1. Introduction

Life expectancy is still improving in developing countries. However, this improvement may be different by subpopulations. Retirees are supposed to benefit from better healthcare and living conditions compared to the rest of the population. As a direct impact, their risk of mortality is assumed to be lower. Hence, the use of dynamic life-tables based on global population data may distort all calculations when used for managing pension plans. Under a Pay-As-You-Go (PAYG) retirement system, as in the case of Algeria, the expected benefits to be paid for retirees during their remaining life depends on their survival function, which could be significantly different from that of the global population. Accordingly, life tables reflecting the retirees’ mortality experience need to be produced and then projected in a way to expect the future longevity of retirees. In addition, in the absence of actuarial prospective life tables based on the insurance industry data, prospective life tables of retirees seem to be more appropriate for life-annuities pricing compared to the global population tables. Indeed, the survival function of annuitants is not assumed to be similar to that of retirees, but the gap should be smaller compared to that of the global population. Such an option can be adopted in the case of countries not having well adapted actuarial life tables. The actuarial life tables in Algeria, TV 97-99 and TD 97-99, are based on old global population data and with no consideration to future longevity. In all circumstances, using retirees’ experience-based life tables would provide a better risk estimation of the annuitants’ mortality compared to the tables currently in use.

However, even the literature on prospective mortality modeling is rich; the implementation of the proposed models is constrained by a set of data limitations. Usually, the length of the retirees’ mortality is not long enough to provide robust forecasts. The second limitation is due to the data size. Since they are based on reduced samples compared to the global population size, the calculated mortality rates can display important variations over time and age. In such a case, the use of the prospective mortality models such as the Lee–Carter (

Lee and Carter 1992) or Cairns–Blake–Dowd models (

Cairns et al. 2006) to predict the future mortality trends is not supposed to provide robust forecasts in all situations.

In the literature, several models have been proposed to deal with data limitation when forecasting mortality. Such an issue is not new, and some simplistic methods have been proposed starting in the 1970s. In 1978, the “Continuous Mortality Investigation CMI” was proposed to forecast the mortality specific to the insured population in the UK. The proposed method aims to estimate a periodic experience life table for which an improvement scale is applied to estimate the future evolution of the mortality specific to the insured population (

CMI 1978). The so-called “improvement scale” consists of age-specific mortality improvement rates estimated from the recent observed years. A very similar method was adopted in the US during the 1990s (

SOA 1995). Starting in 2003, stochastic mortality models have been used to project the annuitants experience mortality in the UK (

CMI 2004). The improvement scale based methods are still used nowadays to model the longevity specific to the insurance industry in some countries, such as Canada (

CIA 2014).

Following the contribution of

Lee and Carter (

1992), many generalized versions have been proposed not only to improve goodness-of-fit and predictive capacity of mortality models but also male–female coherence. In this sense,

Li and Lee (

2005) proposed the augmented common factor Lee–Carter (LC) model to produce male–female coherent mortality forecasts. Their idea consisted of using the LC model (

Lee and Carter 1992) to forecast mortality for male and female populations. To make the two projections evolve in a coherent framework regarding the sex differential mortality, a common age–time factor is added to both models. Afterwards, the model was extended to include heterogeneous subpopulations other than the gender-based ones, leading to what we call two-population models or more broadly multi-population models. Multi-population models are oriented to model the mortality specific to each subpopulation with specific models incorporating some common components (e.g., the Joint-K model and the common factor LC model). Others have proposed to model and forecast the spread between subpopulations and global population or any other reference (

Jarner and Kryger 2011;

Hyndman et al. 2013;

Villegas and Haberman 2014).

Villegas and Haberman (

2014) used an LC model to forecast the spread, while

Jarner and Kryger (

2011) decomposed it into two vectors similar to beta and kappa in the LC model. The product-ratio method proposed by

Hyndman et al. (

2013) is slightly different: by estimating a joint mortality surface for males and females and a corresponding sex ratio surface, both are estimated and forecasted using the LC model. In the same way,

Li et al. (

2015) proposed multi-populations models based on the Cairns–Blake–Dowd (CBD) model and variants (

Cairns et al. 2006,

2009). Detailed descriptions of these models were reported by

Villegas et al. (

2017).

Forecasting the spread is only possible when the historical data length is long enough. Otherwise, the spread is modeled and supposed to keep invariant in the future. That said, the relationship between the book and the reference remains the same over time. In this sense, some methods were proposed to convene the case of limited datasets.

Planchet (

2006) proposed modeling the spread between the experience mortality and the reference using a linear regression similar to the Brass Logit system (

Brass 1971). Starting from an experience mortality surface extended only over 11 years, he estimated a linear regression of the experience mortality rates, in Logit, in function of those issued from the French national life tables. The obtained regression allows deducing the future experience mortality rates from the national forecasts. The same method was reproduced by

Kamega (

2011) to forecast mortality specific to the insurance market in sub-Saharan African countries. Again, the French tables (TG05 and TGF06) were taken as a reference.

Thomas and Planchet (

2014) conducted a comparison of a set of methods that can be applied to model the spread between experience mortality and an external reference, including the Brass-type relational model proposed by

Planchet (

2006).

Plat (

2009) set the spread to be simply the experience mortality rates divided on the references rates. He decomposed the spread into two components related to age and time in a similar manner to

Jarner and Kryger (

2011). The age and time components were respectively fitted using linear regression and a zero-trend stationary time series model ARIMA(0,0,0). The reasoning behind the Plat model seems very similar to that proposed by

Planchet (

2006). Even calculated in different ways, the spread in both models is represented by a linear function across age, assumed to keep constant over time.

In this paper, far from conducting a comparative evaluation of all these methods, we intend to investigate the applicability of the Brass-type relational model proposed by

Planchet (

2006) with some adaptations to Algerian retirees’ data. The first adaptation consists in using the Algerian global population mortality surface as an external reference. The future improvement of the retirees’ mortality is assumed to follow a similar trend to that of the global population, even if different general levels can be displayed. Using the national life tables of the period going from 1977 to 2014, we perform coherent mortality forecasts for the male and female populations aged 50 years and older using the model of

Hyndman et al. (

2013). Both types of data are used in this paper as an external reference to adjust and to forecast the retirees experience mortality. The retirees’ data are available for ten years going from 2004 to 2013 and arranged in five-age intervals from [50,55[ to 95 years and older, for males and females. These data concern the observed number of deaths and the survivals number by the end of each year of the observation period. First, the five-age death rates are calculated and interpolated into age-specific deaths rates (ASDRs) and fitted independently for each year to reduce irregularities. Then, we estimate a logit-linear regression model between the experience rates and the reference ones for common age interval and time range. The quality of the adjustment of the experience mortality to the reference is evaluated by comparing the retirees observed deaths to the confidence bounds predicted by the adjustment model. To improve the quality of the adjustment if required, we propose using a logit-quadratic relational model to adjust the experience death rates to the reference. However, we avoid including higher-order polynomial models to reduce the plausibility of the experience rates compared to the reference in long run forecasts (

Plat 2009).

2. Retirees Experience Mortality

2.1. Data

Before to go through a detailed description of our dataset, it would be appropriate to provide an overview of the retirement scheme from which this data is issued. The Algerian public retirement system is constituted by different regimes: a military regime, a regime dedicated to the high-level officials of the government, and a civil regime. This last one combines two schemes: a scheme for the salaried workers, managed by the “Caisse Nationale des Retraites (CNR)”

1, and another one for the self-employed workers managed by the “Caisse Nationale de Sécurité Sociale des Non-Salariés (CASNOS)”

2. The CNR covers over 90% of the retirees within the civil regime. It provides mainly two types of pension benefits: direct pension benefits (DPB) and survivors pension benefits (SPB).

As mentioned in the Introduction, retirees’ mortality data are available starting from the age of 50 years in our case. That is because the legal age of retirement is 60 and 55 years for men and women, respectively, but some options are offered to retire below those ages. First, a full retirement can be accessed after 32 years of contribution not depending on age. Early retirement is associated with 20 and 15 working years for men and women aged 50 and 45 years, respectively. In addition, women can get a one-year bonus for each birth to a limit of 3. Additionally, some categories can benefit a retirement age bonus: Moudjahidhine

3, disabled workers, and workers in special nuisance conditions.

Our dataset is concerned with the direct pensions’ beneficiaries of the CNR during the period 2004–2013. The beneficiaries of survivor’s benefits were not included. The population at the end of each year and the observed deaths are arranged in five age intervals from [50,55[ to 95 years and older, by sex. We set () to be the number of deaths observed in the age interval during the year “” and () the population aged between and years old by the end of the year “”.

Mortality rates denote the observed numbers of deaths during the year divided by the population at risk during the same year. In the absence of detailed information about the different dates to events, date of entrance/exit in the sample and date of birth/death, the population at risk cannot be accurately estimated. The use of aggregated data leads to less accurate results under some simplifying assumptions.

