Gender Pension Gap in EU Countries: A Between-Group Inequality Approach

Abstract

1. Introduction

2. Institutional Background

3. Methodology

4. Analysis

4.1. Data

4.2. Results and Discussion

5. Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Country | G. | Stat. | W1 | W2 | W4 | W5 | W6 | W7 | W8 |

|---|---|---|---|---|---|---|---|---|---|

| Austria | M. | Obs. | 666 | 309 | 1097 | 1072 | 899 | 145 | 465 |

| Mean | 2588 | 1358 | 1840 | 1652 | 1639 | 1710 | 1850 | ||

| F. | Obs. | 826 | 360 | 1351 | 1298 | 1121 | 207 | 640 | |

| Mean | 1856 | 941 | 1223 | 1199 | 1147 | 1205 | 1353 | ||

| Belgium | M. | Obs. | 1326 | 741 | 1143 | 1290 | 1360 | 553 | 613 |

| Mean | 3158 | 2151 | 3849 | 2717 | 3164 | 2584 | 2993 | ||

| F. | Obs. | 946 | 546 | 882 | 1058 | 1173 | 518 | 595 | |

| Mean | 2036 | 1704 | 2560 | 2080 | 2508 | 1888 | 2727 | ||

| Czech R. | M. | Obs. | 482 | 1111 | 1259 | 1161 | 263 | 763 | |

| Mean | 312 | 422 | 418 | 433 | 460 | 524 | |||

| F. | Obs. | 821 | 1761 | 1982 | 1852 | 413 | 1179 | ||

| Mean | 281 | 370 | 365 | 381 | 407 | 461 | |||

| Denmark | M. | Obs. | 566 | 478 | 399 | 784 | 735 | 334 | 526 |

| Mean | 1510 | 1213 | 1390 | 1482 | 1289 | 1354 | 1424 | ||

| F. | Obs. | 682 | 571 | 499 | 935 | 857 | 433 | 597 | |

| Mean | 1235 | 1066 | 1282 | 1341 | 1202 | 1329 | 1377 | ||

| France | M. | Obs. | 1126 | 595 | 1237 | 1121 | 985 | 383 | 718 |

| Mean | 1934 | 1738 | 1718 | 1808 | 1850 | 2108 | 1924 | ||

| F. | Obs. | 1102 | 587 | 1345 | 1300 | 1130 | 433 | 860 | |

| Mean | 1464 | 1088 | 1186 | 1275 | 1337 | 1466 | 1460 | ||

| Germany | M. | Obs. | 1120 | 537 | 447 | 1194 | 1101 | 300 | 866 |

| Mean | 1465 | 1494 | 1609 | 1576 | 1557 | 1587 | 1732 | ||

| F. | Obs. | 1030 | 504 | 378 | 1111 | 989 | 308 | 868 | |

| Mean | 835 | 835 | 831 | 881 | 911 | 1050 | 1146 | ||

| Italy | M. | Obs. | 1190 | 835 | 944 | 1132 | 1257 | 500 | 459 |

| Mean | 1057 | 1090 | 1180 | 1186 | 1206 | 1182 | 1227 | ||

| F. | Obs. | 884 | 539 | 669 | 831 | 907 | 391 | 332 | |

| Mean | 686 | 708 | 820 | 862 | 917 | 914 | 1000 | ||

| Spain | M. | Obs. | 788 | 493 | 813 | 1339 | 1225 | 355 | 567 |

| Mean | 756 | 831 | 924 | 961 | 993 | 986 | 1113 | ||

| F. | Obs. | 272 | 174 | 316 | 745 | 645 | 185 | 400 | |

| Mean | 637 | 578 | 687 | 760 | 789 | 786 | 846 | ||

| Sweden | M. | Obs. | 1236 | 565 | 503 | 952 | 960 | 287 | 676 |

| Mean | 1668 | 1272 | 1561 | 1936 | 1591 | 1616 | 1666 | ||

| F. | Obs. | 1366 | 581 | 541 | 1017 | 1067 | 389 | 758 | |

| Mean | 1138 | 916 | 1257 | 1610 | 1234 | 1304 | 1341 |

| Country | Gender | W1 | W2 | W4 | W5 | W6 | W7 | W8 |

|---|---|---|---|---|---|---|---|---|

| Austria | Men | 68.4 | 71.7 | 70.8 | 71.5 | 74.1 | 75.5 | 75.5 |

| Women | 69.1 | 71.3 | 69.5 | 70.5 | 74.8 | 73.9 | 73.9 | |

| Belgium | Men | 70.3 | 72.5 | 71.5 | 71.8 | 73.6 | 73.8 | 73.8 |

| Women | 70.6 | 72.6 | 71.9 | 71.9 | 73.5 | 73.7 | 73.7 | |

| Czech R. | Men | - | 72.4 | 71.2 | 71.5 | 73.9 | 74.6 | 74.6 |

| Women | - | 70.1 | 70.0 | 70.5 | 72.8 | 73.7 | 73.7 | |

| Denmark | Men | 72.3 | 73.7 | 73.2 | 73.2 | 74.5 | 75.3 | 75.3 |

| Women | 72.9 | 74.7 | 73.6 | 72.9 | 74.2 | 74.9 | 74.9 | |

