A Financial Stability Model for Iraqi Companies

Abstract

1. Introduction

2. Theoretical Principles

2.1. Financial Stability

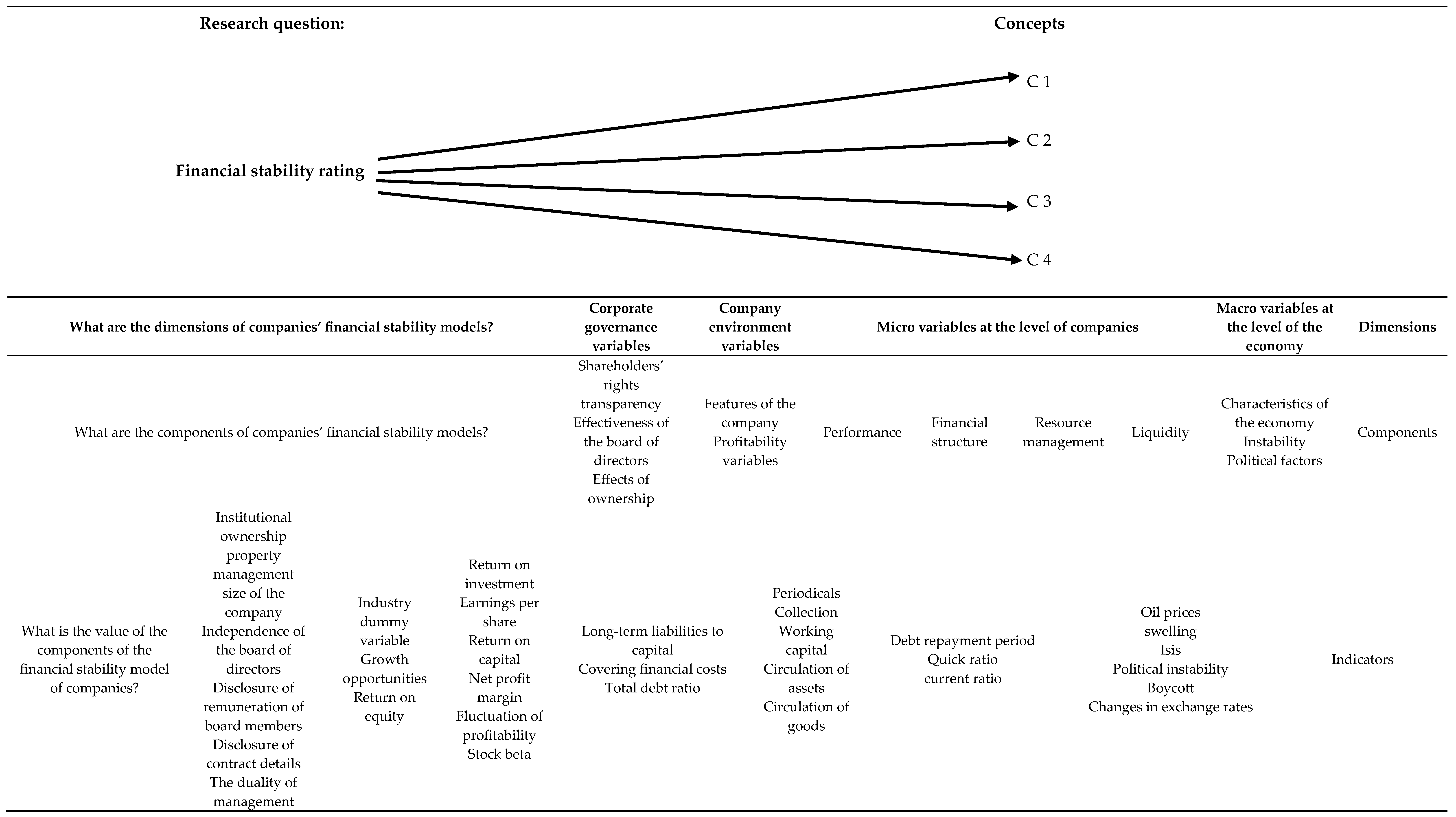

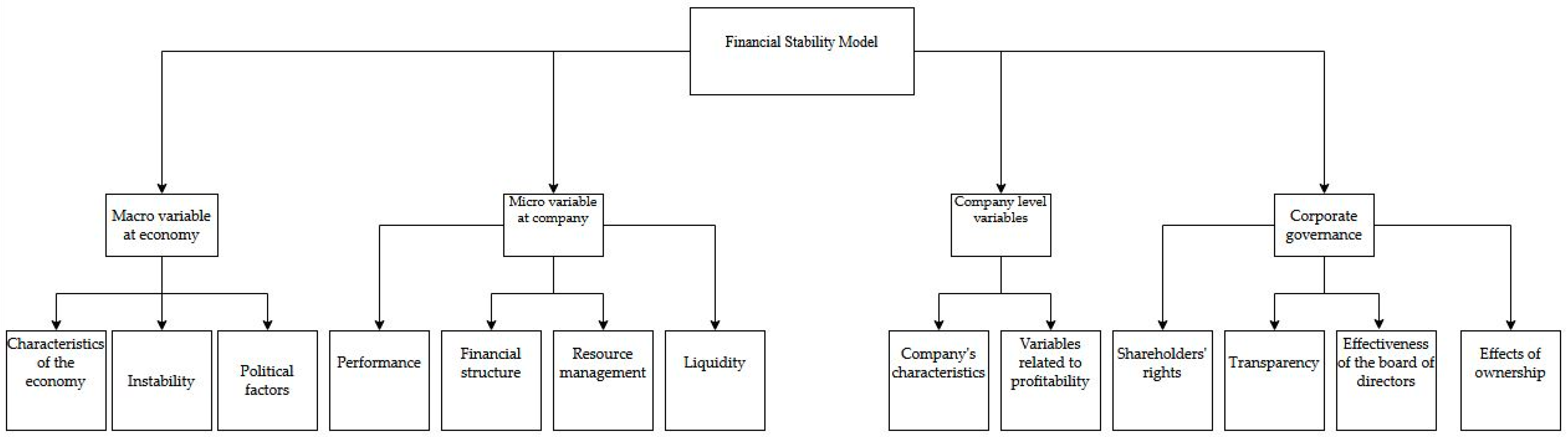

2.2. Financial Stability Dimensions and Indicators

2.3. Research Background

2.4. Conceptual Model

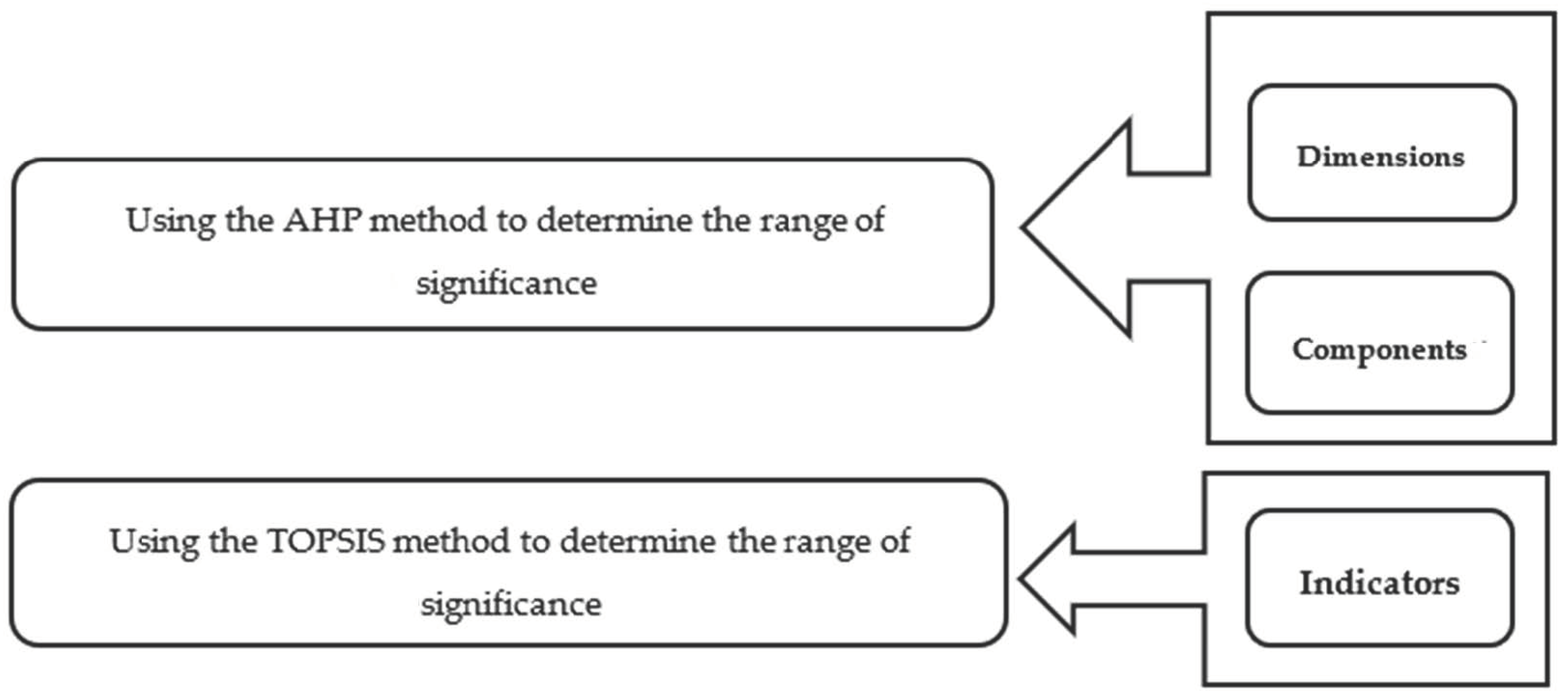

3. Research Method

3.1. Statistical Sample and Research Period

3.2. Sampling

3.3. Necessary Features for Experts

3.4. Data Collection Methods and Instruments

4. Data Analysis

4.1. The Results

4.2. Prioritization of Indicators by TOPSIS Method

5. Discussion

6. Implications

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Employed Questionnaires to Assess the Financial Stability

| No. | Questionnaire Items | Strongly Disagree | Disagree | Neutral | Agree | Strongly Agree | |

| Financial Stability | |||||||

| Firm-level factors | 1 | ||||||

| 2 | The Z-score serves as a suitable indicator of financial stability. | ||||||

| 3 | A model based on net profit margin, total debt-to-assets ratio, and current ratio can predict financial instability. | ||||||

| 4 | Social responsibility is related to financial stability. | ||||||

| 5 | Research and development expense is a significant factor in financial stability. | ||||||

| 6 | Accounting variables play a major role in companies’ financial stability. | ||||||

| 7 | Employee relations affect financial stability. | ||||||

| 8 | Foreign exchange backing of companies affects financial stability. | ||||||

| Corporate governance factors | 9 | Family ownership affect financial stability | |||||

| 10 | Family ownership in companies affects their financial stability. | ||||||

| 11 | The characteristics of the board of directors play a significant role in companies’ financial stability. | ||||||

