Risk of Bankruptcy, Its Determinants and Models

Abstract

1. Introduction

2. Literature Review

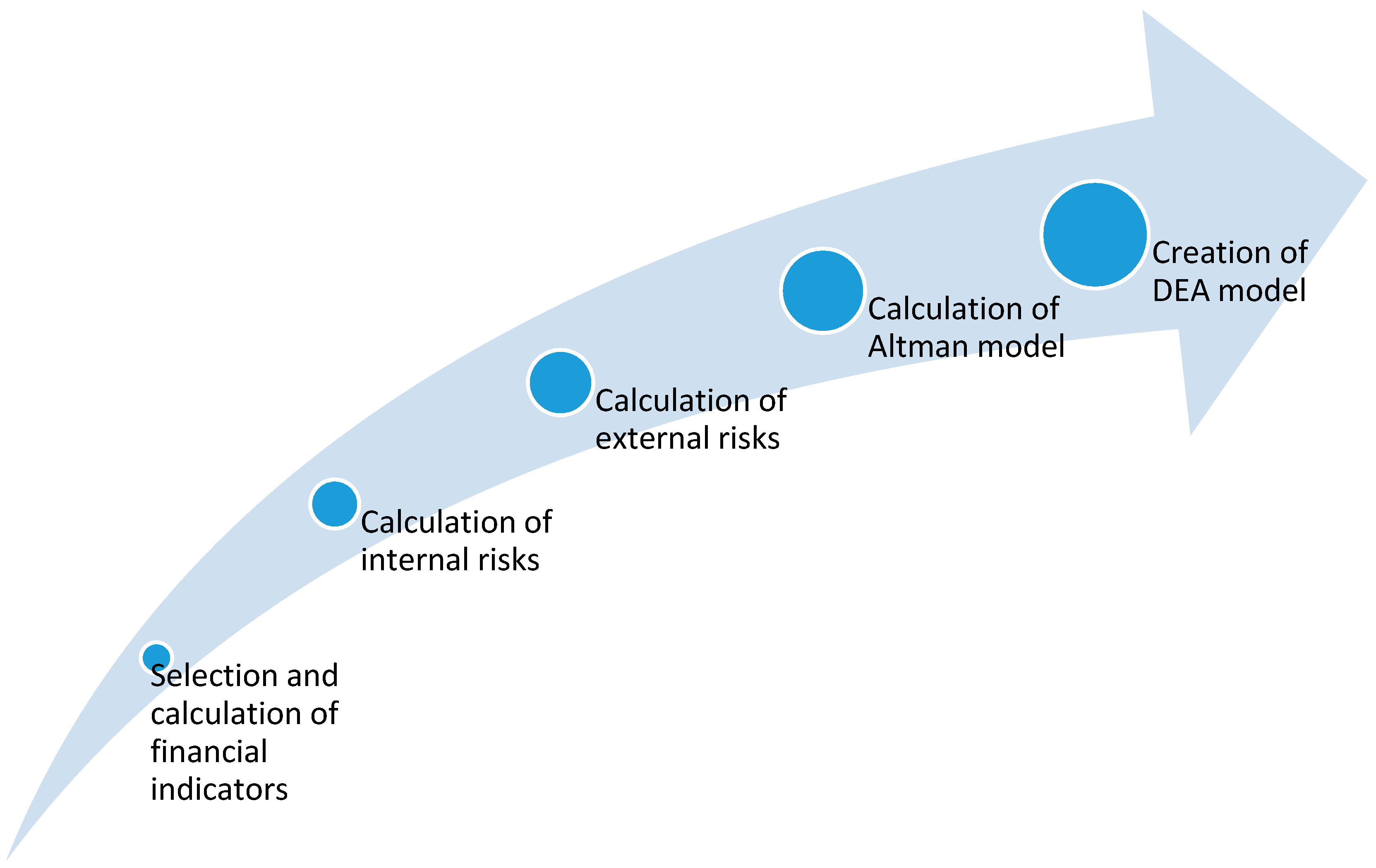

3. Materials and Methods

3.1. Selection and Calculation of Financial Indicators

3.2. Calculation of Internal Risks

3.3. Calculation of external risks

