An Empirical Analysis of Income Elasticity of Out-of-Pocket Healthcare Expenditure in Mauritius

Abstract

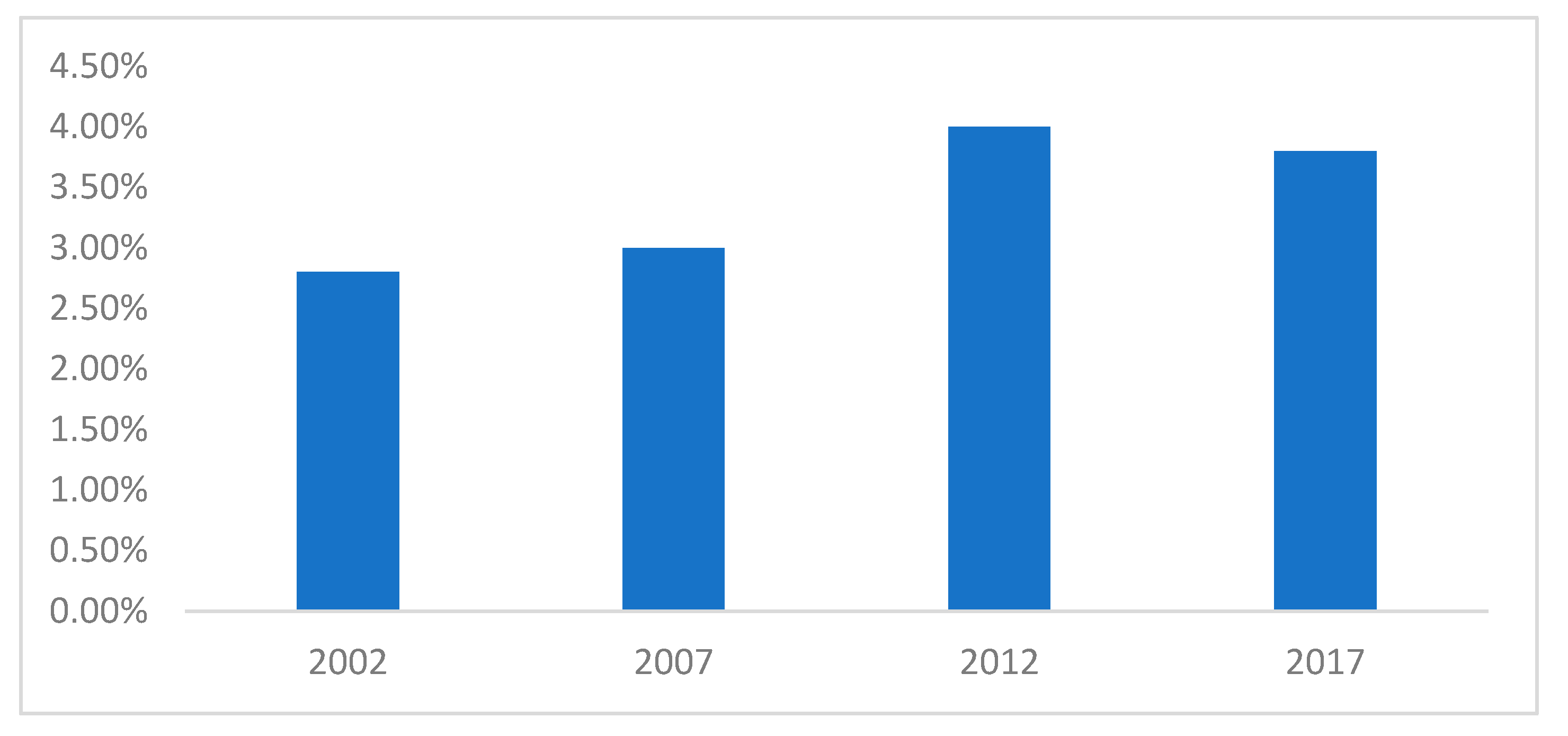

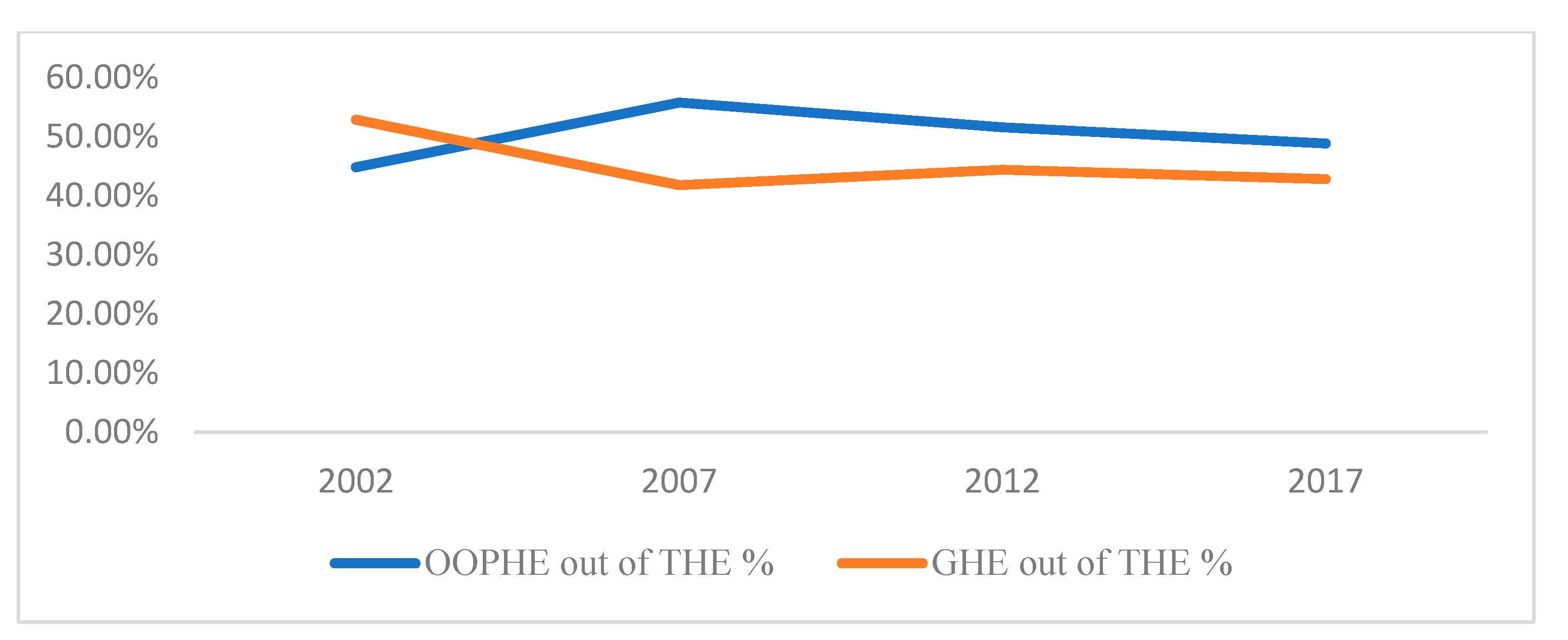

1. Introduction

2. Brief Literature Review

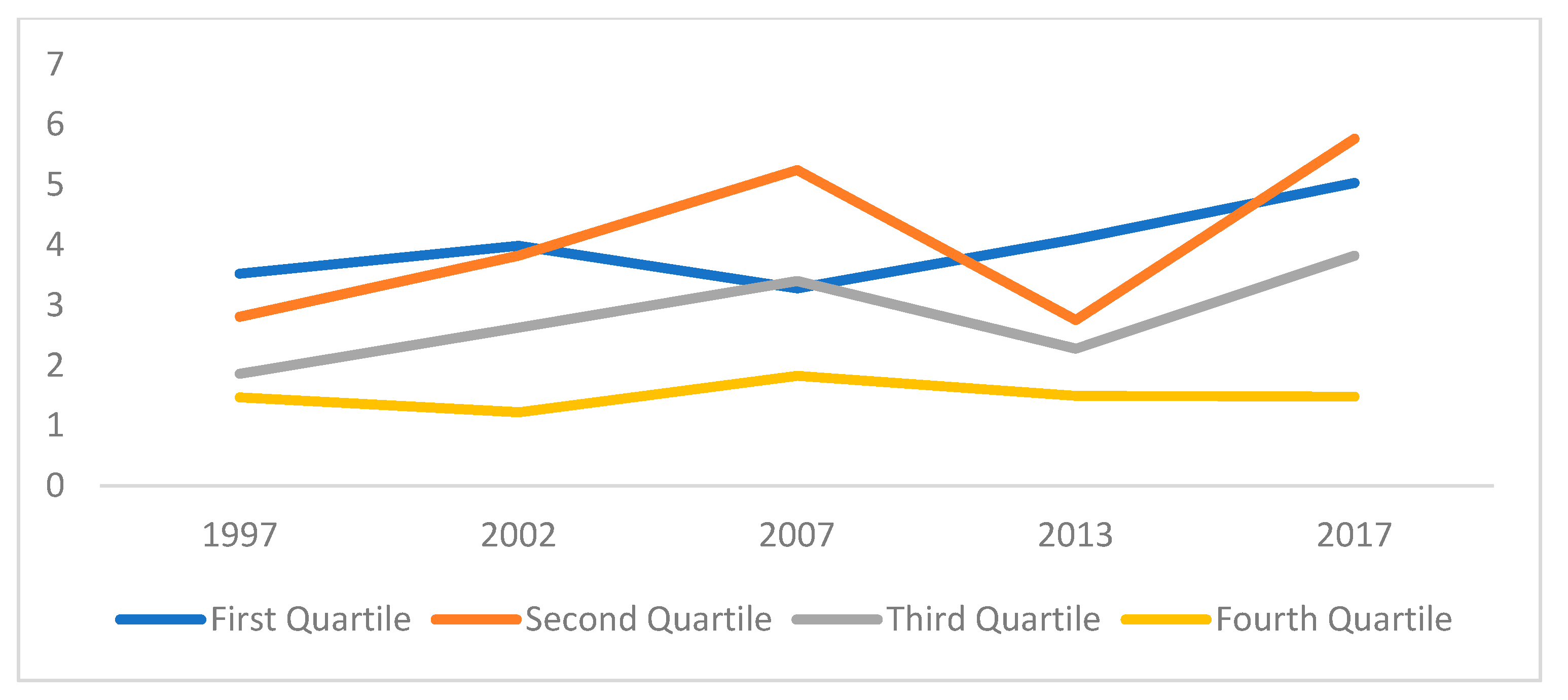

3. Methodology and Data

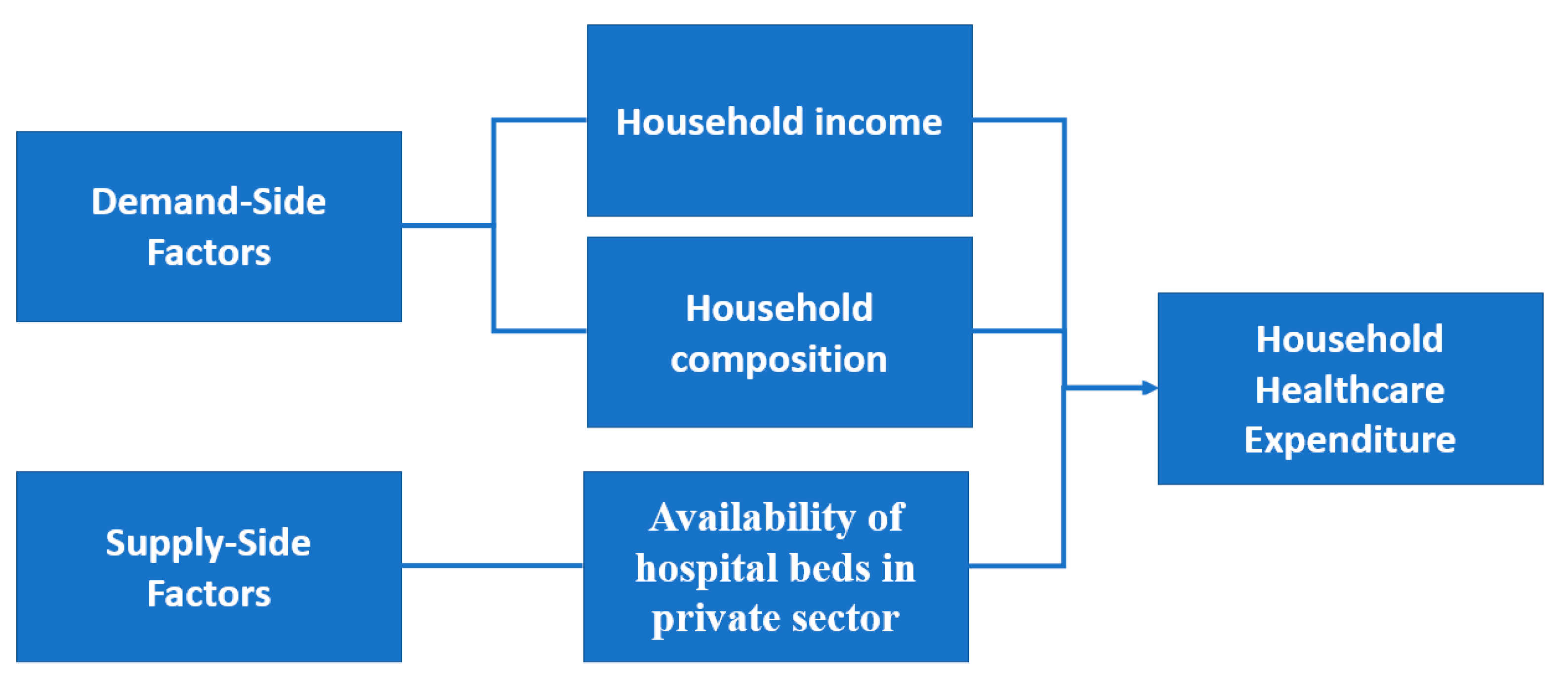

3.1. Theoretical Model

3.2. Data

3.3. Fixed-Effects Model

3.4. Tobit Model

4. Empirical Results

5. Strength and Limitations

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Engel Curve Formulation

Appendix B

General Model Specification

Appendix C

Construction of Pseudo-Panel

| Group | Grouping Criteria | Birth Year | No. of Cohorts | ||

|---|---|---|---|---|---|

| Birth Year | Education | Region | |||

| 1 | 1940–48 | High | Urban | 28 | 5 |

| 2 | 1940–48 | Low | Urban | 97 | 5 |

| 3 | 1940–48 | High | Rural | 67 | 5 |

| 4 | 1940–48 | Low | Rural | 172 | 5 |

| 5 | 1949–57 | High | Urban | 64 | 5 |

| 6 | 1949–57 | Low | Urban | 164 | 5 |

| 7 | 1949–57 | High | Rural | 230 | 5 |

| 8 | 1949–57 | Low | Rural | 299 | 5 |

