2.1. Time-Varying Quantile Spillover Theory

A core challenge in studying risk transmission across financial markets lies in capturing the nonlinear and time-varying nature of systemic interconnectedness. Traditional linear models, such as the standard VAR, or time-varying models that focus solely on conditional means, implicitly assume that the propagation mechanism of shocks remains stable over time and across different market states. However, both empirical evidence and financial practice suggest that market behavior in the tails significantly deviates from normal conditions. For instance, during crisis periods, the transmission of bad news tends to be faster and broader, a phenomenon commonly referred to as asymmetric spillover.

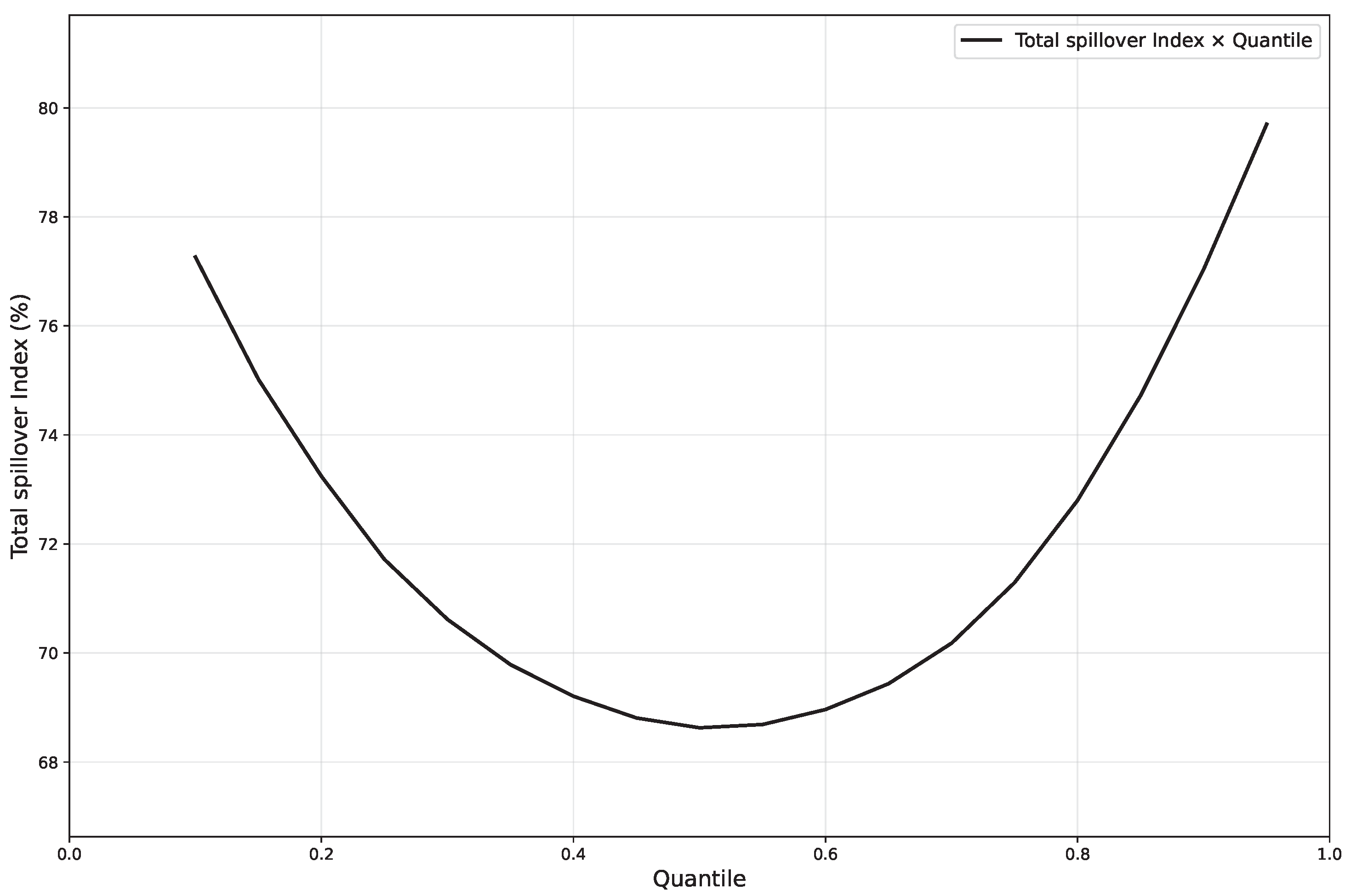

To better characterize such state- and time-dependent connectedness, a comprehensive framework based on time-varying quantile spillovers (TVQs) is developed. This approach facilitates a slice-wise decomposition of spillover effects across various quantile levels (

), capturing market conditions that range from extremely pessimistic to extremely optimistic. In addition, it allows for the dynamic monitoring of how these spillover patterns evolve over time. Following the methodologies proposed by Zhang and Ma [

36], Bouri et al. [

37], Jena et al. [

38], and Gong et al. [

39], the time-varying quantile spillover model is constructed as follows. The Time-Varying Parameter Quantile Vector Autoregressive (TVP-QVAR) model extends the conventional static-coefficient framework to a dynamic, time-varying specification:

where

is an

vector of market returns,

is the time-varying intercept vector, and

are the time-varying autoregressive coefficient matrices. The error structure, characterized by the innovation term

and its time-varying covariance matrix

, is also a function of the target quantile

. This design allows the model to flexibly adapt to different market conditions: when

is set to the median (0.5), the model describes normal market behavior, whereas, when

approaches the tails (0 or 1), it focuses on the market’s tail dynamics under extreme negative or positive shocks, respectively. To facilitate estimation and compact representation, we define the stacked coefficient matrix as

. To model the evolution of the time-varying parameters, they are typically assumed to follow a random walk process:

where

is the stacked form of all lagged coefficient matrices,

