Methodology for Economic Analysis of Highly Uncertain Innovative Projects of Improbability Type

Abstract

1. Introduction

- -

- Increased risk level, which is caused by additional uncertainty due to: long-term character; specificity or uniqueness of the generated results and/or resources expended; ambiguity in the structure of the project, that is, in the composition and sequence of actions performed and their relationships.

- -

- Expressed phasing, which determines the variability: duration of innovative projects; start time of investment; project results.

- Determine approaches to the differentiation of industrial projects of product innovations, since their heterogeneity causes different levels of implementation uncertainty.

- Establish the logic of transformation of methods for analyzing industrial innovation projects, taking into account the specifics of implementation in conditions of increased uncertainty.

- Select methods that can be applied to the economic analysis of industrial innovation projects.

- Form an approach to the choice of methods depending on the level of uncertainty of the innovation project.

- Develop a methodology for the analysis of industrial innovation projects for the conditions of an open interactive model.

- Develop tools for a fuzzy-multiple approach to the economic analysis of innovative projects, taking into account the conditions of increased uncertainty of the improbability type.

- Test the algorithm as part of an industrial innovation project implemented under conditions of increased uncertainty of the improbability type.

2. Results

2.1. Project Type Differenciation

- Early recipients: subjects joining from the earliest stages of the innovation process;

- Early majority: subjects joining from the production development stage (startup stage);

- Majority: subjects joining at the end of the rapid growth stage;

- Laggards: subjects joining at the end of the expansion stage.

2.2. Factors and Directions of Transformation of Economic Analysis Methods of Investment Projects

2.3. Conditions of an Open Model of the Innovation Process

- (1).

- Traditional dynamic methods;

- (2).

- Traditional dynamic methods, taking into account the specifics of innovation forecasts;

- (3).

- Real options method;

- (4).

- Fuzzy set approach;

- (5).

- Qualitative methods/Static quantitative methods.

