Performance Evaluation of Fishery Enterprises Using Data Envelopment Analysis—A Malmquist Model

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

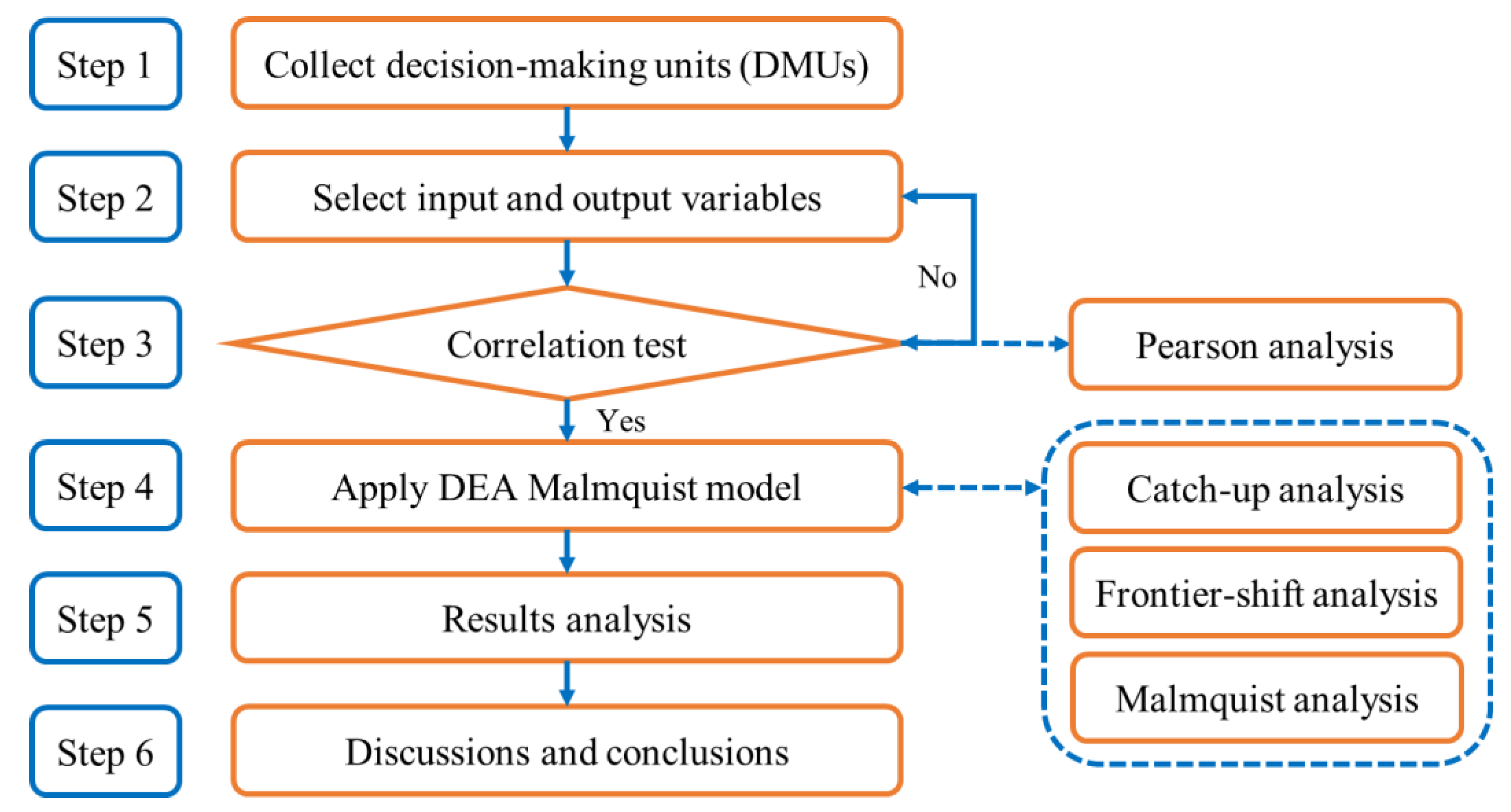

3.1. Research Flow

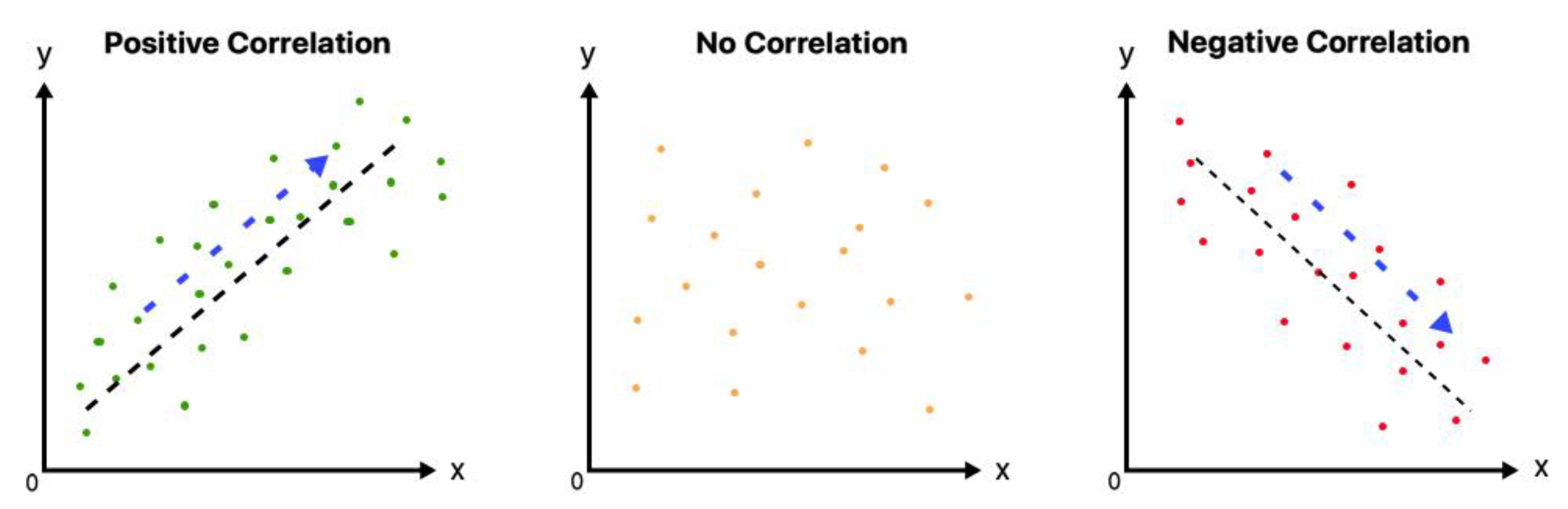

3.2. Pearson’s Correlation Coefficients

3.3. DEA Malmquist Model

4. A Case Study

4.1. Decision-Making Units (DMUs) Selection

4.2. Inputs and Outputs Selection

- Total assets (TOAs): the total number of assets owned by a fishery company.

