Pricing and Reimbursement Pathways of New Orphan Drugs in South Korea: A Longitudinal Comparison

Abstract

1. Introduction

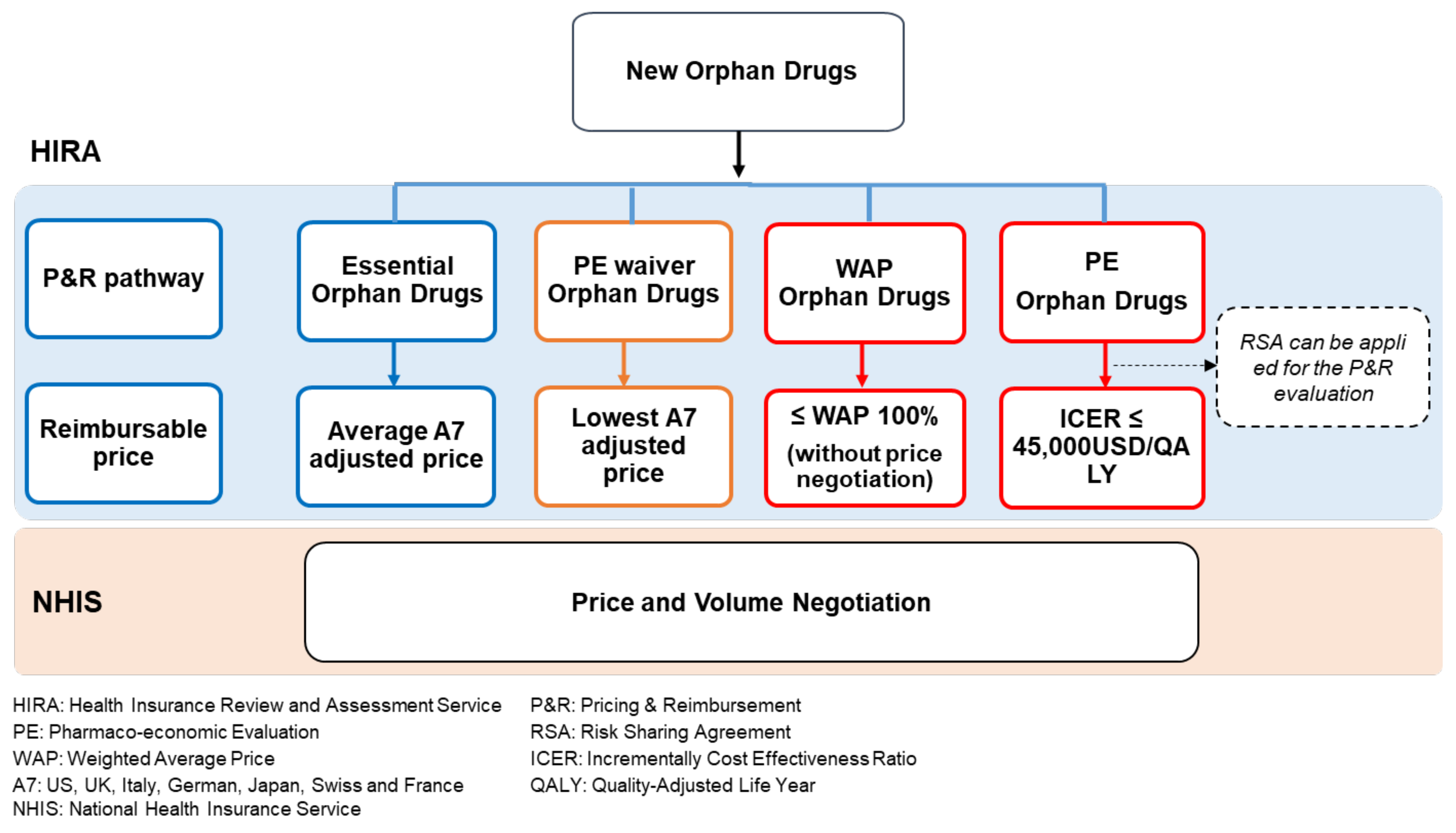

1.1. P&R Pathways for New Orphan Drugs in South Korea

1.2. Price-Cutting System for New Orphan Drugs in South Korea

1.2.1. Price–Volume Agreements (PVA)

1.2.2. Price Cutting in the Case of Generic Drug Listings

1.2.3. Price Cutting with Expanded Indication and Reimbursement Scope

1.2.4. Others

2. Methods

2.1. Analysis of Listing Price of New OD

2.2. Analysis of Post-Listing Price of New ODs

3. Results

3.1. Analysis of Listing Price of New ODs

3.1.1. Essential OD

3.1.2. Pharmacoeconomic Evaluation (PE) Waiver OD

3.1.3. Pharmacoeconomic Evaluation (PE) OD

3.1.4. Weighted Average Price (WAP) OD

3.2. Analysis of Post-Listing Price of New ODs

4. Discussion

5. Conclusions

Funding

Conflicts of Interest

References

- Hofer, M.P.; Hedman, H.; Mavris, M.; Koenig, F.; Vetter, T.; Posch, M.; Vamvakas, S.; Regnstrom, J.; Aarum, S. Marketing Authorisation of Orphan Medicines in Europe from 2000 to 2013. Drug Discov. Today 2018, 23, 424–433. [Google Scholar] [CrossRef]

- Benjamin, K.; Vernon, M.K.; Patrick, D.L.; Perfetto, E.; Nestler-Parr, S.; Burke, L. Patient-Reported Outcome and Observer-Reported Outcome Assessment in Rare Disease Clinical Trials: An ISPOR COA Emerging Good Practices Task Force Report. Value Health 2017, 20, 838–855. [Google Scholar] [CrossRef] [PubMed]

- Bolislis, W.R.; Corriol-Rohou, S.; Hill-Venning, C.; Hoogland, H.; Joos, A.; King, D.; Kitcatt, V.; Le Visage, G.; Kuhler, T.C. Orphan Medicines for Pediatric use: A Focus on the European Union. Clin. Ther. 2019, 41, 2630–2642. [Google Scholar] [CrossRef]

