Abstract

With the rapid development of smart grids, the strategic behavior evolution in user-side electricity market transactions has become increasingly complex. To explore the dynamic evolution mechanisms in this area, this paper systematically reviews the application of evolutionary game theory in user-side electricity markets, focusing on its unique advantages in modeling multi-agent interactions and dynamic strategy optimization. While evolutionary game theory excels in explaining the formation of long-term stable strategies, it faces limitations when dealing with real-time dynamic changes and high-dimensional state spaces. Thus, this paper further investigates the integration of deep reinforcement learning, particularly the deep Q-learning network (DQN), with evolutionary game theory, aiming to enhance its adaptability in electricity market applications. The introduction of the DQN enables market participants to perform adaptive strategy optimization in rapidly changing environments, thereby more effectively responding to supply–demand fluctuations in electricity markets. Through simulations based on a multi-agent model, this study reveals the dynamic characteristics of strategy evolution under different market conditions, highlighting the changing interaction patterns among participants in complex market environments. In summary, this comprehensive review not only demonstrates the broad applicability of evolutionary game theory in user-side electricity markets but also extends its potential in real-time decision making through the integration of modern algorithms, providing new theoretical foundations and practical insights for future market optimization and policy formulation.

Keywords:

smart grids; user-side electricity market; evolutionary game theory; deep Q-learning network (DQN); multi-agent systems; strategy optimization; real-time decision making; supply–demand fluctuations MSC:

65M12

1. Introduction

With the continuous growth of global energy demand and the increasing urgency of sustainable development, the smart grid, as an important part of the modern power system, has gradually attracted wide attention. As an emerging technology, the smart grid is combined with advanced information communication technology []. It greatly improves the efficiency of energy utilization. Unfortunately, Mollah et al. [] find that the smart grid makes it difficult to integrate other approaches in order to improve energy utilization efficiency and reliability. In this context, researchers are gradually applying game theory to smart grids, especially in the field of energy management, to address these complex challenges.

Among the many game theory models, evolutionary game theory (EGT) has gradually become an effective tool for studying smart grid problems because of its ability to capture the dynamic evolution of participants’ strategies and the impact on real-time price formation in non-completely rational environments. Its difference from traditional game theory is that the participants in evolutionary games are not necessarily completely rational []. Moreover, EGT can more effectively describe the gradual optimization and evolution of the strategy of participants in the game process. Therefore, it has a unique advantage in the multi-agent interaction of smart grids.

The rapid development of smart grids and the increasing complexity of user-side electricity markets necessitate advanced models to optimize strategy formulation among market participants. Traditional game theory, while useful for static systems, struggles to capture the dynamic and evolving nature of electricity market transactions where participants exhibit bounded rationality and adapt strategies over time. Traditional game theory typically assumes that agents have full information, as well as perfect rationality, and that a static Nash equilibrium is achievable. However, these assumptions are often unrealistic in decentralized and highly volatile energy markets where agents have limited information and must make decisions under conditions of uncertainty. Moreover, real-time changes in supply and demand require more flexible and adaptive approaches to reflect the continuous shifts in market conditions.

EGT addresses some of the limitations of classical game theory by introducing the concept of bounded rationality and enabling agents to adapt their strategies over time. EGT models the evolution of strategies within a population, where individuals continuously adjust their actions based on observed payoffs and their interactions with others. This makes EGT suitable for modeling the adaptive nature of agents in electricity markets. However, EGT has its own limitations. It primarily focuses on population-level dynamics, meaning that the rate of adaptation can be slow, especially in environments with rapid fluctuations like electricity markets. Furthermore, EGT often relies on simplified replicator dynamics, which may not fully capture the nuances of decision making in environments that are highly non-stationary and stochastic.

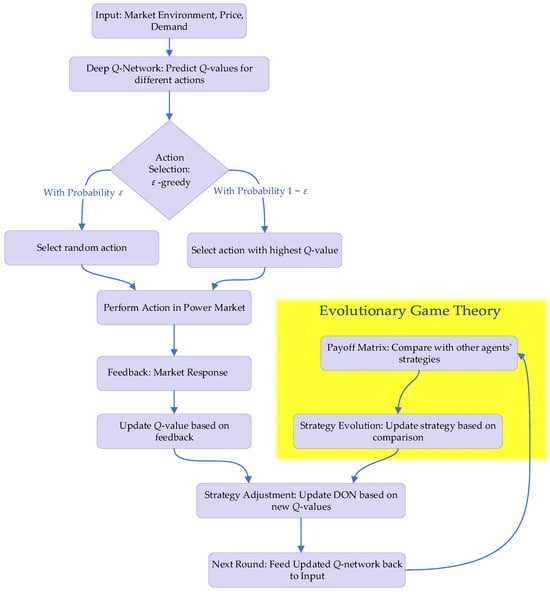

To address these challenges, integrating deep reinforcement learning (DRL) with EGT offers a promising solution by combining the strengths of both approaches. DRL provides a powerful tool for real-time strategy optimization, enabling market participants to adapt to fluctuating conditions effectively. DRL allows agents to interact continuously with their environment, learn from these interactions, and update their strategies in a manner that maximizes cumulative rewards. Unlike traditional methods, DRL uses neural networks to approximate value functions or policies, which makes it particularly effective in dealing with the high-dimensional state and action spaces characteristic of modern energy markets. This allows DRL to efficiently handle the complexity that comes with multiple market participants, dynamic pricing, and the integration of renewable energy sources.

This integration of both EGT and DRL bridges the gap between long-term evolutionary stability and real-time decision making. Specifically, EGT focuses on the evolution and stability of strategies within a population over longer timescales, which provides insights into the emergent behaviors and potential equilibria that can arise from repeated interactions. However, it lacks the granularity needed for individual-level adaptation in highly dynamic settings. On the other hand, DRL excels at enabling individual agents to learn optimal strategies quickly by adapting to changing market signals and optimizing for immediate and long-term rewards. Integrating DRL with EGT allows agents to not only adapt their behavior based on immediate market conditions but also contribute to a broader evolutionary process that ensures population-level stability and robustness in strategy formulation. This combination leads to the emergence of evolutionarily stable strategies (ESSs) that are both adaptive in real time and resilient over longer periods, making them highly suitable for environments like electricity markets where conditions change rapidly and unpredictably.

Furthermore, the combination of EGT and DRL is particularly advantageous in handling the integration of renewable energy sources, which are characterized by high volatility and uncertainty. Renewable energy sources, such as wind and solar power, introduce significant unpredictability into the grid due to their dependence on weather conditions. DRL’s reinforcement learning capabilities enable agents to adapt their strategies dynamically in response to changes in renewable generation, thereby improving the overall reliability of the grid. For example, prosumers (producers and consumers) can leverage DRL to make decisions about energy storage, consumption, or even trading based on real-time data, while EGT ensures that these individual decisions collectively lead to stable and efficient outcomes for the entire market.

Moreover, DRL enhances the scalability of EGT-based models. In traditional EGT models, the computational complexity can increase significantly as the number of participants grows, making it challenging to simulate large-scale markets. DRL, with its neural network-based function approximation, is able to generalize learning across similar states and actions, reducing the computational burden and making it feasible to apply evolutionary models to larger, more complex systems. This scalability is crucial for electricity markets, which are expected to expand significantly with the increasing adoption of distributed energy resources (DERs) and the rise of peer-to-peer (P2P) energy trading platforms. In summary, integrating DRL into EGT provides a synergistic framework that addresses the shortcomings of each individual approach. DRL brings the ability to optimize agent-level strategies in real time, effectively learning from high-dimensional and stochastic environments, while EGT provides the population-level perspective that ensures long-term stability and adaptability. This combination is particularly relevant in user-side electricity markets, where market participants must not only adapt quickly to immediate changes in supply and demand but also contribute to the long-term stability of the energy system. Therefore, the integration of DRL with EGT offers a comprehensive solution to optimize strategic decision making, enhance energy efficiency, and stabilize electricity markets in the face of rapid and unpredictable changes.

The purpose of this paper is to systematically review the application of EGT in a smart grid, especially in power market energy trading. Through an in-depth analysis of the existing literature, this paper not only points out the advantages of EGT over classical game theory but also discusses its high applicability in smart grid. At the same time, this paper also focuses on analyzing the impact of the evolution of participants’ strategies on real-time prices, and it provides new perspectives and suggestions for future research.