| France | Men | 70.2 | 72.2 | 70.8 | 71.5 | 72.5 | 73.3 | 73.3 |

| Women | 71.4 | 73.1 | 71.6 | 72.3 | 73.0 | 74.2 | 74.2 | |

| Germany | Men | 70.3 | 72.3 | 72.8 | 72.8 | 74.1 | 75.5 | 75.5 |

| Women | 71.7 | 73.1 | 72.8 | 72.7 | 73.1 | 74.4 | 74.4 | |

| Italy | Men | 68.4 | 71.2 | 71.8 | 72.4 | 75.9 | 76.2 | 76.2 |

| Women | 68.7 | 70.7 | 70.6 | 72.0 | 74.5 | 75.9 | 75.9 | |

| Spain | Men | 72.7 | 74.8 | 74.4 | 74.8 | 76.6 | 76.9 | 76.9 |

| Women | 74.4 | 75.2 | 74.5 | 75.2 | 75.6 | 76.1 | 76.1 | |

| Sweden | Men | 72.8 | 76.0 | 74.8 | 74.2 | 76.0 | 76.6 | 76.6 |

| Women | 71.7 | 74.8 | 74.0 | 73.6 | 75.6 | 76.4 | 76.4 |

Appendix B

| Country | Index | W1 | W2 | W4 | W5 | W6 | W7 | W8 |

|---|---|---|---|---|---|---|---|---|

| Austria | 0.014 | 0.017 | 0.021 | 0.013 | 0.017 | 0.013 | 0.013 | |

| 0.455 | 0.073 | 0.205 | 0.132 | 0.100 | 0.085 | 0.092 | ||

| 0.469 | 0.090 | 0.226 | 0.145 | 0.116 | 0.099 | 0.105 | ||

| 0.283 | 0.307 | 0.336 | 0.275 | 0.300 | 0.295 | 0.269 | ||

| Belgium | 0.025 | 0.007 | 0.024 | 0.009 | 0.008 | 0.014 | 0.000 | |

| 0.631 | 0.460 | 0.662 | 0.484 | 0.526 | 0.349 | 0.418 | ||

| 0.657 | 0.467 | 0.685 | 0.493 | 0.535 | 0.363 | 0.418 | ||

| 0.355 | 0.208 | 0.335 | 0.235 | 0.208 | 0.269 | 0.089 | ||

| Czech R. | 0.001 | 0.002 | 0.002 | 0.002 | 0.003 | 0.003 | ||

| 0.055 | 0.129 | 0.161 | 0.053 | 0.049 | 0.073 | |||

| 0.056 | 0.131 | 0.164 | 0.055 | 0.053 | 0.076 | |||

| 0.098 | 0.122 | 0.128 | 0.120 | 0.116 | 0.122 | |||

| Denmark | 0.005 | 0.002 | 0.001 | 0.001 | 0.000 | 0.000 | 0.000 | |

| 0.119 | 0.099 | 0.085 | 0.098 | 0.089 | 0.081 | 0.075 | ||

| 0.124 | 0.100 | 0.086 | 0.099 | 0.090 | 0.081 | 0.075 | ||

| 0.182 | 0.121 | 0.077 | 0.095 | 0.067 | 0.019 | 0.033 | ||

| France | 0.009 | 0.028 | 0.017 | 0.015 | 0.013 | 0.016 | 0.009 | |

| 0.366 | 0.197 | 0.165 | 0.169 | 0.147 | 0.168 | 0.128 | ||

| 0.375 | 0.225 | 0.182 | 0.184 | 0.161 | 0.184 | 0.136 | ||

| 0.243 | 0.374 | 0.310 | 0.295 | 0.277 | 0.305 | 0.241 | ||

| Germany | 0.028 | 0.033 | 0.044 | 0.029 | 0.027 | 0.015 | 0.016 | |

| 0.139 | 0.146 | 0.163 | 0.206 | 0.173 | 0.152 | 0.146 | ||

| 0.167 | 0.179 | 0.207 | 0.234 | 0.200 | 0.166 | 0.162 | ||

| 0.430 | 0.441 | 0.484 | 0.441 | 0.415 | 0.338 | 0.338 | ||

| Italy | 0.021 | 0.023 | 0.017 | 0.011 | 0.008 | 0.007 | 0.006 | |

| 0.132 | 0.100 | 0.110 | 0.093 | 0.077 | 0.083 | 0.088 | ||

| 0.153 | 0.123 | 0.127 | 0.104 | 0.085 | 0.090 | 0.095 | ||

| 0.351 | 0.351 | 0.305 | 0.273 | 0.240 | 0.227 | 0.185 | ||

| Spain | 0.003 | 0.015 | 0.008 | 0.004 | 0.005 | 0.006 | 0.005 | |

| 0.208 | 0.154 | 0.101 | 0.092 | 0.087 | 0.088 | 0.098 | ||

| 0.211 | 0.169 | 0.109 | 0.096 | 0.091 | 0.094 | 0.103 | ||

| 0.158 | 0.304 | 0.257 | 0.210 | 0.205 | 0.203 | 0.240 | ||

| Sweden | 0.015 | 0.011 | 0.005 | 0.003 | 0.007 | 0.004 | 0.005 | |

| 0.120 | 0.074 | 0.137 | 0.179 | 0.103 | 0.079 | 0.121 | ||

| 0.136 | 0.085 | 0.142 | 0.182 | 0.109 | 0.083 | 0.126 | ||

| 0.317 | 0.280 | 0.195 | 0.168 | 0.225 | 0.193 | 0.195 |

| Country | W1 | W2 | W4 | W5 | W6 | W7 | W8 | Avg. |

|---|---|---|---|---|---|---|---|---|