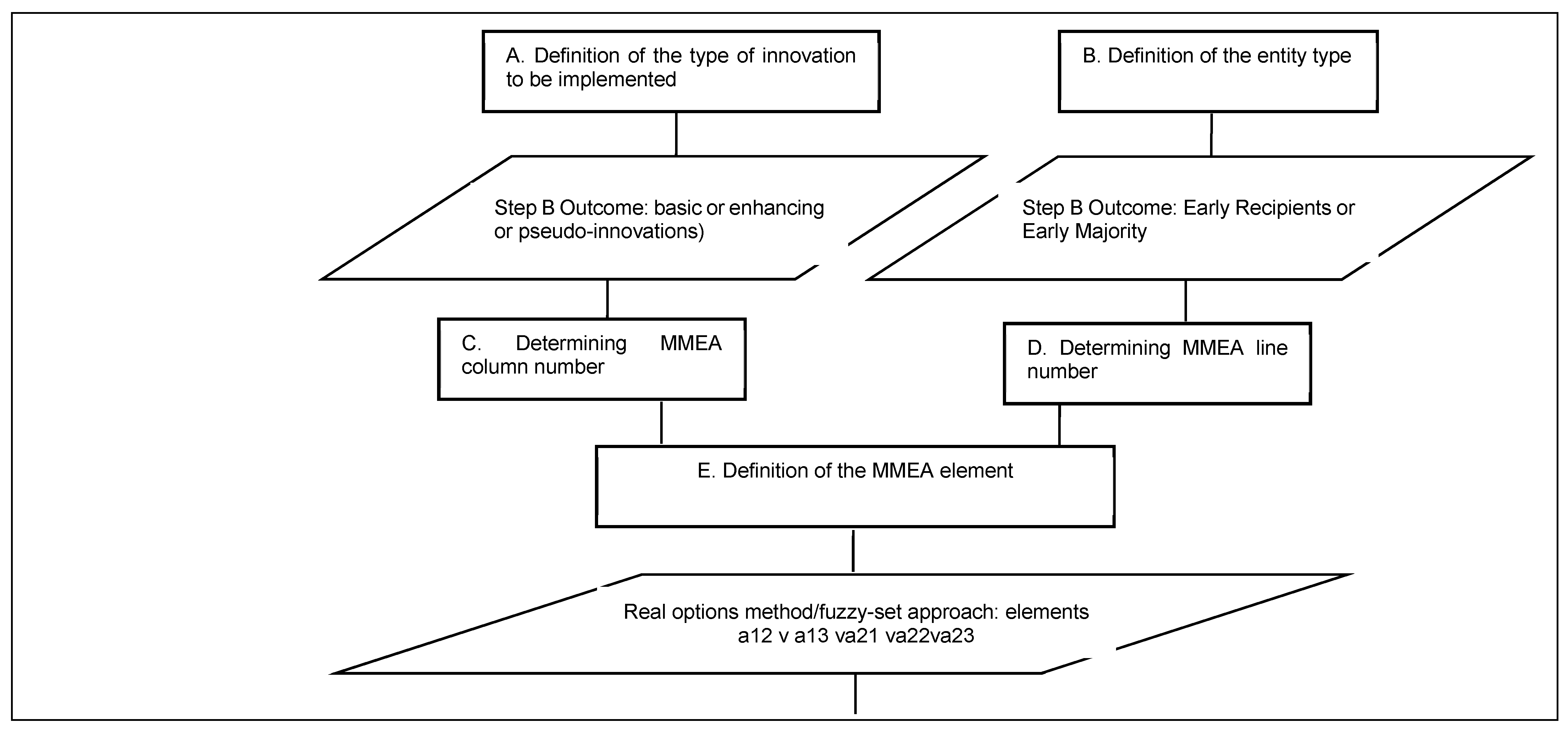

2.4. Matrix Method of Economic Analysis

- Column 1—Basic innovations (elements am1).

- Column 2—Improving innovations (elements am2).

- Column 3—Microinnovations (elements am3).

- Line 1—Early recipients (elements a1n).

- Line 2—Early majority (elements a2n).

- Line 3—Majority (elements 3n).

- Line 4—Laggards (elements a4n).

- a11—Qualitative methods/Static quantitative methods.

- a12—Real options method/Fuzzy set approach.

- a13—Real options method/Fuzzy set approach.

- a21—Real Options Method/Fuzzy Set Approach.

- a22—Real options method/Fuzzy set approach.

- a23—Traditional dynamic methods, taking into account the specifics of innovation forecasts.

- a31—Traditional dynamic methods, taking into account the specifics of innovation forecasts.

- a32—Traditional dynamic methods, taking into account the specifics of innovation forecasts.

- a33—Traditional dynamic methods.

- a41—Traditional dynamic methods.

- a42—Traditional dynamic methods.

- a43—Traditional dynamic methods.

2.5. The Implementation of the Option Model

- analysis of opportunities to make changes to the internal indicators of an innovation-investment project when implementing risky situations (determining the composition of real options) and building an option model of the project;

- assessment of real options for an innovation-investment project;

- definition of parameters of uncertainty and risk, causing favorable and unfavorable deviations for the project, as well as triggering the process of changes and exercise of options.

- -

- Most plausible (reliable) value of the indicator of the innovation-investment project (j is the ordinal number of the indicator).

- -

- The level of plausibility (reliability) of achieving the reference value of the j-th indicator of the innovation-investment project ().

- -

- The level of reliability of the most plausible (reliable) value of the indicator of the innovation-investment project ().

- -

- The level of reliability of the effective values indicator of the innovation-investment project.

2.6. Fuzzy-Multiple Approach

- -

- Method for determining the most plausible (reliable) value of the indicator of the innovation-investment project (Kj).

- -

- Method for determining the level of plausibility (reliability) of achieving the reference value of the j-th indicator of the innovation-investment project ().

- -

- Method for determining the level of reliability of the most plausible (reliable) value of the indicator of the innovation-investment project ().

