Residue Sum Formula for Pricing Options under the Variance Gamma Model

Abstract

1. Introduction

2. Preliminary Theory

2.1. Multidimensional Residue Calculus

2.2. One-Dimensional Mellin–Barnes Integral

2.3. Three-Dimensional Mellin–Barnes Integral

3. Option Pricing Driven by a Variance Gamma Process

3.1. Mellin–Barnes Representation for a Call Option

3.2. Residue Summation Formula for a Call Option

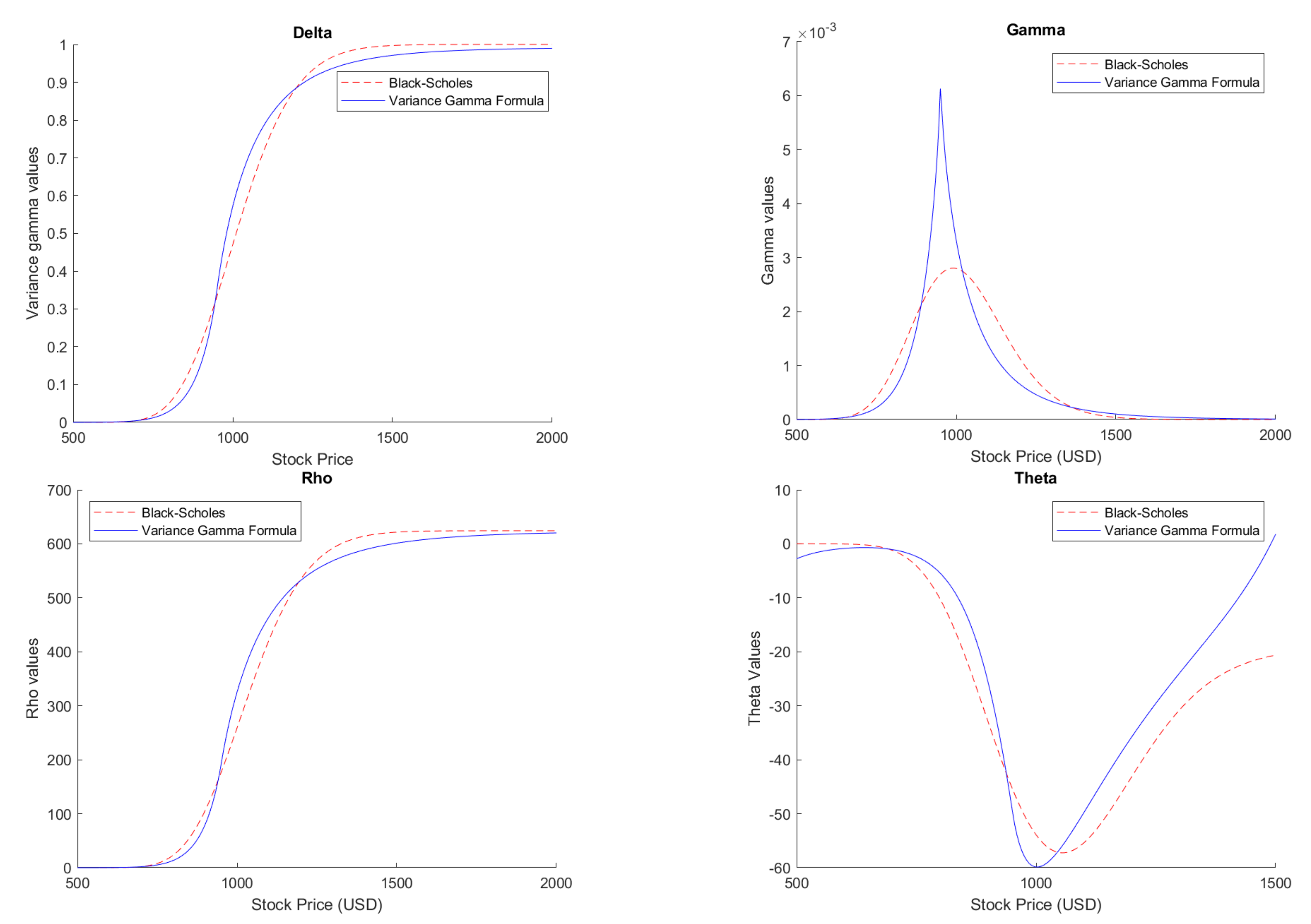

3.3. The Greeks

- Deltais defined as , hence:where , , and are defined by

