Abstract

The COVID-19 pandemic has profoundly impacted global economies, underscoring the urgency of deriving lessons to enhance future crisis preparedness. This study explores the effects of monetary recovery policies on supply chain dynamics across key global cities during the pandemic’s initial phase, emphasising policy interactions, industry engagement, and economic resilience. Utilising principal component analysis (PCA), data envelopment analysis (DEA), and tobit regression, we present a pioneering method to unravel the complex relationship between economic policies and urban supply chains. PCA simplifies data complexity and reveals complex policy-resilience relationships, while DEA facilitates a comparative efficiency analysis. Our findings underscore the critical importance of supply chain resilience in fostering early economic recovery, indicating that cities implementing diverse, sector-specific policies achieved more notable improvements in gross domestic product (GDP). This research not only advances methodological approaches for policy evaluation but also provides valuable insights for optimising urban economic recovery strategies amidst global challenges.

Keywords:

economic resilience; supply chain management; urban monetary economic policy; data envelopment analysis; principal component analysis MSC:

90B06

1. Introduction

Since its emergence in late 2019, the COVID-19 pandemic has caused profound disruptions in the global economy, particularly in supply chain management, which serves as a cornerstone of economic stability and recovery. Lockdown measures implemented in response to the pandemic have significantly disrupted the international flow of goods, services, and labour, exposing the vulnerabilities of global supply chains [1,2].

This unprecedented scenario has necessitated a re-evaluation of traditional economic recovery strategies. In response, governments worldwide have introduced a range of fiscal and monetary measures aimed at mitigating the pandemic’s economic impact [3,4]. These measures have varied widely, from direct financial assistance to complex monetary policy adjustments designed to stabilise economies and support economic activity [5,6]. Local governments in major countries such as the United States and China have typically implemented specific, effective measures tailored to their unique circumstances [7,8]. However, the confluence of supply chain disruptions and evolving consumer behaviours requires innovative approaches tailored to these challenges [9,10].

This study focuses on assessing the effectiveness of monetary recovery policies during the early stages of the pandemic, particularly their impact on supply chain dynamics in key global cities [11]. By evaluating the contributions of monetary recovery policies to the early economic recovery stages in these cities, considering their economic structures, pandemic impacts, and policy implementation diversity, we employ a novel methodological framework that integrates principal component analysis (PCA) and data envelope analysis (DEA), complemented by tobit regression analysis. This method gives a full picture of how well policies are working by looking at the many aspects of economic recovery and how well policies are working. This gives us new information about how economies recover after disasters [5].

Our research is unique because it looks at the effectiveness of monetary recovery policies in many cities around the world, uses a new method that combines PCA, DEA, and tobit regression to evaluate policies, and looks closely at the link between policy effectiveness and economic recovery. This comprehensive approach not only advances the academic discourse by providing a multifaceted evaluation of policy impacts but also delivers practical insights for policymakers on crafting more effective economic recovery strategies in anticipation of future global crises. Our findings, rooted in a global dataset and an innovative methodological framework, significantly contribute to understanding the dynamics of monetary recovery policies and their implications for economic resilience.

The paper is structured as follows: Section 2 reviews the literature on economic resilience during public crises, with a focus on supply chain impacts. Section 3 describes the methodologies used in this study. Section 4 presents the findings from evaluating economic recovery policies. Finally, Section 5 summarises the study and suggests directions for future research.

2. Literature Review

The COVID-19 pandemic has highlighted the pivotal importance of economic resilience and the robustness of supply chains in preserving macroeconomic stability and influencing regional and urban economic policies. It is crucial to comprehend how monetary recovery policies have been implemented in key global cities and to analyse their effects on economic resilience and supply chain dynamics. This understanding is essential for assessing the effectiveness of government interventions in promoting recovery and stability amid such crises.

2.1. Economic Resilience and Supply Chain Disruptions during a Public Crisis

The concept of economic resilience garnered significant attention during the COVID-19 pandemic, highlighting the crucial role of governmental strategies in mitigating economic shocks. This period, characterised by widespread disruptions, underscored the fundamental nature of economic resilience—the capacity of a society to absorb, adapt, and recover from economic adversities [6]. Scholars such as Gourio [12] emphasised the necessity of governmental intervention during such crises. Martin and Sunley [13] provided a comprehensive framework for understanding patterns of economic resilience, which is critical for analysing regional responses to the pandemic. The varying responses documented by the World Bank [2] reveal an uneven global economic recovery trajectory.

Research on the economic impact of COVID-19 has focused on the interplay between economic and public health policies [7,11], the response of the social economy [14,15,16], and the specific effects on industries, highlighting the need for robust governmental strategies and flexible policymaking [4,17,18]. According to Sheffi [19] and Ivanov [20], the robustness of global supply chains is a crucial component of resilience, emphasising the significance of adaptive strategies for supply chain management and quick recovery after disruptions [19,20]. This comprehensive approach underscores the intricate connection between policy effectiveness, supply chain resilience, and economic stability, emphasising sector-specific strategies for crisis management and recovery.

2.2. Urban Response and Supply Chain Recovery

Cities worldwide have adopted diverse strategies in response to the COVID-19 pandemic, profoundly impacting local economies and global supply chains. For instance, Hong Kong bolstered liquidity in its banking sector and supported employment, aiding businesses and the public [21]. Shenzhen leveraged technological advancements to reduce industrial operational costs [22], while Guangzhou prioritised international trade to mitigate economic impacts [23].

Singapore implemented a comprehensive fiscal response, including budget extensions, to address pandemic-related challenges [24]. Seoul focused on supporting employment and small businesses, recognising their vital role in urban economic stability [25]. These varied approaches underscore the complexity of urban policymaking during crises. Tokyo’s strategies to revitalise social and commercial activities also demonstrate a multifaceted approach to crisis management [26].

