Fuzzy Set Models for Economic Resilience Estimation

Abstract

1. Introduction

2. Author’s Models and Methods

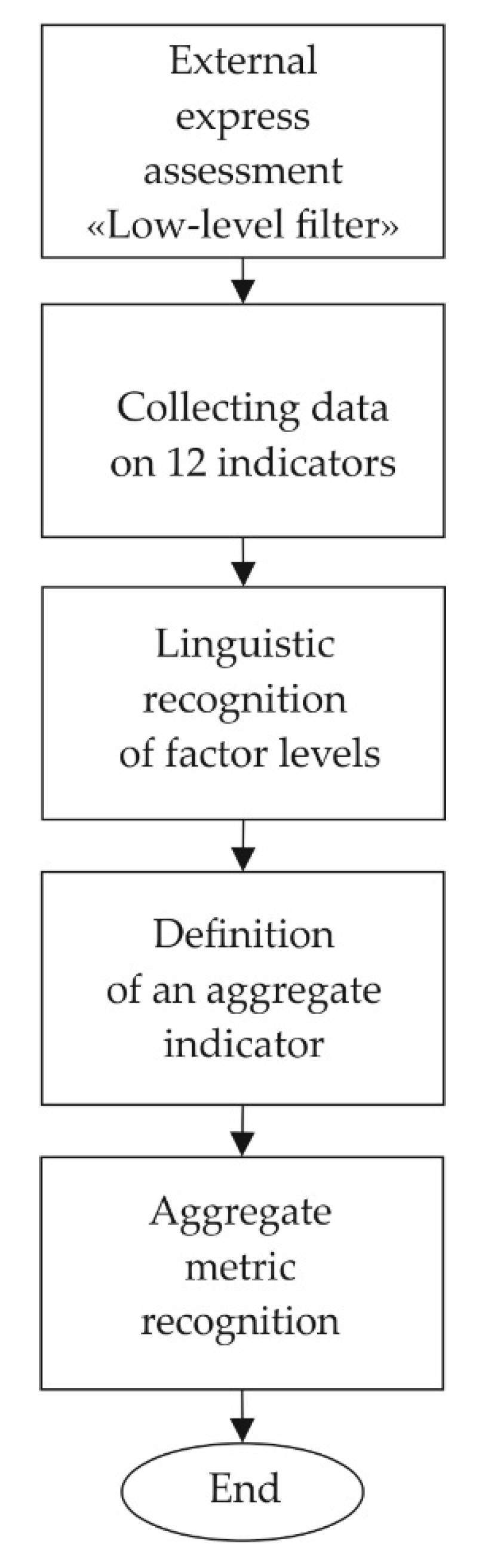

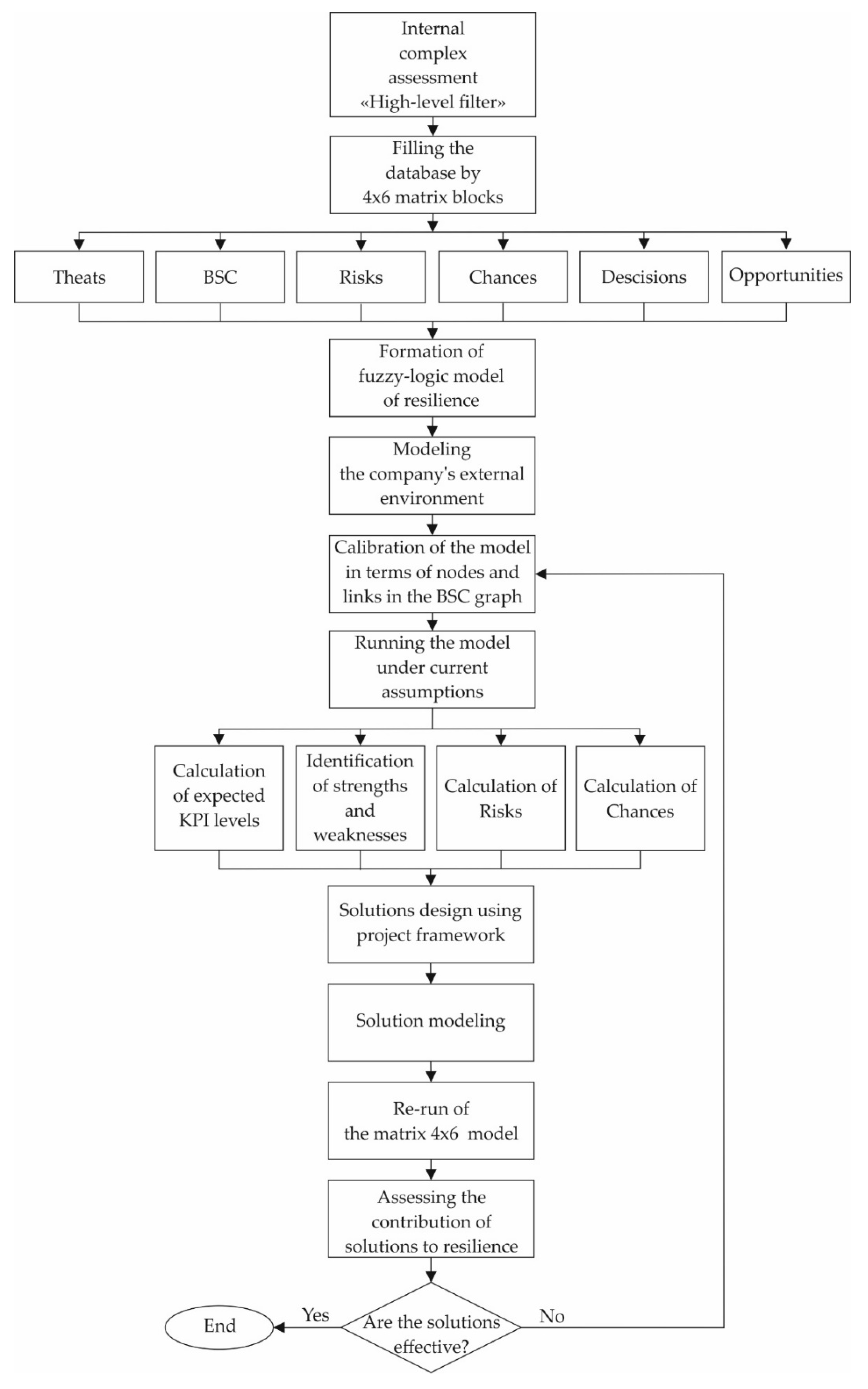

2.1. Enterprise Resilience Assessment Scheme

2.2. The Economic Resilience Fuzzy Model

2.3. MAC-Based RI Resilience Index Score

3. Results

3.1. Modeling Results Obtained: Case 1

- Z1. Launching new models of equipment to the market, working with problem customers.

- Z2. Development of export markets (25 countries).

- Z6. Creation of a new system of motivation for engineering services employees.

- Z8. Development of a new system of production planning and management of the ERP-class.

- Z9. Implementation of the lean manufacturing system at the enterprise.

3.2. Modeling Results Obtained: Case 2

- X1—marginal profitability,%;

- X2—operating profitability,%;

- X3—net profitability,%;

- X4—turnover of liabilities, once a year;

- X5—current assets turnover, once a year;

- X6—general liquidity, dimensionless;

- X7—financial leverage, dimensionless;

- X8—credit burden—percentage of interest payments in the structure of operating profit,%;

- X9—weighted average cost of equity,% per annum;

- X10—weighted average cost of borrowed capital,% per annum;

- X11—labor efficiency, measured by the level of revenue, thousand US dollars per employee per year;

- X12—labor efficiency, measured by the level of net profit, thousand US dollars per employee per year.