is the vectorization operator, and

and

are Gaussian white noise innovations. This specification endows the model with considerable flexibility, enabling it to capture the smooth evolution of shock transmission paths over time (indexed by

t) under different market states (determined by

).

For the estimation of this model, instead of employing computationally intensive Bayesian MCMC methods, this paper adopts the widely used adaptive estimation paradigm from Antonakakis et al. [

40]. The core of this method lies in the combination of the Kalman filter with forgetting factors.

Equation (

1) is first cast into a state-space form. All time-varying coefficients are stacked into a single state vector,

:

The state equation, which governs the evolution of the parameters, assumes a random walk:

where

Q is the covariance matrix of the state disturbances,

.

The measurement equation links the observable data,

, to the unobserved state vector:

where

is the matrix of explanatory variables, including the intercept and lagged values of

, and ⊗ denotes the Kronecker product. In practice, the model is estimated using a recursive forward pass of the Kalman filter. To allow the model to adapt to structural changes, the error covariance matrix,

, and the state covariance matrix,

Q, are updated adaptively using forgetting factors. For instance, the time-varying error covariance matrix is updated as follows:

where the forgetting factor

controls the extent to which the model relies on past information. A value of

close to 1 implies smoother parameter changes, whereas a lower value makes the model more responsive to recent information. This approach yields a unique set of parameter estimates,

, for each point in time

t through a forward recursion.

Based on the time-varying parameter estimates

and

obtained at each time point

t, the corresponding time-varying impulse response functions (IRFs), denoted as

, can be derived. Subsequently, the Generalized Forecast Error Variance Decomposition (GFEVD) framework proposed by Pesaran and Shin [

41] is employed to quantify spillover effects. Within the quantile framework, the contribution of a shock in variable

j to the

H-step forecast error variance of variable

i at time

t, denoted by

, is calculated as follows:

where

is the

-th element of the time-varying covariance matrix

, and

is a selection vector with unity for the

j-th element and zeros otherwise.

