Abstract

With the global climate problem becoming increasingly severe, governments have adopted policies to encourage enterprises to invest in low-carbon technologies. However, the opacity of the carbon emission reduction process leads to incomplete consumer trust in low-carbon products as well as higher supply chain transaction costs. Based on this, this paper constructs Stackelberg game models with and without blockchain under different power structures and compares the impact of these models on low-carbon emission reduction decisions. The results show that: (1) blockchain does not necessarily improve enterprise profits and can only help enterprises maintain optimal profits within a certain range when the carbon emission cost is low; (2) when consumers’ environmental awareness is high, the blockchain can incentivize manufacturers to enhance carbon emission reduction, and it has an obvious promotional effect on retailers’ profits; and (3) the profit gap between enterprises in the supply chain is larger under different power structures, and the implementation of blockchain can coordinate profit distribution and narrow the gap between enterprises. Compared with the manufacturer-dominated model, the emission reduction in products is maximized under the retailer-dominated model. Our study provides theoretical support for the government to regulate greenhouse gas emissions as well as for the optimization of enterprises’ decision-making supported by blockchain.

MSC:

90B06

1. Introduction

With the rapid development of the global economy, carbon emissions are increasing year by year [1]. According to research data from the Global Carbon Project (GCP), carbon emissions will reach a new high by 2023 and grow by more than 1.1%, while the average growth rate in the past decade has been 0.5% per year. Many studies have confirmed that carbon emissions are a main cause of global warming [2,3]. Excessive emission of greenhouse gases has led to rapid changes in the global climate, which has not only caused serious damage to the ecological environment, but also brought great challenges to the survival and development of mankind. As a management model that aims to reduce carbon emissions in the whole supply chain process, a low-carbon supply chain is of great significance in improving the ecological environment and coping with climate change. However, with the complexity and asymmetry of low-carbon supply chain structures, consumer trust in low-carbon products is reduced. Uniform carbon emission standards and regulatory mechanisms have not been established globally, and standards differ in different countries and regions. This makes it difficult for enterprises to choose partners and formulate emission reduction strategies, and it also increases the implementation costs of carbon emission reduction [4]. The promotion of related technologies such as the Internet of Things (IoT), blockchain, and the circular economy has brought new opportunities for low-carbon supply chains. For example, IoT technology is used to monitor operational processes to reduce energy consumption and carbon emissions. Blockchain technology can improve the transparency and traceability of the production process and enhance consumers’ trust in low-carbon products. The circular economy model promotes the recycling of resources and reduces the generation and emission of waste. In addition, through financial support, tax relief, and the establishment of carbon emission trading markets and other measures, the government encourages and supports enterprises to adopt advanced technologies to build a green and low-carbon development system, strictly control the total carbon emissions in their products, and gradually transform to clean and low-carbon.

The continuous promotion of low-carbon policies has led to a gradual increase in consumers’ carbon perception sensitivity and environmental awareness. This not only improves their understanding of carbon emissions but also affects their purchase decisions. In order to meet consumers’ needs, enterprises use low-carbon technologies to increase the carbon emission reduction in products and produce green and low-carbon products [5]. For example, Hesteel Group utilizes hydrogen technology to help green development in the iron and steel industry, as well as to build a green and low-carbon special steel producer. Volkswagen cooperates with Nippon to adopt cured tin-free electrophoretic coatings to improve the green and low-carbon environmental performance in products and to promote the development in both parties towards green circulation and synergy.

In the trend of current environmental protection, not only are manufacturers actively engaged in the research and development of low-carbon products, but retailers are also involved in the sales process of low-carbon products. With the application of big data technologies, retailers have access to more market information, which makes their position in the supply chain competition change significantly. Retailers hope that low-carbon products can bring them more benefits, while manufacturers need to balance the relationship between the costs and benefits of carbon emission reduction to make decisions. However, due to the differences in the information held by enterprises, the status and discourse power of enterprises in decision-making is obviously different [5]. This asymmetry in power structures has an important impact on the operational efficiency and emission reduction in low-carbon supply chains.

Considering information asymmetry and opaque production processes, it may be difficult for consumers to distinguish the differences between low-carbon and high-carbon products when making purchases, thus affecting their willingness to purchase. With the increasing maturity of blockchain technology, its distributed database technology realizes the transparency and traceability of the carbon emission reduction process, which effectively enhances consumers’ trust in low-carbon products [6]. Manufacturers adopt blockchain to record the carbon emission information of their products, and they utilize the tamper-proof characteristics of blockchain technology to transfer the emission reduction information to consumers to help them make purchase decisions for low-carbon products. For example, characteristic agricultural products such as West Lake Longjing and the Dangshan Crispy Pear use blockchain technology to accurately track and predict their carbon footprint so as to manage carbon emissions effectively [7]. Therefore, it is of great practical significance for the sustainable development of low-carbon economies to study the emission reduction decisions of supply chain enterprises under different power structures, as well as how blockchain technology empowers decision optimization for the sustainable development of low-carbon economies.

Although the development of blockchain technology has achieved remarkable results, its application areas are yet to be explored [8]. Especially in the current context of increasingly serious global environmental problems, how to utilize blockchain technology to promote the practice of supply chain emission reduction has become an important research direction. In addition, unequal power structures exacerbate the complexity of low-carbon supply chain management decisions.

In this context, this paper raises the following questions: (1) How do power structures affect energy conservation and emission reduction in enterprises? And what kind of power structures are more conducive to emission reduction? (2) Can blockchain technology achieve carbon emission reduction and supply chain profit optimization? (3) How does blockchain technology coordinate the benefit distribution problem when the power structure is unequal?

In order to solve the above problems, this paper constructs a Stackelberg game model with and without blockchain under different power structures for the retailer owning both online and offline channels, and it compares the effects of different decision-making models on product pricing, carbon emissions reduction, and the profits of supply chain enterprises. On this basis, we analyze the influence of consumers’ skepticism about low-carbon products and blockchain costs on emission reduction decisions, so as to provide decision support for blockchain technology implementation in low-carbon supply chains under different power structures.

The rest of the paper is organized as follows: Section 2 introduces the related literature review and explains our contribution; Section 3 describes the framework of the model and basic assumptions; Section 4 constructs the game models and compares the equilibrium results; Section 5 is a numerical simulation; and Section 6 summarizes the conclusions of this paper and points out future research directions. Concrete proof can be seen in Appendix A.

2. Literature Review

The literature related to this study mainly includes three aspects: carbon emission reduction strategies, power structures in supply chains, and the application of blockchain in supply chain management.

