1. Introduction

In an increasingly volatile financial environment, understanding the dynamic relationship between asset productivity and credit delinquency has become a core concern for regulators and financial intermediaries. For Ecuadorian mutualist institutions and savings and credit cooperatives, which channel resources to households and productive sectors, solvency depends not only on their capacity to generate productive assets but also on the quality of their loan portfolios and their exposure to recurrent credit cycles. In a fully dollarized economy with limited monetary-policy instruments, balance-sheet composition and credit-risk management become the primary buffers against adverse shocks. These features make the joint behavior of productive assets and delinquency ratios a central object of empirical analysis.

Existing evidence for Ecuador underscores this connection.

Rodríguez (

2022) documents a negative relationship between liquidity and total delinquency in mutualist institutions, indicating that deteriorating credit quality rapidly erodes liquidity positions and constrains intermediation.

Urdaneta Montiel et al. (

2024) show that productive credit in Ecuador does not systematically translate into sustained economic growth, in part because financial institutions tend to favor short-term, low-risk operations over longer-term productive investment, limiting the formation of diversified and resilient productive-asset bases. At the micro level,

López-Sánchez et al. (

2021), using data from more than 7000 borrowers in the “Saving and Learning” program, find that repayment performance depends critically on group characteristics such as seniority, accumulated savings, and internal cohesion—evidence that the stability of productive assets is tied not only to their accounting value but also to the behavioral and organizational attributes behind them.

Institutional and regulatory developments further highlight the importance of integrating credit risk and asset productivity in a unified solvency perspective.

Blum and Sánchez Buri (

2018) show that the implementation of IFRS 9 in Ecuadorian financial institutions altered the measurement of expected credit losses, prompting earlier recognition of portfolio deterioration and stricter provisioning, with direct implications for the valuation of productive assets.

Sangacha et al. (

2017), analyzing CACPECO Ltda., illustrate how increases in delinquency during the 2016 slowdown affected equity and revealed the limits of relying solely on volume-based indicators: even with a high share of productive assets, inadequate credit-risk management can compromise solvency.

Torres-Inga et al. (

2022) find that Ecuadorian cooperatives exhibiting higher technical efficiency are those that maintain lower delinquency ratios and a more intensive and effective use of productive assets, whereas less efficient entities experience falling profitability and rising past-due loans. Taken together, these studies suggest that the sustainability of mutualist and cooperative institutions hinges on the interaction between productive asset allocation, portfolio quality, provisioning policies, and internal risk controls.

However, most supervisory and empirical approaches still assess these elements in a fragmented or static way. Early-warning systems often rely on aggregate delinquency ratios, capital adequacy measures, or simple thresholds applied independently to key indicators. Such designs typically assume smooth linear relationships and overlook the possibility that financial institutions alternate between discrete solvency regimes—ranging from normal conditions to intermediate stress and heightened vulnerability—in which the joint configuration of productive assets and segmented delinquency behaves differently. This limits the ability of supervisors and stakeholders to detect emerging stress, to understand how shocks propagate through specific portfolios, and to characterize the persistence or transience of deterioration episodes.

This paper addresses that gap by proposing a multivariate Gaussian Hidden Markov Model (HMM) to jointly model the ratio of productive assets to total assets (PATR) and a set of portfolio-specific delinquency rates for Ecuadorian mutualist institutions, using supervisory monthly data. The HMM framework treats solvency as a latent state that governs the joint distribution of these indicators and evolves over time according to estimated transition probabilities. By allowing for multiple unobserved regimes, the model captures non-linear shifts in behavior—such as transitions from stable configurations with low delinquency and robust productive-asset shares to states characterized by rising arrears and weaker asset productivity—without imposing ex ante thresholds.

The contribution of this study is primarily empirical and methodological in a meso-prudential sense. First, it develops a transparent, replicable procedure for identifying latent solvency regimes in a segment of the Ecuadorian financial system that is structurally important yet empirically underexplored. Second, it integrates portfolio-level delinquency information and PATR into a single dynamic framework, moving beyond isolated or static ratio analysis. Third, it provides quantitative measures of regime persistence, transition patterns, and empirical frequencies that can complement existing supervisory tools. The model is presented explicitly as a diagnostic and exploratory instrument rather than a causal or fully prescriptive framework: its purpose is to map patterns of joint deterioration and resilience, thereby supporting more informed monitoring of mutualist institutions within Ecuador’s prudential architecture.

2. Theoretical Framework

Contemporary research on financial risk shows that financial indicators are highly sensitive to macroeconomic conditions, institutional frictions, and the informational structure of balance-sheet and market data. For instance, a study of 597 commercial banks in Asia-Pacific (2006–2019) documents a curvilinear relationship between liquidity creation and regulatory capital, with the sign reversing as solvency approaches prudential thresholds, underscoring that capital buffers and risk-taking interact in a non-linear fashion (

Gupta et al. 2023). At the sovereign level, the explanatory power of fiscal and external imbalances for CDS premia across 27 European economies is time-varying over the cycle, which motivates the use of dynamic tools able to detect regime shifts in risk pricing (

Afonso et al. 2024). In primary bond markets, natural-language processing of rating reports shows that tonal semantics bears significantly on issuance spreads, suggesting that qualitative signals and the structure of disclosed information can be as decisive as traditional quantitative metrics in shaping credit conditions (

Peng et al. 2024).