To facilitate interpretation and the construction of spillover indices, each row of the GFEVD matrix is normalized so that its elements sum to one:

This yields a time-varying normalized spillover matrix, . The matrix precisely represents the contribution of variable j to the future volatility of variable i at quantile and time t, serving as the direct input for constructing our spillover index system.

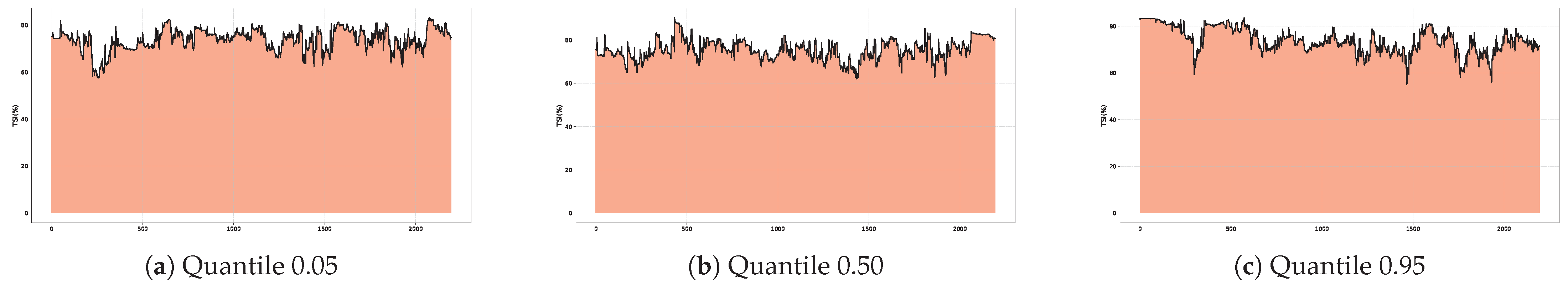

Based on this normalized quantile variance decomposition matrix, a multi-layered spillover index system, from macro to micro levels, can be constructed. First, at the macro level, the total spillover index measures the overall intensity of cross-variable influences within the system and can be seen as a comprehensive metric of systemic connectedness:

Second, to identify the main sources and destinations of spillovers within the network, the total spillover can be further decomposed into directional spillovers. Specifically, the total spillover transmitted from market

i to all other markets and the total spillover received by market

i from all other markets are defined, respectively, as follows:

Finally, the net directional spillover for each market can be computed.