| Austria | 0.03 | 0.18 | 0.09 | 0.09 | 0.14 | 0.14 | 0.12 | 0.10 |

| Belgium | 0.04 | 0.01 | 0.03 | 0.02 | 0.02 | 0.04 | 0.00 | 0.02 |

| Czech R. | 0.02 | 0.01 | 0.01 | 0.04 | 0.06 | 0.03 | 0.03 | |

| Denmark | 0.04 | 0.02 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | 0.01 |

| France | 0.02 | 0.13 | 0.09 | 0.08 | 0.08 | 0.09 | 0.06 | 0.08 |

| Germany | 0.17 | 0.19 | 0.21 | 0.12 | 0.14 | 0.09 | 0.10 | 0.14 |

| Italy | 0.14 | 0.19 | 0.13 | 0.11 | 0.10 | 0.07 | 0.07 | 0.12 |

| Spain | 0.02 | 0.09 | 0.07 | 0.05 | 0.05 | 0.07 | 0.05 | 0.05 |

| Sweden | 0.11 | 0.13 | 0.03 | 0.02 | 0.06 | 0.05 | 0.04 | 0.07 |

| Avg. | 0.08 | 0.10 | 0.07 | 0.06 | 0.07 | 0.06 | 0.05 | 0.07 |

| 1 | The 2000 Millennium Declaration commits States to promote gender equality and the empowerment of women as effective ways to combat poverty, hunger, disease and to stimulate development. |

| 2 | This paper uses data from SHARE Waves 1, 2, 4, 5, 6, 7, and 8 (DOIs: 10.6103/SHARE.w1.800, 10.6103/SHARE.w2.800, 10.6103/SHARE.w4.800, 10.6103/SHARE.w5.800, 10.6103/SHARE.w6.800, 10.6103/SHARE.w7.800, 10.6103/SHARE.w8.800) see Börsch-Supan (2013) for methodological details. (1) The SHARE data collection has been funded by the European Commission, DG RTD, and Horizon 2020 and by DG Employment, Social Affairs and Inclusion. Additional funding from the German Ministry of Education and Research, the Max Planck Society for the Advancement of Science, the U.S. National Institute on Aging, and from various national funding sources is gratefully acknowledged (see www.share-project.org (accessed on 2 January 2023)). |

| 3 | Even though the SHARE database consists of eight waves, the third wave does not provide information on pension incomes and, for this reason, it is not included in our analysis. |

| 4 | For a review see Abatemarco (2010) among all. |

| 5 | The GE index at is obtained from the general formula in (1) by using l’Hopital’s rule (Lambert 2001). The corresponding between-group inequality component is identified by introducing group partitions and then by separating the individual income gaps from average income gaps. |

| 6 | E.g., suppose we compare the dynamics of the GGP in two countries in two periods. In the first period, both countries are characterized by the same pension income distribution, with equally sized gender-based partitions of the population. In the second period, the absolute income gap doubles in both populations, however the sole average pension income of men increases in one country, whereas the sole average pension of income of women decreases in the other country. This would clearly generate two very different variations of the GGP index, which may significantly affect the ordering of different pension distributions in terms of gender gap. |

| 7 | In the first wave, data on average pension payments are gross values. |

| 8 | |

| 9 | Pension incomes in SHARE are reported at the net value of personal income taxes from wave 2 on, not in wave 1. Hence, as far as men are, on average, richer than women, the gender gap in pension might be under-estimated in countries where the progressive personal income tax applies to pension benefits. |

