Abstract

This study employs a quantile-on-quantile connectedness approach to analyze the asymmetric, distribution-dependent, and time-varying spillovers between FinTech indices and traditional financial markets. The results show that spillovers are concentrated in the distribution tails, with FinTech indices exhibiting strong co-movements with equities and Bitcoin under extreme conditions, while linkages with U.S. Treasury bonds are weaker and often inverse. Net connectedness analysis reveals that the S&P 500 and Bitcoin act as the primary transmitters of shocks into FinTech indices, whereas Treasuries generally serve as receivers, except during stress episodes when safe-haven flows or heightened credit risk reverse the direction of spillovers. The dynamic ∆TCI (Difference between the total direct connectedness and the reverse total connectedness) further demonstrates that FinTech indices serve as net transmitters in stable markets but become receivers during crises such as the COVID-19 pandemic, the Federal Reserve’s tightening cycle of 2022–2023, and the FTX-driven crypto collapse. Segmental heterogeneity is also evident: distributed ledger firms are highly sensitive to cryptocurrency dynamics, alternative finance providers respond strongly to both equity and bond markets, and digital payments firms are primarily influenced by equity spillovers. Overall, the findings underscore FinTech’s dual role—transmitting shocks during tranquil periods but amplifying systemic vulnerabilities during crises. For investors, diversification benefits are state-dependent and largely disappear under adverse conditions. For regulators and policymakers, the results highlight the systemic importance of FinTech–equity and crypto–ledger linkages and the need to integrate FinTech exposures into macroprudential surveillance to contain volatility spillovers and safeguard financial stability.

JEL Classification:

G32; E44

1. Introduction

The infusion of technology into financial services, commonly known as financial technology (FinTech), has precipitated a significant transformation in the landscape of investment, reaching substantial importance in asset allocation during recent years. McKinsey and Company (2023) reports that the aggregate market value of fintech firms, public and private, is about $1.5 trillion. In addition, the fintech industry is expected to grow 15% annually, compared to 6% for traditional banking.1 This evolution has attracted investors’ attention and reshaped traditional finance paradigms. The core advantages of FinTech include enhanced accessibility, increased efficiency, and improved decision-making capabilities. The integration of FinTech with investment strategies has the potential to democratize access to financial markets, allowing a broader segment of the population to participate in investment opportunities. In this paper, we examine the performance of Fintech investments and their association with various macroeconomic factors.

Extant literature on FinTech firms identifies an intricate dynamic affecting this rapidly growing sector. Macroeconomic factors such as interest rates, credit risk, cryptocurrency prices, and overall market returns are the most relevant determinants of returns in the FinTech sector. Interest rates serve as a critical determinant of financial performance for FinTech companies, particularly those engaged in lending. As evidenced in Agustin (2023), interest rates influence the profitability of FinTech lending operations, where firms typically generate revenues through both interest and fees. Furthermore, other investigations reveal a correlation between interest rates and financial asset prices, implying an association between FinTech performance and benchmark interest rates (Khan et al. 2018; Iqbal et al. 2022).

The average level of Credit risk in the economy is another vital factor identified in the literature. FinTech firms often leverage technology to assess borrower creditworthiness, which can alter traditional risk assessments and, consequently, stock returns. According to Chu and Wei (2023), FinTech lending competition impacts both credit access and pricing, potentially shifting the market landscape for established financial institutions.

The integration of blockchain technology and cryptocurrency offerings by FinTech companies involves additional complexities in financial markets and increases the complexity of valuing FinTech firms. Cryptocurrencies often exhibit high volatility (Klein et al. 2018), influencing investors’ perceptions of risk and return within the FinTech sector. Understanding the relationship between conventional financial performance metrics and those of cryptocurrency influenced FinTech firms becomes crucial for comprehending broader market trends (Indarwati and Widarjono 2021; Iqbal et al. 2021). Studies indicate that FinTech firms engaged in cryptocurrency services have become increasingly sensitive to macroeconomic shifts due to evolving competition in digital finance and changing risk-reward assessments among market participants (Sadorsky 2024; Peltomäki 2025). Overall, the current body of literature underscores the intricate interplay between macroeconomic factors and FinTech stock performance, illustrating that ongoing research in this domain is vital for understanding and navigating the complexities of modern financial ecosystems.

Our findings display an asymmetric, quantile-dependent, and time-varying relationship between FinTech indices and traditional financial markets. Spillovers, which can be defined as how volatility is transmitted across different indices, are concentrated in the distribution tails, with FinTech indices showing strong co-movements with equities and Bitcoin under extreme market conditions, while the relationship with U.S. Treasury bonds is weaker and often inverse. In addition, S&P-500 returns and Bitcoin act as the primary net transmitters of shocks into FinTech indices, whereas Treasury instruments typically function as net receivers except during stress periods, when safe-haven flows or heightened credit risk temporarily reverse the direction of spillovers. FinTech assets provide diversification benefits only during periods of low volatility yet lose this advantage during crises when spillovers from equities and bond markets dominate. FinTech indices align more closely with risky growth-oriented assets, particularly equities and cryptocurrencies, under adverse shocks.

This study provides important implications for regulators and policymakers, who must acknowledge the systemic significance of FinTech–equity and crypto–ledger linkages. Shocks originating in these markets can rapidly propagate through FinTech channels and magnify financial instability. The findings also yield practical insights for portfolio managers and investors by highlighting the conditional and state-dependent nature of diversification benefits in FinTech assets. Furthermore, this study advances the existing literature by explicitly employing the quantile-on-quantile connectedness framework to examine risk transmission across fintech and credit markets. While prior studies typically rely on mean-based or single-quantile connectedness measures, this approach captures how spillovers vary simultaneously across different parts of the return distribution. By modeling cross-quantile dependence, the framework provides a more nuanced view of shock propagation, particularly under extreme market conditions, thereby addressing an important methodological gap in fintech literature.

2. Literature Review

2.1. Credit Markets

We employ the default risk premium to gauge the condition of the credit market. The default risk premium equals the additional yield investors expect from corporate bonds as compensation for the risk of default relative to Treasury bonds of the same maturity. Gilchrist and Zakrajšek (2012) emphasize that this premium can reflect broader economic conditions, influencing investment decisions and firm behavior, including those within the fintech sector. Increased default risk premiums often correlate with economic downturns, leading to higher costs of borrowing for firms, which can adversely affect their operational capabilities and investment strategies. Chava and Purnanandam (2010) examine firm-specific credit risk, documenting that higher default risk premiums are associated with higher expected stock returns, consistent with the high-risk, high-return relationship.

For the financial performance of fintech firms, the ramifications can be particularly pronounced. This sector is heavily reliant on external financing, and the increasing cost of capital due to higher corporate bond yields can hinder growth and scale (Singh and Singla 2023). This aligns with Chiu et al. (2018b), who argue that fluctuations in default risk premiums can alter the landscape of available financing options, thus impacting overall firm performance and market valuations. Elevated credit market risk perceptions typically lead to wider credit spreads, resulting in higher borrowing costs (Horobeț et al. 2023).

Default risk premiums or credit spreads, serve as a direct indicator of credit risk. Financial research substantiates that widening credit spreads often result in deteriorations in firm returns (Chiu et al. 2018a). For fintech firms, which face additional scrutiny due to their unconventional business practices and emerging market positions, the relationship between credit spreads and equity returns is especially relevant.

Credit risk, proxied by the default risk premium, captures the behavior observed in corporate bond markets. Sharma and Khurana (2025) note that increased perceived economic uncertainty, such as during financial crises, often elevates default risk perceptions, widening credit spreads. The implications for fintech firms are pronounced, as greater economic uncertainty can constrain their access to financing and inflate borrowing costs, limiting growth trajectory and profitability, and affecting stock valuations negatively. Anginer and Yildizhan (2010) highlight that during periods of economic strain or heightened uncertainty, the risk-return dynamics for fintech firms are particularly at risk, as their market valuations may suffer from lower investor confidence as well as reduced market liquidity. These dynamics reinforce the significance of monitoring the prevalent degree of credit risk as an indicator of broader market trends impacting FinTech companies.

The relationship between credit market conditions and risk-return profiles of fintech companies is underscored by the higher financial risks associated with these firms. Najaf et al. (2021) provide evidence that fintech portfolios generally exhibit more financial risk compared to traditional finance sectors, correlating this with a higher market valuation. As credit conditions tighten, the risks that investors associate with fintech also elevate, impacting the return dynamics associated with FinTech investment. Finkelstein-Shapiro et al. (2022) highlight that fintech innovations can improve credit access but may also expose firms to greater risks if macroeconomic conditions weaken. Zhang (2021) provides evidence that Baa-rated corporate bond spreads are influenced by general economic conditions, such as interest rates and stock market volatility, which consequently can impact the expected stock returns for firms in volatile sectors, including fintech. He establishes that fluctuations in credit spreads do affect the stock performance of firms as the market adjusts risk expectations based on macroeconomic influences.