The uneven global economic recovery trajectory during the pandemic highlights the economic resilience of different countries [5]. However, existing studies, while providing insights into urban policy responses, often lack depth in evaluating the direct and indirect impacts of these policies on local supply chains. There is a notable gap in analyses connecting urban economic policies to the specific challenges and resilience of supply chains. This study aims to address this gap by offering a detailed examination of how urban monetary recovery policies have affected supply chain dynamics, thus providing a nuanced understanding of policy effectiveness in maintaining supply chain continuity and resilience during the pandemic.

2.3. Efficiency of Economic Support Policies in Supply Chain Context

The COVID-19 pandemic prompted various economic support measures, significantly impacting supply chain recovery and resilience. Global initiatives included debt financing, tax exemptions, and employment promotion [27,28]. Studies advocate for bolstering infrastructure to support resilient supply chains [29,30] and underscore the pivotal role of these policies in enhancing supply chain efficiency [8,31] . Moreover, policies aimed at formalising informal trade and eliminating supply chain barriers are essential for ensuring uninterrupted supply, particularly in regions like sub-Saharan Africa and India [31,32,33].

3. Methodology

This study employs a sophisticated methodology that combines established research approaches with tailored adaptations to assess the efficiency of economic support policies amid the COVID-19 pandemic, with a specific emphasis on their influence on supply chain dynamics. Essential methodologies are adapted from prior studies by [34,35,36].

3.1. Research Design

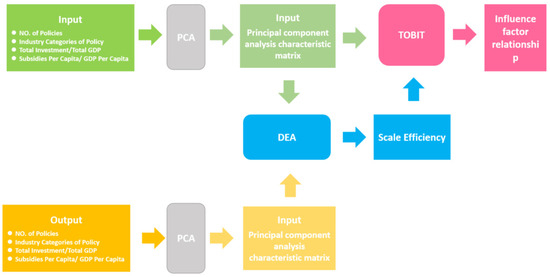

Our two-stage experimental design first utilises principal component analysis (PCA) to extract essential features from a broad range of policy data, emphasising variables that directly or indirectly affect supply chain operations. Following this, data envelope analysis (DEA) is applied to assess the scale efficiency of these policies in either sustaining or reinstating supply chain functionality. After obtaining efficiency scores from DEA, they are used as dependent variables in tobit regression analysis. This helps determine which factors have the largest effects on supply chain resilience and efficiency (Figure 1). We perform the DEA calculations using Dearun Tools (V3.2.0, https://www.dearun.net, Shanghai, China), and computed the PCA and tobit regressions on SPSSAU (https://spssau.com, Beijing Qing Si Technology Co., Beijing, China).

Figure 1.

Research Framework.

3.2. Description of Data and Variables

The study encompasses 20 globally significant cities renowned for their robust supply chains, including Guangzhou, Shenzhen, Macao, Hong Kong, and Singapore, among others. Policies were evaluated based on various factors, including the number of policies, industry coverage, total capital investment, and individual subsidy investments, with a specific focus on their implications for supply chain stability and efficiency (Table 1). Economic and supply chain-related data were normalised against each city’s specific GDP to ensure comparability.

Table 1.

Descriptive statistics of variables.

All cities selected for this study rank prominently on a global economic scale and are classified as healthy cities according to WHO standards, with their designation as 2020 cities by GaWC [37]. Furthermore, they are either core cities within religious areas or country cities (e.g., Singapore) or serve as comparison cities (e.g., Seoul and Tokyo, LA and San Francisco, Hong Kong and Singapore).

Data on all policies were obtained from government websites or official media sources. To align with the research objectives, policies were quantified in terms of the number of policies, industries involved, total capital investment, and individual subsidy investment. Given the significant variation in each city’s economic base, capital investment was normalised by dividing it by the total urban GDP. Similarly, for subsidies, individual subsidy investments were divided by per capita GDP to facilitate accurate and equitable comparisons (refer to Table 2 and Supplementary Materials (Table S1)).

Table 2.

Policy Analysis and the economic feature changes.

Consistent with the approach in De Oliveira et al. [38], import and export trade volumes and passenger volume in civil aviation were employed as proxies for supply resilience. However, considering the economy-wide impact of an epidemic such as the COVID-19 pandemic [39] and the interrelated nature of indicators of normal economic functioning such as the CPI, movement of people, and imports and exports, principal component analysis (PCA) was utilised to aggregate this impact [40,41].

Subheadings may separate this section. It should provide a concise and precise description of the experimental results, their interpretation, and the experimental conclusions that can be drawn.

3.3. Statistical Methods

3.3.1. Principal Component Analysis (PCA)

PCA, first introduced by Hotelling [42], serves as a powerful tool for dimensionality reduction, emphasising variables critical for assessing supply chain dynamics. By transforming original variables into new principal components, PCA retains essential data characteristics while reducing dimensionality. The method makes sure that the first component accounts for the most data variance before moving on to subsequent components, making the analysis of complicated datasets more manageable.

3.3.2. Data Envelopment Analysis (DEA)

The CCR and BCC models are used to determine how economic policies affect supply chain performance, while the DEA method, which was created by Charnes, Cooper, and Rhodes [43], is used to compare how efficient two systems are.

CCR model: Consider a set of n decision-making units (DMUs), denoted as j = 1, n. Let the inputs and outputs of each DMU j be represented by nonnegative and nonzero vectors u_j = (u1_j, u2_j, …, un_j) and y_j = (y1_j, y2_j, …, yn_j), respectively. The efficiency of DMU p evaluated by u(y) is defined as the optimal value obtained from the following procedure, where j_0 represents the efficiency index of the decision-making unit.

where represents the total input of the jth decision-making unit to the -th input element, and is the total output of the rth product in the jth decision-making unit. Moreover, and are the weight coefficients of the -th type input and the rth type output, respectively.