This review is significant, as it synthesizes key advancements in the application of EGT to smart grids, particularly in user-side electricity market transactions. By systematically analyzing the limitations of traditional game theory and the advantages of EGT, the paper offers valuable insights into how multi-agent systems in electricity markets evolve and optimize their strategies. The study further extends the applicability of EGT by exploring its integration with DRL, which provides the adaptability required in rapidly changing market environments. This combination offers new theoretical and practical approaches for improving decision making, enhancing market efficiency, and fostering stability in electricity markets, especially as the sector increasingly incorporates renewable energy sources.

The paper systematically reviews the use of EGT in user-side electricity markets, highlighting its relevance and advantages over classical game theory. It also explores how DRL can be integrated with EGT to optimize strategy formation in dynamic environments. The key innovations of the study are as follows:

- (i)

- Integration of EGT with deep Q-learning network (DQN): The paper introduces a novel integration of EGT with the DQN, a DRL technique, to enhance the adaptability of market participants in real-time. This combination allows for continuous learning and strategy optimization, enabling agents to adjust their behavior dynamically in response to fluctuating market conditions, which is particularly beneficial in fast-changing electricity markets.

- (ii)

- Application to multi-agent systems: The study applies EGT to simulate interactions among multiple agents, such as consumers, producers, and regulators, in electricity markets. The multi-agent model used in the review provides a robust framework for understanding how these participants evolve their strategies over time, particularly under different pricing and demand-response scenarios.

- (iii)

- Real-time decision making in energy trading: The integration of EGT with reinforcement learning (RL) addresses a critical limitation of traditional EGT—its inability to deal with real-time decision making in high-dimensional state spaces. The use of the DQN allows market participants to perform adaptive strategy optimization in real-time, making it possible to better manage supply–demand fluctuations and price volatility in electricity markets.

- (iv)

- Enhanced analysis of demand response: The paper extends the application of EGT to demand-response mechanisms, offering insights into how consumer behavior can be modeled and optimized using evolutionary strategies. This contributes to more effective load management and peak shaving, improving grid stability and reducing operational costs.

- (v)

- Practical applications in renewable energy markets: The study explores the application of EGT in renewable energy integration, including the P2P trading of surplus energy. It demonstrates how EGT can model both cooperative and competitive dynamics in decentralized energy markets, providing a theoretical basis for optimizing energy storage and trading strategies.

In summary, this paper makes significant contributions by reviewing the current state of EGT in electricity markets and proposing its integration with DRL to enhance strategy optimization. The study not only advances the theoretical understanding but also provides practical insights for policymakers and market operators seeking to improve efficiency and adaptability in modern electricity markets.

This paper is organized as follows: Section 1 introduces the background and motivation for the study, highlighting the increasing complexity of user-side electricity markets and the potential of integrating EGT with DRL to optimize strategy dynamics. Section 2 reviews the fundamentals of EGT, including its key principles and advantages over traditional game theory, and explores its applicability in various fields such as biology, economics, and electricity markets. Section 3 focuses on the application of EGT in smart grids, discussing the multi-agent structure and interaction in smart grids and the advantages of using EGT to model dynamic strategic behavior. Section 4 discusses the role of EGT in energy trading, particularly in optimizing real-time pricing, demand response, and renewable energy integration, providing case studies and theoretical insights. Section 5 introduces the DQN and explores its synergy with EGT, demonstrating how the DQN enhances real-time decision making and strategy optimization in dynamic electricity markets. Section 6 delves into the application of EGT to demand response, focusing on user behavior modeling and strategy evolution, with empirical examples of how EGT can enhance energy efficiency and grid stability. Section 7 presents an empirical analysis of EGT’s effectiveness in electricity market transactions, comparing traditional approaches with EGT-based strategies. Finally, Section 8 concludes with future prospects, emphasizing potential advancements in EGT modeling, algorithmic innovations, and interdisciplinary research in user-side electricity markets.

To compensate for the lack of a graphical summary, the following detailed outline helps illustrate the logical flow and relationships between the sections:

- (i)

- Section 2 lays the theoretical groundwork by contrasting EGT with traditional game theory and its relevance in different domains.

- (ii)

- (iii)

- Section 5 introduces DRL, specifically the DQN, as a key tool for enhancing real-time strategic optimization capabilities.

- (iv)

- (v)

- Section 8 connects these findings back to broader research opportunities, thereby providing a holistic view of the potential benefits and future applications of combining EGT with modern machine learning approaches.

2. Fundamentals of EGT

2.1. An Overview of EGT

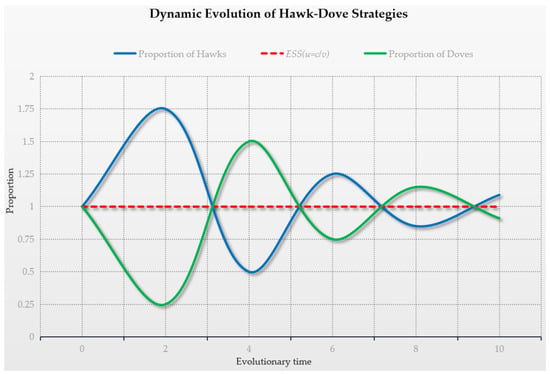

Evolutionary game theory (EGT), pioneered by M. Smith and R. Price, studies the evolution of animal behavior, or phenotypes, as a result of game competition using different strategies []. EGT is a theory that studies the continuous propagation of populations or groups over time in the ideas of biological evolution and dynamic evolution. These basic concepts can be explained using a simple model, the “hawk-dove” game []. Hawk–dove games often reflect ESSs in EGT. The authors of Ref. [] propose that ESS is a strategy with which, if it is adopted by all members of a population, no mutation strategy can invade the population under the influence of natural selection. In the hawk–dove game, it is assumed that there are two strategies: The “hawk” strategy represents the active aggressive type, which will go all out to compete for resources; The “dove” strategy stands for passive defense. When most participants in a group have elected the “eagle” strategy, due to fierce internal competition, individuals who adopt the “eagle” strategy will often pay a high price, such as injury or even death. At this time, the “dove” strategy individuals are more likely to continue to survive and reproduce because they avoid fierce conflicts, and the proportion of “dove” strategy in the group will gradually increase. On the contrary, when the majority of the group are “dove”-strategy individuals, due to the slight competitive advantage of “dove”-strategy individuals, “eagle”-strategy individuals can easily obtain resources and thus have higher adaptability, and the proportion of “eagle”-strategy individuals will increase. Eventually, after a series of dynamic evolution, the proportion of hawk and dove individuals in the group will reach a stable state such that no other “disruptive” strategies will give participants a greater advantage []. This proportion segment that eventually stabilizes is the embodiment of ESS. If expressed as a formula, it can be expressed as []. In this context, “u” denotes the stable proportion of individuals adopting the “hawk” strategy within the population. As one subset of the group opts for the “hawk” strategy, while the other adopts the “dove” strategy, the system evolves until it reaches an equilibrium at which the proportion P stabilizes, representing the equilibrium proportion of “hawk” strategists. The variable v represents the resource payoff, which is the benefit an individual receives upon successfully securing resources in the game, and c stands for the cost of conflict, where the “hawk” strategy incurs higher losses due to intense competition, while the “dove” strategy minimizes conflict-related costs by avoiding direct confrontation. The steady ratio of these two strategies can be explained by borrowing a picture, as shown in Figure 1 [,,,].

Figure 1.

Dynamic evolution of hawk–dove strategies [,,,].

The “hawk” strategy typically involves obtaining resources through aggressive competition, while the “dove” strategy secures resources through passive means. As the relative proportions of these strategies evolve, the system approaches a state of regional equilibrium and stability.

2.2. Advantages of EGT

EGT is based on traditional game theory, but this does not mean that they are identical. There are differences between EGT and traditional game theory in many aspects. Traditional game theory is based on the assumption of complete rationality, where participants are believed to be capable of accurately calculating and selecting the optimal strategy. It employs static analysis methods to solve Nash equilibrium problems, with a primary focus on the existence of the Nash equilibrium and the selection of optimal strategies by participants. In contrast, EGT assumes bounded rationality; participants determine the optimal strategy through continuous trial and error. It utilizes dynamic evolutionary methods to analyze the evolution of participants’ strategies, with an emphasis on the evolutionary process and stability of strategies, particularly the impact of factors such as environmental changes on stabilization strategies over the long-term evolutionary process. Table 1 shows a simple comparison.

Table 1.

Differences between traditional game theory and EGT.