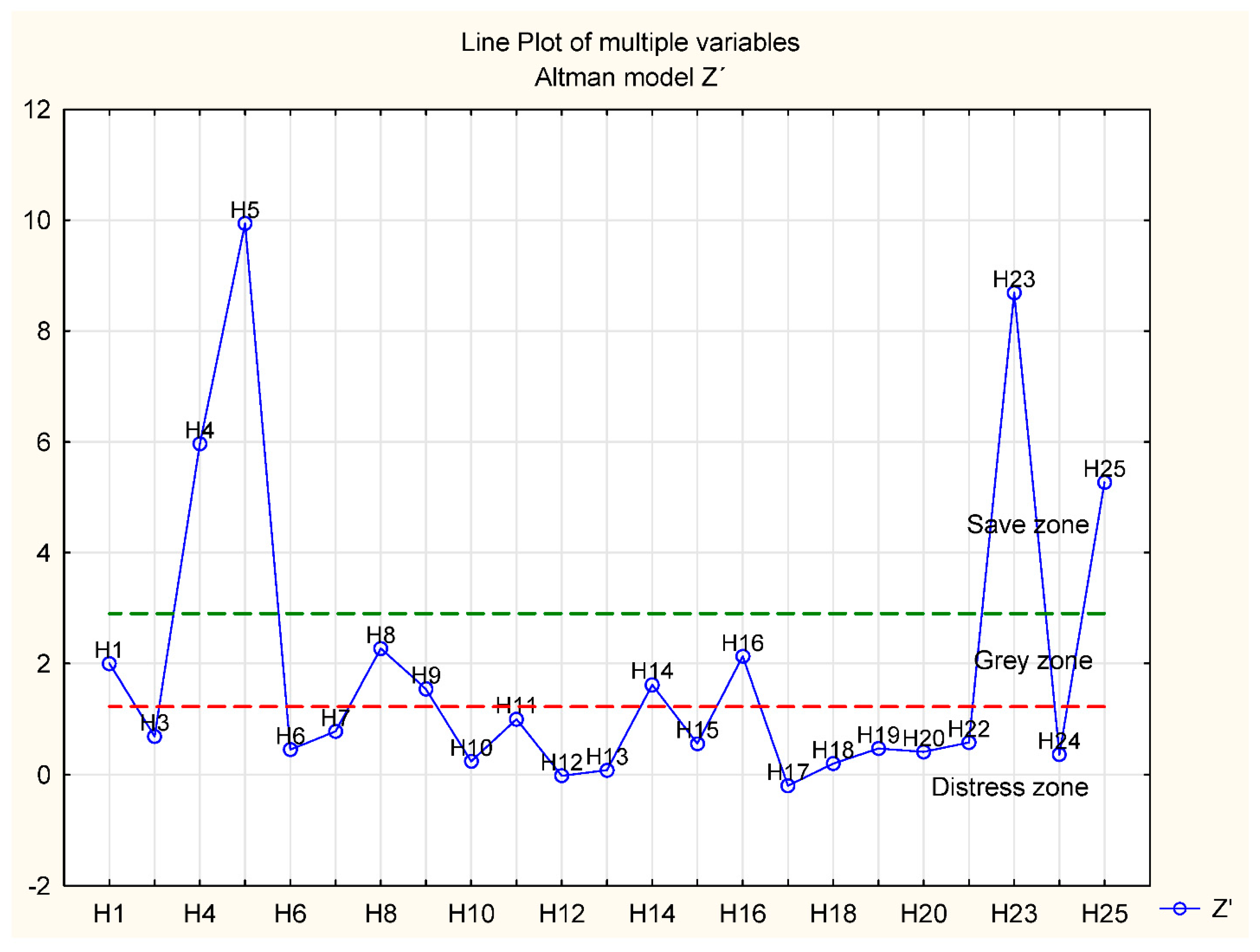

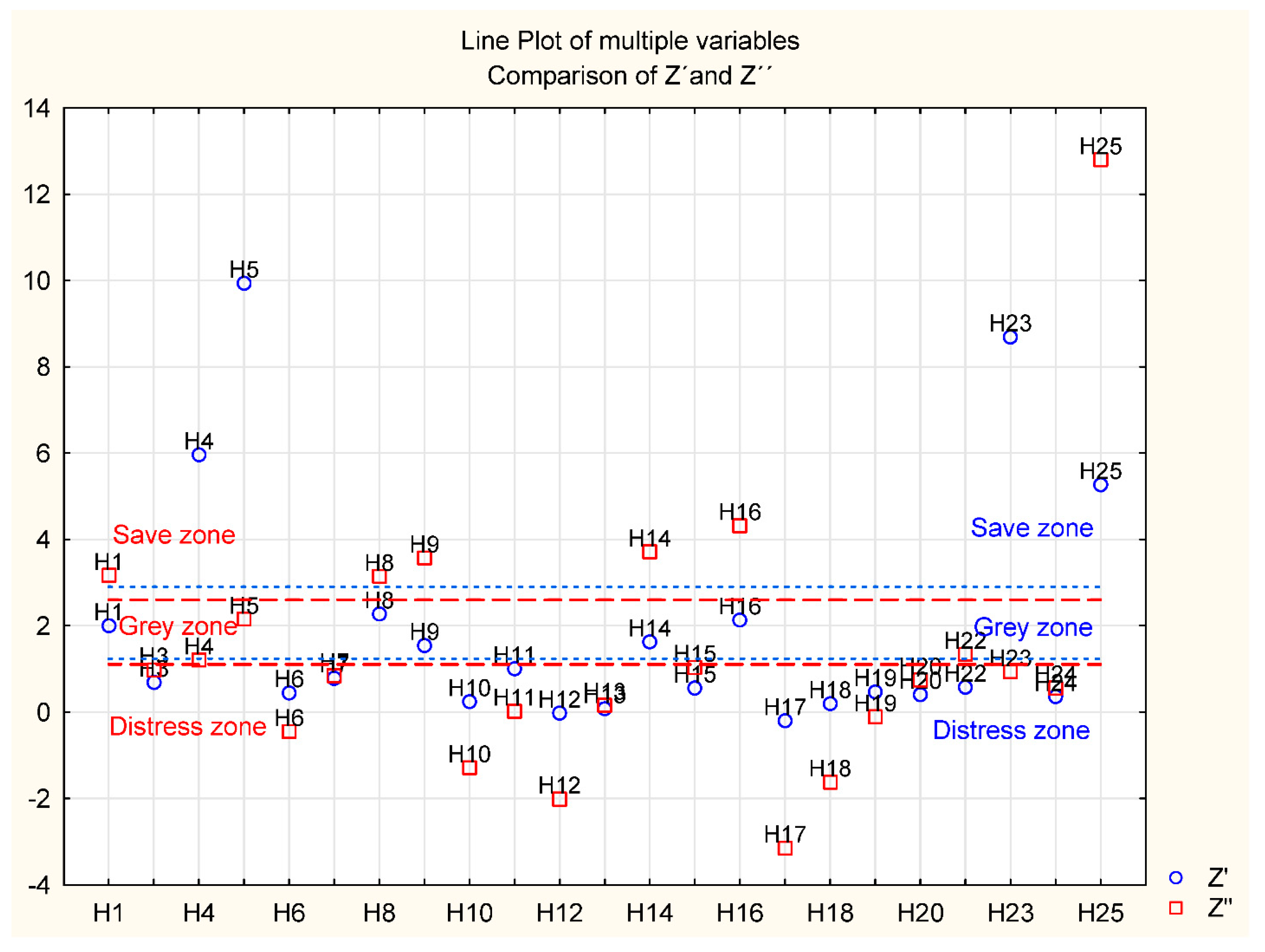

3.4. Calculation of Altman Model

- Zones of discrimination:

- Z’ > 2.9 → safe zone

- Z’ ∈ < 1.23; 2.9 > → grey zone

- Z’ < 1.23 → distress zone

- Zones of discrimination:

- Z” > 2.60 → safe zone

- Z” ∈ < 1.10; 2.60 > → grey zone

- Z” < 1.10 → distress zone

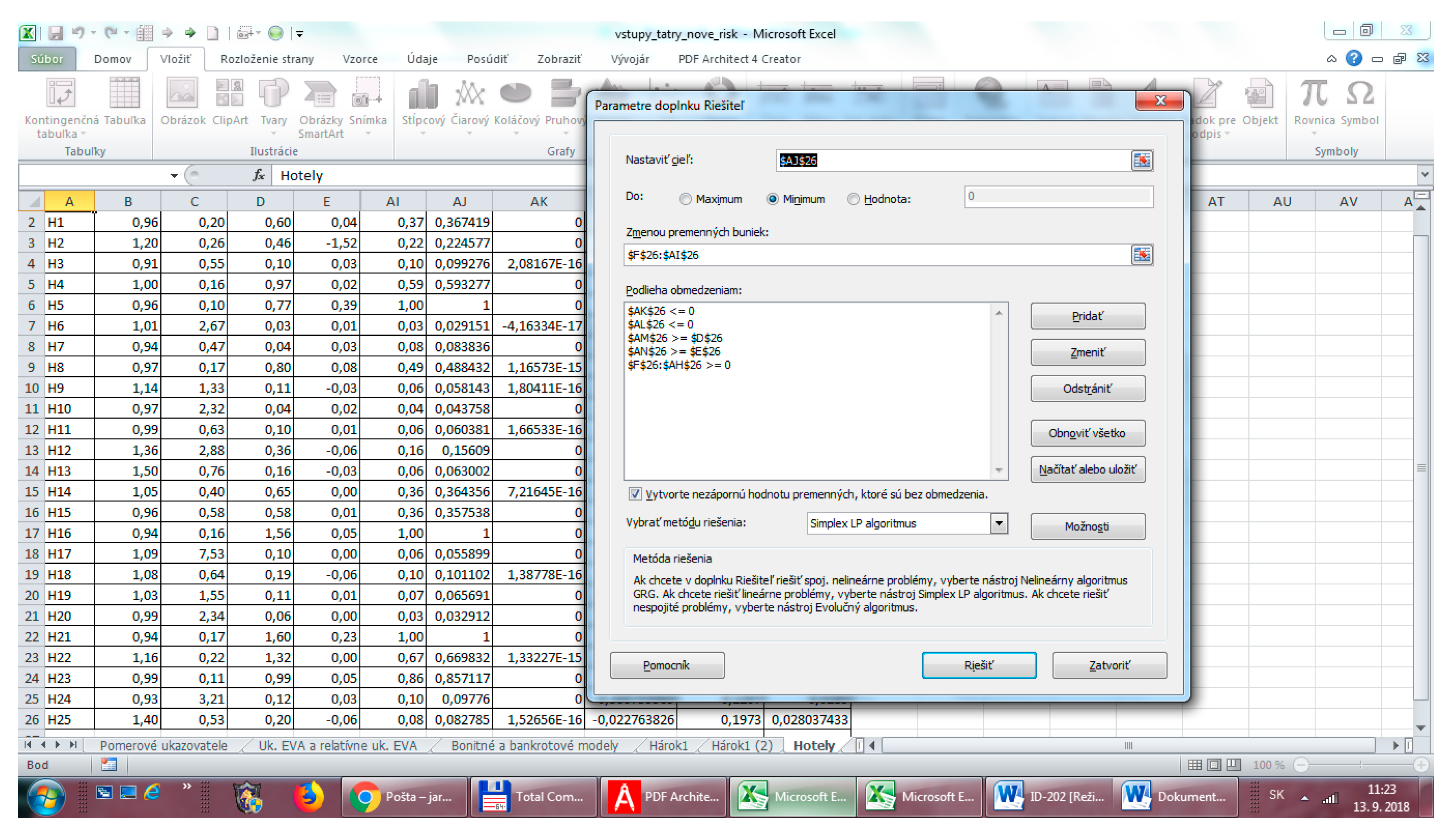

3.5. Creation of DEA Model

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Adamko, Peter, and Lucia Svabova. 2016. Prediction of the risk of bankruptcy of Slovak companies. Paper present at 8th International Scientific Conference Managing and Modelling of Financial Risks, Ostrava, Czech Republic, 5–6 September 2016; pp. 15–20. Available online: https://www.ekf.vsb.cz/export/sites/ekf/rmfr/cs/sbornik/Soubory/Part_I.pdf (accessed on 1 August 2018).

- Agarwal, Vineet, and Richard Taffler. 2008. Comparing the performance of market-based and accounting-based bankruptcy prediction models. Journal of Banking & Finance 32: 1541–51. [Google Scholar] [CrossRef]

- Albright, Jeremy. 2015. What Is the Difference between Logit and Probit Model? Available online: https://www.methodsconsultants.com/tutorial/what-is-the-difference-between-logit-and-probit-models/ (accessed on 10 July 2018).

- Aleksanyan, Lilia, and Jean-Pierre Huiban. 2016. Economic and Financial Determinants of Firm Bankruptcy: Evidence from the French Food Industry. Review of Agricultural, Food and Environmental Studies 97: 89–108. [Google Scholar] [CrossRef]

- Altman, Edward I., Malgorzata Iwanicz-Drozdowska, Erkki K. Laitinen, and Arto Suvas. 2014. Distressed Firm and Bankruptcy Prediction in an International Context: A Review and Empirical Analysis of Altman’s Z-score Model. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2536340 (accessed on 20 July 2018).

- Altman, Edward I. 1982. Accounting Implications of Failure Prediction Models. Journal of Accounting Auditing and Finance 6: 4–19. [Google Scholar]

- Araghi, Maryam K., and Sara Makvandi. 2013. Comparing Logit, Probit and Multiple Discriminant Analysis Models in Predicting Bankruptcy of Companies. Asian Journal of Finance & Accounting 5: 48–59. [Google Scholar] [CrossRef]

- Aziz, Adnan A., and Humayon A. Dar. 2006. Predicting corporate bankruptcy: where we stand? Corporate Governance 6: 18–33. [Google Scholar] [CrossRef]

- Banker, Rajiv. D., Abraham Charnes, and William. W. Cooper. 1984. Some Models for Estimating Technical Scale Inefficiencies in Data Envelopment Analysis. Management Science 30: 1078–92. [Google Scholar] [CrossRef]

- Bauer, Julian, and Vineet Agarwal. 2014. Are hazard models superior to traditional bankruptcy prediction approaches? A comprehensive test. Journal of Banking & Finance 40: 432–42. [Google Scholar] [CrossRef]

- Beaver, William H. 1966. Financial ratios as predictors of failure. Journal of Accounting Research 4: 71–111. [Google Scholar] [CrossRef]

- Becchetti, Leonardo, and Jaime Sierra. 2002. Bankruptcy risk and productive efficiency in manufacturing firms. Journal of Banking and Finance 27: 2099–20. [Google Scholar] [CrossRef]

- Black, Fischer, and Myron Scholes. 1973. The pricing of options and corporate liabilities. Journal of Political Economy 81: 637–54. [Google Scholar] [CrossRef]

- Blum, Marc. 1974. Failing Company Discriminant Analysis. Journal of Accounting Research 12: 1–25. [Google Scholar] [CrossRef]

- Booth, Peter J. 1983. Decomposition measure and the prediction of financial failure. Journal of Business Finance & Accounting 10: 67–82. [Google Scholar] [CrossRef]

- Buganová, Katarína, and Mária Hudáková. 2012. Manažment rizika v podniku, 1st ed. Žiline: EDIS. ISBN 978-80554-0459-2. [Google Scholar]

- Campbell, Harvey R. 2012. Bankruptcy Risk. Available online: https://financial-dictionary.thefreedictionary.com/Bankruptcy + risk (accessed on 15 July 2018).

- Charnes, Abraham, William W. Cooper, and Jean E. Rhodes. 1978. Measuring the Efficiency of Decision Making Units. European Journal of Operational Research 2: 429–44. [Google Scholar] [CrossRef]

- Chen, Ning, Bernardete Ribeiro, Armando Vieira, and An Chen. 2013. Clustering and visualization of bankruptcy trajectory using self−organizing map. Expert Systems with Applications 40: 385–93. [Google Scholar] [CrossRef]

- Chrastinová, Zuzana. 1998. Metódy Hodnotenia Ekonomickej Bonity a Predickei Finančnej situácie Poľnohospodárskych Podnikov. Bratislava: VÚEPP. ISBN 80-8058-022-7. [Google Scholar]

- Cisko, Štefan, and Tomáš Klieštik. 2013. Finančný manažment podniku II. Žilina: EDIS. ISBN 978-80-554-0684-8. [Google Scholar]

- Cornuejols, Gerard, and Michael Trick. 1998. Quantitative Methods for the Management Sciences. Pittsburgh: Carnegie Mellon University. Available online: http://mat.gsia.cmu.edu/classes/QUANT/NOTES/chap0.pdf (accessed on 11 May 2018).