- Kimmel, L.; Conti, R.M.; Volerman, A.; Chua, K.P. Pediatric Orphan Drug Indications: 2010-2018. Pediatrics 2020, 145. [Google Scholar] [CrossRef]

- Fonseca, D.A.; Amaral, I.; Pinto, A.C.; Cotrim, M.D. Orphan Drugs: Major Development Challenges at the Clinical Stage. Drug Discov. Today 2019, 24, 867–872. [Google Scholar] [CrossRef] [PubMed]

- Mulberg, A.E.; Bucci-Rechtweg, C.; Giuliano, J.; Jacoby, D.; Johnson, F.K.; Liu, Q.; Marsden, D.; McGoohan, S.; Nelson, R.; Patel, N.; et al. Regulatory Strategies for Rare Diseases under Current Global Regulatory Statutes: A Discussion with Stakeholders. Orphanet J. Rare Dis. 2019, 14, 36. [Google Scholar] [CrossRef] [PubMed]

- Hughes, D.A.; Poletti-Hughes, J. Profitability and Market Value of Orphan Drug Companies: A Retrospective, Propensity-Matched Case-Control Study. PLoS ONE 2016, 11, e0164681. [Google Scholar] [CrossRef] [PubMed]

- Meekings, K.N.; Williams, C.S.; Arrowsmith, J.E. Orphan Drug Development: An Economically Viable Strategy for Biopharma R&D. Drug Discov. Today 2012, 17, 660–664. [Google Scholar] [PubMed]

- Malinowski, K.P.; Kawalec, P.; Trabka, W.; Czech, M.; Petrova, G.; Manova, M.; Savova, A.; Draganic, P.; Vostalova, L.; Slaby, J.; et al. Reimbursement Legislations and Decision Making for Orphan Drugs in Central and Eastern European Countries. Front. Pharmacol. 2019, 10, 487. [Google Scholar] [CrossRef] [PubMed]

- Zamora, B.; Maignen, F.; O’Neill, P.; Mestre-Ferrandiz, J.; Garau, M. Comparing Access to Orphan Medicinal Products in Europe. Orphanet J. Rare Dis. 2019, 14, 95. [Google Scholar] [CrossRef]

- Simoens, S. Pricing and Reimbursement of Orphan Drugs: The Need for More Transparency. Orphanet J. Rare Dis. 2011, 6, 42–1172. [Google Scholar] [CrossRef]

