1. Introduction

Network modeling in social and economic processes, either analytical- or simulation-based, has demonstrated its importance in scientific literature produced in the last two decades (see [

1,

2] for a general review of related theory, methods, and applications), and the analysis of the emergence of complex and heterogeneous connectivity patterns in many sociotechnical systems has been a hot topic in recent years (see [

3] and references therein). Moreover, in the context of complex networks, the study of processes of epidemic spreading plays a crucial role (see [

3] for an interesting review of the literature).

Recently, different macroprudential policies involving the analysis and control of credit risk have been based on network models [

4,

5], and the main point is, basically, the assessment of financial risk by focusing on key structural vulnerabilities that may expose the system to significant stress. Indeed, modeling the credit risk on networks defined by economic interactions in a coherent yet applicable manner is an important yet challenging problem. In fact, as usual, in many real-world problems, it is a typical multi-scale problem, ranging from the level of the credit portfolio of a single financial institution to a complex network of interacting clusters. Techniques coming from network theory have been applied in recent years to model the financial systemic risk correlated with the phenomenon of contagion. These techniques have shown interesting potential in assessing key features of dynamics, basically with the aim of assessing whether the application of complex system methods may allow the anticipation, avoidance, or mitigation of the spreading of systemic credit risk.

In this paper, we propose a model in which each financial institution representing a node of a financial network is modeled as a portfolio of risky assets. The impact of the structure and diversification of financial institutions’ portfolios is very well known. Indeed, a shock is more likely to lead to failure of the institution if its asset concentration is high. One of the main focuses of our work is based on the simple observation that the susceptibility of the system to shocks is likely to be affected more when the asset and liability portfolios of the other institutes in the complex network of interactions are more alike. The main goals introduced here are to explore resilience of the structure to systemic risk and to fully understand the functioning of the banking system as a balance between competitiveness and stability [

6,

7,

8]. Both analyses aim to exploit the role of potential regulations in reducing systemic risks, remembering that competition in banking is important, because any misbehavior has implications on economic growth. In the scientific literature in this field, authors are concerned with the effect of complexity plus homogeneity, which often does not allow stability; on the contrary, it may lead to fragility. Moreover, connectivity may enhance risk dispersion. To address this issue, we exploit numerical simulations to explore the role of connectivity. Basically, numerical simulations are designed to compare the spread of contagion of non-performing loans on a random network characterized by different levels of connection probability, i.e., a level of connectivity ranging from low to high and on core-periphery networks with different ratios between the core and periphery nodes. The core-periphery network structure is chosen because of its representativeness of most real financial networks (see [

9,

10] for some recent contributions to the scientific literature).

As stated in a recent paper [

11], the use of random graphs is motivated by the unobservable nature of real-world financial networks. Since the underlying financial network cannot be observed exactly, a probabilistic framework is needed.

The network approach enables one to use the self-organizing, adaptive nature of such systems. We attempt to analyze the extent of the underlying network structure on the level of systemic risk.

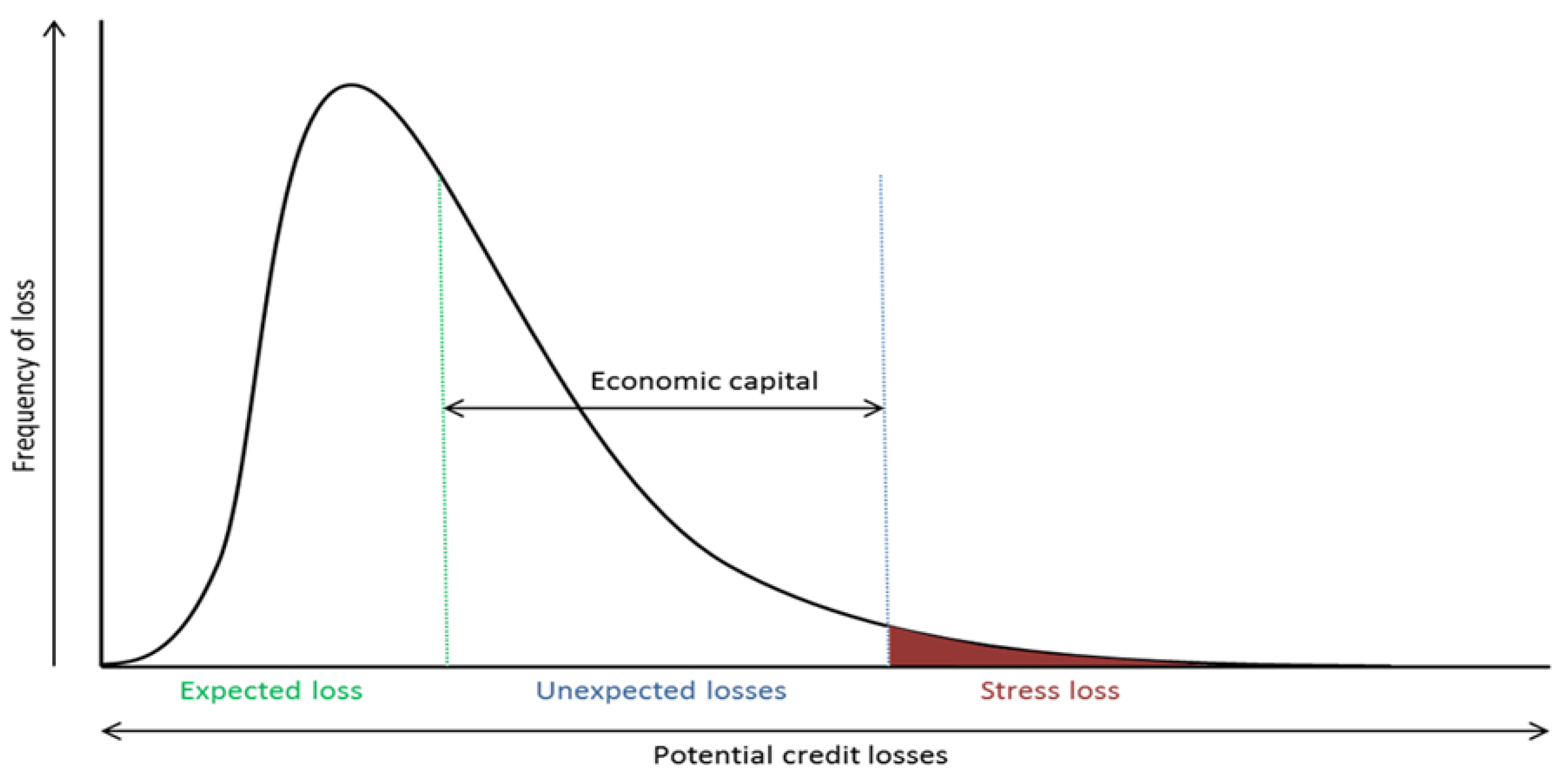

The paper is organized as follows. In

Section 2 we introduce credit risk by discussing the probability density function of credit losses. Moreover, we discuss the Vasicek model which provides the basis of the fundamental regulatory laws [

12]. In

Section 3, we model an interbank network affected by systemic and idiosyncratic risks, where the initial condition for each node, i.e., for each bank in the network, depends on each individual asset structure. We explore the contagion dynamics over different networks’ architectures with the main goal being to understand the impact of the network structure on the systematic part and on the idiosyncratic part of the risk in the Vasicek loan portfolio value model. Linkages among financial institutions represent, in the context of our model, credit swaps. The spreading of risk in the network is modeled in the framework of epidemic processes in complex networks [

3] with the novelty, with respect to other models in the related literature, of having split credits between a group subject to systemic risk and another subject to idiosyncratic risk, following the Vasicek model.

Section 4 is devoted to some numerical experiments aimed at analyzing the dynamics of systemic risk on different topological structures of networks. Finally, a short section of concluding remarks closes the paper.