| 9 | 1958–66 | High | Urban | 113 | 5 |

| 10 | 1958–66 | Low | Urban | 256 | 5 |

| 11 | 1958–66 | High | Rural | 344 | 5 |

| 12 | 1958–66 | Low | Rural | 419 | 5 |

| 13 | 1967–75 | High | Urban | 235 | 5 |

| 14 | 1967–75 | Low | Urban | 394 | 5 |

| 15 | 1967–75 | High | Rural | 488 | 5 |

| 16 | 1967–75 | Low | Rural | 475 | 5 |

| 17 | 1976–84 | High | Urban | 258 | 3 |

| 18 | 1976–84 | Low | Urban | 339 | 3 |

| 19 | 1976–84 | High | Rural | 522 | 3 |

| 20 | 1976–84 | Low | Rural | 308 | 3 |

| 21 | 1985–93 | High | Urban | 178 | 1 |

| 22 | 1985–93 | Low | Urban | 171 | 1 |

| 23 | 1985–93 | High | Rural | 275 | 1 |

| 24 | 1985–93 | Low | Rural | 101 | 1 |

| Total | 96 | ||||

Appendix D

Fixed-Effect Model

Appendix E

Tobit Model

References

- Grossman, M. On the Concept of Health Capital and the Demand for Health. J. Political Econ. 1972, 80, 223–255. [Google Scholar] [CrossRef]

- Honore, P.A.; Amy, B.W. Public Health Finance: Fundamental Theories, Concepts, and Definitions. J. Public Health Manag. Pract. 2007, 13, 89–92. [Google Scholar] [CrossRef]