- Equity (EQU): the remaining amount of assets available to shareholders after all liabilities have been paid, equal assets subtract liabilities.

- Total liabilities (TOLs): the aggregate debt and financial obligations owned by fishery enterprises at any specific period.

- Cost of sales (COS): the accumulated total of all the costs used to create a product or service, which has been sold.

- Output variables:

- Revenue (REV): the total amount of money that will be earned by consuming products, providing services, financial activities, and other activities of the enterprises.

- Profit (PRO): profits earned by the company after deducting costs related to fishing and selling fish.

4.3. Data Collection

5. Results Analysis

5.1. Correlation Coefficients

5.2. DEA Malmquist Results

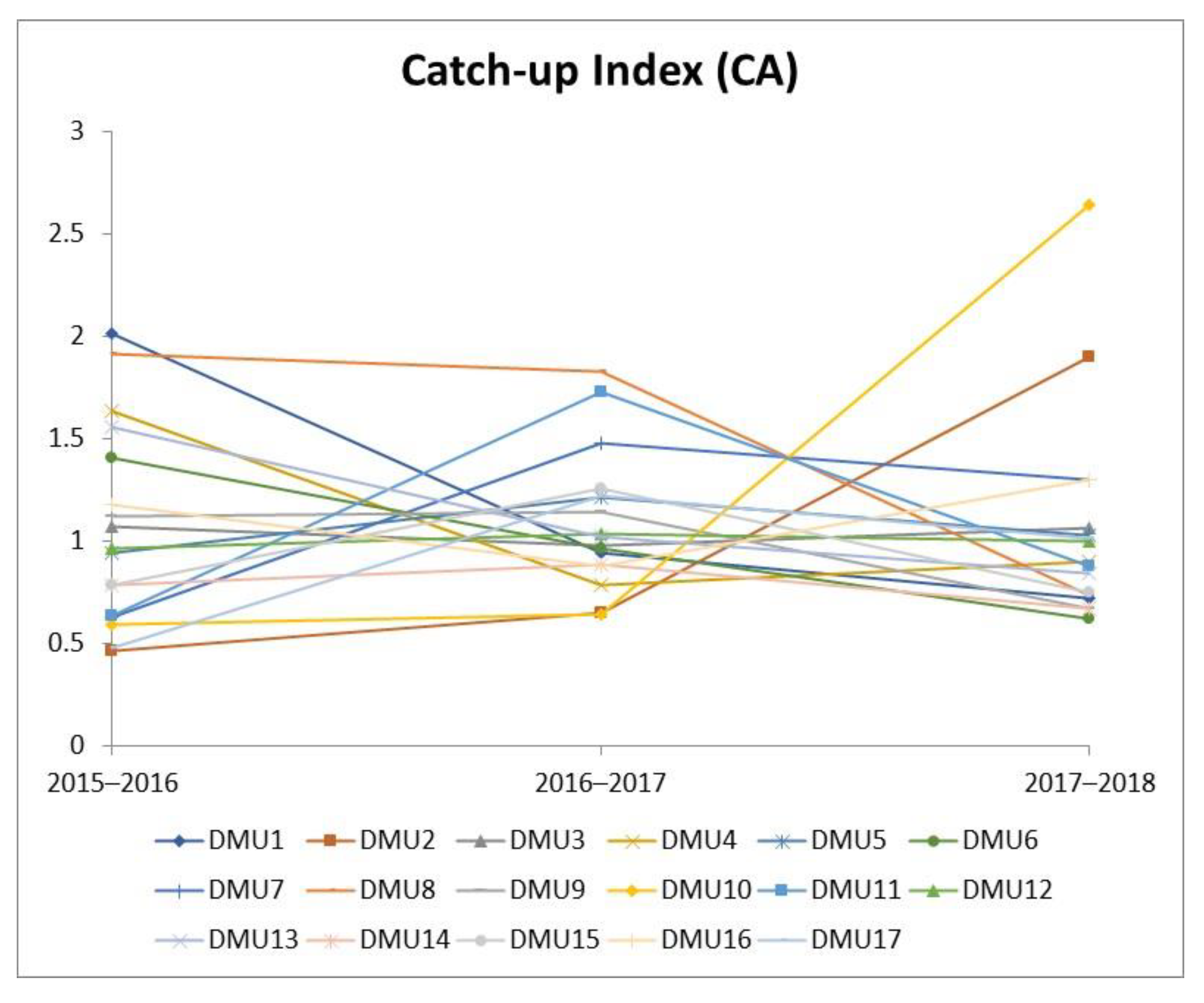

5.2.1. Catch-Up Index (CA)

5.2.2. Frontier-Shift Index (FR)

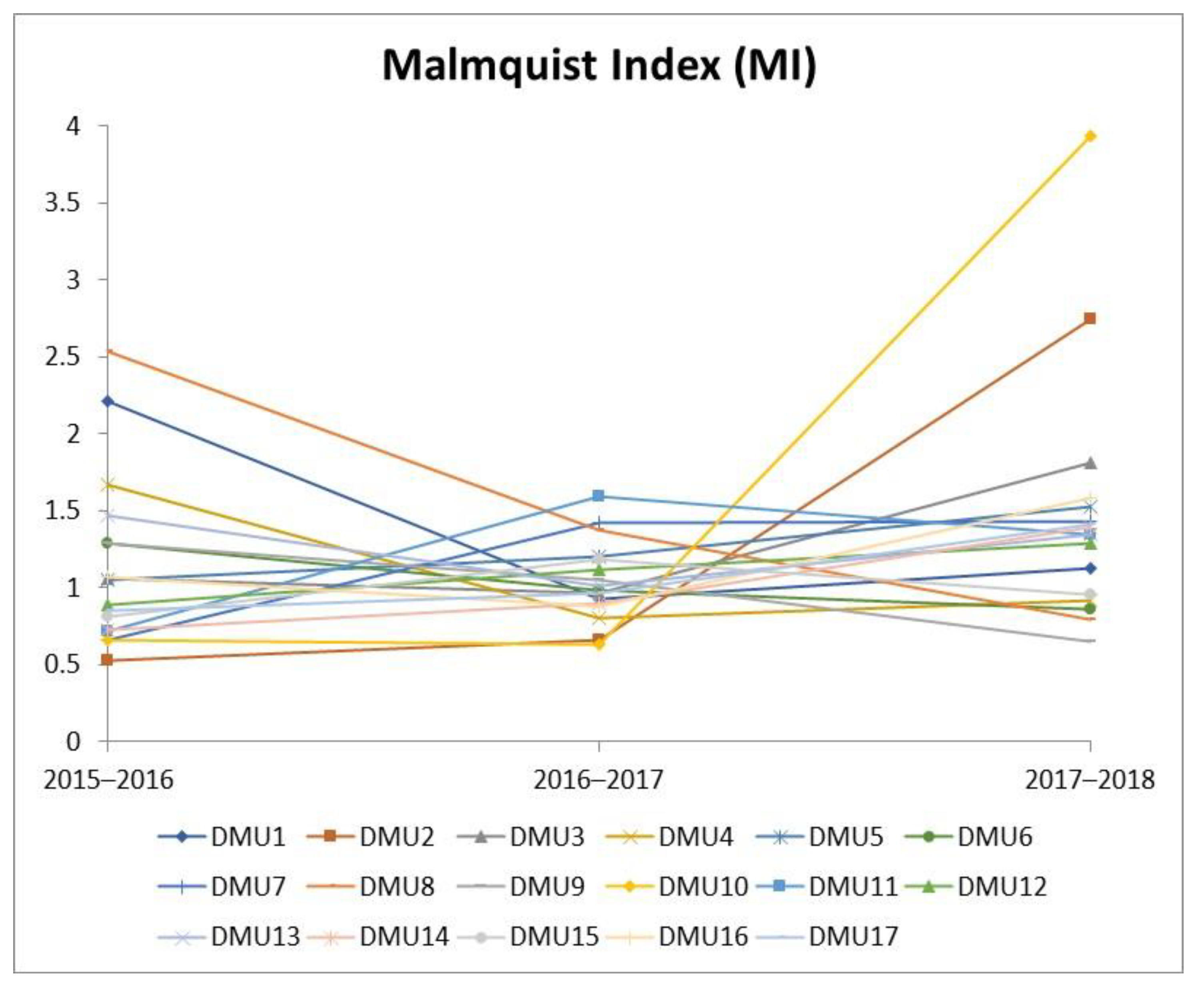

5.2.3. Malmquist Index (MI)

6. Discussions

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- EU. Aquaculture Has Fully Recovered from Downturn. Available online: https://ec.europa.eu/fisheries/press/%E2%82%AC5-billion-sales-and-profits-doubled-eu-aquaculture-has-fully-recovered-downturn_en?fbclid=IwAR1VjErBJcoPeU2XrOVlsuE_-9KZIS6aKvj32humUm-2I7RlAM02ixZ6URI (accessed on 22 January 2021).

- Ionel, B. European Regulation in the Veterinary Sanitary and Food Safety Area, a Component of the European Policies on the Safety of Food Products and the Protection of Consumer Interests: A 2007 Retrospective. Part Two: Regulations; Universul Juridic: Bucharest, Romania, 2018; pp. 16–19. [Google Scholar]

- Cioca, A.A.; Dan, S.D.; Lupău, V.M.; Colobatiu, L.M.; Mihaiu, M. The effect of high pressure processing on major structural proteins of rainbow trout fish fillets. Studia Univ. Babes-Bolyai Chem. 2018, 63, 129–136. [Google Scholar] [CrossRef]

