Relationship Between Japanese Stock Market Behavior and Category-Based News

Abstract

1. Introduction

2. Objective of This Study

3. Data and Preliminary Findings

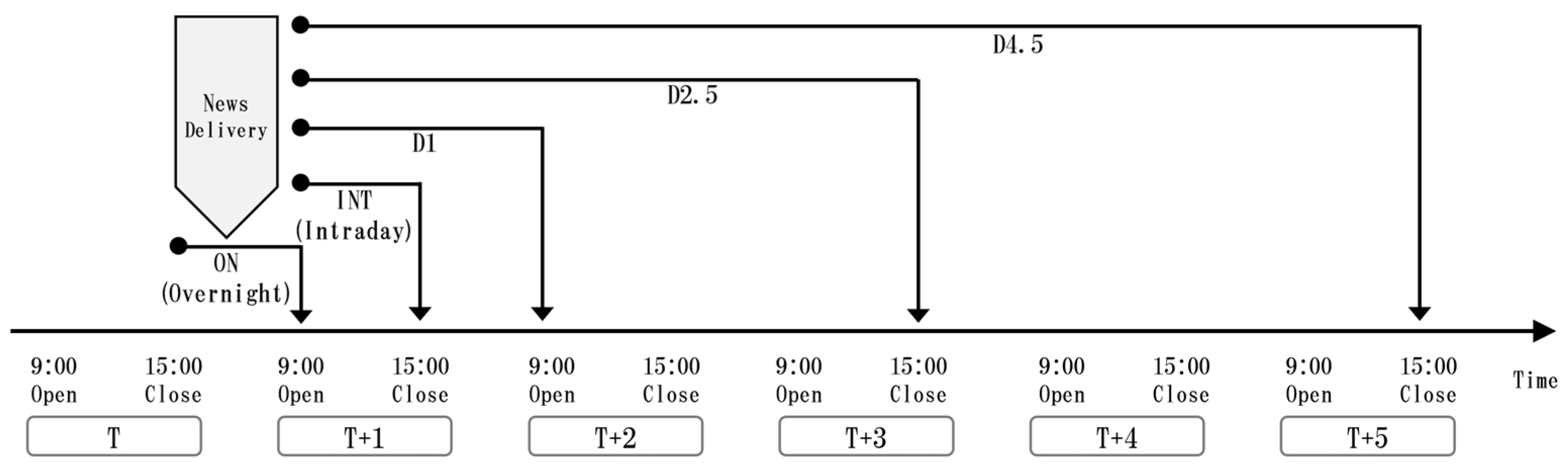

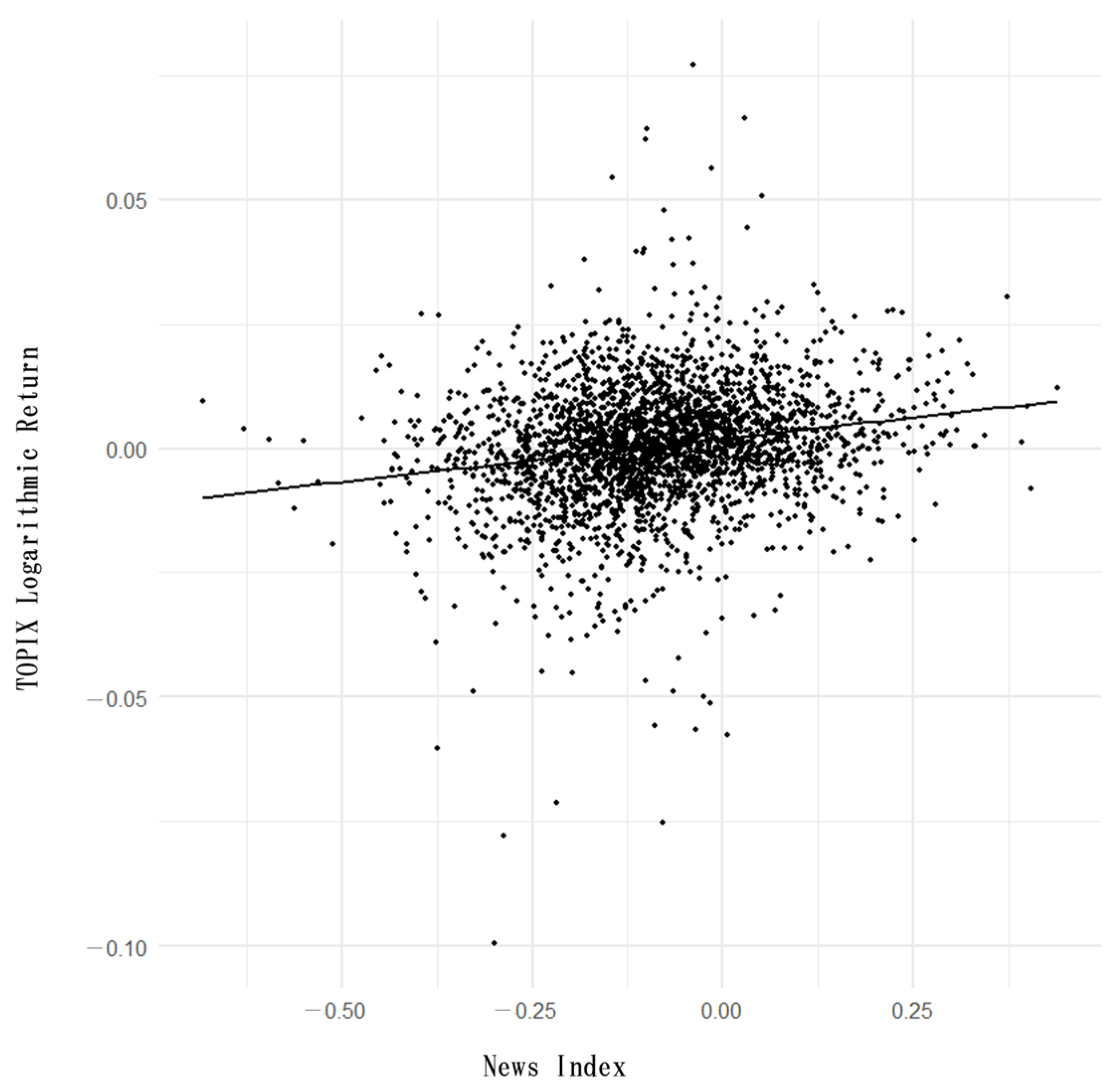

3.1. Relationship Between News Data and Stock Performance

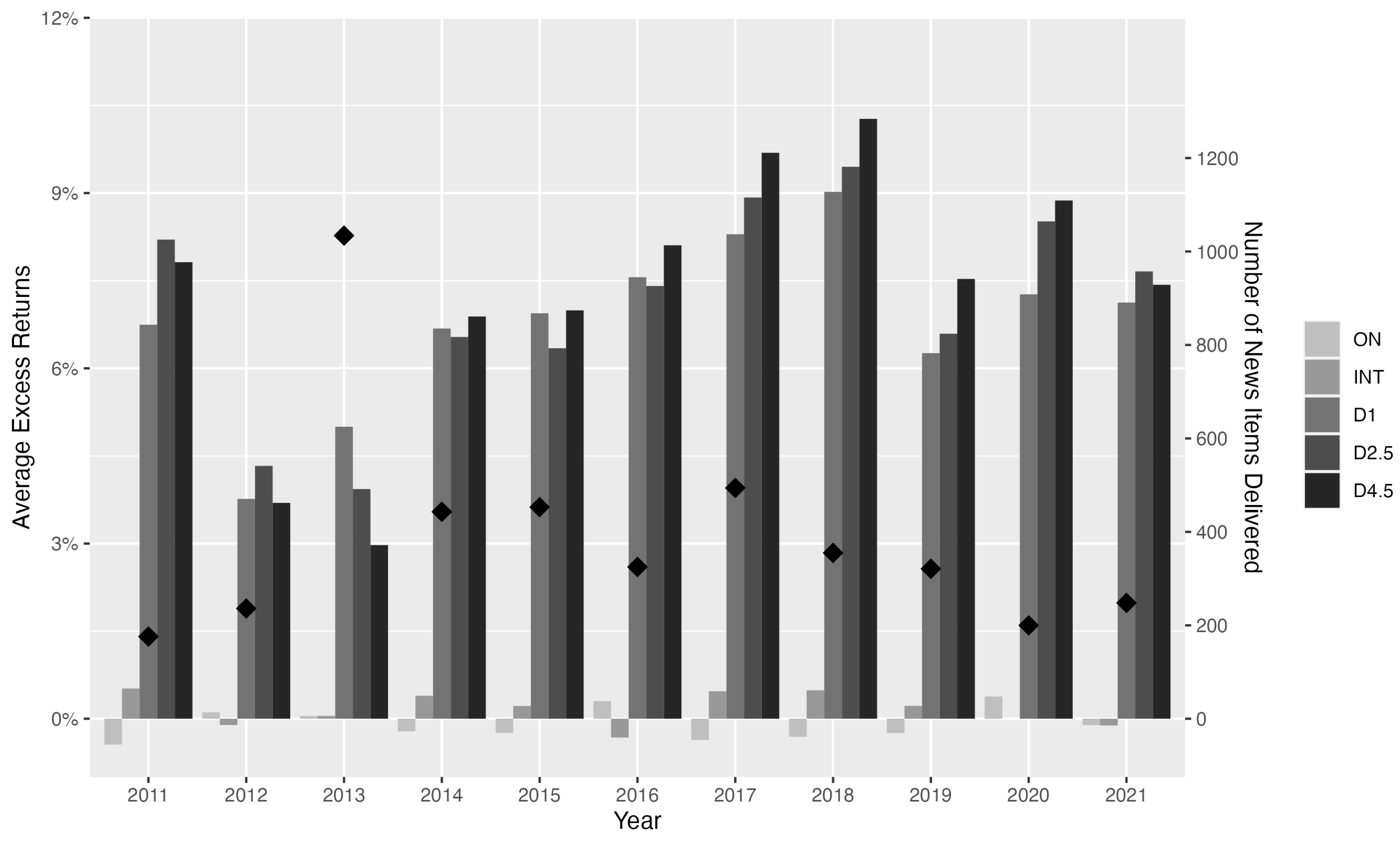

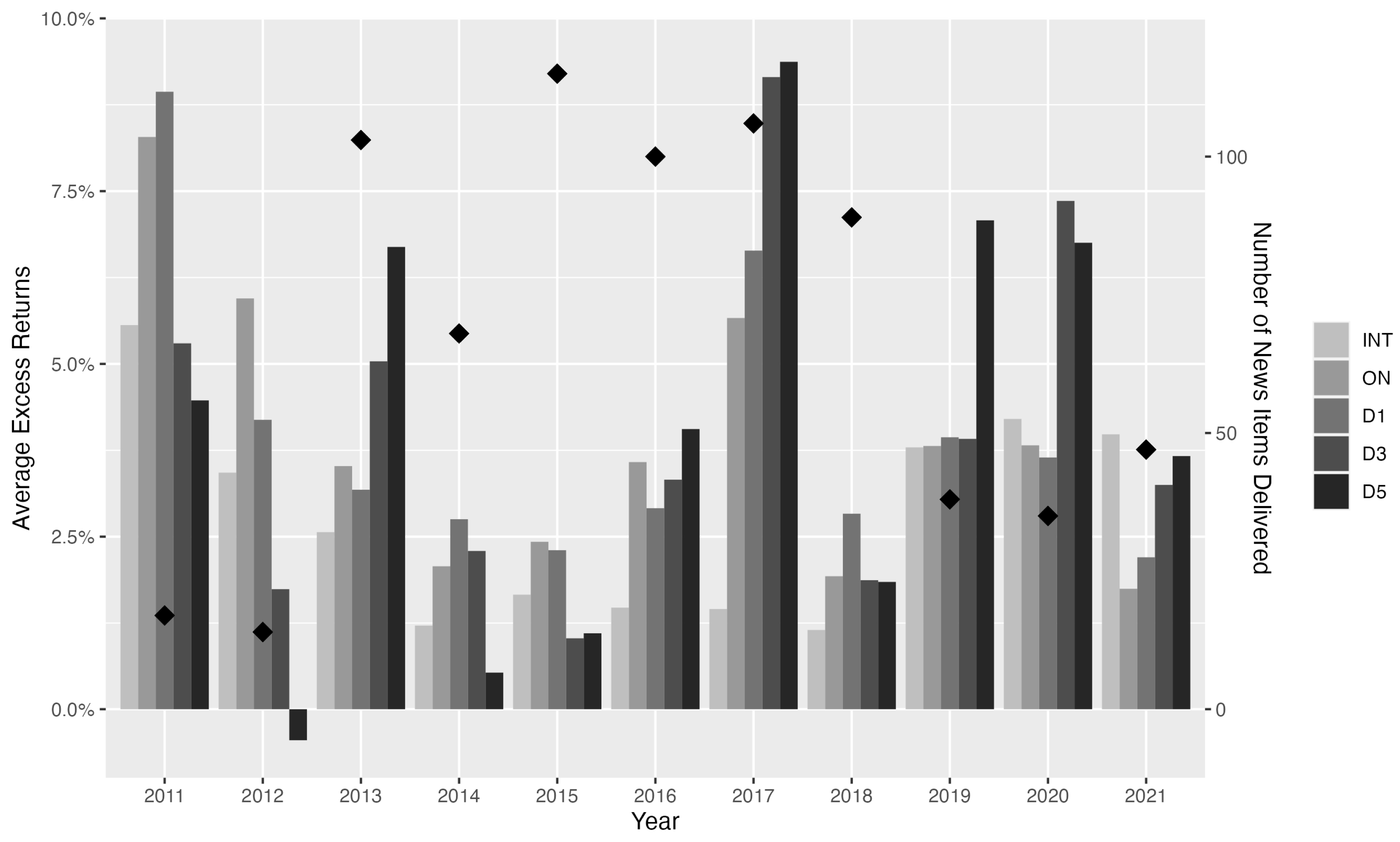

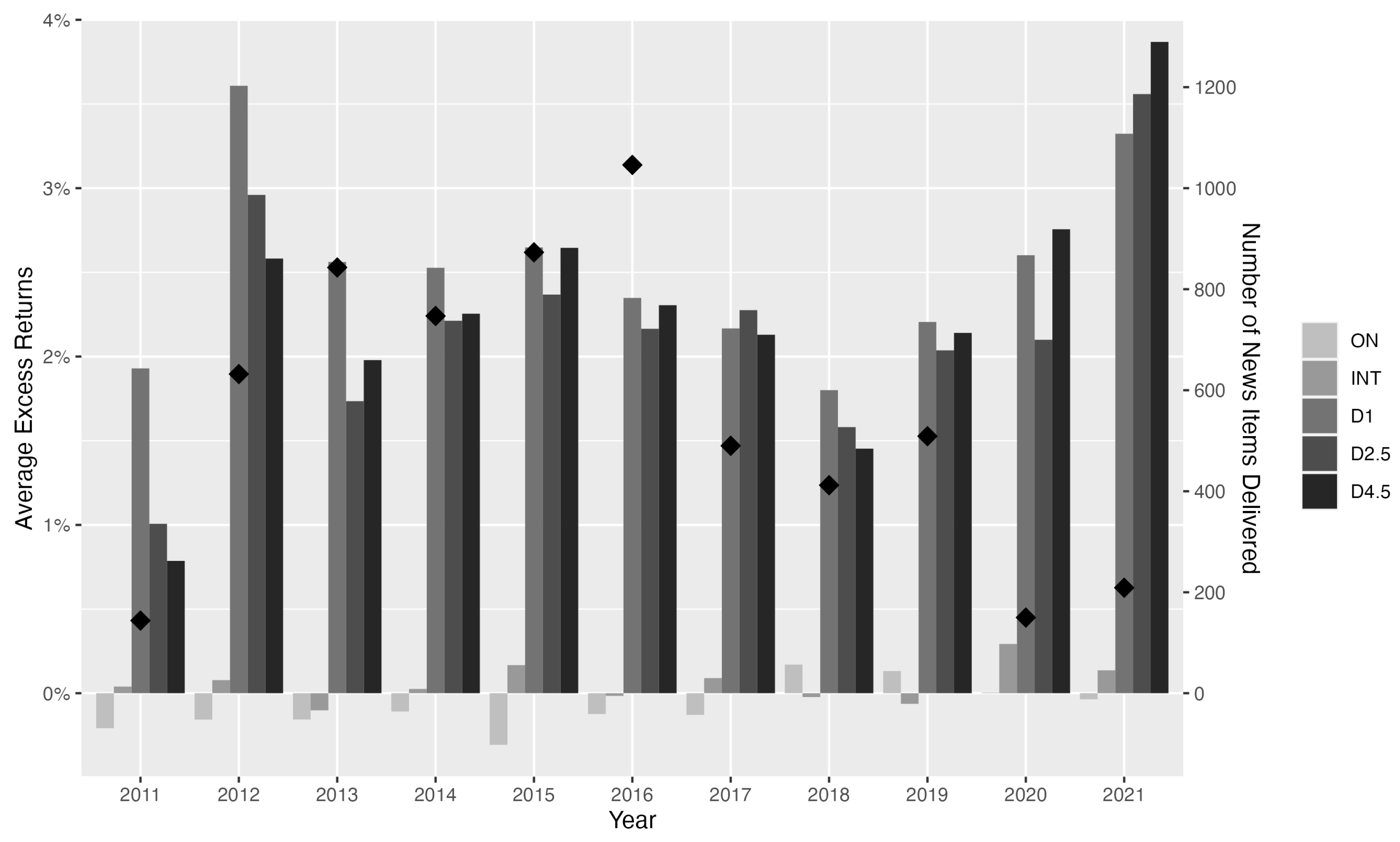

3.1.1. Average Excess Returns for News by Events and Score

3.1.2. Implications of the Analysis of Average Excess Returns

3.1.3. Effects of Each Company’s Market Capitalization

3.2. Detailed Performance of Each News Category

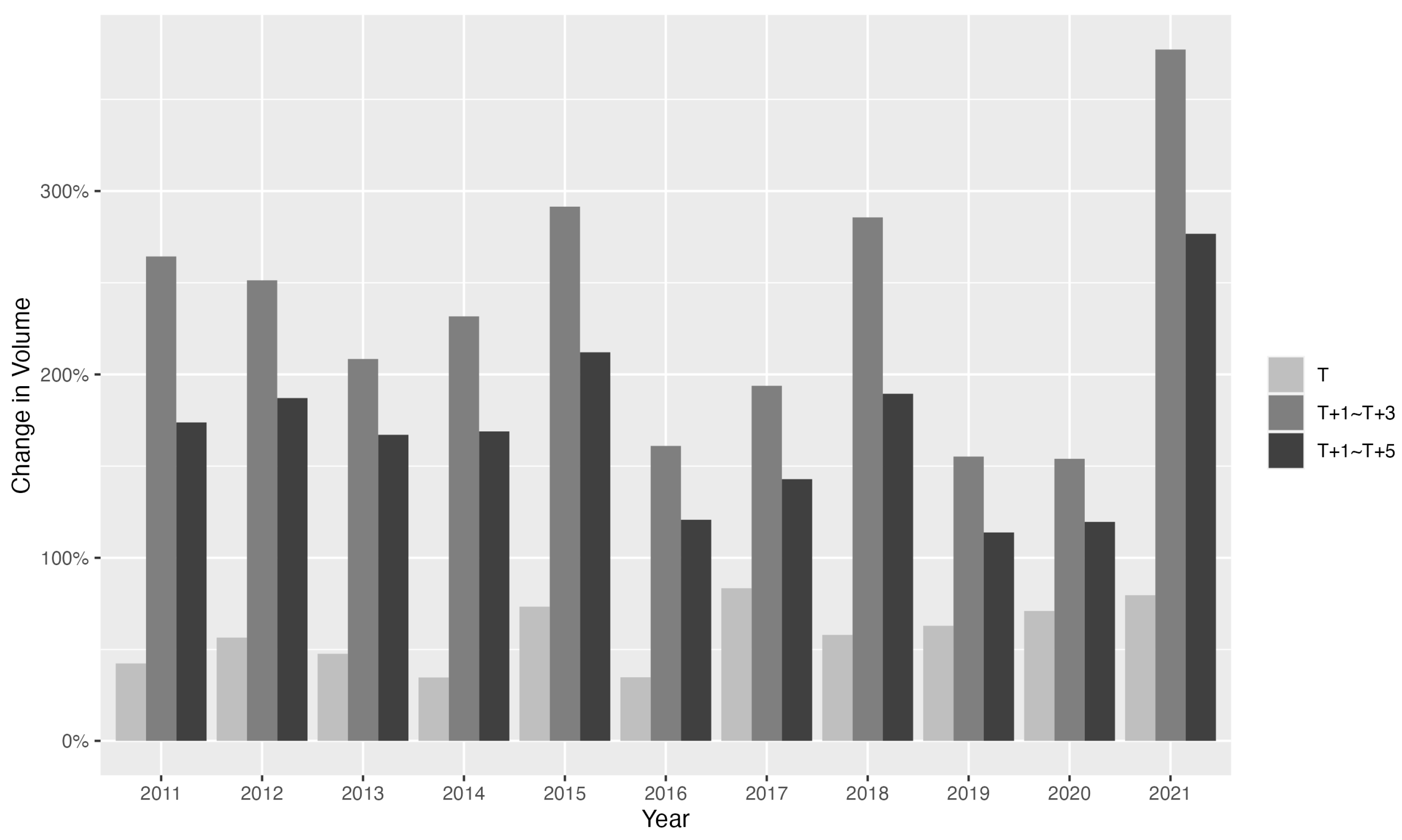

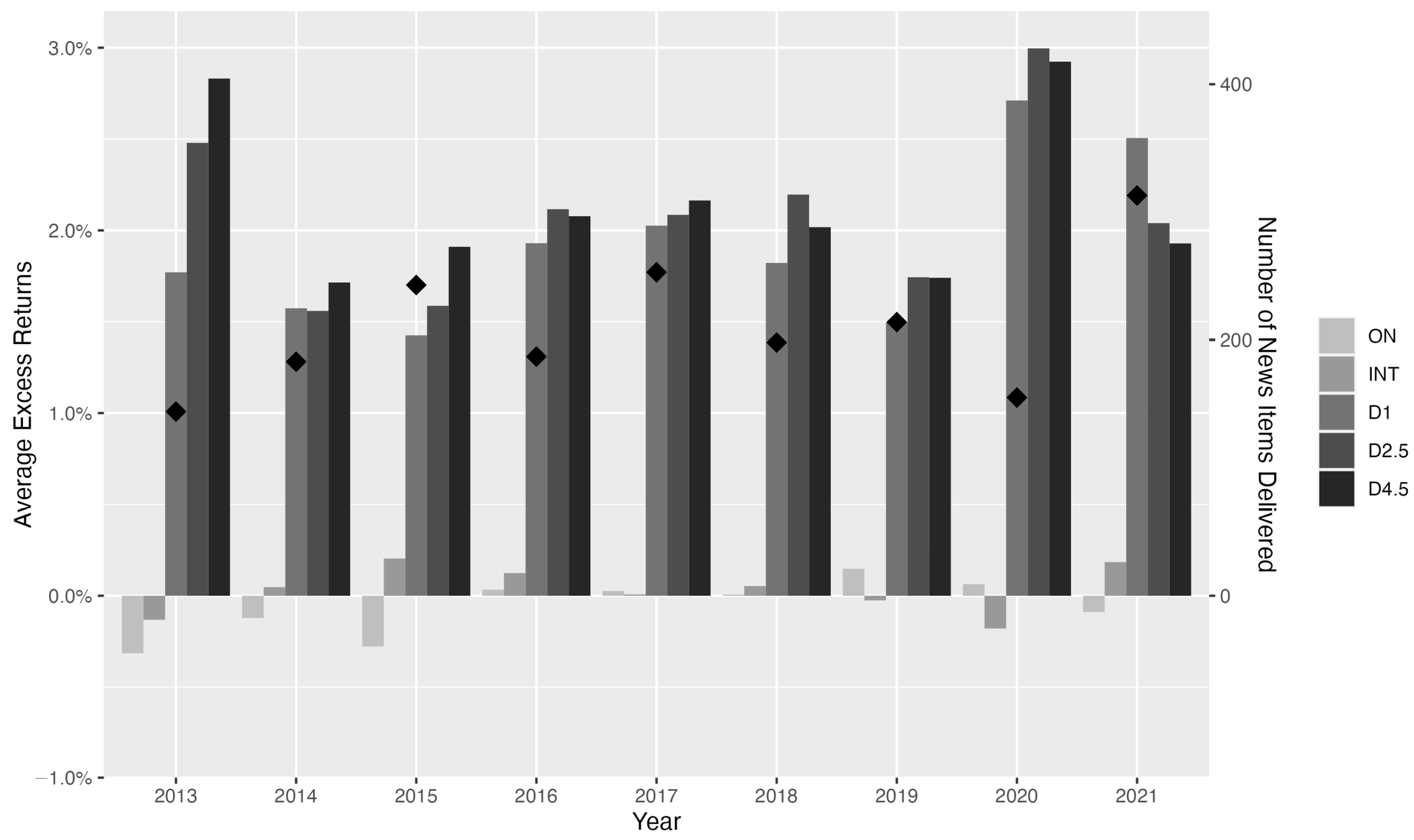

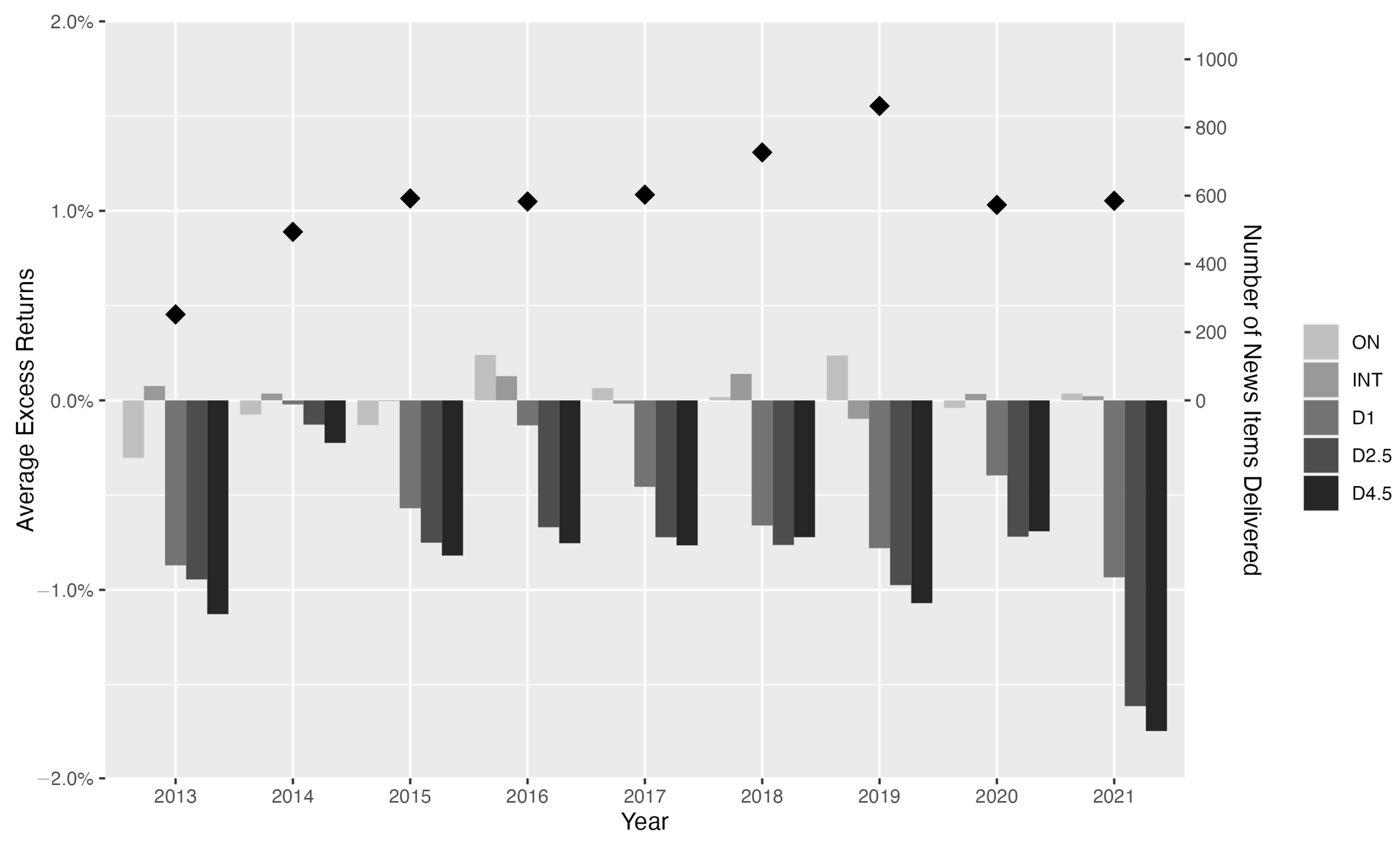

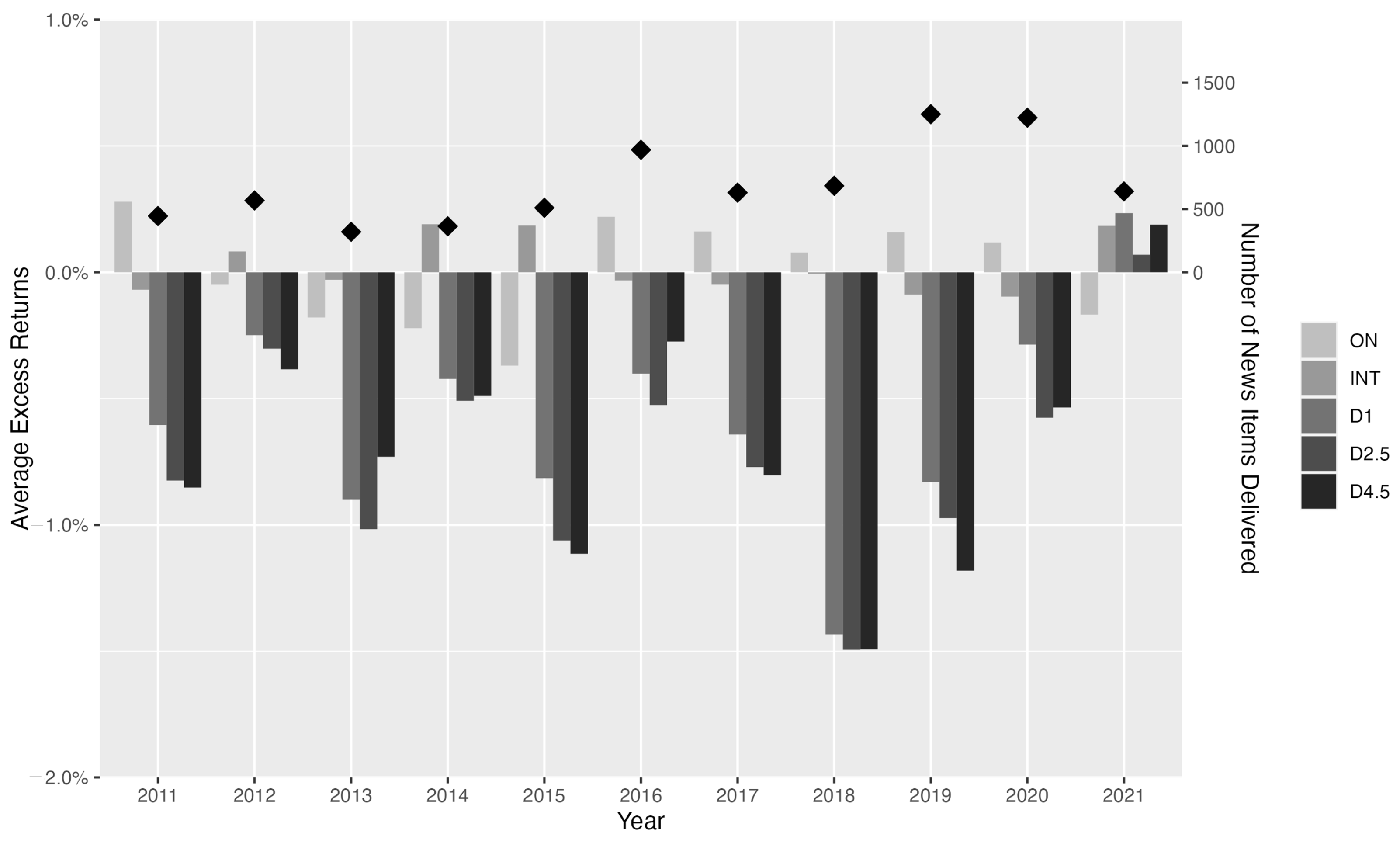

3.2.1. Stock Split

3.2.2. Buyback

3.2.3. Surprise

3.2.4. Profit Increase/Decrease

4. Method

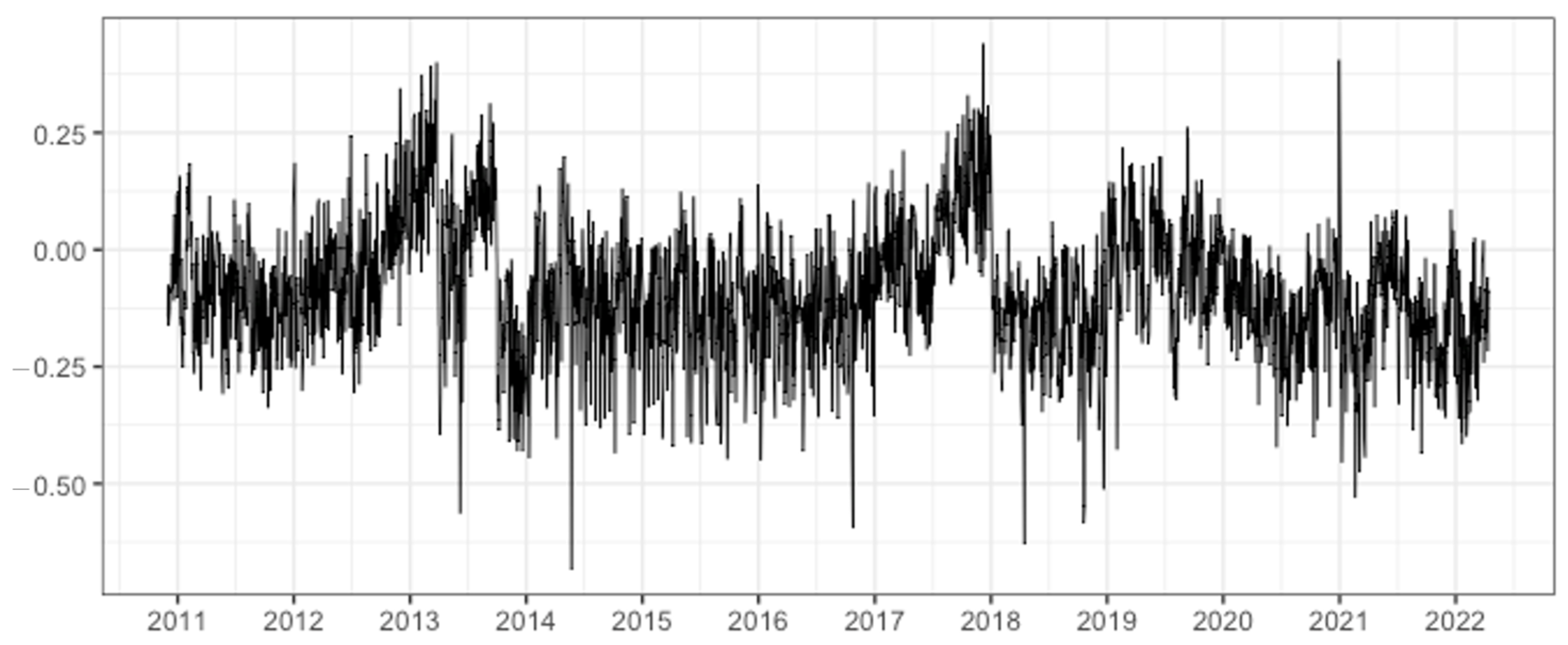

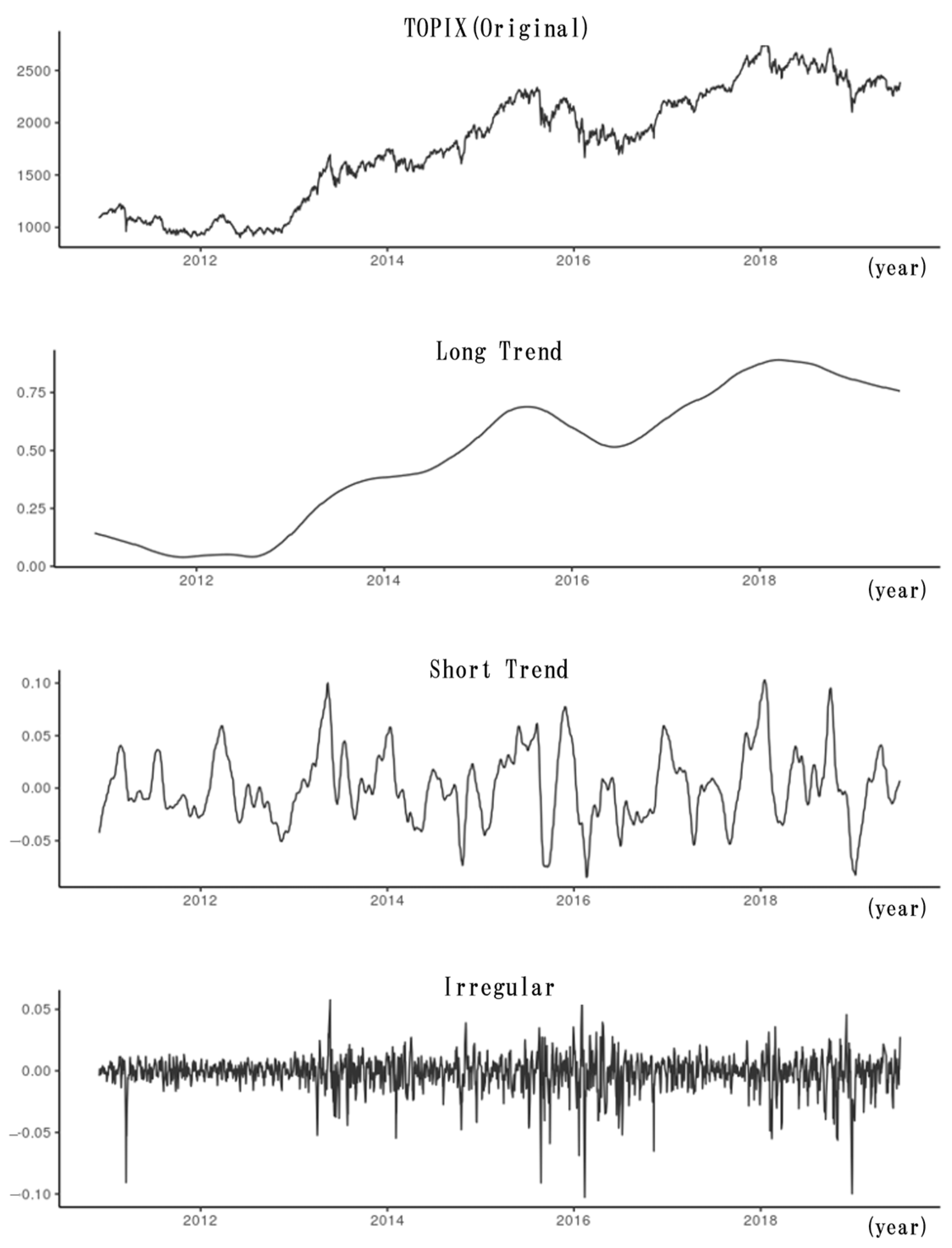

4.1. Create a News Index

4.2. Overview of the Investment Strategy

4.3. Trading Cost Incorporated in Performance

5. Result