- Dzolkarnaini, N.; Atkins, K. Diabetes management: The association of wealth, spending and performance in Latin American and Caribbean countries. Int. J. Manag. Account. Res. 2014, 4, 69. [Google Scholar]

- Jeetoo, J.; Jaunky, V.C. Willingness to Pay to Improve Quality of Public Healthcare Services in Mauritius. Healthcare 2022, 10, 43. [Google Scholar] [CrossRef]

- Chai, P.; Wan, Q.; Kinfu, Y. Efficiency and productivity of health systems in prevention and control of non-communicable diseases in China, 2008–2015. Eur. J. Health Econ. 2021, 22, 267–279. [Google Scholar] [CrossRef]

- McIntyre, D.; Thiede, M.; Dahlgren, G.; Whitehead, M. What are the economic consequences for households of illness and of paying for health care in low-and middle-income country contexts? Soc. Sci. Med. 2006, 62, 858–865. [Google Scholar] [CrossRef] [PubMed]

- Kumara, A.S.; Samaratunge, R. Patterns and determinants of out-of-pocket health care expenditure in Sri Lanka: Evidence from household surveys. Health Policy Plan. 2016, 31, 970–983. [Google Scholar] [CrossRef]

- Mahumud, R.A.; Sarker, A.R.; Sultana, M.; Sheikh, N.; Islam, M.N.; Hossain, M.R.; Hossain, M.G. The Determinants Out-of-Pocket Healthcare Expenditure in Bangladesh: Evidence from Household Income and Expenditure Survey-2010. In Issues on Health and Healthcare in India; Springer: Singapore, 2018; pp. 339–350. [Google Scholar]

- Pallegedara, A.; Grimm, M. Have out-of-pocket health care payments risen under free health care policy? The case of S ri L anka. Int. J. Health Plan. Manag. 2018, 33, e781–e797. [Google Scholar] [CrossRef]

- Ministry of Health and Wellness. Health Sector Strategic Plan 2020–2024. 2020. Available online: https://health.govmu.org/Communique/HSSP%20Final%2015%20September%202020.pdf (accessed on 31 December 2021).

- Ministry of Health and Quality of Life. National Health Accounts 2017. 2017. Available online: https://health.govmu.org/Documents/Main%20Page/New/NHA%20Report%202017%2024%20September%202018.PDF (accessed on 31 December 2021).

- Ministry of Health and Wellness. Health Statistics Report 2019. 2020. Available online: https://health.govmu.org/Documents/Statistics/Health/Mauritius/Documents/HEALTH%20STATISTICS%20REPORT%202019.pdf (accessed on 31 December 2021).