| 12 | Corporate governance characteristics affect financial stability. | ||||||

| 13 | The independence of the board of directors plays a very important role in companies’ financial stability. | ||||||

| 14 | The size of the board of directors is one of the determining factors of a company’s financial stability. | ||||||

| 15 | The composition of the board of directors affects companies’ financial stability. | ||||||

| 16 | The CEO and executive managers play a determining role in the financial stability of companies. | ||||||

| 17 | Private ownership can lead to improved financial stability in companies. | ||||||

| 18 | The disclosure of contract details affects the financial stability of companies. | ||||||

| 19 | The disclosure of board members’ compensation affects companies’ financial stability. | ||||||

| 20 | Managerial ownership affects the financial stability of companies. | ||||||

| 21 | Management duality affects the financial stability of companies. | ||||||

| 22 | The industry in which companies operate affects their financial stability. | ||||||

| 23 | Growth opportunities in the industry affect companies’ financial stability. | ||||||

| 24 | The price of oil affects the financial stability of companies. | ||||||

| 25 | Inflation can affect the financial stability of companies. | ||||||

| 26 | Economic and political sanctions can affect companies’ financial stability. | ||||||

| 27 | Changes in exchange rates play a determining role in financial stability. | ||||||

| 28 | Attacks by the ISIS terrorist group and the occupation of the country by this group have affected the financial stability of companies. | ||||||

| 29 | The quick ratio and current ratio have affected the financial stability of companies. | ||||||

| 30 | The debt repayment period has affected companies’ financial stability. | ||||||

| 31 | Growth opportunities have affected the financial stability of companies. | ||||||

| 32 | Return on equity has affected the financial stability of companies. | ||||||

| 33 | Accounts receivable turnover has affected the financial stability of companies. | ||||||

| 34 | Working capital turnover has affected the financial stability of companies. | ||||||

| 35 | The debt-to-equity ratio has affected the financial stability of companies. | ||||||

| 36 | Interest coverage has affected the financial stability of companies. | ||||||

| |||||||

References

- Abbas, Ali Abdulhassan, Ayat Amer Hadi, and Amna Abbas Muhammad. 2021. Measuring the Extent of Liquidity’s Impact on the Financial Structure. International Journal of Multicultural and Multireligious Understanding 86: 365–89. [Google Scholar]

- Abdullah, Ranj Tahir. 2018. The Impact of Financial Crisis and ISIS on the Performance of Telecommunication Companies in Iraq. Sulaymaniyah: University of Sulaimani. [Google Scholar]

- Akins, Brian, Lynn Li, Jeffrey Ng, and Tjomme O. Rusticus. 2016. Bank competition and financial stability: Evidence from the financial crisis. Journal of Financial and Quantitative Analysis 51: 1–28. [Google Scholar] [CrossRef]

- Akosah, Nana, Francis Loloh, Natalia Lawson, and Claudia Kumah. 2018. Measuring Financial Stability in Ghana: A New Index-Based Approach. MPRA Paper, Ghana. Available online: https://mpra.ub.uni-muenchen.de/86634/ (accessed on 12 May 2018).

- Al-Hadi, Ahmed, Mostafa Monzur Hasan, Grantley Taylor, Mahmud Hossain, and Grant Richardson. 2017. Market risk disclosures and investment efficiency: International evidence from the Gulf Cooperation Council financial firms. Journal of International Financial Management and Accounting 28: 349–93. [Google Scholar] [CrossRef]

- Allen, William, and Geoffrey Wood. 2006. Defining and achieving financial stability. Journal of Financial Stability 2: 152–72. [Google Scholar] [CrossRef]

- Al-Rjoub, Samer. 2021. A financial stability index for Jordan. Journal of Central Banking Theory and Practice 10: 157–78. [Google Scholar] [CrossRef]

- Altman, Edward I. 1968. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance 23: 589–609. [Google Scholar] [CrossRef]

- Antonov, Ivan. 2022. Efficiency of financial management of energy companies as a component of ensuring the financial stability of the industry. Russian Journal of Resources, Conservation and Recycling 9: 1–7. [Google Scholar] [CrossRef]

- Aslam, Ejaz, Farrukh Ijaz, and Anam Iqba. 2016. Does working capital and financial structure impact profitability of Islamic and conventional banks differently? Islamic Banking and Finance Review 301: 50–67. [Google Scholar] [CrossRef]

- Ayam, Justice Ray Achoanya. 2021. Higher education financial sustainability in Ghana: A study of the perceived influential factors. Ghana Journal of Education: Issues and Practice (GJE) 7: 162–98. [Google Scholar]

- Barra, Cristian, and Nazzareno Ruggiero. 2021. The role of nonlinearity on the financial development–economic performance nexus: An econometric application to Italian banks. Empirical Economics 60: 2293–322. [Google Scholar] [CrossRef]

- Barra, Cristian, and Roberto Zotti. 2019. Bank performance, financial stability and market concentration: Evidence from cooperative and non-cooperative banks. Annals of Public and Cooperative Economics 90: 103–39. [Google Scholar] [CrossRef]

- Baur, Dirk, and Niels Schulze. 2009. Financial market stability—A test. Journal of International Financial Markets Institutions and Money 193: 506–19. [Google Scholar] [CrossRef]

- Bazzazan, Fatemeh. 2020. The effects of parametric reforms on retirees’ welfare and financial sustainability of the Social Security Organization pension system. Social Welfare Quarterly 20: 237–69. [Google Scholar]

- Beaver, William H., Maria Correia, and Maureen F. McNichols. 2011. Financial Statement Analysis and the Prediction of Financial Distress. Foundations and Trends® in Accounting 5: 99–173. [Google Scholar] [CrossRef]

