1. Introduction

In today’s complex and catastrophe-plagued business environment, the judicious use of risk mitigation strategies in general and reinsurance in particular is vital to the sustainable financial viability of insurance corporations. Being essentially insurance purchased by an insurer from a reinsurer, reinsurance has served as a time-honored risk management activity on which an insurer can capitalize to achieve manifold mutually complementary business objectives. From a risk management perspective, reinsurance provides a powerful tool for an insurer to stabilize its risk exposure by ceding unbearable catastrophic losses to a reinsurer, which is generally more geographically diversified than an insurer. As a result, the amount of risk and the concomitant capital requirement faced by the insurer can be maintained at a level that the insurer deems appropriate. Meanwhile, reinsurance bolsters the underwriting capacity of the insurer and, in turn, empowers the insurer to assume losses from its policyholders that it is otherwise incapable of underwriting. This results in more insurance business opportunities, contributes to the prosperity of the insurance industry and does a service to the society at large. On an accounting front, reinsurance can be utilized to reduce taxes and effect administrative savings as well as surplus relief. These merits of reinsurance have been documented empirically in various sources, such as Cummins et al. [

1], Holzheu and Lechner [

2], Bernard [

3], Tiller and Tiller [

4], just to name a few.

In the academic community, research on reinsurance has predominantly centered upon the bilateral contract design problem between the insurer and reinsurer. Initiated in Borch [

5] and Arrow [

6] involving the variance minimization and expected utility maximization of the terminal wealth of an insurer, and later extended to a risk-measure-theoretic framework, as in Cai et al. [

7], Chi and Tan [

8], Cui et al. [

9] and Lo [

10], among others, the study of optimal reinsurance contracts has been investigated with a diversity of objective functionals and premium principles of varying degrees of technical sophistication, with noticeable mathematical contributions having been made. Optimal reinsurance contracts ranging from stop-loss, quota-share policies to general insurance layers have been found depending on the precise specification of the reinsurance model under consideration. Apart from being preoccupied with mathematical advancements with little economic motivation, the majority of existing research work is confined to the bilateral insurer–reinsurer setting with an exogenously fixed reinsurable loss in the first place, and ignores the interaction between the insurer and its primary policyholders. Doing so overlooks the substantive fact that reinsurance does enlarge the underwriting capacity of the insurer, which, in turn, affects the amount of insured loss that can be reinsured. In fact, it is the interplay between insurance and reinsurance that differentiates these two technically indistinguishable but practically distinct activities. To the best of the author’s knowledge, Zhuang et al. [

11] were the first to undertake a comprehensive analysis of optimal insurance–reinsurance in the context of a one-period three-party model involving a policyholder, an insurer and a reinsurer. In this model, the insurer has the privilege to decide on not only how much risk to underwrite from the policyholder, but also how much insured loss to cede to the reinsurer in order to achieve minimality of its overall risk. As one may have expected, these two decisions are closely intertwined. It was pointed out in Zhuang et al. [

11] that reinsurance enhances the risk taking capacity and profit of an insurer (see Proposition 3.2 therein).

To bridge the existing gap between empirical studies and theoretical research on optimal reinsurance, this article strives to scientifically quantify the value that reinsurance introduces to an insurer on the basis of a variant (see the next paragraph) of Zhuang et al.’s [

11] distortion-risk-measure (DRM)-based three-party model, where the policyholder, insurer and reinsurer interact closely. By virtue of the tractable properties of DRM, the optimal insurance–reinsurance problem is completely solved through an explicit joint construction of the optimal insurance and reinsurance policies. Compared with Zhuang et al. [

11], our novel contributions include intuitive but mathematically rigorous explanations on the marginal cost and benefit considerations underlying the optimal insurance–reinsurance decisions and the formation of the extra value created by reinsurance. As in Cheung and Lo [

12], the integral form of various quantities under the DRM framework will be instrumental in the development of these explanations. Demystifying our explicit optimal solutions, the cost-benefit discussions indicate that the benefits of reinsurance to the insurer are twofold, via the opportunity to cede currently underwritten losses to the reinsurer for a further reduction in the insurer’s overall risk, as well as an improved capability to accept losses from the policyholder in the first place. Analytic expressions accounting for the benefits in these two respects are obtained. The bottom line is that reinsurance furnishes the insurer with a flexible mechanism to lower its cost of transaction. Overall, our results not only conform to empirically supported findings in most reinsurance markets, but also shed valuable light on the economics of insurance and reinsurance, which most existing research contributions are very much lacking in.