3. Credit Risk Contagion on Networks

Linkages among financial institutions appear to greatly influence the dynamics of the spreading of credit risk; moreover, interconnectedness seems to crucially affect stability. The theory of networks seems to be the more appropriate language to characterize linkages and their related dynamics. Financial networks [

21] help to understand how externalities move along financially related structures and may build up to systemic risk, especially when incomplete information and incomplete risk markets have to be considered [

22].

Originally, the connection topology has been assumed to be regular or completely random ([

23]). Many real-world networks, however, can be considered to be living in between these two extremes. Small-world networks are regular networks “rewired” to introduce increasing amounts of disorder. These networks can be highly clustered, like regular lattices, with small characteristic path lengths, like random graphs [

24]. Another important branch of this field regards the optimization of connectivity of financial systems [

25]. We do not address this issue in the present paper, but we plan to address this issue within the context of the proposed model in our future research.

A network of N nodes and L links is fully characterized by its binary or weighted adjacency matrix . The binary matrix is such that the entry is simply 1 or 0 depending on whether the and nodes are connected or not. For a weighted matrix, each entry is equal to the weight of the link between i and j. In the case of a directed graph, the links are oriented from node i to node j, so that . For undirected graphs, the adjacency matrix is symmetric.

In our model, each node is a financial institution represented by a portfolio of risky assets, and the linkages among nodes are due to financial relations by means of credit swaps between the two linked institutions. We model the network as an undirected binary graph to focus on the basic influence of the architecture of the network on the contagion dynamics.

Real-world networks are usually very different from regular lattices. They are mostly heterogeneous and exhibit dynamic self-organization phenomena, typical of complex systems. The patterns defined by the connectivity properties of real-world networks strongly affect the evolution of epidemic, reactive-diffusive processes of contagion. The statistical distributions related to the features of real-world networks are often heavy-tailed, and this property is very important with respect to risk.

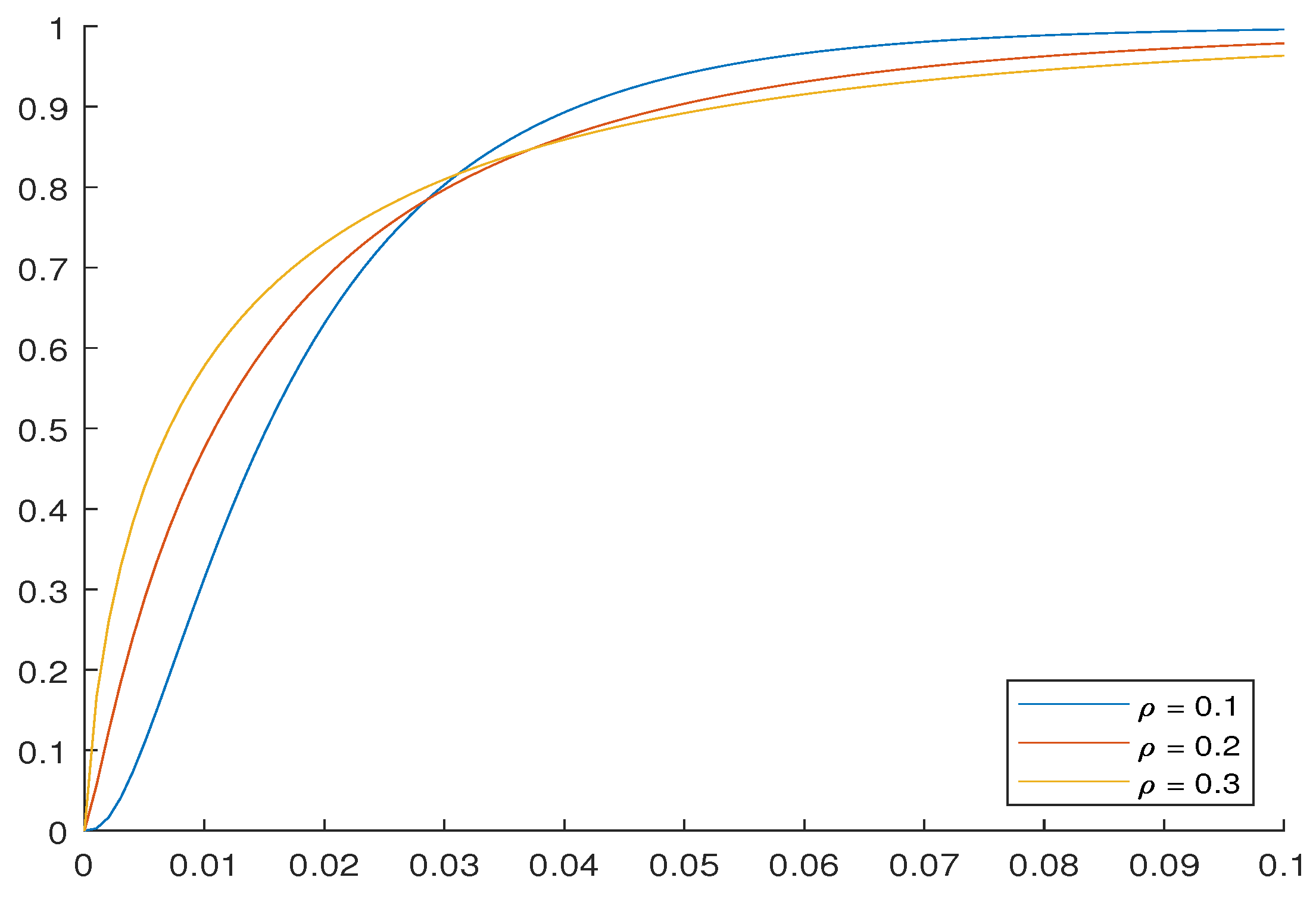

We define the

risk of a financial institution by applying the Vasicek model and introducing a random variable for the

i-th bank as

with

cdf being a standard normal random variable.

z is the

systemic risk factor, and

are the idiosyncratic ones; they are both standard normal random variables. Finally,

is the risk correlation between two different banks, and

is the probability of failure of the

i-th bank [

8]. Failure happens when

. One can easily derive (see [

8])

From Equation (

7), it is clear that for

, there is no systemic risk and failures are statistically independent. On the contrary, when

, we only have systemic risk, and failures are perfectly correlated. In choosing

one can follow Basel II [

12] by setting

with

being the probability of default of firm

i over one year, ignoring credit contagion effects. Quantities

are predicted from tables provided by rating agencies.