Among them, EGT offers advantages over classical game theory in two key areas. First, EGT abandons the assumption that game players must be perfectly rational []. In EGT, participants often cannot calculate the optimal solution rationally but instead find the best strategy through continuous trial and error. Further, game theory can also be thought of as a theory of policy interaction, in which each stakeholder in a decision must consider how other decision-makers will act and how that action will affect their own interests []. In summary, decision-makers must consider not only their own interests but also the strategies and actions of others. They should continuously adjust and optimize their strategies to maximize their benefits. For example, in an open competition, each participant is unable to find the best way to finish the game at the beginning, and they move forward via trial and error, trying different methods several times and drawing on the experience of other participants to finally determine the optimal game strategy. Classical game theory is different from EGT. It is indicated in Ref. [] that the classical game theory represented by Nash is based on the following three assumptions: (1) the players are completely rational, and (2) the participants have common knowledge. However, in real-world scenarios, players cannot be perfectly rational. Their knowledge is influenced by inherent factors and environmental conditions, leading to a lack of common knowledge. This analysis suggests that classical game theory often does not align with real-world scenarios, limiting its practical applicability. Secondly, EGT focuses on ESSs, which prevent any mutant strategy from successfully invading the population under natural selection. This means that ESSs provide stability within a dynamically evolving system. Classical game theory relies on mathematical analysis and logical reasoning to determine Nash equilibrium through modeling. However, Nash equilibrium requires that each player rationally makes their own decisions on choosing proper strategies/actions []. So it is difficult to observe the dynamic process of the game approaching equilibrium. In summary, EGT differs from classical game theory by accounting for participants’ limited rationality and information. It effectively describes the dynamic evolution of strategies, rather than focusing solely on static equilibrium. Because of this, its application in reality is more advantageous.

2.3. Bridging EGT and RL for Enhanced Strategy Formulation in Electricity Markets

EGT and RL are instrumental in understanding adaptive behaviors and strategic decision making in complex systems, such as electricity markets. While EGT models strategic interactions over extended periods within a population, RL facilitates individual learning from environmental interactions to optimize decision making in real time. This section elucidates the intrinsic connection between these theories and their combined potential to innovate electricity market strategies.

Based on this, the theoretical synergy is elaborated as follows.

- (i)

- Interdisciplinary integration: Integrating EGT with RL provides a comprehensive framework that combines the temporal dynamics of strategy evolution with the adaptability of individual learning mechanisms. This integration is particularly potent in environments like electricity markets, where agents must adapt to fluctuating conditions.

- (ii)

- From population to individual learning: EGT focuses on population-level dynamics in which the success of strategies is influenced by their interaction with other strategies over time, tending towards an evolutionarily stable strategy (ESS). RL, conversely, emphasizes learning from individual experiences to maximize a reward function, adjusted continuously as the agent interacts with the environment. This shift from macro-level stability to micro-level adaptability is crucial for real-time responsiveness in electricity markets.

- (iii)

- Dynamic adaptation: Both theories emphasize adaptation, but their approaches offer complementary strengths. EGT provides insights into the strategic stability and drift within populations, which is crucial for predicting long-term market trends. RL contributes by enabling agents to adjust strategies swiftly in response to immediate market changes, enhancing operational flexibility and efficiency.

Furthermore, the application advantages in electricity markets for EGT and RL can be summarized as follows.

- (i)

- Handling high-dimensional data: Electricity markets are characterized by high-dimensional and dynamic state spaces due to variable demand, supply conditions, and numerous participant interactions. RL’s ability to handle large state spaces effectively complements EGT’s approach to population dynamics, making the integrated approach well suited for such environments.

- (ii)

- Real-time optimization: The rapid decision-making capability facilitated through RL, combined with the strategic depth provided via EGT, allows market participants to optimize their strategies not just for immediate gains but also for long-term stability. This is crucial for managing real-time bidding, pricing strategies, and load balancing.

- (iii)

- Enhanced strategic forecasting: By applying EGT, market analysts can predict the evolution of competing strategies in the market, which, when combined with the tactical agility of RL, provides a robust model for anticipating and reacting to market shifts. This dual approach aids in developing strategies that are both competitively robust and highly adaptive.

- (iv)

- Policy development and simulation: The hybrid model facilitates the simulation and analysis of potential policy impacts on market behavior over time, aiding policymakers and companies in crafting rules and strategies that promote efficient and stable market operations.

In summary, the confluence of EGT and RL bridges the gap between strategic stability and operational adaptability, offering a powerful tool for electricity market participants to enhance both their long-term and real-time decision-making processes. This integrated approach not only enriches theoretical models but also delivers practical tools for real-world application, promising to revolutionize strategy formulation in dynamic and complex market environments like those of the electricity markets. This exploration paves the way for future research and development of more sophisticated models that combine these two potent theoretical frameworks.

2.4. Exploration of Multi-Field Application of EGT

Evolutionary game theory (EGT), as a robust analytical tool, has found extensive and profound applications across various fields. This section provides a detailed exploration of the most widely used aspects of EGT in real life, including applications in cybersecurity, healthcare, industrial process optimization, and green electricity trading. Each of these fields leverages the principles of EGT to address complex strategic interactions, highlighting the versatility and continued relevance of EGT in both traditional and emerging domains. For example, Ref. [] indicates that the first—applying EGT to other biological problems—was remarkably fruitful. In competitive environments, species with higher fitness are more likely to survive. EGT offers a crucial theoretical framework for understanding biological evolutionary strategies and population dynamics. First, in cybersecurity, EGT is used to model the dynamic interactions between attackers and defenders, where both parties adapt their strategies over time based on observed outcomes [,,,,,,]. This makes EGT particularly effective for understanding adversarial scenarios and designing robust security protocols. For example, Su et al. [] make a significant contribution by addressing the mutual safety risk prevention and control strategies in industrial park enterprises using blockchain technology. It effectively integrates EGT with the blockchain to enhance transparency, traceability, and collaboration between enterprises, mitigating shared risks. Additionally, the study provides a comprehensive framework for improving decision-making processes in risk management, making it a valuable resource for both researchers and practitioners in the field of industrial safety and blockchain applications. In this research work, EGT was utilized to create a hypothetical model of limited rationality for the behavior of key stakeholders (core enterprises, supporting enterprises, and government regulatory departments) in mutual aid for safety risk prevention and control []. Second, in healthcare, EGT has been employed to optimize resource allocation and model competitive behaviors among healthcare providers, improving both efficiency and patient outcomes [,,,,,]. For example, Xie et al. [] present a novel adherence strategy framework based on evolutionary game theory to model and analyze the behavioral dynamics during epidemic spreading. The primary contribution of this paper lies in its ability to incorporate both individual and collective behavioral factors, offering a more comprehensive understanding of adherence dynamics in response to public health interventions. Additionally, the paper’s use of evolutionary game theory to explore optimal strategies for enhancing adherence provides valuable insights for policymakers aiming to improve compliance during epidemic outbreaks. Third, industrial process optimization benefits from EGT by helping firms determine evolutionarily stable strategies for resource utilization, fostering sustainable competition [,,,,,,]. For example, Xu et al. [] present a novel multidimensional evolutionary game model that addresses both energy efficiency and safety in the transportation of automated guided vehicles (AGVs) at automated container terminals. A key strength of this study is its integration of energy and safety concerns into the evolutionary game framework, which allows for a comprehensive analysis of AGV behavior under dynamic conditions. This proposed model provides significant contributions by offering a practical solution to optimize transportation strategies, improving operational efficiency while minimizing risks in industrial environments. Lastly, green electricity trading utilizes EGT to understand market dynamics involving renewable energy producers and consumers, promoting a stable and sustainable energy system [,,,,,,,]. For example, Zhou et al. [] provide a comprehensive analysis of China’s green certificate trading system, highlighting the critical role of participant heterogeneity in shaping market dynamics. This study’s key contribution lies in applying a collective action framework to examine how varying interests and behaviors among market participants influence the effectiveness of green certificate trading. This approach offers valuable insights for policymakers aiming to enhance the efficiency and fairness of green markets by addressing participant diversity and coordination challenges. In a summary, EGT as a robust analytical tool has found extensive and profound applications across various fields. This section focuses on the broad spectrum of applications of EGT, demonstrating its versatility and sustained relevance in different domains. These domains include traditional fields such as biology, economics, social sciences, and electricity markets, as well as newer areas such as cybersecurity, healthcare, and industrial process optimization. These applications underscore the adaptability of EGT in handling diverse challenges across multiple domains, demonstrating its effectiveness in providing strategic insights, optimizing resource allocation, and predicting outcomes in highly dynamic and uncertain environments. This versatility reinforces the significance of EGT as an analytical tool for modeling strategic behavior in complex, multi-agent systems, enabling stakeholders to make informed decisions and achieve stable, evolutionarily sound outcomes.