- Beck, Thorsten, Hans Degryse, and Christiane Kneer. 2014. Is more finance better? Disentangling intermediation and size effects of financial systems. Journal of Financial Stability 10: 50–64. [Google Scholar] [CrossRef]

- Blank, Iven Aktus. 2013. Upravlenie Finansovoj Bezopasnost’ju Predprijatija. Working Paper. Iowa City: Игoрь Бланк (Igor Blank). [Google Scholar]

- Campbell, John Y., Jens Hilscher, and Jan Szilagyi. 2008. In search of distress risk. The Journal of Finance 63: 2899–939. [Google Scholar] [CrossRef]

- Chen, Ju, He Chang, and Yang Xiao. 2013. The Study on Financial Market Stability Based on Quantile Regression Technique. Finance 3: 59–68. Available online: https://hanspub.org/DownLoad/Page_DownLoad?FileName=FIN20130400000_35430647.pdf (accessed on 6 July 2024). [CrossRef]

- Chiladze, Izolda. 2018. Theoretical and practical aspects of profitability factorial analysis. Science and Studies of Accounting and Finance Problems and Perspectives 12: 12–19. [Google Scholar] [CrossRef]

- Chirilă, Viorica, and Ciprian Chirilă. 2015. Financial market stability: A quantile regression approach. Procedia Economics and Finance 20: 125–30. [Google Scholar] [CrossRef]

- Dai, Zhiyi, and Zhengming Zhou. 2022. Research and forecast analysis of financial stability for policy uncertainty. Computational Intelligence and Neuroscience 2022: 8799247. [Google Scholar] [CrossRef]

- Darrat, Ali, Stephen Gray, Jung Chul Park, and Yanhui Wu. 2016. Corporate governance and bankruptcy risk. Journal of Accounting Auditing and Finance 31: 163–202. [Google Scholar] [CrossRef]

- Eisdorfer, Assaf, Carmelo Giaccotto, and Reilly White. 2013. Capital structure executive compensation and investment efficiency. Journal of Banking and Finance 372: 549–62. [Google Scholar] [CrossRef]

- Elsayed, Ahmed, Nader Naifar, and Samia Nasreen. 2023. Financial stability and monetary policy reaction: Evidence from the GCC countries. The Quarterly Review of Economics and Finance 87: 396–405. [Google Scholar] [CrossRef]

- Enaiati, Anvar, Gholamreza Kordestani, and Ataollah Mohammadi Molgharni. 2022. Factors affecting financial stability in the social security organization. Governmental Accounting 9: 341–72. [Google Scholar]

- Fingleton, Bernard, Paul Charles Cheshire, Harry Garretsen, Danilo Camargo Igliori, Julie Le Gallo, John Stuart Landreth McCombie, Philip McCann, Basil J. Moore, Vassilis Monastiriotis, Mark Roberts, and et al. 2008. Editorial. Spatial Economic Analysis 3: 269–73. [Google Scholar] [CrossRef]

- Ghassan, Hassan, and Noureddine Krichene. 2017. Financial Stability of Conventional and Islamic Banks: A Survey. Munich: University Library of Munich. [Google Scholar]

- Goswami, Shubham, Bibhas Chandra, and Vineet Chouhan. 2014. Predicting financial stability of select BSE companies revisiting Altman Z score. International Letters of Social and Humanistic Sciences 26: 92–105. [Google Scholar]

- Gottardo, Pietro, and Anna Maria Moisello. 2017. Family firms, risk-taking and financial distress. Problems and Perspectives in Management 15: 168–77. [Google Scholar] [CrossRef]

- Habib, Ahsan, Mabel D’ Costa, Hedy Jiaying Huang, Bhuiyan Md. Borhan Uddin, and Sun Li. 2020. Determinants and consequences of financial distress: Review of the empirical literature. Accounting and Finance 60: 1023–75. [Google Scholar] [CrossRef]

- Hadian, Mehdi, and Hassan Dargahi. 2018. The Role of Macroeconomic Policies in the Financial Stability of Iran’s Economy. Iranian Journal of Economic Research 22: 45–82. [Google Scholar]

- Halim, Md. Abdul, Syed Moudud-Ul-Huq, Farid Ahammad Sobhani, Ziaul Karim, and Zinnatun Nesa. 2023. The nexus of banks’ competition ownership structure and economic growth on credit risk and financial stability. Economies 118: 203. [Google Scholar] [CrossRef]

- Hillegeist, Stephen A., Elizabeth K. Keating, Donald P. Cram, and Kyle G. Lundstedt. 2004. Assessing the probability of bankruptcy. Review of Accounting Studies 9: 5–34. [Google Scholar] [CrossRef]

- Hsu, Vernon, and Jing Wu. 2023. Inventory as a Financial Instrument: Evidence from China’s Metal Industries. Management Science 70: 3381–4165. [Google Scholar] [CrossRef]

- Icaza, Victor Echevarria. 2017. The literature on the interaction of fiscal risk and financial stability—A survey. Cuadernos de Economía 40: 177–90. [Google Scholar] [CrossRef]

- Ilesanmi, Kehinde Damilola, and Devi Datt Tewari. 2020. Financial stress index and economic activity in South Africa: New evidence. Economies 8: 110. [Google Scholar] [CrossRef]

- Kallunki, Juha-Pekka, and Elina Pyykkö. 2013. Do defaulting CEOs and directors increase the likelihood of financial distress in the firm? Review of Accounting Studies 18: 228–60. [Google Scholar] [CrossRef]

- Kalsie, Anjala, Jyoti Dhamija, and Ashima Arora. 2020. The Measure of Financial Stability and its Impact on Foreign Direct Investment: Evidence from BRIC Nations. International Journal of Accounting and Finance Review 5: 80–93. [Google Scholar] [CrossRef]