In sum, the prevailing conditions of the credit market, particularly the dynamics of default risk premiums, hold substantial sway over the operational landscape for fintech firms. These firms encounter a dual challenge: navigating the high-risk perception that comes with their business models while also capitalizing on the opportunities arising from a changing credit market. Increasing default risk premiums, reflected through widening credit spreads, often portend higher borrowing costs and potentially diminished growth prospects for fintech firms. Given the expected association between credit spreads and the FinTech industry, we empirically test the dynamics between credit risk and the behavior of FinTech stocks’ returns. To our knowledge, our paper is the first to explore this research question.

2.2. Cryptocurrencies

The behavior of cryptocurrency prices is crucial in shaping the financial performance of fintech firms, especially given the increasing integration of cryptocurrencies into the broader financial ecosystem. Traditionally perceived as a speculative investment, Abakah et al. (2023) and Smales (2019) suggest that these financial assets can serve as a hedge against traditional capital market instruments. However, there is a nuanced association between cryptocurrencies and the stock market behavior. Extant literature indicates that several factors, such as volatility, market sentiment, and investor behavior, influence the dynamic relationship between cryptocurrency prices and stock returns. For instance, Elroukh (2023) discusses how cryptocurrencies can serve various purposes—such as investments, means of payment, and stores of value—making them less sensitive to traditional stock market influences, which are more directly impacted by corporate profitability or economic conditions.

Furthermore, the role of market sentiment reflected in Bitcoin pricing is crucial. For example, Ghaemi Asl et al. (2021) document that investor sentiment significantly impacts Bitcoin’s price, leading to a spillover effect on related assets, including fintech stocks. This influence suggests that movements in Bitcoin prices driven by positive or negative market sentiment can lead to correlated movements in the stock prices of fintech firms. Specifically, when Bitcoin experiences increased demand, it can create investor enthusiasm that extends to the broader fintech sector. Conversely, when Bitcoin prices decline, fear and uncertainty may negatively affect fintech stock returns. This interconnectedness extends to portfolio management implications, especially as cryptocurrencies have emerged as a distinct asset class. Abakah et al. (2024) offer insights into the dependence dynamics between Bitcoin, fintech stocks, and equity markets in the Asia-Pacific region. Fluctuations in Bitcoin prices appear to correlate with the performance of fintech stocks, creating potential spillover effects (Abakah et al. 2024). This necessitates careful consideration in portfolio strategies, as volatility in cryptocurrencies can propagate similar volatility in fintech stocks, as identified by Aydoğan et al. who analyze return and volatility spillovers in their research (Aydoğan et al. 2022).

Field and Inci (2023) document that fintech firms holding cryptocurrencies may experience shifts in their risk profiles, including adjustments to beta values and overall stock returns under varying market conditions. The literature consistently highlights a multifaceted relationship between cryptocurrency prices and the stock returns of fintech firms, underscoring the importance of this dynamic in shaping their financial performance and strategic approaches. Based on this expected relationship, our novel research questions empirically explore the effect of bitcoin prices on the risk and returns of firms in the FinTech industry.

2.3. FinTech Performance and the Macroeconomy

Chan and Ji (2020) find that when interest rates are lower, savers search for alternatives to traditional banking that may offer higher rates, hence, boosting the deposits and inflows to FinTech firms in the banking area. Similarly, Moro-Visconti (2021) highlights that low-interest rates foster an environment conducive to fintech innovations, subsequently resulting in increased market participation and greater customer engagement. Furthermore, fluctuations in interest rates can negatively impact investor confidence and the allocation of capital to fintech ventures, especially during economic downturns characterized by widening yield-bond spreads (Kassner 2024). This insight underscores the importance of fintech firms developing adaptive strategies to mitigate the adverse effects of interest rate volatility.

Assefa et al. (2017) argue that lower interest rates correlate with higher equity returns, which aligns with the inverse relationship between discount rates and fundamental valuations established in the discounted cash flow model. Similarly, Li et al. (2017) note that increased availability of fintech funding, which tends to occur when lending rates are lower, closely correlates with the stock returns of incumbent retail banks. This suggests that a thriving economic environment benefits both traditional banking and fintech sectors. This dynamic interplay between interest rates and their various implications—such as lending rates and the cost of capital—enhances our understanding of how fintech firms can leverage favorable interest rates and periods of positive stock market performance to maximize returns.

From the perspective of asset pricing models, the behavior of the stock market significantly impacts returns across all sectors of the economy, including the fintech industry. According to Gil-Corbacho et al. (2023), the returns on fintech stocks are influenced by the prevailing state of the economy. Xu et al. (2022) note that during periods of stable economic growth, firms within the fintech industry may experience improved access to capital, effectively enhancing their market performance. The COVID-19 pandemic has notably accelerated digital transformation, significantly influencing the stock returns of many fintech firms. Zhang and Tong (2023) document that, in the wake of the pandemic, companies like Square and PayPal experienced substantial stock price increases (over 250% and 110%, respectively) as digital payment solutions became essential during lockdowns. This phenomenon reflects the market’s recognition of fintech companies’ potential amid shifting consumer behavior and a growing reliance on digital financial services.

Understanding the interdependence between traditional financial firms and the fintech sector is crucial for analyzing stock performance dynamics, as it reveals how shifts in one sector can significantly influence the other. Li et al. (2017) uncover a positive relationship between fintech funding and incumbent bank stock returns, underscoring how traditional financial institutions must adapt to the growing fintech landscape. This interplay suggests that market conditions influencing traditional financial stocks may similarly affect fintech returns, given the increasing convergence of their operational frameworks and economic implications.

In summary, the literature consistently indicates that credit risk, interest rates, cryptocurrency prices, and stock market returns are critical determinants of fintech firm returns. Nevertheless, the literature reveals a complex and multifaceted relationship between overall stock market returns and the performance of the fintech sector, influenced by varying factors such as market sentiment, investor behavior, and regional economic conditions. Ongoing research is necessary to better recognize the evolving dynamics as the fintech sector matures within the global financial market landscape.

3. Data and Methodology

3.1. Data

Our analysis utilizes three primary FinTech indices as the dependent variables: the S&P Kensho Distributed Ledger Index (KLDGER), the S&P Kensho Alternative Finance Index (KALFIN), and the S&P Kensho Future Payments Index (KPYMNT). The independent variables comprise Bitcoin prices (USD), the S&P 500 Total Return Index, the U.S. 10-year Treasury benchmark bond yield (USBD10Y), and A-rated U.S. Treasury bonds—the latter serving as a proxy for the default risk premium relative to 10-year corporate bonds. A comprehensive description of all variables is provided in Table 1.

Table 1.

Description of Indices Used in the Analysis.

The dataset employed in this analysis consists of daily observations from 18 May 2018 to 11 April 2025, a period characterized by several key structural and financial regime shifts. The outbreak of the COVID-19 pandemic (2020–2021) dramatically altered global financial conditions by accelerating the digital transformation of financial services, reshaping investor behavior, and increasing reliance on remote, technology-driven payment and financial platforms. These developments directly impacted the fintech industry and cryptocurrency adoption.

Following the pandemic-induced recession, the global economy entered a period of aggressive monetary tightening beginning in early 2022. Major central banks—including the U.S. Federal Reserve—rapidly increased interest rates to combat inflation, resulting in reduced liquidity, higher borrowing costs, and heightened uncertainty in financial markets. These changes are particularly relevant for digital-finance-related firms that are sensitive to capital conditions and innovation funding cycles. Over the same period, the cryptocurrency market experienced multiple high-amplitude cycles. The sharp price surge during 2020–2021 was followed by significant corrections driven by regulatory actions, institutional withdrawals, and speculative unwindings. These fluctuations generated substantial volatility spillovers to both traditional markets and fintech-related securities.

Considering these concurrent structural shifts, the selected period provides an ideal context to examine the dynamic interdependence between fintech innovations, cryptocurrency valuations, and macro-financial environments. Incorporating these regime changes early in the empirical design ensures better contextualization of our findings and enhances the interpretation of time-varying transmission mechanisms explored in this study. To ensure stationarity, all variables were transformed into simple returns, calculated as (Pt/Pt−1 − 1). The summary of the descriptive statistics for the variables is presented in Table 2.

Table 2.

Summary Statistics of Return Series.

According to the results reported in Table 2, the Jarque–Bera (JB) statistics indicate that none of the variables follow a normal distribution, which is consistent with the well-documented properties of financial time series data. The results further show that the excess kurtosis is positive for all variables, suggesting a leptokurtic distribution, with the exception of KLDGER and KALFIN, which exhibit platykurtic behavior. Stationarity tests based on the Elliott et al. (1992) (ERS) procedure confirm that all variables are stationary, thereby making them suitable for further econometric analysis.

As expected, the highest variance is observed in Bitcoin prices, reflecting the well-known volatility of cryptocurrency markets relative to traditional financial assets. In addition, the Ljung–Box Q(20) statistics reveal evidence of serial correlation in the squared residuals, while the Ljung–Box Q2(20) statistics are highly significant across all series, indicating the presence of heteroskedasticity and volatility clustering—a common feature in financial return data. These findings suggest that models capable of capturing time-varying volatility dynamics, such as GARCH-type specifications, are appropriate for further analysis.

