2.2. Barrier Method

For the construction of optimal dividend strategies the barrier method has been used for time and state discrete models in

Hipp (

2018). There, an increasing sequence of barriers had been selected at which dividends are paid, and the dividend value as well as th corresponding ruin probability were computed. We adjust this for the continuous Lundberg model and use an optimal selection of barriers which is based on the Lagrange multiplier method.

The two fundamental ingredients for the Lundberg model are the survival probability

which satisfies

for

and the equation

as well as the scale function

which is the unique solution of the equation

satisfying

and

We also consider the functions

and

With formulas (

11) and (

12) these can be computed as

Many ruin related quantities can be expressed via

, and most dividend values are connected with

Examples are first entry probabilities (before ruin) and discount factors corresponding to the time of first entry (see

Hipp (

2018)). So, e.g., the functions

and

are given by

The Equations (

11) and (

12) have solutions with continuous first derivative when the claim size distribution is non-atomic. All solutions of (

11) vanishing for

are proportional. The same is true for Equation (

12).

Fix an initial surplus

and an allowed ruin probability

with

We first define the running ruin probabilities introduced in

Hipp (

2017) for a dividend strategy

D which is defined via a finite non-decreasing sequence

: whenever we reach

all incoming premia are paid out as dividends until the next claim happens. When the surplus reaches

we pay out all premia as dividends until the next claim happens, and then we stop dividend payment forever. For

the ruin probability

of the (with dividend) risk process

is proportional to

, and

implies that it can be written as

These

running allowed ruin probabilities had been introduced in

Hipp (

2018) for a discrete model. Let

be one of the barrier levels at which all premia are paid out as dividends. Then the corresponding running ruin probability

after hitting

has the form

We leave level

at the first claim during dividend payment. The ruin probability

after leaving the level

and before hitting

is also of the above form with

derived from

or

The ruin probability

for the with dividend process

satisfies

whenever

Lemma 1. For fixed surplus 0 and allowed ruin probability 0 1 let be an infinite sequence with Assume that the corresponding factors converge to 1. Then where D is the dividend strategy which pays dividends on the barrier levels

Proof. The survival probability

is the probability that from surplus

s we reach

after leaving

at a claim we reach

and so on. For

let

be the probability that the without dividend process

starting at

x will reach

B before ruin. Then

The events

that after dividend payment at

the surplus will reach

are independent and have probability

The event

that

starting at

s will reach

has probability

For

we have

and so we obtain the survival probability

☐

With a finite sequence

we represent a dividend strategy in which dividend payment is stopped forever when the surplus leaves

i.e.,

and

The survival probability after reaching

equals

For this strategy we obtain the survival probability

The present value of dividends paid on a barrier

does not depend on

it is

This dividend value is discounted to the time at which

is visited first. The discount factor for the time spent at barrier level

equals

The discount factor for the time between leaving

and hitting

equals

The dividend value for a strategy

D with barriers

satisfying

is given by

where

and

The present value of dividends paid at level

equals

The present value for dividends paid at level

equals

and the next barrier level contributes

and so on. For equal barriers

we easily obtain that for

and with

which is the well known correct value (compare with

Renaud and Zhou (

2007)).

We first consider dividend strategies which have only one barrier B at which dividends are paid a finite number of times. This means that barriers are paid at and after paying dividends on barrier level times we stop paying dividends forever. The barrier B can be chosen such that the allowed ruin probability is exact, and the corresponding dividend value can be given explicitly.

Lemma 2. For any given pair with and we can find B such that the above dividend strategy yields the with dividend ruin probability The corresponding dividend value is Proof. The with dividend survival probability is

which equals

whenever

so the appropriate choice for

B is the solution of

Equation (

21) follows from (

18)–(

20). ☐

These one barrier strategies are clearly suboptimal: the dividend value converges to zero when since the corresponding barriers converge to infinity. However, for moderate values of K the corresponding dividend values are surprisingly good. These can be used for barrier strategies for the tail of a finite barrier sequence we choose K large enough such that the barrier B corresponding to and K is larger than and then the sequence of barriers in which is followed by K values of B has the exact allowed ruin probability. The same method applies to the choice of if then we can decrease to get an exact allowed ruin probability (and a slightly larger dividend value).

