Abstract

This study examines the strategic decisions and profit dynamics of suppliers marketing their products through both offline and online channels, alongside online e-commerce platforms providing their own consumer credit services. We develop a model that incorporates consumer disposable income, channel preferences, and credit utility. Four supply chain scenarios are analyzed: wholesale and agency models with either private or open credit strategies. Using Stackelberg game theory, we explore suppliers’ sales model choices and the conditions under which platforms extend credit to offline channels. Our results show that increasing credit utility generally leads to higher equilibrium prices, while higher service fees compel suppliers to adjust their prices, favoring lower-cost channels. Notably, suppliers are more likely to adopt the wholesale model to secure platform credit for offline sales, especially when credit service fees or credit utility are high. Furthermore, platform credit strategies are strongly influenced by suppliers’ sales model choices: In wholesale models, platforms are more inclined to extend credit to offline channels under specific conditions of high disposable income (DPI) and credit utility, whereas in agency models, open credit strategies are only adopted when both DPI proportions and credit utility are low. This research provides new insights into how platforms can tailor credit offerings based on supplier strategies, offering a theoretical foundation for consumer credit policies in multi-channel sales environments and valuable guidance for managers in determining optimal channel strategies and credit service offerings.

MSC:

91-10; 91A80

1. Introduction

With the rapid growth of global e-commerce, consumer purchasing behaviors and payment habits have undergone significant transformations. Consumer credit refers to a system that allows consumers to borrow money or incur debt with deferred repayment. This encompasses various credit products such as bank credit cards, retail platform consumer credit, and P2P lending. As a new payment method, consumer credit has significantly enhanced consumers’ purchasing power. According to the latest industry report, global retail e-commerce sales exceeded USD 6.1 trillion in 2023 and are expected to surpass USD 8 trillion by 2027 (https://worldpay.globalpaymentsreport.com/en, accessed on 11 December 2024). As e-commerce continues to grow, the consumer credit market has expanded rapidly as well. In 2024, the global consumer credit market is expected to reach USD 120 billion, with a projected compound annual growth rate of 3.9% from 2025 to 2033 (https://www.imarcgroup.com/consumer-credit-market, accessed on 15 December 2024). In contrast, traditional credit mechanisms, such as credit card approval processes, are complex and stringent [1], which makes it challenging for younger consumers to access credit. Many platforms, facing significant market potential, have leveraged their technological and data advantages to launch platform-based consumer credit (referred to as “platform credit”) online, offering consumers the option of deferred payments with interest-free grace periods. Examples of representative platform credit products include Alibaba’s Ant Credit, JD.com’s Bai Tiao, and Amazon’s Afterpay. Platform credit provides purchasing opportunities for consumers with low disposable income (DPI), thus increasing demand on the platforms and generating additional interest income. In Q3 2022, 43.7% of JD.com’s operating cash flow came from accounts receivable from Bai Tiao (https://baijiahao.baidu.com/s?id=1749831670174657381&wfr=spider&for=pc, accessed on 17 December 2024). With continuous innovations in credit payment technology, more platforms have extended credit to various payment scenarios. For instance, Ant Credit expanded its services beyond online channels to include physical stores of certain merchants in 2015.

The literature on consumer credit suggests that credit payments can stimulate greater consumption and are less burdensome for consumers compared to cash payments [2,3]. Consumer credit not only alleviates the issue of insufficient disposable income (DPI) for consumers but also enhances convenience and security through various payment methods such as facial recognition. These advantages have attracted a large number of consumers to use such services. By the end of 2023, Ant Credit had served over 400 million consumers, with more than 60% of them having no prior credit card usage history. For these consumers, Ant Credit is their first encounter with consumer finance (https://news.qq.com/rain/a/20240701A03ITC00, accessed on 11 December 2024). The diversification of payment methods not only reduces consumer payment costs but also enhances their valuation of the platform. Furthermore, consumers who repay on time incur no additional fees.

Online platforms offer significant market opportunities for suppliers, who can choose between two primary sales models: the wholesale model and the agency model. The literature on e-commerce platforms has extensively discussed these two sales models [4,5]. In the wholesale model, the platform acts as a retailer, purchasing products from suppliers and reselling them to consumers. In the agency model, the platform functions as a marketplace, allowing suppliers to sell products directly to consumers through the platform and charging a commission. In practice, e-commerce platforms like Taobao and Amazon allow suppliers to choose between these two sales models and sell their products through traditional offline channels as well. Platform credit not only influences consumer purchasing behavior but also has a profound impact on the profit-sharing dynamics between the platform and suppliers. As both a competitor or collaborator of the supplier and a provider of credit services, the platform can choose to extend credit services to suppliers’ offline channels to expand the market for platform credit. Alternatively, as a retailer or online marketplace, the platform can choose not to extend credit services to suppliers’ offline channels in order to boost online transactions. The differences in these credit strategies reflect the platform’s decision regarding the scope of credit usage, which can influence the supplier’s online sales strategy and the consumer’s purchasing decisions. Moreover, the extent to which platform credit strategies are open influences the depth of cooperation and market competitiveness between the platform and the supplier, subsequently affecting the operational efficiency and profit distribution across the supply chain. For instance, Apple distributes products via the wholesale model on JD.com, where JD has long provided interest-free credit services for Apple’s self-operated flagship stores, but this credit service is not extended to Apple’s offline direct retail stores. In contrast, Huawei adopts the agency model to sell products on Taobao, with Taobao offering interest-free credit services for both Huawei’s flagship store on the platform and its offline stores (https://www.ithome.com/0/491/699.htm, accessed on 27 October 2024).

To date, no theoretical framework has explained the interaction between platform credit offerings and suppliers’ sales model choices in dual-channel systems. Existing studies primarily focus on the intra-platform effects of credit (e.g., online pricing or consumer behavior) but overlook two critical dimensions:

- Offline Credit Extension: Platforms like Alibaba now offer credit services in physical stores (e.g., Huabei in Apple Stores). However, no model explains how this affects supplier–platform coordination.

- Sales Model–Credit Interplay: Previous work treats sales models (wholesale/agency) and credit strategies (private/open) as isolated decisions, neglecting their interdependence.

To address these gaps and explain the underlying mechanisms behind the observed phenomena, this study develops a dual-channel supply chain model consisting of suppliers and online platforms. Suppliers sell products through offline channels while simultaneously selling through the platform’s online channel. The platform offers two distinct sales formats: the agency model and the wholesale model. As a credit service provider, the platform has two credit strategies: the private credit strategy and the open credit strategy. Under the private credit strategy, platform credit can only be used within the online platform. Under the open credit strategy, the platform also provides credit services for offline channels. This research aims to explore the interplay between platform credit strategies and suppliers’ sales model decisions. The study primarily addresses the following three core research questions:

- How do the equilibrium decisions of suppliers and platforms evolve under different channel structures and consumer credit strategies?

- Under what market conditions should an online platform extend credit services to suppliers’ offline channels?

- What sales model are suppliers more inclined to choose, and how does the platform respond?

To answer these questions, we construct four scenarios: (1) WP scenario, where the supplier chooses the wholesale model and the platform adopts the private credit strategy; (2) WO scenario, where the supplier chooses the wholesale model and the platform adopts the open credit strategy; (3) AP scenario, where the supplier chooses the agency model and the platform adopts the private credit strategy; and (4) AO scenario, where the supplier chooses the agency model and the platform adopts the open credit strategy. We consider consumer heterogeneity in disposable income (DPI) and the potential for consumer credit to increase consumer valuation. Suppliers and platforms engage in a Stackelberg game, where the supplier first decides on the online sales model, followed by the platform’s decision on its credit strategy. In the wholesale model, the platform first sets the offline direct sales price and online wholesale price, then sets the retail price for the wholesale channel. In the agency model, the supplier simultaneously decides the prices for both offline and online channels. By solving these four scenarios, we investigate the interaction between suppliers’ sales model decisions and the online retail platform’s consumer credit strategy. To the best of our knowledge, this study is the first to consider the interaction between suppliers’ online sales model choices and e-commerce platform credit strategies for offline channel expansion. We describe in detail the optimal pricing and strategy decisions of both the supplier and the platform and demonstrate how credit service fees and credit utility affect the pricing decisions of both parties. An increase in credit service fees prompts suppliers to adjust their prices to guide demand, while higher credit utility generally leads to higher equilibrium prices. Platform credit strategies in the agency model facilitate synchronized growth of both online and offline channel sales, whereas in the wholesale model, online sales decrease and offline sales increase. Furthermore, our study shows that the best strategies for both suppliers and platforms depend on credit service fees, the proportion of high-DPI consumers, and credit utility. For the platform, regardless of the sales model, when the proportion of high-DPI consumers is high and credit utility is low, the platform is more likely to offer credit services for offline channels, with a higher likelihood of providing credit services to suppliers’ offline channels in the wholesale model. Considering the influence of platform consumer credit, suppliers are likely to adopt the wholesale model only when the proportion of high-DPI consumers is high and credit utility is moderate, or both factors are high. When the proportion of high-DPI consumers is low, suppliers will only consider the agency model, and the platform will not offer credit services for the suppliers’ offline channels.