2.1. Carbon Emission Reduction Strategies

In recent years, the environmental awareness of consumers has gradually increased, and more and more people have begun to pay attention to the environmental performance of products and the social responsibility of enterprises. This forces supply chain enterprises to pay attention to environmental protection and sustainable development while pursuing economic benefits. Therefore, how to achieve carbon emission reduction under the premise of ensuring economic benefits has become an urgent problem for supply chain enterprises. At present, many scholars have studied carbon emission reduction strategies for supply chains from various perspectives, such as low-carbon policy [2,9,10,11], consumers’ low-carbon preferences [12,13], and supply chain coordination mechanisms [14,15]. Wang et al. [2] used differential games to study the carbon emission reduction decisions of construction supply chains under government subsidies. The results showed that the government subsidy strategy could not only achieve the optimal carbon emission reduction in buildings, but it could also improve the market demand for low-carbon buildings. Wang et al. [9] investigated non-cooperative, cooperative, and contractual game scenarios under the constraints of carbon cap-and-trade rules and compared the carbon reduction efforts and optimal profits of supply chain members under the three scenarios. Fu et al. [10] showed that low-carbon enterprises were more likely to benefit from green technologies after the implementation of a carbon tax policy, and that green technologies can mitigate or even eliminate the asymmetry of initial emissions. Jauhari et al. [11] studied that under stochastic demand, the government used a carbon tax policy to regulate manufacturers, so that they could invest in green technology and reduce the total carbon emissions generated by the supply chain. Sun et al. [12] analyzed the relationship between consumers’ preferences for low carbon and the timeliness of carbon emitting technologies on the carbon transfer behavior of manufacturers and suppliers. Yang and Xu [13] researched the impact of consumers’ low carbon preferences on product production and carbon emission reduction decisions. Liu et al. [4] illustrated that under the low carbon preferences of consumers, the carbon emission reduction cost sharing strategy could improve the sales volume and profit of retailers, as well as enhance the cooperative relationship between supply chain enterprises. Yuan et al. [14] proposed a contract model combining option and cost allocation to realize the optimal carbon emission reduction and supply chain coordination under the circumstance of the low carbon preferences of consumers. In the existing research, we have found that consumers have a very high degree of trust in the carbon reduction in products. They believe that enterprises will take effective measures to reduce the carbon emissions in their products and thus have a positive impact on the environment. However, due to information asymmetry, consumers often only have access to limited product information, which makes it difficult for them to accurately judge the degree of carbon reduction in products. This leads to lower consumer trust in low-carbon products, which affects their purchasing decisions and weakens the market share of low-carbon products.

2.2. Power Structures in Supply Chains

The power structure in a supply chain reflects the status and discourse power of the enterprise, which has a significant impact on operational decision-making and performance [15,16]. Currently, the research on supply chain decision-making under different power structures has achieved obvious results. Luo et al. [17] studied the pricing strategy of vertically and horizontally competitive enterprises under different combinations of power structures. Yang et al. [18] compared the product pricing and purchasing decisions of retailers based on trust under different power structures. Yu et al. [19] discussed the role of different power structures on influencer marketing and found that consumer utility and social welfare are maximized when the power is equal. Li et al. [20] explored the impact of three different power structures on price adjustment and inventory decisions under stochastic demands. Chen et al. [21] studied the influence of manufacturers’ and retailers’ output uncertainty and corporate social responsibility on enterprises’ optimal decisions under different market power structures.

The power structure not only directly affects the pricing strategy of products but also has a profound impact on the profit distribution of supply chain enterprises. More importantly, it also plays a crucial role in the emission reduction decisions of low-carbon supply chains. Meng et al. [22] analyzed the product selection strategies of two competing enterprises with different power structures under different carbon tax levels. Zhang et al. [23] studied the production and emission reduction decisions of manufacturers under three power structures in the supply chain, as well as the government’s regulatory strategy on carbon emission allowances. Tang et al. [24] found that under different power structures, the early return of bank loans by manufacturers with limited funds was conducive to promoting carbon emissions and social welfare. Cao et al. [25] considered the choice of platform channels by traditional retailers under different power structures. Xu et al. [26] analyzed the influence of three power structures on low-carbon emission reduction and product pricing decisions for manufacturers with disappointment avoidance behavior. Huang et al. [27] investigated the government’s carbon emission reduction target allocation decision under different supply chain power structures and discussed the impact of supply chain power structures on carbon emission reduction allocation decisions and social welfare. Cai et al. [28] used a differential game model to study the issues of carbon trading limits and trading systems under power structures and consumers’ low-carbon preferences, and they analyzed the optimal pricing and carbon emission reduction decisions of supply chain members. Gong et al. [29] investigated the selection of low-carbon strategies and live marketing models for supply chains under two power structures. The above literature adequately considers the differences in power structures between enterprises and analyzes the influence of different power structures on enterprise decision-making. However, with the promotion of blockchain technology, more and more enterprises use it to coordinate the differences in power structures between enterprises, balance the profit distribution of enterprises, and improve energy conservation and emission reduction, so as to maximize the overall profits of the supply chain.

2.3. Application of Blockchain in Supply Chain Management

The emergence of blockchain technology provides an effective solution to solve the problem of information asymmetry in the traditional operation process. It uses the advantages of decentralization, traceability, and non-tampering to record and track product-related information, and it provides a unified platform for data sharing in all links of the supply chain. In recent years, with the increasing development and application of blockchain technology, more and more scholars have begun to pay attention to the value of blockchain technology in supply chain management. Blockchain technology not only improves the transparency of the supply chain [30], but it also realizes the information sharing among supply chain members [31]. Enterprises use blockchain technology to achieve product traceability [32,33], improve supply chain costs [34,35], and reduce their operational risks [36,37]. Hastig and Sodhi [30] investigated that implementing blockchain can enable supply chain traceability, which improves coordination among supply chain enterprises. Wang et al. [31] have pointed out that blockchain technology can optimize the risk control system of supply chain financing and reduce both enterprise costs and supply chain financing risks. Paulo et al. [32] analyzed that blockchain technology can save costs in the flower supply chain and improve product differentiation and freshness. Wu et al. [33] studied the relationship between the application of blockchain technology and consumers’ awareness of traceability as well as traceability cost sharing. Wu and Yu [34] researched the impact of blockchain technology on platform supply chains from the perspective of information transparency and transaction costs. Qu et al. [35] aimed at the problems in enterprise financing and used blockchain technology to effectively improve the disadvantages of information asymmetry and increase the transparency of information, so as to solve the problem of financing difficulties. Liu et al. [36] studied that blockchain technology solves the trust problem between enterprises in the process of supply chain financing, reduces the operational risk, and improves the efficiency of financing. Tian and Hu [37] investigated the effect of blockchain technology on the pricing of gaming products and the level of platform effort with or without its implementation, finding that enterprises implement blockchain technology only when players have moderate or high price tolerance for their products.

In addition, for the information asymmetry characteristics of low-carbon products, scholars have carried out research on the impact of blockchain technology on green emission reduction. Yang et al. [8] investigated blockchain adoption and value-added service information sharing in a low-carbon supply chain. Lu and Liao [38] analyzed the effects of consumer blockchain acceptance and green uncertainty on product pricing, greenery decision-making, and supply chain members’ profits in a green supply chain under three power structures. Li et al. [39] considered the premise of market uncertainty and risk to analyze the relationship between the risk attitude of supply chain enterprises and consumer surplus and social welfare. Xu et al. [40] investigated the impact of blockchain technology on low-carbon emission reduction inputs in the supply chain of a dual-channel platform. Zhang et al. [41] studied the incentive effects of two low-carbon product subsidy strategies adopted by the government on enterprises’ low-carbon emission reduction with or without the implementation of blockchain. Li et al. [42] established a three-stage Stackelberg game model for the shipping supply chain consisting of the government, port authorities, and shipping companies, and explored the role of blockchain technology and low-carbon subsidies in the decision-making of each stakeholder. These research results have solved many practical problems for enterprises and improved the transparency and efficiency of supply chain management. However, most studies still focus on the discussion of single issues in supply chain management. When enterprises face the challenges of carbon emission reduction and unequal power status at the same time, the way in which blockchain technology affects their decision-making, and how they can deal with the unequal power of discourse for low-carbon emission reduction, have yet to be further studied.

Based on the above results, this paper quantitatively analyzes the impact of power structures and blockchain on low-carbon emission reduction by applying game theory. This study fills the limitations of the existing literature that only focuses on a single variable. Through the comprehensive analysis of multiple variables, the research results are closer to the actual production and operation, which provides more practical support for enterprises when they are making decisions about energy saving and emission reduction. To the best of our knowledge, there is little literature to study the influence of blockchain technology on the decision-making in low-carbon emission reduction from the perspective of supply chain power structures. Especially for the dual-channel situation, no scholars have conducted research. Therefore, this study also fills the research gap in this field and bridges the gaps in previous studies. Table 1 summarizes the main distinction between our research and most related literature.

