1. Introduction

The relentless increase in atmospheric carbon dioxide concentrations represents one of the most formidable challenges confronting humanity, manifesting in accelerating global climate change with profound environmental, economic, and societal consequences [

1]. To mitigate this existential threat, carbon emission trading systems (ETS) have emerged globally as a cornerstone policy instrument, leveraging market mechanisms to incentivize cost-effective greenhouse gas emission reductions. Valued for their economic efficiency, capacity to spur low-carbon innovation, and transparency, carbon markets are pivotal in facilitating the transition towards global carbon neutrality. As the world’s largest energy consumer and carbon dioxide emitter, China’s strategic development and expansion of its national ETS hold immense significance. Having surpassed the European Union ETS in traded volume, China’s carbon market is now a focal point in global carbon mitigation efforts [

2]. According to the International Energy Agency’s 2025 report, China’s carbon emissions in 2024 remained roughly unchanged from those in 2023, amounting to 1.26 billion tonnes, among which emissions from the energy sector increased by

, while those from industrial processes decreased by

. China’s total carbon emissions account for

of the global total, which is comparable to the proportion of China’s manufacturing industry in the global manufacturing sector. Considering China’s GDP growth rate, the value of China’s carbon emission intensity is on a downward trend.

Central to the functioning of any ETS is the carbon price. This critical signal guides resource allocation, informs corporate decarbonization strategies and investment decisions, and underpins the valuation of carbon assets. Only accurate prediction of carbon prices can guide the government in formulating reasonable carbon market policies, encourage enterprises to actively participate in carbon market trading, encourage social capital to actively invest in low-carbon technology industries, and promote the comprehensive low-carbon transformation of the economy [

3]. Carbon price is influenced by the dynamic interactions of policy and institutional factors, financial markets, macroeconomics, climate change, and the crucial energy market [

4]. Using the quantile connectedness approach, Wang et al. [

5] analyzed the spillovers among climate policy uncertainty, energy price, green bond index, and carbon price. Yan et al. [

6] found that there is a long-term equilibrium relationship between carbon price and coal futures price, and they can also influence each other in the short term. Dong et al. [

7] used time frequency network analysis based on quantile vector autoregression and revealed the risk spillovers between China’s energy, financial, and carbon markets in different time and frequency domains. Taking into account economic policy uncertainty and investor sentiment, Man et al. [

8] evaluated the risk spillover and hedging performance of China’s carbon energy finance markets system before and after its establishment of a national unified carbon market.

Among these influencing factors, the energy market vitally impacts the carbon market. Liu et al. [

9] measured the tail dependence and risk spillover effects between China’s carbon market and the coal, crude oil, and natural gas markets using the TVP-Copula-CoVaR method. Based on the methods of network topology analysis and the DY spillover index, Qiao et al. [

10] analyzed the time-varying spillover effect and network structure of risk transmission among renewable energy, non-renewable energy, and carbon markets. By employing the dynamic conditional correlation generalized autoregressive conditional heteroscedasticity model, Chang et al. [

11] investigated the volatility spillover effects and dynamic correlations between China’s emissions allowances and fossil energy markets. Considering different time horizons, Cui et al. [

12] utilized a proposed wavelet-based multi-scale investigation framework to explore the information spillovers and dynamic dependence between China’s energy and regional carbon emission trading markets. Liu et al. [

13] identified the interactions between fossil fuel and carbon market prices in Guangdong. Coal-fired power generation is the main source of carbon emissions [

14,

15] in China and has a significant impact on the carbon price trajectory. A decline in coal prices typically enhances the relative cost competitiveness of coal-fired power generation compared to lower-carbon alternatives. This leads to increased coal consumption, higher CO

2 emissions, and consequently, greater demand for emission allowances within the ETS, exerting upward pressure on carbon prices. Conversely, a significant rise in coal prices can diminish coal consumption, reduce associated emissions, lower compliance demand for allowances, and thus potentially place downward pressure on carbon prices. Studying the dynamic relationship between the coal market and the carbon market is of great practical significance for correctly handling the relationship between carbon reduction policies and energy consumption and achieving carbon peak targets.