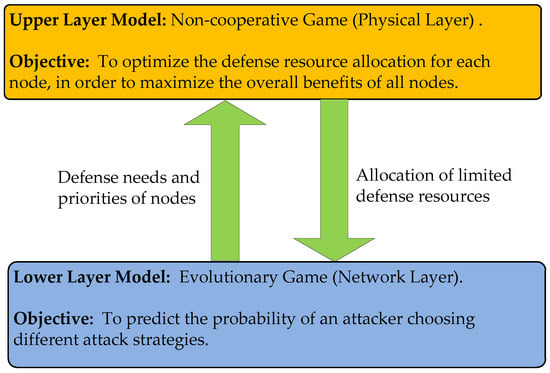

Cybersecurity applications: EGT has been applied to model defense strategies in response to cyber-attacks. For instance, a recent study in 2024 utilized EGT to enhance security measures in decentralized systems by modeling attacker–defender dynamics in a stochastic environment []. This application shows how game theory can adapt to the evolving threats in networked environments by helping stakeholders develop robust defense strategies under conditions of uncertainty. Recent studies have demonstrated the use of EGT in modeling the strategic interactions between attackers and defenders in networked environments. Specifically, the 2024 study on cybersecurity applications in [] explored how EGT can enhance security measures in decentralized systems by predicting and countering adaptive attack strategies. In this study, EGT provided a framework for understanding the evolution of strategies adopted by both attackers and defenders over time, thereby allowing system administrators to implement more resilient security protocols. Furthermore, Su et al. [] examined the game strategy of mutual safety risk prevention and control among industrial park enterprises under blockchain technology, highlighting how EGT can be effectively integrated with emerging technologies like blockchain to improve security collaboration among enterprises. This research shows how EGT can be utilized to facilitate a cooperative defense strategy while maintaining competitive advantages among participants, thus improving the overall cybersecurity resilience of interconnected systems. Another notable contribution to cybersecurity is the study by Liu et al. [], which presented a generic approach to generating network defense strategies based on EGT. This study illustrates the use of EGT in devising adaptive defense strategies that evolve over time, ensuring that defenders can effectively respond to changing attack patterns. The model presented allows for a continuous adaptation process, leading to more robust security measures tailored to evolving threats. Similarly, Wang et al. [] employed a differential game approach to explore antagonistic dynamics in cybersecurity, where attackers and defenders engage in a continuous strategic adjustment, providing insights into real-time security measures and optimizing defense tactics. Additionally, Wu and Pan [] also leveraged EGT combined with deep reinforcement learning to create an evolutionary game model for privacy behavior analysis on social networks. This approach showcases the integration of machine learning techniques with EGT, allowing for enhanced adaptability and deeper insights into privacy behaviors. The model can dynamically adjust to privacy threats, thereby optimizing privacy protection strategies within social network environments. These studies collectively demonstrate the adaptability of EGT in handling dynamic and adversarial environments like cybersecurity, where interactions between entities evolve continuously. By integrating EGT with other advanced technologies, such as blockchain and deep reinforcement learning, researchers can enhance the strategic adaptability of both defensive and cooperative measures, thereby significantly improving the overall resilience of cybersecurity systems.

Healthcare applications: In the healthcare sector, EGT has been applied to model competitive behaviors among healthcare providers. This includes strategic decision-making processes regarding resource allocation, such as hospital beds, medical personnel, and specialized equipment. By simulating the evolutionary dynamics between different healthcare providers, EGT helps to optimize resource distribution and improve public health outcomes []. For instance, healthcare facilities can be considered as agents competing for patients, where their strategies adapt based on patient satisfaction, treatment quality, and operational efficiency. The dynamic nature of EGT makes it suitable for exploring long-term trends in healthcare competition and for providing insights into how policy interventions (such as subsidies or penalties) can influence the evolution of competitive strategies among providers. Recent studies have provided further depth to the application of EGT in healthcare. Zou et al. [] investigated the evolutionary game and risk decision making of four core participants involved in land finance in China, demonstrating how EGT can be used to analyze complex stakeholder interactions involving public resources. Although focused on land finance, the methodologies discussed can be effectively adapted to the healthcare sector, where various stakeholders, including hospitals, insurers, and government bodies, must balance competing interests and resources to achieve public health goals. Similarly, Xie et al. [] applied EGT to develop adherence strategies during epidemic spreading, which could be highly relevant for healthcare providers managing resources during pandemics. Their study showed how EGT can help in determining optimal strategies for encouraging compliance with health guidelines among the public and healthcare professionals. By modeling how different participants (e.g., hospitals, patients, and public health agencies) adapt their behaviors in response to evolving health risks, EGT provides a valuable framework for managing healthcare crises. Chen et al. [] also utilized a three-player evolutionary game perspective to examine green credit and transformation in the plastic supply chain in China. The insights gained from this study could be applied to healthcare systems, where green practices are increasingly important. For instance, hospitals could be modeled as players in an evolutionary game involving the adoption of environmentally sustainable practices, balancing the costs and benefits of green technologies and policies. Nan et al. [] explored the use of EGT in managing major public health emergencies. Their work underscores the importance of modeling the interactions between multiple subjects, such as healthcare providers, government agencies, and the public, during crises. By simulating the strategic behaviors of these entities, EGT can help in devising policies that minimize the negative impacts of public health emergencies and promote cooperative behavior among stakeholders. These applications highlight the versatility of EGT in addressing diverse challenges within the healthcare sector. By incorporating insights from various fields, including land finance, epidemic management, environmental sustainability, and public health emergencies, EGT provides a comprehensive framework for modeling strategic interactions, optimizing resource allocation, and improving overall healthcare outcomes. This interdisciplinary approach ensures that healthcare providers can adapt effectively to changing circumstances, ultimately leading to more resilient and efficient healthcare systems.

Industrial process optimization: EGT has also been utilized for optimizing industrial processes, particularly in shared resource environments such as manufacturing and logistics. In these settings, firms often compete over limited resources, such as production capacity or raw materials. By modeling these interactions using EGT, companies can determine evolutionarily stable strategies (ESSs) that ensure sustainable competition while minimizing resource wastage. For example, firms can continuously adapt their production schedules based on the observed strategies of their competitors, ultimately leading to a stable equilibrium in which resource utilization is optimized. This approach enables firms to remain competitive while maintaining operational efficiency, which is crucial in today’s highly competitive industrial landscape []. Recent research by Xu et al. [] has expanded on the application of EGT in optimizing industrial processes, specifically focusing on energy efficiency and safety-driven multidimensional evolutionary games for automated guided vehicles’ (AGVs) transportation at automated container terminals. In this study, EGT was used to model the interactions between AGVs in terms of energy consumption and collision risk, allowing terminal operators to optimize AGV routing and scheduling while balancing trade-offs between efficiency and safety. This study highlights the adaptability of EGT in managing complex logistical systems where multiple dimensions, such as safety and energy, need to be considered simultaneously. Song et al. [] provided another significant contribution by applying EGT to model the population dynamics of crowdsourcing in smart manufacturing services. Their work focused on balancing and optimizing fulfillment capacity through cooperation and competition dynamics among participants in crowdsourcing platforms. By using EGT, the study demonstrated how participants in smart manufacturing can dynamically adjust their strategies to balance workloads, minimize delays, and maximize service quality. This approach emphasizes the importance of cooperation in enhancing overall system performance, even in inherently competitive environments. Furthermore, Yuan et al. [] explored the use of tripartite evolutionary games to promote the interconnection of charging infrastructure, involving stakeholders such as charging service providers, government authorities, and electric vehicle users. The findings from this study can be adapted to industrial processes, where the collaboration between multiple stakeholders—such as suppliers, manufacturers, and regulators—plays a crucial role in optimizing resource allocation and improving operational efficiency. The application of tripartite evolutionary games enables the identification of optimal strategies that promote infrastructure development while balancing the interests of different stakeholders. Wang et al. [] conducted a study on the optimization of evolutionary dynamic honeypots, which are designed to deceive attackers and gather intelligence on their tactics. Although focused on cybersecurity, the insights gained from the study are highly relevant for industrial optimization, where deception and adaptive strategies can be used to manage competition and protect critical resources. The application of dynamic honeypot strategies in industrial settings can lead to the enhanced protection of sensitive information and more effective responses to competitive threats. These expanded applications of EGT in industrial processes highlight its capacity to address complex, multidimensional optimization problems. By incorporating factors such as energy efficiency, safety, cooperation, and strategic deception, EGT provides a robust framework for companies to adaptively manage their resources and maintain competitiveness in increasingly dynamic environments. This interdisciplinary approach ensures that industrial stakeholders can navigate the complexities of modern supply chains, logistics, and manufacturing processes, ultimately leading to more resilient and efficient industrial systems.

