In this section, we perform an empirical simulation to evaluate the effectiveness of the proposed model and demonstrate the use of our proposed model, with the official data obtained from [

5,

32]. Traditionally, each game in a casino is played independently of the other games. Every form of gambling has rules that define everything about that game, including how the game is dealt so as to fulfil the pre-determined house advantage, what equipment is used and what procedure to follow, etc., to ensure that the house advantage can be realized in the long-run. In effect, the win probability and house advantage can definitely be calculated from the rules. By applying our model, we only need to provide the

p and

a of various games, and the model can calculate the probability outcomes.

4.1. Data Analysis

Interestingly, some casino games are based on pure chance; zero skill or strategy can alter the odds. These games include roulette, craps, baccarat, keno and the Big Six. Of these, baccarat and craps offer the best odds, with house advantages of 1.2% and less than 1.0%, respectively. In practice, the Big Six costs the player much more, in which house advantages are more than 7.0%, and up to nearly 20.0% for betting on “yellow”. In addition, keno is a veritable casino rip-off with an average house advantage close to 30.0%. In contrast, blackjack is the most popular of all table games, providing skilled players with some of the best odds in the casino. The house advantage is slightly different as per the rules and the number of decks, but players who adopt the basic strategies have little or no disadvantages in a single-deck game, while there is only a 0.5% house advantage in an ordinary six-deck game. Rule variations favourable to the player include fewer decks, dealers standing on soft seventeen (worth 0.2%), doubling after splitting (0.14%), late surrender (worth 0.06%) and early surrender (uncommon, but worth 0.24%). Despite these numbers, the average player ends up giving the casino a 2.0% edge due to mistakes and deviations from the basic strategy.

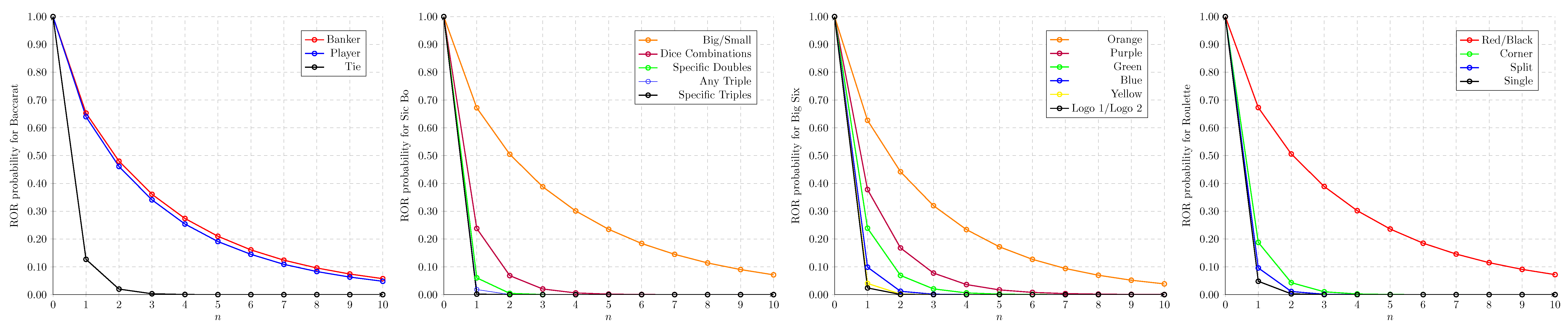

The following tables lay out our configurative setting and the corresponding evaluation outcomes of ROR probabilities. The official data are evaluated with . Each table corresponds to a common casino game with a number of wagers, and the obtained outcomes of the evaluation using the proposed model.

As indicated from

Table 1,

Table 2,

Table 3 and

Table 4 and

Figure 1, in general, ROR probabilities keep decreasing as

n increases, which is coherent with the conclusion of Theorem 1. Further, the smaller the value of

p, the higher the decreasing rate of the ROR probability. Interestingly, when

, the ROR probability is even higher than

p (the probability of the casino winning). This situation lasts until

. Thus, despite the fact that

, casinos are still able to lower the risk of bankruptcy through controlling

n. Take the casino game baccarat, for example. Referring to the

p and

a in

Table 1, when

, the proposed model indicates that the

values of betting on banker and player are 1.25 × 10

−11 and 2.21 × 10

−12, respectively, which implies that no one could bankrupt the casino even if the global population had participated in the game. Based on

, once the casino ensures its operating bankroll to be larger than

, the risk of bankruptcy is negligible.

