1. Introduction

Keynes integrated monetary theory into general economic theory. He broke with the dichotomous approach of classical and neoclassical economists. He examined the effectiveness of monetary policy and the limits of monetary policy. In light of his liquidity preference theory, he assumed that below a certain level of interest rates, monetary policy becomes ineffective because of the portfolio choices of economic agents. Today, economists unanimously refer to this phenomenon as the liquidity trap. A liquidity trap occurs when the market interest rate falls to a low level. This diverts economic agents’ intentions away from other elements of wealth holding and towards money holding (

Keynes 1936).

Keynes based his theory of the liquidity trap on the empirical phenomenon that, despite moderate interest rates in the 1930s, the economy failed to recover and investment activity failed to pick up. He sought solutions to the problems of the British economy in the 1930s and made economic policy recommendations. The ineffectiveness of monetary policy in achieving near-zero interest rates was, for several decades, to become the subject of a rather theoretical debate.

Its practical economic policy relevance came about in the context of the stagnation of the Japanese economy since the early 1990s and the monetary responses to support growth. The theoretical debate also flared up again (

Werner 2005;

Tatay and Tatay 2020). In Japan, an increase in the money supply did not even induce the proportional increase in prices assumed under monetary neutrality, besides being ineffective on real economic performance (

Krugman et al. 1998;

Itoh and Shimoi 2000;

Ueda 2001).

Bibow (

2013) argues that liquidity preference theory is misunderstood and underemphasized by many. Bibow cites Keynes’ liquidity preference theory as a highly relevant theory. He also saw it as a way to assess the phenomena of the 2008 global financial crisis (

Lhuissier et al. 2020).

As a consequence of the global financial crisis, the European Central Bank also started to cut interest rates after 2010. In 2014, it launched its QE program, bringing the entire euro yield curve under control (

Kuroda 2016;

Kiley 2018).

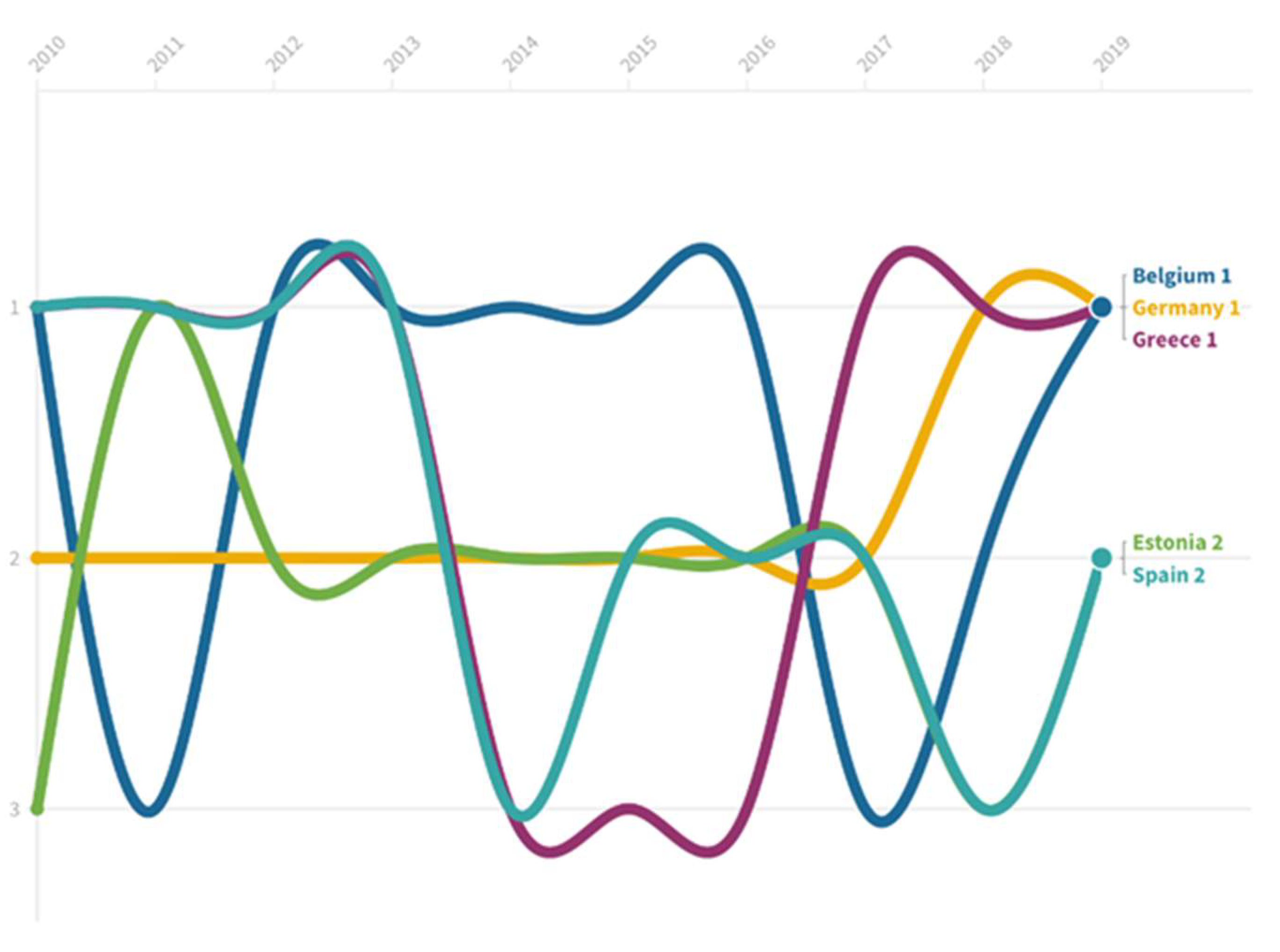

Figure 1 shows the euro spot rate yield curves over the period 2010–2019.

Previously, the phenomenon of a zero-interest rate environment was assessed within a single country’s economy. By 2010, the euro area was made up of 16 countries, with three more soon to join soon (the three countries joining after 2010 can almost be considered members by 2010, as they had to meet the strict criteria for membership several years before joining). Monetary policy actions by the European Central Bank should have the same effect in each economy. The ECB’s interest rate moves should entail a reallocation of similar financial wealth among economic agents in the euro area economies. Under Keynes’ liquidity preference theory, in a zero-interest rate environment, this reallocation is not only of a similar nature, but is also assumed to be of a marked magnitude. In the present paper, we aim to investigate the financial homogeneity of the euro area economies by means of the theoretical assumptions of the liquidity trap phenomenon.

Our assumption was that the euro area economies are not completely homogeneous. Hence, in a zero-interest rate environment, the asset holding decisions of economic agents would exhibit detectable differences across countries. We assumed that the differences due to these divergences persisted even when the ECB controlled not only short, but also long-term, yields.