The results of the Kendall correlation matrix reported in Table 3 show that both the KLDGER and KALFIN return indices exhibit positive correlations with all variables, with the exception of the A-rated Treasury bonds, which display a weak negative association. This suggests that FinTech-related indices tend to move in the same direction as traditional financial markets and Bitcoin but diverge from safer fixed-income securities.

Table 3.

Kendall Correlation Matrix of Return Series.

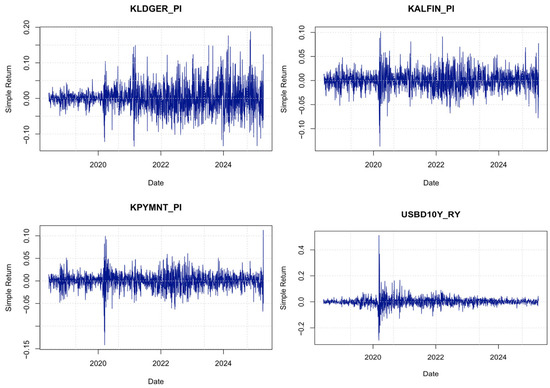

Among the independent variables, the S&P 500 Total Return Index demonstrates the strongest correlation with all three FinTech indices (KLDGER, KALFIN, and KPYMNT), highlighting the close co-movement between equity markets and FinTech performance. In contrast, the 10-year U.S. Treasury benchmark yield (USBD10Y) and Bitcoin prices display relatively lower correlation coefficients, reflecting more independent dynamics. Notably, the negative correlation between A-rated Treasury bonds and the other variables further emphasizes their role as a safe-haven asset that behaves differently from riskier financial instruments. As shown in Figure 1, the return plots provide a clear visualization of the behavior of all variables over time.

Figure 1.

Return plots for all variables.

3.2. Methodology

We have chosen to use the novel methodology introduced by Gabauer and Stenfors (2024) in order to understand the connection between quantiles of the fintech variables against bitcoin prices, the S&P 500 total return index and A rated treasury bonds along with the 10-year U.S. benchmark bond yield returns. This novel technique facilitates the assessment of how the extreme values, or tails, of different market distributions are interrelated. Specifically, it enables the analysis of whether, and to what extent, tail risk originating in one market is transmitted to another. Moreover, it provides insight into the connections between different quantiles across different returns, such as the association between upper quantiles (right tails) of one market and either the upper or lower quantiles (right or left tails) of another; thereby offering a nuanced understanding of asymmetric spillovers in extreme market events.

Before presenting the formal structure of the model, it is useful to briefly clarify how the Quantile-on-Quantile VAR (QQ-VAR) connectedness framework differs from more traditional approaches used in the financial econometrics’ literature. Traditional VAR models examine how shocks effect on average, focusing on the conditional mean of returns. These models implicitly assume that spillover mechanisms remain relatively stable across different market conditions. However, financial markets often behave very differently during severe downturns, high-volatility periods, or extreme positive episodes. A mean-based VAR cannot uncover these state-dependent transmission channels.

In contrast, the QQ-VAR connectedness framework allows both the origin and destination of spillovers to vary across the entire return distribution. Instead of estimating a single spillover measure for all states of the market, the QQ approach examines how a shock in one variable at a specific quantile, such as a large negative return, affects another variable at different points in its own distribution. This quantile-on-quantile structure provides a much richer picture of dependence, capturing asymmetries, nonlinearities, tail behaviors, and crisis-specific spillover patterns that traditional VAR approaches cannot identify.

This methodology developed by Gabauer and Stenfors (2024) innovatively extends the QQ connectedness method by Chatziantoniou et al. (2021) in order to allow seeing interdependency between different quantiles. For example, the previous methods would compare between direct quantiles as (e.g., τ1 = 0.05 and τ2 = 0.05), however the new methodology is able to compare reverse quantile connectedness (e.g., τ1 = 0.05 and τ2 = 0.95).

The connectedness model uses Quantile Vector Autoregressive (QVAR) model as the underlying powerhouse which can be written as,

zt and zt−1 K × 1 vectors represent the endogenous variables and its lags with τ as quantiles for the range [0, 1]. µ(τ) is the conditional mean with K × 1 dimensions. Ωj(τ) is the K × K matrix of the coefficients of the models. p refers to the number of lags in the model and ut(τ) is the error vector of K × 1 dimensions which also includes a K × K variance-covariance matrix denoted as Φ(τ).

The derivation of the generalized forecast error variance decomposition (GFEVD), as proposed by Koop et al. (1996), begins by applying the Wold decomposition theorem; crucial step in the novel Gabauer and Stenfors (2024) methodology. Through this process, the QVAR model is initially reformulated into its quantile vector moving average (QVMA(∞)) representation, which serves as the foundation for obtaining the GFEVD.

In this specific equation, denotes the sequence of quantile-dependent moving-average coefficient matrices. Each captures the dynamic effect of a structural shock that occurred i periods earlier and therefore describes how shocks propagate across variables over time at a given quantile level . Subsequently, the H-step (forecast horizon) ahead GFEVD measures the extent to which a shock originating in series j impacts series i, as determined by the following expression:

where mentions the proportion of the H-step-ahead forecast error variance of variable i explained by shocks in variable j, at quantile τ, and mentions the generalized version of the H-step-ahead forecast error variance of variable i explained by shocks in variable j, at quantile τ. Let ei be a K × 1 zero vector with unity at its i-th position. Since the row sum of does not necessarily equal one, normalization is required. This is achieved by dividing each element by its respective row sum, resulting in the scaled GFEVD (gSOTi←j,τ(H)), as per Diebold and Yilmaz (2012).

Central to the connectedness methodology of Gabauer and Stenfors (2024), the scaled GFEVD provides the means to quantify total directional connectedness both to and from other series. The TO connectedness quantifies the influence exerted by a given series on the rest of the sample (cf. Equation (4)), while the FROM connectedness measures the cumulative effect of all other series on the series of interest (cf. Equation (5)). These measures, calculated from the scaled GFEVD, offer a systematic approach to assessing the direction and magnitude of market interconnectedness.

To quantify the net effect of a series within the connectedness framework, the NET total directional connectedness is calculated as the difference between the TO and FROM measures, as formalized in Equation (6). The TO component indicates the directional impact of the series on others, while the FROM component represents the influence exerted by all other series on the one in question. Thus, the NET measure captures the balance between these two directional effects. Specifically, represents the directional generalized spillover transmitted from variable i to all other variables at quantile . Similarly, represents the directional generalized spillover transmitted from all other variables to variable i at quantile

In the bivariate setting as in this study, a positive value of the NET directional connectedness measure indicates that series i transmits more shocks to series j than it receives from j. Thus, series i functions as a net transmitter of shocks. Conversely, a negative NET measure implies that series i receives more shocks from series j than it transmits, thereby identifying i as a net receiver of shocks. Equation (7) yields the adjusted Total Connectedness Index (TCI) of Chatziantoniou et al. (2021), which quantifies the overall degree of interconnectedness in the system. Higher TCI values indicate greater market-wide risk.

Primary reason quantile-on-quantile (QQ) connectedness framework is being used for this analysis banks on its ability to capture the complex and often asymmetric ways that financial and macroeconomic variables interact; not just on average, but at different points of their distributions. Unlike the well-known Diebold-Yilmaz (DY) approach developed in Diebold and Yılmaz (2014), which looks at average (mean-level) relationships through a standard VAR model, the QQ-VAR framework explores how these connections behave in the extremes—such as during times of market stress or calm.

This is particularly important for financial markets, where what happens at the tails, the most extreme highs and lows—can reveal risks that are not obvious if we only look at average behavior. By examining relationships across a range of quantiles, the QQ framework provides us a perspective to help identify the difference between routine market movements and those that signal high uncertainty or the onset of a crisis. It enables us to pinpoint when markets are more vulnerable to transmitting severe shocks, as opposed to just normal fluctuations.

Furthermore, the QQ-VAR framework is comparatively flexible because it does not require the strong distributional or parametric assumptions typically imposed in standard time-series models. Unlike methods that rely on specifying a particular volatility process such as GARCH-type models, the QQ-VAR does not model conditional variance directly and therefore does not assume a fixed form for how volatility evolves over time. Instead, it operates across quantiles and allows the dependence structure between variables to vary throughout the distribution. This enables the model to capture differences in how shocks propagate during periods of market stress versus stability, as well as to accommodate nonlinearities and potential structural changes that are common in financial data. QQ-VAR model does not model the volatility however see the connectedness of return volatility among different quantiles between different time series.

By embracing the diversity of spillover effects throughout the entire distribution—not just the center—the QQ-VAR framework gives us a richer and more realistic perception of financial market interconnectedness. This deeper perspective is crucial not only for academic research but also for practical tasks like managing risk, designing policy responses, and anticipating rare but impactful market events. Building on this methodological foundation, the next section presents the empirical results, highlighting how these quantile-specific interconnections evolve over time and under different market conditions.

