1. Introduction

This work develops and expands upon a predictive analysis that was carried out in early June 2016, in advance of the Brexit referendum of 23 June 2016. In the United Kingdom [UK] general election of 2015, the Conservative Party campaigned on the basis of holding a public referendum on whether the UK should remain a part of the European Union [EU]. The election was held on 7 May 2015 and the Conservative Party was elected into government. Since then, and up to the date of writing this paper

1, much attention has been focused on the possible scenarios attached to the “Brexit” question. Much of the analysis has been on potential macroeconomic impact from the UK exiting the EU. For example,

HM Treasury (

2016) recently published a report which discussed the potential economic impact on the UK of leaving. They suggested that:

“the effect of this profound shock would be to push the UK into recession and lead to a sharp rise in unemployment.”

In contrast to this macroeconomic analysis, this paper discusses market expectations of how assets were expected to trade following Brexit. We focus on extracting expectations for price action following a Brexit vote using the foreign exchange options market. Many market commentators (

Worrachate 2016) predicted that in the event of a “leave” vote, that the British pound [GBP] would depreciate—potentially dramatically (a GBP devaluation of 20% was predicted by at least one currency manager in the event of Brexit), although this view was by no means universally held. A recent poll of currency forecasters by

Reuters (

2016) suggested that GBPUSD would fall 9% in the event of a leave vote, while it would rise 4% in the event of a “remain” vote. We seek to understand whether these analyst forecasts were also reflected in the GBPUSD volatility market.

On 22 February 2016, the UK Prime Minister David Cameron made a speech to the House of Commons, in which a referendum date of 23 June 2016 was set.

The announcement of the timing of the referendum date makes it possible to apply more quantitative methods than economic forecasting to the analysis of how the British pound was expected to perform after the Brexit referendum date, based on information available in the markets beforehand.

While this study refers to a small time window around a particular referendum date, similar methods have been employed by previous analyses in the literature to make inferences of potential or historical moves in FX spot markets based on the information contained within traded volatility markets.

Malz (

1996) analyses the case of the British pound/Deutsche Mark exchange rate in the context of the European Exchange Rate Mechanism.

Hanke et al. (

2015);

Hertrich and Zimmermann (

2017);

Hui et al. (

2016) and

Jermann (

2017) consider the case of EURCHF, which had a floor at 1.20 enforced by the Swiss National Bank [SNB] between 6 September 2011 to 15 January 2015. More recently,

Clark and Amen (

2017) and

Dupire (

2017) present event studies modelling FX spot moves around Brexit and the 2016 US election result (specifically the Mexican peso), with recent 2017 French elections being examined in

Dupire (

2017). Similarly to the modelling of the FX event risk around these elections, in

Section 8 of this work we consider the case of the Scottish 2014 independence referendum.

These examples show that the methodology presented in this work has a wider applicability beyond the isolated, albeit important, event of Brexit.

2. Options Markets

Options markets are a forward looking measure of the market’s expectation of how tradeable assets perform. It is described in the general case by

Breeden and Litzenberger (

1978) and, in the context of foreign exchange, by

Malz (

1997), that a complete knowledge of the prices of traded options at all strikes is sufficient to infer future risk-neutral probability distributions.

While obviously the outcome of the Brexit referendum vote was unknown beforehand, the referendum date was known in advance. When there is an event risk whose timing is known, such as an election or an economic data event, options markets will incorporate that informational content into the price of tradeable assets, as reflected in the expected volatility of that event and, notably, the skew resulting from event risk on that date.

This paper therefore seeks to analyse information available in the short-dated volatility skew in GBPUSD options to assess the market expectation for GBPUSD as we cross over the expiry threshold, corresponding to FX spot on 24 June 2016, when the result was known. We also analyse EURGBP, though the main focus of this paper is GBPUSD.