Beyond individual institutions, network interactions magnify the transmission of shocks. Evidence on contingent convertible (CoCo) bonds indicates that trigger events can propagate distress through interbank exposures (

Li et al. 2022). A forward-looking equilibrium framework for the corporate sector shows that deteriorating fundamentals increase bankruptcy likelihood and reprice debt costs heterogeneously across industries, highlighting the role of sectoral composition in the build-up of insolvency risk (

Dainelli et al. 2024). In parallel, analyses of extreme spillovers between insurance-linked tokens and traditional equities reveal that system sensitivity escalates in the distribution tails, reinforcing the need for methodologies capable of identifying abrupt transitions across states of stress and calm (

Yousaf et al. 2023). Institutional and policy responses also shape insolvency dynamics: a cooperative deposit-insurance scheme in China reduces spreads on negotiable certificates of deposit and disciplines risk-taking among small banks (

So et al. 2024); for European SMEs, spikes in economic-policy uncertainty significantly raise the likelihood of financial distress, partially buffered by family ownership structures (

Hawach and Requejo 2025); unconventional monetary policies in the euro area reduce banks’ default probabilities while potentially incentivizing greater risk-taking in loan portfolios (

Kabundi and Simone 2022); and modeling jump arrivals in cash flows with Hawkes processes improves credit-risk identification relative to traditional Poisson specifications (

Lin et al. 2025). Further contributions emphasize how reforms to creditor rights, enhanced transparency in crypto-asset markets, and reputational monitoring systems can reconfigure incentives, affect funding structures, and reduce maturity mismatches (

Srivastava 2025;

Vidal-Tomás 2025;

Liang et al. 2025).

Within this debate, the productive-assets-to-total-assets ratio (PATR) emerges as a key indicator of banks’ and intermediaries’ capacity to allocate their balance sheets toward income-generating exposures. Empirical studies show that risk transfer through loan securitization has contributed to lowering non-performing loan (NPL) ratios and indirectly reinforcing the stock of productive assets (

Wengerek et al. 2022). At the same time, evidence on asset encumbrance suggests that increases—rather than the absolute level—of collateralization can exacerbate systemic risk by concentrating loss absorption in encumbered pools (

Cipollini et al. 2024), while the equity-market reaction to Basel reforms indicates that part of the risk burden has shifted from taxpayers to shareholders via higher capital requirements (

Krettek 2025). These findings support viewing PATR not in isolation, but in conjunction with portfolio-quality indicators and institutional arrangements that condition how solvency pressures materialize.

Despite extensive work on credit risk and prudential policy, a specific gap remains with respect to meso-level institutions such as mutuals and cooperatives in emerging markets. First, most early-warning and surveillance frameworks rely on aggregate NPL ratios or capital adequacy measures, without jointly modeling the interaction between segment-specific delinquency (e.g., productive, consumption, mortgage, microcredit, social housing, and education portfolios) and productive asset allocation in a dynamic, regime-based fashion. Second, empirical applications that use supervisory balance-sheet data for these entities often adopt linear or static models, which are ill-suited to capture abrupt shifts in the joint distribution of solvency indicators. This gap is salient for mutualist intermediaries, whose business models, funding bases, and regulatory environments differ from large commercial banks and may exhibit distinct transition patterns across “normal”, “intermediate stress”, and “heightened vulnerability” states.

Hidden Markov Models (HMMs) provide a natural framework to address these issues. In financial markets, HMMs have been widely employed to model switches between latent regimes of expansion, contraction, and high volatility.

Werge (

2021) shows that distinguishing such regimes allows for more accurate risk-adjusted return forecasts than stationary benchmarks.

Kim et al. (

2019) use HMM-based signals to optimize dynamic asset allocation, improving performance and reducing exposure to downturns.

Fons et al. (

2019) develop a feature-saliency HMM that jointly selects variables and regimes, outperforming traditional “smart beta” strategies by endogenously identifying state-dependent drivers of returns. These contributions underscore the suitability of HMMs to represent unobserved states of the system that govern the distribution of observable risk indicators.

Beyond portfolio selection, HMMs have been applied to reliability and operational risk.

Hofmann and Tashman (

2020) introduce mixed-membership Markov models to forecast industrial asset failures within partially observable decision processes, while

Rehab et al. (

2021) combine HMMs with principal component analysis to detect early-stage bearing faults. In these settings, HMMs act as probabilistic representations of “asset health”, where latent states encode different degradation or stability conditions that are not directly measurable but can be inferred from sensor data. The analogy is relevant for financial intermediaries: solvency can likewise be viewed as a latent condition inferred from observable ratios that jointly evolve over time.

In the credit-risk domain, HMMs are increasingly used to capture default dynamics and borrower heterogeneity.

Kamath and Noor (

2020) show that HMMs fed with sentiment and behavioral indicators can anticipate changes in creditworthiness before formal delinquency materializes.

Ntwiga et al. (

2018) apply HMMs to low-income borrowers in group-lending schemes, identifying stable versus volatile repayment states and enabling more granular risk-based pricing.

Meng et al. (

2017) studied the interaction between insurance, investment, and hidden risk using HMMs to derive optimal reinsurance strategies under incomplete information. Collectively, these studies highlight three properties that are central for the present work: (i) HMMs capture unobserved regimes that shape the joint behavior of key indicators; (ii) transition probabilities encode persistence and switching risks between such regimes; and (iii) multivariate specifications allow segment-level information (e.g., different loan portfolios) to inform inferences about the system’s underlying solvency state.

Building on this literature, our study proposes a multivariate Gaussian HMM that jointly models the PATR and a set of delinquency rates segmented by regulatory portfolio categories for a group of Ecuadorian mutualist entities. By focusing on supervisory data at a monthly frequency, the model is designed as an exploratory, yet fully replicable, meso-prudential mapping tool: it identifies latent regimes summarizing configurations of productive asset allocation and credit quality, and characterizes their persistence, transition patterns, and empirical frequencies. Unlike much of the prior work centered on large universal banks or market-based indicators, this approach targets a segment of the financial system that is structurally relevant for local credit provision but empirically underexplored.

4. Results

The information criteria in

Table 1 show a clear pattern of diminishing returns as model complexity increases. Moving from two to seven states substantially improves fit: the log-likelihood rises from 490.84 to 1783.86, indicating that additional regimes help capture heterogeneity in the joint behavior of PATR and segmented delinquency. However, this comes at the cost of an increasing number of parameters (from 73 in the two-state to 293 in the seven-state specification), which makes it essential to evaluate fit penalizing complexity via AIC and BIC.