Risk transfer inevitably introduces counterparty risk, and reinsurance is no exception. By engaging in a reinsurance contract with the reinsurer, the insurer is exposed to the undesirable possibility that the reinsurer fails to deliver on its promised obligations, which, in turn, jeopardizes the insurer’s ability to indemnify the policyholder in the first place. The default risk of the reinsurer, if not taken into account, may result in the insurer forming an overly optimistic view of its risk exposure and devising an unduly aggressive insurance–reinsurance strategy. Motivated by Asimit et al. [

13] and Cai et al. [

14], we embed the reinsurer’s default risk in our three-party model by assuming that the reinsurer will default on its obligations whenever the size of the promised reinsured loss exceeds the reinsurer’s regulatory capital, which is prescribed as the Value-at-Risk (VaR) of the reinsured loss. Such a choice of the regulatory capital is commensurate with the riskiness of the reinsured loss and can be explained by the popularity of VaR in the banking and insurance industries as well as the recent implementation of the Solvency II regulatory framework in European Union countries. We also allow for loss recovery by postulating that a fixed portion of the excess of the reinsured loss over the regulatory capital will be paid to the insurer as partial compensation in the case of default. As a by-product, the results in our three-party model are indicative of the repercussions that the reinsurer’s default risk can have for the design of the optimal insurance and reinsurance policies.

The remainder of this article is structured as follows:

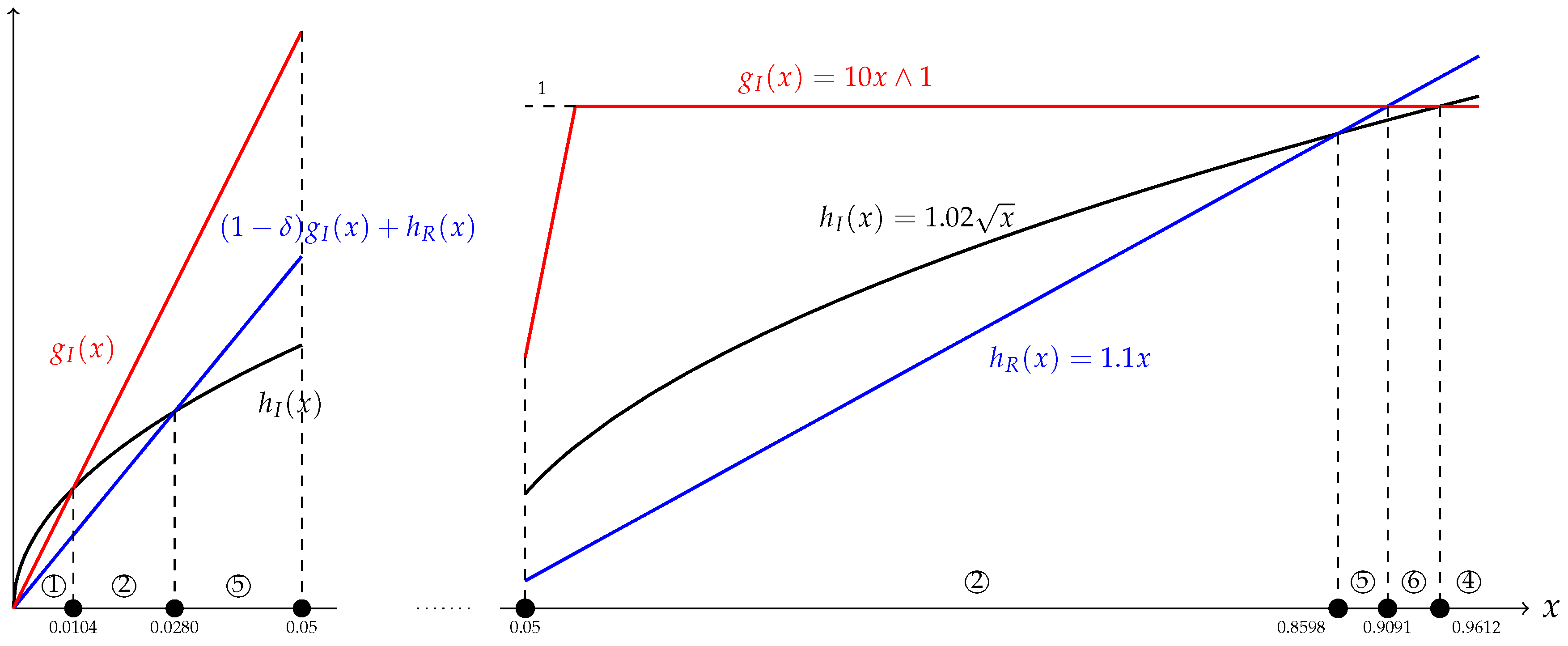

Section 2 sets forth the DRM-based three-party optimal insurance–reinsurance model subject to default risk, which forms the backbone of the entire article, describes its various components and formulates the risk minimization problem faced by the insurer. In

Section 3, the optimal insurance–reinsurance strategies are analytically obtained and intuitively explained from a cost-benefit perspective that informs the value created by reinsurance, and an illustrating numerical example is given.

Section 4 concludes the article with some potential future research directions.

2. Three-Party Optimal Insurance–Reinsurance Model with Default Risk

Synthesizing the discussions in Asimit et al. [

13] and Zhuang et al. [

11], we begin with a precise description of a DRM-based insurance–reinsurance model in which three agents, namely a policyholder, an insurer and a default-prone reinsurer, coexist. In this model, the risk faced by an agent is evaluated by means of

distortion risk measures (DRMs), whose definition calls for the notion of a distortion function (see Denneberg [

15] and Wang [

16]). We say that

is a

distortion function if

g is a non-decreasing function, such that

and

. Unlike Zhuang et al. [

11], no (left- or right-) continuity assumptions are imposed on

g, neither are convexity or concavity conditions, because our analysis is valid without these extraneous technical assumptions and therefore holds in high generality, with the agent being at complete liberty to choose a distortion function that best aligns with his/her risk preference. Corresponding to a distortion function

g, the DRM of a random variable

Y is defined by

where

is the survival function of

Y, provided that at least one of the two integrals in Formula (

1) is finite. For non-negative random variables, Formula (

1) reduces to

In this article, we tacitly assume that all random variables are sufficiently integrable in the sense that their DRMs are well-defined and finite.

As a risk quantification vehicle, DRM enjoys a number of practically appealing and mathematically tractable properties, including:

Translation invariance: If

Y is a random variable and

c is a real constant, then

Positive homogeneity: If

Y is a random variable and

a is a non-negative constant, then

Comonotonic additivity: If

are comonotonic random variables in the sense that they are all non-decreasing functions of a common random variable, then

These properties, which can be found in Equations (52)–(54) of Dhaene et al. [

17], will play a vital role in tackling the objective function of the insurer’s risk minimization problem studied in this article. Furthermore, the class of DRM is a big umbrella under which many common risk measures fall, most notably VaR, whose definition is recalled below. In the sequel, we write

,

and denote the indicator function of a given set

A by

, i.e.,

if

A is true, and

otherwise.

Definition 1. (Definition of VaR)

The Value-at-Risk

(VaR) of a random variable Y at the probability level of is the generalized left-continuous inverse of its distribution function at p:with the convention . It is known that the distortion function that gives rise to the

p-level VaR is

(see Equation (

4) of Dhaene et al. [

17]), which is neither convex nor concave. For more information about the practical use of VaR, readers are referred to the comprehensive guide of Jorion [

18].