3. Data

We have obtained historical spot and implied volatility quotes from Bloomberg (

www.bloomberg.com), together with poll data from The Economist (

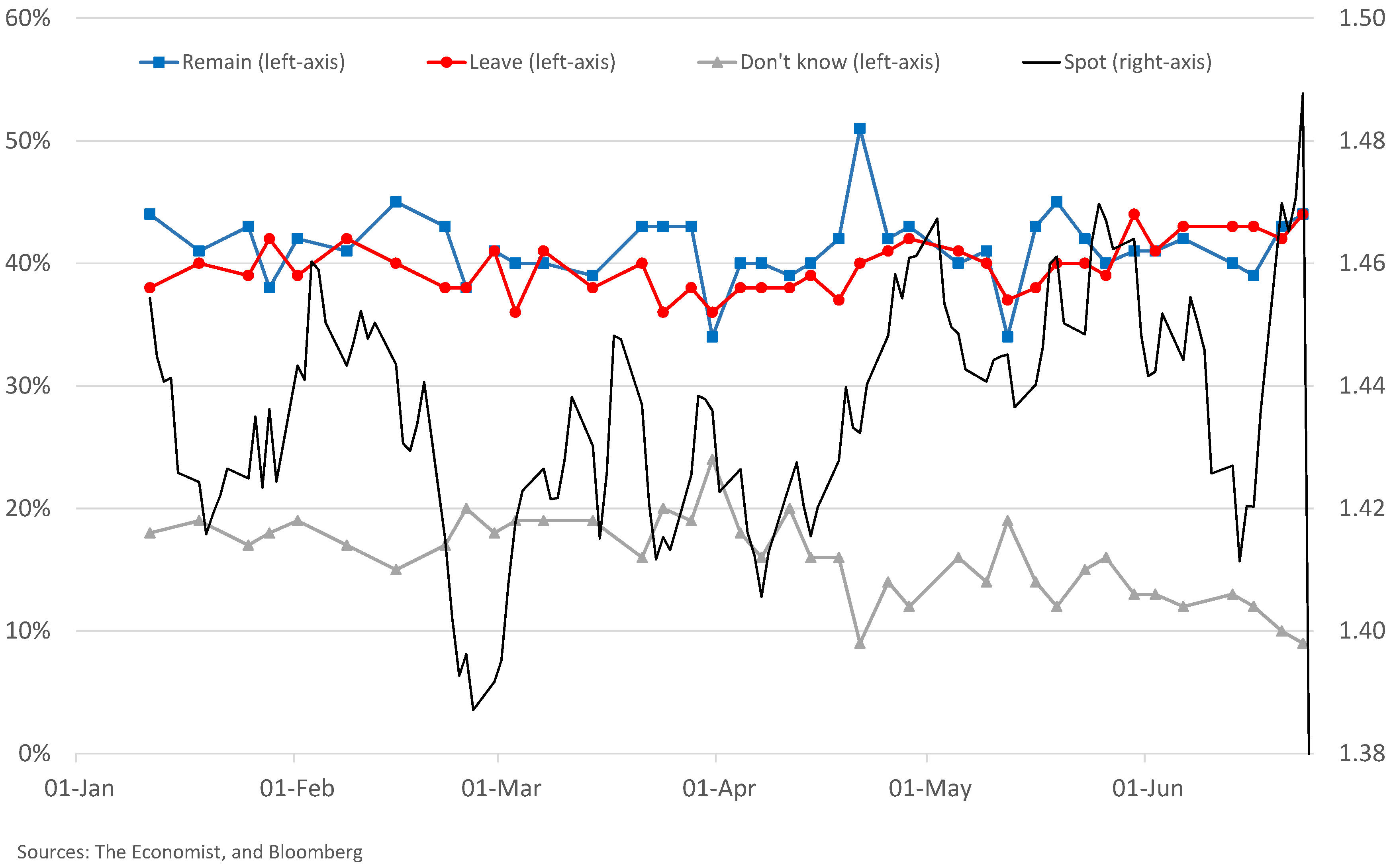

www.economist.com). For the poll data,

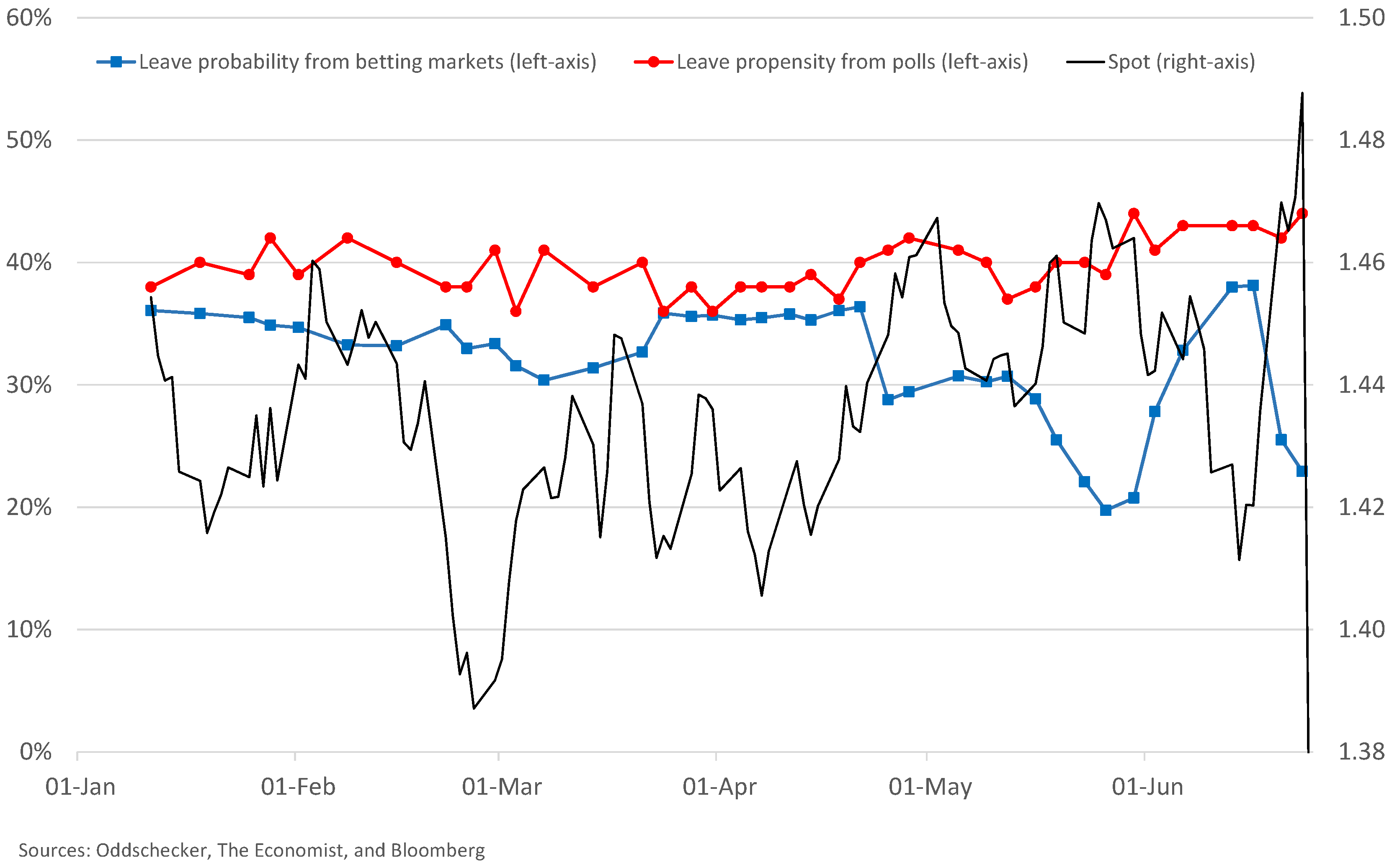

Figure 1 shows how during 2016 the propensity to vote “remain” generally held a very slight lead among respondents over the propensity to vote “leave”; however when the “leave” propensity exceeded “remain” in polls then this was usually followed by a sharp decline in GBPUSD spot. This suggested that a “leave” vote on 23 June 2016 would be significantly negative for GBPUSD.

Figure 2a shows time series for 25-delta and

Figure 2b shows 10-delta risk reversals, of various expiries, from 1 May 2015 to 1 June 2016 together with GBPUSD spot. There are several key features to observe. Firstly, we see the risk reversals converging towards zero in late 2015 during the relatively innocuous period up to 5 November 2015, at which date they start to move into increasingly negative territory over a week or two. This period coincides with David Cameron’s Chatham House speech

2 of 10 November 2015, in which he outlined four key demands for renegotiation of British membership of the EU, as a prelude to an eventual British referendum on whether to continue as a part of it.

The risk reversals shown in

Figure 2 continued to become more negative over the rest of 2015 and into the early part of 2016, up until 20 February 2016, when the Brexit referendum date was announced. At this point, all options with time to expiry in excess of four months were exposed to Brexit risk, and the 6M and 1Y risk reversals moved further away from zero. As seen in

Figure 2a, 25-delta risk reversals of 3M tenor and shorter moved in a separate cluster between −0.5 and −1.5 until 23 March 2016, when the 3M 25-delta risk reversal had, at that point, 23 June 2016 as its expiry date, and therefore experienced a large negative spike as the Brexit uncertainty became reflected in the market quote. Similarly, the 2M 25-delta risk reversal moved dramatically between 25 and 26 April 2016, and the 1M 25-delta risk reversal moved from −1.3 to −5.4 from 25 May to 26 May 2016. However, that was just the start of very rapid moves in the volatility skew, as the 1M 25-delta risk reversal continued to move lower, from −5.4 on 26 May to −7.9 on 10 June 2016—a quite extreme risk reversal by any measure. Similar behaviour was mirrored in the 10-delta risk reversals, as seen in

Figure 2b, indicating a very high degree of skew.

The risk reversals in

Figure 2 embed extensive market specific information about the potential asset price distribution of the GBPUSD exchange rate after the Brexit referendum date. Note that we use the market data as is, rather than engaging in any data cleansing, as these data correspond to actual tradeable quantities as marked by Bloomberg.

Our objective in this paper is to extract quantitative insight into the potential effect upon FX spot rates of a “leave” vote, from these data.