Since we do not have any information about the flow of individuals into/from the considered portfolio, we estimate the exposure to the death risk

by the population number by the mid-year

, which may be approximated by the average between the surviving population at the beginning and the end of the year by using the following formula:

We consider the distribution of the population of retirees by the end of the year “

”,

= 2004, 2005, ... 2013. To estimate the population at risk by five age intervals in 2004, the population distribution at the end of the previous year, i.e., 2003, is needed. For simplification issues, it was deduced from that of the end of 2004 by applying the ratio of the population distribution by the end of 2005 on that of 2004. The observed number of deaths and the population at risk for each age interval

[ and year

are represented in

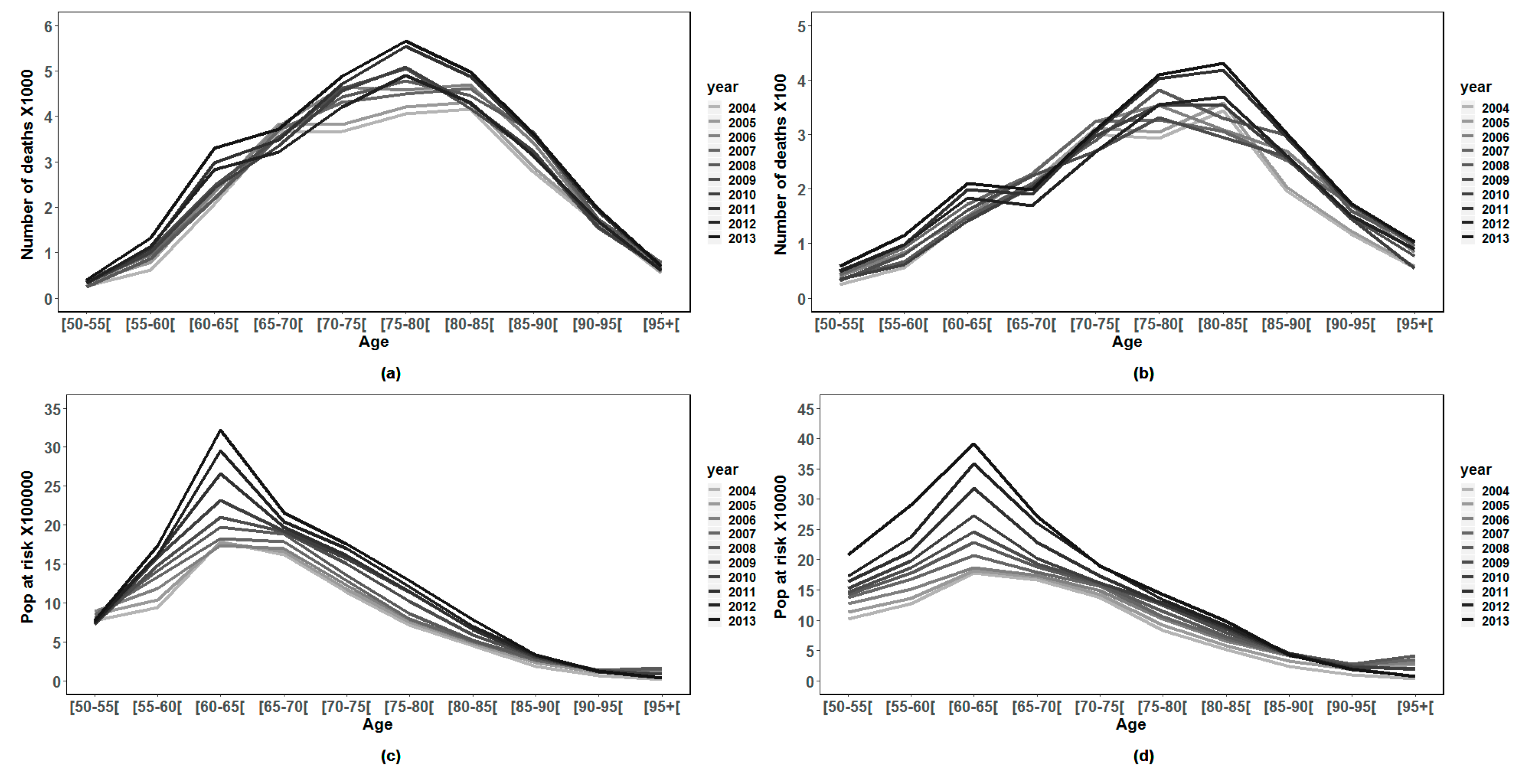

Figure 1.

The number of deaths has grown following a linear trend until the age interval [75,80[ years for men and [80,85[ for women. Then, it decreases slightly beyond those ages. In concern of the distribution of retirees number by age, we observe that the age interval [60,65[ comprises the most important number of retirees, men and women.

Overall, we have an exposure to death risk of more than 11 million person-years along the period from 2004 to 2013, which represents an average of 1.4 million person-years per year and a total of 288,000 deaths were observed during the same period.

2.2. Estimation of the Experience Death Rates

The objective of this section is to estimate the mortality surface for males and females using the available data. Since detailed age data are not available, we estimate the mortality indicators following five age descriptions. The first indicator that we can estimate in such a case is the observed death rate in the age interval

during the year (

) noted

, which represents the number of deaths observed in the age interval

and year (

)

divided by the population at risk during the observation year

. The calculation formula can be written as:

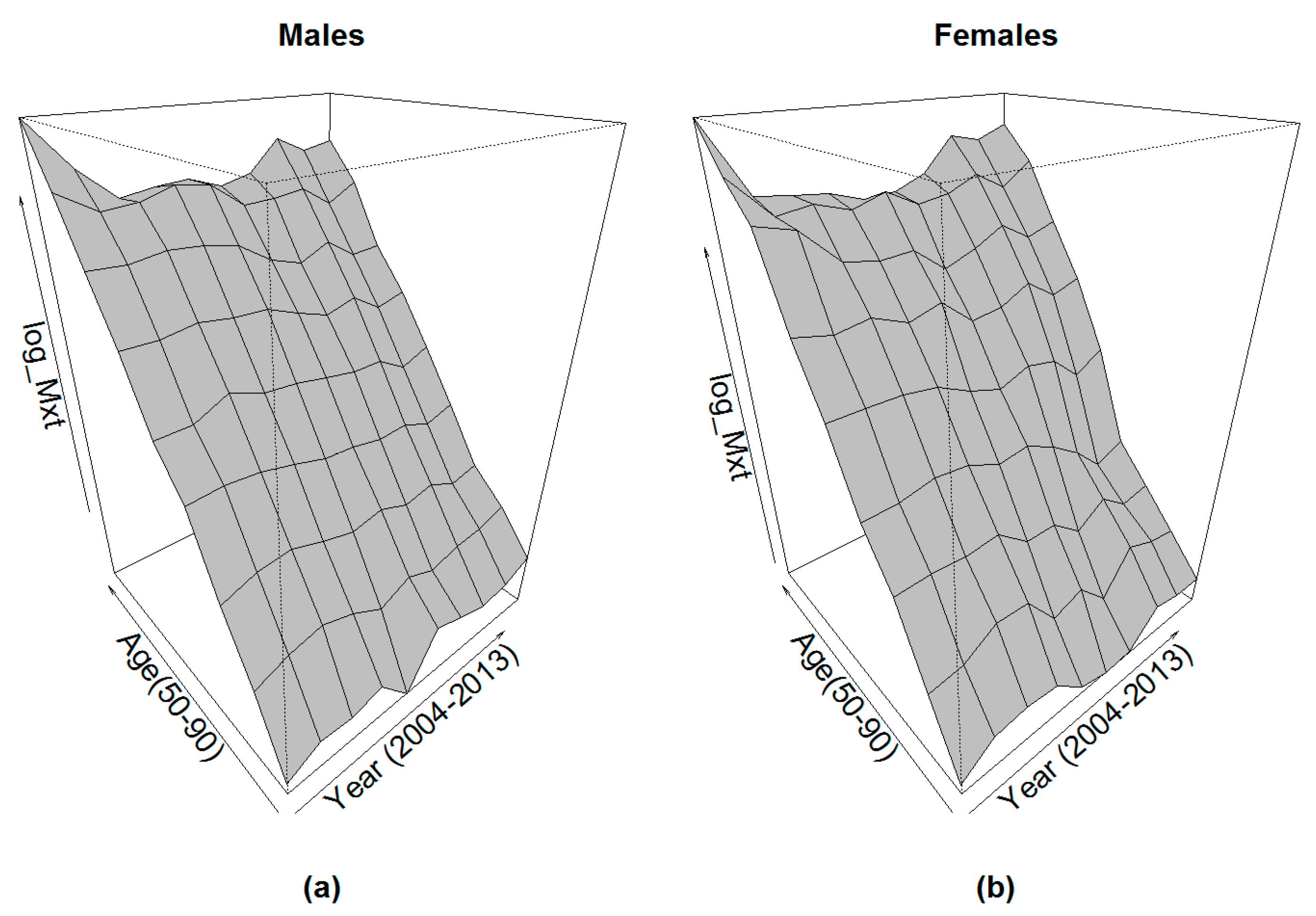

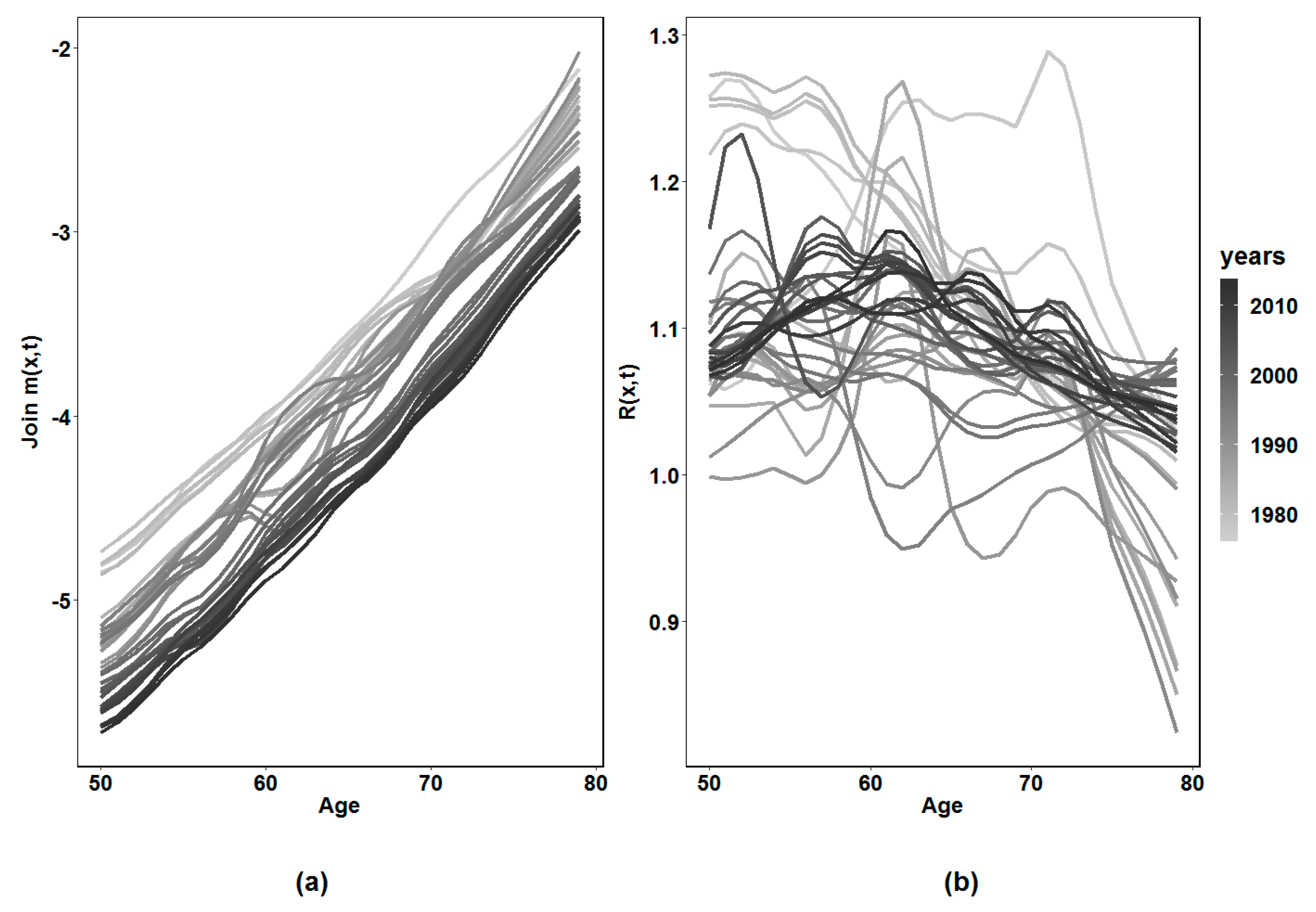

The obtained mortality surfaces are given in

Figure 2.

We observe that the obtained mortality surfaces show relative stability until the ages of 80–85 years. Beyond this age, some irregularities can be observed due to the reduction of the deaths and the population exposed to risk.

2.3. Interpolating and Fitting the Experience Age-Specific Death Rates

The next step aims to construct detailed age life tables. The idea is to suppose that the central death rate of the age interval

noted

to be equal to the observed death rate corresponding to the same age and time points that we previously noted

. We can write:

. Then, we interpolate the ASDRs rates

for

= 50, 51, 52, …, 84. To this end, we use the quadratic model independently for each year “

”:

The fitting process is oriented to minimize the weighted squared errors (WSE). The observed deaths can be used as a weight. The minimization problem can be written as follows:

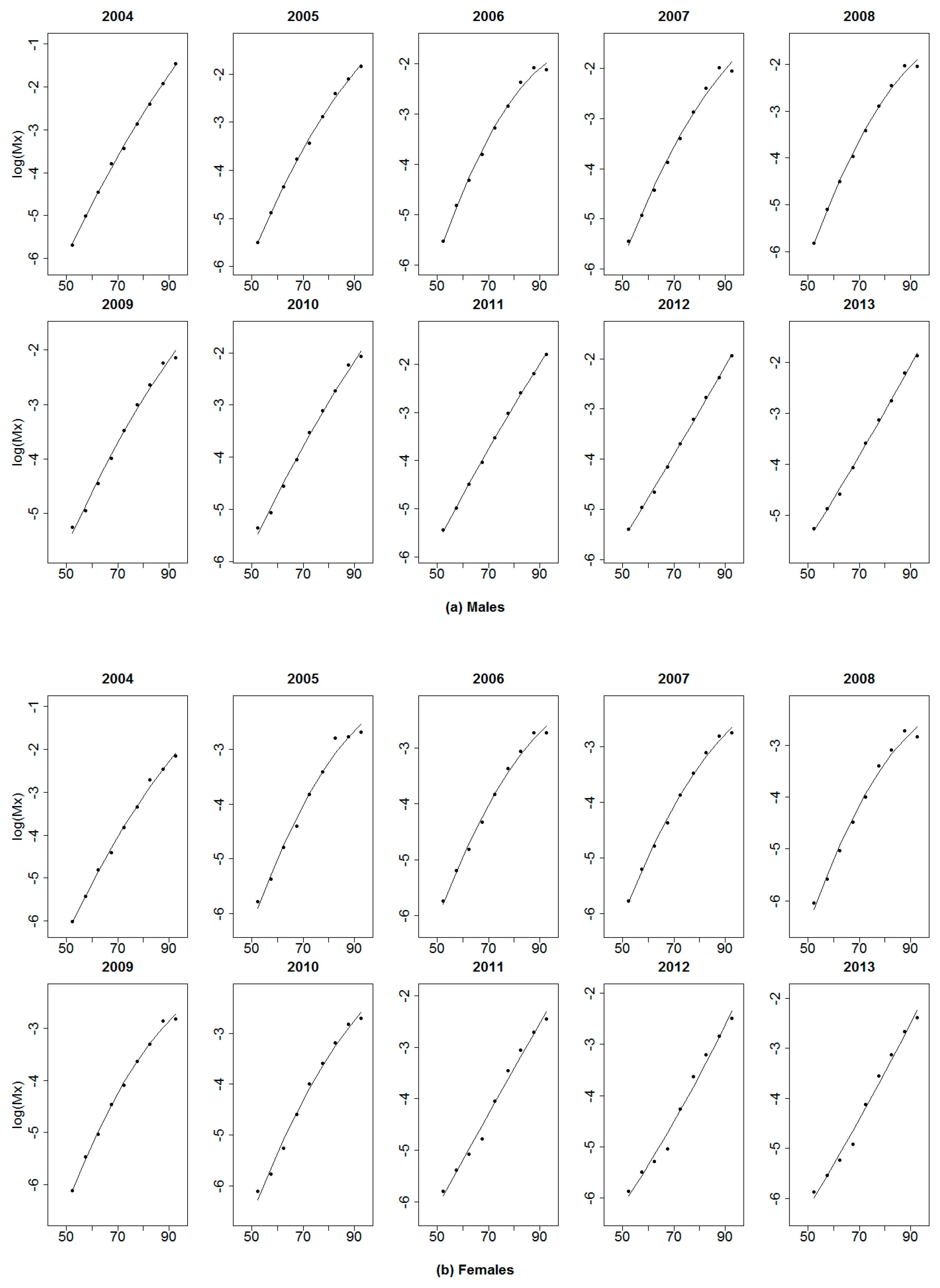

The fitting of the crude annual mortality curves is shown in

Figure 3.

The quadratic fitting of the crude death rates aims to first interpolate the single age death rates and then reduce the irregularities caused by the reduced sample size for some age categories. As a result of this fitting, the annual life tables for the years were interpolated and smoothed. However, specific death rates at each age

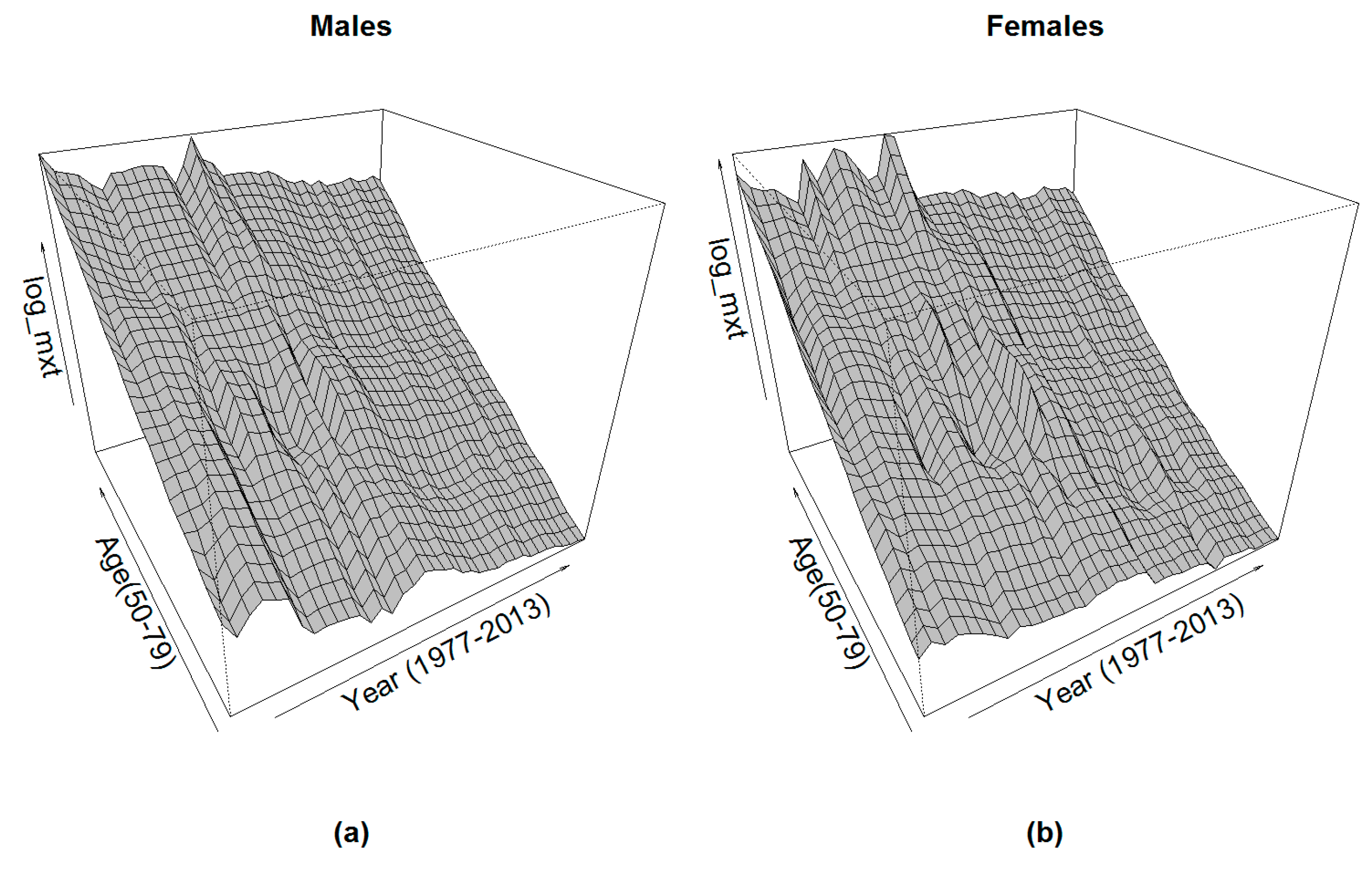

x as time series are still marked by some fluctuations, as shown in

Figure 4.