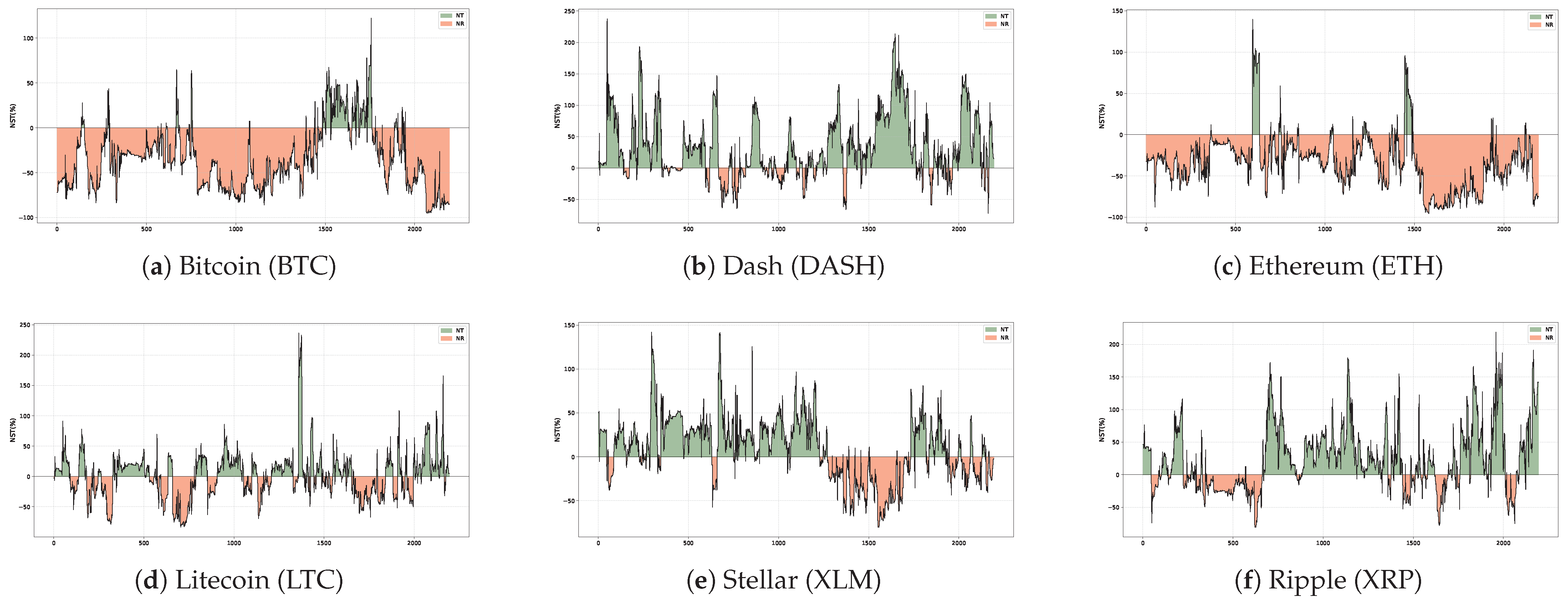

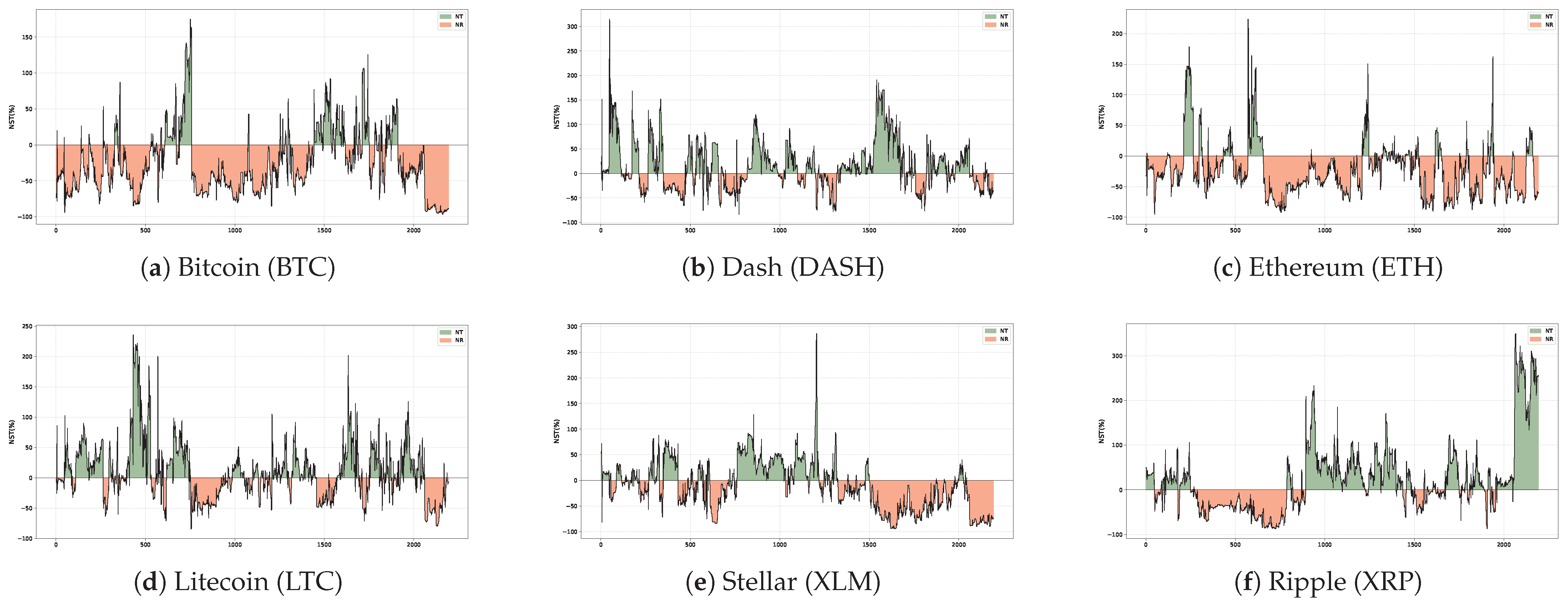

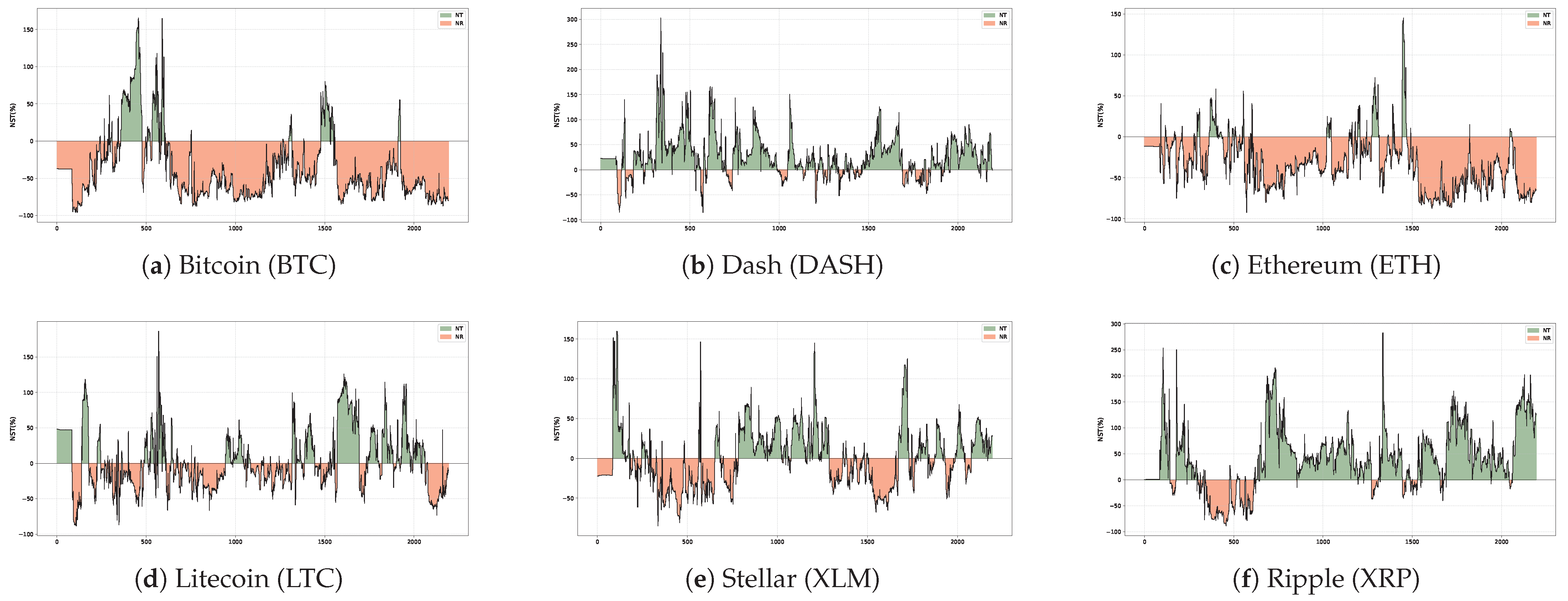

Dynamic Net Spillover Index (NSI): This index quantifies the net spillover contribution of an individual market to the entire system at a specific time and under a given market state. It is calculated as the difference between the gross spillovers transmitted to and received from all other markets:

A positive value of indicates that market i is a net transmitter of spillovers, contributing more to the system than it absorbs. Conversely, a negative value suggests that market i is a net receiver, whose volatility is more susceptible to systemic shocks from external sources. The time series of this index reveals the dynamic role-switching of a market across different periods.