The BCC model, which is named after Banker, Charnes, and Cooper, adds the idea of variable returns to scale (VRS) to the CCR model. It lets you look at efficiency in a more complex way by telling the difference between pure technical efficiency (PTE) and scale efficiency (SE). This distinction is crucial for evaluating the efficiency of decision-making units (DMUs) that may not operate at an optimal scale, particularly in the context of economic policies affecting supply chain performance.

The BCC model is formulated as follows:

where represents the measure of scale efficiency, allowing the BCC model to account for DMUs operating under variable returns to scale. The numerator and denominator represent the weighted sum of outputs and inputs, respectively, like the CCR model but with the addition of to adjust for scale differences among DMUs. This model enables the separation of efficiency into two components: pure technical efficiency, which is independent of the scale of operations, and scale efficiency, which reflects the impact of the scale of operations on efficiency.

By applying the BCC model, we can assess not only the overall technical efficiency of DMUs but also isolate the effects of scale efficiency, providing deeper insights into how economic policies influence supply chain performance. This dual analysis is particularly valuable in understanding the nuances of policy impacts across different scales of operation, underscoring the importance of the BCC model in our methodological framework.

3.3.3. Tobit Model

Drawing upon the pioneering works of Peng and Lian, Nayer et al. [44,45], and Gu, Lian, Peng, and Zhao [46], we incorporate both data envelope analysis (DEA) and tobit regression into our methodology. These studies effectively demonstrate the utility of combining DEA and tobit regression to analyse the efficiency of economic policies and their impact on supply chain resilience and efficiency.

Initially, our approach employs DEA to assess the efficiency of economic policies, with a particular focus on their contributions to maintaining and enhancing the resilience and efficiency of supply chains. Subsequently, the tobit regression model is applied to investigate the determinants of the efficiency scores derived from the DEA analysis. This two-step methodology allows for a comprehensive evaluation of policy effectiveness, from efficiency measurement to the exploration of underlying efficiency drivers.

Incorporating PCA, DEA, and tobit regression analysis, our methodology addresses the multifaceted challenges of assessing economic recovery policies’ impacts on supply chain resilience during the COVID-19 pandemic. Using PCA makes it easier to understand economic indicators by reducing the complexity of the data [47], while DEA gives a more nuanced picture of how well policies work in different situations [48]. Tobit regression further enables the examination of censored variables, providing deeper insights into the determinants of policy efficiency [30,49]. This combined method, which has been shown to work in economic studies, uses the best parts of each to give a full picture of how policies affect the way supply chains work.

The novelty of our study lies in the simultaneous application of PCA, DEA, and tobit regression, marking a significant methodological innovation in the evaluation of monetary recovery policies amidst a global crisis. This approach, inspired by pioneering works such as that of Fumin Deng et al. [50], fills a critical gap in existing literature, providing a new perspective on the effectiveness of economic policies. By combining these methodologies, our research not only contributes to the theoretical understanding of policy impacts on supply chain resilience but also offers practical insights for policymakers navigating the complexities of global supply chain management during the COVID-19 pandemic.

4. Results and Discussion

4.1. CCR Evaluation and Analysis of Economic Policy Efficiency

Using the CCR model, we looked at how well economic recovery policies worked in 20 major cities. As shown in Table 3, there were big differences in how well policies were put into place. Cities like Sydney, Toronto, Milan, Auckland, and Dubai stand out with the highest efficiency scores (1.000), showcasing the effectiveness of their diverse policy approaches. This distinction is further analysed in Table 4, where we delve into the specifics of policy implementation across different metrics.

Table 3.

CCR evaluation result.

Table 4.

Comparison of the impact of the number of policies.

From the CCR analysis, Sydney, Toronto, Milan, Auckland, and Dubai emerge as leaders in policy efficiency, with notable differences in their policy frameworks. Dubai, for instance, stands out in the ‘Number of Policies’ metric, while Sydney and Toronto differ significantly in the ‘Industry Categories of Policy’ covered. Investment ratios, represented as ‘Total Investment/Total GDP’, highlight Toronto and Dubai’s substantial commitments at 0.18% and 0.17%, respectively, compared to Milan and Auckland’s 0.01% and 0.02%. Furthermore, in the ‘Subsidies Per Capita/GDP Per Capita’ category, Toronto’s investment is eight times higher than those of Sydney, Auckland, and Dubai.

This analysis categorises cities into three gradients of economic policy efficiency based on CCR scores: the top performers (Sydney, Dubai, Toronto, Milan, and Auckland), the middle tier (Singapore, Montreal, Shenzhen, Paris, Seoul, Guangzhou, Hong Kong, San Francisco, and London), and the lower tier (Los Angeles, New York, Bangkok, Macau, Tokyo, and Amsterdam), facilitating a nuanced understanding of policy effectiveness and its correlation with urban economic resilience.

4.1.1. Impact of Policy Quantity and Industry Involvement

Our analysis indicates that a greater number of policies and broader industry coverage are associated with higher efficiency. Cities with comprehensive policy frameworks demonstrated better adaptability in managing supply chain disruptions, underscoring the importance of multifaceted strategies during the pandemic.

To provide a more intuitive comparison of the impact of “policy quantity” on efficiency, we utilised Formulas (3) and (4) to average the rankings of all cities with policy quantities of two and one. Similarly, to compare the impact on efficiency more intuitively, the rankings of all cities with the same number of industries covered were averaged using Formulas (5) and (6).

For Formulas (3) and (4), we define as the set of the number of policies, indexed by , and as the set of cities under different number of policies, indexed by . Then, () represents the efficiency of the

th city with a policy count of , Similarly, represents the efficiency ranking of the th city with a policy count of .

