1. Introduction

Sovereign credit risk remains a central source of uncertainty in global financial markets, influencing investor confidence and capital allocation. A sound and widely accepted measure of this risk is the sovereign credit default swap (CDS) spread, which reflects market expectations of default probability and reacts swiftly to macroeconomic shocks, geopolitical tensions, or fiscal imbalances. Beyond their financial role, CDS spreads provide a valuable framework for analyzing how market-based risk perceptions interact with environmental, social, and governance (ESG) factors—an increasingly relevant issue in sustainable finance.

This study addresses the following research question: to what extent does sovereign risk affect the financial performance of ESG investments across different market conditions? Its main objective is to identify and quantify the asymmetric effects of systemic and structural sovereign risk on ESG returns, assessing their implications for financial stability and investment resilience.

Practically, this analysis helps investors and policymakers better understand the transmission of sovereign risk into ESG markets, offering guidance to strengthen sustainable investment strategies and align them with macro-financial risk management.

At the firm level, empirical evidence points to a general risk-reducing effect of ESG performance, though with notable variations.

Anthony and Ajay (

2024), using a comprehensive U.S. CDS database, found that ESG ratings significantly lower perceived credit risk, although this mitigating effect declines as the maturity of the instruments increases. Similarly,

Caiazza et al. (

2023) reported that higher ESG scores are negatively associated with CDS spreads among S&P 500 firms, even after controlling for contract features and financial crises.

Zhao and Zhu (

2024) further demonstrated that firms using CDS as hedging instruments exhibit better ESG performance, particularly those facing high leverage and financial constraints.

Nevertheless, the relationship is not homogeneous. Barth et al. 2022, identified a U-shaped association between ESG scores and CDS spreads, mediated by asset volatility, suggesting nonlinear effects across different ESG rating levels.

Anand et al. (

2023), also highlighted that the influence of ESG ratings on credit spreads varies significantly across data providers, reflecting inconsistencies and the lack of standardization in sustainability metrics. Other studies have emphasized the informational and perceptual dimensions of ESG risk.

Tang et al. (

2024) found that public perceptions of sustainability—especially following major policy events such as the Kyoto Protocol—contribute to lower CDS spreads in East Asia, particularly in contexts of uncertainty. Likewise,

Naumer and Yurtoglu (

2022) showed that both the tone and the source of ESG-related news affect credit markets: positive news can reduce CDS spreads by up to 4%, while negative news can increase financing costs by around 6%. From a pricing and structural risk perspective, recent approaches based on contingent claims and market-based risk premia (

Michopoulos et al. 2025;

Hauch 2025) reinforce the idea that ESG is embedded within asset valuation mechanisms, transcending its reputational interpretation.

On the sovereign side, the literature is more limited but points in a similar direction. Some evidence supports a negative relationship between sovereign ESG ratings and CDS premiums, suggesting that sustainability can act as a buffer against macro-financial volatility (

Karaman 2022;

Hübel 2022;

Zhao 2025). However, most of these findings rely on linear estimation frameworks that overlook potential nonlinearities, asymmetries, and spillover effects—despite increasing recognition that sovereign risk transmission operates in complex, state-dependent ways (

Bajaj et al. 2022). Recent efforts to link ESG and sovereign risk contagion through VAR or panel models (

Zhao 2025;

Öcal and Kamil 2021), have improved understanding of the average interaction but remain limited in capturing tail-risk dynamics and asymmetric responses.

Furthermore, cross-level analyses combining firm- and country-level ESG data (

Gianfrate et al. 2024;

Ballester et al. 2024) highlight the heterogeneity of effects across geographies and market conditions, with even contradictory results depending on sectoral and regional contexts.

In view of this fragmented and partly contradictory evidence, this paper contributes by explicitly modeling the asymmetric response of ESG-based equity returns to sovereign credit risk, using a quantile-based approach that captures nonlinearities across the entire conditional distribution. This framework responds to the need for more refined empirical tools to analyze risk transmission (

Barth et al. 2022;

Kiesel and Lücke 2019) and provides new insights into how sovereign risk dynamics shape sustainable investment strategies under varying market regimes, particularly during periods of heightened financial stress. This study applies to a quantile regression framework to assess the heterogeneous impact of sovereign risk on MSCI ESG index returns. Latent risk factors are extracted through PCA from a wide panel of sovereign CDS data, following

Joaqui-Barandica et al. (

2023) in estimating a global risk component. The results reveal that systemic shocks intensify ESG losses under stress but enhance gains in favorable markets, indicating that ESG performance is state-dependent and sensitive to sovereign credit dynamics—an insight relevant for sustainable portfolio management and policy design. Theoretically, sovereign risk affects ESG returns through both financial and confidence channels. Rising sovereign spreads signal macro-financial stress, leading to portfolio rebalancing and capital outflows that depress ESG valuations, particularly in emerging markets. Conversely, during stable or expansionary periods, improved sovereign credibility enhances investor confidence and reinforces ESG performance. This asymmetry explains why the impact of sovereign risk is expected to differ across quantiles of the return distribution.

Taken together, prior findings suggest two state-dependent hypotheses for ESG equity markets: (i) under adverse conditions (lower quantiles), a global sovereign-risk factor extracted from CDS should exacerbate downside ESG returns; (ii) under favorable conditions (upper quantiles), improvements in sovereign risk should be associated with stronger ESG performance. We also expect these effects to be stronger when global risk appetite dominates idiosyncratic fundamentals, consistent with earlier CDS evidence. The sample covers the period from June 2016 to July 2025. The inclusion of 2025 reflects the most recent available data at the time of analysis, updated through mid-year observations. This ensures that trends are captured without introducing forward-looking bias, and potential sampling imbalances were checked and found not to affect the robustness of results. A key empirical challenge is the potential endogeneity between sovereign risk and ESG returns, as both may respond to shared macroeconomic shocks. This issue is addressed through the use of lagged variables, PCA-derived orthogonal factors, and robustness checks that mitigate reverse causality and omitted variable bias. A key empirical challenge is the potential endogeneity between sovereign risk and ESG returns, as both may respond to shared macroeconomic shocks. This issue is addressed through the use of lagged variables, PCA-derived orthogonal factors, and robustness checks that mitigate reverse causality and omitted variable bias.

Our contribution thus complements sovereign-ESG studies that document average negative associations between sustainability metrics and sovereign risk by focusing on distributional effects and tail behavior. It also connects to the growing quantile-based spillover literature in sustainable finance by linking latent sovereign risk factors to the conditional distribution of ESG returns—a perspective largely absent from linear, mean-based designs.

The remainder of the paper is organized as follows:

Section 2 presents the materials and methods used.

Section 3 presents the main empirical results and offers a critical discussion on the implications of the asymmetric behavior of ESG returns in the face of sovereign risk. Finally,

Section 4 summarizes the study’s conclusions.