We intended to verify our assumptions using Eurostat data. We used the financial asset stocks of the euro area countries to cluster the countries concerned. The homogeneity or heterogeneity, and the changes in clusters, would confirm or refute our hypothesis that the zero lower bound and quantitative easing measures affected the portfolio decisions of economic agents but country specific differences persisted.

Due to the financial turbulence COVID-19 caused all over in the world, the ECB continued with a zero-interest rate environment and extended its asset purchases and, as a result, avoided the return of extremely high yields that characterized the sovereign debt crisis (

Havlik et al. 2022). With the outbreak of the Russian–Ukrainian conflict, the ECB did not change its monetary policy stance and maintained the ZLB (zero lower bound) until July 2022 in contrast to other major central banks, like the Fed and the BoE. The analysis intentionally does not cover the period after 2020 because the economies were then hit by both a negative supply and demand shock and, from 2022, an unprecedented inflationary period followed in the Eurozone and the world which is not to be explained by the liquidity trap phenomenon.

Our results should also be placed in an international context, in a period with strongly deviating monetary policies. From 2010 to the end of 2015 the Fed eventually maintained the effective zero lower bound, while the ECB was gradually cutting its policy rate to zero (apart from two minor rises in 2011) by March 2016 and keeping it at the same level until the end of the period examined in this study. The Fed kept on tightening monetary policy until March 2020 and started its tapering program at the end of 2013, while a higher volume QE was only launched at the end of 2015 by the ECB. The BoE started its first raise in the base rate at the end of 2017, which was continued by further increases, while the Bank of Japan maintained a below zero level of policy rates from the beginning of 2016. Apart from adversely affecting the yield curve, these dissimilar monetary policy actions could also influence the choice of domestic actors between domestic and foreign assets, which the present paper does not separate within the various asset classes, due to limitations in size and scope.

The structure of the paper is as follows. First, we review the literature. In this section we discuss the main elements of Keynes’ liquidity preference theory, and the emergence of the liquidity trap. We then turn to the literature on the fragmentation of the euro area. In the materials and methods section, we present the empirical data of the study and describe the cluster analysis method used. In the subsequent results and discussion section, the results obtained by applying the k-centers cluster method are presented and evaluated. In the final conclusions section, a summary evaluation of the results obtained is made, and the applicability of the results and directions for further research are indicated.