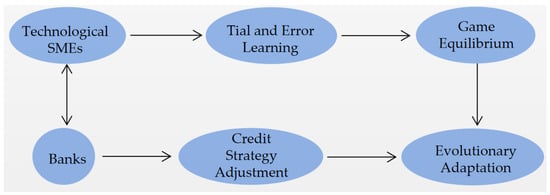

In economics, evolutionary game theory (EGT) serves as a valuable theoretical framework for understanding the dynamics of cooperation between banks and enterprises. By incorporating the concepts of adaptation and strategy evolution, EGT provides insights into how these entities can adjust their behaviors over time to optimize outcomes in fluctuating market conditions. Specifically, in the context of cooperation between banks and technological small and medium-sized enterprises (SMEs), EGT models the interactions as a dynamic game in which both parties—banks and SMEs—continuously revise their strategies based on the flow of information and the perceived benefits of cooperation []. This ongoing exchange of information allows participants to learn from each other and adapt to changing market environments, which is essential for fostering innovation and securing funding in competitive markets. Over time, this process of strategic adaptation leads to the establishment of a stable equilibrium, where both banks and SMEs find mutually beneficial strategies that balance risk, reward, and resource allocation. Ultimately, the evolutionary game model demonstrates how sustained collaboration can evolve naturally and efficiently, helping banks and SMEs overcome uncertainty and achieve long-term success. The model also highlights the importance of information symmetry and trust in facilitating optimal cooperation between these key economic players.

For example, in economics, EGT provides a theoretical reference for the cooperation between banks and enterprises from a unique perspective. The cooperation process between banks and technological SMEs is also a process in which banks and enterprises improve their strategy sets by continuously obtaining information from each other to achieve game equilibrium, as pointed out in Ref. []. Cooperation between banks and technological small and medium-sized enterprises (SEMs) are briefly illustrated in Figure 2. In Figure 2, banks and enterprises belong to the group of limited rationality. Both will maximize benefits and minimize costs through trial and error and adjustment. The bank maintains financial stability by continuously adjusting its credit strategy to achieve optimal returns. The interaction between banks and enterprises resembles biological evolution, involving the adaptation and elimination of ineffective strategies to achieve the final stable state. In the cooperation between banks and SMEs, EGT helps explain the evolution of strategies and guide credit decisions so as to achieve a stable equilibrium.

Figure 2.

EGT: cooperation between banks and technological SEMs [,].

Additionally, evolutionary game theory (EGT) has found extensive application in the social sciences, where it provides a powerful analytical framework for examining the dynamic evolution of social behaviors, norms, and institutions over time. One notable example is the work of Basu [], who explored the intricate relationship between urban social norms and the evolution of human capital agglomeration rules. Basu [] argued that the processes through which individuals and communities form and adhere to social norms—particularly those related to the clustering of talent and knowledge in urban environments—are inherently evolutionary. In this context, EGT is employed to model how individuals and groups interact within urban settings, make decisions about where to locate, and adapt their behaviors based on the collective actions of others. By viewing these interactions as a series of evolving strategies shaped by mutual influence and adaptation, EGT allows for a deeper understanding of how social norms, such as cooperation or competition, emerge and stabilize over time []. For example, the decision to invest in education or professional skills can be influenced by the behaviors of others in the same region, creating a feedback loop that either strengthens or weakens the agglomeration of human capital. Over time, these individual decisions accumulate to form stable patterns of human capital distribution and urban development. From a broader perspective, EGT offers a valuable lens for understanding not only individual decision making but also how collective behaviors evolve in response to changes in the social and economic environment. This perspective is crucial for regional development strategies, as it helps policymakers identify the underlying social and behavioral factors that drive human capital concentration in certain areas, allowing them to implement targeted interventions that foster sustainable growth. Moreover, by highlighting the adaptive nature of social norms and behaviors, EGT provides insights into how policy measures can shape long-term outcomes, such as promoting cooperation, reducing inequality, and enhancing regional competitiveness in a globalized economy.

More recently, EGT has been applied to green electricity trading within the electricity market, highlighting interactions between consumers, suppliers, and regulators. These agents adjust their strategies based on policy changes and market signals to achieve dynamic equilibria that benefit both economic and environmental outcomes []. Such applications underscore the importance of EGT in designing adaptive strategies for energy markets, promoting sustainability and efficiency in the face of renewable energy’s variability.

Green electricity trading and environmental protection: Green electricity trading is another area where EGT has shown significant applicability. In decentralized energy markets, participants—such as renewable energy producers, consumers, and regulatory bodies—interact in a dynamic environment where strategies evolve based on market conditions and policy changes []. By applying EGT, researchers can model both competitive and cooperative dynamics in green electricity trading, such as the interactions between prosumers (producers–consumers) who generate surplus renewable energy and trade it in peer-to-peer markets. EGT also aids in understanding how regulatory policies, like incentives for renewable energy adoption, influence market participants’ strategies, ultimately fostering a stable and sustainable energy market. This application is particularly relevant in addressing the variability and uncertainty associated with renewable energy sources like solar and wind power, where EGT helps optimize decision making in response to fluctuating supply conditions.

Recent research has provided further insights into green electricity trading using EGT. Hu et al. [] examined how dynamic renewable portfolio standards (RPSs) affect the trading behavior of power generators, considering mechanisms such as green certificates and reward/penalty systems. Their study found that EGT could effectively model the adaptive behavior of power generators in response to evolving RPS, helping to balance renewable and conventional energy production while maximizing compliance and economic returns. This work demonstrates how EGT can be used to analyze the interplay between policy-driven incentives and market participants’ strategic behavior. Zhou et al. [] explored the impact of heterogeneity among market participants on China’s green certificate trading from a collective action perspective. Their findings showed that different types of participants (e.g., large-scale power producers, small renewable energy developers, and regulatory bodies) have distinct incentives and behaviors in green certificate trading, which can be modeled using EGT to predict collective outcomes and optimize policy frameworks. This research highlights the importance of understanding the diversity of market participants to foster efficient green electricity markets. Cheng et al. [] conducted an evolutionary game analysis of multi-stakeholders involved in the development of blue and green hydrogen. The study modeled interactions between governments, hydrogen producers, and consumers, identifying the conditions under which cooperation could be maximized to support hydrogen infrastructure development. This study provides valuable insights into how EGT can help promote sustainable energy initiatives beyond traditional green electricity trading, highlighting its applicability in broader renewable energy markets. Teng et al. [] focused on the trading behavior strategies of power plants and the grid under renewable portfolio standards in China, using a tripartite evolutionary game model. By modeling the strategic interactions between power plants, grid operators, and regulatory authorities, the study provided a framework for optimizing renewable energy integration into the power grid. It also demonstrated how EGT could help design effective reward and penalty mechanisms that align the interests of different stakeholders, thus promoting a more stable and cooperative green electricity market. Yue et al. [] used an evolutionary game-based system dynamics approach to optimize strategies for green power and certificate trading in China, considering seasonal variations in renewable energy supply. Their study showed how EGT could help model the influence of seasonal factors on trading strategies and how stakeholders could adapt their behaviors to minimize risks and maximize economic benefits. This research underscores the importance of accounting for temporal variations in green electricity trading to ensure market stability and efficiency. Fan et al. [] analyzed the optimal equilibrium in the carbon trading market using a tripartite evolutionary game perspective. Their study provided insights into the strategic interactions between government, enterprises, and the public in carbon trading, demonstrating how EGT could facilitate the identification of stable equilibria that align economic and environmental objectives. These findings can be extended to green electricity trading, where similar stakeholders are involved in balancing economic incentives with sustainability goals. Wang et al. [] investigated how environmental perceptions, renewable portfolio standards, and subsidies influence trading in China’s green electricity market. By applying EGT, the study modeled the adaptive behaviors of participants in response to changing regulatory frameworks and market conditions, highlighting the effectiveness of subsidies in promoting renewable energy adoption and stable trading environments.