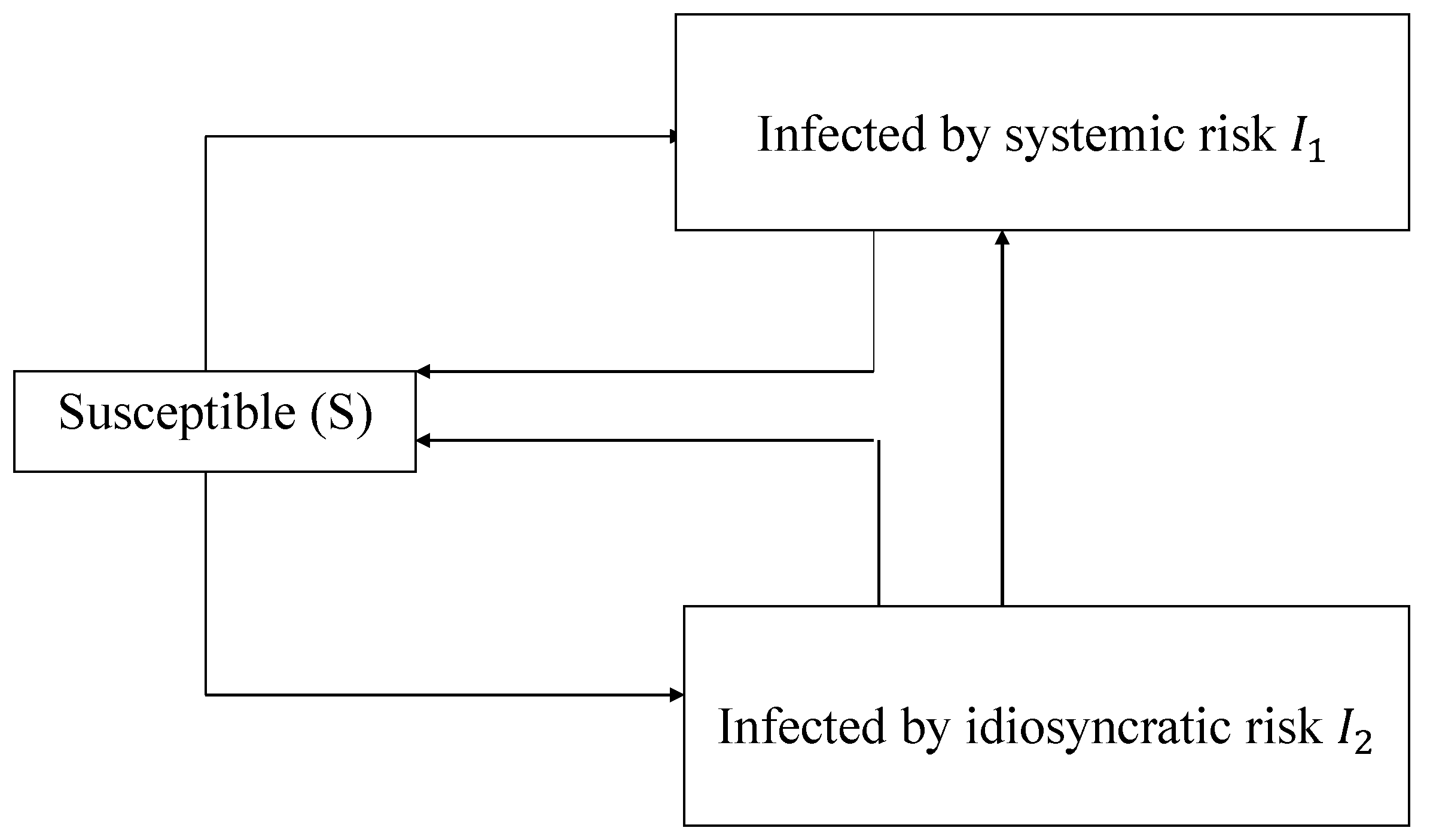

Spreading of Systemic Risk Using the SIIS (Susceptible-Infected1-Infected2-Susceptible) Model

The epidemic modeling metaphor has been widely used to describe a large range of different phenomena which can be conceptually thought of as contagion processes [

26]. That is why epidemic models are widely diffused and represent a cornerstone that crosses different disciplines. Moreover, their efficiency has been improved in recent years due to the integration of large-scale datasets. Epidemic models are constructed to describe the evolution of the contagion process within a population. In our paper, the population is structured into a network architecture, inserting into the wide stream of scientific literature unfolding dynamical processes in complex networks [

3].

The assessment of credit risk in large banks has changed consistently in the last few years. It used to be common to manage the origination process (evaluation of whether a new business should be accepted or rejected), but now it can be managed by using credit derivatives and securitization with loans and bonds as collateral assets (CLOs, collateralized loan obligations; CBOs collateralized bond obligations; CDOs collateralized debt obligations).

This phenomenon, while it may limit the idiosyncratic risk, can be a source of systemic risk; in our model, it is represented by assuming the possibility of a transition from assets infected by idiosyncratic risk to those infected by systemic risk.

The agents of our model are risky assets belonging, for each node, to a bank’s portfolio. Contagion occurs through infection by non-performing loans.

We approach the mathematical representation of credit risk spreading in an interbank network by adopting the simplest definition of epidemic dynamics, which considers the population as fixed, ignoring migration both among the nodes and among birth or death processes. Compartmentalization is a derivation of the simplest two-state susceptible-infected-susceptible (SIS) model, a cornerstone in epidemic spreading modelization and, on the other hand, a widely used modeling scheme for knowledge and information diffusion within social systems. It is worth mentioning here that the heterogeneity of agents is an important issue in this research field, one addressed by the authors in [

27]. Very interesting multi-scale approaches have also proposed by different papers by S. Havlin (see, for instance [

28]). However, it is not the scope of the present paper to include this effect in the model, as we mostly intend to focus on the effect of the network structure on the epidemic spreading of non-performing loans.

The classical approach divides the population into two classes: susceptibles (who can contract the disease) and infectious (who have contracted the infection and can be contagious). Then, one has to define the process governing the transition of agents from one class to another in order to describe the dynamic evolution of the process of contagion within the population. The classical SIS does not assume the possibility of becoming immune, thus undergoing a cycle of .

In our model, we extend the classical approach by dividing the population for each node into three classes: susceptibles

S, i.e., those that may be infected by credit risk, infectious1 (default fraction due to systemic risk)

, and infectious2 (default fraction due to idiosyncratic risk)

. Idiosyncratic risk can be considered to be endemic to a particular asset, depending, for instance, on fluctuations in the stock market or in the interest rates, and then it can be mitigated by diversification.

Figure 3 illustrates the transfer diagram for the SIIS model [

29] adopted here.

Both infected assets may recover to the susceptible state.

We define the process governing the transition of credits from one class to another when the population is structured into a network with the following system of ODEs (Ordinary Differential Equations):

where

,

, and

represent the populations of each compartment within node

i at time

t,

is the recovery rate, and

r is the contagion rate. The adjacency matrix

characterizes interrelations among the

N institutions, and its form determines the structure of the financial network.