4. Numerical Results

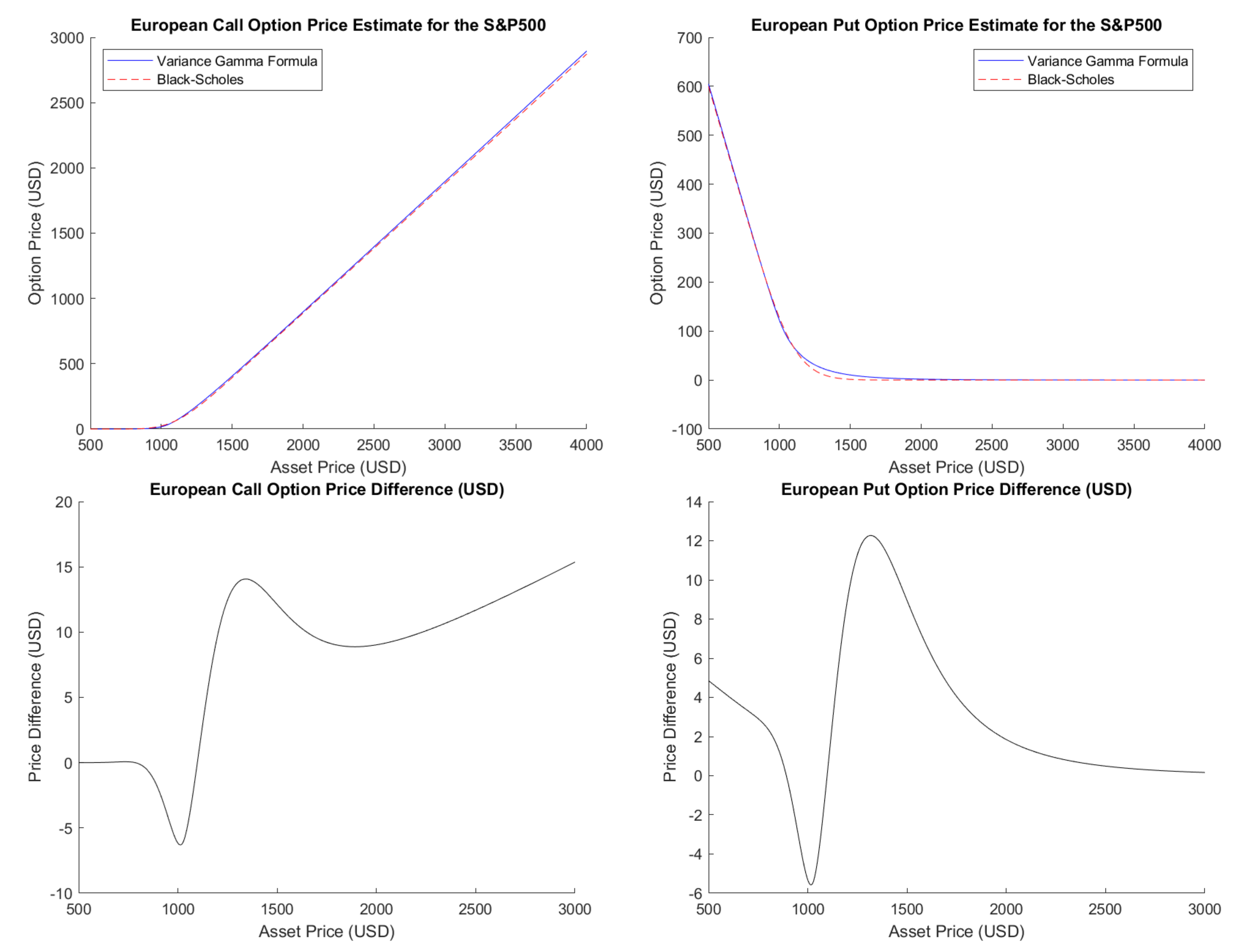

4.1. Variance Gamma Formula Values and Behavior

4.2. Convergence of the Variance Gamma Formula

4.3. The Greek Formulas Behavior

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Proof of Theorem 2

References

- Black, F.; Scholes, M. The pricing of options and Corporate Liabilities. J. Political Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Merton, R.C. The Theory of Rational Option Pricing. Bell J. Econ. Manag. Sci. 1973, 4, 141–183. [Google Scholar] [CrossRef]