Within the evaluated range, both criteria consistently favor the seven-state model. The AIC reaches its lowest value at seven states and deteriorates sharply when an eighth state is introduced, suggesting that the additional regime does not provide commensurate explanatory power. The BIC, which is more conservative, follows the same pattern: it becomes substantially more favorable (more negative) as we move toward seven states, and then worsens dramatically at eight states. The magnitude of the improvement between more parsimonious specifications and the seven-state model exceeds the conventional thresholds proposed by

Kass and Raftery (

1995) for “strong” or “decisive” evidence, while the jump at eight states is indicative of overfitting.

Even so, we interpret the seven-regime structure cautiously. It is presented as the preferred specification within the candidate set and given the available sample, not as a unique or structurally definitive partition. Its main advantage is to separate empirically distinct configurations of PATR and delinquency that would be pooled together under a coarser regime structure. This allows a more refined, yet non-causal, characterization of solvency conditions, while acknowledging that the relatively short sample, high parameterization, and Gaussian assumption remain important limitations and motivate future validation with alternative distributions, longer horizons, and simpler competing models.

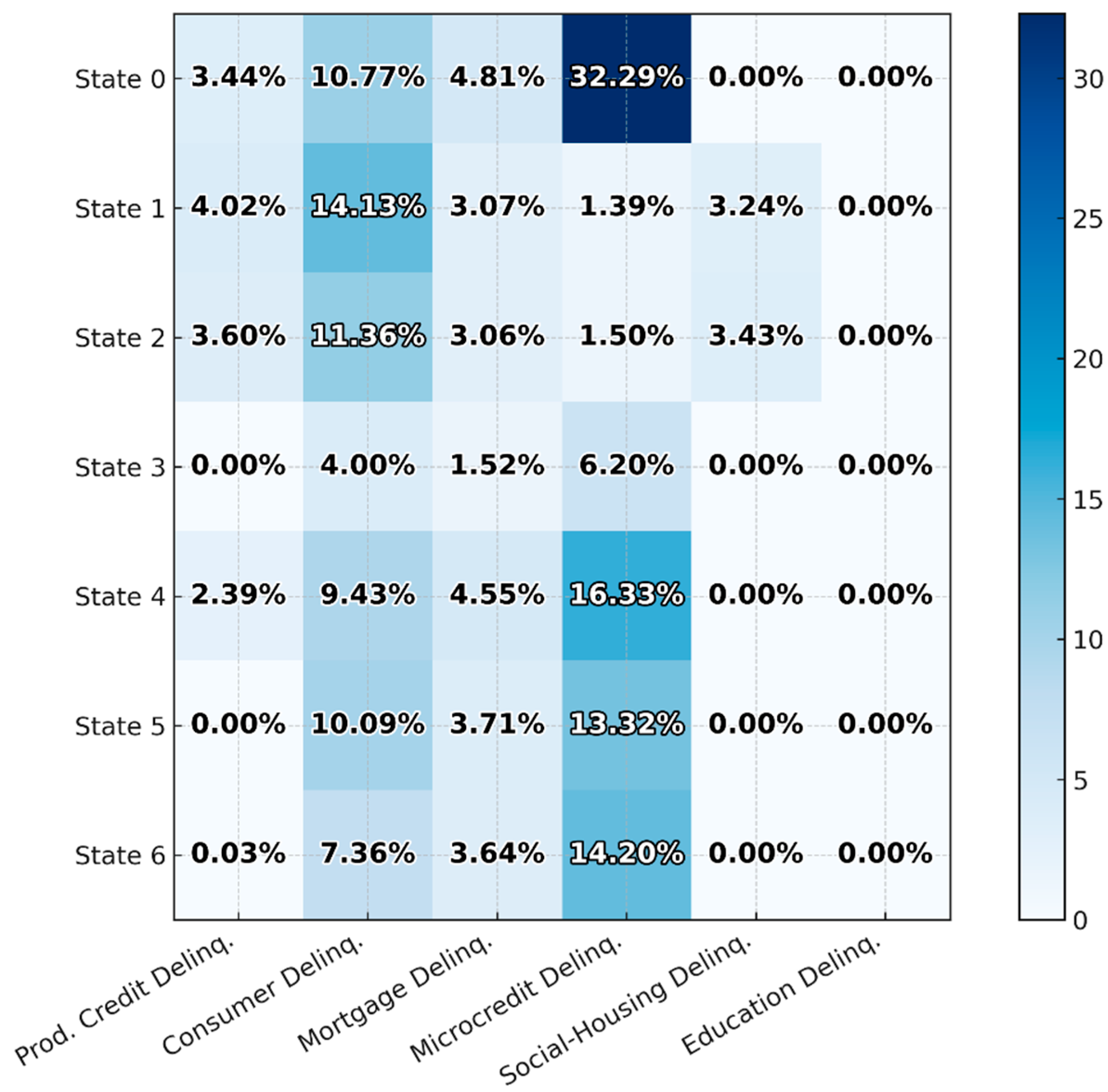

The diagram of means and variances in

Table 2 and the distribution of means in

Figure 1 make it possible to assign an economic identity to each of the seven latent regimes selected by the model. When the productive-assets ratio is transformed from the logistic scale back to the original scale, States 0 and 4 lie in the upper tail of the distribution, with shares close to seventy-three and seventy-one percent, respectively; States 3 and 6 sit around forty percent, while State 5 marks the minimum, around thirty percent, which hints at a context of inefficient balance-sheet utilization. This gradation confirms that the stochastic process does not swing between two poles but rather traverses a spectrum in which asset productivity deteriorates in steps.

State 0 combines the highest level of productivity with microcredit delinquency far above its own average, while the remaining portfolios are only moderately elevated. The coexistence of a first-tier productive-assets ratio and a critical point in microfinance suggests a more risky regime of aggressive credit expansion, supported by margins still able to absorb the impact. The coefficient of variation in this state is low, with the variance of productive-credit delinquency at 0.067 and that of consumer credit at 0.041, indicating that despite the localized stress, conditions remain relatively stable.