For Formulas (5) and (6), we define as the set of the industry categories of policy, indexed by , and as the set of cities under different industry categories, indexed by . Then, () represents the efficiency of the th city with the number of industry categories of . Similarly, represents the efficiency ranking of the th city with the number of industry categories of .

The analysis indicates that cities with two policies, on average, have a ranking of 9, whereas those with only one policy have an average ranking of 14 (Table 4). Additionally, cities with the highest number of industries covered by policies demonstrate the best CCR efficiency performance, whereas those with the lowest policy coverage exhibit poor efficiency. Policies encompassing a wide range of industries and addressing various business aspects are likely to have a significant impact. However, solely analysing the policy effects based on this indicator may be imprecise, as there is a notable disparity between the government’s financial input in these cities and the number of industries covered. This suggests that the number of policies positively influences efficiency. In practical terms, the more policies the government implements, the more attention it dedicates to addressing urban economic challenges during the epidemic, reflecting the comprehensiveness of the policies.

Table 5 further examines this analysis by comparing the impact of the number of industries involved. It highlights that broader industry coverage in policies correlates with higher efficiency, emphasising the importance of implementing diverse and inclusive economic strategies.

Table 5.

Comparison of the impact of industries involved.

4.1.2. Total Capital Investment and Individual Subsidy Analysis

The analysis indicates a positive correlation between total capital investment and policy efficiency. Cities with moderate investment levels often achieve better efficiency, highlighting the effectiveness of well-targeted policies in maintaining supply chain continuity.

Table 6 highlights the correlation between high capital investment and policy efficiency. Conversely, Table 7 examines cities with minimal investment, demonstrating that even with lower investment levels, some cities manage to achieve high efficiency, indicating the effectiveness of well-targeted policies.

Table 6.

The reverse order of the total capital investment.

Table 7.

Competition between cities with 0% and 0.01% investment.

4.1.3. Comparative Analysis of Investment Strategies

Table 8 presents a detailed comparative analysis of cities, categorising them based on their capital investment levels and subsidy allocations. The findings indicate that cities implementing moderate investment strategies tend to achieve superior policy efficiency. This highlights the significance of balanced and strategic financial planning in policy formulation. The results emphasise the critical need for judicious investment, ensuring that such financial commitments align closely with the core needs of urban economies, especially in enhancing and sustaining supply chain resilience.

Table 8.

Ranking of cities by individual subsidy levels in reverse order.

Furthermore, a closer look at specific subsidy levels shows that a moderate approach to subsidies is often more effective in terms of policy efficiency. Cities such as Montreal and Toronto, which maintain balanced subsidy levels, demonstrate enhanced efficiency. This indicates the success of precise subsidy allocations in facilitating economic recovery and ensuring supply chain stability.

Conversely, cities like New York and Los Angeles, despite their higher subsidy contributions, show reduced efficiency due to insufficient capital investment. This trend suggests that an excessive dependence on subsidies, without parallel investment in vital economic sectors like supply chain infrastructure, can diminish the impact of recovery policies.

In conclusion, the CCR analysis has revealed that numerous factors, such as the extent of capital investment, the scope of industry involvement, and the balance of subsidies, play pivotal roles in determining the effectiveness of a policy. Cities that have adopted an all-encompassing strategy, combining financial investment with thoughtfully allocated subsidies, have shown a higher success rate in policy execution and economic revival. These findings highlight the necessity for a versatile policy approach, especially vital for overcoming supply chain obstacles in crisis situations like the COVID-19 pandemic. It is of utmost importance for governments to be both responsive and adaptable, ensuring that policies are not only abundant but also carefully crafted to support key sectors and maintain economic stability.

4.2. BCC Efficiency Evaluation (Dynamic Efficiency Evaluation)

The BCC methodology provides a detailed analysis of policy implementation efficiency by categorising cities into various performance-based gradients. Cities that excelled demonstrated exceptional policy efficiency, a key factor in maintaining and enhancing supply chain operations throughout the pandemic.

4.2.1. Gradient Analysis of BCC Results

The gradient analysis offers insights into different levels of efficiency and identifies potential areas for improvement, especially in the realm of supply chain management. The performances of cities are categorised as follows:

First Gradient: cities achieving the highest scores across all indicators, exemplifying peak policy efficiency; examples include Sydney, Dubai, and Toronto.

Second Gradient: cities with strong Crste and Vrste scores yet exhibiting lower scale efficiency, pointing to potential enhancements needed in scale management.

Third Gradient: cities with moderate scores, indicating a requirement for a more balanced approach to technical and scale efficiency.

Fourth Gradient: cities that score lower across various indicators, underscoring the necessity for comprehensive policy refinement.

The scale efficiency analysis, as depicted in Table 9, reveals that the majority of cities possess a scale efficiency exceeding 0.8, albeit with varying degrees of performance across the gradients.

Table 9.

BCC evaluation results.

4.2.2. Policy Quantity and Efficiency

This study, as shown in Figure 2, shows that cities with more comprehensive policy frameworks consistently had higher dynamic efficiency. This proves the importance of having a lot of different policies to deal with complicated supply chain problems. Our observations clearly show that cities with more comprehensive policies including at least two policies clearly perform better than cities with less comprehensive policies across all benefit indicators we looked at (‘Crste’, ‘Vrste’, and ‘Scale’). This revelation underscores the vital importance of adopting a comprehensive and robust policy strategy for efficacious economic revival, thereby reinforcing the need for diverse and well-rounded policies to navigate the complexities of supply chain challenges effectively.

Figure 2.

Average efficiency comparison of the number of policies.