- Čunderlík, Dušan. 2004. Rizikový manažment a riadenie kontinuity podnikateľskej činnosti podniku. Available online: http://fsi.uniza.sk/kkm/old/publikacie/pp/pp_kap_12.pdf (accessed on 12 August 2018).

- Damodaran, Aswath. 2018. The Data Page. Available online: http://pages.stern.nyu.edu/adamodar/ (accessed on 12 July 2018).

- Damodaran, Aswath. 2014. Equity Risk Premiums: Looking Backwards and Towards. Available online: http://people.stern.nyu.edu/adamodar/pdfiles/country/ERP2014.pdf (accessed on 14 May 2018).

- Das, Sanjiv R., Paul Hanouna, and Atulya Sarin. 2009. Accounting−Based versus Market−Based cross-sectional models for CDS spreads. Journal of Banking & Finance 33: 719–30. [Google Scholar] [CrossRef]

- Deakin, Edward B. 1972. A Discriminant Analysis of Predictors of Business Failure. Journal of Accounting Research 10: 167–79. [Google Scholar] [CrossRef]

- Farrell, Michael J. 1957. The Measurement of Productive Efficiency. Journal of the Royal Statistical Society, Series A 120: 253–90. [Google Scholar] [CrossRef]

- Ferus, Anna. 2010. The Application of DEA Method in Evaluating Credit Risk of Companies. Contemporary Economics 4: 107–13. [Google Scholar]

- Fetisovová, Elena, Karol Vlachynský, and Vladimír Sirotka. 2004. Financie malých a stredných podnikov, 1st ed. Bratislava: Iura Edition. ISBN 80-89047-87-4. [Google Scholar]

- Fulmer, John. G., Jr., James. E. Moon, Thomas. A. Gavin, and Michael. J. Erwin. 2004. A bankruptcy classification model for small firms. Journal of Commercial Bank Iandirg 66: 25–37. [Google Scholar]

- Friedman, Jerome H. 1977. A recursive partitioning decision rule for nonparametric classification. IEEE Transactions on Computers 26: 404–8. [Google Scholar] [CrossRef]

- Gherghina, Stefan C. 2015. An Artificial Intelligence Approach towards Investigating Corporate Bankruptcy. Review of European Studies 7: 5–22. [Google Scholar] [CrossRef]

- Gurčík, Ľubomír. 2002. G—index—metóda predikcie finančního stavu poľnohospodárskych podnikov. Agricultural Economics 48: 373–8. [Google Scholar]

- Gurney, Kevin. 1997. An Introduction to Neural Networks. London: UCL Press Limited. ISBN 0-203-45151-1. Available online: https://www.inf.ed.ac.uk/teaching/courses/nlu/assets/reading/Gurney_et_al.pdf (accessed on 24 August 2018).

- Horváthová, Jarmila, and Martina Mokrišová. 2018. The use of innovative approaches in assessing and predicting business financial health. Paper presented at 27th International Scientific Conference on Economic and Social Development, Rome, Italy, March 1–2; pp. 728–38. Available online: http://www.esd-conference.com/past-conferences (accessed on 12 March 2018).

- Karels, Gordon V., and Arun J. Prakash. 1987. Multivariate Normality and Forecasting of Business Bankruptcy. Journal of Business Finance & Accounting 14: 573–93. [Google Scholar] [CrossRef]

- Kidane, Habtom W. 2004. Predicting Financial Distress in IT and Services Companies in South Africa. Master’s thesis, Faculty of Economics and Management Sciences, Bloemfontein, South Africa. Available online: http://scholar.ufs.ac.za:8080/xmlui/handle/11660/1117 (accessed on 18 June 2018).

- Klieštik, Tomáš, Jana Majerová, and Alexander N. Lyakin. 2015. Metamorphoses and Semantics of Corporate Failures as a Basal Assumption of a Well−founded Prediction of a Corporate Financial Health. Paper presented at 3rd International Conference on Economics and Social Science (ICESS 2015), Changsha, China, December 28–29, vol. 86, pp. 150–4. [Google Scholar]

- Klučka, Jozef. 2006. Riadenie rizika a hodnotenie výkonnosti podniku. BIATEC 14: 22–25. [Google Scholar]

- Koscielniak, Helena. 2014. An improvement of information processes in enterprises—The analysis of sales profitability in the manufacturing company using ERP systems. Polish Journal of Management Studies 10: 65–71. [Google Scholar]

- Kürschner, Manuel. 2008. Limitation of the Capital Asset Princing Model (CAPM). Munich: GRIN Verlag. ISBN 978-3-640-09925. [Google Scholar]

- Lippmann, Richard P. 1987. An Introduction to Computing with Neural Nets. IEEE ASSP Magazine 4: 4–22. [Google Scholar] [CrossRef]

- Liu, Li-lin, Kathryn J. Jervis, Mustafa Z. Younis, and Dana A. Forgione. 2011. Hospital financial distress, recovery and closure: Managerial incentives and political costs. Journal of Public Budgeting, Accounting and Financial Management 23: 31–68. [Google Scholar] [CrossRef]

- Lowrance, William. W. 1976. Of Acceptable Risk. Los Altos: William Kaufman Inc. [Google Scholar]

- Lukason, Oliver, and Erkki K. Laitinen. 2018. Firm failure processes and components of failure risk: An analysis of European bankrupt firms. Journal of Business Research. [Google Scholar] [CrossRef]

- Maddala, Gangadharrao S. 1983. Limited Dependent and Qualitative Variables in Econometrics. Cambridge: Cambridge University Press. [Google Scholar] [CrossRef]

- Mařík, Miloš, Karel Čada, Pavla Maříková, Barbora Rýdlová, and Josef Rajdl. 2011. Metody Oceňování Podniku: Proces Ocenění—Základní metody a Postupy, 3rd ed. Praha: Ekopress. ISBN 978-80-86929-67-5. [Google Scholar]

- Marinič, Pavel. 2008. Plánovaní a Tvorba Hodnoty Firmy. Praha: Grada Publishing, a. s. ISBN 978-80-247-2432-4. [Google Scholar]

- Markovič, Peter. 2010. Opcia a investičný projekt. Finančný Manažment a Controlling 2010: 627–30. [Google Scholar]

- Mendelová, Viera, and Tatiana Bieliková. 2017. Diagnostikovanie finančného zdravia podnikov pomocou metódy DEA: aplikácia na podniky v Slovenskej republike. Politická ekonomie 65: 26–44. [Google Scholar] [CrossRef]

- Min, Hokey, Hyesung Min, Seong J. Joo, and Joungman Kim. 2008. A Data Envelopment Analysis for establishing the financial benchmark of Korean hotels. International Journal of Services and Operations Management 4: 201–17. [Google Scholar] [CrossRef]

- Misankova, Maria, and Viera Bartosova. 2016. Comparison of selected statistical methods for the prediction of bankruptcy. Paper presented at 10th International Days of Statistics and Economics, Prague, Czech Republic, September 8–10; pp. 1260–69. Available online: https://msed.vse.cz/msed_2016/article/205-Misankova-Maria-paper.pdf (accessed on 20 August 2018).