- Kane, Michael J., David Z. Hambrick, and Andrew RA Conway. 2005. Working memory capacity and fluid intelligence are strongly related constructs: Comment on Ackerman, Beier, and Boyle (2005). Psychological Bulletin 31: 66–71. [Google Scholar] [CrossRef]

- Kukushina, O.S., N.A. Kanishcheva, M.V. Kivarina, and E.A. Okomina. 2021. Modeling the Financial Stability of Enterprises in the Third Sphere of the Agro-Industrial Complex of the Region. IOP Conference Series: Earth and Environmental Science 852: 012057. [Google Scholar] [CrossRef]

- Mabvira, Lazarus Tapuwa. 2018. Essays on the Interplay between Bank Competition Corporate Governance Financial Stability and Misreporting in the Context of the Global Financial Crisis. Ph.D. thesis, University of Sussex, Brighton, UK. Available online: https://hdl.handle.net/10779/uos.23460965.v1 (accessed on 9 August 2023).

- Magee, Shane. 2013. The effect of foreign currency hedging on the probability of financial distress. Accounting and Finance 53: 1107–27. [Google Scholar] [CrossRef]

- Mamipour, Siab, and Farzaneh Godarzi. 2020. Investigating of Fiscal Policy Sustainability in Iran, by Markov Switching Unit Root Test. Journal of Economic Research (Tahghighat-E-Eghtesadi) 55: 437–62. [Google Scholar]

- Martinez-Miera, David, and Rafael Repullo. 2020. Interest Rates, Market Power, and Financial Stability. Finance and Economics 26: 4706–22. [Google Scholar]

- Mataibayeva, Gaukhar, Serik Makysh, Nurilya Kuchukova, Saule Zhalbinova, and Aigerim Zhussupova. 2019. Conceptual approaches to the public debt management and its impact on financial stability. Entrepreneurship and Sustainability 72: 1496–513. [Google Scholar] [CrossRef] [PubMed]

- Mayasari, Mayasari, and Niken Wulandari. 2022. Pengaruh financial stability, efectivitas internal control, dan auditor change fraud triangle financial statement fraud. Jurnal Manajemen Dan Bisnis 22: 128–42. [Google Scholar] [CrossRef]

- Misztal, Piotr. 2021. Public Debt Management and The Country’s Financial Stability. Studia Humana 10: 10–18. [Google Scholar] [CrossRef]

- Moudud-Ul-Huq, Syed, Tanmay Biswas, Md Abdul Halim, Miroslav Mateev, Imran Yousaf, and Mohammad Abedin. 2022. The effects of bank competition financial stability and ownership structure: Evidence from the Middle East and North African MENA countries. International Journal of Islamic and Middle Eastern Finance and Management 154: 717–38. [Google Scholar] [CrossRef]

- Nadri, Kamran, Sajad Ebrahimi, and Abbas Fadaie. 2018. An Investigation of Co-Movement of Financial Stability Index with Macro-Prudential Indicator through Wavelet Analysis. Journal of Money and Economy 13: 125–51. [Google Scholar]

- Nwogugu, Michael. 2015. Corporate Governance Financial Stability and Evolving Insurtech: The Case of Insurance Australia Group 2011–15. Working Paper. Available online: https://papers.ssrn.com/sol3/papers.cfm (accessed on 20 June 2023).

- Ohlson, James A. 1980. Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research 1: 109–31. [Google Scholar] [CrossRef]

- Oleynik, Olga, and Irina Borisova. 2019. The Comprehensive Assessment of the Strategy of Achieving Financial Sustainability in Engineering Companies. Regionalnaya Ekonomika Yug Rossii 7: 165–72. [Google Scholar] [CrossRef]

- Orazalin, Nurlan, Cemil Kuzey, Ali Uyar, and Abdullah S. Karaman. 2024. Does CSR contribute to the financial sector’s financial stability? The moderating role of a sustainability committee. Journal of Applied Accounting Research 25: 105–25. [Google Scholar] [CrossRef]

- Ozili, Peterson. 2018. Banking stability determinants in Africa. International Journal of Managerial Finance 14: 462–83. [Google Scholar] [CrossRef]

- Pinčák, Richard, and Erik Bartoš. 2015. With string model to time series forecasting. Physica A: Statistical Mechanics and Its Applications 436: 135–46. [Google Scholar] [CrossRef][Green Version]

- Rubio-Misas, María. 2020. Ownership structure and financial stability: Evidence from Takaful and conventional insurance firms. Pacific-Basin Finance Journal 62: 101355. [Google Scholar] [CrossRef]

- Schulze, Tatjana. 2022. Monetary Policy, Financial Stability, and Default in Advanced and Emerging Marketing Economies. Doctoral dissertation, University of Oxford, Oxford, UK. [Google Scholar]

- Shi, Jin-feng, wei-qi Liu, and wei Yang. 2011. Test for financial market stability based on quantile regression method. Chinese Journal of Management Science 192: 24–29. [Google Scholar]

- Stona, Filipe, Igor AC Morais, and Divanildo Triches. 2018. Economic dynamics during periods of financial stress: Evidence from Brazil. International Review of Economics and Finance 55: 130–44. [Google Scholar] [CrossRef]

- Sudarsanam, Sudi, and Jim Lai. 2001. Corporate financial distress and turnaround strategies: An empirical analysis. British Journal of Management 12: 183–99. [Google Scholar] [CrossRef]

