Blockchain for Mass Customization: The Value of Information Sharing Through Data Accuracy by Contract Coordination

Abstract

1. Introduction

1.1. Background and Motivation

1.2. Major Findings

1.3. Contribution Statement, Feature, and Structure

2. Literature Review

2.1. Mass Customization in Supply Chain Management

2.2. Information Sharing with Blockchain Service

2.3. Contract Coordination in Supply Chain Management

2.4. Discussion of the Existing Literature

3. Model

3.1. Scenario Description

3.2. Model Assumptions

- (1)

- According to the literature [40,41], the retailer offers two types of products to end consumers. Specifically, the consumers’ perceived value is ; their utility from standard product A and customized product B offerings are and , respectively. Note that the decision variables and are the two types of product prices in the environment of standard production and mass customization, respectively. The parameter represents the valuation difference between products A and B. This design is based on product A to analyze the competitive relationship between customized products and standard products. Finally, the parameter represents the accuracy level of data sharing by the blockchain system supporting retailer.

- (2)

- The retailer has access to a demand signal , which is an unbiased estimator , and decides whether to share it with the manufacturer before the demand is observed. According to [42,43], the signal accuracy is defined as and demand is forecasted as follows: . is the variance of market information. This information structure is common knowledge.

- (3)

- Following the literature, we consider that the service cost involves an operational cost of the unit product () and an investment cost () [44,45,46]. The parameters and belong to the cost parameter, which satisfy with . Specifically, we set to show the main discussion. Moreover, retailers choose to invest directly in blockchain technology to ensure the transparency of the supply chain, reduce the problem of counterfeit goods in the supply chain, and improve the trust of consumers. For example, JD company has also achieved a lot of explorations in the application of blockchain technology, especially in supply chain management, commodity traceability, and anti-counterfeiting. It has developed its own blockchain system to strengthen its control and traceability of commodity quality, avoid the circulation of counterfeit goods, and ensure that consumers can obtain real information.

- (4)

- We assume rational economic agents who maximize their benefits to obtain maximum benefits or maximum consumption experience.

3.3. Utility and Profit Functions

3.4. Decision Sequence

4. Basic Analysis

4.1. The Influence of Blockchain Technology on Different Factors

- (1)

- The impact of blockchain services on the wholesale price:

- (2)

- The impact of blockchain services on the retail price:

- (3)

- The impact of blockchain services on the product quantity:

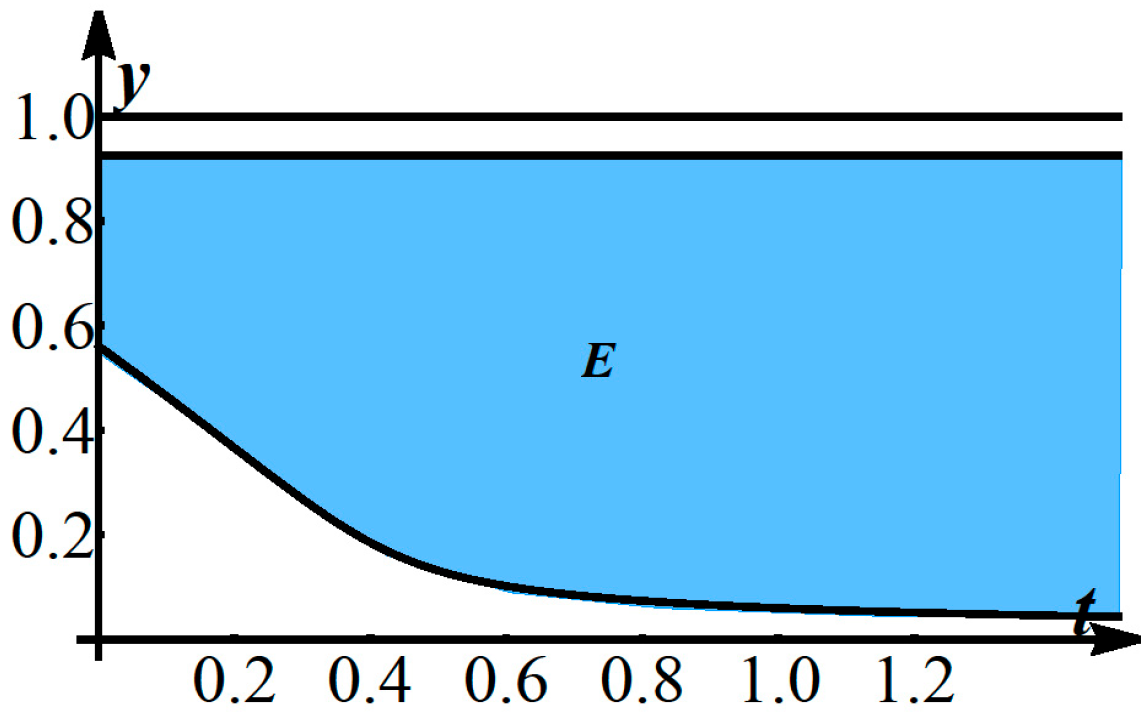

4.2. The Influence of Information Cost for Sharing Behavior

- (1)

- ; .

- (2)

- .

4.3. Profits for Different Shareholders

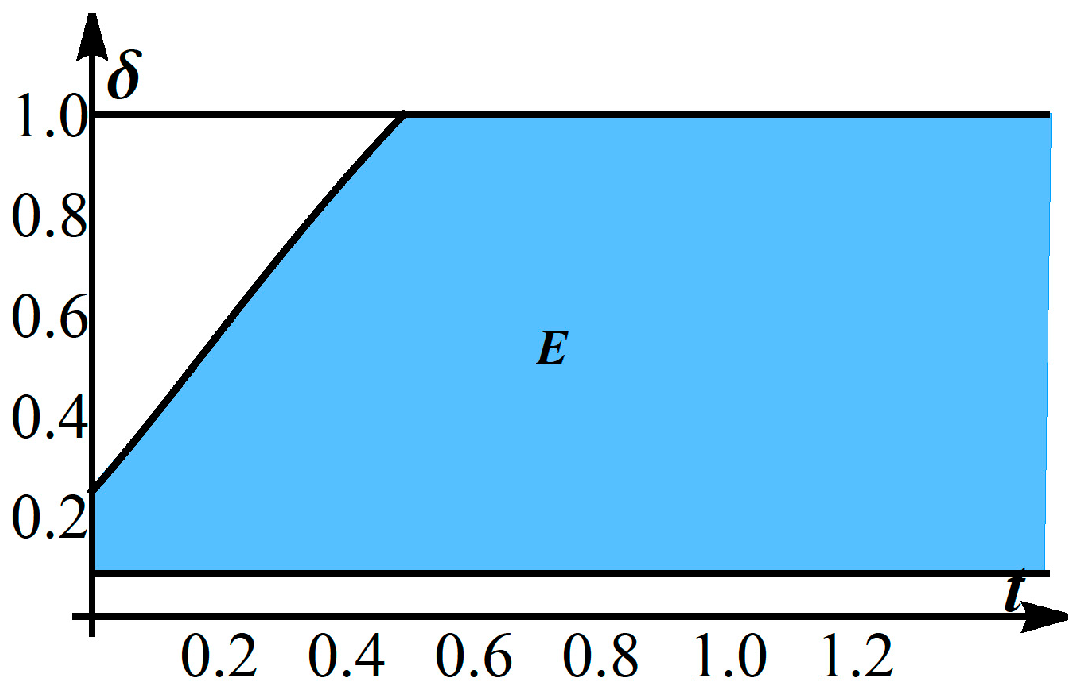

4.4. Contract Coordination for the Equilibrium Strategy

4.4.1. The Cost-Sharing Contract

- (1)

- ; ; ; and .