Existing studies have achieved significant results, laying a solid foundation for further exploration. Note that most of these studies are based on probability theory to characterize uncertainties in energy and carbon price fluctuations. Actually, probability theory is mainly good at dealing with situations where its corresponding probability models can be determined through mathematical statistical methods and data analysis, and uncertainties that exist at this time are aleatory uncertainties [

16]. However, most of the data closely related to human activities in the real world we face are difficult to meet these ideal conditions [

17]. Due to unexpected events, political conflicts, limited access to data information, and insufficient cognitive levels of market participants, there are epistemic uncertainties [

18] in the fluctuations of carbon and energy prices. To reasonably deal with epistemic uncertainty, uncertainty theory [

18] was founded as another axiomatic mathematical system. Under the framework of uncertainty theory, uncertain differential equations [

19] were proposed to characterize the evolution of dynamic systems affected by uncertain noise interference and to describe dynamic phenomena with uncertainty by combining deterministic differential equations with uncertain processes. Chen and Liu [

20] proved the existence and uniqueness theorem of the solution of an uncertain differential equation under the linear growth condition and the Lipschitz condition. Noticing that some uncertain differential equations do not have analytical solutions, Yao and Chen [

21] linked the solutions to a series of ordinary differential equations and designed a numerical method. For practical purposes, moment estimations for unknown parameters based on different forms [

22] and residuals [

23] of uncertain differential equations were investigated. Based on these theory methods, uncertain differential equations have been successfully applied in many fields, such as stock prices [

23], carbon emissions [

24], and reliability evaluation [

25]. It can be seen that uncertain differential equations have already revealed a promising development trend. However, as far as we know, there has been no research on applying uncertain differential equations to the fields related to energy and carbon prices.

Most previous research has utilized probability theory to deal with uncertainties in energy and carbon price fluctuations. In contrast, our study adopts uncertain differential equations to address the epistemic uncertainties that are often overlooked or inadequately handled by these traditional methods. This approach allows us to more effectively deal with the epistemic uncertainties present in the fluctuations of carbon and energy prices due to various real-world factors like unexpected events and limited data access. By establishing a carbon-energy linkage model, this study explores in detail how energy prices affect overall carbon prices by influencing the mean and fluctuation path of carbon market prices and delves into the dynamic relationship between energy markets and carbon markets. The findings of this research have positive significance for clarifying the linkage between carbon and energy prices and are expected to contribute to providing practical implications for policymakers and market participants in navigating the increasingly interconnected energy-carbon markets.

The remainder of this paper is organized as follows.

Section 2 establishes the carbon-energy linkage model and derives its analytical solution to characterize the price trends of carbon and energy. Using historical data on carbon and energy prices, an estimation method and hypothesis testing method for the proposed model are presented in

Section 3. Based on these, a case study is shown in

Section 4. Finally, the conclusions of this study are presented in

Section 5.

2. Model Construction and Analysis

In order to study the impact mechanism of energy prices on carbon prices, it is first necessary to establish a linkage model between carbon prices and energy prices. Despite fluctuations in carbon prices, they often tend to recover to a certain level over a period of time. This is because the supply and demand relationship in the carbon market has a self-regulating mechanism. When carbon prices are too high, companies will have more motivation to adopt energy-saving and emission reduction technologies and optimize production processes to reduce carbon emissions and thus reduce the demand for carbon quotas; at the same time, higher carbon prices will stimulate more carbon reduction projects and increase the supply of carbon quotas. On the contrary, when carbon prices are too low, companies have insufficient motivation to reduce emissions, the demand for carbon quotas is relatively stable, and the supply may decrease, leading to a rebound in carbon prices. This self-regulation of market supply and demand ensures that carbon prices do not deviate from a specific level in the long term, which is consistent with the assumptions of the mean reversion model. Therefore, we use the following mean reversion uncertain differential model:

to describe the linkage between energy prices and carbon prices. In this carbon-energy price linkage model (