These expanded applications of EGT in green electricity trading demonstrate its capacity to address complex interactions among diverse stakeholders, considering factors such as regulatory incentives, participant heterogeneity, and seasonal variations. By providing a robust framework for modeling strategic behavior in dynamic and uncertain environments, EGT contributes significantly to the optimization of renewable energy trading systems and supports the transition towards a more sustainable and resilient energy future.

By integrating examples from a wider range of disciplines and providing references to the latest research, we aim to illustrate that EGT is not only widely used but also continues to evolve as a crucial method in analyzing and optimizing strategic behavior in dynamic, multi-agent environments.

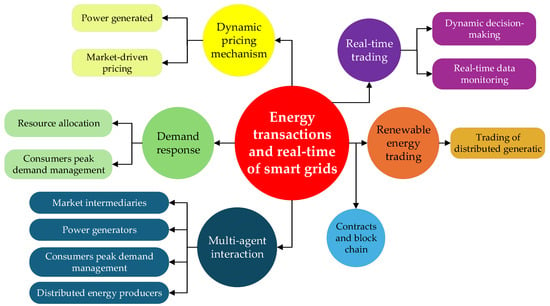

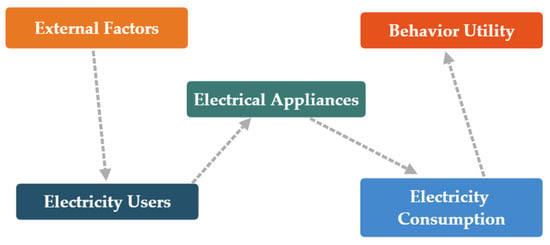

As a dynamic evolution method to study a variety of limited rational agents, EGT has more practical significance in exploring the multi-agent dynamic evolutionary game of green electricity trading in the electricity sale market []. In the electricity market, there are three main bodies: consumers, suppliers and regulators. Based on the premise of EGT, all three have a certain learning ability and can adjust their strategies to maximize their own interests according to the changes of policies of both parties. In electricity market trading, regulatory authorities always hope to build a green trading environment, so they will continue to regulate the behavior of suppliers and consumers through policy adjustments. Suppliers, on the other hand, adjust the price of electricity in real time for the purpose of profit, and they adopt the strategy that enables them to obtain the maximum profit. Consumers’ decisions are often changed due to adjustments to the first two strategies. Most consumers tend to use more electricity when the price is low and less electricity when the price is high. The adjustment of these three strategies is always a dynamic evolutionary process. To gain a more granular understanding of how strategies evolve in user-side electricity market transactions, we apply a multi-agent simulation model []. This approach allows us to capture the dynamic interactions between market participants over time. The agents in the model, representing various stakeholders such as consumers, producers, and regulatory bodies, adjust their strategies based on market signals and EGT principles []. The multi-agent framework provides a robust mechanism to simulate real-world behavior in electricity markets where participants may exhibit imperfect rationality and adapt their strategies dynamically []. The multi-agent model is usually used to simulate the interaction of multiple decision-makers in the electricity market []. Suppose there are n agents, and each agent selects a policy, , at each time step, t. Each policy corresponds to a payment function, which depends on the policy selected by the agent and the policies of other agents. The payment function can be expressed as

where s−i represents the strategy combination of all agents except Agent i, aij is the interaction strength between Agents i and j, and is the payment of a single game when Agent j uses strategy sji and Agent i uses strategy sj.

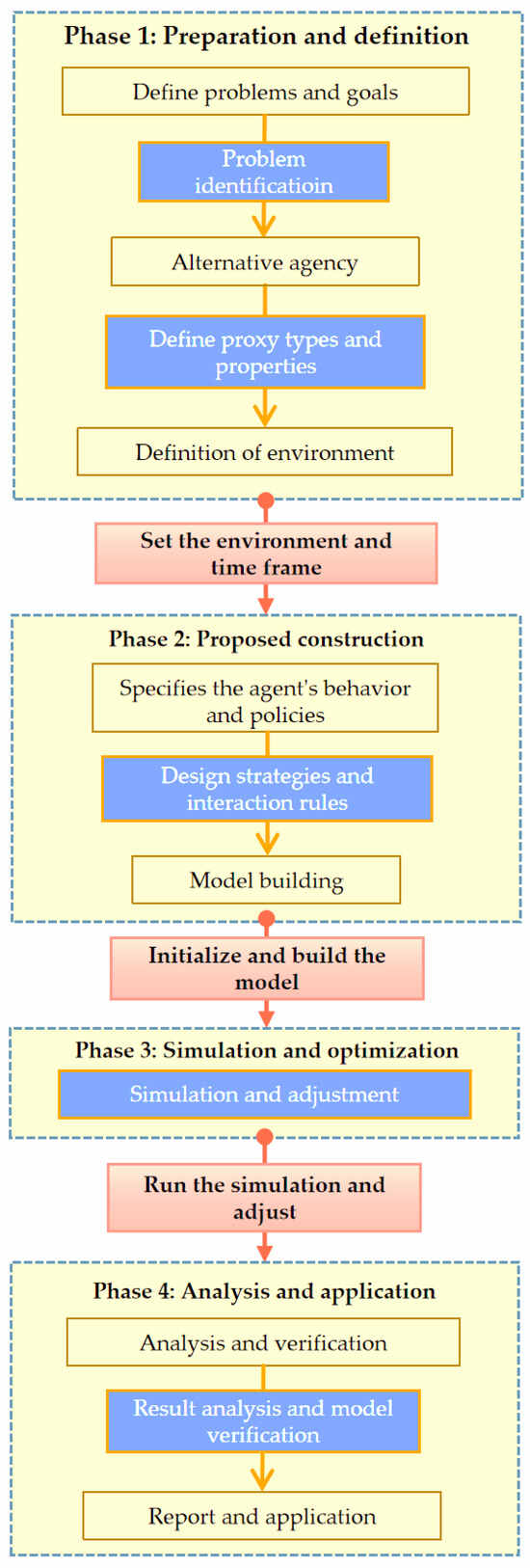

The multi-agent model follows a structured approach to simulating the interactions between market participants []. The process involves several key stages, starting from defining the agents, setting up the market environment, and establishing interaction rules based on EGT. The following flowchart (Figure 3) outlines the step-by-step process of constructing the multi-agent model used in this study [].

Figure 3.

The process of building a multi-agent model [].

Figure 3 provides a visual representation of the model-building process []. It starts with the definition of the problem and objectives, followed by agent selection, behavior specification, and interaction rules. The simulation is then run iteratively, with results analyzed in the final step.

As shown in Figure 3, the process begins by defining the core objective of the model, which is to simulate the strategic behavior of market participants []. Next, agents are selected based on their roles in the electricity market, including suppliers, consumers, and regulators. The environment is then established, taking into account key factors such as demand variability and market regulations []. Each agent’s behavior is governed by predefined strategies, which evolve over time through their interactions.

During the simulation phase, the model runs over multiple time steps, allowing us to observe how the strategies adapt as market conditions fluctuate. The final step involves analyzing the results and determining how different strategies impact market stability and equilibrium [].

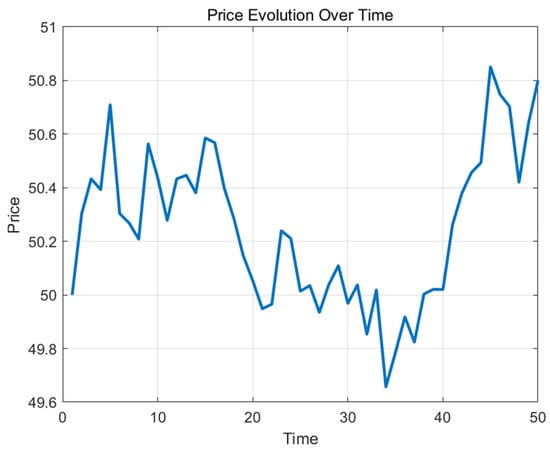

In this section, we explore the dynamics of market pricing influenced by agent interactions using a multi-agent simulation model []. This model, comprising both buyers and sellers, aims to reflect the complexity of real-world market behaviors under varying demand and supply conditions, as demonstrated in Figure 4. Each agent adapts their strategies based on market trends, which are simulated over a defined time period.

Figure 4.

The complexity of real-world market behaviors under varying demand and supply conditions [].