A manual search for good sequences of barrier sequences is tedious: we used

linear sequences of the form

sequences satisfying the recursion

barriers with small n which are selected manually.

Linear sequences produce dividend values which are almost optimal, and sequences from recursion (

24) can do even better, but are still suboptimal. We come close to optimal results when, for large

we maximize the dividend value

using the Lagrange multiplier method. The problem has a high dimension, but using the structure of the function

G we could find some simplifications. As a first step, we look at a related but simpler problem.

Problem: For and a smooth increasing function maximize the functionunder the constraintWe start with the Lagrange system of equationsFor we getwhich leads to the recursive relationsFor the calculation of we would need that is monotone. In our control problem we want to maximize the following term by the choice of barriers

with

and

As in the above problem, we fix

and use the Lagrange equations with a multiplier

L and

With

we get a formula for

Our function

allows for the following simplification: for

the barrier

solves

Here, we first omit the factor

and all terms in which

does not occur, then we divide both sides by

Equation (

27) can be solved easily and quickly using Newton or the false position (regula falsi) method.

Some care is needed since the method has some uncommon features: We start with the last barrier which has practically no impact on the value of the company or the ruin probability, but in the recursion it determines all barriers. If we increase a large N by 1, then the company value as well as the corresponding ruin probability will change a lot, since we add a new first barrier which has a major impact on both numbers. Finally, we want to maximize under the constraint Nevertheless, the method is stable and accurate, even with the numerical precision of MatLab, and it produces admissible solutions. For we obtain and