3. Materials and Methods

The methodological framework combines Principal Component Analysis (PCA) and quantile regression (QR) to analyze the link between sovereign risk and ESG returns. The sample includes emerging and developed economies to capture cross-market heterogeneity, using the MSCI ESG Index as a benchmark for sustainable investment performance. PCA is employed because sovereign CDS spreads co-move due to global risk and contagion effects (

Giudici and Pagnottoni 2019), making dimensionality reduction suitable to identify latent systemic factors. QR is applied to explore asymmetric and tail effects across the conditional distribution of ESG returns, offering richer insights than mean-based estimators (

Koenker and Xiao 2006;

Reboredo and Ugolini 2016;

Mensi et al. 2021). The retained components satisfy the Kaiser criterion and explain over 70% of the variance, ensuring representativeness of common variation in CDS spreads. Loadings were stable over time, with the first component capturing systemic shocks and the second reflecting structural shifts (

Longstaff et al. 2011). To account for external drivers of sovereign and ESG co-movements, the specification incorporates global control variables such as major commodity prices and international financial conditions. Although direct proxies of global risk appetite—such as the VIX or portfolio-flow indicators—are widely used in the literature, the selected controls already embed the information these measures capture, given their high correlation with global sentiment and capital-reallocation dynamics. Including additional proxies would add limited explanatory value while increasing multicollinearity, making the parsimonious set of controls employed here both economically and econometrically appropriate.

3.1. Data

This study employs two primary data sources: sovereign credit default swaps (CDS) and the MSCI Emerging Markets SRI Index. The sovereign CDS data consist of daily time series for 5-year USD-denominated contracts across 24 emerging economies represented in the MSCI Emerging Markets SRI Index, namely Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates. The choice of emerging markets is particularly relevant, as these economies often exhibit greater exposure to global systematic risk factors and higher sensitivity to shifts in ESG-related performance and governance standards. Their structural heterogeneity—spanning different stages of economic development, institutional maturity, and financial depth—offers a unique testing ground to evaluate how sovereign risk perceptions evolve under varying ESG conditions. Data were extracted from Refinitiv Workspace, ensuring harmonized frequency and consistent formatting across countries. Each CDS series captures the spread that reflects the premium demanded by investors to insure sovereign debt against a five-year credit event. To ensure consistency and mitigate market microstructure noise, the “Mid” quote was adopted as the benchmark reference for each contract. All instruments share standardized attributes: sovereign issuer classification, 5-year maturity, USD denomination, senior unsecured status, and inclusion of the Cum-Restructuring clause as per the 2014 ISDA Protocol. The preferred data sources for each series were Markit 5Yr Liquid EOD, Refinitiv EOD, and Markit EOD, selected based on data completeness and reliability.

Due to the absence of a liquid sovereign CDS for Taiwan in Refinitiv’s coverage, we adopt the CDS of the Bank of Taiwan as a proxy. This financial institution is state-owned and closely linked to the Taiwanese government, which allows it to partially reflect the country’s systemic sovereign risk. While this substitution introduces a methodological limitation, its justification is grounded in institutional linkages, and it may be further complemented by structural indicators such as sovereign credit ratings in robustness checks.

The second key dataset used in the analysis is the MSCI Emerging Markets SRI Index, denominated in USD and calculated on a gross return basis. This equity benchmark is composed of large- and mid-cap companies from emerging markets that demonstrate superior ESG performance. Constituents are selected using a best-in-class ESG screening methodology based on MSCI ESG Research, combined with negative filters to exclude firms involved in controversial business activities such as tobacco, weapons, and other socially or environmentally detrimental sectors. The index includes companies from 24 emerging market countries and is weighted by free-float adjusted market capitalization to reflect investability. Selection is further refined through an assessment of ESG controversy scores and intra-sectoral ESG ratings.

Geographically, the index exhibits significant concentration in Asia, with Taiwan, China, and India representing 30.18%, 23.47%, and 11.72% of the total weight, respectively, (

Table 1). This geographic composition makes the index particularly sensitive to systemic risk events originating in Asia or in other emerging markets. As such, it provides a relevant benchmark for evaluating the financial performance of ESG-compliant portfolios under varying macroeconomic and sovereign risk conditions.

Table 2 reports the sectoral composition of the MSCI Emerging Markets SRI Index based on free-float adjusted market capitalization. Financials and Information Technology account for over 50% of the index, with 27.13% and 24.54%, respectively, followed by Consumer Discretionary (14.8%) and Communication Services (11.93%). The index is notably underexposed to sectors such as Energy (0.11%) and Utilities (0.6%), reflecting its ESG screening methodology, which tends to exclude high-carbon or controversial industries. This sectoral allocation influences the index’s sensitivity to both macroeconomic cycles and ESG-related risks.

Systematic risk plays a predominant role in shaping financial outcomes across emerging markets, as these economies are structurally more sensitive to global liquidity shocks, interest rate cycles, and capital flow reversals (

Bekaert and Harvey 2003). In this context, the higher degree of external dependence and institutional heterogeneity observed among emerging economies intensifies the transmission of global financial stress into domestic markets, particularly through sovereign credit channels.

To capture this systemic influence, the study applies Principal Component Analysis (PCA) to standardized sovereign CDS spreads, extracting latent factors that represent shared and structural dimensions of sovereign risk across countries. The first principal component captures global or time-varying shocks that simultaneously affect multiple sovereigns, while the second reflects slower-moving structural dynamics associated with fiscal and institutional fundamentals (

Longstaff et al. 2011;

Dieckmann and Plank 2012). The extracted factors are subsequently incorporated into the quantile regression framework, allowing for the identification of heterogeneous sensitivities across the conditional distribution of ESG-based returns. This methodological design provides a more complete characterization of how systemic pressures and domestic fundamentals jointly influence the behavior of sustainable portfolios under different market regimes. By explicitly modeling these nonlinear interactions, the approach advances the understanding of ESG performance in contexts where financial stability and sustainability objectives converge, reinforcing the empirical relevance of emerging markets as an analytical laboratory for sovereign risk transmission.

In addition, several control variables were incorporated. As indicators of global conditions, the differenced logarithm of the US dollar exchange rate was used, which acts as a proxy for exchange rate risk and the strength of the dollar internationally. Likewise, the variation in the price of Brent crude oil was considered as a measure of commodity price shocks, given its importance as a key energy input for emerging economies. To capture the dynamics of international financial markets, the logarithmic variations in the Nasdaq Index and the MSCI Emerging Markets Index were used, respectively, representing the behavior of the US technology market and the aggregate performance of emerging stock markets. The variation in the US 10-year Treasury bond interest rate was also incorporated as a proxy for monetary policy and the long-term cost of money. Finally, the logarithmic variation in the S&P 500 Index was included as a general benchmark for the US stock market and its potential carryover effect on global returns (

Long et al. 2022).

3.2. Quantile Regression Approach

This study evaluates the asymmetric effects of sovereign credit risk on the returns of the MSCI ESG Leaders Index through a quantile regression (QR) framework. The analysis spans a cross-country panel of sovereign CDS spreads, from which latent risk factors are extracted using PCA. This methodology allows us to capture the nonlinear and state-dependent impact of sovereign risk across the full distribution of ESG returns, particularly under extreme market conditions.

Quantile regression, as proposed by

Koenker and Bassett (

1978), is a semi-parametric approach that estimates the conditional quantile function of the dependent variable, making it especially suitable for analyzing heterogeneous effects and tail behavior. Unlike traditional OLS models, QR does not assume constant variance or normality and is robust to outliers and non-Gaussian errors. Furthermore, it permits the estimation of predictor effects not only at the mean but at different points (quantiles) of the conditional distribution, which is critical for understanding downside risk in ESG performance (

Ma and Koenker 2006;

Koenker 2004;

Uribe and Guillen 2020).