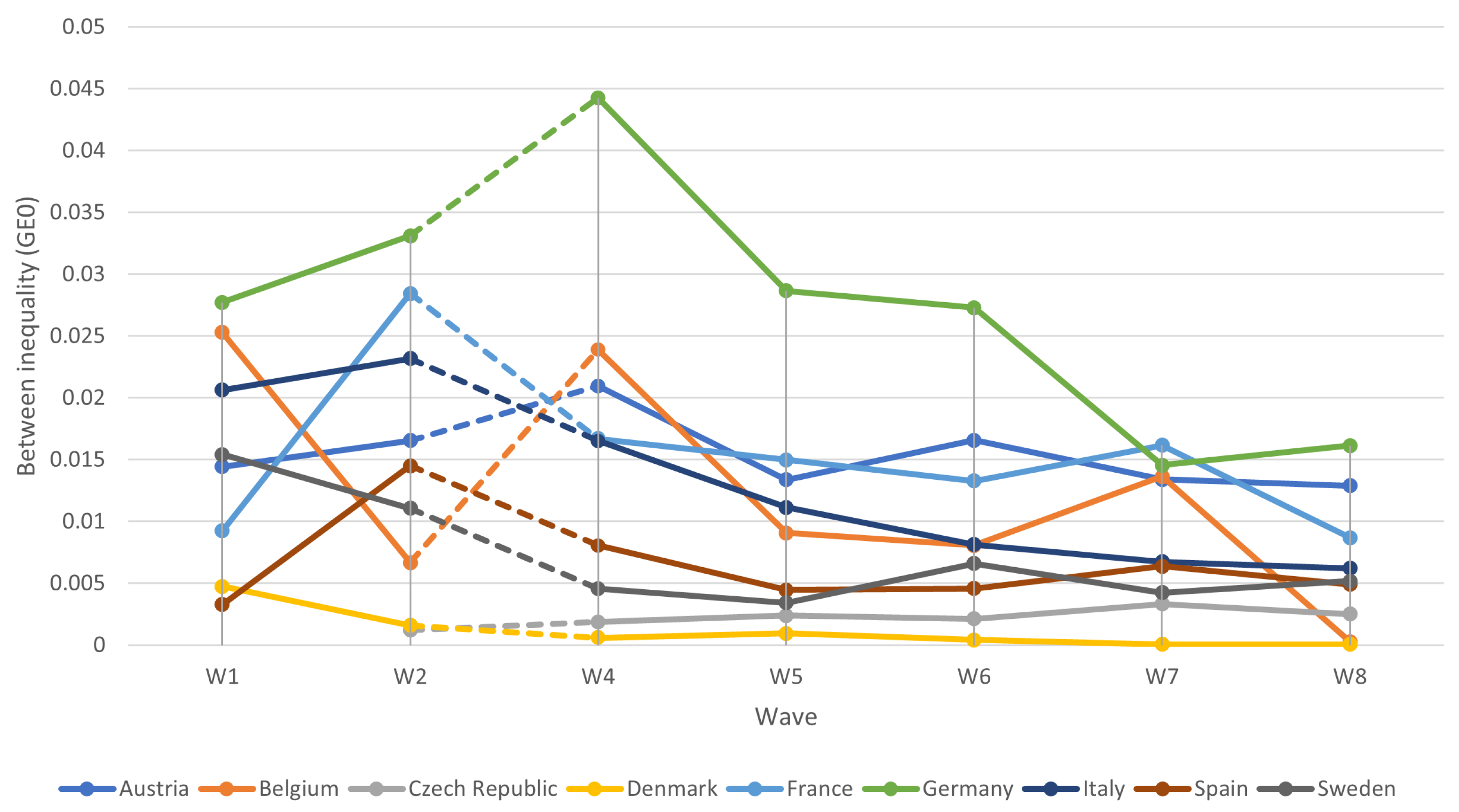

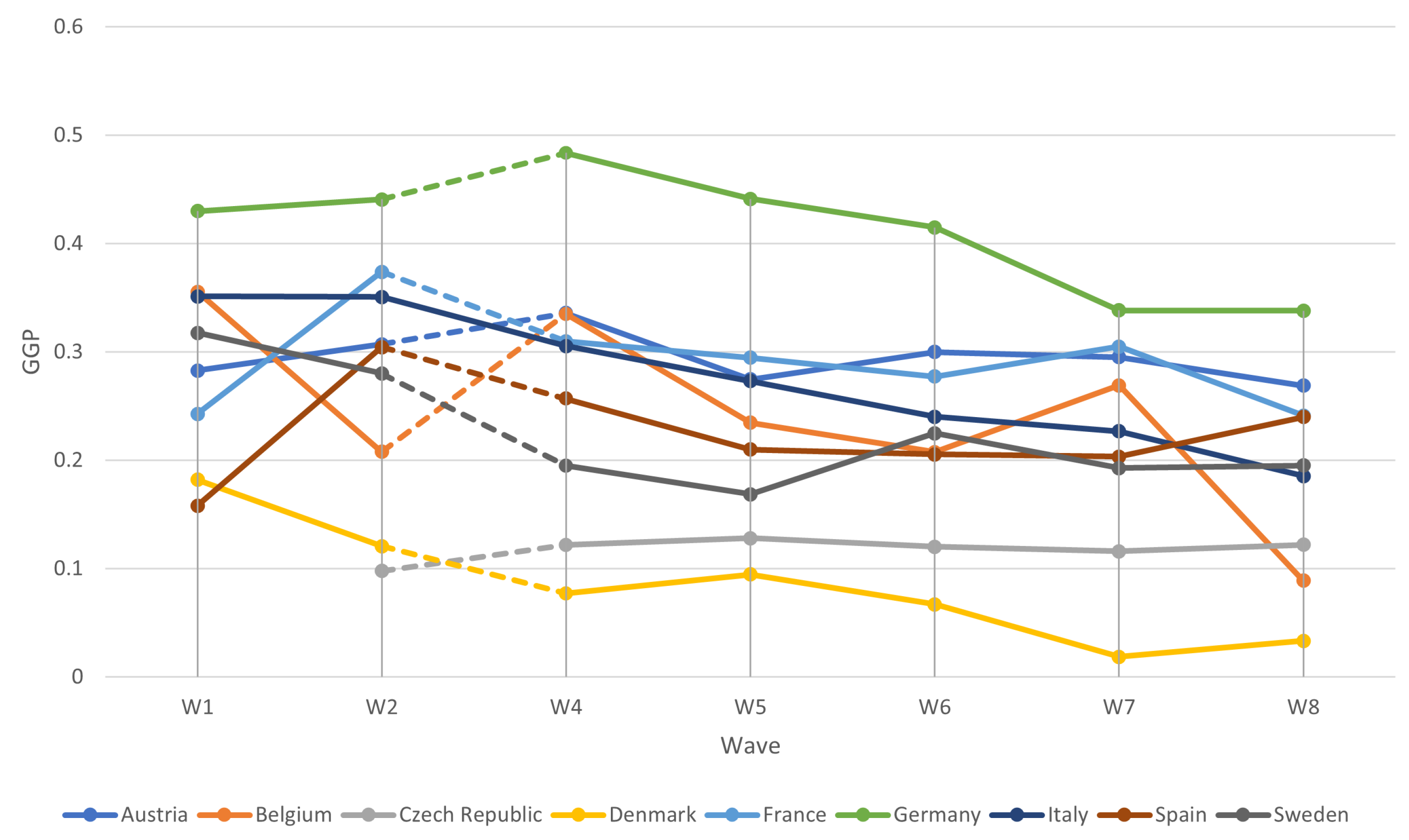

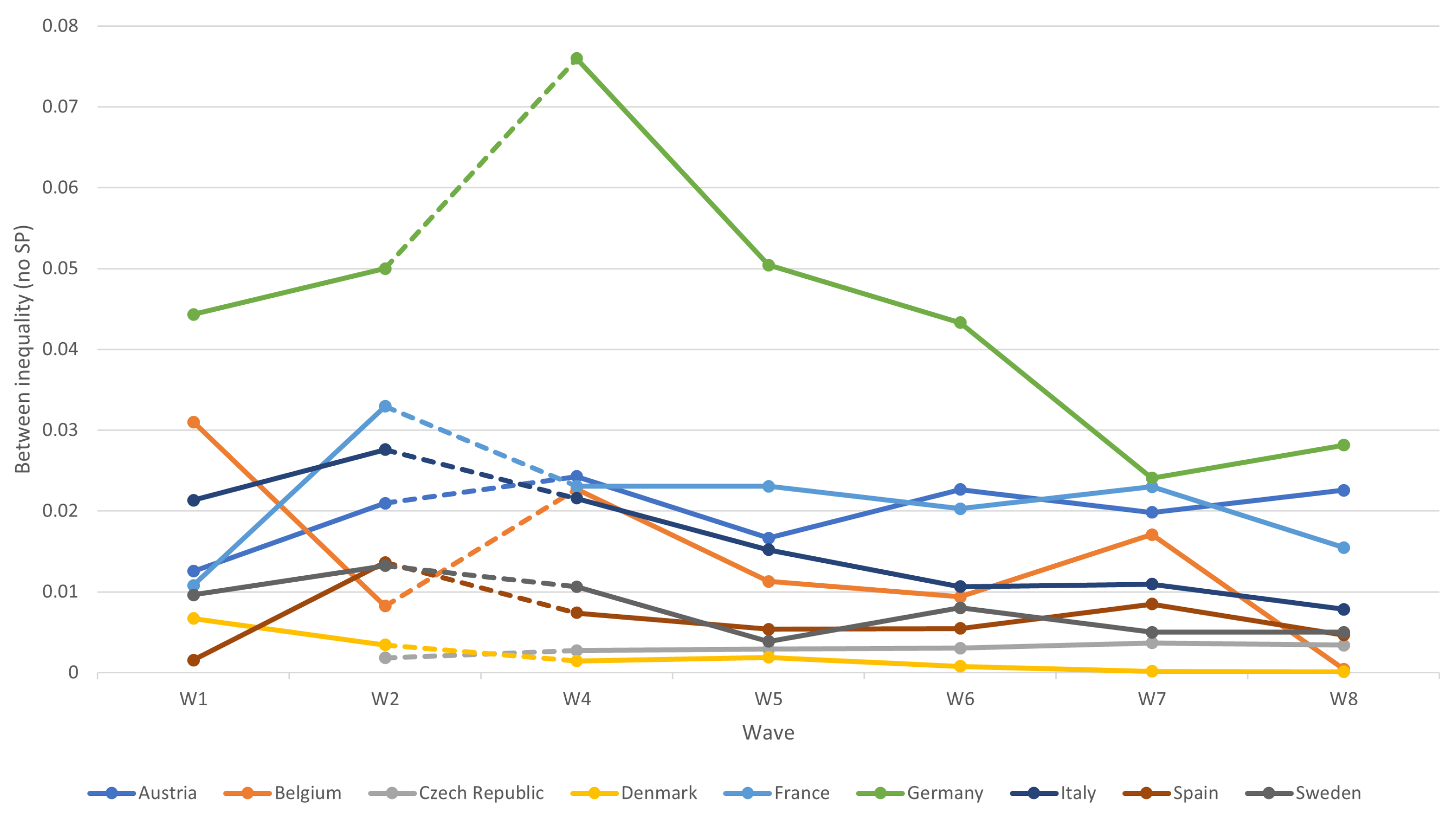

| 10 | The dotted line connecting W2 and W4, in this and the following figures, is used to account for the missing values in W3. |

References

- Abatemarco, Antonio. 2009. Measurement Issues for Adequacy Comparisons among Pension Systems. ENEPRI Research Report. Bruxelles: CEPS, vol. 64. [Google Scholar]

- Abatemarco, Antonio. 2010. Measuring Inequality of Opportunity through Between-Group Inequality Components. Journal of Economic Inequality 8: 475–90. [Google Scholar] [CrossRef]

- Abatemarco, Antonio, and Maria Russolillo. 2022. The dynamics of the gender gap at retirement in Italy: Evidence from SHARE. Italian Economic Journal. [Google Scholar] [CrossRef]

- Barth, Erling, Sari Pekkala Kerr, and Claudia Olivetti. 2021. The dynamics of gender earnings differentials: Evidence from establishment data. European Economic Review 134: 308–28. [Google Scholar] [CrossRef]