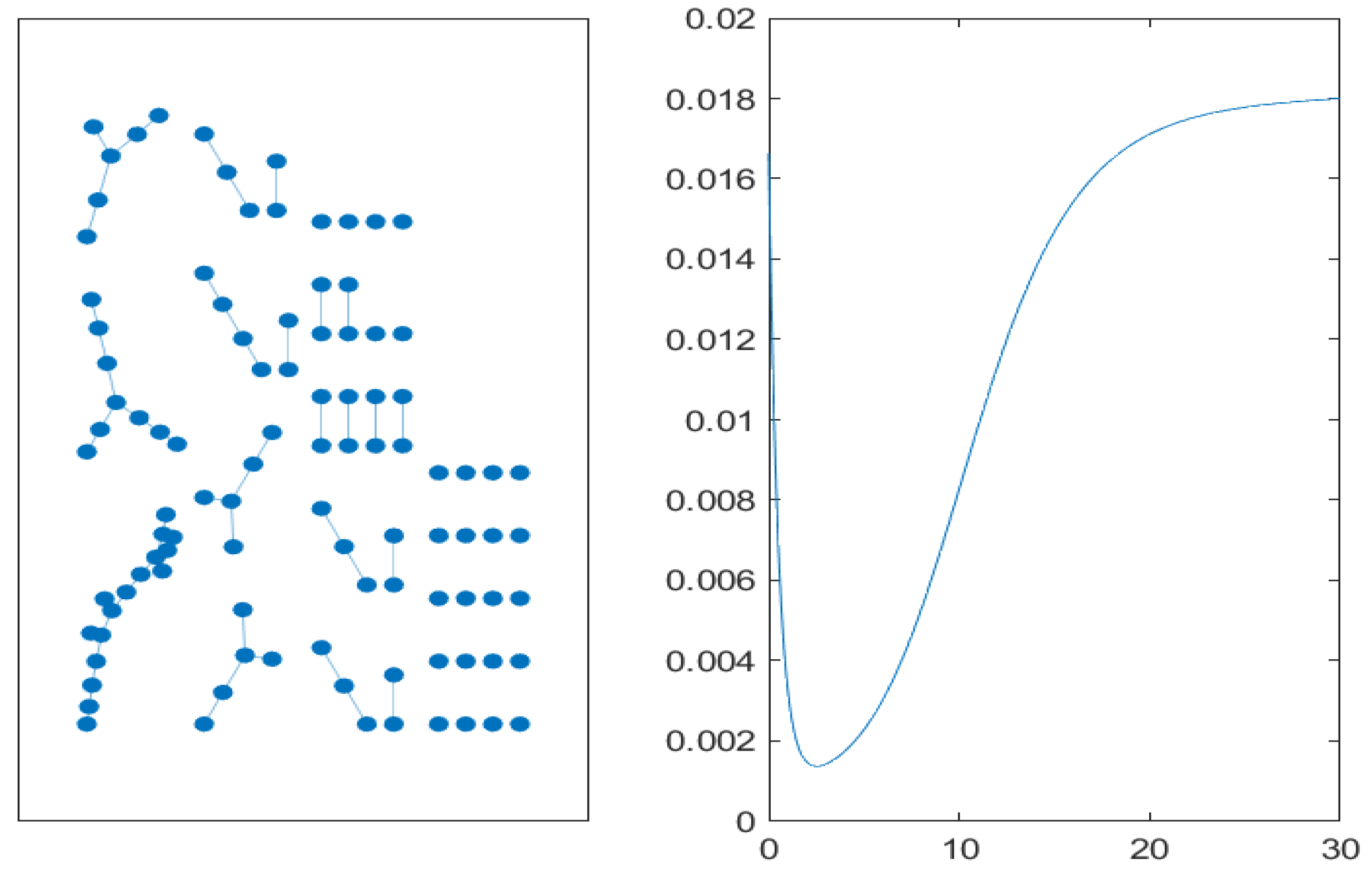

4. Numerical Experiments

In this section, we perform some numerical experiments with the aim of analyzing the dynamics of systemic risk on different topological structures of networks. We adopt the epidemic model splitting agents affected by idiosyncratic risk from those affected by systemic risk, as previously introduced. We aim to compare the effect of credit risk contagion on two different network structures: the basic model for random graphs, i.e., the Erdös–Rényi for different significant connection probabilities, the core-periphery network for different levels of balance between core nodes and periphery nodes [

11], and the small-world networks (Watts–Strogatz networks) for increasing rewiring probability values. In our numerical experiments, we consider a network with 100 nodes in all simulations (it is worth noting that the number of nodes does not influence the results), each of them characterized by a given portfolio with random numbers of assets and correlations. Then, we evaluate the 5% VaR (Value at Risk) of the assets as infectious. The time evolution of the epidemic process is then determined by the system of Equation (

10), and during the time evolution, we analyze the mean value of assets subject to systemic risk when different topological structures of the underlying network are assumed. We use the fixed recovery rate (

) and contagion rate (

) to emphasize the effect of the network structure on the dynamics. We use an exponential distribution to characterize the initial distribution of assets affected by systemic risk on each node, and we evaluate the credit risk at the 5% level by calculating the related percentile. Given this setting, we run three different simulations of the dynamics of contagion on the random network structure on the core-periphery structure and on the small-world network, in each case assuming the model of contagion (10). The basic parameters of the model of epidemic spreading, i.e., the recovery rate and the contagion rate, are the same for all network structures for the sake of a better comparison.