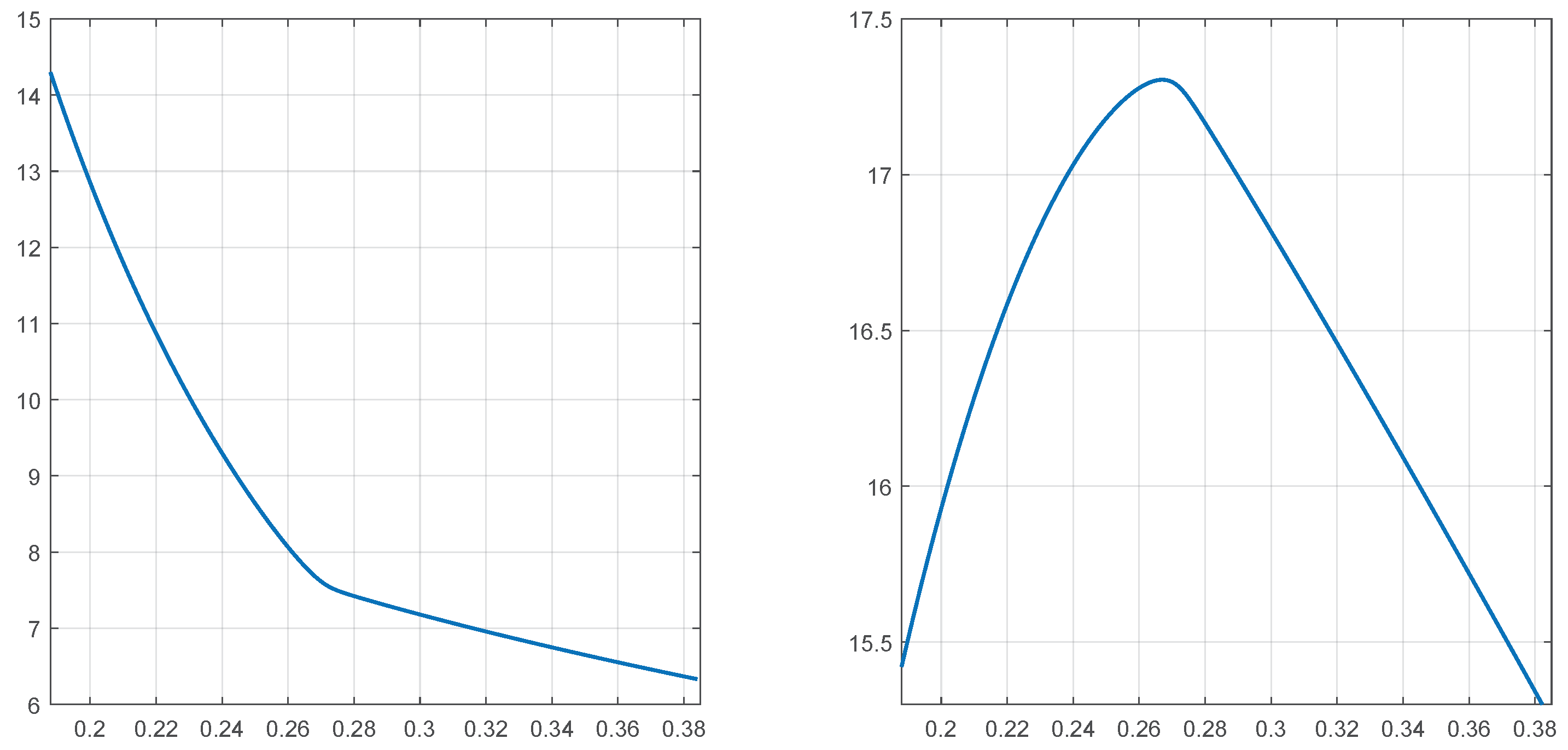

A plot of the resulting optimal barriers

in

Figure 2 explains the good performance of linear sequences: the optimal sequences

are not linear but almost linear.

Figure 2 left and right shows the optimal sequences and their increments in the example considered below.

In dividend control problems, optimal strategies can often be characterized by a single barrier function