- Belloni, Michele, Agar Brugiavini, Raluca E. Buia, Ludovico Carrino, Danilo Cavapozzi, Cristina E. Orso, and Giacomo Pasini. 2020. What do we learn about redistribution effects of pension systems from internationally comparable measures of Social Security wealth? Journal of Pension Economics and Finance 19: 548–66. [Google Scholar] [CrossRef]

- Bergmann, Michael, Thorsten Kneip, Giuseppe De Luca, and Annette Scherpenzeel. 2019. Survey Participation in the Survey of Health, Ageing and Retirement in Europe (SHARE), Wave 1–7. Based on Release 7.0.0. SHARE Working Paper Series 41-2019. Munich: MEA, Max Planck Institute for Social Law and Social Policy. [Google Scholar]

- Bertay, Ata Can, Ljubica Dordevic, and Can Sever. 2020. Gender Inequality and Economic Growth: Evidence from Industry-Level Data. IMF Working Paper No. 20/119. Singapore: International Monetary Fund. [Google Scholar]

- Betti, Gianni, Francesca Bettio, Thomas Georgiadis, and Platon Tinios. 2015. Unequal Ageing in Europe. Women’s Independence and Pension. New York: Palgrave Macmillan. [Google Scholar]

- Bettio, Francesca, Platon Tinios, and Gianni Betti. 2013. The Gender Gap in Pensions in the EU. Luxembourg: Publications office of the European Union. [Google Scholar]

- Bonnet, Carole, Jean-Michel Hourriez, and Paul Reeve. 2002. Gender equality in pension: What role for rights accrued as a spouse or a parent? Population-E 67: 123–46. [Google Scholar] [CrossRef]

- Borella, Margherita, and Flavia Coda Moscarola. 2006. Distributive properties of pension systems: A simulation of the Italian transition from defined benefit to notional defined contribution. Giornale degli Economisti 65: 95–126. [Google Scholar]

- Börsch-Supan, Axel, Martina Brandt, Christian Hunkler, Thorsten Kneip, Julie Korbmacher, Frederic Malter, Barbara Schaan, Stephanie Stuck, and Sabrina Zuber. 2013. Data resource profile: The survey of health, ageing and retirement in Europe (SHARE). International Journal of Epidemiology 150: 549–68. [Google Scholar] [CrossRef] [PubMed]

- Chlon-Dominczak, Agnieszka. 2017. Gender Gap in Pensions: Looking Ahead. Brussels: European Parliament. [Google Scholar]

- Coppola, Mariarosaria, Maria Russolillo, and Rosaria Simone. 2022. On the evolution of the gender gap in life expectancy at normal retirement age for OECD countries. Genus 78: 27. [Google Scholar] [CrossRef]