It is worth mentioning that blackjack and Pai Gow fall into the category of skill games, in which

p varies based on players’ decisions and strategies. Take blackjack, for example. Players can enjoy a house advantage as low as 0.5% if they employ the basic strategy, while players with poor skill can suffer with a much higher one, e.g., 4.0%. In the extreme case (

) indicated in the last paragraph of

Section 3, the casino is confronted by a challenge of bankruptcy. Unfortunately, this extreme case could possibly emerge, as some gamblers with sophisticated skill in card counting, or those who cheat with some equipment in practising advantage plays, could beat the casino and at least force

p to get very close to

. Of course, casinos counter these kinds of practice with some protection measures, such as reinforcing surveillance capabilities, using eight-deck cards and others, in the hope of dragging

p back to the normality of the model. The proposed model also tells us that even though

emerges, the gambler still has to go through at least

n games to bankrupt the casino. Therefore, the casino must set up a proper

to adjust

n, which allows surveillance personnel ample time to find the frauds, if any.

However, no matter how small the chance is, Murphy’s Law suggests that the possibility of bankruptcy might be more likely than we thought. Based on the underlying assumption of the proposed model, the gambler has unlimited credits. In practice, casinos keep operating for a certain period time and have supposedly accumulated a larger bankroll due to the fact of favourable house advantages, implying a larger n. Based on Theorem 1, the larger the value of n, the lower the risk of bankruptcy. Thus, the worry from Murphy’s Law could somewhat subside.

4.2. Evaluation and Discussion

We used the collected settings to perform predictions on other ROR models and compared the results with our proposed model for analysis. The selected benchmark ROR approaches were the Coolidge [

8], Kaufmann [

33] and Ralph-Vince [

34] formulas and the negative binomial regression model (NBRM) [

35]. We also provide the results of our proposed model without considering the house advantage (

). The

of various formulas can also be regarded as the extent of the risk that the casino can assume before reaching the bankruptcy threshold.

For the Coolidge model, it uses the same independent control variables as the Kaufmann and Ralph-Vince formulas, and the dependent variables (p and current win rate) have been described by a more reasonable ordinal model. Similar to the model we proposed, we expanded their concept and took account of the house advantage instead of the current winning percentage. The probability of winning and the bankroll or budget as factors are regarded as the input features (independent variables) each formula must receive. In our empirical simulation, Coolidge provides the roughest prediction, in which it only considers a without p, because it is believed that a and p can be derived directly from each other. They do not have to be used as different input variables, so their results can only reflect very simple situations with a lack of clarity. In contrast, the Kaufmann and Ralph-Vince methods provide us with more accurate results than Coolidge. They analyse the probability of winning and take the risk percentage into their consideration, but it is still not perfect, because the risk percentage requires the size of the risk/return and the win rate, which will change from time to time and is actually not suitable for ROR estimation. However, in reality, instead of predicting the casino’s current ratio of wins and losses, it is better to consider the ROR prediction in the next n rounds. Taking these factors into account can make the formula very complicated, and this is where the model based on Poisson distribution comes into play. It is noted here that when comparing the performance of different models, we should not incorporate the casino profit () into the NBRM model. This is mainly because the model is a counting model and is usually designed to model interval-scale data rather than ordinal-scale data. Furthermore, unlike a and p features, the risk percentage varies from person to person and does not affect the ROR. Instead, the risk percentage usually influences the gambler’s betting behaviour and indirectly affects . As a result, it is not reasonable to directly incorporate this information into NBRM and our proposed model.

Table 5 illustrates the estimates of the benchmark models and our proposed model with and without house advantage consideration. In addition to Coolidge, most of the results indicate the expected performance. In summary, all models present roughly the same situation: The derivative signs of the control variables (

p and

a) are basically the same in all of these models (the greater the value of

p, the greater the ROR caused by

, but the larger the value of

a, the smaller the ROR caused by

). Among all the methods, the Coolidge results are biased toward conservative, rendering higher probabilities of ruin even when the gamblers’ win rates are low. Take Sic Bo’s Specific Triples as an example. While

, its ROR still reaches 6.71 × 10

−2. Compared to Kaufmann and Ralph-Vince, Coolidge’s results are more comprehensive and more readily identifiable. However, this method is still not perfect because the current number of wins/losses must be calculated before predictions can be made due to different outcomes being generated each time. Another limitation is that the upper bound of

n is required to be defined, which is obviously not feasible in practice. Furthermore, the results produced by NBRM are similar to the proposed model, which is similar to Equation (

7) except for taking the house advantage (

a) into consideration. This is because they also make use of the binomial distribution in the derivation process: The NBRM focuses on the binomial distribution of a finite sample and the proposed model is conducted to describe the distribution from an infinite sample, thereby giving the probability of obtaining the entire event in the population. In addition, the ruin prediction can be further alleviated when considering the impact of profit (

). In fact, the simulated outcomes generated through these models are quite well understood and these models can roughly determine how each input feature influences the outcomes. We put forth the mathematical model that merely links up their relationship and describes how these changes affect the ROR through mathematical proof.