- Fama, E.F. The Behavior of Stock-Market Prices. J. Bus. 1965, 38, 34–105. [Google Scholar] [CrossRef]

- Madan, D.B.; Seneta, E. The Variance Gamma (V.G.) Model for Share Market Returns. J. Bus. 1990, 63, 511–524. [Google Scholar] [CrossRef]

- Mandelbrot, B. The Variation of Certain Speculative Prices. J. Bus. 1963, 36, 394–419. [Google Scholar] [CrossRef]

- Madan, D.B.; Carr, P.P.; Chang, E.C. The Variance Gamma Process and Option Pricing. Rev. Financ. 1998, 2, 79–105. [Google Scholar] [CrossRef]

- Carr, P.; Madan, D.B.; Stanley, M. Option valuation using the Fast Fourier Transform. J. Comput. Financ. 1999, 2, 61–73. [Google Scholar] [CrossRef]

- Fang, F.; Oosterlee, C.W. A Novel Pricing Method for European Options Based on Fourier-Cosine Series Expansions. SIAM J. Sci. Comput. 2008, 31, 826–848. [Google Scholar] [CrossRef]

- Cont, R.; Voltchkova, E. A Finite Difference Scheme for Option Pricing in Jump Diffusion and Exponential Lévy Models. SIAM J. Numer. Anal. 2005, 43, 1596–1626. [Google Scholar] [CrossRef]

- Cantarutti, N.; Guerra, J. Multinomial method for option pricing under Variance Gamma. Int. J. Comput. Math. 2019, 96, 1087–1106. [Google Scholar] [CrossRef]

- Sato, K.I. Lévy Processes and Infinitely Divisible Distributions; Cambridge University Press: Cambridge, UK, 1999. [Google Scholar]

- Carr, P.; Wu, L. The finite moment log stable process and option pricing. J. Financ. 2003, 58, 753–777. [Google Scholar] [CrossRef]

- Mainardi, F.; Luchko, Y.; Pagnini, G. The Fundamental Solution of the Space-Time Fractional Diffusion Equation. 2007. Available online: https://arxiv.org/abs/cond-mat/0702419 (accessed on 25 March 2021).

- Gorenflo, R.; Luchko, Y.; Mainardi, F. Analytical Properties and Applications of the Wright Function. 2007. Available online: https://arxiv.org/abs/math-ph/0701069v1 (accessed on 25 March 2021).

- Mainardi, F. Fractional Calculus: Some Basic Problems in Continuum and Statistical Mechanics. In Fractals and Fractional Calculus in Continuum Mechanics; International Centre for Mechanical Sciences (Courses and Lectures); Carpinteri, A., Mainardi, F., Eds.; Springer: Vienna, Austria, 1997; pp. 291–348. [Google Scholar] [CrossRef]

- Gorenflo, R.; Mainardi, F.; Raberto, M.; Scalas, E. Fractional diffusion in finance: Basic theory. In Proceedings of the MDEF2000-Workshop ‘Modelli Dinamici in Economia e Finanza’, Urbino, Italy, 28–30 September 2000. [Google Scholar]

- Passare, M.; Tsikh, A.; Zhdanov, O. A multidimensional Jordan residue lemma with an application to Mellin-Barnes integrals. In Contributions to Complex Analysis and Analytic Geometry; Skoda, H., Trépreau, J.M., Eds.; Vieweg+Teubner Verlag: Wiesbaden, Germany, 1994. [Google Scholar]

- Passare, M.; Tsikh, A.; Cheshel, A. Multiple Mellin-Barnes integrals as periods of Calabi-Yau manifolds with several moduli. Theor. Math. Phys. 1996, 109, 1544–1555. [Google Scholar] [CrossRef]

- Zhdanov, O.; Tsikh, A. Studying the multiple Mellin-Barnes integrals by means of multidimensional residues. Sib. Math. J. 1998, 39, 245–260. [Google Scholar] [CrossRef]