State 1 represents the initial phase of the process—the start probability is one—and exhibits the broadest delinquency profile: productive and consumer credit stand more than one standard deviation above the mean, while social-housing delinquency reaches its relative peak. Meanwhile, asset productivity falls to a medium-low range, approximately forty-five percent. This constitutes a phase we might call “early generalized stress,” characterized by breadth in deterioration and still-moderate variances, which explains its role as the chain’s starting point.

State 2 maintains intermediate productivity, close to the historical median, but retains elevated delinquency in productive credit and social housing, along with a slight uptick in consumer credit. The correlation pattern suggests that productive firms are withstanding a persistent shock of limited breadth. The relatively homogeneous variances—0.577 in productive credit and 0.484 in consumer credit—indicate that risk is distributed more evenly than in State 1, plausibly in a mild-slowdown environment.

State 3 shows a joint decline in productivity and delinquencies, all below the mean, configuring a “breathing space” after the shock. The drop in delinquency rates is accompanied by a significant reduction in their dispersion, especially in productive credit, whose variance falls to 0.001. This suggests a balance-sheet cleanup period in which the contraction of lending activity dominates.

State 4 again exhibits a high share of productive assets, but now with mortgage-credit delinquency clearly in positive territory and microcredit also above average. This is a regime of expansion centered on long-term assets; its microcredit variance rises to 1.641, the highest value in the panel, indicating wide and potentially explosive oscillations in that portfolio. This state provides the early warning signal of vulnerability that precedes correction phases.

State 5 has the lowest productivity and the highest variances: the variance of Ylogit more than doubles relative to the other regimes. The delinquency profile is not extreme in magnitude but is unstable, confirming that this is the acute-crisis phase; internal dispersions dominate the dynamics and prevent short-term efficiency recovery.

State 6 shares the productivity level of State 3 but maintains high variances in consumer and mortgage delinquencies. The reading suggests an exit-from-crisis regime in which fragility persists in specific segments and delays the full restoration of productivity. The elevated dispersion implies that small disturbances could push the system back into more strained phases.

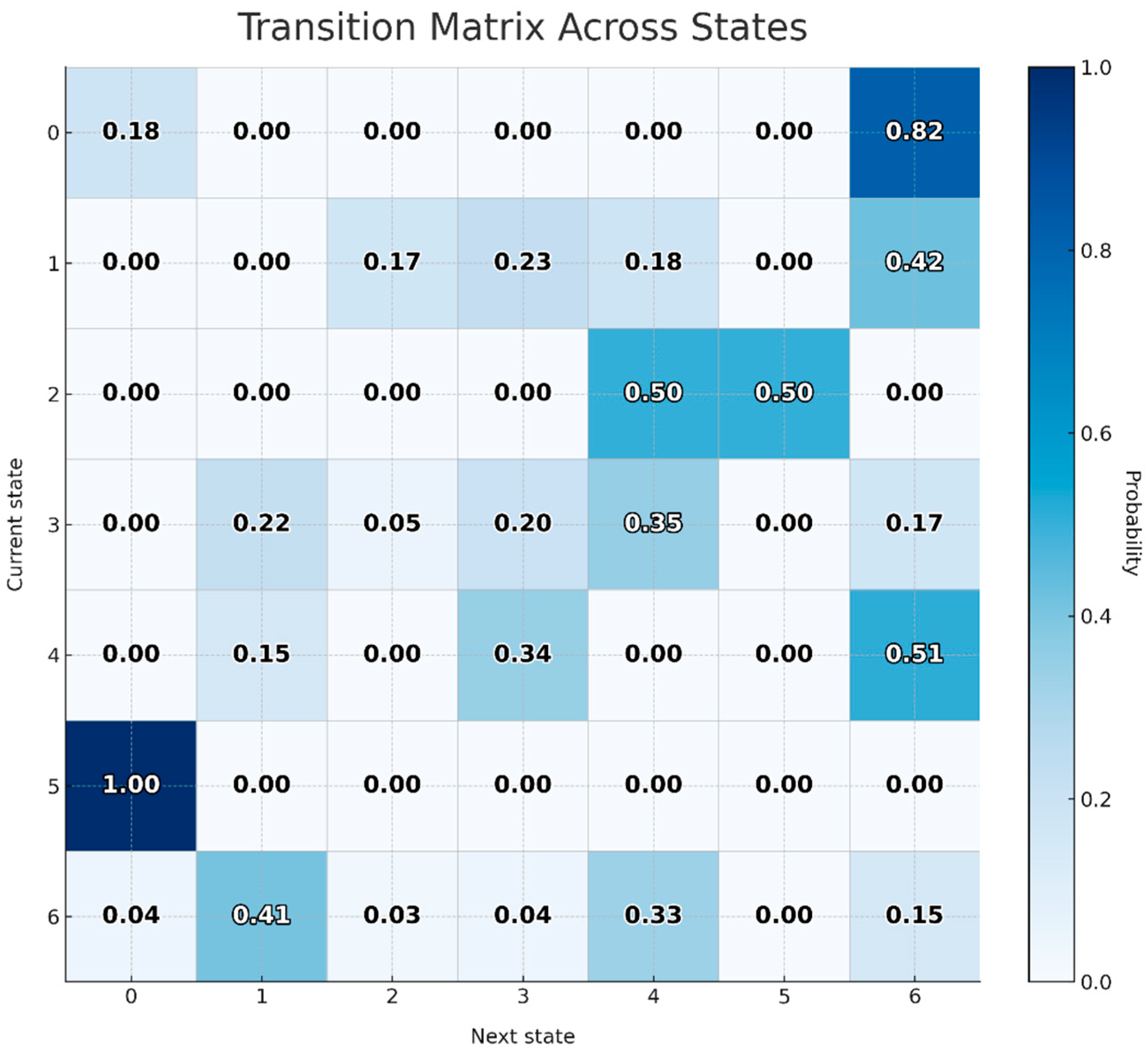

The transition matrix in

Figure 2 confirms that the latent phases link into an almost one-directional cycle that moves from aggressive expansion to severe crisis and, finally, returns to a still-fragile recovery. The empirical starting point is State 5, because its persistence probability is zero and the probability of migrating to State 0 is one. This deterministic jump reflects that episodes of minimal productivity and maximum variance resolve, in the sample, immediately into the phase where productivity reaches its historical peak while microcredit delinquency surges. State 0, in turn, has only 18% persistence and an 82% probability of shifting to State 6, which shares mid-range productivity levels but retains high variances in consumer and mortgage delinquency. The bifurcation widens there: State 6 decompresses mainly toward State 1 with a 41% transition, and to a lesser extent toward State 4 (33%) and State 0 (4%). Its probabilistic structure describes the stage in which imbalances in specific portfolios can either revert to expansion or deteriorate further depending on contemporaneous shocks.