Net Pairwise Directional Connectedness (NPDC): This index measures the net spillover effect between any two specific markets,

i and

j:

The spillover index system constructed above provides the foundation for quantifying the complex linkages within the cryptocurrency network. The central objective of this paper is to leverage this granular network information to select the most effective driving variables for our realized volatility forecasting models. Traditional approaches often select a fixed asset as the driver, overlooking the fact that the primary source of influence can shift across different market environments. To overcome this limitation, this paper proposes a dynamic and composite driving variable selection strategy.

The core idea of this strategy is that forecasting the realized volatility of a target asset, i, should not rely solely on the effects observed under normal market conditions. Instead, it is crucial to identify, across different market states—including high-volatility, low-volatility, and tranquil periods—the key cryptocurrency, j, that exerts the most significant spillover effect on asset i.

The specific implementation steps are as follows:

Step 1: market state classification based on the quantiles of the decomposed realized volatility components of target assets.

First, the market state is classified based on the level of a specific volatility measure,

, for the target asset,

i. This measure may refer to realized volatility (

), realized semi-variance (

), the continuous component (

), or the jump component (

). Using the time series

, the low quantile (

= 0.05) and the high quantile (

= 0.95) are computed to identify the low-volatility and high-volatility states, respectively. The market state variable,

, is therefore defined as follows:

where

is the

-th quantile of the

m-th components of the realized volatility decomposition for the target asset

i.

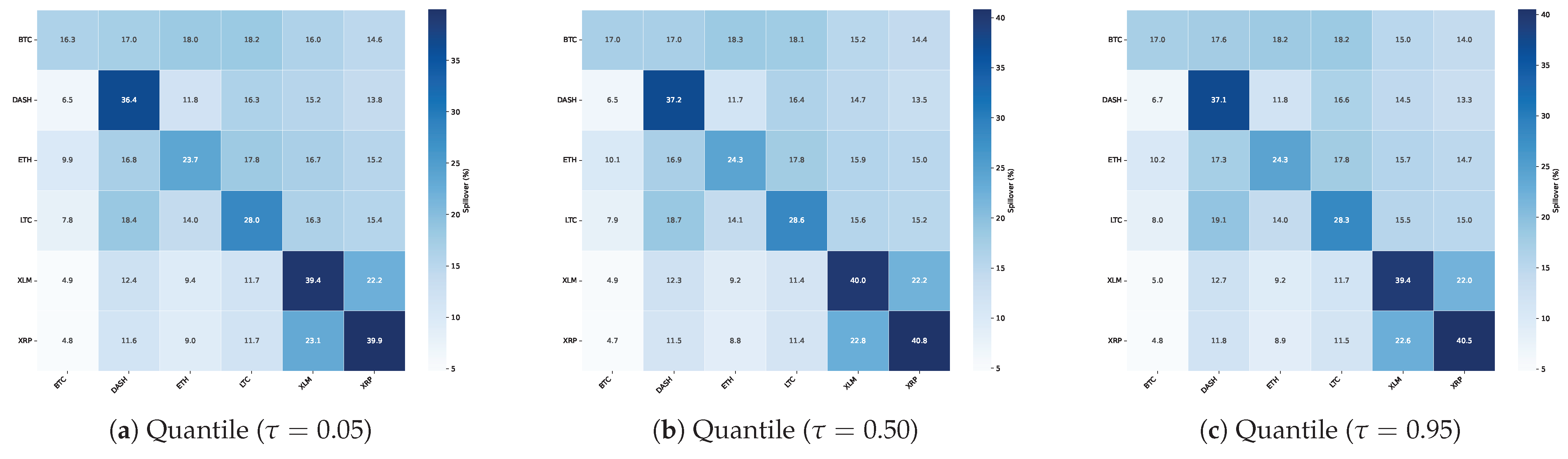

Step 2: identifying the dominant spillover source in each state.