- Mokrišová, Martina, and Jarmila Horváthová. 2018. Linear model as a tool in the process of improving financial health. Paper presented at 28th International Scientific Conference on Economic and Social Development, Paris, France, April 19–20; pp. 435–44. Available online: http://www.esd-conference.com/past-conferences (accessed on 22 May 2018).

- Moyer, Charles R. 1977. Forecasting Financial Failure: A Reexamination. Financial Management 6: 11–7. [Google Scholar] [CrossRef]

- Neumaierová, Inka, and Ivan Neumaier. 2002. Výkonnost a tržní hodnota firmy. Praha: Grada Publishing. ISBN 80-247-0125-1. [Google Scholar]

- Odom, Marcus D., and Ramesh Sharda. 1990. A neural Network Model for Bankruptcy Prediction. Paper presented at International Joint Conference on Neural Networks, San Diego, CA, USA, June 17–21. [Google Scholar] [CrossRef]

- Ohlson, James A. 1980. Financial Ratios and the Probabilistic Prediction of Bankruptcy. Journal of Accounting Research 18: 109–31. [Google Scholar] [CrossRef]

- Premachandra, I. M., Yao Chen, and John Watson. 2011. DEA as a Tool for Predicting Corporate Failure and Success: A Case of Bankruptcy Assessment. Omega 39: 620–6. [Google Scholar] [CrossRef]

- Rahimian, E., S. Singh, T. Thammachote, and R. Virmani. 1993. Bankruptcy prediction by neural network. In Neural Networks in Finance and Investing: Using Artificial Intelligence to Improve Real−World Performance. Edited by Robert R. Trippi and Efraim Turban. Chicago: Probus, pp. 159–76. [Google Scholar]

- Reisz, Alexander S., and Claudia Perlich. 2007. A market-based framework for bankruptcy prediction. Journal of Financial Stability 3: 85–131. [Google Scholar] [CrossRef]

- RÚZ. 2018. Register účtovných závierok. Available online: http://www.registeruz.sk/cruz-public/home/ (accessed on 20 August 2018).

- Rybak, Tatsiana R. 2006. Analysis and estimate of the enterprises bankruptcy risk. Paper presented at the 3rd International Conference Řízení a Modelování Finančních Rizik, Ostrava, Czech Republic, September 6–7; pp. 315–20. [Google Scholar]

- Salchenberger, Linda M., E. Mine Cinar, and Nicholas A. Lash. 1992. Neural networks: A new tool for predicting thrift failures. Decision Sciences 23: 899–916. [Google Scholar] [CrossRef]

- Scott, James. 1981. The probability of bankruptcy: A comparison of empirical predictions and theoretical models. Journal of Banking & Finance 5: 317–44. [Google Scholar] [CrossRef]

- Siegel, Jeffrey G. 1981. Warning Signs of Impending Business Failure and Means to Counteract such Prospective Failure. The National Public Accountant 24: 9–13. [Google Scholar]

- Simak, Paul C. 2000. Inverse and Negative DEA and Their Application to Credit Risk Evaluation. Ph.D. dissertation, University of Toronto, ON, Canada. Available online: https://tspace.library.utoronto.ca/bitstream/1807/13948/1/NQ49942.pdf (accessed on 20 August 2018).

- Soon, Ng Kim, Absulah A. Mohammed, and Rahil M. Mostafa. 2014. Using Altman’s Z−Score Model to Predict the Financial Hardship of Companies Listed in the Trading Services Sector of Malaysian Stock Exchange. Australian Journal of Basic and Applied Sciences 8: 379–84. [Google Scholar]

- Springate, Gordon L. V. 1978. Predicting the possibility of failure in a Canadian firm: A discriminant analysis. Unpublished M.B.A. Research Project, Simon Eraser University. [Google Scholar]

- Spuchľáková, Erika, and Katarína Frajtová-Michalíková. 2016. Comparison of LOGIT, PROBIT and neural network bankruptcy prediction models. Paper presented at ISSGBM International Conference on Information and Business Management, Hong Kong, China, September 3–4; pp. 49–53, ISBN 978-981-09-9757-1. [Google Scholar]

- Sulub, Saed A. 2014. Testing the Predictive Power of Altman’s Revised Z’ Model: The Case of 10 Multinational Companies. Research Journal of Finance and Accounting 5: 174–184. [Google Scholar]

- Šarlija, Nataša, and Marina Jeger. 2011. Comparing financial distress prediction models before and during recession. Croatian Operational Research Review 2: 133–42. [Google Scholar]

- Šotić, Aleksander, and Radenko Rajić. 2015. The review of the definition of risk. Journal of Apllied Knowledge Management 3: 17–26. [Google Scholar]

- Taffler, Richard J. 1984. Empirical Models for the Monitoring of UK Corporations. Journal of Banking & Finance 8: 199–227. [Google Scholar] [CrossRef]

- Tej, Juraj, František Bartko, and Viktória Ali Taha. 2013. Manažment rizík a zmien, 1st ed. Prešov: Bookman. ISBN 978-80-89568-73-4. [Google Scholar]

- Tranchard, Sandrine. 2018. The new ISO 31000 Keeps Risk Management Simple. Available online: https://www.iso.org/news/ref2263.html (accessed on 29 August 2018).

- Valášková, Katarína, Lucia Švábová, and Marek Ďurica. 2017. Verifikácia predikčných modelov v podmienkach slovenského poľnohospodárskeho sektora. Ekonomika Management Inovace 9: 30–38. [Google Scholar]

- Vavřina, Jan, David Hampel, and Jitka Janová. 2013. New Approaches for the Financial Distress Classification in Agribusiness. Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis 61: 1177–82. [Google Scholar] [CrossRef]

- Venkataramana, N., Md. Azash, and K. Ramakrishnaiah. 2012. Financial Performance and Predicting the Risk of Bankruptcy: A Case of Selected Cement Companies in India. International Journal of Public Administration and Management Research 1: 40–56. [Google Scholar]

- Xu, Xiaoyan, and Yu Wang. 2009. Financial Failure Prediction Using Efficiency as a Predictor. Expert Systems with Applications 36: 366–73. [Google Scholar] [CrossRef]

- Závarská, Zuzana. 2012. Manažment kapitálovej štruktúry pri financovaní rozvoja podniku ako nástroj zvyšovania finančnej výkonnosti. Prešov: Prešovská univerzita. ISBN 978-80-555-0553-4. [Google Scholar]

- Zmijewski, Mark E. 1984. Methodological Issues Related to the Estimation of Financial Distress Prediction Models. Journal of Accounting Research 22: 59–82. [Google Scholar] [CrossRef]

| Indicator | Computation method | |

|---|---|---|

| CL | current liquidity | |

| TL | total liquidity | |

| TATR | total assets turnover ratio | |

| ACP | average collection period | |

| CPP | creditors payment period | |

| IR | indebtedness ratio | |

| ER | equity ratio | |

| IC | interest coverage | |

| ROE | return on equity | |

| ROS | return on sales | |

| ROA | return on assets | |

| CR | cost ratio | |

| Risk Premium | Values | Criteria |

|---|---|---|

| rSL | E – equity | |

| rbusiness | EBIT − earnings before interest and taxes I – interests D − debt A – assets | |