Formally, the conditional quantile function for the

q-th quantile is defined as

where

represents the returns of the MSCI ESG index,

is a matrix of covariates including the extracted PCA-based sovereign risk factors, and

is the vector of coefficients to be estimated for quantile

q ∈ (0,1). The parameters

are obtained by solving the following minimization problem:

where

I (condition) = 1 if the condition is true, 0 otherwise.

The latent risk factors included in were derived from a panel of sovereign CDS spreads using PCA, following standardization. The objective was to reduce dimensionality and address multicollinearity, while preserving the principal sources of variation in sovereign risk. The model was estimated across a range of quantiles (0.05, until 0.95), allowing us to capture both downside risk amplification and upside gains associated with varying levels of sovereign credit stress.

ESG returns was transformed to logarithmic differences to ensure stationarity and interpretability in terms of returns and shocks. This methodological framework enables a richer characterization of how sovereign risk transmits into sustainable equity markets under diverse market regimes, from adverse to favorable states.

3.3. The (Regularized) Iterative PCA Algorithm

To estimate the latent sovereign risk factor

, we employ the Regularized Principal Components method proposed by

Josse and Husson (

2012). This technique seeks to identify a reduced-dimensional subspace that minimizes the reconstruction error between the original observations and their projections within that subspace. Specifically, it involves computing two matrices

and

of rank

, with

, that offer the best approximation to the original sovereign CDS data matrix

, with

T: Time and

N: Countries. The optimization problem is defined in a least-squares framework to capture the underlying structure of sovereign credit risk dynamics while addressing potential issues of multicollinearity and overfitting. The minimization criterion is expressed as follows:

where

is a matrix of size

with each row equal to

, i.e., the vector with the mean of each variable. A common technique that deals with missing values in PCA is to ignore missing values by minimizing the least-squares criterion in Equation (3) overall non-missing entries. This can be achieved by introducing a weighted matrix

in the criterion, where

if

is missing or

otherwise:

The iterative (regularized) PCA algorithm minimizes the criterion in Equation (4). The Regularized PCA methodology (

Josse and Husson 2012) inherently addresses the possibility of incomplete observations in panel structures. Should any missing entries arise, the weighted reconstruction criterion in Equation (4) relies exclusively on observed values, ensuring that factor estimation remains consistent without the need for imputation or listwise deletion. Given the high completeness and quality of the CDS dataset and the absence of systematic missingness patterns, additional restrictions such as working with a balanced subsample would not materially affect the extracted latent factor nor enhance the interpretation of the empirical results.

4. Results

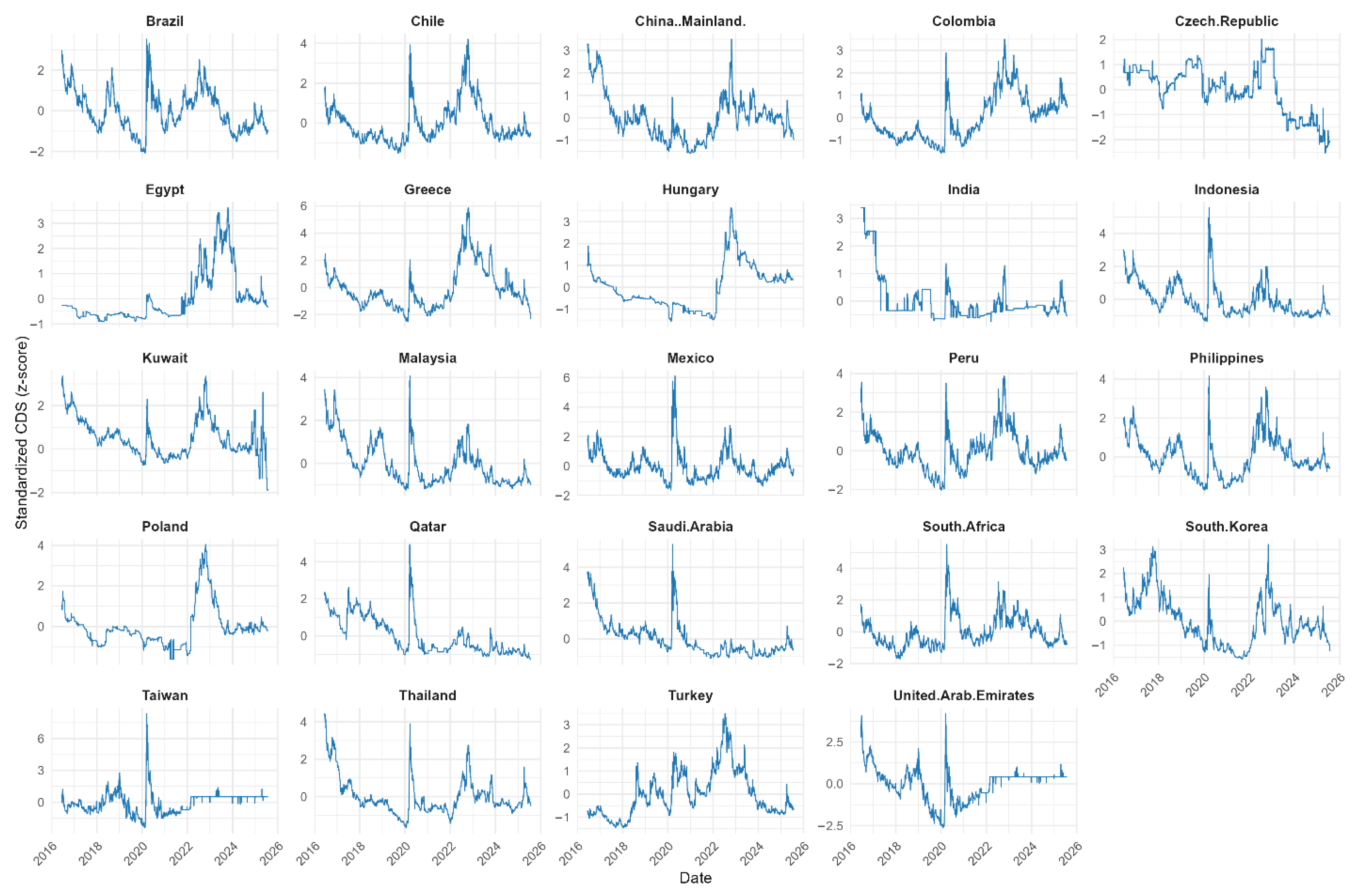

Figure 1 shows the standardized and PCA-imputed sovereign CDS spreads for 30 emerging and frontier economies from 2016 to mid-2025. The data, expressed as z-scores, enable cross-country comparison of relative risk fluctuations. Common risk spikes appear around global shocks—most notably during the 2020 COVID-19 crisis and again in 2022–2023 amid tighter financial conditions and geopolitical tensions—indicating a systemic component of sovereign risk. Country-specific volatility remains evident, with Argentina and Turkey showing persistent instability, while Chile, Taiwan, and South Korea exhibit steadier trajectories. To summarize these intertwined dynamics, a PCA with imputed data was applied to extract latent factors representing the main sources of variation in CDS spreads. These principal components are subsequently used as explanatory variables in the quantile regression analysis to assess their effect on financial performance under different macro-financial contexts.