The remainder of this paper is organized as follows. In Section 2, we position this study within the relevant literature on consumer credit, selling formats on online platforms, and interactions between online platforms and offline channels. In Section 3, we establish the problem model and provide the sequence of events along with the basic assumptions. In Section 4, we derive the equilibrium outcomes under different scenarios and analyze the impact of consumer credit on equilibrium decisions. In Section 5, we analyze the decision-making processes of suppliers in selecting online sales models and the platforms’ decisions regarding credit provision. In Section 6, we present conclusions and future research directions. Additionally, Appendix A at the end of the paper contains proofs for all results.

2. Literature Review

This study is closely related to three streams of literature: online platform credit, selling formats on online platforms, and interactions between online platforms and offline channels. In this section, we provide an overview of these research streams and highlight our contributions to the field.

2.1. Consumer Credit

Consumer credit has been proven to be an effective payment method for consumers, significantly influencing their purchasing decisions. Credit payments play a key role in enhancing consumers’ willingness to pay [6]. Hu et al. [7] found that consumers are increasingly using fintech credit rather than traditional bank credit. Furthermore, consumer credit may have a significant impact on consumers’ mental accounting. Xie et al. [8] proposed that product quality and consumer trust significantly affect the willingness of both platform and strategic consumers to use credit services.

Online credit has gained increasing attention in the field of platform supply chain management. Liu et al. [9] demonstrated that credit refunds can lead to price discrimination and demand shaping among consumers, and under certain conditions, they are more profitable than cash refunds. Zhao et al. [10] studied how e-commerce platforms influence consumer behavior through installment payment and price guarantee strategies. They found that, when the proportion of high disposable income consumers is low, interest-free installment strategies are more profitable, while price guarantee strategies limit the use of interest-free installments. Xie et al. [11] examined the impact of e-commerce consumer credit on pricing strategies and the profits of all participants, revealing that credit services benefit sellers, consumers, and the entire supply chain in low- and mid-end product transactions, though the effect on platform profits remains uncertain.

Wu et al. [12] found that the time cost of funds and credit discount rates influence the willingness of suppliers and retailers to open credit payment options. One study presents a model for e-commerce platforms to determine when to introduce consumer credit services and share them with third-party sellers, revealing that sharing services can benefit both parties under certain conditions but may reduce consumer surplus [13]. In another related study, cognitive biases in borrowers, especially over-optimism, are shown to lead to financial mistakes, with the study proposing policy solutions like financial literacy education and reducing default costs to improve welfare, although the results are mixed [14]. Additionally, research on buy now, pay later (BNPL) services highlights their significant impact on consumer financial behavior, influencing the likelihood of adopting other credit options and shaping broader financial decision making [15]. Li et al. [16] explored how the credit strategy of online retail platforms affects interactions with sellers, revealing that offering credit can impact pricing and demand, and that platform credit strategies depend on credit yield and mismatch costs. Wei et al. [17] discussed the dual credit services of e-commerce platforms and their impact on the ecosystem, finding that dual credit can reduce product prices and benefit consumers, though its effects on sellers and platforms remain uncertain. Duan et al. [18] explored the provision strategy of e-commerce consumer credit services in a dual-channel system and their effect on pricing strategies, showing that credit services may generate positive spillover effects for the platform. Li et al. [19] examined the credit strategy and interest issues of online platforms in integrated and independent system platform supply chains.

Although the existing literature provides ample evidence on how consumer credit influences consumer purchasing behavior, there is limited research on how consumer credit affects platform supply chain management decisions. Furthermore, existing studies primarily focus on the impact of credit services within online platforms (such as their effects on platform revenue, consumer behavior, and supply chain pricing strategies). There is a lack of research on whether credit services should extend to external platforms and their potential impacts. While some studies have explored the impact of consumers’ disposable income differences and credit utility on credit strategies, their specific effects in online and offline dual-channel supply chains have not been sufficiently analyzed. Our study fills the gap in both areas.

2.2. Selling Formats on Online Platforms

Our study is also related to the literature on selling formats on online platforms. Hagiu et al. [4] found that when marketing activities result in spillover effects or network effects that negatively affect supplier profits, the wholesale model is preferred, while the agency model is favored for long-tail products. Abhishek et al. [5] explored the decision-making process of e-commerce platforms when choosing between agency sales and traditional wholesale models. They discovered that agency sales are more efficient in online channels when traditional channel demand declines, but manufacturers, by controlling retail prices, influence the e-commerce platform’s choice. Ha et al. [20] examined how sales efforts impact the channel structure of online retail platforms. Gong et al. [21] pointed out that platforms encourage manufacturers to adopt the agency sales model when information accuracy is high, thereby increasing profits for both parties. Li et al. [22] studied online sales of green products, finding that manufacturers tend to choose the agency sales model at lower agency fees to enhance product greenness, while higher fees suppress online sales, affecting e-commerce platform revenues. Bian et al. [23] found that platforms tend to prefer the wholesale model when offering high-quality services, whereas the agency model may deter suppliers from sharing service information. Chen et al. [24] indicated that a manufacturer’s choice of online sales strategy largely depends on consumers’ acceptance of online channels and the spillover effects from online to offline sales. Under specific conditions, the agency sales strategy can result in a “win-win-win” situation for the manufacturer, offline retailers, and online platforms. Ke et al. [25] analyzed the selection of three sales models (wholesale, agency sales, and mixed sales) in platform supply chains, concluding that the mixed model typically yields higher profits and that the optimal sales model varies with commission rates. Tian et al. [26] studied the choice of online distribution models between an e-commerce platform and two different suppliers selling mutually substitutable products. Liu et al. [27] proposed that online financial services provided by e-commerce platforms can help capital-constrained suppliers optimize their channel strategies, with their choices being constrained by production costs, financial constraints, platform interest rates, and commission rates. Zhen et al. [28] used a game-theory model to analyze how retailers’ sales choices between proprietary channels and third-party platforms are influenced by spillover effects and the intensity of channel competition, showing that under moderate competition, different sales formats may be preferred.

Unlike previous research on selling formats on online platforms, this study aims to delve deeper into the dynamic relationship between vendors’ sales model choices and platform credit strategies. We have developed a Stackelberg game model to investigate how platform credit offering strategies influence cooperation or competition between platforms and suppliers in a dual-channel supply chain based on both offline and online channels. As a credit provider, the platform is also a retailer or an online marketplace. It can choose to offer interest-free credit only to consumers purchasing through the supplier’s online channel, or it can extend interest-free credit services to consumers in both online and offline channels.

2.3. Interactions Between Online Platforms and Offline Channels

Our work also contributes to the literature on interactions between online platforms and offline channels. In recent years, numerous scholars have explored the reciprocal effects between online and offline channels. Yoo et al. [29] investigated the combination structure of a monopoly manufacturer with both online and offline channels, finding that the introduction of online channels does not always lead to lower retail prices or increased consumer welfare. Chiang et al. [30] discovered that the introduction of a direct sales channel by the supplier can reduce double marginalization effects, thereby increasing profits, while simultaneously benefiting retailers when wholesale prices are reduced. Cattani et al. [31] also examined the situation where manufacturers open offline direct sales channels while cooperating with online wholesale channels, and found that when the convenience of online channels is significantly lower than traditional channels, manufacturers can optimize profits and reduce channel conflicts by implementing strategies aligned with retailer prices. Bhunia and Roy et al. [32] focused on carbon emission reduction in green supply chains and used Stackelberg game theory to explore the balance between profit maximization and carbon reduction for manufacturers and retailers across different sales channels (such as offline and online).