- Lee, S.H.; Yoo, S.L.; Bang, J.S.; Lee, J.H. Patient Accessibility and Budget Impact of Orphan Drugs in South Korea: Long-Term and Real-World Data Analysis (2007–2019). Int. J. Environ. Res. Public. Health 2020, 17. [Google Scholar] [CrossRef]

- Schey, C.; Milanova, T.; Hutchings, A. Estimating the Budget Impact of Orphan Medicines in Europe: 2010–2020. Orphanet J. Rare Dis. 2011, 6, 62. [Google Scholar] [CrossRef] [PubMed]

- Sun, W.; Zheng, W.; Simeonov, A. Drug Discovery and Development for Rare Genetic Disorders. Am. J. Med. Genet. A 2017, 173, 2307–2322. [Google Scholar] [CrossRef]

- Michel, M.; Toumi, M. Access to Orphan Drugs in Europe: Current and Future Issues. Expert Rev. Pharmacoecon Outcomes Res. 2012, 12, 23–29. [Google Scholar] [CrossRef] [PubMed]

- Picavet, E.; Morel, T.; Cassiman, D.; Simoens, S. Shining a Light in the Black Box of Orphan Drug Pricing. Orphanet J. Rare Dis. 2014, 9, 62. [Google Scholar] [CrossRef] [PubMed][Green Version]

- Young, K.E.; Soussi, I.; Hemels, M.; Toumi, M. A Comparative Study of Orphan Drug Prices in Europe. J. Mark. Access Health Policy 2017, 5, 1297886. [Google Scholar] [CrossRef]

- Yoo, S.L.; Kim, D.J.; Lee, S.M.; Kang, W.G.; Kim, S.Y.; Lee, J.H.; Suh, D.C. Improving Patient Access to New Drugs in South Korea: Evaluation of the National Drug Formulary System. Int. J. Environ. Res. Public. Health 2019, 16, 288. [Google Scholar] [CrossRef]

- Kim, S.; Cho, H.; Kim, J.; Lee, K.; Lee, J.H. The Current State of Patient Access to New Drugs in South Korea under the Positive List System: Evaluation of the Changes since the New Review Pathways. Expert Rev. Pharmacoecon. Outcomes Res. 2021, 21, 119–126. [Google Scholar] [CrossRef]

- Danzon, P.M.; Wang, Y.R.; Wang, L. The Impact of Price Regulation on the Launch Delay of New Drugs—Evidence from Twenty-Five Major Markets in the 1990s. Health Econ. 2005, 14, 269–292. [Google Scholar] [CrossRef]

- Kanavos, P.; Fontrier, A.M.; Gill, J.; Efthymiadou, O. Does External Reference Pricing Deliver what it Promises? Evidence on its Impact at National Level. Eur. J. Health Econ. 2020, 21, 129–151. [Google Scholar] [CrossRef]

- Remuzat, C.; Urbinati, D.; Mzoughi, O.; El Hammi, E.; Belgaied, W.; Toumi, M. Overview of External Reference Pricing Systems in Europe. J. Mark. Access Health Policy 2015, 3. [Google Scholar] [CrossRef]

- Young, K.E.; Soussi, I.; Toumi, M. The Perverse Impact of External Reference Pricing (ERP): A Comparison of Orphan Drugs Affordability in 12 European Countries. A Call for Policy Change. J. Mark. Access Health Policy 2017, 5, 1369817. [Google Scholar] [CrossRef]

- Kim, S.; Lee, J.H. Price-Cutting Trends in New Drugs After Listing in South Korea: The Effect of the Reimbursement Review Pathway on Price Reduction. Healthcare 2020, 8, 233. [Google Scholar] [CrossRef] [PubMed]

- Ministry of Health and Welfare. Criteria for Decision or Adjustment on Drugs. 2020. Available online: https://www.law.go.kr/admRulSc.do?menuId=5&subMenuId=41&tabMenuId=183#liBgcolor11 (accessed on 10 February 2021).

- Health Insurance Review and Assessment Service. Publication of Results Evaluated by the Drug Reimbursement Evaluation Committee. 2021. Available online: https://www.hira.or.kr/bbsDummy.do?pgmid=HIRAA030014040000 (accessed on 10 February 2021).