4. Results and Discussion

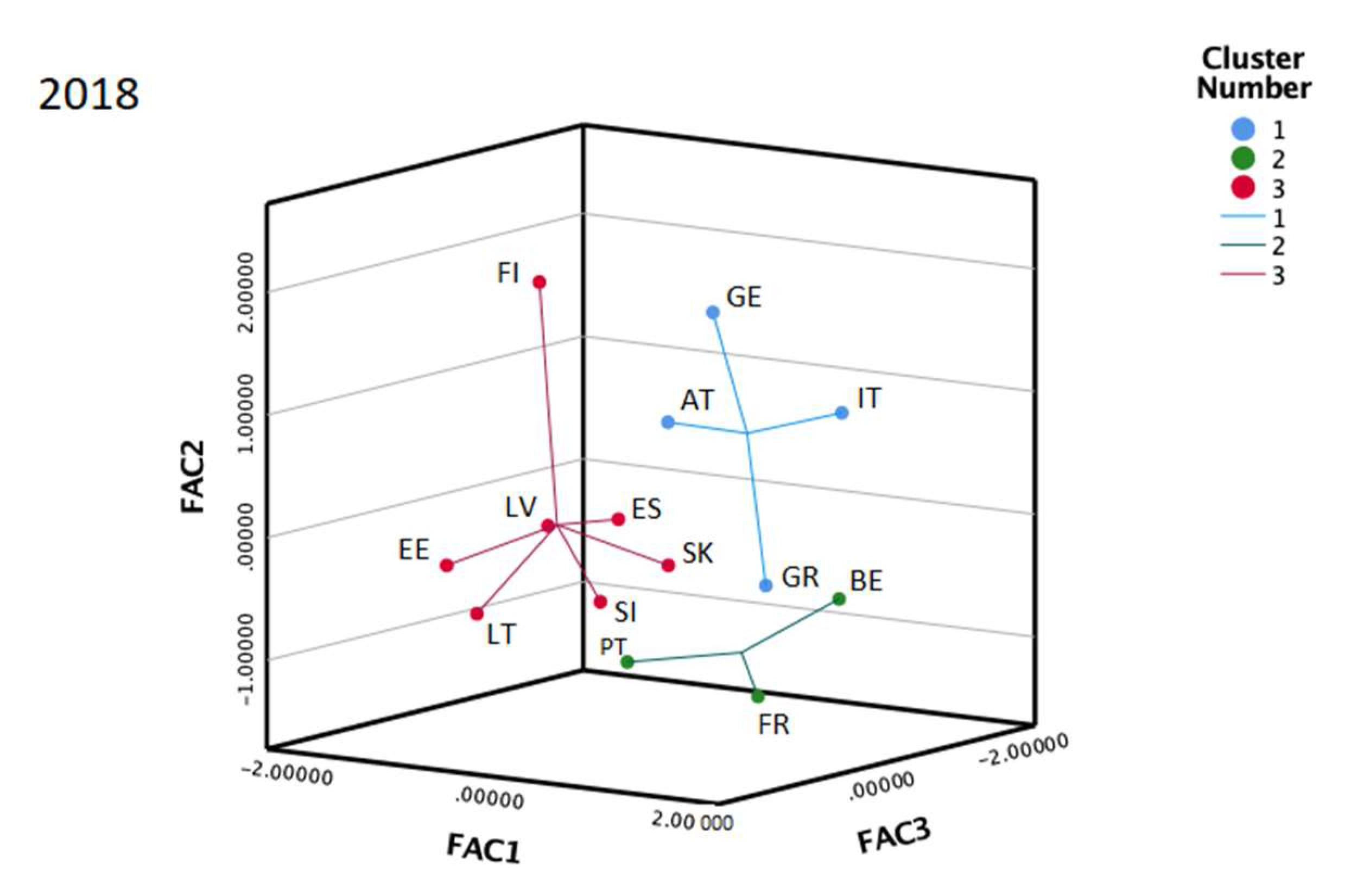

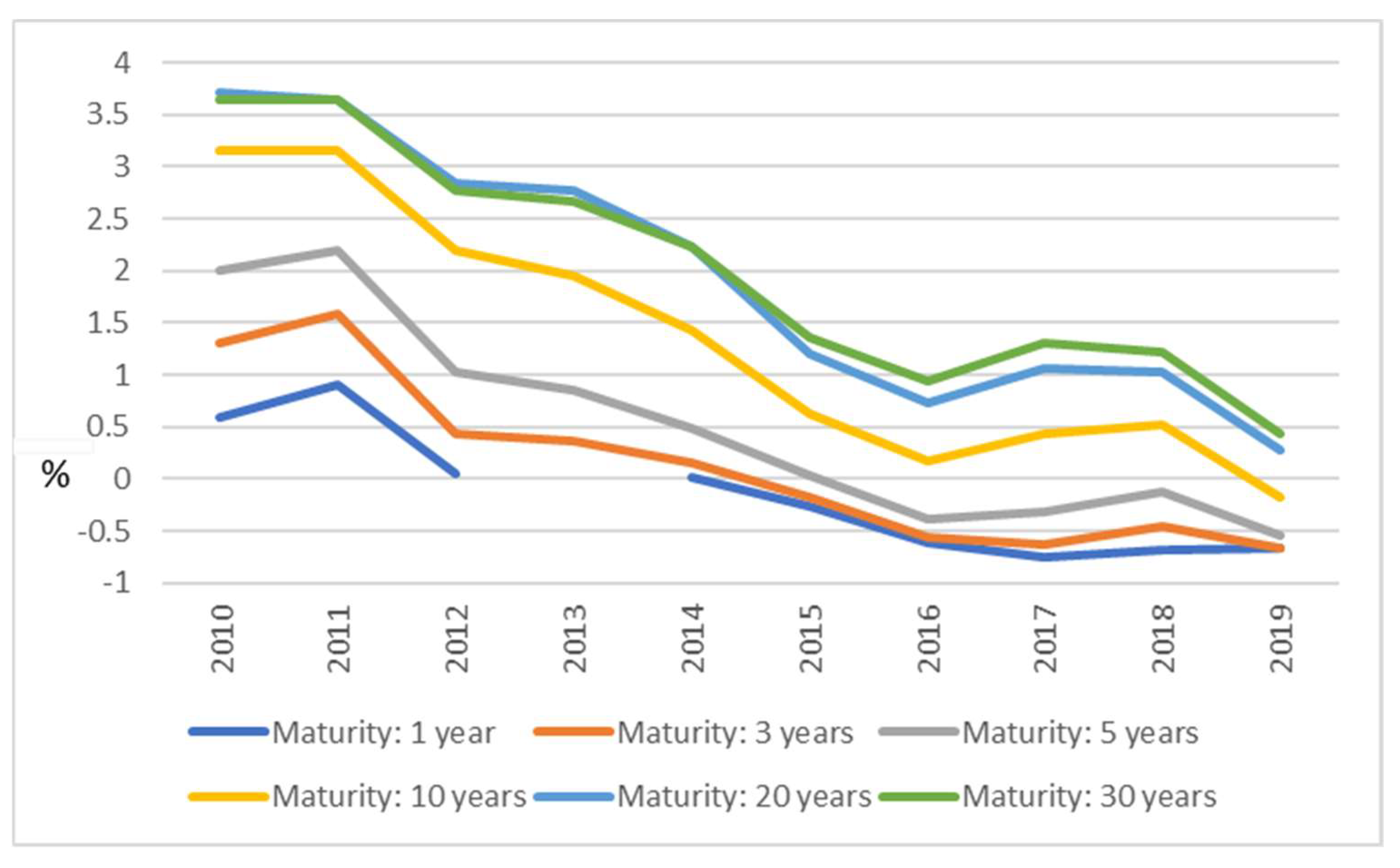

In the dynamic analysis the most obvious phenomenon was the converging behavior of the countries after the sovereign crisis in the eurozone. Whereas at the beginning more or less half of the countries belonged to the first (financially stronger) and half to the second (financially weaker) cluster, after 2013 most of the countries moved to the latter group. Furthermore, after the introduction of the effective zero lower bound and the quantitative easing measures, most of the countries managed to catch up with the first group, as concerns the financial investment structure. Luxembourg formed a third group with a very strong dominance of the first principal component. These situations are shown in

Figure 2.