which identifies the optimal barriers for arbitrary initial surplus

s and allowed ruin probability

we start paying dividends whenever the with dividend process

and the allowed running ruin probability

hit

i.e., when

Notice that the optimal sequences

and the corresponding running ruin probabilities

are points on the curve

i.e.,

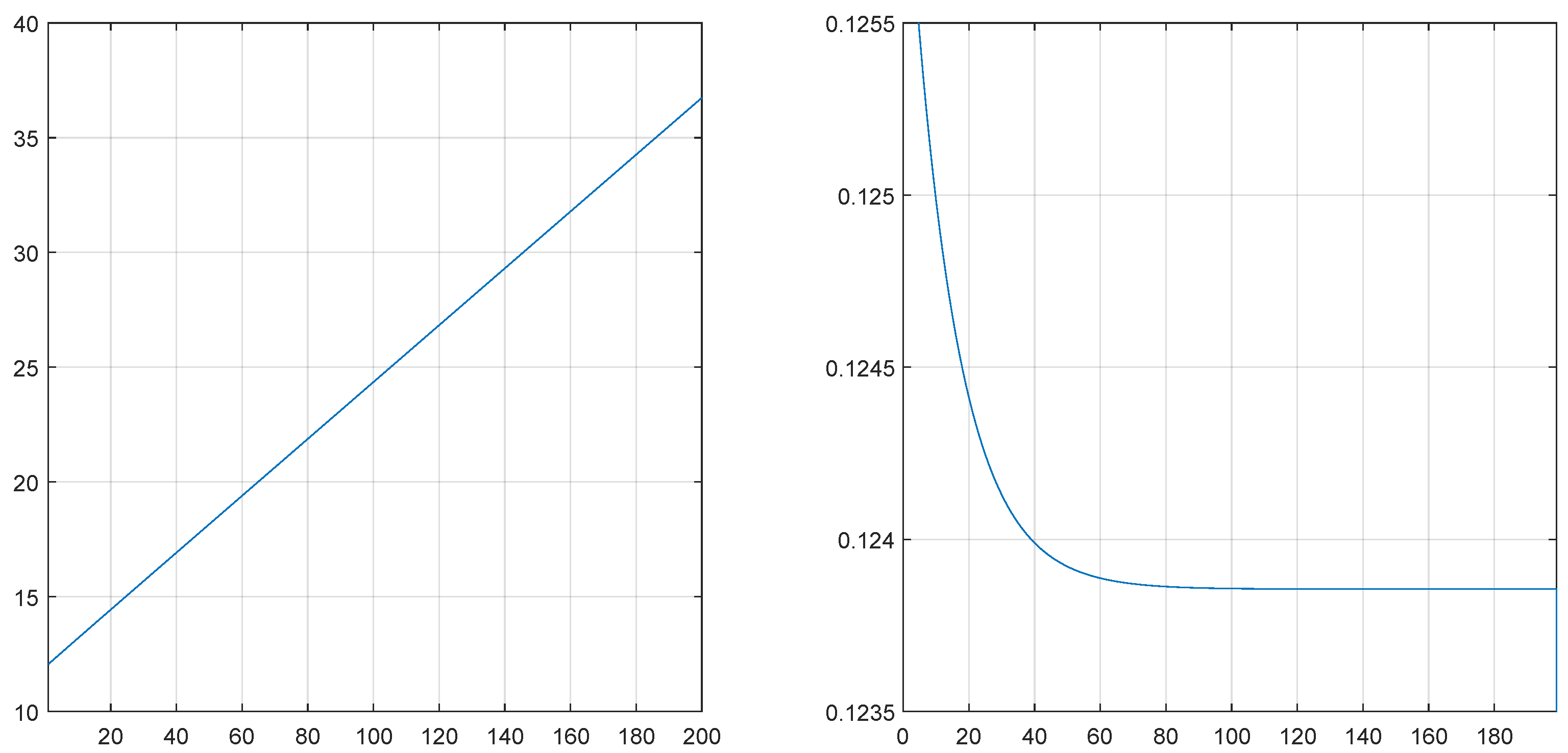

Figure 3 shows the function

at the points

at which

as well as the corresponding curve for the iteration method with

The curves should coincide; however, the second curve shows edges and higher values which are due to the discretization of s and The curves are plotted for only because of

2.3. Reinsurance Control for Company Value with Ruin Constraint

Many problems in stochastic control are solved via the well known Hamilton-Jacobi-Bellman equation. It is written for the value function of the given control problem reflecting the dynamics of the underlying stochastic model and the influence of control variables on these dynamics.

The case of a company value

without ruin constraint is easy. We have a set of possible reinsurance contracts

which describe the risk sharing at a claim of size

X between insurer (paying

) and reinsurer (paying

), and we have a reinsurance premium

for contract

Then the Hamilton-Jacobi-Bellman equation for the candidate solution

satisfying

reads

The optimal dividend strategy is of barrier type if

is decreasing in

and increasing in

and in this case

B is the barrier. We let

when

while

for

On the no action region

we can restrict the possible reinsurance contracts to

and then

The optimal reinsurance strategy in the no action region is given by the minimizer

in (

31). This approach solves our control problem: Equation (

30) is homogeneous, the set of solutions has dimension 1, and the optimal reinsurance strategy is unique. Furthermore, from (

30) we get an iteration producing a non-decreasing sequence of functions converging to

. For reinsurance control to minimize the ruin probability—which uses quite similar techniques—see

Hipp and Vogt (

2003) as well as

Dickson and Waters (

2006).

The situation of a company value with ruin constraint is more complex. We can simplify the problem by fixing a sequence of barriers

on which dividends are paid, and use the running ruin probability

valid for

after visiting the barriers

Then the function

satisfies Equation (

30) above. This implies that the optimal reinsurance strategy for maximizing the company value with ruin constraint equals

for

i.e., the same strategy as without ruin constraint, as long as we are in the no action region. This holds generally when we are not on a barrier level, no matter how many barriers we have visited. With the Markov property we get a constant value for the reinsurance parameter on each single barrier. If the barriers and these parameters

are fixed, then we can compute the corresponding dividend value with formula (

20), where

is replaced by the candidate solution of

In addition, the ruin probabilities

for the no action regions are computed under the optimal reinsurance strategy:

The reinsurance strategies valid on the barriers were specified manually. Our first guess was for which we would not have a jump in the optimal reinsurance strategy when reaching However, in our numerical experiments we found that an optimal strategy uses more reinsurance during dividend payment. This is surprising since this at the same time reduces dividend payment.