X − average return on assets of businesses in given industry | ||

| rfinstab | CR − current ratio XL − average current ratio of businesses in given industry | |

| rcapstr | ||

| Hotels | CR | CPP | CL | ROA | SS | L1 | L3 | L4 | L5 | … | ϴ | Min z= 0 | C1 <= 0 | … | C5 >= 0.6 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| H1 | 0.96 | 0.19 | 0.6 | 0.04 | 0.62 | 0 | 0 | 0 | 0.05 | 0.71 | 0.71 | −0.07 | … | 0.6 | |

| H3 | 0.91 | 0.54 | 0.1 | 0.03 | 0.45 | 0 | 0 | 0 | 0.07 | 0.45 | 0.45 | −0.29 | … | 0.1 | |

| H4 | 1 | 0.16 | 1 | 0.02 | 0.05 | 0 | 0 | 0 | 0 | 0.96 | 0.96 | 0 | … | 0.97 | |

| H5 | 0.95 | 0.09 | 0.77 | 0.39 | 0.16 | 0 | 0 | 0 | 1 | 1 | 1 | 0 | … | … | |

| H6 | 1.008 | 2.66 | 0.03 | 0.01 | 0.43 | 0 | 0 | 0 | 0.02 | 0.03 | 0.03 | 0 | … | … | |

| H7 | 0.94 | 0.47 | 0.04 | 0.03 | 0.54 | 0 | 0 | 0 | 0.08 | 0.08 | 0.08 | 0 | … | … | |

| H8 | 0.97 | 0.17 | 0.8 | 0.08 | 0.71 | 0 | 0 | 0 | 0.15 | 0.57 | 0.57 | 0 | … | … | |

| … | … | … | … | … | … | … | … | … | … | … | … | … | … | … | … |

| … | … | ||||||||||||||

| … | … | … | … | … | … | … | … | … | … | … | … | … | … | … | … |

| H25 | 1.39 | 0.53 | 0.19 | −0.06 | 0.92 | 0 | 0 | 0 | 0 | ……… | 0.08 | 0.08 | 0 | … | … |

| Variable | Valid N | Mean | Median | Minimum | Maximum | Std. Dev. |

|---|---|---|---|---|---|---|

| CL | 25 | 0.404 | 0.16 | 0 | 1.45 | 0.44 |

| TL | 25 | 0.482 | 0.20 | 0 | 1.6 | 0.49 |

| TATR | 25 | 1.58 | 0.26 | 0 | 8.74 | 2.76 |

| ACP | 25 | 0.10 | 0.04 | 0 | 0.65 | 0.16 |

| CPP | 25 | 1.20 | 0.55 | 0.1 | 7.53 | 1.64 |

| IR | 25 | 0.71 | 0.71 | 0.1 | 1.87 | 0.4 |

| ER | 25 | 0.29 | 0.28 | −0.9 | 0.93 | 0.4 |

| IC | 25 | −871.47 | 1.19 | −47,337.7 | 25,388.0 | 10,928.71 |

| ROE | 25 | 0.11 | 0.01 | −0.7 | 1.78 | 0.55 |

| ROS | 25 | −0.069 | 0.004 | −0.7 | 0.07 | 0.18 |

| ROA | 25 | −0.029 | 0.014 | −1.5 | 0.39 | 0.32 |

| CR | 25 | 1.059 | 0.99 | 0.9 | 1.5 | 0.16 |

| Indicator | H1 | H2 | H3 | H4 | H5 | H6 | H7 | H8 | H9 |

| E(€) | 1,518,354 | −409,612 | 4,577,340 | 63,874 | 14,194 | 1,597,188 | 907,038 | 2,039,044 | 11,248,789 |

| rSL (%) | 5.00 | 5.00 | 4.87 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 4.21 |

| ROA | 0.04 | −1.52 | 0.03 | 0.02 | 0.39 | 0.01 | 0.03 | 0.08 | −0.03 |

| rbusiness (%) | 0.05 | 10.00 | 3.04 | 0.00 | 0.00 | 4.45 | 0.00 | 0.00 | 10.00 |

| CL | 0.46 | 0.41 | 0.06 | 0.85 | 0.65 | 0.02 | 0.05 | 0.69 | 0.09 |

| rfinstab (%) | 10.00 | 10.00 | 10.00 | 10.00 | 10.00 | 10.00 | 10.00 | 10.00 | 10.00 |

| IC | 8.30 | −72.05 | 3.75 | 25,388.00 | 219.37 | 0.87 | 1.78 | 1.60 | −44.51 |

| rcapstr (%) | 0.00 | 10.00 | 0.00 | 0.00 | 0.00 | 10.00 | 3.70 | 4.93 | 10.00 |

| Indicator | H10 | H11 | H12 | H13 | H14 | H15 | H16 | H17 | H18 |

| E(€) | 239,330 | 5,605,784 | 2,429,811 | 1,621,510 | 22,000,368 | 7,291,295 | 2,844,134 | 598,602 | 544,180 |

| rSL (%) | 5.00 | 4.77 | 5.00 | 5.00 | 3.25 | 4.60 | 5.00 | 5.00 | 5.00 |

| ROA | 0.02 | 0.01 | −0.06 | −0.03 | 0.00 | 0.01 | 0.05 | 0.00 | −0.06 |

| rbusiness (%) | 0.00 | 9.51 | 10.00 | 10.00 | 10.00 | 4.56 | 0.00 | 10.00 | 10.00 |

| CL | 0.04 | 0.07 | 0.17 | 0.11 | 0.61 | 0.54 | 1.39 | 0.10 | 0.16 |

| rfinstab (%) | 10.00 | 10.00 | 10.00 | 10.00 | 10.00 | 10.00 | 0.00 | 10.00 | 10.00 |

| IC | 2.66 | 1.19 | −3.62 | −2.03 | −0.71 | 2.53 | 51.03 | −0.15 | −14.23 |

| rcapstr (%) | 0.29 | 8.19 | 10.00 | 10.00 | 10.00 | 0.55 | 0.00 | 10.00 | 10.00 |