- Select the range of initial values of the factor. For example, if 15 enterprises of the same industry are observed for a selected factor of 16 quarters, then we have 15 * 16 = 240 measurement points in an array with the properties of mass and uniformity. The left border of the range is the minimum value of the factor in the sample, the right border of the range is the maximum value in the sample;

- We recognize all factors as direct or inverse. For a direct factor, the condition is satisfied: the higher the level of the factor, the higher the resilience of the enterprise, understood in a general sense. For the inverse factor, the opposite is true: the higher the level of the factor, the lower the resilience. For example, the indicator X1 is direct, and the indicator X10 is inverse. In the logic of research, the qualitative gradations of the term set are synchronized with the logic of direct factors;

- We carry out preliminary filtering of the obtained measurements, taking from the sample extremely low and extremely high values that fall out of the dense group in the sample (trimming of the histograms is performed). Thus, we narrow the range for analysis and carry out a more accurate calibration of the linguistic variable;

- We select seven key points on the measuring interval, and A1 is the minimum value for the interval, A4 is the weighted average value for the interval, A7 is the maximum value for the interval, and the coordinates of three other significant points A2, A3, A5, A6 are determined by the formulas:A2 = A1 + (A4 − A1)/3; A3 = A1 + 2 ∗ (A4 − A1)/3;