4. Empirical Findings

In this section, the empirical results are obtained using a 200-day rolling-window Quantile Vector Autoregressive (QVAR) model with a forecast horizon of 20 steps ahead (H = 20). The estimations are conducted separately for each bivariate specification, with the three FinTech indices serving as dependent variables. This framework allows for the investigation of the dynamic interconnections between FinTech performance and bonds with varying credit ratings across different quantiles of the return distribution.

The lag order of the model is set to p = 1, selected according to the Bayesian Information Criterion (BIC), which provides a parsimonious specification while ensuring robustness in financial time series analysis. The use of a rolling-window approach accounts for potential structural breaks, regime shifts, and evolving market dynamics, thereby capturing time-varying relationships that may be overlooked in static models.

From a methodological perspective, the QVAR framework extends the traditional VAR by allowing for the modeling of conditional quantiles rather than conditional means. This feature is particularly advantageous in financial applications, as it enables the analysis of tail dependencies, asymmetric spillovers, and heterogeneous responses across different market states (e.g., bearish, normal, and bullish conditions). Consequently, QVAR provides a more comprehensive understanding of the dependence structure and risk transmission mechanisms between FinTech indices and bond markets compared to mean-based linear models.

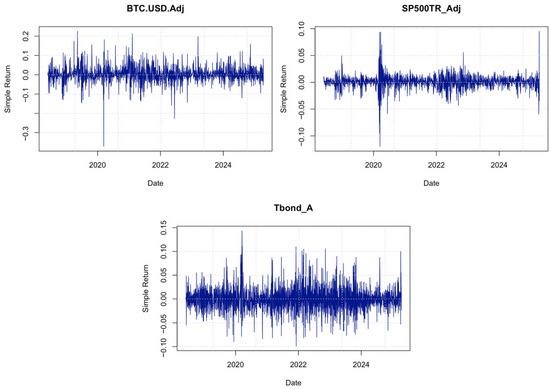

4.1. Total Connectedness Indices

Figure 2 shows the dynamic total connectedness of each FinTech variable with the 4 independent variables in each bi-variate case. The quantiles range from 0.05 till 0.95 in gaps of 0.05. Panel on the right shows the total connectedness of KLDGER FinTech variable which comprise companies that involve in distributed ledger services and different types of U.S. Bonds in with different credit ratings. The middle section shows the total connectedness of the KALFIN FinTech variable, which comprises companies that provide alternative financing and different types of U.S. Bonds in with different credit ratings. Finally, the rightmost column shows the total connectedness of KPYMNTS FinTech variable which comprise companies providing products or services for general-purpose platforms allowing consumers to transact with a digital balance, and different types of U.S. Bonds in with different credit ratings. For reading the graphs, areas of intense connectedness appear in dark blue, whereas lighter and near-white tones correspond to minimal interdependence.

Figure 2.

TCI for all dependent variables on independent series bi-variate cases. Note: Darker cells represent higher connectedness. The results are derived from a QVAR(τ1,τ2) model estimated over a 200-day rolling window, with the lag order selected as one according to the BIC. Forecasts are computed 20 steps ahead. The analysis spans quantiles from 0.05 to 0.95, in increments of 0.05.

The peak average total connectedness can be seen as 95% with the variables KPYMNT and SP500TR between direct quantiles (τ1 = 0.95; τ2 = 0.95). The lowest values come from the middle quantiles, suggesting that nonextreme values do not have much interconnectedness. However, the tails of each return are highly connected. Moving deeper into the analysis, we will continue analyzing each dependent variable and its connected to each of the independent variables.

Considering the KLDGER variable which includes companies with ledger distribution such as blockchain technology, the connectedness with SP500TR and BTC is the highest in direct quantiles for both (τ1 = 0.05; τ2 = 0.05 and τ1 = 0.95; τ2 = 0.95). The connectedness is slightly higher for SP500TR. The relationship is similar for 10-year benchmark U.S. bonds. However, the U.S. treasury bonds of ratings A are quite the opposite which shows that inversely related quantile connectedness is slightly greater than the direct quantiles (τ1 = 0.05; τ2 = 0.95 and τ1 = 0.95; τ2 = 0.05).

For the KALFIN index, which represents firms engaged in alternative financing (e.g., peer-to-peer lending, crowdfunding), the connectedness structure largely mirrors that of KLDGER. Specifically, SP500TR and BTC exhibit strong direct quantile connectedness, highlighting their alignment with riskier asset classes. Meanwhile, A-rated bonds consistently demonstrate inverse quantile connectedness, again emphasizing a flight-to-quality phenomenon during stress conditions. The 10-year benchmark bonds exhibit notable direct connectedness, suggesting that alternative finance is more exposed to macroeconomic and interest rate shocks compared to digital ledger technologies.

A more distinct pattern emerges for the KPYMNT index, which captures firms providing digital payments infrastructure. Here, all bonds exhibit inverse quantile connectedness, and the magnitudes are substantially stronger compared to KLDGER and KALFIN. This indicates that high returns in payment-oriented FinTech companies are associated with lower bond returns, reflecting a potential substitution effect between traditional fixed-income instruments and payment innovations. The evidence also points toward capital reallocation dynamics, where investor preferences shift between bond markets and high-growth FinTech payment providers, particularly during extreme quantile movements. Conversely, SP500TR and BTC maintain strong positive connectedness at direct quantiles, implying that the payments segment behaves more like an equity- and crypto-linked growth sector than a traditional financial service.

Taken together, the results highlight several important patterns:

- Asymmetric Connectedness: Stronger connectedness at extreme quantiles underscores the nonlinear and tail-dependent nature of FinTech–bond interactions, consistent with financial contagion and stress-period co-movement theories.

- Equity and Crypto Alignment: FinTech indices—especially KLDGER and KALFIN—are more tightly linked to SP500TR and BTC, suggesting that these sectors behave like growth-oriented, high-risk assets rather than defensive investments.

- Bond Market Divergence: The inverse quantile connectedness with A-rated bonds, especially for KPYMNT, reflects a flight-to-quality effect and highlights the risk-hedging properties of safer fixed-income securities.

- Segment-Specific Dynamics: The payments sector (KPYMNT) shows the strongest divergence from bond markets, implying that innovations in digital transactions may act as a substitute for traditional debt markets from an investor allocation perspective. From a portfolio diversification perspective, the findings suggest that FinTech assets, particularly payment-related firms, can provide diversification benefits against bond-heavy portfolios, but only under normal conditions. In times of stress, however, the strong tail dependence indicates that these assets may co-move with equities and cryptocurrencies, thereby limiting their safe-haven potential. For policymakers and regulators, the asymmetric relationships imply that shocks in the FinTech sector could propagate differently depending on the segment—posing greater systemic risks through payment platforms relative to distributed ledger or alternative finance firms.