Jiang et al. [33] explored interactions between platforms and independent sellers, showing that platforms’ actions to prioritize high-demand products may incentivize sellers to conceal true demand, while platform entry threats may actually benefit sellers. Barman and Roy et al. [34] focused on closed-loop supply chains and introduced a fuzzy optimization model to address the challenges of carbon emission reduction, cost minimization, and policy compliance under uncertain data conditions. This study focuses on the interaction between supplier strategic decisions and platform credit policies in a multi-channel sales environment, particularly examining how this interaction affects the decisions and profits of both parties. Gilbert et al. [35] found that when traditional channel competition is moderate and the substitutability between online platforms and traditional channels is high, suppliers prefer the agency model over wholesale, as it is Pareto superior. Crombrugge et al. [36] found through empirical analysis that the introduction of direct sales channels typically leads to a reduction in the number of SKUs purchased by retailers and an increase in unit wholesale prices. Most previous studies have focused on the impact of online channels on offline channel operations. In contrast, our study considers a different direction of interaction, namely, the interaction between platform credit strategies and the channel strategies of suppliers with both offline and online dual channels. We explore how this unique interaction affects the equilibrium outcomes.

To clearly illustrate the contributions of our work in comparison to recent studies, Table 1 below presents a comparison of the key contributions and research gaps of our study with the following recent works:

Table 1.

Comparison of key contributions and research gaps.

3. Model Setup

This study examines a two-tier supply chain consisting of a supplier (S) and an online platform (O), where the supplier sells products directly to consumers through offline channels and via the platform. The platform offers two distinct sales models: wholesale (e.g., JD’s self-operated stores) and agency (e.g., the Tmall platform).

3.1. Supplier and Online Platform

We model a dual-channel supply chain in which the supplier sells products directly to consumers through offline channels while simultaneously using the online platform to sell the same products via either a wholesale (W) or agency (A) model. In the wholesale model, the platform functions as a retailer, purchasing products at a wholesale price () and selling them at a retail price (). In the agency model, the platform operates as an online marketplace with the supplier acting as a third-party seller and setting the online sales price (). The platform charges the supplier a commission based on product category. Additionally, if consumers use platform credit to make payments, the platform collects a fee () for credit services. If platform credit is allowed in the supplier’s offline channel, the supplier must also pay a fee of to the platform.

Since platform commission rates and credit service fees are typically fixed and disclosed before a supplier joins the platform, we treat and as exogenous variables, where and . The model ignores the potential risks associated with credit default, simplifying the analysis to focus on credit expansion strategies.

We assume consumers have limited disposable income, and the platform’s credit strategy is modeled in two forms: (1) private credit service strategy, where the credit service is exclusive to the platform’s online channel; and (2) open credit service strategy, where the credit service is extended to the supplier’s offline channels. We assume that the marginal operating costs of both products and credit services are zero, following common practice in the literature, which does not affect the qualitative results of the analysis [16].

3.2. Consumer Choice Model

Consumers have heterogeneous valuations for products, with uniformly distributed within the interval . Since the platform typically offers superior logistics and after-sales services [37], consumers are more likely to accept products purchased via the platform, resulting in a valuation of , where represents the advantage of the platform’s channel. The higher the value of , the greater the platform’s advantage over the supplier’s offline channel.

We assume that consumer disposable income (DPI) varies, classifying consumer into two types: high DPI consumers (proportion ) and low DPI consumers (proportion ). High DPI consumers can afford to purchase products in full, while low DPI consumers rely on platform credit to make purchases. Consumers using credit gain positive utility, represented by (), such as the psychological benefit of early product access or exclusive discounts.

Therefore, the utility for a consumer with valuation is as follows:

- For full payment via online platform: ;

- For credit payment via online platform: ;

- For full payment via offline channel: ;

- For credit payment via offline channel: .

- When the platform does not offer credit services for the supplier’s offline channel, high DPI consumers will choose to buy using credit on the platform if . In contrast, low DPI consumers will always use platform credit. The sales volumes of online and offline channels are as follows:

- Online channel: ;

- Offline channel: .

- When the platform offers credit services for offline channels, low DPI consumers can choose to buy via credit in either channel. The demand for online and offline channels are as follows:

- Online channel: ;

- Offline channel: .

In the wholesale model, the profit functions for the supplier and the platform are as follows:

- ;

- .

In the agency model, the profit functions for the supplier and the platform are as follows:

- ;

- .

If the platform only provides credit for the online channel, the demand for offline credit purchases is .

The meanings of the relevant parameters and variables are summarized in Table 2.

Table 2.

Summary of notation.

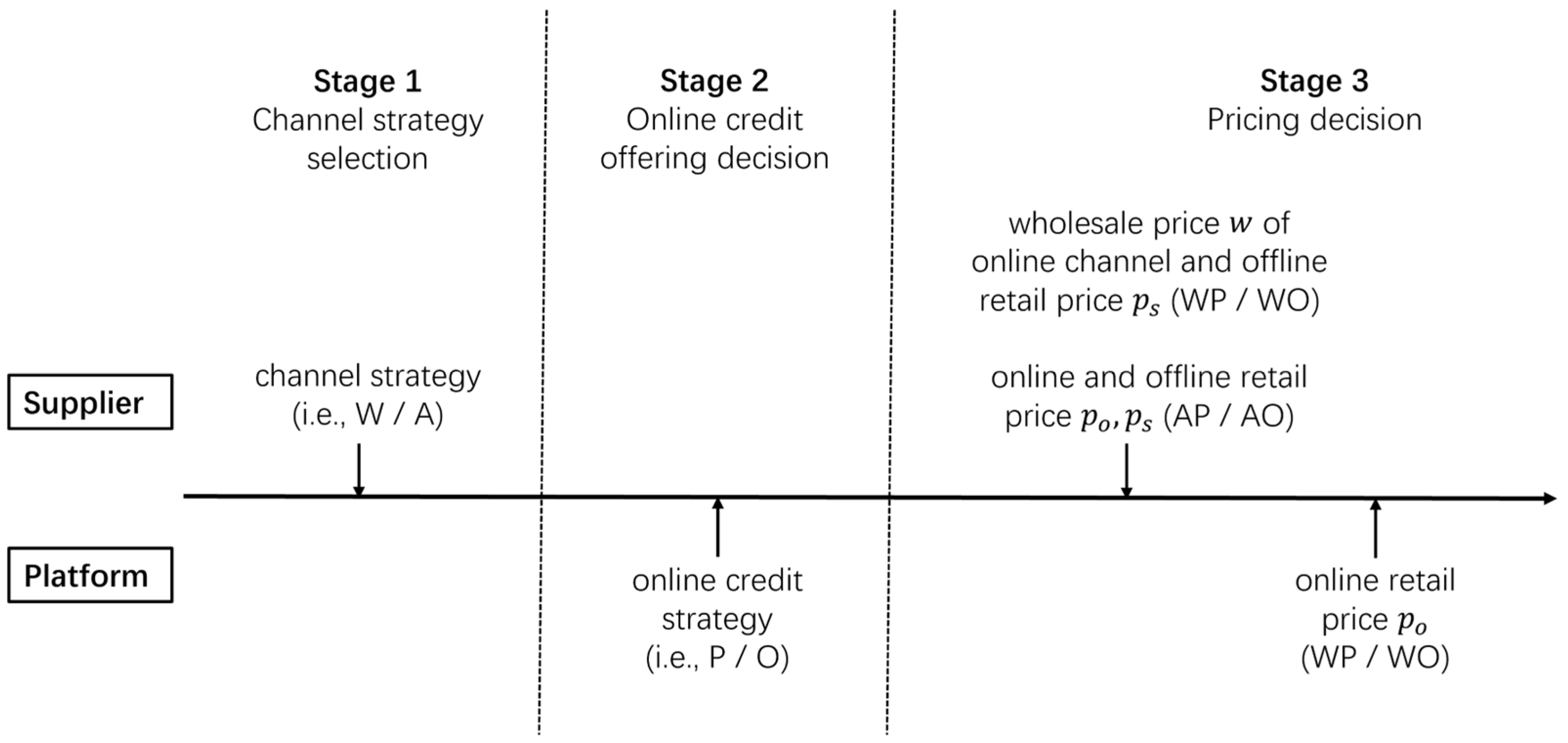

The sequence of events is as follows: In the first stage, the supplier chooses the sales model for the online platform channel, either reselling or acting as an agent. In the second stage, the platform decides whether to offer consumer credit services through offline channels. In the third stage, if the supplier selects the reselling model, the supplier first sets the wholesale price and the offline retail price, after which the platform determines the online retail price. If the supplier chooses the agency model, the supplier simultaneously sets both the offline and online retail prices. Finally, consumers choose their preferred purchase channel and payment method, and market demand is realized. The timing of these events is illustrated in Figure 1.

Figure 1.

Timing of events.