- (2)

- .

4.4.2. The Discount Coupons

4.4.3. The Discount of the Wholesale Price

5. Extensions

5.1. The Case of Unreal Product Quantity in Information Sharing

- (1)

- ; ; ; and .

- (2)

- An optimal increment of false output exists such that is satisfied when information is shared.

5.2. The Changes of Utility Function for Basic Analysis

5.3. The Optimal Strategy in the Case of an Uncovering Market

5.4. The Optimal Strategy in the Case of a Product with a Delay Strategy

- (1)

- When and : ; ; .

- (2)

- When : ; ; .

5.5. The Optimal Strategy in the Case of Additional New Technology

- (1)

- When and : ; ; .

- (2)

- When , , and : ; ; .

6. Discussion

7. Conclusions, Managerial Implications, and Limitations

7.1. Conclusions

7.2. Managerial Implications

7.3. Limitations and Future Work

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Basic Results

- 1.

- The supply chain does not use the solution of information sharing (N):

- 2.

- The supply chain uses the solution of information sharing (Y):

- 3.

- The supply chain uses the solution of information sharing in the case of cost-sharing (Y-C):

- 4.

- The supply chain uses the solution of information sharing in the case of discount coupons (Y-S):

- 5.

- The supply chain uses the solution of information sharing in the case of discount of wholesale price (Y-D):

- 6.

- The supply chain uses the solution of information sharing in the case of unreal product quantity (Y-R):

- 7.

- The new utility function in the case of non-sharing in the market information (N′):

- 8.

- The new utility function in the case of sharing in the market information (Y′):

- 9.

- The supply chain uses the solution of information sharing in the case of uncovering all the market share (Y-N):

- 10.

- The supply chain uses the solution of information sharing in the case of uncovering all the market share and cost-sharing (Y-N-C):

- 11.

- The supply chain uses the solution of information sharing in the case of uncovering all the market share and alliance (Y-N-CO):

- 12.

- The supply chain uses the solution of information sharing in the case of delay strategy (Y-DE):

- (1)

- (2)

- 13.

- The supply chain uses the solution of information sharing in the case of new technology of big data (Y-NEW):

Appendix B. Proof of Propositions

Appendix B.1. Proposition 1

Appendix B.2. Proposition 2

Appendix B.3. Proposition 3

Appendix B.4. Proposition 4

Appendix B.5. Proposition 5

Appendix B.6. Proposition 6

Appendix B.7. Proposition 7

Appendix B.8. Proposition 8

Appendix B.9. Proposition 9

Appendix B.10. Proposition 10

References

- Yetis, H.; Karakose, M.; Baygin, N. Blockchain-based mass customization framework using optimized production management for industry 4.0 applications. Eng. Sci. Technol. Int. J. 2022, 36, 101151. [Google Scholar] [CrossRef]

- Ganji, E.N.; Shah, S.; Coutroubis, A. Mass customization and technology functions: Enhancing market responsiveness. In Proceedings of the 2018 IEEE International Conference on Engineering, Technology and Innovation (ICE/ITMC), Stuttgart, Germany, 17–20 June 2018; 1–6. [Google Scholar] [CrossRef]

- Iarovyi, S.; Lastra, J.L.M.; Haber, R.; del Toro, R. From artificial cognitive systems and open architectures to cognitive manufacturing systems. In Proceedings of the 2015 IEEE 13th International Conference on Industrial Informatics (INDIN), Cambridge, UK, 22–24 July 2015; 1225–1232. [Google Scholar] [CrossRef]

- Karaköse, M.; Yetiş, H. A cyberphysical system based mass-customization approach with integration of Industry 4.0 and smart city. Wirel. Commun. Mob. Comput. 2017, 2017, 1058081. [Google Scholar] [CrossRef]

- Investopedia. Mass customization. Investopedia. Available online: https://www.investopedia.com/terms/m/masscustomization.asp#:~:text=Mass%20customization%20allows%20a%20customer,a%20semi%2Dcustom%20final%20product (accessed on 5 September 2022).