4. Method

Following standard practice (

Clark 2011;

Malz 2014), we build volatility smiles

for the option expiry tenors

in the analysis period, in order to be able to construct implied probability distributions. FX volatility smiles are given by delta and tenor, as described in

Malz (

1997) and

Jermann (

2017). We have market data from Bloomberg corresponding to at-the-money straddles and 25-delta and 10-delta strangles and risk reversals with expiries corresponding to the overnight maturity, at 1, 2 and 3 weeks, and at 1, 2, 3, 6 and 12 months, these being the principal tenors. For each expiry

, let us denote the five market quotes from the volatility surface by

,

,

,

and

. This means we have five implied volatilities

,

,

,

and

which satisfy

with

and where the strikes

,

,

,

and

are chosen so that

with

for a put and

for a call in

For example, a 25-delta call has a strike

chosen (relative to today’s spot rate

) so that it has a delta of 0.25, and a 10-delta put has a delta of −0.10. We use premium adjusted deltas for EURGBP but not for GBPUSD in (

3), in line with market conventions, and solve numerically for

using Brent’s method.

Once converted into a strike based representation we can now extend

3 the set of volatility smiles

over tenors

to an entire volatility surface

by using flat forward volatility interpolation in time for

,

,

,

and

and polynomial in delta smile interpolation, as described in

Clark (

2011).

Having an entire volatility surface, we can price call and put options of

any strike

K and maturity

T by using

in the Black-Scholes equation. As the price

of call options are known, we can follow the standard Breeden-Litzenberger analysis (

Breeden and Litzenberger 1978), using (

4) to back out the implied asset distribution

in the domestic risk-neutral measure:

5. Mixture Model Approach

In order to address the deficiencies of the Breeden-Litzenberger approach, namely, the noisiness of the interpolation introduced by taking the numerical second derivative, we construct a mixture model, following the approaches of

Hanke et al. (

2015),

Brigo and Mercurio (

2000;

2002),

Brigo et al. (

2003),

Brigo et al. (

2004) and

Jermann (

2017). Unlike

Brigo et al. (

2004) and

Jermann (

2017), who model the possibility of a regime switch potentially occurring at any time, we construct a model with a specific probability

of a Brexit “leave” event at the referendum date, where

denotes the time to the referendum date.

In the event of a vote for Brexit, i.e a “leave” vote, we model this outcome with a post-referendum exchange rate obtained by integrating the stochastic process from 0 to , subject to “leave” drift and volatility terms and . If, however, the “remain” vote is successful, we model the post-referendum distribution for using the standard Black-Scholes model with a compensated drift and a “remain” volatility . Note that both and are expressed as annualised volatilities.

Risk-neutrality requires that

so the “remain” scenario has a terminal distribution for

consistent with that of a Black-Scholes model with a compensated risk-neutral drift term

The terminal distribution of FX rates under our mixture model can be written as

Valuation of any European option with strike

K is simply obtained by taking a weighted sum of the two Black-Scholes prices corresponding to integration of the payout function over the two density kernels.

We integrate the equation in the second case of (

7), thereby obtaining the random variable

where

denotes the point estimate for the FX rate under the “leave” scenario and

, as in Section 2.4 of

Clark (

2011). Our objective is to use the information embedded in market volatility surfaces to estimate “leave” probabilities

and 95% confidence intervals (using the quantile function of

) for the random variable

which we use to model the GBPUSD FX spot distribution immediately after the event of a “leave” vote.

The standard Black-Scholes model has two terms

and

. The first term can be obtained by risk-neutrality and the second term can be obtained from a single implied volatility observable in the market (which we denote as

in the above). In contrast, our mixture model has three extra unknown terms

, and since we have not one but five implied volatilities, we are able to conduct a least-squares calibration using a Levenberg-Marquardt optimisation. We impose the constraints that

as

is a probability, that

(making the not unreasonable model assumption that dispersion would increase after a “leave” vote), and that

– i.e., that a “leave” vote would be associated with a devaluation of the British pound (see

Section 7 for justification).

We have calibrated the mixture model to four months of FX market data, from 24 February to 22 June 2016, in order to obtain a sufficiently long time window for the analysis. This also allows us to perform some robustness checks on the parameter stability over this period of analysis, though it should be noted that the period of time just before the Brexit referendum was characterised by particularly volatile price action in the financial markets, and one would not realistically expect a great degree of parameter smoothness given the high degree of uncertainty and potential market disruption around the Brexit referendum date.