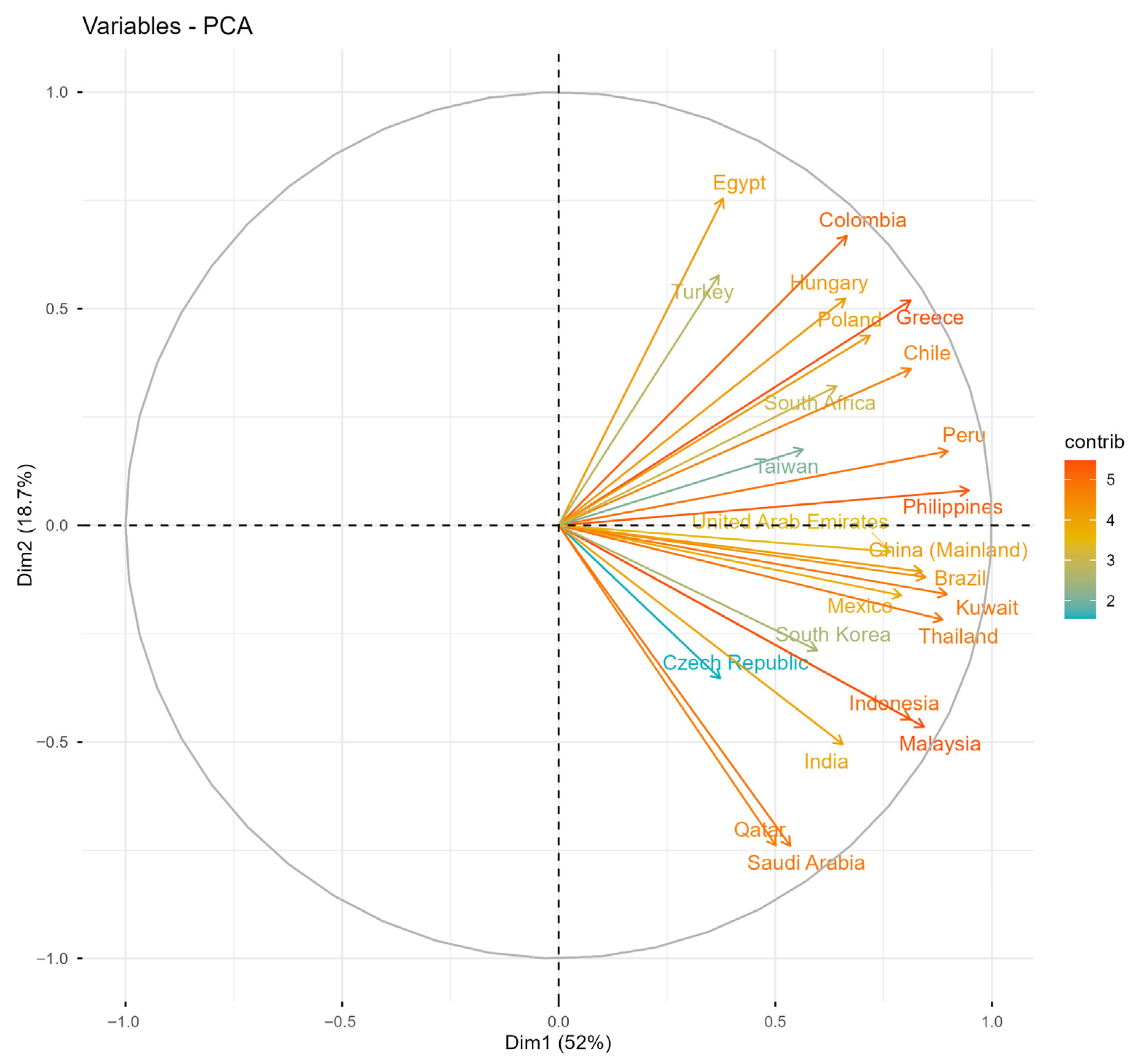

Figure 2 shows the correlation circle from the PCA, illustrating how sovereign CDS spreads move together across countries. The direction and proximity of the vectors indicate shared risk patterns, with most economies showing strong alignment along the main axis, suggesting a common global risk factor. Countries such as Colombia, Greece, and Chile exhibit higher sensitivity to global shocks, while others like South Korea and Taiwan display more independent dynamics.