| Indicator | H19 | H20 | H21 | H22 | H23 | H24 | H25 | ||

| E(€) | 874,218 | 2,266,362 | −291,054 | 638,301 | 21,678 | 732,519 | 7,814,753 | ||

| rSL (%) | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 4.54 | ||

| ROA | 0.01 | 0.00 | 0.23 | 0.00 | 0.05 | 0.03 | −0.06 | ||

| rbusiness (%) | 4.78 | 10.00 | 0.00 | 10.00 | 0.00 | 1.98 | 10.00 | ||

| CL | 0.10 | 0.05 | 1.45 | 1.19 | 0.70 | 0.08 | 0.07 | ||

| rfinstab (%) | 10.00 | 10.00 | 0.00 | 0.03 | 10.00 | 10.00 | 10.00 | ||

| IC | 0.00 | 1.27 | 4.00 | 0.03 | 0.00 | 1.91 | −47,337.70 | ||

| rcapstr (%) | 10.00 | 7.48 | 0.00 | 10.00 | 10.00 | 2.99 | 10.00 |

| Year | ERP % | CRP % | B |

|---|---|---|---|

| 2001 | 5.51 | 2.5 | 0.84 |

| 2002 | 5.51 | 1.45 | 0.9 |

| 2003 | 4.51 | 2.03 | 0.91 |

| 2004 | 4.82 | 1.43 | 0.84 |

| 2005 | 4.84 | 1.43 | 0.74 |

| 2006 | 4.8 | 1.2 | 0.82 |

| 2007 | 4.91 | 1.05 | 0.77 |

| 2008 | 4.79 | 1.05 | 1.25 |

| 2009 | 5 | 2.1 | 1.7 |

| 2010 | 4.5 | 1.35 | 1.74 |

| 2011 | 5 | 1.28 | 1.75 |

| 2012 | 6 | 1.28 | 1.74 |

| 2013 | 5.8 | 1.5 | 1.65 |

| 2014 | 5 | 1.28 | 1.27 |

| 2015 | 5.75 | 1.28 | 1.18 |

| 2016 | 6.25 | 1.33 | 0.97 |

| 2017 | 5.69 | 1.21 | 0.96 |

| 2018 | 5.08 | 0.98 | 0.94 |

| 2019 | 5.08 | 0.69 | 0.81 |

| 2020 | 4.66 | 0.34 | 0.65 |

| H1 | H2 | H3 | H4 | H5 | H6 | H7 | H8 | H9 | H10 | H11 | H12 | H13 | |

| Z’ | 2.00 | 1.87 | 0.69 | 5.96 | 9.94 | 0.45 | 0.78 | 2.27 | 1.54 | 0.24 | 1.00 | −0.02 | 0.08 |

| Z’’ | 3.16 | −15.23 | 0.97 | 1.20 | 2.15 | −0.45 | 0.84 | 3.14 | 3.57 | −1.29 | 0.02 | −2.01 | 0.16 |

| H14 | H15 | H16 | H17 | H18 | H19 | H20 | H21 | H22 | H23 | H24 | H25 | ||

| Z’ | 1.62 | 0.56 | 2.13 | −0.20 | 0.20 | 0.47 | 0.41 | 3.41 | 0.58 | 8.69 | 0.36 | 5.27 | |

| Z” | 3.71 | 1.03 | 4.32 | −3.14 | −1.62 | −0.11 | 0.74 | 3.18 | 1.33 | 0.93 | 0.56 | 12.80 |

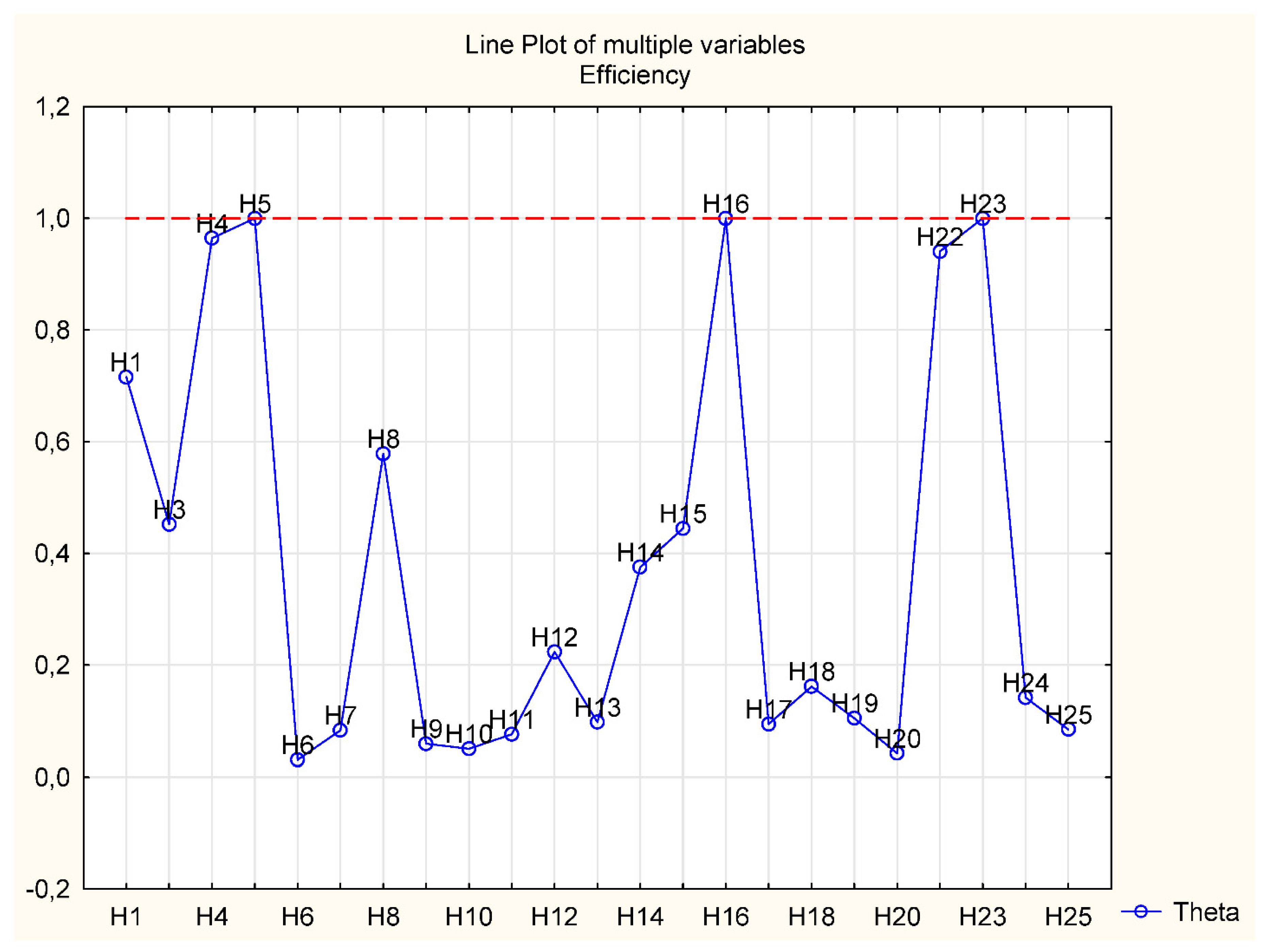

| CR | CPP | CL | ROA | ER | ϴ | |

|---|---|---|---|---|---|---|

| H1 | 0.9579 | 0.196655 | 0.6 | 0.0441 | 0.6188 | 0.715571 |

| H3 | 0.9124 | 0.546228 | 0.1 | 0.0319 | 0.445 | 0.452083 |

| H4 | 0.9965 | 0.163558 | 0.97 | 0.0202 | 0.0509 | 0.964491 |

| H5 | 0.9569 | 0.095564 | 0.77 | 0.3894 | 0.1647 | 1 |

| H6 | 1.0083 | 2.669453 | 0.03 | 0.0108 | 0.4639 | 0.031132 |

| H7 | 0.9409 | 0.471121 | 0.04 | 0.0321 | 0.5425 | 0.083836 |

| H8 | 0.9688 | 0.173098 | 0.8 | 0.0829 | 0.7143 | 0.578691 |

| H9 | 1.138 | 1.334135 | 0.1128 | −0.025 | 0.7712 | 0.059882 |

| H10 | 0.967 | 2.317649 | 0.0429 | 0.0156 | 0.1511 | 0.050876 |

| H11 | 0.9888 | 0.625902 | 0.0994 | 0.0149 | 0.6047 | 0.076718 |

| H12 | 1.3649 | 2.879761 | 0.3632 | −0.0574 | 0.2881 | 0.223671 |

| H13 | 1.5018 | 0.757406 | 0.1613 | −0.0347 | 0.1878 | 0.098295 |

| H14 | 1.0516 | 0.398902 | 0.6532 | −0.0027 | 0.7835 | 0.375252 |

| H15 | 0.9596 | 0.579216 | 0.5849 | 0.0144 | 0.3567 | 0.444627 |

| H16 | 0.9431 | 0.156296 | 1.5611 | 0.0498 | 0.5884 | 1 |

| H17 | 1.0903 | 7.527214 | 0.1039 | −0.0015 | 0.0511 | 0.094868 |

| H18 | 1.0809 | 0.640634 | 0.1863 | −0.0581 | 0.107 | 0.162098 |

| H19 | 1.026 | 1.550154 | 0.1149 | 0.0069 | 0.1153 | 0.105382 |

| H20 | 0.9945 | 2.343649 | 0.0558 | 0.0045 | 0.3729 | 0.042476 |

| H22 | 1.157 | 0.218919 | 1.3212 | 0.0012 | 0.269 | 0.940739 |