6. Results

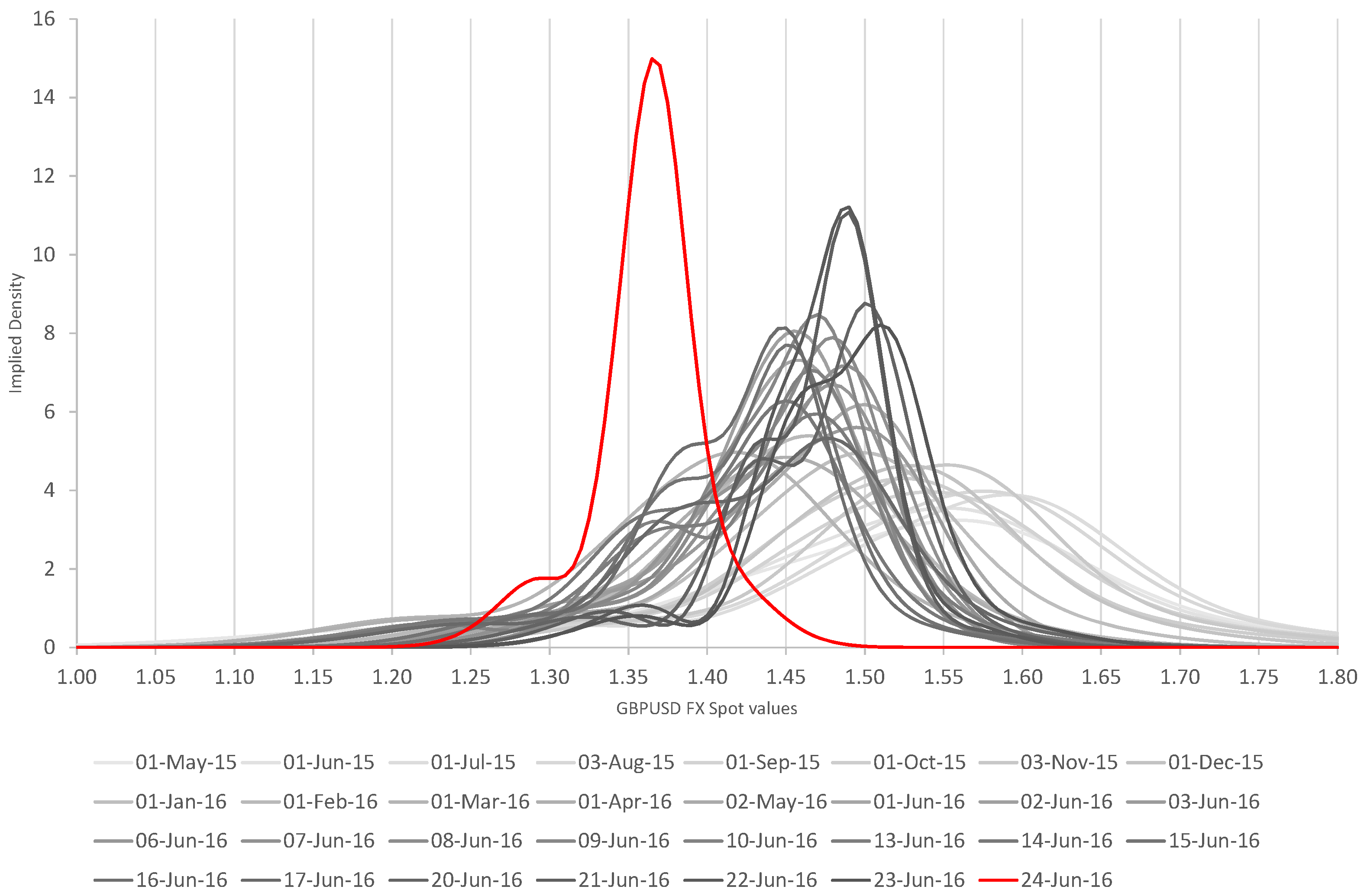

In

Figure 3, we tabulate the implied densities for GBPUSD from 1 May 2015 through to 23 June 2016 for options expiring at the very beginning of the day after the referendum date (when the announcement is expected), together with the implied density as seen on Friday 24 June 2016 for the GBPUSD spot distribution early on the morning of Monday 27 June 2016.

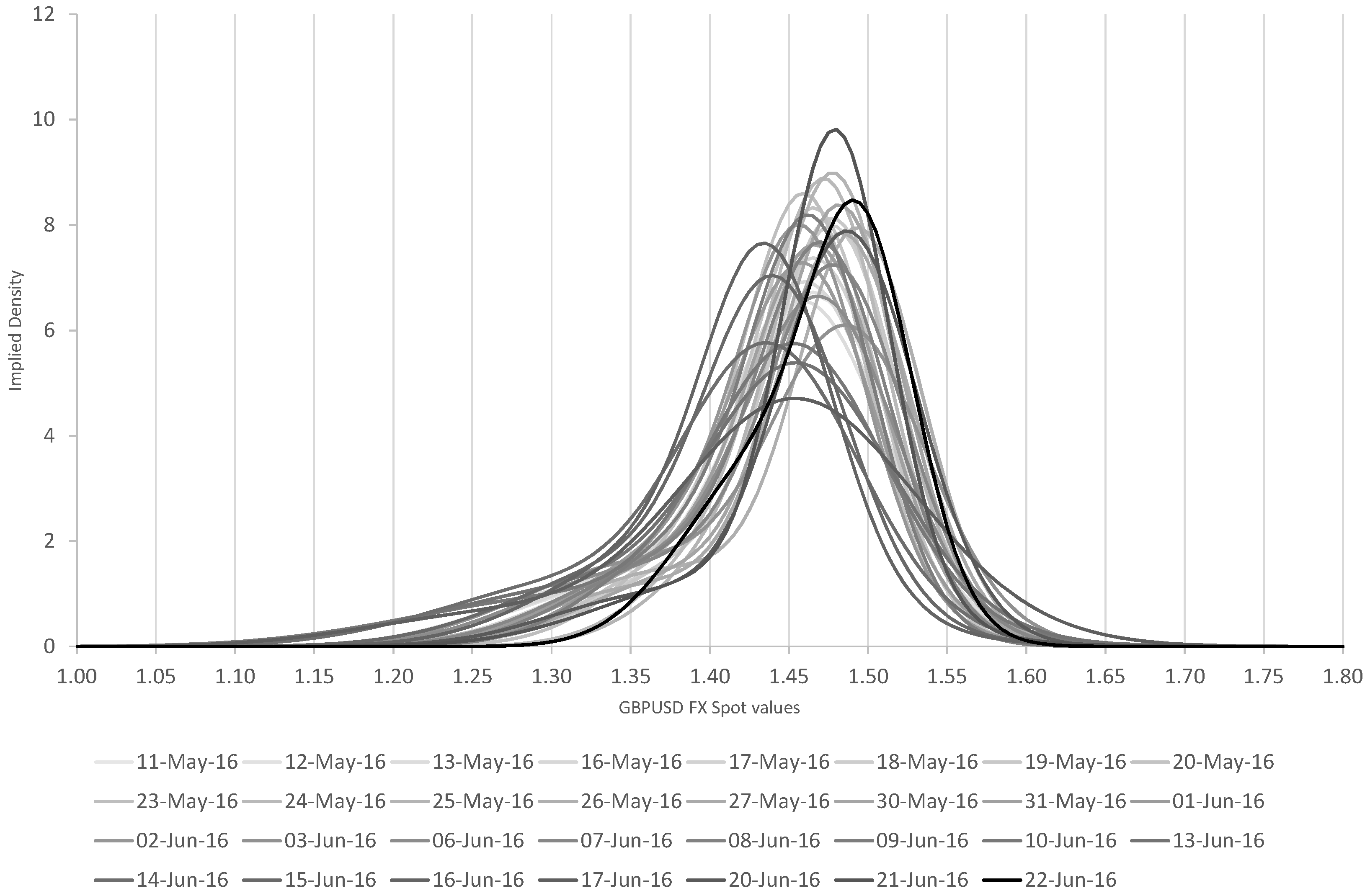

In early June 2016 we have relatively moderate levels for the risk reversals, as shown in

Figure 2. The probability density function on 1 June 2016 (relative to

) has some downside risk, but is quite sharply peaked around 1.45 due to 1M implied volatilities of 21.1% and 1M 10-delta risk reversals of −10.54. During the first eight trading days of June 2016, the 1M 10-delta risk reversals moved even lower, from −10.54 down to −13.9 on 10 June 2016. This indicates a very high degree of skewness. While the implied distributions are only fitted to volatilities at the benchmark strikes, we can still see evidence of probability mass between 1.10 and 1.35, and certainly below the 10-delta put strike of 1.2960 computed on 10 June 2016. Note that in the absence of any volatility benchmark strikes below the 10-delta put, all we can say is that there is some implied probability mass below that strike, but with limited opportunity to infer directly where the distribution is clustered.

At the date of writing this article

4, therefore, we estimated post-referendum levels of [1.10, 1.30] in the event of a “leave” vote, and [1.46, 1.48] in the case of a “remain” vote. In the event of a “leave” vote, we expected a very high degree of volatility as GBPUSD moves well below 1.30, much as happened in January 2015 after the EURCHF defence level of 1.20 was breached (

Hanke et al. 2015;

Jermann 2017).

Densities shown in

Figure 3 are with respect to a post-Brexit GBPUSD spot reference of

on Friday 24 June 2016,

on Thursday 23 June 2016 (and the prevailing spot rates on the previous dates).

