Analysis of Yields and Their Determinants in the European Corporate Green Bond Market

Abstract

1. Introduction

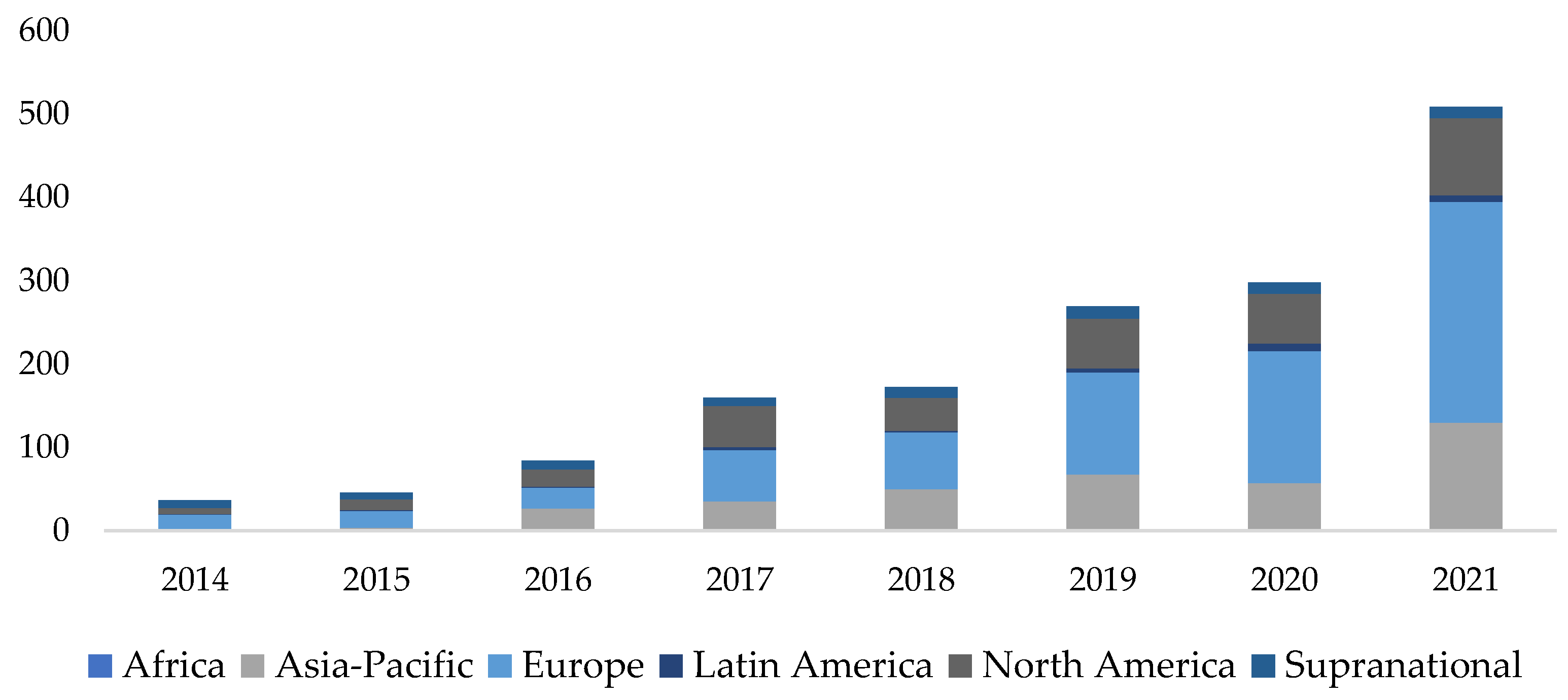

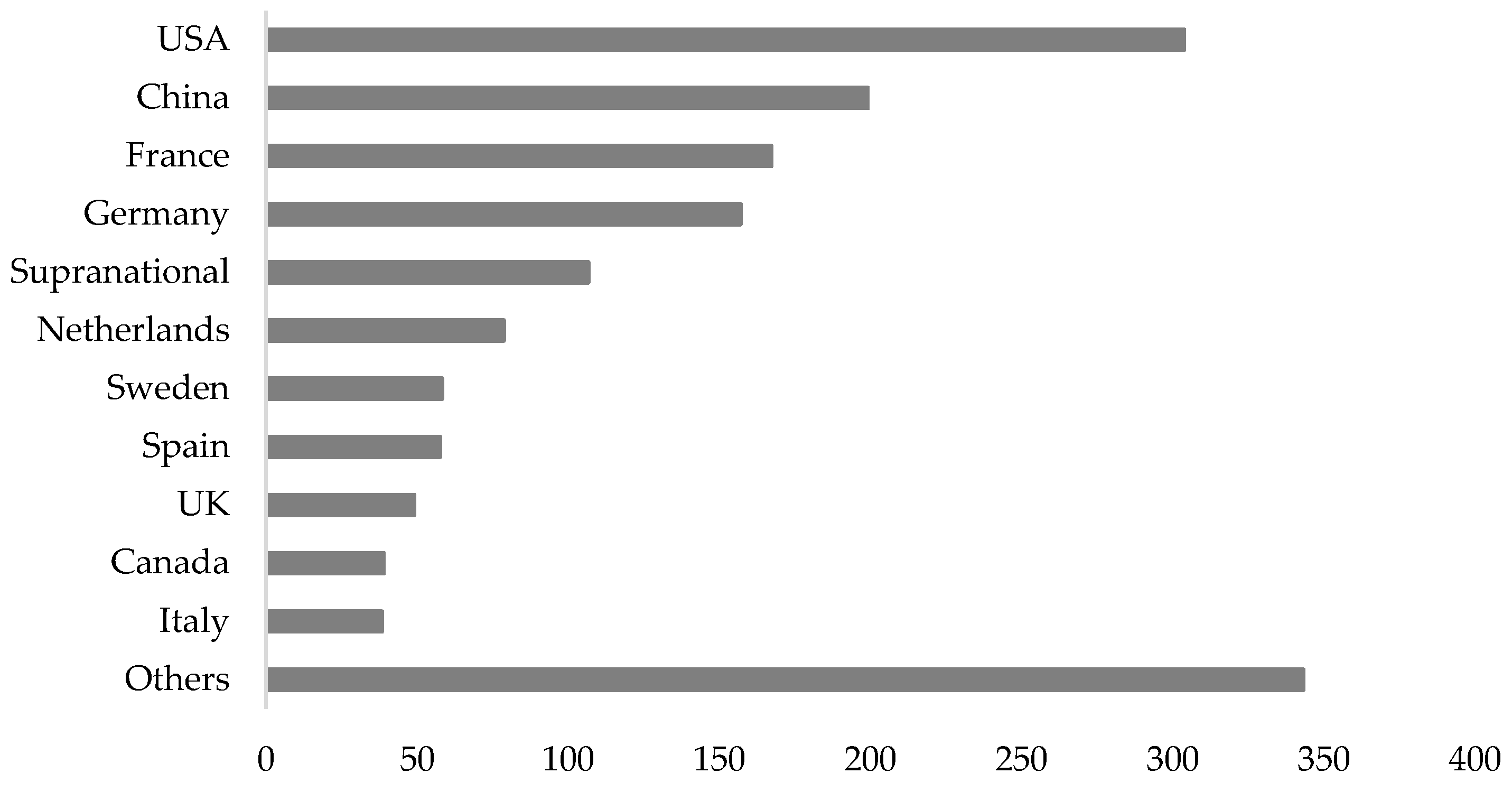

2. The Green Bonds and the Greenium: Corporate Green Bond Markets in USA and Europe

3. Literature Review

4. Materials and Methods

4.1. The Model

- Xit—Time dependent variables.

- Xj—Other variables (not time dependent).

- at—The age of the green bond market since 2007. This metric captures the changes in the balance between supply and demand in the green bond markets across years.

- δi—Time fixed affects to consider time-varying unobservable factors that may affect the selected bond markets in a specific year.