Table 1.

Distinction between our research and most related literature.

3. Problem Description and Basic Assumptions

3.1. Problem Description

Without the implementation of blockchain technology by manufacturers, because consumers cannot obtain the carbon emission information of products in the entire production and supply process, it is difficult for them to judge whether the purchased products are truly low-carbon and environmentally friendly. As a result, the information asymmetry in carbon emission reduction makes consumers skeptical of low-carbon products, which leads to a great loss in product sales [25]. In the case of manufacturers with blockchain technology, consumers can clearly understand the carbon emissions in the product throughout the life cycle, thereby enhancing consumers’ recognition of the product. Blockchain technology affects the profits and emission reduction decisions of low-carbon supply chain enterprises, while the unequal power structure determines the influence and voice of all parties. Referring to the studies of Xu et al. [26] and Gong et al. [29], due to different power structures, leaders in the low-carbon supply chain will have different motivations and strategies for emission reduction, which will affect the effect of carbon emission reduction.

Consider a two-level low-carbon supply chain consisting of a single manufacturer and a single retailer. The manufacturer independently develops energy-saving and emission reduction technologies and sells low-carbon products to the retailer. This paper constructs a Stackelberg game model between manufacturers and retailers under two power structures to analyze the impact of blockchain technology on emission reduction decisions. The two game models are the following: (1) Consider the situation where the manufacturer is the leader and the retailer is the follower. The manufacturer moves first to determine the carbon emissions reductions per unit of product and set the wholesale price according to its profit level, and then the retailer sets the dual-channel product retail price and according to the decision result of the manufacturer. (2) Consider the situation where the retailer is the leader and the manufacturer is the follower. The retailer first sets the dual-channel product retail price and , and then the manufacturer determines the carbon emissions reductions per unit of product and the wholesale price according to the decision of the retailer.

3.2. Basic Assumptions

To simplify the model calculations without losing generality, the following assumptions are given:

Assumption 1.

In order to increase the degree of carbon reduction in products, the manufacturer needs to pay extra costs. There is a functional relationship between the carbon emission reduction cost and the carbon emission reduction in the product. Referring to the studies of Meng et al. [22], Zhang et al. [23], Cao et al. [25], and Lu and Liao [38], this paper assumes that the manufacturer’s carbon emission reduction cost function is .

Assumption 2.

When manufacturers do not implement blockchain, consumer skepticism about low-carbon products resulting from information asymmetry weakens the market demand for the product. Due to the traceability and immutability of blockchain technology, once the production enterprise implements blockchain technology, consumers can access all the carbon reduction information of the product and subsequently eliminate skepticism about low-carbon products. Assuming that consumers are environmentally conscious, they will be more inclined towards low-carbon products when making purchases. Following common practice in the existing literature, it is assumed that the market demand of low-carbon products is linearly related to the retail price of products, the degree of carbon emission reduction, the price competition between channels, and the environmental awareness of consumers [12,14,18]. Therefore, the demand functions for online and offline channels are, respectively:

We assume that only a proportion of consumers have a preference for online channels. Let be the cross-price elasticity coefficient between channels ( also reflects the intense competition of product price between channels), and obviously . In the above functions, represents the consumers’ environmental awareness, where represents the level of consumer skepticism about low-carbon products; without blockchain technology, we get , otherwise, we set equal to 0.

Assumption 3.

The existing literature contains different definitions of blockchain cost: some only consider usage cost, some only consider construction cost, and some consider both usage cost and construction cost. Drawing on the research of Li et al. [39] and Zhang et al. [41], the manufacturer implements blockchain technology with the help of blockchain servicers, so they do not need to invest in fixed costs and only pay for the use of blockchain per unit of product. Assume that the blockchain cost per unit is . When the manufacturer decides not to adopt blockchain technology (i.e., ), in this condition, becomes zero; on the contrary, . When blockchain cost is greater than one-half (i.e., ), owing to the high cost of blockchain usage, this makes it unprofitable for the manufacturer, and thus the manufacturer chooses to not adopt blockchain. As a consequence, this paper only discusses the case of .

Assumption 4.

As the production cost per unit of the product has no influence on the conclusions of our study, the production cost is not considered in order to simplify the analysis. Both the manufacturer and the retailer are rational decision makers who aim to maximize their profits. The related notations and descriptions are shown in Table 2.

Table 2.

Notations and descriptions.

4. Model

The comparative analysis is divided into four situations based on different power structures and with or without blockchain implementation: (1) the manufacturer-dominated without blockchain (NM model); (2) the retailer-dominated without blockchain (NR model); (3) the manufacturer-dominated with blockchain (BM model); and (4) the retailer-dominated with blockchain (BR model).

The profit functions of the manufacturer and retailer without blockchain are as follows:

The profit functions of the manufacturer and retailer with blockchain are as follows:

where and are the marginal profit functions for the retailer’s online and offline channels, respectively.

4.1. The Decision Modeling for the Manufacturer-Dominated

Theorem 1.

In the manufacturer-dominated model, there exists a unique equilibrium solution when .

According to the objective function of the retailer in Equations (4) and (6), the Hessian matrix is obtained as

The first-order sequential principal minor is , and the second-order sequential principal minor is . The Hessian matrix is a negative definite matrix and there exists a unique optimal solution, which can be obtained from the first derivative.

Thus, we can solve the online and offline prices.

Put (7) and (8) into Equations (3) and (5). Similarly, the Hessian matrix is obtained as

The Hessian matrix is negative definite when . The optimal solution to the manufacturer’s objective function can be calculated. The optimal equilibrium results are shown in Table 3.

Table 3.

Optimal equilibrium results with and without blockchain in the manufacturer-dominated model.

Corollary 1.

The impacts on carbon emission reduction with and without blockchain in the manufacturer-dominated model are as follows: when , ; when , ; where .

Corollary 1 shows that in the manufacturer-dominated model, the implementation of blockchain technology is beneficial to the carbon emission reduction in products when the cost of this technology is less than a certain threshold, i.e., . When , the high cost will increase the cost of the enterprise, which is not conducive to product emission reduction.

Corollary 2.

The impacts on the profits of the manufacturer and the retailer with and without blockchain in the manufacturer-dominated model are as follows:

- (1)

- when , ; when , ;

- (2)

- when, ; when , ;

where , .

Corollary 2 suggests that it is easy to recognize that is smaller than . When the blockchain cost is between and , the implementation of blockchain adds to the retailer’s profit but diminishes the manufacturer’s profit. When blockchain costs are low, the implementing of blockchain can prompt the profits of supply chain enterprises within a certain range, compared to not implementing blockchain. For the retailer, when blockchain costs exceed a certain threshold, the benefits from increased product sales are less than the losses from higher wholesale prices, and the retailer’s profit declines accordingly. For manufacturers, the benefits from wholesale prices and sales volume are less than the blockchain cost; the manufacturer’s profit is also reduced, consequently. Therefore, whether the manufacturer implements blockchain or not, and what effect blockchain brings, depends largely on the cost of blockchain. Enterprises need to weigh the pros and cons in decision-making and then develop a reasonable implementation plan.

4.2. Decision Modeling for the Retailer-Dominated

Theorem 2.

In the retailer-dominated model, there exists a unique equilibrium solution when.

According to the objective function of the manufacturer in Equations (3) and (5), the Hessian matrix is obtained as

The first-order sequential principal minor is , and the second-order sequential principal minor is . When the second-order sequential principal minor is bigger than zero, that is, , the Hessian matrix is a negative definite matrix and there exists a unique optimal solution that can be obtained from the first derivative.