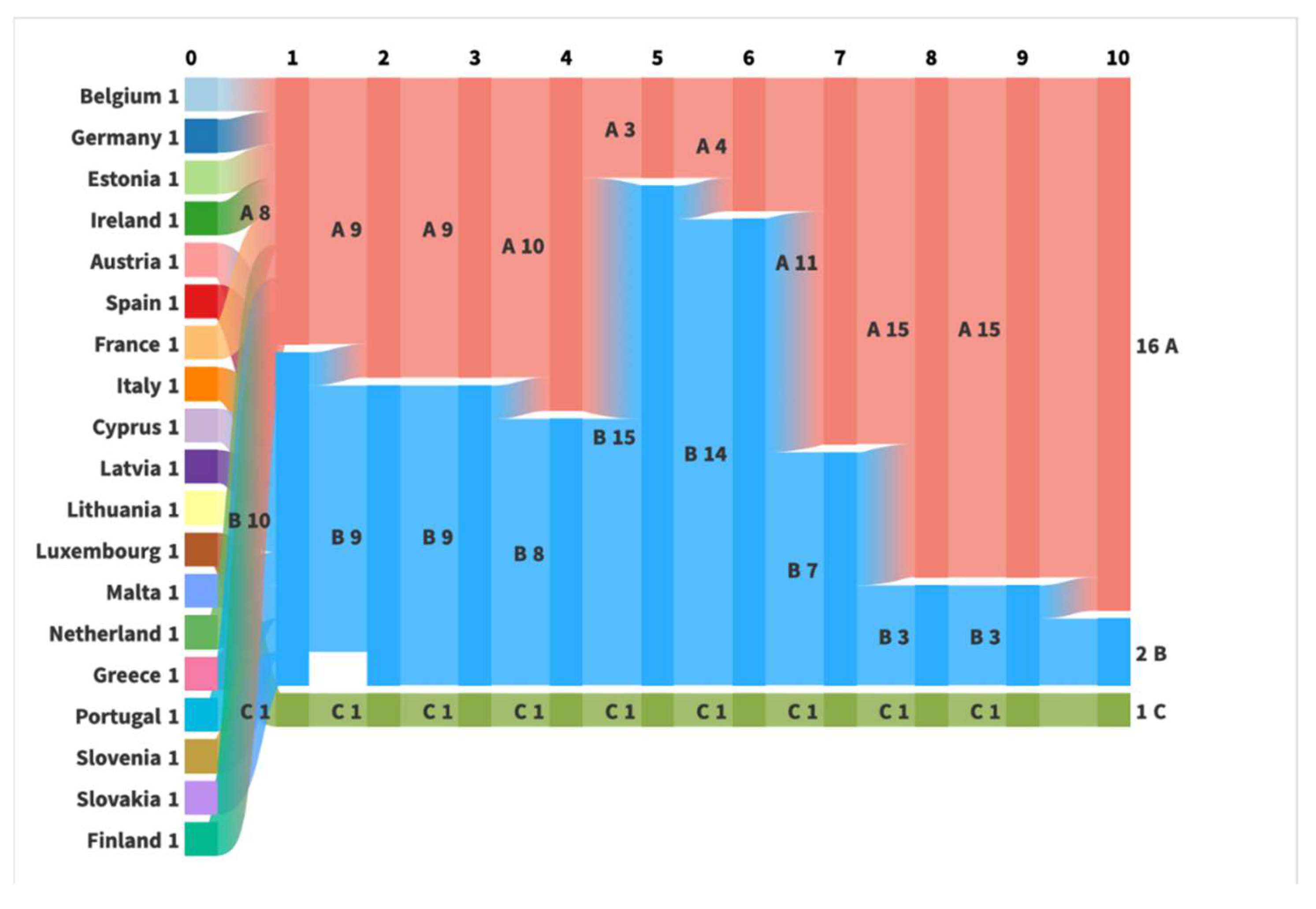

Between 2010 and 2013 countries belonging to the first cluster (A) had a somewhat below average value for the first principal component, which means less financial assets in general, higher than average for the second component, that is higher volume of other deposits or, in other words, non-transferable deposits, and lower than average for the third principal component, currency. Countries belonging to this first group were Belgium, Germany, Estonia, Ireland, France, the Netherlands, Portugal and Finland. The second group (B), consisting of the rest of the countries (Greece, Spain, Italy, Cyprus, Latvia, Lithuania, Malta, Austria, Slovenia, Slovakia), had somewhat higher levels of financial assets in general than the first cluster (less negative relationship with the first component) but much higher currency-to-GDP levels and lower savings in insurance and technical reserves. Until 2014, only Austria and Latvia changed their positions, both moving to the first group from the second, Austria in 2011 and Latvia in 2013. In this period, the most representative (closest to the cluster centroid) country in the first group was Germany, while for the second it was Italy and Spain. In 2014, a lot of countries (Belgium, Germany, Estonia, Latvia, Austria, Portugal and Finland) moved to the second group, probably due to the effects of the sovereign debt crisis on portfolio decisions. The central country in this second group remained Spain in 2014. Some rearrangements occurred also in 2015 (the Netherlands and France went to group B, while Cyprus, Latvia, Slovakia moved to group A), but the number of countries belonging to the second group remained almost the same; there was a slight reduction from 15 countries to 14 countries. Nevertheless, the most spectacular change in 2015 was that the main features of group A and B were reversed, while group A became the country group with a relatively higher proportion in financial assets than the other group, higher-than average currency holdings but lower-than-average insurance reserves, in particular, whereas group B could be described with lower savings to GDP in currency, and higher insurance technical reserves (other deposits ceased to play an important role in the formation of clusters from 2014 onwards). This change in characteristics prevailed until the end of the whole period considered. In 2015, the ECB introduced a series of monetary easing measures and, as a result, the number of countries in the second group (B) declined to 7 in 2016 and then to 3 and 2 in 2017 and 2019, respectively, which meant that both the effective lower bound and the asset purchase programs caused a strong convergence in the portfolio structure of the countries under examination if countries were only observed in a two-cluster framework (see

Figure 3a–c). The most representative country for group A was Austria between 2017 and 2019 and France for group B, but for this second group the distances from the centroid were increasing over the same years.

The detailed move of countries between the two groups is reflected in

Figure 3a–c.