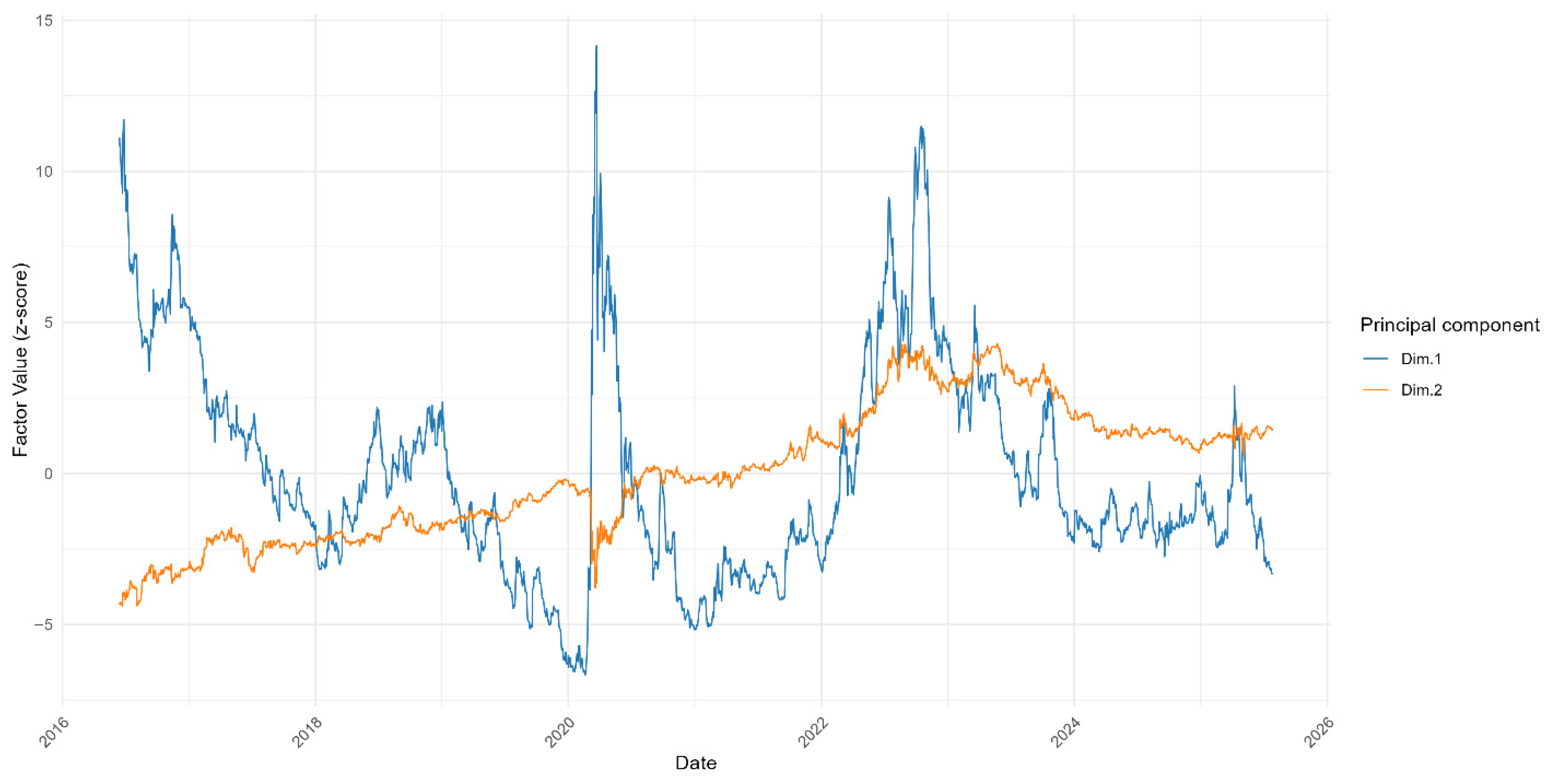

Figure 3 illustrates the first two principal components extracted from the panel of standardized sovereign CDS spreads for 24 emerging market economies. Each component captures a latent risk factor that summarizes the co-movements across countries in sovereign credit risk over time. The first dimension (Dim.1) explains 52% of variability, depicted in blue, appears to capture a systemic or global risk factor, with sharp increases during periods of widespread market stress—most notably around the COVID-19 crisis in 2020 and during episodes of financial tightening in 2022–2023. This component reflects the synchronized reaction of sovereign risk to global shocks and suggests the existence of a shared vulnerability across the sovereign credit profiles of the countries in the sample.

In contrast, the second dimension (Dim.2) explains 18% of variability, shown in orange, follows a smoother and more persistent upward trend over time. This factor may be interpreted as reflecting structural or medium-term shifts in the cross-country configuration of risk, such as gradual changes in global risk appetite, commodity dependency, or external financial conditions. Unlike Dim.1, its dynamics do not exhibit pronounced peaks but rather a slow-moving trend, suggesting that it may absorb regional or long-term latent forces not directly tied to sudden global events. The decision to retain two principal components was guided by both statistical and economic criteria. Beyond the Kaiser rule, the interpretability of these dimensions was central: Dim.1 captures short-term systemic shocks linked to global contagion, while Dim.2 embodies slower structural adjustments across economies, consistent with persistent macro-financial and institutional differences. Together, they represent the dual nature of sovereign risk transmission—between transient market stress and deeper structural vulnerabilities. Building on this baseline interpretation, a robustness exercise was conducted using a Robust Principal Component Analysis (RPCA) framework, which is specifically designed to separate low-rank common structures from idiosyncratic noise and outliers in high-dimensional financial data. Applying RPCA to the standardized sovereign CDS panel leads to a substantial improvement in the explanatory power of the extracted factors: the first robust component accounts for 68.9% of the total variability, while the second captures 19.5%, yielding a combined explained variance of 88.5%. These results reinforce the dual-factor structure identified earlier and while demonstrating that the underlying risk patterns remain highly stable when using a more resilient decomposition method. The complete results of this robustness test are reported in

Appendix E.

The combined behavior of these two components supports the hypothesis that sovereign CDS spreads can be decomposed into a small number of underlying drivers, distinguishing between fast-moving global shocks and slower, more persistent structural trends. The PCA results reveal two economically meaningful dimensions of sovereign risk. The first component captures a global systemic factor, reflecting how emerging economies co-move in response to widespread shocks such as tightening global financial conditions, shifts in risk appetite, or liquidity stress. Countries like Brazil, Chile, Peru, Colombia, and Greece load heavily on this dimension, indicating that their sovereign spreads are strongly driven by global market turbulence and therefore highly sensitive to contagion effects. In contrast, economies such as the United Arab Emirates, the Czech Republic, and Taiwan exhibit weaker loadings, suggesting greater resilience to systemic pressures. The second component reflects structural or idiosyncratic risk, distinguishing countries with persistent domestic vulnerabilities—such as Egypt and Turkey, often characterized by fiscal fragility or institutional instability—from more structurally robust economies like Qatar and Saudi Arabia. This dual structure highlights that sovereign credit risk in emerging markets is shaped both by global financial cycles and by country-specific fundamentals, underscoring the need to jointly consider systemic exposure and structural strength when assessing sovereign risk dynamics. These dimensions will be used as key explanatory variables in the quantile regression analysis that follows, helping to disentangle the heterogeneous effects of sovereign risk on financial performance across the return distribution.