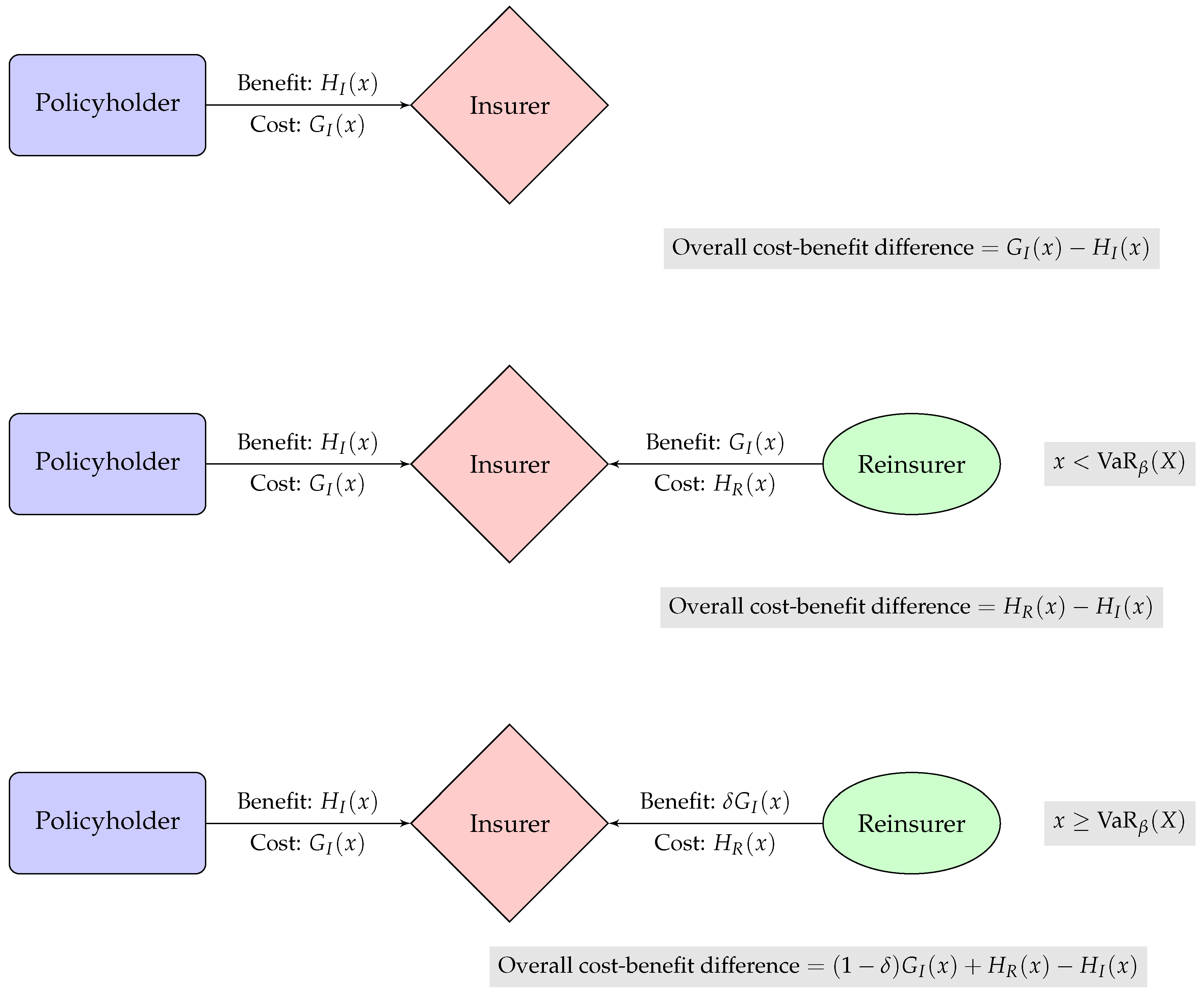

In the current three-party insurance–reinsurance model, the policyholder, insurer and reinsurer interact as follows. Underlying the entire analysis is the policyholder’s ground-up loss modeled by a non-negative random variable X with a known distribution, which can be underwritten by the insurer via an insurance contract characterized by the insurance indemnity function . The effect of insurance is that the ground-up loss X is partitioned into , the insured loss against which the insurer is obligated to indemnify the policyholder, and , the loss retained by the policyholder. In return for insuring part of the ground-up loss, the insurer receives the insurance premium , which is a function of the insured loss, from the policyholder. At this point, the insurer’s net risk exposure is .