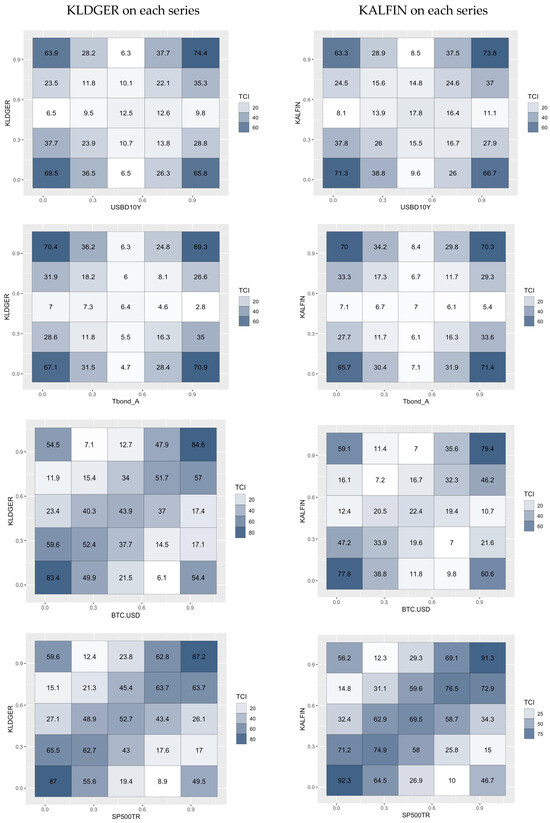

4.2. Net Directional Connectedness

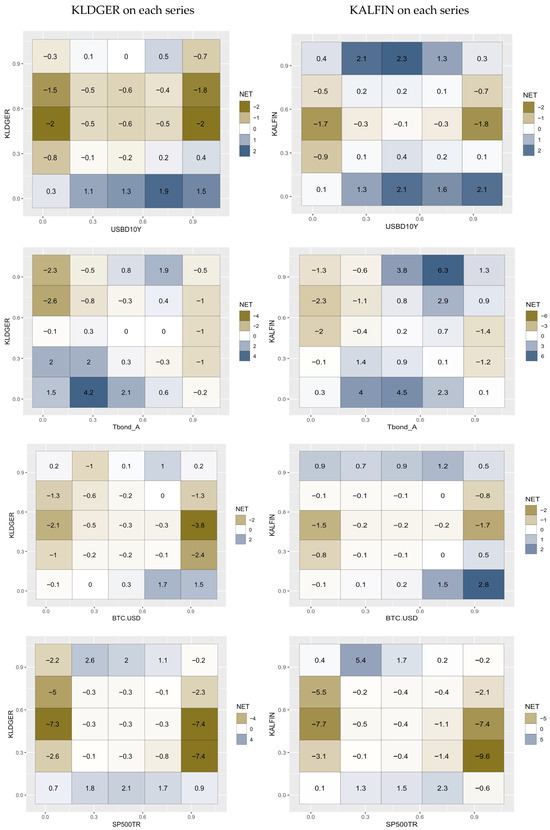

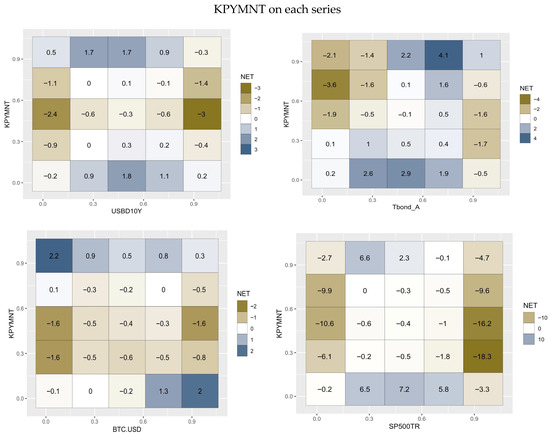

Figure 3 illustrates the net directional connectedness across bivariate cases for each FinTech index against the independent variables. The trichromatic gradient shows blue for positive spillovers (FinTech indices as net transmitters), gold for negative spillovers (independent variables as net transmitters), and white for values near zero.

Figure 3.

NET for all dependent variables on independent series bi-variate cases. Note: The net directional spillover measures across quantiles from a QVAR(τ1,τ2) model estimated over a 200-day rolling window, with the lag order selected as one according to the BIC. Forecasts are computed 20 steps ahead. The analysis spans quantiles from 0.05 to 0.95, in increments of 0.05.

The figure confirms that BTC and SP500TR consistently emerge as strong net transmitters, while U.S. Treasury bonds (both A-rated and the 10-year benchmark) tend to act as net receivers. Importantly, the KALFIN index exhibits the highest overall transmission intensity, highlighting the vulnerability of alternative finance firms to external market shocks. In contrast, the KPYMNT index shows more asymmetric dynamics, with pronounced inverse connectedness against bonds.

4.2.1. U.S. 10-Year Benchmark Bonds

For the 10-year Treasury yields, the results show moderate gold shading in several lower quantiles (northwest corners), particularly for KLDGER and KPYMNT, suggesting that these bonds often transmit shocks into FinTech sectors when yields are at low levels. However, the effects are weaker compared to equities and BTC, implying that benchmark rates serve as secondary transmitters.

4.2.2. Credit Risk

Credit risk more pronounced negative spillovers (gold zones), especially in the northwest quantiles of KLDGER and KALFIN. This indicates that when A-rated bonds experience lower quantile returns, they transmit shocks to FinTech indices, reflecting the default risk premium channel. At higher quantiles, however, the connectedness often shifts to blue, suggesting that FinTech variables can also act as transmitters in bullish bond environments.

4.2.3. Bitcoin (BTC)

Contrary to expectations of high volatility, Bitcoin shows moderate but localized transmission effects. For KLDGER, BTC transmits positively (blue) in the upper quantiles, consistent with their shared technological foundation in blockchain. For KPYMNT, however, BTC’s spillovers are weaker, suggesting a less direct link between cryptocurrency and digital payment platforms.

4.2.4. S&P 500 Total Return Index (SP500TR)

The equity market spillovers are by far the strongest. In particular, the KALFIN index displays large negative values (deep gold) at (τ1 = 0.275; τ2 = 0.95, indicating that SP500TR dominates as a net transmitter into FinTech sectors under bullish conditions. Similarly, for KPYMNT, extreme negative values appear in the lower quantiles (−18.3–18.3−18.3), reinforcing the dominance of equity markets over payment-based FinTech firms. The KLDGER index also receives strong spillovers, though less intense than KALFIN or KPYMNT.

4.2.5. Segment-Specific Insights

- KLDGER (Distributed Ledger Technologies): More sensitive to BTC and SP500TR, reflecting blockchain–crypto–equity linkages.

- KALFIN (Alternative Finance): Exhibits the highest connectedness overall, strongly influenced by equity markets and moderately by bonds, underscoring its exposure to systemic financial risks.

- KPYMNT (Digital Payments): Shows the sharpest negative spillovers from SP500TR, suggesting strong competition or substitution effects between equity markets and payment innovations.

4.2.6. The Net Connectedness Analysis Provides Several Key Insights

- Equity dominance: SP500TR consistently emerges as the strongest net transmitter, with especially intense effects on KALFIN and KPYMNT.

- Crypto–ledger linkage: BTC spillovers are most relevant for KLDGER, consistent with blockchain-related interdependencies.

- Bond asymmetry: Treasury instruments act as conditional transmitters, with A-rated bonds transmitting risk premia at lower quantiles, while 10-year benchmark yields show more balanced but weaker effects.

- FinTech heterogeneity: Payment firms (KPYMNT) are more vulnerable to equity spillovers, alternative finance (KALFIN) to systemic shocks, and distributed ledger firms (KLDGER) to crypto-market dynamics.

It is noted that Payment-focused FinTech companies exhibit stronger equity dependence because their underlying business models are fundamentally tied to transaction volume, macroeconomic momentum, and investor sentiment, factors that closely track equity market cycles. Unlike alternative finance or distributed-ledger firms, whose performance is shaped by credit conditions or blockchain-specific technological shifts, digital payment firms grow primarily by expanding user adoption, merchant integration, and platform activity. These drivers accelerate in bullish environments characterized by higher consumer spending, increased e-commerce transactions, and strong capital inflows into growth-oriented technology sectors. As a result, payment-oriented FinTech behaves like a high-beta technology subsector, responding more directly to equity valuations, liquidity conditions, and shifts in market-wide risk appetite. The pronounced equity dependence also reflects the relative absence of intrinsic hedging mechanisms within payment firms: unlike blockchain-related firms that can partially anchor value to crypto-market cycles or alternative-finance firms that are linked to credit provisioning, payment companies offer services that correlate closely with aggregate economic activity and thus inherit the cyclical exposure of equity markets.

4.2.7. Portfolio Implications

From an investment perspective, these results highlight important trade-offs for portfolio diversification. The fact that equity markets (SP500TR) dominate as net transmitters implies that FinTech indices provide limited diversification benefits when paired with equities, particularly during extreme market conditions. Conversely, the inverse connectedness between FinTech indices and credit risk suggests that high-grade bonds may still function as a diversification option against FinTech-related risks, though their effectiveness diminishes under stress. The relatively modest transmission from Bitcoin—except toward blockchain-related firms—implies that crypto exposure does not always amplify systemic risk across the broader FinTech sector. Overall, investors seeking to diversify across FinTech, equities, and bonds should recognize the quantile-dependent and asymmetric nature of spillovers, as diversification benefits are strongest in moderate regimes but can collapse in tail events.