- Vietnam Association of Seafood Exporters and Producers (VASEP). Available online: http://vasep.com.vn/1192/OneContent/tong-quan-nganh.htm (accessed on 29 November 2020).

- FAO Fisheries and Aquaculture. Available online: http://www.fao.org/3/w3839e/W3839e01.htm (accessed on 29 November 2020).

- Vietnam Misses 2019 Seafood Export. Available online: https://www.seafoodsource.com/news/supply-trade (accessed on 29 November 2020).

- Pomeroy, R.; Nguyen, K.A.T.; Thong, H.X. Small-scale marine fisheries policy in Vietnam. Mar. Policy 2009, 33, 419–428. [Google Scholar] [CrossRef]

- Hoang, H.D.; Momtaz, S.; Schreider, M. Assessing the vulnerability of small-scale fishery communities in the estuarine areas of Central Vietnam in the context of increasing climate risks. Ocean Coast. Manag. 2020, 196, 105302. [Google Scholar] [CrossRef]

- Quynh, C.N.T.; Schilizzi, S.; Hailu, A.; Iftekhar, S. Vietnam’s Territorial Use Rights for Fisheries: How do they perform against Ostrom’s institutional design principles? World Dev. Perspect. 2020, 17, 100171. [Google Scholar] [CrossRef]

- Dang, N.B.; Momtaz, S.; Zimmerman, K.; Nhung, P.T.H. Effectiveness of formal institutions in managing marine fisheries for sustainable fisheries development: A case study of a coastal commune in Vietnam. Ocean Coast. Manag. 2017, 137, 175–184. [Google Scholar] [CrossRef]

- CP Group. Available online: https://tatthanh.com.vn/top-30-website-cong-ty-thuy-san-hang-dau-viet-nam?fbclid=IwAR2ZM_iU8AqcK8yHonXp2YeDIn-rxGro9CVmUSsW7adPAUaCDyfPBAdipLc (accessed on 17 February 2021).

- Top Fisheries Companies in Vietnam. Available online: https://thuysanvietnam.com.vn/10-thuong-hieu-thuy-san-hang-dau-viet-nam/ (accessed on 17 February 2021).