4. Equilibrium Results

This section derives the equilibrium results for four scenarios: WP, WO, AP, and AO. The first letter represents the supplier’s decision regarding the online sales model in the first stage, while the second letter indicates the online platform’s decision regarding the provision of platform credit in the second stage. The equilibrium results for these four scenarios are derived using backward induction.

4.1. Case WP

In the WP case, the supplier selects the wholesale model for the online platform, while the platform adopts a private credit strategy, making credit available only for online purchases. A representative example of the WP scenario is Apple’s wholesale partnership with JD.com. Apple supplies products to JD at a fixed wholesale price, while JD operates the “Apple JD Self-operated Flagship Store”, offering exclusive “JD Baitiao” installment services for online purchases. Notably, Apple’s offline flagship stores do not integrate JD’s credit system, which aligns with the definition of the private credit strategy. Using backward induction, we derive the optimal retail price for the online platform by solving the following optimization problem: . Solving this optimization problem, we obtain the platform’s optimal reaction price: . Given this, the supplier anticipates the platform’s optimal price and selects the wholesale price and offline retail price to maximize profit:

Solving the above optimization problem, we derive the supplier’s optimal wholesale price and offline retail price:

Substituting these prices into the profit functions for the supplier and the platform, we obtain the optimal profits:

4.2. Case WO

In the WO case, the supplier selects the wholesale model for the online channel, and the platform extends credit services to the supplier’s offline channel. The WO scenario is exemplified by LEGO’s wholesale collaboration with Amazon. Through Amazon Vendor Central, LEGO provides products at wholesale prices, with Amazon setting retail prices and offering “Amazon Pay Later” installments (five-period interest-free) both on its platform and in LEGO’s physical stores (e.g., New York Fifth Avenue flagship). This dual-channel credit extension embodies the open credit strategy. Using backward induction, we derive the optimal online retail price for the platform by solving the following optimization problem:

Solving this gives the platform’s optimal reaction price:

Substituting this into the supplier’s profit function, the supplier chooses and to maximize their profit:

The optimal pricing decisions for the supplier in the WO case are

Substituting these into , we obtain the platform’s optimal pricing decision:

Substituting these optimal prices into the profit functions of the supplier and the platform, we obtain

4.3. Case AP

In the AP case, when the supplier sells through the agency model on an online platform, and the platform adopts a private credit strategy (where the platform serves as both an online marketplace and a provider of consumer credit services), the supplier simultaneously determines the online () and offline () retail prices. A representative AP case is DJI’s agency model partnership with Pinduoduo. DJI operates an official store on Pinduoduo using the agency model, where “Duoduofenqi” installment services are exclusively available online. Crucially, DJI’s offline flagship stores in China reject Pinduoduo’s credit system, relying instead on Alipay Huabei/bank installments—consistent with private credit constraints. The optimization problem is formulated as follows:

By solving the above optimization equation, we obtain the equilibrium results:

By substituting and into the profit functions of the supplier and the platform, we derive their optimal profits:

4.4. Case AO

In the AO case, when the supplier sells through the agency model on the online platform, and the platform adopts an open credit strategy (where the platform serves as both an online marketplace and a credit service provider for both online and offline channels), the supplier simultaneously determines the online () and offline () retail prices. The AO model finds perfect implementation in Apple’s Tmall partnership. Through Tmall’s agency model, Apple directly controls pricing in its flagship store (paying ~5% commission), with “Huabei Installment” services (3/6/12-period interest-free) synchronized across both Tmall online store and Apple’s physical stores in China—a textbook example of open credit strategy under agency sales. The optimization problem is formulated as follows:

By solving this optimization problem, we obtain the supplier’s optimal pricing strategy:

Substituting and into the profit functions of the supplier and the platform, we derive their optimal profits:

4.5. Sensitivity Analysis

In the wholesale model, we conducted a sensitivity analysis of equilibrium prices and profits with respect to the credit service fee rate and credit utility . By differentiating with respect to and , we derived Proposition 1, which reveals how pricing strategies and profit distribution adjust in response to changes in the parameters of consumer credit.

Proposition 1.

When the supplier uses the wholesale model for the online channel, the equilibrium outcomes change as follows with increasing credit service fee rates and credit utility :

- (a)

- For the WP case:

- i.

- ii.

- (b)

- For the WO case:

- i.

- ii.

Proposition 1 indicates that when the supplier adopts the wholesale model, an increase in the credit service fee rate will lead to a decrease in the supplier’s wholesale price, unless under the open credit strategy. On the other hand, an increase in credit utility will lead to an increase in the equilibrium price, except for the offline retail price of the supplier under the private credit strategy. In the wholesale model, the response of profits to credit parameters depends on the power structure: Under the private credit strategy (WP), the supplier dominates the profit allocation, while under the open credit strategy (WO), the platform captures incremental profits through service fees.

Specifically, under the resale model, both parties’ profits increase as rises. The enhancement of credit utility stimulates consumers’ preference for credit payments, resulting in a demand expansion effect. Although the online (or offline) retail prices increase, the reduced demand elasticity makes the simultaneous increase in both quantity and price possible, thus driving profit growth. Under the WP case, both parties’ profits are unaffected by the unit credit service fee rate . In contrast, under the WO case, as increases, the supplier’s profit decreases, while the platform’s profit rises. As the provider of credit services, the platform directly gains from the service fee, while the supplier is forced to lower the wholesale price to compensate for channel costs, thereby squeezing their profit.

Through differentiation of the equilibrium outcomes with respect to the credit service fee rate and credit utility , we derive the following proposition:

Proposition 2.

When the supplier adopts the agency model for online sales, an increase in the credit service fee rate and credit utility leads to the following equilibrium changes for the supplier and platform:

- (a)

- For the AP case:

- i.

- ii.

- (b)

- For the AO case:

- i.

- ii.

Proposition 2 suggests that when suppliers adopt the agency model on an online platform, the equilibrium price of the online agency channel will consistently increase with the rise in both the platform’s consumer credit service fee rate and credit utility . However, the equilibrium price of the offline direct sales channel does not necessarily decrease. When the platform adopts an open credit strategy, an increase in credit utility generally leads to a rise in the supplier’s offline direct sales price.

The platform transfers the credit costs to the supplier through a revenue-sharing mechanism. However, the demand-creation effect of credit utility provides a win–win profit space for both parties, especially under the open credit strategy (AO), where price and profit both rise simultaneously. Specifically, the supplier’s profit is negatively affected by the increase in , while the platform’s profit benefits. As increases, the supplier is forced to lower offline prices to sustain demand, while the platform raises online prices and captures service fee revenue, creating a “scissors gap” in profit distribution. On the other hand, when credit utility increases, both parties’ profits improve. This is because, under the private credit strategy, the demand expansion effect driven by credit utility dominates the profit change: The revenue from increased online sales offsets the losses from offline discounts, creating a “price-for-quantity” synergy effect. Under the open credit strategy, the platform and the supplier jointly leverage the brand premium capacity of credit utility to achieve cross-channel price coordination, prevent demand substitution, and maximize joint profits.

5. Decision Analyses

In this section, we examine the impact of platform credit strategies under two channel models and provide the conditions under which the platform should choose different credit strategies. The decision-making process for selecting a credit strategy is influenced by several factors, including the proportion of low-DPI consumers, credit utility, and the platform’s overall pricing strategy. Through a comparative analysis of optimal pricing decisions and profitability under private and open credit strategies in the online wholesale model, we derive Proposition 3.

Proposition 3.

(a) ; (b) , and always hold.

Proposition 3 indicates that in the online wholesale model, compared to private credit strategies, an open credit strategy reduces the optimal wholesale and retail prices for online channels, leading to a decrease in the online platform’s sales. This decision is primarily driven by the platform’s strategy to balance the benefits of increased offline sales with the potential loss in online sales. Conversely, the retail price and sales in offline channels increase. This is because, under a private credit strategy, offline sales are constrained by consumers’ disposable income, limiting overall sales. However, with open credit strategies, this constraint is alleviated, enabling more sales in offline channels, which also allows for higher prices.

Regarding the platform, the open credit strategy may weaken its competitiveness, especially among price-sensitive consumers with low disposable income, who may switch to offline channels, reducing online sales. However, as the usage of credit expands, the total market demand increases, as more consumers can now afford the products. Therefore, the platform’s decision is not just about short-term pricing but also about long-term market expansion, balancing the trade-off between competitive pressure and demand growth.

By comparing the unit profit of the platform in the wholesale channel under different credit strategies, we derived Proposition 4.

Proposition 4.