- Health Insurance Review and Assessment Service. Information of Reimbursement History. 2021. Available online: https://www.hira.or.kr/rf/medicine/getHistoryList.do?pgmid=HIRAA030035020000 (accessed on 10 February 2021).

- Kim, S.; Kim, J.; Cho, H.; Lee, K.; Ryu, C.; Lee, J.H. Trends in the Pricing and Reimbursement of New Anticancer Drugs in South Korea: An Analysis of Listed Anticancer Drugs during the Past Three Years. Expert Rev. Pharmacoecon. Outcomes Res. 2020, 17, 1–10. [Google Scholar]

- Gammie, T.; Lu, C.Y.; Babar, Z.U. Access to Orphan Drugs: A Comprehensive Review of Legislations, Regulations and Policies in 35 Countries. PLoS ONE 2015, 10, e0140002. [Google Scholar] [CrossRef] [PubMed]

- Verghese, N.R.; Barrenetxea, J.; Bhargava, Y.; Agrawal, S.; Finkelstein, E.A. Government Pharmaceutical Pricing Strategies in the Asia-Pacific Region: An Overview. J. Mark. Access Health Policy 2019, 7, 1601060. [Google Scholar] [CrossRef]

- Han, E.; Park, S.Y.; Lee, E.K. Assessment of the Price-Volume Agreement Program in South Korea. Health Policy 2016, 120, 1209–1215. [Google Scholar] [CrossRef] [PubMed]

- Piatkiewicz, T.J.; Traulsen, J.M.; Holm-Larsen, T. Risk-Sharing Agreements in the EU: A Systematic Review of Major Trends. Pharmacoecon. Open 2018, 2, 109–123. [Google Scholar] [CrossRef]

- Bae, E.Y.; Hong, J.M.; Kwon, H.Y.; Jang, S.; Lee, H.J.; Bae, S.; Yang, B.M. Eight-Year Experience of using HTA in Drug Reimbursement: South Korea. Health Policy 2016, 120, 612–620. [Google Scholar] [CrossRef] [PubMed]

- Park, S.E.; Lim, S.H.; Choi, H.W.; Lee, S.M.; Kim, D.W.; Yim, E.Y.; Kim, K.H.; Yi, S.Y. Evaluation on the First 2 Years of the Positive List System in South Korea. Health Policy 2012, 104, 32–39. [Google Scholar] [CrossRef] [PubMed]

- Medic, G.; Korchagina, D.; Young, K.E.; Toumi, M.; Postma, M.J.; Wille, M.; Hemels, M. Do Payers Value Rarity? an Analysis of the Relationship between Disease Rarity and Orphan Drug Prices in Europe. J. Mark. Access Health Policy 2017, 5, 1299665. [Google Scholar] [CrossRef] [PubMed]

- Mattingly, T.J., 2nd; Levy, J.F.; Slejko, J.F.; Onwudiwe, N.C.; Perfetto, E.M. Estimating Drug Costs: How do Manufacturer Net Prices Compare with Other Common US Price References? Pharmacoeconomics 2018, 36, 1093–1099. [Google Scholar] [CrossRef] [PubMed]

| Categorization | Total | Essential Orphan Drug | PE Waiver Orphan Drug | PE Orphan Drug | WAP Orphan Drug |

|---|---|---|---|---|---|

| No. of orphan drug | 48 | 10 | 11 | 11 | 16 |

| No. of RSA orphan drug | 13 | 2 | 7 | 4 | 0 |

| KR vs. AAP ratio (%) | |||||

| Mean (SD) | 69.4 (±29.7) | 93.8 (±52.5) | 65.1 (±10.0) | 65.8 (±13.5) | 59.0 (±21.0) |

| Median (minimum, maximum) | 65.4 (35.3, 232.4) | 80.8 (39.7, 232.4) | 65.4 (46.9, 86.2) | 66.1 (40.4, 86.7) | 48.6 (35.3, 93.2) |

| No | Brand Name | Indication | Listing Date (Month/Date/Year) | RSA Type | List Price (KRW) | Strength | KR vs. AAP Ratio (%) |