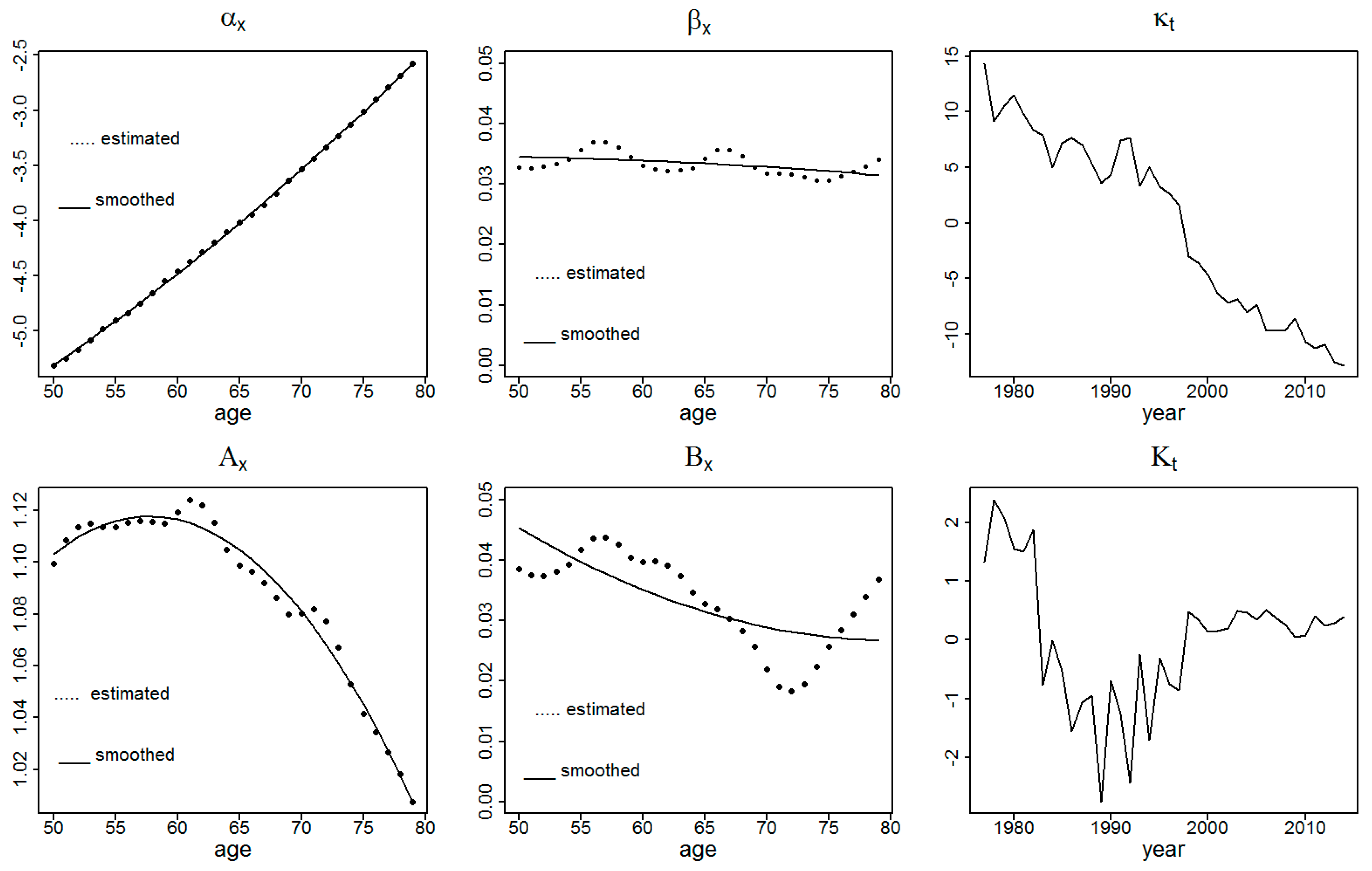

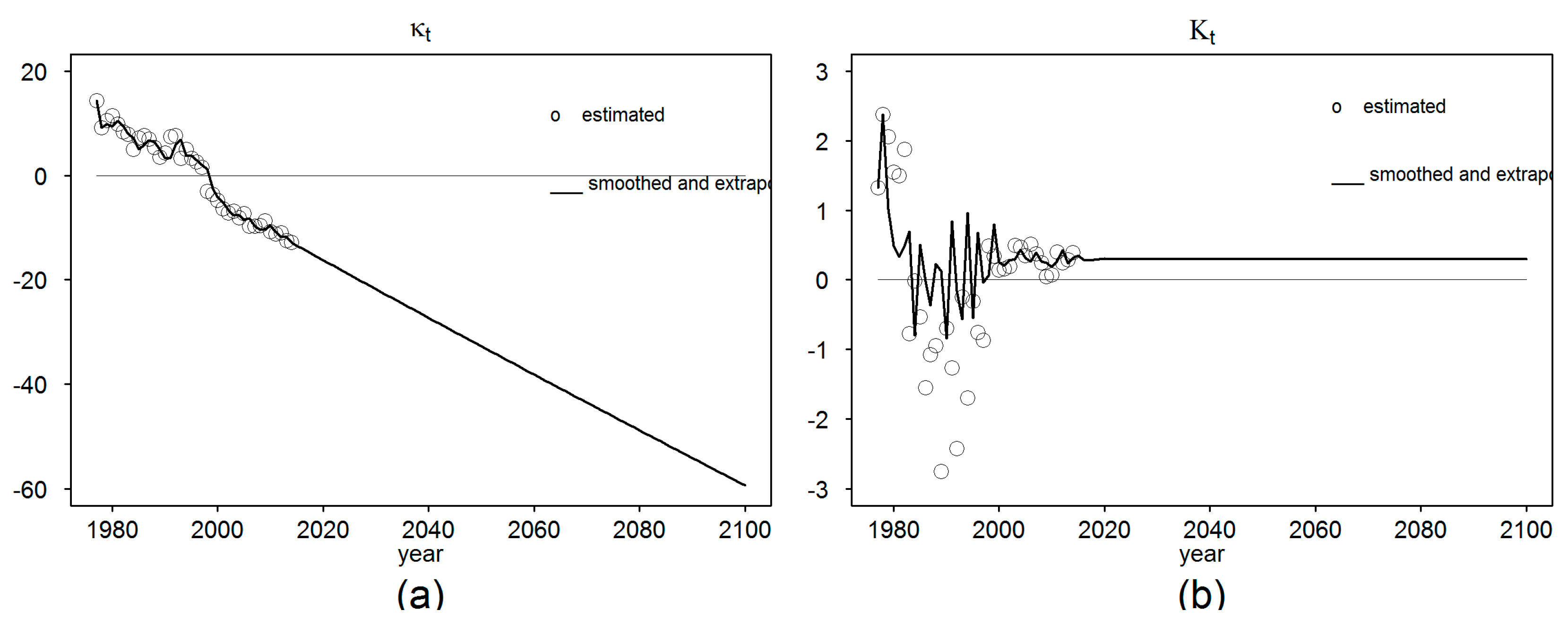

4. Adjustment to an External Reference

The forecasting of the experience mortality rates by an adjustment to an external reference can be made through the estimation of the adjustment model and then using the resulted parameters to deduce the future experience rates from the forecasted reference rates. Let

be the fitted ASDRs for age

at time

for the reference population and

the fitted ASDRs related to the retired population. We remind that, until now,

were projected until 2100.

are only available for the period from 2004 to 2013. The adjustment model needs to be estimated on common age interval and time range connecting the experience and the reference surfaces. In our case, the experience mortality rates are available for the ages from 50 to 94 during the years from 2004 to 2013, while the reference rates are provided for ages from 0 to 79 along the period from 1977 to 2014. Consequently, the age interval [50,79] as well as the period from 2004 to 2013 can be considered as common age and time intervals, respectively. To improve the quality of the adjustment, a comparison is conducted between the original Logit-linear regression model proposed by

Planchet (

2006) and a generalized Logit-quadratic version.