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Zhu, J. Multi-factor performance measure model with an application to Fortune 500 companies. Eur. J. Oper. Res. 2000, 123, 105–124. [Google Scholar] [CrossRef]

- Drake, L.; Hall, M.J. Efficiency in Japanese banking: An empirical analysis. J. Bank. Financ. 2003, 27, 891–917. [Google Scholar] [CrossRef]

- Wang, C.-N.; Dang, T.-T.; Tibo, H.; Duong, D.-H. Assessing Renewable Energy Production Capabilities Using DEA Window and Fuzzy TOPSIS Model. Symmetry 2021, 13, 334. [Google Scholar] [CrossRef]

- Bayyurt, N.; Gokhan, D.U.Z.U. Performance measurement of Turkish and Chinese manufacturing firms: A comparative analysis. Eurasian J. Bus. Econ. 2008, 1, 71–83. [Google Scholar]

- Liu, C.; Lin, S.; Lewis, C. Evaluation of thermal power plant operational in Taiwan by data envelopment analysis. Energy Policy 2010, 38, 1049–1058. [Google Scholar] [CrossRef]

- Halkos, G.E.; Tzeremes, N.G. Analyzing the Greek renewable energy sector: A Data Envelopment Analysis approach. Renew. Sustain. Energy Rev. 2012, 16, 2884–2893. [Google Scholar] [CrossRef]

- Chen, L.; Jia, G. Environmental efficiency analysis of China’s regional industry: A data envelopment analysis (DEA) based approach. J. Clean. Prod. 2017, 142, 846–853. [Google Scholar] [CrossRef]

- Caves, D.W.; Christensen, L.R.; Diewert, W.E. The economic theory of index numbers and the measurement of input, output, and productivity. Econ. J. Econ. Soc. 1982, 1393–1414. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Lindgren, B.; Roos, P. Productivity changes in Swedish pharamacies 1980–1989: A non-parametric Malmquist approach. J. Prod. Anal. 1992, 3, 85–101. [Google Scholar] [CrossRef]

- Worthington, A. Malmquist Indices of Productivity Change in Australian Financial Services. J. Int. Financ. Mark. Inst. Money 1999, 9, 303–320. [Google Scholar] [CrossRef]

- Asmild, M.; Paradi, J.C.; Aggarwall, V.; Schaffnit, C. Combining DEA window analysis with the Malmquist index approach in a study of the Canadian banking industry. J. Prod. Anal. 2004, 21, 67–89. [Google Scholar] [CrossRef]

- Chang, D.; Kuo, L.; Chen, Y. Industrial changes in corporate sustainability performance—An empirical overview using data envelopment analysis. J. Clean. Prod. 2013, 56, 147–155. [Google Scholar] [CrossRef]

- Wang, D. Performance assessment of major global cities by DEA and Malmquist index analysis. Comput. Environ. Urban Syst. 2019, 77, 101–365. [Google Scholar] [CrossRef]

- Tingley, D.; Pascoe, S.; Coglan, L. Factors affecting technical efficiency in fisheries: Stochastic production frontier versus data envelopment analysis approaches. Fish. Res. 2005, 73, 363–376. [Google Scholar] [CrossRef]

- Mustapha, N.H.N.; Aziz, A.A.; Hashim, N.M.H. Technical efficiency in aquaculture industry using Data Envelopment Analysis (DEA) window: Evidences from Malaysia. J. Sustain. Sci. Manag. 2013, 8, 137–149. [Google Scholar]

- Arita, S.; Leung, P. A technical efficiency analysis of Hawaii’s aquaculture industry. J. World Aquac. Soc. 2014, 45, 312–321. [Google Scholar] [CrossRef]

- Hassanpour, M.; Pamucar, D. Evaluation of Iranian household appliance industries using MCDM models. Oper. Res. Eng. Sci. Theory Appl. 2019, 2, 1–25. [Google Scholar] [CrossRef]

- Anthony, P.; Behnoee, B.; Hassanpour, M.; Pamucar, D. Financial performance evaluation of seven Indian chemical companies. Decis. Mak. Appl. Manag. Eng. 2019, 2, 81–99. [Google Scholar] [CrossRef]

- Bayazid, Y.; Umetsu, C.; Hamasaki, H.; Miyanishi, T. Measuring the efficiency of collective floodplain aquaculture of Bangladesh using Data Envelopment Analysis. Aquaculture 2019, 503, 537–549. [Google Scholar] [CrossRef]

- Li, C.J.; Jeon, J.W.; Kim, H.H. An Efficiency Analysis of Fishery Output in Coastal Areas of China. Int. J. Adv. Smart Converg. 2020, 9, 127–136. [Google Scholar]

- Blagojević, A.; Vesković, S.; Kasalica, S.; Gojić, A.; Allamani, A. The application of the fuzzy AHP and DEA for measuring the efficiency of freight transport railway undertakings. Oper. Res. Eng. Sci. Theory Appl. 2020, 3, 1–23. [Google Scholar] [CrossRef]

- Wanke, P.F.; Barbastefano, R.G.; Hijjar, M.F. Determinants of efficiency at major Brazilian port terminals. Transp. Rev. 2011, 31, 653–677. [Google Scholar] [CrossRef]

- Alam, F. Measuring technical, allocative and cost efficiency of pangas (Pangasius hypophthalmus: Sauvage 1878) fish farmers of Bangladesh. Aquac. Res. 2011, 42, 1487–1500. [Google Scholar] [CrossRef]

- Madau, F.A.; Furesi, R.; Pulina, P. The technical efficiency in Sardinian fisheries cooperatives. Mar. Policy 2018, 95, 111–116. [Google Scholar] [CrossRef]

- Park, S.H.; Pham, T.Y.; Yeo, G.T. The impact of ferry disasters on operational efficiency of the South Korean coastal ferry industry: A DEA-window analysis. Asian J. Shipp. Logist. 2018, 34, 248–255. [Google Scholar] [CrossRef]

- Gutiérrez, E.; Lozano, S.; Guillén, J. Efficiency data analysis in EU aquaculture production. Aquaculture 2020, 520, 734962. [Google Scholar] [CrossRef]

- Vestergaard, N.; Squires, D.; Kirkley, J. Measuring capacity and capacity utilization in fisheries: The case of the Danish Gill-net fleet. Fish. Res. 2003, 60, 357–368. [Google Scholar] [CrossRef]

- Lindebo, E. Multi-national industry capacity in the North Sea flatfish fishery. Mar. Resour. Econ. 2005, 20, 385–406. [Google Scholar] [CrossRef]

- Van Hoof, L.; De Wilde, J.W. Capacity assessment of the Dutch beam-trawler fleet using data envelopment analysis (DEA). Mar. Resour. Econ. 2005, 20, 327–345. [Google Scholar] [CrossRef]

- Walden, J.B. Estimating vessel efficiency using a bootstrapped data envelopment analysis model. Mar. Resour. Econ. 2006, 21, 181–192. [Google Scholar] [CrossRef]