4.2. The Data

5. Results

5.1. Summary Outcome

5.2. Results for Entire European Corporate Debt Market (33 Countries)

5.3. Results for Selected European Corporate Bond Markets

6. Discussion

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Fitch | Moody’s | S&P | Category |

|---|---|---|---|

| AAA | Aaa | AAA | 1 |

| AA+ | Aa1 | AA+ | 2 |

| AA | Aa2 | AA | 3 |

| AA− | Aa3 | AA− | 4 |

| A+ | A1 | A+ | 5 |

| A | A2 | A | 6 |

| A− | A3 | A− | 7 |

| BBB+ | Baa3 | BBB+ | 8 |

| BBB | Baa2 | BBB | 9 |

| BBB− | Baa1 | BBB− | 10 |

| BB+ | Ba3 | BB+ | 11 |

| BB | Ba2 | BB | 12 |

| BB− | Ba1 | BB− | 13 |

| B+ | B3 | B+ | 14 |

| B | B2 | B | 15 |

| B− | B1 | B− | 16 |

| CCC+ | Caa3 | CCC+ | 17 |

| CCC | Caa2 | CCC | 18 |

| WD | NR | NR | 19 |

Appendix B

| ModDurMid | ESG Rating | Green | Coupon | Bid-Ask Spread | Tenor | Revenue Growth | Energy_Dummy | Utilities_Dummy | Industrials_Dummy | GDP Growth | CPI | ln_Amout | ln_Finlev | Coupon Type | Coupon Frequency | Credit Rating | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Modified Duration | 1.00 | 0.09 | −0.02 | −0.03 | 0.32 | 0.80 | 0.00 | −0.02 | 0.13 | −0.02 | −0.09 | 0.02 | 0.17 | −0.02 | 0.08 | 0.10 | −0.11 |

| ESG Rating | 1.00 | −0.02 | −0.05 | 0.00 | 0.09 | 0.02 | −0.02 | 0.04 | −0.01 | −0.01 | −0.01 | 0.24 | −0.33 | 0.11 | 0.07 | −0.31 | |

| Green | 1.00 | −0.04 | −0.02 | −0.03 | −0.01 | 0.01 | 0.05 | −0.01 | −0.09 | −0.04 | 0.03 | 0.01 | −0.12 | 0.00 | 0.04 | ||

| Coupon | 1.00 | 0.10 | 0.14 | 0.00 | 0.14 | −0.06 | 0.01 | 0.07 | 0.20 | −0.05 | 0.02 | −0.04 | −0.30 | 0.08 | |||

| Bid-Ask Spread | 1.00 | 0.38 | 0.05 | 0.12 | 0.07 | 0.02 | −0.04 | 0.12 | −0.01 | 0.01 | −0.03 | −0.08 | 0.01 | ||||

| Tenor | 1.00 | 0.00 | 0.01 | 0.24 | −0.03 | −0.04 | 0.07 | 0.16 | −0.02 | 0.03 | −0.07 | −0.08 | |||||

| RevenueGrowth | 1.00 | 0.03 | 0.00 | −0.02 | −0.04 | −0.01 | 0.01 | 0.02 | 0.00 | −0.01 | −0.02 | ||||||

| Energy_dummy | 1.00 | −0.09 | −0.04 | −0.01 | −0.03 | −0.10 | 0.00 | 0.00 | −0.08 | 0.04 | |||||||

| Utilities_dummy | 1.00 | −0.22 | −0.05 | 0.01 | 0.15 | −0.03 | 0.04 | 0.13 | −0.08 | ||||||||

| Industrials_dummy | 1.00 | −0.01 | −0.05 | 0.00 | −0.02 | 0.05 | 0.02 | 0.00 | |||||||||