State 1 is the cycle’s hinge: it retains no probability mass of its own (zero persistence) and disperses toward three destinations. 42% flows to State 6, evidencing oscillation between broad systemic strain and sector-specific fragility; 23% advances to State 3, where all delinquencies fall below the mean; and 17% goes to State 2, a regime of intermediate productivity with still-elevated delinquency in strategic portfolios. The largest flow from State 1 to 6 explains why full recovery is delayed: the probability of re-entering a fragile state exceeds that of converging to the cleanup phase.

Once reached, State 2 operates as a switching platform: it has no self-persistence and splits identical probabilities (50%/50%) between advancing to State 4—a renewed expansion with real-estate risk—and dropping to State 5, thereby restarting the collapse cycle. State 4, for its part, is defined by a bifurcation between deepening the adjustment (51% to 6) and partially retracing (34% to 3). Its zero persistence makes clear that it is a transitory regime with an expected duration of less than two periods.

State 3 displays the most balanced transition structure: it persists 20% of the time and distributes the remainder across States 1, 4, and 6, with the highest individual probability along the 3 → 4 path (35%). This dispersion pattern confirms its role as a “breathing window” after contraction, as the latent economy can rebound toward real-estate-led expansion (State 4) or, if tensions reappear, slide back into the systemic-stress phase (State 1).

Overall, the chain forms a directed cycle with few loops; the most relevant is 0 → 6 → 1 → 0, and long diagonal moves have virtually zero probability. This suggests that recovery and deterioration unfold in well-defined steps rather than abrupt jumps between opposite extremes. The probabilistic mapping thus provides direct inputs to estimate the average duration of elevated liquidity, the critical window during which systemic delinquency dominates, and the speed with which the collapse phase returns to expansion. With these parameters, one can calibrate, for example, the optimal time horizon for dynamic provisioning and the spacing of stress tests, aligning them with the empirical persistence of each regime.