Marginal unit profit for the platform in wholesale model: When , the unit profit increases (); otherwise, it decreases ().

Proposition 4 indicates that in the wholesale model, when credit utility is low, the open credit strategy positively impacts the platform’s marginal profit by reducing the double marginalization effect in the wholesale channel. However, when credit utility is high, opening credit to offline channels reduces the platform’s marginal profit, although additional revenue from credit service fees may offset this loss. The platform’s decision is based on maximizing its profit, where it has to weigh the immediate gains from credit service fees against the long-term impact on sales and pricing.

Next, we compare the differences in online and offline prices under private and open credit strategies in the agency model, with results detailed in Proposition 5.

Proposition 5.

(a) always holds; holds only when or ; otherwise, ; (b) holds only when ; otherwise, ; similarly, holds only when ; otherwise, .

Proposition 5 indicates that in the agency model, when the platform adopts the open credit strategy, suppliers raise offline prices. This is because with open credit, consumers can use credit to increase their valuation of products, attracting low-income consumers, and allowing suppliers to engage in price discrimination without reducing demand.

For the online channel, the availability of platform credit may change the substitution relationship between online and offline channels. Since online channels already offer credit, prices may remain stable or slightly increase. Specifically, when the proportion of low-DPI consumers is high or credit utility is large, online prices may rise, whereas when low-DPI consumers are fewer or credit utility is small, prices may decrease. Offline channels, enhanced by credit payment options, gain competitiveness, which allows them to match or even exceed online pricing, particularly when offering better customer experiences.

In contrast to the wholesale model, the effect of open credit strategies on equilibrium in the agency model is more complex. In the wholesale model, the availability of credit usually leads to a decrease in online sales and an increase in offline sales. However, in the agency model, when the proportion of low-DPI consumers is high and credit utility is low (i.e., when is large and is small), the opening of platform credit may lead to increased online sales and reduced offline sales. This difference arises from the supplier’s greater control over pricing in the agency model, where they can adjust online and offline retail prices directly to manage sales. The decision-making process here is more nuanced, as it involves strategic pricing by both the platform and the suppliers, taking into account not only credit utility but also the elasticity of demand.

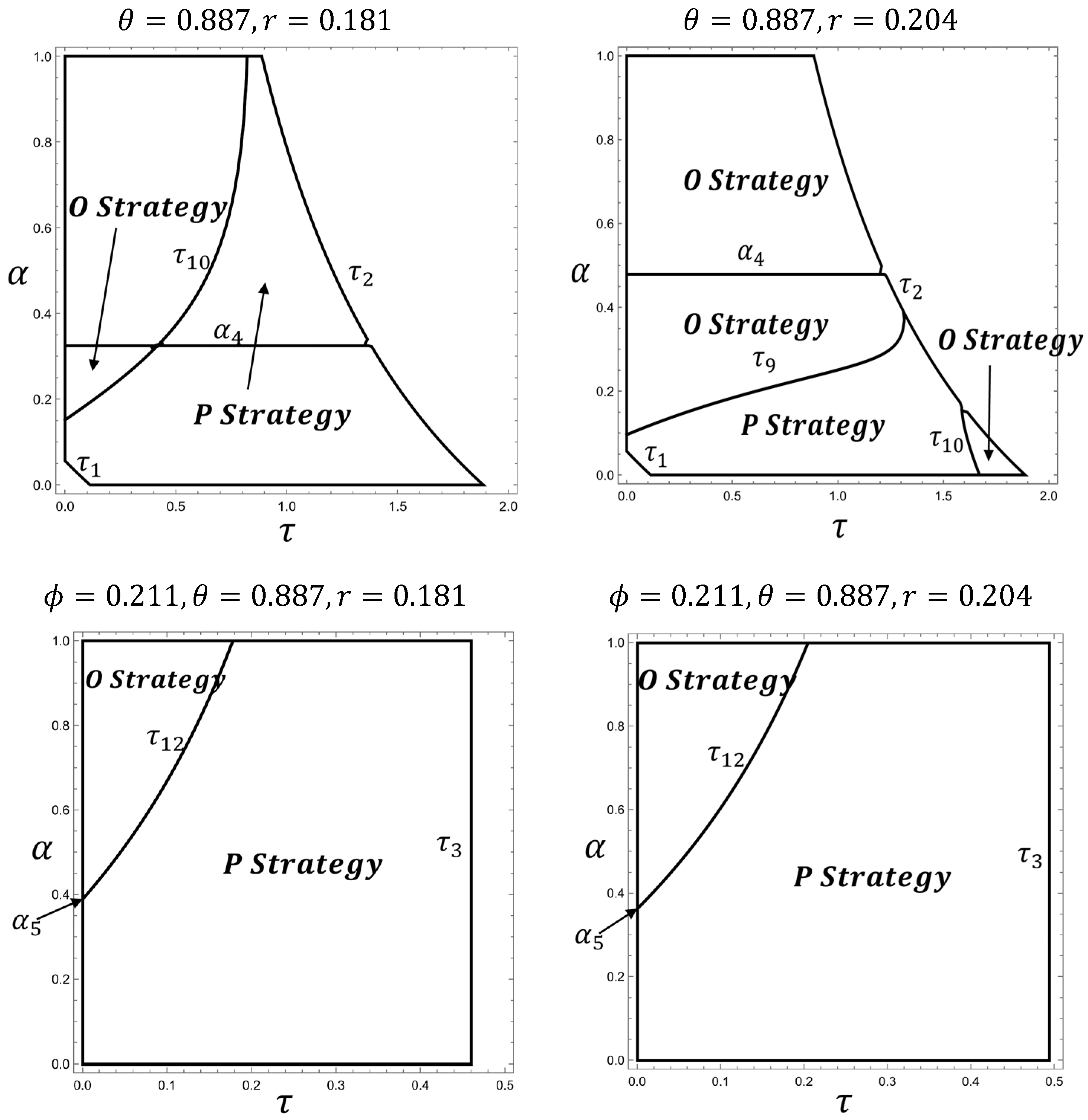

By comparing platform profits under private and open credit strategies, we derive the conditions for platform decisions, as shown in Proposition 6.

Proposition 6.

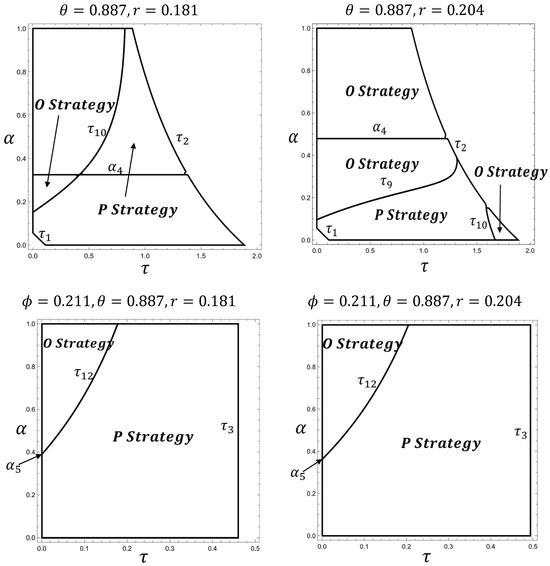

The conditions under which the platform opens consumer credit services in different models are as follows. (a) When the supplier adopts the wholesale model on the online channel, (i) when , and or , , otherwise, ; and (ii) when , and , , otherwise, . (b) When the supplier adopts the agency model on the online channel, the platform chooses the open credit strategy only when and , otherwise, the platform chooses the private credit strategy.

As illustrated in Figure 2, Proposition 6 shows that in the wholesale model, when the proportion of low-DPI consumers is high (i.e., ), the platform does not benefit from the open credit strategy unless the credit utility is moderate, in which case the platform selects the private credit strategy. Conversely, when the proportion of low-DPI consumers is low and credit utility is small, the platform chooses the open credit strategy.

Figure 2.

The platform’s equilibrium consumer credit strategy under the wholesale and agency models.

In the agency model, when the proportion of low-DPI consumers is high, the platform does not offer credit services to the supplier’s offline channels. However, when the proportion of low-DPI consumers is low, and credit utility is below threshold , the platform chooses the open credit strategy, otherwise the private credit strategy is selected.