| GDP Growth | 1.00 | 0.21 | −0.08 | −0.02 | 0.06 | −0.06 | −0.03 | ||||||||||

| CPI | 1.00 | 0.00 | −0.01 | −0.04 | −0.17 | −0.01 | |||||||||||

| ln_Amount Outstand | 1.00 | −0.20 | 0.17 | 0.05 | −0.49 | ||||||||||||

| Debt/EBITDA | 1.00 | −0.05 | −0.04 | 0.23 | |||||||||||||

| Coupon type | 1.00 | 0.16 | −0.30 | ||||||||||||||

| Coupon frequency | 1.00 | −0.12 | |||||||||||||||

| Credit rating | 1.00 |

Appendix C

| Country | F-Statistics | p-Value | Include in the Model? |

|---|---|---|---|

| Austria | 0.36 | 0.969 | No |

| Belgium | 0.65 | 0.762 | No |

| UK | 2.47 | 0.004 | Yes |

| Bulgaria | 0.2 | 0.94 | No |

| Croatia | 0 | 0.99 | No |

| Czech | 0.33 | 0.97 | No |

| Denmark | 2.16 | 0.02 | Yes |

| Estonia | 0.06 | 0.99 | No |

| Finland | 0.24 | 0.99 | No |

| France | 1.52 | 0.114 | No |

| Germany | 3.8 | 0 | Yes |

| Greece | 0.02 | 0.99 | No |

| Hungary | 0.19 | 0.99 | No |

| Iceland | 0.15 | 0.86 | No |

| Ireland | 1.57 | 0.107 | No |

| Italy | 0.35 | 0.98 | No |

| Jersey | 0.44 | 0.5 | No |

| Lithuania | 0 | 0.99 | No |

| Luxembourg | 0.75 | 0.69 | No |

| Malta | 1.01 | 0.43 | No |

| Netherlands | 24.5 | 0.0 | Yes |

| Norway | 0.68 | 0.75 | No |

| Poland | 0.55 | 0.85 | No |

| Portugal | 0.41 | 0.94 | No |

| Romania | 0.01 | 0.93 | No |

| Slovakia | 0.5 | 0.86 | No |

| Spain | 0.16 | 0.99 | No |

| Sweden | 1.55 | 0.107 | No |

| Switzerland | 0.48 | 0.92 | No |

References

- Agliardi, Elettra, and Rossella Agliardi. 2021. Corporate green bonds: Understanding the greenium in a two-factor structural model. Environmental and Resource Economics 80: 257–78. [Google Scholar] [CrossRef]

- Ahelegbey, Daniel Felix, Paolo Giudici, and Branka Hadji-Misheva. 2019. Latent factor models for credit scoring in P2P systems. Physica A: Statistical Mechanics and Its Applications 522: 112–21. [Google Scholar] [CrossRef]

- Bachelet, Maria Jua, Leonardo Becchetti, and Stefano Manfredonia. 2019. The green bonds premium puzzle: The role of issuer characteristics and third-party verification. Sustainability 11: 1098. [Google Scholar] [CrossRef]

- Baker, Malcolm, Daniel Bergstresser, George Serafeim, and Jeffrey Wurgler. 2018. Financing the Response to Climate Change: The Pricing and Ownership of US Green Bonds. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Barnett, Michael, and Robert Salomon. 2012. Does it pay to be really good? Addressing the shape of the relationship between social and financial performance. Strategic Management Journal 33: 1304–20. [Google Scholar] [CrossRef]

- Björkholm, Linn, and Othmar Lehner. 2021. Nordic green bond issuers’ views on the upcoming EU Green Bond Standard. ACRN Journal of Finance and Risk Perspectives 10: 222–79. [Google Scholar] [CrossRef]

- Burnham, Alison, John MacGregor, and Roman Viveros. 1999. Latent variable multivariate regression modelling. Chemometrics and Intelligent Laboratory Systems 48: 167–80. [Google Scholar] [CrossRef]

- Cavallo, Eduardo, and Patricio Valenzuela. 2010. The determinants of corporate risk in emerging markets: An option-adjusted spread analysis. International Journal of Finance & Economics 15: 59–74. [Google Scholar]

- Climate Bond Initiative (CBI). 2021a. Climate Bonds Standard Version 3.0. International Best Practice for Labelling Green Investments. Available online: https://www.climatebonds.net/files/files/climate-bonds-standard-v3-20191210.pdf (accessed on 3 January 2023).

- Climate Bond Initiative (CBI). 2021b. Sustainable Debt Global State of the Market 2021. Available online: https://www.climatebonds.net/files/reports/cbi_global_sotm_2021_02h_0.pdf (accessed on 3 January 2023).

- Cortellini, Giuseppe, and Ida Claudia Panetta. 2021. Green bond: A systematic literature review for future research agendas. Risk Financial Management 14: 589. [Google Scholar] [CrossRef]

- Deschryver, Pauline, and Frederic de Matiz. 2020. What Future for the Green Bond Market? How Can Policymakers, Companies, and Investors Unlock the Potential of the Green Bond Market? Journal of Risk and Financial Management 13: 61. [Google Scholar] [CrossRef]

- Díaz, Antonio, and Ana Escribano. 2021. Sustainability premium in energy bonds. Energy Economics 95: 105113. [Google Scholar] [CrossRef]

- European Commission (EC). 2017. Drivers of Corporate Bond Market Liquidity in the European Union. European Green Bonds Report. Brussels: European Union. ISBN 978-92-79-59845-6. Available online: https://doi.org/10.2874/499825 (accessed on 3 January 2023).