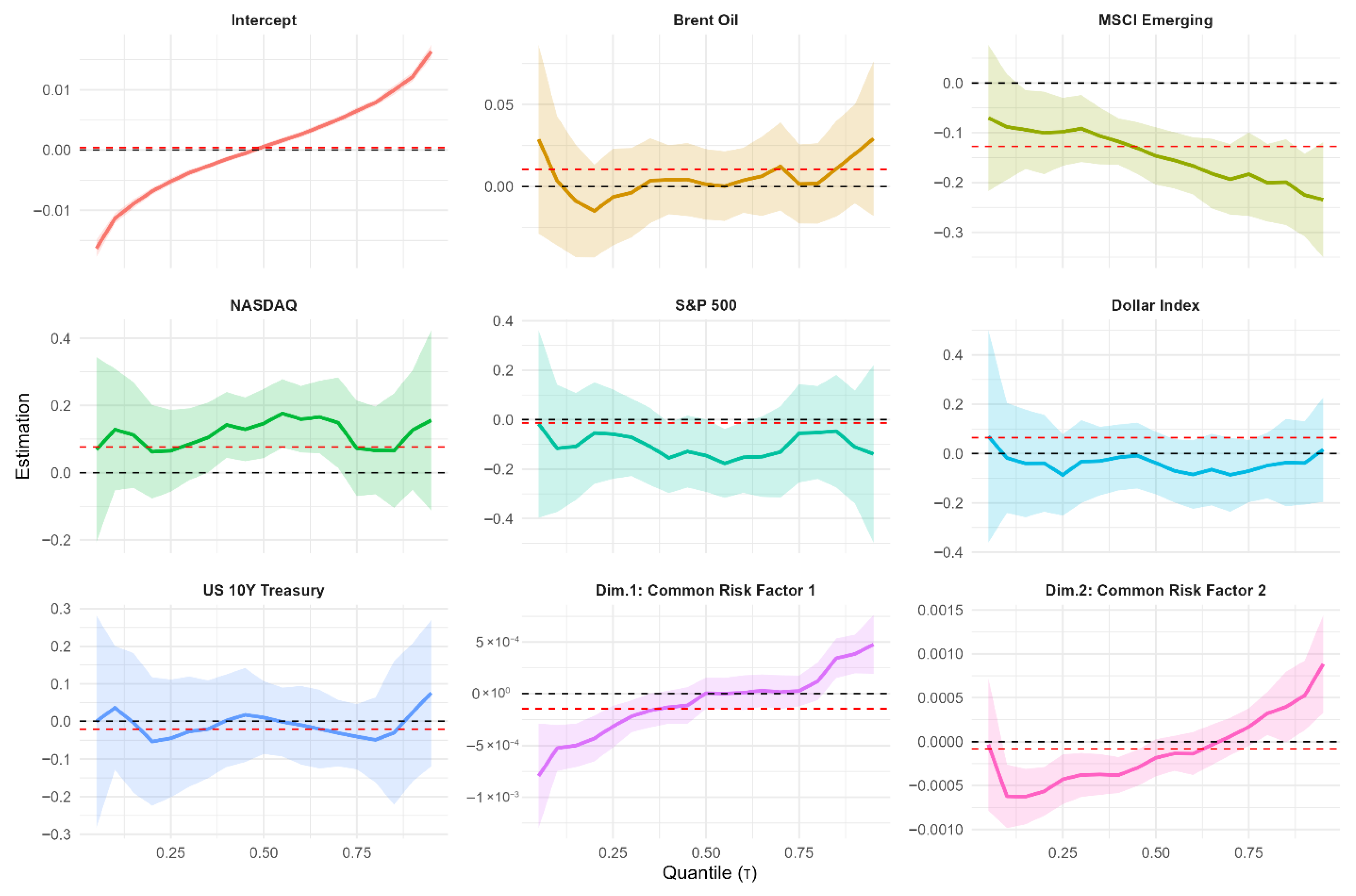

Table 3 presents the estimated coefficients of the quantile regression model for different quantile levels, with increments of 0.05. This approach allows for analyzing how the impact of the explanatory variables on the returns of the MSCI ESG Index varies across its conditional distribution, capturing potential asymmetries and non-homogeneous effects. The results show that the effects of the explanatory variables are not constant across the return distribution, validating the use of the quantile approach instead of classical linear models. Factors such as emerging markets and the Nasdaq index have persistent and significant effects, while others such as exchange rates and interest rates have more modest or non-significant impacts. The evidence also suggests that the sensitivity of the MSCI index to global factors is asymmetric, being more pronounced at the extreme quantiles, which has relevant implications for risk management and the design of hedging strategies.

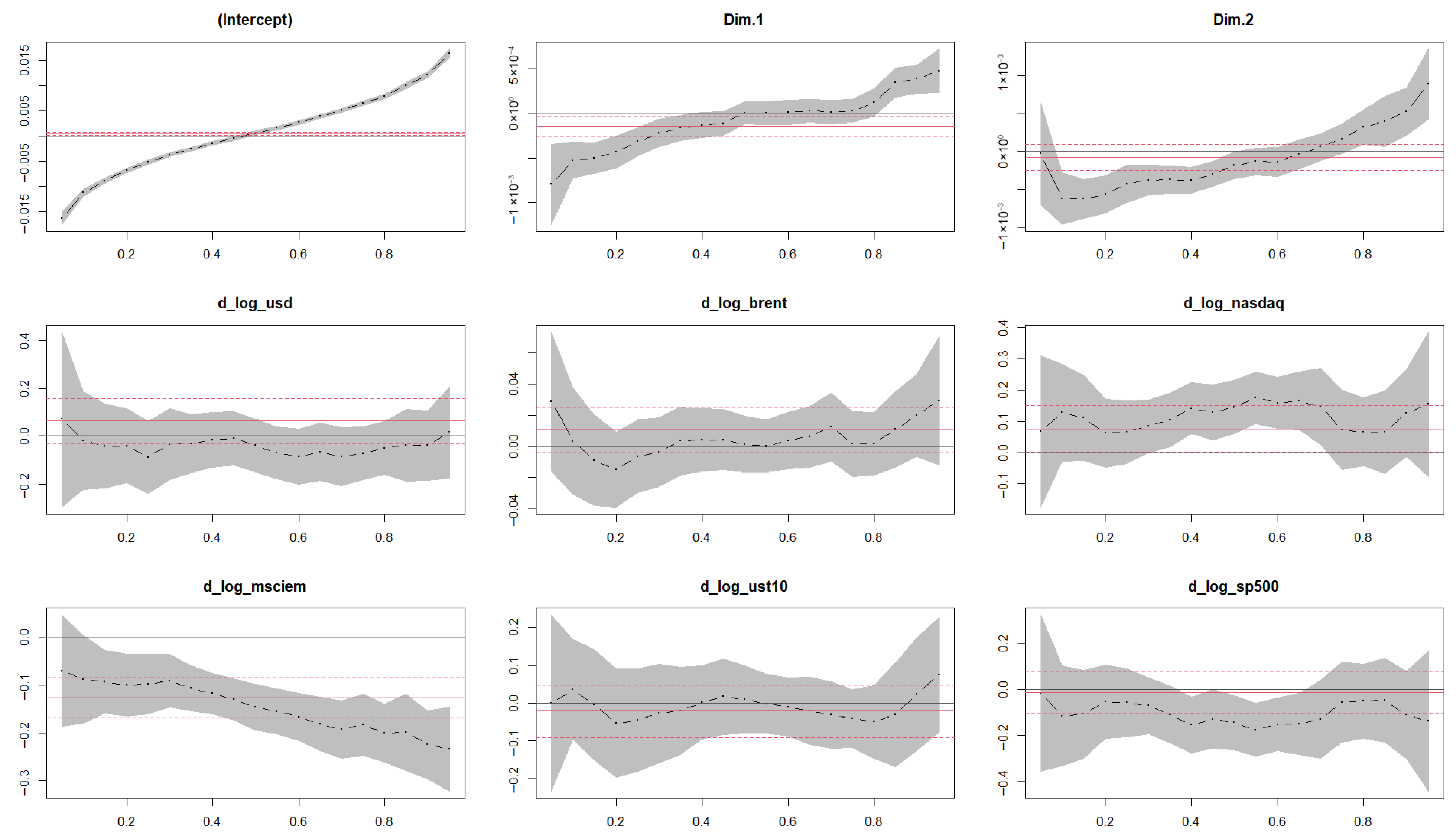

As shown in

Figure 4, the intercept is significant and increasing as the quantiles increase, moving from a negative value in the low quantiles to a positive value in the high quantiles, reflecting an asymmetric distribution of returns conditioned by the remaining covariates.

The principal components Dim.1 and Dim.2, which summarize latent factors or structural correlations in the system, exhibit a negative and significant relationship with returns in most of the low and middle quantiles. Dim.1 shows a change in sign around the 0.5 quantile, indicating that its negative impact occurs mainly in loss scenarios (lower tails), while Dim.2 becomes positive and significant only in the high quantiles (0.80 to 0.95), suggesting a divergent effect depending on the level of return analyzed.

Exchange rate fluctuations are not a significant variable in most quantiles, although they appear with a persistent negative sign from τ = 0.15 to τ = 0.85. This suggests that their effect on returns is weak or marginal, although it could be interpreted as slight downward pressure when the dollar appreciates. The oil price has a weak and nonsignificant impact in almost all quantiles. Only at the 0.95 quantile does it become positive and significant, suggesting that in very high-return scenarios, rising oil prices may coincide with improved returns. The technology market, represented by the Nasdaq, exhibits a positive, increasing, and significant effect from τ = 0.3, with peaks around τ = 0.55. This confirms the high sensitivity of the MSCI index to Nasdaq returns, especially in the middle and upper quantiles, indicating a transmission of optimism in the stock markets.