- Aguilar, J.P.; Coste, C.; Korbel, J. Series representation of the pricing formula for the European option driven by space-time fractional diffusion. Fract. Calc. Appl. Anal. 2018, 21, 981–1004. [Google Scholar] [CrossRef]

- Aguilar, J.P.; Korbel, J. Option pricing models driven by the space-time fractional diffusion: Series representation and applications. Fractal Fract. 2018, 2, 15. [Google Scholar] [CrossRef]

- Aguilar, J.P.; Korbel, J. Simple formulas for pricing and hedging European options in the finite moment log-stable model. Risks 2019, 7, 36. [Google Scholar] [CrossRef]

- Schoutens, W. Lévy Processes in Finance: Pricing Financial Derivatives; Wiley: Hoboken, NJ, USA, 2003. [Google Scholar] [CrossRef]

- Griffiths, P.; Harris, J. Principles of Algebraic Geometry; Wiley Online Library: Hoboken, NJ, USA, 1978. [Google Scholar] [CrossRef]

- Begehr, H.G.; Dzhuraev, A.; Begher, H. An Introduction to Several Complex Variables and Partial Differential Equations; Addison-Wesley Longman: Harlow, UK, 1997. [Google Scholar]

- Titchmarsh, E.C. Introduction to the Theory of Fourier Integrals; The Clarendon Press: Oxford, UK, 1937. [Google Scholar]

- Abramowitz, M.; Stegun, I.A. Handbook of Mathematical Functions with Formulas, Graphs, and Mathematical Tables, 9th dover printing, 10th gpo printing ed.; Dover: New York, NY, USA, 1964. [Google Scholar]

- Cont, R.; Tankov, P. Financial Modelling with Jump Processes; Chapman and Hall/CRC Financial Mathematics Series; CRC Press: Boca Raton, FL, USA, 2003. [Google Scholar] [CrossRef]

| Time of Maturity | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Strike | May | June | September | December | March | June | December | ||||||||||||||

| Price | 2002 | 2002 | 2002 | 2002 | 2003 | 2003 | 2003 | ||||||||||||||

| F | MC | Real | F | MC | Real | F | MC | Real | F | MC | Real | F | MC | Real | F | MC | Real | F | MC | Real | |

| 975 | 152.76 | 151.72 | - | 156.80 | 156.19 | - | 166.83 | 168.05 | 161.60 | 176.13 | 176.13 | 173.30 | 184.76 | 183.79 | - | 192.81 | 194.67 | - | 207.41 | 206.05 | - |

| 995 | 133.42 | 132.40 | - | 138.17 | 137.60 | - | 149.64 | 150.82 | 144.80 | 159.98 | 160.09 | 157.00 | 169.40 | 168.42 | - | 178.07 | 179.85 | 182.10 | 193.65 | 192.31 | - |

| 1025 | 104.69 | 103.73 | - | 110.74 | 110.27 | - | 124.65 | 125.79 | 120.10 | 136.64 | 136.93 | 133.10 | 147.27 | 146.28 | 146.50 | 156.88 | 158.52 | - | 173.84 | 172.57 | - |

| 1050 | 81.09 | 80.20 | - | 88.49 | 88.16 | 84.50 | 104.71 | 105.81 | 100.70 | 118.12 | 118.59 | 114.80 | 129.75 | 128.65 | - | 140.10 | 141.69 | 143.00 | 158.15 | 156.92 | 171.40 |

| 1075 | 57.95 | 57.12 | - | 67.00 | 66.78 | 64.30 | 85.75 | 86.78 | 82.50 | 100.59 | 101.29 | 97.60 | 113.15 | 111.92 | - | 124.20 | 125.73 | - | 143.24 | 142.10 | - |

| 1090 | 44.39 | 43.58 | 43.10 | 54.58 | 54.41 | - | 74.92 | 75.90 | - | 90.59 | 91.42 | - | 103.68 | 102.36 | - | 115.11 | 116.57 | - | 134.67 | 133.62 | - |

| 1100 | 35.53 | 34.74 | 35.60 | 46.56 | 46.42 | - | 67.97 | 68.91 | 65.50 | 84.15 | 85.08 | 81.20 | 97.57 | 96.19 | 96.20 | 109.23 | 110.66 | 111.30 | 129.13 | 128.15 | 140.40 |