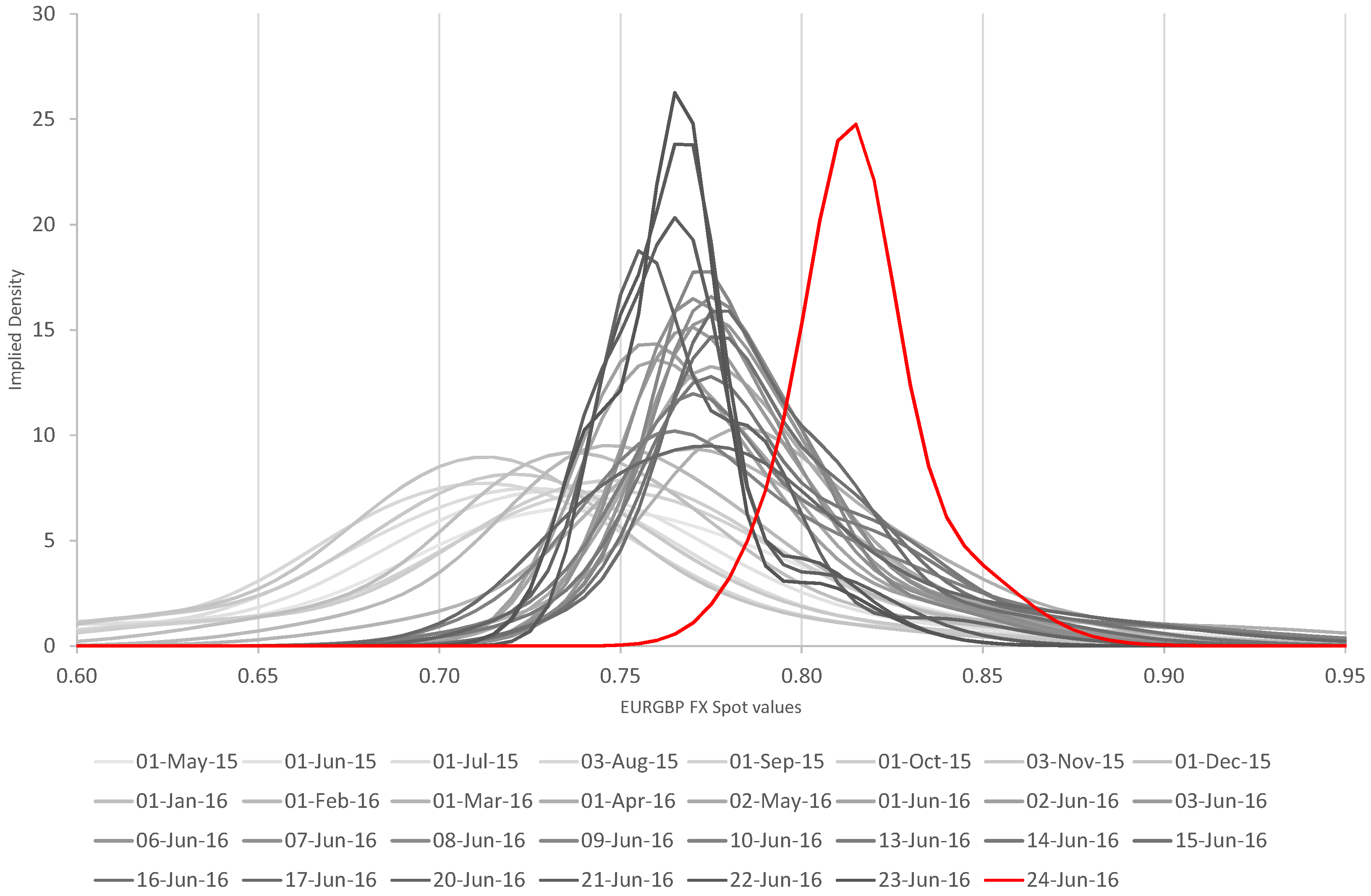

We also apply the same analysis for EURGBP, finding significant probability mass between 0.825 and 0.95 at the referendum date (relative to EURGBP spot reference of

on 17 June 2016 and, as before, prevailing spot rates on previous dates). Results are shown in

Figure 4.

In an attempt to quantify the “leave” scenario and its implications for GBPUSD, we have calibrated the mixture model of

Section 5 to the GBPUSD volatility surface on all trading days from 24 February to 22 June 2016. We tabulate the results in

Table 1 and

Table 2 and illustrate in

Figure 5. Relative to each analysis date and the FX spot prevailing on that date, we show the implied probability of a “leave” vote and the midpoint

of the spot price distribution in the event of a Brexit “leave” vote, together with the expected GBP percentage appreciation

(negative numbers, which are ubiquitous for this model since

, indicate devaluation). Finally we show a 95% confidence interval for the realised post-referendum FX spot rate for GBPUSD in the event of a “leave vote”, together with “remain” and “leave” volatilities

and

respectively.