4.2.3. Industry Involvement and Policy Efficiency

The research shown in Figure 3 and Table 10 looks at how industry involvement affects policy efficiency. It shows that cities with policies that cover a wider range of industries are more efficient overall. This finding is in harmony with the insights from the CCR analysis, which showed a direct correlation between the level of comprehensive efficiency (‘Crste’) and the extent of industry coverage. Intriguingly, policies that span four industries tend to yield higher technological and comprehensive benefits compared to those covering five industries. This is attributed to the higher average value of technological benefits in the former category. This observation underscores the critical significance of technological benefits as a primary driver of comprehensive policy efficiency. It highlights the necessity of adopting multi-sectoral policy approaches to effectively address the economic impacts of the pandemic on supply chains, further emphasising the importance of a diversified approach in policy formulation and implementation.

Figure 3.

Average efficiency comparison of policy industry categories.

Table 10.

Comparison of different classes of cities that behave well or badly.

4.3. Summary of DEA Analysis

In our DEA analysis, we juxtaposed the economic recovery strategies of the four least-effective cities with those of the two most-effective ones during the initial phase of the COVID-19 pandemic. The lagging cities, predominantly reliant on tourism, typically implemented singular policies with limited industrial scope, modest financial investment, and an emphasis on personal subsidies. Dubai, a key tourist hub, emerged as a benchmark in this context. For cities like Bangkok, Amsterdam, and Macau, we advocate for an expansion of policy reach across diverse industries, an increase in total capital investment, prudent management of individual subsidies, and a focus on amplifying scientific and technological benefits.

Table 11 and Table 12 included in the analysis shed light on the returns to scale indicators. Cities showcasing high levels of scientific and technological advancement, along with comprehensive scale benefits, are advised to scale down economic activities (as denoted by “drs”) to refine policy efficiency. In contrast, “irs” encourages cities with modest benefits to increase their technological scale in order to increase efficiency.

Table 11.

Comparison of cities with the “drs” in the Scale Returns.

Table 12.

Comparation of economic recovery strategies in Los Angeles, Macao, Amsterdam, and Bangkok.

This DEA analysis provides a contrasting view of city performances during the pandemic, underscoring the substantial challenges faced by tourism-dependent cities. In contrast, cities like Dubai, with their varied policy approaches, demonstrated greater resilience, thus highlighting the importance of balanced and holistic strategies in managing supply chain intricacies and driving economic recovery.

Recommendations for Tourism-Oriented Cities: Addressing the challenges confronted by tourism-centric cities like Bangkok, Amsterdam, and Macau requires a multifaceted strategy. This includes broadening the spectrum of policy application across various industries, enhancing total capital investment, and judiciously balancing individual subsidies. Moreover, it is crucial to upgrade the technological facets of city policies and optimise scale benefits where possible to significantly improve policy efficacy.

Factors for Policy Effectiveness: In summary, our study emphasises that the success of economic recovery policies in cities is contingent upon multiple factors. These encompass diversifying policy outreach, executing appropriate financial investments, and customising subsidy allocations. For urban centres, particularly those with a heavy reliance on tourism, adapting policy strategies to cover a wider array of industries and focusing on both technological and scale aspects are key to strengthening economic resilience and facilitating a robust recovery.

4.4. Decisive Effect Analysis (Tobit Regression)

Upon scrutinising the factors that shape the efficacy of policy implementation in each city amidst the pandemic and their impact on economic recovery, we applied the tobit model to pinpoint the elements exerting a decisive influence on these factors. Herein, comprehensive efficiency, as gauged by the DEA model, is employed as the dependent variable. To make a tobit panel model of policy efficiency that considers how policy efficiency is different in each city, we look at several independent variables, such as the number of policies, the number of industry categories, the total amount of investment, and the amount of subsidies given per person. The specific model is structured as follows:

In this model, EFF denotes the efficiency of economic support policies during the early stages of the COVID-19 pandemic, with D as a constant. A represents the number of policies, B the scope of policy coverage, C the ratio of total investment, and D the individual subsidy.

Table 13 delineates the outcomes of the factors influencing policy efficiency. The fact that the L.R. value passed the test at the 0.05% significance level shows that each model has a significant individual effect. This proves that the random-effects tobit panel model can be used in our regression design. Among the selected influential factors, the quantity of policies (0.196) significantly impacts the efficiency of economic recovery policies. Additionally, the ratio of total investment to overall GDP (0.357) emerges as a positive factor. The data reveal that the range of industries encompassed by the policies positively affects efficiency, albeit with a minimal coefficient of merely 0.011. In contrast, subsidies are inversely related to policy efficiency (−0.257).

Table 13.

Random tobit regression results on factors influencing policy efficiency.

Notably, the quantity of economic support policies exerts a positive and significant effect on efficiency. A higher number of policies indicates a government’s heightened focus on the urban economy’s challenges during the pandemic, partially reflecting the comprehensiveness of the policies. Under such circumstances, their economic efficiency is naturally enhanced. Inputs for economic recovery policies can be strategically released in phases during their development, allowing for flexible adjustments based on the effectiveness of the policies [8]. This approach amplifies societal expectations of the government’s ongoing dissemination of positive developments, in turn bolstering market confidence and public sentiment.

The tobit regression analysis elucidates key factors that influence policy efficiency, with an emphasis on their impact on supply chain resilience. The findings suggest that both the number of policies and the proportion of total investment are crucial determinants of policy efficiency, significantly affecting the cities’ capacity to maintain effective supply chain operations during the pandemic.

5. Implications and Limitations

5.1. Conclusions

This research provides a thorough analysis of the efficacy of economic recovery policies in major global cities during the early stages of the COVID-19 pandemic, with a particular focus on their influence on supply chain resilience and efficiency. The findings highlight the crucial role that various policy frameworks and astute financial planning play in boosting the overall success of economic recovery efforts.

We observed that cities boasting a broad spectrum of policies customised to their unique economic structures and the distinct challenges of different sectors typically exhibited superior policy efficiency. This underscores the need for comprehensive and adaptable strategies not merely addressing immediate economic challenges but also bolstering supply chain operations, a key element in upholding urban economic stability.