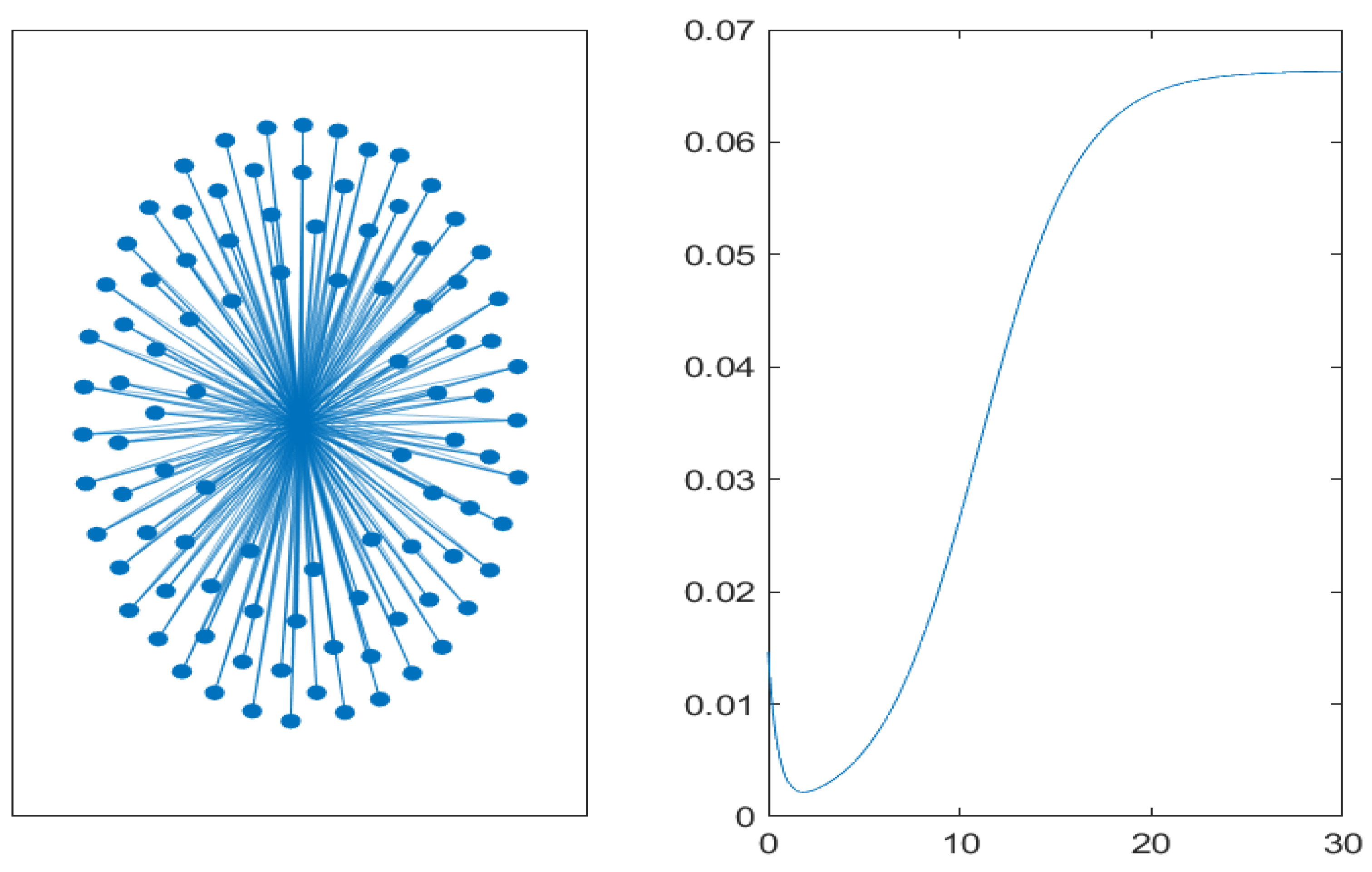

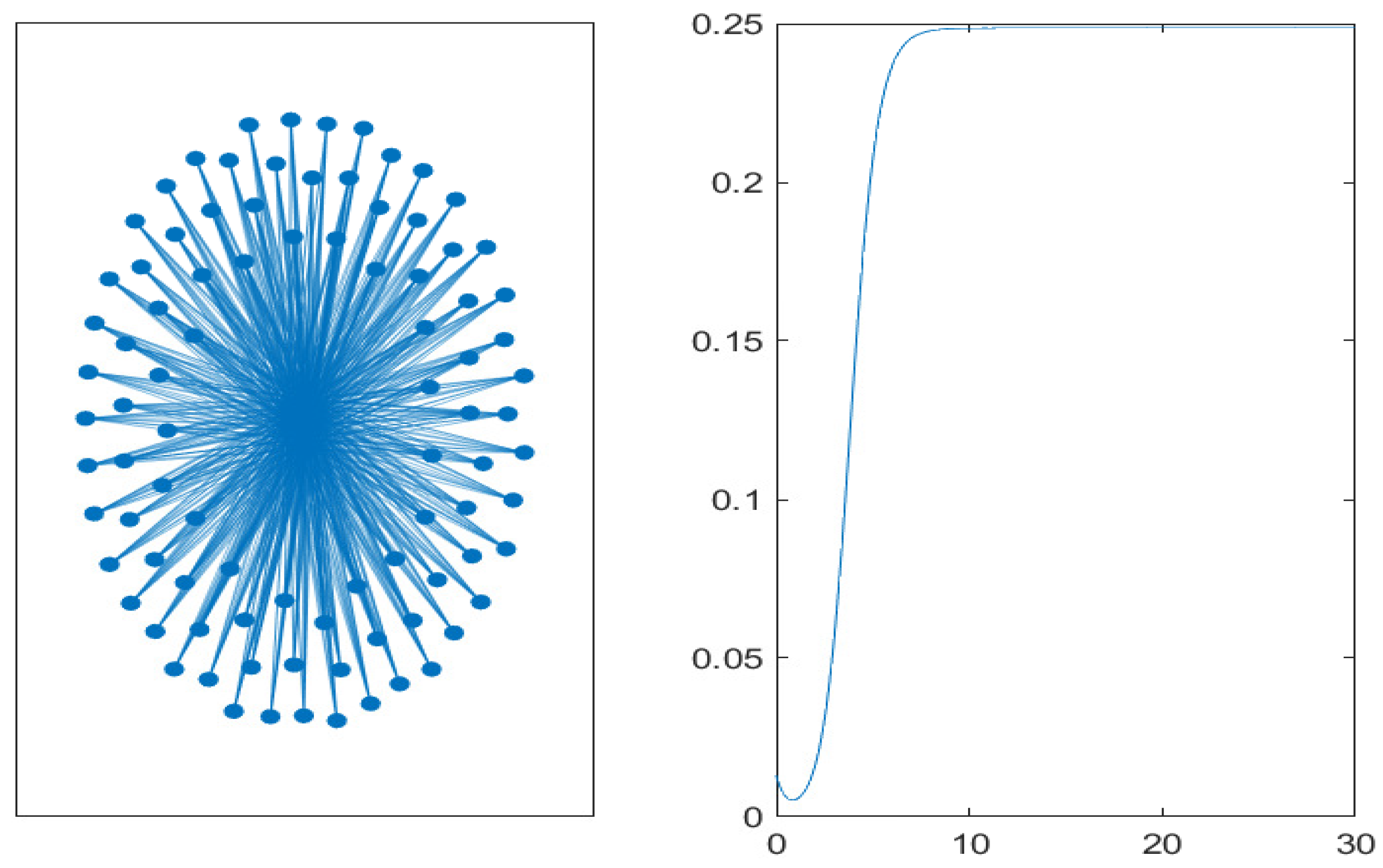

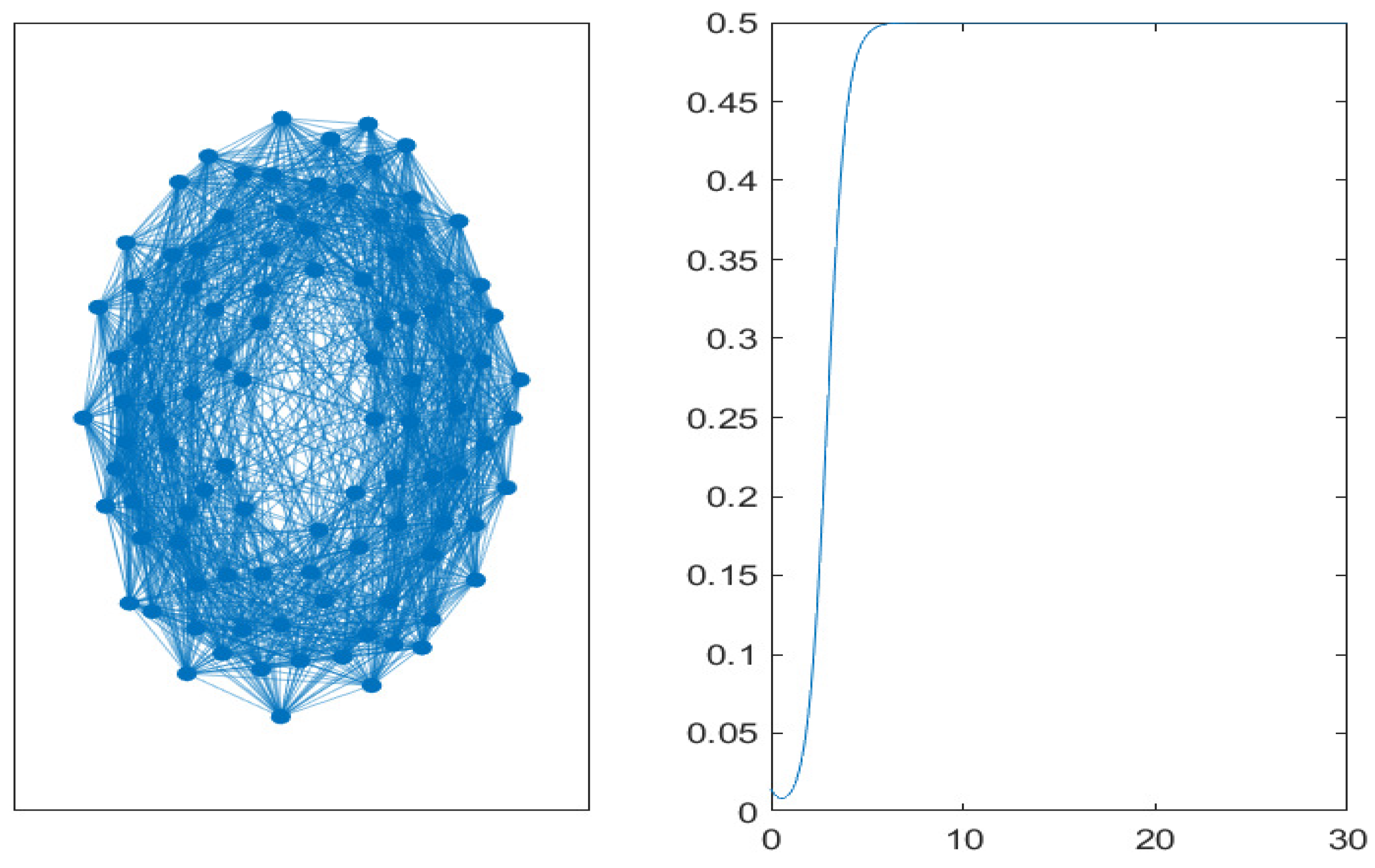

Each simulation adopts different connection probabilities for the Erdös–Rényi network, which represent typical threshold values. The first value (

) is related to the appearance of the first linkages, the second (

) is the value related to the existence of a giant component, and the third one (

) provides a connected network, with a few nodes representing exceptions. For each simulation, we evaluate the dynamics of the mean value of assets subject to systemic risk on the network whose graphical representation is provided on the right-hand side of each figure (codes available upon request to the authors). In

Figure 4, we use a realization of an Erdös–Rényi random graph with a connection probability of

