Abstract

The current paper is devoted to the dynamical property of the stochastic Cox–Ingersoll–Ross (CIR) model with pure jump noise, which is an extension of the CIR model. Firstly, we characterize the existence and 2-moment of the CIR process with a pure jump process. Consequently, we provide sufficient conditions for the compensated Poisson random measure under which the CIR process with a pure jump process is ergodic. Moreover, the stationary solution can be constructed from the invariant measure. Some numerical simulations are provided to visualize the theoretical results.

MSC:

60H15

1. Introduction

Modeling the term structure of interest rates is a long-standing topic in financial economics. Many stochastic interest rate models have been proposed in the past decades to provide a realistic and tractable method of describing the term structure; some early contributions include Vasicek [1], Dothan [2], Cox et al. [3], and Hull-White [4]. If the interest rate is determined by only one stochastic differential equation, the model is referred to as a one-factor model. Cox et al. [3] assume that the evolution of the interest rate dynamics and the stochastic volatility is given by

where the constants characterize the long time mean, the volatility, and the speed of adjustment, respectively. In the classical case, is assumed to be the standard Brownian motion. The stochastic differential equation (SDE) defined by (1) is said to be a CIR model. It is well known that the CIR model (1) is nonnegative and has some empirically relevant properties. In this model, when , the interest rate has a light-tailed stationary distribution; when , the interest rate does not have a stationary distribution (see Shreve [5]). Single-factor term structure models have been extended to multi-factor models in the literature, for example, by Longstaff–Schwartz [6] and Duffie–Kan [7]. According to the memory phenomena in the real market, an appropriate modification (see e.g., [8,9,10,11,12,13]) for the CIR model is to replace the standard Brownian motion by the fractional Brownian motion (fBm) with Hurst parameter H. For example, Hong et al. [8] investigated the first result on strong convergence rate for the numerical approximation of (1) when in which case (1) is understood as a pathwise Riemann–Stieltjes integral equation.

As is known, interest rates usually undergo sudden changes; see [14,15,16] and references therein. In the real world, we observe that asset price processes have jumps or spikes, and risk managers have to take them into consideration. Therefore, we consider the CIR model driven by pure jump noise,

where Z is a function space and is a compensated Poisson random measure on Z with intensity measure , and and are constants. However, Jin et al. [15] dealt with the pure jump noise in an additive sense,

where , , are constants and is a pure jump Lévy process with its Lévy measure concentrating on and satisfying

where they proved the ergodicity under certain conditions. Compared to a classical CIR model (1), we replace the standard Brownian motion by pure jump process to reflect sudden changes in the stock market, forward market, etc. Compared with Jin [15], we consider the multiplicative noise rather than additive noise, which better reflects the influence of the classical CIR model itself. The main goal of this paper is to prove the well-posedness and ergodicity of the CIR model driven by pure jump noise, and construct the stationary solution of the CIR model (2).

Compared to the standard Brownian setting, the main difficulty in studying equations driven by pure jump noise is that the trajectory is not continuous, which makes the Kolmogorov continuity criterion inapplicable in such situation. We will use the truncation method and Picard iteration to prove the existence and uniqueness of truncated equation, and estimate the lower bound of the solution to truncated equation and Equation (2); thus, the well-posedness of Equation (2) can be obtained by the convergence of solution. As for providing ergodicity, we perform some estimations to obtain the irreducibility; then, the ergodicity can be obtained with the Feller property. In addition, to the best of our knowledge, there are few papers about the CIR model driven by pure jump noise in a multiplicative sense.

The paper is organized as follows. In Section 2, we introduce definitions and properties of Poisson jump process, the corresponding Poisson random measure, transition semigroup, transition probability, invariant measure, etc. In Section 3, we show the well-posedness of the solution and estimate it. Subsequently, we obtain the ergodicity of CIR model driven by the pure jump process in Section 4. Eventually, using the Skorohod embedding theorem, we construct the stationary solution to Equation (2) from the invariant measure in Section 5.

2. Preliminaries

Let be a filtered probability space, for each , and denoted by the -norm.

Assumption 1.

Assume that

- ; there exists a positive constant , such that

- , and ; it permits that .