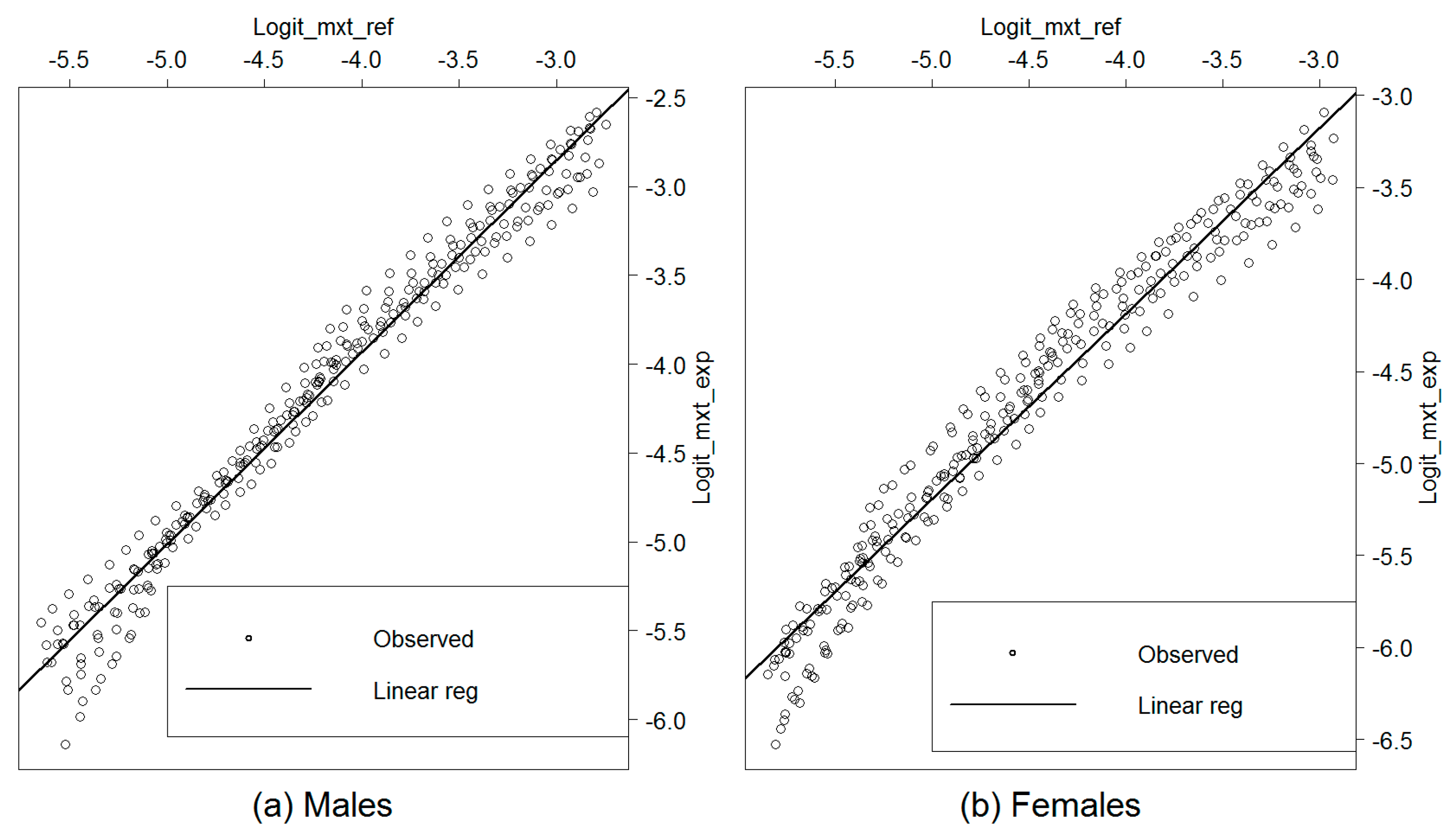

4.1. Logit-Linear Regression Model

We remind that the Logit-linear regression model is based on the expression of the Logit of the experience death rates in function of the Logit of the reference death rates. That can be formulated as:

with

γ and

δ being the parameters of the linear regression model and

an error term normally distributed. The model is estimated by minimizing the sum of squared errors (SSE) between the observed and the predicted experience death rates:

We observe that the linear equation does not fit well the regression of the experience death rates on the reference ones. The regression seems to have a quadratic shape more relevant in the case of females. To evaluate the quality of the linear regression and its capacity to predict the experience death rates starting from the reference ones, we compare the observed deaths to those expected by the model. For this, the expected rates must be considered in respect to an error threshold beyond which the model is qualified inappropriate. That returns to the estimation of the confidence interval of the predicted death rates and the numbers of deaths.

We remind that the initial data were provided by five age intervals. For comparability issues, the deaths expected by the regression following a detailed age description, need to be arranged into five age intervals.

If we denote

the annual average number of deaths observed in the age interval

during the period from 2004 to 2013 and

the corresponding population at risk, the crude death rates averaged on the period from 2004 to 2013 can be calculated as

. On the other side of the comparison, the predicted number of deaths that we denote

can be calculated by multiplying the adjusted death rates

by the observed population at risk

. We can write:

. The

can be averaged on the

for “

” going from 2004 to 2013. For each year “

”,

can be reconstructed using a geometric mean of the ASDRs at the detailed ages

. With

equal to 5, we can write:

with

denoting the ASDR at age

(going from

to

) and year

.

If we consider six age intervals for which the observed and the expected deaths are to be compared, the confidence bound must be calculated simultaneously for the six points. That recalls the notion of confidence bound, which is different from a confidence interval that can be estimated independently for each of the six age intervals. Here, we follow the methodology proposed by

Planchet and Kamega (

2013) on the estimating of confidence bounds for single age death rates. We adjust the proposed formula to suit the case of five-age death rates.

Estimating a confidence interval at a confidence level of 1 −

for

, which is supposed to be normally distributed, aims that there is a probability 1 −

that the real death rate is comprised in the confidence interval:

with

) representing the (

) quantile of the reduced centered normal distribution.

Contrary to confidence intervals designed for the case of independent estimates, the confidence bounds consider the probability that all observed values are simultaneously within the corresponding confidence intervals. Accordingly, if there were a probability

that

is within its confidence interval, there would be a probability

that a “

” number of independent observations are simultaneously within their respective confidence intervals with

. The confidence bound can be then calculated by:

Here, the confidence bounds have been estimated for an overall confidence level of corresponding to local confidence levels at each age group of

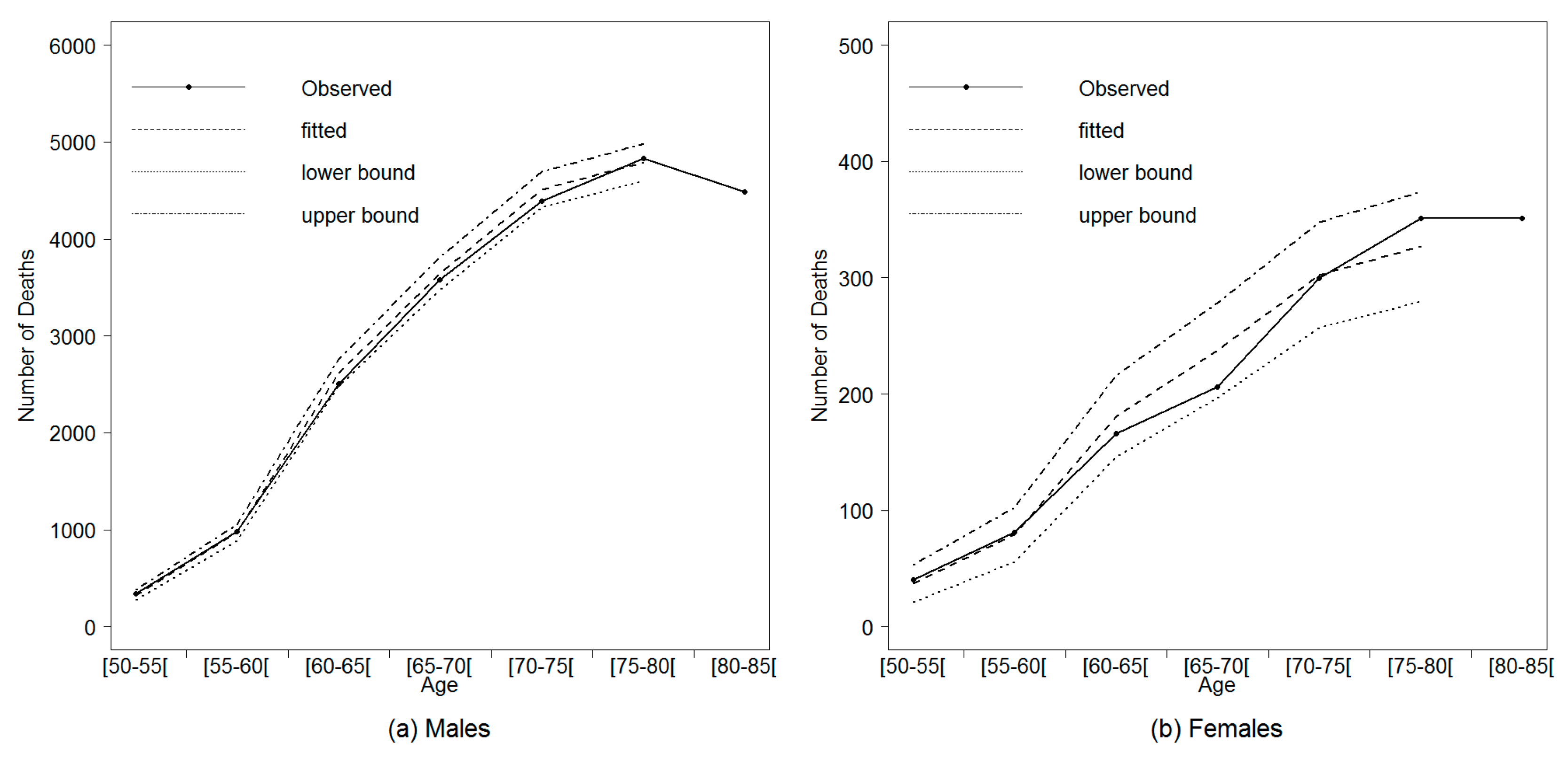

The confidence bounds calculated on the number of deaths (averaged on the period from 2004 to 2013) predicted by the linear regression are represented in

Figure 12 as well a comparison to the observed deaths.