1),

and

are carbon price and coal price at time

t, respectively, and

is the initial carbon price at time

,

is a Liu process that measures the uncertainty of carbon prices over time,

m,

a,

,

,

, and

are unknown parameters to be estimated,

represents the average level of carbon prices,

a measures the speed at which carbon prices return to the average level,

represents the degree to which energy prices affect the level of carbon price fluctuations, and

represents the degree of impact of energy prices on the average carbon prices, and power parameters

and

are added considering the possibility of nonlinear effects. In addition to the above analysis, we also use uncertain hypothesis testing to verify the model’s ability to fit actual data in the subsequent case study (see

Table 1).

Firstly, we utilize the properties of uncertain differential equations [

20] to obtain analytical solutions for the carbon-energy price linkage model (

1).

Theorem 1. As the solution for the carbon-energy price linkage model (1)

, the carbon price is written as follows:where and are prices of carbon and energy at time t, respectively, m, a, γ, σ, , and are unknown parameters to be estimated, and is a Liu process. Proof. Inspiring by Chen and Liu [

20], we denote two uncertain processes

and

via uncertain differential equations, written as follows:

and

where

,

,

, and

. According to [

20], we obtain the following:

and

It follows from the integration by parts [

20] that the following:

which mean the uncertain process

is the solution of the carbon-energy price linkage model (

1). Taking

and

, the solution can be obtained as follows:

The theorem is proved. □

Secondly, based on the carbon-energy price linkage solution (

2), we obtain the following properties for carbon prices.

Theorem 2. At any given time t, the carbon price is a normal uncertain variable with the expected value, calculated as follows:and the standard deviation is calculated as follows:where is the energy price at time t, m, a, γ, σ, , are unknown parameters to be estimated, and is a Liu process. Proof. According to properties of Liu process [

18], we know that the following is calculated:

is a normal uncertain variable with the expected value 0 and the standard deviation, written as follows:

at each time

t. It follows from properties of normal uncertain variable [

18] that at each time

t the carbon price

is also a normal uncertain variable with the expected value, written as follows:

and the standard deviation, written as follows:

The theorem is proved. □

Recall that the uncertainty distribution and inverse uncertainty distribution for a normal uncertain variable with the expected value

e and the standard deviation

[

18] are written as follows:

and

respectively. Correspondingly, at time

t the uncertainty distribution and inverse uncertainty distribution for the carbon price

are written as follows:

and

respectively, where

and

are shown in Theorem 2. Therefore, the

(

) confidence interval for the carbon price

can be constructed as follows:

5. Conclusions

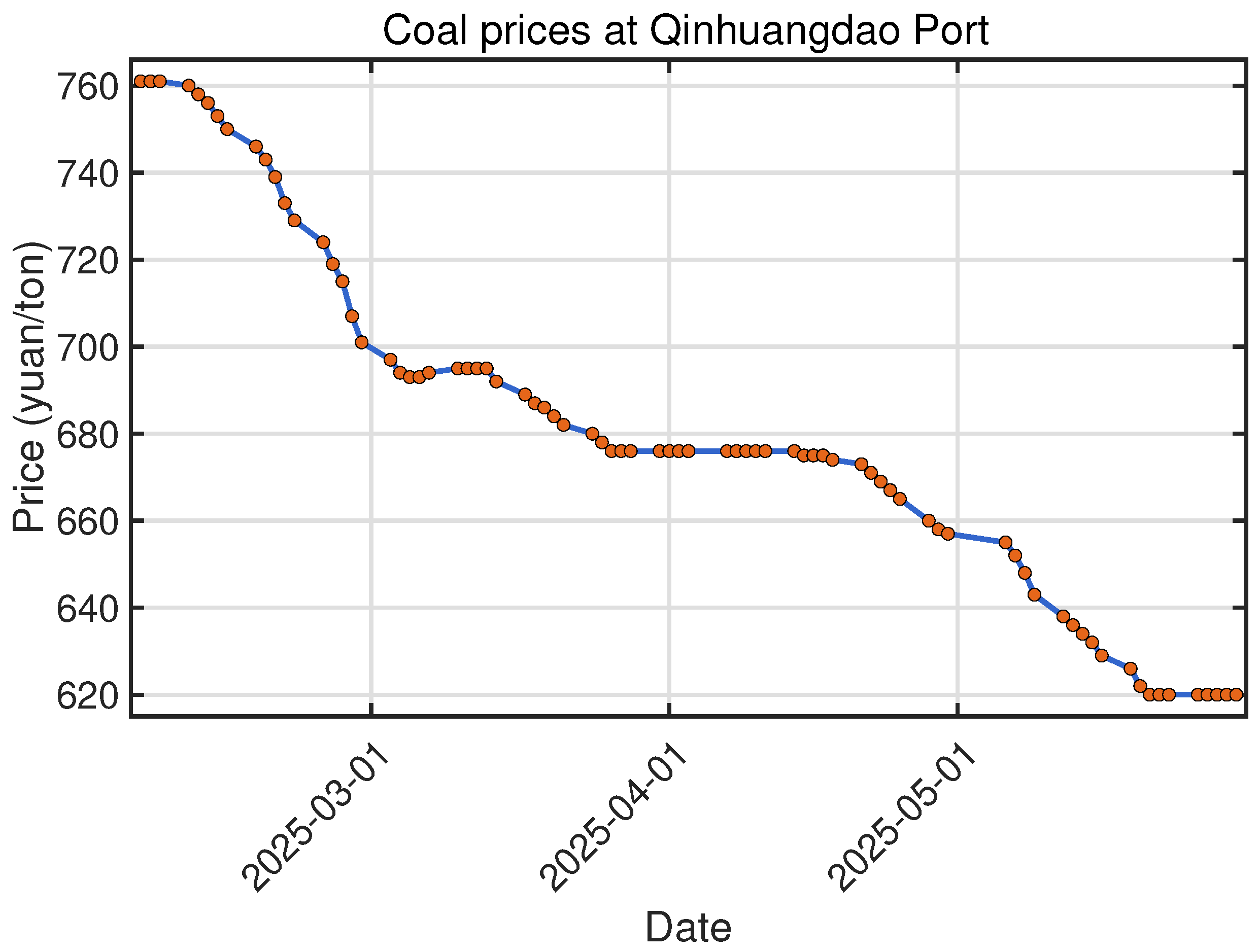

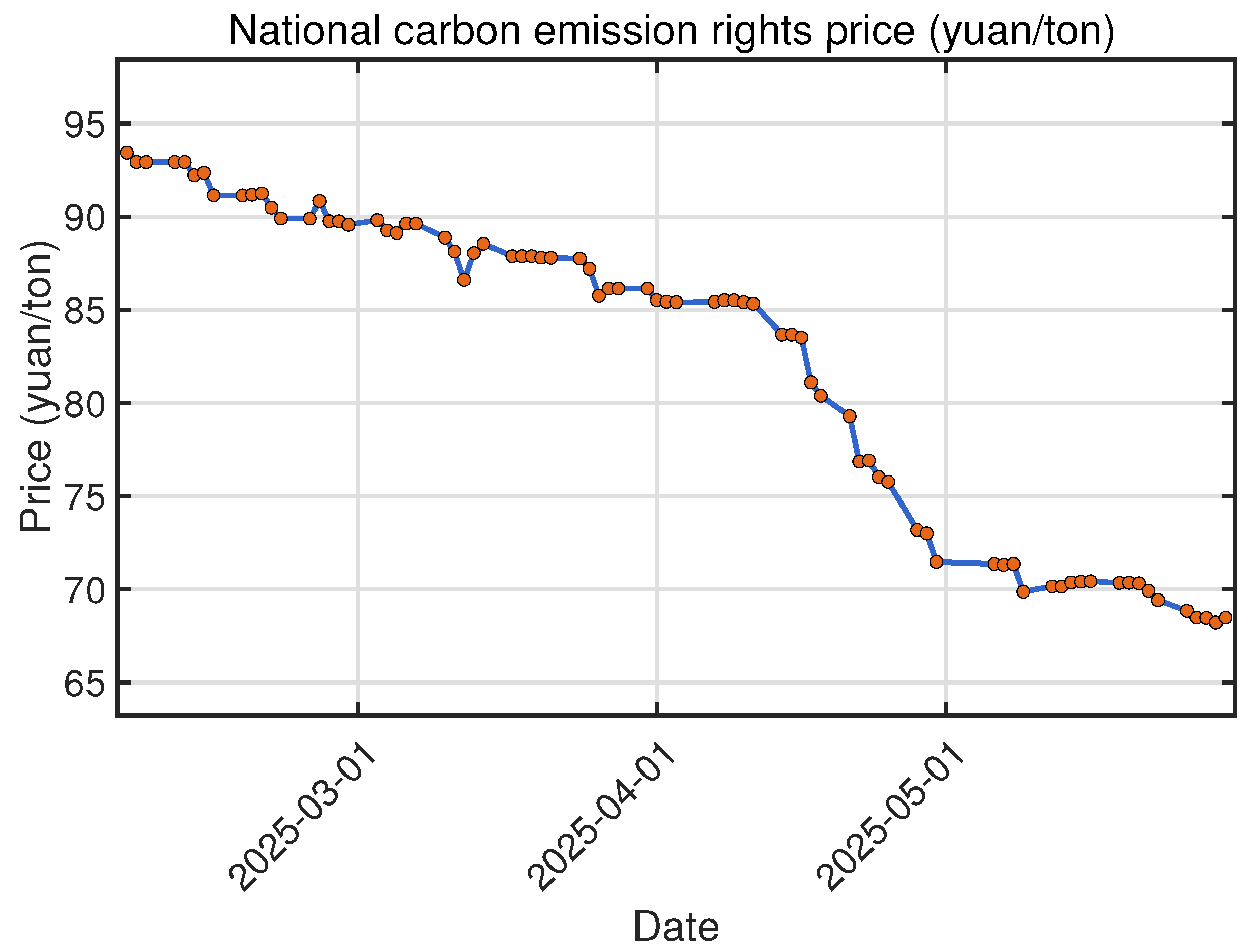

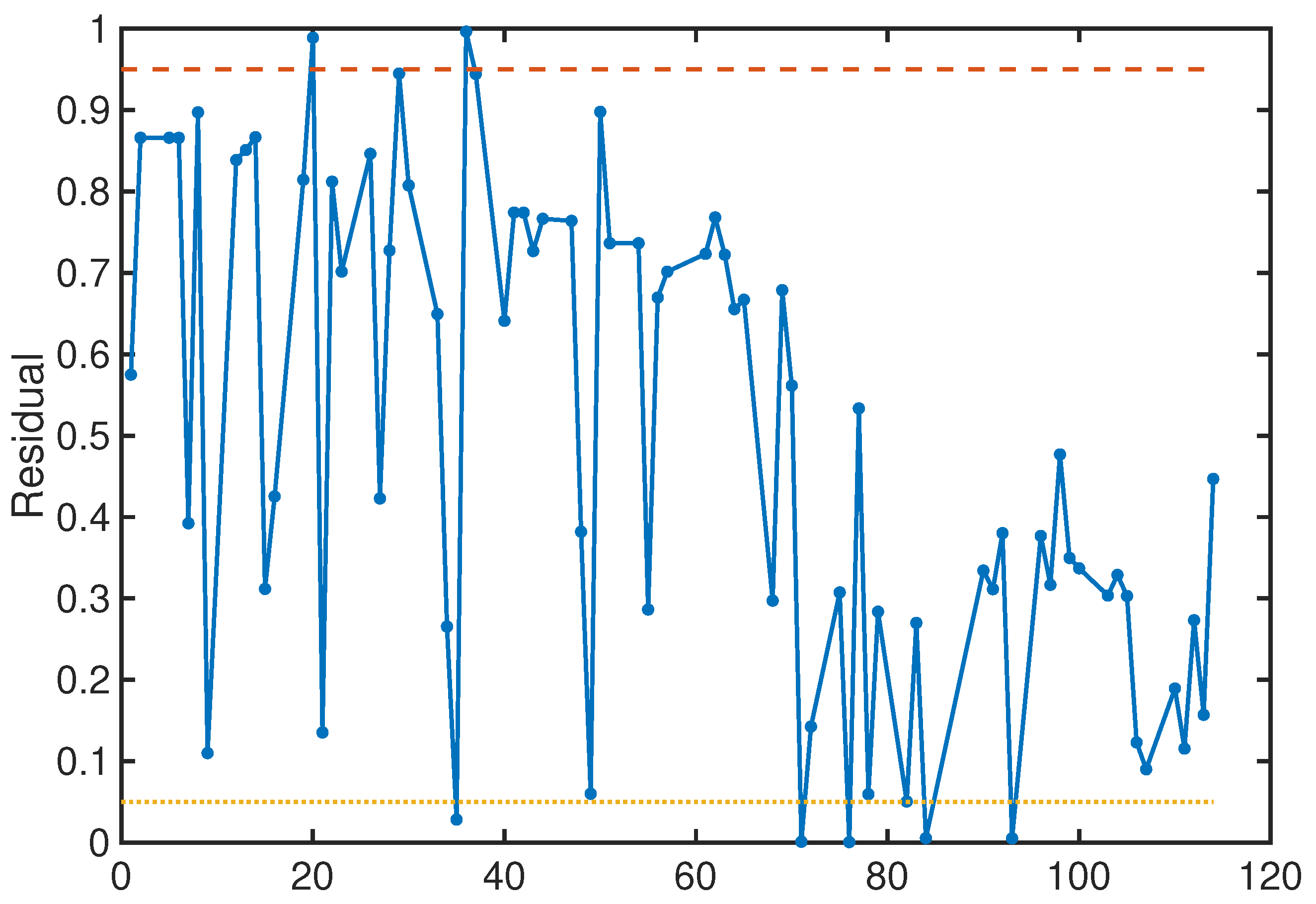

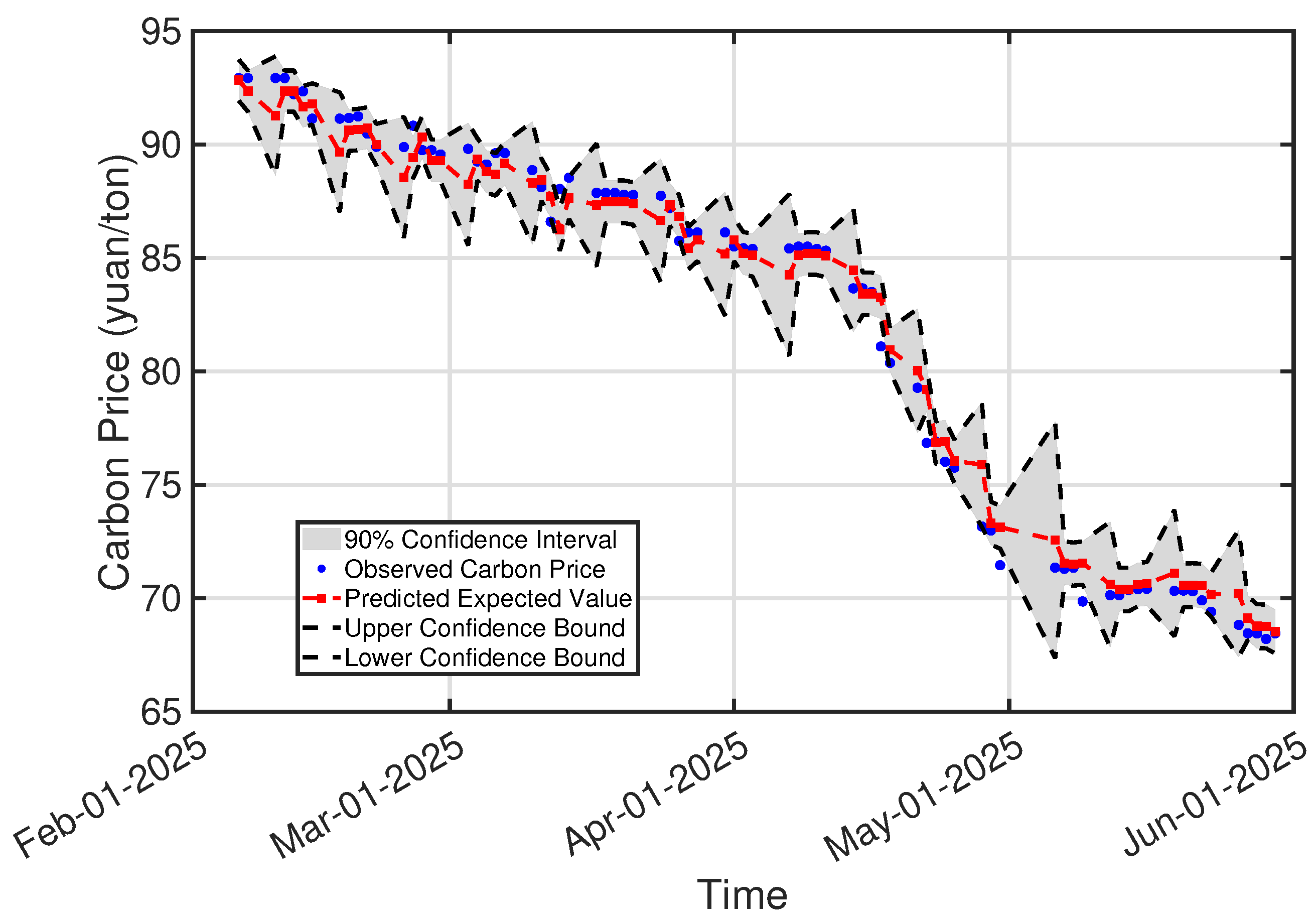

In the face of escalating atmospheric carbon dioxide concentrations, ETS have become crucial policy tools, and understanding the dynamic relationship between energy prices and carbon prices within this context is of great significance. This study delved into the dynamic connection between the energy market and the carbon market through uncertain differential equations, aiming to address the gaps in existing research regarding epistemic uncertainties in energy and carbon price fluctuations. By deriving the analytical solution of the carbon-energy