We further analyze that when the proportion of low-DPI consumers is low and credit utility is small, regardless of the supplier’s sales model, the platform will always choose the open credit strategy. The platform’s decision to expand credit services to offline channels reflects a strategic move to increase overall market reach and combat price competition. This is because the higher credit utility and low-DPI consumer ratio make it beneficial for the platform to expand credit services to offline channels, alleviating price competition and generating additional income. However, when credit utility is high, if the platform does not offer credit to offline channels, it gains a competitive advantage over suppliers, forcing them to increase wholesale prices, thereby reducing the platform’s marginal profit. Finally, by comparing the conditions for providing credit services to offline channels in the wholesale and agency models, we find that the conditions for extending credit services to offline channels are more relaxed in the wholesale model.

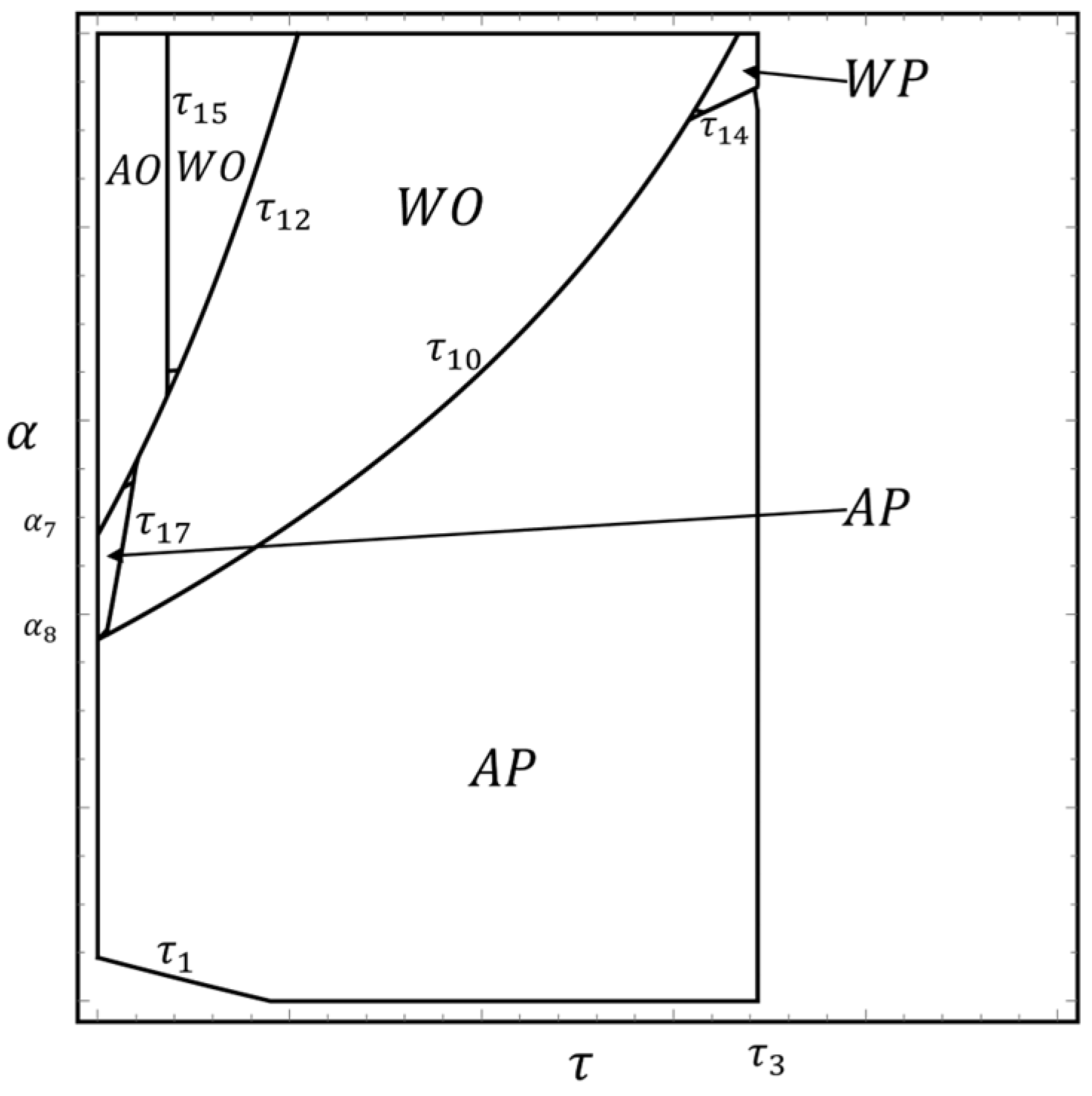

We continue to analyze the first-stage supplier’s strategy equilibrium as presented in Proposition 7.

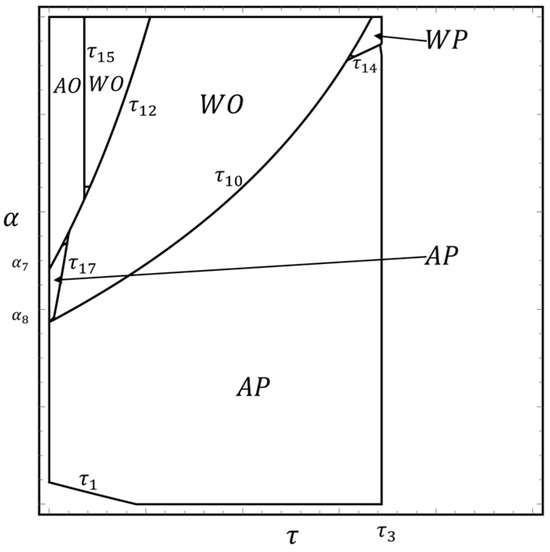

Proposition 7.

(a) WP is the equilibrium strategy when ; (b) WO is the equilibrium strategy when and or ; (c) AP is the equilibrium strategy when , or , or ; and (d) AO is the equilibrium strategy when , and .

Proposition 7 analyzes key parameters, including the credit service fee rate , the proportion of high-DPI consumers , and credit utility , to determine the optimal strategy for suppliers and platforms under different market conditions. As shown in Figure 3, when the proportion of high-DPI consumers is high and credit utility is large, suppliers choose the wholesale model, and the platform chooses the private credit strategy. When the credit service fee rate is high and credit utility is small or moderate, suppliers choose the wholesale model, and the platform chooses the open credit strategy. When the proportion of high-DPI consumers is low or credit utility is very small or large, suppliers choose the agency model, and the platform chooses the private credit strategy. The platform chooses the open credit strategy only when the credit service fee rate is low, and the proportion of high-DPI consumers is high with small credit utility.

Figure 3.

Supplier’s equilibrium channel strategy under consumer credit.

6. Conclusions and Discussion

6.1. Conclusions

This study explores the complex relationship between channel strategies and platform credit strategies within a dual-channel supply chain consisting of a supplier and an online platform. The supplier sells products through both offline and online channels, while the platform provides interest-free credit services to consumers. The platform has two distinct credit offering strategies: private and open credit strategies. These strategies are influenced by the supplier’s online channel sales model. We analyze four specific scenarios: the wholesale model with a private credit strategy (WP), the wholesale model with an open credit strategy (WO), the agency model with a private credit strategy (AP), and the agency model with an open credit strategy (AO). Using a game theory model, we derive the optimal pricing and strategic decisions for both the supplier and platform under different channel strategies. Through sensitivity analysis, we examine the impact of credit service fees and credit utility on the equilibrium decisions of both the supplier and platform. In particular, the credit service fee does not affect the platform’s equilibrium decision. However, under the open credit strategy or the agency model, as the per-unit credit service fee increases, the supplier is incentivized to adjust online and offline prices—raising the online price and lowering the offline price. This helps redirect demand toward the lower-cost channel, reducing overall expenses. An increase in credit utility generally leads to higher equilibrium prices. However, in the agency model with a private credit strategy, an increase in credit utility results in a decrease in the offline sales price. Importantly, the profit allocation mechanism exhibits distinct patterns across channel strategies. Under the wholesale model, the private credit strategy stabilizes supplier profits through fixed contractual terms, while the open credit strategy enables the platform to capture additional gains through service fee extraction. When adopting the agency model, platforms strategically transfer credit costs to suppliers while leveraging credit utility to create mutual profit growth opportunities—a phenomenon most evident in AO scenarios where coordinated price adjustments drive synchronized profit escalation for both parties.