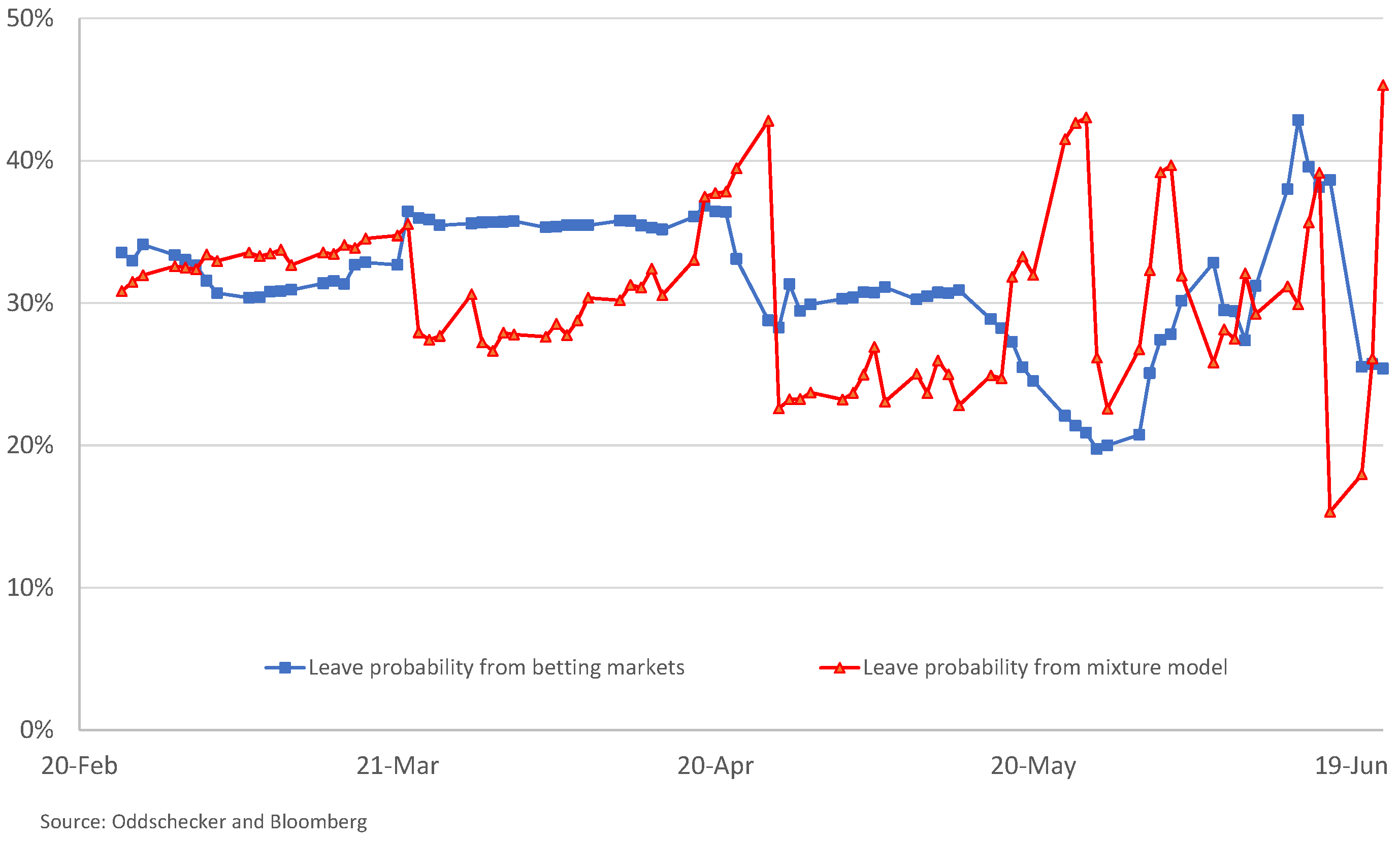

We see a high degree of parameter stability attached to the expected GBP devaluation in the event of a “leave” vote, which is in a range between 1.1% and 10.2% throughout the period of analysis, with a mean expected devaluation of 4.5%, which is less of an extreme market move than we would have expected by visual observation of the probability distributions. The probabilities of a “leave” vote are less robust, but still relatively stable, within the range 15.3% to 45.3%, with a mean value of 30.6%. It is interesting that even at the beginning of our analysis, back in late February 2016, the mixture model was estimating “leave” probabilities slightly above 30%, which is very close to the mean value over the entire analysis period. The time series for is relatively stationary, and in fact most of the uncertainty in occurs in the final few days before the referendum, which very likely mirrors the real-world uncertainty that was prevailing both in the news and in the markets.

A single point estimate

for

is reported in

Table 1 and

Table 2, which has a mean value of 1.3705 (with a minimum of 1.2900 and a maximum of 1.4536). This is remarkably close to the actual value for GBPUSD after the referendum, as we have

on Friday 24 June 2016, which suggests that the estimation technique correctly maps distributions to referendum scenarios. However, we also report 95% confidence intervals for the post-referendum FX spot rate

in the event of a“leave” vote, and see a considerable amount of dispersion in this quantity, which is to be expected given the magnitude of

. In all cases, though, the 95% confidence interval contains the observed spot fixing of 1.3622 after the referendum date.

7. Betting Markets and Attribution of Modes

Following the original preprint publication, we were asked—what evidence do you have that the lower mode of the GBPUSD distribution is associated with a “leave” vote, and that the higher mode corresponds to a “remain” vote? In order to answer this, we show in

Figure 6 not one but two sets of tabulated quantities pertaining to the final vote being for the UK to leave the EU, using both polls of polls data as detailed in

Section 3 above (an average individual propensity to vote for “leave” based on small samples) as well as betting market odds (an implied probability of “leave” across the aggregate population) obtained from bookmaker quotes from the Oddschecker web site (

www.oddschecker.com). The use of betting market odds in conjunction with options volatility data is also employed in

Hanke et al. (

forthcoming).

Note that the “leave” propensity in polls does not directly relate to the probability of “leave” for two reasons: firstly in the limiting case of a poll sampling the entire population, the polls will still be split following reported voting intentions (assuming honesty) but the referendum decision will be known with complete certainty, and secondly most polls have a “don’t know” response option.

Visually, in

Figure 6, we see that the decreasing probability across late April 2016 of a “leave” result implied from betting markets is correlated with a strengthening of GBPUSD over the same period, and the increasing probability observed over late May and early June 2016 of the same “leave” result correlates to a weakening of GBPUSD over that period. While neither the probability for “leave” from betting markets nor the propensity for “leave” from polls was an especially good predictor of the final vote for the UK’s independence from the EU, we can see correlation between a “leave” event and GBPUSD weakness. We believe this observation substantiates our attribution that the probability tail for GBPUSD below 1.30 would be associated with a vote for “leave”. In

