics that is a kind of approximation for the real situation: the theory ensures the statistical validity of our estimators if the value of is practically ‘small’ enough and if we assume that the observed surplus is a realization of a Lévy process we assumed here. In this context, we may need “a new aspect" for the surplus model as described in Shimizu (2009).

7. Preliminary Lemmas

Lemma 3.

The functions and in Proposition 1 satisfy .

Proof.

Note that, from (1), it follows that

Hence,

Moreover, note that is a probability density function, and is the probability density. In particular, we see that is the density of a defective distribution since

by (3). Therefore,

Note that

since the last term is a probability tail function. Hence, , which yields

As a consequence,

This completes the proof. □

Lemma 4.

for any .

Proof.

From Proposition 1, we have the following Laplace transform of :

The last term of right-hand side can be attributed to since by Lemma 3. Therefore, we have

Hence, . Considering that is the probability of ruin, it follows for any that

This completes the proof. □

Lemma 5.

Let be a differentiable function such that for a constant , and let for . It then follows that

Proof.

Since f is a polynomial growth function, we see, using integration by parts, that

Taking a constant , we have

with the last function being integrable. Therefore, it follows from the Lebesgue convergence theorem that

□

Author Contributions

Formal analysis, Y.S. and Z.Z.; Investigation, Y.S.; Methodology, Y.S.; Software, Z.Z.; Writing—original draft, Y.S.; Writing—review & editing, Y.S. and Z.Z.

Funding

The first author is supported by JSPS KAKENHI Grant-in-Aid for Scientific Research (A), Grant Number 17H01100. The second author is supported by the National Natural Science Foundation of China (11871121, 11471058), MOE (Ministry of Education in China) Project of Humanities and Social Sciences (16YJC910005) and Fundamental Research Funds for the Central Universities (2018CDQYST0016).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Biffis, Enrico, and Manuel Morales. 2010. On a generalization of the Gerber-Shiu function to path dependent penalties. Insurance: Mathematics and Economics 46: 92–97. [Google Scholar] [CrossRef]

- Carroll, Raymond J., Arnoud C. M. Van Rooij, and Frits H. Ruymgaart. 1991. Theoretical aspects of ill-posed problems in statistics. Acta Applicandae Mathematica 24: 133–40. [Google Scholar] [CrossRef]

- Chauveau, D. El, A. C. M. Vanrooij, and F. H. Ruymgaart. 1994. Regularized inversion of noisy Laplace transforms. Advances in Applied Mathematics 15: 186–201. [Google Scholar] [CrossRef]

- Feng, Runhuan, and Yasutaka Shimizu. 2013. On a generalization from ruin to default in a Lévy insurance risk model. Methodology and Computing in Applied Probability 15: 773–802. [Google Scholar] [CrossRef]

- Huzak, Miljenko, Mihael Perman, Hrvoje Šikić, and Zoran Vondraček. 2004. Ruin probabilities and decompositions for general perturbed risk processes. The Annals of Applied Probability 14: 1378–97. [Google Scholar]

- Jacod, Jean. 2007. Asymptotic properties of power variations of Lévy processes. ESAIM: Probability and Statistics 11: 173–96. [Google Scholar] [CrossRef]

- Kyprianou, Andreas E. 2014. Fluctuations of Lévy Processes with Applications. Introductory Lectures, 2nd ed.Heidelberg: Springer. [Google Scholar]

- Lundberg, Fillip. 1903. Approximerad Framställning av Sannolikehetsfunktionen. Ph.D. Dissertation, Aterförsäkering av Kollektivrisker, Almqvist & Wiksell, Stockholm, Uppsala. [Google Scholar]

- Mnatsakanov, Robert, L. L. Ruymgaart, and Frits H. Ruymgaart. 2008. Nonparametric estimation of ruin probabilities given a random sample of claims. Mathematical Methods of Statistic 17: 35–43. [Google Scholar] [CrossRef]

- Schoutens, Wim, and Jessica Cariboni. 2009. Lévy Processes in Credit Risk. New York: John Wiley & Sons Ltd. [Google Scholar]

- Shimizu, Yasutaka. 2009. A new aspect of a risk process and its statistical inference. Insurance: Mathematics and Economics 44: 70–77. [Google Scholar] [CrossRef]

- Shimizu, Yasutaka. 2011. Estimation of the expected discounted penalty function for Lévy insurance risks. Mathematical Methods of Statistics 20: 125–49. [Google Scholar] [CrossRef]

- Shimizu, Yasutaka. 2012. Nonparametric estimation of the Gerber-Shiu function for the Wiener-Poisson risk model. Scandinavian Actuarial Journal 2012: 56–69. [Google Scholar] [CrossRef]

- Shimizu, Yasutaka, and Shuji Tanaka. 2018. Dynamic risk measures for stochastic asset processes from ruin theory. Annals of Actuarial Science 12: 249–68. [Google Scholar] [CrossRef]

- Shimizu, Yasutaka, and Zhimin Zhang. 2017. Estimating Gerber-Shiu functions from discretely observed Lévy driven surplus. Insurance: Mathematics and Economics 74: 84–98. [Google Scholar] [CrossRef]

- Trufin, Julien, Hansjoerg Albrecher, and Michel M. Denuit. 2011. Properties of a risk measure derived from ruin theory. The Geneva Risk and Insurance Review 36: 174–88. [Google Scholar] [CrossRef]

- Zhang, Zhimin. 2016. Estimating the Gerber-Shiu function by Fourier-Sinc series expansion. Scandinavian Actuarial Journal 2017: 898–919. [Google Scholar] [CrossRef]

- Zhang, Zhimin, and Wen Su. 2017. A new efficient method for estimating the Gerber-Shiu function in the classical risk model. Scandinavian Actuarial Journal 5: 426–49. [Google Scholar] [CrossRef]

- Zhang, Zhimin, and Hailiang Yang. 2013. Nonparametric estimate of the ruin probability in a pure-jump Lévy risk model. Insurance: Mathematics and Economics 53: 24–35. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).