- -

- Method for determining the level of reliability of the effective values indicator of the innovation-investment project.

- -

- Determination of the reference value of the j-th indicator of the innovation project ().

- -

- Determination of effective and ineffective ranges of values of the j-th indicator of the innovation-investment project based on the j-th benchmark. In most cases, when the value of the j-th indicator is effective.

- -

- Determination of areas of effective () and ineffective () confidence zones.

- -

- Determination of the area of values of the j-th indicator of the innovation-investment project according to the Formula (4):

- -

- The value of the indicator of reliability of achieving effective values of the j-th indicator of the innovation-investment project according to the Formula (5):

- -

- Evaluation of the value of the indicator of reliability of achieving effective values of the j-th indicator of the innovation-investment project using the Harrington scale.

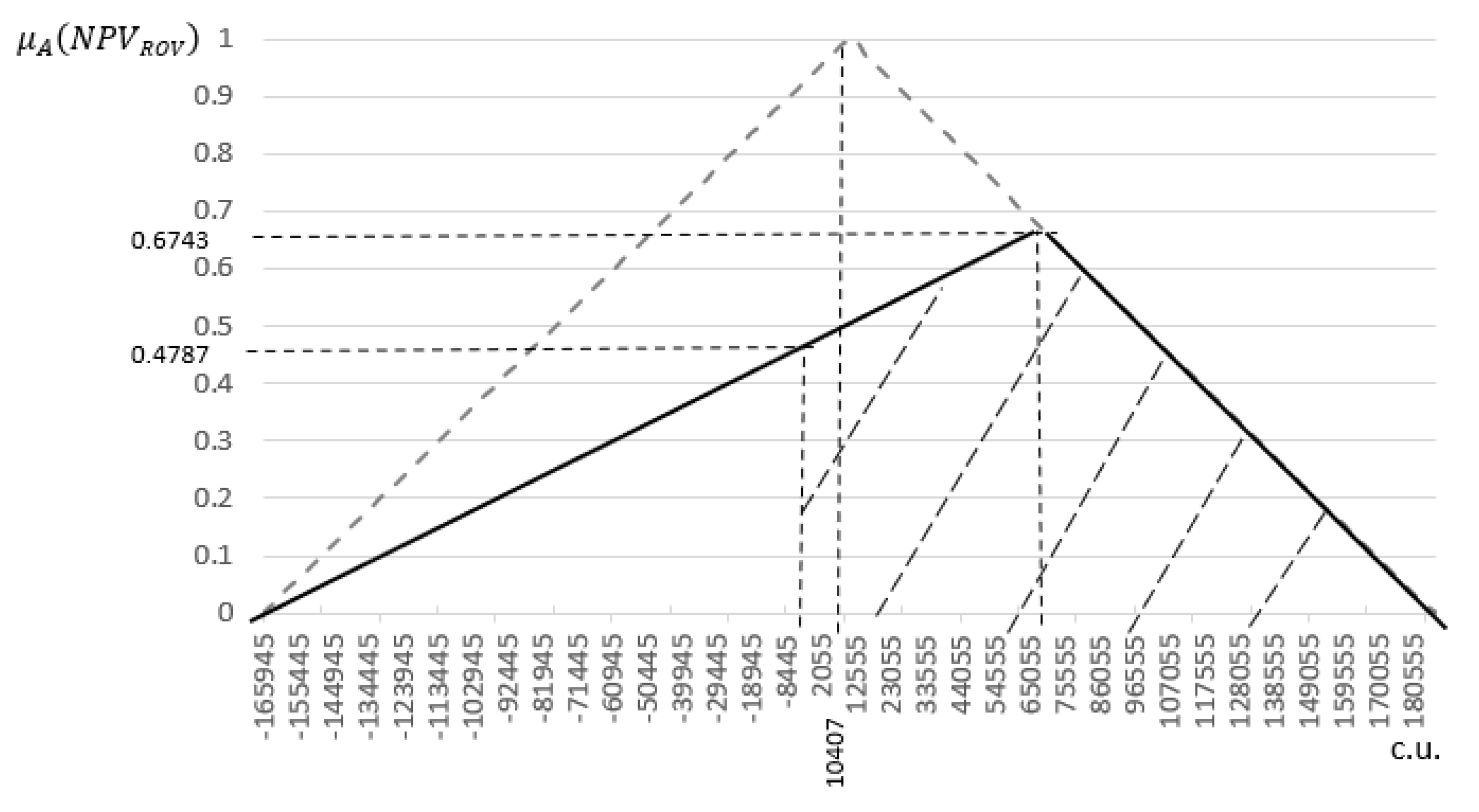

2.7. Results of Applying the Proposed Economic Analysis Algorithm

- -

- Reference value of indicator = 0.

- -

- The effective range of values of the efficiency indicator of the considered project .

- -

- The area of the effective region is (c.u.), the area of the ineffective region is (c.u.).

- -

- The area of fuzzy values of the indicator is S (c.u.).

- -

- The value of the reliability indicator for achieving effective values is .

- -

- In accordance with the Harrington scale, the reliability of achieving the effective values of the integral indicator of the project is high.

- -

- Fixing real options in the project and determining the factors that trigger the process of changes and the exercise of options.

3. Materials and Methods

3.1. Criteria for Projects Differentiation

- -

- The level of innovation novelty. The level differentiation was based on the approach (Mensch 1975) without taking into account the fake innovations group. Taking into account that the improving innovations group is not homogeneous, a subgroup of micro-innovations is singled out in it.

- -