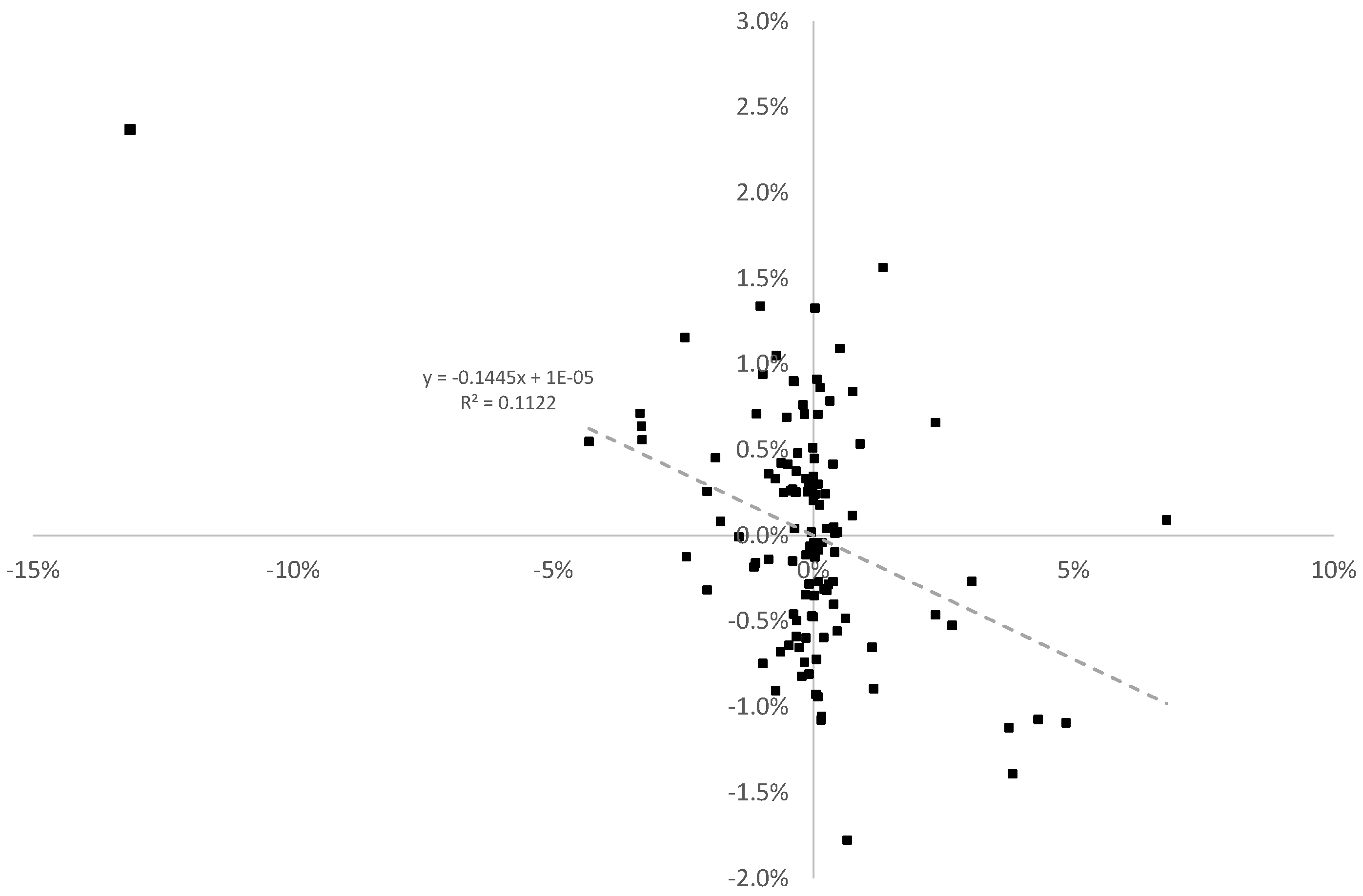

Figure 7, we graph the percentage change in GBPUSD against the absolute change in the betting market implied probability of a “leave” vote, using the same time stencil as the “poll of polls” sampling data. A simple linear regression indicates that a 1% increase in the probability of a “leave” vote is correlated with a 0.16% decrease in GBPUSD (albeit with an

coefficient of determination of only 0.205), nevertheless yielding the directionality we argue for. For completeness, we show in

Figure 7 the linear regression with the data point on 20 June 2016 excluded, as this corresponds to rebased betting odds at the beginning of the final week, where we see a 0.1445% decrease in GBPUSD for a 1% increase in the probability of a “leave” vote, with a

coefficient of determination of 0.1122.

Finally, we show in

Figure 8 how the implied “leave” probabilities from our mixture model relate to those from betting markets. We find they are in very good agreement, though the implied “leave” probabilities obtained from the mixture model calibrated to FX volatility surfaces experience quite a lot of variation. It is an open question whether this is a property of the interpolation with respect to time, or the calibration procedure of the mixture model itself, and one that we believe warrants further analysis.

It should be noted that all the implied probabilities in this work refer to risk-neutral distributions rather than real world distributions. The predictive analysis of this work extends to a horizon of a few weeks at most, though, and the effect of any difference in drift between real-world and risk-neutral measures is small compared to the potential moves in GBPUSD and EURGBP in the event of a “leave” vote.

8. Comparison with Scottish Referendum 2014

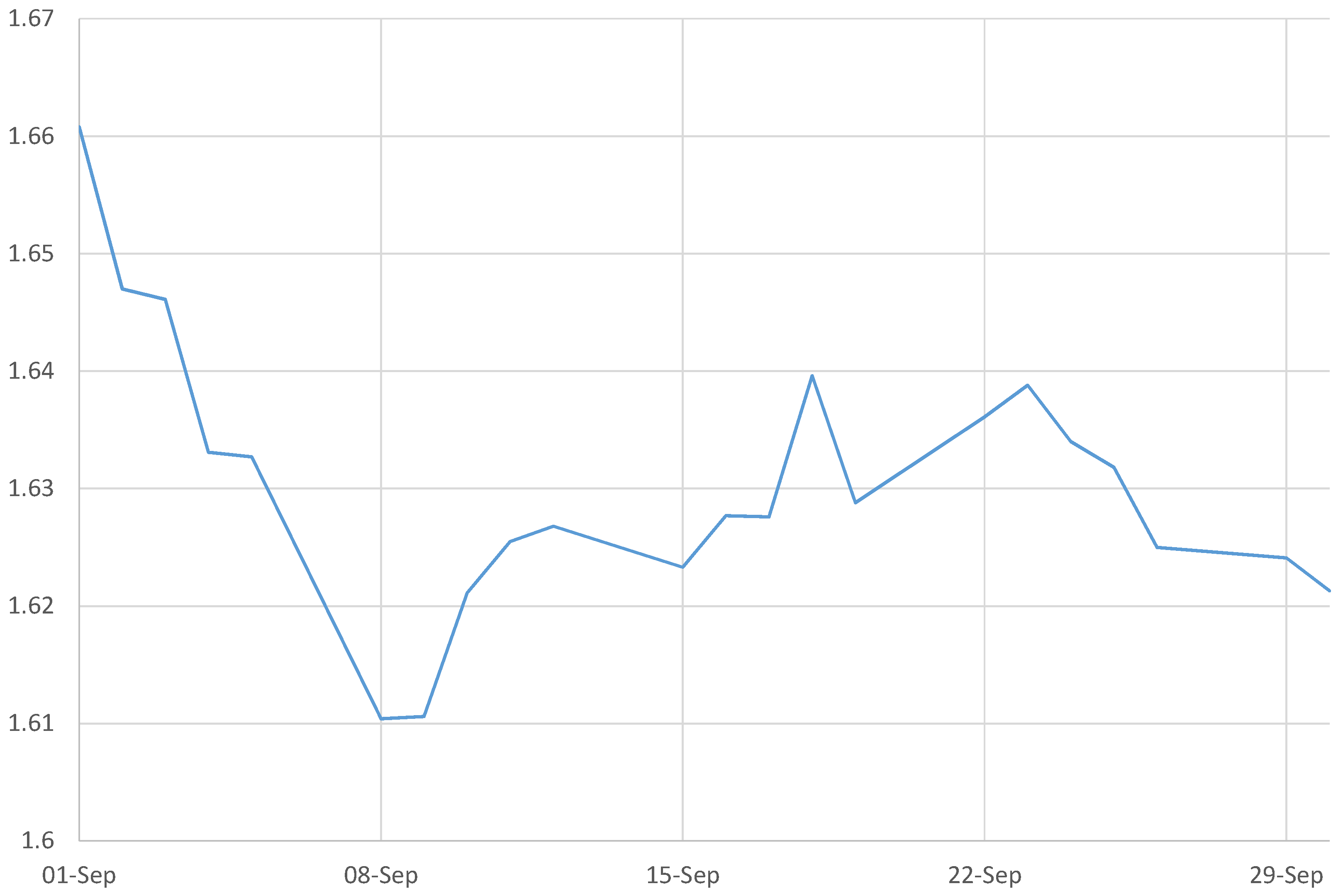

Many market commentators find it informative to draw parallels between the Brexit referendum and an earlier referendum on whether Scotland should remain in Great Britain. This referendum was held on 18 September 2014. GBPUSD overnight implied volatilities spiked as high as 27.03% during the trading day of 18 September 2014, pending the result. In the end, as predicted by various polls, the Scottish public voted to stay in Great Britain.

Figure 9 shows GBPUSD spot spiking up to 1.6396 on the day of the referendum, as the eventual result had been already priced in, before retracing back down to 1.6288 the day after, on the back of profit taking and continuing pessimism about the UK economy.