- Fatica, Serena, Roberto Panzica, and Michela Rancan. 2021. The pricing of green bonds: Are financial institutions special? Journal of Financial Stability 54: 100873. [Google Scholar] [CrossRef]

- Febi, Wulandari, Dorothea Shafer, Andreas Stephan, and Chen Sun. 2018. The impact of liquidity risks on the yield spread of green bonds. Finance Research Letters 27: 53–59. [Google Scholar] [CrossRef]

- Gianfrate, Gianfranco, and Mattia Peri. 2019. The green advantage: Exploring the convenience of issuing green bonds. Journal of Cleaner Production 219: 127–35. [Google Scholar] [CrossRef]

- Guo, Dong, and Peng Zhou. 2021. Green bonds as hedging assets before and after COVID. Energy Economics 104: 105696. [Google Scholar] [CrossRef]

- Harrison, Caroline. 2022. Green Bond Pricing in the Primary Market H2 2021 Climate Bonds Initiative. March. Available online: https://www.europarl.europa.eu/RegData/etudes/BRIE/2022/698870/EPRS_BRI(2022)698870_EN.pdf (accessed on 3 January 2023).

- Hyun, Suk, Donghyun Park, and Shu Tian. 2021. Pricing of green labeling: A comparison of labeled and unlabeled green bonds. Finance Research Letters 41: 101816. [Google Scholar] [CrossRef]

- Immel, Moritz, Britta Hachenberg, Florian Kiesel, and Dirk Schiereck. 2021. Green bonds: Shades of green and brown. Journal of Asset Management 22: 96–109. [Google Scholar] [CrossRef]

- International Capital Market Association (ICMA). 2021. Green Bond Principles. Voluntary Process Guidelines for Issuing Green Bonds. June. Available online: https://www.icmagroup.org/assets/documents/Sustainable-finance/2022-updates/Green-Bond-Principles_June-2022-280622.pdf (accessed on 3 January 2023).

- Ivashkovskaya, Irina, and Anna Mikhaylova. 2020. Do Investors Pay Yield Premiums on Green Bonds? Journal of Corporate Finance Research 14: 7–21. [Google Scholar]

- Karpf, Andreas, and Antonie Mandel. 2018. The changing value of the “green” label on the US municipal bond market. Nature Climate Change 8: 161–65. [Google Scholar] [CrossRef]

- Larcker, David, and Edward Watts. 2020. Where’s the greenium? Journal of Accounting and Economics 69: 101312. [Google Scholar] [CrossRef]

- Loffler, Kristin Ulrike, Aleksandar Petreski, and Andreas Stephan. 2021. Drivers of green bond issuance and new evidence on the “greenium”. Eurasian Economic Review 11: 1–24. [Google Scholar] [CrossRef]

- MacAskill, Stefen, Eduardo Roca, Benjamin Liu, Rodney Stewart, and Oz Sahin. 2021. Is there a green premium in the green bond market? Systematic literature review revealing premium determinants. Journal of Cleaner Production 280: 124491. [Google Scholar] [CrossRef]

- Nanayakkara, Madurika, and Sisira Colombage. 2019. Do investors in green bond market pay a premium? Global evidence. Applied Economics 51: 4425–37. [Google Scholar] [CrossRef]

- Partridge, Candace, and Francesca Romana Medda. 2020. The evolution of pricing performance of green municipal bonds. Journal of Sustainable Finance & Investment 10: 44–64. [Google Scholar]

- Preclaw, Ryan, and Anthony Bakshi. 2015. The Cost of Being Green. Available online: https://www.environmental-finance.com/content/research/the-cost-of-being-green.html (accessed on 3 January 2023).