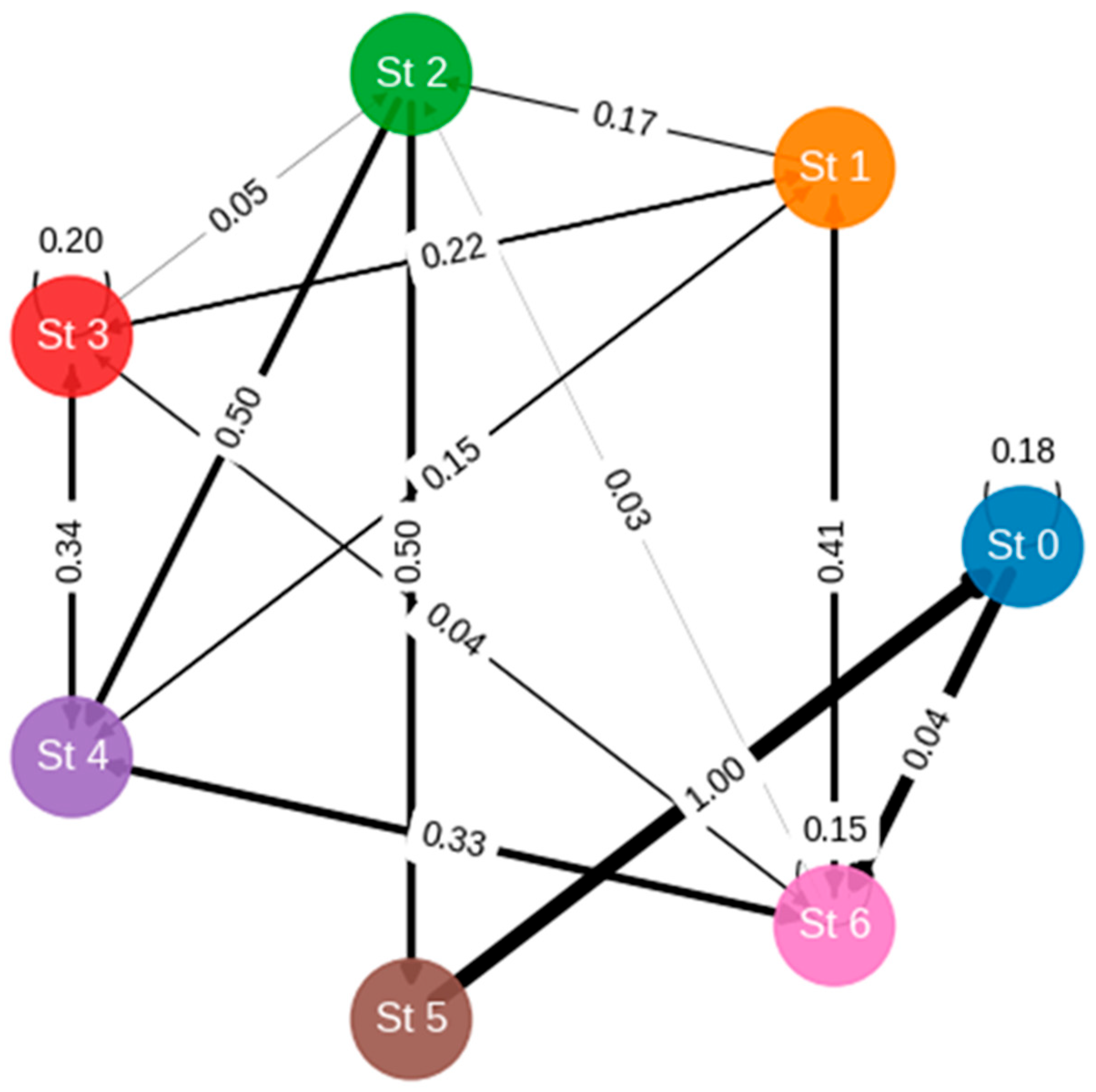

The transition graph in

Figure 3 visually captures the geometry of the detected cycle and corroborates the near-unidirectional flow already inferred from the numerical matrix. The weighted edges immediately reveal three key nodes by their centrality in the probabilistic flow. The first is State 5, which shows a unit weight toward State 0 and no return path; in graph-theoretic terms, it behaves as a source node that channels all traffic from the severe-crisis phase to aggressive expansion in a single step. The second critical vertex is State 0, whose thickest edge, with weight 0.41, leads to State 6. The latter emerges as a true pivot node: it aggregates four incoming and outgoing edges with meaningful weights and functions as a distributor among aggressive expansion, early systemic stress, and incomplete recovery, confirming its role as the cycle’s route exchanger.

The equal thickness of edges 2 → 5 and 2 → 4 (both 0.50) underscores the fundamental bifurcation that occurs once productivity returns to its median level. The graph shows that trajectories rarely make long diagonal jumps; instead, they chain through well-defined intermediate transitions—evident in the absence of direct lines between State 3 and State 5 or between State 1 and State 4. The most probable full cycle follows the sequence 5 → 0 → 6 → 1 → 2 → 4 → 6, before a new disturbance drives the system back onto the branch that leads to State 5. This structural repeatability is the distinguishing feature that legitimizes the seven-regime segmentation: the largest transitions recur on each turn of the circuit, offering a predictable time horizon for prudential decision-making.

Self-reinforcing loops are scarce: only State 0 exhibits visible persistence (18%), which indicates that phases are transitory and, therefore, that portfolio-management policies should anticipate regime changes rather than rely on prolonged periods of stability. In a single glance, the graph thus synthesizes the system’s internal propagation logic: an acute crisis triggers a burst of productivity that soon decays into sectoral vulnerability, evolves into generalized stress, and—absent effective intervention—feeds back into a new episode of severe contraction.