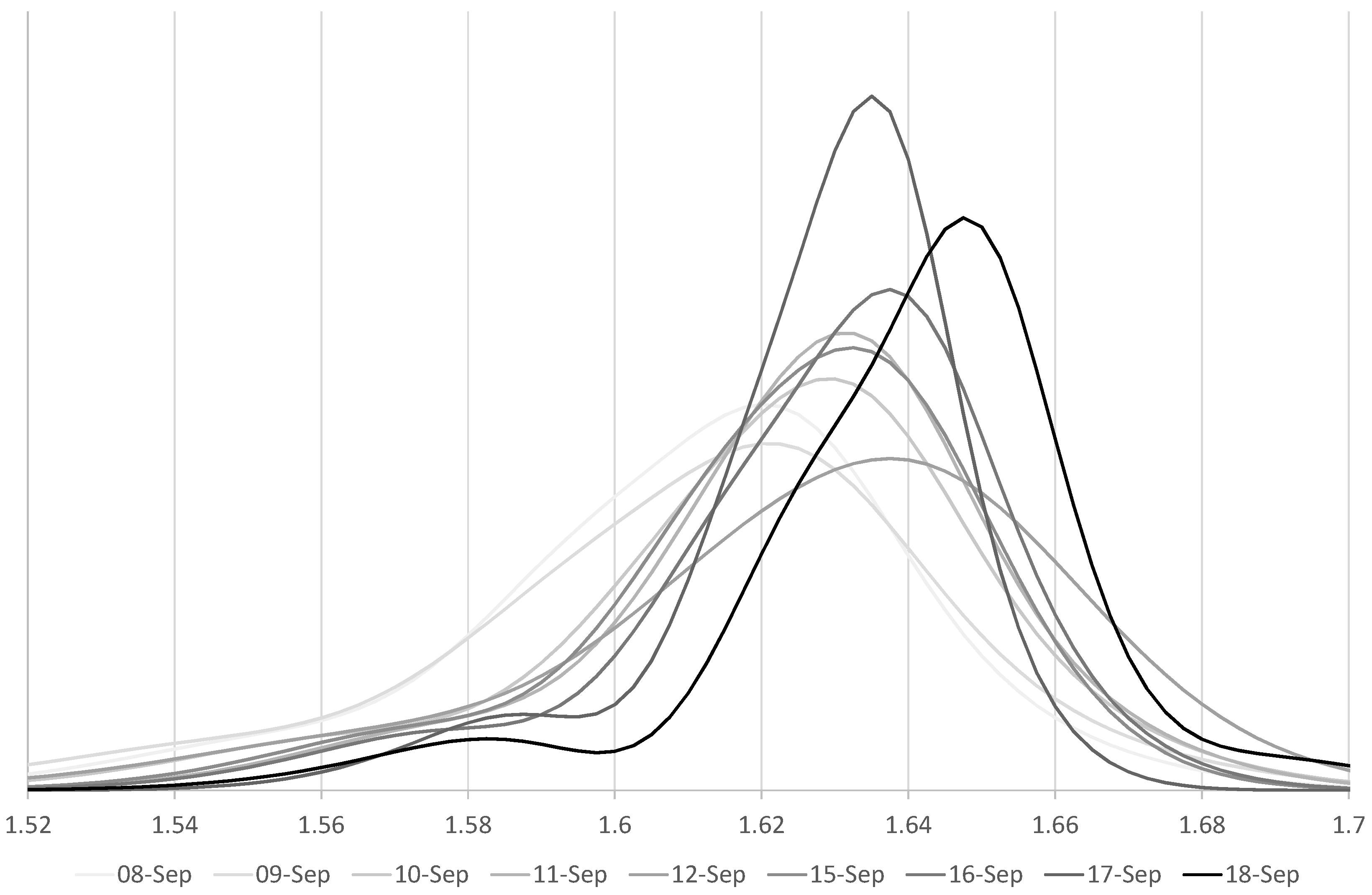

We apply a similar analysis to look at the implied probability distributions

before the referendum date of the terminal spot rate for GBPUSD

after the referendum vote. Constructing implied densities for the spot price distribution at the end of the referendum day, we see definite skew in the densities in

Figure 10.

The probability density function on 8 September 2014, with ten days until the referendum date, is quite dispersed, with a mode around 1.62 (relative to ) and a heavy left tail corresponding to probability mass between 1.55 and 1.61. As we move forward towards the referendum date itself, we continue to see an elevated probability mass between 1.50 and 1.60, and particularly so on the last two days (17 and 18 September 2014) when we see bimodality—the market having one smaller peak around [1.58, 1.59]—which we interpret as a scenario where Scotland votes for independence—together with larger modes centred around [1.63, 1.65] corresponding to a “yes” vote for Scotland remaining within the United Kingdom. The probability skew on 18 September 2014 is particularly skewed due to a large spike in overnight implied volatilities to 27.03% and 25-delta risk reversals of −5.75%.

The outcome of the referendum, with Scotland voting 55.3% to remain in the UK and 44.7% to leave, and a move in GBPUSD to 1.6288 and subsequently trading in the [1.62, 1.64] range, is consistent with the implied distributions computed from volatility skew data shown in

Figure 10.

We can see a small amount of probability mass in the overnight density between 1.55 and 1.60, presumably corresponding to a scenario in which Scotland decides to leave the Union, but the bulk of the probability density is in the region between 1.60 and 1.70 (which we interpret as the scenario in which Scotland remains in the UK).

All this uncertainty vanished after the referendum outcome was decided (Scotland voting “Yes” to remain in the UK), leading to a much more symmetric and lognormal distribution the day after, relative to a spot rate of 1.6288, which is certainly consistent with the probability densities in

Figure 10.

9. Conclusions

We have applied option pricing theory to analyse information embedded in the volatility surfaces for GBPUSD, obtaining implied distributions for the GBPUSD exchange rate at two referendum dates—firstly, the Brexit referendum date on 23 June 2016 and secondly, the Scottish independence referendum date on 18 September 2014. In the second case, we find asset price distributions which are consistent with the observed post-referendum spot price data after the event. In the first case we find significant tail mass probability corresponding to a potential Brexit “leave” vote, in addition to the main mode of the distribution, though we are naturally constrained by the inability of standard delta-based FX quotes to map out the extreme tails of the distribution.

In order to quantify more objectively the two possible scenarios attached to the Brexit referendum, we construct a mixture model and calibrate it to the observed GBPUSD volatility surfaces on all trading days from 24 February to 22 June 2016. In doing so, we estimate that a vote for “leave” would be associated with a devaluation of the British pound, either a relative devaluation of about 4.5% or an absolute decline to a level around 1.3705. This objective approach is more conservative than our earlier heuristic method which estimated possible GBPUSD devaluation to the range 1.10 to 1.30, or a 10–25% decline. In actuality, the point estimate from the mixture model was the best predictor, whereas the 8.44% devaluation in GBP experienced immediately after the “leave” vote is between the two estimates for the percentage decline in the British pound after a vote for “leave”.

10. Afterword

This paper is the final version of a preprint dated 13 June 2016 that originally appeared on SSRN (

https://ssrn.com/abstract=2794888) on 14 June 2016, in advance of the referendum date of 23 June 2016.