Meanwhile, to mitigate its risk exposure resulting from the insurance contract, the insurer has the opportunity to reinsure part of the insured loss through a reinsurance contract with the reinsurer, which is capable of indemnifying the insurer up to the amount of its regulatory capital in place. Given the recent implementation of the Solvency II regulatory framework in the countries of the European Union, we follow Asimit et al. [

13] and assume that the reinsurer operates in a VaR-regulated environment and thus prescribes its regulatory capital in accordance with the

β-level VaR of the reinsured loss for some large probability level

β (e.g.,

in Solvency II). If

represents the

reinsurance indemnity function and

is the recovery rate of the loss given default, then the insurer is in effect compensated for

. In exchange, the insurer pays the reinsurer the reinsurance premium

, which is a function of the reinsured loss

. As a result of coupling insurance with reinsurance, the insurer’s overall risk exposure is

We note in passing that setting

or sending

retrieves the default-free framework of Zhuang et al. [

11].

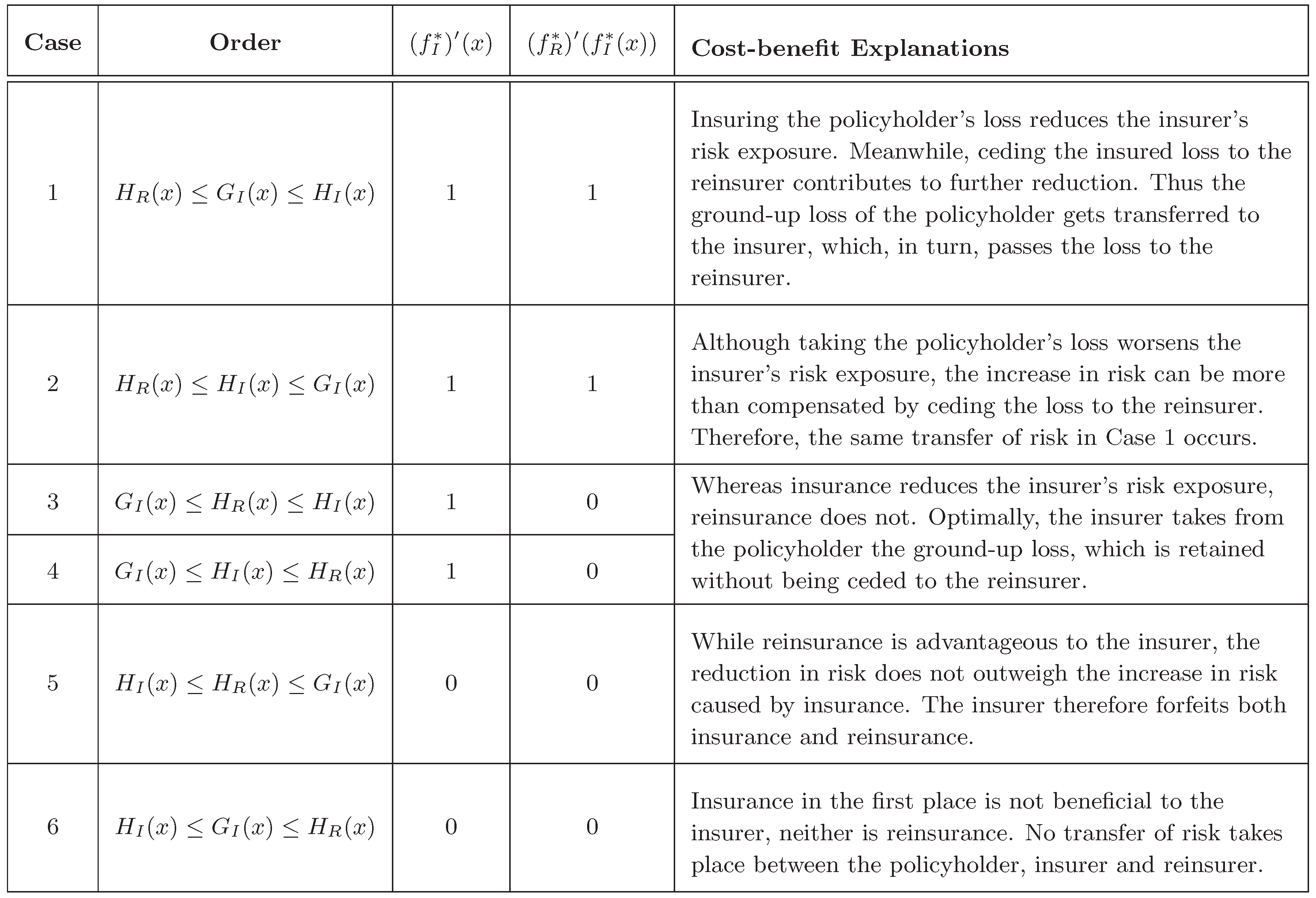

In contrast to the classical policyholder–insurer and insurer–reinsurer settings, where the optimal insurance and reinsurance arrangements can be determined in isolation, in the current three-party model, insurance and reinsurance do interact with each other. This is because how much risk the insurer underwrites from the policyholder in the first place dictates the amount of insured loss available for reinsurance, while the presence of reinsurance can potentially stimulate the underwriting capability of the insurer. It is the interplay between insurance and reinsurance that is the focus of this article, with our prime interest lying in the

joint analysis of the optimal insurance–reinsurance strategy

, which minimizes the DRM of the insurer’s overall risk exposure. Mathematically, we seek

that solves

where

is the distortion function adopted by the insurer and

is the class of feasible insurance–reinsurance strategies.

To make Problem (

3) well-defined, it remains to specify the feasible set

as well as the insurance and reinsurance premium principles that define

and

. In this article, the insurance and reinsurance policies available for sale in the market are restricted to the following collection of non-decreasing and 1-Lipschitz functions null at zero:

The conditions imposed on

are meant to tackle the practical issue of

ex post moral hazard due to the manipulation of ground-up or insured losses. In fact, due to the 1-Lipschitz condition, both the policyholder and insurer will be worse off as the ground-up loss becomes more severe, thereby having no incentive to tamper with claims. The same applies to the insured loss between the insurer and reinsurer. Technically, the 1-Lipschitz condition does result in some appealing mathematical convenience, with every

and

being absolutely continuous with derivatives

and

that exist almost everywhere and are bounded between 0 and 1. In line with Zhuang et al. [