Subsequently, the previously calculated index NPDC is employed to identify the asset, j, that exerts the largest net volatility spillover on the target asset, i, within each market state. The quantile-dependent nature of the NPDC enables a precise matching of an optimal spillover source to each market state.

Spillover source in the low-volatility state (): for the low-volatility state (defined by quantile

), the asset that generates the largest net spillover to asset

i is identified as the primary spillover source.

Spillover source in the high-volatility state (): similarly, in the high-volatility state, defined by quantile

, the asset generating the maximum net spillover is selected.

Spillover source in the normal-volatility state (): for the normal-volatility state, the asset with the largest net spillover at the median quantile (

= 0.50) is selected.

It is worth noting that the spillover network should be constructed using the same type of volatility data, , as that used for the state classification. Consequently, the optimal risk source, indexed with , is also dependent on the volatility type, m.

Step 3: constructing the state-dependent dynamic driving variable.

Finally, based on the identified state-dependent risk sources, a dynamic driving variable,

, is constructed. The value of this variable at time

t is determined by the concurrent market state,

, and it is set to the lagged volatility (

) of the corresponding spillover source:

The core advantage of this construction method is its ability to capture the most influential risk transmission pathways affecting the target asset’s future volatility, as identified by time-varying quantile spillovers. This renders the forecasting model both more forward-looking and economically interpretable.

2.2. Time-Varying Markov Transition Probability Model

This study adopts the Markov-Switching (MS) model proposed by Hamilton [

42] as the foundational framework. In this model, the distribution of the observed variable

depends on an unobservable discrete state variable,

, where

.

To capture the dynamic nature of risk transmission in financial markets, the approach of Bouri et al. [

37] is adopted, allowing the transition probabilities between states to vary over time. Specifically, a time-varying transition probability matrix,

, is constructed, where

denotes the probability of transitioning from state

i to state

j at time

t. In contrast to traditional models, these probabilities are specified as functions of a state-dependent dynamic driver variable, denoted as

, which is constructed in the previous section. For notational convenience,

is used to represent

in the subsequent discussion. The transition probabilities are defined as follows:

subject to the conditions

and

.

In the empirical implementation of this paper, two latent states are considered (

): state

corresponds to a low-volatility regime, while state

indicates a high-volatility regime. The transition probabilities between states are specified through logistic functions to ensure they lie within the

interval. Specifically, the probabilities of remaining in the same state,

and

, are modeled as functions of the lagged dynamic driver variable

.

Here, and are intercept terms reflecting state persistence, while and are slope coefficients capturing the influence of the dynamic driver on state transitions. When all slope coefficients (e.g., , ) are set to zero, the model reduces to a fixed transition probability (FTP) Markov model.

Accordingly, the full

time-varying transition probability matrix

can be expressed as follows:

This transition matrix, driven by external dynamic information, constitutes the core mechanism through which the proposed TVTP-MS-HAR model captures the complex dynamics of the financial market.

To incorporate time-varying regime-switching dynamics into the volatility model, this paper extends the seminal Markov-switching framework of Hamilton [

42] by allowing the regime transition probabilities to vary over time as a function of observable covariates. Specifically, a covariate-dependent transition probability specification is adopted. To construct the covariate

, net spillover contributions of various assets are analyzed across different variables and quantile levels. The asset exerting the most significant spillover impact on the target market is identified, and the exogenous driver in the TVTP specification is constructed accordingly, based on the corresponding variable and quantile level.