(represented on the left) to simulate the SIIS model given by Equation (

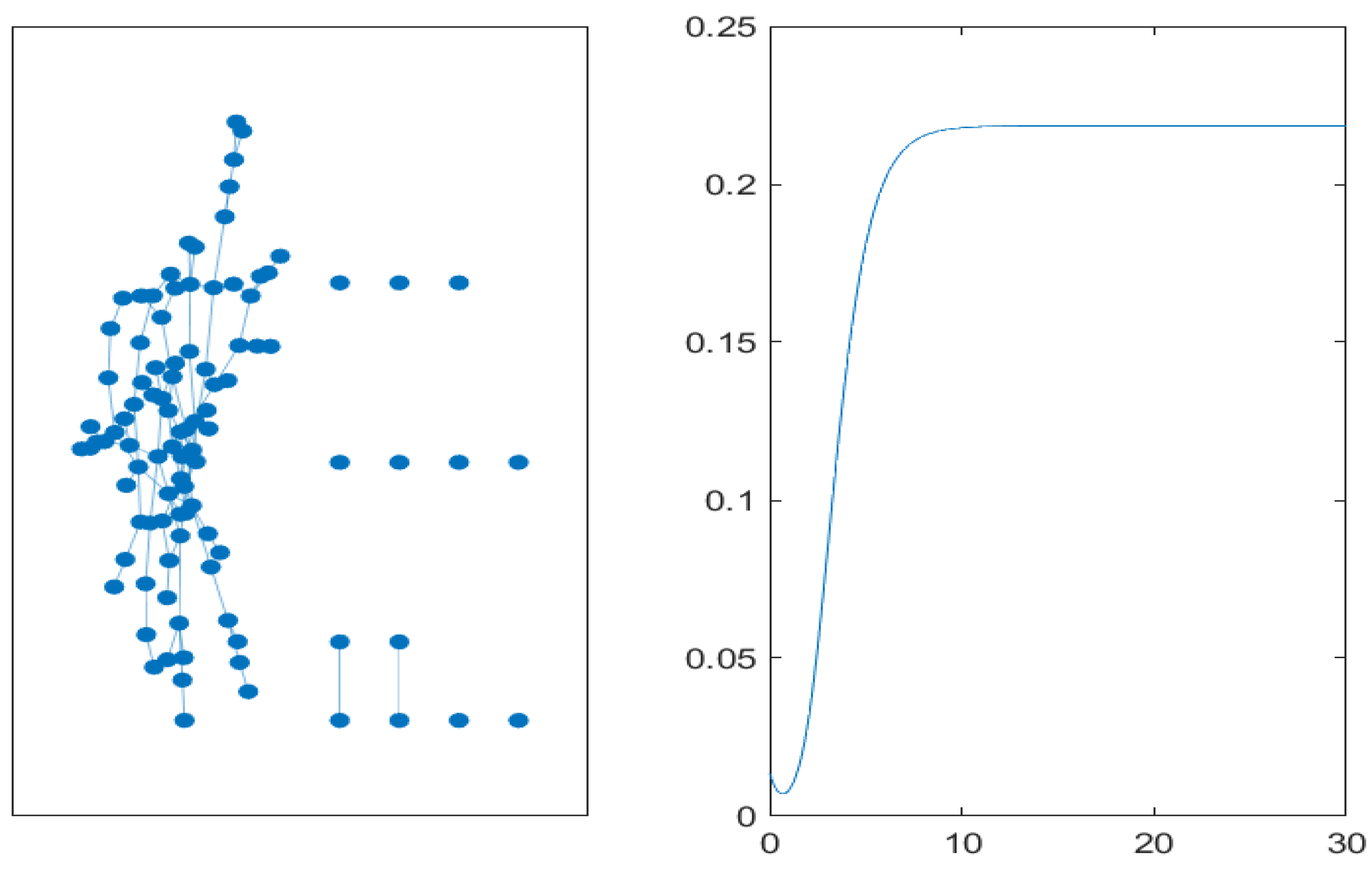

10). In the right part of the figure, we report the time evolution of the mean of the subset of the population infected by systemic risk (non-performing loans). After a transient, a steady-state value of about 1.8% is attained for the whole population. The value appears quite low in accordance with the low level of network connectivity. In