- Tsitsika, E.; Maravelias, C.; Wattage, P.; Haralabous, J. Fishing capacity and capacity utilization of purse seiners using data envelopment analysis. Fish. Sci. 2008, 74, 730–735. [Google Scholar] [CrossRef]

- Vassdal, T.; Holst, H.M.S. Technical Progress and Regress in Norwegian Salmon Farming: A Malmquist Index Approach. Mar. Resour. Econ. 2011, 26, 329–341. [Google Scholar] [CrossRef]

- Lim, G.; Ismail, A.L.; Hussein, M.A. Does technology and other determinants effect fishing efficiency? An application of stochastic frontier and data envelopment analyses on trawl fishery. J. Appl. Sci. 2012, 12, 48–55. [Google Scholar]

- Asche, F.; Guttormsen, A.G.; Nielsen, R. Future challenges for the maturing Norwegian salmon aquaculture industry: An analysis of total factor productivity change from 1996 to 2008. Aquaculture 2013, 396, 43–50. [Google Scholar] [CrossRef]

- Vázquez-Rowe, I.; Tyedmers, P. Identifying the importance of the “skipper effect” within sources of measured inefficiency in fisheries through data envelopment analysis (DEA). Mar. Policy 2013, 38, 387–396. [Google Scholar] [CrossRef]

- Ceyhan, V.; Gene, H. Productive efficiency of commercial fishing: Evidence from the Samsun Province of Black Sea, Turkey. Turk. J. Fish. Aquat. Sci. 2014, 14, 309–320. [Google Scholar]

- Ding, L.L.; Lei, L.; Wang, L.; Zhang, L.F.; Calin, A.C. A novel cooperative game network DEA model for marine circular economy performance evaluation of China. J. Clean. Prod. 2020, 253, 120071. [Google Scholar] [CrossRef]

- Pan, W.T.; Zhuang, M.E.; Zhou, Y.Y.; Yang, J.J. Research on sustainable development and efficiency of China’s E-Agriculture based on a data envelopment analysis-Malmquist model. Technol. Forecast. Soc. Chang. 2020, 162, 120298. [Google Scholar] [CrossRef]

- Elkadeem, M.R.; Kotb, K.M.; Ullah, Z.; Atiya, E.G.; Dán, A.; Wang, S. A two-stage multi-attribute analysis method for city-integrated hybrid mini-grid design: A case study in Egypt. Sustain. Cities Soc. 2020, 65, 102603. [Google Scholar] [CrossRef]

- Deveci, K.; Cin, R.; Kağızman, A. A modified interval valued intuitionistic fuzzy CODAS method and its application to multi-criteria selection among renewable energy alternatives in Turkey. Appl. Soft Comput. 2020, 96, 106660. [Google Scholar] [CrossRef]

- Wang, C.N.; Dang, T.T.; Nguyen, N.A.T.; Le, T.T.H. Supporting Better Decision-Making: A Combined Grey Model and Data Envelopment Analysis for Efficiency Evaluation in E-Commerce Marketplaces. Sustainability 2020, 12, 10385. [Google Scholar] [CrossRef]

- Wang, C.N.; Nguyen, T.L.; Dang, T.T. Analyzing Operational Efficiency in Real Estate Companies: An Application of GM (1,1) and DEA Malmquist Model. Mathematics 2021, 9, 202. [Google Scholar] [CrossRef]

- Emili, T.A.; Emili, G.T.; Carmen, A.; David, C. Sensitivity analysis of efficiency and Malmquist productivity indices: An application to Spanish savings banks. Eur. J. Oper. Res. 2008, 184, 1062–1084. [Google Scholar]

- Morita, H.; Avkiran, N.K. Selecting inputs and outputs in data envelopment analysis by designing statistical experiments. J. Oper. Res. Soc. Jpn. 2009, 52, 163–173. [Google Scholar]

- Vietnam Financial Report. Available online: https://vietstock.vn/ (accessed on 29 November 2020).

- Theodoridis, A.; Batzios, C.; Ragkos, A.; Angelidis, P. Technical efficiency measurement of mussel aquaculture in Greece. Aquac. Int. 2017, 25, 1025–1037. [Google Scholar] [CrossRef]

- Pham, T.D.T.; Huang, H.W.; Chuang, C.T. Finding a balance between economic performance and capacity efficiency for sustainable fisheries: Case of the Da Nang gillnet fishery, Vietnam. Mar. Policy 2014, 44, 287–294. [Google Scholar] [CrossRef]

- Anh, P.V.; Everaert, G.; Vinh, C.T.; Goethals, P. Need for integrated analysis and management instruments to attain sustainable fisheries in Vietnam. Sustain. Water Qual. Ecol. 2014, 3, 151–154. [Google Scholar] [CrossRef]

- Vietnam Seafood Exports Drop Due to Pandemic. Available online: https://fishfocus.co.uk/vietnam-seafood-exports-drop/ (accessed on 29 November 2020).

- Seafood Exports in May Continues to Be Affected by Covid-19, the Agency of Foreign Trade in Vietnam. Available online: http://vietfishmagazine.com/markets/seafood-exports-in-may-continues-to-be-affected-by-covid-19.html (accessed on 29 November 2020).

- Kaewnuratchadasorn, P.; Smithrithee, M.; Sato, A.; Wanchana, W.; Tongdee, N.; Sulit, V.T. Capturing the Impacts of COVID-19 on the Fisheries Value Chain of Southeast Asia. Fish People 2020, 18, 2–8. [Google Scholar]

- Investment Commerce Fisheries Corp Company Profile. Available online: https://www.investing.com/equities/investment-commerce-fisheries-corp-company-profile (accessed on 22 January 2021).

- Tra Fish Companies See Profits Slump in Pandemic. Available online: https://vietnamnews.vn/economy/770605/tra-fish-companies-see-profits-slump-in-pandemic.html (accessed on 22 January 2021).

- The Sustainable Future of Viet Nam’s Fisheries after COVID-19. Available online: https://wwf.panda.org/_/search_wwf_news/?363051%2FThe-sustainable-future-of-Viet-Nams-fisheries-after-COVID-19&fbclid=IwAR3UQjMI_DG5RWyJcMDwDENxlAk6aZlMWGRboVLdcNtZ1nPMg1eO0iy-hcU (accessed on 22 January 2021).