- Types of subjects of innovation. The distinction between the types of innovative projects subjects was based on the approach (Schumpeter 1989).

3.2. Choice of a Method for Analyzing an Innovation Project

3.3. Methods of Innovative Projects Analysis

3.3.1. Traditional Dynamic Methods

3.3.2. Traditional Dynamic Methods, Taking into Account the Specifics of Innovation Forecasts

3.3.3. Real Options Method

3.3.4. Fuzzy Set Approach

3.3.5. Qualitative Methods/Static Quantitative Methods

3.4. Decision Matrix Aproach

3.5. Algorithmization Method

3.6. Fuzzy-Set Approach Metodology

- -

- 0.81–1.0 very high;

- -

- 0.64–0.80 high;

- -

- 0.37–0.63 average;

- -

- 0.20–0.36 low;

- -

- 0–0.19 very low.

3.7. Calculating the Performance Indicators

4. Discussion

4.1. Thedependence of Uncertainty Level of a Product Innovation Project

4.2. Influende of Different Factors

4.3. Investmnent Analysis Method

4.4. Decision Matrix

4.5. Algoritm for Effective Rael Option Model Implementation

4.6. Development of the Fuzzy-Set Approach

4.7. Algorithm Testing

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | Numerical values have been adjusted by a certain coefficient and converted to conventional currency units (c.u.) |

References

- Alekseev, Andrej, and Kirill Khlebnikov. 2018. Factors of economic efficiency of innovative entrepreneurship in the manufacturing industry. Proceedings of the St. Petersburg State University of Economics 5: 128–36. [Google Scholar] [CrossRef]

- Antokhina, Yulia, Evgenij Voroshin, and Alexander Kolesnikov. 2019. Formation of approaches to the analysis of the effectiveness of investment and innovation projects of industrial business systems. Scientific Journal NRU ITMO 1: 85–92. [Google Scholar] [CrossRef]

- Baranov, Aleksander, Evgenij Muzyko, and Vladimir Pavlov. 2018. Evaluation of the Effectiveness of Innovative Projects Using Optional and Fuzzy-Set Approaches. Russian Academy of Sciences, Siberian Branch, Institute of Economics and Organization of Industrial Production of the Siberian Branch of the Russian Academy of Sciences. Novosibirsk: Institute of Economics and Organization of Industrial Production of the Siberian Branch of the Russian Academy of Sciences. 335p, ISBN 978-5-89665-324-0. [Google Scholar] [CrossRef]