|---|---|---|---|---|---|---|---|

| (Generic Name) | List Price (USD) | ||||||

| 1 | Cystadane | Homocystinuria | 12/01/2007 | NA | 313,019 | 180 g | 232.4 |

| (betaine anhydrous) | 284.6 | ||||||

| 2 | Sprycel | Chronic myeloid leukemia | 06/01/2008 | NA | 55,000 | 70 mg | 89.3 |

| (dasatinib) | 50.0 | ||||||

| 3 | Naglazyme | Mucopolysaccharidosis VI | 01/01/2009 | Refund | 1,614,000 | 5 mg | 79.2 |

| (galsulfase) | 1467.3 | ||||||

| 4 | Elaprase | Mucopolysaccharidosis II | 01/01/2009 | NA | 2,790,000 | 6 mg | 98.8 |

| (idursulfase) | 2536.4 | ||||||

| 5 | Myozyme | Pompe disease (GAA deficiency) | 05/01/2009 | NA | 705,000 | 50 mg | 82.5 |

| (alglucosidase alfa) | 640.9 | ||||||

| 6 | Zavesca | Type 1 Gaucher disease | 12/01/2009 | NA | 98,766 | 100 mg | 65.2 |

| (miglustat) | 89.8 | ||||||

| 7 | Inovelon | Lennox–Gastaut syndrome | 05/01/2010 | NA | 1280 | 400 mg | 39.7 |

| (rufinamide) | 1.2 | ||||||

| 8 | Remodulin | Pulmonary arterial hypertension | 12/01/2010 | NA | 5,720,000 | 2.5 mg/mL | 62.5 |

| (treprostinil sodium) | 5200.0 | ||||||

| 9 | Soliris | Paroxysmal nocturnal hemoglobinuria | 10/01/2012 | Refund | 7,360,629 | 300 mg | 110.0 |

| (eculizumab) | 6691.5 | ||||||

| 10 | Carbaglu | NAGS (N-acetylglutamate synthase) deficiency | 01/01/2015 | NA | 98,000 | 200 mg | 78.1 |

| (carglumic acid) | 89.1 |

| No. | Brand Name | Indication | Listing Date (Month/Date/Year) | RSA Type | List Price (KRW) | Strength | KR vs. AAP Ratio (%) |

|---|---|---|---|---|---|---|---|

| (Generic Name) | List Price (USD) | ||||||

| 1 | Caprelsa | Medullary thyroid cancer | 11/01/2015 | Expenditure cap | 139,800 | 300 mg | 55.1 |

| (vandetanib) | 127.1 | ||||||

| 2 | Adcetris | Hodgkin lymphoma | 02/01/2016 | NA | 3,262,400 | 50 mg | 69.7 |

| (brentuximab vedotin) | 2965.8 | ||||||

| 3 | Vimizim | Morquio A syndrome | 06/01/2016 | Expenditure cap | 1,019,100 | 5 mg | 86.2 |

| (elosulfase alfa) | 926.5 | ||||||

| 4 | Imbruvica | Chronic lymphocytic leukemia | 06/01/2016 | NA | 65,257 | 140 mg | 69.3 |

| (ibrutinib) | 59.3 | ||||||

| 5 | Zykadia | Non-small-cell lung cancer | 08/01/2016 | NA | 40,805 | 150 mg | 60.8 |

| (ceritinib) | 37.1 | ||||||

| 6 | Blincyto | Acute lymphoblastic leukemia | 10/01/2016 | NA | 2,480,000 | 35 ug | 71.0 |

| (blinatumomab) | 2254.5 | ||||||

| 7 | Diterin | Hyperphenylalaninemia | 01/01/2017 | Expenditure cap | 20,421 | 100 mg | 65.4 |

| (sapropterin dihydrochloride) | 18.6 | ||||||

| 8 | Defitelio | Veno-occlusive disease | 06/01/2017 | Expenditure cap | 380,300 | 200 mg | 46.9 |

| (defibrotide) | 345.7 | ||||||

| 9 | Zelboraf | Melanoma | 07/01/2017 | Expenditure cap | 27,200 | 240 mg | 62.7 |

| (vemurafenib) | 24.7 | ||||||

| 10 | Lynparza | Advanced ovarian cancer | 10/01/2017 | Expenditure cap | 10,510 | 50 mg | 61.0 |