- Kapelko, M.; Lansink, A.O. An international comparison of productivity change in the textile and clothing industry: A bootstrapped Malmquist index approach. Empir. Econ. 2015, 48, 1499–1523. [Google Scholar] [CrossRef]

- Hoff, A. Bootstrapping Malmquist indices for Danish seiners in the North Sea and Skagerrak. J. Appl. Stat. 2006, 33, 891–907. [Google Scholar] [CrossRef]

- Simar, L.; Wilson, P.W. Estimating and bootstrapping Malmquist indices. Eur. J. Oper. Res. 1999, 115, 459–471. [Google Scholar] [CrossRef]

| No. | Authors | DEA CCR | DEA BCC | DEA SBM | DEA Window | DEA Malmquist | SPF | Tobit Regression | (Fuzzy) AHP | (Fuzzy) TOPSIS | (Fuzzy) COPRAS | (Fuzzy) CODAS |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Vestergaard et al., 2003 [40] | x | ||||||||||

| 2 | Tingley et al., 2005 [27] | x | x | x | ||||||||

| 3 | Lindebo, 2005 [41] | x | ||||||||||

| 4 | Van Hoof and DeWilde, 2005 [42] | x | ||||||||||

| 5 | Walden, 2006 [43] | x | x | |||||||||

| 6 | Tsitsika et al., 2008 [44] | x | ||||||||||

| 7 | Wanke et al., 2011 [35] | x | x | |||||||||

| 8 | Alam, 2011 [36] | x | x | |||||||||

| 9 | Vassdal and Holst, 2011 [45] | x | ||||||||||

| 10 | Lim et al., 2012 [46] | x | x | |||||||||

| 11 | Vázquez-Rowe and Tyedmers, 2013 [28] | x | x | |||||||||

| 12 | Asche et al., 2013 [47] | x | ||||||||||

| 13 | Mustapha et al., 2013 [48] | x | ||||||||||

| 14 | Arita and Leung, 2014 [29] | x | x | |||||||||

| 15 | Ceyhan and Gene, 2014 [49] | x | ||||||||||

| 16 | Madau et al., 2018 [37] | x | ||||||||||

| 17 | Park et al., 2018 [38] | x | x | |||||||||

| 18 | Hassanpour and Pamucar, 2019 [30] | x | x | |||||||||

| 19 | Anthony et al., 2019 [31] | x | x | x | ||||||||

| 20 | Bayazid et al., 2019 [32] | x | x | x | ||||||||

| 21 | Li et al., 2020 [33] | x | x | |||||||||

| 22 | Gutiérrez et al., 2020 [39] | x | x | |||||||||

| 23 | Blagojević et al., 2020 [34] | x | x | x | ||||||||

| 24 | Deveci et al., 2020 [53] | x | ||||||||||

| 25 | Elkadeem et al., 2020 [52] | x | x | x | x | |||||||

| 26 | Zhang et al., 2020 [50] | x | ||||||||||

| 27 | Pan et al., 2020 [51] | x |

| Order | DMU | Companies Name | Stock Code |

|---|---|---|---|

| 1 | DMU1 | Mekong Fisheries Joint Stock Company | AAM |

| 2 | DMU2 | Ben Tre Aquaproduct Import and Export JSC | ABT |

| 3 | DMU3 | Cuu Long Fish Joint Stock Company | ACL |

| 4 | DMU4 | An Giang Fisheries Import Export JSC | AGM |

| 5 | DMU5 | Nam Viet Corporation | ANV |

| 6 | DMU6 | Camimex Group JSC | CMX |

| 7 | DMU7 | Sao Ta Foods Joint Stock Company | FMC |

| 8 | DMU8 | Hoang Long Group | HLG |

| 9 | DMU9 | Hung Vuong Joint Stock Corporation | HVG |

| 10 | DMU10 | Investment Commerce Fisheries Corporation | ICF |

| 11 | DMU11 | International Development & Investment Corporation | IDI |

| 12 | DMU12 | Seafood Joint Stock Company No4 | TS4 |

| 13 | DMU13 | Vinh Hoan Corporation | VHC |

| 14 | DMU14 | Bac Lieu Fisheries Joint Stock Company | BLF |

| 15 | DMU15 | Kien Hung JSC | KHS |

| 16 | DMU16 | Ngo Quyen Export Seafood Processing JSC | NGC |

| 17 | DMU17 | Hung Hau Agricultural Corporation | SJ1 |

| Papers | Input Variables | Output Variables | Research Scope |

|---|---|---|---|

| Tingley et al., 2005 [27] | Annual day fished Engine power Overall length | Annual revenue | 3 DMUs United Kingdom |

| Arita and Leung, 2014 [29] | Labor expense Number of employees Size of land | Total sales | 82 DMUs Hawaii |

| Theodoridis et al., 2017 [59] | Farm size Labor Capital cost | Gross revenue | 66 DMUs Greece |

| Madau et al., 2018 [37] | Materials cost Labor cost Production cost Capital endowment | Production value Net income | 104 DUMs Sea of Sardinia |

| Li et al., 2020 [33] | Fish farms Ships Staff numbers | Fish catch Net income | 11 DMUs China |

| Ding et al., 2020 [50] | Labor cost Capital investment | Gross ocean product | 11 DMUs China |

| Gutiérrez et al., 2020 [39] | Number of employees Assets Livestock cost Operation cost | Production value | 18 DMUs Europe |

| This paper | Total assets Equity Total liabilities Cost of sales | Revenue Profit | 17 DMUs Vietnam |