Moreover, our analysis revealed that a balance between total capital investment and subsidy allocation is significantly impactful in determining policy efficiency. Strategic investments in public infrastructure and employment support, particularly in sectors critical to supply chain management, emerged as key for effective economic recovery. However, an overreliance on personal subsidies without substantial investment in crucial economic sectors could lead to inefficiencies, potentially compromising long-term recovery efforts.

In conclusion, this study advocates for future policy development to merge diverse and extensive policy frameworks with balanced financial strategies. Tailoring these policies to the specific needs of various sectors, especially those vital to the supply chain, will maximise the impact of recovery efforts. This dual approach is fundamental to developing resilient urban economies capable of weathering future crises, ensuring both immediate recovery and prolonged stability and resilience of supply chains.

5.2. Implications

5.2.1. Theoretical Implications

This study marks a pioneering application of the DEA–PCA–tobit model to intricate urban policies, presenting a more objective depiction of real-world scenarios by minimising subjectivity. Traditional methods such as social experiments and other econometric tools [51], while valuable, often fail to fully capture the multi-dimensional impacts of crises on urban economies and supply chains. In line with recent methodologies underscoring the need for innovative policy evaluation approaches [52,53,54], our DEA–PCA–tobit model offers a comprehensive and accurate analysis of policy effectiveness in enhancing supply chain resilience and efficiency. Importantly, the introduction of an industry coverage indicator in policy assessment recognises the extensive damage inflicted by the COVID-19 pandemic on various industries and supply chains, underscoring its significance in evaluating policy effectiveness. Additionally, this study addresses a significant gap in the current literature concerning urban crisis responses, providing empirical insights into the efficacy of economic support policies during the early stages of the COVID-19 outbreak.

5.2.2. Implications for Practice

The varied economic instruments necessitated by the COVID-19 crisis, as elucidated in our research, suggest that policymakers ought to broaden the range of industries encompassed by their policies and refine the total investment-to-GDP ratio. It is imperative to maintain a balanced subsidy per capita relative to GDP, augment industry-specific policy coverage, and capitalise on technological advancements in policy development. Furthermore, our analysis underpins the notion that amplifying investments, particularly in underexploited capacities, could be markedly beneficial.

In tackling the challenges posed by the COVID-19 pandemic, our research aligns with the insights of Fu [55], who underscores the pivotal role of digital technology in fostering sustainable economic recuperation, and Hassankhani et al. [56], who advocate for intelligent urban solutions in crisis management. Our DEA–PCA–tobit model accentuates the necessity of widening the ambit of policy interventions and honing investment strategies. For instance, metropolises such as Los Angeles, which have adopted technological advancements, stand to gain considerably from our model’s guidance on escalating investments, especially in underutilised sectors. In a similar vein, cities categorised under the ‘increasing returns to scale’ metric, including Macau, Amsterdam, and Bangkok, are counselled to augment their operational scales to fully exploit technological and economic benefits. This could be achieved, for example, by utilising existing research infrastructures (universities, R&D departments in major organisations, etc.) to attract and foster talented technologists for innovation and entrepreneurial ventures and by aggressively enhancing the funding and support for start-ups and the development of technology, both in scale and intensity.

5.3. Limitations and Future Research

While this study offers valuable insights, it is crucial to recognise its limitations, including a relatively brief observation period and potential data gaps. Future research could expand these aspects as follows:

- Extending the data observation period to encompass a longer economic cycle, enabling a more holistic analysis of policy efficiency;

- Incorporating policy implementation as an additional factor in the efficiency evaluation to provide a more nuanced understanding of policy impacts;

- Integrating time series analysis to assess the evolving effectiveness of policies across different stages of economic recovery.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/math12050673/s1, Table S1. Policies of economy recovery.

Author Contributions

Conceptualization and funding acquisition, X.Z.; methodology, original preparation, review, and editing, J.L.; data curation, review, and editing, G.F. All authors have read and agreed to the published version of the manuscript.

Funding

Supported by Education Fund of the Macao SAR Government: HSS-MUST-2020-15.

Data Availability Statement

The datasets presented in this article are not readily available because the data are part of an ongoing study. Requests to access the datasets should be directed to jli@must.edu.mo.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Coleman, R.; Mullin-McCandlish, B. The harms of state, free-market common sense and COVID-19. State Crime J. 2021, 10, 170. [Google Scholar] [CrossRef]

- The World Bank. The World Bank Annual Report 2021: From Crisis to Green, Resilient, and Inclusive Recovery; The World Bank: Washington, DC, USA, 2021. [Google Scholar]

- Bonadio, B.; Huo, Z.; Levchenko, A.A.; Pandalai-Nayar, N. Global supply chains in the pandemic. J. Int. Econ. 2021, 133, 103534. [Google Scholar] [CrossRef]

- Zhang, Z. China’s support policies for businesses under COVID-19: A comprehensive list. China Briefing News, 24 May 2020. [Google Scholar]

- Naseer, S.; Khalid, S.; Parveen, S.; Abbass, K.; Song, H.; Achim, M.V. COVID-19 outbreak: Impact on global economy. Front. Public Health 2023, 10, 1009393. [Google Scholar] [CrossRef]

- Maclellan, N. The Region in Review: International Issues and Events, 2021. Contemp. Pac. 2022, 34, 422–446. [Google Scholar] [CrossRef]

- Ligo, A.K.; Mahoney, E.; Cegan, J.; Trump, B.D.; Jin, A.S.; Kitsak, M.; Keenan, J.; Linkov, I. Relationship among state reopening policies, health outcomes and economic recovery through first wave of the COVID-19 pandemic in the US. PLoS ONE 2021, 16, e0260015. [Google Scholar] [CrossRef]