5.1. Simulation Results Using All Categories

5.2. Simulation Results Excluding Specific Categories

5.3. Change in Investment Timing

6. Further Discussion

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Examination of the Size Effects on the Relationship Between Stock Performance and Category-Based News

| No. | News Tag | Average Score | INT (%) | ON (%) | D1 (%) | D3 (%) | D5 (%) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Small | Large | Small | Large | Small | Large | Small | Large | Small | Large | Small | Large | ||

| 1 | Market Rise | 87.1 | 83.7 | 2.3 | 0.7 | 3.4 | 0.7 | 2.4 | 0.6 | 2.1 | 0.6 | 1.5 | 0.6 |

| 2 | Market Decline | 14.0 | 17.8 | −2.4 | −0.6 | −2.0 | −0.7 | −2.9 | −0.8 | −4.7 | −0.8 | −5.6 | −0.8 |

| 3 | Increase in Large-Volume Holdings | 49.7 | 49.6 | 0.2 | 0.0 | −0.1 | 0.1 | −0.1 | 0.1 | −0.2 | 0.2 | −0.4 | 0.2 |

| 4 | Decrease in Large-Volume Holdings | 39.4 | 39.3 | −0.2 | 0.0 | 0.1 | 0.0 | 0.0 | 0.0 | −0.1 | 0.1 | −0.1 | 0.1 |

| 5 | Sales Increase | 56.5 | 54.6 | 0.1 | 0.0 | 0.1 | 0.1 | 0.1 | 0.1 | 0.5 | 0.0 | 0.5 | 0.1 |

| 6 | Profit Increase | 59.3 | 60.3 | −1.4 | 0.2 | −0.5 | 0.2 | −0.9 | 0.3 | −1.1 | 0.0 | −1.8 | 0.1 |