- Susanto, Joko, and Sri Walyoto. 2023. The Effect of Corporate Governance on Financial Stability Sharia Bank in Indonesia. Journal of Management and Islamic Finance 31: 132–43. [Google Scholar] [CrossRef]

- Taranova, Irina V., Irina M. Podkolzina, Fatima M. Uzdenova, Oksana S. Dubskaya, and Alla V. Temirkanova. 2021. Methodology for assessing bankruptcy risks and financial sustainability management in regional agricultural organizations. In The Challenge of Sustainability in Agricultural Systems. Cham: Springer International Publishing, vol. 2, pp. 239–45. [Google Scholar] [CrossRef]

- Tennyson, Ben, Robert Ingram, and Michael Dugan. 2008. Assessing the Information Content of Narrative Disclosures in Explaining Bankruptcy. Journal of Business Finance and Accounting 17: 391–410. [Google Scholar] [CrossRef]

- Tinoco, Mario Hernandez, and Nick Wilson. 2013. Financial distress and bankruptcy prediction among listed companies using accounting, market and macroeconomic variables. International Review of Financial Analysis 30: 394–419. [Google Scholar] [CrossRef]

- Virolainen, Kimmo. 2004. Macro stress testing with a macroeconomic credit risk model for Finland. Bank of Finland Research Discussion Paper 1: 1–48. [Google Scholar]

- Wang, Jiaming, Andrey P. Jivkov, Dirk L. Engelberg, and Qingming Li. 2022. Image-Based vs. Parametric Modelling of Concrete Meso-Structures. Materials 15: 704. [Google Scholar] [CrossRef] [PubMed] [PubMed Central]

- Xie, Zhikang, Xinglin Liu, Hina Najam, Qinghua Fu, Jawad Abbas, Ubaldo Comite, Laura Mariana Cismas, and Andra Miculescu. 2022. Achieving financial sustainability through revenue diversification: A green pathway for financial institutions in Asia. Sustainability 14: 3512. [Google Scholar] [CrossRef]

- Yusgiantoro, Inka, Wahyoe Soedarmono, and Amine Tarazi. 2019. Bank consolidation and financial stability in Indonesia. International Economics 159: 94–104. [Google Scholar] [CrossRef]

- Zaiane, Salma, and Fatma Ben Moussa. 2021. What drives banking profitability during financial crisis and political turmoil? Evidence from the MENA region. Global Journal of Emerging Market Economies 133: 380–407. [Google Scholar] [CrossRef]

- Zargarkoche, Narges, and Saba SoroushRad. 2019. Investigating the dimensions of financial sustainability in the public sector. Accounting and Budgeting of the Public Sector 1: 24–36. [Google Scholar]

- Zhang, Honghui, Hedy Jiaying Huang, and Ahsan Habib. 2018. The effect of tournament incentives on financial restatements: Evidence from China. The International Journal of Accounting 53: 118–35. [Google Scholar] [CrossRef]

- Zmijewski, Mark E. 1984. Methodological issues related to the estimation of financial distress prediction models. Journal of Accounting Research 22: 59–82. [Google Scholar] [CrossRef]

| Authors | The Index Used for Financial Instability |

|---|---|

| Altman (1968) | Altman’s Z-score index is a measure to predict the probability of financial instability or helplessness based on financial ratios, including working capital to assets, residual profit to assets, profit before interest and tax to assets, the market value of stocks, and sales to assets. |

| Ohlson (1980) | Score index 9-factor linear combination of coefficients to evaluate the business probability of failure or financial instability. In this regard, the exponential power of this score is divided by 1 plus this exponential power. In this index, the forecasting factors are the sum of assets, the price index in national income, the sum of liabilities, working capital, current liabilities, and current assets; if the sum of liabilities is greater than the sum of assets, it takes 1; otherwise, 0. Net profit, operating cash flows; if the company has made losses in the last 2 years, it takes 1; otherwise, 0. |

| Zmijewski (1984) | It uses a model based on net profit to assets, total liabilities to assets, and current assets to current liabilities to predict financial instability. |

| Hillegeist et al. (2004) | They have used famous indicators based on accounting and market variables called BSM-Prob, which indicates the probability of financial helplessness and instability. The variables used include the current market value of assets, the objective value of debt, the expected return on assets, and the expected interest rate of stocks. |

| Campbell et al. (2008) | To measure financial stability and instability, the following model is developed by the authors: CHS = −20.26NIMTAAVG + 1.42TLMAT − 2.13EXRETAVG + 1.41SIGMA − 0.045RSIZE − 2.13CASHMTA + 0.075MB − 0.58PRICE − 9.1 In this model, NIMTAAVG is the measure of profitability, TLMTA is the measure of financial leverage, EXRETAVG is the average past excess return, SIGMA is the volatility of stock returns, RSIZE is the relative size of the company based on market value, CASHMTA is liquidity and short-term investment. In addition, MB is the market’s ratio to the stock’s book value and PRICE is the stock price based on decimals. CHS uses quarterly accounting data, lack of success, or instability for reasons related to performance and receiving points from rating agencies. The probability of failure and financial instability for a few years is based on logistic regression estimation. |

| Sudarsanam and Lai (2001) | The Toffler Z Index consists of components such as profit before tax, current liabilities to current assets, total liabilities to current liabilities, and total assets to the non-credit interval. |

| Zhang et al. (2018) | Crisis and non-crisis model. This index classifies companies into two categories, crisis and non-crisis, in terms of financial stability. |

| Authors | Research Question | Sample Studied | Method Used | Findings | Economic Significance |

|---|---|---|---|---|---|

| Al-Hadi et al. (2017) | The relationship between CSR and the probability of occurrence of financial instability in the economic cycle | 651 Australian companies, years 2007–2013, randomly selected | Altman’s Z-index: Lower values indicate less financial instability. | CSR reduces the possibility of financial instability at the maturity stage. | One deviation of the CSR benchmark reduces the probability of financial instability by 46%. |