- Brayley, Richard. 2019. Principles of Corporate Finance. V.2. Edited by Richard Braley and Myers Steward Allen. Moscow: Williams. 656p. [Google Scholar]

- Carlsson, Christer, Markku Heikkilä, and Robert Fuller. 2010. Fuzzy Real Options Models for Closing/Not Closing a Production Plant. Berlin: Springer, chp. 22. [Google Scholar]

- Casper Boongaling, Agaton. 2021. Application of real options in carbon capture and storage literature: Valuation techniques and research hotspots. Science of The Total Environment 795: 148683. [Google Scholar] [CrossRef]

- Chandra, A., Peter R. Hartley, and Gopalan Nair. 2022. Multiple Volatility Real Options Approach to Investment Decisions Under Uncertainty. Decision Analysis 19: 79–98. [Google Scholar] [CrossRef]

- Damodaran, Aswath. 2019. Real Option Models in Valuation. Available online: http://people.stern.nyu.edu/adamodar (accessed on 15 January 2022).

- Deeney, Peter, Mark Cummins, Heintz Katarina, and Mary Pryce. 2021. A real options based decision support tool for R&D investment: Application to CO2 recycling technology. European Journal of Operational Research 289: 696–711. [Google Scholar] [CrossRef]

- Demidenko, Daniil, Alexander Kolesnikov, and Ekaterina Malevskaya-Malevich. 2019. Determination of the economic efficiency of investments in innovative products, taking into account the peculiarities of investment. Economic Vector 4: 68–72. [Google Scholar] [CrossRef]

- Geske, Robert. 1979. The valuation of compound options. Journal of Financial Economics 7: 63–81. [Google Scholar] [CrossRef]

- Ginbo, Tsegaue, Luca Di Corato, and Ruben Hoffmann. 2021. Investing in climate change adaptation and mitigation: A methodological review of real-options studies. Ambio 50: 229–41. [Google Scholar] [CrossRef]

- Harikae, Seiji, James Dyer, and Tianyang Wang. 2021. Valuing Real Options in the Volatile Real World. Production and Operations Management 30: 171–89. [Google Scholar] [CrossRef]

- Hassanzadeh, Farhad, Mikael Collan, and Mohammad Modarres. 2011. A practical R&D selection model using fuzzy pay-off method. Journal of Applied Munufacturing Technology 58: 227–36. [Google Scholar]

- Jalonen, Harri. 2012. The uncertainty of innovation: A systematic review of the literature. Journal of Management Research 4: 1–47. [Google Scholar] [CrossRef]

- Lamberts-Van Assche, Hanne, and Tine Compernolle. 2022. Using Real Options Thinking to Value Investment Flexibility in Carbon Capture and Utilization Projects: A Review. Sustainabilit 14: 2098. [Google Scholar] [CrossRef]

- Kolk, Mihael, and Rick Eagar. 2014. How to manage your return on investment in innovation. PRISM 1: 66–83. [Google Scholar]

- Kornilova, Svetlana. 2021. Ensuring the Effectiveness of Investment and Construction Projects in Conditions of Increasing Uncertainty: Specialty 08.00.05 “Economics and Management of the National Economy (By Industry and Area of Activity)”: Dissertation for the Degree of Candidate of Economic Sciences. St. Petersburg: S. V. Kornilov. 211p. [Google Scholar]

- Koskinen, Yrjö, and Joril Maeland. 2016. Innovation, Competition, and Investment Timing. Review of Corporate Finance Studies 5: 166–99. [Google Scholar] [CrossRef]

- Kotov, Vladidmir. 2019. Risk Analysis of Investment Projects Based on Sensitivity Functions and the Theory of Fuzzy Sets, 3rd ed. supplemented and revised. St. Petersburg: Center for Scientific and Production Technologies “Asterion”. 349p, ISBN 978-5-00045-675-0. [Google Scholar]