Lemma 1 ([17]).

Assume that λ is a probability measure on S, where S is a separable and complete metric space. Then, for any small enough, there exists a compact set , such that .

Definition 1 ([17]).

Denote by the value at time t of the solution to (2), starting at time s from x. Define

and for all , , and ,

We call the transition semigroup, and the corresponding transition function.

3. The Existence and Uniqueness of Solution

Considering the CIR equation driven by pure jump process, we denote , . As for the well-posedness of (2), we have the following conclusion.

Theorem 1.

If Assumption 1 holds and , then for any arbitrary fixed, there exists a unique solution to (2) with the form

and

where ,

In order to prove Theorem 1, we need following two lemmas.

Lemma 2.

Proof.

On the contrary, we assume that there exists a time such that , and . Without generality, we assume that ; then, we have . Considering the properties of Poisson process, for a small , we assume there is no jump happened on (otherwise there will be a time , ). Therefore, on interval , the Equation (2) reduces to

which is an ODE and the trajectory of is continuous on . It often follows that there exists , and for . However, on the interval , holds and strictly increases, which is contrary to our assumption . The proof is complete. □

Consequently, we use truncation methods with Equation (2) and denote

if , , then , , and we have . If , , then , , and we have . If , then , , and we have . Then Equation (2) after being truncated can be rewritten as

obviously, it is easy to verify that f and h satisfy the Lipschitz condition and linear growth, i.e., there exists a constant such that

and

Thus, we can use Picard iteration to prove the existence and uniqueness of the solution, and give the estimation of the solution on with the bounded initial data.

Lemma 3 ([18]).

Proof.

Define a sequence of processes , , and for all ,

A simple inductive argument and use of Theorem 4.2.12 in [18], is cádlág. For each , we have

We need to make some estimates, and for , for each , we have

Take the expectations and apply Doob’s martingale inequality; the following can be obtained:

With the linear growth of f and h, we can finally deduce that

where and, moreover, for general, . Similarly, we can obtain

Via Cauchy–Schwarz inequality, we can obtained

for all . In addition, by It’s isometry, the following can be obtained:

according to the Lipschitz condition, it can be easily found that

By induction based on (5) and (6), we can perform some iterations and integrals, and we deduce the key estimation:

for all , where , .

One can easily find that is convergent in for each . In fact, we can denote the -norm by ; thus, for each and for each , the following can be obtained:

moreover, the right term converging implies that each is Cauchy, and obviously convergent to some . Through standard limiting argument, it yields a useful estimate

for each , and .

Frequently, the almost sure convergence of needs to be established. Via the Chebyshev–Markov inequality given in (7), it can be deduced that

from which we see that

through Borel’s lemma. Moreover, is almost surely uniformly convergent to on finite intervals ; thus, it follows that is cádlág.

At present, we need to verify that satisfies the Equation (4). We can define a stochastic process by

Hence, for each ,

According to (8), for all , the following can be obtained:

Hence, each as required, and the existence has been proved. Let and be two distinct solutions to (4). Hence, for each ,

Similar to the argument used in deducing (6), it can be found that

thus, by Gronwall’s inequality,

therefore, the following can be obtained:

With the continuity of probability, we have

□

The rest of the proof is to assure that the solution of (4) converges to the solution of (2) as , which implies . Now, we will show the proof of Theorem 1.

Proof of Theorem 1.

From Lemma 2, the solution to truncated Equation (4) is

The key to prove is to prove that there exists an integer , for any , . Let us analyze it. If we go back to the truncation method , obviously, if , , and if , . With Lemma 2, it is easy to find that there exists an integer ; for any , we have , which implies . Therefore, the solution to Equation (4) is in the form of

which satisfies Equation (2). Hence, there is a unique solution to Equation (2) with the form

In fact, with Lemma 2, it is easy to find that the global Lipschitz condition holds. Indeed, since ,

together with , the Lipschitz constant . Meanwhile, since

with Doob inequality, we obtain

with Gronwall inequality,

The proof is completed. □

4. Ergodicity

In this section, we are supposed to prove the existence and uniqueness of invariant measure by using Krylov–Bogoliubov theorem. Firstly, we introduce the most original Krylov–Bogoliubov theorem. E is denoted as a Polish space, is the -field of all Borel subsets of E, and is the set of all probability measures defined on .