- Nundoochan, A. Improving public hospital efficiency and fiscal space implications: The case of Mauritius. Int. J. Equity Health 2020, 19, 152. [Google Scholar] [CrossRef]

- Getzen, T.E. Health care is an individual necessity and a national luxury: Applying multilevel decision models to the analysis of health care expenditures. J. Health Econ. 2000, 19, 259–270. [Google Scholar] [CrossRef]

- Baltagi, B.H.; Lagravinese, R.; Moscone, F.; Tosetti, E. Health care expenditure and income: A global perspective. Health Econ. 2017, 26, 863–874. [Google Scholar] [CrossRef]

- Di Matteo, L. The income elasticity of health care spending. Eur. J. Health Econ. 2003, 4, 20–29. [Google Scholar] [CrossRef]

- Colombi, R.; Martini, G.; Vittadini, G. Determinants of transient and persistent hospital efficiency: The case of Italy. Health Econ. 2017, 26, 5–22. [Google Scholar] [CrossRef]

- Guerrini, A.; Romano, G.; Campedelli, B.; Moggi, S.; Leardini, C. Public vs. private in hospital efficiency: Exploring determinants in a competitive environment. Int. J. Public Adm. 2018, 41, 181–189. [Google Scholar] [CrossRef]

- Samut, P.K.; Cafrı, R. Analysis of the efficiency determinants of health systems in OECD countries by DEA and panel tobit. Soc. Indic. Res. 2016, 129, 113–132. [Google Scholar] [CrossRef]

- Dhaoui, I. Healthcare System Efficiency and Its Determinants: A Two-Stage Data Envelopment Analysis (DEA) from MENA Countries; Economic Research Forum (ERF): Giza, Egypt, 2019. [Google Scholar]

- Moreno-Serra, R.; Anaya-Montes, M.; Smith, P.C. Potential determinants of health system efficiency: Evidence from Latin America and the Caribbean. PLoS ONE 2019, 14, e0216620. [Google Scholar] [CrossRef]

- Neumann, P.J.; Kim, D.D.; Trikalinos, T.A.; Sculpher, M.J.; Salomon, J.A.; Prosser, L.A.; Owens, D.K.; Meltzer, D.O.; Kuntz, K.M.; Krahn, M.; et al. Future directions for cost-effectiveness analyses in health and medicine. Med. Decis. Mak. 2018, 38, 767–777. [Google Scholar] [CrossRef]

- Shields, G.E.; Wells, A.; Doherty, P.; Heagerty, A.; Buck, D.; Davies, L.M. Cost-effectiveness of cardiac rehabilitation: A systematic review. Heart 2018, 104, 1403–1410. [Google Scholar] [CrossRef]

- Jiang, X.; Ming, W.K.; You, J.H. The cost-effectiveness of digital health interventions on the management of cardiovascular diseases: Systematic review. J. Med. Internet Res. 2019, 21, e13166. [Google Scholar] [CrossRef]

- Vanness, D.J.; Lomas, J.; Ahn, H. A health opportunity cost threshold for cost-effectiveness analysis in the United States. Ann. Intern. Med. 2021, 174, 25–32. [Google Scholar] [CrossRef]

- Wilder-Smith, A.; Longini, I.; Zuber, P.L.; Bärnighausen, T.; Edmunds, W.J.; Dean, N.; Spicher, V.M.; Benissa, M.R.; Gessner, B.D. The public health value of vaccines beyond efficacy: Methods, measures and outcomes. BMC Med. 2017, 15, 138. [Google Scholar] [CrossRef]

- Huang, L.; Frijters, P.; Dalziel, K.; Clarke, P. Life satisfaction, QALYs, and the monetary value of health. Soc. Sci. Med. 2018, 211, 131–136. [Google Scholar] [CrossRef]

- Tsevat, J.; Moriates, C. Value-based health care meets cost-effectiveness analysis. Ann. Intern. Med. 2018, 169, 329–332. [Google Scholar] [CrossRef]

- Newman, M.G.; Zainal, N.H. The value of maintaining social connections for mental health in older people. Lancet Public Health 2020, 5, e12–e13. [Google Scholar] [CrossRef]

- Newhouse, J.P. Medical-care expenditure: A cross-national survey. J. Hum. Resour. 1977, 12, 115–125. [Google Scholar] [CrossRef]

- Freeman, D.G. Is health care a necessity or a luxury? Pooled estimates of income elasticity from US state-level data. Appl. Econ. 2003, 35, 495–502. [Google Scholar] [CrossRef]

- Jaunky, V.C.; Khadaroo, A.J. Health care expenditure and GDP: An African perspective. Appl. Econom. Int. Dev. 2008, 8, 131–146. [Google Scholar] [CrossRef][Green Version]

- Baltagi, B.H.; Moscone, F. Health care expenditure and income in the OECD reconsidered: Evidence from panel data. Econ. Model. 2010, 27, 804–811. [Google Scholar] [CrossRef]

- Murthy, V.N.; Okunade, A.A. Determinants of US health expenditure: Evidence from autoregressive distributed lag (ARDL) approach to cointegration. Econ. Model. 2016, 59, 67–73. [Google Scholar] [CrossRef]

- Dubey, J.D. Income Elasticity of Demand for Health Care and It’s Change over Time: Across the Income Groups and Levels of Health Expenditure in India; No. 20/324; National Institute of Public Finance and Policy: New Delhi, India, 2020. [Google Scholar]

- Murthy, V.N.; Okunade, A.A. The core determinants of health expenditure in the African context: Some econometric evidence for policy. Health Policy 2009, 91, 57–62. [Google Scholar] [CrossRef]

- Casas, I.; Gao, J.; Peng, B.; Xie, S. Modelling Time-Varying Income Elasticities of Health Care Expenditure for the OECD. 2018. Available online: https://ssrn.com/abstract=3262326 (accessed on 31 December 2021).