- Kvasha, Nadezhda, and Ekaterina Malevskaia-Malevich. 2021. Intelligent quasi-rent as a value-creating factor for modern industrial enterprises. Presented at the 22nd European Conference on Knowledge Management, ECKM, Virtual, 2–3 September; pp. 476–83. [Google Scholar] [CrossRef]

- Kvasha, Nadezhda, Ekaterina Malevskaia-Malevich, and Daniel Demidenko. 2021. Ensuring innovative development of enterprises in the context of reduced government support. Presented at the European Conference on Innovation and Entrepreneurship, ECIE, Virtual, September; pp. 486–93. [Google Scholar] [CrossRef]

- Lee, Yaung-Chan, and Seung-Seok Lee. 2011. The valuation of RFID investment using fuzzy real option. Expert Systems with Applications 38: 12195–201. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda, and Etem Iseni. 2018. Role of Analysis CVP (Cost-Volume-Profit) as Important Indicator for Planning and Making Decisions in the Business Environment. European Journal of Economics and Business Studies Articles 4: 99–114. [Google Scholar] [CrossRef]

- Lyubushin, Nikolaj, and George Brikach. 2014. Use of the generalized Harrington desirability function in multiparameter economic problems. Economic Analysis: Theory and Practice 18: 2–10. [Google Scholar]

- Mensch, Gerhard. 1975. Das Technologische Patt: Innovationen überwinden die Depression. Frankfurt: Umschau Verlag Breidenstein. [Google Scholar]

- Muñoz, José Ignacio, Javier Contreras, J. Caamaño, and P. F. Correia. 2011. A decision-making tool for project investments based on real options: The case of wind power generation. Annals of Operations Research 186: 465–90. [Google Scholar] [CrossRef]

- Nadajarah, Selvaprabu, and Nicola Secomandi. 2022. A review of the operations literature on real options in energy. European Journal of Operational Research. in press. [Google Scholar] [CrossRef]

- Nedosekin, Aleksey. 2003. Methodological Foundations of Modeling Financial Activity Using Fuzzy-Multiple Descriptions. Ph.D. Thesis, Saint Petersburg State University, St. Petersburg, Russia; 280p. [Google Scholar]

- Oslo Guide. 2018. Oslo Manual 2018: Guidelines for Collecting, Reporting and Using Data on Innovation, 4th ed. Paris: The Measurement of Scientific, Technological and Innovation Activities, OECD Publishing. Luxembourg: Eurostat. [Google Scholar] [CrossRef]

- Panchenko, Aleksey, and Anton Abrakhmanov. 2014. Methods for evaluating the effectiveness of innovative projects using real options. Russian Entrepreneurship 10: 48–56. [Google Scholar]

- Schumpeter, Joseph. 1989. Essays: On Entrepreneurs, Innovations, Business Cycles and the Evolution of Capitalism, 1st ed. London: Routledge. [Google Scholar] [CrossRef]

- Wang, Qian, Mark Kilgour, and Keith W. Hipel. 2015. Facilitating Risky Project Negotiation: An Integrated Approach Using Fuzzy Real Options, Multicriteria Analysis, and Conflict Analysis. Information Sciences 295: 544–57. [Google Scholar] [CrossRef]

| Type of Organization | Type of Innovation | Basic Innovations | Improving Innovations | Microinnovations | |||

|---|---|---|---|---|---|---|---|

| Early recipients | a11 | Qualitative Methods/static quantitative methods | a12 | Real Options Method / Fuzzy-Set Approach | a13 | Real Options Method/Fuzzy-Set Approach | |

| Early majority | a21 | Real Options Method/Fuzzy-Set Approach | a22 | Real Options Method / Fuzzy-Set Approach | a23 | Traditional dynamic methods, taking into account the specifics of innovation forecasts | |

| Majority | a31 | Traditional dynamic methods, taking into account the specifics of innovation forecasts | a32 | Traditional dynamic methods, taking into account the specifics of innovation forecasts | a33 | Traditional Dynamic Methods | |