| 1110 | 26.88 | 26.12 | - | 38.79 | 38.69 | 39.50 | 61.25 | 62.16 | - | 77.92 | 78.92 | - | 91.65 | 90.18 | - | 103.52 | 104.91 | - | 123.71 | 122.81 | - |

| 1120 | 18.50 | 17.81 | 22.90 | 31.33 | 31.25 | 33.50 | 54.79 | 55.68 | - | 71.91 | 72.96 | - | 85.90 | 84.37 | - | 97.97 | 99.33 | - | 118.43 | 117.61 | - |

| 1125 | 14.47 | 13.82 | 20.20 | 27.74 | 27.69 | 30.70 | 51.66 | 52.54 | 51.00 | 68.98 | 70.07 | 66.90 | 83.10 | 81.54 | 81.70 | 95.25 | 96.61 | 97.00 | 115.84 | 115.07 | - |

| 1130 | 10.60 | 10.00 | - | 24.26 | 24.25 | 28.00 | 48.60 | 49.50 | - | 66.11 | 67.23 | - | 80.34 | 78.76 | - | 92.58 | 93.91 | - | 113.29 | 112.55 | - |

| 1135 | 7.09 | 6.53 | - | 20.93 | 20.93 | 25.60 | 45.63 | 46.45 | 45.50 | 63.30 | 64.45 | - | 77.63 | 76.04 | - | 89.94 | 91.26 | - | 110.76 | 110.07 | - |

| 1140 | 5.99 | 5.49 | 13.30 | 17.77 | 17.79 | 23.20 | 42.73 | 43.52 | - | 60.55 | 61.73 | 58.90 | 74.97 | 73.36 | - | 87.35 | 88.66 | - | 108.28 | 107.62 | - |

| 1150 | 4.66 | 4.26 | - | 12.55 | 12.60 | 19.10 | 37.20 | 37.92 | 38.10 | 55.23 | 56.44 | 53.90 | 69.81 | 68.17 | 68.30 | 82.30 | 83.58 | 83.30 | 103.40 | 102.81 | 112.80 |

| 1160 | 3.75 | 3.44 | - | 10.02 | 10.09 | 15.30 | 32.06 | 32.72 | - | 50.17 | 51.39 | - | 64.84 | 63.20 | - | 77.43 | 78.65 | - | 98.67 | 98.13 | - |

| 1170 | 3.08 | 2.82 | - | 8.24 | 8.32 | 12.10 | 27.37 | 27.96 | - | 45.38 | 46.59 | - | 60.09 | 58.46 | - | 72.72 | 73.88 | - | 94.07 | 93.58 | - |

| 1175 | 2.81 | 2.57 | - | 7.52 | 7.61 | 10.90 | 25.23 | 25.78 | 27.70 | 43.09 | 44.28 | 42.50 | 57.79 | 56.18 | 56.60 | 70.44 | 71.56 | - | 91.82 | 91.36 | 99.80 |

| 1200 | 1.82 | 1.68 | - | 4.93 | 5.06 | - | 17.15 | 17.54 | 19.60 | 32.79 | 33.78 | 33.00 | 47.14 | 45.62 | 46.10 | 59.70 | 60.65 | 60.90 | 81.11 | 80.74 | - |

| 1225 | 1.22 | 1.15 | - | 3.35 | 3.55 | - | 12.16 | 12.50 | 13.20 | 24.61 | 25.46 | 24.90 | 37.91 | 36.50 | 36.90 | 50.10 | 50.90 | 49.80 | 71.28 | 70.97 | - |

| 1250 | 0.84 | 0.80 | - | 2.34 | 2.53 | - | 8.79 | 9.12 | - | 18.59 | 19.29 | 18.30 | 30.17 | 28.88 | 29.30 | 41.67 | 42.34 | 41.20 | 62.30 | 62.03 | 66.90 |

| 1275 | 0.59 | 0.57 | - | 1.67 | 1.84 | - | 6.45 | 6.76 | - | 14.14 | 14.76 | 13.20 | 23.92 | 22.71 | 22.50 | 34.40 | 34.92 | - | 54.19 | 53.94 | - |

| 1300 | 0.42 | 0.41 | - | 1.20 | 1.34 | - | 4.79 | 5.08 | - | 10.84 | 11.40 | - | 18.96 | 17.90 | 17.20 | 28.24 | 28.59 | 27.10 | 46.90 | 46.63 | 49.50 |