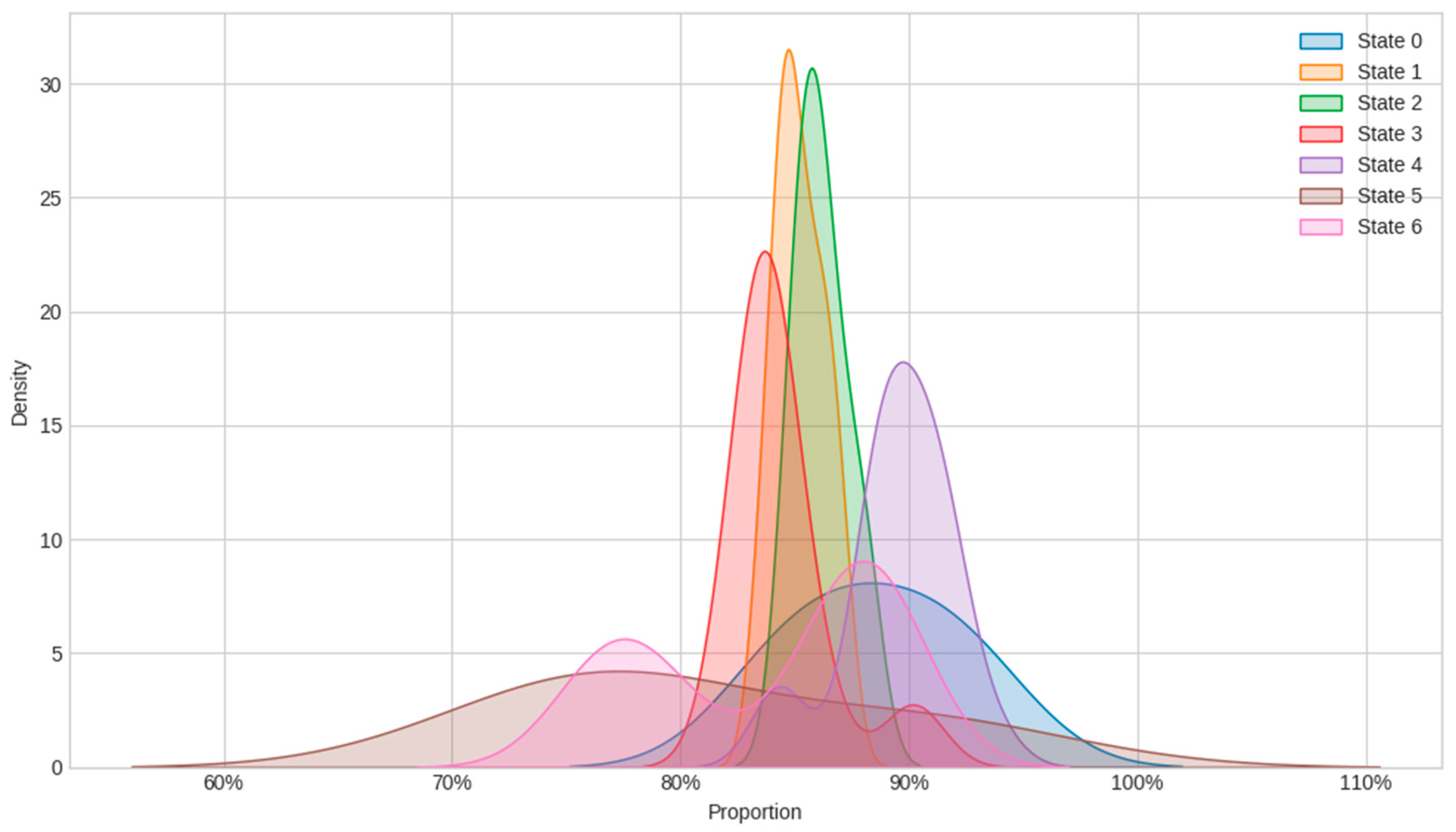

The density function in

Figure 4 estimates the distribution for the Productive Assets–to–Total Assets ratio and confirms the hierarchical stratification that the hidden-state model inferred from the means and variances. The distribution associated with State 0 spans from 83% to levels close to 100%, with a mode near 92%. That right tail shows that, even within the aggressive-expansion phase, the institution can move from outstanding efficiency to levels only slightly above average without leaving the same latent regime, a feature consistent with its intermediate variance. State 4 describes a block located between 88% and 93%, much denser and narrower; the high kurtosis confirms that productivity is sustained but with lower dispersion—a typical trait of an expansion leveraged in long-term assets whose returns rest on stable margins.

The triad of States 1, 2, and 3 is ordered in a descending staircase of productivity. State 2, with a mode around 86%, partially overlaps State 1, which concentrates mass around 84%; this shared band explains how easily the system oscillates between both regimes, as suggested by the 1 → 2 transition probability. State 3 shows the sharpest and narrowest density in the entire spectrum, with a peak near 81% and minimal variance; this is the phase in which credit contraction compresses both productivity and its volatility—a profile reflected by steep flanks and the absence of tails.

At the lower end lie States 6 and 5. State 6 exhibits a bell shifted toward 78–80% and retains some symmetry, indicating that productivity can rebound with similar probability toward higher or lower values without leaving the regime. In contrast, the curve for State 5 shows the greatest dispersion and left skew: it starts at 68% and extends beyond 75%, confirming that in the acute-crisis phase, efficiency degrades with very wide variability. This broad distribution justifies assigning State 5 the highest internal variances; the empirical spread shows that during severe contraction, the productive-assets ratio not only falls, but also becomes extremely uncertain.

The visible separation between the high and low densities reduces the likelihood of ambiguous classifications, so Viterbi decoding clearly discriminates when the system leaves a robust-productivity regime and enters fragile territory. The graph thus serves as a visual verification of the model’s ability to segment the space of financial states into clearly identifiable bands—an essential condition for transition probabilities and expected durations to translate into risk-management policies grounded in concrete, quantitative levels of operational efficiency.

Table 3 presents the summary statistics and D’Agostino–Pearson normality tests for the standardized features used as HMM emissions. The variables correspond to the logit-transformed productive-assets-to-total-assets ratio (Y_logit) and the standardized portfolio-specific delinquency rates.

The transformations deliver centered and unit-scaled variables, with Y_logit and some portfolios (e.g., mortgage credit) displaying acceptable deviations from normality. However, several delinquency rates—particularly Microcredit and Social Housing—exhibit positive skewness and statistically significant departures from normality, reflecting the presence of rare but high-stress realizations. The education portfolio is structurally zero in the sample, effectively non-informative.

These results confirm that the multivariate Gaussian assumption is an approximation rather than a literal description of the data-generating process. In the context of this study, the Gaussian HMM is therefore justified as an exploratory and diagnostic tool, but tail behavior and zero-inflated segments are acknowledged as limitations and natural motivations for future extensions with heavy-tailed or alternative emission distributions.

Table 4 summarizes the seven latent regimes estimated under the preferred full-covariance Gaussian HMM. For each state, we report mean PATR in levels, empirical frequency, expected duration (in months), stationary probability, and mean delinquency rates by portfolio (in percent). Labels are added ex post to facilitate interpretation; they are descriptive, not imposed as priors.

The regimes are non-redundant and economically interpretable:

States 4 and, to a lesser extent, 0 represent configurations with relatively high PATR. State 4 combines this with moderate microcredit delinquency and is relatively frequent; State 0 is rare and dominated by extreme microcredit arrears.

State 6 is the most frequent “baseline” regime, with intermediate PATR and moderate consumer/microcredit delinquency, indicating a normal but vulnerable configuration.

States 1 and 2 reflect broader or transitory stress, with higher consumer delinquency and slightly lower PATR.

States 3 and 5 capture more concentrated stress patterns—particularly in microcredit and selected portfolios—associated with lower or weakening PATR.

Expected durations are short (around 1–1.25 months), which reflects the relatively limited sample and high frequency of regime switching in the estimated process. This reinforces the need for cautious interpretation: the HMM is best viewed as a meso-prudential classification device of short-run configurations rather than as evidence of long structural cycles.

To verify that the results are not an artifact of an overly flexible covariance structure, we estimate alternative HMMs under a diagonal covariance assumption, using the same set of candidate numbers of states (2–8).

Table 5 reports the log-likelihood, number of parameters, AIC, and BIC for both families.

The seven-state full-covariance specification is strongly preferred by BIC, with a value of −2155.38, far below any diagonal-covariance alternative or lower-state full models. Diagonal HMMs favor a three-state solution under BIC but exhibit substantially worse fit than the full seven-state model, and fail to capture the rich cross-portfolio dependence structure that is central to the solvency mapping.

A small non-convergence warning appears for one diagonal specification, but the selected full-covariance model converges satisfactorily. Overall, the information-criterion evidence supports using the seven-state full-covariance Gaussian HMM as the main specification, while also showing that its advantage is not a marginal artifact.

In this specific application, the available data is aggregated at the mutual system level and does not uniformly include an institutional identifier that can be used for this exercise. Consequently, the jackknife test is not implemented due to the limited valid information provided by the SEPS (four mutual entities with short-term validity of annual financial data).