- Singh, S.; Sarin, S.C. Modeling and analysis of a new production methodology for achieving mass customization. Int. J. Prod. Res. 2024, 62, 183–203. [Google Scholar] [CrossRef]

- Lee, G.; Kim, H.Y. Human vs. AI: The battle for authenticity in fashion design and consumer response. J. Retail. Consum. Serv. 2024, 77, 103690. [Google Scholar] [CrossRef]

- Mindas, M.; Bednar, S. Mass customization in the context of Industry 4.0: Implications of variety-induced complexity. Adv. Ind. Eng. 2016, 21, 21–38. [Google Scholar]

- Aheleroff, S.; Philip, R.; Zhong, R.Y.; Xu, X. The degree of mass personalisation under Industry 4.0. Procedia CIRP 2019, 81, 1394–1399. [Google Scholar] [CrossRef]

- Ouyang, L.; Yuan, Y.; Wang, F.-Y. A blockchain-based framework for collaborative production in distributed and social manufacturing. In Proceedings of the 2019 IEEE International Conference on Service Operations and Logistics, and Informatics (SOLI), Zhengzhou, China, 6–8 November 2019; pp. 76–81. [Google Scholar] [CrossRef]

- Song, Z.; Sun, Y.; Wan, J.; Huang, L.; Zhu, J. Smart e-commerce systems: Current status and research challenges. Electron. Mark. 2019, 29, 221–238. [Google Scholar] [CrossRef]

- Dou, Z.; Sun, Y.; Wu, Z.; Wang, T.; Fan, S.; Zhang, Y. The architecture of mass customization–social Internet of Things system: Current research profile. ISPRS Int. J. Geo-Inf. 2021, 10, 653. [Google Scholar] [CrossRef]

- Kouhpayeh, M.G.; Ziari, E.D.; Rousta, A. Designing and offering a customer trust model in the marketing ecosystem based on blockchain technology. Int. J. Innov. Manag. Organ. Behav. 2024, 4, 1–10. [Google Scholar] [CrossRef]

- Qu, Y.; Gao, L.; Xiang, Y.; Shen, S.; Yu, S. FedTwin: Blockchain-enabled adaptive asynchronous federated learning for digital twin networks. IEEE Netw. 2022, 36, 183–190. [Google Scholar] [CrossRef]

- Guo, S.; Choi, T.-M.; Chung, S.-H. Self-design fun: Should 3D printing be employed in mass customization operations? Eur. J. Oper. Res. 2022, 299, 883–897. [Google Scholar] [CrossRef]

- Jain, P.; Garg, S.; Kansal, G. A TISM approach for the analysis of enablers in implementing mass customization in Indian manufacturing units. Prod. Plan. Control 2023, 34, 173–188. [Google Scholar] [CrossRef]

- Longo, F.; Padovano, A.; Cimmino, B.; Pinto, P. Towards a mass customization in the fashion industry: An evolutionary decision aid model for apparel product platform design and optimization. Comput. Ind. Eng. 2021, 162, 107742. [Google Scholar] [CrossRef]

- Qi, Y.; Mao, Z.; Zhang, M.; Guo, H. Manufacturing practices and servitization: The role of mass customization and product innovation capabilities. Int. J. Prod. Econ. 2020, 228, 107747. [Google Scholar] [CrossRef]

- Shao, X.-F. What is the right production strategy for horizontally differentiated product: Standardization or mass customization? Int. J. Prod. Econ. 2020, 223, 107527. [Google Scholar] [CrossRef]

- Wu, Q.; Liao, K.; Deng, X.; Marsillac, E. Achieving automotive suppliers’ mass customization through modularity. J. Manuf. Technol. Manag. 2019, 31, 306–329. [Google Scholar] [CrossRef]