- Vo, N.N.; Xu, G.; Le, D.A. Causal Inference for the Impact of Economic Policy on Financial and Labour Markets amid the COVID-19 Pandemic. Web Intell. 2022, 20, 1–19. [Google Scholar] [CrossRef]

- Falkendal, T.; Otto, C.; Schewe, J.; Jägermeyr, J.; Konar, M.; Kummu, M.; Watkins, B.; Puma, M.J. Grain export restrictions during COVID-19 risk food insecurity in many low-and middle-income countries. Nat. Food 2021, 2, 11–14. [Google Scholar] [CrossRef]

- Rozhkov, M.; Ivanov, D.; Blackhurst, J.; Nair, A. Adapting supply chain operations in anticipation of and during the COVID-19 pandemic. Omega 2022, 110, 102635. [Google Scholar] [CrossRef]

- Li, X.; Fang, Y.; Chen, G.; Liu, Z. Using Pandemic Data to Examine the Government’s Pandemic Prevention Measures and Its Support Policies for Vulnerable Groups. Front. Public Health 2022, 10, 882872. [Google Scholar] [CrossRef]

- Gourio, F. Disaster risk and business cycles. Am. Econ. Rev. 2012, 102, 2734–2766. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P. On the notion of regional economic resilience: Conceptualization and explanation. J. Econ. Geogr. 2015, 15, 1–42. [Google Scholar] [CrossRef]

- Cellini, R.; Torrisi, G. Regional resilience in Italy: A very long-run analysis. Reg. Stud. 2014, 48, 1779–1796. [Google Scholar] [CrossRef]

- Islam, A.M. Impact of Covid-19 pandemic on global output, employment and prices: An assessment. Transnatl. Corp. Rev. 2021, 13, 189–201. [Google Scholar] [CrossRef]

- Wang, Y.G.; Gao, J. Economic resilience and China’s high quality development. Bus. Manag. J. 2020, 42, 7–19. [Google Scholar]

- Shi, Y.; Huang, R.; Cui, H. Prediction and analysis of tourist management strategy based on the SEIR model during the COVID-19 period. Int. J. Environ. Res. Public Health 2021, 18, 10548. [Google Scholar] [CrossRef]

- Suescún Barón, C.A.; Bernal, M.L.; Guevara Castañeda, D.A.; Morillo, Ó. Food Supply and Popular Economy in Bogotá and Some Surrounding Municipalities in Times of Pandemic. Apunt. Cenes 2022, 41, 243–274. [Google Scholar]

- Sheffi, Y. The New (ab) Normal: Reshaping Business and Supply Chain Strategy Beyond COVID-19; MIT CTL Media: Cambridge, MA, USA, 2020. [Google Scholar]

- Ivanov, D. Supply chain viability and the COVID-19 pandemic: A conceptual and formal generalisation of four major adaptation strategies. Int. J. Prod. Res. 2021, 59, 3535–3552. [Google Scholar] [CrossRef]

- ChinaBriefing. Hong Kong Budget 2021-22: Blueprint for Economic Recovery. China Briefing. 2021. Available online: https://www.China-briefing.com/news/hong-kong-budget-2021-22-blueprint-for-economic-recovery/ (accessed on 11 November 2021).

- Zou, H.; Shu, Y.; Feng, T. How Shenzhen, China avoided widespread community transmission: A potential model for successful prevention and control of COVID-19. Infect. Dis. Poverty 2020, 9, 89. [Google Scholar] [CrossRef]

- McKibbin, W.; Vines, D. Global macroeconomic cooperation in response to the COVID-19 pandemic: A roadmap for the G20 and the IMF. Oxf. Rev. Econ. Policy 2020, 36 (Suppl. S1), S297–S337. [Google Scholar] [CrossRef]

- Quah, D. Singapore’s policy response to COVID-19. In Impact of COVID-19 on Asian Economies and Policy Responses; World Scientific: Singapore, 2020; pp. 79–88. [Google Scholar]

- Lee, J.; Yang, H.-S. Pandemic and employment: Evidence from COVID-19 in South Korea. J. Asian Econ. 2022, 78, 101432. [Google Scholar] [CrossRef]

- Yabe, T.; Tsubouchi, K.; Fujiwara, N.; Wada, T.; Sekimoto, Y.; Ukkusuri, S.V. Non-compulsory measures sufficiently reduced human mobility in Tokyo during the COVID-19 epidemic. Sci. Rep. 2020, 10, 18053. [Google Scholar] [CrossRef] [PubMed]

- Aldieri, L.; Bruno, B.; Vinci, C.P. Employment Support and COVID-19: Is Working Time Reduction the Right Tool? Economies 2022, 10, 141. [Google Scholar] [CrossRef]

- Hu, X.; Li, L.; Dong, K. What matters for regional economic resilience amid COVID-19? Evidence from cities in Northeast China. Cities 2022, 120, 103440. [Google Scholar] [CrossRef]

- Pretorius, O.R.; Drewes, J.E.; Engelbrecht, W.H.; Malan, G.C. Developing resilient supply chains in the Southern African Development Community: Lessons from the impact of COVID-19. J. Transp. Supply Chain Manag. 2022, 16, 737. [Google Scholar] [CrossRef]

- Hidayat, A.; Atiyatna, D.P.; Sari, D.D.P. The Influence of the COVID-19 Outbreak on the Open Unemployment Rate and Economic Growth in the Affected Sectors in Indonesia. Indones. J. Bus. Anal. 2023, 3, 33–40. [Google Scholar] [CrossRef]

- Renzaho, A.M.N. The need for the right socio-economic and cultural fit in the COVID-19 response in sub-Saharan Africa: Examining demographic, economic political, health, and socio-cultural differentials in COVID-19 morbidity and mortality. Int. J. Environ. Res. Public Health 2020, 17, 3445. [Google Scholar] [CrossRef]