Thus, we can solve the wholesale price and the emission reduction.

Put (9) and (10) into Equations (4) and (6). Similarly, the Hessian matrix is obtained as

It follows that , so . The Hessian matrix is a negative definite matrix and the optimal solution of the retailer’s objective function can be calculated. The optimal equilibrium decisions are shown in Table 4.

Table 4.

Optimal equilibrium decisions with and without blockchain in the retailer-dominated model.

Corollary 3.

The impacts on carbon emission reduction with and without blockchain in the retailer-dominated model are as follows: when , ; when , ; where .

Corollary 3 reveals that the retailer-dominated model is similar to the manufacturer-dominated model, in that the blockchain cost remains a key factor influencing the implementation of blockchain by the manufacturer.

Corollary 4.

The impacts on the profits of the manufacture and the retailer with and without blockchain in the retailer-dominated model are as follows: when , , ; when , , ; where .

Corollary 4 is similar to Corollary 2. When the blockchain cost is between and , the enterprise profits are higher than those without blockchain in the manufacturer-dominated model; however, the enterprise profits are optimal in the retailer-dominated model without blockchain.

4.3. Comparative Analysis of Models

Corollary 5.

The effects of environmental awareness, the cross-price elasticity coefficient, and channel preference on the equilibrium decision of the supply chain are derived as follows:

- (1)

- , , , , , ;

- (2)

- , , when , , ; when , , ; , ;

- (3)

- , , , , , .

Corollary 5 reveals that as consumers become more environmentally conscious (i.e., increases), carbon emission reduction, wholesale price, retail price, and dual-channel sales all increase. However, the promotion of low-carbon product sales through increased consumer environmental awareness is weakened owing to consumer skepticism and concern about low-carbon products. While raising consumers’ low-carbon awareness through publicity, enterprises are also adopting blockchain technology to increase the transparency of emission reduction information, so as to enhance consumers’ trust in low-carbon products. In addition, when rises, the competition between channels becomes more intense, and the product sales are more obviously affected by the price for this reason. Furthermore, we find that price has little to do with carbon emission reduction, wholesale price, and sales. This finding has implications for understanding consumer behavior and formulating market strategies. What’s more, although consumer channel preference has no effect on carbon reduction and wholesale price, it notably contributes to retail price and consumers’ purchasing decisions. As climbs, consumers are more inclined to purchase products through online channels, contributing to the boost in online sales and price.

Corollary 6.

Comparative analysis of carbon reduction decisions and enterprise profits with or without blockchain:

- (1)

- ;

- (2)

- when , ; when , ;

- (3)

- .

Corollary 6 illustrates that the retailer-dominated model contributes to energy savings and emissions reduction, regardless of whether the manufacturer implements blockchain or not. For the manufacturer, the extent to which its position affects the profit depends directly on the size of . When , is relatively low at this time, and the manufacturer can incentivize consumers to buy products by increasing carbon emission reduction; what’s more, the sales of low-carbon products are much higher in the retailer-dominated model. In a word, the retailer-dominated model can not only be conducive to the retailer’s own profit, but also to the manufacturer’s profit. When , consumers are skeptical about carbon emission reduction; furthermore, the high cost of increasing carbon emission reduction negatively affects the manufacturer’s profit. In view of that, the manufacturer may reduce product sales in the face of higher low-carbon research and development costs. For the retailer, on the one hand, the retailer-dominated model can improve enterprise profits; on the other hand, it also reduces the effect of consumer skepticism about carbon emission reduction in low-carbon products.

Corollary 7.

The sensitivity analysis of price and sales related to the skepticism about carbon reduction and the blockchain cost:

- (1)

- , , , , ;

- (2)

- When, , ; when , , ; ; .

Corollary 7 indicates that the price and sales of a product are negatively correlated with the level of consumer skepticism. As the level of consumer skepticism grows, the asymmetry of information about low-carbon products causes the price and sales of the product to decrease. Although blockchain technology can enhance consumer trust in low-carbon products, it also adds to the cost of the product. In this instance, the manufacturer will raise the wholesale price of the product to compensate for the loss caused by the cost of the blockchain application. When , the increase in the wholesale price will result in additional costs for the retailer, who will subsequently lift the retail price as well. This price escalation can have a negative impact on the market demand for and carbon emission reduction in the product, which in turn undermines the profitability of the manufacturer and the retailer. When , the cost of carbon reduction in the product is high. When the cost of blockchain is also high, the implementation of blockchain is detrimental to the manufacturer’s profit.

Corollary 8

.Under different power structures, a comparative analysis of the sensitivity of carbon emission reductions and enterprise profits to the degree of skepticism about carbon emission reductions is as follows:

- (1)

- , , ;

- (2)

- , , ;

- (3)

- , , .

In the production process, the opacity of carbon emission reduction information leads to consumer skepticism about low-carbon products, which further affects the decision to purchase low-carbon products. Corollary 8 shows that without blockchain, consumer skepticism about carbon emission reduction can undermine the effectiveness of energy conservation and emission reduction. The profits of the manufacturer and retailer are also negatively affected. The more consumers are skeptical of low-carbon products, the less willing they are to purchase such products. The manufacturer needs to improve consumers’ trust in low-carbon products by publicly disclosing the carbon emission information of its products, so as to promote energy conservation and emission reduction. In addition, when consumers are skeptical about low-carbon products, the retailer-dominated model is more conducive to enterprise profitability. However, as consumers become more skeptical about low-carbon products, the retailer-dominated model is more affected.

Corollary 9.

Under different power structures, a comparative analysis of the sensitivity of carbon emission reduction and enterprise profits to blockchain cost is as follows.

- (1)

- , , ;

- (2)

- , , when , ; when , ;

- (3)

- , , .

Corollary 9 shows that the cost of blockchain technology has a negative impact on the reduction in carbon emissions, as well as on the profits of the supply chain enterprises. It means that using blockchain technology may hinder the carbon emission reduction in the product, and also increase the operating cost of the enterprise. The negative impact of blockchain cost on carbon emission reduction and retail enterprise profits is greater in the retail-dominated model. When , the blockchain cost has the greatest impact on its profit in the manufacturer-dominated model. When the cost coefficient of carbon emission reduction exceeds a certain threshold, the manufacturer is reluctant to take the initiative of reducing carbon emissions and reduce the impact of cost on profit by increasing the wholesale price of products. As the carbon emissions in the products increase, consumers will be less inclined to purchase the products. In the retailer-dominated model, the retailer can take the lead in determining their own profit margins. However, because of the higher wholesale prices they have to pay, and the lower demand for their products due to the reduction in carbon emissions, the retailer’s marginal profit is greatly reduced, which affects their overall profits.

Corollary 10.

Under different power structures, the impacts of consumer skepticism about low-carbon products and blockchain cost on carbon emission reduction with and without blockchain are as follows:

- (1)

- ,,;

- (2)

- ,,;

where , .

Corollary 10 indicates that in different power structures, the level of variation in carbon emission reduction with and without blockchain is positively correlated with the blockchain cost and negatively correlated with the consumers’ low-carbon skepticism. The degree of consumer skepticism without blockchain undermines carbon emission reduction. Compared with the manufacturer-dominated model, the retailer-dominated model is more inclined to increase self-interest, which damages the manufacturer’s profit. In this case, carbon emission reduction is the lowest. Blockchain enhances products’ carbon reduction transparency and helps consumers to better identify low-carbon products and the carbon reduction level, which leads to increased product sales. More product sales also drive carbon emission reduction. Carbon emission reduction is highest due to the largest product sales under the retailer-dominated model. Therefore, the level of variation in carbon emission reductions with and without blockchain is the most retailer-dominated.