- Qu, L.; Wen, F.; Huang, H.; Wang, Z. Aggregation-chain: A consortium blockchain based multi-chain data sharing framework with efficient query. Cluster Comput. 2025, 28, 46. [Google Scholar] [CrossRef]

- Xu, X.; Chen, X.; Chen, J.; Cheng, T.C.E.; Yu, Y.; Liu, S.S. Adoption of blockchain considering platform’s information sharing and service effort under the cap-and-trade scheme. Int. J. Prod. Res. 2024, 62, 6688–6712. [Google Scholar] [CrossRef]

- Zheng, K.; Zhang, Z.; Chen, Y.; Wu, J. Blockchain adoption for information sharing: Risk decision-making in spacecraft supply chain. Enterp. Inf. Syst. 2021, 15, 8. [Google Scholar] [CrossRef]

- Du, M.; Chen, Q.; Chen, J.; Ma, X. An optimized consortium blockchain for medical information sharing. IEEE Trans. Eng. Manag. 2021, 68, 1677–1689. [Google Scholar] [CrossRef]

- Dwivedi, S.K.; Amin, R.; Vollala, S. Blockchain-based secured information sharing protocol in supply chain management system with key distribution mechanism. J. Inf. Secur. Appl. 2020, 54, 102554. [Google Scholar] [CrossRef]

- Wang, Z.; Wang, T.; Hu, H.; Gong, J.; Ren, X.; Xiao, Q. Blockchain-based framework for improving supply chain traceability and information sharing in precast construction. Autom. Constr. 2020, 111, 103063. [Google Scholar] [CrossRef]

- Si, H.; Sun, C.; Li, Y.; Qiao, H.; Shi, L. IoT information sharing security mechanism based on blockchain technology. Future Gener. Comput. Syst. 2019, 101, 1028–1040. [Google Scholar] [CrossRef]

- Crettez, B.; Hayek, N.; Martín-Herrán, G. Existence of equilibrium in a dynamic supply chain game with vertical coordination, horizontal competition, and complementary goods. Eur. J. Oper. Res. 2025, 321, 302–313. [Google Scholar] [CrossRef]

- Quadir, A.; Raj, A.; Foropon, C.R. Sharing demand information in competing supply chains with greening efforts. J. Environ. Manag. 2025, 373, 123626. [Google Scholar] [CrossRef] [PubMed]

- Gago-Rodríguez, S.; Márquez-Illescas, G.; Núñez-Nickel, M. Bargaining power as moderator of the “delay costs effect” in supply chain negotiations. Manag. Account. Res. 2021, 51, 100737. [Google Scholar] [CrossRef]

- Hosseini, S.M.; Paydar, M.M. Discount and advertisement in ecotourism supply chain. Asia Pac. J. Tour. Res. 2021, 26, 668–684. [Google Scholar] [CrossRef]

- Zhang, C.; Wang, Y.; Ma, P. Optimal channel strategies in a supply chain under green manufacturer financial distress with advance payment discount. Int. Trans. Oper. Res. 2021, 28, 1347–1370. [Google Scholar] [CrossRef]

- He, P.; He, Y.; Shi, C.V.; Xu, H.; Zhou, L. Cost-sharing contract design in a low-carbon service supply chain. Comput. Ind. Eng. 2020, 139, 106160. [Google Scholar] [CrossRef]

- Wu, D.; Chen, J.; Li, P.; Zhang, R. Contract coordination of dual channel reverse supply chain considering service level. J. Clean. Prod. 2020, 260, 121071. [Google Scholar] [CrossRef]

- Yu, B.; Wang, J.; Lu, X.; Yang, H. Collaboration in a low-carbon supply chain with reference emission and cost learning effects: Cost sharing versus revenue sharing strategies. J. Clean. Prod. 2020, 250, 119460. [Google Scholar] [CrossRef]