A5 = A4 + (A7 − A4)/3; A6 = A4 + 2 ∗ (A7 − A4)/3,

- For factor X with direct logic:gradation 1: X ∈ (−∞, A2];

gradation 2: X ∈ A2, A3];

gradation 3: X ∈ (A3, A5];

gradation 4: X ∈ (A5, A6];

gradation 5: X ∈ (A6, ∞), - For factor X with inverse logic:gradation 1: X ∈ (A6, ∞);

gradation 2: X ∈ [A5, A6);

gradation 3: X ∈ [A3, A5);

gradation 4: X ∈ [A2, A3);

gradation 5: X ∈ (−∞, A2)

gradation 2: RI ∈ [0.26, 0.42);

gradation 3: RI ∈ [0.42, 0.58);

gradation 4: RI ∈ [0.58, 0.74);

gradation 5: RI ∈ [0.74, 0.9].

4. Discussion. Presented Fuzzy Model Development

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Altman, E. A Complete Guide for Predicting, Avoiding and Dealing with Bankruptcy; Wiley: New York, NY, USA, 1983. [Google Scholar]

- Martin, R.; Sunley, P. On the notion of regional economic resilience: Conceptualization and explanation. J. Econ. Geogr. 2015, 15, 1–42. [Google Scholar] [CrossRef]

- Reggiani, A.; De Graaff, T.; Nijkamp, P. Resilience: An evolutionary approach to spatial economic systems. Netw. Netw. Spat. Econ. 2002, 2, 211–229. [Google Scholar] [CrossRef]

- Holling, C.S. Resilience and stability of ecological systems. Annu. Rev. Ecol. Syst. 1973, 4, 1–23. [Google Scholar] [CrossRef]

- Martin, R. Regional economic resilience, hysteresis and recessionary shocks. J. Econ. Geogr. 2012, 12, 1–32. [Google Scholar] [CrossRef]

- Holling, C.S. Engineering resilience versus ecological resilience. Eng. Ecol. Constraints 1996, 31, 32. [Google Scholar]

- Gunderson, L.H.; Pritchard, L. Resilience and the Behavior of Large-Scale Systems. Manag. Environ. Qual. Int. J. 2003. [Google Scholar] [CrossRef]

- Walker, B.; Gunderson, L.; Kinzig, A.; Folke, C.; Carpenter, S.; Schultz, L. A handful of heuristics and some propositions for understanding resilience in social-ecological systems. Ecol. Soc. 2006. Available online: https://www.ecologyandsociety.org/vol11/iss1/art13/ (accessed on 5 May 2020).

- Perrings, C. Resilience and sustainable development. Environ. Dev. Econ. 2006, 11, 417–427. [Google Scholar] [CrossRef]

- Hill, E.; Wial, H.; Wolman, H. Exploring regional economic resilience. Work. Pap. 2008. Available online: https://www.econstor.eu/bitstream/10419/59420/1/592859940.pdf (accessed on 5 May 2020).

- Sabatino, M. Economic resilience and social capital of the Italian region. Int. Rev. Econ. Financ. 2019, 61, 355–367. [Google Scholar] [CrossRef]

- Müller, G.; Koslowski, T.G.; Accorsi, R. Resilience-a new research field in business information systems? In International Conference on Business Information Systems; Springer: Berlin/Heidelberg, Germany, 2013. [Google Scholar] [CrossRef]

- Buheji, M. Understanding the Power of Resilience Economy: An Inter-Disciplinary Perspective to Change the World Attitude to Socio-Economic Crisis; Author House: Bloomington, IN, USA, 2018. [Google Scholar]

- Hosseini, S.; Barker, K.; Ramirez-Marquez, J.E. A review of definitions and measures of system resilience. Reliab. Eng. Syst. Saf. 2016, 145, 47–61. [Google Scholar] [CrossRef]

- Vinogradov, V.V.; Abdoulaeva, Z.I. Fuzzy-set economic stability analysis model of mineral complex of the Russian Federation. In Proceedings of the 2016 XIX IEEE International Conference on Soft Computing and Measurements (SCM), St. Petersburg, Russia, 25–27 May 2016. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. Alignment: Using the Balanced Scorecard to Create Corporate Synergies; Harvard Business Press: Brighton, MA, USA, 2006; Volume 31, pp. 367–369. [Google Scholar] [CrossRef]

- Zadeh, L.A.; Kacpyrzyk, J. Fuzzy Logic for the Management of Uncertainty; Wiley: New York, NY, USA, 1992. [Google Scholar]