linkage model, analyzing its properties, proposing parameter estimation and hypothesis testing methods using historical data, and discussing how energy prices impact carbon prices, we have established a viable framework. The case study with Qinhuangdao Port coal price and national carbon price verified the effectiveness of our methodology in capturing the uncertain interactions in carbon-energy markets. In terms of deterministic trend fitting, the established model’s mean squared error is , with the fitting error controlled within . In terms of quantifying uncertainty trends, the confidence interval covers the majority of the observed data points. The maximum error between the upper bound of the confidence interval and the observed values is , accounting for of the corresponding observed values. The maximum error between the lower bound of the confidence interval and the observed values is , which accounts for of the corresponding observed values. In terms of predictive ability, the predicted value for the next day obtained by the proposed model is , with a prediction error of . The confidence interval for the prediction is . Moreover, the value at risk of the logarithmic return rate of carbon prices is predicted to be .

This research proposes a new approach to better handle dynamic cognitive uncertainty caused by unexpected events, political conflicts, limited access to data information, and insufficient cognitive levels of market participants. This helps to clarify the price linkage mechanism between carbon and energy, which is beneficial for improving the risk management of participants in energy and carbon markets. It also provides more reasonable policy-making references for policymakers, enabling them to better navigate the increasingly interconnected energy-carbon markets. Moreover, it is worth noting that the methodology employed herein holds the potential for generalization to other markets and for analyzing prices of various products, although the specific model forms may need to be adjusted accordingly. Future research efforts could focus on exploring such extensions to further enhance the applicability of our approach in a broader context.