Lemma 4 ([19]).

Assume that is a Feller semigroup. If for some and some sequence , , and weakly as , then μ is the invariant measure for , where , ,

However, we usually prove the existence of invariant measures in a condition weaker than Lemma 4.

Lemma 5 ([20]).

For , let , and . For the solution process , suppose that the transition probability function has the Feller property, and satisfies the following condition:

For some , there exists a sequence , strictly increasing to such that

uniformly in n. Then, there is an invariant measure μ on .

In other words, once the Feller property and irreducibility of the transfer semigroup is proved, then the existence of the invariant measure can be obtained. Moreover, we will prove the uniqueness of the invariant measure for the Equation (2), and use the invariant measure to construct stationary solutions in the next section.

Lemma 6.

If the conditions in Theorem 1 hold, for each , there exists a positive constant , such that

Proof.

For , using Itô formula and Young inequality, we can obtain

where ; thus, it can be deduced that

Obviously, the left is uniformly bounded for all . □

Theorem 2.

If Lemma 6 holds, there exists a unique invariant measure for Equation (2).

Proof.

Assume that and are solutions to Equation (2) with initial data and , respectively; with inequality (9), we obtain

thus, by Gronwall inequality,

For any , it can be approximated pointwise by a sequence of functions in . Therefore, it suffices to take a bounded Lipschitz-continuous function to verify the Feller property. Thus, for , and ,

where is Lipschitz constant. Making use of (10), the Feller property follows. Since the probability measure of the solution supported in ,

together Chebyshev inequality with (9), it can be deduced that

which converges to zero as uniformly in . Hence by Lemma 4, there exists an invariant measure . By the convergence, for ,

now, for any invariant measure , it can be obtained that

which implies is the unique invariant measure. □

5. Stationary Solution

In Section 4, we proved that the sequences of solution to the truncated Equation (4) are convergent in , and there exists a unique invariant measure. Hence, we can construct the stationary solution to (2) by approximation scheme and Skorohod embedding theorem [21].

Theorem 3.

If Assumption 1 holds, then there exists a stationary solution to Equation (2).

Proof.

Take Equation (4) into account and define a sequence Lipschitz continuous function , which converges to h uniformly on bounded sets in . Let be a solution of the following equation

Similarly, the ergodicity of (11) can be obtained, and denoted by . We can construct a new stochastic basis , and on this basis, the Poisson random measure is the same as . Then, in the following equation

where is a -measurable stochastic process with laws , and takes values in , satisfying thus, it can be deduced that the corresponding solutions of Equation (12) are stationary processes in . It follows from Section 4 that is convergent in ; through Skorohod embedding theorem [21], there exists a -valued stochastic process and on , such that has the same law of ; thus, is a -valued stationary process. And it follows from Section 3 that -a.s.; hence, , which is both the solution to Equation (2) and also a -valued stationary process. □

6. Numerical Simulation

In this section, we will perform some numerical simulations to visualize and verify our theoretical results. For a concrete CIR model driven by pure jump process, we take Poisson parameter , and as for the CIR model itself, we take , and . In order to verify the boundedness of , we take different initial data and ; then, we have explicit CIR as follows