- Rodríguez, A.F.; Valdés, M.N. Health care expenditures and GDP in Latin American and OECD countries: A comparison using a panel cointegration approach. Int. J. Health Econ. Manag. 2019, 19, 115–153. [Google Scholar] [CrossRef]

- Rana, R.H.; Alam, K.; Gow, J. Health expenditure and gross domestic product: Causality analysis by income level. Int. J. Health Econ. Manag. 2020, 20, 55–77. [Google Scholar] [CrossRef]

- Khan, J.A.; Mahumud, R.A. Is healthcare a ‘Necessity’or ‘Luxury’? an empirical evidence from public and private sector analyses of South-East Asian countries? Health Econ. Rev. 2015, 5, 3. [Google Scholar] [CrossRef]

- Jeetoo, J. Spillover effects in public healthcare expenditure in Sub-Saharan Africa: A spatial panel analysis. Afr. Dev. Rev. 2020, 32, 257–268. [Google Scholar] [CrossRef]

- Chen, M.Y.; Lin, F.L.; Chang, C.K. Relations between health care expenditure and income: An application of local quantile regressions. Appl. Econ. Lett. 2009, 16, 177–181. [Google Scholar] [CrossRef]

- Tian, F.; Gao, J.; Yang, K. A quantile regression approach to panel data analysis of health-care expenditure in Organisation for Economic Co-operation and Development countries. Health Econ. 2018, 27, 1921–1944. [Google Scholar] [CrossRef]

- Okunade, A.A.; Suraratdecha, C.; Benson, D.A. Determinants of Thailand household healthcare expenditure: The relevance of permanent resources and other correlates. Health Econ. 2010, 19, 365–376. [Google Scholar] [CrossRef]

- Zare, H.; Trujillo, A.J.; Leidman, E.; Buttorff, C. Income elasticity of health expenditures in Iran. Health Policy Plan. 2012, 28, 665–679. [Google Scholar] [CrossRef]

- Tsai, Y. Is Health Care an Individual Necessity? Evidence from Social Security Notch. 2015. Available online: https://ssrn.com/abstract=2477863 (accessed on 31 December 2021).

- Senturk, B.; Isik, A.D.; Gokmen, C.E. Determinants of out of pocket healthcare expenditures: The case of Mugla province in Turkey. Glob. J. Bus. Econ. Manag. Curr. Issues 2019, 9, 76–83. [Google Scholar] [CrossRef]

- Haque, M.S.; Barman, S.D. Determinants of Household Healthcare Expenditure in Chittagong, Bangladesh. IUP J. Appl. Econ. 2010, 9, 5–13. [Google Scholar]

- Bock, J.-O.; Matschinger, H.; Brenner, H.; Wild, B.; Haefeli, W.E.; Quinzler, R.; Saum, K.-U.; Heider, D.; König, H.-H. Inequalities in out-of-pocket payments for health care services among elderly Germans–results of a population-based cross-sectional study. Int. J. Equity Health 2014, 13, 3. [Google Scholar] [CrossRef]

- Zhou, Z.; Su, Y.; Gao, J.; Xu, L.; Zhang, Y. New estimates of elasticity of demand for healthcare in rural China. Health Policy 2011, 103, 255–265. [Google Scholar] [CrossRef]

- Propper, C.; Rees, H.; Green, K. The demand for private medical insurance in the UK: A cohort analysis. Econ. J. 2001, 111, 180–200. [Google Scholar] [CrossRef] [PubMed]

- Breyer, F.; Lorenz, N.; Niebel, T. Health care expenditures and longevity: Is there a Eubie Blake effect? Eur. J. Health Econ. 2015, 16, 95–112. [Google Scholar] [CrossRef] [PubMed]

- Lewbel, A.; Pendakur, K. Estimation of collective household models with Engel curves. J. Econom. 2008, 147, 350–358. [Google Scholar] [CrossRef]

- Chai, A.; Moneta, A. Retrospectives: Engel curves. J. Econ. Perspect. 2010, 24, 225–240. [Google Scholar] [CrossRef]

- Séne, L.M.; Cissé, M. Catastrophic out-of-pocket payments for health and poverty nexus: Evidence from Senegal. Int. J. Health Econ. Manag. 2015, 15, 307–328. [Google Scholar] [CrossRef]