19], we designate

and

as the

marginal insurance indemnity function and the

marginal reinsurance indemnity function, respectively, which measure the rate of increase in the insured loss with respect to the ground-up loss, and the rate of increase in the reinsured loss with respect to the insured loss. In addition to being handy equivalent representations of the optimal

due to the one-to-one correspondences

and

, these marginal indemnity functions will be central to the cost-benefit analysis of insurance and reinsurance featured in this article.

Premium-wise, we assume that the insurer and reinsurer calibrate the insurance and reinsurance premiums according to the general distortion premium principle via

where

and

are the premium functions adopted by the insurer and reinsurer, respectively, such that each

is a non-decreasing function satisfying

. Without the need for assuming

, this premium principle provides enough flexibility to accommodate a wide variety of safety loading structures. In addition, in parallel with the versatility of DRMs to encompass a wide family of risk measures, various common premium principles, including the renowned expected value premium principle and Wang’s premium principle, can be retrieved from Formula (

4) by different choices of the function

(see Cui et al. [

9] for details). More remarkably, the striking symmetry between Formula (

2) and Formula (

4), when viewed in the correct light, will substantially facilitate understanding the marginal costs and benefits of insurance and reinsurance.

Compared with the reinsurance premium principles in Asimit et al. [

13] and Zhuang et al. [

11], Formula (

4) possesses two subtle differences. First, unlike Asimit et al. [

13], no allowance is made in Formula (

4) for the possibility of default when the reinsurer charges the reinsurance premium. In other words, the reinsurance premium is computed based on the promised reinsured loss

, rather than the actual reimbursed loss

. While calculating the reinsurance premium based on the actual reimbursed loss is mathematically feasible and can be easily accommodated by some minor modifications to our model, it would be practically unthinkable for the reinsurer to openly admit the possibility of default. Moreover, when the prospect of default is incorporated, as in Asimit et al. [

13], the discrepancy between the beliefs of the insurer and reinsurer about the recovery rate of the loss given default may give rise to more aggressive risk transfer from the insurer and therefore counter-intuitive optimal reinsurance contracts. Second, it was shown in Proposition 3.1 of Zhuang et al. [

11] that the insurance premium function

should be set as the distortion function of the policyholder, provided that the policyholder is also a DRM-adopter. Such a specification provides the minimum incentive for the policyholder to “participate” in the insurance contract. In this article, we do not dwell on this participation issue and denote the insurance premium function by a generic function

to simplify notation and to ease the cost-benefit discussions that follow.