| 7 | Rise in Stock Rating | 76.6 | 83.2 | 1.0 | 0.2 | 1.2 | 0.3 | 0.7 | 0.4 | 1.2 | 0.6 | 1.9 | 0.7 |

| 8 | Profit increase: Market Rise | 93.1 | 92.2 | 2.0 | 0.5 | 2.4 | 0.4 | 1.5 | 0.4 | −1.3 | 0.5 | −1.6 | 0.5 |

| 9 | Sales Decrease | 40.5 | 40.9 | −0.1 | −0.1 | 0.0 | 0.0 | 0.1 | 0.0 | −0.1 | 0.0 | −0.5 | 0.0 |

| 10 | Profit Forecast Increase: Market Rise | 92.5 | 93.4 | 0.9 | 0.7 | 2.4 | 0.7 | 1.6 | 0.7 | 1.5 | 0.9 | 0.5 | 0.9 |

| 11 | Sales Increase: Market Rise | 85.8 | 94.4 | 4.9 | 0.7 | 7.2 | 0.6 | 5.3 | 0.6 | −0.4 | 0.8 | −1.6 | 0.8 |

| 12 | Profit Decrease | 28.7 | 36.8 | −0.8 | −0.1 | −0.4 | −0.3 | 0.0 | −0.5 | 0.1 | −0.7 | −1.0 | −0.6 |

| 13 | Stock Rating Downgrade | 13.6 | 13.9 | −0.3 | −0.3 | 0.8 | −0.4 | 0.5 | −0.4 | −0.3 | −0.5 | −0.9 | −0.4 |

| 14 | Missing QUICK Consensus Estimate | − | 38.2 | − | −0.2 | − | −0.2 | − | −0.3 | − | −0.6 | − | −0.7 |

| 15 | Profit Forecast Decrease: Market Decline | 7.5 | 6.0 | −0.4 | −0.4 | −1.5 | −0.8 | −1.5 | −0.9 | −2.3 | −1.1 | −3.3 | −1.1 |

| 16 | Profit Decrease: Market Decline | 8.9 | 7.9 | 0.2 | −0.7 | −1.1 | −0.3 | −1.3 | −0.4 | −2.4 | −0.4 | −1.7 | −0.5 |