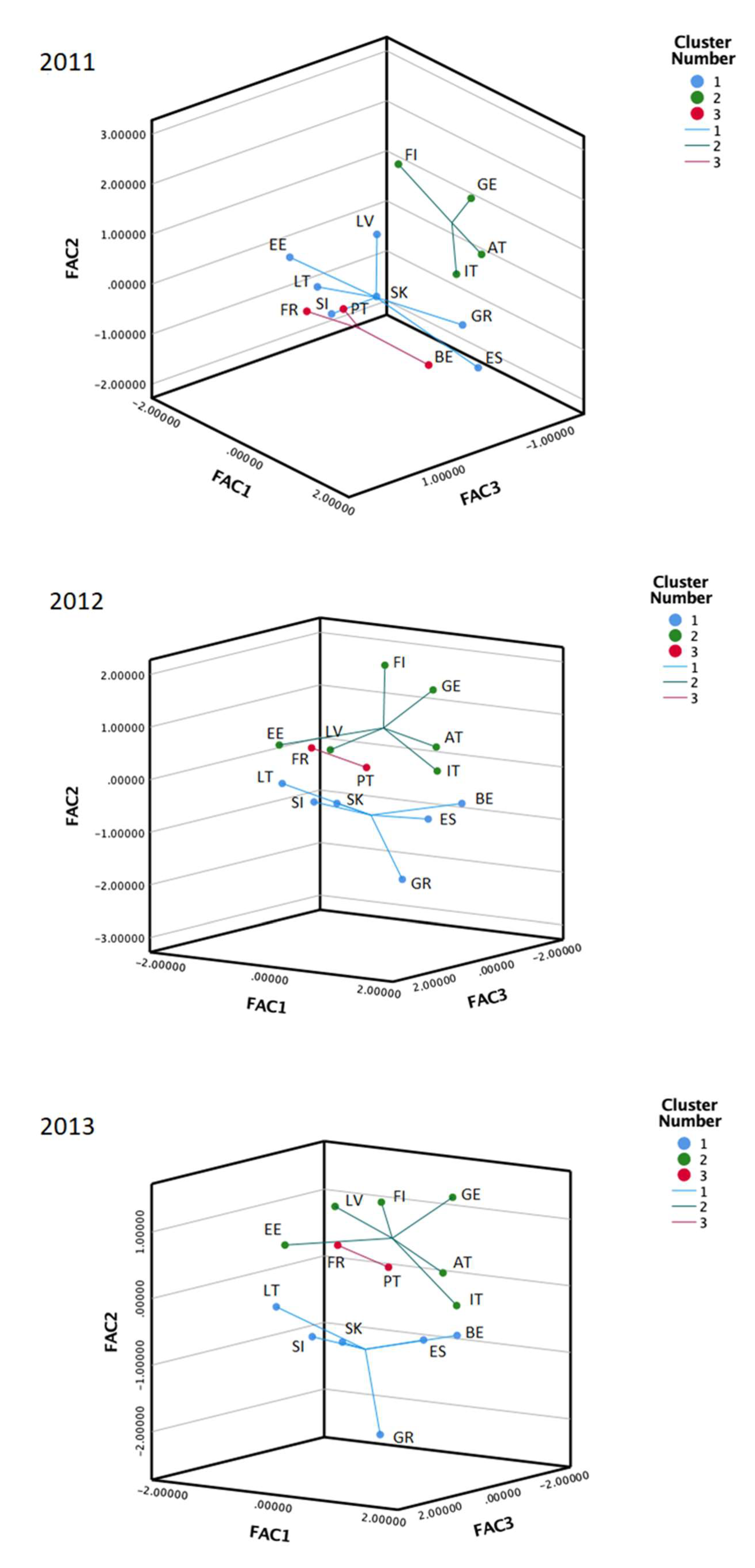

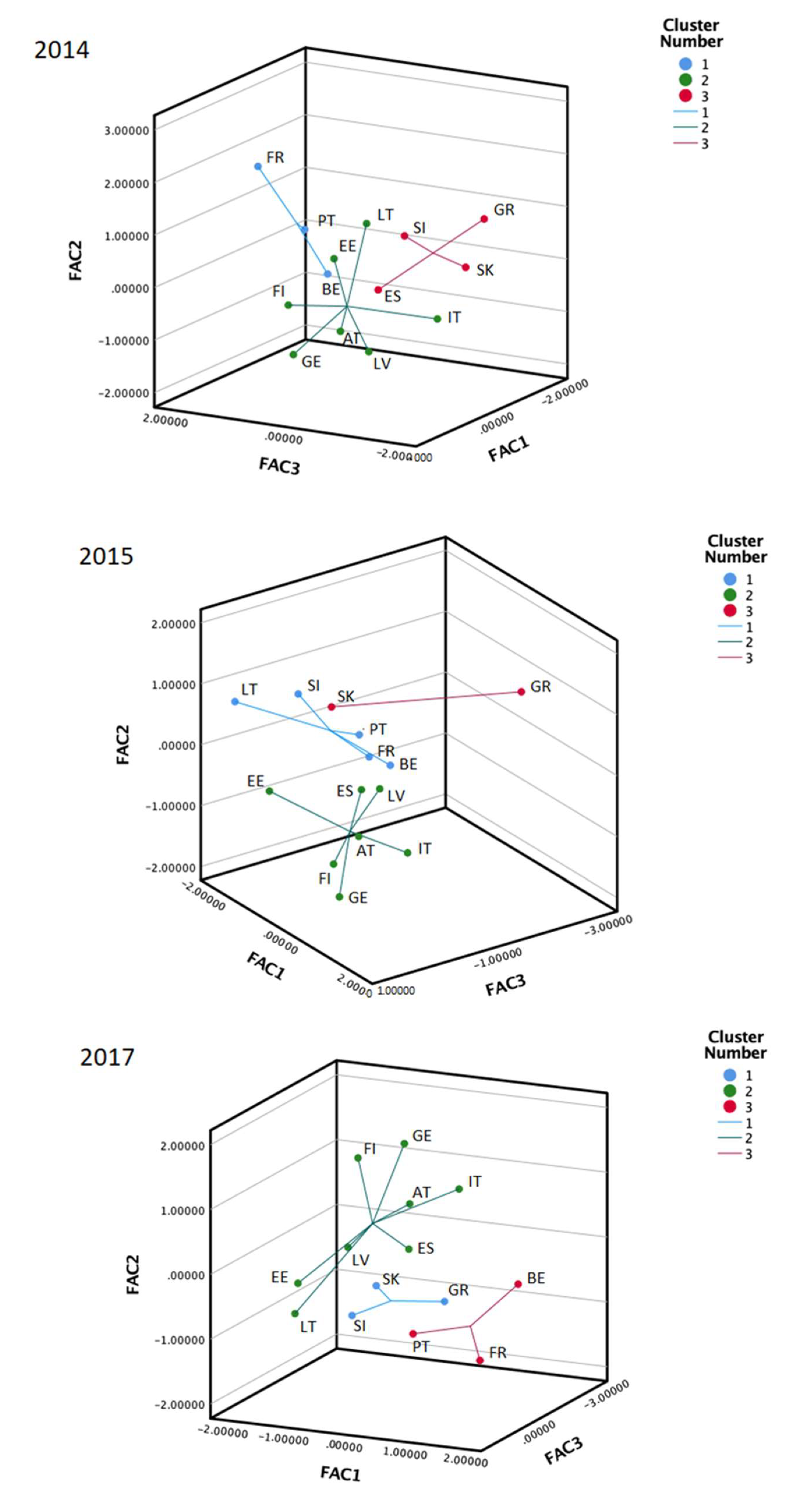

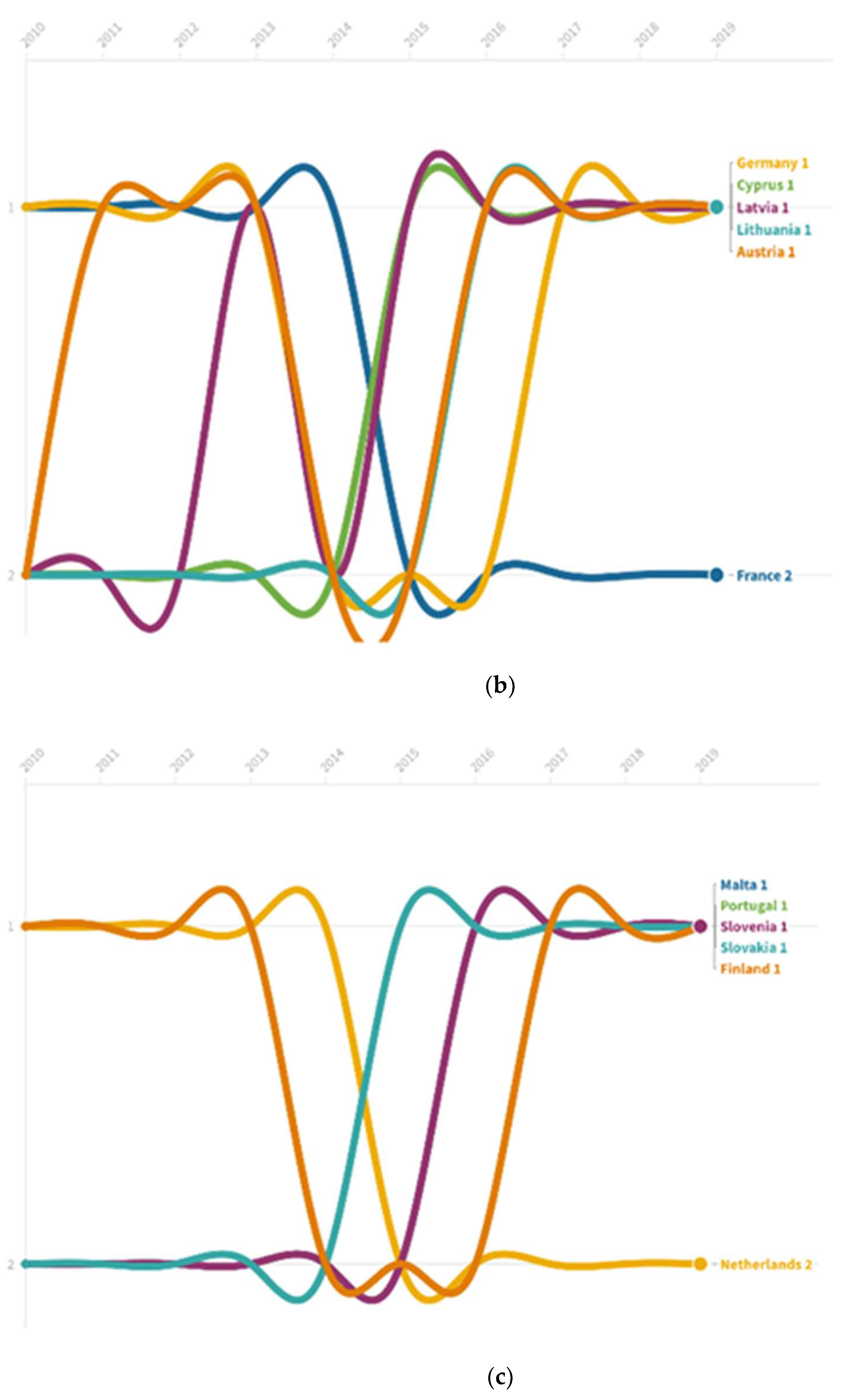

As some countries (namely the above-mentioned Luxembourg, forming a separate cluster in every analysis) still behaved as outliers, after filtering out Luxembourg, in a three-cluster representation, as well, they were dropped one by one from the list of countries examined (first Cyprus, then Malta, Ireland and the Netherlands, respectively). With 14 countries remaining, the three clusters formed in the particular years between 2010 and 2019 were easily distinguishable, based on the three principal components. Now that the component correlations had changed, short-term debt securities, currency and investment fund shares, and transferable deposits became the most important explanatory factors for the second and third components, while the first component remained most strongly correlated to the general level of financial assets.

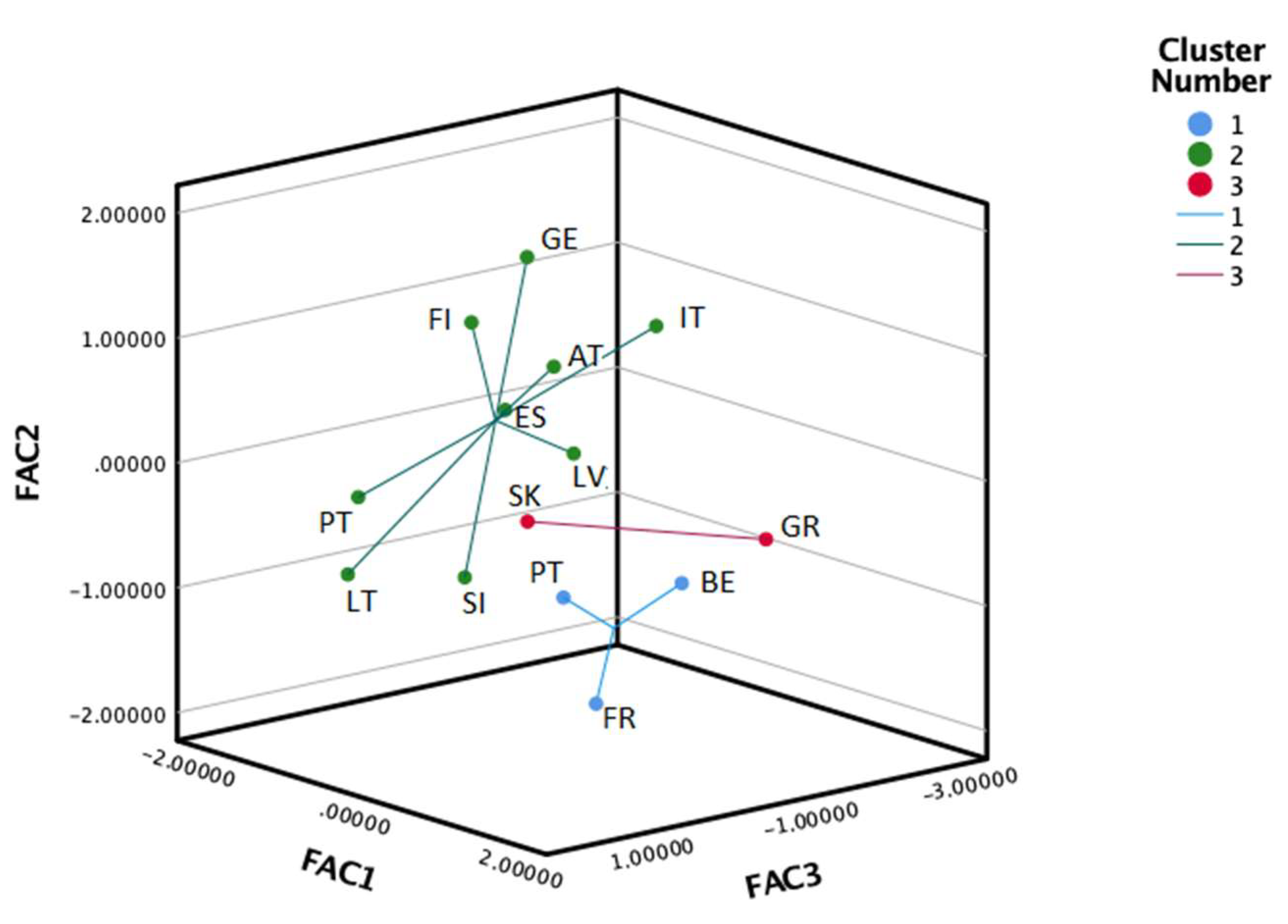

In 2010 (see

Figure 4), the “truncated” sample was clearly separable for a three-cluster grouping. In the first cluster, Belgium, Greece, Spain and Portugal had higher scores for the first component (generally higher-than-average financial assets), and lower-than average values for the second and third components (less transferable deposits and short debt securities and more currency). The second group of countries (consisting of Germany, Italy, Latvia, Austria, Finland) had somewhat lower than zero factor scores for the first and second principal components, but higher loadings for the third (representing somewhat higher currency and transferable deposits and lower short-debt securities holdings). The third group of countries (including Estonia, France, Lithuania, Slovenia, Slovakia) had an outstanding score for the second component (higher short-term debt securities and lower currency holdings), while having the lowest for the first and the third components. Belgium had the highest scores for the first component (corresponding to a general level of financial assets), France for the second (highest weight of short-term debt securities and lowest of currency), and Germany for the third component (a dominant transferable deposit holding within the overall portfolio of the total economy).