- Kar, P.; Ramasundaram, P.; Kumar, A.; Singh, S.; Sharma, R.; Rakshit, S.; Singh, G.P. Strengthening the Multi-Stakeholder Partnerships in Wheat, Maize and Barley Value Chains: Policy Advisories for the New Normal Agriculture. Policy Pap. 2021, 2, 1–34. [Google Scholar]

- Maqbool, I.; Riaz, M.; Siddiqi, U.I.; Channa, J.A.; Shams, M.S. Social, economic and environmental implications of the COVID-19 pandemic. Front. Psychol. 2023, 13, 898396. [Google Scholar] [CrossRef]

- Omrani, H.; Valipour, M.; Mamakani, S.J. Construct a composite indicator based on integrating Common Weight Data Envelopment Analysis and principal component analysis models: An application for finding development degree of provinces in Iran. Socio-Econ. Plan. Sci. 2019, 68, 100618. [Google Scholar] [CrossRef]

- Hajiagha, S.H.R.; Mahdiraji, H.A.; Hashemi, S.S.; Garza-Reyes, J.A.; Joshi, R. Public hospitals performance measurement through a three-staged data envelopment analysis approach: Evidence from an emerging economy. Cybern. Syst. 2023, 54, 1–26. [Google Scholar] [CrossRef]

- Štefko, R.; Horváthová, J.; Mokrišová, M. The application of graphic methods and the DEA in predicting the risk of bankruptcy. J. Risk Financ. Manag. 2021, 14, 220. [Google Scholar] [CrossRef]

- GAWC. The World According to GaWC 2020. 2020. Available online: https://www.lboro.ac.uk/microsites/geography/gawc/world2020.html (accessed on 25 May 2021).

- De Oliveira, U.R.; Dias, G.C.; Fernandes, V.A. Evaluation of a conceptual model of supply chain risk management to import/export process of an automotive industry: An action research approach. Oper. Manag. Res. 2023, 16, 1–19. [Google Scholar] [CrossRef]

- Meier, M.; Pinto, E. Covid-19 supply chain disruptions. Eur. Econ. Rev. 2024, 162, 104674. [Google Scholar] [CrossRef]

- How, B.S.; Lam, H.L. PCA method for debottlenecking of sustainability performance in integrated biomass supply chain. Process Integr. Optim. Sustain. 2019, 3, 43–64. [Google Scholar] [CrossRef]

- How, B.S.; Lam, H.L. Sustainability evaluation for biomass supply chain synthesis: Novel principal component analysis (PCA) aided optimisation approach. J. Clean. Prod. 2018, 189, 941–961. [Google Scholar] [CrossRef]

- Hotelling, H. Analysis of a complex of statistical variables into principal components. J. Educ. Psychol. 1933, 24, 417. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Peng, L.; Lian, Z. Diversification and efficiency of life insurers in China and India. Geneva Pap. Risk Insur. Issues Pract. 2021, 46, 710–730. [Google Scholar] [CrossRef]

- Nayer, M.Y.; Fazaeli, A.; Hamidi, Y. Hospital Efficiency Measurement in the West of Iran: Data Envelopment Analysis and Tobit Approach. Cost Eff. Resour. Alloc. 2022, 20, 5. [Google Scholar] [CrossRef]

- Gu, X.; Lian, Z.; Peng, L.; Zhao, Q. A comparative study of bank efficiency in three Chinese regions: Mainland China, Hong Kong, and Macao. J. Financ. Res. 2023, 46, 547–571. [Google Scholar] [CrossRef]

- Ezzat, H.M. The effect of COVID-19 on the Egyptian exchange using principal component analysis. J. Humanit. Appl. Soc. Sci. 2023, 5, 402–416. [Google Scholar] [CrossRef]

- Annisya, T.; Nurbaiti, N. Efficiency Analysis of Islamic Commercial Banks Using a Two-Stage Data Analysis Method. Tazkia Islam. Financ. Bus. Rev. 2022, 16, e295. [Google Scholar] [CrossRef]

- Mourad, N.; Habib, A.M.; Tharwat, A. Appraising healthcare systems’ efficiency in facing COVID-19 through data envelopment analysis. Decis. Sci. Lett. 2021, 10, 301–310. [Google Scholar] [CrossRef]

- Deng, F.; Xu, L.; Fang, Y.; Gong, Q.; Li, Z. PCA-DEA-tobit regression assessment with carbon emission constraints of China’s logistics industry. J. Clean. Prod. 2020, 271, 122548. [Google Scholar] [CrossRef]

- Blundell, R.; Dias, M.C. Alternative approaches to evaluation in empirical microeconomics. J. Hum. Resour. 2009, 44, 565–640. [Google Scholar]

- Garcés-Velástegui, P. Using the capability approach and fuzzy set qualitative comparative analysis in development policy evaluation. J. Comp. Policy Anal. Res. Pract. 2022, 24, 179–197. [Google Scholar] [CrossRef]

- Al Hudib, H.; Cousins, J.B. Understanding evaluation policy and organizational capacity for evaluation: An interview study. Am. J. Eval. 2022, 43, 234–254. [Google Scholar] [CrossRef]

- Walker, S.; Fox, A.; Altunkaya, J.; Colbourn, T.; Drummond, M.; Griffin, S.; Gutacker, N.; Revill, P.; Sculpher, M. Program evaluation of population-and system-level policies: Evidence for decision making. Med. Decis. Mak. 2022, 42, 17–27. [Google Scholar] [CrossRef]

- Fu, X. Digital transformation of global value chains and sustainable post-pandemic recovery. Transnatl. Corp. J. 2020, 27, 157–166. [Google Scholar] [CrossRef]

- Hassankhani, M.; Alidadi, M.; Sharifi, A.; Azhdari, A. Smart city and crisis management: Lessons for the COVID-19 pandemic. Int. J. Environ. Res. Public Health 2021, 18, 7736. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).