| 17 | Stock Rating Downgrade: Market Decline | 5.0 | 5.8 | 1.1 | −0.6 | 0.5 | −0.6 | −0.8 | −0.6 | 0.7 | −0.5 | −4.6 | −0.4 |

| 18 | Profit increase: Market Decline | 11.5 | 9.6 | −2.1 | −0.8 | −2.6 | −0.5 | −4.3 | −0.6 | −7.1 | −0.7 | −6.6 | −0.7 |

| 19 | Scandal | 50.1 | 43.2 | −2.0 | −0.1 | −2.2 | −0.7 | −2.6 | −0.7 | −3.9 | −1.0 | −2.7 | −0.9 |

| 20 | Buyback | 86.5 | 82.3 | 1.1 | 1.4 | 3.2 | 0.7 | 2.5 | 0.8 | 2.0 | 0.8 | 1.9 | 0.9 |

| 21 | Profit Forecast Increase | 76.2 | 72.6 | −0.2 | 0.2 | 1.8 | 0.4 | −0.3 | 0.5 | −2.9 | 0.6 | −3.1 | 0.6 |

| 22 | Market Rise: Sales Increase | 93.3 | 91.1 | 1.5 | 0.9 | 4.7 | 0.6 | 3.2 | 0.8 | 1.1 | 0.9 | 1.6 | 0.8 |

| 23 | Buyback: Market Rise | 95.4 | 93.0 | 0.0 | 0.6 | 0.5 | 0.2 | −0.6 | 0.1 | −0.2 | 0.3 | −1.0 | 0.4 |

| 24 | Exceeding QUICK Consensus Estimate | - | 72.9 | - | 0.6 | - | 0.7 | - | 0.9 | - | 0.9 | - | 1.0 |

| 25 | Stock Split | 77.0 | 72.9 | 3.1 | 1.0 | 3.7 | 1.5 | 3.4 | 1.6 | 5.4 | 1.2 | 6.5 | 1.4 |

| 26 | Profit Forecast Decrease | 28.1 | 24.4 | 1.1 | −0.1 | −2.1 | −0.8 | −2.7 | −1.1 | −3.5 | −1.4 | −4.4 | −1.3 |