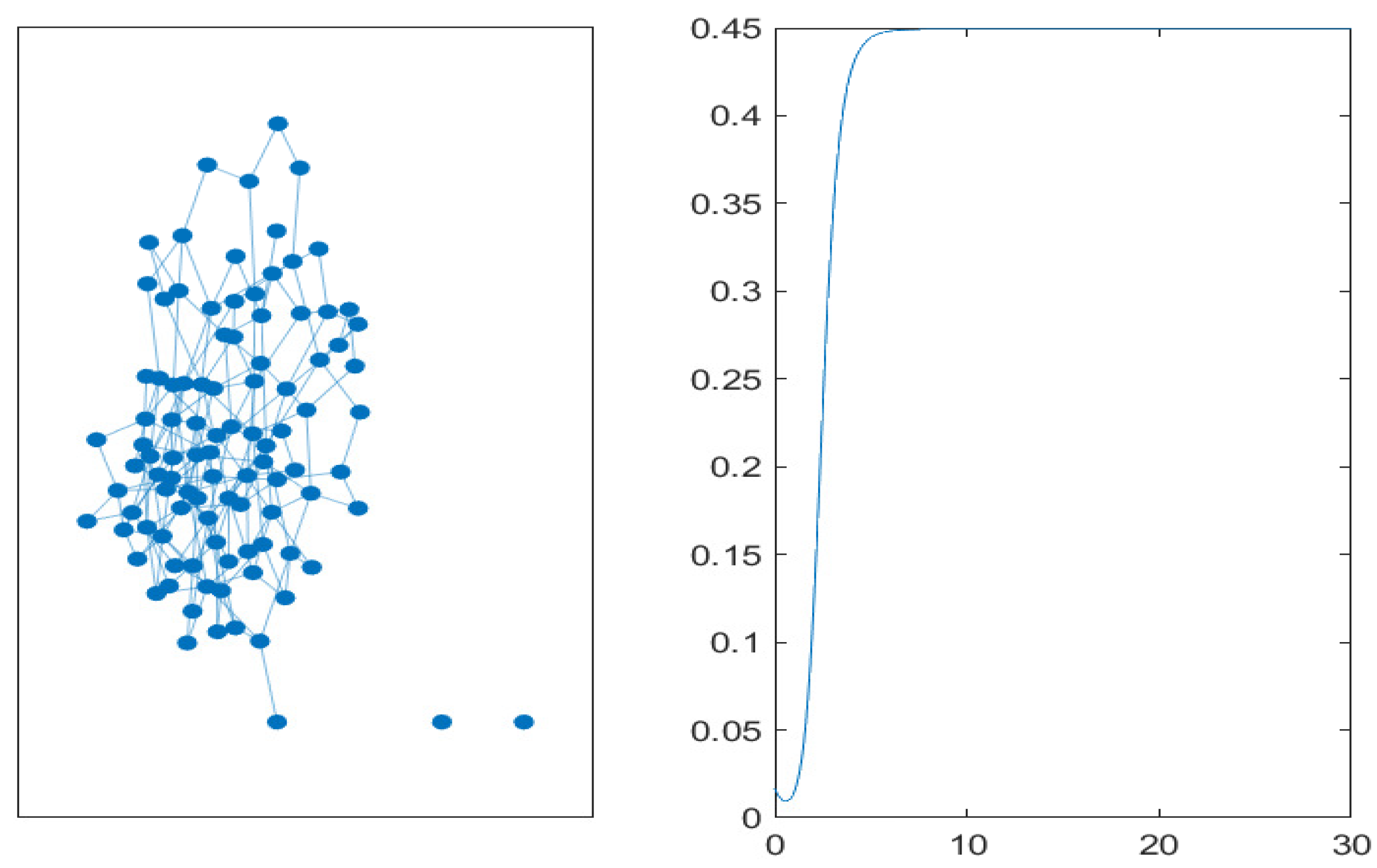

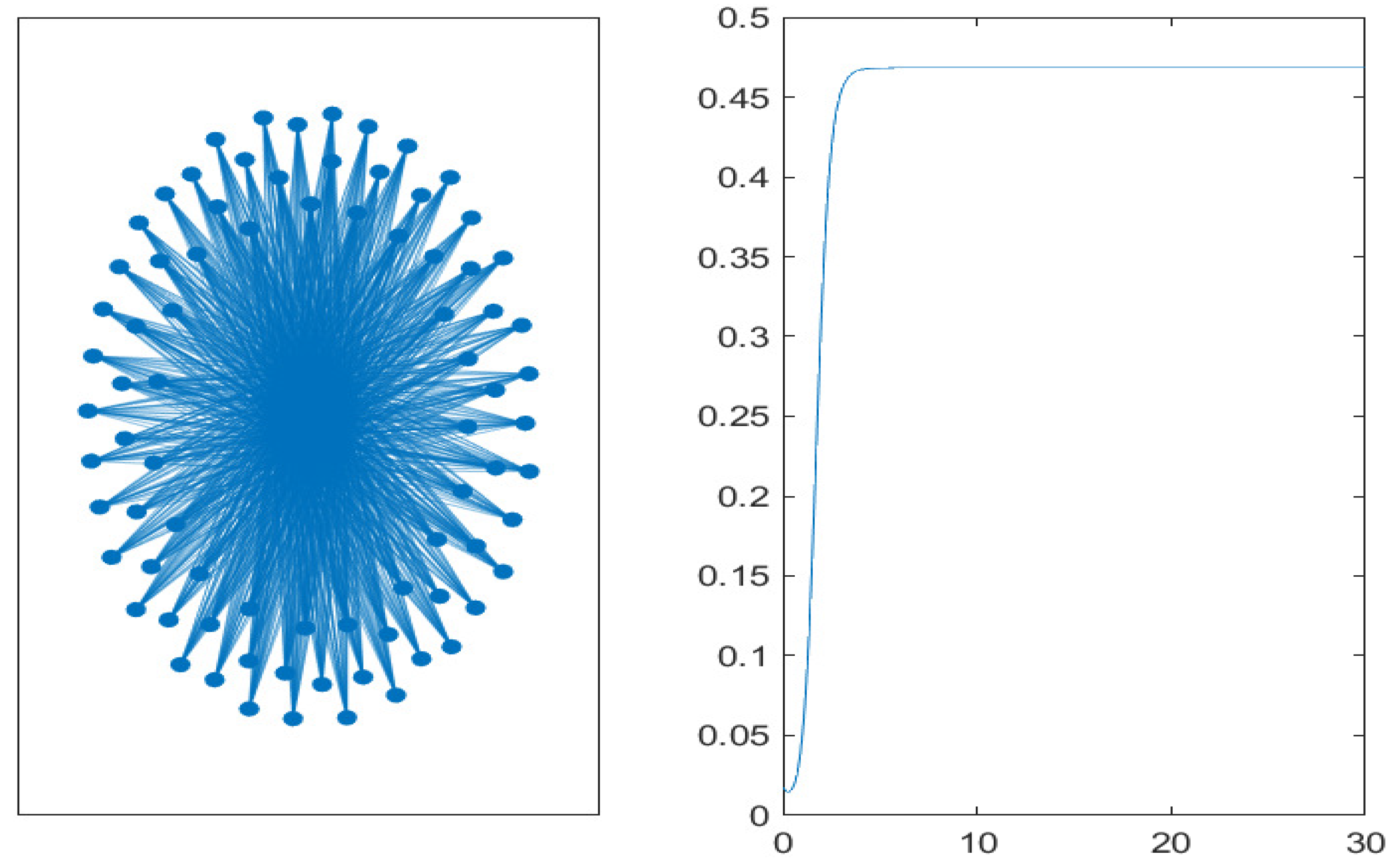

Figure 5, an analogous simulation on a core-periphery network is performed. We use five core nodes over the total number of nodes corresponding to a low connectivity level as well. Although the steady-state value is higher, a similar transient with respect to the low-connectivity random network is observed. To end this first part of the simulations, i.e., with low connectivity, we run the model on a small-world network by increasing the rewiring probability to

(ring network); results are shown in

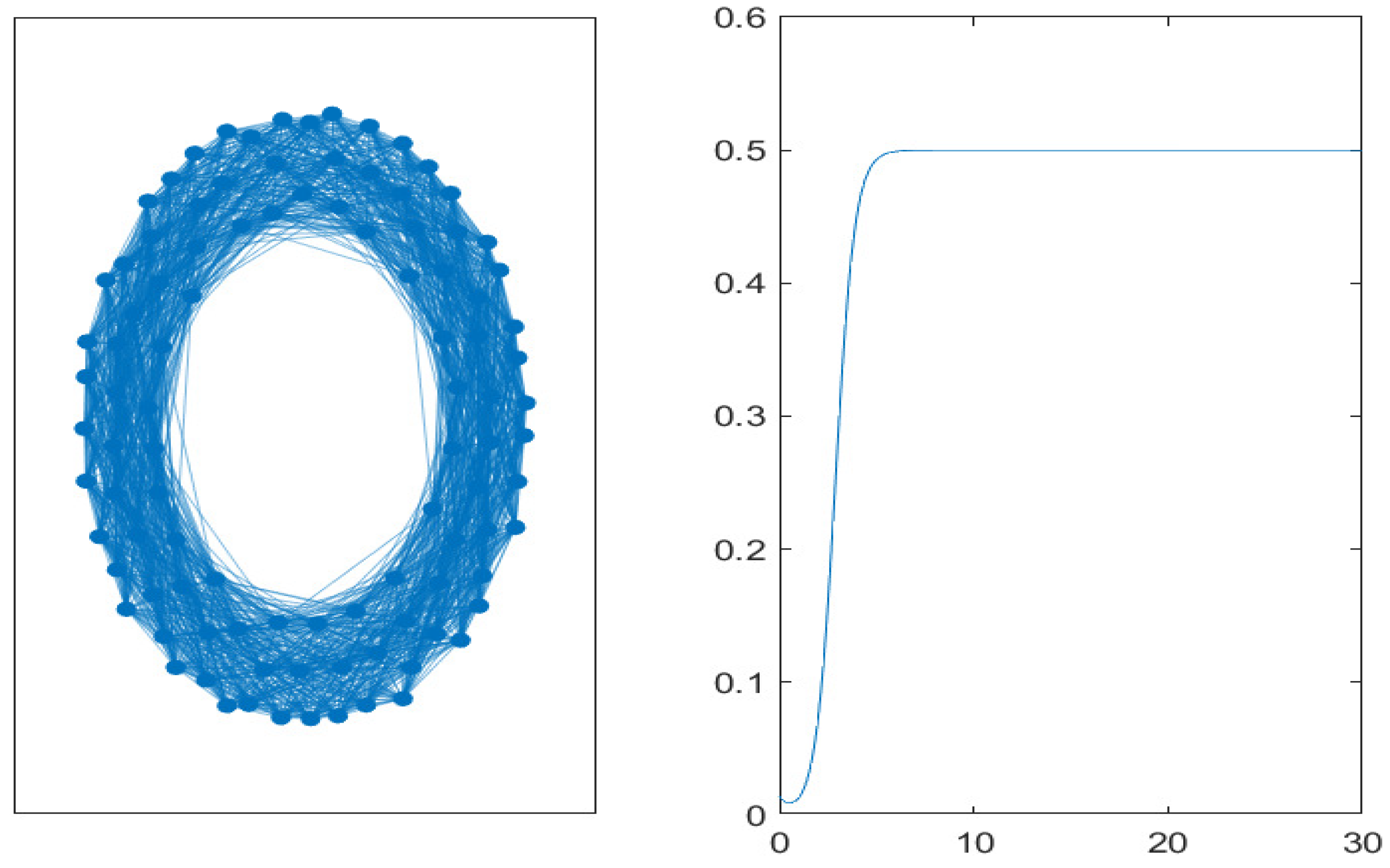

Figure 6. In this case, both the rate of increase and the mean values of the non-performing loans are much higher than in the previous network structures. Simulations with higher connectivity values are reported in