5. Numerical Analysis

In this section, the main conclusions are further analyzed by numerical simulation. This is achieved through collecting the relevant data of enterprises with blockchain and carbon emission reduction in practice, and referring to relevant literature [17,28,29,32] to process the data without loss of generality. The relevant parameter values are set as follows: , , , , , .

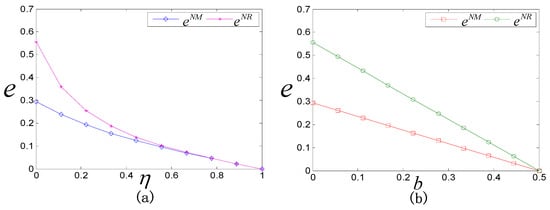

5.1. The Impacts of the Cost Coefficient for Carbon Emission Reduction on Carbon Emission Reduction and Profits of Enterprises

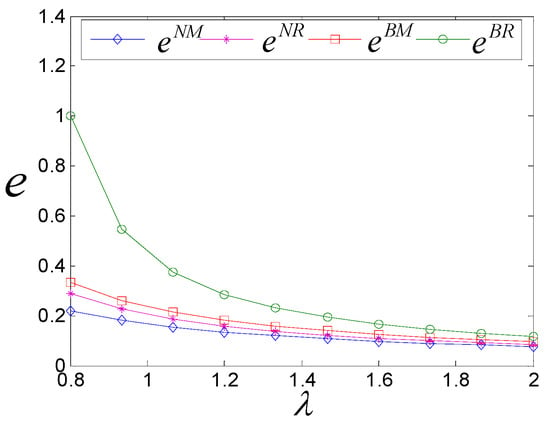

With the continuous progress and promotion of low-carbon emission reduction technology, the cost faced by the manufacturer in implementing this technology is also steadily growing. From Figure 1, as increases, the emission reduction cost per unit product increases, and the high cost has a negative effect on the motivation of the manufacturer to reduce carbon emissions. Carbon reduction activities by the manufacturer are not open and transparent, which causes consumers to be less trusting in low-carbon products and hurts their willingness to purchase. In view of this, the manufacturer should adopt blockchain technology to provide more transparent carbon reduction information, so as to enable consumers to better recognize and enhance their trust in low-carbon products. This increased transparency and trust will further drive consumer demand for low-carbon products, which in turn will incentivize the manufacturer to increase the energy efficiency and emissions reduction in its products. The retailer-dominated model is more conducive to energy saving and emissions reduction than the manufacturer-dominated model.

Figure 1.

The impact of on carbon emission reduction.

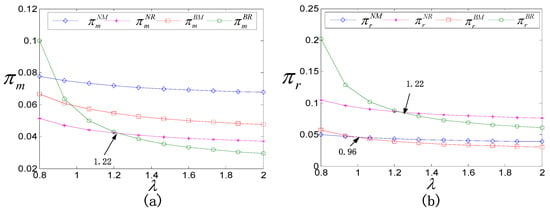

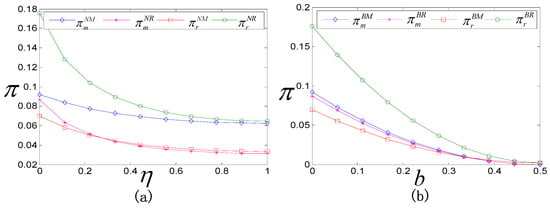

Figure 2 illustrates that the cost coefficient of carbon emission reduction is negatively correlated with the profits of supply chain enterprises, and the profit of the retailer is most affected by it. In the manufacturer-dominated model, the application of blockchain technology does not improve the profit of the manufacturer. Even the manufacturer loses the advantage of capturing the market at a lower price due to the blockchain cost. Therefore, the manufacturer is reluctant to invest in blockchain technology. For the retailer, when , the blockchain strengthens the consumers’ valuation of low-carbon products, and it also elicits a boom in the sales and profit of products. However, when , the benefits of implementing blockchain are much less than its cost, and this technology will not be adopted. Under the retailer-dominated model, the manufacturer has limited control over price. When , implementing blockchain technology can expand the manufacturer’s profit and help the retailer to optimize their profit within a certain range. But as grows, the product cost, the wholesale price, as well as the retail price all go up, which reduces consumer demand for low-carbon products and reduces the profitability of the retailer.

Figure 2.

The impact of on the profits of supply chain enterprises: (a) the impact of on the manufacturer’s profit; (b) the impact of on the retailer’s profit.

5.2. The Impact of Consumer Environmental Awareness on Carbon Emission Reduction and the Profits of Supply Chain Enterprises

Consumers’ environmental awareness is getting stronger and stronger, attributed to the propaganda of low-carbon policies by the state and enterprises, and they are more inclined towards low-carbon and environmentally friendly products when making purchases. As can be seen in Figure 3, as consumers’ environmental awareness increases, the manufacturer should actively adopt advanced technologies to reduce the carbon emissions in its products. When the manufacture implements blockchain technology, the variation of has a more remarkable influence on the degree of carbon emission reduction. Carbon emission reduction is especially most affected by environmental awareness under the retailer-dominated model. The application of blockchain technology makes information about energy saving and emission reduction more transparent; thus, the consumers’ trust in low-carbon products is enhanced, and the viscosity of demand increases, which brings more profit for the supply chain eventually. For the manufacturer, the increase in profit is a greater incentive to expand its carbon reduction efforts and makes products more low-carbon and environmentally friendly.

Figure 3.

The impact of on carbon emission reduction.

Figure 4 illustrates that both the manufacturer and the retailer will benefit as consumers become more environmentally aware. In the manufacturer-dominated model, the implementation of blockchain weakens the profitability of supply chain enterprises, especially when environmental awareness is relatively low, and the degree of skepticism about low-carbon products has little effect on demand. Given the high cost of blockchain technology, the implementation of blockchain technology has little effect on the profitability of enterprises. However, as environmental awareness rises, the effect of distrust about low-carbon products on consumer demand gradually enlarges, and the profits of enterprises without blockchain will suffer. When consumers’ environmental awareness increases, the profits gained from blockchain are used to compensate for blockchain costs; hence, the profit margin with or without blockchain remains unchanged for the manufacturer. The situation is exactly the opposite for the retailer: not only consumers’ environmental awareness, but also the application of blockchain technology, can promote consumers’ trust in low-carbon products, which in turn pushes product sales up. In this condition, the retailer gains more profit, and the profit margin with or without blockchain gradually shrinks. In the retailer-dominated model, the implementation of blockchain technology is beneficial to supply chain enterprises and is far more favorable to the manufacturer than the retailer.

Figure 4.

The impact of on the profits of supply chain enterprises: (a) the impact of on the manufacturer’s profit; (b) the impact of on the retailer’s profit.