For females, we observe that the observed numbers of deaths are located within the confidence bound at all the age intervals. For males, the confidence bound fails to predict the observed numbers of deaths at the age intervals [65,70[ and [75,80[. That said, the variability of the experience mortality rates has not been correctly captured by the linear regression model.

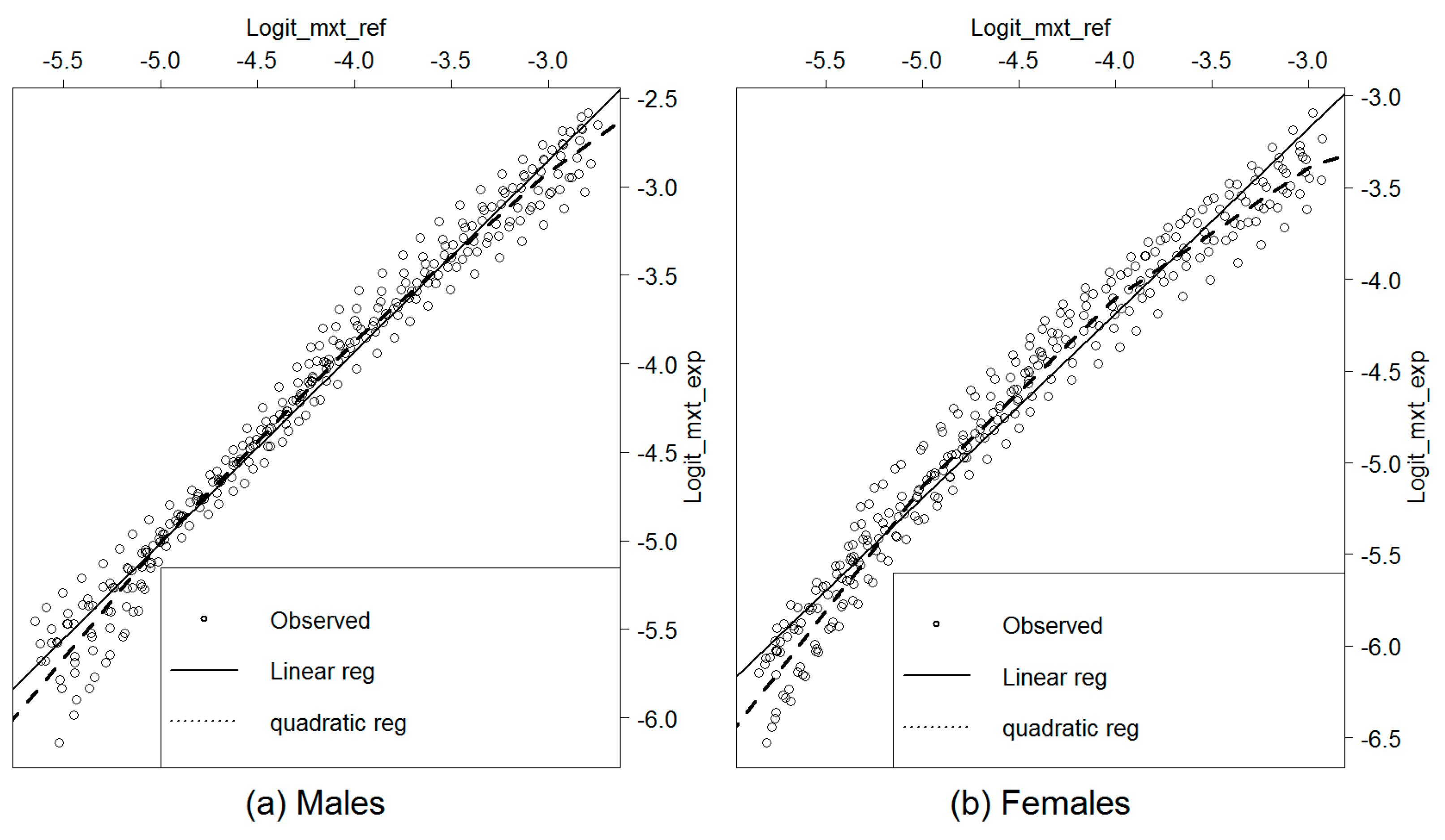

4.2. The Logit-Quadratic Regression Model

To improve the quality of the adjustment, we propose a slight adaptation of the regression model to capture the curvature of the cloud points. The regression of the experience death rates on the reference rates is supposed to be expressed by a two-order polynomial function:

where

,

and

are the regression parameters and

is an error term.

Figure 13 shows the quadratic regression results compared to those previously obtained using the linear regression model.

To evaluate the quality of quadratic adjustment, we compare the distribution of the observed deaths to those predicted by the model. The recalculated confidence bounds are presented in

Figure 14.

We observe that the Logit-quadratic model fits the pattern of the experience mortality rates in function of the reference ones better than the linear regression. The observed numbers of deaths are within the confidence bound at all ages for both males and females.

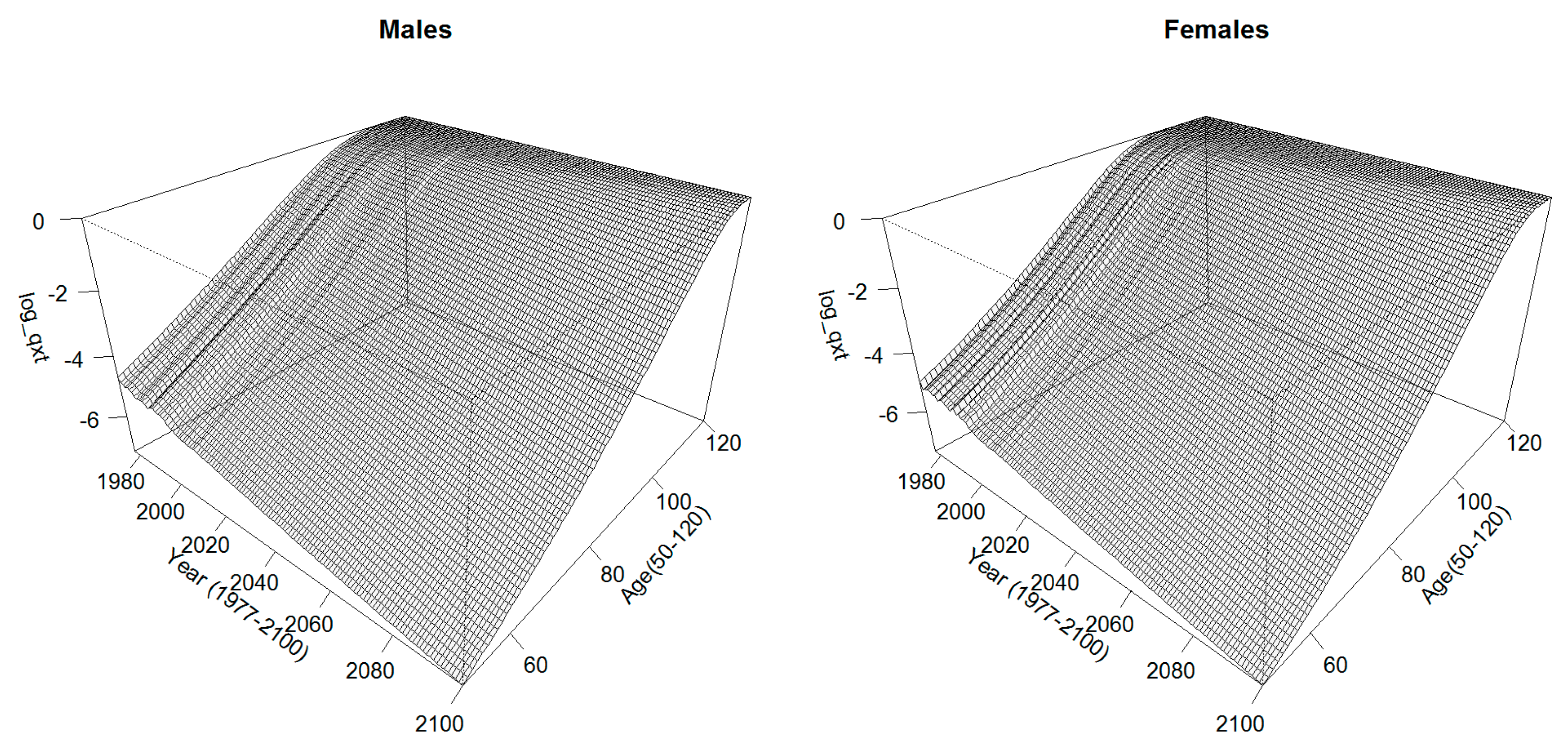

4.3. Retired Population Dynamic Life Tables

Using the coefficients of the quadratic regression model, the Logit of the retirees’ experience ASDRs can be deduced from those of the reference population already projected until 2100 for the age interval [50,79]. The ASDRs for the ages beyond are extrapolated using the Coale–Kisker model (

Coale and Kisker 1990).