- Babar, A.; Shahnawaz, M. Household Consumption Patterns in Pakistan: A Rural Urban Analysis. Forman J. Econ. Stud. 2010, 6, 1–25. [Google Scholar]

- Deaton, A. Panel data from time series of cross-sections. J. Econom. 1985, 30, 109–126. [Google Scholar] [CrossRef]

- Guillerm, M. Pseudo-panel methods and an example of application to Household Wealth data. Econ. Stat. 2017, 491, 109–130. [Google Scholar]

- Tobin, J. Estimation of relationships for limited dependent variables. Econom. J. Econom. Soc. 1958, 26, 24–36. [Google Scholar] [CrossRef]

- Costa-Font, J.; Gemmill, M.; Rubert, G. Biases in the healthcare luxury good hypothesis? A meta-regression analysis. J. R. Stat. Soc. Ser. A 2011, 174, 95–107. [Google Scholar] [CrossRef]

- Molla, A.A.; Chi, C.; Mondaca, A.L.N. Predictors of high out-of-pocket healthcare expenditure: An analysis using Bangladesh household income and expenditure survey, 2010. BMC Health Serv. Res. 2017, 17, 94. [Google Scholar] [CrossRef] [PubMed]

- Molla, A.A.; Chi, C. Who pays for healthcare in Bangladesh? An analysis of progressivity in health systems financing. Int. J. Equity Health 2017, 16, 167. [Google Scholar] [CrossRef]

- Olasehinde, N.; Olaniyan, O. Determinants of household health expenditure in Nigeria. Int. J. Soc. Econ. 2017, 44, 694–1709. [Google Scholar] [CrossRef]

- Rous, J.J.; Hotchkiss, D.R. Estimation of the determinants of household health care expenditures in Nepal with controls for endogenous illness and provider choice. Health Econ. 2003, 12, 431–451. [Google Scholar] [CrossRef]

- Fields, G.; Viollaz, M. Can the Limitations of Panel Datasets be Overcome by Using Pseudo-Panels to Estimate Income Mobility; Universidad Cornell-CEDLAS: Ithaca, NY, USA, 2013. [Google Scholar]

- Antman, F.; McKenzie, D.J. Earnings mobility and measurement error: A pseudo-panel approach. Econ. Dev. Cult. Chang. 2007, 56, 125–161. [Google Scholar] [CrossRef]

- World Health Organiation. Annual Report. Country Office. Mauritius. 2018. Available online: https://www.afro.who.int/sites/default/files/2019-10/WHO%20MAURITIUS%20ANNUAL%20REPORT%202018.pdf (accessed on 31 December 2021).

- Culyer, A.J. Health Care Expenditures in Canada: Myth and Reality, Past and Future; No. 82; Canadian Tax Foundation: Toronto, ON, Canada, 1988. [Google Scholar]

- Jeetoo, J. Healthcare Expenditure and Baumol Cost Disease in Sub-Sahara Africa. Econ. Bull. 2020, 40, 2704–2716. [Google Scholar]

- Chikobola, M.M.; Edriss, A.K. Estimation of rural-urban expenditure and elasticities of food items in Zambia: Evidence from Living Conditions Monitoring Survey. Mod. Econ. 2016, 7, 567–574. [Google Scholar] [CrossRef]

- Smith, L.C.; Subandoro, A. Measuring Food Security Using Household Expenditure Surveys; International Food Policy Research Institute: Washington, DC, USA, 2007; Volume 3. [Google Scholar]

- Tansel, A.; Bircan, F. Demand for education in Turkey: A tobit analysis of private tutoring expenditures. Econ. Educ. Rev. 2006, 25, 303–313. [Google Scholar] [CrossRef]

- Harold, J.; Cullinan, J.; Lyons, S. The income elasticity of household energy demand: A quantile regression analysis. Appl. Econ. 2017, 49, 5570–5578. [Google Scholar] [CrossRef]

- Verbeek, M. Pseudo-panels and repeatd cross-sections. In The Econometrics of Panel Data; Matyas, L., Sevestre, P., Eds.; Springer: Berlin/Heidelberg, Germany, 2008; pp. 369–383. [Google Scholar]

- Russell, J.E.; Fraas, J.W. An application of panel regression to pseudo panel data. Mult. Linear Regres. Viewp. 2005, 31, 1–15. [Google Scholar]

- Verbeek, M.; Nijman, T. Can cohort data be treated as genuine panel data? Empir. Econ. 1992, 17, 9–23. [Google Scholar] [CrossRef]

- Tsai, C.H.; Leong, W.; Mulley, C.; Clifton, G. Examining Estimation Bias and Efficiency for Pseudopanel Data in Travel Demand Analysis. Transp. Res. Rec. J. Transp. Res. Board 2013, 2354, 1–8. [Google Scholar] [CrossRef]