- Dessimirova, Denitza, and Maria Audera Bustamante. 2019. The Gender Gap in Pensions in the EU. Washington, DC: Policy Department for Economic, Scientific and Quality of Life Policies. [Google Scholar]

- Diamond, Peter. 2004. Social security. American Economic Review 94: 1–24. [Google Scholar] [CrossRef]

- EC. 1999. Communication from the Commission to the Council, the European Parliament, the Economic and Social Committee and the Committee of the Regions. A Concerted Strategy for Modernizing Social Protection. COM 347 Final—Not Published in the Official Journal. Brussels: Commission of the European Communities. [Google Scholar]

- EC. 2003. Adequate and Sustainable Pensions. Joint Report by the Commission and the Council. Brussels: Commission of the European Communities. [Google Scholar]

- EC. 2015. Report on Equality between Women and Men. Luxembourg: Office for Publications of the European Communities. [Google Scholar]

- Eurofound and EIGE. 2021. Upward Convergence in Gender Equality: How Close is the Union of Equality? Luxembourg: Publications Office of the European Union. [Google Scholar]

- Leythienne, Denis, and Marina M. Pérez-Julián. 2021. Gender Pay Gaps in the European Union: A Statistical Analysis. EUROSTAT Statistical Working Papers. Luxembourg: EUROSTAT. [Google Scholar]

- Flory, Judith. 2012. The Gender Pension Gap—Developing an Indicator Measuring Fair Income Opportunities for Women and Men. Berlin: Federal Ministry for Family Affairs, Senior Citizens, Women and Youth, BMFSFJ Publication. [Google Scholar]

- Foster, James E., and Artyom A. Shneyerov. 2000. Path independent inequality measures. Journal of Economic Theory 91: 199–22. [Google Scholar] [CrossRef]

- Jefferson, Therese. 2009. Women and Retirement Pensions: A Research Review. Feminist Economics 15: 115–45. [Google Scholar] [CrossRef]

- Jarvis, Sarah, and Stephen Jenkins. 1998. How much income mobility is there in Britain? The Economic Journal 108: 428–43. [Google Scholar] [CrossRef]

- Kleven, Henrik, and Camille Landais. 2017. Gender Inequality and Economic Development: Fertility, Education and Norms. Economica 84: 180–209. [Google Scholar] [CrossRef]

- Kochhar, Ms Kalpana, Ms Sonali Jain-Chandra, and Ms Monique Newiak, eds. 2017. Women, Work, and Economic Growth: Leveling the Playing Field. Washington, DC: International Monetary Fund. [Google Scholar]

- Lambert, Peter. 2001. The Distribution and Redistribution of Income: A Mathematical Analysis, 3rd ed. Manchester: Manchester University Press. [Google Scholar]

- Leombruni, Roberto, and Michele Mosca. 2012. Le système de retraite italien compense-t-il les inégalités hommes-femmes sur le marché du travail? Retraite et Société 2: 139–63. [Google Scholar] [CrossRef]

- Levine, Phillip B., Olivia S. Mitchell, and John Phillips. 1999. Worklife Determinants of Retirement Income Differentials between Men and Women. NBER Working Paper. Cambridge: NBER, p. 7243. [Google Scholar]

- Maasoumi, Esfandiar. 2019. The Gender Gap between Earnings Distributions. Journal of Political Economy 127: 2438–504. [Google Scholar] [CrossRef]

- Mavrikiou, Petroula M., and Julijana Angelovska. 2020. Factors Determining Gender Pension Gap in Europe: A Cross National Study. UTMS Journal of Economics 11: 151–60. [Google Scholar]

- Niessen-Ruenzi, Alexandra, and Christoph Schneider. 2022. The Gender Pension Gap in Germany—Reasons and Remedies. In CESifo Forum. München: IFO Institute—Leibniz Institute for Economic Research at the University of Munich, vol. 23, pp. 20–24. [Google Scholar]

- OECD. 2012. Closing the Gender Gap Act Now: Act Now. Paris: OECD Publishing. [Google Scholar]

- OECD. 2018. OECD Pensions Outlook 2018. Paris: OECD Publishing. [Google Scholar]

- OECD. 2021. Pensions at a Glance 2021: OECD and G20 Indicators. Paris: OECD Publishing. [Google Scholar]

- Redmond, Paul, and Seamus McGuinness. 2019. The Gender Wage Gap in Europe: Job Preferences, Gender Convergence and Distributional Effects. Oxford Bulletin of Economics and Statistics 81: 564–87. [Google Scholar] [CrossRef]

- Shorrocks, Anthony. 1980. The class of additively decomposable inequality measures. Econometrica 48: 613–25. [Google Scholar] [CrossRef]