- Abdoulaeva, Z.I.; Kurbanbaeva, D.F.; Topuzov, M.E. Application of the matrix aggregate calculator (MAC) for forecasting disease recommendations. In Proceedings of the 2017 XX IEEE International Conference on Soft Computing and Measurements (SCM), St. Petersburg, Russia, 24–26 May 2017; pp. 684–685. [Google Scholar]

- Khan, S.; Khalid, M.M. A Fuzzy Chance Constraint Programming Approach for Optimal Allocation in Multivariate Stratified Surveys: A Compromise Solution. Int. J. Oper. Res. 2014, 11, 100–111. [Google Scholar]

- Ashby, W.R. An Introduction to Cybernetics; 1956; Available online: http://dspace.utalca.cl/bitstream/1950/6344/2/IntroCyb.pdf (accessed on 5 May 2020).

- Zadeh, L.A. Toward a theory of fuzzy information granulation and its centrality in human reasoning and fuzzy logic. Fuzzy Sets Syst. 1997, 90, 111–127. [Google Scholar] [CrossRef]

- Statistical Classification of Economic Activities in the European Community. Available online: https://ec.europa.eu/eurostat/ramon/nomenclatures/index.cfm?TargetUrl=LST_CLS_DLD&StrNom=NACE_1_1# (accessed on 5 May 2020).

- Abdoulaeva, Z.; Voronov, D.; Kozlovskiy, A.; Nedosekin, A.; Pelymskaya, I. Comparison of the properties of competitiveness and economic sustainability of metallurgical enterprises (on the example of MMK). Audit Financ. Anal. 2019, 6, 62–70. [Google Scholar]

- Yahoo Finance Portal. Available online: https://finance.yahoo.com (accessed on 5 May 2020).

- General Electric, a Bigger Fraud Than Enron. Available online: http://fm.cnbc.com/applications/cnbc.com/resources/editorialfiles/2019/8/15/2019_08_15_GE_Whistleblower_Report.pdf (accessed on 5 May 2020).

- Abosuliman, S.; Abdullah, S.; Qiyas, M. Three-Way Decisions Making Using Covering Based Fractional Orthotriple Fuzzy Rough Set Model. Mathematics 2020, 8, 1121. [Google Scholar] [CrossRef]

- Biswas, P.; Pal, B.B. A fuzzy goal programming method to solve congestion management problem using genetic algorithm. Decis. Mak. Appl. Manag. Eng. 2019, 2, 36–53. [Google Scholar] [CrossRef]

- Habib, A.; Akram, M.; Farooq, A. q-Rung Orthopair Fuzzy Competition Graphs with Application in the Soil Ecosystem. Mathematics 2019, 7, 91. [Google Scholar] [CrossRef]

- Lee, T.; Wang, C.; Yu, C. Fuzzy Evaluation Model for Enhancing E-Learning Systems. Mathematics 2019, 7, 918. [Google Scholar] [CrossRef]

- Si, A.; Das, S.; Kar, S. An approach to rank picture fuzzy numbers for decision making problems. Decis. Mak. Appl. Manag. Eng. 2019, 22, 54–64. [Google Scholar] [CrossRef]

| Indicator | The Weight P of the Indicator in MAC | Present Value | Membership Functions Values for Terms of X: | ||||

|---|---|---|---|---|---|---|---|

| L1 | L2 | L3 | L4 | L5 | |||

| X1 | p1 | x1 | μ11 | μ12 | μ13 | μ14 | μ15 |

| X2 | p2 | x2 | μ21 | μ22 | μ23 | μ24 | μ25 |

| X3 | p3 | x3 | μ31 | μ32 | μ33 | μ34 | μ35 |

| X4 | p4 | x4 | μ41 | μ42 | μ43 | μ44 | μ45 |

| X5 | p5 | x5 | μ51 | μ52 | μ53 | μ54 | μ55 |

| Nodal points Y | y1 | y2 | y3 | y4 | y5 | ||

| Factor | Name | Dimension | Value |

|---|---|---|---|

| X1 | Gross profitability | % | 29% |

| X2 | Operative profitability | % | 18% |

| X3 | Net profitability | % | 13% |

| X4 | All assets turnover | once a year | 1.1 |

| X5 | Current assets turnover | once a year | 1.737 |

| X6 | Liquidity | no dimension | 12.667 |

| X7 | Financial leverage | no dimension | 0.087 |

| X8 | Credit | % | 4% |

| X9 | WACC1 | % a year | 9% |

| X10 | WACC2 | % a year | 10% |

| X11 | Labor efficiency 1 | USD1000 per 1 emp. a year | 44 |

| X12 | Labor efficiency 1 | USD1000 per 1 emp. a year | 5.6 |

| Factor | Norms for Gradations: | ||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| X1 | X1 < 23% | 23.1 % < X1 < 26% | 26.1% < X1 < 36% | 36.1% < X1 < 43% | X1 > 43% |