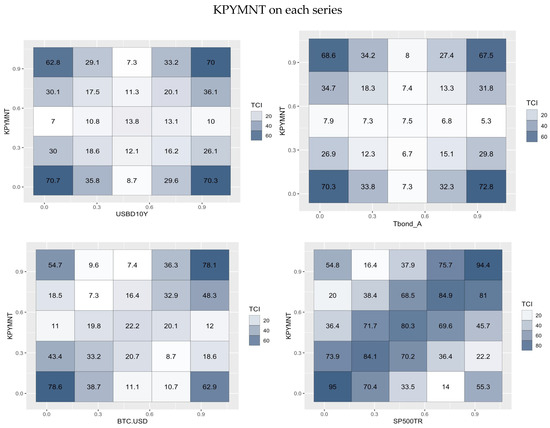

4.2.8. Dynamically Related Total Connectedness Indices

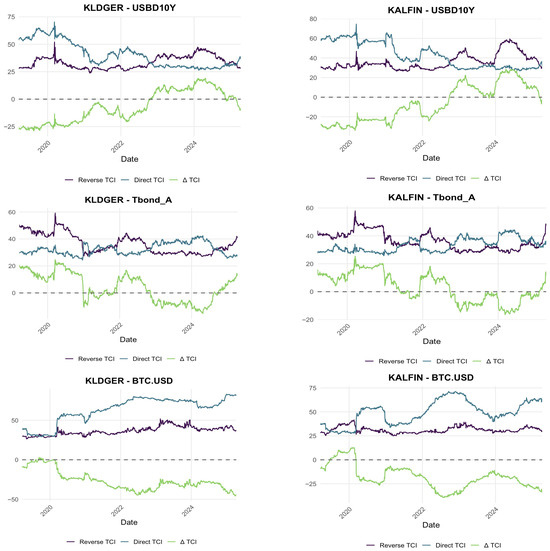

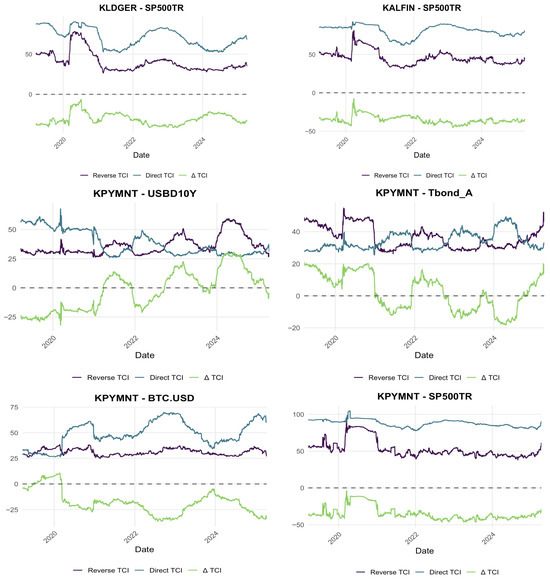

Figure 4 plots the time-varying dynamics of direct and reverse Total Connectedness Indices (TCI), along with their differences (∆TCI), for each FinTech index against U.S. bonds, Bitcoin, and the S&P 500. The results show that distributed ledger firms (KLDGER) are persistently dominated by spillovers from Bitcoin, with ∆TCI remaining negative during the crypto boom of 2020–2021 and turning sharply more negative during the downturn following the FTX collapse in late 2022, reflecting the structural dependence of blockchain companies on cryptocurrency cycles. Following the failure of FTX in November 2022, FinTech indices experienced heightened negative spillovers from Bitcoin, reflecting credibility shocks and concerns over digital finance stability. Blockchain-oriented firms (KLDGER) were the most exposed due to their technological and sentiment linkage with crypto markets.

Figure 4.

Direct and Reverse Total Connectedness Indices, dependent variables on independent series bi-variate cases. Note: The dynamic directly and reversely related quantiles total connectedness indices are based on a QVAR(τ1,τ2) model estimated over a 200-day rolling window, with the lag order selected as one according to the BIC. Forecasts are computed 20 steps ahead. The analysis spans quantiles from 0.05 to 0.95, in increments of 0.05.

Against Treasury bonds, ∆TCI for KLDGER turns negative in early 2020 during the COVID-19 outbreak, indicating that bond markets acted as strong net transmitters amid a flight-to-safety episode, and again during the Federal Reserve’s tightening cycle of 2022–2023, underscoring the systemic influence of fixed-income markets during monetary policy shocks. During the COVID-19 pandemic (Q1 2020–mid-2021), spillovers from Treasury markets and equities into FinTech intensified sharply. This reflects strong flight-to-quality behavior and heightened sensitivity of FinTech firms to systemic risk. Digital ledger and alternative finance firms were heavily driven by crypto-equity sentiment during this stress period. The aggressive rate hikes of 2022–2023 shifted FinTech assets into strong net-receiver positions, indicating vulnerability to liquidity constraints and declining risk appetite. Spillover dominance from U.S. equity and bond markets highlights the dependence of FinTech growth on accommodative monetary conditions.

The alternative finance index (KALFIN) displays a similar pattern: Treasury markets dominated in early 2020, while equity spillovers intensified during the post-pandemic recovery, with SP500TR serving as the persistent transmitter after 2020. KALFIN also shows more bidirectional spillovers with Bitcoin compared to KLDGER, with ∆TCI fluctuating between positive and negative values, suggesting that alternative finance both absorbed shocks from crypto markets and transmitted them back during periods of stress. The digital payments index (KPYMNT) emerges as the most equity-sensitive, with ∆TCI against SP500TR overwhelmingly negative across the sample and reaching extreme values near –100 during the COVID-19 shock and again in late 2022, indicating that digital payments firms are almost entirely dictated by equity market dynamics. KPYMNT is also strongly affected by Treasury spillovers during crises, while Bitcoin spillovers become more pronounced after 2021 as the crypto cycle reversed. Taken together, the figure demonstrates that FinTech indices act as net transmitters only under stable conditions but become net receivers during systemic episodes such as the COVID-19 pandemic, the Fed’s rate hikes of 2022–2023, and the crypto collapse of 2022. These results highlight FinTech’s vulnerability to external market shocks, with blockchain firms most tied to crypto markets, alternative finance to both bonds and equities, and digital payments to equity cycles, limiting their potential role as diversifiers during periods of financial instability.

Figure 4 illustrates the dynamic total connectedness indices—both direct and reverse—between the FinTech indices and the selected benchmarks. The left column presents the relationships for the KLDGER index, the middle column for KALFIN, and the right column for KPYMNT, each paired with the USBD10Y, Tbond A, BTC.USD, and SP500TR series, respectively. Periods in which the reverse TCI exceeds the direct TCI correspond to strong negative associations between the respective series.

Figure 4 illustrates the dynamic total connectedness indices—both direct and reverse—between the FinTech indices and the selected benchmarks, with the left, middle, and right panels corresponding to KLDGER, KALFIN, and KPYMNT, respectively, each paired with the USBD10Y, Tbond A, BTC.USD, and SP500TR series. Periods in which the reverse TCI exceeds the direct TCI correspond to strong negative associations, highlighting episodes where external markets dominate FinTech dynamics. The relationships with the 10-year benchmark bonds (USBD10Y) are broadly positive from mid-2018 until around Q2 2022, after which alternating phases of positive and negative connectedness emerge. All three indices show a pronounced shift into negative correlation territory during Q4 2022, with KPYMNT experiencing the steepest decline, followed by a partial recovery in mid-2023, another downturn in early 2024, and a rebound into positive territory by Q1 2025. These fluctuations suggest that certain FinTech segments—particularly payment technologies—are highly sensitive to shifts in long-term yields and broader macro-financial conditions.

The Spread with A-Corp Bonds series(credit risk) displays a cyclical pattern, with moderately positive correlations from mid-2018 through late 2020, a sharp reversal into negative territory in early 2021, a rebound peaking in early 2023, and another downturn in Q4 2023. By early 2025, correlations are slightly positive for KLDGER and KALFIN, but remain marginally negative for KPYMNT, implying that even high-grade credit risk do not consistently provide safe-haven properties for FinTech exposures and instead reflect shifting monetary policy and risk sentiment. The Bitcoin relationships show predominantly positive connectedness with KLDGER and KALFIN, particularly during late 2019 to early 2020 and again in early 2024, whereas KPYMNT exhibits greater instability, with persistent negative associations from mid-2022 through early 2023 and another drop in Q1 2025. This divergence indicates that distributed ledger and alternative finance firms tend to move in tandem with cryptocurrency markets, while payment-oriented FinTech often decouples due to different adoption drivers and regulatory constraints. The SP500TR plots reveal consistently strong positive linkages with all three FinTech indices during the post-COVID recovery from late 2020 to mid-2021, following an initial dip toward negative territory during the onset of the pandemic in March 2020. Toward the end of the sample in May 2025, a similar pattern emerges, suggesting that equity market dynamics may again reflect recessionary conditions. Overall, the results demonstrate a complex and evolving structure of interconnectedness, with positive phases aligning with investor optimism and favorable macroeconomic conditions, and negative phases reflecting risk aversion, regulatory disruptions, or sector-specific shocks. The heterogeneity across KLDGER, KALFIN, and KPYMNT underscores the differentiated exposures within the FinTech sector and highlights the implications for diversification, hedging, and monitoring cross-market risk transmission during periods of heightened uncertainty.

The combined evidence from Figure 2, Figure 3 and Figure 4 highlights the asymmetric, quantile-dependent, and time-varying nature of connectedness between FinTech indices and traditional asset markets. The total connectedness results (Figure 2) show that spillovers are concentrated in the tails, with strong co-movements between FinTech indices, equities, and Bitcoin under extreme market conditions, while bond linkages are weaker and often inverse. The net connectedness analysis (Figure 3) further reveals that SP500TR and Bitcoin are the dominant net transmitters, while Treasury instruments act largely as receivers, except during stress episodes when credit risk premia or safe-haven flows reverse the transmission channel. The dynamic ∆TCI patterns (Figure 4) add an important temporal dimension, showing that FinTech indices act as net transmitters in stable periods but shift into net receivers during crises such as the COVID-19 pandemic, the Federal Reserve’s monetary tightening cycle of 2022–2023, and the crypto collapse in late 2022. Segmental differences are also evident: KLDGER is most sensitive to crypto cycles, KALFIN is influenced by both equities and bonds, and KPYMNT is overwhelmingly driven by equity market dynamics. Collectively, these findings suggest that FinTech markets are deeply integrated with global financial systems, but their exposure channels differ across subsectors, amplifying systemic vulnerabilities during stress events.