Subsequently, we conducted a comparative analysis, which revealed that the platform’s credit strategy significantly influences the allocation of pricing power between the platform and the supplier. In the agency model, suppliers can effectively control channel sales by flexibly adjusting online and offline retail prices, potentially achieving synchronized sales growth across both channels. This contrasts with the wholesale model, where the platform’s open credit service leads to decreased online sales and increased offline sales. Additionally, we find that the proportion of high-DPI consumers, denoted as , and the positive credit utility, denoted as , play crucial roles in the platform’s willingness to provide credit services to the supplier’s offline channels. Specifically, regardless of the vendor’s online sales model, when the proportion of low-DPI consumers and the credit utility are both low, the platform will choose to offer credit services through the vendor’s offline channels. However, when the proportion of low-DPI consumers is high, the platform will only provide consumer credit services to offline channels under a wholesale model, and only when the credit utility is moderate. Under the wholesale model, the platform’s conditions for offering credit services to offline channels are more lenient.

Our study further analyzes the supplier’s optimal channel strategy and the platform’s best response. The optimal channel and credit strategy are determined by the credit service fee, the proportion of high-DPI consumers, and the credit utility. For suppliers, they are more likely to adopt the wholesale model when the proportion of high-DPI consumers is relatively high and credit utility is moderate, or when both the proportion of high-DPI consumers and credit utility are high. In such cases, the platform decides whether to offer credit services to the offline channel to maximize its own benefit. Both suppliers and platforms need to adjust their sales models and credit strategies flexibly based on changes in the credit service fee, the proportion of high-DPI consumers, and credit utility. This provides a theoretical basis for suppliers and e-commerce platforms to make strategic decisions that consider channel preferences and consumer DPI heterogeneity.

6.2. Managerial Insights

The findings of this study offer valuable practical insights for both platforms and suppliers. As the utility of credit increases, the equilibrium prices for both parties tend to rise. Therefore, platforms should focus on enhancing the quality of their credit services to foster mutually beneficial profit growth. Additionally, changes in the per-unit credit service fee significantly influence pricing and profits. Platforms must adapt their credit strategies according to different models to achieve the optimal equilibrium. Pricing strategies for suppliers and platforms vary across sales models. Platforms should be flexible in adjusting product pricing based on whether the supplier adopts a wholesale or agency sales model to maximize overall profit. For suppliers, choosing an online sales model is influenced by the platform’s credit policy. Platforms should design their credit policies thoughtfully, considering factors such as the supplier’s product positioning, to encourage suppliers to select sales models that align with the platform’s long-term development goals. Under certain conditions, the platform’s unit profit will vary depending on the supplier’s choice of sales model. Therefore, platforms should closely monitor key parameters like credit service fees and credit utility, adjusting strategies in response to market feedback to ensure optimal profit maximization.

6.3. Limitations of the Work and Future Research

While this study provides valuable insights, several limitations warrant further investigation. Our study has several limitations. First, we do not account for the potential negative utility of consumer credit, such as the failure of credit providers to remind consumers about repayments or the possibility of consumers forgetting to repay, which could damage their credit. Future research could explore these aspects and their impact on platform and supplier strategies. Second, high-credit-risk consumers could significantly impact both the supplier’s and platform’s channel and credit strategies. Future studies should investigate how credit risk influences strategic decision making, providing a more comprehensive understanding of the dynamics at play. Third, we assume that the platform’s consumer credit is the sole option for the supplier’s offline channels, without considering alternative credit products such as credit cards. However, a variety of competing consumer credit products could influence the strategic equilibrium between the supplier and platform. Future research could explore how the presence of alternative credit options affects platform–supplier dynamics, providing further insights into optimal credit strategy development.

Funding

This research received no external funding.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The author declares no conflicts of interest.

Appendix A

Proof of Equilibrium Results.

In the agency model (AP), the supplier simultaneously decides both the online and offline retail prices to maximize its profit. The profit function is

The second-order Hessian matrix is

To ensure negative definiteness, the following conditions must be satisfied:

We solve the first-order conditions:

These yield the optimal supplier price decisions:

To avoid negative demand, we need to satisfy the condition , where Similarly, the prices, demand, and profits under the WP, WO, and AO modes can be derived. □

Proof of Proposition 1.

When the supplier adopts the wholesale model, and the platform does not provide consumer credit to offline channels, it is evident that the equilibrium prices , and do not depend on . This implies that , , .

The derivative of , , and with respect to is as follows:

When suppliers adopt a wholesale model and the platform chooses to provide consumer credit to offline channels, by taking the derivative of the equilibrium outcomes with respect to and , we obtain

This completes the proof. □

Proof of Proposition 2.

When supplier adopt an agency model and the platform chooses not to provide consumer credit to offline channels, by taking the derivative of the equilibrium outcomes with respect to and , we obtain

When suppliers adopt the agency model and the platform chooses to provide consumer credit to offline channels, by taking the derivative of the equilibrium outcomes with respect to and , we obtain

This completes the proof. □

Proof of Proposition 3.

The difference between the wholesale price under the WO and WP models is

This shows that the wholesale price in the WO model is lower than in the WP model for .

The difference between the offline price in the WO and WP models is

The difference between the online price in the WO and WP models is

For demand,

The difference in demand between the WO and WP models is

This completes the proof. □

Proof of Proposition 4.

We define as the difference between and : .

Substituting the expressions for the prices,

To analyze the behavior of , we compute the derivative of with respect to :

This is a constant, indicating that is a linear function of . Since , we know that is decreasing in .

To find the value of where , solving for ,

Thus, for values between and , we have

For , we have

From the above analysis, we conclude that when is between , we have , meaning ; otherwise, .

This completes the proof of Proposition 4. □

Proof of Proposition 5.

The equilibrium difference in the offline prices is defined as

We define as the difference in the online prices for the AO and AP models:

We now compute the derivative of with respect to :

Since the partial derivative is positive, this implies that is increasing in .

When , ; otherwise, . Let , which gives . Therefore, when or , ; otherwise, .

Consider the function , where implies that is an increasing function of . It is given that . When , we have ; otherwise, . By setting , we determine . Therefore, for or ; otherwise, . Where .

Finally, we consider the function . It holds that and for all in the interval . When , we have ; otherwise, By setting , we determine . Therefore, for and ; otherwise, .

The proof of proposition 5 is completed. □

Proof of Proposition 6.

- Part 1: Wholesale Model (WO and WP)

Let us define the difference in profits between the online platform under the WO and WP models as .

We are given that

where the coefficients and are given as

We also know that is a quadratic function, and thus, the number of roots of this equation (i.e., the values of ) depends on the discriminant of the quadratic.

The roots of are denoted by and .

When , we have , and the roots satisfy . In this case, if lies between and , then ; otherwise, .

When , , and the roots satisfy . Here, if lies between and , then ; otherwise, .

The roots are given by , where .

- Part 2: Agency Model (AO and AP)

Let us define the profit difference function between the online platform under the AO and AP models as .

Profit Difference Function f2(τ)f2(τ)

For the agency model, the profit difference function is

We also know that

is negative, indicating that is decreasing with respect to .

, so, we conclude that , given that , is a downward-opening parabola. Now, we investigate the behavior of under different values of :

where .

This completes the proof of Proposition 6. □

Proof of Proposition 7.

- Case 1: WP and AP Region

Since , the intersection region where both WP and AP can coexist is

Also, when , we have .

We define the profit difference function for the supplier:

where

This means that is a quadratic function opening downward. The roots of this function, and , are derived from solving .

When , , and when . Thus, in this region, , and when , .

Thus, the equilibrium strategy for supplier in the WP and AP region is WP when , where

- Case 2: WP and AO Region

Since , and , the intersection between WP and AO is empty, meaning that the WP and AO strategies do not overlap in this region.

- Thus, there is no equilibrium in the WP and AO region.

- Case 3: WO and AP Region

When , we have and , meaning that the WO and AP regions only overlap in areas with lower DPI consumer proportions.

Let the profit difference function be .

When , , and is monotonically increasing in the interval , so WO is always the equilibrium strategy in this region.

When , if , then ; if , then . In this case, for and , there exists a point in the interval such that .

When , , meaning WO is the equilibrium strategy. Otherwise, if the condition is not met, AP is the equilibrium strategy.

Where is the solution of in the interval ,

- Case 4: WO and AO Region

We define the profit difference function in the WO and AO region as

where . The roots of are and , with always. If , then , and holds when is between and . Thus, when and , the equilibrium strategy is WO. WP is the equilibrium strategy only when , and , where , and is the solution of in the interval .