| Period | Statistics | TOA | EQU | TOL | COS | REV | PRO |

|---|---|---|---|---|---|---|---|

| 2015 | Max | 622,677 | 142,586 | 480,091 | 16,856 | 531,768 | 38,385 |

| Min | 4703 | 959 | 3116 | 268 | 5323 | 939 | |

| Avg. | 94,351 | 28,667 | 65,684 | 3755 | 91,917 | 9774 | |

| SD | 146,824.0 | 37,968.2 | 111,760.5 | 4403.8 | 131,500.4 | 11,086.7 | |

| 2016 | Max | 715,647 | 140,808 | 574,840 | 22,142 | 770,876 | 58,170 |

| Min | 4491 | 976 | 557 | 320 | 4807 | 754 | |

| Avg. | 104,494 | 32,524 | 71,970 | 3969 | 118,384 | 11,449 | |

| SD | 169,397.3 | 41,318.9 | 133,935.8 | 5544.1 | 186,427.1 | 16,080.0 | |

| 2017 | Max | 598,139 | 126,837 | 490,435 | 20,634 | 668,740 | 50,512 |

| Min | 4597 | 1002 | 457 | 213 | 5493 | 366 | |

| Avg. | 99,629 | 32,808 | 66,820 | 3987 | 119,528 | 11,821 | |

| SD | 145,820.4 | 39,712.7 | 115,396.9 | 5282.4 | 169,095.2 | 15,510.0 | |

| 2018 | Max | 369,976 | 173,068 | 277,614 | 12,548 | 399,626 | 89,189 |

| Min | 4626 | 1055 | 788 | 250 | 7725 | 1.000 | |

| Avg. | 94,188 | 37,636 | 56,551 | 3344 | 113,826 | 16,485 | |

| SD | 110,016.4 | 48,446.7 | 71,182.5 | 3625.0 | 123,704.5 | 22,622.2 |

| TOA | EQU | TOL | COS | REV | PRO | ||

|---|---|---|---|---|---|---|---|

| Total assets (TOA) | Pearson correlation | 1 | 0.858 ** | 0.981 ** | 0.945 ** | 0.963 ** | 0.759 ** |

| p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Sample size | 68 | 68 | 68 | 68 | 68 | 68 | |

| Equity (EQU) | Pearson correlation | 0.858 ** | 1 | 0.740 ** | 0.868 ** | 0.883 ** | 0.932 ** |

| p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Sample size | 68 | 68 | 68 | 68 | 68 | 68 | |

| Total liabilities (TOL) | Pearson correlation | 0.981 ** | 0.740 ** | 1 | 0.904 ** | 0.923 ** | 0.637 ** |

| p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Sample size | 68 | 68 | 68 | 68 | 68 | 68 | |

| Cost of sales (COS) | Pearson correlation | 0.945 ** | 0.868 ** | 0.904 ** | 1 | 0.949 ** | 0.805 ** |

| p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Sample size | 68 | 68 | 68 | 68 | 68 | 68 | |

| Revenue (REV) | Pearson correlation | 0.963 ** | 0.883 ** | 0.923 ** | 0.949 ** | 1 | 0.844 ** |

| p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Sample size | 68 | 68 | 68 | 68 | 68 | 68 | |

| Profit (PRO) | Pearson correlation | 0.759 ** | 0.932 ** | 0.637 ** | 0.805 ** | 0.844 ** | 1 |

| p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Sample size | 68 | 68 | 68 | 68 | 68 | 68 | |