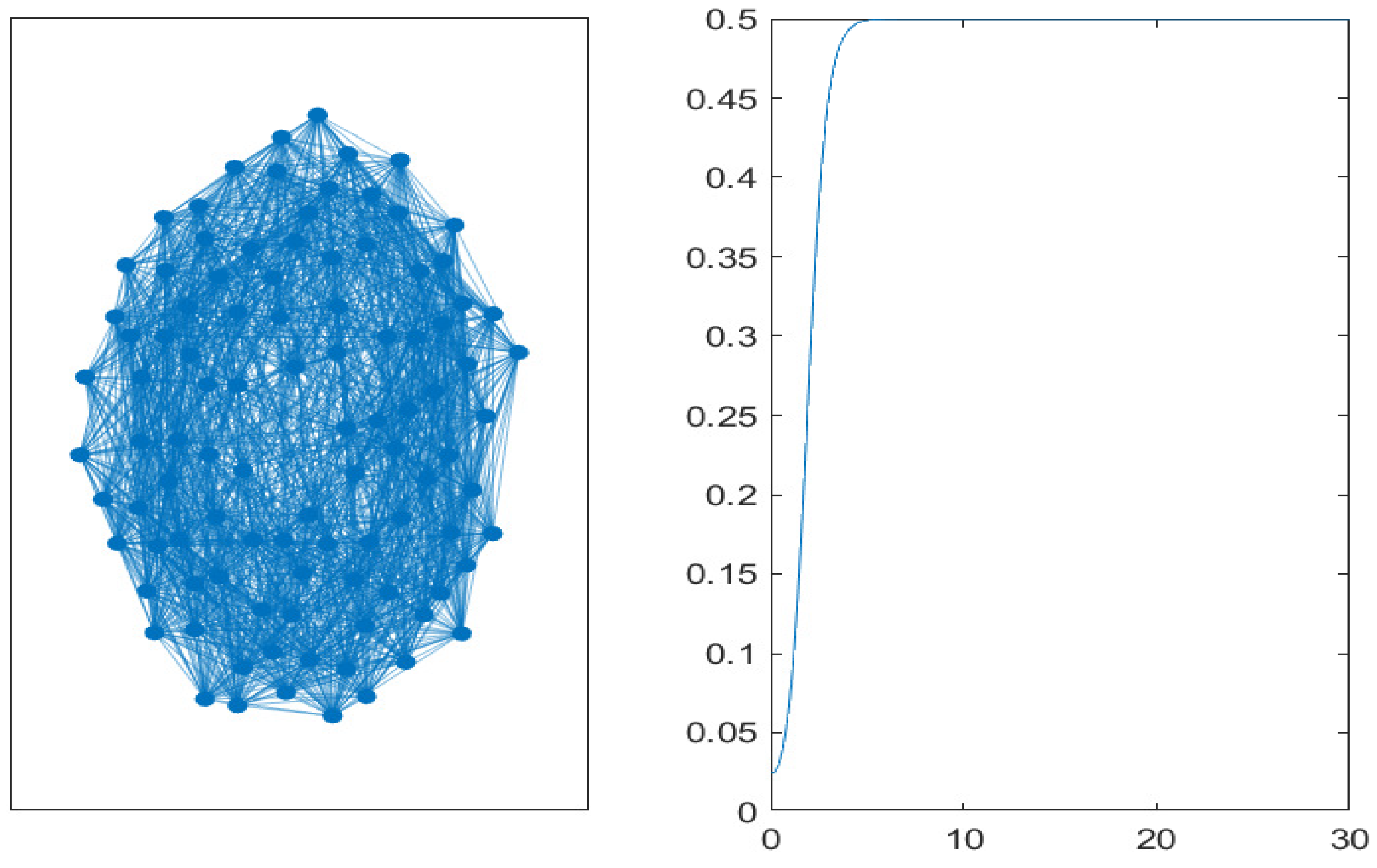

Figure 7 and

Figure 8 for the random and core-periphery networks, respectively. It is interesting to observe that in this case, similar transients can be observed, even with different steady-state values. Also, the increased connectivity leads to closer steady-state values in the two network representations. In

Figure 9, we run the model on a small-world network with a slightly higher rewiring probability of

. Also, in this case, both the rate of increase and the mean values of non-performing loans are much higher than in the previous network structures.

Finally, in

Figure 10,

Figure 11 and

Figure 12, networks with high connectivity are simulated. Again, the duration of the transient phase is quite similar in the two representations, and the steady-state values are closer. In the small-world network with a rewiring probability of

, the steady-state value of non-performing loans is similar to the previous simulations, but the rate of increase is even higher.

In summary, from the point of view of the epidemic spreading of systemic risk, the random graph, usually considered to be a “benchmark ”network topology structure, can be considered to be being almost equivalent to the core-periphery topological structure, in the case in which the probability of linkages in the random network is related to the ratio between the core and the peripheral nodes. Specifically, by increasing the probability of linkages in the random network, the effects on the long-term solutions are analogous, both in terms of the time interval needed for stabilization and in terms of the average long-term value for the systemic risk-infected assets based on the results obtained by increasing the number of core nodes in the core-periphery structure. The small-world network has a quite different behavior characterized by a higher positive rate of infectious spreading by non-performing loans in the structure.

5. Conclusions and Research Perspectives

When assessing the risk of credit portfolios as well as investment portfolios, banks should look not only at the risk of individual exposures but also at possible exposure correlations. There have been different attempts to measure risk at the level of the banking system [

30]. Our paper enters this stream of research by adopting a model of risk contagion which distinguishes between systemic and idiosyncratic risk. Usually, the probability of systemic risk is thought of in terms of the fraction of financial institutions whose portfolios are affected by systemic risk. We numerically explored the long-term solutions of a model of epidemic credit risk spreading on networks for two different topological structures with different levels of connectivity. Our numerical results show that connectivity increases the spreading of assets infected by systemic risk in the network, in the case of random graphs. In the case of a core-periphery structure, the spreading is controlled by diminishing the number of core institutions. The numerical experiments show that the spread of credit risk is analogous in network structures of the Erdös–Renyi random type and core-periphery type when the probability of linkages in the first type is compared to the ratio of core nodes and periphery nodes. It is worth noting that the quality and specific category of credit risk should be defined; we did not address this issue in the present paper, as our model focuses on the network properties. Our research plans are to extend the model by providing specifications regarding the risk categories. Of course, specifying risk implies the use of directed networks, i.e., one can use the same network structure but with unilateral links with the direction determined by the quality of the risk. Moreover, heterogeneity in size (see the seminal review [

31,

32], not only in centrality, might be worth analyzing using a future extension of the proposed model.

One research perspective would be to analyze the propagation of asymmetric information, i.e., the consequences of information imperfections propagating through the structure, and how this propagation may affect the network’s performance in terms of resilience. Resilience is defined in many different ways; one definition is the ability of structures, which have been impacted by external shocks, to recover and adapt to new conditions. In any case, thinking about resilience requires the assessment of potential future threats at the scale of systems, rather than at the scale of individual components. As proposed by Helbing [

33], a useful approach for influencing complex systems, is to support the self-organization and self-control of the system, rather than adopting controlling actions in the conventional way. This approach would lead to a more flexible and adaptive system that is more able to cope with challenges coming from external perturbations. One may benefit from some basic characteristics of complex systems which through self-organization, can be adapted to the environment and are often robust and resource-efficient. For instance, decentralized coordination strategies, which have already been successfully applied in traffic control, may be more efficient than centralized ones. There is also the possibility of decompartmentalization of a network into weakly coupled, or even uncoupled, sub-networks. Data could be retrieved from the literature. For instance, an interesting source is provided in [

34], where authors construct a matrix of interbank loans for Switzerland based on known marginal loan distributions. Simulated experiments, analyses of real-world financial data, and theoretical insights may improve regulations, increasing financial stability.