Taken together, the empirical evidence reveals a clear and meaningful segmentation within the FinTech ecosystem, with each subsector exhibiting a distinct pattern of interconnectedness with equities, bonds, and cryptocurrencies. Distributed-ledger firms (KLDGER) display the strongest alignment with Bitcoin and equity markets across both tails of the distribution, underscoring their dependence on blockchain-driven sentiment and broader risk-on dynamics. Alternative-finance firms (KALFIN) emerge as the most interconnected segment overall, absorbing substantial spillovers from SP500TR and, to a lesser extent, benchmark bonds; highlighting their heightened sensitivity to systemic market conditions, credit-risk premia, and macro-financial shocks. By contrast, payment-technology firms (KPYMNT) diverge sharply from bond markets, exhibiting consistently inverse connectedness across quantiles and the most pronounced vulnerability to equity-market spillovers, especially during stress episodes. This segment-specific structure implies that while all FinTech indices exhibit asymmetric and tail-dependent transmission patterns, the underlying channels differ substantively: blockchain firms are predominantly driven by crypto-equity cycles, alternative finance responds to both equity and fixed-income shocks, and digital payments are overwhelmingly shaped by equity dynamics. These heterogeneous spillover pathways highlight the importance of treating FinTech not as a homogeneous asset class but as a set of differentiated sectors with unique exposure profiles, systemic risk implications, and policy-relevant interdependencies.

Our findings align with established theories of financial contagion and tail dependence, which posit that cross-market linkages intensify under extreme stress conditions. The stronger spillovers observed in the lower and upper quantiles confirm tail-dependent shock transmission, while the tendency of FinTech indices to transition into net-receiver roles during major crises is consistent with contagion dynamics documented in prior literature. Moreover, the cyclical behavior of FinTech segments is heterogeneous. Distributed-ledger (KLDGER) and alternative-finance firms (KALFIN) behave predominantly as pro-cyclical assets, with spillovers from equities and Bitcoin strengthening during periods of elevated risk appetite and market expansion. In contrast, digital payment firms (KPYMNT) display more counter-cyclical linkages with bond markets in normal conditions, suggesting a temporary reallocation of capital toward payment technologies when fixed-income returns weaken. However, during systemic stress events such as COVID-19, the Fed tightening cycle, or the crypto-market collapse, all FinTech segments become pro-cyclical, thereby losing their diversification benefits and acting as net receivers of market shocks.

In conclusion, while FinTech indices contribute to the expansion and innovation of financial markets, their interconnectedness with equities, bonds, and cryptocurrencies limits their role as diversification instruments, particularly under tail-risk scenarios. Investors should recognize that FinTech assets provide diversification benefits only in tranquil periods but lose this advantage during crises when spillovers from equities and bond markets dominate. For regulators and policymakers, the results underscore the systemic importance of monitoring FinTech–equity and crypto–ledger linkages, as shocks from these markets can propagate quickly into FinTech sectors and amplify instability. Moreover, the asymmetric behavior of Treasury bonds highlights that safe-haven properties cannot be taken for granted, as credit risk and policy-driven shifts can reverse their role. Policymakers should therefore integrate FinTech exposures into broader systemic risk assessments, strengthen regulatory oversight of crypto–FinTech interactions, and encourage robust risk management practices in payment and alternative finance sectors. By recognizing these vulnerabilities, both market participants and regulators can better prepare for the potential amplification of financial shocks through FinTech channels, ensuring that innovation contributes to resilience rather than fragility in global markets.

5. Conclusions and Policy Implications

The empirical results demonstrate that the connectedness between FinTech indices and traditional financial markets is asymmetric, quantile-dependent, and time-varying. The total connectedness analysis indicates that spillovers are concentrated in the distribution tails, with FinTech indices showing strong co-movements with equities and Bitcoin under extreme market conditions, while the relationship with U.S. Treasury bonds is weaker and often inverse. The net connectedness findings reveal that the S&P 500 Total Return Index and Bitcoin act as the primary net transmitters of shocks into FinTech indices, whereas Treasury instruments typically function as net receivers except during stress periods, when safe-haven flows or heightened credit risk temporarily reverse the direction of spillovers. The dynamic ∆TCI analysis further highlights that FinTech indices serve as net transmitters during stable market conditions, but shift into net receivers during crises such as the COVID-19 outbreak, the Federal Reserve’s tightening cycle of 2022–2023, and the crypto crash following the FTX collapse. Segmental heterogeneity is also evident: distributed ledger firms (KLDGER) are most sensitive to cryptocurrency dynamics, alternative finance providers (KALFIN) respond strongly to both equity and bond markets, and digital payments firms (KPYMNT) are overwhelmingly influenced by equity market spillovers. These results collectively underscore the dual role of FinTech as both a transmitter of shocks under normal conditions and a receiver of systemic stress during periods of heightened volatility. Overall, the study emphasizes that FinTech innovation, while expanding financial opportunities, also introduces new channels of vulnerability. For regulators, the key policy implication is the need to integrate FinTech exposures into macroprudential surveillance frameworks, strengthen oversight of crypto–FinTech interactions, and ensure that risk management practices in FinTech-related firms are sufficiently robust to withstand external shocks. For investors, the results highlight the importance of recognizing the state-dependent nature of diversification benefits in FinTech, with tranquil periods offering opportunities for portfolio enhancement but crises exposing heightened co-movement risks. By situating FinTech within the broader financial system rather than as an isolated innovation-driven sector, these findings provide a foundation for both scholars and policymakers to better understand and mitigate the potential for FinTech to amplify systemic instability.

From a policy perspective, these findings carry important implications for both investors and regulators. For investors, the results suggest that FinTech assets provide limited diversification benefits in periods of financial stress, as their performance is largely dictated by equity and bond market spillovers. While they may offer some diversification potential in tranquil conditions, FinTech indices align more closely with risky growth-oriented assets, particularly equities and cryptocurrencies, under adverse shocks. For regulators and policymakers, the evidence highlights the systemic importance of FinTech–equity and crypto–ledger linkages, as shocks originating in these markets can rapidly propagate through FinTech channels and amplify financial instability. Moreover, the behavior of Treasury bonds demonstrates that even high-grade sovereign debt does not consistently act as a safe haven for FinTech exposures, as monetary policy shifts and changes in credit risk premia can alter the transmission mechanism. These results underscore the need for integrating FinTech exposures into systemic risk assessments, strengthening oversight of FinTech–crypto interactions, and developing macroprudential tools to address volatility spillovers. By recognizing these vulnerabilities, regulators can better mitigate contagion risks while ensuring that FinTech innovation contributes to the stability and resilience of global financial markets.

Despite its contributions, this study is not without limitations. First, the analysis is restricted to three S&P Kensho FinTech indices, which, although representative of distributed ledger technologies, alternative finance, and digital payments, do not capture the full breadth of the rapidly evolving FinTech ecosystem, such as insurtech, robo-advisory, or decentralized finance (DeFi). Second, the focus on daily data from 2018–2025 provides valuable insights into recent market dynamics, but longer historical datasets would allow for a deeper assessment of structural changes across different monetary policy regimes and crisis episodes. Third, while the quantile-based connectedness framework effectively captures nonlinear and tail-dependent spillovers, incorporating higher-dimensional models such as panel QVAR or network-based connectedness measures could further enrich the understanding of cross-market interactions. Future research could expand the scope by including a wider set of FinTech subsectors, examining cross-country comparisons to explore the role of institutional and regulatory environments, and assessing how emerging technologies such as central bank digital currencies (CBDCs) and tokenized assets may reshape FinTech–market linkages. By addressing these avenues, future studies can build on the current findings to provide a more comprehensive picture of FinTech’s role in global financial stability.

Author Contributions

M.S.K.: Conceptualization, methodology, validation, formal analysis, review and editing, visualization. O.E.: Conceptualization, writing, original draft preparation, data curation. N.M.W.: data curation, methodology, validation, review and editing. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data used in the article can be made available upon request and written authorization from the data providers due to their proprietary restrictions.

Use of Artificial Intelligence

During the preparation of this work, the authors used Chat GPT (OpenAI) to assist with sentence structure refinement and to check for spelling and grammatical errors. After using this tool/service, the authors reviewed and edited the content as needed and take full responsibility for the content of the publication.

Conflicts of Interest

The authors declare no conflict of interest.