The graphical results from our simulation reveal significant fluctuations in pricing strategies, which correspond to the theoretical underpinnings of EGT applied to electricity markets []. Initially, agents tend to adopt aggressive pricing strategies in order to maximize individual payoffs, leading to a volatile market environment. Over time, as agents learn from interactions and adapt their strategies, a pattern of strategy stabilization emerges, indicating the evolution towards an ESS.

This trend is particularly pronounced in scenarios simulating high demand volatility, where adaptive strategies are crucial for survival and profitability in the market []. The simulation underscores the critical role of dynamic strategy adaptation in achieving market equilibrium, reflecting real-world observations of electricity markets often experiencing rapid changes in pricing due to fluctuating demand and supply conditions.

However, the limitations of our model, including the simplification of market dynamics and the assumption of rational behavior, may affect the generalizability of the results []. Future studies could enhance model realism by incorporating more complex behavioral models and exploring the impact of external market shocks.

Further research is also warranted to explore how policy interventions, such as pricing caps or subsidies, might influence strategic behavior in user-side electricity markets. Such studies could help policymakers design more effective regulations that encourage stable and efficient market outcomes. In the subsequent chapters of this paper, we will continue to explore the applicability of EGT to electricity market trading in smart grids.

Additionally, EGT plays a crucial role in various domains by revealing underlying rules and trends. As research progresses and expands, EGT is likely to reveal new insights across additional, previously unexplored fields.

2.5. Modeling Dynamics Using EGT

EGT is utilized to model the strategic interactions between multiple agents in dynamic and competitive environments. In our proposed framework, the payment function (Equation (1)) plays a central role in defining the fitness levels for each agent’s strategy, which is then used in the dynamic specifications typical of EGT, such as replicator dynamics. The replicator dynamic equation, commonly used in EGT to represent the evolution of strategy proportions over time, is given by , where xi represents the proportion of agents adopting strategy i, fi represents the fitness (payoff) of strategy i, and is the average fitness of the population. In this formulation, the payment function (1) is directly related to the fitness fi, and it thus influences how strategies evolve within the agent population over time.

The payment function is integral to both individual learning through RL and population-level dynamics through EGT. Specifically, it serves two main purposes in the context of dynamic systems:

- (i)

- Defining fitness for population-level dynamics: In typical EGT formulations, the fitness of a strategy determines whether it becomes more or less prevalent in the population. In our model, the payment function (Equation (1)) serves as the basis for calculating fi, which is used in the replicator dynamic equation. By doing so, it directly affects the evolution of strategy proportions in the population, providing the necessary link between individual agent actions and population-level outcomes.

- (ii)

- Incentivizing individual agent behavior: The payment function also serves as a reward mechanism within the RL framework. This reward directly influences the learning process of individual agents, guiding their decisions to either exploit known strategies or explore new ones. The connection between the payment function and agent learning ensures that the rewards an agent receives align with the broader evolutionary dynamics modeled by EGT, fostering both individual adaptation and collective stability.

To clarify the integration of the payment function within the dynamic framework, we have added the following explanations.

- (i)

- Replicator dynamics: The replicator dynamic equation is used to describe how the proportion of agents using a particular strategy changes over time based on the relative fitness of that strategy. In this study, the fitness, fi, is derived from payment function (1), which takes into account factors such as energy costs, consumption patterns, and market interactions. This fitness value feeds directly into the replicator dynamics to determine the growth rate of each strategy.

- (ii)

- Role in dynamic specifications: The payment function plays a dual role by influencing both the replicator dynamics and the agent-level learning process. This dual functionality ensures that the strategies not only evolve according to individual incentives but also conform to population-level evolutionary stability. The replicator dynamics equation means that the payment function directly influences how strategies evolve at the population level by determining which strategies are more successful and should be propagated over time. Higher fitness, as determined by the payment function, means a greater likelihood that a given strategy will increase in prevalence, thereby influencing the evolutionary trajectory of the entire system. This ensures that the resulting equilibrium is an ESS, which is robust against invasion by alternative strategies. At the agent level, the payment function serves as a reward mechanism within the RL process. This reward is based on the immediate and cumulative payoffs that agents receive for choosing certain strategies, which subsequently influence their learning pathways. By using the payment function to guide individual agent decisions, we ensure that agents are continually learning to improve their own payoffs while also contributing to broader, collective dynamics. The reward structure based on the payment function provides critical feedback to the agents, informing them of the success or failure of their strategies in real time. This feedback loop is essential for ensuring that individual learning aligns with the desired long-term outcomes of the population. The dual functionality of the payment function—acting both as the determinant of population-level fitness in replicator dynamics and as a reward mechanism in agent-level RL—ensures that the evolution of strategies is both adaptive and stable. At the individual level, agents learn based on their experiences, optimizing their actions according to the rewards (derived from the payment function). At the population level, the replicator dynamics use these same fitness values to adjust the distribution of strategies among the agents, thus ensuring that successful strategies spread while less successful ones diminish. This interplay between individual learning and population dynamics facilitates a more holistic adaptation process, where both the micro-level decisions of agents and the macro-level evolution of strategies are consistently guided by the same underlying metrics. By influencing both replicator dynamics and agent-level learning, the payment function effectively links the micro and macro aspects of strategy evolution, ensuring that individual incentives are aligned with population-level evolutionary stability. This dual role addresses the reviewer’s concern by clearly demonstrating that the payment function is not merely an arbitrary payoff measure but is foundational to defining evolutionary stability through replicator dynamics. It ensures that the strategies that emerge from individual-level learning are sustainable and evolutionarily stable, thereby contributing to a more resilient and optimized system in the context of electricity markets. As agents adapt their strategies to maximize individual payoffs, the population-level replicator dynamics ensure that such strategies contribute to overall system stability, thus closing the feedback loop between individual adaptation and collective outcomes. The payment function thus ensures coherence between the incentives driving individual behavior and the evolutionary forces acting on the population, making it a fundamental element in the proposed dynamic specifications framework.

3. Integrating EGT for Strategic Optimization and Stability in Smart Grids

3.1. Multi-Agent Characteristics in Smart Grids

Smart grids exhibit a multi-agent architecture that reflects both structural and operational complexity. This structure is characterized by the involvement of multiple independent yet interconnected agents, each contributing to the system’s overall performance.

One key characteristic of smart grids is the distributed nature of energy resources. With the increasing adoption of distributed energy systems, traditional centralized dispatch methods are becoming less effective. Instead, smart grids employ distributed algorithms to manage and schedule resources more efficiently [,]. These algorithms allow the integration of diverse agents, including power producers (e.g., power plants and distributed energy systems), electricity consumers (e.g., residential, commercial, and industrial entities), network operators, and market intermediaries. This distributed architecture provides greater flexibility, enabling the system to adapt to dynamic changes in both energy production and consumption.

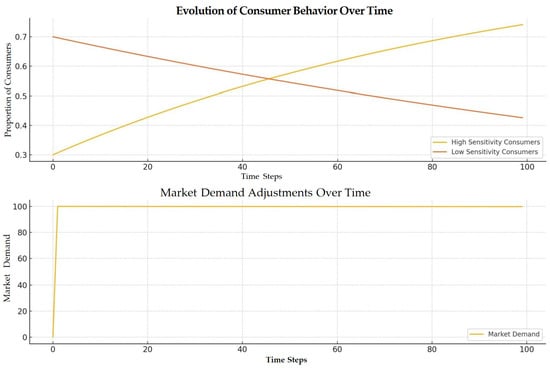

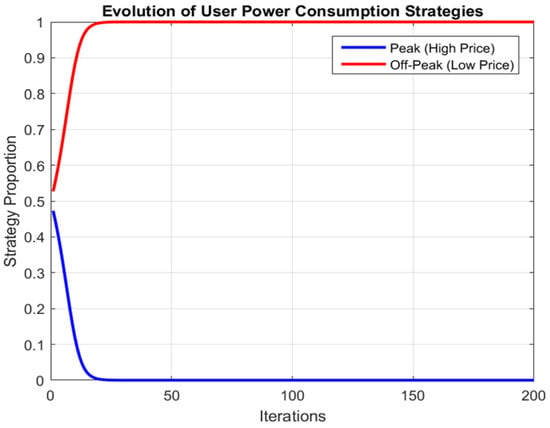

Another significant feature is the autonomy of smart grid agents. These agents operate independently, making decisions based on their specific objectives and constraints []. A prominent example is real-time pricing, a core mechanism within smart grids, where electricity prices fluctuate based on supply and demand conditions [,]. Take the application of evolutionary game coordination in islanded microgrids as an example []. In this example, the integration of distributed generation game theory plays a crucial role in designing pricing models that incentivize consumers to reduce their electricity usage during peak periods []. By simulating various consumer responses, this approach allows power producers to assess price sensitivity and optimize their generation strategies. As shown in Figure 5, over time, more consumers adopt energy-saving strategies, reducing overall electricity demand and smoothing a peak load, which enhances the system’s economic and operational stability [,].