| 27 | Profit Decrease: Market Rise | 88.9 | 89.7 | 0.8 | 0.8 | 8.8 | 0.7 | 7.8 | 0.7 | 4.9 | 0.7 | 1.1 | 0.6 |

| 28 | Profit Forecast Decrease: Market Decline | 9.1 | 10.7 | −2.3 | −0.9 | −1.5 | −0.5 | −1.9 | −0.6 | −3.0 | −1.0 | −3.1 | −1.1 |

| 29 | Falsehood and Disguise | 41.5 | 44.0 | 4.5 | 0.0 | 0.5 | −0.8 | −2.1 | −0.7 | 1.9 | −0.6 | 1.8 | −0.2 |

| 30 | Sales Increase: Sales Decrease | 39.5 | 41.3 | 0.0 | 0.0 | 0.0 | −0.1 | 0.1 | 0.0 | −0.3 | −0.4 | −0.7 | −0.7 |

| No. | News Tag | Average Score | ON (%) | INT (%) | D1 (%) | D2.5 (%) | D4.5 (%) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Small | Large | Small | Large | Small | Large | Small | Large | Small | Large | Small | Large | ||

| 1 | Rise in Stock Rating | 78.1 | 80.5 | −0.2 | −0.1 | 0.3 | 0.1 | 3.1 | 1.2 | 3.6 | 1.4 | 2.7 | 1.5 |

| 2 | Increase in Large-Volume Holdings | 49.9 | 49.9 | 0.2 | −0.1 | −0.1 | 0.1 | 0.4 | 0.3 | 0.3 | 0.4 | −0.1 | 0.7 |

| 3 | Decrease in Large-Volume Holdings | 39.2 | 39.0 | 0.3 | −0.1 | −0.2 | 0.0 | −0.3 | 0.0 | −0.7 | 0.0 | −1.0 | 0.0 |

| 4 | Stock Rating Downgrade | 17.5 | 20.8 | −0.5 | 0.1 | 0.3 | −0.1 | −1.2 | −1.0 | −3.0 | −1.1 | −3.2 | −1.1 |