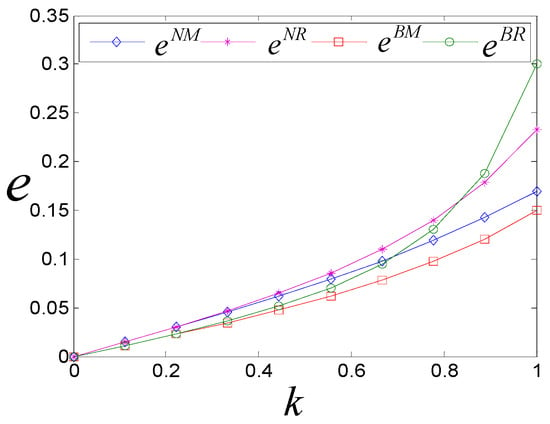

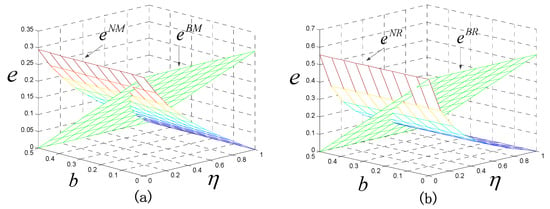

5.3. The Impacts of Consumer Environmental Awareness on Carbon Emission Reduction and the Profits of Supply Chain Enterprises

According to Figure 5a, the effect of carbon emission reduction without blockchain technology under different power structures gradually decreases with the rise of . The lack of transparency and traceability makes it challenging for consumers to accurately understand the carbon emission reduction in products, resulting in lower demand for low-carbon products. Meanwhile, under the retailer-dominated model, the marginal profit per unit product of the manufacturer is diminished, which further shrinks the manufacturer’s profit and causes less motivation on the part of the manufacturer to save energy and reduce emissions for products, and thus the degree of carbon emission reduction is most affected by . However, as we can see from Figure 5b, in spite of the upsurge in blockchain cost, the effect magnitude of blockchain cost on carbon emission reduction is narrowed compared to Figure 5a. The evidence indicates that blockchain technology has some potential for carbon emission reduction. By providing greater transparency and traceability of products, blockchain technology can facilitate consumers in better understanding carbon emission reduction, thereby raising their willingness to make purchases.

Figure 5.

The impact of on carbon emission reduction: (a) the impact of on carbon emission reduction without blockchain; (b) the impact of on carbon emission reduction with blockchain.

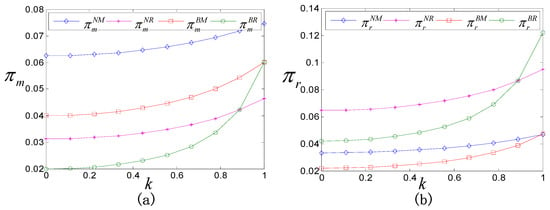

Figure 6a,b demonstrates that profit differentials between supply chain enterprises are relatively small under the manufacturer-dominated model. However, without blockchain, consumers are skeptical about the carbon reduction in products, which will negatively affect the profits of supply chain enterprises. However, after the manufacturer implements blockchain technology, the retailer’s profit is boosted considerably, while this is not the case for the manufacturer. Blockchain technology enhances consumers’ trust in products, thereby boosting the retailer’s sales and profit. However, as the cost of blockchain rises, it is notably detrimental to the profits of the supply chain under the retailer-dominated model. This is because the retailer cannot afford the high cost of blockchain, resulting in a compression of the retailer’s profit, which in turn affects the stability of the entire supply chain.

Figure 6.

The impact of power structure on the profits of the supply chain: (a) the impact of on the profits of the supply chain without blockchain; (b) the impact of on the profits of the supply chain with blockchain.

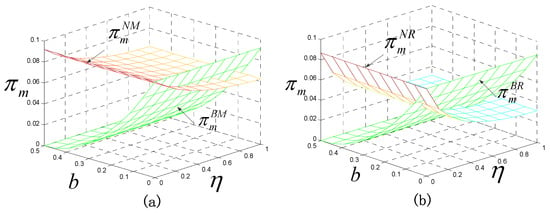

5.4. The Impacts of Blockchain Technology on Carbon Emission Reduction and the Profits of Supply Chain Enterprises under Different Power Structures

A comparison with Figure 7a,b reveals that the greatest product carbon reductions occur in the retailer-dominated model. However, as rises, consumer demand for low-carbon products weakens much more than in the manufacturer-dominated model. In this case, the manufacturer’s profit is significantly reduced, and its incentive to save energy and reduce emissions is considerably weakened, consequently leading to a larger magnitude of decline in carbon reduction. In contrast, in the manufacturer-dominated model, as the manufacturer has some pricing power, they can raise the wholesale price to make up for the loss caused by carbon reduction skepticism. Therefore, the manufacturer’s profit does not falling rapidly, and its behavior towards energy efficiency and carbon reduction remains relatively steady.

Figure 7.

The impact of blockchain technology on carbon emission reduction: (a) the impact of blockchain technology on carbon emission reduction in the manufacturer-dominated model; (b) the impact of blockchain technology on carbon emission reduction in the retailer-dominated model.

The influence of with or without blockchain on the profits of the manufacturer and the retailer is similar under different power structures, so we only simulated and analyzed the impact of blockchain technology on the manufacturer’s profit, and the results are shown in Figure 8a,b. In the manufacturer-dominated model, as the manufacturer has a certain status and voice in product pricing, its decision-making mainly aims at maximizing its profit. When consumers’ skepticism about carbon emission reduction in products and blockchain costs are both low, whether the manufacturer adopts blockchain has little impact on corporate profits. In order to expand the market share, the manufacturer should implement blockchain technology to reduce consumer skepticism about low-carbon products and boost product demand. When the level of low-carbon skepticism is high and the blockchain cost is low, the implementation of blockchain technology will contribute to an increase in the manufacturer’s profit. However, when the blockchain cost is high, the implementation of blockchain technology will substantially erode the manufacturer’s profit regardless of the level of consumer skepticism about the carbon reduction; under these circumstances, the implementation of blockchain technology will be detrimental to the manufacturer. Compared with the retailer-dominated model, the manufacturer’s profit is less affected by blockchain cost and more affected by the skepticism about carbon reduction in the manufacturer-dominated model.

Figure 8.

The impact of blockchain technology on the manufacturer’s profit: (a) the impact of blockchain technology on the manufacturer’s profit under the manufacturer-dominated model; (b) the impact of blockchain technology on the manufacturer’s profit under the retailer-dominated model.

6. Conclusions

This paper investigates the intrinsic connection between the implementation of blockchain technology and the carbon reduction decision-making of supply chain enterprises under different power structures. More specifically, by adding a variety of factors such as the carbon emission reduction cost coefficient, consumer environmental awareness, the degree of consumer skepticism about low-carbon products, and blockchain cost into four models, we explored the impact of these factors on product pricing, the degree of carbon emission reduction, and the profits of the supply chain enterprises. The following issues were thoroughly investigated: whether blockchain technology can achieve carbon emission reduction and supply chain profit optimization, and how to coordinate the distribution of benefits when the power structure is unequal. The main findings of this paper can be summarized as follows.

- (1)

- When the carbon reduction cost is low, enterprise profits are maximized under the retailer-dominated model, yet when the carbon reduction cost is high, blockchain technology does not improve enterprise profits. For the retailer, blockchain helps enterprise profits remain optimal within a certain range, but as the carbon reduction cost coefficient goes up, the wholesale price as well as the retail price of the product becomes higher, consumer demand for low-carbon products decreases, and the retailer’s profit is inevitably impaired. When the carbon reduction cost coefficient is moderate, the profit can achieve optimization without blockchain under the retailer-dominated model.

- (2)

- When consumer environmental awareness is low, and the consumers’ acceptance of low-carbon products is not universal, then the impact of the level of skepticism of low-carbon products on market demand is not significant, so the manufacturer chooses to not implement blockchain technology. On the contrary, the implementation of blockchain technology can eliminate consumers’ skepticism about low-carbon products and raise the demand for the products, thus enhancing the profits of supply chain enterprises.