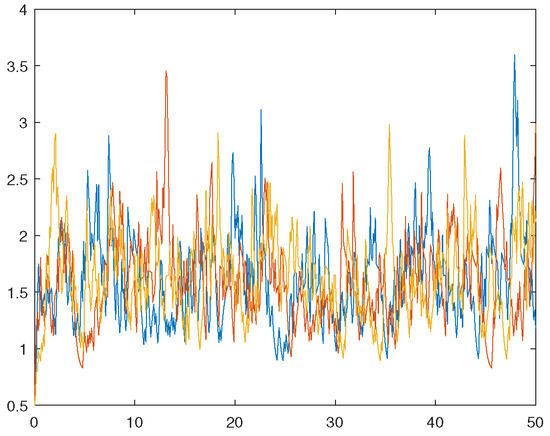

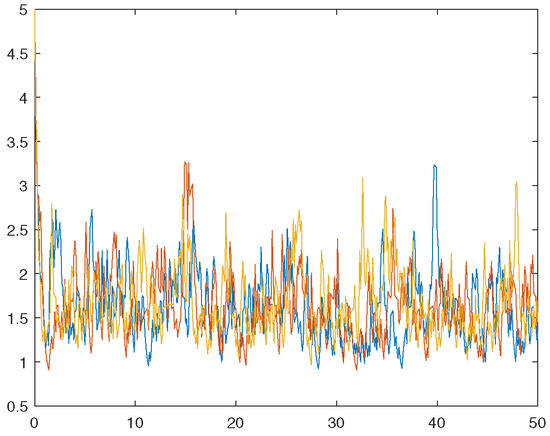

We will use the Euler–Maruyama method to iteration [22], in which the time interval and step length . Firstly, we present three sample paths of the solution to verify the boundedness of in time. Hence, we take the initial data in Figure 1 and in Figure 2, respectively.

Figure 1.

Sample paths with .

Figure 2.

Sample paths with .

Remark 1.

In Figure 1 and Figure 2, we show sample paths at random, and they undergo great ups and downs, which shows the influence of the Poisson process on the properties of the equation solution well. Meanwhile, the trend of the trajectory shows the effect of the item, , on the solution, which makes its distribution concentrated as is supposed. Furthermore, the phenomenon verifies our discussion about the boundedness of the solution quite well.

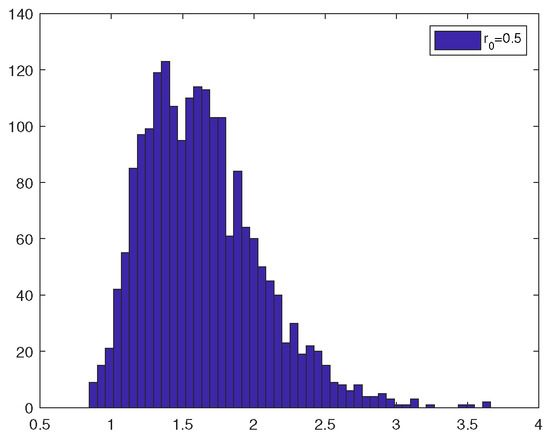

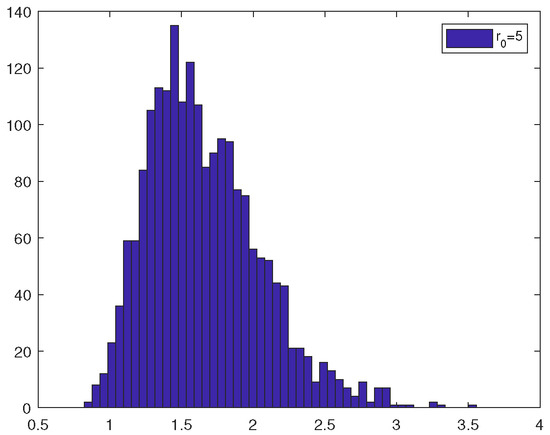

In order to show the statistical characteristics to verify the ergodicity of (13), similarly, we take two different initial data and and calculate and count the data of 1000 sample paths. Moreover, the statistical characteristics with different initial data are as follows. In Figure 3 and Figure 4, the values of the 1000 trajectories at the final moment show a tendency to concentrate, which explains the invariant measure numerically.

Figure 3.

Empirical density with .

Figure 4.

Empirical density with .