| 5 | Profit Increase | 61.0 | 60.1 | 0.2 | 0.0 | 0.0 | 0.0 | 2.1 | 0.7 | 1.1 | 0.5 | −1.0 | 0.5 |

| 6 | Sales Increase | 53.8 | 53.5 | 0.0 | −0.1 | 0.0 | 0.1 | 0.7 | 0.2 | 0.5 | 0.3 | 0.1 | 0.3 |

| 7 | Profit Decrease | 33.2 | 36.5 | 0.2 | 0.1 | −0.2 | 0.0 | −1.5 | −0.5 | −1.8 | −0.7 | −1.8 | −0.7 |

| 8 | Market Rise | 58.5 | 62.9 | −4.8 | −0.9 | 5.1 | 0.4 | 9.5 | 1.0 | 5.2 | 0.9 | 2.8 | 1.0 |

| 9 | Sales Decrease | 41.0 | 41.9 | 0.0 | 0.0 | −0.1 | 0.0 | 0.0 | −0.2 | −0.2 | −0.4 | −0.6 | −0.5 |

| 10 | Buyback | 80.9 | 78.3 | −0.1 | −0.1 | 0.0 | 0.0 | 3.9 | 2.1 | 2.7 | 2.0 | 2.5 | 2.2 |

| 11 | Profit Increase: Sales Increase | 63.4 | 64.0 | −0.2 | −0.1 | 0.2 | 0.1 | 2.8 | 0.7 | 1.4 | 0.6 | 0.8 | 0.6 |

| 12 | Missing QUICK Consensus Estimate | - | 37.7 | - | 0.0 | - | 0.0 | - | −0.6 | - | −0.8 | - | −0.9 |

| 13 | Market Decline | 40.0 | 37.3 | 4.6 | 1.0 | −3.2 | −0.3 | −6.2 | −1.1 | −8.6 | −1.2 | −9.7 | −1.2 |

| 14 | Stock Split | 87.6 | 87.0 | −0.2 | 0.0 | 0.2 | 0.1 | 7.4 | 4.1 | 7.5 | 4.1 | 7.2 | 4.2 |

| 15 | Increased Dividend | 81.8 | 79.2 | −0.5 | −0.2 | 0.6 | 0.2 | 5.9 | 2.0 | 4.6 | 1.9 | 4.0 | 2.1 |

| 16 | Profit Forecast Increase | 71.7 | 72.7 | −0.7 | 0.0 | 0.7 | 0.0 | 4.2 | 1.6 | 1.0 | 1.5 | 0.0 | 1.5 |

| 17 | No or Reduced Dividend | 20.9 | 22.3 | 0.3 | 0.0 | −0.2 | 0.1 | −2.1 | −1.2 | −3.3 | −1.7 | −3.8 | −1.9 |

| 18 | Profit Forecast Decrease | 20.2 | 25.8 | 0.2 | 0.1 | 0.0 | 0.0 | −2.8 | −1.9 | −2.9 | −2.1 | −3.2 | −2.1 |

| 19 | Scandal | 40.8 | 43.9 | 0.7 | 0.1 | −0.3 | −0.1 | −1.2 | −0.8 | −4.5 | −1.0 | −4.6 | −1.2 |

| 20 | Profit Decrease: Sales Decrease | 29.5 | 32.0 | 0.2 | 0.0 | −0.2 | 0.0 | −0.4 | −0.4 | 0.0 | −0.4 | −0.2 | −0.4 |

| 21 | Exceeding QUICK Consensus Estimate | - | 73.7 | - | −0.1 | - | 0.1 | - | 1.9 | - | 2.1 | - | 2.2 |

| 22 | Public Offering | 16.6 | 22.5 | 0.1 | 0.1 | −0.2 | −0.1 | −1.8 | −3.5 | −1.9 | −3.9 | −4.0 | −4.1 |

| 23 | Profit Increase: Profit Forecast Increase: Sales Increase | 80.6 | 73.8 | 0.9 | −0.1 | −1.4 | 0.1 | 2.4 | 1.3 | 0.5 | 1.2 | −0.2 | 1.3 |

| 24 | Profit Decrease: Sales Increase | 32.3 | 31.3 | −0.1 | 0.1 | −0.3 | 0.0 | −1.1 | −0.9 | −1.0 | −1.0 | −1.4 | −1.0 |

| 25 | Falsehood and Disguise | 37.9 | 44.2 | 0.3 | 0.1 | 0.0 | 0.1 | −1.0 | −0.3 | 0.0 | −0.1 | −2.0 | 0.2 |

| 26 | Change of Listing Market | 63.8 | 63.7 | −0.4 | 0.0 | 0.2 | 0.1 | 5.2 | 3.5 | 4.8 | 3.6 | 4.5 | 3.3 |

| 27 | Enterprise Continuity | 50.0 | 49.9 | 0.4 | −0.2 | −0.2 | 0.2 | 0.1 | 0.0 | −1.6 | 1.2 | −1.6 | 1.7 |

| 28 | Administrative Measures | 41.2 | 46.0 | 0.1 | 0.0 | −0.4 | 0.0 | −1.0 | −0.1 | −1.7 | 0.0 | −1.4 | 0.3 |

| 29 | Sales Increase: Sales Decrease | 39.1 | 40.1 | 0.1 | 0.1 | −0.3 | −0.1 | −0.5 | −0.2 | −1.4 | −0.3 | −1.1 | −0.3 |

| 30 | Issue of Share Options | 19.6 | 20.3 | −0.1 | 0.0 | 0.2 | 0.3 | −1.0 | −2.5 | −1.7 | −2.1 | −1.7 | −2.4 |

| Quantile | INT (%) | ON (%) | D1 (%) | D3 (%) | D5 (%) | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Small | Large | Small | Large | Small | Large | Small | Large | Small | Large | |

| 1 | −1.9 | −0.7 | −1.9 | −0.7 | −2.4 | −0.7 | −4.0 | −0.8 | −4.8 | −0.8 |

| 2 | −0.3 | 0.0 | −0.3 | −0.2 | −0.6 | −0.2 | −1.2 | −0.3 | −1.8 | −0.2 |

| 3 | −0.1 | 0.0 | 0.1 | 0.0 | −0.1 | 0.0 | −0.2 | 0.0 | −0.4 | 0.0 |

| 4 | −0.2 | 0.0 | 0.0 | 0.0 | −0.1 | 0.0 | −0.4 | −0.1 | −0.6 | −0.1 |

| 5 | 0.1 | 0.0 | −0.1 | 0.0 | −0.1 | 0.0 | −0.2 | 0.0 | −0.5 | 0.0 |

| 6 | 0.2 | 0.0 | −0.1 | 0.0 | −0.1 | 0.0 | −0.2 | 0.0 | −0.3 | 0.0 |

| 7 | 0.1 | 0.1 | 0.3 | 0.0 | 0.2 | 0.1 | 0.0 | 0.0 | −0.1 | 0.1 |

| 8 | 0.5 | 0.1 | 0.5 | 0.0 | −0.2 | 0.0 | −1.5 | 0.0 | −2.2 | 0.0 |

| 9 | 1.4 | 0.4 | 1.8 | 0.4 | 1.1 | 0.4 | 0.1 | 0.4 | −0.5 | 0.4 |

| 10 | 2.6 | 0.9 | 3.9 | 0.7 | 2.6 | 0.7 | 1.1 | 0.8 | −0.2 | 0.8 |

| Quantile | ON (%) | INT (%) | D1 (%) | D2.5 (%) | D4.5 (%) | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Small | Large | Small | Large | Small | Large | Small | Large | Small | Large | |

| 1 | −0.9 | −0.8 | −0.5 | 0.0 | −0.5 | −0.1 | −1.6 | −0.1 | −1.7 | −0.1 |

| 2 | −0.1 | −0.2 | −0.1 | 0.0 | −0.1 | 0.0 | −0.5 | −0.1 | −0.8 | −0.1 |

| 3 | 0.3 | −0.1 | −0.1 | 0.0 | −0.1 | 0.0 | −0.1 | −0.1 | −0.1 | −0.1 |

| 4 | 0.2 | 0.0 | −0.1 | 0.0 | 0.1 | −0.1 | −0.2 | −0.1 | −0.1 | −0.1 |

| 5 | 0.6 | 0.1 | 0.0 | 0.0 | 0.2 | 0.0 | 0.0 | −0.1 | −0.1 | 0.0 |

| 6 | 0.8 | 0.1 | 0.0 | 0.0 | 0.5 | 0.0 | 0.1 | 0.0 | 0.0 | 0.0 |

| 7 | 1.5 | 0.1 | −0.1 | 0.0 | 0.4 | 0.0 | −0.4 | 0.0 | −0.5 | 0.0 |

| 8 | 2.6 | 0.3 | −0.2 | 0.0 | 0.2 | 0.0 | −0.4 | 0.0 | −0.7 | 0.0 |

| 9 | 4.0 | 0.6 | −0.3 | 0.0 | 0.4 | 0.0 | −0.9 | 0.0 | −1.4 | 0.0 |

| 10 | 5.6 | 1.3 | −0.4 | 0.0 | 0.6 | 0.1 | −0.3 | 0.1 | −0.4 | 0.2 |

Appendix B. Script of the R Function for Time-Series Decomposition

| 1 | |

| 2 | The QUICK terminal is a specialized financial information terminal provided by Quick Inc. |

| 3 | The news data we used are described in detail on the QUICK website: https://corporate.quick.co.jp/data-factory/en/product/data035/ (accessed on 1 November 2024). |

| 4 | “Surprise” refers to news that is either positive or negative relative to QUICK Consensus. |

| 5 | Similar to previous studies, we excluded news not linked to listed stocks from the analysis. |

| 6 | In this study, we used timestamp information indicating the news distribution time, which was not included in the data used by Okimoto and Hirasawa (2014). This allowed us to create news indices that distinguish between news distributed before and after stock market trading hours. |

| 7 | In the R function “decomp”, described in Appendix B, “long_length” corresponds to long-term trend and “short_length” refers to short-term trend. |

| 8 | This refers to the average period return from the opening price of TOPIX futures on the trading day following the trigger for starting the investment to the settlement price of the futures 10 trading days later, representing the average return over approximately 9.5 trading days. |

| 9 | This indicates the initiation of investment in TOPIX futures when the absolute value of the deviation between the short-term trend level of the news index after time-series decomposition and the short-term trend level of the TOPIX on the most recent business day exceeds 15%. |

| 10 | The strategy involves holding a position for 9.5 days per instance, calculated as 9.5 × 0.8 = 7.6 for 0.8 investments per month. |

References

- Bollen, Johan, Huina Mao, and Xiaojun Zeng. 2011. Twitter mood predicts the stock market. Journal of Computational Science 2: 1–8. [Google Scholar] [CrossRef]

- Boudoukh, Jacob, Ronen Feldman, Shimon Kogan, and Matthew Richardson. 2012. Which News Moves Stock Prices? A Textual Analysis. NBER Working Paper 18725. Available online: https://www.nber.org/papers/w18725 (accessed on 6 September 2024).