- Reboredo, Juan, Andrea Ugolini, and Fernando Antonio Lucena Aiube. 2020. Network connectedness of green bonds and asset classes. Energy Economics 86: 104629. [Google Scholar] [CrossRef]

- Sheng, Qiaoyan, Xuan Zheng, and Nian Zhong. 2021. Financing for sustainability: Empirical analysis of green bond premium and issuer heterogeneity. Natural Hazards 107: 2641–51. [Google Scholar] [CrossRef]

- Tealab, Ahmed, Hesham Hefny, and Amr Badr. 2017. Forecasting of nonlinear time series using ANN. Future Computing and Informatics Journal 2: 39–47. [Google Scholar] [CrossRef]

- The Global Risks Report. 2022. Available online: https://www3.weforum.org/docs/WEF_The_Global_Risks_Report_2022.pdf (accessed on 3 January 2023).

- Tolliver, Clarence, Alexander Ryota Keeley, and Shunsuke Managi. 2020. Drivers of green bond market growth: The importance of Nationally Determined Contributions to the Paris Agreement and implications for sustainability. Journal of Cleaner Production 244: 118643. [Google Scholar] [CrossRef]

- Trumpp, Christoph, and Thomas Guenther. 2017. Too little or too much? Exploring U-shaped relationships between corporate environmental performance and corporate financial performance. Business Strategy and the Environment 26: 49–68. [Google Scholar] [CrossRef]

- Uma Maheswari, Balaji, Ramdas Sujatha, Sucy Fantina, and Anifa Mansurali. 2021. ARIMA versus ANN—A comparative study of predictive modelling techniques to determine stock price. In Proceedings of the Second International Conference on Information Management and Machine Intellingence. Singapore: Springer, pp. 315–23. [Google Scholar]

- Vukovic, Darko, Victor Prosin, and Moinak Maiti. 2021. A study on the factors that governs US and EU YTM. Contaduria y Administracion 66: 34–52. [Google Scholar] [CrossRef]

- Wang, Qinghua, Yaning Zhou, Li Luo, and Junping Ji. 2019. Research on the factors affecting the risk premium of China’s green bond issuance. Sustainability 11: 6394. [Google Scholar] [CrossRef]

- Zerbib, Olivier David. 2019. The effect of pro-environmental preferences on bond prices: Evidence from green bonds. Journal of Banking & Finance 98: 39–60. [Google Scholar]

- Zhang, Ran, Yanru Li, and Yingzhu Liu. 2021. Green bond issuance and corporate cost of capital. Pacific-Basin Finance Journal 69: 101626. [Google Scholar] [CrossRef]

| Characteristics | US Market | European Market (Including UK) |

|---|---|---|

| Total green bonds issued (monetary), excluding Fannie Mae and supranational | USD147.5 bn | USD720 bn |

| Number of deals | 744 | 8658 |

| Number of entities | 348 | 472 |

| Average size | USD198m | EUR330 |

| Prevailing currency | USD | EUR |

| Weighted average term | 15 years | 10 years |

| Use of proceeds | Energy and water (35%) Building (45%) Transport (11%) | Energy and water (42%) Building (28%) Transport (17%) |

| Distinctive feature | Significant share of municipal bonds and mortgage-backed securities issued by Fannie Mae (62%). Bonds issued by non-financial companies comprised about 20% | Bonds issued by non-financial companies comprised about 24% |

| Variable Name | Expected Sign | Variable Description |

|---|---|---|

| Time dependent variables | ||

| Tenorit | “+” | The length of time until the bond is due. The more years to maturity that remain, the higher the yield spread of this bond to compensate for the growing risk. |

| Credit ratingit | “+” | A numerical value of the top three rating agencies’ (S&P, Moody’s, Fitch) ratings of the bond. For modeling purposes, the ratings were translated into numeric equivalents (Appendix A). The variable is estimated as the minimum among the ratings assigned by S&P, Moody’s, and Fitch Rating. A high credit rating indicates that a borrower is likely to repay the loan in its entirety without any issues, while a low credit rating suggests that the borrower might struggle to make their payments. Consequently, the lower the rating the higher should be the bond’s yield. |

| ESG Ratingit | 1/0 “−” | The dummy variable equals one if the bond has an ESG rating, otherwise, it is zero. The existence of an ESG rating of the green bond should lead to a lower yield of this bond. This is because the existence of the ESG rating indicates that an independent agency verified the purpose of the bond proceeds and evaluated the degree of integration of ESG practices into the strategy and operations of the green bond issuer. |

| Coupon | “+” | The size of the bond coupon. Higher the coupon, so should be the yield of the bond to compensate for the higher risk of such a bond in comparison to others. |