5. Discussion

The results position Ecuadorian mutualist institutions within a solvency dynamic that is consistent with previous evidence, while adding a meso-prudential structure that had not been formally quantified. The identification of seven latent regimes—defined by specific combinations of the productive-assets-to-total-assets ratio (PATR) and segmented delinquency rates—confirms that solvency does not evolve in a linear or binary fashion, but through discrete, relatively stable short-run configurations. This perspective is in line with national studies documenting the sensitivity of liquidity, profitability, and equity to changes in delinquency (

Rodríguez 2022;

Sangacha et al. 2017;

Torres-Inga et al. 2022), and shows that mutualists do not merely face “more” or “less” risk: they move across qualitatively distinct states in which portfolio quality and the deployment of productive assets are jointly reconfigured.

In particular, the presence of a frequent baseline regime with intermediate PATR and moderate delinquency, alongside states of localized stress (notably in microcredit and consumer credit) and others of broader vulnerability, is coherent with

Urdaneta Montiel et al. (

2024), who show that credit in Ecuador often concentrates in short-term, lower-risk operations, limiting the consolidation of robust productive portfolios. The regimes identified by the HMM illustrate how this tension materializes: phases with relatively high PATR can coexist with concentrated increases in delinquency in specific segments, whereas lower-PATR states display more diffuse or unstable stress patterns. In this way, the model provides empirical confirmation that the relationship between delinquency and the use of productive assets is non-linear and regime-dependent, aligning with international evidence on non-monotonic responses of liquidity, capital, and risk to shifts in the financial environment (

Gupta et al. 2023;

Dainelli et al. 2024).

The state structure also resonates with micro- and organizational-level findings.

López-Sánchez et al. (

2021) show that repayment performance in savings and credit groups hinges on institutional features and internal cohesion. At the aggregated mutualist level, our results suggest that such mechanisms are reflected in regimes where relatively small changes in specific portfolios (e.g., microcredit) trigger discrete shifts in the system’s overall solvency configuration. The “selective tension” states in microcredit or consumer credit—where PATR remains acceptable—are consistent with a segment that absorbs shocks through internal reallocation and tactical management before they escalate into generalized deterioration. This nuances a purely accounting view of risk: what matters is not only the size of past-due loans, but also in which portfolios they are concentrated and under what accompanying structure of productive assets.

From a regulatory and accounting perspective, the findings complement the discussion on provisioning and early loss recognition raised by

Blum and Sánchez Buri (

2018). The regime segmentation offers a probabilistic view of configurations in which deterioration in certain portfolios coexists with relatively strong PATR, suggesting that dynamic provisioning schemes or stress tests could be calibrated not only against fixed thresholds, but against joint patterns of indicators. Similarly, regimes characterized by low productivity and heightened volatility in delinquency show how short episodes can concentrate a significant share of systemic risk, reinforcing the argument that supervisory frameworks should detect rapid transitions rather than rely solely on annual averages. In this sense, the empirical results are consistent with studies showing how institutional reforms and incentive structures reshape the risk landscape (

Srivastava 2025;

Vidal-Tomás 2025;

Liang et al. 2025), although in this paper, that dimension is captured indirectly through the joint behavior of PATR and delinquency rates, without asserting structural causality.

Methodologically, the application of a multivariate Gaussian HMM to the Ecuadorian mutualist segment is aligned with the literature that employs regime-switching models to identify phases of markets, risk, or hidden deterioration (

Werge 2021;

Kim et al. 2019;

Fons et al. 2019;

Kamath and Noor 2020;

Ntwiga et al. 2018;

Meng et al. 2017;

Hofmann and Tashman 2020;

Rehab et al. 2021). The contribution here does not lie in proposing a radically new statistical structure, but in adapting an established framework to a specific institutional context, using official regulatory indicators and an exhaustive sample of the only four mutualist institutions under SEPS oversight. The systematic comparison of specifications shows that the seven-state, full-covariance model is strongly supported by the BIC relative to models with fewer states or diagonal covariance, suggesting that the richness of the identified patterns reflects genuine heterogeneity rather than arbitrary over-parameterization. At the same time, the normality diagnostics and the presence of skewness and heavy tails in several delinquency series confirm that Gaussianity is an approximation: the model should be interpreted as a first-generation diagnostic tool, open to future refinement via heavy-tailed emissions or more flexible structures.

The results must also be read within clearly defined boundaries. The time window is short, the analysis is performed at the aggregated mutualist-system level, and no explicit macroeconomic or external shock variables are included; consequently, the model does not establish causal relations nor does it evaluate, in a formal counterfactual sense, whether HMM-based triggers outperform simple rules based on delinquency or capital thresholds. The model is not intended to replace risk-based supervision or structural stress testing. Its role is to provide a compact mapping of typical solvency configurations and their transition dynamics. In this respect, the exercise is consistent with empirical work that uses regime-switching models primarily as classification and early-warning instruments, rather than as standalone prescriptive mechanisms. Making these restrictions explicit strengthens the credibility of the findings and prevents overstatements regarding the model’s predictive or normative capacity.

Despite these limitations, the evidence offers several practical insights. First, it shows that with routine regulatory data and a transparent methodology, it is possible to derive latent states that capture relevant combinations of productivity and credit risk at a meso-prudential level. Second, it suggests that certain trajectories—such as those combining declines in PATR with rising consumer and microcredit delinquency—may serve as early indicators of transitions toward higher-vulnerability regimes, opening the door to monitoring frameworks based on state probabilities rather than solely on deterministic cut-offs. Third, by documenting that some regimes are short-lived while others exhibit higher stationary probabilities, the model provides useful inputs for aligning provisioning horizons, intensified monitoring, and concentration limits with the empirical persistence of different risk configurations.

Taken together, the dialogue between our results and the cited literature indicates that the proposed approach occupies a robust middle ground. It is methodologically consistent with contemporary uses of regime-switching models, empirically anchored in the Ecuadorian institutional reality, and based exclusively on official indicators and the full universe of supervised mutualists, while openly acknowledging its constraints in terms of causality, coverage, and distributional assumptions. Under these conditions, the multivariate Gaussian HMM applied to the mutualist segment should not be read as a definitive statement on the structure of risk, but as a replicable instrument that organizes supervisory information into analytically useful states—upon which future research can layer macro-financial variables, longer horizons, and formal comparisons with alternative prudential rules.