The emerging markets index has a significant negative effect across all quantiles from τ = 0.15 to τ = 0.95, suggesting that losses in emerging markets tend to coincide with declines in the MSCI index, regardless of the return level analyzed. This denotes a strong interdependence among emerging markets. Meanwhile, US interest rates are not significant across most quantiles, although they have moderately negative coefficients at some points. This could reflect an ambiguous relationship or one mediated by other, more dominant macroeconomic factors.

The S&P 500, similar to the Nasdaq, has a significant negative effect from the 0.3 quantile onward. This negative relationship could be interpreted as imperfect diversification between MSCI assets and the S&P 500, where positive movements in the S&P 500 coincide with adjustments in other international markets due to portfolio rebalancing or capital flows.

Taken together, the results provide strong empirical support for the hypothesis that sovereign risk dynamics—and their latent transmission to sustainable investment indices—are shaped by a combination of global systemic pressures and structural asymmetries across the return distribution. The quantile regression approach reveals heterogeneous sensitivities, with risk factors exerting differentiated effects depending on the performance regime of the MSCI ESG Index. The goodness of fit of the quantile regression models was evaluated using the pseudo R

2 statistic, which measures the proportion of variation in ESG returns explained by the explanatory variables at each quantile level. These values, which range from 0.01 in the median quantile to approximately 0.70 in the tails, confirm the model’s capacity to capture asymmetric and nonlinear relationships across the return distribution. The detailed results for all quantiles are presented in

Appendix C, where the pseudo R

2 values are reported for each estimated model. In addition, we conduct a robustness test excluding Taiwan, re-estimating the full quantile framework; the corresponding pseudo R

2 values

Appendix D, confirm that the results remain highly similar despite the exclusion. To statistically validate these distributional differences, a quantile ANOVA test was conducted, confirming that the estimated coefficients vary significantly across quantiles. The detailed results of this test are reported in

Appendix A, further supporting the robustness of the heterogeneous effects identified in the main analysis. This asymmetry is particularly relevant in the context of sustainable finance, where extreme downside events may compromise the perceived resilience of ESG-linked portfolios. To address potential concerns regarding collinearity and causal distortion within the quantile regression framework, it is important to note that the inclusion of PCA-derived dimensions (DIM1 and DIM2) as explanatory factors was specifically intended to mitigate multicollinearity by transforming correlated variables into orthogonal latent components. This methodological approach follows the recommendations of

Fan et al. (

2017), who emphasize that the PCA–CQR method can eliminate the multicollinearity among explanatory variables and provide probabilistic loadings and quantile coefficients.

Davino et al. (

2022), demonstrate that principal component regression applied to quantile contexts preserves the information content of predictors while alleviating redundancy among highly correlated variables

The model specification explicitly incorporates temporal ordering and lagged effects to strengthen causal interpretation within a non-experimental framework. While causality remains limited by the observational nature of the data, these design elements enhance robustness and interpretability of the estimated quantile effects.

The first principal component, associated with global financial shocks, tends to have a more pronounced negative influence during periods of poor performance (lower quantiles), aligning with the notion that systemic sovereign stress disproportionately affects sustainable assets when market conditions deteriorate. In contrast, the second component—interpreted as a structural trend—becomes relevant only in high-return regimes, potentially reflecting investor reallocation toward ESG assets in contexts of favorable macroeconomic tailwinds or positive sentiment. This suggests that sustainable investment indices may benefit from structural shifts in global risk appetite, but remain vulnerable to short-term sovereign risk spillovers.

The role of emerging markets (as captured by the MSCI Emerging Index) stands out as a consistently negative and significant driver across the distribution. This not only highlights the financial fragility of emerging sovereigns but also questions the robustness of ESG portfolios that include substantial exposure to these markets. It raises important considerations for sustainability-oriented investors, especially given the trade-off between ESG impact and exposure to macro-financial instability in the Global South.

Interestingly, classical control variables such as interest rates and exchange rates exhibit limited explanatory power, except at specific quantiles. This aligns with recent findings that traditional macroeconomic indicators may be insufficient to capture nonlinear dynamics in ESG-linked financial performance, especially under stress. The consistent effect of Nasdaq returns, by contrast, suggests that tech-driven optimism and innovation narratives continue to influence ESG valuations, reinforcing the hypothesis that sustainable finance is not insulated from broader speculative cycles.

The observed sensitivity of the MSCI ESG Index to both latent sovereign risk dimensions and global equity benchmarks reveals a structural contradiction: while ESG investments aim to prioritize long-term environmental and social resilience, their short-term behavior remains closely tied to conventional market risk channels. This finding challenges the assumption that ESG portfolios inherently offer downside protection or reduced volatility, and instead points to the need for more robust frameworks to integrate sovereign and systemic risk assessments into sustainable investment strategies. The results have clear implications for both investors and policymakers. The negative impact of the systemic sovereign risk component (Dim.1) on the lower quantiles indicates that global financial stress disproportionately amplifies losses in ESG portfolios, reinforcing the need for risk-sensitive portfolio construction and hedging mechanisms that account for sovereign contagion. Conversely, the structural component (Dim.2) exerts a positive influence in the upper quantiles, suggesting that improvements in fiscal governance, institutional strength, and macroeconomic credibility enhance the performance of ESG assets during favorable conditions. The persistent negative link between the MSCI Emerging Markets Index and ESG returns reveals a structural vulnerability that limits diversification benefits and highlights the trade-off between sustainability impact and financial fragility in emerging economies. These findings underscore the practical need for integrating sovereign risk assessments and quantile-based stress testing into sustainable investment frameworks. Overall, this evidence advances current understanding of the nonlinear dynamics connecting sovereign risk and ESG performance, showing that sustainable portfolios remain sensitive to global shocks yet benefit from long-term structural resilience. A robustness test is conducted in this study to validate the stability and consistency of the main model’s results. This analysis, presented in

Appendix B, assesses the sensitivity of the coefficients to alternative specifications and confirms that the estimated effects retain their sign, magnitude, and statistical significance, thereby reinforcing the reliability of the findings.

5. Discussion

The results presented in this study provide a comprehensive understanding of the heterogeneous influence of sovereign risk dynamics on sustainable investment performance across different points of the return distribution. By integrating principal component analysis (PCA) and quantile regression, the empirical framework captures both systemic and structural dimensions of sovereign risk and their nonlinear transmission to ESG-related financial indices.

The quantile-based results reveal strong distributional asymmetries. The first principal component, which reflects systemic global financial stress, exerts a more pronounced negative impact in the lower quantiles—periods associated with market downturns and risk aversion. This finding supports the notion that ESG assets are not immune to systemic contagion, as heightened sovereign stress tends to amplify losses even within sustainability-oriented portfolios. Conversely, the second component—interpreted as a structural or long-term factor—shows significance only in higher quantiles, suggesting that favorable macroeconomic conditions and positive investor sentiment can enhance the relative performance of ESG indices. Together, these results highlight a dual structure in the relationship between sovereign risk and sustainable returns: one that is highly sensitive to global shocks and another that evolves more gradually in response to persistent macro-financial conditions.