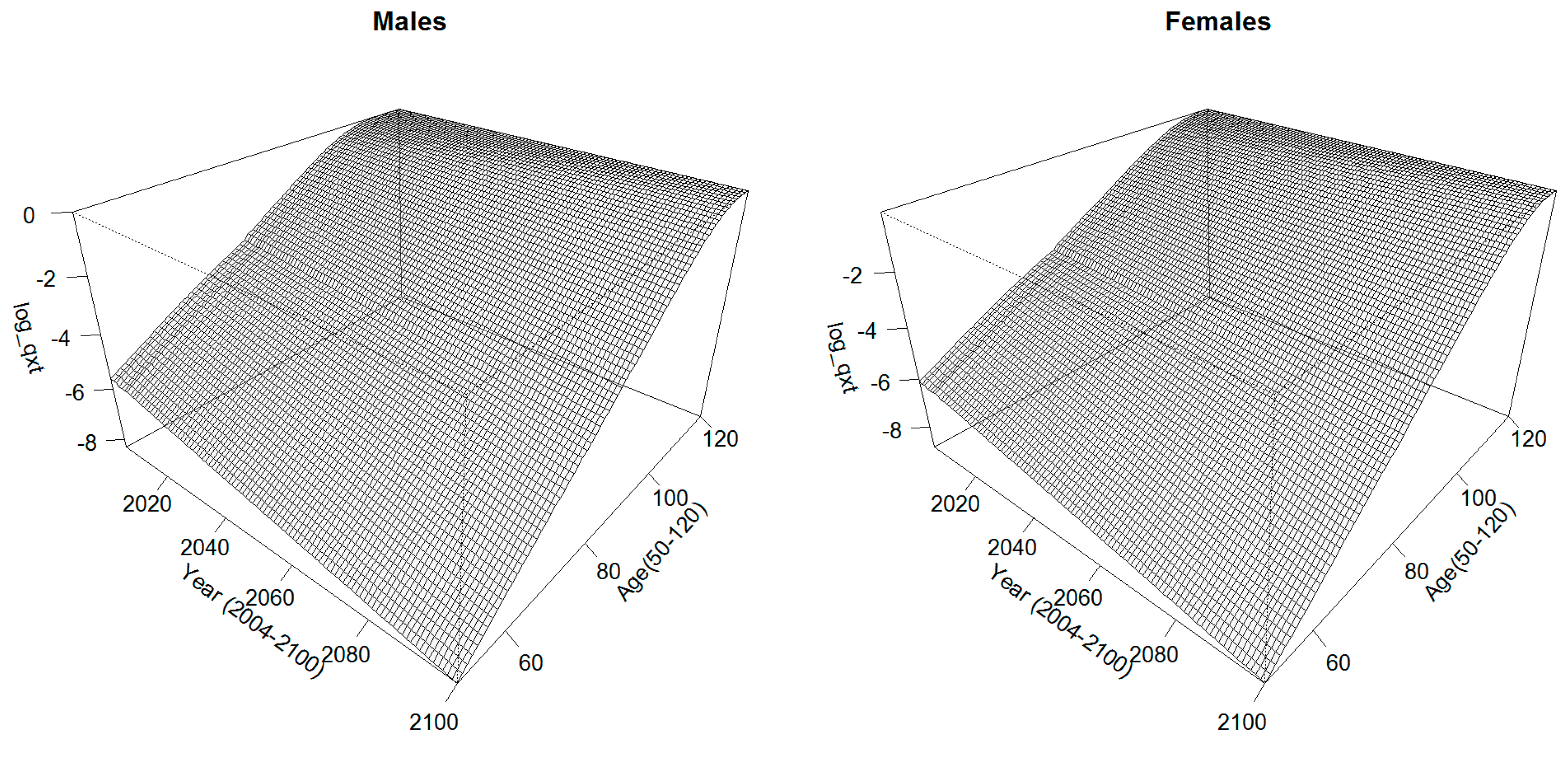

Figure 15 shows the extrapolated mortality surfaces.

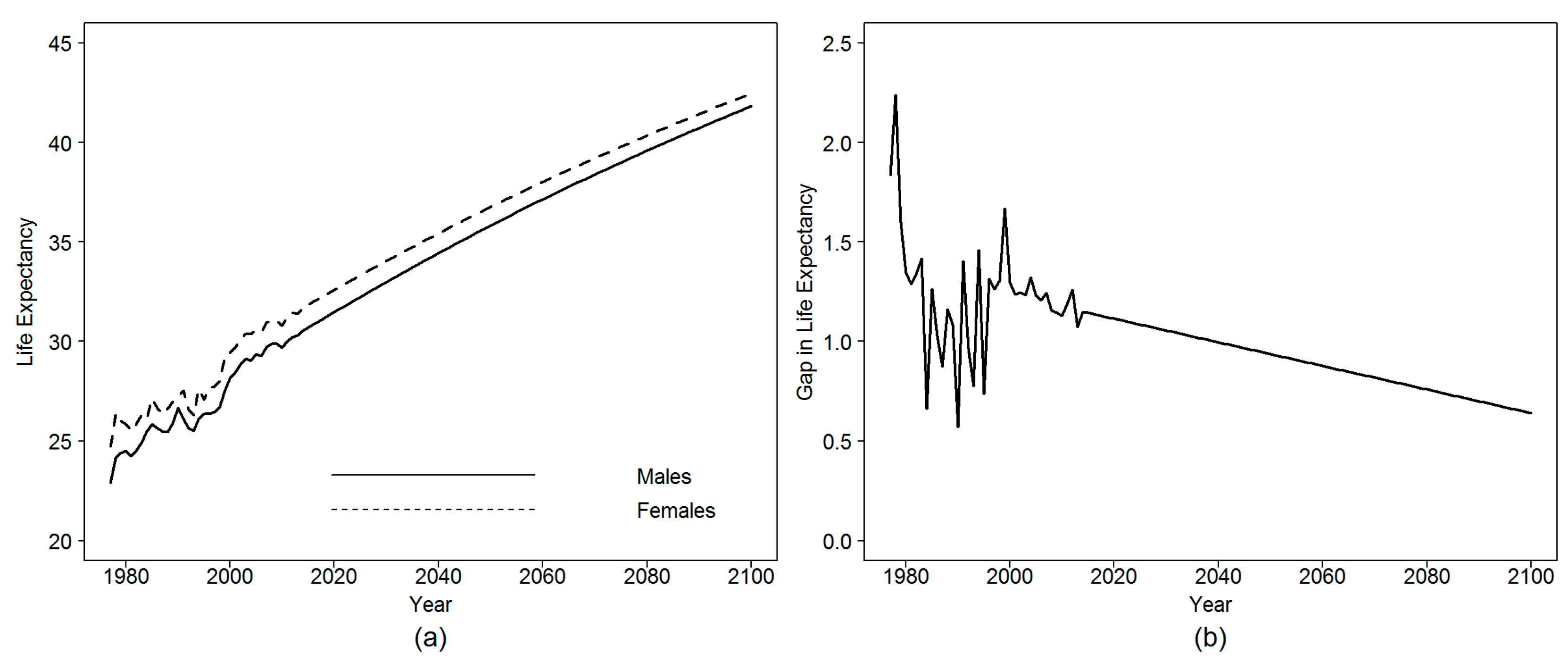

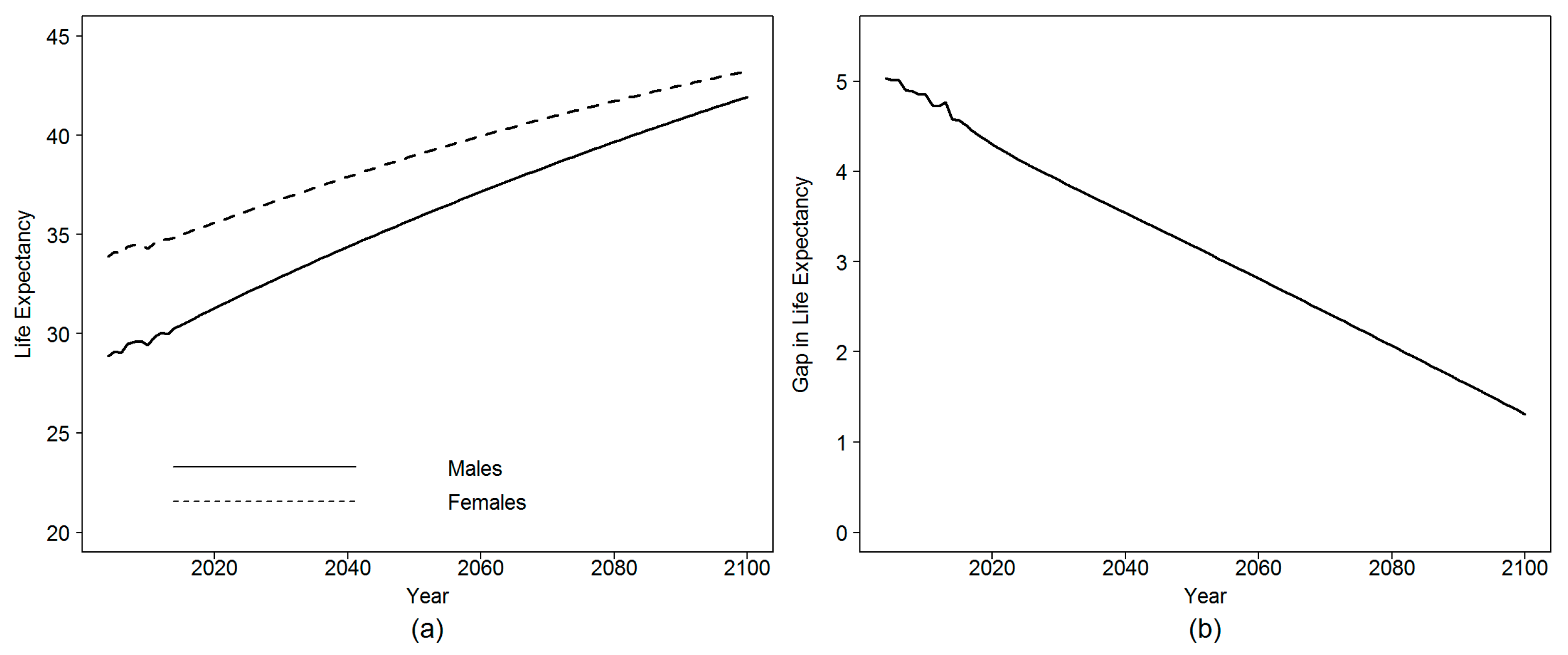

According to the forecasting results, the female life expectancy at age 50 is supposed to increase from 34.8 in 2014 to 39 and 40.9 in 2050 and 2070, respectively. For males, this value is expected to rise from 30.4 in 2014 to 35.8 and to 38.5 in 2050 and 2070, respectively. The sex gap in life expectancy at age 50, which was 4.4 in 2014, is expected to decrease to 2.4 by 2070.