- (3)

- Without blockchain, the profit gap between supply chain enterprises is large. The implementation of blockchain can coordinate the profit distribution between supply chain enterprises. Its effect is especially obvious under the manufacturer-dominated model. Compared to the manufacturer-dominated model, the carbon emission reduction is greatest under the retailer-dominated model. When the cost of blockchain is high, the cost per unit product also rises, and the implementation of blockchain technology cannot incentivize the manufacturer to reduce carbon emissions. Therefore, when implementing blockchain technology, enterprises need to consider the pros and cons thoroughly before making appropriate decisions.

We can draw the following management insights from what has been discussed above.

- (1)

- When the manufacturer decides to save energy and reduce emissions for their products, not only the cost of carbon emission reduction but also the consumers’ trust in low-carbon products need to be considered. Blockchain technology solves the problem of information asymmetry in the traditional operation process, and realizes the transparency and traceability of emission reduction information, which has a certain promotion effect on low-carbon emission reduction. Although blockchain technology can help consumers better identify the carbon emission reduction in products, it can cause some privacy issues owing to the disclosure of transaction information. Meanwhile, in light of the novelty of blockchain technology, the laws and regulations governing it have yet to be perfected. Therefore, enterprises still need to weigh the pros and cons of blockchain technology when implementing it and make appropriate decisions.

- (2)

- For the manufacturer, consumers’ environmental awareness plays a vital role in the implementation of blockchain technology. Driven by policies and increased consumer environmental awareness, the manufacturer can synchronize production and demand with blockchain technology, which not only improves the operation efficiency but also enhances consumers’ trust in low-carbon products. Particularly in the manufacturer-dominated model, blockchain technology can better coordinate the profits of the supply chain. When the manufacturer chooses to proceed without blockchain technology, they need to publicize their low-carbon products to make their products more valued for consumers, thus boosting the profits of the supply chain. When the supply chain is profit-oriented, the manufacturer-dominated model is more conducive to profit maximization. However, when the supply chain shifts to carbon reduction, the retailer-dominated model is more conducive to achieving carbon reduction targets.

- (3)

- A higher blockchain cost will hinder the implementation of blockchain technology. When the cost is high, both the manufacturer and the retailer face the risk of profit loss. It is advised for the manufacturer to cooperate with large blockchain companies. In this way, both scale effects and lower blockchain cost can be achieved. The manufacturer can also adopt the model of cooperative research and development to share the cost of blockchain construction for mutual benefit. The government can provide more convenient conditions and policy support for enterprises, such as strengthening technical subsidies and reducing or exempting relevant taxes and fees. The active participation and support of the government will provide a better environment for the development of blockchain technology.

Our study also has some limitations. It focused on a single low-carbon product, which means that we have not considered the competitive relationship between ordinary products and low-carbon products in the same market. This competitive relationship may have an influence on the decision-making of carbon emission reduction and may also undermine the application of blockchain technology. However, in actual economic activities, the competition between similar products is ubiquitous. This competitive relationship will have an impact on the production decision, product pricing, and market strategy of the enterprise, thus affecting the carbon emission reduction effect in products. From the perspective of product competition, it is very necessary to further study the role of blockchain technology in carbon emission reduction in low-carbon products, which may provide more scientific and effective guidance for actual economic activities. Therefore, future research should expand the model from the perspective of competition between low-carbon products and ordinary products, so as to more comprehensively analyze the role of power structures and blockchain technology on low-carbon emission reduction. It should also explore the effect of blockchain technology on carbon emission reduction as well as the profits of the entire supply chain in a competitive environment.

Author Contributions

Conceptualization, M.J.; methodology, Q.H.; software, M.J.; validation, L.Q. and W.Z.; formal analysis, L.Q.; investigation, W.Z.; resources, Q.H.; writing—original draft preparation, M.J.; writing—review and editing, L.Q.; visualization, M.J.; supervision, Q.H.; project administration, W.Z.; funding acquisition, M.J., L.Q., Q.H. and W.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Scientific Research Fund of Zhejiang Provincial Education Department, China, grant numbers Y202147046 and Y202249393; the Development Foundation Project of Shanghai University of Finance and Economics Zhejiang College, China, grant number 2021GR004; the Key Project of Philosophy and Social Sciences Planning of Zhejiang Province, China, grant number 23NDJC055Z; and the Humanities and Social Sciences Youth Foundation of Ministry of Education of China, grant number 23YJC630054.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare that they have no competing interests.

Appendix A

Appendix A.1

Proof of Corollary 1.

Let , we can obtain .

When , then , therefore, ; when , then , thus, . □

Appendix A.2

Proof of Corollary 2.

Let , we can obtain

When , then , therefore, ; when , then , thus, .

Similarly, we can obtain

When , then ; when , thus, . □

The proofs of Corollary 3 and 4 are similar to that of Corollary 1 and 2, which will not be repeated here. □

Appendix A.3

Proof of Corollary 5.

When , then , ; when , then , .

□

- (1)

- It follows from the fact that , , , , and that

- (2)

- Similarly, we know that

- (3)

- Similarly, , , , ,

Appendix A.4

Proof of Corollary 6.

Due to and , from , we know .

Similarly, , let’s set , we get .

When , ; when ,; similarly, we know . □

Appendix A.5

Proof of Corollary 7.

When , then ; when , then .

When , then , ; when , then , . □

- (1)

- It follows from the fact that , , , and that

- (2)

- Similarly, we know that

Appendix A.6

Proof of Corollary 8.

, due to , we know that , thus, .

- (1)

- It follows from the fact that

- (2)

- Similarly, we know that , ,

, due to , so , thus, .

- (3)

- ,

, due to , we know that . Thus, . □

The proof of Corollary 9 is similar to that of Corollary 8, which will not be repeated here. □

Appendix A.7

Proof of Corollary 10.

It follows from the fact that

From the proof of Corollary 8, we know , thus, . □

References

- Chen, W.; Han, M.; Meng, Y. Pricing and carbon emission decisions in the assembly supply chain. J. Clean. Prod. 2023, 415, 137826. [Google Scholar] [CrossRef]

- Wang, Y.; Xu, X.; Zhu, Q. Carbon emission reduction decisions of supply chain members under cap-and-trade regulations: A differential game analysis. Comput. Ind. Eng. 2021, 162, 107711. [Google Scholar] [CrossRef]

- Xia, L.; Li, K.; Wang, J.; Xia, Y.; Qin, J. Carbon emission reduction and precision marketing decisions of a platform supply chain. Int. J. Prod. Econ. 2024, 268, 109104. [Google Scholar] [CrossRef]

- Liu, M.; Li, Z.; Anwar, S.; Zhang, Y. Supply chain carbon emission reductions and coordination when consumers have a strong preference for low-carbon products. Environ. Sci. Pollut. Res. 2021, 28, 19969–19983. [Google Scholar] [CrossRef]

- Huang, D.; Zhang, J. The impacts of carbon tax on emissions abatement level in a supply chain under different power structures. J. Manag. Sci. China 2021, 29, 57–70. [Google Scholar]

- Choi, T.; Guo, S.; Liu, N. Optimal pricing in on-demand-service platform-operations with hired agents and risk-sensitive customers in the blockchain era. Eur. J. Oper. Res. 2020, 284, 1031–1042. [Google Scholar] [CrossRef]

- Babich, V.; Hilary, G. Distributed ledgers and operations: What operations management researchers should know about blockchain technology. Manuf. Serv. Oper. Manag. 2020, 22, 223–240. [Google Scholar] [CrossRef]

- Yang, T.; Li, C.; Yue, X. Decisions for blockchain adoption and information sharing in a low carbon supply chain. Mathematics 2022, 10, 2233. [Google Scholar] [CrossRef]

- Wang, W.; Hao, S.; He, W.; Mohamed, M. Carbon emission reduction decisions in construction supply chain based on differential game with government subsidies. Build. Environ. 2022, 222, 109149. [Google Scholar] [CrossRef]