- Bybee, Leland, Bryan Kelly, and Yinan Su. 2023. Narrative Asset Pricing: Interpretable Systematic Risk Factors from News Text. The Review of Financial Studies 36: 4759–87. [Google Scholar] [CrossRef]

- Bybee, Leland, Bryan Kelly, Asaf Manela, and Dacheng Xiu. 2021. Business News and Business Cycles. NBER Working Paper 29344. Available online: https://www.nber.org/papers/w29344 (accessed on 6 September 2024).

- Chen, Andrew Y., and Mihail Velikov. 2022. Zeroing In on the Expected Returns of Anomalies. Journal of Financial and Quantitative Analysis 58: 968–1004. [Google Scholar] [CrossRef]

- Cleveland, William S. 1979. Robust Locally Weighted Regression and Smoothing Scatterplots. Journal of the American Statistical Association 74: 829–36. [Google Scholar] [CrossRef]

- Cleveland, William S., and Susan J. Devlin. 1982. Calendar Effects in Monthly Time Series: Modeling and Adjustment. Journal of the American Statistical Association 77: 520–28. [Google Scholar] [CrossRef]

- Lee, Heeyoung, Mihai Surdeanu, Bill MacCartney, and Dan Jurafsky. 2014. On the Importance of Text Analysis for Stock Price Prediction. Paper presented at the 9th International Conference on Language Resources and Evaluation, LREC 2014, Reykjavik, Iceland, May 26–31; Available online: https://nlp.stanford.edu/pubs/lrec2014-stock.pdf (accessed on 28 September 2024).

- Li, Xinyi, Yinchuan Li, Hongyang Yang, Liuqing Yang, and Xiao-Yang Liu. 2019. DP-LSTM: Differential Privacy-Inspired LSTM for Stock Prediction Using Financial News. arXiv arXiv:1912.10806. [Google Scholar]

- Nakayama, Jun, and Daisuke Yokouchi. 2018. Applying Time Series Decomposition to Construct Index-Tracking Portfolio. Asia-Pacific Financial Markets 25: 341–52. [Google Scholar] [CrossRef]

- Narayan, Paresh Kumar, and Deepa Bannigidadmath. 2017. Does Financial News Predict Stock Returns? New Evidence from Islamic and Non-Islamic Stocks. Pacific-Basin Finance Journal 42: 24–45. [Google Scholar] [CrossRef]

- Okimoto, Tatsuyoshi, and Eiji Hirasawa. 2014. Stock market predictability using news indexes. Security Analysis Journal 52: 67–75. [Google Scholar]

- Roll, Richard. 1988. R2. The Journal of Finance 43: 541–66. [Google Scholar] [CrossRef]

- Schumaker, Robert P., and Hsinchun Chen. 2009. Textual analysis of stock market prediction using breaking financial news. The AZFinText system. ACM Transactions on Information Systems 27: 1–19. [Google Scholar] [CrossRef]

- Shen, Shulin, Le Xia, Yulin Shuai, and Da Gao. 2022. Measuring news media sentiment using big data for Chinese stock markets. Pacific-Basin Finance Journal 74: 101810. [Google Scholar] [CrossRef]

- Shibata, Ritei, and Ryozo Miura. 1997. Decomposition of Japanese Yen Interest Rate Data Through Local Regression. Asia-Pacific Financial Markets 4: 125–46. [Google Scholar] [CrossRef]

- Shimadzu, Hideyasu, and Ritei Shibata. 2005. Analysis of bird count series by local regression to explore environmental changes. Journal of the Japan Statistical Society 34: 187–207. (In Japanese). [Google Scholar]

- Tetlock, Paul C. 2007. Giving Content to Investor Sentiment: The Role of Media in the Stock Market. The Journal of Finance 62: 1139–68. [Google Scholar] [CrossRef]

- Tetlock, Paul C. 2011. All the News That’s Fit to Reprint: Do Investors React to Stale Information? The Review of Financial Studies 24: 1481–512. [Google Scholar] [CrossRef]

- Tetlock, Paul C., Maytal Saar-Tsechansky, and Sofus Macskassy. 2008. More Than Words: Quantifying Language to Measure Firms’ Fundamentals. The Journal of Finance 63: 1437–67. [Google Scholar] [CrossRef]

- Tukey, John Wilder. 1977. Exploratory Data Analysis. Reading: Addison-Wesley. [Google Scholar]

- Uhl, Matthias W., and Milos Novacek. 2020. When it Pays to Ignore: Focusing on Top News and their Sentiment. Journal of Behavioral Finance 22: 461–79. [Google Scholar] [CrossRef]

- Zhang, X. Frank. 2006. Information Uncertainty and Stock Returns. The Journal of Finance 61: 105–37. [Google Scholar] [CrossRef]

| No. | Events | Average | Median | Max | Min | SD | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|---|

| 1 | Market Rise | 66.0 | 50 | 99 | 14 | 20.8 | 0.6 | −1.7 |

| 2 | Market Decline | 36.2 | 50 | 85 | 1 | 20 | −0.8 | −1.4 |

| 3 | Increase in Large-Volume Holdings | 49.7 | 50 | 96 | 11 | 10.1 | 1.2 | 3.5 |

| 4 | Decrease in Large-Volume Holdings | 39.6 | 39 | 86 | 13 | 5.4 | 0.9 | 3.3 |

| 5 | Rise in Stock Rating | 79.8 | 84 | 84 | 4 | 13.2 | −1.4 | 1.0 |

| No. | News Tag | Average Score | INT (%) | ON (%) | D1 (%) | D3 (%) | D5 (%) |

|---|---|---|---|---|---|---|---|

| 1 | Market Rise | 83.3 | 1.1 | 1.3 | 1.0 | 1.0 | 0.9 |

| 2 | Market Decline | 18.2 | −0.8 | −0.8 | −0.9 | −1.1 | −1.1 |

| 3 | Increase in Large-Volume Holdings | 49.6 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 |

| 4 | Decrease in Large-Volume Holdings | 39.4 | −0.1 | 0.0 | 0.0 | 0.0 | 0.0 |

| 5 | Sales Increase | 55.1 | 0.0 | 0.1 | 0.1 | 0.1 | 0.1 |

| 6 | Profit Increase | 60.4 | 0.1 | 0.1 | 0.2 | −0.1 | −0.1 |

| 7 | Rise in Stock Rating | 82.5 | 0.2 | 0.5 | 0.6 | 0.7 | 0.9 |

| 8 | Profit Increase: Market Rise | 92.4 | 0.7 | 0.6 | 0.5 | 0.5 | 0.5 |

| 9 | Sales Decrease | 40.8 | −0.1 | 0.0 | 0.0 | 0.0 | −0.1 |

| 10 | Profit Forecast Increase: Market Rise | 93.4 | 0.8 | 1.1 | 0.9 | 0.9 | 0.9 |

| 11 | Sales Increase: Market Rise | 94.3 | 0.8 | 0.7 | 0.7 | 0.8 | 0.8 |

| 12 | Profit Decrease | 36.4 | −0.2 | −0.3 | −0.4 | −0.6 | −0.6 |

| 13 | Stock Rating Downgrade | 13.9 | −0.3 | −0.4 | −0.5 | −0.7 | −0.6 |

| 14 | Missing QUICK Consensus Estimate | 38.3 | −0.2 | −0.2 | −0.3 | −0.7 | −0.7 |

| 15 | Profit Forecast Decrease: Market Decline | 6.0 | −0.4 | −0.9 | −1.1 | −1.4 | −1.4 |

| 16 | Profit Decrease: Market Decline | 7.7 | −0.6 | −0.5 | −0.5 | −0.6 | −0.6 |

| 17 | Stock Rating Downgrade: Market Decline | 5.8 | −0.6 | −0.6 | −0.6 | −0.6 | −0.5 |

| 18 | Profit Increase: Market Decline | 9.6 | −1.0 | −0.6 | −0.9 | −1.3 | −1.4 |

| 19 | Scandal | 43.1 | −0.2 | −0.8 | −0.8 | −1.2 | −1.3 |

| 20 | Buyback | 83.3 | 1.7 | 0.9 | 0.9 | 0.9 | 1.0 |

| 21 | Profit Forecast Increase | 72.8 | 0.2 | 0.5 | 0.4 | 0.4 | 0.5 |

| 22 | Market Rise: Sales Increase | 91.3 | 1.1 | 1.1 | 1.1 | 1.2 | 1.0 |

| 23 | Buyback: Market Rise | 93.2 | 0.5 | 0.3 | 0.1 | 0.3 | 0.3 |

| 24 | Exceeding QUICK Consensus Estimate | 72.8 | 0.6 | 0.7 | 0.9 | 0.9 | 1.0 |

| 25 | Stock Split | 77.2 | 2.1 | 3.4 | 3.6 | 4.0 | 4.3 |

| 26 | Profit Forecast Decrease | 24.7 | −0.1 | −0.8 | −1.0 | −1.3 | −1.1 |

| 27 | Profit Decrease: Market Rise | 89.4 | 1.0 | 1.0 | 0.9 | 0.8 | 0.6 |

| 28 | Profit Forecast Decrease: Market Decline | 10.9 | −1.1 | −0.6 | −0.8 | −1.1 | −1.3 |