Moreover, the role of emerging markets stands out as a consistently negative and statistically significant driver across most quantiles. This underscores the structural vulnerability of these economies and the exposure of ESG portfolios that integrate a substantial share of emerging market assets. Such patterns call into question the presumed stability of ESG-linked investments and emphasize the need to differentiate between sustainability narratives and real financial resilience under stress. Traditional macroeconomic variables such as interest rates and exchange rates display limited explanatory power, which aligns with recent evidence that linear macro-financial relationships may fail to capture the nonlinear dynamics of ESG performance under volatility.

To statistically validate the heterogeneity of these effects, a quantile ANOVA test was performed, confirming that the estimated coefficients differ significantly across quantiles (

Appendix A). This result reinforces the appropriateness of the quantile regression approach and provides empirical evidence of asymmetric sensitivities throughout the return distribution. Furthermore, a robustness test based on bootstrapped standard errors was conducted to assess the stability of the results under alternative specifications (

Appendix B). The findings indicate that coefficient estimates remain consistent in sign, magnitude, and statistical significance across replications, thereby supporting the overall reliability of the model. Overall, these findings underscore a fundamental paradox within sustainable finance: despite their purported resilience, ESG-linked portfolios remain strongly exposed to systemic market forces and sovereign risk spillovers. The empirical evidence suggests that their short-term dynamics are still governed by conventional channels of global financial transmission, even as they pursue long-term sustainability goals. This tension highlights the importance of incorporating sovereign and systemic risk diagnostics into the design of sustainable investment frameworks, ensuring that the transition toward greener finance does not overlook the vulnerabilities embedded in emerging and interconnected markets. The robustness checks presented in

Appendix B further confirm the stability of these results, validating both the direction and consistency of the estimated effects across alternative model specifications. To assess potential endogeneity within the quantile-regression framework, we implemented the IVQR estimator of

Chernozhukov and Hansen (

2005,

2006), but the procedure did not converge due to the non-invertibility of the Jacobian matrix—a known computational limitation (

Chernozhukov and Hansen 2005;

Machado and Santos Silva 2019). Given this constraint, we rely on a robust PCA to detect latent common factors that could generate omitted-variable bias or structural endogeneity. The decomposition does not reveal underlying confounding patterns, supporting the validity of the baseline quantile-regression specification.

6. Conclusions

The results presented in this study emphasize an important and nuanced insight: the relationship between sovereign risk and sustainability is neither static nor homogeneous. Although ESG-labeled financial instruments are designed to embody environmental, social, and governance principles, the empirical evidence suggests that the MSCI ESG Index remains exposed to the broad macro-financial forces that shape global markets. Rather than being insulated from systemic volatility, ESG assets appear integrated into the same financial dynamics, contagion channels, and investor reactions that influence conventional portfolios.

The quantile regression estimates reinforce this interpretation. The first principal component capturing the dominant, systemic dimension of sovereign risk derived from standardized CDS spreads exhibits a negative and significant association with ESG returns in lower quantiles. This pattern indicates that under adverse market conditions, such as recessions, geopolitical tensions, or tightening financial cycles, rising sovereign risk coincides with disproportionately negative outcomes for ESG assets. Rather than exhibiting countercyclical behavior, ESG portfolios tend to be drawn into broader risk-off episodes in which investors retrench and rebalance exposures independently of sustainability considerations.

In contrast, the second principal component, reflecting slow-moving structural improvements in sovereign profiles, becomes relevant only in the upper quantiles of the return distribution. Under favorable market conditions, countries with stronger institutional quality, fiscal fundamentals, and long-term creditworthiness tend to see relatively better ESG performance. This suggests that the credibility and resilience of sustainable finance ultimately depend not only on corporate-level ESG disclosures but also on sovereign-level macroeconomic and institutional conditions. Strengthening public governance, fiscal transparency, and long-term policy frameworks may therefore indirectly reinforce the appeal and stability of ESG-linked investments.

A similar pattern emerges when considering exposure to emerging markets. The consistently negative and significant effect of the MSCI Emerging Markets Index across quantiles points to structural vulnerabilities among ESG investments concentrated in developing economies. This reflects a broader tension within sustainable finance: although emerging markets offer the greatest potential for environmental and social impact, they also exhibit higher sovereign risk, weaker institutional buffers, and greater exposure to external shocks. Investors and policymakers therefore face a trade-off between maximizing sustainability impact and navigating heightened macro-financial fragility.

The performance of traditional control variables such as interest rates and exchange rates also offers insight. Their limited statistical significance across the return distribution suggests that conventional macroeconomic indicators may not fully capture the risk dynamics affecting ESG assets. Instead, the most influential drivers appear to be latent, market-driven, or structural in nature, including major stock-market indices and composite risk factors obtained through dimensionality-reduction techniques. This underscores the importance of considering global financial integration, investor sentiment, and sovereign-level fundamentals when evaluating ESG portfolios.

Overall, the evidence points to an important conclusion: ESG and sovereign risk are deeply interconnected. The long-term effectiveness and credibility of sustainable finance depend not only on firm-level ESG practices but also on macro-level fiscal sustainability, institutional stability, and sovereign risk management frameworks. The contrast between emerging and developed economies further illustrates structural asymmetries. Sovereign risk appears to exert stronger and more persistent effects in emerging markets, where institutional resilience is lower and financial systems have more limited capacity to absorb shocks. In developed economies, deeper markets and more robust public institutions mitigate the impact of volatility, reinforcing the need for context-specific strategies in the transition toward sustainable finance.

From a practical standpoint, investors can integrate sovereign-risk metrics alongside ESG criteria when designing portfolios, adjusting exposures according to systemic vulnerabilities. Policymakers and regulators can enhance credibility by incorporating sovereign-level ESG indicators in risk assessments, improving transparency, and designing stress-testing frameworks that explicitly consider systemic risk transmission into ESG portfolios.

Despite the relevance of these findings, the conclusions should be interpreted with caution. The empirical design faces several methodological constraints that limit the strength of causal interpretation and the robustness of the policy implications. First, the measurement of sovereign risk for Taiwan required the construction of an imputed CDS series, which may introduce noise and reduce comparability. Second, although control variables and dimensionality-reduction techniques were employed, the study did not implement a comprehensive set of robustness or sensitivity checks—such as alternative risk measures, sub-sample analyses, or model diagnostics. Third, endogeneity concerns remain only partially addressed, as the analysis did not apply standard instrumental-variable procedures or identification strategies capable of isolating causal effects. Finally, issues related to missing data required the use of robust PCA for dimensionality reduction, which, while effective for handling incomplete panels, may still leave residual uncertainty about the influence of data imputation on the extracted components. These limitations define the empirical scope of the study and suggest that the results should be viewed as indicative rather than definitive.

Ultimately, the evidence challenges the assumption that ESG assets are inherently insulated from systemic shocks. Instead, the findings point to the importance of integrating sovereign-risk assessment into sustainable investment frameworks to enhance resilience. Future research would benefit from expanding the analysis to additional asset classes, implementing more rigorous identification strategies, and exploring how investor behavior responds to the joint dynamics of sovereign risk and sustainability under varying financial conditions.