Figure 5.

Illustrates the impact of EGT on consumer behavior and market demand under real-time pricing [,].

In addition to autonomy, smart grids are highly interactive. Agents engage in continuous exchanges of information and participate in market mechanisms, considering not only their own conditions but also the behavior of other agents. This interactivity drives the evolution of energy systems toward greater efficiency and sustainability, promoting the integration of distributed generation and energy storage systems []. For instance, based on user load characteristics, smart grid systems can predict peak loads and proactively interact with users to adjust energy usage before peak demand is reached. This facilitates efficient load management and contributes to peak shaving [].

The balance of collaboration and competition among smart grid agents is another critical aspect. Collaboration enables the sharing and optimization of resources, such as through co-generation or demand-response programs, which improves overall system coordination and efficiency. At the same time, competition, such as bidding among suppliers, encourages market dynamism. This interaction between collaborative and competitive forces fosters innovation and efficiency within the system.

Communication is integral to the functioning of multi-agent systems in smart grids. Effective communication between agents, such as negotiating prices or sharing data on energy supply and demand, ensures the stability and reliability of the grid. Through advanced data analytics and decision support systems, agents can process large data sets and make real-time decisions to optimize grid performance.

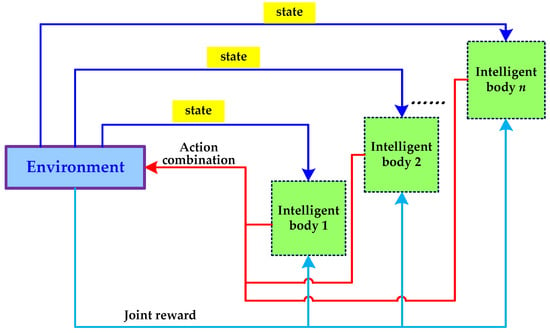

The intelligent decision-making capabilities of smart grid agents are supported by machine learning and game theory. In the framework of multi-agent reinforcement learning (MARL), agents make decisions based on environmental states, and the system provides feedback, allowing the agents to continuously adapt and improve their strategies over time (Figure 6) [,].

Figure 6.

A basic framework for MARL or game theory [,].

Each agent makes decisions (selection actions) based on state information in the environment, and the environment then updates the state and provides reward feedback based on the combination of these actions. This process is a cycle in which the agent is constantly learning or adjusting its strategies through interaction to optimize the outcome.

Finally, smart grids are known for their resilience. The decentralized nature of multi-agent systems enhances the grid’s ability to withstand disruptions. If one part of the system fails, other agents can continue operating independently, reducing the impact on the grid as a whole. This resilience is particularly important in addressing challenges such as grid faults [,,] and extreme weather events [,,,,]. Furthermore, the system’s scalability allows for the easy integration of additional DERs without requiring significant changes to the existing infrastructure. This flexibility is crucial as the number of renewable energy sources, such as solar panels and wind turbines, continues to grow.

3.2. Fit Analysis of EGT and Smart Grid

Smart grids are intricate systems composed of multiple independent entities, such as power generators, consumers, and dispatch centers, which interact and influence one another. In this context, EGT serves as a powerful analytical tool for understanding and predicting the dynamic behaviors of these agents over time. To fully capture these interactions, it is imperative that a game is well defined among agents, allowing for the analysis of competitive and cooperative dynamics. By defining a game among agents, we can leverage EGT to evaluate how strategies evolve based on observed outcomes and the influence of competing strategies. EGT is particularly suited to modeling the smart grid’s strategic interactions due to its capacity to capture the evolving nature of decision-making processes.

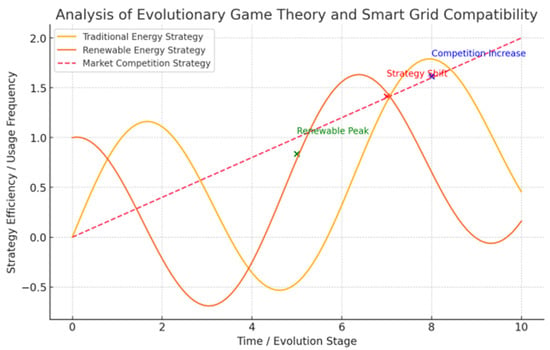

Figure 7 illustrates the evolution of energy strategy efficiency and frequency over time []. It highlights that, as market competition intensifies, renewable energy strategies may eventually surpass traditional ones in terms of usage frequency. This suggests that competitive market forces can significantly drive the evolution of energy strategies within the smart grid, accelerating the shift toward renewable energy sources.

Figure 7.

The evolution of energy strategy efficiency and frequency [].

In the smart grid, agents such as electricity consumers and generators adjust their strategies based on market feedback and environmental changes. This interaction and the autonomy of agents align well with the dynamic game models of EGT. By evaluating the success and persistence of various strategies in competitive environments, EGT enables a deeper understanding of the long-term behavior and trends among smart grid participants. These insights can help predict how strategies evolve and which may dominate over time, especially as external conditions like market prices and renewable energy availability fluctuate.

The smart grid is characterized by a delicate balance between cooperation and competition. Participants engage in both competitive activities, such as price setting and market share battles, and cooperative initiatives, such as demand-response programs and resource sharing for optimization. EGT can identify stable strategy combinations under different conditions, guiding participants in balancing competition with cooperation to maximize system efficiency []. This understanding can be used to design more effective incentive mechanisms that promote cooperative behavior, leading to mutual benefits for all grid participants.

Adaptability is another key strength of EGT in modeling smart grids, which operate in environments that are often unpredictable due to the reliance on intermittent renewable energy sources like solar and wind. EGT offers a framework for analyzing how demand-response mechanisms can influence consumer behavior in these fluctuating conditions. One of the critical challenges in smart grid management is encouraging consumers to reduce electricity usage during peak periods through price signals and incentives, helping balance the grid’s load. For example, energy storage operators might develop strategies to store or release energy based on future price forecasts and the expected availability of renewable energy, ensuring more efficient grid operation.

As renewable energy becomes increasingly prominent, EGT provides valuable insights into the sustainability of energy systems. It can be used to analyze the interactions between different power generation actors, focusing on both competitive and cooperative strategies. EGT models also capture the co-evolution of behaviors between renewable energy producers and consumers. By understanding these dynamics, EGT supports the seamless integration of renewable energy into the grid and promotes the sustainability of the overall power system’s development

3.3. Challenges and Limitations

Despite the many advantages of evolutionary game theory (EGT) for modeling smart grids, several significant challenges and limitations persist that must be carefully addressed to fully leverage its potential:

- (1)

- Complexity in real-world systems: As EGT models scale up to represent complex, real-world smart grids involving numerous agents, diverse objectives, and intricate interactions, the overall system can become highly complex. This complexity makes it difficult to derive straightforward analytical solutions, and computational demands increase substantially as the number of agents grows. In real-world applications, the heterogeneity of agents—ranging from large energy producers to small prosumers—adds further layers of intricacy, requiring sophisticated modeling approaches to capture the nuances of each participant’s strategic behaviors. Moreover, interactions between renewable energy sources, market dynamics, and distributed energy resources (DERs) further increase the dimensionality and computational complexity of EGT-based models.

- (2)

- Convergence to suboptimal solutions: One of the inherent challenges of EGT in smart grid modeling is the risk of convergence to suboptimal solutions. The evolutionary nature of these models means that strategies evolve based on fitness, which may not always guarantee a globally optimal solution. In practice, agents can converge on locally optimal strategies that are beneficial within their immediate context but fail to provide the best outcome for the overall grid or the broader energy market. This challenge is especially pronounced when multiple Nash equilibria exist, where EGT might settle at a suboptimal equilibrium that does not maximize system efficiency or benefit all stakeholders equitably. Additionally, the presence of non-cooperative behaviors and competitive dynamics between agents can exacerbate the likelihood of such suboptimal convergence, leading to inefficiencies in the allocation of resources or market imbalances.

- (3)