| 29 | Falsehood and Disguise | 43.8 | 0.1 | −0.7 | −0.8 | −0.7 | −0.5 |

| 30 | Sales Increase: Sales Decrease | 38.9 | 0.0 | 0.0 | 0.0 | −0.3 | −0.5 |

| No. | News Tag | Average Score | ON (%) | INT (%) | D1 (%) | D2.5 (%) | D4.5 (%) |

|---|---|---|---|---|---|---|---|

| 1 | Rise in Stock Rating | 80.3 | −0.1 | 0.1 | 1.4 | 1.7 | 1.8 |

| 2 | Increase in Large-Volume Holdings | 49.9 | 0.0 | 0.0 | 0.3 | 0.4 | 0.4 |

| 3 | Decrease in Large-Volume Holdings | 39.1 | 0.1 | −0.1 | −0.2 | −0.4 | −0.6 |

| 4 | Stock Rating Downgrade | 20.9 | 0.1 | −0.1 | −1.0 | −1.1 | −1.2 |

| 5 | Profit Increase | 60.2 | 0.0 | 0.1 | 0.7 | 0.5 | 0.4 |

| 6 | Sales Increase | 53.7 | −0.1 | 0.1 | 0.3 | 0.3 | 0.3 |

| 7 | Profit Decrease | 36.3 | 0.0 | 0.0 | −0.6 | −0.7 | −0.7 |

| 8 | Market Rise | 61.0 | −1.1 | 0.7 | 1.5 | 1.1 | 1.0 |

| 9 | Sales Decrease | 41.2 | 0.0 | 0.0 | −0.2 | −0.4 | −0.5 |

| 10 | Buyback | 79.2 | −0.1 | 0.0 | 2.6 | 2.2 | 2.3 |

| 11 | Profit Increase: Sales Increase | 64.0 | −0.1 | 0.1 | 0.9 | 0.6 | 0.6 |

| 12 | Missing QUICK Consensus Estimate | 37.7 | 0.0 | 0.0 | −0.5 | −0.8 | −0.9 |

| 13 | Market Decline | 38.8 | 1.1 | −0.4 | −1.4 | −1.6 | −1.7 |

| 14 | Stock Split | 87.7 | −0.1 | 0.2 | 6.6 | 6.6 | 6.8 |

| 15 | Increased Dividend | 80.7 | −0.4 | 0.4 | 3.6 | 3.1 | 3.0 |

| 16 | Profit Forecast Increase | 72.3 | 0.0 | 0.1 | 1.8 | 1.7 | 1.6 |

| 17 | No or Reduced Dividend | 21.4 | 0.1 | 0.0 | −1.3 | −1.9 | −2.2 |

| 18 | Profit Forecast Decrease | 25.4 | 0.1 | 0.0 | −2.2 | −2.4 | −2.5 |

| 19 | Scandal | 43.4 | 0.1 | −0.1 | −0.9 | −1.2 | −1.4 |

| 20 | Profit Decrease: Sales Decrease | 31.3 | 0.0 | 0.0 | −0.5 | −0.5 | −0.5 |

| 21 | Exceeding QUICK Consensus Estimate | 73.6 | −0.1 | 0.1 | 1.9 | 2.1 | 2.2 |

| 22 | Public Offering | 21.1 | 0.0 | −0.1 | −3.9 | −4.0 | −4.4 |

| 23 | Profit Increase: Profit Forecast Increase: Sales Increase | 74.0 | −0.1 | 0.1 | 1.5 | 1.4 | 1.4 |

| 24 | Profit Decrease: Sales Increase | 31.0 | 0.0 | 0.0 | −0.9 | −0.9 | −0.8 |

| 25 | Falsehood and Disguise | 44.2 | 0.1 | 0.0 | −0.4 | −0.4 | −0.2 |

| 26 | Change of Listing Market | 64.6 | −0.2 | 0.2 | 5.5 | 5.4 | 5.6 |

| 27 | Enterprise Continuity | 50.0 | 0.4 | −0.2 | −0.1 | −1.3 | −1.4 |

| 28 | Administrative Measures | 45.7 | 0.0 | 0.0 | −0.2 | −0.3 | −0.1 |

| 29 | Sales Increase: Sales Decrease | 39.8 | 0.1 | −0.1 | −0.2 | −0.5 | −0.5 |

| 30 | Issue of Share Options | 19.2 | −0.3 | 0.4 | −1.5 | −2.0 | −2.3 |

| Quantile | INT (%) | ON (%) | D1 (%) | D3 (%) | D5 (%) |

|---|---|---|---|---|---|

| 1 | −0.8 | −0.8 | −0.9 | −1.1 | −1.2 |

| 2 | 0.0 | −0.2 | −0.2 | −0.4 | −0.3 |

| 3 | 0.0 | 0.0 | 0.0 | −0.1 | −0.1 |

| 4 | −0.1 | 0.0 | −0.1 | −0.1 | −0.2 |

| 5 | 0.1 | 0.0 | 0.0 | −0.1 | −0.1 |

| 6 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| 7 | 0.1 | 0.1 | 0.1 | 0.0 | 0.0 |

| 8 | 0.1 | 0.1 | 0.1 | 0.0 | 0.0 |

| 9 | 0.6 | 0.7 | 0.6 | 0.5 | 0.4 |

| 10 | 1.3 | 1.4 | 1.2 | 1.1 | 0.9 |

| Quantile | ON (%) | INT (%) | D1 (%) | D2.5 (%) | D4.5 (%) |

|---|---|---|---|---|---|

| 1 | −0.9 | −0.1 | −0.2 | −0.3 | −0.4 |

| 2 | −0.2 | 0.0 | −0.1 | −0.1 | −0.2 |

| 3 | 0.0 | 0.0 | −0.1 | −0.1 | −0.1 |

| 4 | 0.0 | 0.0 | 0.0 | −0.1 | −0.1 |

| 5 | 0.1 | 0.0 | 0.0 | −0.1 | 0.0 |

| 6 | 0.2 | 0.0 | 0.0 | 0.0 | 0.0 |

| 7 | 0.2 | 0.0 | 0.0 | −0.1 | −0.1 |

| 8 | 0.4 | 0.0 | 0.0 | 0.0 | 0.0 |

| 9 | 0.9 | 0.0 | 0.0 | 0.0 | −0.1 |

| 10 | 2.1 | −0.1 | 0.1 | 0.1 | 0.2 |

| Threshold | Number of Trades | Buy/Sell | Average Return | SD | Win Ratio |

|---|---|---|---|---|---|

| 5% | 98 | 36/62 | 0.01% | 3.63% | 50.00% |

| 10% | 102 | 44/58 | −0.01% | 3.58% | 47.06% |

| 15% | 81 | 39/42 | 0.48% | 3.75% | 54.32% |

| 20% | 49 | 25/24 | 0.49% | 4.70% | 55.10% |

| Threshold | Buy | Sell | ||||

|---|---|---|---|---|---|---|

| Number of Trades | Average Return | Win Ratio | Number of Trades | Average Return | Win Ratio | |

| 5% | 36 | 0.61% | 63.89% | 62 | −0.33% | 41.94% |

| 10% | 44 | 0.02% | 52.27% | 58 | −0.03% | 43.10% |

| 15% | 39 | 0.90% | 61.54% | 42 | 0.08% | 47.62% |

| 20% | 25 | 0.77% | 64.00% | 24 | 0.20% | 45.83% |

| Threshold | Number of Trades | Buy/Sell | Average Return | SD | Win Ratio |

|---|---|---|---|---|---|

| 5% | 110 | 42/68 | 0.08% | 3.58% | 53.64% |

| 10% | 113 | 51/62 | −0.10% | 3.51% | 46.02% |

| 15% | 95 | 45/50 | 0.61% | 3.19% | 53.68% |

| 20% | 66 | 33/33 | 0.82% | 3.70% | 59.09% |

| Strategy | Number of Trades | Buy/Sell | Average Return | SD | Win Ratio |

|---|---|---|---|---|---|

| Original | 81 | 39/42 | 0.48% | 3.75% | 54.32% |

| Proposal 1 | 95 | 45/50 | 0.61% | 3.19% | 53.68% |

| Proposal 2 | 81 | 39/42 | 0.47% | 3.74% | 55.56% |

| Proposals 1 and 2 | 95 | 45/50 | 0.59% | 3.20% | 55.79% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nakayama, J.; Yokouchi, D. Relationship Between Japanese Stock Market Behavior and Category-Based News. Risks 2025, 13, 50. https://doi.org/10.3390/risks13030050

Nakayama J, Yokouchi D. Relationship Between Japanese Stock Market Behavior and Category-Based News. Risks. 2025; 13(3):50. https://doi.org/10.3390/risks13030050

Chicago/Turabian StyleNakayama, Jun, and Daisuke Yokouchi. 2025. "Relationship Between Japanese Stock Market Behavior and Category-Based News" Risks 13, no. 3: 50. https://doi.org/10.3390/risks13030050

APA StyleNakayama, J., & Yokouchi, D. (2025). Relationship Between Japanese Stock Market Behavior and Category-Based News. Risks, 13(3), 50. https://doi.org/10.3390/risks13030050