| (olaparib) | 9.6 | ||||||

| 11 | Meqsel | Non-small-cell lung cancer | 11/01/2017 | Expenditure cap | 166,681 | 2 mg | 68.6 |

| (trametinib) | 151.5 |

| No. | Brand Name | Indication | Listing Date (Month/Date/Year) | RSA Type | List Price (KRW) | Strength | KR vs. AAP Ratio (%) |

|---|---|---|---|---|---|---|---|

| (Generic Name) | List Price (USD) | ||||||

| 1 | Torisel | Renal cell carcinoma | 01/06/2011 | NA | 793,000 | 30 mg | 60.9 |

| (temsirolimus) | 720.9 | ||||||

| 2 | Trisenox | Acute promyelocytic leukemia | 01/06/2011 | NA | 373,000 | 10 mg/mL | 64.3 |

| (arsenic trioxide) | 339.1 | ||||||

| 3 | Xtandi | Castration-resistant prostate cancer | 01/11/2014 | Refund | 29,000 | 40 mg | 66.1 |

| (enzalutamide) | 26.4 | ||||||

| 4 | Jakavi | Myelofibrosis | 01/03/2015 | NA | 56,100 | 20 mg | 57.0 |

| (ruxolitinib) | 51.0 | ||||||

| 5 | Xalkori | Non-small-cell lung cancer | 01/05/2015 | Refund | 124,000 | 250 mg | 86.7 |

| (crizotinib). | 112.7 | ||||||

| 6 | Sirturo | Multidrug-resistant tuberculosis | 01/05/2015 | NA | 158,000 | 100 mg | 82.1 |

| (bedaquiline fumarate) | 143.6 | ||||||

| 7 | Tysabri | Multiple sclerosis | 01/10/2015 | NA | 1,370,000 | 300 mg | 51.4 |

| (natalizumab) | 1245.5 | ||||||

| 8 | Pirespa | Idiopathic pulmonary fibrosis | 30/10/2015 | Refund | 5750 | 200 mg | 40.4 |

| (pirfenidone) | 5.2 | ||||||

| 9 | Lemtrada | Multiple sclerosis | 01/11/2015 | NA | 10,371,700 | 12 mg | 78.5 |

| (alemtuzumab) | 9428.8 | ||||||

| 10 | Gazyva | Chronic lymphocytic leukemia | 01/04/2017 | NA | 4,177,600 | 1000 mg | 69.5 |

| (obinutuzumab) | 3797.8 | ||||||

| 11 | Pomalyst | Multiple myeloma | 09/06/2017 | Refund | 394,300 | 4 mg | 66.8 |

| (pomalidomide) | 358.5 |

| No. | Brand Name | Indication | Listed Date (Month/Date/Year) | RSA Type | List Price (KRW) | Strength | KR vs. AAP Ratio (%) |

|---|---|---|---|---|---|---|---|

| (Generic Name) | List Price (USD) | ||||||

| 1 | Dacogen | Myelodysplastic syndrome | 08/01/2008 | NA | 772,220 | 50 mg | 72.1 |

| (decitabine) | 702.0 | ||||||

| 2 | Volibris | Pulmonary arterial hypertension | 11/01/2011 | NA | 53,500 | 10 mg | 39.3 |

| (ambrisentan) | 48.6 | ||||||

| 3 | Tasigna | Chronic myelogenous leukemia | 12/01/2011 | NA | 23,050 | 200 mg | 41.1 |

| (nilotinib) | 21.0 | ||||||

| 4 | Stribild | Hiv | 02/01/2014 | NA | 27,750 | 150 mg | 44.2 |

| (elvitegravir/cobicistat/emtricitabine/tenofovir) | 25.2 | ||||||

| 5 | Aubagio | Multiple sclerosis | 08/01/2014 | NA | 38,200 | 14 mg | 42.5 |

| (teriflunomide) | 34.7 | ||||||

| 6 | Replagal | Fabry disease | 08/01/2015 | NA | 2,403,718 | 3.5 mg | 93.2 |

| (agalsidase alfa) | 2185.2 | ||||||

| 7 | Vpriv | Type-1 Gaucher disease | 08/01/2015 | NA | 1,888,000 | 400 unit | 86.2 |