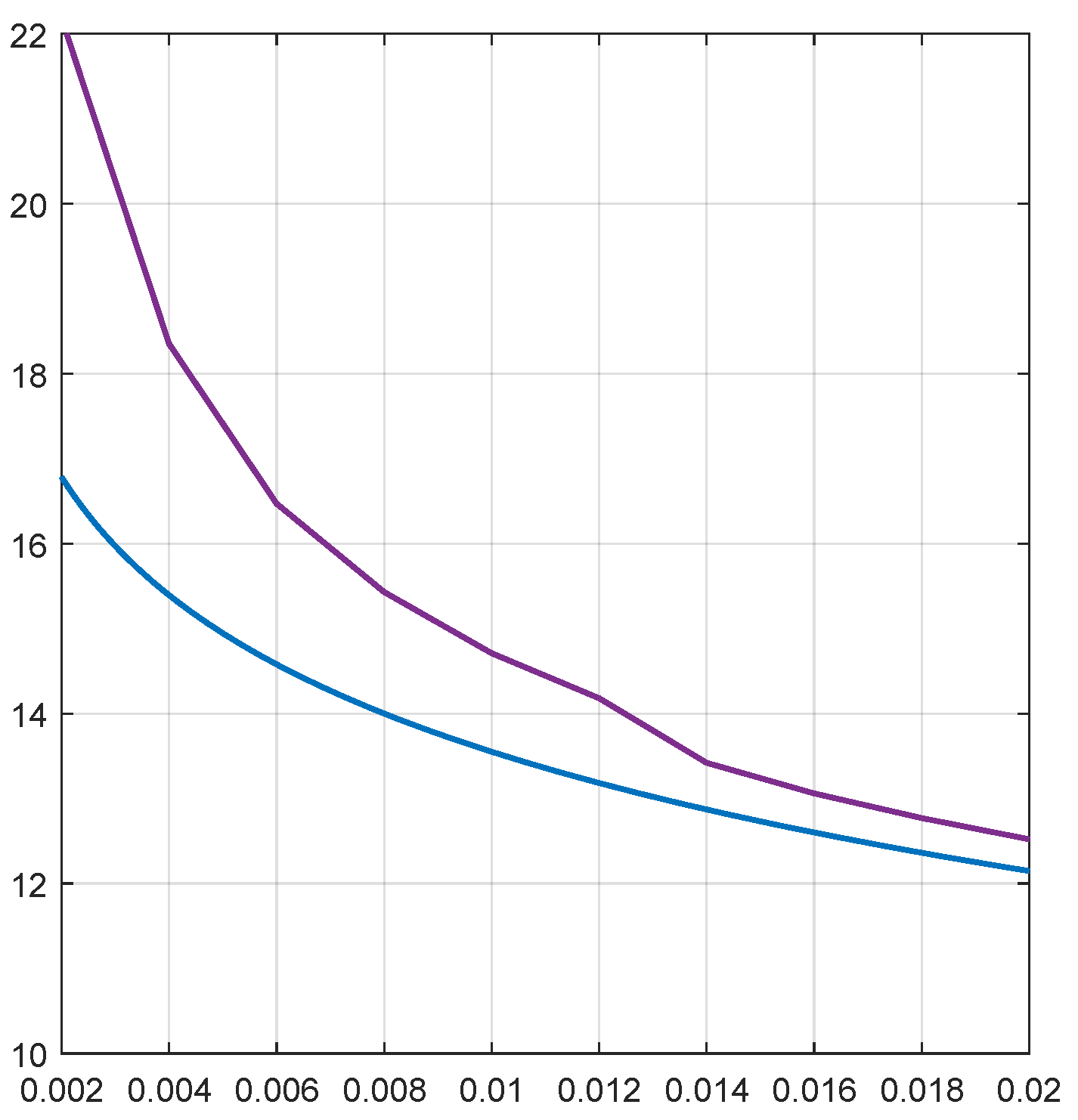

In our numerical example we use these tools to manually construct a solution via the choice of a barrier sequence

and contract parameters

on these barriers. The corresponding dividend strategy pays the dividend rate

on the barrier

and the running ruin probabilities

are concatenated via