- Mcdonald, J.F.; Moffit, R.A. The Uses of the Tobit Analysis. Rev. Econ. Stat. 1980, 62, 318–321. [Google Scholar] [CrossRef]

| Author | Country | Data | Methodology | Major Findings |

|---|---|---|---|---|

| Okunade et al. [44] | Thailand | Thailand Socio-Economic Surveys (Period Covered: 1994–2000) | Double-hurdle model | Out-of-pocket healthcare spending behaves as a technical necessity across income quintiles and household sizes. |

| Zare et al. [45] | Iran | Iran Household Expenditure and Income Surveys (Period Covered: 1984 to 2008) | Spline and quantile regression techniques | Healthcare is a necessity for all income brackets and income elasticity is lowest for the poorest Iranians. |

| Tsai [46] | US | US Consumer Expenditure Survey (Period Covered: 1986–1994) | Two-stage least squares estimator | Income elasticities of out-of-pocket total medical costs and medical service expenses, and prescription drug expenses are all less than unity. |

| Kumara and Samaratung [7] | Sri Lanka | Household Income and Expenditure Surveys (Period Covered: 2006–2010) | Probit and Tobit models | The burden of private healthcare is less sensitive towards changes in household income. |

| Mahumud et al. [8] | Bangladesh | Bangladesh Household Income and Expenditure Survey data (Period Covered: 2010 | Ordinary least square method | Income elasticity out-of-pocket healthcare expenditure is below unity. |

| Pallegedara and Grimm [9] | Sri Lanka | Sri Lanka Household Income and Expenditure Surveys (Period Covered: 1990–2013) | Random-effects regression analysis | Income elasticity for the aggregate of all health care expenditure categories is estimated to be 1.7 (above unity). |

| Senturk et al. [47] | Turkey | 200 households in Turkey | Ordinary least square method | Income elasticity of out-of-pocket healthcare expenditure is estimated to be 0.646 (below unity). |

| Dubey [35] | India | Indian household survey (Period Covered: 2014–2018) | Spline and quantile regression techniques | Healthcare is a necessity with a significant decline in its income elasticity over time. |

| Percentage of Households with Zero OOPHE by Income Quartiles | |||||

|---|---|---|---|---|---|

| 1996/97 | 2001/02 | 2006/07 | 2012 | 2017 | |

| First Quartile (Q1) | 66.6% | 72.5% | 72.0% | 62.4% | 70.3% |

| Second Quartile (Q2) | 49.1% | 56.8% | 53.8% | 40.4% | 51.7% |

| Third Quartile (Q3) | 40.2% | 49.0% | 45.5% | 29.8% | 39.0% |

| Fourth Quartile (Q4) | 32.1% | 38.2% | 33.8% | 22.1% | 28.6% |

| Variable | Coefficient |

|---|---|

| lnRMPCE | 0.938 ** (0.444) |

| lnMHS | −1.530 ** (0.748) |

| lnMCI | −0.973 *** (0.243) |

| lnMPO | 0.037 (0.092) |

| lnBED | −1.197 (0.473) |

| Constant | 0.145 (2.927) |

| R-Squared: | |

| Number of Observations | 67 |

| Within | 0.7468 |

| Between | 0.9379 |

| Overall | 0.8684 |

| Quartile | 1996/97 | 2001/02 | 2006/07 | 2012 | 2017 |

|---|---|---|---|---|---|

| First Quartile (Q1) | 3.527 *** | 3.988 *** | 3.282 *** | 4.098 *** | 5.031 *** |

| Second Quartile (Q2) | 2.810 *** | 3.822 *** | 5.248 *** | 2.754 *** | 5.765 *** |

| Third Quartile (Q3) | 1.864 *** | 2.630 *** | 3.403 *** | 2.279 *** | 3.822 *** |

| Fourth Quartile (Q4) | 1.473 *** | 1.224 *** | 1.830 *** | 1.496 *** | 1.485 *** |

| Overall | 2.236 *** | 2.527 *** | 2.793 *** | 2.511 *** | 2.959 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jeetoo, J.; Jaunky, V.C. An Empirical Analysis of Income Elasticity of Out-of-Pocket Healthcare Expenditure in Mauritius. Healthcare 2022, 10, 101. https://doi.org/10.3390/healthcare10010101

Jeetoo J, Jaunky VC. An Empirical Analysis of Income Elasticity of Out-of-Pocket Healthcare Expenditure in Mauritius. Healthcare. 2022; 10(1):101. https://doi.org/10.3390/healthcare10010101

Chicago/Turabian StyleJeetoo, Jamiil, and Vishal Chandr Jaunky. 2022. "An Empirical Analysis of Income Elasticity of Out-of-Pocket Healthcare Expenditure in Mauritius" Healthcare 10, no. 1: 101. https://doi.org/10.3390/healthcare10010101

APA StyleJeetoo, J., & Jaunky, V. C. (2022). An Empirical Analysis of Income Elasticity of Out-of-Pocket Healthcare Expenditure in Mauritius. Healthcare, 10(1), 101. https://doi.org/10.3390/healthcare10010101