| Laggards | a41 | Traditional Dynamic Methods | a42 | Traditional Dynamic Methods | a43 | Traditional Dynamic Methods | |

| Year | Number of Stage | Investments, c.u. | CF, c.u. | DCF, c.u. | ||||

|---|---|---|---|---|---|---|---|---|

| Low | Forecast | High | Low | Forecast | High | |||

| 2021 | 0 | 1,300,000 | ||||||

| 2022 | 1 | −31,207 | −8370 | 3049 | −27,031 | −7250 | 2641 | |

| 2023 | 2 | 179,650 | 246,500 | 279,925 | 134,784 | 184,939 | 210,017 | |

| 2024 | 3 | 326,650 | 404,500 | 443,425 | 212,276 | 262,867 | 288,163 | |

| 2025 | 4 | 346,259 | 419,690 | 456,406 | 194,906 | 236,240 | 256,907 | |

| 2026 | 5 | 257,848 | 308,080 | 333,196 | 125,717 | 150,208 | 162,454 | |

| 2027 | 6 | 197,600 | 247,000 | 271,700 | 83,449 | 104,312 | 114,743 | |

| 2028 | 7 | 177,840 | 222,300 | 244,530 | 65,054 | 81,317 | 89,449 | |

| 2029 | 8 | 154,721 | 193,401 | 212,741 | 49,023 | 61,278 | 67,406 | |

| 2030 | 9 | 128,573 | 160,716 | 176,788 | 35,286 | 44,108 | 48,518 | |

| 2031 | 10 | 100,326 | 125,407 | 137,948 | 23,849 | 29,811 | 32,793 | |

| 2032 | 11 | 71,672 | 89,589 | 98,548 | 14,758 | 18 447 | 20,292 | |

| 2033 | 12 | 45,060 | 56,325 | 61,958 | 8037 | 10,046 | 11,050 | |

| 2034 | 13 | 23,311 | 29,138 | 32,052 | 3601 | 4501 | 4951 | |

| 2035 | 14 | 8684 | 10,854 | 11,940 | 1162 | 1452 | 1598 | |

| 2036 | 15 | 1600 | 2000 | 2200 | 185 | 232 | 255 | |

| Index | ||||||||

| TV | 1,136,732 | 284,404 | 355,504 | 391,055 | ||||

| ∑ | 1,300,000 | 1,988,585 | 2,507,132 | 2,766,405 | 925,056 | 1,182,509 | 1,311,236 | |

| NPV | −374,944 | −117,491 | 11,236 | |||||

| i | 15.45% | 15.45% | 15.45% | |||||

| IRR | 7.96% | 13.20% | 15.66% | |||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Babkin, A.; Kvasha, N.; Demidenko, D.; Malevskaia-Malevich, E.; Voroshin, E. Methodology for Economic Analysis of Highly Uncertain Innovative Projects of Improbability Type. Risks 2023, 11, 3. https://doi.org/10.3390/risks11010003

Babkin A, Kvasha N, Demidenko D, Malevskaia-Malevich E, Voroshin E. Methodology for Economic Analysis of Highly Uncertain Innovative Projects of Improbability Type. Risks. 2023; 11(1):3. https://doi.org/10.3390/risks11010003

Chicago/Turabian StyleBabkin, Aleksandr, Nadezhda Kvasha, Daniil Demidenko, Ekaterina Malevskaia-Malevich, and Evgeny Voroshin. 2023. "Methodology for Economic Analysis of Highly Uncertain Innovative Projects of Improbability Type" Risks 11, no. 1: 3. https://doi.org/10.3390/risks11010003

APA StyleBabkin, A., Kvasha, N., Demidenko, D., Malevskaia-Malevich, E., & Voroshin, E. (2023). Methodology for Economic Analysis of Highly Uncertain Innovative Projects of Improbability Type. Risks, 11(1), 3. https://doi.org/10.3390/risks11010003