| 1325 | 0.31 | 0.30 | - | 0.88 | 0.98 | - | 3.59 | 3.82 | - | 8.35 | 8.85 | - | 15.06 | 14.15 | 12.80 | 23.12 | 23.33 | - | 40.42 | 40.09 | - |

| 1350 | 0.23 | 0.22 | - | 0.65 | 0.71 | - | 2.71 | 2.92 | - | 6.47 | 6.88 | - | 11.99 | 11.23 | - | 18.92 | 19.01 | 17.10 | 34.71 | 34.31 | 35.70 |

| 1400 | 0.12 | 0.13 | - | 0.36 | 0.41 | - | 1.58 | 1.72 | - | 3.95 | 4.16 | - | 7.66 | 7.16 | - | 12.67 | 12.67 | 10.10 | 25.37 | 24.87 | 25.20 |

| 1450 | 0.07 | 0.09 | - | 0.21 | 0.24 | - | 0.95 | 1.03 | - | 2.45 | 2.55 | - | 4.95 | 4.62 | - | 8.51 | 8.46 | - | 18.42 | 17.69 | 17.00 |

| 1500 | 0.04 | 0.06 | - | 0.13 | 0.14 | - | 0.58 | 0.67 | - | 1.55 | 1.61 | - | 3.23 | 3.03 | - | 5.76 | 5.66 | - | 13.33 | 12.48 | 12.20 |

| RMSE | |

|---|---|

| Black–Scholes | 6.6692 |

| Variance Gamma Monte Carlo | 3.9979 |

| Variance Gamma Formula | 3.7373 |

| Double Series Sum | Double Series Sum | ||||||

|---|---|---|---|---|---|---|---|

| (n) | (m) | (k) | (n) | (m) | (k) | ||

| 0 | 1573.462 | 1573.462 | 1573.462 | 14 | 3.451 | 5.456 | 0.000 |

| 1 | 942.085 | 1624.942 | 93.249 | 15 | 1.263 | 2.653 | 0.000 |

| 2 | 1473.360 | 2138.478 | 14.602 | 16 | 0.430 | 1.277 | 0.000 |

| 3 | 396.878 | 2185.591 | 0.656 | 17 | 0.137 | 0.609 | 0.000 |

| 4 | 530.501 | 1834.503 | 0.121 | 18 | 0.041 | 0.288 | 0.000 |

| 5 | 350.999 | 1328.181 | 0.008 | 19 | 0.011 | 0.135 | 0.000 |

| 6 | 358.913 | 862.780 | 0.001 | 20 | 0.003 | 0.063 | 0.000 |

| 7 | 287.068 | 518.316 | 0.000 | 21 | 0.001 | 0.029 | 0.000 |

| 8 | 214.182 | 294.406 | 0.000 | 22 | 0.000 | 0.013 | 0.000 |

| 9 | 139.772 | 160.554 | 0.000 | 23 | 0.000 | 0.006 | 0.000 |

| 10 | 81.751 | 84.932 | 0.000 | 24 | 0.000 | 0.003 | 0.000 |

| 11 | 42.733 | 43.875 | 0.000 | 25 | 0.000 | 0.001 | 0.000 |

| 12 | 20.221 | 22.236 | 0.000 | 26 | 0.000 | 0.001 | 0.000 |

| 13 | 8.716 | 11.090 | 0.000 | 27 | 0.000 | 0.000 | 0.000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Febrer, P.; Guerra, J. Residue Sum Formula for Pricing Options under the Variance Gamma Model. Mathematics 2021, 9, 1143. https://doi.org/10.3390/math9101143

Febrer P, Guerra J. Residue Sum Formula for Pricing Options under the Variance Gamma Model. Mathematics. 2021; 9(10):1143. https://doi.org/10.3390/math9101143

Chicago/Turabian StyleFebrer, Pedro, and João Guerra. 2021. "Residue Sum Formula for Pricing Options under the Variance Gamma Model" Mathematics 9, no. 10: 1143. https://doi.org/10.3390/math9101143

APA StyleFebrer, P., & Guerra, J. (2021). Residue Sum Formula for Pricing Options under the Variance Gamma Model. Mathematics, 9(10), 1143. https://doi.org/10.3390/math9101143