| Zhang et al. (2018) | The impact of R&D spending on financial volatility | 55652 American companies, years 1980–2011 | Linear regression | R&D positively impacts financial volatility, especially in a recession, and intangible assets negatively impact future financial volatility. | One standard deviation of R&D reduces financial volatility by 1.3 percentage points. |

| Beck et al. (2014) | The relationship between CSR and the likelihood of financial instability | 58 Taiwanese companies in 2007–2010 | The structural equation model can predict financial volatility. | CSR reduces the possibility of financial instability in the global recession crisis. | - |

| Tinoco and Wilson (2013) | Accounting variables, capital market, and financial volatility | 23218 English companies, years 1980–2011 | Binary logistic regression | The full model has the same power to explain volatility changes as Altman. | No |

| Magee (2013) | Foreign exchange backing and financial instability | 401 American companies, 1996–2000 | Merton’s instability probability (1974) | Foreign exchange backing has a negative impact on financial instability. | One deviation of the foreign exchange backing benchmark reduces the probability of financial instability by 0.785%. |

| Kane et al. (2005) | Employee relations and the possibility of financial instability | 2228 American companies, 1991–2001 | Altman’s Z-index | Good relationships with employees have a negative impact on financial instability. | No |

| Tennyson et al. (2008) | Usefulness of financial information and financial instability | Two examples of 23 successful and unsuccessful English companies | The level of relevance of financial information has a negative impact on financial instability. | No |

| Authors | Research Question | Sample Studied | Method Used | Findings |

|---|---|---|---|---|

| Gottardo and Moisello (2017) | Family ownership and financial instability | 1137 views of Italy in 2004–2013 | Binary logistic regression | Family ownership, the number of family members in management, and female CEOs negatively affect financial instability. |

| Schulze (2022) | Characteristics of the board of directors and financial instability | 962 Australian companies, years 2000–2007 | Probability of financial instability, Merton (1974) | Management ownership reduces financial instability, and the percentage of non-executive directors increases financial instability. |

| Darrat et al. (2016) | Characteristics of corporate governance and financial instability | 217 successful and 9100 unsuccessful American companies, 1996–2006 | Logistic regression | Obligator, personal knowledge and experience, percentage of female managers, length of CEO tenure, CEO succession, reduced financial volatility, and CEO power increases financial volatility. |

| Hsu and Wu (2023) | Board composition and financial instability | Two samples of 234 English companies in 1997–2000 | Binary variable for financial instability and financial stability of the company | A company with more non-obligatory grey managers has more financial stability. |

| Kallunki and Pyykkö (2013) | Managing Director, Executive Director, and financial instability | 48716 Finnish companies, years 2001–2008 | Z-adjusted salary or benchmark CEO pay | A CEO or executive with a history of self-interest increases financial instability. |

| Tinoco and Wilson (2013) | Private ownership and financial instability | 1852 acquired companies from 15 European countries in 2008–2000 | Altman’s Z index and Olson’s index | Experienced private acquisition syndication managements have a negative effect on financial instability. |

| Variable | Respondent Opinion | Frequency | Percentage |

|---|---|---|---|

| Gender | Male | 19 | 90% |

| Female | 2 | 10% | |

| Age | Less than 40 | 11 | 53% |

| 40–45 | 4 | 19% | |

| 45–50 | 2 | 09% | |

| 50–55 | 4 | 19% | |

| Position | University professor | 2 | 10% |

| Accountants | 5 | 24% | |

| Auditor | 4 | 19% | |

| Financial manager | 6 | 28% | |

| Other | 4 | 19% | |

| Work experience | Less than 10 | 11 | 52% |

| 10–15 | 3 | 14% | |

| 15–20 | 1 | 06% | |

| 20–25 | 3 | 14% | |

| 25 and up | 3 | 14% | |

| Education | Bachelor’s degree | 12 | 57% |

| Master’s degree | 4 | 19% | |

| PhD | 5 | 24% | |

| Field of study | Economics | 6 | 28% |

| Accounting | 11 | 53% | |

| Management | 4 | 19% |

| Dimensions | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Macro Variable at Economy Level (C1) 0.168 | Micro Variable at Company Level (C2) 0.236 | Company Level Variables (C3) 0.251 | Corporate Governance Variables (C4) 0.345 | ||||||||

| Code | Title | Coefficient | Code | Title | Coefficient | Code | Title | Coefficient | Code | Title | Coefficient |

| C11 | Characteristics of the economy | 0.304 | C21 | Performance | 0.201 | C31 | Company’s characteristics | 0.401 | C41 | Shareholders’ rights | 0.225 |

| C12 | Instability | 0.265 | C22 | Financial structure | 0.331 | C32 | Variables related to profitability | 0.590 | C42 | Transparency | 0.312 |

| C13 | Political factors | 0.431 | C23 | Resource management | 0.163 | C43 | Effectiveness of the board of directors | 0.129 | |||

| C24 | Liquidity | 0.305 | C44 | Effects of ownership | 0.334 | ||||||

| Index Code | Definition | Index Coefficient in Component | Index Coefficient in the Final Model |

|---|---|---|---|

| The priority of component indicators of macro variables at the economic level | |||

| The priority of component indicators of economic characteristics | |||

| C111 | Oil price | 0.428 | 0.021 |

| C112 | Inflation | 0.572 | 0.029 |

| The priority of volatility component indicators | |||

| C121 | Isis | 0.331 | 0.014 |

| C121 | Changes in exchange rates | 0.273 | 0.012 |

| C123 | Economic and political instability | 0.369 | 0.016 |

| C131 | Sanctions | 1 | 0.07241 |

| According to the definition of only one index for this component, its coefficient is one. | |||