| (velaglucerase alfa) | 1716.4 | ||||||

| 8 | Deltyba | Multidrug-resistant tuberculosis | 11/01/2015 | NA | 39,800 | 50 mg | 91.2 |

| (delamanid) | 36.2 | ||||||

| 9 | Revolade | Immune thrombocytopenia | 03/01/2016 | NA | 35,443 | 50 mg | 63.1 |

| (eltrombopag) | 32.2 | ||||||

| 10 | Nplate | Immune thrombocytopenia | 03/01/2016 | NA | 735,000 | 500 ug | 35.3 |

| (romiplostim) | 668.2 | ||||||

| 11 | Tecfidera | Multiple sclerosis | 07/01/2016 | NA | 20,558 | 240 mg | 44.5 |

| (dimethyl fumarate) | 18.7 | ||||||

| 12 | Fytarex | Multiple sclerosis | 06/01/2017 | NA | 40,176 | 0.5 mg | 41.6 |

| (fingolimod) | 36.5 | ||||||

| 13 | Kynteles | Ulcerative colitis, Crohn’s disease | 08/01/2017 | NA | 1,492,000 | 300 mg | 46.2 |

| (vedolizumab) | 1356.4 | ||||||

| 14 | Tafinlar | Melanoma | 09/01/2017 | NA | 41,765 | 75 mg | 61.4 |

| (dabrafenib) | 38.0 | ||||||

| 15 | Alecensa | Non-small-cell lung cancer | 10/01/2017 | NA | 20,453 | 150 mg | 51.0 |

| (alectinib) | 18.6 | ||||||

| 16 | Cerdelga | Gaucher disease type 1 | 11/01/2017 | NA | 469,000 | 84 mg | 90.7 |

| (eliglustat) | 426.4 |

| No. of Years * | No. of New ODs ** | No. of Price Cuts | Ratio (%) | Median Cumulative Price-Cutting Rate (%) (Min-Max) |

|---|---|---|---|---|

| 1 | 48 | 2 | 4.3 | 6.4 (1.9–10.9) |

| 2 | 42 | 12 | 28.6 | 5.0 (1.5–10.9) |

| 3 | 33 | 12 | 36.4 | 7.2 (1.6–40.8) |

| 4 | 21 | 10 | 47.6 | 6.2 (1.1–16.6) |

| 5 | 14 | 8 | 57.1 | 5.7 (0.4–16.6) |

| 6 | 12 | 7 | 58.3 | 5.0 (0.4–18.1) |

| 7 | 11 | 7 | 63.6 | 5.0 (0.5–9.3) |

| 8 | 8 | 4 | 50.0 | 6.5 (5.0–12.7) |

| 9 | 5 | 3 | 60.0 | 5.1 (5.0–12.7) |

| 10 | 3 | 3 | 100.0 | 5.3 (5.0–39.3) |

| Orphan Drugs | |||||

|---|---|---|---|---|---|

| Oncology | Non-Oncology | ||||

| No. of Product | Median Time to First Cut | Median Price Cut Rate | No. of Product | Median Time to First Cut | Median Price Cut Rate |

| Month | % | Month | % | ||

| 11 | 20.0 | 5.0 | 11 | 25.0 | 3.5 |

| (8.2%) | (8.0–83.0) | (0.4–20.0) | (8.2%) | (15.0–48.0) | (0.6–9.1) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, J.H. Pricing and Reimbursement Pathways of New Orphan Drugs in South Korea: A Longitudinal Comparison. Healthcare 2021, 9, 296. https://doi.org/10.3390/healthcare9030296

Lee JH. Pricing and Reimbursement Pathways of New Orphan Drugs in South Korea: A Longitudinal Comparison. Healthcare. 2021; 9(3):296. https://doi.org/10.3390/healthcare9030296

Chicago/Turabian StyleLee, Jong Hyuk. 2021. "Pricing and Reimbursement Pathways of New Orphan Drugs in South Korea: A Longitudinal Comparison" Healthcare 9, no. 3: 296. https://doi.org/10.3390/healthcare9030296

APA StyleLee, J. H. (2021). Pricing and Reimbursement Pathways of New Orphan Drugs in South Korea: A Longitudinal Comparison. Healthcare, 9(3), 296. https://doi.org/10.3390/healthcare9030296