Figure 16 shows the obtained results in more details.

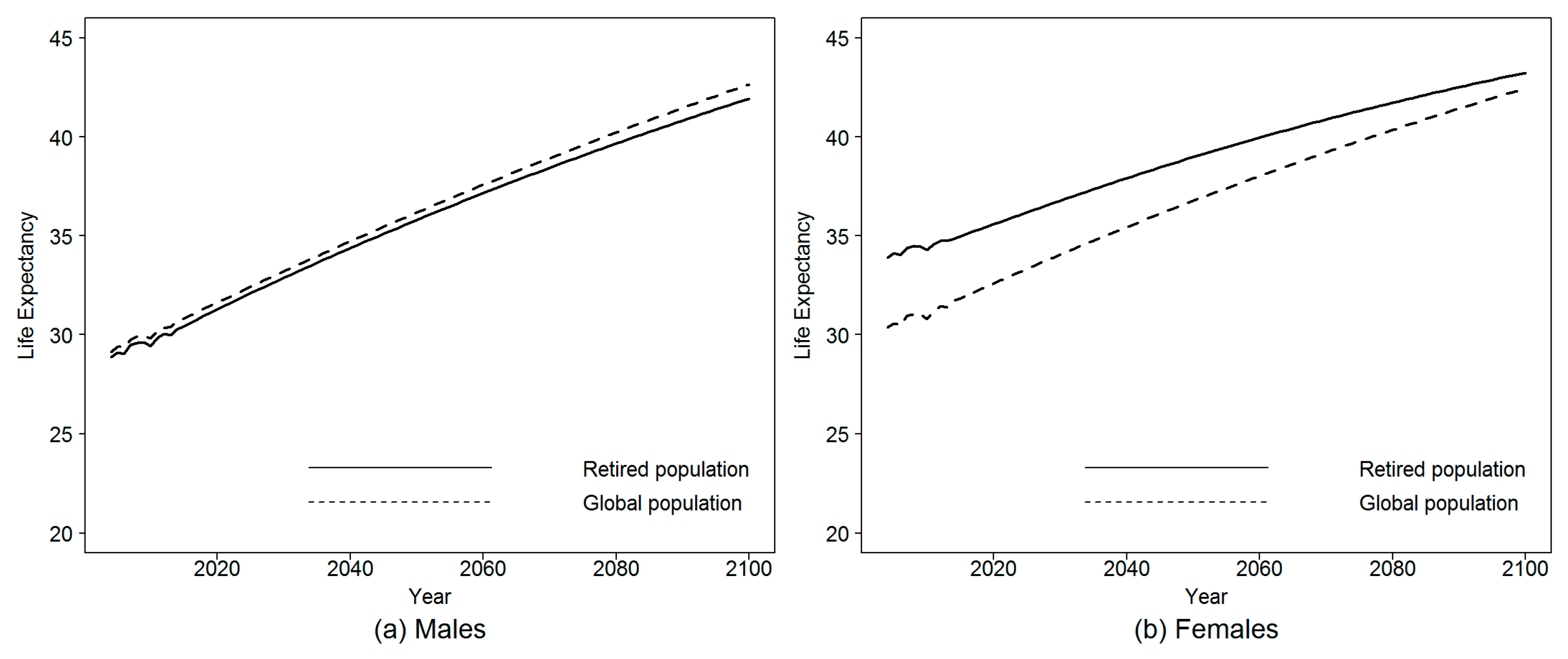

When we compare the obtained results to the global population life expectancy, significant differences arise when comparing males and females.

Figure 17 gives a comparison in this sense.

According to

Figure 17, there is no significant difference between the global and the retired population in terms of remaining life expectancy at age 50 in the case of males. The average gap is nearly five months during the whole observation period in favor of the global population. For females, the life expectancy of the retired women is 3.16 years higher than that of the female global population in 2014. This gap is expected to decrease to a value of 2.2 and 1.7 in 2050 and 2070, respectively.

There are two possible explanations for this last finding. The first explanation assumes that working has a positive effect on the female population contrary to men. For men, living conditions are not different whether they are insured or not. Adversely, working women have better and healthier living conditions compared to the rest of the female population. Such an assumption is supported by the fact that working women are more concentrated in un-risky activity sectors (services and administration) compared to men (

ONS 2014). The second alternative supports the assumption that the ONS underestimates the life expectancy of the global female population. This last finding is sustained by the results of

Flici and Hammouda (

2016). When analyzing the data issued from the Multi Indicators Cluster Survey

4 MICS2012, which focused on the period from 2008 to 2012, they found a gap of 3.9 years in life expectancy at birth between males and females of the global population. This result is near to the gap and the life expectancy obtained on the retired population. That let us suppose that the retired population (men and women) does not present any particularity in terms of remaining life expectancy compared to the global population and that ONS estimates about the female life expectancy could be inaccurate. To assess such assumption, we need to explore additional data sources (insurance companies, social security, etc.) and to investigate the methodology adopted by the ONS to estimate female mortality.

5. Conclusions

Two important points need to be considered when using life tables for managing retirement plans and pricing life annuities: one consists of the adjustment of the risk function to the experience of the targeted population, and the other aims to take the future improvement of this experience mortality into account. Being usually available for short periods, the data of the insured population make it hard to implement efficiently the prospective mortality models to predict future longevity. On the other side, using prospective life tables of the national population for actuarial calculations assumes that insured or retired people have the same age–mortality pattern as the global population. Such an assumption is not always realistic and may lead to risk misestimating.

In the late 1970s, the Continuous Mortality Investigation (

CMI 1978) proposed to use actuarial life tables incorporating an improvement scale to predict the future mortality of annuitants in the UK. Later, this model was adopted in the US (

SOA 1995) and Canada (

CIA 2014). Due to the remarkable advancement in mortality stochastic modeling following the contribution made by

Lee and Carter (

1992), several models have been proposed to forecast mortality for different populations in a coherent way. Beginning with male–female coherent mortality forecasting (

Li and Lee 2005) to two-population and multi-population models (e.g.,

Jarner and Kryger 2011;

Hyndman et al. 2013;

Villegas and Haberman 2014;

Li et al. 2015), models were extended to forecasting limited mortality data by using relatively more important population data as a reference (e.g.,

Planchet 2006;

Plat 2009;

Planchet and Kamega 2013;

Thomas and Planchet 2014). The idea behind these last models is to model the spread between the small population mortality, time-limited, and the reference, and then to derive the future evolution of the first from that of the second. This adjustment technique is highly suited for the case of the insured populations for which the observation history is limited in time.

In this paper, we have considered the case of the Algerian retirees within the salaried workers’ scheme. The experience data are available for the period 2004–2013, for males and females, and arranged in five age intervals from age 50 to 90 years and older. Our objective was to forecast the retirees experience mortality through an adjustment to an external reference using the Brass-type relational model proposed by

Planchet (

2006). To this end, we used the mortality surface of the Algerian male and female populations, available starting from 1977, as a reference. The model was estimated in the age interval [50,79] and for the period from 2004 to 2013, which correspond to the common age and time intervals between the global population and retirees’ data. Then, the estimated parameters were used to deduce the future experience death rates from the projected reference rates. Recall that the reference mortality, for males and females, has been projected in the future using the product-ratio model proposed by

Hyndman et al. (

2013).

To evaluate the performance of the Logit-linear model, we compared the observed deaths to the confidence bounds of the deaths predicted by the model. The comparison showed that the adjustment model failed to predict the experience mortality rates at some ages. Hence, we proposed a Logit-quadratic model to better fit the curvature of the distribution of the experience rates compared to the reference ones. The comparison of the observed deaths and the model predictions displayed a better quality compared to those provided by the Logit-linear model.

After having assessed its quality, the Logit-quadratic model was used to deduce the age-specific death rates of the retired population from the projected global population rates. The final results showed that the remaining life expectancy at age 50 of the male retirees is quite similar to that of men of the global population. Both indicators display a value of around 30 years in 2014 expected to improve to nearly 35.8 years in 2050. Adversely, the results reveal an important gap between retired women and women of the global population. The former have a higher remaining life expectancy at age 50, with three additional years. This gap is expected to narrow over time to two years by 2050.

Using the national life table to expect the future benefits to be paid for retirees during their remaining lifetime would lead to underestimating the real benefits owed to retirees and consequently to serious unexpected financial unbalance between contributions and retirement benefits. Indeed, such a finding remains true if retirees have better life expectancy compared to the global population. Accordingly, the case of retired women in Algeria cannot be ignored. Following the rise of the women’s employment rate in Algeria during the last two decades, one should expect a growing part of women among retirees in the future. Hence, neglecting the residual remaining life expectancy of the retired women will have an increasing impact on the financial imbalance of the retirement system. Nowadays, the calls for reforming the Pay-As-You-Go retirement systems in North Africa are mainly oriented to reduce the generosity of pensions (

Ben Brahem 2009) and to ensure a stronger contribution–benefit linkage (

Chourouk 2003). In such a context, the prospective life tables of the retired population will be necessary to evaluate the sustainability of retirement systems and to plan reforms.