| Bid-Ask Spread | “+” | A proxy of a liquidity measure. A higher liquidity of the bond issue reflects high investors’ demand which leads to the lower yield of the bond. |

| Revenue growthit | “−” | The measure of percentage increase (decrease) in revenue of the bond issuer over the year. The higher revenue growth indicates better economic prospects and thus the lower yield of the bond. |

| Modified duration | “+” | Modified duration measures the change in the value of a bond in response to a change in a 100-basis-point (1%) change in interest rates. The longer the duration the higher the risk of the bond, hence the higher the yield is. |

| Debt/EBITDA | “+” | Debt/EBITDA measures an issuer’s ability to repay its incurred debt. A high ratio result could indicate that a company has a too-heavy debt load, and thus, a higher credit risk. We, therefore, expect the positive relationship between this metric and the yield of the bond to compensate for the higher risk. |

| GDP Growthit | “−” | The growth rate of the gross domestic product in the country of the issuer’s origin. The higher the GDP growth, the better the economic prospects and, consequently, the lower the yield of the bond. |

| CPIit | “+” | The consumer price index (CPI) also corresponds to the country of the bond’s issuer. The higher the inflation, the higher the demanded yield to compensate for inflation. |

| Non-time-dependent variables | ||

| Greeni | 1/0 “−” | A dummy variable equals one if the bond is labeled as “green”, otherwise, it is zero. This variable is of the main interest in this research and the indication of greenium. |

| Industryi | 1/0 | The dummy variable equals one if the issuer operates in the particular industry (see the Data section), otherwise, it is zero. |

| Other variables | ||

| T | The year of observation. | |

| At | 1–15 “+” | Reflects the number of years passed since the first issuance of green bonds. This metric captures the changes in the balance between supply and demand in the green bond markets across the years. We expect that, with the passage of time, the supply of green bonds will increase faster than the demand for those bonds. This should negatively affect the magnitude of the greenium, thus the sign of this variable is expected to be positive. |

| Variables | Mean | sd | min | max |

|---|---|---|---|---|

| Yield | 2.75 | 1.92 | 0 | 25 |

| ESG Rating | 0.15 | 0.36 | 0 | 1 |

| Credit Rating | 12.97 | 4.95 | 4 | 18 |

| Green | 0.12 | 0.32 | 0 | 1 |

| Coupon | 2.85 | 1.87 | 0 | 12.50 |

| Amount Outstanding | 3.146 × 108 | 3.670 × 108 | 86.66 | 3.000 × 109 |

| Bid-Ask Spread | 0.798 | 1.55 | 0 | 63 |

| Tenor | 11.43 | 8.74 | 1.51 | 100.00 |

| Revenue Growth | 11.65 | 95.88 | −94.28 | 2.34 |

| Utilities_dummy | 0.32 | 0.47 | 0 | 1 |

| GDP Growth | 0.59 | 3.55 | −10.82 | 25.18 |

| CPI | 1.31 | 0.96 | −4.48 | 7.96 |

| Fin_dummy | 0.37 | 0.48 | 0 | 1 |

| Industrials_dummy | 0.09 | 0.29 | 0 | 1 |

| VARIABLES | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Entire European Market | Britain | France | Netherlands | Germany | |