| The priority of micro variable component indicators at the level of companies | |||

| The priority of liquidity component indicators | |||

| C211 | Debt repayment period | 0.278 | 0.013 |

| C212 | Quick ratio | 0.457 | 0.021 |

| C213 | Current ratio | 0.265 | 0.012 |

| The priority of resource management component indicators | |||

| C221 | Periodicals Collection | 0.196 | 0.015 |

| C222 | Working capital | 0.350 | 0.027 |

| C223 | Turnover of assets | 0.258 | 0.020 |

| C224 | Turnover of goods | 0.196 | 0.015 |

| The priority of financial structure component indicators | |||

| C231 | 0.225 | 0.008 | |

| C232 | 0.312 | 0.012 | |

| C233 | 0.463 | 0.017 | |

| The priority of performance component indicators | |||

| C241 | Return on investment | 0.116 | 0.008 |

| C242 | Earnings per share | 0.237 | 0.016 |

| C243 | Return on capital | 0.145 | 0.010 |

| C244 | Net profit margin | 0.119 | 0.008 |

| C245 | Fluctuation of profitability | 0.215 | 0.015 |

| C246 | Stock beta | 0.168 | 0.012 |

| The priority of the component indicators of the variables of the company’s environment | |||

| The priority of the component indicators of the company’s characteristics | |||

| C11 | Industry dummy variable | 1 | 0.10291 |

| According to the definition of only one index for this component, its coefficient is one | |||

| The priority of profitability component indicators | |||

| C321 | Growth opportunities | 0.362 | 0.053 |

| C322 | Return on equity | 0.638 | 0.094 |

| Prioritization of component indicators of corporate governance variables | |||

| Priority of shareholder rights component indicators | |||

| C411 | Announcement of dividend policy | 0.183 | 0.014 |

| C412 | Providing financial reports | 0.298 | 0.023 |

| C413 | Future management and performance forecasting | 0.193 | 0.014 |

| C414 | Presenting the report of the board in meeting | 0.326 | 0.025 |

| The priority of transparency component indicators | |||

| C421 | Disclosure of remuneration of board members | 0.421 | 0.045 |

| C422 | Disclosure of contract details | 0.351 | 0.037 |

| C423 | Disclosure of shares of board members | 0.228 | 0.024 |

| The priority of indicators of the effectiveness of corporate governance | |||

| C431 | Independence of the board of directors | 0.250 | 0.011 |

| C432 | Financial expertise of the board of directors | 0.319 | 0.014 |

| C433 | Expertise in the board industry | 0.103 | 0.004 |

| C434 | The duality of management | 0.119 | 0.005 |

| C435 | The existence of an audit committee | 0.209 | 0.009 |

| The priority of ownership affects component indicators | |||

| C441 | Institutional ownership | 0.467 | 0.053 |

| C442 | Property management | 0.533 | 0.061 |

| No. | Code | Title | Coefficient in the Final Model | No. | Code | Title | Coefficient in the Final Model |

|---|---|---|---|---|---|---|---|

| 1 | C32 | Variables related to profitability | 0.148 | 8 | C41 | Shareholders’ rights | 0.069 |

| 2 | C44 | Effects of ownership | 0.115 | 9 | C11 | Characteristics of the economy | 0.051 |

| 3 | C42 | Transparency | 0.107 | 10 | C21 | Function | 0.047 |

| 4 | C31 | Features of the company | 0.102 | 11 | C12 | Instability | 0.044 |

| 5 | C22 | Financial structure | 0.078 | 12 | C43 | Effectiveness of the board of directors | 0.044 |

| 6 | C24 | Liquidity | 0.072 | 13 | C23 | Resource management | 0.038 |

| 7 | C13 | Political factors | 0.072 | ||||

| Code | Index Title | Coefficient in the Final Model |

|---|---|---|

| C311 | Industry dummy variable | 0.102 |

| C322 | Return on equity | 0.094 |

| C131 | Sanctions | 0.072 |

| C442 | Managerial ownership | 0.061 |

| C441 | Institutional ownership | 0.053 |

| C321 | Growth opportunities | 0.053 |

| C421 | Disclosure of remuneration of board members | 0.045 |

| C422 | Disclosure of contract details | 0.037 |

| C112 | Inflation | 0.029 |

| C222 | Working capital | 0.027 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abdlkareem Ibrahim, N.; Salehi, M.; Amran Naji Al-Refiay, H.; Lari Dashtbayaz, M. A Financial Stability Model for Iraqi Companies. Risks 2024, 12, 140. https://doi.org/10.3390/risks12090140

Abdlkareem Ibrahim N, Salehi M, Amran Naji Al-Refiay H, Lari Dashtbayaz M. A Financial Stability Model for Iraqi Companies. Risks. 2024; 12(9):140. https://doi.org/10.3390/risks12090140

Chicago/Turabian StyleAbdlkareem Ibrahim, Narjis, Mahdi Salehi, Hussen Amran Naji Al-Refiay, and Mahmoud Lari Dashtbayaz. 2024. "A Financial Stability Model for Iraqi Companies" Risks 12, no. 9: 140. https://doi.org/10.3390/risks12090140

APA StyleAbdlkareem Ibrahim, N., Salehi, M., Amran Naji Al-Refiay, H., & Lari Dashtbayaz, M. (2024). A Financial Stability Model for Iraqi Companies. Risks, 12(9), 140. https://doi.org/10.3390/risks12090140