- Wang, Z.; Brownlee, A.E.I.; Wu, Q. Production and joint emission reduction decisions based on two-way cost-sharing contract under cap-and-trade regulation. Comput. Ind. Eng. 2020, 146, 106549. [Google Scholar] [CrossRef]

- Fan, J.; Ni, D.; Fang, X. Liability cost sharing, product quality choice, and coordination in two-echelon supply chains. Eur. J. Oper. Res. 2020, 284, 514–537. [Google Scholar] [CrossRef]

- Gilotra, M.; Pareek, S.; Mittal, M.; Dhaka, V. Effect of Carbon Emission and Human Errors on a Two-Echelon Supply Chain under Permissible Delay in Payments. Int. J. Math. Eng. Manag. Sci. 2020, 5, 225–236. [Google Scholar] [CrossRef]

- Raza, S.A. Supply chain coordination under a revenue-sharing contract with corporate social responsibility and partial demand information. Int. J. Prod. Econ. 2018, 205, 1–14. [Google Scholar] [CrossRef]

- Jullien, B.; Reisinger, M.; Rey, P. Personalized Pricing and Distribution Strategies. Manag. Sci. 2023, 69, 1687–1702. [Google Scholar] [CrossRef]

- Jiang, B.; Yang, B. Quality and Pricing Decisions in a Market with Consumer Information Sharing. Manag. Sci. 2019, 65, 272–285. [Google Scholar] [CrossRef]

- Ha, A.Y.; Tian, Q.; Tong, S. Information Sharing in Competing Supply Chains with Production Cost Reduction. Manuf. Serv. Oper. Manag. 2017, 19, 246–262. [Google Scholar] [CrossRef]

- Wu, X.; Zhang, F. Home or Overseas? An Analysis of Sourcing Strategies Under Competition. Manag. Sci. 2014, 60, 1223–1240. [Google Scholar] [CrossRef]

- Khanjari, N.E.; Iravani, S.; Shin, H. The Impact of the Manufacturer-Hired Sales Agent on a Supply Chain with Information Asymmetry. Manuf. Serv. Oper. Manag. 2014, 16, 76–88. [Google Scholar] [CrossRef]

- Yang, X.; Cai, G.; Ingene, C.A.; Zhang, J. Manufacturer Strategy on Service Provision in Competitive Channels. Prod. Oper. Manag. 2020, 29, 72–89. [Google Scholar] [CrossRef]

- Wang, J.; Liu, J.; Wang, F.; Yue, X. Blockchain technology for port logistics capability: Exclusive or sharing. Transp. Res. Part B: Methodol. 2021, 149, 347–392. [Google Scholar] [CrossRef]

- Luo, S.; Choi, T. E-commerce supply chains with considerations of cyber-security: Should governments play a role? Prod. Oper. Manag. 2022, 31, 2107–2126. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ye, Z.; Wang, J.; Zhao, H. Blockchain for Mass Customization: The Value of Information Sharing Through Data Accuracy by Contract Coordination. Mathematics 2025, 13, 404. https://doi.org/10.3390/math13030404

Ye Z, Wang J, Zhao H. Blockchain for Mass Customization: The Value of Information Sharing Through Data Accuracy by Contract Coordination. Mathematics. 2025; 13(3):404. https://doi.org/10.3390/math13030404

Chicago/Turabian StyleYe, Zhening, Jie Wang, and Huida Zhao. 2025. "Blockchain for Mass Customization: The Value of Information Sharing Through Data Accuracy by Contract Coordination" Mathematics 13, no. 3: 404. https://doi.org/10.3390/math13030404

APA StyleYe, Z., Wang, J., & Zhao, H. (2025). Blockchain for Mass Customization: The Value of Information Sharing Through Data Accuracy by Contract Coordination. Mathematics, 13(3), 404. https://doi.org/10.3390/math13030404