| Yield | Yield | Yield | Yield | Yield | |

| Green | −0.0357 ** | −0.0278 ** | −0.0200 | −0.0217 ** | −0.0558 |

| (0.0313) | (0.0263) | (0.422) | (0.0253) | (0.508) | |

| ESG Rating | −0.0338 * | −0.107 | −0.0512 | −0.0349 * | 0.0265 |

| (0.0957) | (0.160) | (0.172) | (0.0757) | (0.769) | |

| Coupon | 0.976 *** | 1.026 *** | 0.943 *** | 0.952 *** | 1.010 *** |

| (0) | (0) | (0) | (0) | (0) | |

| Tenor | −0.0242 *** | −0.0373 *** | −0.0179 *** | −0.0277 *** | 0.00409 |

| (0) | (8.93 × 10−6) | (4.51 × 10−8) | (1.86 × 10−5) | (0.852) | |

| Utilities_dummy | −0.149 *** | −0.190 * | −0.0529 | −0.0793 | −0.348 |

| (3.76 × 10−5) | (0.0934) | (0.0158) | (0.162) | (0.219) | |

| Fin_dummy | −0.139 *** | −0.168 | −0.0274 | −0.0220 | −0.238 |

| (0.000278) | (0.218) | (0.352) | (0.653) | (0.376) | |

| Industrials_dummy | −0.0748 | −0.0464 | 0.0440 | −0.0166 | −0.304 |

| (0.143) | (0.816) | (0.531) | (0.775) | (0.373) | |

| Credit Rating | 0.0218 ** | −0.00619 | 0.000281 | 0.0127 * | 0.0167 |

| (0.0320) | (0.660) | (0.921) | (0.0812) | (0.252) | |

| Bid Ask Spread | 0.0295 *** | 0.106 | 0.0415 *** | 0.0663 ** | −0.151 |

| (0.00382) | (0.137) | (3.86 × 10−8) | (0.00295) | (0.270) | |

| Revenue Growth | −0.000121 | 8.14 × 10−5 | 9.01 × 10−5 | −0.000289 | −0.000293 |

| (0.161) | (0.919) | (0.891) | (0.734) | (0.741) | |

| GDP Growth | 0.00700 *** | 0.0133 | 0.0127 *** | 0.00885 | 0.0270 |

| (0.00157) | (0.183) | (0.00174) | (0.249) | (0.324) | |

| CPI | −0.0186 ** | −0.0250 | −0.0416 ** | 0.000563 | −0.151 |

| (0.0488) | (0.209) | (0.0335) | (0.980) | (0.158) | |

| Constant | 0.240 *** | 0.263 | 0.163 ** | 0.0821 | 0.143 |

| (1.03 × 10−5) | (0.180) | (0.0238) | (0.507) | (0.597) | |

| Time Passed | 0.00959 ** | 0.0206 ** | 0.0168 | 0.0149 ** | 0.00416 |

| (0.0145) | (0.0408) | (0.549) | (0.0325) | (0.801) | |

| Issuer FE | Yes | Yes | Yes | Yes | Yes |

| R-squared | 0.893 | 0.856 | 0.961 | 0.964 | 0.664 |

| Variables | Entire European Market Yield | p-Value |

|---|---|---|

| Green | −0.0301 ** | 0.0209 |

| ESG Rating | −0.0201 ** | 0.0109 |

| Coupon | 0.972 *** | (0) |

| Tenor | −0.0243 *** | (0) |

| Utilities_dummy | −0.142 *** | (3.43 × 10−5) |

| Fin_dummy | −0.145 *** | (0.000140) |

| Industrials_dummy | −0.0619 | (0.204) |

| Credit Rating | 0.00556 ** | (0.0194) |

| Bid-Ask Spread | 0.0274 ** | (0.0146) |

| Revenue Growth | −0.000104 | (0.218) |

| Country = United Kingdom | 0.0756 ** | (0.0168) |

| Country = Denmark | −0.233 | 0.176 |

| Country = Germany | 0.0764 | (0.364) |

| Country = Netherlands | 0.300 ** | (0.0168) |

| Time Passed (a) | 0.00580 | (0.146) |

| Issuer FE | Yes | |

| Constant | 0.194 *** | (0.000589) |

| R-squared | 0.894 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Grishunin, S.; Bukreeva, A.; Suloeva, S.; Burova, E. Analysis of Yields and Their Determinants in the European Corporate Green Bond Market. Risks 2023, 11, 14. https://doi.org/10.3390/risks11010014

Grishunin S, Bukreeva A, Suloeva S, Burova E. Analysis of Yields and Their Determinants in the European Corporate Green Bond Market. Risks. 2023; 11(1):14. https://doi.org/10.3390/risks11010014

Chicago/Turabian StyleGrishunin, Sergei, Alesya Bukreeva, Svetlana Suloeva, and Ekaterina Burova. 2023. "Analysis of Yields and Their Determinants in the European Corporate Green Bond Market" Risks 11, no. 1: 14. https://doi.org/10.3390/risks11010014

APA StyleGrishunin, S., Bukreeva, A., Suloeva, S., & Burova, E. (2023). Analysis of Yields and Their Determinants in the European Corporate Green Bond Market. Risks, 11(1), 14. https://doi.org/10.3390/risks11010014