In 2016 (see

Figure 5), which can be regarded the first year in which the zero lower bound was in effect, most of the countries were massed in the second cluster with lowest scores for the first component and highest for the second and the third, meaning that the share of currency had a lower and transferable deposits and investment fund share, holding a higher weight in the majority of the countries, especially in countries with lower-than-average financial assets-to-GDP, in most of the financial asset categories considered. Belgium, France and Portugal formed the first cluster with most extreme data, an overall high level of financial assets-to-GDP (this time France leading the list) and lowest transferable deposit and currency holdings. The third group only covered Slovakia and Greece, countries with negative scores for all the components, low levels of financial assets, in general, high levels of transferable deposits, in particular, and high currency holdings.

In 2019 (see

Figure 6), it was still the second cluster with the greatest number of members having a low but positive score for the first component (overall level of financial assets) and a negative score for the second component (meaning this time higher-than-average currency holdings), and close to zero score for the third component (which was strongly correlated with transferable deposits and investment fund shares). The first group, with France and Portugal, having the highest level in financial assets, in general, seemed to have suffered little from low interest rates, as currency holdings remained at levels much below average and short-term debt securities above average, while the level of transferable deposits (and investment fund shares) was still below average. The third group (encompassing Estonia, Spain, Latvia, Lithuania, Finland) consisted of countries with much lower-than-average financial assets than the two other clusters, relatively low currency holdings but higher-than average savings in transferable deposits and investment fund shares.

While in 2010 more than half of the countries had a relatively high weigh of currency in their portfolio, and their number was reducing until 2016, the opposite process evolved between 2016 and 2019, with more and more countries becoming members of the “high-currency-holding” group. Among the non-interest paying instruments, transferable deposits did not become evidently more favorable among the “core” countries and short-term deposits disappeared as a cluster forming variable after 2014, to be replaced by investment fund shares after 2017. Between 2010 and 2015 Belgium was the leading country, as concerns the first component, but France was gradually taking over and won the leading role in 2016, while Belgium had fallen back to the second cluster by 2019. Greece was constantly having a relatively high weight in currency holdings, whereas Italy was observing a great expansion after 2012. Country characteristics remained, however, strong. Germany and Finland had a high rank in transferable deposit holdings and France stood out in short-term debt securities over the whole period considered.

The research covered the relationship between the position of budgets and the clustering of financial instruments.

If we cluster countries according to HICP, public debt-to-GDP, budgetary deficit, convergence interest rates and current account deficit we have different outliers than using financial portfolio statistics. The outliers in 2010 were Ireland, Portugal, Greece, Latvia (this latter was because of extreme inflation data), in 2013 Greece and Slovenia, in 2016 Greece and Cyprus and in 2019 Greece and Italy. In 2010, the rest of the countries remained relatively homogeneous. In 2013, Germany, Luxembourg and the Netherlands came away from the rest, and in 2016 the same countries detached from the others plus most of the countries joining after 2000 lived separate lives as well. Finally, in 2019, Ireland, Portugal and Cyprus started forming a new group after filtering out individual outliers, the rest remained rather homogeneous.

Novák and Tatay (

2021b) carried out a cluster analysis using a mixture of financial asset and macroeconomic variables, and using budgetary deficit among the variables defining the various clusters. They concluded that, due to the low interest rates, variables capturing portfolio rearrangements supported the countries’ convergence (at least as concerns older and newer eurozone members), though the adjustment happened partly by the accumulation of more liquid assets and partly by favoring equity investment and insurance technical reserves among the countries examined.

Following on

Novák and Tatay (

2021b), it is easy to observe that clustering countries by budget deficit/public debt and debt securities results in a very similar grouping of countries, which is especially apparent if we use household holdings of debt securities. Calculating correlations, however, resulted in diminishing correlations, between 2010 and 2019, between government debt-to GDP and debt securities holdings of the economies.

The authors have examined the government deficits throughout all clusters and time periods.

Table 1 shows the averages and standard deviations of government deficits for each year and each cluster, according to the reduced class of the countries (14 countries in the examination).

Since the cluster sample sizes were small, between 2 and 9, the condition of normal distribution could not be guaranteed. Therefore, we applied the Kruskal-Wallis nonparametric statistical test in order to examine if there was a significant difference in means between the clusters regarding government deficits. The significance level was 0.05. Significance values were adjusted by the Bonferroni correction for multiple tests. If the Kruskal-Wallis test showed significant difference between the clusters in a specified year, we indicated the results of the pairwise comparisons of the clusters for that year (2012, 2013, and 2014). Based on the results, we could say that there was significant difference in means between the clusters only in years 2012, 2013 and 2014, the period of the petering out of the sovereign debt crisis. In all of these years the second cluster (Germany, Estonia, Italy, Latvia, Austria, Finland, and Lithuania in 2014) showed significantly smaller government deficit than the other two clusters. The cluster with the lowest deficit values corresponded to the more balanced cluster based on the principal components at the same time.

The results confirmed that euro area financial markets were fragmented. There were significant differences in the stock of financial assets across countries before the ECB cut the base rate to the zero level. Clustering components were total cash holdings and transferable deposits. In the low interest rate environment, money holdings were becoming more significant, but their share of GDP differed across countries. Within each cluster, core countries and periphery countries were also found in different groups. The movement over time between the core and periphery country groups was not entirely unidirectional. However, an assessment of the time course showed that the launch of QE led to different movements between clusters than the monetary policy that had previously operated only by lowering interest rates. This result was also similar to empirical data analyses in previous literature. On the other hand, in the cluster analysis of this paper supplementing previous research findings, the fragmentation of euro area financial markets was assessed by the evolution of financial aggregates based on Keynes’ liquidity preference theory.

5. Materials and Methods

The paper uses k-centers cluster analysis based on Euclidean distance for detecting changes in the portfolio holdings of eurozone economic actors owing to economic crises and monetary policy responses.

The rationale behind the use of cluster analysis is to detect any change in the evolution of clusters in the eurozone within the member states as a result of the changing monetary policy. Similar cluster analysis was carried out by

Danko and Suchỳ (

2021) on the capital market integration of European economies, but this study did not discuss the importance of monetary policy decisions. Cluster analysis can capture well the change of country groupings based on portfolio decisions of economic actors, but cannot explain the responses of individual countries to the various monetary policy steps taken. Therefore, the selected methodology has its shortcomings in explaining the effect of monetary policy, in that it is not able to present impulse responses to internal monetary policy decisions or external shocks. Thus, the cluster analysis applied within this paper allows only for the changing participation of countries in the various clusters defined by the most important portfolio assets with which the principal components most strongly correlate.