| H23 | 0.9947 | 0.112835 | 0.9943 | 0.0463 | 0.0423 | 1 |

| H24 | 0.9337 | 3.214863 | 0.1207 | 0.0285 | 0.0965 | 0.142196 |

| H25 | 1.398 | 0.531999 | 0.1973 | −0.0561 | 0.9268 | 0.08526 |

| Hotel | H1 | H2 | H3 | H4 | H5 | H6 | H7 | H8 | H9 | H10 | H11 | H12 | H13 |

| CL | 0.46 | 0.41 | 0.06 | 0.85 | 0.65 | 0.02 | 0.05 | 0.69 | 0.09 | 0.04 | 0.07 | 0.17 | 0.11 |

| rfinstab (%) | 10 | 10 | 10 | 10 | 10 | 10 | 10 | 10 | 10 | 10 | 10 | 10 | 10 |

| Hotel | H14 | H15 | H16 | H17 | H18 | H19 | H20 | H21 | H22 | H23 | H24 | H25 | |

| CL | 0.61 | 0.54 | 1.39 | 0.10 | 0.16 | 0.10 | 0.05 | 1.45 | 1.19 | 0.70 | 0.08 | 0.07 | |

| rfinstab (%) | 10 | 10 | 0 | 10 | 10 | 10 | 10 | 0 | 0.025 | 10 | 10 | 10 |

| Risk | H1 | H2 | H3 | H4 | H5 | H6 | H7 | H8 | H9 | H10 | H11 | H12 | H13 |

| Internal risk (%) | 15.0 | 35.0 | 17.9 | 15.0 | 15.0 | 29.4 | 18.7 | 19.9 | 34.2 | 15.3 | 32.5 | 35.0 | 35.0 |

| External risk (%) | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 |

| Risk | H14 | H15 | H16 | H17 | H18 | H19 | H20 | H21 | H22 | H23 | H24 | H25 | |

| Internal risk (%) | 33.2 | 19.7 | 5.0 | 35.0 | 35.0 | 29.8 | 32.5 | 5.0 | 25.0 | 25.0 | 20.0 | 34.5 | |

| External risk (%) | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 | 7.52 |

| Hotel | Altman Model | Ranking | DEA Model (ϴ) | Ranking | Difference in Rankings (di) | di2 |

|---|---|---|---|---|---|---|

| H5 | 9.94 | 1 | 1 | 1 | 0 | 0 |

| H23 | 8.69 | 2 | 1 | 1 | 1 | 1 |

| H4 | 5.96 | 3 | 0.96 | 2 | 1 | 1 |

| H25 | 5.27 | 4 | 0.09 | 15 | −11 | 121 |

| H8 | 2.27 | 5 | 0.58 | 5 | 0 | 0 |

| H16 | 2.13 | 6 | 1 | 1 | 5 | 25 |

| H1 | 2.00 | 7 | 0.72 | 4 | 3 | 9 |

| H14 | 1.62 | 8 | 0.38 | 8 | 0 | 0 |

| H9 | 1.54 | 9 | 0.06 | 18 | −9 | 81 |

| H11 | 1.00 | 10 | 0.08 | 17 | −7 | 49 |

| H7 | 0.78 | 11 | 0.08 | 16 | −5 | 25 |

| H3 | 0.69 | 12 | 0.45 | 6 | 6 | 36 |

| H22 | 0.58 | 13 | 0.94 | 3 | 10 | 100 |

| H15 | 0.56 | 14 | 0.44 | 7 | 7 | 49 |

| H19 | 0.47 | 15 | 0.11 | 12 | 3 | 9 |

| H6 | 0.45 | 16 | 0.03 | 21 | −5 | 25 |

| H20 | 0.41 | 17 | 0.04 | 20 | −3 | 9 |

| H24 | 0.36 | 18 | 0.14 | 11 | 7 | 49 |

| H10 | 0.24 | 19 | 0.05 | 19 | 0 | 0 |

| H18 | 0.20 | 20 | 0.16 | 10 | 10 | 100 |

| H13 | 0.08 | 21 | 0.10 | 13 | 8 | 64 |

| H12 | −0.02 | 22 | 0.22 | 9 | 13 | 169 |

| H17 | −0.20 | 23 | 0.09 | 14 | 9 | 81 |

businesses threatened with bankruptcy according to Altman model and DEA model; and

businesses threatened with bankruptcy according to Altman model and DEA model; and businesses threatened with bankruptcy only according to Altman model.

businesses threatened with bankruptcy only according to Altman model.© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Horváthová, J.; Mokrišová, M. Risk of Bankruptcy, Its Determinants and Models. Risks 2018, 6, 117. https://doi.org/10.3390/risks6040117

Horváthová J, Mokrišová M. Risk of Bankruptcy, Its Determinants and Models. Risks. 2018; 6(4):117. https://doi.org/10.3390/risks6040117

Chicago/Turabian StyleHorváthová, Jarmila, and Martina Mokrišová. 2018. "Risk of Bankruptcy, Its Determinants and Models" Risks 6, no. 4: 117. https://doi.org/10.3390/risks6040117

APA StyleHorváthová, J., & Mokrišová, M. (2018). Risk of Bankruptcy, Its Determinants and Models. Risks, 6(4), 117. https://doi.org/10.3390/risks6040117