Note

| 1 | https://www.mckinsey.com/industries/financial-services/our-insights/fintechs-a-new-paradigm-of-growth, accessed on 22 August 2025. |

References

- Abakah, Emmanuel Joel Aikins, Aviral Kumar Tiwari, Sudeshna Ghosh, and Buhari Doğan. 2023. Dynamic effect of Bitcoin, fintech and artificial intelligence stocks on eco-friendly assets, Islamic stocks and conventional financial markets: Another look using quantile-based approaches. Technological Forecasting and Social Change 192: 122566. [Google Scholar] [CrossRef]

- Abakah, Emmanuel Joel Aikins, Nader Trabelsi, Aviral Kumar Tiwari, and Samia Nasreen. 2024. Bitcoin, Fintech stocks and Asian Pacific equity markets: A dependence analysis with implications for portfolio management. The Journal of Risk Finance 25: 792–839. [Google Scholar] [CrossRef]

- Agustin, Grisvia. 2023. The Rise of Financial Technology and Its Credit Risk in Indonesia. International Journal of Accounting and Finance in Asia Pasific 6: 98–109. [Google Scholar] [CrossRef]

- Anginer, Deniz, and Celim Yildizhan. 2010. Is There a Distress Risk Anomaly?: Corporate Bond Spread as a Proxy for Default Risk. Development Research Group, Finance and Private Sector Development Team. Washington, DC: World Bank. [Google Scholar] [CrossRef]

- Assefa, Tibebe A., Omar A. Esqueda, and André Varella Mollick. 2017. Stock returns and interest rates around the World: A panel data approach. Journal of Economics and Business 89: 20–35. [Google Scholar] [CrossRef]

- Aydoğan, Berna, Gülin Vardar, and Caner Taçoğlu. 2022. Volatility spillovers among G7, E7 stock markets and cryptocurrencies. Journal of Economic and Administrative Sciences 40: 364–87. [Google Scholar] [CrossRef]

- Chan, Stephanie, and Yang Ji. 2020. Do interest rate liberalization and fintech mix? Impact on shadow deposits in China. China & World Economy 28: 4–22. [Google Scholar] [CrossRef]

- Chatziantoniou, Ioannis, David Gabauer, and Alexis Stenfors. 2021. Interest rate swaps and the transmission mechanism of monetary policy: A quantile connectedness approach. Economics Letters 204: 109891. [Google Scholar] [CrossRef]

- Chava, Sudheer, and Amiyatosh Purnanandam. 2010. Is Default Risk Negatively Related to Stock Returns? The Review of Financial Studies 23: 2523–59. [Google Scholar] [CrossRef]

- Chiu, Tzu-Ting, Yuyan Guan, and Jeong-Bon Kim. 2018a. The Effect of Risk Factor Disclosures on the Pricing of Credit Default Swaps. Contemporary Accounting Research 35: 2191–224. [Google Scholar] [CrossRef]

- Chiu, Wan-Chien, Chih-Wei Wang, and Juan Ignacio Peña. 2018b. Does the source of debt financing affect default risk? Review of Financial Economics 36: 232–51. [Google Scholar] [CrossRef]

- Chu, Yinxiao, and Jianxing Wei. 2023. Fintech Lending and Credit Market Competition. Journal of Financial and Quantitative Analysis 59: 2199–225. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Kamil Yilmaz. 2012. Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting 28: 57–66. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Kamil Yılmaz. 2014. On the network topology of variance decompositions: Measuring the connectedness of financial firms. Journal of Econometrics 182: 119–34. [Google Scholar] [CrossRef]

- Elliott, Graham, Thomas Rothenberg, and James Stock. 1992. Efficient Tests for an Autoregressive Unit Root. Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Elroukh, Ahmed W. 2023. Does banning cryptocurrencies affect stock markets? Studies in Economics and Finance 41: 998–1011. [Google Scholar] [CrossRef]

- Field, Jack, and A. Can Inci. 2023. Risk translation: How cryptocurrency impacts company risk, beta and returns. Journal of Capital Markets Studies 7: 5–21. [Google Scholar] [CrossRef]

- Finkelstein-Shapiro, Alan, Federico S. Mandelman, and Victoria Nuguer. 2022. Fintech Entry, Firm Financial Inclusion, and Macroeconomic Dynamics in Emerging Economies. IDB Working Paper Series. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4221531 (accessed on 29 August 2025).

- Gabauer, David, and Alexis Stenfors. 2024. Quantile-on-quantile connectedness measures: Evidence from the US treasury yield curve. Finance Research Letters 60: 104852. [Google Scholar] [CrossRef]

- Ghaemi Asl, Mahdi, Muhammad Mahdi Rashidi, and Seyed Ali Hosseini Ebrahim Abad. 2021. Emerging digital economy companies and leading cryptocurrencies: Insights from blockchain-based technology companies. Journal of Enterprise Information Management 34: 1506–50. [Google Scholar] [CrossRef]

- Gilchrist, Simon, and Egon Zakrajšek. 2012. Credit Spreads and Business Cycle Fluctuations. American Economic Review 102: 1692–720. [Google Scholar] [CrossRef]

- Gil-Corbacho, Azahara, María Mar Miralles-Quirós, and José Luis Miralles-Quirós. 2023. Stock market performance differences between fintech and traditional financial firms. Studies of Applied Economics 41. [Google Scholar] [CrossRef]

- Horobeţ, Alexandra, Irina Mnohoghitnei, Lucian Belaşcu, and Ionuț Marius Croitoru. 2023. ESG Reporting and Capital Market Investors: Insights from the Global Technology and Fintech Industries. Studies in Business and Economics 18: 178–95. [Google Scholar] [CrossRef]

- Indarwati, Septiana, and Agus Widarjono. 2021. The Determinant of Indonesian Stock Returns’ Volatility: Evidence from Islamic and Conventional Stock Market. Shirkah: Journal of Economics and Business 6: 277–96. [Google Scholar] [CrossRef]

- Iqbal, Muhammad, Arianto Muditomo, and Alindha Farezha. 2022. The Existence of Islamic Fintech in Encouraging National Economic Growth. Jurnal Ilmiah Ekonomi Islam 8: 3145–52. [Google Scholar] [CrossRef]

- Iqbal, Muhammad, Prameswara Samofa Nadya, and Saripudin Saripudin. 2021. Islamic Fintech Growth Prospects in Accelerating MSMEs Growth during the COVID-19 pandemic: Evidence in Indonesia. International Journal of Islamic Economics and Finance Studies 7: 126–40. [Google Scholar] [CrossRef]

- Jarque, Carlos M., and Anil K. Bera. 1980. Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Economics Letters 6: 255–59. [Google Scholar] [CrossRef]

- Kassner, Andreas Joel. 2024. Factors influencing investment into PropTech and FinTech—Only new rules or a new game? Journal of European Real Estate Research 17: 395–411. [Google Scholar] [CrossRef]

- Khan, Muhammad Tahir, Asaf Khan, Adnan Ahmad, and Obaid Ullah Bashir. 2018. Impact of Macroeconomic Factors on Stock Returns of KSE 100 Index. Journal of Business & Tourism 4: 133–45. [Google Scholar] [CrossRef]

- Klein, Tony, Hien Pham Thu, and Thomas Walther. 2018. Bitcoin is not the New Gold—A comparison of volatility, correlation, and portfolio performance. International Review of Financial Analysis 59: 105–16. [Google Scholar] [CrossRef]

- Koop, Gary, M. Hashem Pesaran, and Simon M. Potter. 1996. Impulse response analysis in nonlinear multivariate models. Journal of Econometrics 74: 119–47. [Google Scholar] [CrossRef]

- Li, Yinqiao, Renée Spigt, and Laurens Swinkels. 2017. The impact of FinTech start-ups on incumbent retail banks’ share prices. Financial Innovation 3: 26. [Google Scholar] [CrossRef]

- Ljung, M. Greta, and George E. P. Box. 1978. On a measure of lack of fit in time series models. Biometrika 65: 297–303. [Google Scholar] [CrossRef]

- McKinsey and Company. 2023. Fintechs: A New Paradigm of Growth. New York: McKinsey and Company, October 24, Available online: https://www.mckinsey.com/industries/financial-services/our-insights/fintechs-a-new-paradigm-of-growth (accessed on 22 August 2025).

- Moro-Visconti, Roberto. 2021. FinTech Valuation. In Handbook of Digital Finance and Financial Inclusion. Amsterdam: Elsevier, pp. 245–79. [Google Scholar] [CrossRef]

- Najaf, Khakan, Christophe Schinckus, and Liew Chee Yoong. 2021. VaR and market value of Fintech companies: An analysis and evidence from global data. Managerial Finance 47: 915–36. [Google Scholar] [CrossRef]

- Peltomäki, Jarkko. 2025. The Fintech Sector as an Investment: Old Wine in a New Bottle? Economic Notes 54: e70011. [Google Scholar] [CrossRef]

- Sadorsky, Perry. 2024. Using Precious Metals to Reduce the Downside Risk of FinTech Stocks. FinTech 3: 537–50. [Google Scholar] [CrossRef]

- Sharma, Meena, and Sakshi Khurana. 2025. Impact of Effective Generic Business Strategies on Probability of Default: A Study of NSE Listed Firms. NMIMS Management Review 33: 29–39. [Google Scholar] [CrossRef]

- Singh, Gurmeet, and Ravi Singla. 2023. Default Risk and Stock Returns: Evidence from Indian Corporate Sector. Vision: The Journal of Business Perspective 27: 347–59. [Google Scholar] [CrossRef]

- Smales, Lee A. 2019. Bitcoin as a safe haven: Is it even worth considering? Finance Research Letters 30: 385–93. [Google Scholar] [CrossRef]

- Xu, Lei, Qian Liu, Bin Li, and Chen Ma. 2022. Fintech business and firm access to bank loans. Accounting & Finance 62: 4381–421. [Google Scholar] [CrossRef]

- Zhang, Wenqi. 2021. Explain the Determinants of Credit Spreads in the US. Open Journal of Business and Management 9: 775–94. [Google Scholar] [CrossRef]

- Zhang, Ying, and Zixin Tong. 2023. Comparing the ARIMA and LSTM Models on the Stock Price of FinTech Companies. Academic Journal of Business & Management 5: 38–43. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).