In this study, the annual GDP-proportionate total economic financial assets data were retrieved from the Eurostat database for the period 2010 and 2019 for analysis. As a starter, data on investment into total assets, loans, currency, debt securities, transferable deposits, other deposits, equity, investment funds and insurance, pension and guarantee funds were examined with the help of principal component analysis. The principal components were standardized and subject to Kaiser-Meyer-Olkin measure to check the suitability of the data series to the factor analysis. Three components were identified to condense the information in the dataset, applying the varimax rotation. The first principal component resulting this way had a strong connection to most of the financial assets, apart from currency, deposits and insurance technical reserves. The second principal component condensed information, mostly from deposits and/or debt securities, and the third had high correlation with currency, often having a negative relationship with the third component. The content of the components, however, changed from one year to the other and depended on the sample data coverage.

First, all the 19 countries were subject to cluster analysis over the period considered by keeping Luxembourg as the biggest outlier within the group of countries examined. This method helped to understand the evolution of clusters over time. When keeping all the countries in the sample, including Luxembourg, as forming a separate group over the entire time period, the Kaiser-Meyer-Olkin measure showed very low values for the principal components identified this way. Then, dividing the selected countries into two clusters, while casting off Luxembourg, helped detect each major move of the individual countries from one cluster to another within a two-cluster framework. Finally, all the major outliers, including Cyprus, Malta, Luxembourg, Ireland and the Netherlands, were excluded from the sample and an annual three-cluster examination was carried out. The Kaiser-Meyer-Olkin measure took values above 0.5, or, in some years, even above 0.6 for the truncated samples. For a better illustration of the changing composition of clusters timelines, Sankey representations and three-dimensional diagrams (where each axis indicated the particular principal component value) were applied. All the calculations and illustrations were conducted with the help of IBM SPSS 28.

6. Conclusions

We assumed the fragmentation of financial markets in euro area economies. Based on Keynes’ liquidity preference theory, we assumed that the liquidity trap phenomenon would lead to a change in the structure of financial asset holdings of the countries concerned, due to the ECB’s policy of interest rate cuts. Due to the fragmented nature of their financial markets, we assumed that the structure of the change would be different in each country. We wanted to show the fragmentation precisely by showing the changes in portfolio structures from different aspects.

For our analysis we used cluster analysis as a method, by using asset data series from the Eurostat database. When the clusters were formed, five of the euro area countries showed strikingly different pictures. These were Ireland, Cyprus, Luxembourg, Malta and the Netherlands. These outliers were likely to behave in a very distinguishable nature, due to their specific balances of payments resulting from their specific tax rules. Excluding these outliers, the data for the other countries were further analyzed.

The remaining 14 countries could be split into three distinct clusters throughout the period 2010–2019. Total financial assets, transferable deposits, short-term debt and currency were the main components used to form the clusters. The clustering was, therefore, carried out along three dimensions capturing these characteristics with the help of principal components. Our hypothesis proved to be valid with respect to the fragmentation of the euro area financial markets. At the same time, in line with the liquidity preference theory, agents in the economies changed their portfolio and, in general, moved to more currency and less debt securities holdings. Overall, however, there was evidence for money demand becoming higher after 2015, as transferable deposits remained and even grew in importance as portfolio components for countries such as Germany, Finland, Austria and Italy, while, among the rest of the countries, especially in Spain, a positive move was mostly perceptible as well.

It is important to emphasize, however, that the changing portfolio structure of the eurozone economies in the period considered, full of financially turbulent subperiods, such as the aftermath of the global financial crisis, the sovereign debt crisis and some financial anomalies already present preceding the 2020 COVID 19 crisis, cannot only be explained by concrete monetary policy decisions and the declining yield curve. Apart from some traditional investment preferences, that economic actors of the selected countries could be characterized by, especially the household sectors, it is important to note that the financial sector’s investment decisions were largely influenced by international liquidity and risk conditions, especially those deriving from US market tensions (see, among others,

Sifat et al. 2022). Moreover, it has also been justified in the empirical literature that the asset structure of the financial sector and, therewith, the sources of systemic risk were strongly related to the general financing structure of the economy, whether it was more capital market-based or bank-based (

Qin and Zhou 2019). On the other hand, uncertainty around monetary policy decisions, especially discernible under the zero lower bound, had a notable impact on the yield curve and the effectiveness of monetary policy easing or tightening (

Tillmann 2020), especially if one considers that policy uncertainty from the US could have a greater effect on European economies than that perceived in Europe itself (

Colombo 2013). Therefore, our results should also be placed in an international context, in a period with strongly deviating monetary policies.

At the same time, in line with the liquidity preference theory, agents in the economies changed their portfolio and, in general, moved to more currency and less debt securities holdings, Greece being the most apparent example of behaving the opposite way and, thus, converging to average levels. Overall, there was evidence for money demand becoming higher after 2015, as transferable deposits remained and even grew in importance as portfolio components for countries such as Germany, Finland, Austria and Italy, while, among the rest of the countries, especially in Spain, a positive move was mostly perceptible as well. In some countries, the adjustment of investors’ preferences resulted in a move to more equity securities and investment fund shares instead of simply accumulating more liquid (non-interest paying) instruments, as

Novák and Tatay (

2021b) conjectured. These portfolio restructuring decisions happened despite the dissimilar monetary policy steps taken by the Fed and the ECB, as the Fed gave up the zero lower bound as soon as the end of 2015. At the same time, it was also generally observable that, while the sovereign debt crisis occurred, during which the ECB only marginally resorted to asset purchases and more to long-term refinancing operations, and did not cut the policy rate to zero, fiscal policy was a much more important aspect for portfolio decisions (as justified by the evolution of the various clusters and the investment into debt securities) than after 2015. After 2015 QE became a more characteristic tool of the ECB and the base rate was cut effectively to zero and we found no statistical evidence for the relationship between investment decisions and fiscal policy variables. Despite some convergence and generally observable tendencies, like in the “central cluster” with Germany in the nucleus, as

Danko and Suchỳ (

2021) also pointed out, the common monetary policy was conducted in an economic environment with a rather diverse portfolio structure during the low interest rate environment and the inhomogeneity of member states, suggested by the literature, gained further justification.

The analysis showed that the ECB’s monetary policy does not have a uniform impact on euro area financial markets, having different effects in the economies concerned. Moreover, the use of different monetary policy instruments also modifies these differences.

A further line of research could be to examine the financial asset holdings of each sector of economic agents individually, with a focus on the portfolio decisions of households.