| Catch-up | 2015–2016 | 2016–2017 | 2017–2018 | Average |

|---|---|---|---|---|

| DMU1 | 2.00923 | 0.93957 | 0.71915 | 1.22265 |

| DMU2 | 0.46266 | 0.65018 | 1.89570 | 1.00285 |

| DMU3 | 1.06983 | 0.97697 | 1.06537 | 1.03739 |

| DMU4 | 1.63670 | 0.78556 | 0.90077 | 1.10768 |

| DMU5 | 0.94129 | 1.21225 | 1.02382 | 1.05912 |

| DMU6 | 1.40703 | 0.96565 | 0.61960 | 0.99743 |

| DMU7 | 0.62399 | 1.47912 | 1.30108 | 1.13473 |

| DMU8 | 1.91433 | 1.82901 | 0.73058 | 1.49131 |

| DMU9 | 1.12230 | 1.13894 | 0.67123 | 0.97749 |

| DMU10 | 0.58969 | 0.63994 | 2.64071 | 1.29011 |

| DMU11 | 0.63122 | 1.72734 | 0.87598 | 1.07818 |

| DMU12 | 0.95978 | 1.03593 | 0.99720 | 0.99764 |

| DMU13 | 1.55202 | 1.01652 | 0.83853 | 1.13569 |

| DMU14 | 0.78357 | 0.88487 | 0.66860 | 0.77901 |

| DMU15 | 0.78096 | 1.25688 | 0.74675 | 0.92820 |

| DMU16 | 1.17335 | 0.87917 | 1.30037 | 1.11763 |

| DMU17 | 0.47763 | 1.21910 | 1.01167 | 0.90280 |

| Average | 1.06680 | 1.09629 | 1.05924 | 1.07411 |

| Max | 2.00923 | 1.82901 | 2.64071 | 1.49131 |

| Min | 0.46266 | 0.63994 | 0.61960 | 0.77901 |

| Frontier | 2015–2016 | 2016–2017 | 2017–2018 | Average |

|---|---|---|---|---|

| DMU1 | 1.10090 | 0.98679 | 1.56698 | 1.21822 |

| DMU2 | 1.13555 | 1.02020 | 1.44704 | 1.20093 |

| DMU3 | 0.99140 | 0.98482 | 1.70087 | 1.22570 |

| DMU4 | 1.01858 | 1.01603 | 1.02068 | 1.01843 |

| DMU5 | 1.11979 | 0.99227 | 1.49384 | 1.20196 |

| DMU6 | 0.91846 | 1.01715 | 1.39101 | 1.10887 |

| DMU7 | 1.05126 | 0.95858 | 1.09797 | 1.03594 |

| DMU8 | 1.32646 | 0.75311 | 1.09002 | 1.05653 |

| DMU9 | 1.14453 | 0.92009 | 0.97268 | 1.01243 |

| DMU10 | 1.11779 | 0.98020 | 1.49067 | 1.19622 |

| DMU11 | 1.13458 | 0.92352 | 1.53585 | 1.19798 |

| DMU12 | 0.92113 | 1.08192 | 1.28773 | 1.09693 |

| DMU13 | 0.94667 | 0.99792 | 1.59941 | 1.18133 |

| DMU14 | 0.92834 | 1.01640 | 2.08939 | 1.34471 |

| DMU15 | 1.04349 | 0.93943 | 1.28159 | 1.08817 |

| DMU16 | 0.90836 | 1.00011 | 1.21763 | 1.04203 |

| DMU17 | 1.78698 | 0.79241 | 1.39858 | 1.32599 |

| Average | 1.09378 | 0.96359 | 1.39306 | 1.15014 |

| Max | 1.78698 | 1.08192 | 2.08939 | 1.34471 |

| Min | 0.90836 | 0.75311 | 0.97268 | 1.01243 |

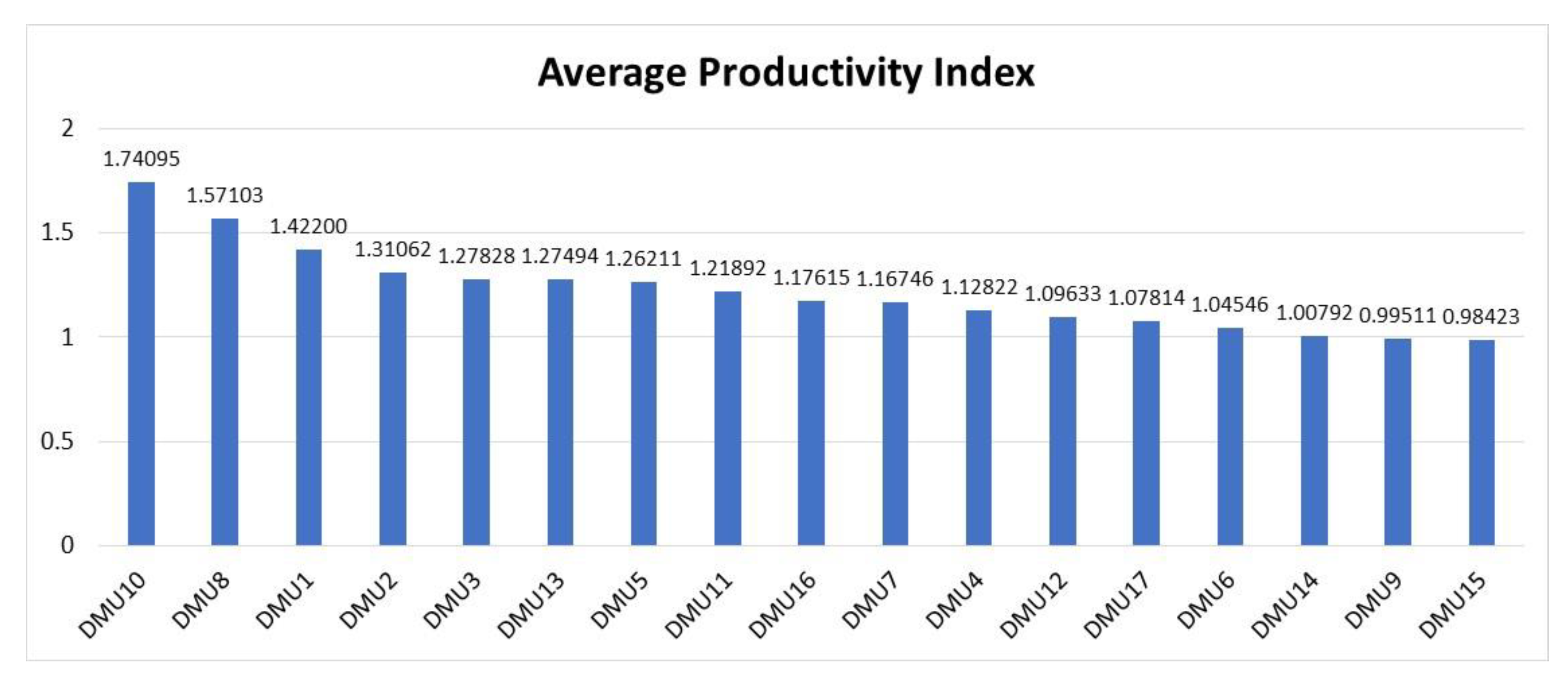

| Malmquist | 2015–2016 | 2016–2017 | 2017–2018 | Average |

|---|---|---|---|---|

| DMU1 | 2.21195 | 0.92716 | 1.12690 | 1.42200 |

| DMU2 | 0.52538 | 0.66331 | 2.74316 | 1.31062 |

| DMU3 | 1.06063 | 0.96214 | 1.81205 | 1.27828 |

| DMU4 | 1.66710 | 0.79816 | 0.91940 | 1.12822 |

| DMU5 | 1.05405 | 1.20287 | 1.52943 | 1.26211 |

| DMU6 | 1.29230 | 0.98221 | 0.86187 | 1.04546 |

| DMU7 | 0.65598 | 1.41786 | 1.42855 | 1.16746 |

| DMU8 | 2.53928 | 1.37745 | 0.79634 | 1.57103 |

| DMU9 | 1.28450 | 1.04793 | 0.65289 | 0.99511 |

| DMU10 | 0.65915 | 0.62727 | 3.93644 | 1.74095 |

| DMU11 | 0.71617 | 1.59522 | 1.34538 | 1.21892 |

| DMU12 | 0.88409 | 1.12079 | 1.28413 | 1.09633 |

| DMU13 | 1.46926 | 1.01440 | 1.34115 | 1.27494 |

| DMU14 | 0.72742 | 0.89938 | 1.39696 | 1.00792 |

| DMU15 | 0.81493 | 1.18075 | 0.95703 | 0.98423 |

| DMU16 | 1.06582 | 0.87927 | 1.58337 | 1.17615 |

| DMU17 | 0.85351 | 0.96602 | 1.41489 | 1.07814 |

| Average | 1.14597 | 1.03895 | 1.47823 | 1.22105 |

| Max | 2.53928 | 1.59522 | 3.93644 | 1.74095 |

| Min | 0.52538 | 0.62727 | 0.65289 | 0.98423 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, C.-N.; Nguyen, T.-L.; Dang, T.-T.; Bui, T.-H. Performance Evaluation of Fishery Enterprises Using Data Envelopment Analysis—A Malmquist Model. Mathematics 2021, 9, 469. https://doi.org/10.3390/math9050469

Wang C-N, Nguyen T-L, Dang T-T, Bui T-H. Performance Evaluation of Fishery Enterprises Using Data Envelopment Analysis—A Malmquist Model. Mathematics. 2021; 9(5):469. https://doi.org/10.3390/math9050469

Chicago/Turabian StyleWang, Chia-Nan, Thi-Ly Nguyen, Thanh-Tuan Dang, and Thi-Hong Bui. 2021. "Performance Evaluation of Fishery Enterprises Using Data Envelopment Analysis—A Malmquist Model" Mathematics 9, no. 5: 469. https://doi.org/10.3390/math9050469

APA StyleWang, C.-N., Nguyen, T.-L., Dang, T.-T., & Bui, T.-H. (2021). Performance Evaluation of Fishery Enterprises Using Data Envelopment Analysis—A Malmquist Model. Mathematics, 9(5), 469. https://doi.org/10.3390/math9050469