Author Contributions

Conceptualization, X.L. and H.W.; methodology, X.H.; software, F.T.; writing—original draft preparation, X.L. and C.X.; writing—review and editing, H.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data presented in this study are available on request from the corresponding author. The data are not publicly available due to that the Poisson process in this article is randomly generated and it is impossible to completely reproduce the same numerical simulation results, and readers can refer to [22] to do the numerical simulations.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Vasicek, O.A. An equilibrium characterization of the term structure. J. Financ. Econ. 1977, 5, 177–188. [Google Scholar] [CrossRef]

- Dothan, U.L. On the term structure of interest rates. J. Financ. Econ. 1978, 6, 59–69. [Google Scholar] [CrossRef]

- Cox, J.; Ingersoll, J.; Ross, S. A theory of the term structure of interest rates. Econometrica 1985, 53, 385–407. [Google Scholar] [CrossRef]

- Hull, J.; White, A. Pricing interest rate derivatives. Rev. Financ. Stud. 1990, 3, 573–592. [Google Scholar] [CrossRef]

- Shreve, S. Stochastic Calculus for Finance. II: Continuous-Time Models; Springer-Verlag: New York, NY, USA, 2004. [Google Scholar]

- Longstaff, F.A.; Schwartz, E. Interest rate volatility and the term structure: A two-factor general equilibrium model. J. Financ. 1992, 47, 1259–1282. [Google Scholar]

- Duffe, D.; Kan, R. A yield-factor model of interest rates. Math. Financ. 1996, 6, 379–406. [Google Scholar] [CrossRef]

- Hong, J.; Huang, C.; Kamrani, M.; Wang, X. Optimal strong convergence rate of a backward Euler type scheme for the Cox-Ingersoll-Ross model driven by fractional Brownian motion. Stoch. Process. Their Appl. 2019, 130, 2675–2692. [Google Scholar] [CrossRef]

- Hu, Y.; Nualart, D.; Song, X. A singular stochastic differential equation driven by fractional Brownian motion. Stat. Probab. Lett. 2008, 78, 2075–2085. [Google Scholar] [CrossRef]

- Mandelbrot, B.B.; Van Ness, J.W. Fractional Brownian motions, fractional noises and applications. SIAM Rev. 1968, 10, 422–437. [Google Scholar] [CrossRef]

- Mishura, Y.; Yurchenko-Tytarenko, A. Fractional Cox-Ingersoll-Ross process with non-zero mean. Mod. Stoch. Theory Appl. 2018, 5, 99–111. [Google Scholar] [CrossRef]

- Abidin, M.Z.; Chen, J. Global Well-Posedness and Analyticity of Generalized Porous Medium Equation in Fourier-Besov-Morrey Spaces with Variable Exponent. Mathematics 2021, 9, 498. [Google Scholar] [CrossRef]

- Abidin, M.Z.; Marwan, M.; Ullah, N.; Mohamed Zidan, A. Well-Posedness in Variable-Exponent Function Spaces for the Three-Dimensional Micropolar Fluid Equations. J. Math. 2023, 2023, 4083997. [Google Scholar] [CrossRef]

- Bao, J.; Yuan, C. Long-term behavior of stochastic interest rate models with jumps and memory. Insur. Math. Econ. 2013, 53, 266–272. [Google Scholar] [CrossRef]

- Jin, P.; Kremer, J.; Rüdiger, B. Moments and ergodicity of the jump-diffusion CIR process. Stochastics 2019, 91, 974–997. [Google Scholar] [CrossRef]

- Zhao, J. Long time behaviour of stochastic interest rate models. Insur. Math. Econ. 2009, 44, 459–463. [Google Scholar] [CrossRef]

- Peszat, S.; Zabczyk, J. Stochastic partial differential equations with Lévy noise (An evolution equation approach). In Encyclopedia of Mathematics & Its Applications; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- Applebaum, D. Lévy Processes and Stochastic Calculus; Cambridge University Press: Cambridge, UK, 2004. [Google Scholar]

- Da Prato, G. Ergodicity for Infinite Dimensional Systems; Cambridge University Press: Cambridge, UK, 1996. [Google Scholar]

- Chow, P. Stochastic Partial Differential Equations; CRC Press: Boca Raton, FL, USA, 2015. [Google Scholar]

- Flandoli, F.; Gatarek, D. Martingale and stationary solutions for stochastic Navier-Stokes equations. Probab. Theory Relat. Fields 1995, 102, 367–391. [Google Scholar] [CrossRef]

- Yang, H.; Li, X. Explicit approximations for nonlinear switching diffusion systems in finite and infinite horizons. J. Differ. Equ. 2018, 7, 2921–2967. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).