| X2 | X2 < 2% | 2.1% < X2 < 5% | 5.1% < X2 < 13% | 13.1% < X2 <19% | X2 > 19% |

| X3 | X3 < 1% | 1.1% < X3 < 3% | 3.1% < X3 < 8% | 8.1% < X3 < 13% | X3> 13% |

| X4 | X4 < 0.36 | 0.36 < X4 < 0.48 | 0.49 < X4 < 0.78 | 0.79 < X4 < 0.95 | X4 > 0.95 |

| X5 | X5 < 1.1 | 1.11 < X5 < 1.5 | 1.51 < X5 < 2.4 | 2.41 < X5 < 2.6 | X5 > 2.6 |

| X6 | X6 < 0.75 | 0.75 < X6 < 1.1 | 1.1 < X6 < 2.0 | 2.01 < X6 < 2.5 | X6 > 2.5 |

| X7 | X7 > 4.1 | 4 > X7 > 3.3 | 3.2 > X7 > 1.81 | 1.8 > X7 > 1.31 | X7 < 1.3 |

| X8 | X8 > 36% | 36% > X8 > 22.1% | 22% > X8 > 5.1% | 5% > X8 > 2.5% | X8 < 2.5% |

| X9 | X9 > 13% | 13% > X9 > 9.1% | 9% > X9 > 4.1% | 4% > X9 > 2.1% | X9 < 2% |

| X10 | X10 > 2% | 2% > X10 > 1.61% | 1.6% > X10 > 0.71% | 0.7% > X10 > 0.31% | X10 < 0.3% |

| X11 | X11 < 233 | 233 < X11 < 366 | 367 < X11 < 667 | 667 < X11 < 832 | X11 > 833 |

| X12 | X12 < 8 | 8 < X12 < 16 | 17 < X12 < 32 | 33 < X12 < 42 | X12 > 42 |

| Factor | |||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| X1 | 1 | ||||

| X2 | 1 | ||||

| X3 | 1 | ||||

| X4 | 1 | ||||

| X5 | 1 | ||||

| X6 | 1 | ||||

| X7 | 1 | ||||

| X8 | 1 | ||||

| X9 | 1 | ||||

| X10 | 1 | ||||

| X11 | 1 | ||||

| X12 | 1 | ||||

| Industry Code (NACE) | Tickers of Flagship Companies (RI_2018) | Outsiders Tickers (RI_2018) | Industry RI Values by Years: | |||

|---|---|---|---|---|---|---|

| 2015 | 2016 | 2017 | 2018 | |||

| C11 | PSX (0.557) | ROSN.ME (0.356) | 0.404 | 0.380 | 0.442 | 0.474 |

| DJ27 | PKX (0.596) | SAIL.NS (0.314) | 0.353 | 0.369 | 0.427 | 0.465 |

| DK29 | MMM (0.657) | DAI.DE (0.431) | 0.498 | 0.470 | 0.487 | 0.513 |

| DL31 | 900925.SS (0.616) | GE (0.317) | 0.447 | 0.441 | 0.451 | 0.461 |

| E40 | ELE.MC (0.603) | RWE.DE (0.304) | 0.472 | 0.473 | 0.488 | 0.487 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nedosekin, A.; Abdoulaeva, Z.; Konnikov, E.; Zhuk, A. Fuzzy Set Models for Economic Resilience Estimation. Mathematics 2020, 8, 1516. https://doi.org/10.3390/math8091516

Nedosekin A, Abdoulaeva Z, Konnikov E, Zhuk A. Fuzzy Set Models for Economic Resilience Estimation. Mathematics. 2020; 8(9):1516. https://doi.org/10.3390/math8091516

Chicago/Turabian StyleNedosekin, Alexey, Zinaida Abdoulaeva, Evgenii Konnikov, and Alexander Zhuk. 2020. "Fuzzy Set Models for Economic Resilience Estimation" Mathematics 8, no. 9: 1516. https://doi.org/10.3390/math8091516

APA StyleNedosekin, A., Abdoulaeva, Z., Konnikov, E., & Zhuk, A. (2020). Fuzzy Set Models for Economic Resilience Estimation. Mathematics, 8(9), 1516. https://doi.org/10.3390/math8091516