This completes the proof of Proposition 7. □

References

- Allen, F.; Gale, D. Competition and Financial Stability. J. Money Credit Bank. 2004, 36, 453–480. [Google Scholar] [CrossRef]

- Feinberg, R.A. Credit Cards as Spending Facilitating Stimuli: A Conditioning Interpretation. J. Consum. Res. 1986, 13, 348–356. [Google Scholar] [CrossRef]

- Soman, D. Effects of Payment Mechanism on Spending Behavior: The Role of Rehearsal and Immediacy of Payments. J. Consum. Res. 2001, 27, 460–474. [Google Scholar] [CrossRef]

- Hagiu, A.; Wright, J. Marketplace or Reseller? Manag. Sci. 2015, 61, 184–203. [Google Scholar] [CrossRef]

- Abhishek, V.; Jerath, K.; Zhang, Z.J. Agency Selling or Reselling? Channel Structures in Electronic Retailing. Manag. Sci. 2016, 62, 2259–2280. [Google Scholar] [CrossRef]

- Prelec, D.; Simester, D. Always Leave Home Without It: A Further Investigation of the Credit-Card Effect on Willingness to Pay. Mark. Lett. 2001, 12, 5–12. [Google Scholar] [CrossRef]

- Hu, J.; Huang, Y.; Liu, J. The changing face of consumer credit: Evidence from a big tech platform in China. Pac.-Basin Finance J. 2024, 83, 102254. [Google Scholar] [CrossRef]

- Xie, X.; Hu, P.; Yu, J.; Dai, B. Impact of capacity on the supplier’s distribution channel selection in facing a retail platform. Nav. Res. Logist. NRL 2021, 68, 837–854. [Google Scholar] [CrossRef]

- Liu, Y.; Zhang, D. Intraconsumer Price Discrimination with Credit Refund Policies. Manag. Sci. 2024, 70, 6835–6851. [Google Scholar] [CrossRef]

- Zhao, C.; Wu, J. Online installment payments and price guarantees under randomized pricing. Decis. Support Syst. 2024, 178, 114127. [Google Scholar] [CrossRef]

- Xie, J.; Wei, L.; Zhu, W.; Zhang, W. Platform supply chain pricing and financing: Who benefits from e-commerce consumer credit? Int. J. Prod. Econ. 2021, 242, 108283. [Google Scholar] [CrossRef]

- Wu, H.; Zheng, H.; Zhang, M. Credit payment services and pricing strategy in the digital economy era. Ann. Oper. Res. 2022, 1–18. [Google Scholar] [CrossRef]

- Feng, Y.; Zhang, Z.; Yao, Y.; Chen, Y.; Liu, J. To Share or Not? Hybrid e-Commerce Platform’s Provision and Sharing Strategies of Consumer Credit Service. Manag. Decis. Econ. 2025, 46, 910–927. [Google Scholar] [CrossRef]

- Exler, F.; Livshits, I.; MacGee, J.; Tertilt, M. Consumer Credit with Over-Optimistic Borrowers. J. Eur. Econ. Assoc. 2024, jvae057. [Google Scholar] [CrossRef]

- Cervellati, E.M.; Filotto, U.; Sgrulletti, D.; Stella, G.P. Buy now, pay later consumer credit behavior: Impacts on financing decisions. Qual. Res. Financ. Mark. 2025; ahead-of-print. [Google Scholar] [CrossRef]

- Proprietarily or Open? Online Credit Offering Strategy for a Platform-Based Retailer. Available online: https://wvpn.ustc.edu.cn/https/77726476706e69737468656265737421f9f244993f20645f6c0dc7a59d50267b1ab4a9/document/10292498 (accessed on 18 December 2024).

- Wei, L.; Xie, J.; Zhu, W.; Li, Q. Pricing of platform service supply chain with dual credit: Can you have the cake and eat it? Ann. Oper. Res. 2023, 321, 589–661. [Google Scholar] [CrossRef]

- Adoption strategies of E-commerce consumer credit services: A dual-channel competition perspective. Int. J. Prod. Econ. 2024, 277, 109387. [CrossRef]

- Li, Q.; Zha, Y.; Li, L.; Yu, Y. The Platform’s Credit-Offering Strategy in the Presence of Integrated and Independent Systems. IEEE Trans. Syst. Man Cybern. Syst. 2022, 52, 2933–2944. [Google Scholar] [CrossRef]

- Ha, A.Y.; Tong, S.; Wang, Y. Channel Structures of Online Retail Platforms. Manuf. Serv. Oper. Manag. 2022, 24, 1547–1561. [Google Scholar] [CrossRef]

- Gong, C.; Ignatius, J.; Song, H.; Chai, J.; Day, S.J. The Impact of Platform’s Information Sharing on Manufacturer Encroachment and Selling Format Decision. Eur. J. Oper. Res. 2024, 317, 141–155. [Google Scholar] [CrossRef]

- Li, J.; Wang, H.; Shi, V.; Sun, Q. Manufacturer’s choice of online selling format in a dual-channel supply chain with green products. Eur. J. Oper. Res. 2024, 318, 131–142. [Google Scholar] [CrossRef]

- Bian, Y.; Wang, H.; Yan, S.; Han, X. Platform channel strategy of selling format: Effect of asymmetric service information. Transp. Res. Part E Logist. Transp. Rev. 2024, 185, 103508. [Google Scholar] [CrossRef]

- Chen, L.; Nan, G.; Li, M.; Feng, B.; Liu, Q. Manufacturer’s online selling strategies under spillovers from online to offline sales. J. Oper. Res. Soc. 2023, 74, 157–180. [Google Scholar] [CrossRef]

- Ke, W.; Zhou, X.; Lev, B.; Zhang, K. Agency, reselling, or hybrid mode? Competing with store brand. Transp. Res. Part E Logist. Transp. Rev. 2024, 184, 103487. [Google Scholar] [CrossRef]

- Tian, L.; Vakharia, A.J.; Tan, Y.; Xu, Y. Marketplace, Reseller, or Hybrid: Strategic Analysis of an Emerging E-Commerce Model. Prod. Oper. Manag. 2018, 27, 1595–1610. [Google Scholar] [CrossRef]

- Liu, Y.; Lu, J.; Yan, N. Agency or reselling? Supplier’s online channel strategies with platform financing. Eur. J. Oper. Res. 2024, 318, 1014–1027. [Google Scholar] [CrossRef]

- Zhen, X.; Xu, S.; Li, Y.; Shi, D. When and how should a retailer use third-party platform channels? The Impact of spillover effects. Eur. J. Oper. Res. 2022, 301, 624–637. [Google Scholar] [CrossRef]

- Yoo, W.S.; Lee, E. Internet Channel Entry: A Strategic Analysis of Mixed Channel Structures. Mark. Sci. 2011, 30, 29–41. [Google Scholar] [CrossRef]

- Chiang, W.K.; Chhajed, D.; Hess, J.D. Direct Marketing, Indirect Profits: A Strategic Analysis of Dual-Channel Supply-Chain Design. Manag. Sci. 2003, 49, 1–20. [Google Scholar] [CrossRef]

- Cattani, K.; Gilland, W.; Heese, H.S.; Swaminathan, J. Boiling Frogs: Pricing Strategies for a Manufacturer Adding a Direct Channel that Competes with the Traditional Channel. Prod. Oper. Manag. 2006, 15, 40–56. [Google Scholar] [CrossRef]

- Bhunia, S.; Das, S.K.; Jablonsky, J.; Roy, S.K. Evaluating carbon cap and trade policy effects on a multi-period bi-objective closed-loop supply chain in retail management under mixed uncertainty: Towards greener horizons. Expert Syst. Appl. 2024, 250, 123889. [Google Scholar] [CrossRef]

- Jiang, B.; Jerath, K.; Srinivasan, K. Firm Strategies in the “Mid Tail” of Platform-Based Retailing. Mark. Sci. 2011, 30, 757–775. [Google Scholar] [CrossRef]

- Barman, H.; Pervin, M.; Roy, S.K.; Weber, G.-W. Analysis of a dual-channel green supply chain game-theoretical model under carbon policy. Int. J. Syst. Sci. Oper. Logist. 2023, 10, 2242770. [Google Scholar] [CrossRef]

- Gilbert, S.M.; Hotkar, P.; Liu, C. Channel Choice via On-Line Platform. Prod. Oper. Manag. 2024, 33, 1373–1392. [Google Scholar] [CrossRef]

- Van Crombrugge, M.; Breugelmans, E.; Gryseels, F.; Cleeren, K. How Retailers Change Ordering Strategies When Suppliers Go Direct. J. Mark. 2024, 89, 00222429241266576. [Google Scholar] [CrossRef]

- Song, W.; Chen, J.; Li, W. Spillover Effect of Consumer Awareness on Third Parties’ Selling Strategies and Retailers’ Platform Openness. Inf. Syst. Res. 2021, 32, 172–193. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).