- Veremchuk, Anna. 2020. Gender Gap in Pension Income: Cross-Country Analysis and Role of Gender Attitudes. Tartu: University of Tartu, Faculty of Social Sciences, School of Economics and Business Administration. [Google Scholar]

| First-Tier | Second-Tier | ||||

|---|---|---|---|---|---|

| Res. | Cont. | % AW Earnings | Public | Private | |

| Austria | ✔ | 25.3 | DB | ||

| Belgium | ✔ | 30.7 | DB | ||

| Czech Rep. | ✔ | 11.5 | DB | ||

| Denmark | ✔ | 18.6 | FDC | FDC | |

| France | ✔ | 24.3 | DB+Pts | ||

| Germany | 19.3 | Pts | |||

| Italy | ✔ | 21.2 | DB+NDC | ||

| Spain | ✔ | 27.9 | DB | ||

| Sweden | ✔ | 22.2 | NDC+FDC | FDC | |

| Country | Minimum Eligibility Age | Civil Union | Cohab. | After Divorce | After Remarriage | % of Deceased’s Pension | Means-Testing |

|---|---|---|---|---|---|---|---|

| Austria | No | Yes | No | Yes | No | 60 | APE |

| Belgium | 46.5 | No | No | No | No | 100 | APE |

| Czech R. | 55/58 | No | No | No | No | 58 | AP |

| Denmark | Only temporary payments | ||||||

| France | 55/66 | No | No | Yes | Yes | 57 | AOI |

| Germany | 45.5 | Yes | No | Yes | No | 57 | OT |

| Italy | No | Yes | No | Yes | No | 60 | APE |

| Spain | No | Yes | Yes | Yes | Yes | 60 | NA |

| Sweden | No mandatory survivor pension programs | ||||||

| Country | Gender | Obs. | Mean (€) | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| Austria | Women | 5803 | 1289 | 1401 | 167 | 20,000 |

| Men | 4653 | 1830 | 1812 | 200 | 22,000 | |

| Belgium | Women | 5718 | 2248 | 3727 | 60 | 25,776 |

| Men | 7026 | 3025 | 4748 | 76 | 31,839 | |

| Czech R. | Women | 8008 | 377 | 126 | 24 | 1021 |

| Men | 5039 | 430 | 142 | 24 | 971 | |

| Denmark | Women | 4574 | 1262 | 561 | 134 | 5369 |

| Men | 3822 | 1386 | 699 | 134 | 5802 | |

| France | Women | 6757 | 1318 | 1117 | 80 | 18,200 |

| Men | 6165 | 1845 | 1263 | 75 | 18,000 | |

| Germany | Women | 5188 | 924 | 590 | 65 | 4600 |

| Men | 5565 | 1569 | 797 | 67 | 5000 | |

| Italy | Women | 4553 | 829 | 414 | 73 | 4200 |

| Men | 6317 | 1155 | 512 | 100 | 4200 | |

| Spain | Women | 2737 | 749 | 444 | 59 | 6720 |

| Men | 5580 | 939 | 499 | 52 | 8333 | |

| Sweden | Women | 5719 | 1267 | 979 | 108 | 17,338 |

| Men | 5179 | 1646 | 952 | 108 | 16,402 |

| Country | Gender | Obs. | Mean (€) | Std. Dev. |

|---|---|---|---|---|

| Austria | Women | 4707 | 1242 | 1422 |

| Men | 4606 | 1831 | 1819 | |

| Belgium | Women | 4761 | 2209 | 3724 |

| Men | 6981 | 3024 | 4750 | |

| Czech Rep | Women | 6525 | 366 | 117 |

| Men | 4810 | 427 | 139 | |

| Denmark | Women | 4319 | 1225 | 531 |

| Men | 3772 | 1380 | 695 | |

| France | Women | 5205 | 1221 | 1071 |

| Men | 5969 | 1835 | 1252 | |

| Germany | Women | 4294 | 833 | 550 |

| Men | 5393 | 1568 | 803 | |

| Italy | Women | 3955 | 800 | 402 |

| Men | 6244 | 1155 | 513 | |

| Spain | Women | 2208 | 728 | 461 |

| Men | 5553 | 939 | 499 | |

| Sweden | Women | 5154 | 1243 | 980 |

| Men | 4807 | 1611 | 933 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abatemarco, A.; Lagomarsino, E.; Russolillo, M. Gender Pension Gap in EU Countries: A Between-Group Inequality Approach. Risks 2023, 11, 63. https://doi.org/10.3390/risks11030063

Abatemarco A, Lagomarsino E, Russolillo M. Gender Pension Gap in EU Countries: A Between-Group Inequality Approach. Risks. 2023; 11(3):63. https://doi.org/10.3390/risks11030063

Chicago/Turabian StyleAbatemarco, Antonio, Elena Lagomarsino, and Maria Russolillo. 2023. "Gender Pension Gap in EU Countries: A Between-Group Inequality Approach" Risks 11, no. 3: 63. https://doi.org/10.3390/risks11030063

APA StyleAbatemarco, A., Lagomarsino, E., & Russolillo, M. (2023). Gender Pension Gap in EU Countries: A Between-Group Inequality Approach. Risks, 11(3), 63. https://doi.org/10.3390/risks11030063