- Fu, K.; Li, Y.; Mao, H.; Miao, Z. Firms’ production and green technology strategies: The role of emission asymmetry and carbon taxes. Eur. J. Oper. Res. 2023, 305, 1100–1112. [Google Scholar] [CrossRef]

- Jauhari, W.; Novia Ramadhany, S.; Nur Rosyidi, C. Pricing and green inventory decisions for a supply chain system with green investment and carbon tax regulation. J. Clean. Prod. 2023, 425, 138897. [Google Scholar] [CrossRef]

- Sun, L.; Cao, X.; Alharthi, M.; Zhang, J. Carbon emission transfer strategies in supply chain with lag time of emission reduction technologies and low-carbon preference of consumers. J. Clean. Prod. 2020, 264, 121664. [Google Scholar] [CrossRef]

- Yang, Y.; Xu, X. Production and carbon emission abatement decisions underdifferent carbon policies: Supply chain network equilibrium models with consumers’ low-carbon awareness. Int. Trans. Oper. Res. 2023, 1, 13242. [Google Scholar] [CrossRef]

- Yuan, X.; Bi, G.; Li, H.; Zhang, B. Stackelberg equilibrium strategies and coordination of a low-carbon supply chain with a risk-averse retailer. Int. Trans. Oper. Res. 2022, 29, 3681–3711. [Google Scholar] [CrossRef]

- Hu, S.; Fu, K.; Wu, T. The role of consumer behavior and power structures in coping with shoddy goods. Transp. Res. Part E Logist. Transp. Rev. 2021, 155, 102482. [Google Scholar] [CrossRef]

- Li, H.; Zha, Y.; Bi, G. Agricultural insurance and power structure in a capital-constrained supply chain. Transp. Res. Part E Logist. Transp. Rev. 2023, 171, 103037. [Google Scholar] [CrossRef]

- Luo, Z.; Chen, X.; Chen, J.; Wang, X. Optimal pricing policies for differentiated brands under different supply chain power structures. Eur. J. Oper. Res. 2017, 259, 437–451. [Google Scholar] [CrossRef]

- Yang, F.; Wang, M. Optimal remanufacturing decisions in supply chains considering consumers’ anticipated regret and power structures. Transp. Res. Part E Logist. Transp. Rev. 2021, 148, 102267. [Google Scholar] [CrossRef]

- Yu, T.; Guan, Z.; Dong, J. Research on live e-commerce supply chain decision-making considering social media influencer’s marketing efforts under different power structures. J. Manag. Sci. China 2022, 19, 714–722+748. [Google Scholar]

- Li, M.; Mizyno, S. Dynamic pricing and inventory management of a dual-channel supply chain under different power structures. Eur. J. Oper. Res. 2022, 303, 273–285. [Google Scholar] [CrossRef]

- Chen, N.; Cai, J.; Govindan, K. Decision analysis of supply chain considering yield uncertainty and CSR under different market power structures. J. Clean. Prod. 2024, 434, 139006. [Google Scholar] [CrossRef]

- Meng, X.; Yao, Z.; Nie, j.; Zhao, Y.; Li, Z. Low-carbon product selection with carbon tax and competition: Effects of the power structure. Int. J. Prod. Econ. 2018, 200, 224–230. [Google Scholar] [CrossRef]

- Zhang, S.; Wang, C.; Yu, C. Governmental cap regulation and manufacturer’s low carbon strategy in a supply chain with different power structures. Comput. Ind. Eng. 2019, 134, 27–36. [Google Scholar] [CrossRef]

- Tang, R.; Yang, L. Impacts of financing mechanism and power structure on supply chains under cap-and-trade regulation. Transp. Res. Part E 2020, 139, 101957. [Google Scholar] [CrossRef]

- Cao, K.; Su, Y.; Xu, Y.; Guo, Q. Channel selection for retailers in platform economy under cap-and-trade policy considering different power structures. Elec. Comm. Res. Appl. 2022, 56, 101205. [Google Scholar] [CrossRef]

- Xu, H.; Yu, T.; Guan, Z.-M. Research on low-carbon supply chain decisions considering manufacturers’ disappointment aversion behaviors under different power structures. Oper. Res. Manag. Sci. 2023, 32, 45–52. [Google Scholar]

- Huang, F.; Hu, H.; Song, H. Allocation of the carbon emission abatement target in low carbon supply chain considering power structure. Sustainability 2023, 15, 10469. [Google Scholar] [CrossRef]

- Cai, J.; Jiang, F. Decision models of pricing and carbon emission reduction for low-carbon supply chain under cap-and-trade regulation. Int. J. Prod. Econ. 2023, 264, 108964. [Google Scholar] [CrossRef]

- Gong, Y.; He, G. Research on low-carbon strategies of supply chains, considering live streaming marketing modes and power structures. Processes 2023, 11, 1505. [Google Scholar] [CrossRef]

- Hastig, G.M.; Sodhi, M.S. Blockchain for supply chain traceability: Business requirements and critical success factors. Prod. Oper. Manag. 2020, 29, 935–954. [Google Scholar] [CrossRef]

- Wang, L.; Wang, Y. Supply chain financial service management system based on block chain IoT data sharing and edge computing. Alex. Eng. 2022, 61, 147–158. [Google Scholar] [CrossRef]

- Paulo, R.; Joe, N.; Samir, E. Blockchain-enabled supply chains: An application in fresh-cut flowers. Appl. Math. Model. 2022, 110, 841–858. [Google Scholar]

- Wu, X.; Fan, Z.; Li, G. Strategic analysis for adopting blockchain technology under supply chain competition. Int. J. Logist. Res. Appl. 2023, 26, 1384–1407. [Google Scholar] [CrossRef]

- Wu, J.; Yu, J. Blockchain’s impact on platform supply chains: Transaction cost and information transparency perspectives. Int. J. Prod. Res. 2023, 61, 3703–3716. [Google Scholar] [CrossRef]

- Qu, S.; Li, S. A supply chain finance game model with order-to-factoring under blockchain. Syst. Eng. Theory Pract. 2023, 9, 3570–3586. [Google Scholar]

- Liu, L.; Li, Y.; Jiang, T. Optimal strategies for financing a three-level supply chain through blockchain platform finance. Int. J. Prod. Res. 2023, 61, 3564–3581. [Google Scholar] [CrossRef]

- Tian, L.; Hu, B. The impacts of blockchain adoption on pricing and efforts decisions in online game supply chains with information asymmetry. Int. J. Prod. Econ. 2023, 266, 109030. [Google Scholar] [CrossRef]

- Lu, Q.; Liao, C. Impact of blockchain technology and channel power on green supply chain decisions. East China Econ. Manag. 2023, 37, 12–22. [Google Scholar]

- Li, Z.; Xu, X.; Bai, Q. Implications of information sharing on blockchain adoption inreducing carbon emissions: A mean–variance analysis. Transp. Res. Part E Logist. Transp. Rev. 2023, 178, 103254. [Google Scholar] [CrossRef]

- Xu, X.; Zhang, M.; Dou, G. Coordination of a supply chain with an online platform considering green technology in the blockchain era. Int. J. Prod. Res. 2023, 61, 3793–3810. [Google Scholar] [CrossRef]

- Zhang, L.; Peng, B.; Cheng, C. Research on government subsidy strategy of low-carbon supply chain based on block-chain technology. J. Manag. Sci. China 2023, 31, 49–60. [Google Scholar]

- Li, Z.; Wang, L.; Wang, G. Investment and subsidy strategy for low-carbon port operation with blockchain adoption. Ocean Coast. Manag. 2024, 248, 106966. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).